IST,

IST,

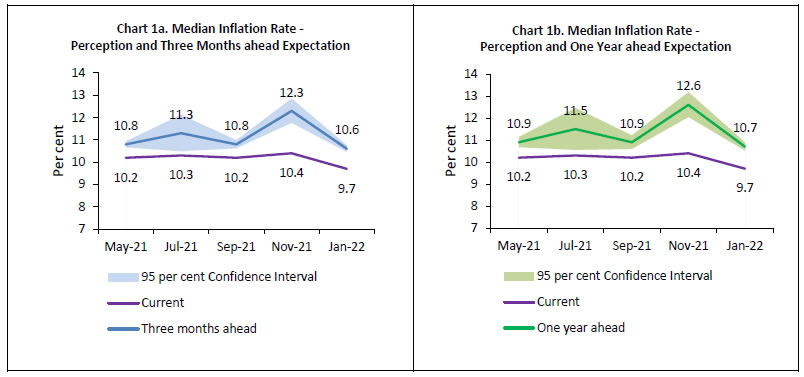

Households’ Inflation Expectations Survey

Today, the Reserve Bank released the results of the January 2022 round of the Inflation Expectations Survey of Households (IESH)1. The survey was conducted during January 2 to 12, 2022 in 18 major cities. The results2 are based on responses from 5,985 urban households3. Highlights:

Note: Please see the excel file for time series data.

1 The survey results reflect the respondents’ views, which are not necessarily shared by the Reserve Bank. Results of the previous survey round were released on the Bank’s website on December 8, 2021. 2 The survey is conducted at bi-monthly intervals by the Reserve Bank of India. It provides directional information on near-term inflationary pressures as expected by the respondents and may reflect their own consumption patterns. Hence, they should be treated as households’ sentiments on inflation. 3 Unit-level data for previous rounds of the survey are available on the Database on Indian Economy (DBIE) portal of the Bank (weblink: https://dbie.rbi.org.in/DBIE/dbie.rbi?site=unitLevelData). | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Page Last Updated on: