IST,

IST,

Consumer Confidence Survey

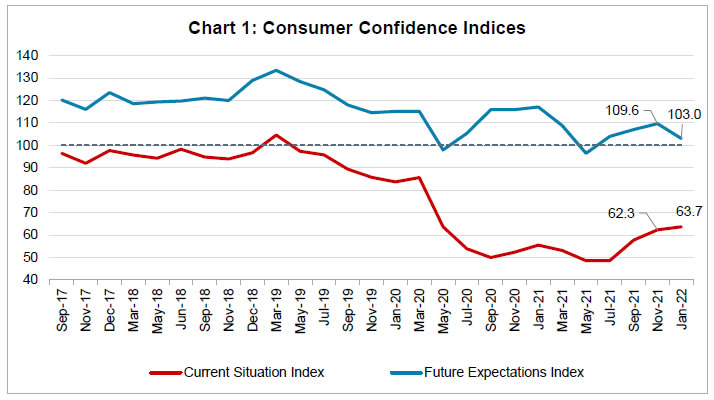

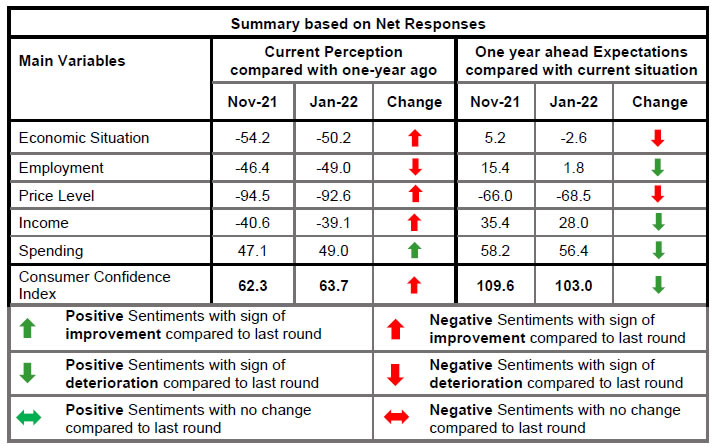

Today, the Reserve Bank released the results of its Consumer Confidence Survey (CCS)1 for the January 2022 round. The survey was conducted during January 02 to January 11, 2022 in 13 major cities, viz., Ahmedabad; Bengaluru; Bhopal; Chennai; Delhi; Guwahati; Hyderabad; Jaipur; Kolkata; Lucknow; Mumbai; Patna; and Thiruvananthapuram. The survey obtained current perceptions (vis-à-vis a year ago) and one year ahead expectations on general economic situation, employment scenario, overall price situation and own income and spending from 5,387 households across these cities2. Highlights:

Note: Please see the excel file for time series data.

1 The survey results reflect the respondents’ views, which are not necessarily shared by the Reserve Bank. Results of the previous survey round were released on the Bank’s website on December 08, 2021. 2 Unit-level data for previous rounds of the survey are available on the Database on Indian Economy (DBIE) portal of the Bank (weblink: https://dbie.rbi.org.in/DBIE/dbie.rbi?site=unitLevelData) 3 CSI and FEI are compiled on the basis of net responses on the economic situation, income, spending, employment and the price level for the current period (as compared with one year ago) and a year ahead, respectively. CSI and FEI = 100 + Average of Net Responses of the above parameters. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Page Last Updated on: