IST,

IST,

Services and Infrastructure Outlook Survey for Q2:2021-22

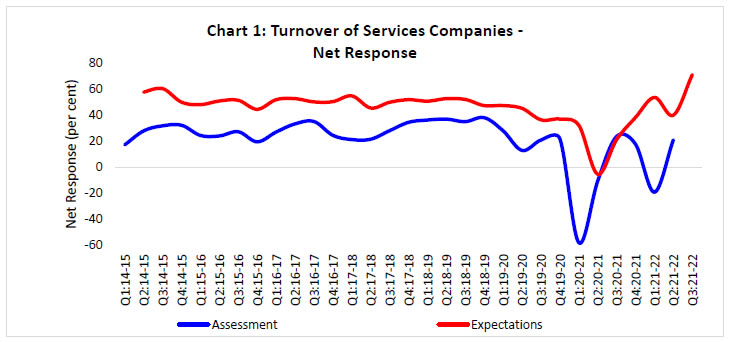

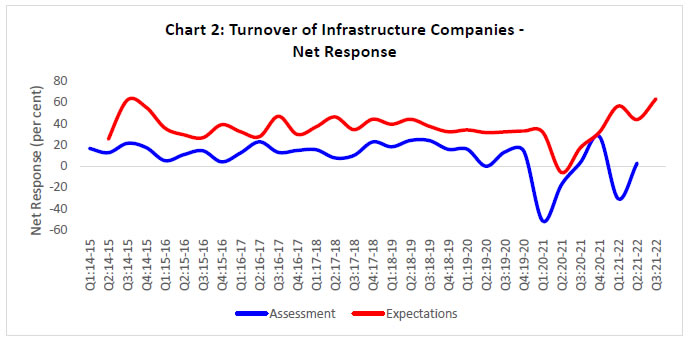

Today, the Reserve Bank released the results of 30th round of its quarterly services and infrastructure outlook survey (SIOS) conducted during Q2:2021-22. This forward-looking survey captures qualitative assessment and expectations of Indian companies in the services and infrastructure sectors on a set of business parameters relating to demand conditions, price situation and other business conditions. 788 companies provided their assessment for Q2:2021-22 and expectations for Q3:2021-22 in the latest round of the survey1. Owing to uncertainties emanating from the COVID-19 pandemic, an additional block was included in this round of the survey for assessing the outlook on key parameters for two quarters ahead as well as three quarters ahead. Highlights: A. Services Sector Assessment for Q2:2021-22

Expectations for Q3:2021-22

Expectations for Q4:2021-22 and Q1:2022-23

B. Infrastructure Sector Assessment for Q2:2021-22

Expectations for Q3:2021-22

Expectations for Q4:2021-22 and Q1:2022-23

Note: Please see the excel file for time series data. Services Sector

Infrastructure Sector

1 The survey results reflect the respondents’ views, which are not necessarily shared by the Reserve Bank. Results of the previous survey round were released on the Bank’s website on August 06, 2021. This round of the survey was launched on July 20, 2021 and results were compiled with data received till September 24, 2021. 2 Net Response (NR) is the difference between the percentage of respondents reporting optimism and those reporting pessimism. It ranges between -100 to 100. Positive value indicates expansion/optimism and negative value indicates contraction/pessimism. In other words, NR = (I – D); where, I is the percentage response of ‘Increase/optimism’, D is the percentage response of ‘Decrease/pessimism’ and E is the percentage response as ‘no change/ equal’ (i.e., I+D+E=100). For example, increase in turnover is optimism whereas decrease in cost of inputs is optimism. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Page Last Updated on: