IST,

IST,

Fourth Bi-Monthly Monetary Policy Statement, 2014-15

By Part A: Monetary Policy Monetary and Liquidity Measures On the basis of an assessment of the current and evolving macroeconomic situation, it has been decided to:

Consequently, the reverse repo rate under the LAF will remain unchanged at 7.0 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 9.0 per cent. Assessment 2. Since the third bi-monthly monetary policy statement of August 2014, global activity has been recovering slowly from the setback in Q1 of 2014, on the back of strengthening consumer spending and gradually improving labour market conditions in advanced economies (AEs) like the United States. However, the Euro area, where growth has stalled in the core economies, continues to be weak. Major emerging market economies (EMEs) continue to struggle with tepid domestic demand and headwinds from structural impediments. With monetary policy in AEs remaining highly accommodative, investor risk appetite has increased and spread to various asset classes. With volatility perhaps excessively low, financial markets have risen to new highs, driving surges of capital flows to EMEs. Apart from concerns about a sudden correction in financial markets if investors misread the timing of a reversal of the US monetary policy stance or if geopolitical tensions intensify, some downside risks to growth also persist, such as a possible further slowdown in the Euro area. 3. Domestic activity appears to have come off somewhat after the stronger-than-expected upturn in Q1 of 2014-15. In Q2, the growth of industrial production slumped in July, as capital goods production followed consumer durables into contraction. Exports cushioned the fall in manufacturing output, with the Reserve Bank’s industrial outlook survey indicating expansion in export orders. Rainfall from the south west monsoon, now expected to be about 12 per cent deficient, will weigh on the kharif crop, mainly due to its uneven spatial distribution. This has resulted in drought-like conditions in some major production zones in the north-west region but also floods in the northern and eastern regions. In the services sector, constituents are moving at varying speeds and the purchasing managers’ index points to uncertainty around future prospects. The recent cautious optimism that is building in the economy on the back of improved business sentiment needs to be placed on solid foundations through a step-up in investment. In this context, the resumption of stalled projects should provide a boost to inventory and capex cycles, while reducing distressed bank loans and revitalising growth. 4. Retail inflation measured by the consumer price index (CPI) came off the vegetable prices-driven spike in July 2014 and eased in all major groups barring food. Large and persistent upside pressures on food prices have resulted in their contribution rising to almost 60 per cent of headline inflation in August. The full impact of the skewed rainfall distribution carries risks to the future path of food inflation, though vegetable prices have fallen recently after the recent spike. CPI inflation excluding food and fuel decelerated to its lowest level in the new series, mainly on account of sharp disinflation in transport and communication and household requisites. Future food prices and the timing and magnitude of held back administered price revisions impart some uncertainty to an otherwise improving inflation outlook, where lower oil prices, a relatively stable currency, and a negative output gap continue to put downward pressure. Base effects will also temper inflation in the next few months only to reverse towards the end of the year. The Reserve Bank will look through base effects. 5. Liquidity conditions have remained broadly balanced through Q2 of 2014-15, except for transient tightness in the second half of July and early August due to delayed Government expenditure. Thereafter, as these expenditures began to flow, liquidity conditions eased. With credit growth falling well below deposit growth in August and September, structural sources of liquidity pressures also eased. The average recourse to liquidity from the Reserve Bank, measured by daily net liquidity injection through LAF, term repo and MSF, decreased from `870 billion in July to `795 billion during August and further to `450 billion during September so far (up to September 28). The Reserve Bank revised its liquidity management framework with effect from September 5, 2014, with more frequent 14-day term repos and daily overnight variable rate repo operations, to ensure flexibility, transparency and predictability in liquidity management operations. 6. Non-food credit growth decelerated in September 2014, the lowest level since June 2001, despite liquidity conditions remaining comfortable and deposit growth remaining normal. Partly, this sharp deceleration is on account of a high base – monetary tightening to curb the exchange market pressures in July-September last year raised interest rates on alternative sources of funds and pushed up the demand for credit from the banking system. Adjusting for these base effects, non-food credit growth would have been around 11 per cent in September 2014. Corporates have also opted to raise financing through alternative sources such as commercial paper, which are significantly larger than a year ago. Finance from other non-bank sources such as foreign direct investment and external commercial borrowing has also increased. Also, a few banks have sold stressed loans to asset reconstruction companies, and so these loans no longer appear as bank credit. Net bank credit is also lower because of repayments of loans by entities that have received payments by government departments and public enterprises, and because oil marketing companies’ borrowing is lower. Finally, the slowdown in credit growth is more pronounced in public sector banks, but how much of this is because of needed bank balance sheet restructuring, repayments of stressed loans, or increased risk aversion is to be established. Going forward, as the investment cycle gathers momentum and overall demand picks up, banks will need to prepare to meet financing requirements as the credit cycle also turns. Equally, given the easy availability of foreign finance, corporations should be wary of being lulled by relative exchange rate stability and neglect to hedge foreign exchange liabilities. 7. Incoming data suggest that the current account deficit, placed at 1.7 per cent of GDP for Q1 of 2014-15 may remain contained in Q2. Over April-August 2014, the trade deficit was narrower than a year ago, notwithstanding a slowdown in export growth in July and August and a strengthening of non-oil non-gold import growth to its highest level since March 2013. The improvement in the trade balance has benefited from the fall in the value of gold imports. Even as the external financing requirement stays moderate, all categories of capital flows remain buoyant. As a result, there has been an accretion to international reserves, even though reserves denominated in US dollars have moderated somewhat in recent weeks, largely because of the strength of the US dollar. Policy Stance and Rationale 8. Since June, headline inflation has ebbed to levels which are consistent with the desired near-term glide path of disinflation -- 8 per cent by January 2015. The most heartening feature has been the steady decline in inflation excluding food and fuel, by a cumulative 111 basis points since January 2014, to a new low. With international crude prices softening and relative stability in the foreign exchange market, some upside risks to inflation are receding. Yet, there are risks from food price shocks as the full effects of the monsoon’s passage unfold, and from geo-political developments that could materialise rapidly. 9. For the near-term objective, therefore, the risks around the baseline path of inflation are broadly balanced, though with a slant to the downside (Chart 1). However, the undershooting of the objective may be temporary because of base effects. Turning to the medium-term objective (6 per cent by January 2016) the balance of risks is still to the upside, though somewhat lower than in the last policy statement. This continues to warrant policy preparedness to contain pressures if the risks materialise. Therefore, the future policy stance will be influenced by the Reserve Bank’s projections of inflation relative to the medium term objective (6 per cent by January 2016), while being contingent on incoming data. 10. The momentum of activity in all sectors of the economy is yet to stabilize. Agriculture should shed the effects of recent shocks and pick up in Q4 of 2014-15. Industrial activity will await improvement in the business environment and the resumption of consumption and investment demand before gaining sustained speed. Post-monsoon revival in construction activity and the likely strengthening of momentum in business and financial services should sustain the recent signs of expansion in the services sector. The key to a turnaround in the growth path of the economy in the second half of the year is a revival in investment activity – in greenfield as well as brownfield stalled projects – supported by fiscal consolidation, stronger export performance and sustained disinflation. With expectations of these conditions remaining broadly unchanged, the projection of growth for 2014-15 is retained at 5.5 per cent within a range of 5 to 6 per cent around this central estimate. The quarterly growth path may slow mildly in Q2 and Q3 before recovering in Q4.  11. With liquidity conditions easing, the recourse to ECR has fallen off substantially to about 10 per cent of the outstanding export credit eligible for refinance. Accordingly, in pursuance of the Dr. Urjit R. Patel Committee’s recommendation to move away from sector-specific refinance, the access to the ECR is being brought down to 15 per cent of the eligible export credit, thus continuing to give banks room for manoeuvre. This will be in effect from October 10, 2014. 12. The fifth bi-monthly monetary policy statement is scheduled on Tuesday, December 2, 2014. Part B: Developmental and Regulatory Policies 13. This part of the Statement reviews the progress on various developmental and regulatory policy measures announced by the Reserve Bank in recent policy statements and also sets out new measures. 14. Developmental and regulatory measures are being put in place within the organising framework of the five-pillar approach announced in October 2013 in the Second Quarter Review of Monetary Policy for 2013-14. This approach emphasises the strengthening of the monetary policy framework; fortifying the banking structure; broadening and deepening financial markets; expanding access to finance; and dealing with stress in corporate and financial assets and putting them back to work. I. Monetary Policy Framework 15. Efforts to improve the monetary policy framework are documented in Part A of this Statement and in the accompanying Monetary Policy Report. In continuation of the process of implementing recommendations of the Expert Committee to Revise and Strengthen the Monetary Policy Framework (Chairman: Dr. Urjit R Patel), the first issue of the Reserve Bank’s Monetary Policy Report is being placed in the public domain along with this Statement. Steps have also been taken to refine the liquidity management framework with a view to making it flexible, transparent and predictable. II. Banking and Financial Structure 16. The approach to strengthening the financial structure has been multi-pronged, comprising:

17. Turning to expanding the banking space, draft guidelines on Small Banks and Payments Banks as differentiated or restricted banks were placed on the Reserve Bank’s website on July 17, 2014. Based on the feedback received:

18. With regard to non-banking financial companies(NBFCs):

With these changes coming into force, the Reserve Bank will recommence registering new NBFCs. 19. Pursuant to the guidelines issued on the liquidity coverage ratio (LCR) in June 2014 which permitted banks to reckon government securities to the extent allowed by the Reserve Bank under its marginal standing facility as Level 1 High Quality Liquid Assets (HQLA) under the LCR, banks will be allowed to:

Detailed guidelines will be issued by mid-November 2014. 20. To carry forward regulatory and supervisory initiatives,

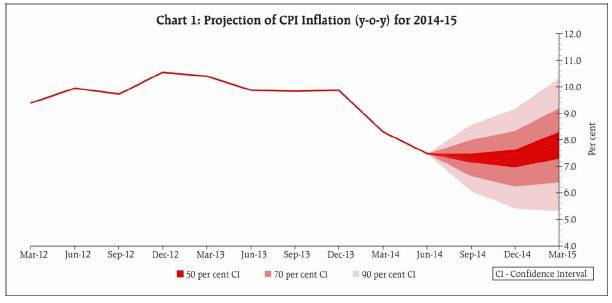

21. An Early Warning System (EWS) is being put in place to track banks’ critical financial parameters. Deviations from pre-defined benchmarks would trigger more granular oversight in the form of enhanced off-site monitoring, focused discussions, on-site examination and punitive action, if warranted. 22. Along with early detection mechanisms for frauds, a Central Fraud Registry is also proposed to be created simultaneously as a searchable centralised database for use by banks. 23. Guidelines for declaring borrowers as “non-co-operative” will be put out by end-October 2014. III. Financial Markets 24. As part of the Reserve Bank’s continuous engagement in broadening and deepening financial markets, it has been decided to:

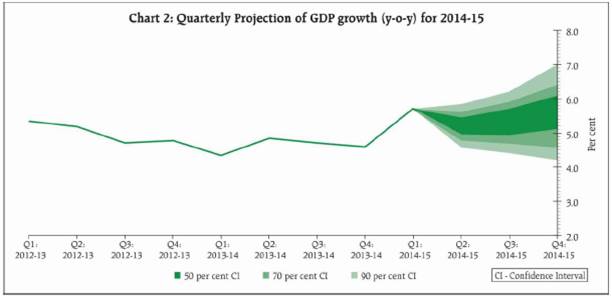

Detailed guidelines will be issued separately by mid-October 2014. 25. In order to further develop the government securities market and enhance liquidity, it has been decided to:

Detailed guidelines are being issued separately. 26. In April 2014, the Reserve Bank announced that it would examine the possibility of allowing limited re-repo/re-hypothecation of repoed government securities with the objective of developing the term repo/money market. In view of the growth of repo markets during the last decade and the availability of a robust trading, clearing and settlement infrastructure with a central counter-party (CCP) guarantee, it has been decided to:

Detailed guidelines will be issued in consultation with all stakeholders by end- January 2015. 27. In order to address operational issues faced by foreign portfolio investors and long term foreign investors, it has been decided to:

Detailed guidelines in this regard would be issued by end-November 2014. 28. With a view to easing operational conditions for hedging of foreign exchange risk by market participants, it has been decided to:

IV. Access to Finance 29 Expanding access of finance to the small, the poor, the unorganised and the underserved sections of society has been a central tenet of the Reserve Bank’s developmental policies. 30. State-Level Coordination Committees (SLCCs) are being strengthened to focus on financial inclusion for flow of public savings to the formal channels and protection of public deposits mopped up by unauthorised and unscrupulous entities. In line with the recommendation of the Financial Stability and Development Council (FSDC):

31. With a view to easing difficulties faced by common persons while opening bank accounts and during periodic updating, guidelines on ‘know your customer’ (KYC) will be further simplified with immediate effect so that banks:

32. There is a need for banks to complete KYC for all customers including long standing ‘low risk’ customers. Banks should complete documentation, while minimising the effort on the part of the customer to what is strictly needed. In the event that customers are unable to comply within a reasonable time period, ‘partial freezing’ may be introduced in respect of KYC non-compliant customers i.e., credits would be allowed in such accounts while debits would not be allowed, with an option to the account holder to close the account and take back the money in the account. 33. In line with its vision of migrating towards electronic payments and a ‘less-cash’ society, the Reserve Bank has been examining the feasibility of (a) standardisation in the operational processes and procedures involved in extension of mobile banking services, and (b) implementation of a pan-India bill payment system (recommended by GIRO Advisory Group (GAG)) facilitating anytime/anywhere payment of a variety of bills and dues. Similarly, the setting up and operationalisation of a system for uploading, accepting, discounting and settlement of the invoices/bills of micro, small and medium enterprises (MSMEs) is also being envisaged to facilitate faster financing for such entities. In this connection, it has been decided to:

34. Customer protection is an integral element of the endeavour to expand access to finance. Accordingly, a draft Charter of Customer Rights under Consumer Protection regulations was placed on the Reserve Bank’s website in August for comments from the public. For operationalising the Charter of Customer Rights:

35. Criteria for inviting applications from entities eligible under the Depositor Education and Awareness Fund (DEA-Fund) for registration will be issued on the Reserve Bank’s website by the end of October 2014. 36. Looking ahead, the Reserve Bank’s developmental and regulatory policies will continue to evolve within the five-pillar approach to build a competitive, vibrant and sound financial system that is geared to intermediating the financing needs of a growing economy. Efforts will be made to harness appropriate technology and ensure that financial services are available to all even as customer awareness and protection is reinforced. The Reserve Bank will continue to carry forward banking sector reforms by adapting the best international practices to country-specific requirements. Alpana Killawala Press Release : 2014-2015/672 |

પેજની છેલ્લી અપડેટની તારીખ: