IST,

IST,

Systemic Risk Survey

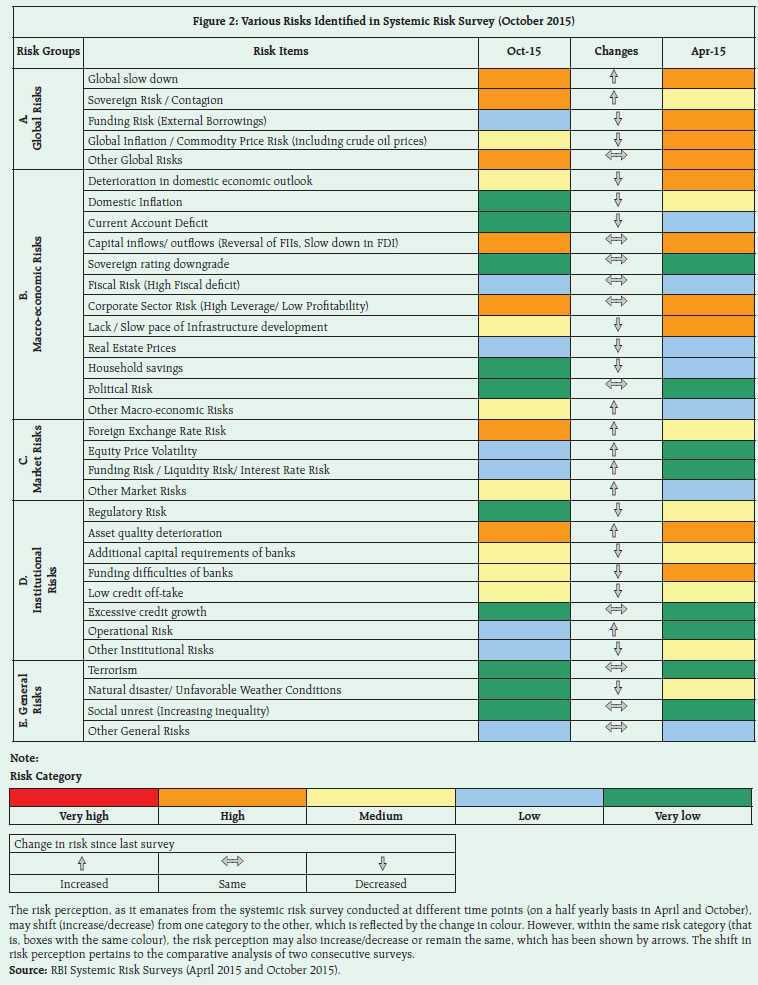

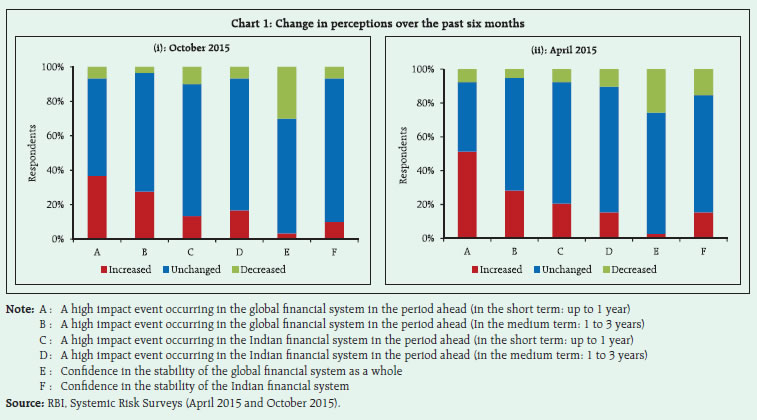

The Systemic Risk Survey (SRS), the ninth in the series, was conducted in October 20151 to capture the perceptions of experts, including market participants, on the major risks the financial system is facing presently. The results indicate that global risks continued to be perceived as major risks affecting the financial system in a high risk category. The macroeconomic risks moved to the medium risk category. Market risks have been perceived to be elevated to high risk category from the low risk category, showing a cyclical nature with rise & fall observed in alternative rounds of survey. On the other hand, the Institutional risks remained in the medium risk category. General risks have decreased in this survey (Figure 1). Within global risks, the risk of a global slowdown and sovereign risks increased in the current survey, whereas the global funding and global inflation risks indicated a downward shift. Within the macroeconomic risk category, risks from deterioration in the domestic economic outlook declined to the medium risk category in the current survey, while the risks on account of domestic inflation and current account deficit have declined considerably. The capital flows and corporate sector risks remained elevated in the high risk category. The respondents have rated the foreign exchange risk, equity price volatility and funding risk as having increased in the current survey. Among the institutional risks, while the asset quality of banks was still perceived as a high risk factor, the risk on account of low credit off-take has marginally receded (Figure 2). Participants in the current round of survey felt that there is an increased possibility of a high impact event occurring in the global financial system in the period ahead (short to medium term). Their confidence in the global financial system was moderate, and a greater number participants indicated that their confidence has marginally reduced during the past six months. However, according to participants, there is ‘medium’ possibility of an occurrence of a high impact event in the Indian financial system in the period ahead (short to medium term) even though the respondents continued to show their confidence in the Indian financial system (Figure 3 and Chart 1). On the issue of likely changes in demand for credit in the next three months, the majority of the respondents were of the view that it might increase marginally. A majority of the respondents indicated that the average quality of credit could improve in the next three months. However, a group of respondents also perceived that it is likely to deteriorate marginally (Chart 2). 1 These surveys are conducted on a half-yearly basis. The first survey was conducted in October 2011. |

Page Last Updated on: