IST,

IST,

Report of the Expert Committee on Micro, Small and Medium Enterprises

The Report of the ‘Expert Committee on Micro, Small and Medium Enterprises’ was made possible with the support of individuals and organizations. The Committee would like to gratefully acknowledge representatives of various Ministries, State Governments, World Bank, Asian Development Bank for their valuable inputs and suggestions. The Committee would like to place on record suggestions from other stakeholders viz., SEBI, SIDBI, TransUnion CIBIL, GSTN, SBI General Insurance, NSeDL, A.TREDS, CRISIL, Acuite Ratings & Research Ltd, Capital Float, LetsVenture and Omidyar Network India. The Committee benefitted from the interactions which the Chairman had with Shri Nitin Gadkari, Minister of MSME; Shri Arun Jaitley, former Finance Minister; Shri N K Singh, Chairman of the Fifteenth Finance Commission; Shri Shaktikanta Das, Governor, Reserve Bank of India; Shri Subhash Garg, Secretary, Department of Economic Affairs, Ministry of Finance; Shri Rajeev Kumar, Secretary, Department of Financial Services, Ministry of Finance; Shri Arun Kumar Panda, Secretary, Ministry of MSME; and Shri Junaid Ahmad, Country Director, World Bank (India). The Committee is also grateful to Shri Ramesh Abhishek, Secretary, DPIIT, Ministry of Commerce & Industry; Shri Amarjeet Sinha, Secretary, Ministry of Rural Development; Shri Yaduvendra Mathur, Special Secretary, NITI Aayog; and other representatives of Ministries and organisations who made presentations before the Committee. The Committee invited submissions from members of the public and is grateful for a number of helpful suggestions received. The Committee greatly benefitted from the inputs received during the discussions held with various Industry Associations and MSME entrepreneurs. The Committee would also like to express gratitude to all the Regional Offices of Reserve Bank of India for the studies conducted and inputs provided. Special thanks to Regional Offices of Ahmedabad, Bengaluru, Chennai, Guwahati, Kolkata, New Delhi and College of Agricultural Banking, Pune for the support extended towards organizing meetings of the Committee. The Committee also places on record the assistance provided by Shri Ashish Jaiswal, Deputy General Manager, Financial Inclusion and Development Department; Shri Radheshyam Verma, Assistant Adviser; Shri Kunal Priyadarshi and Shri Sarthak Gulati, Managers of Department of Economic & Policy Research, Reserve Bank of India. Finally, the Committee would like to commend the efforts put in by the Secretariat team from Financial Inclusion and Development Department, Reserve Bank of India led by Smt. Sonali Sen Gupta, Chief General Manager and supported by Smt. Baljit Birah, General Manager; Smt. Shruti Joshi, Assistant General Manager; and Shri Gajendra Sahu, Manager. Micro, Small and Medium Enterprises form a vital component of the Indian Economy. The Government and Reserve Bank of India have taken a number of measures from time to time to support this sector. A number of committees appointed by the Government/RBI have identified issues and made recommendations in the past. Many of these recommendations have guided different policy initiatives. However, MSMEs continue to face challenges of formalization, access to knowledge services, access to timely and adequate finance, improving competitiveness, availability of skilled man-power, access to latest technology and marketing. The MSME sector is yet to benefit from the advances in digitization, which can substantially reduce the cost and time for this sector. SHGs and rural entrepreneurship have made very good progress in the last few years, but creating the environment for the next stage of their growth is a task yet to be accomplished. The sector was also affected in the recent past due to structural changes in the economy. In this backdrop, Reserve Bank of India constituted the present Expert Committee on MSMEs to undertake a comprehensive review of the sector and to identify causes and propose long-term solutions, for their economic and financial sustainability. The Committee held fifteen meetings, had consultations with industry associations and State Governments across the country. It met representatives of Central Government in different ministries and several experts and other stakeholders. The Committee also examined the experiences in other countries. Inputs received during these discussions have considerably helped the Committee in its deliberations. The Committee has looked into areas of capacity building, policy changes and financing needs so as to unlock the potential of this sector. I hope that RBI and the Government will find proposals made in the report useful. U K Sinha 1. Micro, Small and Medium Enterprise (MSME) sector has emerged as a very important sector of the Indian economy, contributing significantly to employment generation, innovation, exports, and inclusive growth of the economy. The MSMED Act, 2006, was enacted to provide enabling policy environment for promotion and development of the sector by way of defining MSMEs, putting in place a framework for developing and enhancing competitiveness of the MSME enterprises, ensuring flow of credit to the sector and paving the way for preference in Government procurement to products and services of the MSEs, address the issue of delayed payments, etc. However, in the changed circumstances, it is imperative that the thrust of this important legislation should be focused more on market facilitation and promoting ease of doing business for MSMEs. Accordingly, the legislation may be reimagined as a comprehensive and holistic MSME Code having a provision for sunset on plethora of complex laws scattered all over the legislative framework. Under this new law, the territorial jurisdiction based and arbitrary inspection system may be substituted with a policy based and transparent inspection system. It is expected that the new law will be able to address the major challenges, relating to physical infrastructural bottlenecks, absence of formalisation, technology adoption, capacity building, backward and forward linkages, lack of access to credit, risk capital, perennial problem of delayed payments, etc. These problems are hindering the development of a conducive business environment for expansion of the sector. The Committee noted that a thriving entrepreneurial eco-system is a policy imperative for realizing the potential of the sector and ensuring sustainable growth of the sector. 2. Global trends in classifying the MSMEs show that it widely differs across jurisdictions and depends upon the government policies of the country. Though, a comparison of some of the countries revealed that most of them are using number of employees as a variable to define MSMEs, in India, MSMEs are presently defined based on investment in plant and machinery / equipment. To facilitate ease of doing business, the Government has proposed turnover based definition by replacing the current investment-based definition of MSMEs. The Committee deliberated upon the proposed definition and found it rational, transparent, progressive and easier to implement with the introduction and operationalization of Goods and Services Tax (GST). Further, the registration under GST has also led to formalization of the sector to a certain extent. The Committee also felt that in view of the need to adjust the definition criteria from time to time in the context of the changing economic scenario, the Parliament may consider delegating the power of classifying MSMEs to the Executive. 3. MSEs face problems of delayed payments and hesitate to enforce the legal provisions available to them under the MSMED Act due to their low bargaining power. As timely payments to MSEs is of least priority to the buyers, the solution must be necessarily designed around the buyers. The Committee recommends amendment to the MSMED Act requiring all MSMEs to mandatorily upload all their invoices above an amount to be specified by Government, from time to time, to an Information Utility. Further, a monitoring authority should be set up under DC MSME and should be notified under IBBI IU Regulation No. 23. While this mechanism will entail automatic display of the names of the defaulting buyers, it will also act as a moral suasion on the buyers to release payment to MSE suppliers. Further, majority of the States have only one MSE Facilitation Council (MSEFC) which is not adequate to cater to delayed payment cases arising in the entire State. Hence, there is a need to increase the number of Facilitation Councils particularly in larger States. 4. As per the MSMED Act, Government has notified procurement policy wherein PSUs/ Government Departments have to make 25% of their procurement from MSEs. To further strengthen the procurement mechanism, the Government has also launched the GeM portal. The Committee recommends that Government should make it mandatory for PSUs/ Government Department to procure from MSEs up to the mandated target of 25% through the GeM portal only. Further, the portal can be developed as a full-fledged market place enabling MSE sellers to procure raw-material as well. The Committee also recommends that the General Financial Rules (GFR) and Departmental Procurement Codes/ Manuals, as the case may be, be amended to prohibit placing of purchase orders in excess of the annual budget approved by the Legislature/ Government. 5. Presently, MSMEs must do multiple registrations with various entities such as Udyog Aadhaar portal, GSTN, NSIC, etc. This leads to cumbersome registration process and duplication of efforts. It is, therefore, recommended that the Government should make PAN as a Unique Enterprise Identifier (UEI) and the same should be used for various purposes like procurement, availing government sponsored benefits, etc. 6. Enabling environment, encompassing tax concessions, well developed infrastructure, ease of doing business, exit policy, etc. available in other countries is incentivising the Indian startups to migrate. It is recommended that suitable financial and non-financial incentives must be deployed to retain successful Indian startups entities in India. 7. Capacity building of the entrepreneurs is an essential pre-requisite for development of the sector as it equips the entrepreneurs with the necessary knowledge and wherewithal to function. It has been proposed to establish Enterprise Development Centres (EDCs) within District Industries Centres (DICs) in each district. These institutions should be strengthened to be able to run professionally and facilitate development of entrepreneurs into full-fledged, self-sustaining enterprises. Support extended to these entities by national and state level SPVs for knowledge creation and dissemination will be crucial for their success. The Committee observed that such a step, if implemented, effectively would provide necessary handholding support in various aspects such as technical know-how, managerial skill, filling up of the knowledge gap, etc., leading to a multiplier effect. They should also be equipped to assist rural enterprises in respect of GST, IT, UAM registration, PAN application, loan document preparation, etc. 8. Presently, MSME clusters are inadequately equipped in areas such as tool rooms, innovation centres, testing facility, etc. The Committee recommends that these clusters should collaborate with companies having innovation infrastructure, R&D institutions and universities that specialize in a specific industry or knowledge area. Most cluster development initiatives are funded to a large extent by the public agencies and private sector contribution for such common initiatives is miniscule. It is recommended that ways and means to enhance private sector contribution must be found, viz., through debt instruments like bonds, CDs, etc., with tax incentives through SIDBI, so that larger number of clusters can be supported. 9. MSMEs lack expertise in product development, technology adoption and marketing strategy. To alleviate these problems, it is recommended that Government should build networks of development service providers that can provide customized solutions to MSMEs in the area of technology, product development and marketing techniques. Further, the Committee recommends for strengthening of MSME Export Promotion Council. 10. Ministry of MSME may consider setting up of a Non-Profit Special Purpose Vehicle (SPV) to support crowd sourcing of investments by various agencies particularly to pave the way for conducive business ecosystem for MSMEs. Further, for convergence of policies and creating a promotional ecosystem, it is recommended that a National Council for MSMEs should be set up at the apex level under the Chairmanship of the Prime Minister with the Ministers for MSME, Commerce & Industry, Textiles, Food Processing, Agriculture, Rural Development, Railways and Surface Transport being members. The States should have a similar State Council for MSMEs, for better co-ordination of developmental initiatives. 11. SIDBI is the apex body responsible for the development of the MSME sector. The Committee has made wide ranging recommendations for expanding the role of SIDBI. The Government should deploy the PSL shortfall to SIDBI on the lines of RIDF fund of NABARD, for lending to State Governments as soft loans for infrastructural and cluster development. SIDBI should deepen credit markets for MSMEs in underserved districts and regions by handholding private lenders such as Non-Banking Finance Companies (NBFCs) and Micro Finance Institutions (MFIs). Further, they must develop additional instruments for debt and equity which would help crystallise new sources of funding for MSMEs and MSME lenders such as first loss guarantees, Pass Through Certificates (PTCs), etc. SIDBI should gradually take on the role of a market maker for SME debt on select platforms. 12. SIDBI, as a nodal agency, should ideally play the role of a facilitator to create platforms wherein various Venture Capital Funds can participate and in turn create multiplier effect for providing equity support to MSMEs. A Government sponsored Fund of Funds (FoF) to support VC/PE firms investing in the MSME sector should be set up to encourage them to invest in the MSME segment. 13. Insolvency and Bankruptcy Code provides for a differentiated regime for insolvency / bankruptcy of firms, proprietary firms and individuals. Delegated legislation/ rules in this regard are currently under discussion. The finalization of these rules can boost lender confidence because lenders will have more certainty and predictability regarding the recovery of defaulted loans. Considering their vulnerability and size, Insolvency Code / delegated legislation should provide for out-of-court assistance to MSMEs, who are predominantly proprietorships, such as mediation, debt counselling, financial education, etc. 14. The Committee recommends for the creation of a Distressed Asset Fund, with a corpus of ₹ 5000 crore, structured to assist units in clusters where a change in the external environment, e.g. a ban on plastics or ‘dumping’ has led to a large number of MSMEs becoming NPA. This fund could then operate on the lines of the Textile Upgradation Fund Scheme (TUFS) which has been in existence over many years. This would be of significant size in order to make equity investments that help unlock debt or help revive sick units. 15. Credit guarantee is an important risk mitigating tool which provides cushion to the lender for lending to MSEs. Currently, CGTMSE and NCGTC have devised credit guarantee schemes for MSE loans. However, these entities are currently outside the purview of regulation. It is, therefore, recommended that all Credit Guarantee Schemes should be subject to the regulation and supervision of RBI. While framing the regulatory and supervisory guidelines RBI can draw upon the well acknowledged principles for design implementation and evaluation of Public Credit Guarantee Schemes for SMEs, which has been evolved by the World Bank Group. 16. MSMEs lack the wherewithal to cope with situations like natural calamities. Government should take active efforts to provide insurance coverage to MSME employees on the lines of PMSBY and PMJJBY schemes. Workers at urban and rural formalised MSEs need to be specifically covered under Ayushman Bharat - PMJAY. 17. The Committee observed that MUDRA would require enhancement of in-house (or outsourced) capabilities, including underwriting, risk management, fund raising based on its own AAA rating and sharper focus on emerging trends in the market. Hence, a reimagining of MUDRA is necessary including assessing the rationale for continuing it as a subsidiary of SIDBI. The Committee further recommends that SHG enterprises may be brought under the purview of MUDRA’s guarantee programme. 18. With the increased availability of data from several sources, including GSTN, Income Tax, Credit Bureaus, Fraud Registry, etc., it is now possible to do most of the due diligence online and appraise the MSME loan proposals expeditiously. It is recommended that banks should have access to such surrogate data for speedier and robust credit underwriting standards. 19. The PSBLoansIn59Minutes portal as of now caters only to existing entrepreneurs having information required for in-principle approval such as GSTIN, Income Tax returns, bank statement, etc. The Committee recommends that the portal should also cater to new entrepreneurs, who may not necessarily have such information, including those applying under PMMY loan and Standup India. A timeline of 7 – 10 days needs to be fixed for disposal of applications, which have received in-principle approval and threshold of loan should be enhanced upto ₹5 crore. Further, the portal should be linked with land records, CERSAI and CGTMSE. 20. The traditional bank lending system by banks is based on financial statements and collateral of the borrower. Operationalization of GSTN has made available turnover related data. Further, when Account Aggregators (AA) gets operationalized, lenders will have access to borrowers’ transactions at a single point. These new architectures would facilitate cash flow-based lending. It is, therefore, recommended that banks need to move towards cash flow-based lending. 21. TReDS is an effective mechanism to solve the problem of delayed payments and liquidity issues of MSMEs. The Committee deliberated upon scaling up of the platform and recommends for creation of pooled API of all TReDS platforms providers that would enable the financiers to understand the past repayment history of buyers thus enabling them to take more informed decisions. It will also rule out the possibility of dual financing. National Payments Corporation of India (NPCI) which acts as settlement entity for TReDS may consider creating such an API. The Committee observed that reverse factoring has not picked up on the platform, which needs to be promoted due to its inherent advantage. It is, therefore, recommended that a second TReDS window should be created for reverse factoring so that supplier financing can be provided easily. The Committee was apprised that GeM and TReDS platforms have worked out collaborative arrangement whereby invoices, which have a certificate of acceptance, will be put up for discounting on TReDS platform through an integrated system. This will enable the bill to be discounted, the PSE will get time to make the payment and the MSME supplier will get funds. The integration of GeM and TReDS needs to be completed within a time bound manner. 22. The PSL guidelines apply uniformly to all the lenders and mandates specific targets to banks to lend to priority sectors, i.e. agriculture, small and marginal farmers, micro enterprises, weaker sections, etc. The Committee recommends introducing a concept of adjusted PSL to enable the banks to specialise in lending to a specific sector. This will be a win-win situation for both lenders and borrowers as lenders will have the advantage to build expertise in lending to the specific sector and borrowers will benefit from customised financial products and services. 23. As per RBI’s extant guidelines issued in 2010, banks are mandated not to seek collateral security for loans upto ₹10 lakh. Considering price rise, the Committee recommends to revise the collateral free loan limit to ₹20 lakh. The same should also apply to loans sanctioned under PMMY and to SHG based enterprises. 24. In order to provide loan portability in a seamless manner to MSMEs, the Committee recommends that RBI should come out with measures on portability of MSME loans with a lock in period of one year. 25. The Committee considered that there is a case for increasing the exposure limit of ₹5 crore for Regulatory Retail to at least ₹7.5 crore, which can benefit a large number of MSMEs. 26. With a view to reduce the credit gap, a new intermediary i.e., Loan Service Providers (LSPs) – who will be an agent of the borrowers is recommended for consideration by RBI. Further, the Committee recommends that the RBI should facilitate the creation of a Self-Regulatory Organization, on the lines of AMFI and RIAs, to organize and provide light touch regulation for this category of players. The LSPs will offer individualized advice and should act in borrowers’ best interests, respecting fiduciary duties of disclosure, loyalty and prudence. 27. The Committee recommends for creation of Digital Public Infrastructure that will have the potential to reduce loan operating costs significantly. Furthermore, it will address information asymmetry that improves credit access and overall quality in the lending space. Under the Digital Public Infrastructure, deployment of E-Liens will lock the future incoming cash flows and would lead to better repayment rates. 1.1 Background 1.1.1 Micro, Small and Medium Enterprises (MSMEs) are amongst the strongest drivers of economic development, innovation and employment. The MSME sector also contributes in a significant way to the growth of the Indian economy with a vast network of about 63.38 million1 enterprises. The sector contributes about 45% to manufacturing output, more than 40% of exports, over 28% of the GDP while creating employment for about 111 million2 people, which in terms of volume stands next to agricultural sector. The MSME sector in India is exceedingly heterogeneous in terms of size of the enterprises and variety of products and services, and levels of technology employed. However, the sector has the potential to grow at a faster pace. To provide impetus to the manufacturing sector, the recent National Manufacturing Policy envisaged raising the share of manufacturing sector in GDP from 16% at present to 25% by the end of 2022.1.1.2 In order to enable identification and facilitate development of MSMEs, Government of India had enacted the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006. Prior to the enactment of this act, small industries encompassed tiny, cottage, traditional, and village enterprises and MSEs in India were collectively termed as Small Scale Industries (SSIs) under the Industrial Development and Regulation (IDR) Act, 1951. The MSMED Act, 2006 has provided the legal framework for identifying the concept of ‘enterprise’ which includes entities both in manufacturing and service sectors and has categorized the enterprises into three tiers viz., Micro, Small and Medium. 1.1.3 The definition of small scale industries differs from country to country as the classification is based on different parameters viz., turnover, number of employees, etc. Under the Industrial Development and Regulation (IDR) Act, 1951, the notion of small industries in India was conceived in terms of number of employees. In absence and difficulty in obtaining reliable data on number of employees, investments in plant & machinery / equipment was suggested as a proxy. Currently, the classification of MSMEs is done based on investment in plant & machinery/equipment in accordance with the provision of Section 7 of MSMED Act, 2006, as indicated below: 1.2 Major Challenges faced by the sector The contribution of the sector in the economy is currently constrained due to several challenges affecting growth of the sector. Some of the major ones are mentioned below: 1.2.1 Policy and institutional interventions In order to provide support to the MSME sector and to facilitate its growth, there are numerous institutions in the country. At the apex level, the Ministry of MSME formulates policies for overall growth of the sector while the Office of Development Commissioner MSME implements these policies through its various organisations. MSMED Act, 2006 contains various facilitative provisions for the promotion and development of the MSME sector. SIDBI is the apex financial Institution for supporting financing and development of MSMEs. RBI and SEBI frame broad policies for facilitating funding support to the sector. The above institutions through their legislative and policy interventions are enabling growth of the sector. However, formulation of targeted policies in the areas of infrastructure development, formalisation, technology adoption, backward and forward linkage, credit gap reduction and timely payments to MSMEs and their effective implementation has been a challenge for all the stakeholders. Government interventions have tended to be fairly supply-side oriented and unable to effectively respond to demands of the market. 1.2.2 Accelerating growth and enabling formalisation The role of MSME sector is critical in job creation, innovation, and entrepreneurship and supply chains. Hence, there is a need to facilitate, nurture and support innovative business ideas and shape them into enterprises. Further, with limited number of entrepreneurial development and incubation centres, entrepreneurial ethos of the MSME eco- system is not evolving. Utilisation and reach of various schemes and credit support is constrained due to lack of formalisation and low level of registration of MSMEs in Udyog Aadhaar Memorandum (UAM). Promoting formalisation and digitisation amongst MSMEs and encouraging them to register in UAM has remained a challenge. 1.2.3 Addressing infrastructural bottlenecks Infrastructural bottlenecks affect the competitiveness of MSMEs and reduces their ability to venture into domestic as well as global markets. Inadequate availability of basic amenities such as work sheds, tool rooms, product testing laboratories, electricity, rural broadband and innovation hubs is acting as a deterrent to the growth of the sector. Development of MSME clusters has been largely confined to Government organisations with low level of private investment. 1.2.4 Facilitating capacity building Traditionally, MSMEs are subject to severe information asymmetry problems. Lack of information about various schemes for instance, deprive MSMEs from availing benefits offered by Government, banks and other agencies. Access to information about market opportunities is sub optimal and unstructured. In many cases, they also lack managerial, legal and technical knowhow and the necessary wherewithal to function effectively. 1.2.5 Facilitating access to credit and risk capital Due to their informal nature, MSMEs lack access to formal credit as banks face challenges in credit risk assessment owing to lack of financial information, historical cash flow data, etc. Further, very few MSMEs are able to attract equity support and venture capital financing. 1.2.6 Technological interventions for improving underwriting standards and delivery Implementation of GST has made turnover data available at a single network. However, MSMEs are not identifiable as the data on investments in plant and machinery is not captured under GSTN. Income tax data base contains information relating to financials of the units. On the other hand, Udyog Aadhaar portal contains registration related information of MSMEs. However, there is no single interface available for the lenders to access, map or triangulate data from these data sources and they have to primarily rely upon manual information furnished by borrowers. Further, absence of data protection laws and unique enterprise identifier limit ability of various agencies to share data. 1.2.7 Enabling market linkage and tie-up with public procurement platforms MSMEs face the twin challenge of limited access to quality raw material and market for finished product. National Small Industries Corporation (NSIC) through market assistance scheme facilitates MSMEs to discover markets for their products and the Government e-Marketplace (GeM) portal has enabled MSMEs to connect with buyers from Public Sector Undertakings (PSUs) and Government Departments. However, the number of MSMEs availing benefits under the schemes are few. For example, the GeM portal has 38,609 registered MSMEs on the platform as on June 12, 2019. 1.3 Need for a Committee 1.3.1 The Government and RBI have taken several initiatives and measures to address the issues faced by MSMEs. However, the sector remains informal and vulnerable to structural and cyclical shocks, at times with persistent outcomes. Further, an increasingly globalized world, marked by competition and innovation is posing newer and varied challenges to the MSMEs. The increasing stress in the sector is a matter of concern and therefore, it was felt imperative that a comprehensive review should be undertaken of the entire MSME ecosystem along with global best practices for suggesting measures for a holistic development of the sector. For this, an all- inclusive approach was necessary to be adopted with special focus on appropriate policy and institutional interventions, accelerating incubation and enabling formalisation, addressing infrastructural bottlenecks, facilitating capacity building, enabling access to risk capital, credit and technological interventions for improving underwriting standards and delivery, supporting market linkage and tie-up with public procurement platforms, etc. 1.3.2 Towards this end, it was announced in the Fifth Bi-Monthly Monetary Policy Statement for 2018 -19, dated December 5, 2018, that RBI will constitute an Expert Committee on Micro, Small and Medium Enterprises to propose long term solutions, for the economic and financial sustainability of the MSME sector. As an outcome to this announcement, an Expert Committee was constituted under the Chairmanship of Shri U K Sinha with the following terms of reference:

1.3.3 The Committee comprises of the following:

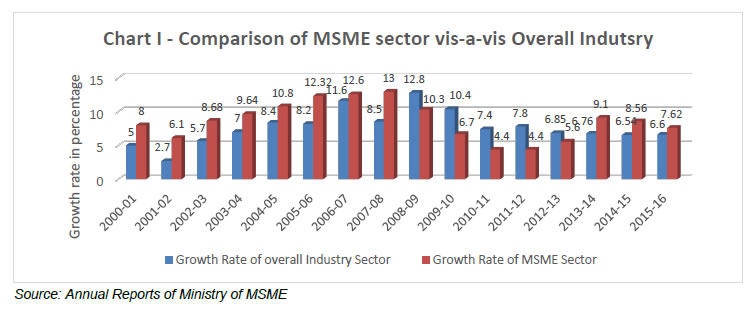

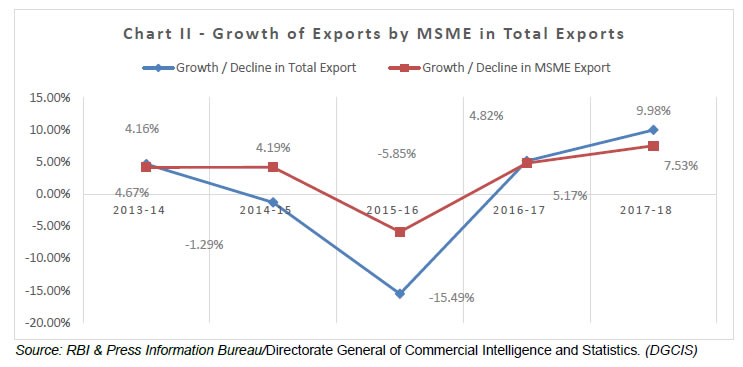

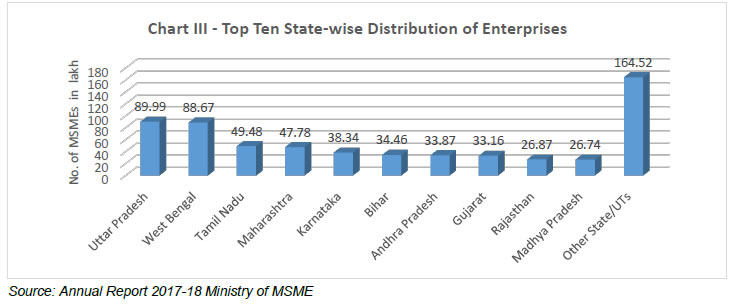

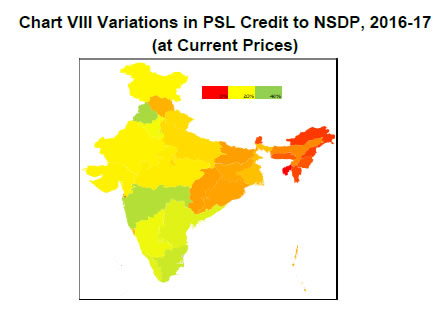

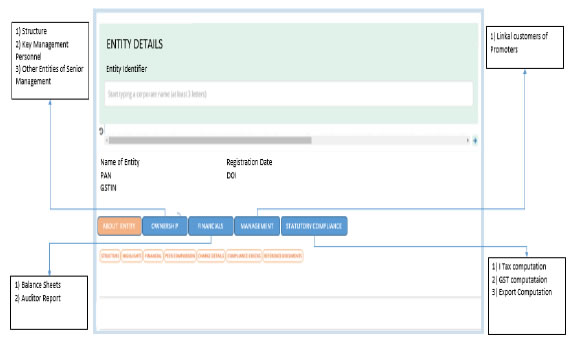

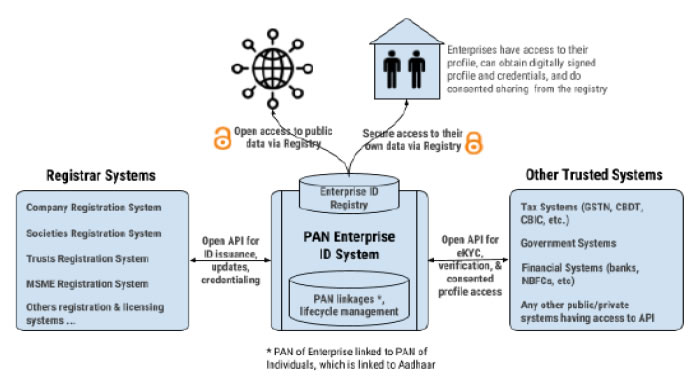

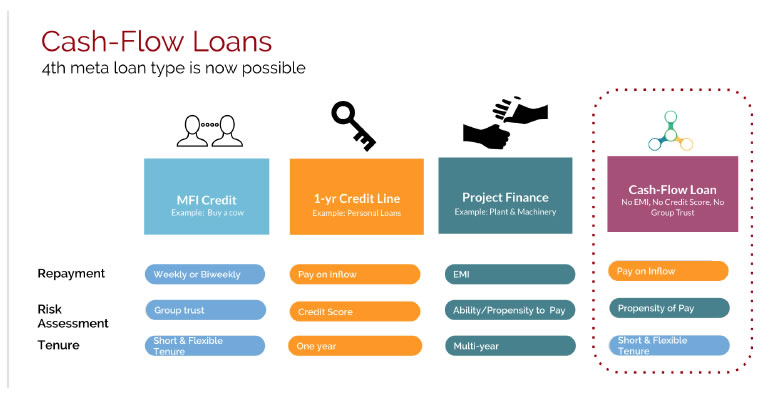

1.4 Approach / Methodology The Expert Committee held fifteen meetings in various parts of India between January 2019 and June 2019. The details of the meetings are given in Annex I. During these meetings, the Committee interacted with all stakeholders including representatives of Ministries of Central, / State Governments Departments, NITI Aayog, MP Finance Corporation, Industry Associations, and MSME borrowers to deliberate on the issues of the sector and get suggestions for its improvement. The Committee also met representatives from SEBI, TransUnion CIBIL, GSTN, SIDBI, A-TREDS, CRISIL, Acuite Ratings & Research Ltd., Capital Float, LetsVenture, Omidyar Network India, etc., to understand their role in promoting growth of the sector. Further, the Committee had consultation with Multilateral Organization like World Bank and IFC to get cross country experience related to development of MSME sector. The Committee deliberated on the various issues relating to its terms of reference. Various presentations were made to the Committee by the experts. The major findings and the recommendations of the Committee are discussed in the chapters that follow. 1.5 Structure of the Report The Report has nine chapters apart from Executive Summary. Chapter 1 provides an introduction outlining the role of the sector and its issues leading to the constitution of the present Committee. Chapter 2 presents growth in MSME sector under various parameters. Chapter 3 briefly outlines the success stories of various models adopted in other countries for the sector that are relevant for India. Chapter 4 deals with various legislations and Institutional framework for MSME sector. Chapter 5 touches upon the Infrastructural bottlenecks and capacity building for the sector. Chapter 6 deals with Government Schemes for the sector. Chapter 7 deals with various issues related to credit for the sector. Chapter 8 covers the new technological interventions required for MSME lending and Chapter 9 contains summary of recommendations. The MSME sector is universally regarded as an engine of economic growth and for promoting equitable development. The sector also helps the economy by promoting a balanced development of industries across all regions of the nation. The major advantage of the sector is its employment potential at low capital cost. 3Small and Medium enterprises (SMEs) account for about 90 percent of businesses and more than 50 percent of employment worldwide. They are key engines of job creation and economic growth in developing countries. 2.1 Growth Pattern of MSMEs in India India is currently one of the fastest growing economies of the world. MSME sector is likely to continue to play a significant role in the growth of the Indian economy. In the last ten years, MSME sector has shown impressive growth in terms of parameters like number of units, production, employment, and exports. Given the right set of support systems and enabling framework, this sector can contribute much more, enabling it to actualize its immense potential. 2.2 Growth rate of MSME Sector in comparison with the Overall Industrial Sector MSMEs provide employment opportunities at comparatively lower capital cost and act as ancillary units for large enterprises to support the system in growth. Chart I depicts the growth rate of MSME sector in comparison with the overall industrial sector during last sixteen years. The MSME sector has in many years registered a higher growth rate than the overall growth of industrial sector. During 2000 to 2006, India witnessed industrial growth in the range of 5-8% annually. Subsequently, it recorded double digit growth for 4-5 years, before slowing down to around 6% growth during 2015-2016. The MSME sector improved its growth performance during 2003 – 2009 and recorded a growth of over 10% during 2008-09. Introduction of MSMED Act, 2006 apparently played a role here. However, post 2008 global financial crisis, MSME growth fell sharply and hovered around 4-7%. 2.3 Contribution of MSMEs in Indian Economy 2.3.1 MSMEs have been contributing significantly to the expansion of entrepreneurial base through business innovations. MSMEs are widening their domain across sectors of the economy, producing diverse range of products and services to meet demands of domestic as well as global markets. There are over 60004 products ranging from traditional to high-tech items, which are being manufactured by the MSMEs in India. 2.3.2 As per the latest data available with Central Statistics Office (CSO), Ministry of Statistics & Programme Implementation (MoSPI), the contribution of MSME Sector in the country’s GVA and GDP, at current prices for the last five years is given in Table II: The contribution of the MSME sector to India’s GDP remained stagnant around 30% in recent years. GVA of MSMEs decelerated marginally during the same period. 2.3.3 As a close proxy of the dimension of the diversity of MSME sector, composition of establishments and number of persons employed by broad activity groups, with break-up for each type of establishment based on 6th Economic Census is presented in Table III. ‘5Retail trade’, ‘Manufacturing’ and ‘Other service activities not elsewhere classified (including membership organization, repair of computers and personnel household goods)’ are the three most important activity groups in terms of number of establishments in the non-agricultural sector. Together these three activity groups account for 67% of the total establishments, of which ‘retail trade’ held a share of over 35%. 2.3.4 As per the National Sample Survey (NSS) 73rd round, conducted by National Sample Survey Office (NSSO), MoSPI, during the period 2015-16, there were 633.88 lakh unincorporated non-agriculture MSMEs in the country engaged in different economic activities excluding the MSMEs registered under (a) Sections 2m(i) and 2m(ii) of the Factories Act, 1948, (b) Companies Act, 1956 and (c) Construction activities falling under Section F of National Industrial Classification (NIC) 2008. Table IV shows the distribution of MSMEs category wise. 2.3.5 MSMEs require low capital to start the business, but create huge employment opportunities. As per the National Sample Survey (NSS) 73rd round conducted during the period 2015-16, MSME sector has been creating 1109 lakh jobs (360.41 lakh in Manufacturing, 387.18 lakh in Trade and 362.22 lakh in Other Services and 0.07 lakh in Non-captive Electricity Generation and Transmission) in the rural and the urban areas across the country. Table V shows activity- wise distribution of employment generated by MSMEs. 2.4 SME Employment share of select Asian Economies As per the data of ADB 2015 report, the share of the workforce employed by SMEs varies greatly over countries. It ranges from 32% to 88% as shown in Table VI. 2.5 Comparison of MSME export to total exports 2.5.1 The MSME sector in India is contributing more than 40% to exports. It can be seen from the Table VII below that the share of MSME exports has increased from 43% in 2012-13 to 49% in 2017-18. 2.5.2 Further, the trend in growth of MSME exports is in line with the total exports of the country. As can be seen from Chart II, MSME exports grew by 4.19% in 2014-15, which declined to -5.85 % in 2015-16. During the same period total exports also declined from -1.29% to -15.49%. During 2016-17 and 2017-18 there was positive growth in case of both MSME exports and total exports. 2.6 State-wise distribution of estimated MSMEs In India, MSMEs are concentrated mainly in top ten states. Nearly 93% of enterprises comes from these ten States. Chart III shows the distribution of estimated enterprises in top ten States. It can be seen that Uttar Pradesh has the largest number of estimated MSMEs with a share of 14.20% of MSMEs in the country. West Bengal comes a close second with a share of 14%. The top ten States together accounted for a share of 74% of the total estimated number of MSMEs in the country. 2.7 Registration of New MSMEs 2.7.1 One of the critical indicators to assess the successful development of the MSME Sector in an economy is the data on opening of new MSMEs; it depicts the conducive environment provided for the sector to grow. Before the MSMED Act, 2006, there was a system of registration by small scale industrial units to the District Industries Centre (DICs). Subsequently, as per the provisions of the MSMED Act, 2006, MSMEs used to file Entrepreneurs Memorandum (Part-I) at DICs before starting an enterprise. After commencement of production, the entrepreneur concerned used to file Entrepreneurs Memorandum (Part-II)/ [EM-II]. A total of 21,96,902 EM-II filings took place between 2007 and 2015. 2.7.2 Since September 2015, with a view to promoting ease of business, an online filing system under UAM based on self-declared information has been put in place. Till June 12, 2019, 68.98 lakh MSMEs have already registered on the Udyog Aadhaar Portal. This topic has been discussed in detail in Chapter 4 on – Legislation and Institutional Support. 2.8 MSME Census A brief write up on MSME Census is given in Box I

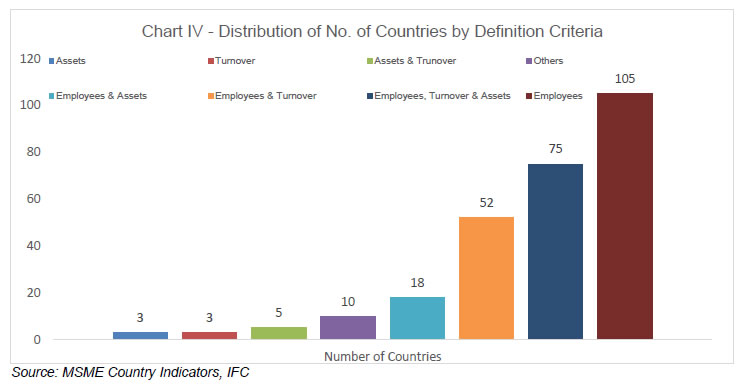

Development of a dynamic MSME sector is perceived as a policy priority in both developed and emerging economies. A few successful and effective MSME models adopted by various countries have been identified in the areas related to Definition of MSMEs, Credit Guarantee, Single Nodal Entity, Cluster Development, Risk Capital Financing, Capacity Building, etc. In this context, the models adopted in Italy, Malaysia Turkey, Mexico and China are very relevant. 3.1 Global trends in classifying MSMEs 3.1.1 The definition of MSMEs differ widely across countries due to heterogeneity in MSMEs themselves as well the economy specific issues in which they operate. According to the World Bank definition, a business is classified as MSME when it meets two of the three criteria viz., employee strength, assets size, or annual sales. 3.1.2 As per IFC (2014) report, among the 267 definitions used by different institutions in 155 economies, the most widely used variable for defining an MSME is the number of employees (92% of the analysed definitions utilize this variable). Other variables commonly found in MSME definitions are turnover as well as value of assets (49% and 36%, respectively). Overall, 11% (out of 267) of the analysed definitions make use of alternative variables such as loan size, formality, years of experience, type of technology, size of the manufacturing space, and initial investment amount, among others. However, most of the countries are using only one variable to define MSMEs. Chart IV below shows the distribution of number of countries by their definitions of MSMEs. 3.1.3 A brief description of criteria used by countries to define SMEs is shown in Table VIII. It also gives an account of acts/policies under which SMEs are defined in different countries and measures to promote their growth. Irrespective of how MSMEs are defined, many countries have put in place institutions, systems or processes which open up possibilities for learning and replication. Some of these are highlighted below: 3.2 United States Small Business Administration (SBA) - Set up under the Small Business Act of 1953, SBA acts as a nodal, independent agency of the federal government. Through an extensive network of field offices and partnerships, the SBA assists and protects the interests of small businesses. Helping in starting, building and growing businesses, creating jobs and serving as the voice for small businesses by providing an advocacy role are some of the key functions of SBA. It plays various roles to help the small businesses by providing access to capital, entrepreneurial development, access to government contracts and fostering a small business friendly environment by reducing unfair regulatory burdens. 3.3 Italy Cluster Development - Italy has been considered as the leader of cluster development. Although there is strong competition among firms, often there is also a high degree of cooperation among firms which is famously known as ‘Competition by cooperation’. In this system, the production processes are divided into distinct phases with separate firms responsible for different phases. The competitive advantages of SMEs grouped in clusters are based on three aspects ‘specialization, cooperation and flexibility’. The advantage of specialization is related to individual firms, but also to the cluster as a whole. Furthermore, local infrastructure and training institutions become increasingly specialized in the cluster activity. Cooperation amongst firms also help them to be flexible in terms of type of production by grouping different contractors together according to the specialties required in the product. 3.4 Colombia Equity Financing - Colombia has advanced in recent years on structuring financing instruments that address needs at different stages of a company’s life cycle. In the area of seed financing, the National Learning Service (SENA) manages the Emprender Fund, which over 2005-14, has supported 4,141 projects and allocated USD 137.1 million in seed capital resources, generating 19,723 jobs. A number of new financing instruments are also being introduced, with the creation of networks of angel investors and capital funds. 3.5 Malaysia 3.5.1 Central Coordinating Agency - SME Corporation Malaysia is the Central Coordinating Agency (CCA) under the Ministry of Entrepreneur Development Malaysia (MED) that coordinates the implementation of SMEs development programmes across all related Ministries and agencies. It ensures that financial assistance schemes by all relevant ministries and government agencies are monitored for their effectiveness in facilitating SMEs to progress up the value chain. It acts as the central point of reference for research and data dissemination on SMEs and entrepreneurs, as well as provides business advisory services for SMEs. 3.5.2 Development Policies - SME Master Plan 2012-20 has set four goals, to increase business formation, expand number of high growth and innovative firms, raise productivity and intensify formalization. The Action Plan has 32 initiatives with six High Impact Programmes (HIPs):

3.6 Turkey Turkish Economy Bank (TEB) SME Academy provides guidance to SMEs trying to expand their businesses through its free training and workshop programs and leads SMEs to gain more success and income. Some of the programs conducted by the Academy relates to Corporate Development Training Programs, Business Analysis Workshop, Strategic Management Workshop for SMEs Management and Planning Workshop for Foreign Trade. 3.7 Mexico The state-owned Nacional Financiera (NAFIN) is one of the well-recognised models of the Mexican Development Bank that operates receivables financing platform. It also provides contract financing which is explained in Box II. 3.8 Brazil Government Procurement - Brazil is not a signatory to the WTO Agreement on Government Procurement (GPA). Under the national law, all government tenders up to R$80,000 in value must be granted exclusively to small and micro enterprises and 25% of the contract value of those tenders with a value exceeding this threshold, must be reserved for micro-enterprises and small companies (MPEs). In addition, 30% of subcontracts from large and medium businesses are to go to small and micro enterprises. Micro and small enterprises would also be favoured with an allowance up to 10% difference in price between the small or micro enterprise’s price and the medium or large firm’s price. The government uses demand driven procurement approach in which it buys from SMEs, while at the same time providing technical assistance in all phases of the businesses involved in procurement. The government does not purchase from individual SMEs but through associations of small manufacturers. 3.9 China 3.9.1 To fast forward the SME sector growth, the Chinese government came out with a law on SME promotion in 2003, which provided the legal basis for government involvement in the promotion of the SME sector. The SME Promotion Law emphasizes on fair treatment and level playing field for SMEs. The Law also ensures greater access to finance and encouragement to venture capital investments in SMEs. 3.9.2 Credit Guarantee Agencies - Recognizing the limited access to finance to MSMEs, the Chinese Government has created a network of credit guarantee agencies. In contrast to other countries, China does not have a centralized government institution providing credit guarantees to MSMEs. From 203 in the year 2000, the number of guarantee organizations is reported to have increased to 4800 at the end of 2010. Operating at either the provincial level or the city level, about two thirds of these companies are privately owned, while others are either fully or partly owned by local governments. The amount of SME loans, guaranteed by the credit guarantee companies, has increased rapidly since 2000. 3.9.3 Industrial Clusters - China has also witnessed rapid growth of industrial clusters in accordance with the principles of socialization, specialization and market-orientation. Three important features of these clusters are small products but big markets; small enterprises but large-scale cooperation and small clusters but great achievements. The cluster economy is made up of professional towns and villages functioning as production hubs, with one or more towns focusing on one product enabling economies of scale. Some areas have set up large-scale specialized production and marketing, which shows great potential for success. This essentially illustrates the concept of - one village, one product or ―one town, one industry as exemplified by provinces like Jiangsu, Zhejiang, and Guangdong. The concentration of production of certain products in these areas has given rise to such catch phrases as Shengze textiles, Hengshan sewing machines, Ningbo costumes, Wenzhou shoes, Shaoxing synthetic textiles, Haining leather coats, Yiwu small commodities, Yongkang hardware, to name a few. Local government units provide an enabling environment through appropriate policies and regulations as well as vital infrastructure, which are essential for business. Shenzhen’s Municipal Government has made it a priority to encourage more innovation led startups for which they have introduced several financial incentives which are given in Box III. 4 LEGISLATION & INSTITUTIONAL SUPPORT SYSTEM 4.1 Legislations/ Acts relating to MSMEs 4.1.1 Government and regulators through various legislations and directives have attempted to create a conducive environment for development of MSME sector. One of the major steps in this direction was enactment of the MSMED Act, 2006. The Act defines enterprises as MSME based on value of investment in plant and machinery / equipment to enable focused policy interventions in this sector. Further, provisions of the Act facilitate MSMEs in terms of public procurement, delayed payment, marketing support, etc. It also empowers Central and State Government to establish institutions for promotion of MSMEs. 4.1.2 With the passage of time, new challenges have emerged and the composition of economic activities has undergone a change. For instance, the services sector has gained greater importance within GDP. MSMEs in services have increased in number and range of activities, formalisation of MSMEs has increased, value chains have become longer, payment systems have become electronic, alternate data is being used for lending decisions and so on. Changing realities of the economy and the MSME sector necessitate concomitant amendments in the MSMED Act and a review of what it should aim to achieve. 4.1.3 Recommendation The MSMED Act, 2006 may be reimagined as a comprehensive and holistic MSME Code having a provision for sunset on plethora of complex laws scattered all over the legislative framework. Under this new law, the territorial jurisdiction based and arbitrary inspection system may be substituted with a policy based and transparent inspection system. The major challenges are related to physical infrastructural bottlenecks, as well as other complexities like absence of formalisation, technology adoption, capacity building, backward and forward linkages, lack of access to credit and risk capital as well as a perennial problem of delayed payments. This may also include sunset clauses on inspections. 4.2 Definition of MSMEs Across the world, MSMEs are defined in different ways based on various criteria viz., turnover, investment in assets and number of employees. In India, MSMEs are defined based on investment in Plant and Machinery / equipment. In terms of Chapter III – 7 (1) of MSMED Act, 2006, MSMEs are classified into Manufacturing and Service Enterprises and are defined as mentioned in Table - I. 4.2.1 Issues relating to existing definition Definitions based on investment limits in plant and machinery/ equipment were decided when the Act was formulated in 2006 and does not reflect the current increase in price index of plant and machinery / equipment. Furthermore, MSMEs due to their informal and small scale of operations often do not maintain proper books of accounts and hence find it difficult to get classified as MSMEs as per the current definition. 4.2.2 Proposed Definition Presently, Government of India has proposed to classify MSMEs based on turnover as mentioned below:

4.2.3 Recommendation The Committee deliberated upon the proposed turnover based definition of MSMEs with various Ministries, Associations and other Stakeholders. The Committee also debated the merits of an employment-based definition and recognized that while this was an additional feature preferred in some countries, this definition would pose challenges in implementation. The proposed definition has been considered progressive and suitable because of introduction of Goods and Services Tax (GST). Under the new tax regime, turnover details of enterprises are being captured by Goods and Services Tax Network (GSTN) and turnover declared by GST registered MSME units can be easily verified through GSTN. Hence, turnover based definition would be transparent, progressive and easier to implement. It would also help in removing the bias towards manufacturing enterprises in the existing definition and would improve the ease of doing business. The Committee also felt that in view of the need to adjust the definition criteria from time to time in the context of changing economic scenario, the Parliament may consider delegating the power of classifying MSMEs to the Executive. 4.3 Delayed Payments to MSMEs 4.3.1 To solve the problem of delayed payments of small-scale (Micro and Small) sector, Delayed Payments Act was promulgated on April 2, 1993. In MSMED Act, 2006, the provisions of Delayed Payments Act, have been strengthened and the following provisions have been made:

4.3.2 Micro and Small Enterprises Facilitation Council (MSEFC) With a view to solve the delayed payments issue of MSEs a provision had been made in the MSMED Act, 2006 for setting up of Micro and Small Enterprises Facilitation Council (MSEFC). As per Chapter V, Section – 20 of the Act, the State Government shall, by notification, establish one or more Facilitation Councils. The Council examines the case filed by MSE unit and issue directions to the buyer unit for payment of due amount along with interest as per the provisions under the MSMED Act. However, the mechanism of facilitation council has not been uniformly effective primarily because of the limited bargaining power of the MSEs and the fear of retaliation from the buyers. In order to expedite the disposal of cases, the Ministry of MSME has launched MSME Delayed Payment Portal – MSME Samadhaan for empowering MSEs across the country to directly register their cases relating to delayed payments by Central Ministries/Departments/CPSEs/State Governments. These will be viewed by MSEFC for their actions. Total number of cases filed with MSEFC and reported on the Samadhaan portal as on June 14, 2019 is given in Table IX: 4.3.3 Recommendations The Committee deliberated on strengthening of facilitation council and recommended the following:

4.3.4 Delayed payment to MSMEs i. Buyers tend to use MSMEs as an alternative to banks. In order to delay payments, buyers have incentives to raise objections or point errors in submitted bills. Credit notes or adjustment notes are often used to avoid cash payment. Strict legislative measures of payments within fixed days (and penalty in the form of charging interest) have had limited effect on account of inhibitions on the part of the MSME sellers to complain, as loss of future business is feared. Electronic bill discounting systems (such as TReDS) have provided a partial solution but the problem persists. Naming and shaming are being used quite effectively in countries like UK and other European nations. ii. Like in many other markets, in India, most large corporates operate with MSMEs only on a credit basis. When the buyer does not honour the invoices on time, MSMEs face a financial crunch in the business. Their interest burden increases, cash flow becomes stressed and business continuity is impacted. Such MSMEs hesitate to file complaint against large buyers to MSEFC or fight a legal battle with the buyer to enforce the contract. iii. An Information Utility (IU) could help resolve this problem. IUs are set up under the Insolvency and Bankruptcy Code (IBC) and regulated by the Insolvency and Bankruptcy Board of India (IBBI). An IU is a repository of electronic legal evidence pertaining to any debt/claim as submitted by a financial or operational creditor that is verified and authenticated by parties thereby making the information non-refutable or prima facie evidence. For a small user charge, creditors (in this case MSMEs) can electronically file their outstanding or default amounts on the IU and invoke IBC provisions. iv. IBC mandates financial creditors to submit information to an IU, but only encourages operational creditors to submit information. When a case is admitted under IBC, management of the defaulting company vests in the Resolution Professional, thereby bringing much needed discipline in enforcing contracts. Operational creditors have been in the forefront of availing this benefit under IBC having filed the maximum number of defaults with NCLT (of a total of 1858 resolution processes triggered as at the end of March 2019, operational creditors have caused 920 cases). v. Filing of default by the operational creditors and submission of information to IU serves as an early warning signal to other financial or operational creditors with exposure to the defaulting debtor. The IU issues a ‘Record of default’ that is attached to the filing by operational creditors with the Adjudicating Authority for initiating corporate insolvency process. Call for “Record of Default by Adjudicating Authority from the Information Utility”, has been declared by Hon Supreme Court as a prima facie evidence (case of Swiss Ribbons) in such cases. For example, let us assume that the bill is due to be paid in 90 days. On the 90th day, payment is made. At this point, the bank or the buyer uploads fact of the payment on the IU. The MSME is required to do this. The transaction is complete. The other situation is that bill is not paid on the due date i.e., the 90th day. At this point the MSME may choose to invoke usual provisions. 4.3.5 Benefits for MSME

4.3.6 In turn, the operational debtor (large buyer) is also benefitted, if its disputes are registered on the IU at the earliest, thereby preventing operational creditors from approaching the Adjudicating Authority with frivolous claims. Yet, as noted above, MSMEs may still hesitate to file default against their large buyers, fearing loss of future business/debarment. There is a need for a system to handle cases where the MSME fears to complain as there is a huge difference in negotiating strengths of MSMEs and large corporates. 4.3.7 Recommendations

4.4 Public Procurement Policy 4.4.1 Due to their lack of scale and in-house capabilities, MSEs find it difficult to access proper market for selling their products. Inaccessibility to remunerative market affects their growth and sustainability. In order to support MSEs in selling their products at a competitive price various countries have framed public procurement policy wherein certain percentage of goods manufactured by them are procured by the Government, Government Departments, etc. 4.4.2 Legislative backing for procurement preference to MSMEs exists. Chapter IV – Section 11 of the MSMED Act, 2006 states that for facilitating promotion and development of MSEs, the Central Government or State Government may, by order notify from time to time, preference policies in respect of procurement of goods and services, produced and provided by MSEs, by its Ministries or Departments, as the case may be, or its aided institutions and Public Sector Enterprises. In India, Public Procurement Policy for MSEs was introduced in the year 2012, the policy was revised in November, 2018, and came into effect from April 1, 2019. The objective of Policy is promotion and development of MSEs by supporting them in marketing of products produced and services rendered by them. Complexity of the public procurement system and its process deters MSEs to participate in public procurement. MSEs are disproportionately affected due to their internal constraints in terms of financial, technical and administrative capacities to access procurement opportunities, prepare tender documents, apply the procedures and execute the contracts. Study conducted by World Bank on barriers for SMEs in Procurement Process is given in Box V. 4.4.3 The Procurement Policy, 2012 mandated Government Departments, CPSEs, etc. to achieve 20% procurement target for MSEs. It is observed that in the year 2016-17, CPSEs achieved 19% against the target of 20%. However, in the year 2017-18 they could achieve only 15%. As per the revised procurement policy, PSUs /Government Departments have to procure 25% from MSEs: 4.4.4 Recommendations

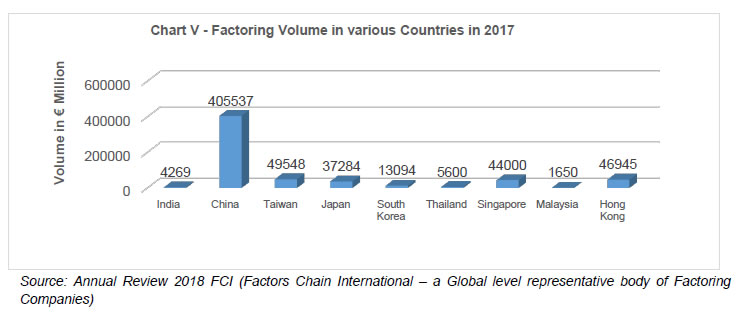

4.5 Formalization of MSMEs As per 73rd round of National Sample Survey (NSS), there are 63.39 million MSMEs in the country. However, a large number of MSEs exist in the informal sector and are not registered with any statutory authority. Reasons for lack of registration are many and varied. For nano/household type of enterprises, in their view, not obtaining registration is an escape from official machinery, paperwork, costs and rent seeking. For them, it is perhaps “the art of not being governed”. Registration offers them little by way of tangible benefits. There are other MSEs who, upon reaching a minimum size seek legitimacy and acknowledgement of their existence to seek benefits or credit for instance, but they too struggle. While Udyog Aadhaar offers a simple mode of registration, it is usually not enough. Often, more is needed e.g., Shops and Establishments, PAN, GST, etc. Lack of formalization impacts the sector in terms of development and also impacts in availing credit from financial institutions like banks and in terms of policy making as well as development interventions. Registration provides information on nature of business, location, segmentation, etc. In the absence of a robust system of registration for capturing information on operational units, new units and exits, reliance has to be placed on surrogate data or on national census/ surveys, which are infrequent. The various avenues available to the MSMEs for formalization are discussed below: 4.5.1 Registration of Enterprises i. The Committee deliberated on the lack of formalization of a large number of MSMEs particularly in the micro category. The registration requirements of Indian enterprises is primarily governed by the First Schedule to the Industrial Development and Regulation (IDR) Act, 1951. It is mandatory only for a class of Medium enterprises which are engaged in the manufacture of goods. The registration of MSEs and Medium enterprises engaged in services activities is discretionary. However, over a period of time, registration has been an intrinsic part of the development of MSMEs itself. Having a registration certificate entitles an MSME for numerous benefits. Particularly after the MSMED Act, 2006, which came into effect from October 2, 2006, availability of registration certificate has assumed greater importance. Some of the direct incentives provided by the Government are summarized in Table XI below. ii. The registration process of MSMEs was radically simplified with the introduction of Udyog Aadhaar, with effect from September 18, 2015. It is an Aadhaar based electronic platform and requires a few basic entries including PAN details. Registration certificate is also issued electronically. In terms of coverage, 68.89 lakh MSMEs (as on June 12, 2019) have registered through this system. Udyog Aadhaar has facilitated registration of MSMEs in a user friendly way. However, given that this data is self-verified, it is often not a reliable source of information for lenders and buyers. During interactions with the Committee, State Government officials, MSME Associations and MSME borrowers have highlighted other challenges in respect of Udyog Aadhaar. The Committee was informed that the Udyog Aadhaar database needs cleaning up as retailers have obtained Udyog Aadhaar registration. Instances have also been reported of UAM being filed product wise. The Udyog Aadhaar system is based on self-certification and there is no evidence of whether the unit was set up at all. The concept of provisional registration, which helped in pre-start up stage, is missing. In addition to Udyog Aadhaar, there are several other registrations which MSMEs need. For example, for public procurement, all MSME units are to be registered with NSIC. iii. Registration with NSIC is called single point registration. But for all practical purpose, this registration is not accepted by most of the organizations. MSMEs have to register separately with each organizations. For example, MSMEs have to register with DQA for defence related procurement; ONGC, Engineers India for Oil and Gas, RDSO for Railways, etc. This registration process is cumbersome, time consuming, leading to duplication of efforts. On the other hand, without this registration, MSMEs cannot participate in any tendering, primarily because NSIC registration is neither trusted nor accepted by these organizations. iv. This needs to change. NSIC should be the nodal agency for all MSME units. When the units apply for registration/renewal, they can inform the NSIC that they need registration with whichever organization they want to do business and NSIC should coordinate with them for being registered. This should be done completely electronically. Presently, these procuring organizations maintain vendor registration cell at very high cost. For units seeking registration with them, one expert may be asked to join the team from NSIC. The MSME unit may then be given graded registration or a clear direction/ road map to improve the set up to get registration. 4.6 Goods and Services Tax Network (GSTN) 4.6.1 GSTN is a nonprofit non-government company, which is providing shared IT infrastructure and service to both central and state governments including tax payers and other stakeholders. The frontend services of registration, returns and payments to all MSMEs are being provided by GSTN. Implementation of GSTN under GST has integrated the entire indirect tax ecosystem. 4.6.2 Under GST, MSMEs are not defined as per the definition of MSMED Act, 2006 as it is not possible to ascertain the investment in plant and machinery/equipment in GST return. Hence, there is no mapping of MSME definition in the GSTN data. As on date 1.21 crore tax payers have registered with GSTN, out of which majority of the units are estimated to be MSMEs, if the proposed turnover definition were to be applied. PAN information collected in Udyog Aadhaar filing could be suitably used with PAN information registered with GSTN so that MSMEs and GSTN are integrated and monitored on real time basis. 4.6.3 To ascertain the standing of the business entity (say registration, compliance with tax codes and other regulations) for various purpose (lending or delivery of services) is a time-consuming process due to the multiple silos of information storage and lack of a common identifier across the various databases. This lack of common identifier may be a barrier towards implementation of single window registration processes for businesses, a policy initiative that is envisaged as a major thrust under the Business Reforms Action Plan 2017 released by the Department for Promotion of Industry and Internal Trade (erstwhile DIPP), Ministry of Commerce and Industry, in partnership with the World Bank Group. Lack of a proper identification mechanism for the MSMEs may also lead to significant inefficiencies in the delivery of the benefits enumerated under the MSMED Act, 2006 and various policies. 4.6.4 The Committee deliberated on the issue relating to registration in GSTN and UAM. Since, UAM is not mandatory, large number of MSMEs have not registered. Therefore, the objective of Government to promote formalization amongst MSMEs through registration has not yet yielded the desired result. Further, UAM is completely self-declared and there is no verification of authenticity of data contained therein. As regards GSTN, MSME units having turnover above ₹40 lakh are mandated to register under GSTN but most MSMEs fall below that threshold. Also, unit operating in multiple States can have multiple GSTN. The Committee, therefore, felt the need for a unique identifier for MSME units. 4.6.5 Taking a long-term view to build an enabling environment for businesses in the country to grow based on their unique merits, the Committee concluded that it is imperative to develop a ‘Unique Enterprise Identifier’ to identify all the entities across the country. This will enable tax compliance, delivery of service under various MSME schemes and provide seamless integration with financial institutions. A similar approach, for creation of a unique business identifier and amalgamation of the various data silos of the government has been adopted by other nations. A brief synopsis is presented in Box VI. The detailed modalities on Unique Enterprise Identifier (UEI) are discussed in Chapter 8. 4.7 Registration of Startups 4.7.1 Startup India Scheme is an initiative of the Indian government, the primary objective of which is the promotion of startups, generation of employment, and wealth creation. It was launched in January, 2016. Startups are incorporated as a private limited company (as defined in the Companies Act, 2013) or registered as a partnership firm (registered under section 59 of the Partnership Act, 1932) or a limited liability partnership (under the Limited Liability Partnership Act, 2008) in India. These enterprises can be called Startups upto ten years from the date of incorporation/ registration provided turnover for any of the financial years since incorporation/ registration has not exceeded ₹100 crore. The profits of recognized Startups are exempted from income-tax for a period of 3 years out of 7 years since incorporation. 4.7.2 However, in the recent years many Indian startups which were well-funded and primarily operated in India have chosen to relocate. These next-generation technology startups are choosing foreign countries as their base primarily because of the enabling environment available in these countries. 4.7.3 By far the single biggest concern for investors wanting to invest in Indian companies has been the tax liability. For instance, progressive tax regimes such as Singapore have 0% capital gains taxes which incentivizes flow of capital. Also, these investors are likely to plough back the profits from startup entities into new startups thereby, creating a virtuous cycle of investment. Higher tax rate for investors in India is hindering investment in startups. 4.7.4 On the other hand, maturing startups that have achieved or are on the precipice of achieving profitability are eyeing lower corporate taxes. Countries such as Singapore are offering a simplified tax regime which charges 17% on corporates compared to the global average of approximately 22% (in 2015). Singapore boasts of 0% Capital Gains taxes and a low corporate tax of 17% whereas India charges 30% for corporate tax on domestic companies if taxable income exceeds ₹1 Crore. Startups which have not yet reached this level are still liable to pay the Minimum Alternate Tax (MAT) at 18.5%. Though the MAT credit has been extended to 15 years it has not been eliminated completely. 4.7.5 The issue of corporate taxes assumes significant importance for maturing startups, especially when they are about to go public and the high taxes impact their profitability. This clearly incentivizes them to move their base to a lower tax country. Therefore, the successful companies not only move their headquarters away from India but also take with them the Intellectual Property (IPs), and the proceeds from any possible Initial Public Offerings. Furthermore, it’s a double whammy for India because most retail Indian investors would not be able to participate in such companies’ IPOs if they list on foreign exchanges such as NASDAQ. 4.7.6 Singapore is ranked consistently in the top 3 in World Bank’s Ease of Doing Business (EODB) rankings. Although India improved significantly from 100 to 77 it still lags behind countries such as China and Vietnam. There are multiple procedures to be followed before a business can start functioning in India. Even though a lot of states have been taking progressive steps (as in the case of Telangana – mentioned in Box VII) in providing single window clearances and self-certifications, the sentiment is still weak and more needs to be done. 4.7.7 Recommendation The Committee deliberated on all the aspects relating to Startups in India. The major reason for migration of startups to other countries is because of better enabling environment such as tax concessions, well developed infrastructure, ease of doing business, exit policy, etc. Hence, the Committee is of the view that financial incentives and excellent infrastructure facilities must be deployed to retain successful Indian startups and to lure the best talent from across the world to start businesses in India. Telangana has adopted an innovative model for startup which may be assessed for possible replication in other States. 4.8 Factoring Act, 2011 4.8.1 Receivables form a major part of the current assets of MSMEs and management of such receivables is the most important concern for them. Factoring is a financial option for the management of receivables. It is a tool to obtain quick access to short-term finance and mitigate risks related to payment delays and defaults by buyers. In the process of factoring, the seller sells its receivables to a financial institution (“Factor”) at a discount. After the sale, there is an immediate transfer of ownership of the receivables to the Factor. In course of time, either the factor or the MSMEs, depending upon the type of factoring, collects payments from the debtors. Factoring helps the MSMEs to improve their cash flows and cover credit risk. 4.8.2 The Factoring Regulation Act, 2011 deals with the issues relating to assignment of debt to factor, registration requirements for factoring and debtor protection. The Act also provides special provisions for MSEs where the debtor of assigned receivables is liable to them within the stipulated time mentioned in the MSMED Act, 2006. As per the Act, an NBFC engaged in factoring business as its principal business registered with RBI may carry on the factoring business. In terms of Chapter II of the Act, every factor for the purposes of registration, shall file the particulars of every transaction of assignment of receivables with the CERSAI within a period of thirty days. Present status of Factoring in Asian Countries is as below:  4.8.3 Factoring is an accepted method of receivables financing across the globe and is regulated by a stringent set of rules and procedures. Initially, in India, factoring was not a typical or mainstream financial service in the absence of legislation. However, with the enactment of Factoring Regulation Act, the necessary legal framework is now in place for factoring to gain traction. But unfortunately, reservations on part of corporates and PSU buyers to accept assignment of receivables made in favour of factors, issues with the legal system and dominance of banks in factoring business have been hampering the growth. Recommendations relating to Factoring Act are given under the section on TReDS in Chapter 7. 4.9 Monitoring and Review Mechanisms at Apex Level 4.9.1 National Board for MSME The Chapter II, Section 3 to Section 6 of the MSMED Act, 2006 provides for establishment of National Board for Micro, Small & Medium Enterprises (NBMSME). The National Board consists of 47 members including Chairman, Vice Chairman and Member Secretary in accordance with the Section 3 (1) of MSMED Act, 2006 and NBMSME Rules, 2006. The Minister in-charge of Ministry of MSME is ex-officio Chairman of the National Board. 4.9.2 Functions of the National Board

4.9.3 Recommendation National Board may continue to function as the body for reviewing and steering the overall implementation of various policies / schemes of MSMEs impacting all aspects of the MSME ecosystem, involving all stakeholders, particularly in terms of bringing MSMEs out of informal category, improving infrastructure, skill and capacity building, technical and financial know-how, etc. The functioning and scope of the Board may be reviewed to strengthen its role. 4.9.4 Standing Advisory Committee The Standing Advisory Committee (SAC) was constituted by RBI in 1986, in terms of orders of the then Governor. It is a permanent Committee which meets twice a year. The Committee is chaired by Deputy Governor, RBI and has participation from Ministry of MSME, DFS, Banks, Industry Associations, etc. The purpose of the Committee is given below:

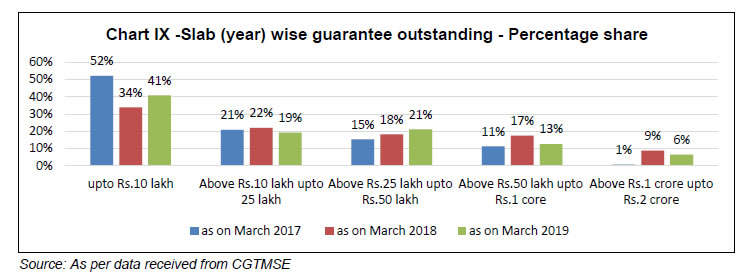

4.10 Institutional Support System developed by State Government 4.10.1 District Industries Centers (DICs) DIC programme was started in 1978 with a view to providing integrated administrative framework at the district level for promotion of small scale industries in rural areas. The DICs were envisaged as a single window agency at the district level providing service and support to small entrepreneurs. DICs act as the implementation body for several schemes of both the State and Centre. Typically, the organizational structure of the DICs consists of General Manager, Functional Managers and Project Managers to provide technical services in areas relevant to the district concerned. The management of the DIC is under State Governments. DICs have the following as their main objectives:

4.10.2 Need for Improvement of DICs DICs have become integral in shaping industrial development at district level. The State and Centre deploy various schemes to reach the entire country through this network of DICs. To continue to benefit the citizens at the district level, the DICs must be able to evolve and remain relevant with the times. The following problems persist with the DICs:

4.10.3 A new Central Scheme is proposed for setting up of Enterprise Development Centres (EDCs) within DICs. The key features of EDCs are given in Box VIII. 4.10.4 Recommendations The DICs can be made more effective through the measures discussed below:

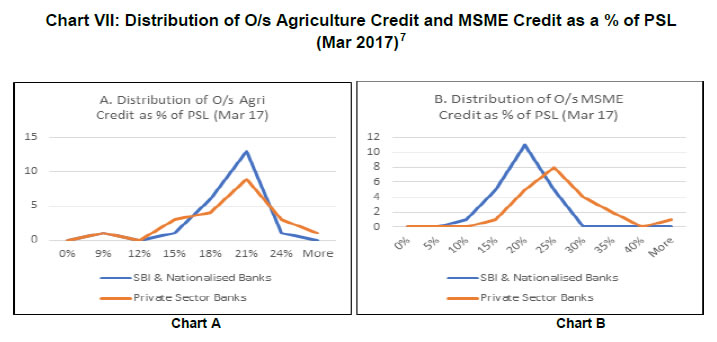

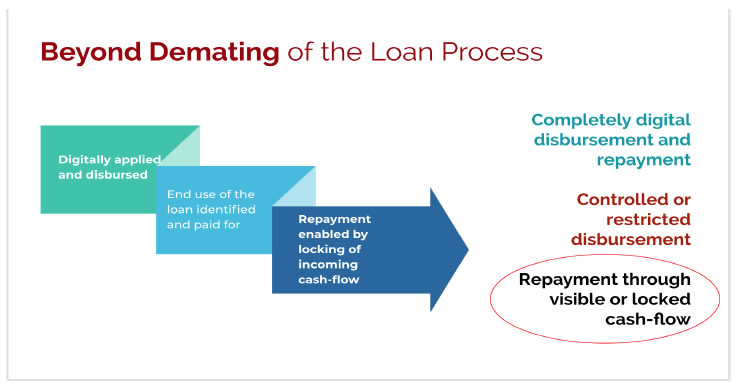

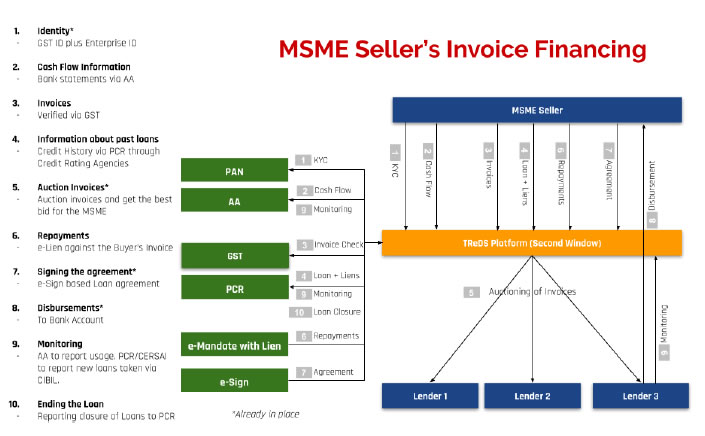

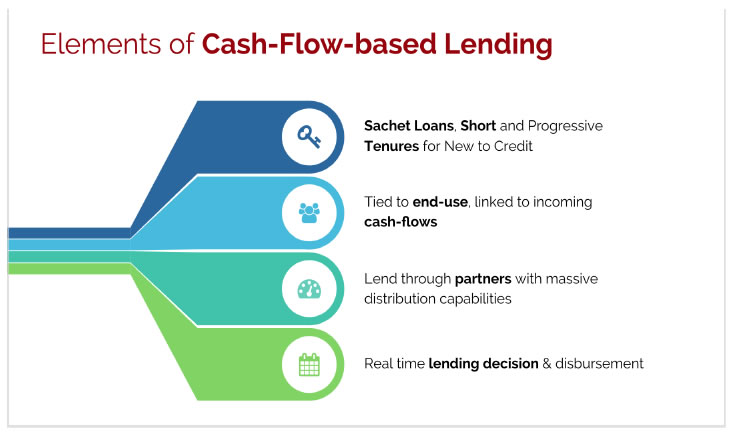

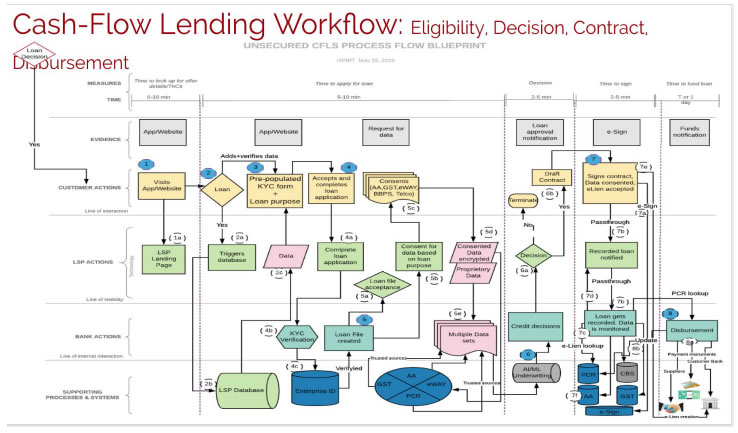

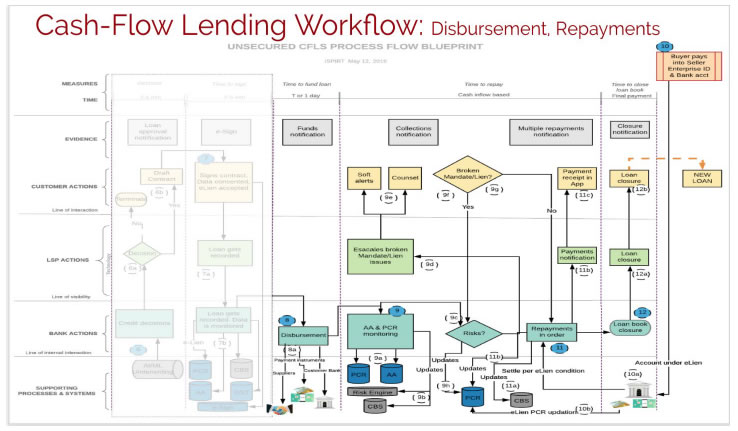

4.11 State Financial Corporation (SFC) 4.11.1 State Financial Corporations were set up to promote industry through extension of term loans and help them unlock equity financing. Their focus was Small Scale Industries (SSI). The authorised Capital of a SFCs is fixed by the State Government within the minimum and maximum limits of ₹50 lakh and ₹5 crore and is divided into shares of equal value which were taken by the respective State Governments, RBI, Scheduled Banks, Co-operative Banks, other financial institutions such as insurance companies, investment trusts and private parties. At present, there are 18 SFCs and only a handful of them are active. 4.11.2 Functions of State Financial Corporations