IST,

IST,

Annexure 1: Systemic Risk Survey

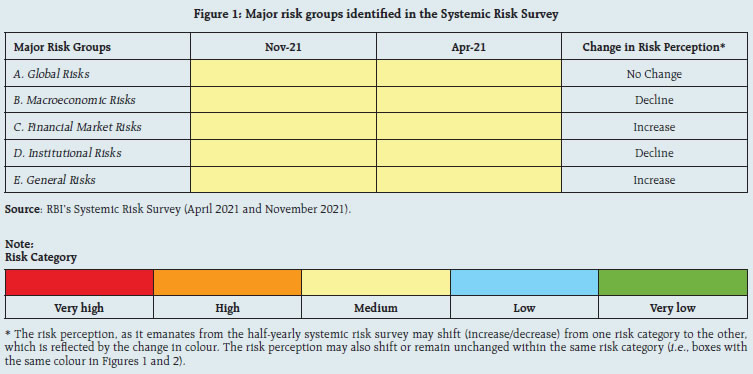

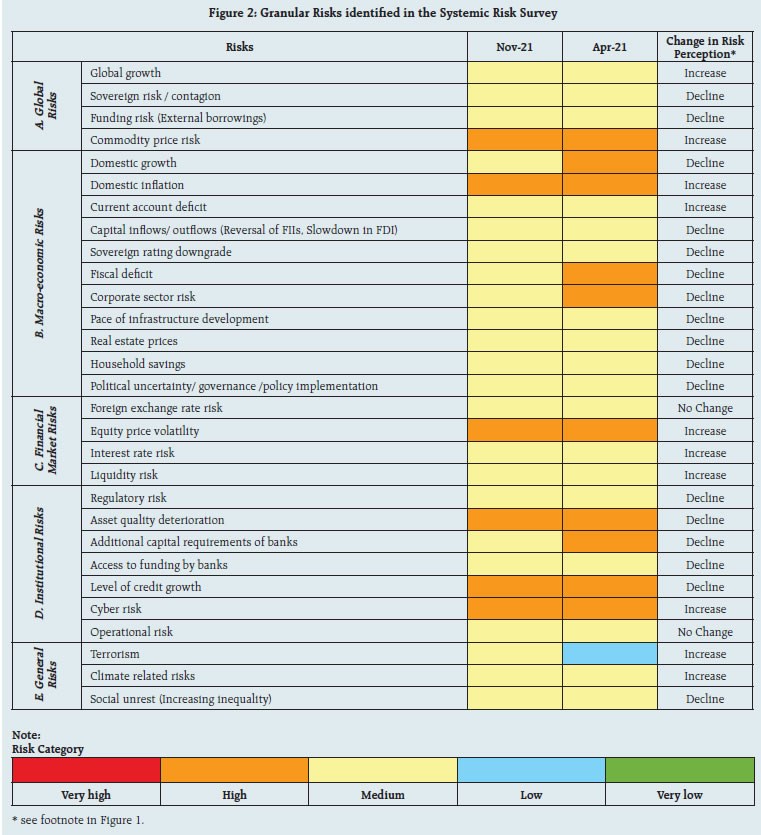

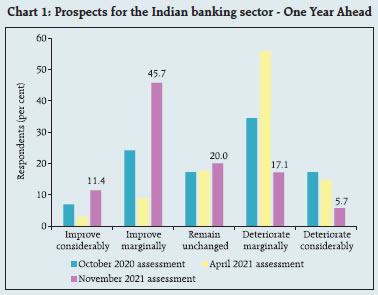

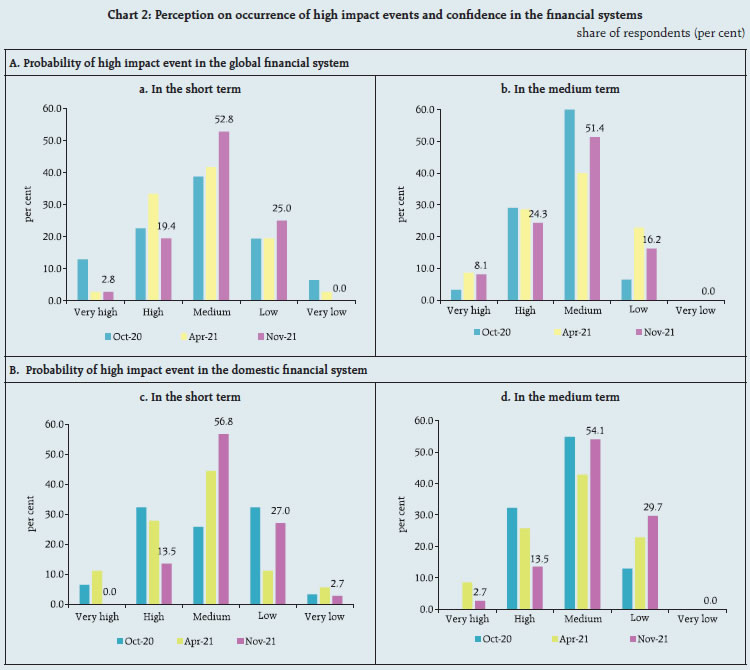

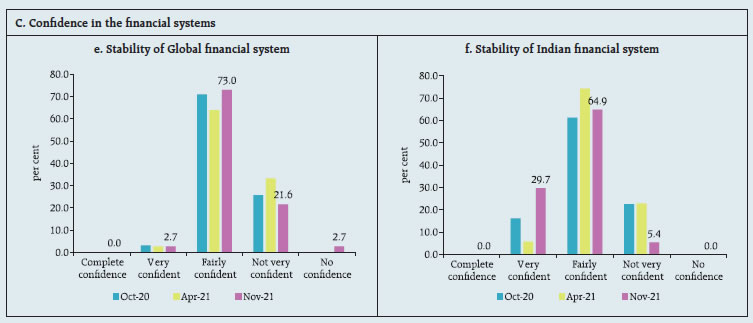

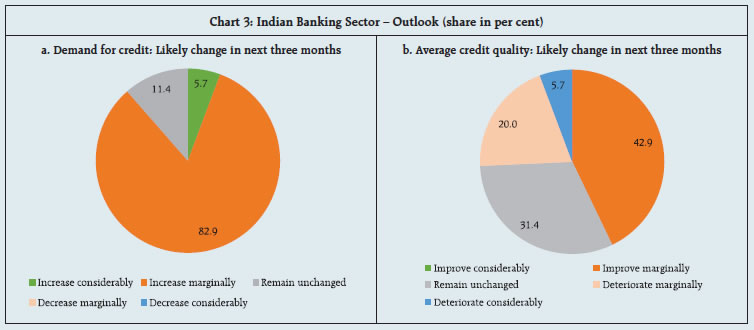

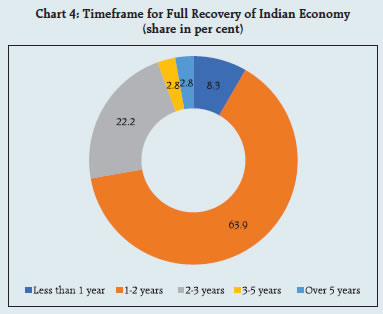

The twenty first round of the Reserve Bank of India’s Systemic Risk Survey (SRS) was conducted during November 2021 to capture perceptions on major risks faced by the Indian financial system. For the first time, views of the panellists were also solicited in this round on (i) the sectors/sub-sectors of the Indian economy which are likely to exhibit slower recovery from the impact of the COVID-19 pandemic; (ii) the segments of the financial markets, that are expected to experience higher volatility in the next six months to one year; and (iii) the time frame within which they expect the Indian economy to recover fully from the fallout of the pandemic. The survey results, which are based on feedback from 37 respondents, are encapsulated below. • The respondents perceived all broad categories of risks to the financial system – global spillovers; macroeconomic uncertainty; financial market volatility; institutional vulnerability; and general risks – as ‘medium’ in magnitude, but assessed global and financial market risks to be higher vis-a-vis other parameters (Figure 1). • Commodity prices, domestic inflation, equity price volatility, cyber risk, credit growth and asset quality were perceived as the major risk drivers (Figure 2).   • Risk perception on global growth, the current account deficit, interest rates, liquidity, terrorism and climate change increased, but remained in the medium risk category. • Risks posed to domestic growth, capital requirements of banks, the fiscal deficit, and corporate sector vulnerabilities were perceived to have declined. • Over half of the respondents expected better prospects for the Indian banking sector over the next one year (Chart 1). • Most respondents assigned medium probability to the occurrence of a high impact event in the global and domestic financial systems up to one to three years ahead (Chart 2), with the share of panellists assigning a low probability to such an event in the domestic financial system rising (Charts 2c, 2d, 2e and 2f).    • Over 80 per cent of the respondents expected a pick-up in credit demand over the next three months, with 43 per cent of them also expecting the quality of banks’ assets to improve on account of better macroeconomic prospects, improving financial health of borrowers, setting up of the NARCL and ongoing restructuring of assets (Charts 3 a and 3 b). • Majority of the respondents expected the Indian economy to recover completely from the fallout of the COVID-19 pandemic in a span of 1-2 years (Chart 4), but contact intensive sectors (tourism and hospitality; aviation; automobiles; MSMEs; retail trade; real estate; and entertainment) could lag over the year ahead.

Risks to Financial Stability Panellists in the 21st round of the Reserve Bank of India’s Systemic Risk Survey identified the following major risk factors for financial stability:

|

Page Last Updated on: