IST,

IST,

Households’ Inflation Expectations Survey

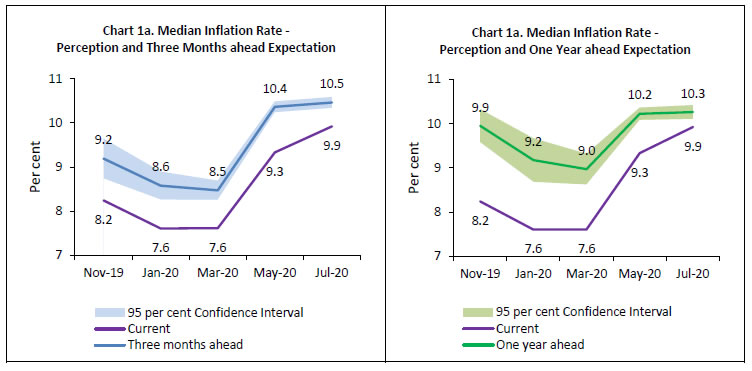

Today, the Reserve Bank released the results of the July 2020 round of the Inflation Expectations Survey of Households (IESH)1. In view of the Covid-19 pandemic, the survey was conducted through telephonic interviews during July 1-12, 2020 in 18 major cities. The results are based on responses from 5,411 urban households. Highlights: i. Households’ median inflation perception increased by 60 basis points in July 2020 as compared with the May 2020 survey round [Charts 1a and 1b; Table 3]. ii. Inflation expectations for both three months and one year horizons increased by 10 basis points each, over the previous round; three months ahead median inflation expectation stood higher than that for one year horizon for the second consecutive survey round [Charts 1a and 1b; Table 3]. iii. Households’ expectations on price changes at aggregate level are closely aligned with those of food products and cost of services. Higher expectation of food prices over three month horizon vis-à-vis one year period contributed to higher short term inflation expectations [Tables 1a and 1b].  Note: Please see the excel file for time series data.

1 The survey is conducted at bi-monthly intervals by the Reserve Bank of India. It provides directional information on near-term inflationary pressures as expected by the respondents and may reflect their own consumption patterns. Hence, they should be treated as households’ sentiments on inflation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Page Last Updated on: