IST,

IST,

When Circumspection is the Better Part of Communication

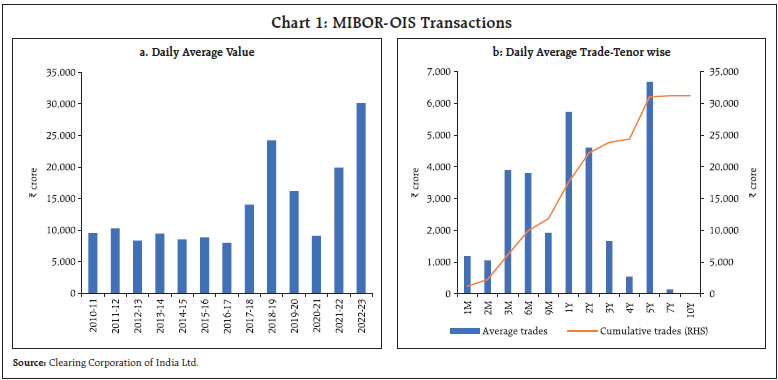

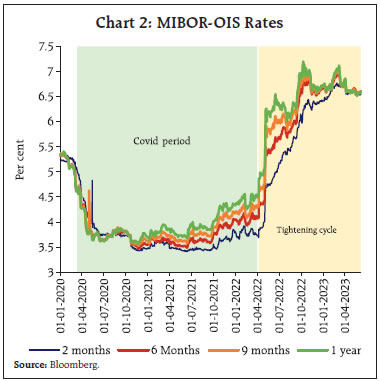

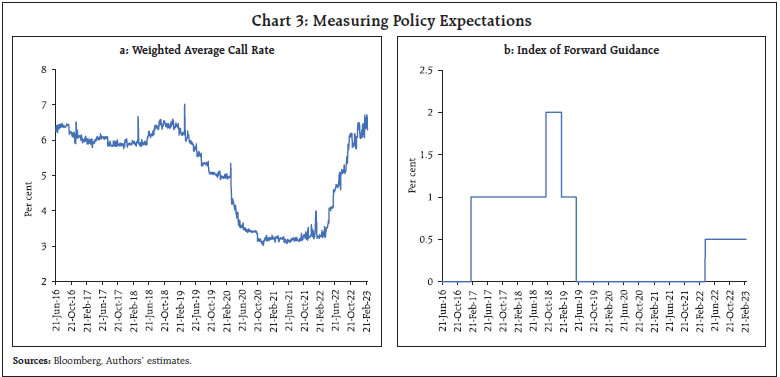

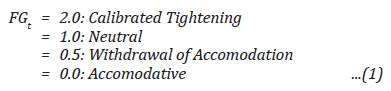

by Michael Debabrata Patra, Indranil Bhattacharyya and Joice John^ The role of monetary policy communication in the form of forward guidance in the tightening phase of the policy cycle is under close scrutiny. The results of an auto regressive conditional heteroscedastic (ARCH) model on overnight indexed swap rates indicate that forward guidance has a statistically significant impact on long-term interest rate expectations, but it progressively loses potency as the policy rate rises from highly accommodative levels. “…Communication comes with the cost of misinterpretation and also may limit flexibility. So I think we should use forward guidance sparingly when the course of policy is either reasonably well understood, or on the contrary, is so dependent on uncertain future developments that little really can be said constructively about the future.” – remarks by Jerome Powell, Chairman of the Federal Reserve of the United States (US), Panel Discussion, Thomas Laubach Research Conference, Washington, D. C. on May 19, 2023. Introduction The global financial crisis (GFC) brought about a paradigm shift in the manner in which monetary policy is communicated to the public. The monetary mystique or “constructive ambiguity”1 of the 1990s was jettisoned in favour of greater openness and clarity. Overwhelmingly, central banks chose to provide information about their view of the state of the economy and the likely future course of monetary policy. The term forward guidance gained currency worldwide. Central banks began to provide verbal assurance to the public about the intent of monetary policy going forward so as to anchor expectations to their stated goals and nudge the behaviour of the public in the direction they desired. This was a natural corollary to their encounter with the zero lower bound on interest rates – the glass floor below which it was believed that interest rates cannot fall. Forward guidance became recognised as an important instrument in the monetary policy toolkit – “monetary policy is 98 per cent talk, and only two per cent action” (Bernanke, 2015). The underlying belief has been that transparency instils credibility. The shock and awe of the pandemic overlapped by the war in Ukraine produced a surge of inflation across the world to heights last seen four decades ago. This inflation visitation has also turned out to be tenacious and broad-based, resisting one of the most aggressive and sychronised episodes of monetary policy tightening in recent global history – illustratively, policy rates have been increased since January 2022 in the range of 225-675 basis points (bps) in major advanced economies2 (AEs) and 75-5900 bps in major emerging market economies3 (EMEs) – accompanied by active balance sheet consolidation. More recently, as inflation has shown grudging signs of relenting, central banks have either tempered the size of rate increases or have paused only to find themselves in a twilight zone on communicating their future intentions to the public. In fact, a few central banks have recently resumed policy rate increases after pausing.4 These developments have brought the role of monetary policy communication, especially forward guidance, in the tightening phase of the policy cycle under close scrutiny. As central banks raised interest rates, they also engaged in hawkish forward guidance which unleashed bouts of high turbulence in global financial markets, amplified the tightening of financial conditions and triggered exodus of capital from the emerging world. Once again, the paradigm began to shift, with monetary policy communication seen as engendering risks to financial stability. With banking collapses in some jurisdictions, the view gaining ascendency is that financial stability considerations should be taken into account while formulating monetary policy and communicating it (Schnabel, 2023). Implicit in this view is that unlike the zero lower bound to interest rate cuts, there is no upper bound to interest rate increases, and a shrill pitch in forward guidance can be deeply destabilising. Discretion in forward guidance when monetary policy has to be formulated under heightened uncertainty is increasingly gaining advocacy over the value of hawkishness, as reflected in the influential view with which this paper began. In India, monetary policy communication has imbibed global best practices with country-specific adaptations. The decision of the monetary policy committee (MPC) on the policy rate and its underlying rationale along with forward guidance are conveyed to the public through a resolution on the day of the MPC’s meeting. This is backed up by a statement of the Governor, Reserve Bank of India (RBI), as the chairman of the MPC. In addition, press briefings, speeches, forward-looking surveys, research, minutes of the MPC meeting and a semi-annual monetary policy report are other avenues of conditioning expectations. In this context, however, there has been animated debate in the public domain in India about the relevance of forward guidance in conveying the future intent of monetary policy in a rate tightening cycle. The dilemma is sharpened by the public’s elation with recent small moderations in inflation and improvements in growth performance whereas the MPC remains focused on closing the wide gap between headline inflation and the target, and the relatively smaller gap between output and its potential. Addressing this dilemma is the main motivation of this paper. Employing an auto regressive conditional heteroscedastic (ARCH) model, we find that forward guidance communicated in the policy resolution has a statistically significant impact on long-term interest rate expectations, but it progressively loses potency as the policy rate rises from highly accommodative levels. The rest of the paper is organised, into three sections. The next section presents some stylised facts about recent monetary policy developments in India as reflected in market expectations, as a backdrop for the choice of the methodological framework and results obtained therefrom in Section III. The last section concludes the paper with a few policy perspectives. II. Forward Guidance through the Lens of Financial Markets While forward guidance has been elevated to the status of a monetary policy instrument, no consensus has yet emerged on what constitutes “optimal”. The challenge is to strike the right balance between the quantity and the quality of information and between clarity and sensitivity in a highly uncertain outlook. In other words, even if monetary policy communication is clear and unambiguous, it may not deliver the desired results if it is not interpreted by the public/markets in the way envisioned by the central bank. In times of uncertainty when there is incomplete information about the state of the economy in the future, the feasibility and desirability of announcing a future path of policy rates, which is what forward guidance seeks to achieve, has been questioned (Natvik, et al.,2020). Markets and the public may not fully understand the conditionality attached to the announced future policy path forecasts or the underlying assumptions. Forward guidance on the likely future path of policy rates in this milieu may be misinterpreted as a quasi-promise or commitment and could lead to disorderly adjustment of interest rate expectations (Blinder, 2018). If the communication of future policy rates consistently deviates from their realised path, it may weaken the public’s confidence in the central bank and its commitment to the stated policy objectives. This may even entail the risk of delivering unpleasant monetary surprises to financial market expectations and eventually aggravate inflation and output volatility. Forward guidance is priced in by financial markets as expectations of interest rates and this is reflected in financial prices, both spot and future. In countries that do not have money market futures segments or they are shallow, overnight indexed swap (OIS) rates are a natural candidate for measuring monetary policy expectations of market participants (Hubert and Labondance, 2018; Kamber and Mohanty, 2018; Altavilla et al., 2019; Lloyd, 2018, 2021). An OIS is an interest rate derivative contract in which two entities agree to exchange a fixed interest rate payment (the OIS rate) vis-à-vis a floating interest rate payment computed over a notional principal amount during the tenor of the contract. The floating leg interest payment is derived by calculating the accrued interest payments from a strategy of investing the notional principal in a reference rate and repeating this on an overnight basis for the duration of the contract, reinvesting principal plus interest continuously. The floating rate for OIS contracts is the overnight (unsecured) interbank rate. Thus, the OIS rate is a combination of the current overnight interest rate, the expected future overnight rates, and the term premium (Lloyd, 2021). The use of OIS offers various advantages. First, counterparty risk is minimal in OIS contracts since it does not involve an exchange of principal amounts (Finlay and Olivan, 2012). Second, OIS contracts do not involve any initial cash flow and only the net payments are exchanged, thus minimising liquidity risk. In India, the reference floating rate for OIS contracts is the Mumbai Interbank Offered Rate (MIBOR). The overnight MIBOR is traded on the basis of the inter-bank call money rate – the operating target of monetary policy. The 2-month OIS rate, which has the same tenor as the bi-monthly monetary policy cycle, gradually hardens over the ensuing two months if the market expects an increase in the policy repo rate in the upcoming monetary policy meeting and vice versa. OIS rates of longer maturity reflect expectations about the future path of the policy rate and the term premia in accordance with the expectation hypothesis of the term structure of interest rates – interest rates are expected to move in a way that equalises the expected return on short and long-term investment strategies for comparable investment horizons (Piazzesi and Swanson, 2008; Lloyd, 2021). The daily average values of MIBOR-based OIS transactions have increased considerably since COVID-19 (Chart 1a). April 2023 data suggest that trading is primarily concentrated in the 1 year, 2 years and 5 years maturity segments, with the segments up to 1 year comprising more than 50 per cent of total trade volume (Chart 1b). Since the beginning of the formal adoption of flexible inflation targeting (FIT) in October 2016, the OIS rates have tracked changes in monetary policy. After the sharp reduction in the policy rate following the outbreak of the pandemic in March 2020, OIS rates (up to one year) moved in tandem across maturities, indicating that market expectations were anchored to accommodative monetary policy (Chart 2). From 2021 onwards, longer term OIS rates firmed up above the 2-month rate, indicating market expectations of an eventual increase in the policy repo rate. With the progressive tightening of policy since May 2022, OIS rates across tenors firmed up with a steeper increase in longer maturities. Since then, the longer-term rates remained above the shorter-term rates till April 2023 when the MPC decided to pause. Thereafter, the OIS rates seem to have converged.   We adopt a high-frequency approach that relies on daily movements in OIS rates. This is because movements in OIS rates that can be specifically attributed only to monetary policy related developments occur on the day of the policy announcement. This assumption is vital for the identification of monetary policy impulses on OIS rates since it strips out the variations that are associated with shocks due to other factors (Kuttner, 2001; Cochrane and Piazzesi, 2002; Hubert and Labondance, 2018). Adapting from the recent literature cited above, monetary policy changes are bifurcated into two parts (a) policy actions viz. repo rate changes; liquidity measures; specific changes in the operating procedure such as an asymmetric corridor; and so on, and (b) explicit forward guidance (FG). The impact of policy actions is reflected in the movements of the weighted average call money rate (WACR), which is the operating target of monetary policy in India (Chart 3a). Adapting from Hubert and Labondance (2018), forward guidance is represented by an ordinal index measure of the form:   By construction, this index ranges between 0 to 2, with an increase indicating progressive tightening (Chart 3b). The increase is expected to have a positive effect on the long-term OIS rates, hardening policy rate expectations. We regress the daily changes in OIS rates of different maturities (up to 1 year) on changes in the WACR and changes in the index. An interaction term is also incorporated into this equation to identify the differential impact of forward guidance on OIS rates at different levels of the monetary policy rate. Two separate sets of regression equations are estimated: with and without the interaction term. To address the autocorrelation problem in residuals, an auto regressive error term is added to the specification. One of the standard assumptions of the classical linear regression model (CLRM) is constant variance (homoscedasticity) of the error term. In high frequency financial markets data, however, the variance of the error term changes over time mainly due to “volatility clustering” i.e., periods of increased volatility followed by periods of relative calm. Under these conditions, volatility measures like implied volatility or other measures of variance can at best be comparative static indicators. On the other hand, an autoregressive conditionally heteroscedastic (ARCH) model allows the variance to change over time and is often used in situations characterised by short periods of increased variation. Apart from a mean equation, the ARCH model has a variance equation which expresses the variance of the error as a function of the squared error terms of previous time periods. The equations are estimated on daily data from June 2016 to February 2023 (1,626 observations) representing the flexible inflation targeting (FIT) period, during which forward guidance has been explicitly used for monetary policy communication. The ARCH model is estimated by using the maximum likelihood (ML) method5 with the following specification:  Equation (3) represents the auto regressive error term6 and (4) is the variance equation with ARCH effects.7 The results indicate that the contemporaneous impact of policy actions is significant across all maturities of OIS rates, though progressively lower for longer-term rates, as expected. Forward guidance also has a statistically significant impact on OIS rates of maturities of 2 months and beyond – and hence on monetary policy expectations – with a relatively higher impact on longer-term OIS rates up to one year, which are in this exercise (Table 1). As stated earlier, an interaction term is introduced to identify the differential impact of forward guidance on policy rate expectations at different levels of policy rates. The interaction term is found to be negative and statistically significant for maturities of 1 month and beyond. This indicates that at higher levels of policy rates, the impact of forward guidance on policy rate expectations declines progressively (Table 2). The results in Table 2 can be used to generate the impact of forward guidance on OIS rates at different levels of policy repo rates (Table 3). It is observed that as the repo rate increases, the impact of forward guidance on policy rate expectation declines. Notably, the impact of it on near term OIS rates, i.e., where monetary policy action is expected to be the most potent, disappears as the policy rate crosses 5.5 per cent. In fact, as the level of policy rate reaches 6 per cent, forward guidance has a near zero impact on OIS rates except in the outermost maturity (one year). By the time the policy rate reaches 6.5 per cent, even this impact fades away. The experience with conducting monetary policy through the overlapping shocks of the pandemic and geo-political conflict sheds new light on the role of monetary policy communication, especially through forward guidance. While its utility at very low policy rates is unambiguously proven, its efficacy at higher rates is questionable. This is consistent with the asymmetric nature of the monetary policy cycle – the way down has a lower bound but the way up is technically unbridled by any upper bound.8 Under heightened uncertainty, discretion in forward guidance is increasingly under active consideration of major central banks, as we cited at the start of this paper. Such views have been expressed in the context of India as well: “ ...it would be inadvisable to provide specific guidance when we are in a tightening cycle and when we are experiencing such extreme uncertainty. The only forward guidance that we can provide is that we will remain vigilant, monitor every incoming information and data, and shall act appropriately to maintain price stability in the interest of strengthening medium-term growth” (Das, 2023a). “...Recognising that explicit guidance in a rate tightening cycle is inherently fraught with risks, the MPC has also eschewed from providing any future guidance on the timing and level of the terminal rate” (Das, 2023b). Our results indicate that forward guidance is a useful instrument of monetary policy in extraordinary times that warrant ultra-accommodation. In these periods, the policy rate itself is usually much lower than its normal level. In this context, forward guidance becomes valuable to the conduct of monetary policy because of its influence on longer-term interest rate expectations – the central bank leapfrogs the structure of interest rates in transmission and nudges long-term rates towards the level of the ultra-low short-term rates. It loses steam, however, as the policy rate increases. Separate articulation of forward guidance loses its relevance when monetary policy is in a tightening mode and the economy is returning to normalcy. At the other end of the spectrum, the utility of forward guidance when the economy is overheating can be the subject of future research and empirical verification when the current monetary policy framework encounters such an episode. In the interregnum, a pragmatic solution has been offered: “ … monetary policy can be well served by calibrating the size of the policy rate to the dynamics of the situation and the size of the change itself can convey the stance of policy… This approach can also be useful when the central bank is on a tightening mode and potentially help avoid policy turnaround from forward guidance via stance too far into the future, which in a highly volatile global scenario, may not even be a year. …” (Das, 2019). References Aldrich, J. (1997). RA Fisher and the making of maximum likelihood 1912-1922. Statistical science, 12(3), 162-176. Altavilla, C., Brugnolini, L., Gürkaynak, R. S., Motto, R., & Ragusa, G. (2019). Measuring euro area monetary policy. Journal of Monetary Economics, 108, 162-179. Bernanke, B. S. (2015). Inaugurating a new blog. The Brookings Institution, March 30, 2015. https://www.brookings.edu/blog/ben-bernanke/2015/03/30/inaugurating-a-new-blog/ Blinder, A. S. (2018). Through a crystal ball darkly: The future of monetary policy communication. In AEA Papers and Proceedings (Vol. 108, pp. 567-71), May. Cochrane, J. H., & Piazzesi, M. (2002). The fed and interest rates—a high-frequency identification. American economic review, 92(2), 90-95. Das, S. (2019). Global Risks and Policy Challenges facing Emerging Market Economies, Speech delivered on the sidelines of the Fund-Bank Spring Meetings, Washington, D. C., USA, April 12. __________ (2023a). Minutes of the February 6-8, 2023 Monetary Policy Committee Meeting, Reserve Bank of India, February 22. __________ (2023b). Central Banking in Uncertain Times: The Indian Experience, Opening Plenary address delivered at the Summer Meetings organised by Central Banking, London, UK, June 13. Finlay, R., & Olivan, D. (2012). Extracting Information from Financial Market Instruments. RBA Bulletin, (March). Hubert, P., & Labondance, F. (2018). The effect of ECB forward guidance on the term structure of interest rates. International Journal of Central Banking, 56th issue (December). Kamber, G., & Mohanty, M.S. (2018) “Do interest rates play a major role in monetary policy transmission in China?,” BIS Working Papers 714, Bank for International Settlements. Kuttner, K. N. (2001). Monetary policy surprises and interest rates: Evidence from the Fed funds futures market. Journal of Monetary Economics, 47(3), 523-544. Lloyd, S.P. (2018). “Overnight index swap market-based measures of monetary policy expectations,” Bank of England Working Paper 709. Lloyd, S. P. (2021). Overnight indexed swap-implied interest rate expectations. Finance Research Letters, 38, 101430. Natvik, G. J., Rime, D., & Syrstad, O. (2020). Does publication of interest rate paths provide guidance?. Journal of International Money and Finance, 103, 102123. Piazzesi, M., & Swanson, E. T. (2008). Futures prices as risk-adjusted forecasts of monetary policy. Journal of Monetary Economics, 55(4), 677-691. Schnabel, I. (2023). Monetary and financial stability – can they be separated? Speech at the Conference on Financial Stability and Monetary Policy in honour of Charles Goodhart, London, May 19. ^ The authors are from the Reserve Bank of India. The views expressed in this article are those of the authors and do not represent the views of the Reserve Bank of India. 1 A phrase credited to Henry Kissinger, it has been used to characterise the manner of monetary policy communication by Alan Greenspan, former Chairman of the US Federal Reserve. 3 excluding China, Russia and Turkey 4 Australia, Canada, Norway and Malaysia. 5 Estimating the parameters of a regression model using an ML method is accomplished by maximising the likelihood function - joint probability - of the observed data, so that it has the maximum probability (likelihood) of occurrence under the specified regression framework. Ronald A. Fisher introduced the ML method in a series of papers from 1912-1922 (Aldrich, 1997). 6 Controls for the autocorrelation in residuals. 7 Controls for the non-constant variance of residuals (ARCH effects). 8 Illustratively, the policy rate in Argentina was 97 per cent in May 2023, having been increased by a cumulative 5900 basis points. |

Page Last Updated on: