IST,

IST,

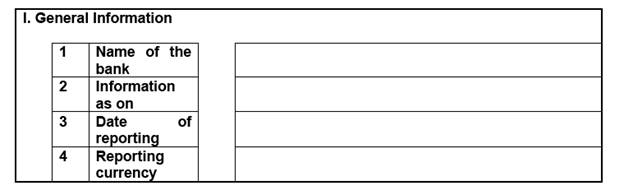

Annex 6: Data Template for Domestic Systemically Important Banks

II. Organizational/Financial Group Structure and Key Legal Entity Information 1. Organizational/Financial Group Structure 1.1 Furnish a diagram as well as detailed description of the bank's organizational structure and their arrangement in hierarchical order (i) Description of Organizational structure should include:

1.2 Branches and Subsidiaries of legal entities (i) Furnish a list of branches and subsidiaries separately for each of the legal entities of the organization/group with location and geography, other than India. (ii) Give details of the business done in each of the branch and subsidiary separately with a summary on P & L Statement and balance sheet. 1.3 Support Functions (i) Give details of the support functions provided by the legal entities within the organization/group. The support functions include IT services, accounting and tax, internal audit and compliance, data storage and maintenance, and other support functions. The information should also include the name of the legal entity providing a particular support function and to which legal entities, along with the procedure of providing the support. 2. Capital Structure and Shareholding Pattern 2.1 Capital Structure (i) Give information on minimum regulatory capital requirements specified by the sectoral regulator/host regulator for each of the material legal entity of the organization/group (ii) Furnish details of authorized capital, paid-up capital, and capital structure split into components of CET1, Tier 1, Tier 2, etc., including the analysis, for each of material legal entity of organization/group. (iii) Give details of sources of capital raised/to be raised by each legal entity, including details of sources outside the organization/group. (iv) Amount of surplus capital maintained vis-à-vis current regulatory requirements/prescriptions, by each legal entity and in aggregate. (v) Give information on each of outstanding debt securities by class (senior unsecured, lower Tier 1 subordinated debt, etc.) and type (medium term notes, commercial paper, certificate of deposits, etc.).

2.1 Shareholding Pattern (i) Give names of major equity shareholders in each legal entity of organization/group along with details of total number of equity shares, number of equity shares held by major shareholders (5% or more equity holding), percentage shareholding by major shareholders. (ii) Information on amount of capital allocated by parent entity to each entity along with method of provision of capital to each entity. (iii) Details of payment of dividend, coupon, maturity cash flows, etc. by the legal entities to the parent entity. (iv) Information on restrictions, if any, on transfers of capital to other legal entities within the group. 3. Funding of entities 3.1 Give details of sources of funding for each of the legal entity. The information must include the names and amounts of funds provided: (i) details of deposits; (ii) certificate of deposits; (iii) debt securities as part of capital; (iv) off-balance sheet funding; (v) access to central bank funding, split into normal and special operations, where applicable. (vi) other sources including short-term financing, repos, etc. 3.2 Give overview of funding relationships within the group. The information should include: (i) Current intra-group balances; (ii) Current intra-group guarantees. This information should detail the following:

3.3 Other financial dependencies (i) Furnish details of all other intra-group financial dependencies. III. Financial interconnectedness 1. Intra-financial system assets 1.1 Lending/deposits to/in financial institutions (i) Amount lent to other financial institutions, including break-up of names and amounts lent to each of the financial institution; (ii) Amount deposited with other financial institutions, including break-up of names and amounts deposited in each of the financial institution; (iii) Undrawn committed lines extended to other financial institutions. 1.2 Investments in securities issued by other financial institutions (i) Information should include names and amount of investments made by the bank in each of the financial institutions:

1.3 Securities financing transactions with other financial institutions (part of Collateralised Borrowing and Lending Obligations) (i) Names and amount of net positive current exposure of securities financing transactions with each of the other financial institutions. 1.4 OTC derivatives with other financial institutions (i) Net positive fair value (ii) Potential future exposure using current exposure method (iii) Fair value of collateral that is held for these derivatives 1.5 Total intra-financial system assets 2. Inter-financial system liabilities 2.1 Deposits from other financial institutions (i) Information should include break-up of names and amount of deposits received from each of the financial institutions:

2.2 Loans/borrowings from other financial institutions (i) Information should include break-up of names and amount of loans/borrowings received from each of the financial institutions:

2.3 Marketable securities issued by the bank (i) Information should include break-up of names and amount of securities issued to which financial institutions:

2.4 Securities financing transactions with other financial institutions (part of CBLOs) (i) Names and amount of net negative current exposure of securities financing transactions with each of the other financial institutions. 2.5 OTC derivatives with other financial institutions (i) Net negative fair value; (ii) Potential future exposure using current exposure method; (iii) Fair value of collateral provided in respect of these derivative contracts. 2.6 Total intra-financial system liabilities 3. Critical Functions in each legal entity Critical functions (as defined by FSB in its consultative document on Recovery and Resolution Planning – Making the key attributes requirements operational) are activities performed for third parties, where failure would lead to disruption of services vital for the functioning of the real economy and for financial stability due to the banking group’s size or market share, external and internal interconnectedness, complexity or cross-border activities. E.g. payments, custody, particular lending and deposit activities in commercial or retail sector, clearing and settling, limited segments of wholesale markets, market making in certain securities and highly concentrated specialty lending sectors. 3.1 Deposit taking services (other than financial intermediaries) (i) Total number and total amount of savings accounts

(ii) Total number and total amount of fixed deposit accounts, with different maturity buckets

(iii) Total number and total amount of current accounts

3.2 Lending/credit services (other than financial intermediaries) (i) Total number and total amount of loans (outstanding) provided (a) Retail customers - with bifurcation on short-term and long-term lending Of which, secured loans by type of securities collaterals (such as mortgage, equipment, auto, etc.) (b) Retail lending made available through credit card products Total outstanding amount (c) Corporate lending - with bifurcation on short-term and long-term lending Of which, secured loans with details of nature of loans (d) Trade finance Total outstanding amount 3.3 Capital market exposures/activities (i) Long term investments in capital (on its own account) of:

(ii) Investments in capital (on behalf of clients) of:

(iii) Advisory services on trading of securities

(iv) Is the bank taking part as primary dealer (departmentally or as a subsidiary) in making of government securities market

3.4 Payment and settlement services (i) Services as a settlement bank in cheque clearing

(ii) Services for electronic payment and settlement

(iii) Transaction volume and value in handling fund transfer requests from customers under RTGS (iv) Credit card merchant services (a) Transaction volume and value of intermediary payment and settlement services provided by the bank between merchants and service providers and credit card networks (v) Exchange services

(vi) Membership of securities settlement system

3.5 Cash services (i) Size of retail branch network and ATM network

(ii) Details of currency chests managed by the bank

3.6 Critical shared services Critical shared services are activities performed within the bank, or outsourced to third parties, where failure would lead to the inability to perform critical functions, and therefore to disruption of services vital for the functioning of the real economy or for financial stability. Examples include information technology provisioning given the dependency of core banking services on IT and other services such as, facility management and/or administrative services. (i) Third party services (a) Services provided by the bank to other financial institutions, such as credit card systems, cheque processing, etc. Names of financial institutions with details of services provided (b) Details of IT services provided by the bank to other financial institutions Data storage and processing (ii) Functions outsourced by the bank (a) Details of financial services outsourced (b) Details of IT services outsourced Data storage and processing (c) Transaction processing outsourced Names of the service provider with details of service level agreements (d) Legal services/compliance Details of corporate legal support |

Page Last Updated on: