The process of deleveraging and dysfunctional financial markets in the advanced economies accentuating a global financial crisis has highlighted the importance of orderly functioning of markets for achieving macroeconomic objectives. In the third quarter of 2008-09, when liquidity dried down in the global money markets and the credit markets almost froze, there were knock-on effects on the domestic money and foreign exchange markets, which prompted the Reserve Bank to initiate measures to ensure adequate provision of both rupee and foreign exchange liquidity in the market. While orderly conditions were restored in the money market by November 2008, the pressure on the exchange rate continued, alongside pressure on the country’s balance of payments and draw down of foreign exchange reserves. The equity markets followed the general global sentiments and market trends and after a phase of sharp downward movement, the market has shown some recovery since March 2009. In the government securities market, reflecting the economy’s need for large fiscal stimulus, the gross market borrowings of the Government in 2008-09 were substantially higher than that for 2007-08. The entire market borrowing programme was managed smoothly by the Reserve Bank. In the credit market, following significant reduction in policy rates by the Reserve Bank, the lending rates of banks have begun to exhibit some moderation. In the context of the high volatility that was witnessed in global financial markets in 2008-09, one notable aspect of the Indian financial markets was that all segments functioned normally, with occasional volatility for short periods. V.1 The subprime crisis, that emerged in the US housing mortgage market in the second half of 2007, snowballed into a global financial crisis and a global economic crisis. The global financial landscape changed significantly during the course of 2008-09 wherein several large international financial institutions either failed or were restructured, with the support of very large goverment interventions in many countries, to prevent imminent collapse. The significant deterioration in global financial conditions since mid-September 2008, led to severe disruptions in the short-term funding markets, widening of risk spreads, sharp fall in equity prices and inactivity in the markets for asset-backed securities. Consequently, the strain on the balance sheets of financial institutions increased, threatening the viability of some of the most well known financial entities in the world. The freezing up of credit markets necessitated extraordinary actions on the part of central banks and governments in countries across the world to mitigate the systemic risks posed by the ongoing financial crisis. V.2 To restore confidence and facilitate orderly functioning of markets, central banks have been responding through both conventional and unconventional measures and there have been instances of coordinated policy actions by the central banks. The conventional measure of monetary easing has been achieved through policy rate cuts which has taken the policy rate to nearly zero as in the case of the US and to an all-time low of 0.5 per cent as in the case of UK and 1.25 per cent in the Euro area. The other measures include lending by central banks to non-banks, large-scale provision of term-funding in local currency and dollar markets and expansion of the range of acceptable collateral for receiving funding from the central bank. Further, steps have been taken to deal with distressed assets and provide liquidity, including through bank recapitalisation.

V.3 The important initiatives taken by the US Federal Reserve, besides reduction of the federal funds rate, include conducting direct purchases of agency debt and agency mortgage-backed securities, broadening of liquidity programmes to financial intermediaries and other central banks and initiating programmes in support of systemically important market segments. The US government entities also undertook extraordinary initiatives to support the financial sector by injecting capital into the banking system and providing guarantees on select liabilities of depository institutions. Many foreign central banks and governments took similar steps. Despite the host of measures taken in most countries, normalcy continues to elude the international financial markets. This has contributed to the continued uncertainty and deterioration of the world economic outlook. The financial markets need to be stabilised in order to achieve a turnaround in global growth conditions.

V.4 Restoring investor confidence is key to achieving financial stability. In this context, there is a paramount need to deal with distressed assets and recapitalise vital institutions. This entails substantial contribution from governments for support of the financial sector. Simultaneously, governments have been addressing the recession through growth stimulus packages, while the tax receipts are likely to reduce in the face of the economic downturn. The longer it takes to effectively implement the support packages for the financial sector, the negative feedback transmitting from the financial sector to the real sector may lead to more protracted recession. The US government and the Federal Reserve have initiated programmes for systemically important segments/institutions of the financial market. The authorities are conducting severe stress tests on all the major banks, and if they are found short of capital required under more severe but plausible scenarios, they could fill the gap by recourse to private financing or through temporary capital buffers made available by the government. The US Treasury, in conjunction with the Federal Deposit Insurance Corporation and the Federal Reserve, has announced the details of a Public-Private Investment Programme which would use US$ 75-100 billion of Troubled Assets Relief Programme (TARP) capital and capital from private investors and seek to generate US$ 500 billion in purchasing power to buy legacy assets, with the potential to expand to US$ 1 trillion over time.

V.5 Due to the inter-linkages in the global financial markets, the ramifications of developments in the advanced economies are felt in the emerging economies. Hence, there needs to be greater coordination and cooperation amongst the policy-making bodies so as to restore trust in the markets. In this regard, the Basel Committee on Banking Supervision and the Financial Stability Forum, to be known as Financial Stability Board in its expanded version, have extended their membership to a number of emerging market economies including India.

V.6 The knock-on effects of the international developments spilled into the Indian financial markets in mid-September 2008. The Reserve Bank, like most central banks, has since taken a number of conventional and unconventional measures to augment the domestic and foreign exchange liquidity and address the supply constraints impacting the growth momentum in the domestic economy. An important distinction between the actions taken by the Reserve Bank and other central banks is that the interaction is still largely through the banking channel and even the measures aimed at addressing the liquidity and redemption needs of mutual funds, non-banking financial companies (NBFCs) and housing finance companies are directed through the banks1. Another notable distinction is that there has not been any dilution of the collateral taken by the Reserve Bank. The array of instruments available allow for flexibility in Reserve Banks operations. Liquidity modulation through flexible use of a combination of instruments, to a significant extent, cushioned the impact of the international financial turbulence on domestic financial markets by absorbing excessive market pressures and ensuring orderly conditions. Thus, liquidity pressures were evident in India for a temporary period in September and October 2008. The Indian financial markets are robust and working normally with no dislocations in the foreign exchange, money and government securities markets.

International Financial Markets

V.7 Since mid-October 2008, the developments in the international financial markets have been largely conditioned by the policy responses to the crisis. The pricing behaviour has begun to mirror the strains of the ongoing economic recession and prices have been decidedly volatile given the environment of heightened uncertainty. Pressure on credit market persists in the wake of recession in many economies and subdued corporate performance, which has given rise to the expectation of possible increase in defaults. During the fourth quarter of 2008-09, the equity valuations generally remained low on account of concerns stemming from the weak financial and economic outlook.

Money Markets

V.8 The policies initiated by central banks and the guarantees offered by governments assuaged to an extent the

funding pressures that were evident in the international financial markets during September and October 2008. The spreads between Libor and overnight index swaps (OIS) have been gradually narrowing. In the UK, however, bank funding markets came under renewed pressure. The Sterling Libor-OIS spreads slightly widened and the interbank term-lending remained subdued during late January and February 2009.

1 The Government of India had announced an arrangement for providing liquidity support to meet the temporary liquidity mismatches for eligible Systemically Important Non-Deposit taking Non-Banking Financial Companies (NBFC-ND-SI) through the Industrial Development Bank of India Stressed Asset Stabilisation Fund Trust, which has been notified as a Special Purpose Vehicle for undertaking this operation.

V.9 The benchmark credit default swap (CDS) indices have shown significant spread volatility since end-November 2008 up to the fourth quarter of 2008-09. Investment grade spreads, however, mostly performed better than the lower-rated borrowers. For instance, between end-November 2008 and end-February 2009, the US five-year CDX high-yield index spread had risen by 148 basis points, while the investment grade spreads registered a decline of 28 basis points. The same pattern was exhibited by the European CDS indices. As problems persist in the banking sector internationally and recessionary conditions have become widespread, it is expected that default rates will increase. Risk tolerance in the market is low and lower-rated spreads are expected to see increased volatility. In March 2009, the Federal Reserve approved the application of the ICE Trust to become a member of the Federal Reserve system. The ICE trust would provide central counterparty services for CDS contracts conducted by its participants. Under the arrangement, the ICE Trust would work towards reducing the risk associated with the trading and settlement of CDS transactions by assuming counterparty credit risk and enforcing participation standards and margin requirements.

V.10 As spreads continued to be affected by financial market concerns, in January 2009, the authorities in the UK announced a further broad-based package for rescue of the financial institutions in the country. Additional support measures were announced by other European countries as well. However, as concerns mounted over the fiscal implications of the support packages and the depressed risk appetite, spreads on sovereign CDS rose during the first three months of 2009.

V.11 Recent measures taken by the governments and central banks do seem to be having a favourable impact on certain segments of the money and credit markets, which had faced severe disruptions during the acute phase of the crisis in the third quarter of 2008-09. For instance, the US government’s announcement in November 2008 and the subsequent initiation of a programme for purchase of up to US$ 100 billion of direct obligations of housing-related government-sponsored enterprises and up to US$ 500 billion of mortgage-backed securities (MBS) backed by Fannie Mae, Freddie Mac, and Ginnie Mae has helped in reducing spreads on agency debt and the conditions for high-quality borrowers in the primary residential mortgage market recovered to an extent. In March 2009, the Federal Open Market Committee also announced plans to purchase an additional US$ 750 billion of agency MBS and invest an additional US$ 100 billion in agency debt. The Committee also announced that it would buy up to US$ 300 billion of longer-term Treasury securities over the next six months to help improve conditions in private credit markets.

V.12 The Federal Reserve launched the Term-Asset Backed Securities Loan Facility (TALF) on March 3, 2009 in an attempt to unfreeze markets for securities backed by loans. Spreads in the areas where the programme is focussed – pooled credit card, auto, student and small business loans – narrowed during the first two months of 2009 in anticipation of TALF and narrowed considerably in March with the launch of the programme. The first tranche of funding under TALF was settled on March 25, 2009.

V.13 The banking sector in the US and Europe continued to show further signs of problems, despite the massive injection of capital by the government and from private sources since late 2007. Notable instances of governments picking up or hiking their stakes in financial entities during the fourth quarter of 2008-09 include the German government taking a 25 per cent stake in the merged entity of Commerzbank and Dresdner Bank, the US authorities’ investment of US $ 20 billion in Bank of America through a preferred equity stake and the UK government restructuring its investment in the Royal Bank of Scotland. The UK authorities continued to announce a series of measures during the fourth quarter of 2008-09 for enabling sufficient credit flow to households and businesses. These measures include capping the losses on banks’ holdings of risky assets, state guarantees to facilitate bank funding and purchase of commercial paper, corporate bonds and other securities to enhance credit availability in the economy. In March 2009, the Bank of England embarked upon a policy of credit/quantitative easing entailing the purchase of £ 75 billion worth of conventional gilts and notified private sector assets in the secondary market, in a bid to support the flow of corporate credit. The UK programme has resulted in significantly lower yields for the gilts, which the Bank has agreed to buy. Corporate bond yields have also fallen. By the first week of April 2009, £ 26 billion of asset purchases had been made and it is expected that the programme will be completed in another two months. In April 2009, the Bank of Japan announced that it would offer credit-worthy commercial banks subordinated loans worth up to ¥1 trillion to smoothen financial intermediation in the country. The programme is likely to commence in May 2009.

Short-term Interest Rates

V.14 The easing of short-term interest rates in advanced economies persisted in the fourth quarter of 2008-09, as policy rates continued to be cut with inflation concerns disappearing and the recession in most advanced economies turning out to be deeper and more protracted than was earlier estimated (Table 41). The US federal funds rate remains in the range of 0.0-0.25 per cent set in mid-December 2008. The Bank of England effected a 50 basis point cut in policy rates in each of the three months of the fourth quarter of 2008-09. As of March 5, 2009, the official bank rate was at an all-time low of 0.5 per cent. The ECB has reduced its policy rates by 300 basis points since October 2008, the rate for main refinancing operations thus stands reduced to 1.25 per cent. The softening of interest rates was broad-based and across the spectrum, as emerging economies also saw frequent cuts in policy rates and liquidity injections by the authorities. Countries that effected cuts in policy rates during the fourth quarter of 2008-09 include Turkey (cumulative reduction of 725 basis points since October 2008), South Africa (cumulative reduction of 250 basis points since October 2008) and South Korea (cumulative reduction of 300 basis points since October 2008). The policy rate cuts by the Czech Republic, Peru, Sri Lanka, Chile, Egypt, Canada, Poland, Malaysia, New Zealand, Iceland and Brazil, during the fourth quarter of 2008-09, ranged from 50 basis points to 600 basis points.

Table 41: Short-term Interest Rates |

(Per cent) |

Region/Country |

End of |

March 2007 |

March 2008 |

June 2008 |

Sept 2008 |

Dec 2008 |

March 2009 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Advanced Economies |

|

|

|

|

|

|

Euro Area |

3.91 |

4.72 |

4.96 |

5.07 |

2.97 |

1.50 |

Japan |

0.57 |

0.75 |

0.75 |

0.75 |

0.62 |

0.54 |

UK |

5.55 |

6.01 |

5.93 |

6.25 |

2.73 |

1.70 |

US |

5.23 |

2.26 |

2.29 |

2.04 |

0.44 |

0.50 |

Emerging Market Economies |

|

|

|

|

|

|

Argentina |

9.63 |

10.44 |

16.50 |

13.81 |

19.56 |

14.44 |

Brazil |

12.68 |

11.18 |

12.17 |

13.66 |

13.66 |

11.16 |

China |

2.86 |

4.50 |

4.48 |

4.31 |

1.86 |

1.22 |

Hong Kong |

4.17 |

1.83 |

2.33 |

3.66 |

1.00 |

0.90 |

India |

7.98 |

7.23 |

8.73 |

8.56 |

5.04 |

4.95 |

Malaysia |

3.64 |

3.62 |

3.69 |

3.70 |

3.40 |

2.09 |

Philippines |

5.31 |

6.44 |

6.00 |

4.00 |

5.25 |

4.50 |

Singapore |

3.00 |

1.38 |

1.25 |

1.75 |

0.91 |

0.56 |

South Korea |

4.94 |

5.32 |

5.36 |

5.78 |

3.98 |

2.41 |

Thailand |

4.45 |

3.25 |

3.65 |

3.85 |

3.85 |

1.80 |

Note : Data for India refer to 91-day Treasury Bills rate and for other countries 3-month money market rates.

Source : The Economist. |

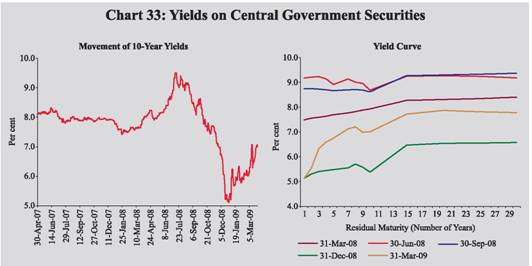

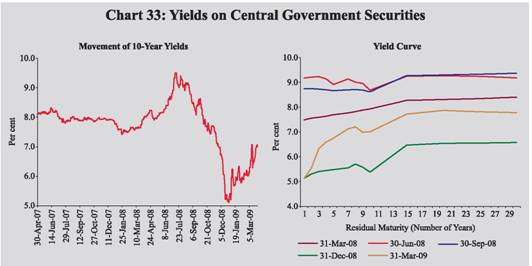

Government Bond Yields

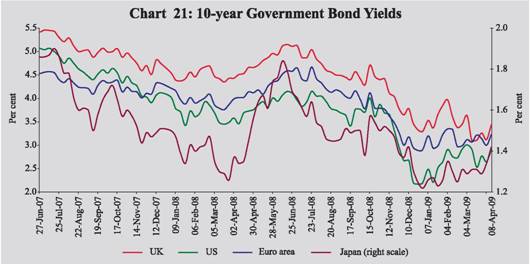

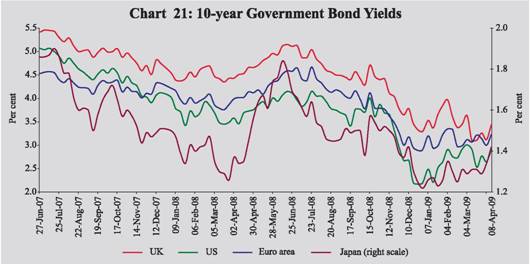

V.15 There has been much volatility in the government bond yields because even as most advanced economies are facing a recession, concerns have mounted over the increased borrowing requirements of the governments. This contributed to the increase in the 10-year government bond yields in some advanced countries during the fourth quarter of 2008-09. The 10-year government bond yield in the US increased by 72 basis points between December 29, 2008 and April 8, 2009. During the same period, yields on 10-year government papers increased by 34 basis points in the Euro area, 20 basis points in Japan and 15 basis points in the UK (Chart 21).

Foreign Exchange Markets

V.16 The international financial markets witnessed extreme dislocations in the period immediately following the collapse of the Lehman Brothers in mid-September 2008. The volatility in the markets, which peaked by end-2008, moderated somewhat in 2009. Due to the unwinding of carry trade positions and low risk appetite, the yen appreciated against most other currencies, including the US dollar during 2008-09.However, beginning mid-February 2009 up to mid-April 2009, the yen has generally depreciated against the US dollar.

V.17 Although, the foreign exchange swap spreads have begun to soften, the foreign exchange markets remained strained for most countries during the first quarter of 2009. The Bank of Mexico had to directly intervene in the foreign-exchange markets for the first time in more than a decade in February 2009 because of the severity of the impact of the crisis on its currency trading. Four eastern European central banks (of Romania, Hungary, Poland and the Czech Republic) announced that they would make coordinated effort to bolster their currencies as the sharp depreciations experienced by their respective currencies were not in line with the economic fundamentals.

V.18 The US dollar, generally, appreciated against most of the currencies as the US investors were liquidating their positions in overseas equity and bond markets and repatriating the money back to the US. Notwithstanding the deepening of the financial crisis and weakness in economic activity in the US, the flight to safety considerations helped strengthen the US dollar. During 2008-09, the US dollar appreciated against most major currencies including the euro and the pound sterling. The US dollar, however, depreciated against the Japanese yen, as a result of unwinding of carry trades. Amongst Asian currencies also, the US dollar appreciated against Korean won, Thai baht, Malaysian ringgit, Indonesian rupiah and Indian rupee but depreciated against Chinese yuan. As on April 14, 2009, however, the US dollar depreciated against most major currencies, except the euro and the Japanese yen, over end-March 2009 levels (Table 42).

Equity Markets

V.19 The year 2008-09 continued to be a dismal year for the stock markets. As a reflection of the economic and financial market outlook, the year was characterised by depressed equity valuations. Equity price indices in most advanced economies were relatively flat during July and August 2008, but caught on the downward spiral subsequently, which continued into the first two months of 2009 (Table 43). V.20 Consequently, price/earnings ratios in most markets across the world followed a downward trend. They remained at or close to all-time low levels for most regions during the fourth quarter of 2008-09.

Table 42: Appreciation (+)/Depreciation (-) of the US dollar vis-à-vis other Currencies |

(Per cent) |

Currency |

End-March 2008 @ |

End-March 2009 @ |

April 14, 2009* |

1 |

2 |

3 |

4 |

Euro |

-15.77 |

18.82 |

0.24 |

Pound Sterling |

-1.53 |

38.67 |

-3.78 |

Japanese Yen |

-14.92 |

-2.00 |

1.78 |

Chinese Yuan |

-9.34 |

-2.61 |

-0.09 |

Russian Ruble |

-9.68 |

44.25 |

-1.52 |

Turkish Lira |

-5.75 |

27.69 |

-6.03 |

Indian Rupee |

-8.30 |

27.47 |

-2.15 |

Indonesian Rupiah |

1.09 |

25.58 |

-5.13 |

Malaysian Ringgit |

-7.77 |

14.42 |

-1.41 |

South Korean Won |

5.47 |

38.86 |

-3.26 |

Thai Baht |

-10.16 |

12.85 |

-0.24 |

Argentine Peso |

2.08 |

17.32 |

-0.84 |

Brazilian Real |

-16.99 |

31.20 |

-3.02 |

Mexican Peso |

-3.48 |

32.90 |

-7.53 |

South African Rand |

11.34 |

17.22 |

-4.95 |

@ : Year-on-year variation.

* : Variation over end-March 2009. |

Though the decline in equity valuations was broad-based across all sectors, financial institutions, particularly in Japan, were the worst sufferers. The volatility in the markets in the fourth quarter was compounded by the lack of detailed information about government rescue packages. The equity markets saw a slight recovery in most countries/regions since mid-March 2009, helped further by the US government announcing the details of the public-private investment programme aimed at repairing balance sheets of financial institutions.

Emerging Markets V.21 The ongoing crisis has invalidated the ‘decoupling hypothesis’, as emerging economies too have been hit by the crisis. Even though institutions in most of the emerging economies did not have direct exposure to the toxic assets, these economies are suffering the consequences of the economic recession that has gripped the advanced economies. The emerging market economies witnessed capital flow reversals, sharp widening of spreads on sovereign and corporate debt and abrupt currency depreciations during 2008-09. Banks have curtailed their lending to emerging economies as reflected in the near halving of the total volume of international syndicated loan facilities given to borrowers in emerging markets in the last quarter of 2008 as against the corresponding period of the previous year.

Table 43: International Stock Markets |

Country/Index |

Percentage Variation (year-on-year) |

End-March 2007 |

End-March 2008 |

End-March 2009 |

1 |

2 |

3 |

4 |

Developed Markets |

|

|

|

US (Dow Jones) |

11.2 |

-0.7 |

-38.0 |

US (NASDAQ) |

3.5 |

-5.9 |

-32.9 |

FTSE UK 100 |

5.8 |

-9.6 |

-31.2 |

Euro area (FTSE 100) |

7.5 |

-15.7 |

-40.1 |

Japan (Nikkei 225) |

1.3 |

-27.6 |

-35.3 |

Hong Kong (Hang Seng) |

25.3 |

15.4 |

-40.6 |

Emerging Markets |

|

|

|

Russia |

34.9 |

6.1 |

-66.4 |

Brazil |

20.7 |

33.1 |

-32.9 |

Colombia |

-3.7 |

-16.0 |

-10.6 |

South Africa |

34.3 |

11.5 |

-32.7 |

South Korea |

6.8 |

17.3 |

-29.2 |

Hungary |

1.6 |

-7.3 |

-49.0 |

Singapore |

28.2 |

-4.9 |

-43.5 |

Malaysia |

34.6 |

0.1 |

-30.1 |

Argentina |

16.8 |

0.0 |

-46.5 |

Turkey |

1.8 |

-10.6 |

-34.0 |

Indonesia |

38.4 |

33.7 |

-41.4 |

India |

15.9 |

19.7 |

-37.9 |

Thailand |

-8.1 |

21.3 |

-47.2 |

China |

145.2 |

9.1 |

-31.7 |

Memo: |

|

|

|

World (MSCI) |

13.4 |

-5.1 |

-44.0 |

EMEs (MSCI) |

17.9 |

18.9 |

-48.4 |

Source : Bloomberg. |

V.22 The central and east European economies seem to have suffered the brunt of the global financial markets upheaval, given their large current account deficits. Banks in most of these countries are in need of government support in the form of recapitalisation. Several emerging eastern European countries, including Hungary, Romania and Ukraine, have sought IMF support to stabilise their financial markets. The emerging economies of Europe which saw plummeting valuations in equity markets include the Czech Republic, Hungary, Poland and Russia. During the fourth quarter of 2008-09, the foreign exchange markets of most emerging market economies continued to be under pressure. The Russian rouble continued the downward spiral against both the US dollar and the euro, with the plunge being particularly persistent during the fourth quarter of 2008-09. Some other currencies that suffered sharp losses during the period include the Czech koruna, the Hungarian forint, the Polish zloty, the Brazilian real, the Korean won, the Mexican peso and the Indonesian rupiah. Ten ASEAN members and China, Japan and Korea have together pledged US$ 120 billion to counter the risk of a currency collapse in the region by enhancing the total size of the multilateralised Chiang Mai Initiative.Sovereign credit spreads in select emerging market economies showed improvement over the levels that were seen in October 2008. However, for most low-rated Latin American and Eastern European issuers, the spreads continued to be at record highs.

V.23 Though emerging market economies, including India, do not have direct or significant exposure to stressed

financial instruments or troubled financial institutions, they are not immune to the adverse effects of the financial crisis. During the fourth quarter of 2008-09, a number of countries announced further measures for monetary easing, provision of liquidity and restructuring/ recapitalisation of the financial system (Table 44).

Table 44: Recent Global Response to Financial Market Turmoil |

Country |

Key Measures |

1 |

2 |

United States |

Monetary Policy Easing |

• The target range for federal funds rate was set between 0.00 and 0.25 per cent on December 16, 2008 and has remained unchanged since then. |

Liquidity Provision |

• Term funds continued to be auctioned through new channels such as the Term Auction Facility (TAF). |

• The set of eligible collateral for loans extended by the Term Asset-Backed Securities Loan Facility (TALF) was expanded to include four additional categories of asset-backed securities. |

• Five liquidity facilities - the Primary Dealer Credit Facility (PDCF), the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF), the Commercial Paper Funding Facility (CPFF), the Money Market Investor Funding Facility (MMIFF) and the Term Securities Lending Facility (TSLF) -were extended up to October 30, 2009. |

• The Temporary Money Market Funds Guarantee Program extended up to September 18, 2009. |

• The set of institutions eligible to participate in the MMIFF was expanded. Several economic parameters of the MMIFF were adjusted so that it remained a viable source of back-up liquidity for money market investors even at very low levels of money market interest rates. |

• The Federal Reserve to purchase US$ 1.25 trillion of agency mortgage-backed securities and US$ 200 billion of agency debt in 2009. |

• The Federal Reserve to purchase US$ 300 billion of longer-term Treasury securities by September 2009. |

• A Public-Private Investment Programme to generate purchasing power of up to US$ 1 trillion to buy legacy assets. |

Recapitalisation of the Financial System |

• Restructuring of Government’s financial support to the American International Group (AIG) was announced in March 2009. |

• The US government entered into an agreement with Bank of America to provide a package of guarantees, liquidity access and capital. |

• The US Treasury to participate in Citigroup’s exchange offering by converting a portion of its preferred security to common equity alongside the other preferred holders. |

• Community Development Financial Institutions (CDFI) Fund announced to award nearly US$ 100 million in grants and US$ 3 billion in additional tax credit authority to support community-based financial institutions such as loan funds, credit unions, banks, venture capital firms and other financing entities. |

• Total Capital Purchase Program (CPP) investment of US$ 195.3 billion in 359 institutions since October 2008. |

• Capital Assistance Programme announced for the major US banking institutions. |

(Contd...) |

Table 44: Recent Global Response to Financial Market Turmoil (Concld.) |

Country |

Key Measures |

1 |

2 |

| |

Other Measures |

| |

• A policy announced to help avoid preventable foreclosures on certain residential mortgage assets held, owned or controlled by a Federal Reserve Bank. |

| |

• Application of the ICE trust to provide central counterparty services for certain CDS contracts was approved. |

United Kingdom |

Monetary Policy Easing |

| |

• Official bank rate was cut thrice by 50 basis points (bps) each during January-March, 2009 to 0.5 per cent. |

| |

Liquidity Provision |

| |

• Asset Purchase Facility to buy gilts, commercial paper and corporate bonds from the secondary market using central bank reserves amounting to £ 75 billion. |

| |

• Extension of the drawdown window of the Credit Guarantee Scheme (CGS) up to December 31, 2009.

• Extension of the term of the Bank of England’s permanent discount window facility to 364 days for an

additional fee of 25 bps. |

| |

Financial Restructuring |

| |

• The UK Treasury’s preference share investment in RBS was converted to ordinary shares. |

| |

Recapitalisation of the Financial System |

| |

• Asset Protection Scheme, which aims to remove uncertainty about the value of banks’ past investments, clean up banks’ balance sheets and enable them to rebuild and restructure their operations and increase lending in the economy. The scheme is available for a fee on eligible assets of select participating institutions. Agreement signed with Lloyds Banking Group and Royal Bank of Scotland. |

| |

Other Measures |

| |

• The Banking Act 2009, which strengthens the UK’s statutory framework for financial stability and depositor protection, was enacted. |

Other Countries |

Monetary Policy Easing |

| |

• ECB cut its interest rates on the main refinancing operations by 50 bps each in January and March 2009 and by 25 bps in April 2009 to 1.25 per cent, on the marginal lending facility by 50 bps in March 2009 and by 25 bps in April 2009 to 2.25 per cent and on deposit facility by 100 bps in January, 50 bps in March 2009 and 25 bps in April 2009 to 0.25 per cent. |

| |

• Central Bank of the Republic of Turkey cut its overnight borrowing rate by 450 bps during January-March 2009. |

| |

• South Korea reduced its monetary policy base rate by 50 bps each in January and February 2009 to 2.0 per cent as on February 12, 2009. |

| |

Liquidity Provision |

| |

• Japan issued fresh guidelines on eligible collateral for credit extended by banks. |

| |

• Bank of Japan announced terms and conditions for the outright purchase of corporate financing instruments such as CP and corporate bonds. |

| |

• The frequency and duration of special funds supplying operations were increased. Most other provisions taken for achieving financial stability, that were set to expire in April 2009, were extended up to at least September 2009. |

| |

Recapitalisation of the Financial System |

| |

• Germany extended a bailout package to Commerzbank to backstop losses at newly acquired Dresdner Bank and took a 25 per cent holding in the combined entity. |

| |

• Ireland took control of the Anglo Irish Bank. |

| |

• The Dutch authorities granted ING Group a backup facility guaranteeing part of the bank’s securitised mortgage portfolio worth US$ 35 billion. |

| |

Other Measures |

| |

• To address continued pressures in global US dollar funding markets, the temporary reciprocal currency arrangements (swap lines) between the Federal Reserve and other central banks were extended till October 30, 2009. |

Source : Websites of respective central banks, finance ministries. |

Domestic Financial Markets

V.24 Beginning mid-September 2008, the Indian financial markets came under pressure owing to the knock-on effects of the global crisis through the monetary, financial, real and confidence channels. The contagion was initially felt in the equity markets due to the reversal of foreign institutional portfolio flows. With sharp tightening of global liquidity, Indian banks and corporates saw their overseas financing drying up. As a means of substitute financing, corporates withdrew their investments from domestic money market mutual funds, thereby putting redemption pressure on them and on NBFCs where the mutual funds had invested a significant portion of their funds. This substitution of overseas financing by domestic financing brought both money market and credit market under pressure. Moreover, the foreign exchange market was impacted by the reversal of capital flows as part of the global deleveraging process. Simultaneously, corporates were converting the funds raised locally into foreign currency to meet their external obligations. Both these factors put downward pressure on the rupee. Furthermore, the Reserve Bank’s intervention in the foreign exchange market to manage the volatility in the rupee temporarily tightened the money market.

V.25 In response, the Reserve Bank initiated several measures since September 16, 2008 to augment domestic and foreign exchange liquidity for proper functioning of the domestic markets and maintaining financial stability (Annex 2). Reflecting the impact of the measures, call rates in the money market have settled back into the informal LAF corridor since November 2008, having breached the upper bound in the preceding two months (Table 45). In the foreign exchange market, the Indian rupee generally depreciated against major currencies. In the credit market, the lending rates of scheduled commercial banks (SCBs) have begun to exhibit some moderation since November 2008. The government securities market was bearish for most of the fourth quarter of 2008-09 and yields hardened. Indian equity markets, picking up global cues, staged some recovery in March 2009.

Liquidity Conditions

V.26 The Reserve Bank’s monetary policy response to the global crisis impinging on India was to keep the domestic money and credit markets functioning normally and ensure that the liquidity stress did not trigger solvency issues. The need to maintain a comfortable rupee liquidity position, to augment foreign exchange liquidity and to ensure credit delivery to all productive sectors of the economy marked a reversal of Reserve Bank’s policy stance from monetary tightening in the first half of 2008-09 to monetary easing in the second half. The measures to meet the above objectives came in several policy packages starting mid-September 2008.

Table 45: Domestic Financial Markets at a Glance |

Year/ Month |

Call Money |

Government Securities |

Foreign Exchange |

Liquidity Management |

Equity |

Average Daily Turnover (Rs.crore) |

Average Call Rates* (Percent) |

Average Turnover in Govt. Securities+ (Rs.crore) |

Average 10-Year Yield@ (Percent) |

Average Daily Inter- bank Turnover (US $million) |

Average Ex-change Rate (Rs. perUS $) |

RBI’sNet Foreign Currency Sales(-)/ Purchases (+) (US $million) |

Average MSS Out-standing# (Rs. crore) |

Average Daily Reverse Repo (LAF) Outstanding (Rs. crore) |

Average Daily BSE Turnover (Rs.crore) |

Average Daily NSE Turnover (Rs.crore) |

Average BSE Se-nsex** |

Average S&PCNXNifty** |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

14 |

2006-07 |

21,725 |

7.22 |

4,863 |

7.78 |

18,540 |

45.28 |

26,824 ## |

37,698 |

21,973 |

3,866 |

7,812 |

12,277 |

3,572 |

2007-08 |

21,393 |

6.07 |

8,104 |

7.91 |

34,044 |

40.24 |

78,203 ## |

1,28,684 |

4,677 |

6,275 |

14,148 |

16,569 |

4,897 |

2008-09 P |

22,436 |

7.06 |

7,175 |

7.56 |

- |

45.92 |

- |

1,48,889 |

2,885 |

4,498 |

11,212 |

12,366 |

3,731 |

Apr 2008 |

19,516 |

6.11 |

6,657 |

8.10 |

37,580 |

40.02 |

4,325 |

1,70,726 |

26,359 |

5,773 |

13,561 |

16,291 |

4,902 |

May 2008 |

19,481 |

6.62 |

6,780 |

8.04 |

32,287 |

42.13 |

148 |

1,75,565 |

11,841 |

6,084 |

13,896 |

16,946 |

5,029 |

Jun 2008 |

21,707 |

7.75 |

6,835 |

8.43 |

38,330 |

42.82 |

-5,229 |

1,74,433 |

-8,622 |

5,410 |

12,592 |

14,997 |

4,464 |

Jul 2008 |

24,736 |

8.76 |

5,474 |

9.18 |

37,173 |

42.84 |

-6,320 |

1,72,169 |

-27,961 |

5,388 |

12,862 |

13,716 |

4,125 |

Aug 2008 |

23,408 |

9.1 |

7,498 |

9.06 |

38,388 |

42.94 |

1,210 |

1,71,944 |

-22,560 |

4,996 |

11,713 |

14,722 |

4,417 |

Sep 2008 |

23,379 |

10.52 |

10,418 |

8.45 |

44,700 |

45.56 |

-3,784 |

1,75,666 |

-42,591 |

5,147 |

12,489 |

13,943 |

4,207 |

Oct 2008 |

28,995 |

9.9 |

4,321 |

7.85 |

36,999 |

48.66 |

-18,666 |

1,69,123 |

-45,612 |

3,911 |

10,810 |

10,550 |

3,210 |

Nov 2008 |

21,812 |

7.57 |

5,866 |

7.41 |

31,322 |

49.00 |

-3,101 |

1,47,648 |

-8,017 |

3,539 |

9,618 |

9,454 |

2,835 |

Dec.2008 |

21,641 |

5.92 |

11,451 |

5.88 |

34,874 |

48.63 |

-318 |

1,24,848 |

22,294 |

3,851 |

95,928 |

9,514 |

2,896 |

Jan 2009 |

18,496 |

4.18 |

9,568 |

5.84 |

27,171P |

48.83 |

-29 |

1,13,535 |

45,474 |

3,526 |

9,559 |

9,350 |

2,854 |

Feb 2009 |

22,241 |

4.16 |

5,916 |

5.98 |

24,840P |

49.26 |

230 |

1,02,934 |

50,649 |

2,856 |

7,887 |

9,188 |

2,819 |

March 2009P |

23,818 |

4.17 |

5,322 |

6.56 |

- |

51.23 |

- |

88,077 |

33,360 |

3,488 |

10,140 |

8,995 |

2,802 |

* : Average of daily weighted call money borrowing rates. + : Average of daily outright turnover in Central Government dated securities.

@ : Average of daily closing rates. # : Average of weekly outstanding MSS.

** : Average of daily closing indices. ## : Cumulative for the financial year.

LAF : Liquidity Adjustment Facility. BSE : Bombay Stock Exchange Limited

MSS : Market Stabilisation Scheme. NSE : National Stock Exchange of India Limited .

P :Provisional – :Not available.

Note : In column 10, (-) indicates injection of liquidity, while (+) indicates absorption of liquidity. |

Cash Management of the Central Government

V.27 The surplus cash balance of Rs.76,686 crore as at end-March 2008 was used up by the Central Government to meet its expenditure needs and it resorted to ways and means advances (WMA) during August 4-6, 2008 and again during September 2-14, 2008. During the third quarter of 2008-09, the Government announced fiscal stimulus packages even as revenue receipts decelerated. The Central Government was in WMA for 23 days and resorted to overdraft (OD) for 10 days during the third quarter. The Central Government was in WMA for 70 days and in OD for 55 days during the fourth quarter of 2008-09 (Table 46 and Chart 22).

Table 46: Cash Management of the Central Government |

| |

2007-08 |

2008-09 |

1 |

2 |

3 |

Total Number of Days |

|

|

WMA |

91 |

109 |

OD |

37 |

65 |

Cash Deficit |

91 |

109 |

Average Daily Utilisation* |

|

|

WMA |

3,615 |

2,077 |

OD |

647 |

1,823 |

* : in Rupees crore. |

Liquidity Management

V.28 During the financial year 2008-09, liquidity management operations had to change course beginning mid-September 2008 as the knock-on effects of the severe disruptions in international financial markets began to be felt in the domestic financial markets. The use of liquidity management tools such as the cash reserve ratio (CRR) and the Open Market Operation (OMO), including the Market Stabilisation Scheme (MSS) and the Liquidity Adjustment Facility (LAF), was thus modulated in accordance with the evolving conditions in financial markets. Variations in the cash balances of the Central Government and the capital flows and the concomitant foreign exchange operations of the Reserve Bank continued to be the key drivers of liquidity conditions during the year (Table 47).

V.29 There was a reduction in the generation of domestic liquidity during the period from April to mid-September 2008, as the drying up of capital inflows had brought a turnaround in the foreign exchange operations of the Reserve Bank from net spot purchases up to May 2008 to net spot sales thereafter, barring August 2008 (refer Table 47). Consequently, the MSS auctions of dated securities were kept in abeyance after end-April 2008 and MSS issuances, even through Treasury Bills, were stopped after September 2, 2008 (Chart 23). Reflecting the impact of these developments, the LAF turned from absorption mode to injection mode after the first week of June 2008.

Table 47: Reserve Bank’s Liquidity Management Operations |

(Rupees crore) |

Item |

2007-08 (April-March |

2008-09 (April-February) |

2008-09 |

Q1 |

Q2 |

Q3 |

Jan |

Feb |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

A. |

Drivers of Liquidity (1+2+3+4+5) |

2,03,121 |

-1,24,579 |

6,061 |

-18,917 |

-1,01,304 |

-12 |

-10,408 |

| |

1. |

RBI’s net purchases from Authorised Dealers |

3,12,054 |

-1,60,765 |

-8,555 |

-40,249 |

-1,12,168 |

-129 |

336 |

| |

2. |

Currency with the Public |

-85,475 |

-82,369 |

-30,071 |

12,294 |

-40,096 |

-7,724 |

-16,771 |

| |

3. |

Surplus cash balances of the Centre with the Reserve Bank |

-26,594 |

76,586 |

40,073 |

-3,845 |

36,554 |

3,804 |

0 |

| |

4. |

WMA and OD |

0 |

9,603 |

0 |

0 |

0 |

9,166 |

437 |

| |

5. |

Others (residual) |

3,136 |

32,366 |

4,615 |

12,884 |

14,406 |

-5,129 |

5,590 |

B. |

Management of Liquidity (6+7+8+9) |

-1,17,743 |

1,06,952 |

-37,659 |

7,217 |

1,33,325 |

-3,516 |

7,586 |

| |

6. |

Liquidity impact of LAF Repos |

21,165 |

-1,10,170 |

-18,260 |

24,390 |

-71,110 |

-39,975 |

-5,215 |

| |

7. |

Liquidity impact of OMO (Net) * |

13,510 |

48,472 |

14,642 |

11,949 |

10,681 |

5,173 |

6,028 |

| |

8. |

Liquidity impact of MSS |

-1,05,418 |

66,400 |

-6,041 |

628 |

53,754 |

11,286 |

6,773 |

| |

9. |

First round liquidity impact due to CRR change |

-47,000 |

1,02,250 |

-28,000 |

-29,750 |

1,40,000 |

20,000 |

0 |

C |

Bank Reserves (A+B) # |

85,378 |

-17,627 |

-31,598 |

-11,700 |

32,021 |

-3,528 |

-2,822 |

(+) : Indicates injection of liquidity into the banking system.

(-) : Indicates absorption of liquidity from the banking system.

# : Includes vault cash with banks and adjusted for first round liquidity impact due to CRR change.

* : Includes oil bonds but excludes purchases of Government securities on behalf of State Governments.

Note : Data pertain to March 31 and last Friday for all other months. |

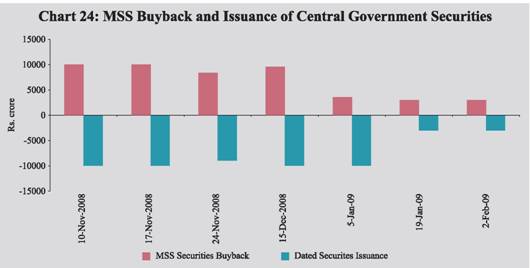

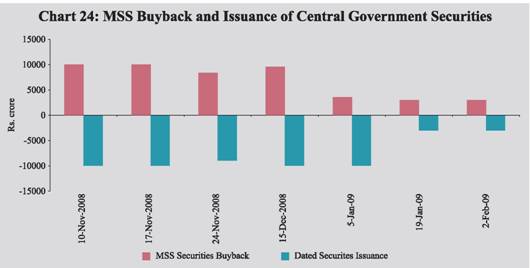

V.30 Beginning mid-September 2008, the severe disruptions in international financial markets brought pressures on the domestic money and foreign exchange markets in conjunction with transient local factors such as advance tax payments. In order to alleviate these stresses and with the abatement of inflationary pressures, the Reserve Bank augmented rupee liquidity through a series of measures including reduction in CRR by a cumulative 400 basis points to 5.0 per cent and a slew of special facilities (refer Annex 2). Furthermore, the repo rate and the reverse repo rate under LAF were progressively reduced from 9.0 per cent to 5.0 per cent and 6.0 per cent to 3.5 per cent, respectively. These apart, MSS buyback auctions were started from November 6, 2008, largely dovetailed with the Government’s normal market borrowing programme to provide another avenue for injecting liquidity (Table 48 and Chart 24). Reflecting the impact of these measures, the average daily net outstanding liquidity injection under LAF, which had increased to around Rs.43,000-46,000 crore during September and October 2008, declined sharply thereafter and turned into net absorption from early December 2008.

| Table 48: Liquidity Management |

| (Rupees crore) |

Outstanding as on Last Friday |

LAF |

MSS |

Centre’s Surplus

with the RBI @ |

Total

(2 to 4) |

1 |

2 |

3 |

4 |

5 |

2008 |

|

|

|

|

January |

985 |

1,66,739 |

70,657 |

2,38,381 |

February |

8,085 |

1,75,089 |

68,538 |

2,51,712 |

March* |

-50,350 |

1,68,392 |

76,586 |

1,94,628 |

April |

32,765 |

1,72,444 |

36,549 |

2,41,758 |

May |

-9,600 |

1,75,362 |

17,102 |

1,82,864 |

June |

-32,090 |

1,74,433 |

36,513 |

1,78,856 |

July |

-43,260 |

1,71,327 |

15,043 |

1,43,110 |

August |

-7,600 |

1,73,658 |

17,393 |

1,83,451 |

September |

-56,480 |

1,73,804 |

40,358 |

1,57,682 |

October |

-73,590 |

1,65,187 |

14,383 |

1,05,980 |

November |

-9,880 |

1,32,531 |

7,981 |

1,30,632 |

December |

14,630 |

1,20,050 |

3,804 |

1,38,484 |

2009 |

|

|

|

|

January |

54,605 |

1,08,764 |

-9,166 |

1,54,203 |

February |

59,820 |

1,01,991 |

-9,603 |

1,52,208 |

March* |

1,485 |

88,077 |

16,219 |

1,05,781 |

April 10 |

1,29,810 |

71,145 |

-13,779 |

1,87,176 |

@ : Excludes minimum cash balances with the Reserve Bank in case of surplus.

* : Data pertain to March 31.

Note : 1. Negative sign in column 2 indicates injection of liquidity through LAF.

2. The Second LAF that was discontinued from August 6, 2007 was re-introduced rom August

1, 2008 on reporting Fridays and from September 17, 2008 on a daily basis.

3. Negative sign in column 4 indicates injection of liquidity through WMA/OD. |

V.31 For more effective liquidity management and to ensure that the market borrowing programme of the Government was conducted in a non-disruptive manner, the scope of the OMO was widened with effect from February 19, 2009 by including purchases of government securities through an auction-based mechanism in addition to purchases through the Negotiated Dealing System – Order Matching (NDS-OM) segment. The cut-off yields in the OMO purchase auctions were based on the attractiveness of offers for securities relative to their secondary market yields. Auction-based purchases aggregated Rs.5,000 crore whereas purchases through NDS-OM aggregated Rs.800 crore during February 2009.

V.32 With the change in the external accounts in the recent period resulting in attendant draining of primary liquidity reflecting the impact of the Reserve Bank’s operations in the foreign exchange market, the Memorandum of Understanding (MoU) on the MSS was amended on February 26, 2009 to permit the transfer of the sterilised liquidity from the MSS cash account to the normal cash account of the Government (details covered in the Central Government securities section later in the Chapter).

V.33 In March 2009, the OMO purchases through auctions and NDS-OM were placed at Rs.41,640 crore and Rs.4,475 crore, respectively, whereas MSS redemptions amounted to Rs.2,000 crore (over and above the de-sequestering of Rs.12,000 crore of MSS balances); these helped to further ease liquidity conditions. The average daily net outstanding liquidity absorption through LAF, however, declined to around Rs.33,000 crore in March 2009 from over Rs.50,000 crore in the previous month, reflecting, inter-alia, advance tax outflows. It is, however, noteworthy that the net injection of liquidity through LAF did not occur even on a single day of March 2009, including the last day of the month, in sharp contrast to the experience in the previous few years.

Money Market

V.34 During the first half of 2008-09 (up to mid-September 2008), reflecting the orderly conditions in the money market, the call rates remained largely within the informal corridor of the reverse repo and repo rates. The failure of Lehman Brothers and a few other global financial institutions in September 2008 saw the abrupt freezing of money market activities in the major financial centres. In order to contain the excess volatility in the foreign exchange market, the Reserve Bank made available substantial dollar liquidity. This had a tightening impact on rupee liquidity. The impact was magnified on account of domestic factors such as advance tax outflows from the banking system. The call rate moved above the repo rate in mid-September 2008 (Chart 25). As the series of measures initiated by the Reserve Bank to augment liquidity began to take effect, the weighted average call money rate declined and mostly remained within the LAF corridor from November 3, 2008 onwards.

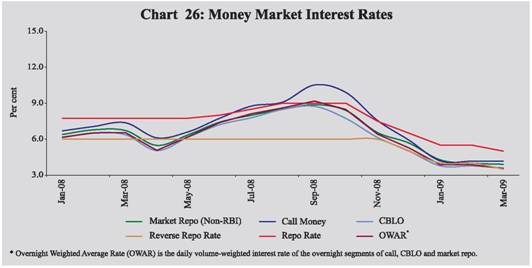

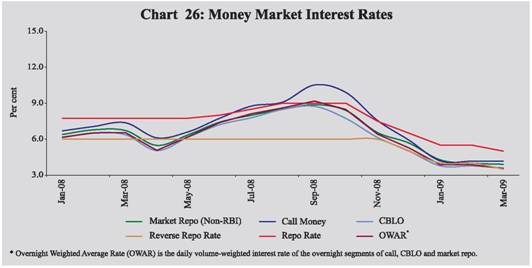

V.35 Interest rates in the collateralised segments of the money market – the market repo (outside the LAF) and the Collateralised Borrowing and Lending Obligation (CBLO) – moved in tandem with, but remained below, the call rate during 2008-09 in general, including in the last quarter of the year (Chart 26). Average daily volumes in the CBLO and market repo segments, declined sharply during April-October 2008, mainly on account of tightening of liquidity conditions and increasing recourse to LAF repos. The CBLO and market repo volumes picked up substantially in the last quarter of 2008-09, largely reflecting the easing of liquidity conditions and the enhanced lending capacity of mutual funds. The total average daily volume of the three segments of the money market was placed at Rs.82,000 crore in March 2009 as compared with Rs.41,000 crore in October 2008 and Rs.64,000 crore in April 2008. The shares of the CBLO, market repo and call segments in total money market were placed at 59 per cent, 26 per cent and 15 per cent in March 2009, nearly the same as in April 2008.

Certificates of Deposit

V.36 The outstanding amount of certificates of deposit (CDs) issued by SCBs increased from end-March 2008 up to September 2008. This was followed by a decline up to December 2008, reflecting the indirect impact of the global financial turmoil. Subsequently, with the easing of liquidity conditions, the outstanding amount of CDs rose from January 2009. The outstanding amount constituted 5.23 per cent of aggregate deposits of CD-issuing banks with significant inter-bank variation as on March 13, 2009. The weighted average discount rate (WADR) of CDs generally increased up to November 2008 but declined thereafter in consonance with the movements in other money market rates (Table 49).

Table 49: Activity in Money Market Segments |

(Rupees crore) |

Year/ Month |

Average Daily Volume (One Leg) |

Commercial Paper |

Certificates of Deposit |

Call Money Market |

Repo Market (Outside the LAF) |

Collate ralised Borrowing and Lending Obligation (CBLO) |

Total (2+3+4) |

Money Market Rate* (Per cent) |

Term Money Market |

Outstanding |

WADR

(Per cent) |

Outstanding |

WADR (Per cent) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

2006-07 |

10,863 |

8,419 |

16,195 |

35,477 |

6.57 |

506 |

21,329 + |

8.08 + |

64,821 + |

8.24 + |

2007-08 |

10,697 |

13,684 |

27,813 |

52,194 |

5.48 |

352 |

33,813 + |

9.20 + |

1,17,186 + |

8.94 + |

2008-09 P |

11,218 |

14,330 |

30,776 |

56,323 |

6.43 |

397 |

47,312 + |

10.57 + |

1,61,257 + |

9.39 + |

Apr 2008 |

9,758 |

14,966 |

38,828 |

63,552 |

5.31 |

374 |

37,584 |

8.85 |

1,50,865 |

8.49 |

May 2008 |

9,740 |

14,729 |

36,326 |

60,795 |

6.29 |

420 |

42,032 |

9.02 |

1,56,780 |

8.95 |

Jun 2008 |

10,854 |

11,262 |

35,774 |

57,890 |

7.35 |

253 |

46,847 |

10.03 |

1,63,143 |

9.16 |

Jul 2008 |

12,368 |

8,591 |

23,669 |

44,628 |

8.09 |

226 |

51,569 |

10.95 |

1,64,892 |

10.23 |

Aug 2008 |

11,704 |

10,454 |

22,110 |

44,268 |

8.65 |

501 |

55,036 |

11.48 |

1,71,966 |

10.98 |

Sep 2008 |

11,690 |

10,654 |

20,547 |

42,891 |

9.26 |

335 |

52,038 |

12.28 |

1,75,522 |

11.56 |

Oct 2008 |

14,497 |

9,591 |

16,818 |

40,906 |

8.66 |

345 |

48,442 |

14.17 |

1,58,562 |

10.00 |

Nov 2008 |

10,906 |

15,191 |

24,379 |

50,476 |

6.58 |

319 |

44,487 |

12.42 |

1,51,493 |

10.36 |

Dec 2008 |

10,820 |

16,943 |

32,261 |

60,024 |

5.37 |

415 |

40,391 |

10.70 |

1,51,214 |

8.85 |

Jan 2009 |

9,248 |

18,053 |

31,794 |

59,095 |

3.99 |

454 |

51,668 |

9.48 |

1,64,979 |

7.33 |

Feb 2009 |

11,121 |

19,929 |

38,484 |

69,534 |

3.89 |

669 |

52,560 |

8.93 |

1,75,057 |

6.73 |

March 2009 P |

11,909 |

21,593 |

48,319 |

81,821 |

3.76 |

451 |

49,953 |

9.78 # |

1,67,320 |

6.73 # |

– : Not available. * : Weighted average rate of the call, CBLO and market repo segments. + : Fortnightly average for the year. Data for 2008-09 are up to mid-March 2009. # : Provisional data as on mid-March 2009. P : Provisional. WADR : Weighted Average Discount Rate. |

Commercial Paper V.37 The outstanding amount of commercial paper (CP) issued by corporates, which had increased gradually during April-August 2008-09, declined thereafter till December 2008, mainly reflecting tight liquidity conditions and general risk-aversion. Subsequently, the outstanding amount of CPs picked up, as liquidity conditions eased. Leasing and finance companies continued to be the major issuers of CPs, accounting for 63.1 per cent of total outstanding as of March 15, 2009 (Table 50). The WADR of CPs increased steadily up to October 2008, and generally declined subsequently up to mid-March 2009, with the easing of liquidity conditions (refer Table 49). The differential in the WADR of CP vis-a-vis CD, however, continues to remain elevated since October 2008.

Treasury Bills

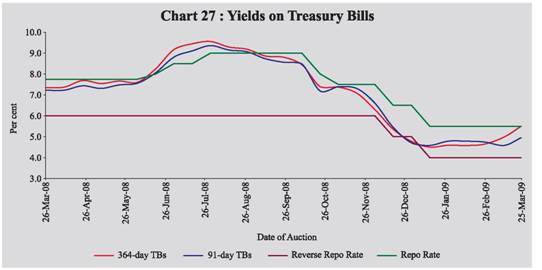

V.38 The notified amounts for 91-day, 182-day and 364-day Treasury Bills (excluding MSS) were raised during the

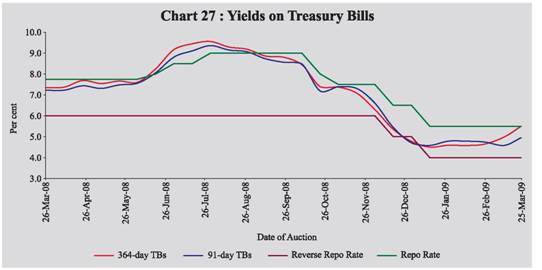

course of the year to finance the temporary cash mismatch, inter alia, arising from the expenditure on the Agricultural Debt Waiver Scheme. Thus, an additional amount of Rs.1,87,500 crore (Rs.97,000 crore, net) was raised over and above the notified amount during the year. During 2008-09, primary market yields on 91-day Treasury Bills increased steadily from 6.94 per cent on April 2, 2008 (first auction of the year 2008-09) and peaked at 9.36 per cent on July 30, 2008, reflecting tight liquidity conditions in response to measures taken to combat inflation such as hike in CRR and repo rate. It started declining thereafter, responding to various measures taken to ease liquidity and stimulate the economy amidst global recessionary trends. Yields on 91-day Treasury Bills declined sharply in December 2008 and were lowest at 4.58 per cent on January 14, 2009 and March 12, 2009 (Table 51 and Chart 27). Similar trend was observed in yields on 182-day

and 364-day Treasury Bills. The yield spread between 364-day and 91-day Treasury Bills

was 48 basis points during March 2009 (8.9 basis points in March 2008).

Table 50: Commercial Paper - Major Issuers |

(Rupees crore) |

Category of Issuer |

End of |

March 2007 |

March 2008 |

June 2008 |

September 2008 |

December 2008 |

March 15, 2009 |

1 |

2 |

3 |

4 |

5 |

6 |

|

Leasing and Finance |

12,594 |

24,925 |

34,957 |

39,053 |

27,965 |

31,528 |

| |

(70.5) |

(76.5) |

(76.6) |

(75.0) |

(73.5) |

(63.1) |

Manufacturing |

2,754 |

5,687 |

8,150 |

9,925 |

6,833 |

13,925 |

| |

(15.4) |

(17.4) |

(17.4) |

(19.1) |

(18.0) |

(27.9) |

Financial Institutions |

2,515 |

1,980 |

3,740 |

3,060 |

3,257 |

4,500 |

| |

(14.1) |

(6.1) |

(8.0) |

(5.9) |

(8.5) |

(9.0) |

Total |

17,863 |

32,592 |

46,847 |

52,038 |

38,055 |

49,953 |

| |

(100.0) |

(100.0) |

(100.0) |

(100) |

(100) |

(100) |

Note : Figures in parentheses are percentage shares in the total outstanding. |

Table 51: Treasury Bills in the Primary Market |

Year/Month |

Notified

Amount

(Rupees crore) |

Average Implicit Yield at

Minimum Cut-off Price

(Per cent) |

Average Bid-Cover Ratio |

91-day |

182-day |

364-day |

91-day |

182-day |

364-day |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

2007-08 |

2,24,500@ |

7.10 |

7.40 |

7.42 |

2.84 |

2.79 |

3.21 |

2008-09 |

2,99,000@ |

7.10 |

7.22 |

7.15 |

3.43 |

2.91 |

3.47 |

Apr 2008 |

22,000 |

7.28 |

7.41 |

7.53 |

1.70 |

1.36 |

2.36 |

May 2008 |

21,000 |

7.41 |

7.55 |

7.61 |

2.65 |

2.78 |

3.05 |

Jun 2008 |

11,500 |

8.01 |

8.42 |

7.93 |

2.00 |

2.76 |

2.80 |

Jul 2008 |

16,000 |

9.07 |

9.33 |

9.39 |

2.35 |

2.72 |

2.70 |

Aug 2008 |

23,500 |

9.15 |

9.31 |

9.24 |

2.99 |

2.86 |

4.35 |

Sept 2008 |

25,000 |

8.69 |

8.92 |

8.83 |

3.06 |

3.04 |

3.57 |

Oct 2008 |

35,000 |

8.13 |

8.36 |

7.92 |

1.95 |

2.42 |

4.00 |

Nov 2008 |

28,000 |

7.30 |

7.13 |

7.23 |

7.95 |

2.97 |

4.33 |

Dec 2008 |

16,500 |

5.69 |

5.35 |

5.07 |

5.36 |

4.67 |

5.14 |

Jan 2009 |

38,500 |

4.69 |

4.60 |

4.64 |

4.56 |

3.22 |

4.80 |

Feb 2009 |

32,000 |

4.78 |

4.71 |

4.62 |

2.81 |

1.86 |

2.62 |

March 2009 |

25,000 |

4.77 |

4.86 |

5.25 |

2.10 |

2.67 |

1.44 |

@ : Total for the financial year.

Note : Notified amounts are inclusive of issuances under the MSS. |

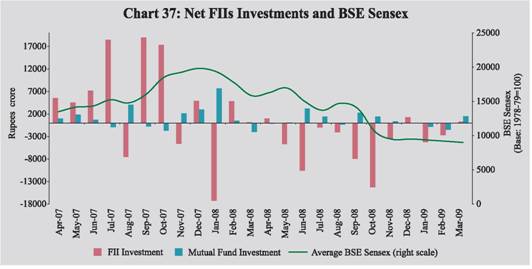

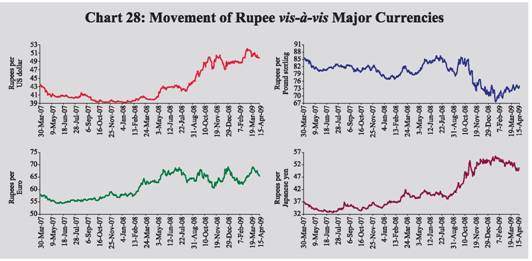

Foreign Exchange Market

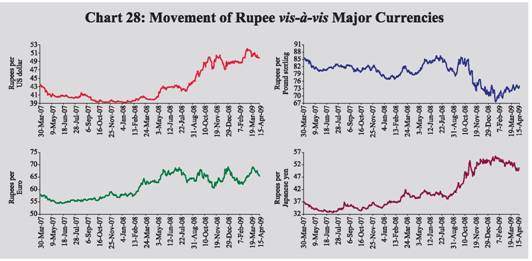

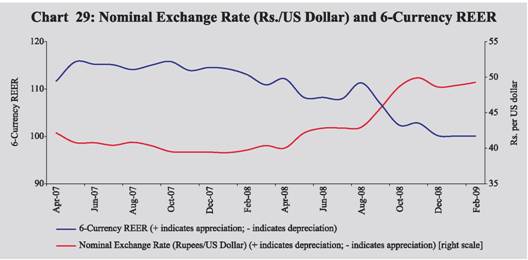

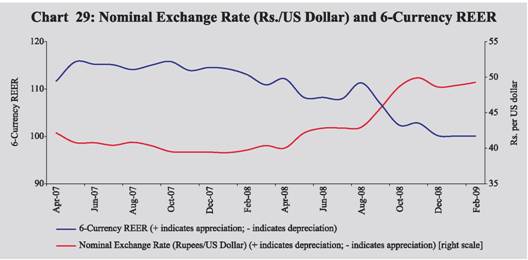

V.39 During 2008-09, the rupee depreciated on account of widened trade deficit, capital outflows and strengthening of the US dollar vis-à-vis other major currencies. The rupee/US dollar exchange rate was Rs. 39.99 per dollar at end-March 2008. It fell to Rs. 52.09 per dollar on March 5, 2009, before recovering to Rs. 50.95 per dollar at end-March 2009. As on March 31, 2009, the Indian rupee had depreciated by 21.5 per cent against the US dollar over its level on March 31, 2008. Over the same period, the rupee experienced a depreciation of 6.5 per cent against the euro, 22.8 per cent against the Japanese yen and 23.6 per cent against the Chinese yuan. However, the rupee showed an appreciation of 9.1 per cent against the pound sterling. The rupee/US dollar exchange rate was 49.90 on April 15, 2009. As on April 15, 2009, the rupee had generally appreciated against the US dollar, the euro and the Japanese yen but depreciated against the pound sterling over the end-March 2009 level (Chart 28). V.40 It is also useful to look at the indices of NEER and REER, which are often used as indicators of external competitiveness over a period of time. REER captures movements in cross-currency exchange rates as well as inflation differential between India and its major trading partners over time. The average 6-currency trade-based REER (base: 1993-94=100) was 114.09 in 2007-08, indicating an overvaluation of 14.1 per cent in real terms. There was a reduction in the extent of overvaluation during the first half of 2008-09 and the REER has moved closer to its base level (1993-94=100), especially since December 2008 (Chart 29). The 6-currency trade-based REER which stood at 112.16 in April 2008, indicating an overvaluation of 12.2 per cent, gradually declined to 100.07 in February 2009 mainly on account of significant depreciation of the rupee against the US dollar and against other major currencies like the euro, the Japanese yen and the Chinese yuan during 2008-09. The sharp decline in inflation rate in India in the recent months has also contributed towards the correction in the extent of the overvaluation of the rupee. Over the same period, the 6-currency NEER declined gradually from 70.63 in April 2008 to 62.75 in February 2009 (Table 52).

V.41 The 36-currency trade-weighted NEER and REER depreciated by 5.3 per cent and 10.7 per cent, respectively, between March 2008 and February 2009 (as against an appreciation of 6.9 per cent and 3.0 per cent, respectively, during the corresponding period of the previous year).

Table 52: Nominal and Real Effective Exchange Rate of the Indian Rupee

(Trade-based Weights) |

Year/Month |

Base : 1993-94 (April-March) = 100 |

|

Year/Month |

Base : 1993-94 (April-March) = 100 |

6-Currency Weights |

36-Currency Weights |

6-Currency Weights |

36-Currency Weights |

| |

NEER |

REER |

NEER |

REER |

|

NEER |

REER |

NEER |

REER |

1 |

2 |

3 |

4 |

5 |

1 |

2 |

3 |

4 |

5 |

2007-08 (P) |

74.17 |

114.09 |

93.91 |

104.81 |

Sep. 2008(P) |

64.37 |

106.96 |

85.42 |

95.97 |

Apr 2008 (P) |

70.63 |

112.16 |

93.26 |

101.86 |

Oct 2008(P) |

62.08 |

102.36 |

83.23 |

92.29 |

May 2008 (P) |

67.48 |

108.23 |

89.04 |

97.72 |

Nov 2008(P) |

63.06 |

102.80 |

84.69 |

92.54 |

Jun 2008 (P) |

66.38 |

108.20 |

87.65 |

97.76 |

Dec 2008(P) |

62.12 |

100.18 |

83.91 |

90.40 |

July 2008(P) |

65.83 |

107.94 |

87.04 |

97.40 |

Jan 2009(P) |

62.28 |

100.06 |

83.63 |

90.01 |

Aug 2008(P) |

67.22 |

111.30 |

88.60 |

99.65 |

Feb 2009(P) |

62.75 |

100.07 |

85.20 |

91.07 |

Movement of Average Exchange Rate – Per cent change |

| |

2007-08 |

2007-08 (April-Feb) |

2008-09 (April-Feb) |

36-currency trade-based REER |

6.4 |

6.9 |

-9.4 |

36-currency trade-based NEER |

9.3 |

9.9 |

-8.2 |

6-Currency trade-based REER |

8.1 |

8.5 |

-7.8 |

6-Currency trade-based NEER |

6.7 |

7.3 |

-12.9 |

Memo: |

Rupees/ US dollar Exchange Rate |

12.5 |

|

-12.4* |

NEER : Nominal Effective Exchange Rate. REER : Real Effective Exchange Rate. P : Provisional.

* : Average for April-March.

Note : Rise in indices indicates appreciation of the rupee and vice versa. |

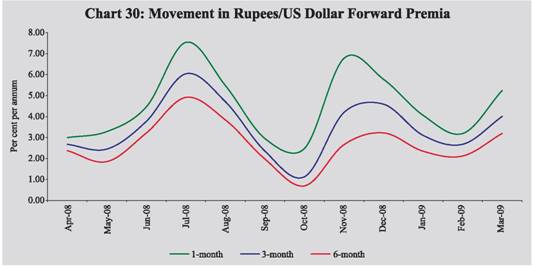

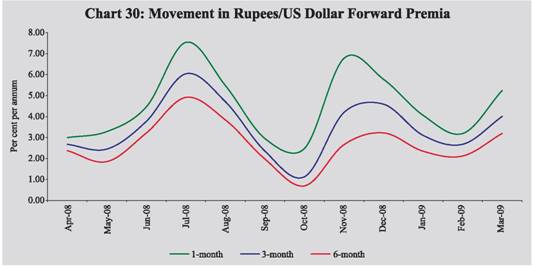

V.42 During 2008-09, forward premia showed significant variation reflecting the underlying supply and demand conditions. As on March 31, 2009, the one month, three month and six month premia were at 4.71 per cent, 3.34 per cent and 2.78 per cent, respectively. As on April 9, 2009, the one month, three month and six month premia were 3.85 per cent, 3.29 per cent and 2.76 per cent, respectively (Chart 30).

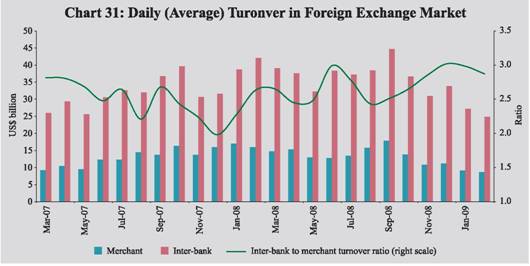

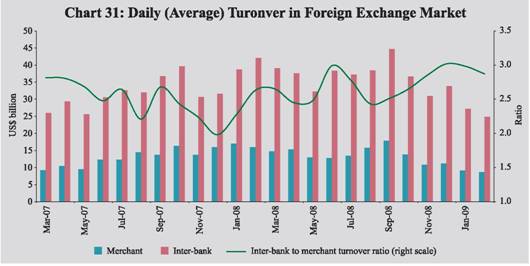

V.43 The daily average turnover in the foreign exchange market was lower at US$ 47.8 billion during April-February 2008-09 as compared with US$ 47.4 billion during the corresponding period of the previous year. The ratio of inter-bank to merchant turnover increased to 2.7 from 2.4 during this period (Chart 31).

Credit Market

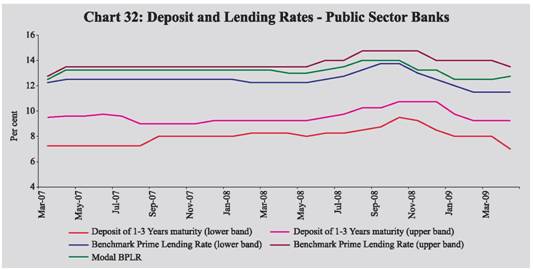

V.44 Bank deposit and lending rates, which had firmed up during 2008-09 up to October 2008, started easing from November 2008, reflecting measures taken by the Reserve Bank. Interest rates offered by public sector banks (PSBs) on deposits of maturity of one year to three years were in the range of 8.00-9.25 per cent in March 2009 as compared with the range of 8.50-10.75 per cent in December 2008, while those on deposits of maturity of over three years were in the range of 7.50-9.00 per cent as compared with the range of 8.50-9.75 per cent during the same period (Table 53). Similarly, the range of interest rates offered by private sector banks and foreign banks on deposits of varying maturity declined in March 2009 as compared with the range in December 2008. Notably, the administered interest rates on most small savings instruments have remained unchanged since March 2003.

Table 53: Deposit and Lending Rates |

(Per cent) |

Item |

March 2007 |

March 2008 |

September 2008 |

December 2008 |

March 2009 |

1 |

2 |

3 |

4 |

5 |

6 |

1. |

Domestic Deposit Rate Public Sector Banks |

|

|

|

|

|

| |

Up to 1 year |

2.75-8.75 |

2.75-8.50 |

2.75-10.25 |

2.75-10.25 |

2.75-8.25 |

| |

More than 1 year and up to 3 years |

7.25-9.50 |

8.25-9.25 |

8.75-10.25 |

8.50-10.75 |

8.00-9.25 |

| |

More than 3 years |

7.50-9.50 |

8.00-9.00 |

8.50-9.75 |

8.50-9.75 |

7.50-9.00 |

| |

Private Sector Banks |

|

|

|

|

|

| |

Up to 1 year |

3.00-9.00 |

2.50-9.25 |

3.00-9.75 |

3.00-10.00 |

3.00-8.75 |

| |

More than 1 year and up to 3 years |

6.75-9.75 |

7.25-9.25 |

8.30-10.50 |

9.00-11.00 |

7.50-10.25 |

| |

More than 3 years |

7.75-9.60 |

7.25-9.75 |

8.25-10.25 |

8.50-11.00 |

7.50-9.75 |

| |

Foreign Banks |

|

|

|

|

|

| |

Up to 1 year |

3.00-9.50 |

2.25-9.25 |

3.50-9.75 |

3.50-9.75 |

2.50-8.50 |

| |

More than 1 year and up to 3 years |

3.50-9.50 |

3.50-9.75 |

3.50-10.50 |

3.50-11.25 |

2.50-9.50 |

| |

More than 3 years |

4.05-9.50 |

3.60-9.50 |

3.60-11.00 |

3.60.11.00 |

2.50-10.00 |

2. |

Benchmark Prime Lending Rate |

|

|

|

|

|

| |

Public Sector Banks |

12.25-12.75 |

12.25-13.50 |

13.75-14.75 |

12.50-14.00 |

11.50-14.00 |

| |

Private Sector Banks |

12.00-16.50 |

13.00-16.50 |

13.75-17.75 |

13.00-17.25 |

12.75-16.75 |

| |

Foreign Banks |

10.00-15.50 |

10.00-15.50 |

10.00-16.00 |

10.00-17.00 |

10.00-17.00 |

3. |

Actual Lending Rate* |

|

|

|

|

|

| |

Public Sector Banks |

4.00-17.00 |

4.00-17.75 |

6.00-18.75 |

5.25-18.00 |

- |

| |

Private Sector Banks |

3.15-25.50 |

4.00-24.00 |

5.06-23.00 |

5.06-30.00 |

- |

| |

Foreign Banks |

5.00-26.50 |

5.00-28.00 |

5.00-25.50 |

5.00-26.00 |

- |

4. |

Weighted Average Lending Rate** |

|

|

|

|

|

| |

Public Sector Banks |

11.81 |

12.15 # |

|

- |

|

| |

Private Sector Banks |

11.91 |

12.67 # |

|

- |

|

| |

Foreign Banks |

13.03 |

12.94 # |

|

- |

|

– : Not available. # : Provisional.

* : Interest rate on non-export demand and term loans above Rs.2 lakh excluding lending rates at the extreme five per cent

on both sides.

** : Data based on the accounts with credit limit of over Rs.2 lakh and is exclusive of inland and foreign bills purchased and

discounted. Oustanding amounts are used as weights for calculating average lending rates. |

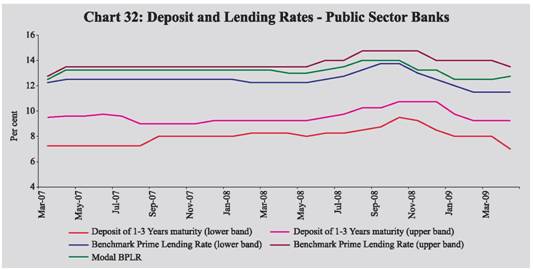

V.45 The benchmark prime lending rates (BPLRs) of PSBs and private sector banks declined from the range of 12.50-14.00 per cent and 13.00-17.25, respectively, in December 2008 to the range of 11.50-14.00 per cent and 12.75-16.75 per cent, respectively, in March 2009 (Chart 32). The range of BPLRs of foreign banks remained unchanged at 10.00-17.00 per cent during the same period. The weighted average BPLR of PSBs and private sector banks decreased from 14.00 per cent and 16.48 per cent, respectively, in October 2008 to 12.48 per cent and 16.03 per cent, respectively, in March 2009. The weighted average BPLR of foreign banks decreased marginally from 15.32 to 15.07 per cent during the same period.

V.46 The share of sub-BPLR lending (excluding export credit and small loans) for PSBs decreased to 68.0 per cent in December 2008 from 70.6 per cent in March 2008. The sub-BPLR lending of private sector banks, at 87.9 per cent, decreased from the March 2008 level of 88.7 per cent. The sub-BPLR lending of foreign banks, however, declined significantly from the high of 77.6 per cent in March 2008 to 61.3 per cent in December 2008. Together, the share of sub-BPLR lending for all SCBs (excluding export credit and small loans) declined from 75.9 per cent in March 2008 to 71.5 per cent in December 2008. At the disaggregated level, the major share of sub-BPLR lending of PSBs was for longer tenure term loans (above 5 years), whereas for the private sector banks and foreign banks, the major share of sub-BPLR loans was for consumer credit.

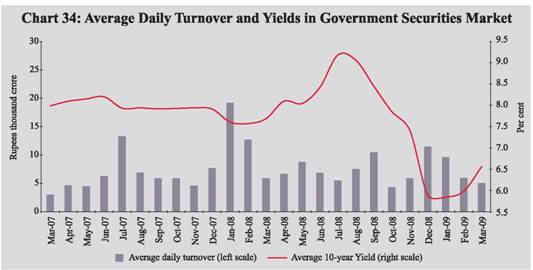

Government Securities Market

Central Government Securities

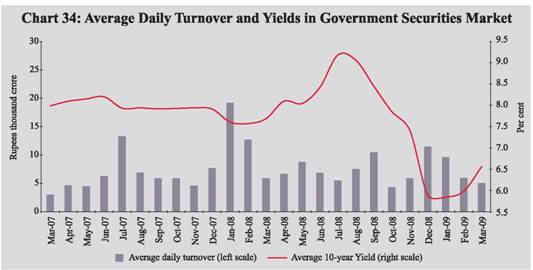

V.47 The financial year 2008-09 was characterised by a significantly higher level of Central Government market borrowing than budgeted earlier (as detailed in Chapter II), particularly during the second half of the year, in order to finance the expanding fiscal deficit in the wake of fiscal stimulus measures and various other committed expenditure of the Government. During the first six months of 2008-09, all issuances of dated securities were in accordance with the issuance calendar for the first half of the year, except on two occasions (Table 54). On the other hand, for the second half of the year, apart from the scheduled issuance calendar for dated securities released on September 26, 2008 in consultation with the Government of India, three additional indicative calendars were issued on December 5, 2008, January 6, 2009 and February 10, 2009. The Government of India raised Rs.1,16,000 crore to meet the additional expenditure approved by the Parliament by way of two supplementary demands for grants and various stimulus packages.

V.48 Furthermore, the MoU on the MSS signed between the Government of India and the Reserve Bank, in March 2004, was amended on February 26, 2009 to enable the Government and the Reserve Bank to de-sequester MSS cash balance for financing the Government’s approved expenditure. Accordingly, it was decided to transfer an amount of Rs.45,000 crore, in installments, from the MSS cash account to the normal cash account of Government of India by March 31, 2009. An equivalent amount of government securities was to accordingly form part of the normal borrowing of the Government. In this regard, an amount of Rs.12,000 crore was transferred from the MSS cash account to the normal cash account of the Government of India on March 4, 2009. Inclusive of this amount, gross and net market borrowings (dated securities and 364-day Treasury Bills) of the Central Government during 2008-09 amounted to Rs.3,18,550 crore and Rs.2,42,316 crore, respectively, accounting for 93 per cent and 91 per cent of the revised market borrowings for the year, respectively. In view of the comfortable cash position, the Government of India, in consultation with the Reserve Bank, decided not to effect the transfer of the balance amount of Rs.33,000 crore in 2008-09. Based on the fund requirements of the Government, the balance amount would be de-sequestered against the approved market borrowing for 2009-10 or the MSS securities would be bought back in 2009-10. The MSS outstanding as on March 31, 2009 was Rs.88,773 crore.