IST,

IST,

Monetary Policy Statement, 2023-24 Resolution of the Monetary Policy Committee (MPC) October 4 to 6, 2023

|

On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (October 6, 2023) decided to:

The standing deposit facility (SDF) rate remains unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 2. Global growth is losing momentum. Inflation is easing gradually but remains well above target in major economies. Concerns about higher for longer rates are imparting volatility to global financial markets. Sovereign bond yields have hardened, the US dollar has appreciated, and equity markets have corrected. Emerging market economies (EMEs) are experiencing currency depreciation and volatile capital flows. Domestic Economy 3. Real gross domestic product (GDP) posted a growth of 7.8 per cent year-on-year (y-o-y) in Q1:2023-24 (April-June), underpinned by private consumption and investment demand. 4. South-west monsoon rainfall recovered during September and ended 6 per cent below the long period average. The acreage under kharif crops was 0.2 per cent higher than a year ago. The index of industrial production rose by 5.7 per cent in July; core industries output expanded by 12.1 per cent in August. Purchasing managers’ indices (PMIs) and other high frequency indicators of the services sector exhibited healthy expansion in August-September. 5. On the demand front, urban consumption is buoyant while rural demand is showing signs of revival. Investment activity is benefitting from public sector capex. Strong growth is seen in steel consumption, cement production as well as in imports and production of capital goods. Merchandise exports and non-oil non-gold imports remained in contraction in August, although the pace of decline eased. Services exports improved in August. 6. CPI headline inflation surged by 2.6 percentage points to 7.4 per cent in July due to spike in vegetable prices, before moderating somewhat in August to 6.8 per cent. Fuel inflation edged up to 4.3 per cent in August. Core inflation (i.e., CPI excluding food and fuel) softened to 4.9 per cent during July-August 2023. 7. As on September 22, 2023, money supply (M3) expanded by 10.8 per cent (y-o-y) and bank credit grew by 15.3 per cent. India’s foreign exchange reserves stood at US$ 586.9 billion as on September 29, 2023. Outlook 8. The near-term inflation outlook is expected to improve on the back of vegetable price correction and the recent reduction in LPG prices. The future trajectory will be conditioned by a number of factors like lower area sown under pulses, dip in reservoir levels, El Niño conditions and volatile global energy and food prices. According to the Reserve Bank’s enterprise surveys, manufacturing firms expect higher input cost pressures but marginally lower growth in selling prices in Q3 compared to the previous quarter. Services and infrastructure firms expect a moderation in growth of input costs and selling prices. Taking into account these factors, CPI inflation is projected at 5.4 per cent for 2023-24, with Q2 at 6.4 per cent, Q3 at 5.6 per cent and Q4 at 5.2 per cent, with risks evenly balanced. CPI inflation for Q1:2024-25 is projected at 5.2 per cent (Chart 1). 9. Domestic demand conditions are expected to benefit from the sustained buoyancy in services, revival in rural demand, consumer and business optimism, the government’s thrust on capex, and healthy balance sheets of banks and corporates. Headwinds from global factors like geopolitical tensions, volatile financial markets and energy prices, and climate shocks pose risks to the growth outlook. Taking all these factors into consideration, real GDP growth for 2023-24 is projected at 6.5 per cent, with Q2 at 6.5 per cent, Q3 at 6.0 per cent, and Q4 at 5.7 per cent, with risks evenly balanced. Real GDP growth for Q1:2024-25 is projected at 6.6 per cent (Chart 2).  10. The MPC observed that the unprecedented food price shocks are impinging on the evolving trajectory of inflation and that recurring incidence of such overlapping shocks can impart generalisation and persistence. Accordingly, the MPC resolved to remain on high alert, given the prevailing environment of elevated global food and energy prices and global financial market volatility. While vegetable prices may undergo further correction and core inflation is easing, the MPC noted that headline inflation is ruling above the tolerance band and its alignment with the target is getting interrupted. Hence, monetary policy needs to remain actively disinflationary. Domestic economic activity is holding up well and is expected to be boosted by festive consumption demand, pick up in investment intentions and improving consumer and business outlook. As the cumulative policy repo rate hike of 250 basis points is still working its way through the economy, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent in this meeting, but with preparedness to undertake appropriate and timely policy actions, should the situation so warrant. The MPC will remain resolute in its commitment to aligning inflation to the target and anchoring inflation expectations. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. 11. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 6.50 per cent. 12. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. Prof. Jayanth R. Varma expressed reservations on this part of the resolution. 13. The minutes of the MPC’s meeting will be published on October 20, 2023. 14. The next meeting of the MPC is scheduled during December 6-8, 2023. (Yogesh Dayal) Press Release: 2023-2024/1052 |

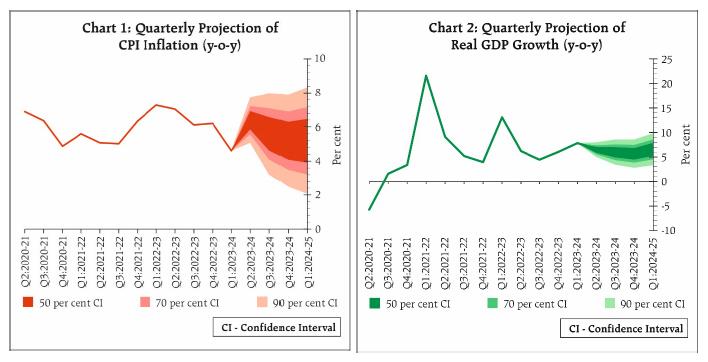

પેજની છેલ્લી અપડેટની તારીખ: