IST,

IST,

II. Recent Economic Developments (Part 3 of 3)

2.63 Issuances of CP have increased in the recent period following large investments interest seen from mutual funds on account of the guidelines on non-SLR debt securities by banks. Furthermore, reduction in stamp duty on CP effective March 1, 2004 has also boosted its issuance. Though, the CP market is overwhelmingly dominated by first class prime rated issuers (i.e., P1+ and above of CRISIL or its equivalent), it has been found that their share in issuances of CP has declined from as much as 92 per cent during 2002-03 to 85 per cent in April-November 2004. Correspondingly, that of medium rated issuers has increased from 8 per cent to 15 per cent over this period. This increase in investment in medium rated issuers could be on account of investors' search for higher returns.

2.64 There has been a sharp increase in the volume of Forward Rate Agreements/Interest Rate Swaps (FRAs/IRS) during the current financial year so far, both in terms of the number of contracts and outstanding notional principal amount (Table 2.37). Also, the participation in the market has been broad based and includes select public sector banks, PDs and foreign and private sector banks. In a majority of

these contracts, the NSE-MIBOR and MIFOR were used as the benchmark rates. The other benchmark rates used included secondary market yields on the Government of India securities having residual maturity of one year and the primary cut-off yield on 364-day TBs.

2.65 CBLO was operationalised with effect from January 20, 2003 as a money market instrument through the CCIL. CBLO can have original maturity between one day and upto one year. Though regulatory provisions and accounting treatment for the CBLO are the same as those applicable to other money market instruments, it has been exempted from CRR subject to banks maintaining a minimum CRR of 3 per cent. Securities lodged in the Gilts Account of the banks maintained with the CCIL under the Constituents' Subsidiary General Ledger (CSGL) facility remaining unencumbered at the end of any day could be reckoned for SLR purposes by the concer ned bank. By November 2004, 79 members had been admitted to the CCIL's CBLO segment. Of this, 42 were active members. The daily average turnover in CBLO increased from Rs.47 crore in April 2003 to Rs.2,506 crore during March

|

Table 2.37: Activity in Other Money Market Segments |

|||||||

|

(Rupees crore) |

|||||||

|

Year/Month |

Average |

Average Daily |

Forward Rate Agreements/ |

|

Average Daily |

||

|

Daily Turnover in |

Turnover in Repo |

Interest Rate Swaps |

|

Turnover in |

|||

|

Term Money Market |

Market (Outside |

No. of Contracts |

|

Notional Amount |

|

CBLO |

|

|

|

Reserve Bank) |

|

|

|

|

|

|

|

1 |

2 |

3 |

4 |

|

5 |

|

6 |

|

2003-04 |

|||||||

|

April |

604 |

5,575 |

9,691 |

2,49,449 |

47 |

||

|

May |

455 |

5,591 |

10,956 |

2,84,641 |

41 |

||

|

June |

610 |

6,481 |

11,384 |

2,93,127 |

37 |

||

|

July |

573 |

9,669 |

11,581 |

3,05,409 |

126 |

||

|

August |

644 |

9,528 |

12,046 |

3,14,708 |

166 |

||

|

September |

772 |

9,268 |

12,951 |

3,33,736 |

234 |

||

|

October |

543 |

11,542 |

15,032 |

3,92,303 |

156 |

||

|

November |

428 |

12,190 |

15,495 |

4,05,102 |

248 |

||

|

December |

403 |

13,068 |

16,479 |

4,31,597 |

363 |

||

|

January |

482 |

15,426 |

18,604 |

4,86,571 |

708 |

||

|

February |

343 |

12,674 |

18,515 |

4,89,151 |

1,693 |

||

|

March |

376 |

13,378 |

19,867 |

5,18,260 |

2,506 |

||

|

2004-05 |

|||||||

|

April |

376 |

15,195 |

20,413 |

5,76,808 |

2,496 |

||

|

May |

372 |

15,932 |

23,331 |

6,11,595 |

3,872 |

||

|

June |

274 |

17,517 |

22,670 |

6,04,669 |

4,015 |

||

|

July |

182 |

19,226 |

23,013 |

5,90,118 |

4,508 |

||

|

August |

189 |

13,561 |

23,880 |

6,40,173 |

4,962 |

||

|

September |

189 |

18,178 |

31,252 |

8,23,257 |

6,149 |

||

|

October |

243 |

15,719 |

34,371 |

9,25,175 |

8,466 |

||

|

November |

498 |

18,560 |

33,623 |

* |

8,88,059 |

* |

9,651 |

|

* as on November 12, 2004. |

|||||||

2004. It has further increased to Rs.9,651 crore with weighted average rate working out to 5.48 per cent in November 2004. Initially, only one insurance company and few cooperative banks had been supplying funds in this market. Now, mutual funds have emerged as the largest suppliers of funds. On the demand side, apart from cooperative banks, public and private sector banks, the composition has also been changing with regular participation of PDs on account of softer borrowing costs in CBLO vis-à-vis call market.

Government Securities Market

Central Government Borrowings - 2004-05

2.66 The gross market borrowings by the Central Government during the year so far (up to December 15, 2004) amounted to Rs.87,046 crore (Rs.68,000 through dated securities and Rs.19,046 crore by way of 364-day Treasury Bills), substantially lower than that during the corresponding period of the previous year (Table 2.38). As indicated in the calendar for the first half (April 1, 2004-September 30, 2004), Rs.59,000 crore were to be issued. However, only Rs.54,000 crore were raised through dated securities during the first half. On September 20, 2004, an indicative calendar for issue of dated securities for the second half of the year (October 1, 2004-March 31, 2005) amounting to Rs.44,000 crore was released. Of the total issuances amounting to Rs.32,000 crore of dated securities scheduled during October 1, 2004 to December 8, 2004, Rs.14,000 crore were raised while the balance scheduled auctions for Rs.18,000 crore were cancelled. The weighted average yield of the dated securities issued during the current year so far (up to December 15, 2004) at 5.96 per cent was marginally higher than that of 5.80 per cent during the corresponding period of the previous year. The weighted average maturity of the dated securities issued during 2004-05 so far at 13.92 years has been lower than that of 15.67 years during the corresponding period of the fiscal 2003-04. The weighted average yield on the outstanding stock of government securities continued its declining trajectory. It fell to 8.92 per cent as on November 30, 2004 from 9.30 per cent as at end-March 2004 and 10.44 per cent as at end-March 2003. The weighted average maturity on the outstanding securities declined marginally to 9.65 years as on November 30, 2004 as compared with 9.78 years as at end-March 2004 but higher than that of 8.9 years as at end-March 2003.

Floating Rate Bonds

2.67 Issuance of Floating Rate Bonds (FRBs), which serve as an instrument for management of interest rate risk by investors in the context of elongation of the maturity profile of Government debt, was continued in 2004-05. During the current year so

|

Table 2.38: Central Government’s Market Borrowing |

|||||||

|

(Rupees crore) |

|||||||

|

Item |

2003-04 |

2003-04 |

2004-05 |

||||

|

(April-December 15, 2003) |

(April-December 15, 2004) |

||||||

|

Gross |

Net |

Gross |

Net |

Gross |

Net |

||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

|

1. |

Budget Estimates* |

1,66,014 |

1,07,014 |

– |

– |

1,50,817 |

90,365 |

|

Of which Dated Securities |

1,40,014 |

1,07,140 |

– |

– |

1,24,817 |

90,501 |

|

|

364-day T Bills |

26,000 |

-126 |

26,000 |

-136 |

|||

|

2. |

Completed so far @ |

1,47,636 |

88,816 |

1,14,036 |

77,319 |

87,046 |

33,694 |

|

Of which Dated Securities |

1,21,500 |

88,807 |

95,000 |

77,316 |

68,000 |

33,684 |

|

|

364-day T Bills |

26,136 |

9 |

19,036 |

2 |

19,046 |

10 |

|

|

3. |

Private Placements |

21,500 |

5,000 |

– |

|||

|

4. |

Devolvements on |

||||||

|

RBI |

0 |

0 |

847 |

||||

|

PDs |

0 |

0 |

985 |

||||

|

5. |

Weighted Average Yield on |

5.71 |

5.82 |

5.96 |

|||

|

dated securities (Per cent) |

|||||||

|

6. |

Weighted Average Maturity of |

14.94 |

16.13 |

13.92 |

|||

|

dated securities (Years) |

|||||||

|

* For the full financial year. |

|||||||

far (upto December 15, 2004), FRBs were issued in four tranches aggregating Rs.22,000 crore.

Treasury Bills

2.68 The notified amounts of 91-day and 364-day Treasury Bills for each auction were increased from Rs.500 crore and Rs.1,000 crore, respectively, to Rs.2,000 crore each, effective April 2004. The increase was on account of issuances under the MSS with a view to absorbing surplus liquidity from the market. However, taking into account the prevailing liquidity conditions in the market, the absorption under the MSS through the Treasury Bills was discontinued for a brief period during November 2004. Accordingly, the notified amount for 91-day and 364-day Treasury Bills was reduced to Rs. 500 crore and Rs. 1,000 crore, respectively for the auctions held between November 10, 2004 to December 1, 2004. The primary market cut-off yields of 91-day and 364-day Treasury Bills have edged up during the year so far. Yields have generally been above the Reserve Bank's liquidity absorption rate under the LAF since mid-June 2004.

State Government Borrowings

2.69 The gross and net market borrowings allocated for States for the fiscal year 2004-05 (provisional) are placed at Rs.43,897 crore and Rs.38,774 crore, respectively. This is inclusive of the additional allocation of Rs.22,274 crore under the debt-swap scheme. During the current year so far (up to December 15, 2004), the State Governments have raised Rs.32,848 crore (Rs.31,963 crore through tap sale and Rs.885 crore through auction) under the market borrowing programme; of this, Rs.13,781 crore was raised under the debt-swap scheme. During the current year so far, the weighted average yield of State Government securities worked out to 6.32 per cent, higher than that of 6.20 per cent during the corresponding period of 2003-04.

Secondary Market for Government Securities -Yield Movement

2.70 During the current financial year, the rise in the secondar y market yield of gover nment securities reflected a number of factors such as higher than expected inflation, interest rate hikes by major central banks and sharp increases in the international crude oil prices. Consequently, 10-year yield rose to 6.73 per cent on August 11, 2004. However, the yields retracted to 6.16 per cent by end-August 2004 reflecting fiscal measures taken by the Government to rein in inflation, lower than anticipated hike in the MSS ceiling amount at Rs.80,000 crore, some moderation in global oil prices and one time permission by the Reserve Bank to banks to transfer the securities to Held-to-Maturity (HTM) category. The yields again increased on account of the hike in the CRR by 50 basis points in two stages on September 18, 2004 and October 2, 2004, sharp rise in international oil prices, hike in domestic energy prices, rise in domestic inflation and tightening of liquidity in November 2004. On November 8, 2004, the 10-year yield peaked at 7.31 per cent as compared with 5.15 per cent as at end-March 2004 (Chart II.19). Subsequently, yields fell on cancellation of scheduled auctions, fall in international oil prices and easing of liquidity conditions. On December 15, 2004, the 10-year yield was at 6.76 per cent. The yield spread of AAA-rated bonds over those of gilts has been broadly constant (Chart II.20).

Foreign Exchange Market

2.71 The foreign exchange market has generally exhibited orderly conditions during 2004-05 so far (up to December 15, 2004). The exchange rate of the Indian rupee vis-à-vis the US dollar has moved within a range of Rs 43.57 - 46.46 per US dollar during the year 2004-05 so far (up to December 15, 2004). Reflecting large capital flows, the rupee appreciated vis-à-vis the US dollar during April 2004. It, however,

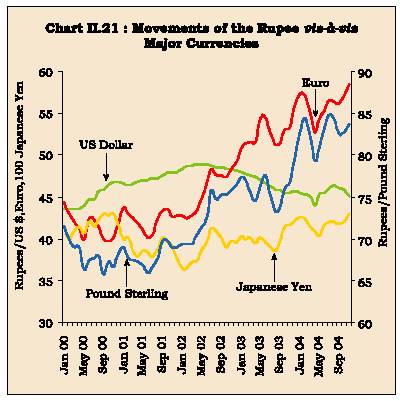

depreciated during May-August 2004, mainly on account of ebbing of capital flows and rising demand for foreign exchange due to high oil prices. In the subsequent months, with the revival of capital flows, the rupee appreciated vis-à-vis the US dollar. Overall, the Indian rupee depreciated by 1.6 per cent against the US dollar during April-December 15, 2004. The rupee also depreciated against the Pound Sterling, the Euro and the Japanese Yen by 6.2 per cent, 9.4 per cent and 0.7 per cent, respectively, during the same period (Chart II.21). During April-October 2004, in terms of monthly averages, while the 5-country (trade-weighted) REER of the rupee appreciated by 1.8 per cent, the NEER depreciated by 1.9 per cent.

2.72 The forward markets reflected the developments in the spot segment of the foreign exchange market. Reflecting excess supplies in the markets, the forward premia turned into discounts during April 2004. The forward rates, however, turned into premia thereafter, as the exchange rate depreciated against the US dollar, import demand picked up and international oil prices steadily edged up (Chart II.22).

Capital Market

Primary Market

2.73 During the current financial year so far (April-October 2004), the primary market showed a mixed trend. Resource mobilisation through public issues increased significantly in consonance with pick-up in the industrial activity. All the public issues floated

during April-October 2004 were equity issues belonging to the private sector excepting one issue from public sector (Table 2.39). On the other hand, the resource mobilisation through private placement as well as Euro issues registered a decline. The decline in resource mobilisation under private placement route was entirely due to the public sector. The public sector entities accounted for 62.7 per cent of total resource mobilisation through private placement as compared with 70.3 per cent during the corresponding period of the previous year.

|

Table 2.39: Mobilisation of Resources from the Primary Market* |

|||||||||||

|

(Rupees crore) |

|||||||||||

|

Item |

2002-03 |

2003-04 |

April-October |

||||||||

|

2003-04 |

2004-05 |

||||||||||

|

No. of |

Amount |

No. of |

Amount |

No. of |

Amount |

No. of |

Amount |

||||

|

Issues |

Issues |

Issues |

Issues |

||||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|||

|

A.Prospectus and Rights Issues |

17 |

4,867 |

35 |

7,190 |

9 |

1,654 |

26 |

10,751 |

|||

|

I. |

Public Sector |

8 |

2,989 |

8 |

3,980 |

4 |

820 |

1 |

2,684 |

||

|

II. |

Private Sector |

9 |

1,878 |

27 |

3,210 |

5 |

834 |

25 |

8,067 |

||

|

B.Private Placement # |

1,144 |

66,948 |

800 |

59,215 |

514 |

33,161 |

401 |

28,973 |

|||

|

I. |

Public Sector |

267 |

41,871 |

222 |

44,349 |

127 |

23,317 |

105 |

18,156 |

||

|

II. |

Private Sector |

877 |

25,077 |

578 |

14,866 |

387 |

9,844 |

296 |

10,817 |

||

|

C.Euro Issues |

11 |

3,426 |

18 |

3,098 |

7 |

1,818 |

6 |

1,367 |

|||

|

*Including both debt and equity. |

|||||||||||

Disbursements by the All-India Financial Institutions (AIFIs) increased during

April-September 2004 mainly on account of the Life Insurance Corporation (LIC).

2.74 The resource mobilisation by mutual funds during April-October 2004 was considerably lower -it was only around one-fourth of that recorded during the corresponding period of the previous year. UTI mutual fund and also public sector mutual funds recorded net outflows (Table 2.40).

Secondary Market

2.75 The stock market, which had witnessed a sustained and broad-based rally between end-May 2003 and February 2004, remained subdued during March-July 2004. This was on account of several domestic and international factors such as diversion of funds to primary market due to certain attractive Initial Public Offers (IPOs), uncertainty regarding the outcome of the general elections and its effects on the reform process, slowdown in institutional investments, rise in domestic inflation, rising

|

Table 2.40: Net Resource Mobilisation by Mutual Funds |

|||||

|

(Rupees crore) |

|||||

|

Category |

April-October |

||||

|

2002-03 |

2003-04 |

2003-04 |

2004-05 |

||

|

1 |

2 |

3 |

4 |

5 |

|

|

I. |

Unit Trust of India |

-9,434 |

1,667 |

360 |

-2,150 |

|

II. |

Private Sector |

12,069 |

42,544 |

33,930 |

11,203 |

|

III. |

Public Sector |

1,561 |

2,597 |

1,675 |

-231 |

|

Total (I+II+III) |

4,196 |

46,808 |

35,965 |

8,822 |

|

|

Note : Data for UTI do not include data for UTI-I since February 2003. |

|||||

|

Source : Securities and Exchange Board of India. |

|||||

international crude oil prices and a strengthening dollar. The stock markets declined sharply on May 17, 2004 - the BSE Sensex declined by more than 11 per cent - due to a variety of domestic and international factors, viz., uncertainties on the political front after the general elections, declining trend in other East Asian markets and rising international crude oil prices. The stock markets, however, recovered immediately on the next trading day and the contagion effects to other segments of the financial markets were contained due to the effective and coordinated regulatory actions undertaken by the Reserve Bank and the Securities and Exchange Board of India (SEBI) as well as strong underlying fundamentals of the economy.

2.76 The stock markets also reacted sharply to the proposal of the Union Budget, 2004-05 to impose Securities Transaction Tax (STT) of 0.15 per cent on all securities transacted in the stock exchanges. The market sentiment revived subsequently on the statement by the Government to revise the STT. Notwithstanding the volatility in international crude oil prices, the stock markets have registered gains in recent months, mainly on account of sustained macroeconomic fundamentals, encouraging quarterly results of major corporates and strong investments by Foreign Institutional Investors’ (FIIs) in equities. The BSE Sensex reached the historic high of 6,402.29 on December 15, 2004. Turnover, market capitalisation as well as the price-earning ratio, on both the Stock Exchange, Mumbai (BSE) and the National Stock Exchange (NSE) in the current year so far, have been higher than those in the corresponding period of the previous year. The volatility was much lower (Table 2.41).

|

Table 2.41: Trends in Stock Markets |

|||||

|

BSE |

NSE |

||||

|

Item |

April-November |

April-November |

|||

|

2003 |

2004 |

2003 |

2004 |

||

|

1 |

2 |

3 |

4 |

5 |

|

|

Average BSE Sensex/ S&P CNX Nifty (Index) |

3896.73 |

5365.31 |

1235.30 |

1687.48 |

|

|

Volatility (Coefficient of Variation) |

17.8 |

7.7 |

18.0 |

8.0 |

|

|

Turnover (Rupees crore) |

2,79,933 |

3,15,388 |

6,41,298 |

7,11,702 |

|

|

Market Capitalisation (end-period) (Rupees crore) |

10,65,853 |

15,39,595 |

9,79,541 |

14,46,292 |

|

|

P/E ratio (end-period) |

16.01 |

18.79 |

17.81 |

16.39 |

|

|

Source : The Stock Exchange, Mumbai (BSE) and The National Stock Exchange of India Limited (NSE). |

|||||

2.77 Most of the sectoral indices, including those of technology, banking and Public Sector Units (PSU) registered a downtrend during April-May 2004, but witnessed a revival subsequently. Banking scrips gained after the Supreme Court upheld the validity of the new securitisation law paving the passage for higher recoveries in the banking sector. They also benefited from the relaxation made by the Reserve Bank in the rules governing the investment portfolio of banks. The FMCG scrips gained on hopes of a rise in demand for these products in the near future (Chart II.23).

2.78 In view of the turnaround since August 2004 onwards, the investments by FIIs in equities are now quite close to that in the corresponding period of the previous year. FIIs have, however, turned net sellers in debt during the current financial year so far. In contrast, the mutual funds have remained net sellers

|

Table 2.42: Institutional Investments |

||||

|

(Rupees crore) |

||||

|

Year |

FIIs |

Mutual Funds |

||

|

Equity |

Debt |

Equity |

Debt |

|

|

1 |

2 |

3 |

4 |

5 |

|

2001-02 |

8,067 |

685 |

-3,796 |

10,959 |

|

2002-03 |

2,528 |

162 |

-2,067 |

12,604 |

|

2003-04 |

39,959 |

5,805 |

1,308 |

22,701 |

|

2003-04 (April-November) |

22,620 |

3,776 |

-117 |

17,658 |

|

2004-05 (April-November) |

21,103 |

-2,181 |

-1,388 |

5,440 |

|

Source :Securities and Exchange Board of India. |

||||

in equities but net buyers in debt during the current financial year so far (Table 2.42).

2.79 The derivatives segment continued to attract larger volumes. The total turnover in the derivative markets on the NSE during April-November 2004 was more than double the turnover in cash markets (Table 2.43). In response to a demand from market participants for shorter maturity options, BSE decided to offer, effective September 13, 2004, weekly options series with maturity of one week and two weeks in addition to the existing monthly options series.

|

Table 2.43: Turnover in Derivatives Market |

||

|

vis-à-vis Cash Market in NSE |

||

|

(Rupees crore) |

||

|

Year |

Derivatives |

Cash |

|

1 |

2 |

3 |

|

2001-02 |

1,01,925 |

5,13,167 |

|

2002-03 |

4,39,855 |

6,17,989 |

|

2003-04 |

21,30,612 |

10,99,535 |

|

2003-04 (April-November) |

10,34,359 |

6,41,298 |

|

2004-05 (April-November) |

14,61,088 |

7,11,702 |

|

Source : The National Stock Exchange of India Limited. |

||

Financial Sector

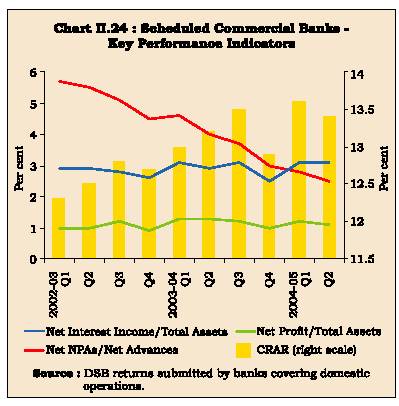

2.80 Against the backdrop of strong macroeconomic performance, nearly all segments of the financial sector registered significant improvement in their operations, profitability and financial health during 2003-04. The spread of the Scheduled Commercial Banks (SCBs) continued to improve during 2003-04 (Table 2.44). The net profits of the SCBs registered strong growth on the back of a sharp increase in non-interest income, in particular trading profits, in a declining interest rate scenario. The soundness indicators also registered an improvement. The capital to risk-weighted assets ratio (CRAR) improved marginally to 12.9 per cent from 12.7 per cent during 2002-03. Only two banks accounting for a negligible 0.5 per cent of the assets of the SCBs could not satisfy the stipulated 9.0 per cent CRAR. The gross non-performing assets (NPAs) of the banking system declined in absolute terms for the second year in succession despite the switchover to 90-days delinquency norm. The net NPAs to net advances ratio came down sharply to 2.9 per cent from 4.4 per cent during 2002-03 with the range of net NPAs varying between 1.5 per cent for foreign banks and 3.0 per cent for the public sector banks. Improved risk management practices, greater recovery efforts, impact of the Securitisation

|

Table 2.44: Important Parameters of Select Bank-Groups |

||||

|

(Per cent) |

||||

|

Item |

1996-97 |

2001-02 |

2002-03 |

2003-04 |

|

1 |

2 |

3 |

4 |

5 |

|

Operating Expenses/Total Assets |

||||

|

Scheduled Commercial Banks |

2.9 |

2.2 |

2.2 |

2.2 |

|

Public Sector Banks |

2.9 |

2.3 |

2.3 |

2.2 |

|

Old Private Sector Banks |

2.5 |

2.1 |

2.1 |

2.0 |

|

New Private Sector Banks |

1.9 |

1.1 |

2.0 |

2.0 |

|

Foreign Banks |

3.0 |

3.0 |

2.8 |

2.8 |

|

Spread/Total Assets |

||||

|

Scheduled Commercial Banks |

3.2 |

2.6 |

2.8 |

2.9 |

|

Public Sector Banks |

3.2 |

2.7 |

2.9 |

3.0 |

|

Old Private Sector Banks |

2.9 |

2.4 |

2.5 |

2.6 |

|

New Private Sector Banks |

2.9 |

1.2 |

1.7 |

2.0 |

|

Foreign Banks |

4.1 |

3.2 |

3.4 |

3.5 |

|

Net Profit/Total Assets |

||||

|

Scheduled Commercial Banks |

0.7 |

0.8 |

1.0 |

1.1 |

|

Public Sector Banks |

0.6 |

0.7 |

1.0 |

1.1 |

|

Old Private Sector Banks |

0.9 |

1.1 |

1.2 |

1.2 |

|

New Private Sector Banks |

1.7 |

0.4 |

0.9 |

0.8 |

|

Foreign Banks |

1.2 |

1.3 |

1.6 |

1.7 |

|

Gross NPAs to Gross Advances |

||||

|

Scheduled Commercial Banks |

15.7 |

10.4 |

8.8 |

7.2 |

|

Public Sector Banks |

17.8 |

11.1 |

9.4 |

7.8 |

|

Old Private Sector Banks |

10.7 |

11.0 |

8.9 |

7.6 |

|

New Private Sector Banks |

2.6 |

8.9 |

7.6 |

5.0 |

|

Foreign Banks |

4.3 |

5.4 |

5.3 |

4.6 |

|

Net NPAs to Net Advances |

||||

|

Scheduled Commercial Banks |

8.1 |

5.5 |

4.4 |

2.9 |

|

Public Sector Banks |

9.2 |

5.8 |

4.5 |

3.0 |

|

Old Private Sector Banks |

6.6 |

7.1 |

5.5 |

3.8 |

|

New Private Sector Banks |

2.0 |

4.9 |

4.6 |

2.4 |

|

Foreign Banks |

1.9 |

1.9 |

1.8 |

1.5 |

|

CRAR |

||||

|

Scheduled Commercial Banks |

10.4 |

12.0 |

12.7 |

12.9 |

|

Public Sector Banks |

10.0 |

11.8 |

12.6 |

13.2 |

|

Old Private Sector Banks |

11.7 |

12.5 |

12.8 |

13.7 |

|

New Private Sector Banks |

15.3 |

12.3 |

11.3 |

10.2 |

|

Foreign Banks |

N.A. |

12.9 |

15.2 |

15.0 |

|

Source : Balance Sheets of banks and returns submitted by banks. |

||||

and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002 and corporate debt restructuring mechanism have led to the improvement in the recovery of NPAs during 2003-04. SCBs sustained their performance during the first half of 2004-05. The CRAR of SCBs at end-September 2004 was higher than its end-March 2004 levels. Over the same period, the ratio of net NPAs to net advances declined (Chart II. 24).

2.81 As regards the scheduled urban co-operative banks (UCBs), the policy induced changes - in particular, higher investments in the Government securities - led to a significant improvement in their asset quality and profitability during 2003-04. The net profits of the scheduled UCBs showed a turnaround (Table 2.45).

|

Table 2.45: Urban Co-operative Banks - Select Financial Indicators |

|||

|

Indicator |

2001-02 |

2002-03 |

2003-04 |

|

1 |

2 |

3 |

4 |

|

Growth in Major Aggregates (Per cent) |

|||

|

Deposits |

15.1 |

9.1 |

7.5 |

|

Credits |

14.1 |

4.5 |

3.4 |

|

Financial Indicators@ |

|||

|

(as percentage of total assets) |

|||

|

Operating Profits |

1.5 |

1.5 |

1.8 |

|

Net Profits |

-0.9 |

-1.1 |

0.6 |

|

Spread |

2.2 |

2.0 |

2.1 |

|

Non-Performing Assets |

|||

|

(as percentage of advances) |

|||

|

Gross NPAs |

21.9 |

19.0 |

17.6 |

|

Net NPAs |

.. |

13.0 |

11.1 |

|

.. Not Available. |

|||

|

@ Relates to Scheduled Urban Co-operative banks. |

|||

Their NPAs declined both in absolute as well as percentage terms. The Tier-I capital also registered a turnaround to Rs.297 crore from a negative Rs.10 crore during 2002-03. The performance of the rural cooperatives, however, remained below potential. While profitability of the state co-operative banks increased marginally during 2002-03, the central co-operative banks continued to register losses. The NPAs of rural co-operative banks continued to remain high.

2.82 The income and expenditure of the select AIFIs declined leading to an unchanged profit ratio in 2003-04. The CRAR of all the AIFIs, except IFCI and IIBI, remained well above the regulatory minimum. The net NPAs, however, increased during 2003-04 (Table 2.46).

2.83 The lead data on the performance of the major Non-Banking Financial Companies (NBFCs) (other than RNBCs) holding public deposits of Rs.20 crore and above, accounting for three - fourth of sectoral assets, indicates some changes in their structure of assets and liabilities (Table 2.47). There was a marginal increase in their public deposits during 2003-04 accompanied by a larger recourse to bank loans, partly driven by the softening of the lending rates. In terms of deployment of funds, only loans and advances recorded a marginal increase in contrast to declines in the other areas of business. Investment pattern of Residuary Non-Banking Companies (RNBCs) shifted towards unencumbered approved securities during 2002-03, indicating an improvement in the risk profile of their investment portfolio (Table 2.48).

|

Table 2.46: Financial Institutions - |

|||||

|

Select Performance Indicators |

|||||

|

Indicator |

2001-02 |

2002-03 |

2003-04 |

||

|

1 |

2 |

3 |

4 |

||

|

Balance sheet Indicators |

|||||

|

(as percentage of assets) |

|||||

|

Operating Profits |

1.6 |

1.4 |

1.3 |

||

|

Net Profits |

0.7 |

0.9 |

0.9 |

||

|

Spread |

0.6 |

0.7 |

0.2 |

||

|

Non-Performing Assets |

8.8 |

10.6 |

.. |

||

|

(as percentage of net advances) |

|||||

|

Resource flows (Rupees crore) |

|||||

|

Sanctions |

27,619 |

22,272 |

23,407 |

||

|

Disbursements |

20,725 |

17,225 |

14,057 |

||

|

Credit |

-4,706 |

-6,021 |

-2,845 |

||

|

.. Not Available. |

|||||

|

Table 2.47: Assets and

Liabilities of Non-Banking |

||||

|

(as at end-March) |

||||

|

(Rupees crore) |

||||

|

Item |

2003 |

2004 |

||

|

Amount |

Percentage |

Amount Percentage |

||

|

to total |

to total |

|||

|

1 |

2 |

3 |

4 |

5 |

|

Liabilities |

||||

|

Paid-up capital |

1,693 |

6.4 |

1,100 |

5.2 |

|

Free Reserve |

||||

|

(adjusted for loss) |

1,325 |

5.0 |

1,324 |

6.3 |

|

Public Deposits |

3,686 |

14.0 |

3,233 |

15.3 |

|

Convertible Debentures |

3,755 |

14.2 |

3,140 |

14.9 |

|

Other Borrowings |

8,675 |

32.9 |

7,601 |

36.1 |

|

of which: Banks |

6,785 |

25.7 |

6,130 |

29.1 |

|

Other Liabilities |

7,222 |

27.4 |

4,685 |

22.2 |

|

Total Liabilities |

26,355 |

100.0 |

21,083 |

100.0 |

|

Assets |

||||

|

Investments |

2,696 |

10.2 |

1,113 |

5.3 |

|

Loans and Advances |

8,576 |

32.5 |

8,588 |

40.7 |

|

Other Financial Assets |

10,255 |

38.9 |

8,619 |

40.9 |

|

of which: Hire Purchase |

8,571 |

32.5 |

7,648 |

36.3 |

|

Equipment Leasing |

1,546 |

5.9 |

916 |

4.3 |

|

Other Assets |

4,828 |

18.3 |

2,763 |

13.1 |

|

Total Assets |

26,355 |

100.0 |

21,083 |

100.0 |

2.84 The financial health of the NBFCs improved during 2002-03. The decline in their income was more than compensated by the fall in expenditure resulting in a turnaround in their financial performance from the losses witnessed during the previous two years. Reduced interest costs on the back of a softening interest rate regime and a rise in the fee-based income resulted in profits during 2002-03. The gross and net NPAs declined during 2002-03. The CRAR of most NBFCs remained well above the 30 per cent. Only a few NBFCs reported CRAR lower than the stipulated minimum of 12 per cent.

|

Table 2.48: Profile of RNBCs |

|||

|

(as at end-March) |

|||

|

(Rupees crore) |

|||

|

Item |

2002 |

2003 |

|

|

1 |

2 |

3 |

|

|

Number of RNBCs |

5 |

5 |

|

|

Net Owned Funds |

111 |

809 |

|

|

Aggregate Liability to Depositors |

12,889 |

15,065 |

|

|

Total Assets (a to e) |

18,458 |

20,362 |

|

|

a. |

Unencumbered Approved Securities |

4,080 |

6,129 |

|

b. |

Fixed Deposits with Banks |

1,830 |

1,470 |

|

c. |

Bonds/Debentures/Commercial |

||

|

Papers of a Government Company, |

|||

|

Public Sector Bank, Public Financial |

|||

|

Institution/Corporation |

6,265 |

6,553 |

|

|

d. |

Other Investments |

529 |

912 |

|

e. |

Other Assets |

6,169 |

6,040 |

V. EXTERNAL SECTOR

Global Economic Outlook

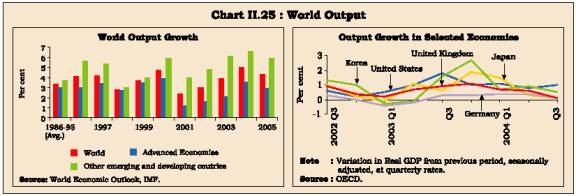

2.85 Global economic activity strengthened further during 2004. According to the International Monetary Fund (IMF), global GDP growth is projected at around 5.0 per cent during 2004, 0.3 percentage points higher than its April 2004 estimate. At this level, global GDP growth would be the highest in the past three decades as the growth pick-up in industrial countries is supported by rapid expansion in emerging markets, notably China. While global growth in the first quarter was much stronger than expected earlier, the momentum of the recovery has, however, slowed thereafter as GDP in major countries such as the US and Japan fell below expectations (Chart II.25). GDP growth in China also eased, which is considered a welcome development, given the concerns of overheating. The recovery in the euro area remains relatively weak and is heavily dependant on external demand. Notwithstanding the firming up of economic activity, the

sharp rise in international crude oil prices poses the main downward risk to global economic prospects. According to estimates by the IMF, a sustained increase of US $ 5 per barrel in crude oil prices can reduce global growth by about 0.3 percentage point with a lag of one year (see Chapter V). Another source of downside risk is the global macroeconomic imbalances which increased further, as the US current account deficit continued to widen matched by higher surpluses in Japan, the Euro Area and the emerging economies of Asia (see Chapter IV).

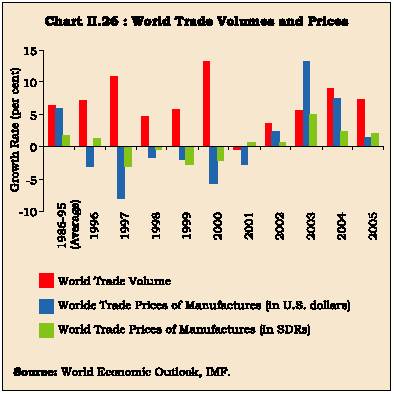

2.86 The growth in world trade volume, which accelerated during 2004, is expected to moderate during 2005 (Chart II.26). Growth in trade prices is expected to decelerate further during 2005. Private capital flows (net) to developing markets during 2004 are projected to be lower than that during 2003 and are expected to fall even further in 2005. In contrast to the falling trend in total capital flows, foreign direct investment flows have been rising. Emerging Asian countries are expected to see a further build up in their reserves during 2005.

India's Merchandise Trade

2.87 India's merchandise exports exhibited a robust growth during 2004-05 indicative of growing competitiveness of the manufacturing sector. According to the Directorate General of Commercial Intelligence and Statistics (DGCI&S), merchandise exports during April-November 2004 posted a growth of 24 per cent in US dollar terms, substantially higher than the annual target of 16 per cent as well as that

|

Table 2.49: Merchandise Exports - Global Scenario |

|||

|

(Percent change in US $ terms) |

|||

|

Country |

January-August |

||

|

2003 |

2003 |

2004 |

|

|

1 |

2 |

3 |

4 |

|

World |

16.1 |

16.6 * |

21.1 * |

|

Industrial Countries |

14.3 |

13.4 |

18.7 |

|

USA |

4.3 |

2.4 |

13.6 |

|

Germany |

22.7 |

23.1 |

22.4 |

|

Japan |

13.2 |

11.4 |

22.7 |

|

Developing Countries |

18.9 |

18.6 * |

26.0 * |

|

China |

34.5 |

33.9 * |

35.7 * |

|

India |

16.7 |

10.0 |

35.6 |

|

South Korea |

19.3 |

16.1 |

36.9 |

|

Singapore |

15.2 |

12.8 |

25.3 |

|

Indonesia |

5.1 |

7.8 |

3.0 |

|

Malaysia |

6.5 |

10.3 |

20.2 |

|

Thailand |

18.0 |

16.5 |

21.6 |

|

* Relate to January-June. Source : International Financial Statistics, IMF. For India, the source is DGCI&S. |

|||

recorded in the corresponding period of the previous year. The growth rate of India’s exports during 2004 (January - August) remained higher than that of major exporting nations (Table 2.49).

2.88 Merchandise imports continued to record a strong growth during 2004-05. Both oil and non-oil imports contributed to this increase (Table 2.50). Non-oil imports posted a strong growth of 26.8 per cent with the firming up of industrial activity. Oil imports

|

Table 2.50: India's Foreign Trade |

|||||

|

(US $ billion) |

|||||

|

Item |

April-March |

April-November |

|||

|

2002-03 |

2003-04 |

2003-04 |

2004-05 P |

||

|

1 |

2 |

3 |

4 |

5 |

|

|

Exports |

52.7 |

63.8 |

37.4 |

46.4 |

|

|

(20.3) |

(21.1) |

(9.3) |

(24.2) |

||

|

Oil |

2.6 |

3.6 |

2.3 |

.. |

|

|

(21.6) |

(38.5) |

(48.1) |

(–) |

||

|

Non-oil |

50.1 |

60.3 |

35.1 |

.. |

|

|

(20.2) |

(20.2) |

(7.5) |

(–) |

||

|

Imports |

61.4 |

78.1 |

47.8 |

64.3 |

|

|

(19.4) |

(27.3) |

(21.7) |

(34.6) |

||

|

Oil |

17.6 |

20.6 |

12.8 |

19.9 |

|

|

(26.0) |

(16.6) |

(12.4) |

(56.0) |

||

|

Non-oil |

43.8 |

57.6 |

35.0 |

44.3 |

|

|

(17.0) |

(31.5) |

(25.5) |

(26.8) |

||

|

Trade Balance |

-8.7 |

-14.3 |

-10.4 |

-17.9 |

|

|

Oil |

-15.1 |

-17.0 |

-10.5 |

.. |

|

|

Non-oil |

6.4 |

2.7 |

0.2 |

.. |

|

|

..Not Available. |

|||||

|

Table 2.51: India's Principal Exports |

||||||||

|

Item |

April-March |

April-July |

||||||

|

US $ million |

Growth Rate (Per cent) |

US $ million |

Growth Rate (Per cent) |

|||||

|

2002-03 |

2003-04 |

2002-03 |

2003-04 |

2003-04 |

2004-05 P |

2003-04 |

2004-05 |

|

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|

Primary Products |

8,706 |

9,902 |

21.5 |

13.7 |

2,642 |

3,565 |

1.9 |

35.0 |

|

Agricultural & Allied Products |

6,710 |

7,533 |

13.7 |

12.3 |

2,053 |

2,513 |

4.7 |

22.4 |

|

Ores & Minerals |

1,996 |

2,369 |

58.1 |

18.7 |

588 |

1,052 |

-6.7 |

78.8 |

|

Manufactured Goods |

40,245 |

48,492 |

20.6 |

20.5 |

13,564 |

17,437 |

7.1 |

28.6 |

|

Leather & Manufactures |

1,848 |

2,163 |

-3.2 |

17.0 |

632 |

706 |

-0.9 |

11.6 |

|

Chemicals & Related Products |

7,455 |

9,446 |

23.2 |

26.7 |

2,695 |

3,450 |

16.3 |

28.0 |

|

Engineering Goods |

9,033 |

12,405 |

29.8 |

37.3 |

3,465 |

4,639 |

28.2 |

33.9 |

|

Textiles |

11,036 |

12,145 |

14.2 |

10.0 |

3,432 |

3,887 |

-5.9 |

13.2 |

|

Gems & Jewellery |

9,030 |

10,573 |

23.6 |

17.1 |

2,803 |

4,091 |

1.9 |

46.0 |

|

Handicrafts |

785 |

500 |

43.1 |

-36.3 |

151 |

92 |

-38.3 |

-39.2 |

|

Carpets |

533 |

586 |

4.4 |

9.9 |

172 |

164 |

-4.6 |

-4.2 |

|

Petroleum Products |

2,577 |

3,568 |

21.6 |

38.5 |

988 |

1,768 |

20.4 |

78.8 |

|

Others |

1,192 |

1,880 |

1.5 |

57.9 |

486 |

915 |

44.8 |

88.5 |

|

Total Exports |

52,719 |

63,843 |

20.3 |

21.1 |

17,679 |

23,685 |

7.7 |

34.0 |

|

P : Provisional. |

||||||||

|

Source : DGCI&S. |

||||||||

swelled by 56.0 per cent largely due to the sharp increase in international crude oil prices. The average international crude oil price (Dubai variety) increased by 38 per cent to US $ 35.2 per barrel during April-November 2004. As overall import growth outstripped export growth, trade deficit widened to US $ 17.9 billion during April-November 2004.

2.89 Commodity-wise data show that the growth in exports was spread across all the major commodity-groups. Primary products exhibited a sharp turnaround with substantial contributions from major agricultural commodities (such as tea, wheat, cotton, tobacco, cashew, spices and oil meal), ores and minerals. Exports of manufactured products maintained the tempo of high growth with gems and jewellery, engineering goods and chemicals as the key drivers. Among the engineering goods, exports of transport equipments surged by 74.9 per cent during April-July 2004. Increase in textile exports mainly emanated from readymade garments. Exports of petroleum products posted a sharp increase during April-July 2004, benefiting from higher international oil prices (Table 2.51).

2.90 Destination-wise, exports to almost all the major regions/country groups recorded marked improvement. Exports to the Asian countries maintained their rising profile. Among the major partner countries, sharp increases were recorded in respect of the UK, the US, China, Hong Kong, UAE and Singapore (Table 2.52).

|

Table 2.52: Major Destination of India's Exports |

||||||||

|

Country |

April-March |

April-July |

||||||

|

US $ million |

Growth Rate (Per cent) |

US $ million |

Growth Rate (Per cent) |

|||||

|

2002-03 |

2003-04 |

2002-03 |

2003-04 |

2003-04 |

2004-05 P |

2003-04 |

2004-05 |

|

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|

USA |

10,896 |

11,490 |

28.0 |

5.5 |

3,330 |

4,129 |

-5.3 |

24.0 |

|

UAE |

3,328 |

5,126 |

33.5 |

54.1 |

1,242 |

2,090 |

13.9 |

68.2 |

|

UK |

2,496 |

3,023 |

15.5 |

21.1 |

871 |

1,118 |

6.4 |

28.4 |

|

Hong Kong |

2,613 |

3,262 |

10.4 |

24.8 |

852 |

1,090 |

-0.2 |

27.9 |

|

Germany |

2,107 |

2,545 |

17.8 |

20.8 |

742 |

845 |

12.3 |

13.9 |

|

China |

1,976 |

2,955 |

107.5 |

49.6 |

622 |

1,070 |

32.4 |

71.9 |

|

Japan |

1,864 |

1,709 |

23.4 |

-8.3 |

544 |

576 |

-8.1 |

6.0 |

|

Belgium |

1,662 |

1,806 |

19.5 |

8.6 |

536 |

721 |

5.0 |

34.5 |

|

Singapore |

1,422 |

2,125 |

46.2 |

49.4 |

447 |

1,125 |

-8.1 |

151.6 |

|

Italy |

1,357 |

1,729 |

12.5 |

27.4 |

513 |

609 |

23.8 |

18.7 |

|

Bangladesh |

1,176 |

1,741 |

17.3 |

48.0 |

521 |

441 |

55.1 |

-15.3 |

|

Srilanka |

921 |

1,319 |

46.0 |

43.2 |

384 |

408 |

62.2 |

6.3 |

|

France |

1,074 |

1,281 |

13.7 |

19.3 |

341 |

564 |

-1.1 |

65.7 |

|

P : Provisional. |

||||||||

|

Source : DGCI&S. |

||||||||

|

Table 2.53: India's Principal Imports |

||||||||

|

Commodity |

April-March |

April-July |

||||||

|

US $ million |

Growth Rate (Per cent) |

US $ million |

Growth Rate (Per cent) |

|||||

|

2002-03 |

2003-04 |

2002-03 |

2003-04 |

2003-04 |

2004-05 P |

2003-04 |

2004-05 |

|

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|

Petroleum, Petroleum Products & |

||||||||

|

Related Material |

17,640 |

20,570 |

26.0 |

16.6 |

6,115 |

9,480 |

11.7 |

55.0 |

|

Edible oil |

1,814 |

2,543 |

33.8 |

40.2 |

885 |

735 |

61.3 |

-17.0 |

|

Non-Ferrous Metals |

667 |

949 |

3.0 |

42.5 |

257 |

342 |

26.8 |

33.0 |

|

Metalliferous Ores and |

||||||||

|

Metal Scraps |

1,038 |

1,296 |

-9.3 |

24.8 |

414 |

710 |

9.0 |

71.3 |

|

Iron & Steel |

943 |

1,506 |

13.2 |

59.7 |

431 |

733 |

49.0 |

70.3 |

|

Capital Goods |

13,498 |

18,279 |

36.6 |

35.4 |

4,632 |

6,028 |

30.7 |

30.1 |

|

Pearls, Precious & |

||||||||

|

Semi-Precious Stones |

6,063 |

7,129 |

31.2 |

17.6 |

2,180 |

2,636 |

-1.2 |

20.9 |

|

Textiles, Yarn, Fabrics, etc. |

970 |

1,258 |

29.8 |

29.7 |

378 |

415 |

31.0 |

9.8 |

|

Chemicals, Organic & Inorganic |

3,025 |

4,032 |

8.1 |

33.3 |

1,114 |

1,434 |

13.2 |

28.7 |

|

Gold & Silver |

4,288 |

6,856 |

-6.4 |

59.9 |

2,430 |

3,105 |

107.6 |

27.8 |

|

P : Provisional. |

||||||||

|

Source : DGCI&S. |

||||||||

2.91 As regards imports, the sharp increase in imports of petroleum, petroleum products and related materials reflected mainly the impact of hardening in international crude oil prices. In terms of volume, these imports grew by only 11 per cent during April-July 2004, roughly the same order of growth as during fiscal 2003-04. Among the major 'non-oil' items, imports of gold and silver increased sharply, while bulk consumption goods (notably, edible oils) declined. Imports of 'mainly industrial inputs' (i.e., non-oil imports net of gold and silver, bulk consumption goods, manufactured fertilisers, and professional instruments) recorded a strong increase, signalling the firming up of domestic manufacturing activity (Table 2.53).

2.92 Country-wise details indicate sharp increase in imports from all major country groups. Among the major partner countries, imports from Germany, China, Australia, South Korea and USA showed remarkable increases (Table 2.54).

|

Table 2.54: Sources of India's Imports |

||||||||

|

Country |

April-March |

April-July |

||||||

|

US $ million |

Growth Rate (Per cent) |

US $ million |

Growth Rate (Per cent) |

|||||

|

2002-03 |

2003-04 |

2002-03 |

2003-04 |

2003-04 |

2004-05 P |

2003-04 |

2004-05 |

|

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|

USA |

4,444 |

5,035 |

41.1 |

13.3 |

1,428 |

1,721 |

13.9 |

20.5 |

|

Belgium |

3,712 |

3,976 |

34.3 |

7.1 |

1,294 |

1,552 |

– |

20.0 |

|

China |

2,792 |

4,053 |

37.1 |

45.2 |

1,120 |

1,877 |

39.6 |

67.5 |

|

UK |

2,777 |

3,234 |

8.3 |

16.5 |

1,040 |

926 |

8.5 |

-11.0 |

|

Germany |

2,405 |

2,919 |

18.6 |

21.4 |

785 |

1,011 |

4.5 |

28.8 |

|

Switzerland |

2,330 |

3,313 |

-18.8 |

42.2 |

1,318 |

1,636 |

102.9 |

24.1 |

|

South Africa |

2,094 |

1,899 |

45.3 |

-9.3 |

845 |

512 |

58.9 |

-39.4 |

|

Japan |

1,836 |

2,668 |

-14.4 |

45.3 |

739 |

859 |

32.7 |

16.2 |

|

South Korea |

1,522 |

2,829 |

33.3 |

85.9 |

642 |

930 |

85.1 |

45.0 |

|

Malaysia |

1,465 |

2,047 |

29.3 |

39.7 |

580 |

631 |

29.0 |

8.7 |

|

Australia |

1,337 |

2,649 |

2.3 |

98.2 |

560 |

1,076 |

35.1 |

92.2 |

|

Indonesia |

1,381 |

2,122 |

33.2 |

53.7 |

645 |

825 |

68.5 |

27.8 |

|

UAE |

957 |

2,060 |

4.6 |

115.2 |

371 |

1,037 |

33.0 |

179.2 |

|

P : Provisional. |

||||||||

|

Source : DGCI&S. |

||||||||

Invisibles and Current Account

2.93 Early indications for 2004-05 suggest that the invisible surplus is expected to be buoyant as in recent past (Table 2.55 and Chart II.27). Net invisible surplus during the first quarter of 2004-05 was underpinned by remittances from expatriate Indians, software exports and travel earnings. Net investment income continued to remain negative. During April-June 2004, services payments increased sharply in relation to 2003-04 reflecting the impact of growth in outbound tourist traffic, transportation and insurance payments associated with merchandise trade and expanding demand for imports of business services such as business and management consultancy, engineering, technical and distribution services. Nonetheless, net earnings from services trebled during the quarter leading to a net surplus of US $ 3.2 billion. India emerged as a favoured travel destination with international tourist traffic rising by 26.8 per cent in the quarter. This trend continued in July-September 2004 with a rise of 26 per cent in foreign tourist arrivals (16.5 per cent in July-September 2003).

2.94 Software exports have continued to remain strong belying the fears of protectionist pressures. During April-June 2004, software exports posted a rise of 28.7 per cent and the results announced by major software companies indicate that the

|

Table 2.55: India's Current Account |

|||||||

|

(US $ million) |

|||||||

|

Item |

April-June |

||||||

|

2001-02 |

2002-03 |

2003-04 |

2003 |

2004 |

|||

|

1 |

2 |

3 |

4 |

5 |

6 |

||

|

I. |

Merchandise Balance |

-11,574 |

-10,690 |

-15,454 |

-5,565 |

-6,274 |

|

|

II. |

Invisibles Balance |

||||||

|

(a+b+c) |

14,974 |

17,035 |

26,015 |

4,929 |

8,178 |

||

|

a) Services |

3,324 |

3,643 |

6,591 |

999 |

3,193 |

||

|

i) |

Travel |

123 |

-29 |

611 |

-68 |

-282 |

|

|

ii) |

Transportation |

-1,306 |

-736 |

929 |

144 |

-6 |

|

|

iii) |

Insurance |

8 |

19 |

57 |

-13 |

267 |

|

|

iv) |

G.n.i.e. |

235 |

65 |

70 |

18 |

35 |

|

|

v) |

Miscellaneous |

4,264 |

4,324 |

4,924 |

918 |

3,179 |

|

|

Of which: |

|||||||

|

Software Services |

6,884 |

8,863 |

11,750 |

2,544 |

3,376 |

||

|

b) Transfers |

15,856 |

16,838 |

23,396 |

4,871 |

5,339 |

||

|

i) |

Official |

458 |

451 |

563 |

73 |

220 |

|

|

ii) |

Private |

15,398 |

16,387 |

22,833 |

4,798 |

5,119 |

|

|

c) Income |

-4,206 |

-3,446 |

-3,972 |

-941 |

-354 |

||

|

i) |

Investment Income |

-3,844 |

-3,544 |

-3,291 |

-783 |

-148 |

|

|

ii) |

Compensation of |

||||||

|

Employees |

-362 |

98 |

-681 |

-158 |

-206 |

||

|

Total Current Account |

|||||||

|

(I+II) |

3,400 |

6,345 |

10,561 |

-636 |

1,904 |

||

|

G.n.i.e.: Government not included elsewhere. |

|||||||

impressive growth continued during July-September 2004. Buoyant software exports reflect the initiatives towards market diversification, moving up the value chain, focus on high-end processes and setting up of Research and Development Centres for offshore partners. In the recent past, there are clear signs of the BPO industry heading towards consolidation. Acquisitions of leading Indian BPO firms by global giants, setting up of captive BPO operations by multinationals in India, overseas acquisitions by Indian companies and rise in venture capital investments indicate growing maturity of the BPO segment of the software industry. Finance and accounting have drawn the maximum venture capital attention. These moves tow

ards consolidation bring with them benefits like access to a large base of established clientele/acquired knowledge and business practices, leverage against competitors while also enabling the merged entities to improve their higher level consulting skills.

2.95 Inward remittances from Indians working abroad have continued to surge, maintaining India's position as the leading recipient of remittances in the world. During April-June 2004, workers' remittances remained the mainstay of the current account accounting for about 30 per cent of gross invisible receipts (Table 2.55). The increase in net invisible surplus was able to more than offset the sharp increase in the trade deficit. Consequently, the current account balance remained in surplus during April-June 2004 in contrast to a deficit during the corresponding period of 2003 (Chart II.28).

2.96 Net capital inflows have remained buoyant during 2004-05 so far. During the first quarter of 2004-05 (April-June), net capital flows at US $ 5.6 billion were driven mainly by ECBs, short-term trade credits on account of substantially higher crude oil import requirements and Foreign Direct Investment (FDI) (Table 2.56). FII inflows have revived in subsequent months.

2.97 Foreign investment inflows in the current financial year are mainly attributable to investors' confidence in the Indian economy. International liquidity conditions and portfolio diversification by investors also contributed to foreign investment inflows during the year (Table 2.57). After remaining

|

Table 2.56: Capital Flows |

||||

|

(US $ billion) |

||||

|

Component |

April - March |

April-June |

||

|

2002-03 |

2003-04 |

2003-04 |

2004-05 |

|

|

1 |

2 |

3 |

4 |

5 |

|

Foreign Direct Investment |

3.2 |

3.4 |

0.7 |

1.2 |

|

Portfolio Investment |

0.9 |

11.4 |

1.4 |

0.1 |

|

External Assistance |

- 3.1 |

- 2.7 |

-0.3 |

0.1 |

|

External Commercial |

||||

|

Borrowings |

- 1.7 |

-1.5 |

0.4 |

1.2 |

|

NRI Deposits |

3.0 |

3.6 |

1.8 |

-0.8 |

|

Other Banking Capital |

7.4 |

2.6 |

0.1 |

1.9 |

|

Short-term Credits |

1.0 |

1.4 |

0.9 |

1.6 |

|

Other Capital |

0.1 |

2.3 |

1.0 |

0.3 |

|

Total |

10.8 |

20.5 |

6.0 |

5.6 |

|

Table 2.57: Foreign InvestmentFlows by Category |

||||||

|

(US $ million) |

||||||

|

Item |

April-September |

|||||

|

2002-03 R |

2003-04 P |

2003 |

2004 P |

|||

|

1 |

2 |

3 |

4 |

5 |

||

|

A. |

Direct Investment |

|||||

|

(I+II+III) |

5,035 |

4,673 |

1,600 |

2,596 |

||

|

I. |

Equity |

|||||

|

(a+b+c+d+e) |

2,764 |

2,387 |

1,034 |

2,046 |

||

|

a. Government |

||||||

|

(SIA/FIPB) |

919 |

928 |

470 |

704 |

||

|

b. RBI |

739 |

534 |

263 |

659 |

||

|

c. NRI |

– |

– |

– |

– |

||

|

d. Acquisition |

||||||

|

of shares * |

916 |

735 |

253 |

635 |

||

|

e. Equity capital |

||||||

|

of unincorporated |

||||||

|

bodies |

190 |

190 |

48 |

48 |

||

|

II. |

Re-invested |

|||||

|

earnings $ |

1,833 |

1798 |

450 |

454 |

||

|

III. |

Other capital $$ |

438 |

488 |

116 |

96 |

|

|

B. |

Portfolio Investment |

|||||

|

(a+b+c) |

979 |

11,377 |

3,534 |

512 |

||

|

a. |

GDRs/ADRs # |

600 |

459 |

347 |

170 |

|

|

b. |

FIIs ** |

377 |

10,918 |

3,187 |

339 |

|

|

c. |

Offshore funds |

|||||

|

and others |

2 |

– |

– |

3 |

||

|

C. |

Total (A+B) |

6,014 |

16,050 |

5,134 |

3,108 |

|

|

*Relates to acquisition of shares of Indian companies by non- residents

under Section 5 of FEMA, 1999. |

||||||

subdued during 2002-03 and 2003-04, FDI is showing clear signs of a pick-up backed by policy support and optimism about the investment opportunities being offered by several sectors. Ongoing liberalisation of the FDI policy, including the budget proposals of raising the sectoral caps on FDI in telecom, civil aviation and insurance sector as well as strong macroeconomic performance of the Indian economy are the main factors behind the higher FDI inflows during the current year. Of the three sectors, the hike in FDI cap to 49 per cent in private airlines has already been approved. Issues like procedural and policy bottlenecks are being addressed on a priority basis. An Investment Commission has been set up to act as an interface between the Government and investors to attract investment in infrastructure. A recent survey by global management consultancy firm AT Kearney reveals that India is now the third most preferred FDI destination in the world behind only China and the US and ahead of other emerging markets like Brazil, Mexico and Poland. According to the survey, the global investors view India as the world's business process and IT services provider, with longer-term market potential. Reflecting the same, services industry emerged as the largest recipient of FDI flows during April-September 2004, followed by engineering and computers. Source-wise, Mauritius continued to be the single largest source of FDI into India during April-September 2004, followed by the US and the Netherlands.

2.98 A revival of FII sentiments since August 2004 has brought about a turnaround in FII inflows (Chart II.29). This is attributed to a number of factors such as improvement in economic outlook of emerging markets including India; tax benefits extended in the Union Budget 2004-05; and, the Initial Public Offerings (IPO). FIIs registrations with SEBI have continued to surge with the number increasing to 634 as on December 15, 2004 (540 on March 31, 2004). The Indian equity market is correlated with other emerging markets but its correlation with developed markets is not strong.

2.99 NRI deposits have registered net outflows during 2004-05 so far (up to September 2004) responding to the alignment of interest rates on thesedeposits in tune with rates of return in the international markets (Table 2.58 and Chart II.30).

|

Table 2.58: Inflows under NRI Deposit Schemes |

||||

|

(US $ million) |

||||

|

Scheme |

April - September |

|||

|

2002-03 |

2003-04 |

2003-04 |

2004-05 P |

|

|

1 |

2 |

3 |

4 |

5 |

|

1. FCNR (B) |

526 |

762 |

-247 |

125 |

|

2. NR (E) RA |

6,195 |

4,695 |

3,464 |

-724 |

|

3. NR (NR) RD @ |

-3,745 |

-1,816 |

-1,027 |

-651 |

|

Total |

2,976 |

3,641 |

2,190 |

-1,250 |

|

@ Discontinued with effect from April 1, 2002 |

||||

2.100 ECBs have risen substantially during the current financial year reflecting the strong demand for these funds from corporates. During April-June 2004, net inflows on account of ECBs surged to US $ 1.2 billion from US $ 0.4 billion in April-June 2003. Approvals data for the subsequent months also indicate an increasing appetite for ECBs (Table 2.59). Under the automatic route, the companies have resorted to ECBs mainly for the import of capital goods, project financing, capital investment/ modernisation of plant expansion of activity which can be considered as a sign of capacity and investment expansion. Under the approval route, the ECB approvals have been granted primarily to financial institutions (for the purpose of on-lending to exporters), Power Finance Corporation (for power projects) and banks (that have participated in steel/ textile restructuring packages).

|

Table 2.59: External Commercial |

|||

|

(US $ million) |

|||

|

Month |

Automatic Route |

Approval Route |

Total |

|

1 |

2 |

3 |

4 |

|

April 2004 |

1,356 |

400 |

1,756 |

|

May 2004 |

454 |

100 |

554 |

|

June 2004 |

793 |

0 |

793 |

|

July 2004 |

811 |

350 |

1,161 |

|

August 2004 |

886 |

0.38 |

886 |

|

September 2004 |

1,553 |

2 |

1,555 |

|

October 2004 |

1,010 |

69 |

1,079 |

|

Total |

6,863 |

921 |

7,784 |

2.101 Short-term trade credit disbursements grew in line with import growth in the first quarter of 2004-05. Net disbursements were also sizeable at US $ 1.6 billion. Banks in India increased their recourse to overseas borrowings and drew down foreign currency assets held abroad during April-June 2004. While the overseas borrowings continued to rise, there was a build-up of Nostro balances by banks during July-September 2004.

2.102 FDI by the Indian corporates abroad is assuming increasing significance as they have started to explore new expansion opportunities outside the national boundaries in areas of their competitive advantage. Access to markets, natural resources, distribution networks and foreign technology are some of the factors that have driven the process of formation of strategic alliances by Indian corporates with the international business partners. Mergers and acquisitions, and joint venture route have been the commonly adopted modes for FDI by Indian corporates. The sectors that are being preferred for outward FDI include IT, steel, telecom, oil exploration, power and pharmaceuticals.

Foreign Exchange Reserves

2.103 India's foreign exchange reserves comprising foreign currency assets, gold, Special Drawing Rights (SDRs) and Reserve Position in the Fund (RTP) reached US $ 129.7 billion on December 10, 2004. Foreign exchange reserves increased by US $ 6.6 billion in April-June 2004. Current account surplus led by buoyant invisibles receipts and large worker remittances, FDI flows, short-term trade credits and banking capital (excluding NRI deposits) were the major contributors to the accretion to foreign exchange reserves during this period. However, during the second quarter of 2004-05 (July-September), net accretion to foreign exchange reserves turned negative. This reflected partly the impact of ebbing of capital flows arising as a result of net outflows under NRI deposits. In the subsequent months, with the revival of FII inflows, foreign exchange reserves have again recorded a strong increase. Overall, the accretion to foreign exchange reserves in the current financial year up to December 10, 2004 was US $ 16.7 billion as compared with a rise of US $ 23.5 billion in the corresponding period of 2003-04 (Chart II.31).

External Debt

2.104 India's total external debt at end-June 2004 remained broadly unchanged from its previous quarter (Table 2.60). This marked a moderation of the sharp increase in the debt stock in 2003-04. According to the World Bank's classification, India continues to be among the Less Indebted Low-Income Countries (LILICs). Furthermore, significant improvements in the form of buoyant export performance and the rising level of foreign exchange reserves have strengthened the external debt servicing capacity, imparting strength and resilience to external debt management.

2.105 Among the major components, the increase in short-term debt during the quarter was driven up by the substantial increase in trade credits for financing the surge in the demand for imports. On the other hand, NRI deposits declined during the quarter, responding to rationalisation of interest rates on these deposits in line with international interest rates.

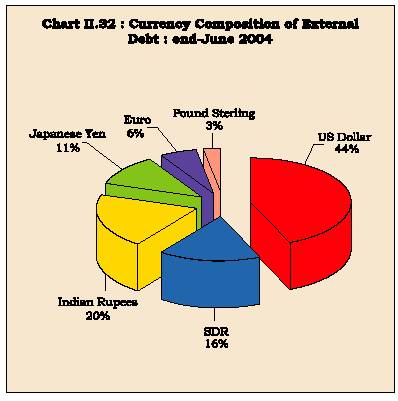

2.106 The US dollar continued to dominate the currency composition of India's external debt

|

Table 2.60: India's External Debt |

||||||||

|

Item |

end-March 2004 |

end-June 2004 |

||||||

|

Amount |

Percentage |

Amount |

Percentage |

Variation during the Quarter |

||||

|

(US $ million) |

to total |

(US $ million) |

to total |

(US $ million) |

(Per cent) |

|||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

||

|

1. |

Multilateral |

29,614 |

26.3 |

29,705 |

26.4 |

91 |

0.3 |

|

|

2. |

Bilateral |

17,489 |

15.5 |

17,149 |

15.2 |

-340 |

-1.9 |

|

|

3. |

IMF |

0 |

0 |

0 |

0 |

– |

– |

|

|

4. |

Export Credit |

4,588 |

4.1 |

4,464 |

4.0 |

-124 |

-2.7 |

|

|

5. |

Commercial Borrowings # |

22,163 |

19.7 |

22,316 |

19.8 |

153 |

0.7 |

|

|

6. |

NRI Deposits (long-term) |

31,216 |

27.7 |

30,785 |

27.3 |

-431 |

-1.4 |

|

|

7. |

Rupee Debt |

2,709 |

2.4 |

2,309 |

2.0 |

-400 |

-14.8 |

|

|

8. |

Long-term Debt (1 to 7) |

1,07,779 |

95.8 |

1,06,728 |

94.8 |

-1,051 |

-1.0 |

|

|

9. |

Short-term Debt |

4,736 |

4.2 |

5,908 |

5.2 |

1,172 |

24.7 |

|

|

10. |

Total Debt |

(8+9) |

1,12,515 |

100 |

1,12,636 |

100 |

121 |

0.1 |

|

#Includes net investment by 100 per cent FII debt funds. |

||||||||

(Char t II.32). Valuation effects on account of movements in international currencies had a tempering impact on external debt in April-June 2004-05, in sharp contrast to the experience in 2003-04. Excluding valuation effects on account of the appreciation of the US dollar against other major international currencies during April-June 2004, the stock of external debt would have increased by about US $ 2 billion. Measured in rupees, the external debt stock rose by 5.9 per cent during April-June 2004. This is in contrast to the fact that external debt during the quarter ended March 2004 had increased mainly on account of the valuation effect.

2.107 Among the key indicators of stability and sustainability of external debt, the ratio of short-term to total debt posted a modest rise during April-June 2004, which was also reflected in an upward movement in the ratio of short-term debt to foreign exchange reserves. On the other hand, a distinct positive feature was that India's foreign exchange reserves exceeded the external debt by US $ 6.9 billion providing a cover of 106.1 per cent to the external debt stock at the end of June 2004 (Table 2.61).

VI. CONCLUDING OBSERVATIONS

2.108 Developments during 2004-05 confirm the growing resilience of the Indian economy. The economy continued to be buffeted by exogenous shocks emanating from the monsoon conditions and international oil prices. In contrast to earlier expectations, the South-West Monsoon turned out to be weak and erratic with an adverse effect on the kharif crop. A major source of uncertainty during the year was the heightened volatility in international crude oil markets. International crude oil prices increased sharply during the course of the year, touching record highs and crossed US $ 50 per barrel.

|

Table 2.61: Debt Indicators |

||||

|

(Per cent) |

||||

|

Indicator |

March 2004 |

June 2004 |

||

|

1 |

2 |

3 |

||

|

Concessional debt |

/ Total debt |

35.8 |

35.4 |

|

|

Short-term debt / Total debt |

4.2 |

5.2 |

||

|

Short-term debt |

/ Reserves |

4.2 |

4.9 |

|

|

Reserves / Total debt |

100.4 |

106.1 |

||

In the recent weeks, although these prices have retreated sharply, they remain high. Financial markets also operated in an environment of uncertainty on concerns about the pace and timing of monetary tightening in the US and its probable repercussions on the rest of the global economy. Notwithstanding these shocks, the Indian economy exhibited remarkable stability.