Growth is expected to firm up in 2018-19 and 2019-20 on the back of higher private consumption. Consumer price inflation is expected to remain above 4.0 per cent till Q2:2019-20. The Reserve Bank has been conducting the Survey of Professional Forecasters (SPF) since September 2007. Twenty-nine panellists participated in the 54th round of the survey conducted during September 20182. The survey results are summarised in terms of their median forecasts and consolidated in Annexes 1-7, along with quarterly paths for key variables. Highlights: 1. Output • Real gross domestic product (GDP) is likely to grow at 7.4 per cent in 2018-19 ― up from 6.7 per cent in 2017-18 ― and is expected to accelerate further by 10 basis points (bps) in 2019-20 on the back of support from private consumption (Table 1). • The investment rate, proxied by the ratio of gross fixed capital formation to GDP, is expected to improve in 2018-19 and 2019-20, commensurate with an upturn in the saving rate. • Real gross value added (GVA) is expected to grow by 7.2 per cent in 2018-19 and by 7.3 per cent in 2019-20, supported by activity in the industrial and services sectors. | Table 1: Median Forecast of Growth in Real GDP, GVA and Components | | (in per cent) | | | 2018-19 | 2019-20 | | Real GDP Growth | 7.4

(0.0) | 7.5

(-0.1) | Private Final Consumption Expenditure (nominal)

(growth rate in per cent) | 12.4

(+0.8) | 12.4

(+0.6) | Gross Fixed Capital Formation Rate

(per cent of GDP) | 28.8

(-0.2) | 29.1

(-0.4) | | Real GVA Growth | 7.2

(0.0) | 7.3

(-0.1) | | a. Agriculture and Allied Activities | 3.9

(+0.5) | 3.6

(+0.6) | | b. Industry | 7.7

(+0.8) | 7.2

(+0.2) | | c. Services | 7.9

(-0.3) | 8.4

(-0.2) | Gross Saving Rate

[per cent of gross national deposable income (GNDI)] | 29.8

(-0.2) | 30.0

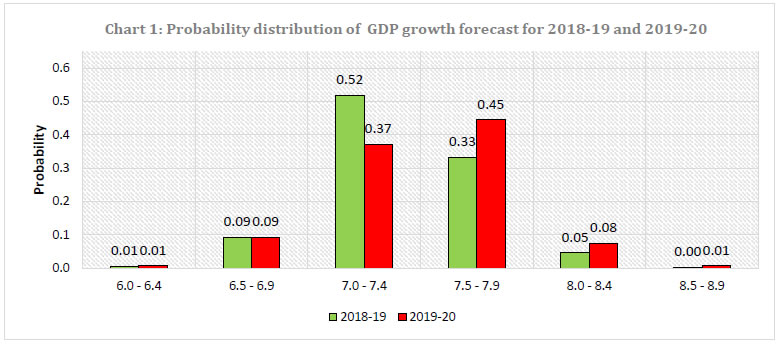

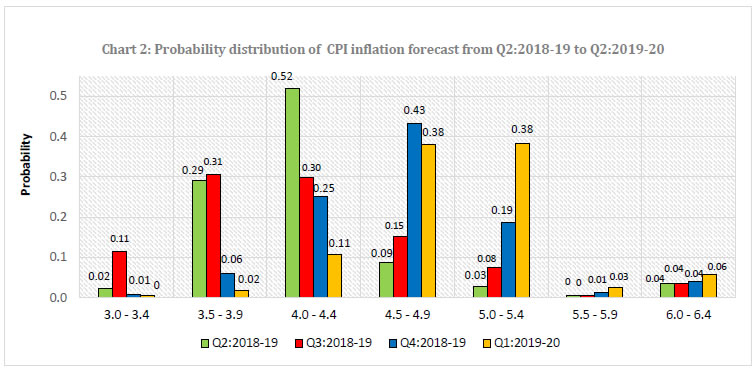

(-0.5) | | Note: In all the tables, the figures in parentheses indicate the extent of revision in median forecasts (percentage points) relative to the previous SPF round. | • Forecasters have assigned the maximum probability to GDP growth being in the range of 7.0-7.4 per cent in 2018-19 and 7.5-7.9 per cent in 2019-20 (Chart 1). 2. Inflation • Headline consumer price index (CPI) inflation is likely to remain above 4.0 per cent till Q2:2019-20. • Core inflation (i.e., CPI excluding food and beverages, pan, tobacco and intoxicants, and fuel and light) is likely to remain above 5.0 per cent during 2018-19 before edging down to 5.0 per cent in the first half of 2019-20. | Table 2: Median Forecast of Quarterly Inflation | | (in per cent) | | | Q2:18-19 | Q3:18-19 | Q4:18-19 | Q1:19-20 | Q2:19-20 | | CPI Headline | 4.1

(-0.6) | 4.1

(-0.2) | 4.5

(-0.3) | 5.0

(-0.1) | 5.1 | | CPI excluding food & beverages, pan, tobacco & intoxicants and fuel & light | 6.0

(-0.1) | 5.6

(0.0) | 5.3

(0.0) | 5.0

(+0.1) | 5.0 | | WPI All Commodities | 4.8

(-0.3) | 4.2

(-0.1) | 4.0

(-0.2) | 3.7

(-0.3) | 3.6 | | WPI Non-food Manufactured Products | 4.8

(-0.1) | 4.6

(+0.1) | 3.9

(-0.1) | 3.6

(+1.0) | 3.3 | • Forecasters have assigned the highest probability to CPI inflation being in the range 4.0-4.4 per cent in Q2:2018-19. • For Q3:2018-19, highest probability has been assigned to inflation being in the range of 3.5-4.4 per cent. • Forecasters have assigned the highest probability to CPI inflation being in the range 4.5- 4.9 per cent for Q4:2018-19. • Highest probability has been assigned to inflation being in the range of 4.5- 5.4 per during Q1:2019-20 (Chart 2). 3. External Sector • The forecast of growth in merchandise exports and merchandise imports during 2018-19 have been revised up to 10.4 per cent and 14.3 per cent, respectively, but some deceleration is expected in 2019-20 (Table 3). • The current account deficit (CAD) is expected at 2.7 per cent of GDP in 2018-19 and at 2.5 per cent of GDP in 2019-20. • The Indian rupee is likely to remain around ₹72 per US Dollar till Q4:2018-19 (Annex 3). | Table 3: Median Forecast of Select External Sector Variables | | | 2018-19 | 2019-20 | Merchandise Exports – in US $ terms

(annual growth in per cent) | 10.4

(+0.6) | 9.7

(+1.3) | Merchandise Imports– in US $ terms

(annual growth in per cent) | 14.3

(+1.3) | 8.4

(-0.2) | Current Account Deficit

(Ratio to GDP at current market price, in per cent) | 2.7

(+0.2) | 2.5

(0.0) |

The Reserve Bank thanks the following institutions for their participation in this round of the Survey of Professional Forecasters (SPF): Aditi Nayar, ICRA Limited; Anubhuti Sahay, Standard Chartered Bank; Debopam Chaudhuri, Piramal Enterprises Limited; Devendra Kumar Pant, India Ratings and Research; Dr Arun Singh, Dun & Bradstreet; Gaurav Kapur, IndusInd Bank Ltd.; ICICI Securities Primary Dealership; Indranil Pan, IDFC Bank Ltd.; Nikhil Gupta, Motilal Oswal; PHD Research Bureau; Sameer Narang, Bank of Baroda; Shailesh Kejariwal, B&K Securities India Pvt Ltd; Siddharth V Kothari, Sunidhi Securities & Finance Ltd; Sumedh Deorukhkar, BBVA and Upasna Bhardwaj, Kotak Mahindra Bank. The Bank also acknowledges the contribution of 14 others SPF panellists, who prefer to remain anonymous. |

| Annex 1: Annual Forecasts for 2018-19 | | Key Macroeconomic Indicators | Annual Forecasts for 2018-19 | | Mean | Median | Max | Min | 1st quartile | 3rd quartile | | 1 | GDP at constant (2011-12) prices: Annual Growth (per cent) | 7.4 | 7.4 | 7.8 | 7.0 | 7.3 | 7.5 | | 2 | Private Final Consumption Expenditure (PFCE) at current prices: Annual Growth (per cent) | 12.3 | 12.4 | 13.3 | 10.3 | 12.0 | 12.8 | | 3 | Gross Fixed Capital Formation (GFCF) Rate (per cent of GDP at current market prices) | 28.5 | 28.8 | 29.5 | 26.5 | 28.1 | 29.0 | | 4 | GVA at basic prices at constant (2011-12) prices: Annual Growth rate (per cent) | 7.3 | 7.2 | 9.7 | 6.7 | 7.1 | 7.4 | | a | Agriculture & Allied Activities (growth rate in per cent) | 3.9 | 3.9 | 7.1 | 3.0 | 3.5 | 4.3 | | b | Industry (growth rate in per cent) | 7.7 | 7.7 | 10.9 | 6.3 | 7.1 | 8.0 | | c | Services (growth rate in per cent) | 7.9 | 7.9 | 8.6 | 7.2 | 7.7 | 8.1 | | 5 | Gross Saving Rate (per cent of Gross National Disposable Income) - at current prices | 29.6 | 29.8 | 30.6 | 27.6 | 29.3 | 30.1 | | 6 | Fiscal Deficit of Central Govt. (per cent of GDP at current market prices) | 3.4 | 3.3 | 3.7 | 3.3 | 3.3 | 3.5 | | 7 | Combined Gross Fiscal Deficit (per cent to GDP) | 6.2 | 6.2 | 6.9 | 5.9 | 6.0 | 6.4 | | 8 | Bank Credit - Scheduled commercial banks: Annual Growth (per cent) | 11.7 | 12.0 | 15.0 | 8.0 | 10.8 | 12.5 | | 9 | Yield on 10-Year G-Sec of Central Govt. (end-period) | 8.1 | 8.1 | 8.5 | 7.6 | 7.9 | 8.3 | | 10 | Yield on 91-day T-Bill of Central Govt. (end-period) | 7.2 | 7.2 | 8.1 | 6.6 | 7.0 | 7.4 | | 11 | Merchandise Exports - BoP basis (in US$ terms)- Annual Growth (per cent) | 10.8 | 10.4 | 20.0 | 4.9 | 9.0 | 11.9 | | 12 | Merchandise Imports - BoP basis (in US$ terms)- Annual Growth (per cent) | 15.0 | 14.3 | 25.0 | 10.5 | 12.9 | 16.9 | | 13 | Current Account Balance - Ratio to GDP at current market price (per cent) | -2.7 | -2.7 | -2.1 | -3.0 | -2.8 | -2.6 | | 14 | Overall BoP - In US $ bn. | -20.7 | -20.7 | -3.6 | -40.0 | -30.0 | -13.0 | | 15 | Inflation based on CPI-Combined - Headline | 4.5 | 4.5 | 5.2 | 3.9 | 4.3 | 4.7 | | 16 | Inflation based on CPI-Combined - excluding 'Food & Beverages', 'Pan, Tobacco & Intoxicants' and 'Fuel & Light' | 5.7 | 5.7 | 6.2 | 5.4 | 5.6 | 5.8 | | 17 | Inflation based on WPI - All Commodities | 4.5 | 4.5 | 5.3 | 4.0 | 4.2 | 4.7 | | 18 | Inflation based on WPI -Non-food Manufactured Products | 4.4 | 4.4 | 5.4 | 3.4 | 4.0 | 4.6 |

| Annex 2: Annual Forecasts for 2019-20 | | Key Macroeconomic Indicators | Annual Forecasts for 2019-20 | | Mean | Median | Max | Min | 1st quartile | 3rd quartile | | 1 | GDP at constant (2011-12) prices: Annual Growth (per cent) | 7.5 | 7.5 | 8.0 | 7.0 | 7.3 | 7.8 | | 2 | Private Final Consumption Expenditure (PFCE) at current prices: Annual Growth (per cent) | 12.3 | 12.4 | 13.5 | 10.5 | 11.5 | 13.1 | | 3 | Gross Fixed Capital Formation (GFCF) Rate (per cent of GDP at current market prices) | 28.9 | 29.1 | 30.0 | 27.1 | 28.0 | 29.5 | | 4 | GVA at basic prices at constant (2011-12) prices: Annual Growth rate (per cent) | 7.5 | 7.3 | 9.5 | 6.7 | 7.2 | 7.8 | | a | Agriculture & Allied Activities (growth rate in per cent) | 3.7 | 3.6 | 7.3 | 1.3 | 3.0 | 4.2 | | b | Industry (growth rate in per cent) | 7.3 | 7.2 | 10.2 | 5.8 | 6.6 | 7.6 | | c | Services (growth rate in per cent) | 8.3 | 8.4 | 8.9 | 7.5 | 8.1 | 8.6 | | 5 | Gross Saving Rate (per cent of Gross National Disposable Income) - at current prices | 29.9 | 30.0 | 30.9 | 27.8 | 29.4 | 30.8 | | 6 | Fiscal Deficit of Central Govt. (per cent of GDP at current market prices) | 3.2 | 3.1 | 3.5 | 3.0 | 3.1 | 3.3 | | 7 | Combined Gross Fiscal Deficit (per cent to GDP) | 6.1 | 5.9 | 6.8 | 5.6 | 5.8 | 6.3 | | 8 | Bank Credit - Scheduled commercial banks: Annual Growth (per cent) | 12.5 | 12.3 | 14.0 | 11.3 | 11.6 | 13.6 | | 9 | Yield on 10-Year G-Sec of Central Govt. (end-period) | 8.0 | 8.0 | 8.5 | 7.5 | 7.6 | 8.4 | | 10 | Yield on 91-day T-Bill of Central Govt. (end-period) | 7.1 | 7.2 | 7.8 | 6.5 | 6.5 | 7.5 | | 11 | Merchandise Exports - BoP basis (in US$ terms)- Annual Growth (per cent) | 10.2 | 9.7 | 22.0 | 3.3 | 7.3 | 11.6 | | 12 | Merchandise Imports - BoP basis (in US$ terms)- Annual Growth (per cent) | 10.8 | 8.4 | 30.0 | 4.3 | 6.6 | 12.0 | | 13 | Current Account Balance - Ratio to GDP at current market price (per cent) | -2.5 | -2.5 | -1.9 | -2.8 | -2.7 | -2.2 | | 14 | Overall BoP - In US $ bn. | 4.4 | 0.3 | 49.0 | -30.0 | -7.3 | 19.8 | | 15 | Inflation based on CPI-Combined - Headline | 4.8 | 4.8 | 5.5 | 4.5 | 4.6 | 5.0 | | 16 | Inflation based on CPI-Combined - excluding 'Food & Beverages', 'Pan, Tobacco & Intoxicants' and 'Fuel & Light' | 5.1 | 4.9 | 6.2 | 4.1 | 4.8 | 5.7 | | 17 | Inflation based on WPI - All Commodities | 4.0 | 4.2 | 5.7 | 2.3 | 2.9 | 4.9 | | 18 | Inflation based on WPI -Non-food Manufactured Products | 3.8 | 4.2 | 6.0 | 2.0 | 2.3 | 4.5 |

| Annex 3: Quarterly Forecasts from Q2:2018-19 to Q2:2019-20 | | Key Macroeconomic Indicators | Quarterly Forecasts | | Q2: 2018-19 | Q3: 2018-19 | Q4: 2018-19 | | Mean | Median | Max | Min | Mean | Median | Max | Min | Mean | Median | Max | Min | | 1 | GDP at constant (2011-12) prices: Annual Growth (per cent) | 7.4 | 7.4 | 8.1 | 7.0 | 7.1 | 7.1 | 7.7 | 6.4 | 7.0 | 6.9 | 7.7 | 6.3 | | 2 | PFCE at current prices: Y-on-Y Growth (per cent) | 11.8 | 12.5 | 15.7 | 8.0 | 11.1 | 11.8 | 13.4 | 7.0 | 10.8 | 11.7 | 13.3 | 7.0 | | 3 | GFCF Rate (per cent of GDP at current market prices) | 28.5 | 28.5 | 29.6 | 27.7 | 28.3 | 28.6 | 29.0 | 27.3 | 28.7 | 28.9 | 29.5 | 27.1 | | 4 | GVA at constant (2011-12) prices: Annual Growth (per cent) | 7.3 | 7.3 | 8.1 | 6.8 | 6.9 | 6.9 | 7.4 | 6.3 | 6.7 | 6.8 | 7.5 | 6.0 | | a | Agriculture & Allied Activities (growth rate in per cent) | 3.8 | 3.9 | 6.3 | 2.2 | 3.5 | 3.6 | 4.9 | 2.5 | 3.3 | 3.0 | 5.2 | 1.1 | | b | Industry (growth rate in per cent) | 7.4 | 7.2 | 9.9 | 6.1 | 6.9 | 6.7 | 10.0 | 5.6 | 6.3 | 6.4 | 8.0 | 5.1 | | c | Services (growth rate in per cent) | 8.0 | 7.8 | 9.0 | 7.1 | 8.0 | 8.0 | 9.0 | 7.1 | 7.8 | 7.9 | 8.7 | 6.7 | | 5 | IIP (2011-12=100): Quarterly Average Growth (per cent) | 5.3 | 5.1 | 7.2 | 4.5 | 4.4 | 4.0 | 7.3 | 2.7 | 4.1 | 4.0 | 6.6 | 1.8 | | 6 | Merchandise Exports - BoP basis (in US$ bn.) | 83.8 | 84.0 | 90.0 | 79.0 | 84.5 | 84.9 | 94.0 | 77.0 | 87.3 | 86.9 | 98.0 | 79.6 | | 7 | Merchandise Imports - BoP basis (in US$ bn.) | 132.0 | 131.0 | 140.0 | 127.2 | 136.8 | 136.4 | 150.0 | 130.7 | 137.2 | 135.8 | 161.0 | 127.1 | | 8 | Rupee – US Dollar Exchange rate (RBI reference rate) (end-period) | - | - | - | - | 72.4 | 72.3 | 75.0 | 69.0 | 71.8 | 72.0 | 75.0 | 68.5 | | 9 | Crude Oil (Indian basket) price (US $ per barrel) (end-period) | - | - | - | - | 75.9 | 75.5 | 80.0 | 72.0 | 75.1 | 75.0 | 78.0 | 71.5 | | 10 | Repo Rate (end-period) | - | - | - | - | 6.74 | 6.75 | 7.00 | 6.25 | 6.79 | 7.00 | 7.25 | 6.00 |

| Key Macroeconomic Indicators | Quarterly Forecasts | | Q1: 2019-20 | Q2: 2019-20 | | Mean | Median | Max | Min | Mean | Median | Max | Min | | 1 | GDP at constant (2011-12) prices: Annual Growth (per cent) | 7.2 | 7.2 | 7.7 | 6.5 | 7.4 | 7.4 | 8.2 | 7.0 | | 2 | PFCE at current prices: Y-on-Y Growth (per cent) | 11.3 | 11.7 | 13.3 | 7.5 | 11.6 | 12.0 | 13.6 | 8.0 | | 3 | GFCF Rate (per cent of GDP at current market prices) | 28.8 | 28.9 | 29.3 | 27.9 | 28.6 | 28.6 | 29.5 | 27.7 | | 4 | GVA at constant (2011-12) prices: Annual Growth (per cent) | 7.1 | 7.1 | 7.5 | 6.2 | 7.3 | 7.3 | 8.2 | 6.8 | | a | Agriculture & Allied Activities (growth rate in per cent) | 3.5 | 3.5 | 5.0 | 1.7 | 3.5 | 3.4 | 6.0 | 0.9 | | b | Industry (growth rate in per cent) | 6.6 | 6.6 | 8.7 | 4.8 | 6.9 | 6.8 | 9.0 | 5.4 | | c | Services (growth rate in per cent) | 8.1 | 8.0 | 8.6 | 7.3 | 8.2 | 8.0 | 9.1 | 7.3 | | 5 | IIP (2011-12=100): Quarterly Average Growth (per cent) | 5.1 | 5.7 | 6.6 | 2.9 | 5.4 | 5.4 | 7.1 | 2.9 | | 6 | Merchandise Exports - BoP basis (in US$ bn.) | 89.0 | 89.5 | 91.3 | 85.0 | 91.3 | 91.3 | 97.6 | 87.1 | | 7 | Merchandise Imports - BoP basis (in US$ bn.) | 139.6 | 139.6 | 145.0 | 133.1 | 144.1 | 138.3 | 160.0 | 136.5 | | 8 | Rupee – US Dollar Exchange rate (RBI reference rate) (end-period) | 71.2 | 71.0 | 75.0 | 68.5 | 70.6 | 70.5 | 74.0 | 66.0 | | 9 | Crude Oil (Indian basket) price (US $ per barrel) (end-period) | 75.2 | 75.0 | 80.5 | 70.5 | 72.8 | 73.5 | 75.0 | 69.0 | | 10 | Repo Rate (end-period) | 6.78 | 7.00 | 7.25 | 6.00 | 6.78 | 7.00 | 7.25 | 6.00 |

| Annex 4: Forecasts of CPI-Combined Inflation | | (per cent) | | | CPI Combined Headline | Core CPI Combined (excluding ‘Food & Beverages’, 'Pan, Tobacco & Intoxicants' and ‘Fuel & Light’) | | Mean | Median | Max | Min | Mean | Median | Max | Min | | Q2:2018-19 | 4.2 | 4.1 | 5.1 | 3.9 | 6.0 | 6.0 | 6.4 | 5.8 | | Q3:2018-19 | 4.2 | 4.1 | 5.3 | 3.5 | 5.6 | 5.6 | 6.4 | 5.0 | | Q4:2018-19 | 4.7 | 4.5 | 5.9 | 3.7 | 5.4 | 5.3 | 6.5 | 4.6 | | Q1:2019-20 | 5.1 | 5.0 | 6.0 | 4.5 | 5.1 | 5.0 | 6.4 | 4.1 | | Q2:2019-20 | 5.1 | 5.1 | 6.0 | 4.2 | 5.2 | 5.0 | 6.5 | 4.1 |

| Annex 5: Forecasts of WPI Inflation | | (per cent) | | | WPI Headline | WPI Non-food Manufactured Products | | Mean | Median | Max | Min | Mean | Median | Max | Min | | Q2:2018-19 | 4.8 | 4.8 | 5.2 | 4.5 | 4.8 | 4.8 | 5.2 | 4.4 | | Q3:2018-19 | 4.2 | 4.2 | 5.3 | 3.5 | 4.6 | 4.6 | 5.7 | 4.0 | | Q4:2018-19 | 4.1 | 4.0 | 5.5 | 3.4 | 4.0 | 3.9 | 6.1 | 2.9 | | Q1:2019-20 | 3.8 | 3.7 | 5.5 | 2.7 | 3.6 | 3.6 | 6.1 | 2.2 | | Q2:2019-20 | 3.7 | 3.6 | 5.6 | 2.4 | 3.5 | 3.3 | 6.3 | 1.9 |

| Annex 6: Mean probabilities attached to possible outcomes of Real GDP growth | | Growth Range | Forecasts for 2018-19 | Forecasts for 2019-20 | | 10.0 per cent or more | 0.00 | 0.00 | | 9.5 to 9.9 per cent | 0.00 | 0.00 | | 9.0 to 9.4 per cent | 0.00 | 0.00 | | 8.5 to 8.9 per cent | 0.00 | 0.01 | | 8.0 to 8.4 per cent | 0.05 | 0.08 | | 7.5 to 7.9 per cent | 0.33 | 0.45 | | 7.0 to 7.4 per cent | 0.52 | 0.37 | | 6.5 to 6.9 per cent | 0.09 | 0.09 | | 6.0 to 6.4 per cent | 0.01 | 0.01 | | 5.5 to 5.9 per cent | 0.00 | 0.00 | | 5.0 to 5.4 per cent | 0.00 | 0.00 | | 4.5 to 4.9 per cent | 0.00 | 0.00 | | 4.0 to 4.4 per cent | 0.00 | 0.00 | | 3.5 to 3.9 per cent | 0.00 | 0.00 | | 3.0 to 3.4 per cent | 0.00 | 0.00 | | 2.5 to 2.9 per cent | 0.00 | 0.00 | | 2.0 to 2.4 per cent | 0.00 | 0.00 | | Below 2.0 per cent | 0.00 | 0.00 |

| Annex 7: Mean probabilities attached to possible outcomes of CPI (Combined) inflation | | Inflation Range | Forecasts for Q2:2018-19 | Forecasts for Q3:2018-19 | Forecasts for Q4:2018-19 | Forecasts for Q1:2019-20 | | 8.0 per cent or above | 0.00 | 0.00 | 0.00 | 0.00 | | 7.5 to 7.9 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | 7.0 to 7.4 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | 6.5 to 6.9 per cent | 0.01 | 0.01 | 0.00 | 0.02 | | 6.0 to 6.4 per cent | 0.04 | 0.04 | 0.04 | 0.06 | | 5.5 to 5.9 per cent | 0.01 | 0.01 | 0.01 | 0.03 | | 5.0 to 5.4 per cent | 0.03 | 0.08 | 0.19 | 0.38 | | 4.5 to 4.9 per cent | 0.09 | 0.15 | 0.43 | 0.38 | | 4.0 to 4.4 per cent | 0.52 | 0.30 | 0.25 | 0.11 | | 3.5 to 3.9 per cent | 0.29 | 0.31 | 0.06 | 0.02 | | 3.0 to 3.4 per cent | 0.02 | 0.11 | 0.01 | 0.00 | | 2.5 to 2.9 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | 2.0 to 2.4 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | 1.5 to 1.9 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | 1.0 to 1.4 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | 0.5 to 0.9 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | 0 to 0.4 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | Below 0 per cent | 0.00 | 0.00 | 0.00 | 0.00 | | Note: CPI: Consumer Price Index; GDP: Gross Domestic Products; GNDI: Gross National Disposable Income; GVA: Gross Value Added; IIP: Index of Industrial Production; WPI: Wholesale Price Index. |

|

IST,

IST,