IST,

IST,

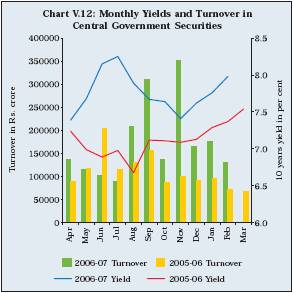

V. Government Securities Market

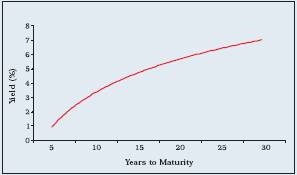

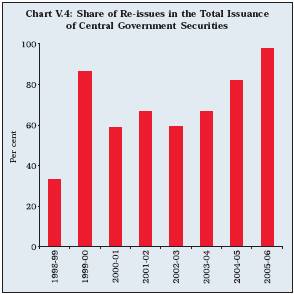

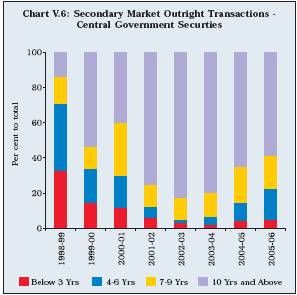

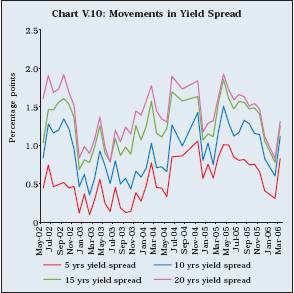

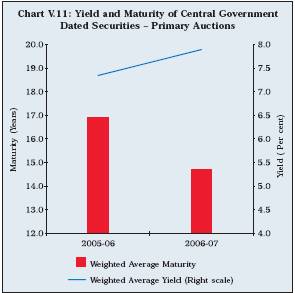

5.1 The government securities market is at the core of financial markets in most countries. It deals with tradeable debt instruments issued by the Government for meeting its financing requirements.1 The development of the primary segment of this market enables the managers of public debt to raise resources from the market in a cost effective manner with due recognition to associated risks. A vibrant secondary segment of the government securities market helps in the effective operation of monetary policy through application of indirect instruments such as open market operations, for which government securities act as collateral. The government securities market is also regarded as the backboneof fixed income securities markets as it provides the benchmark yield and imparts liquidity to other financial markets. The existence of an efficient government securities market is seen as an essential precursor, in particular, for development of the corporate debt market. Furthermore, the government securities market acts as a channel for integration of various segments of the domestic financial market and helps in establishing inter-linkages between the domestic and external financial markets. 5.2 The government securities market has witnessed significant transformation across countries over the years in terms of system of issuance, instruments, investors, and trading and settlement infrastructure. It has grown internationally in tune with the financing requirements of Governments. The fiscal discipline exercised by many countries in recent years has restricted the size of the market. Accordingly, countries have focussed on improving trading liquidity of the market through various measures. Many countries in the recent past have pursued a strategy of managing the cost of Government borrowing in the medium to long-term so as to reduce the rollover risk and other market risks in the debt stock, although this may entail higher debt service costs in the short run. Historically, in most countries, the central banks as managers of public debt have played a key role in developing the government securities markets. Although debt management authorities are increasingly being established outside the central banks in various countries, central banks continue to play a major role in developing the trading and settlement infrastructure of the government securities market. 5.3 The evolution of the government securities market in India has been in line with the developments in other countries. Slow development of the market in the 1970s and the 1980s was shaped by the need to meet the growing financing requirements of the Government. This essentially resulted in financial repression as progressively higher statutory requirements were stipulated, mandating banks to invest in government securities at administered interest rates. Although this captive financing provided low cost resources to the Government, it impeded the development of the market and distorted the interest rate structure. Furthermore, such arrangements, along with automatic monetisation of Government deficits, hampered the conduct of monetary policy. 5.5 Wide ranging reforms in the government securities market were largely undertaken in response to the changing economic environment. Increased borrowing requirements of the Government, stemming from high fiscal deficits, had to be met in a cost effective manner without distorting the financial system. The underlying perspective of the reform process was, therefore, to raise government debt at market related rates through an appropriate management of market borrowing. There was also a need to develop a benchmark for other fixed income instruments for the purposes of their pricing and valuation. An active secondary market for government securities was also needed for operating monetary policy through indirect instruments such as open market operations and repos. Reforms, therefore, focussed on the development of appropriate market infrastructure, elongation of maturity profile, increasing the width and depth of the market, improving risk management practices and increasing transparency. 1 Governments issue securities with maturities ranging from less than a year to a very long-term stretching up to 50 years. Typically, short-term maturities up to one year, viz., Treasury Bills, form a part of the money market and facilitate the Government's cash management operations, while bonds with maturities more than a year facilitate its medium to long-term financing requirements. This chapter discusses developments with respect to bonds with maturities more than a year. Treasury Bills being short-term instruments are covered in Chapter III. 5.6 As stipulated under the Fiscal Responsibility and Budget Management Act, 2003, the Reserve Bank has withdrawn from participating in the primary market for government securities from April 1, 2006. The increasing move towards fuller capital account convertibility as recommended by the Committee on Fuller Capital Account Conver tibility (FCAC) (Chairman: Shri S.S. Tarapore) would necessitate measures that promote greater integration of the domestic financial markets with global markets. The deepening of the government securities market is, therefore, essential not only for transmission of policy signals but also for developing the derivatives market which would meet future challenges thrown up by further liberalisation of the capital account. Moreover, an environment of freer capital flows will also necessitate widening of the government securities market with further persification of the investor base 5.7 Against this backdrop, this chapter traces the development of the government securities market in India since the early 1990s, in order to identify the key issues that need to be addressed to meet the emerging challenges. The chapter is organised in six sections. Section I sets out the theoretical underpinnings, and principles and policy strategy for developing a deep and liquid government securities market. Section II presents international experiences in terms of key features of the government securities market in developed and developing countries. Section III outlines the developments in the government securities market in India since the early 1990s and the role played by the Reserve Bank in shaping it. An assessment of the government securities market in terms of various indicators is presented in Section IV. Drawing from the lessons from international experiences, Section V raises the key issues that need to be addressed for enabling the government securities market to play a more effective role in the emerging scenario. The final section presents concluding observations. 5.8 The supply of government securities is generally exogenous to the market, determined mainly by the fiscal policy of the Government. The demand for government securities may be fragmented into several components implying that the demand curve is not uniformly downward sloping, but is rather kinked (Commonwealth of Australia, 2002). For instance, the demand by investors such as insurance companies and superannuation funds is in the nature of ‘buy and hold’ as the revenue streams from government securities generally match with their liability payment stream. These investors may have very few substitutes and, hence, their demand is less price sensitive. Mandated investments in government securities by banks and other institutions would also fall into the category of ‘buy and hold’. The demand from other investors in government securities is more for active trading and portfolio management. These investors may have many substitutes for government securities and, hence, their demand is generally more price elastic. The overall demand elasticity is, therefore, determined by the balance between these two groups of investors. Greater the share of active investors, higher is the demand elasticity or price sensitivity of government securities. Increased volume of government securities may increase concerns of a default by the Government which may affect the risk characteristics of the instrument. This may result in a fall in prices as yields steepen. At the other end of the spectrum, very limited supply of government securities may generate concerns over liquidity. Illiquidity premium can then drive down the prices, although there could be some resistance to the downward bias, if ‘buy and hold’ investors dominate the market. Thus, very high volumes as well as very low volumes of government securities may result in a fall in prices of government securities. 5.9 Activity in the government securities market can affect overall investment in the economy in two ways. First, it may adversely affect private investment by directly competing for the limited resources. As the interest rate on private bonds is determined by the usual downward sloping demand and upward sloping supply curves, the interest rate in the economy would be determined by the combined demand for and supply of government securities and private bonds. An increase in the supply of government securities in the face of high budget deficits would drive down their prices, leading to a substitution of private bonds with government securities, particularly, by investors whose demand is driven by trading and portfolio management requirements. This phenomenon is often described as ‘crowding out’. 5.10 Second, the government securities market can also have a positive influence on private investment by enabling the development of private bond market in two ways: (i) by putting in place a basic financial infrastructure, including laws, institutions, products, services, repo and derivatives markets; and (ii) by playing a role as an informational benchmark. A single private issuer of securities would never be of sufficient size to generate a complete yield curve and his securities would not be riskless because only supply of government securities and private bonds. An increase in the supply of government securities in the face of high budget deficits would drive down their prices, leading to a substitution of private bonds with government securities, particularly, by investors whose demand is driven by trading and portfolio management requirements. This phenomenon is often described as ‘crowding out’. Box V.1 Yield curve, also known as term structure of interest rates, is the representation of zero coupon yields of a series of maturities at a point of time. It is constructed by plotting the yields against the respective maturity periods of benchmark fixed-income securities. The yield curve is a measure of market’s expectations of future interest rates, given the current market conditions. Securities issued by the Government are considered risk-free, and as such, their yields are often used as the benchmarks for fixed-income securities with the same maturities. Graphic Representation of a Normal Yield Curve

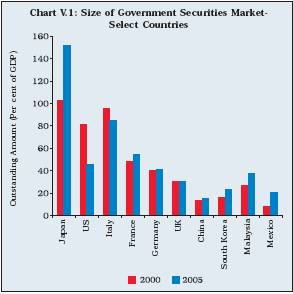

The difference between short and long ends of the yield curve (spread) determines the shape of the curve which is an important indicator of the expected performance of the economy and inflation. Since the government securities yield curve represents the risk-free interest rates, it is used for pricing other instruments of various maturities. The yield The difference between short and long ends of the yield curve (spread) determines the shape of the curve which is an important indicator of the expected performance of the economy and inflation. Since the government securities yield curve represents the risk-free interest rates, it is used for pricing other instruments of various maturities. The yield curve has informational value to bond issuers for pricing as well as timing of their issue depending on the expected performance of the economy. Investors can also use the curve in choosing the right tenor of investment. For overseas investors, expected performance of different countries could be compared by looking at the respective yield curves to make investment decisions. 5.11 One of the key features of development of the government securities market is the evolution of yield curve over a reasonably long period. The upward sloping yield curve, which is considered to be the usual term structure, may reflect either the presence of interest rate risk premium or the so called Hicksian liquidity premiums, or it may simply reflect the market’s anticipation about the upward trend in the general level of interest rates over the period. Theoretical analysis confirms that in an efficient market, yield curve will solely depend upon the market’s response to collective beliefs about future interest rate movements, i.e., interest rates derived from the prevailing term structure of interest rates are correct forecast of future interest rates. Thus, development of the government securities market is essential for establishing the risk-free benchmarks in financial markets and ensuring their functioning in an efficient manner. Significance of the Government Securities Market 5.12 The need to develop the government securities market emerges from the three roles it seeks to play, i.e., for the financial markets, for the Government and for the central bank (Reddy, 2002). As alluded to earlier, the government securities market serves as the backbone of fixed income markets through the creation of risk-free benchmarks of a sovereign borrower. Ipso facto, it acts as a channel of integration of various segments of the financial market. The government securities market constitutes a key segment of the financial market, offering virtually credit risk-free highly liquid financial instruments, which market participants are more willing to transact and take positions. The willingness of market participants to transact in government securities, in turn, imparts liquidity to these instruments, which benefits all segments of the financial market. Consequently, government securities are used by dealers as a major hedging tool for interest rate risk and as underlying assets and collateral for related markets, such as repo, futures and options (BIS,1999). Furthermore, large borrowings by the Government also provide an impetus to the development of the bond market. 5.13 From the perspective of an issuer, i.e., the Government, a deep and liquid government securities market facilitates its borrowings from the market at reasonable cost. A greater ability of the Government to raise resources from the market at market determined rates of interest allows it to refrain from monetisation of the deficit through central bank funding. It also obviates the need for a captive market for its borrowings. Instead, investor participation is voluntary and based on risk and return perception. A developed government securities market provides flexibility to the manager of public debt to optimise maturity and cost of even a lumpy government borrowing. 5.14 For the central bank, a developed government securities market allows greater application of indirect or market-based instruments of monetary policy such as open market (including repo) operations. A greater recourse to the market by the Government for meeting its funding requirements expands the eligible set of collaterals, thereby enabling the central bank to conduct monetary policy through indirect instruments. The expanding quantum of eligible collaterals has impar ted flexibility to central banks of many developing economies in their conduct of monetary policy, especially in sterilising the capital flows. As a part of reforms, even if the central bank’s participation in the primary market of government securities is phased out, the stock of government securities in the financial system would continue to enable the central bank to re-balance its portfolio through participation in the secondary market. 5.15 The government securities market, which is often the predominant segment of the overall debt market in many economies, plays a crucial role in the monetary policy transmission mechanism. Thus, irrespective of whether the central bank acts as manager of public debt or not, there are three main channels through which government debt structure might influence monetary conditions, viz., quantity of debt, composition of debt and ownership of debt (Box V.2). 5.16 In the aftermath of financial crises in the late 1990s in many economies, a consensus emerged on the need to develop deep and liquid financial markets, especially government securities markets. Studies suggested that the size is a key determinant of liquidity of the government securities market (McCauley and Remolona, 2000). A critical issue in this regard is trading liquidity, i.e., the ability of the market to execute transactions at short notice, low cost and with little impact on price (Lagana et al., 2006). The extent of liquidity in a market is usually captured by any or all of the four indicators, viz., width (width of the bid-ask spread), depth (the ability to carry out large trading without significant changes in price levels), immediacy (the ability to carry out large trading promptly without significant changes in price levels) and resilience (the ability of prices to quickly return to normal) (Harris, 1990). The Bank for International Settlements (BIS) identified four interrelated general principles for designing deep and liquid markets (Box V.3). 5.17 A five-pronged policy strategy can be pursued to promote liquidity in the government securities market (BIS, op.cit). First, there is a need to pursue a coherent public debt management strategy whereby distribution of government securities across various maturities and frequency of their issuances are modulated appropriately so as to facilitate sufficient supply of instruments for enhancing market liquidity. This can be ensured through large size of issuances, which, by creating of a homogeneous stock with a common maturity date, enhances liquidity. Alternatively, even where the government’s borrowing requirement is fixed, a debt manager can still enlarge the size of issuances of specific securities as demanded by investors at ‘key maturities’ across the yield curve by reducing the number of original maturities and/or reducing the frequency of issuances. A standard practice to enlarge the issue size, however, is to conduct regular reissuances of identical securities in several consecutive auctions instead of a single auction. Buyback of illiquid or older securities may also enable large sized issuances. Box V.2 Government Debt Structure and Monetary Conditions The absolute size of Government borrowings, especially when the financial markets are underdeveloped, often raises concerns about public debt management as there could be recourse to short-term financing from the central bank leading to monetary expansion. However, as the public debt/GDP ratio declines and government securities market develops with introduction of new instruments (like index-linked gilts), new issuing techniques (such as auctions) and improved market infrastructure, practical concerns about debt management impinging on monetary control get reduced. For instance, in the United Kingdom, a steady decline in the debt/GDP ratio and the emergence of a new structure in capital markets, after reforms of the London securities market in 1986, alleviated many of these concerns. The central policy concern about the ownership of public debt is related to the composition in terms of holding by banks and non-banks. Several empirical studies, using data mainly from the United States, found that increased debt issuances could lead to increase in bank holdings of debt. New issues of debt taken up by banks act as a substitute for lending to the private sector and, therefore, reduce the supply of bank credit to it. During monetary tightening, however, banks would extend loans to the private sector by running down their holdings of government debt. Thus, banks’ holding of public debt acts as a buffer. The experience in the United Kingdom was, however, contrary as the available evidence found that debt sales to banks had only a small impact on either money supply growth or bank lending. Source: 5.18 Second, as taxes increase the transaction costs and hinder market liquidity, there is a need to weigh the potential increase in tax revenue against the potential decline in market liquidity. The liquidity impairing effect of transaction tax, however, could be mitigated by exempting the active market participants. 5.19 Third, there is a need to enhance transparency of issuers, issue schedule and market information. Greater transparency by Governments in furnishing of information plays an important role in improving liquidity of government securities. Adherence to a regular issuance cycle and pre-announcement of issue schedule provide an opportunity to investors to plan their portfolio management. In this regard, the existence of ‘when issued’ trading in government securities enables better market acceptability of issuances with availability of time between announcement and actual auction dates. A greater degree of transparency observed by market par ticipants also improves market liquidity. Dissemination of market information on a real time basis, without disclosing identity of market participants, narrows bid-ask spreads and improves market liquidity. Box V.3 Principles of a Deep and Liquid Government Securities Market A few general inter-related principles emerge from the experience of the mature markets that can guide the creation of deep and liquid government securities markets in countries after due adjustment to suit particular market situations (BIS, 1999). First, there is a need to maintain a competitive market structure in the government securities market to facilitate efficient price discovery. A government security, like any financial instrument, can be traded through a wide variety of mechanisms like over-the-counter (OTC) markets, organised exchanges and other platforms which cannot be placed in either of these categories. A fundamental strategy is to infuse competition among dealers which would narrow bid-ask spreads and increase liquidity of the market. In the case of exchanges, even when their number is limited, dynamic competition between the leading exchange and other exchanges, and between the OTC market and organised exchanges contribute to market liquidity. Thus, it is necessary to maintain a ‘contestable market’ where the dominant market participants can be challenged by new entrants if monopolistic or oligopolistic practices develop. Second, the government securities market needs to have a low level of fragmentation offering instruments which have high degree of substitutability. Market liquidity tends to be enhanced when instruments can be substituted one for another since the market for each of them becomes less fragmented. A high degree of substitutability enhances trading supply of securities which facilitates in meeting the transaction demand. However, there is also a need to have some degree of heterogeneity in instruments for catering to specific investor needs. The trade-off between homogeneous product of large volume and some heterogeneity can be resolved by having a system of issuing government bonds at several ‘key maturities’ from the short end to the long end of the yield curve. Third, liquidity of the government securities market can be improved by lowering transaction costs, which include taxes, cost of sustaining necessary infrastructure and compensation for liquidity provision services. Higher transaction costs widen the gap between the effective price received by sellers of the instrument and that paid by buyers, thereby making it difficult to match sell and buy orders. This leads to low market liquidity. Some transaction costs, however, are inevitable such as those associated with ensuring sound payment and settlement infrastructure and improving overall robustness of the market. Thus, transaction costs need to be minimised as long as this does not reduce the security of the market in question. Fourth, there is a need to ensure a sound, robust and safe market infrastructure comprising (i) payment and settlement systems; (ii) the regulatory and supervisory framework; and (iii) market monitoring and surveillance. This increases the resilience of the government securities market against external shocks and contributes to continuous price discovery, thereby enhancing market liquidity. Source: BIS. 1999. “How Should We Design Deep and Liquid Markets? The Case for Government Securities.” Basel, October. 5.21 Finally, the development of related markets such as repo, futures and options also improves market liquidity of the government securities market by enabling participants to undertake hedging, arbitrage operations and speculative transactions. Repo transactions enable market participants to finance long positions and cover short positions. A well structured futures market reduces hedging costs and, thus, makes it easier to undertake cash transactions. An options market provides flexibility for hedging and arbitrage. 5.22 Central banks also impact liquidity of the government securities market through the various roles they perform. First, information on the policy decisions, release of data on various economic indicators and notification of open market operations (OMO) by central banks get incorporated into market prices. Second, as major market participants, central banks’ conduct of OMO using government securities affects supply of securities in the financial system. Third, central banks influence market liquidity by providing clearing and settlement services of government securities. 5.23 The government securities market has generally increased in size across countries in tandem with the growing financing requirements of Governments over the years. Notwithstanding the onset of fiscal consolidation processes and the consequent shrinking supply of issuances in the primary market in some countries in recent years, public debt managers have honed the development of the government securities market through various measures. Several Governments now raise funds through market-based mechanisms in a transparent and predictable fashion. They have also strived to broaden the investor base for the issuances of government securities. The Governments and central banks have adopted a strategy of jointly working with market participants to promote the development of the secondary market for government securities as also to establish sound clearing and settlement systems to handle transactions in government securities. While an abiding objective of public debt management in various countries has continued to be minimising the cost of government borrowings, a striking feature in the last two decades has been to pursue this objective with a focus particularly on managing risks inherent in the debt portfolio (IMF-World Bank, 2002). Size and Liquidity of Government Securities Market 5.24 Historically, government securities markets grew with the need to finance government budget deficits. Since the 1970s, government securities markets in the United States (US) and in many other industrial countries underwent significant expansion in terms of size. Large fiscal deficits resulted in increased issuances of treasury bills and bonds. The US government securities market was, historically, the largest. However, as a result of fiscal consolidation in the 1990s, the government bond market shrank sharply in the US. On the other hand, the size of the Japanese Government Bonds (JGBs) market expanded substantially to about 150 per cent of GDP by 2005. In many other countries, including India, the size of the government securities market increased between 2000 and 2005 (Chart V.1).

Management of Public Debt and Role of the Central Bank 5.26 The degree of involvement of central banks in the government bond market varies significantly across countries. At one end are countries such as Japan, the US, Australia, the UK (since 1998) and Republic of Korea, where the finance ministry solely decides the fiscal policy, government debt related issues and the course of operation of the government bond market. The Governments in these countries, however, co-ordinate with central banks, which may be independently pursuing monetary policy and selling/buying securities in the secondary market.2 At the other end are countries in which central banks, being statutory bodies under the jurisdiction of Ministry of Finance, operate in the government bond market at the behest of their Governments. For instance, in Malaysia, the central bank is one of the five statutory bodies under the Ministry of Finance. As a banker to the Government, it advises on the details of government securities issuances and facilitates such issuances through various market infrastructures that it owns and operates. Central banks in some countries assume twin responsibilities of conducting independent monetary policy and managing public debt. For instance, in Thailand, the central bank is responsible for monetary policy and developing the bond market for private and public saving and debt management. Hence, the monetary policy stance of the Bank of Thailand is set keeping in view certain objectives relating to fiscal deficit and future financing needs of the Government. The experiences of these countries indicate that the degree of independence of the central bank may be a necessary but not a sufficient condition for the development of the government bond market.