IST,

IST,

Consumer Confidence Survey

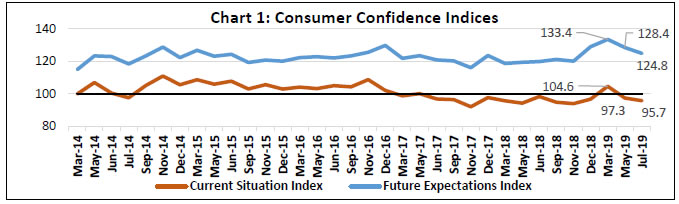

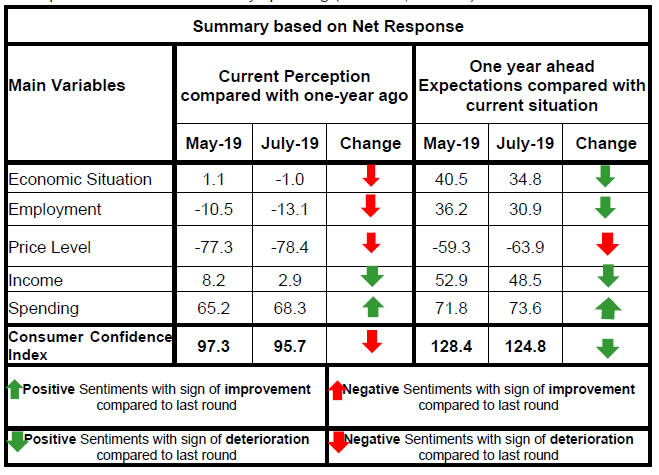

Today, the Reserve Bank released the results of the July 2019 round of its Consumer Confidence Survey (CCS)1. The survey was conducted in 13 major cities – Ahmedabad; Bengaluru; Bhopal; Chennai; Delhi; Guwahati; Hyderabad; Jaipur; Kolkata; Lucknow; Mumbai; Patna; and Thiruvananthapuram - and obtained 5,351 responses on households’ perceptions and expectations on the general economic situation, the employment scenario, the overall price situation and their own income and spending. Highlights: I. Consumer confidence declined in July as reflected in the current situation index (CSI)2; the future expectations index (FEI) fell by about 4 points (Chart 1). Note: Please see the excel file for time series data II. Consumers’ perceptions on the general economic situation (Table 1) and the employment scenario (Table 2) softened, while their assessment of their own incomes (Table 5) turned out to be less optimistic than in May 2019. III. Respondents perceived a rise in the price level and the majority expect prices to rise over the year ahead (Tables 3 and 4); this boosted sentiments on overall spending, but they were less optimistic about discretionary spending (Tables 6, 7 and 8).  1 The survey results are based on the views of respondents. 2 CSI and FEI are compiled on the basis of net responses on the economic situation, income, spending, employment and the price level for the current period and a year ahead, respectively. CSI/FEI = 100 + Average of Net Responses of the above parameters. |

Page Last Updated on: