IST,

IST,

Some Macroeconomic Impacts of Different Types of Public Expenditure in India - Analysis Using a Computable General Equilibrium Model

by

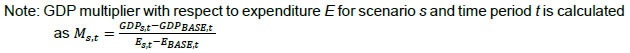

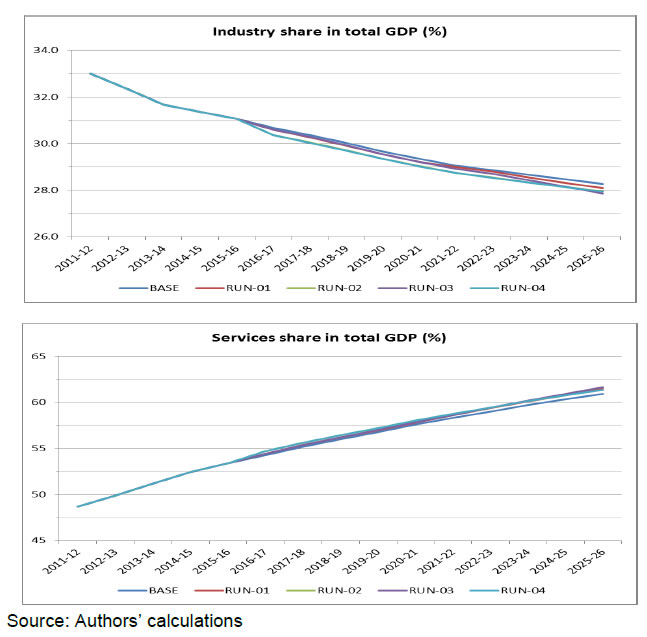

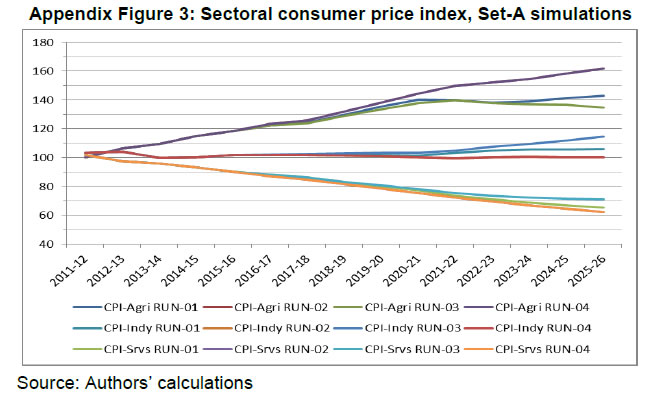

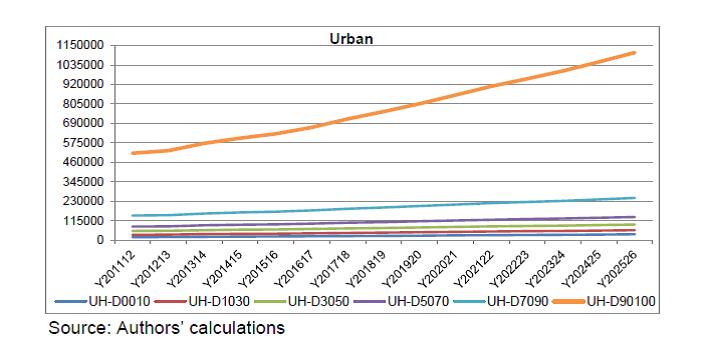

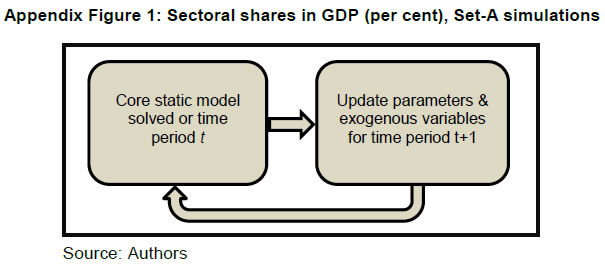

The authors are deeply grateful to Dr. M.D. Patra, Executive Director, Reserve Bank of India for his constant support/encouragement to complete the study. We are also thankful to Dr. Rajiv Ranjan, Adviser, Department of Economic and Policy Research (DEPR) for his valuable guidance and support. We thank Dr. Satyananda Sahoo, Director, DEPR and his team members for their constant support and suggestions at each stages. The authors would also like to thank the participants at the various meetings held at the DEPR for their comments and suggestions, including on a set of preliminary results that were presented at the DEPR, which has helped shape the scope of this study and refine the analysis carried out here. The authors would also like to thank an anonymous referee for the insightful comments on an earlier draft, which have helped improve the report. Needless to say, the views expressed here are those of the authors alone and not of the Institutions to which they belong or of the FSU/DEPR/ RBI or the participants in the various meetings held at the DEPR or of the referee. In this study, we examine the impacts of various types of government expenditure on the Indian economy. In particular, we examine the impacts of a rise in (a) Government consumption expenditure in general and the nature of the relation between government expenditure and GDP, (b) Government expenditure in Social Sectors and in Public Administration, (c) Government transfer payments to households, and (d) Public investment. Towards this, we have used a recursively dynamic computable general equilibrium (CGE) model of the Indian economy developed by Bhakta and Ganesh-Kumar (2016), which is built around a social accounting matrix (SAM) for the year 2011-12. The SAM and the model distinguish 9 commodities/ sectors, 9 factors of production, and 12 household types distinguished by their location and by the monthly per capita expenditure (MPCE) percentile. The model is solved annually over the period 2011-12 to 2025-26. As a first step, we develop a BASE scenario that captures a “Business As Usual” trajectory that the Indian economy is likely to take over the 10-year period 2016-17 to 2025-26 given the current structural characteristics of the economy, and the set of policies currently prevailing. We then develop five sets of counter-factual policy scenarios to study the economy-wide impacts of different types of public expenditure. Each of these sets consists of two or more simulations that are designed to address one main question and its sub-questions, if any. The impacts in each simulation are assessed by comparing the model outcomes in that simulation with the BASE scenario. Our results show that the impact of expansion in government expenditure across different types of expenditure depends crucially on the prevailing macroeconomic conditions, especially whether there is full employment/ unemployment of factors, and also on the complementary set of policies that are needed to generate the resources required to finance the additional expenditure. The main messages that emerge are as follows: