Today, the Reserve Bank released the results of 35th round of its quarterly services and infrastructure outlook survey (SIOS) conducted during Q3:2022-23. This forward-looking survey1 captures qualitative assessment and expectations of Indian companies in the services and infrastructure sectors on a set of business parameters relating to demand conditions, price situation and other business conditions. In the latest round of the survey, 1,091 companies provided their assessment for Q3:2022-23 and expectations for Q4:2022-23 as well as outlook on key parameters for the subsequent two quarters. Highlights: A. Services Sector Assessment for Q3:2022-23 -

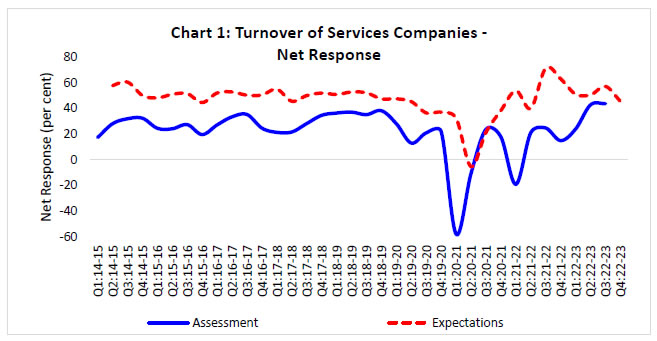

Services sector enterprises assessed improvement in overall business situation and their turnover during Q3:2022-23; respondents were especially optimistic on employment and availability of finance (Chart 1 and Table A). -

Higher pressure stemming from cost of finance and salary outgo was assessed during Q3:2022-23; sentiments on input cost pressures recorded marginal moderation. -

Service companies assessed improvement in their pricing power in terms of selling prices and profit margins during Q3:2022-23. Expectations for Q4:2022-23 -

Respondents continue to be optimistic on overall business situation and their own turnover during Q4:2022-23; the level of optimism, however, moderated when compared with a higher net response in the previous quarter. (Chart 1 and Table A). -

Job landscape is likely to expand further in services sector for both full time and part time employees. -

Service companies expect similar cost pressures on sequential basis and polled for higher growth in both selling prices and profit margins during Q4:2022-23. Expectations for Q1:2023-24 and Q2:2023-24 -

Respondents remain optimistic on the services sector business conditions for the first half of 2023-24 (Table C). -

In tandem, job scenario is also expected to improve in ensuing quarters. -

Input cost pressure is likely to continue and selling prices are likely to rise during H1:2023-24. B. Infrastructure Sector Assessment for Q3:2022-23 -

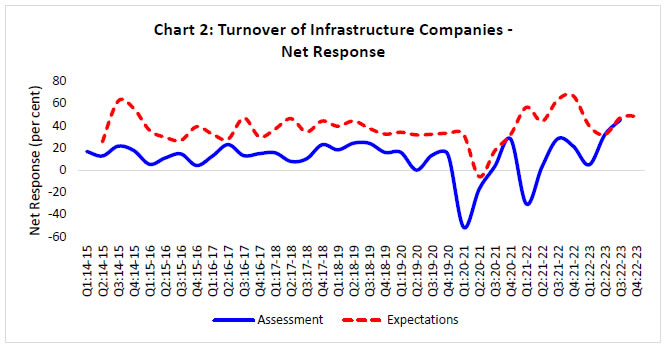

Infrastructure companies gauged sharp uptick in overall business situation and turnover (Chart 2 and Table B). -

Respondents assessed notable improvement in both full-time and part-time employment conditions, resulting in higher salary outgo. -

Selling prices are assessed to have risen in the face of cost pressures in the sector during Q3:2022-23. Expectations for Q4:2022-23 -

Turnover of infrastructure companies is expected to improve further in Q4:2022-23 (Chart 2). -

Respondent expressed upbeat sentiments on employment conditions. -

Higher cost pressures are expected to stem from wage cost and finance cost in Q4:2022-23; outlook on selling prices and profit margins is more upbeat. Expectations for Q1:2023-24 and Q2:2023-24 -

Respondents remain optimistic on demand and employment conditions till the first half of 2023-24 (Table D). -

Input cost pressures are likely to persist in near term and sentiments on selling prices to remain at elevated level. Summary of Net Responses2 on Survey Parameters | Table A: Services Sector | | (per cent) | | Parameters | Assessment period | Expectations period | | Q2:2022-23 | Q3:2022-23 | Q3:2022-23 | Q4:2022-23 | | Overall Business Situation | 40.5 | 48.1 | 53.0 | 50.1 | | Turnover | 42.7 | 43.7 | 57.1 | 45.5 | | Full-time Employees | 28.9 | 38.4 | 32.6 | 42.3 | | Part-time Employees | 16.2 | 34.9 | 22.8 | 36.7 | | Availability of Finance | 19.6 | 37.5 | 26.7 | 36.9 | | Cost of Finance | -29.7 | -36.1 | -36.5 | -36.5 | | Salary & Wages | -43.3 | -44.2 | -40.9 | -38.7 | | Cost of Inputs | -42.4 | -41.4 | -44.5 | -44.8 | | Selling Price | 13.2 | 36.0 | 19.6 | 33.4 | | Profit Margin | 2.0 | 35.8 | 26.8 | 39.4 | | Inventories | 30.1 | 43.5 | 37.8 | 43.5 | | Technical/Service Capacity | 21.8 | 37.1 | 27.7 | 37.0 | | Physical Investment | 19.4 | 37.0 | 21.3 | 36.7 |

| Table B: Infrastructure Sector | | (per cent) | | Parameters | Assessment period | Expectations period | | Q2:2022-23 | Q3:2022-23 | Q3:2022-23 | Q4:2022-23 | | Overall Business Situation | 30.6 | 49.0 | 45.1 | 50.9 | | Turnover | 31.7 | 45.4 | 47.2 | 48.8 | | Full-time Employees | 23.4 | 44.7 | 29.8 | 45.5 | | Part-time Employees | 10.7 | 43.8 | 17.8 | 45.9 | | Availability of Finance | 22.0 | 44.7 | 37.7 | 46.4 | | Cost of Finance | -36.4 | -44.9 | -41.7 | -43.8 | | Salary & Wages | -27.0 | -51.9 | -32.5 | -44.7 | | Cost of Inputs | -44.2 | -46.0 | -48.7 | -48.5 | | Selling Price | 15.0 | 44.5 | 27.0 | 43.8 | | Profit Margin | -1.6 | 44.6 | 16.5 | 45.1 | | Inventories | 28.8 | 45.9 | 39.0 | 46.4 | | Technical/Service Capacity | 19.1 | 44.2 | 25.9 | 44.6 | | Physical Investment | 16.5 | 43.4 | 24.1 | 43.2 | Expectations of Select Parameters for extended period – Net response (in per cent) | Table C: Services Sector | | Parameter | Round 34 | Round 35 | | Q3:2022-23 | Q4:2022-23 | Q1:2023-24 | Q2:2023-24 | | Overall Business Situation | 53.0 | 50.1 | 50.3 | 49.8 | | Turnover | 57.1 | 45.5 | 46.8 | 47.1 | | Full-time Employees | 32.6 | 42.3 | 38.3 | 42.2 | | Part-time Employees | 22.8 | 36.7 | 36.5 | 37.3 | | Cost of Inputs | -44.5 | -44.8 | -44.6 | -45.5 | | Selling Price | 19.6 | 33.4 | 36.0 | 36.8 |

| Table D: Infrastructure Sector | | Parameter | Round 34 | Round 35 | | Q3:2022-23 | Q4:2022-23 | Q1:2023-24 | Q2:2023-24 | | Overall Business Situation | 45.1 | 50.9 | 50.9 | 49.3 | | Turnover | 47.2 | 48.8 | 48.3 | 48.6 | | Full-time Employees | 29.8 | 45.5 | 45.4 | 43.5 | | Part-time Employees | 17.8 | 45.9 | 44.0 | 45.4 | | Cost of Inputs | -48.7 | -48.5 | -46.6 | -46.6 | | Selling Price | 27.0 | 43.8 | 43.6 | 44.3 | Note: Please see the excel file for time series data. Services Sector | Table S1: Assessment and Expectation for Overall Business Situation | | (Percentage responses)@ | | Quarter | Assessment | Expectation | | Better | No Change | Worse | Net response# | Better | No Change | Worse | Net response | | Q3:21-22 | 41.9 | 44.3 | 13.8 | 28.2 | 75.3 | 22.3 | 2.4 | 72.9 | | Q4:21-22 | 40.7 | 36.0 | 23.4 | 17.3 | 68.3 | 28.2 | 3.5 | 64.8 | | Q1:22-23 | 47.0 | 38.3 | 14.7 | 32.2 | 56.6 | 40.1 | 3.3 | 53.4 | | Q2:22-23 | 45.9 | 48.7 | 5.4 | 40.5 | 59.6 | 36.7 | 3.7 | 55.9 | | Q3:22-23 | 52.4 | 43.3 | 4.3 | 48.1 | 57.4 | 38.1 | 4.4 | 53.0 | | Q4:22-23 | | | | | 55.0 | 40.0 | 5.0 | 50.1 | ‘Increase’ in Overall business situation is optimistic.

@: Due to rounding off percentage may not add up to 100.

#: Net Response (NR) is the difference of percentage of the respondents reporting optimism and that reporting pessimism. The range is -100 to 100. Any value greater than zero indicates expansion/ optimism and any value less than zero indicates contraction/ pessimism. |

| Table S2: Assessment and Expectation for Turnover | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 41.5 | 41.7 | 16.8 | 24.7 | 75.0 | 21.4 | 3.7 | 71.3 | | Q4:21-22 | 41.0 | 32.9 | 26.1 | 14.9 | 67.2 | 28.6 | 4.1 | 63.1 | | Q1:22-23 | 43.1 | 37.7 | 19.2 | 23.9 | 55.5 | 40.2 | 4.3 | 51.1 | | Q2:22-23 | 51.2 | 40.3 | 8.5 | 42.7 | 54.6 | 41.4 | 4.0 | 50.6 | | Q3:22-23 | 49.2 | 45.2 | 5.5 | 43.7 | 61.6 | 34.0 | 4.4 | 57.1 | | Q4:22-23 | | | | | 51.5 | 42.5 | 6.0 | 45.5 | | ‘Increase’ in Turnover is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table S3: Assessment and Expectation for Full-time Employees | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 23.0 | 65.9 | 11.2 | 11.8 | 55.5 | 41.9 | 2.6 | 52.9 | | Q4:21-22 | 20.1 | 61.5 | 18.4 | 1.7 | 49.7 | 47.9 | 2.4 | 47.2 | | Q1:22-23 | 28.2 | 57.5 | 14.3 | 13.8 | 27.0 | 68.6 | 4.4 | 22.6 | | Q2:22-23 | 35.6 | 57.7 | 6.7 | 28.9 | 29.1 | 67.8 | 3.1 | 26.0 | | Q3:22-23 | 42.9 | 52.5 | 4.6 | 38.4 | 38.4 | 55.9 | 5.8 | 32.6 | | Q4:22-23 | | | | | 47.1 | 48.0 | 4.8 | 42.3 | | ‘Increase’ in Full-time Employees is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table S4: Assessment and Expectation for Part-time Employees | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 22.6 | 69.9 | 7.4 | 15.2 | 70.3 | 27.0 | 2.7 | 67.6 | | Q4:21-22 | 18.5 | 70.4 | 11.1 | 7.4 | 57.5 | 39.7 | 2.7 | 54.8 | | Q1:22-23 | 25.2 | 65.9 | 8.9 | 16.3 | 25.0 | 67.8 | 7.2 | 17.8 | | Q2:22-23 | 22.2 | 71.8 | 6.0 | 16.2 | 29.0 | 64.5 | 6.6 | 22.4 | | Q3:22-23 | 40.1 | 54.8 | 5.1 | 34.9 | 27.8 | 67.3 | 5.0 | 22.8 | | Q4:22-23 | | | | | 41.8 | 53.1 | 5.1 | 36.7 | | ‘Increase’ in Part-time Employees is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table S5: Assessment and Expectation for Availability of Finance | | (Percentage responses) | | Quarter | Assessment | Expectation | | Improve | No Change | Worsen | Net response | Improve | No Change | Worsen | Net response | | Q3:21-22 | 25.6 | 61.1 | 13.3 | 12.4 | 59.8 | 37.5 | 2.6 | 57.2 | | Q4:21-22 | 32.2 | 46.2 | 21.6 | 10.5 | 50.7 | 45.9 | 3.4 | 47.3 | | Q1:22-23 | 28.5 | 54.9 | 16.5 | 12.0 | 33.5 | 61.3 | 5.2 | 28.2 | | Q2:22-23 | 26.9 | 65.8 | 7.3 | 19.6 | 33.2 | 61.7 | 5.1 | 28.2 | | Q3:22-23 | 42.1 | 53.4 | 4.6 | 37.5 | 32.9 | 61.0 | 6.2 | 26.7 | | Q4:22-23 | | | | | 42.3 | 52.4 | 5.4 | 36.9 | | ‘Improve’ in Availability of Finance is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table S6: Assessment and Expectation for Cost of Finance | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 19.5 | 73.6 | 6.9 | -12.6 | 56.0 | 41.2 | 2.7 | -53.3 | | Q4:21-22 | 15.5 | 75.0 | 9.5 | -6.0 | 43.6 | 54.0 | 2.4 | -41.2 | | Q1:22-23 | 34.4 | 58.5 | 7.1 | -27.3 | 17.3 | 79.9 | 2.8 | -14.5 | | Q2:22-23 | 35.1 | 59.5 | 5.4 | -29.7 | 31.5 | 66.0 | 2.5 | -29.1 | | Q3:22-23 | 40.7 | 54.7 | 4.6 | -36.1 | 39.7 | 57.1 | 3.2 | -36.5 | | Q4:22-23 | | | | | 41.6 | 53.2 | 5.2 | -36.5 | | ‘Decrease’ in Cost of Finance is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table S7: Assessment and Expectation for Salary/Wages | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 24.0 | 69.2 | 6.8 | -17.2 | 53.4 | 44.9 | 1.7 | -51.7 | | Q4:21-22 | 24.1 | 71.6 | 4.3 | -19.8 | 49.6 | 49.3 | 1.1 | -48.5 | | Q1:22-23 | 40.4 | 55.1 | 4.5 | -35.9 | 37.0 | 62.4 | 0.6 | -36.3 | | Q2:22-23 | 46.1 | 51.0 | 2.9 | -43.3 | 28.4 | 70.5 | 1.1 | -27.3 | | Q3:22-23 | 47.9 | 48.4 | 3.7 | -44.2 | 42.4 | 56.0 | 1.6 | -40.9 | | Q4:22-23 | | | | | 43.3 | 52.1 | 4.6 | -38.7 | | ‘Decrease’ in Salary/Wages is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table S8: Assessment and Expectation for Cost of Inputs | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 47.5 | 48.5 | 4.0 | -43.5 | 69.3 | 30.3 | 0.4 | -68.8 | | Q4:21-22 | 63.5 | 32.9 | 3.6 | -59.9 | 73.1 | 26.1 | 0.8 | -72.4 | | Q1:22-23 | 67.0 | 29.9 | 3.2 | -63.8 | 61.0 | 36.6 | 2.3 | -58.7 | | Q2:22-23 | 46.0 | 50.3 | 3.6 | -42.4 | 62.0 | 36.1 | 1.9 | -60.2 | | Q3:22-23 | 46.1 | 49.2 | 4.7 | -41.4 | 49.4 | 45.6 | 4.9 | -44.5 | | Q4:22-23 | | | | | 50.1 | 44.5 | 5.3 | -44.8 | | ‘Decrease’ in Cost of Inputs is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table S9: Assessment and Expectation for Selling Price | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 22.4 | 68.2 | 9.4 | 13.0 | 62.3 | 35.6 | 2.1 | 60.2 | | Q4:21-22 | 24.2 | 65.7 | 10.2 | 14.0 | 54.1 | 43.1 | 2.8 | 51.4 | | Q1:22-23 | 31.9 | 60.1 | 8.0 | 23.9 | 29.5 | 65.9 | 4.6 | 24.9 | | Q2:22-23 | 19.1 | 74.9 | 5.9 | 13.2 | 33.3 | 63.1 | 3.6 | 29.8 | | Q3:22-23 | 40.8 | 54.4 | 4.8 | 36.0 | 25.7 | 68.3 | 6.1 | 19.6 | | Q4:22-23 | | | | | 38.9 | 55.6 | 5.5 | 33.4 | | ‘Increase’ in Selling Price is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table S10: Assessment and Expectation for Profit Margin | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 21.2 | 58.3 | 20.5 | 0.7 | 55.0 | 38.8 | 6.2 | 48.8 | | Q4:21-22 | 21.2 | 46.4 | 32.4 | -11.1 | 46.5 | 47.0 | 6.5 | 40.1 | | Q1:22-23 | 19.0 | 49.3 | 31.7 | -12.7 | 28.9 | 61.3 | 9.8 | 19.1 | | Q2:22-23 | 21.9 | 58.3 | 19.9 | 2.0 | 30.1 | 58.1 | 11.8 | 18.3 | | Q3:22-23 | 41.9 | 52.0 | 6.1 | 35.8 | 36.3 | 54.3 | 9.5 | 26.8 | | Q4:22-23 | | | | | 44.8 | 49.7 | 5.4 | 39.4 | | ‘Increase’ in Profit Margin is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table S11: Assessment and Expectation for Inventories | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 23.5 | 69.0 | 7.5 | 16.0 | 62.8 | 34.8 | 2.4 | 60.4 | | Q4:21-22 | 18.9 | 70.6 | 10.6 | 8.3 | 54.9 | 41.8 | 3.4 | 51.5 | | Q1:22-23 | 25.4 | 66.7 | 8.0 | 17.4 | 22.9 | 72.5 | 4.7 | 18.2 | | Q2:22-23 | 33.7 | 62.7 | 3.6 | 30.1 | 27.5 | 68.9 | 3.6 | 24.0 | | Q3:22-23 | 48.3 | 46.9 | 4.8 | 43.5 | 40.5 | 56.8 | 2.7 | 37.8 | | Q4:22-23 | | | | | 48.8 | 46.0 | 5.2 | 43.5 | | ‘Increase’ in Inventories is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table S12: Assessment and Expectation for Technical/Service Capacity | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 23.1 | 72.5 | 4.3 | 18.8 | 73.7 | 25.7 | 0.6 | 73.2 | | Q4:21-22 | 23.7 | 71.6 | 4.7 | 18.9 | 65.1 | 34.1 | 0.8 | 64.3 | | Q1:22-23 | 25.8 | 71.9 | 2.3 | 23.5 | 31.3 | 66.9 | 1.8 | 29.4 | | Q2:22-23 | 24.0 | 73.8 | 2.2 | 21.8 | 33.9 | 63.8 | 2.3 | 31.7 | | Q3:22-23 | 41.7 | 53.6 | 4.7 | 37.1 | 29.5 | 68.8 | 1.7 | 27.7 | | Q4:22-23 | | | | | 41.5 | 53.9 | 4.6 | 37.0 | | ‘Increase’ in Technical/Service Capacity is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table S13: Assessment and Expectation for Physical Investment | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 20.7 | 74.4 | 4.9 | 15.8 | 68.8 | 30.7 | 0.5 | 68.2 | | Q4:21-22 | 20.5 | 74.3 | 5.3 | 15.2 | 61.5 | 37.4 | 1.1 | 60.3 | | Q1:22-23 | 25.0 | 72.5 | 2.5 | 22.5 | 27.7 | 69.9 | 2.4 | 25.3 | | Q2:22-23 | 21.4 | 76.7 | 2.0 | 19.4 | 32.5 | 66.5 | 1.0 | 31.5 | | Q3:22-23 | 41.3 | 54.4 | 4.3 | 37.0 | 22.8 | 75.8 | 1.5 | 21.3 | | Q4:22-23 | | | | | 41.4 | 53.9 | 4.7 | 36.7 | | ‘Increase’ in Physical Investment is optimistic. Footnotes @ and # given in Table 1 are applicable here. | Infrastructure Sector | Table I1: Assessment and Expectation for Overall Business Situation | | (Percentage responses)@ | | Quarter | Assessment | Expectation | | Better | No Change | Worse | Net response# | Better | No Change | Worse | Net response | | Q3:21-22 | 41.9 | 44.1 | 14.0 | 27.9 | 71.3 | 26.7 | 2.1 | 69.2 | | Q4:21-22 | 46.9 | 29.6 | 23.5 | 23.5 | 75.7 | 19.9 | 4.4 | 71.3 | | Q1:22-23 | 46.9 | 26.9 | 26.2 | 20.8 | 59.3 | 34.6 | 6.2 | 53.1 | | Q2:22-23 | 41.9 | 46.8 | 11.3 | 30.6 | 53.1 | 36.9 | 10.0 | 43.1 | | Q3:22-23 | 55.5 | 38.0 | 6.5 | 49.0 | 49.2 | 46.7 | 4.1 | 45.1 | | Q4:22-23 | | | | | 56.8 | 37.2 | 6.0 | 50.9 | ‘Increase’ in Overall business situation is optimistic.

@: Due to rounding off percentage may not add up to 100.

#: Net Response (NR) is the difference of percentage of the respondents reporting optimism and that reporting pessimism. The range is -100 to 100. Any value greater than zero indicates expansion/ optimism and any value less than zero indicates contraction/ pessimism. |

| Table I2: Assessment and Expectation for Turnover | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 40.7 | 46.7 | 12.6 | 28.1 | 67.9 | 27.5 | 4.6 | 63.3 | | Q4:21-22 | 45.0 | 31.3 | 23.8 | 21.3 | 73.3 | 20.0 | 6.7 | 66.7 | | Q1:22-23 | 37.2 | 30.2 | 32.6 | 4.7 | 51.3 | 37.5 | 11.3 | 40.0 | | Q2:22-23 | 45.5 | 40.7 | 13.8 | 31.7 | 43.0 | 46.1 | 10.9 | 32.0 | | Q3:22-23 | 52.6 | 40.2 | 7.2 | 45.4 | 56.1 | 35.0 | 8.9 | 47.2 | | Q4:22-23 | | | | | 55.8 | 37.2 | 7.0 | 48.8 | | ‘Increase’ in Turnover is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table I3: Assessment and Expectation for Full-time Employees | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 20.1 | 72.4 | 7.5 | 12.7 | 50.0 | 45.8 | 4.2 | 45.8 | | Q4:21-22 | 12.5 | 80.0 | 7.5 | 5.0 | 54.5 | 39.6 | 6.0 | 48.5 | | Q1:22-23 | 22.7 | 62.5 | 14.8 | 7.8 | 23.1 | 71.8 | 5.1 | 17.9 | | Q2:22-23 | 31.5 | 60.5 | 8.1 | 23.4 | 20.6 | 74.6 | 4.8 | 15.9 | | Q3:22-23 | 51.2 | 42.3 | 6.5 | 44.7 | 36.4 | 57.0 | 6.6 | 29.8 | | Q4:22-23 | | | | | 52.4 | 40.7 | 6.9 | 45.5 | | ‘Increase’ in Full-time Employees is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table I4: Assessment and Expectation for Part-time Employees | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 24.5 | 74.5 | 1.0 | 23.5 | 69.3 | 28.8 | 2.0 | 67.3 | | Q4:21-22 | 4.4 | 88.9 | 6.7 | -2.2 | 73.2 | 24.7 | 2.1 | 71.1 | | Q1:22-23 | 17.2 | 75.9 | 6.9 | 10.3 | 20.5 | 75.0 | 4.5 | 15.9 | | Q2:22-23 | 19.7 | 71.3 | 9.0 | 10.7 | 21.8 | 72.7 | 5.5 | 16.4 | | Q3:22-23 | 50.3 | 43.2 | 6.5 | 43.8 | 24.6 | 68.6 | 6.8 | 17.8 | | Q4:22-23 | | | | | 52.1 | 41.7 | 6.2 | 45.9 | | ‘Increase’ in Part-time Employees is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table I5: Assessment and Expectation for Availability of Finance | | (Percentage responses) | | Quarter | Assessment | Expectation | | Improve | No Change | Worsen | Net response | Improve | No Change | Worsen | Net response | | Q3:21-22 | 27.6 | 62.7 | 9.7 | 17.9 | 56.1 | 39.7 | 4.2 | 51.9 | | Q4:21-22 | 31.3 | 46.3 | 22.5 | 8.8 | 66.4 | 29.1 | 4.5 | 61.9 | | Q1:22-23 | 29.5 | 49.6 | 20.9 | 8.5 | 28.8 | 67.5 | 3.8 | 25.0 | | Q2:22-23 | 30.9 | 60.2 | 8.9 | 22.0 | 33.9 | 59.8 | 6.3 | 27.6 | | Q3:22-23 | 50.5 | 43.7 | 5.8 | 44.7 | 43.4 | 50.8 | 5.7 | 37.7 | | Q4:22-23 | | | | | 52.2 | 41.9 | 5.8 | 46.4 | | ‘Improve’ in Availability of Finance is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table I6: Assessment and Expectation for Cost of Finance | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 24.2 | 71.9 | 3.9 | -20.3 | 49.8 | 47.7 | 2.6 | -47.2 | | Q4:21-22 | 27.4 | 67.1 | 5.5 | -21.9 | 59.4 | 38.3 | 2.3 | -57.0 | | Q1:22-23 | 43.0 | 51.2 | 5.8 | -37.2 | 26.8 | 71.8 | 1.4 | -25.4 | | Q2:22-23 | 43.8 | 48.8 | 7.4 | -36.4 | 39.8 | 58.5 | 1.7 | -38.1 | | Q3:22-23 | 51.0 | 42.8 | 6.2 | -44.9 | 47.5 | 46.7 | 5.8 | -41.7 | | Q4:22-23 | | | | | 49.7 | 44.5 | 5.8 | -43.8 | | ‘Decrease’ in Cost of Finance is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table I7: Assessment and Expectation for Salary/Wages | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 22.4 | 73.9 | 3.7 | -18.7 | 51.3 | 46.2 | 2.5 | -48.7 | | Q4:21-22 | 23.8 | 72.5 | 3.8 | -20.0 | 59.0 | 41.0 | 0.0 | -59.0 | | Q1:22-23 | 38.5 | 55.4 | 6.2 | -32.3 | 38.8 | 60.0 | 1.3 | -37.5 | | Q2:22-23 | 31.1 | 64.8 | 4.1 | -27.0 | 20.8 | 76.9 | 2.3 | -18.5 | | Q3:22-23 | 56.3 | 39.2 | 4.4 | -51.9 | 35.0 | 62.4 | 2.6 | -32.5 | | Q4:22-23 | | | | | 50.5 | 43.6 | 5.8 | -44.7 | | ‘Decrease’ in Salary/Wages is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table I8: Assessment and Expectation for Cost of Inputs | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 53.8 | 46.2 | 0.0 | -53.8 | 76.5 | 23.0 | 0.4 | -76.1 | | Q4:21-22 | 77.5 | 19.7 | 2.8 | -74.6 | 83.1 | 15.4 | 1.5 | -81.5 | | Q1:22-23 | 79.5 | 19.7 | 0.8 | -78.7 | 80.3 | 18.3 | 1.4 | -78.9 | | Q2:22-23 | 50.0 | 44.2 | 5.8 | -44.2 | 76.0 | 23.1 | 0.8 | -75.2 | | Q3:22-23 | 52.2 | 41.6 | 6.2 | -46.0 | 53.0 | 42.7 | 4.3 | -48.7 | | Q4:22-23 | | | | | 55.3 | 37.8 | 6.9 | -48.5 | | ‘Decrease’ in Cost of Inputs is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table I9: Assessment and Expectation for Selling Price | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 27.0 | 67.6 | 5.4 | 21.6 | 59.9 | 38.1 | 2.0 | 57.9 | | Q4:21-22 | 21.4 | 73.2 | 5.4 | 16.1 | 66.4 | 32.7 | 0.9 | 65.5 | | Q1:22-23 | 32.2 | 54.0 | 13.8 | 18.4 | 25.0 | 73.2 | 1.8 | 23.2 | | Q2:22-23 | 27.5 | 60.0 | 12.5 | 15.0 | 34.1 | 62.4 | 3.5 | 30.6 | | Q3:22-23 | 51.4 | 41.8 | 6.8 | 44.5 | 32.2 | 62.6 | 5.2 | 27.0 | | Q4:22-23 | | | | | 50.3 | 43.1 | 6.6 | 43.8 | | ‘Increase’ in Selling Price is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table I10: Assessment and Expectation for Profit Margin | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 26.5 | 52.9 | 20.6 | 5.9 | 49.8 | 43.5 | 6.7 | 43.1 | | Q4:21-22 | 19.0 | 35.4 | 45.6 | -26.6 | 57.4 | 33.1 | 9.6 | 47.8 | | Q1:22-23 | 13.8 | 34.6 | 51.5 | -37.7 | 27.8 | 57.0 | 15.2 | 12.7 | | Q2:22-23 | 22.0 | 54.5 | 23.6 | -1.6 | 22.5 | 62.0 | 15.5 | 7.0 | | Q3:22-23 | 52.2 | 40.1 | 7.6 | 44.6 | 34.7 | 47.1 | 18.2 | 16.5 | | Q4:22-23 | | | | | 52.8 | 39.6 | 7.6 | 45.1 | | ‘Increase’ in Profit Margin is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table I11: Assessment and Expectation for Inventories | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 26.3 | 69.3 | 4.4 | 21.9 | 58.6 | 36.5 | 5.0 | 53.6 | | Q4:21-22 | 19.1 | 74.5 | 6.4 | 12.8 | 64.9 | 31.6 | 3.5 | 61.4 | | Q1:22-23 | 20.9 | 70.1 | 9.0 | 11.9 | 24.4 | 71.1 | 4.4 | 20.0 | | Q2:22-23 | 36.4 | 55.9 | 7.6 | 28.8 | 25.8 | 71.2 | 3.0 | 22.7 | | Q3:22-23 | 52.4 | 41.0 | 6.6 | 45.9 | 45.8 | 47.5 | 6.8 | 39.0 | | Q4:22-23 | | | | | 53.6 | 39.2 | 7.2 | 46.4 | | ‘Increase’ in Inventories is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table I12: Assessment and Expectation for Technical/Service Capacity | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 27.5 | 71.4 | 1.1 | 26.4 | 82.1 | 16.4 | 1.5 | 80.6 | | Q4:21-22 | 28.6 | 60.7 | 10.7 | 17.9 | 76.7 | 22.2 | 1.1 | 75.6 | | Q1:22-23 | 23.5 | 73.5 | 2.9 | 20.6 | 32.1 | 64.3 | 3.6 | 28.6 | | Q2:22-23 | 25.5 | 68.2 | 6.4 | 19.1 | 29.4 | 67.6 | 2.9 | 26.5 | | Q3:22-23 | 50.2 | 43.9 | 6.0 | 44.2 | 27.7 | 70.5 | 1.8 | 25.9 | | Q4:22-23 | | | | | 50.5 | 43.5 | 6.0 | 44.6 | | ‘Increase’ in Technical/Service Capacity is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

| Table I13: Assessment and Expectation for Physical Investment | | (Percentage responses) | | Quarter | Assessment | Expectation | | Increase | No Change | Decrease | Net response | Increase | No Change | Decrease | Net response | | Q3:21-22 | 30.1 | 68.8 | 1.1 | 29.0 | 73.6 | 23.6 | 2.8 | 70.8 | | Q4:21-22 | 17.2 | 75.9 | 6.9 | 10.3 | 77.4 | 20.4 | 2.2 | 75.3 | | Q1:22-23 | 27.0 | 67.6 | 5.4 | 21.6 | 24.1 | 69.0 | 6.9 | 17.2 | | Q2:22-23 | 22.0 | 72.5 | 5.5 | 16.5 | 38.9 | 58.3 | 2.8 | 36.1 | | Q3:22-23 | 49.7 | 44.1 | 6.3 | 43.4 | 26.9 | 70.4 | 2.8 | 24.1 | | Q4:22-23 | | | | | 49.8 | 43.6 | 6.6 | 43.2 | | ‘Increase’ in Physical Investment is optimistic. Footnotes @ and # given in Table 1 are applicable here. |

|  IST,

IST,