Broad money growth accelerated during

2006-07, and remained above the indicative trajectory projected by the Reserve

Bank at the beginning of the fiscal year. Bank credit continued to grow at a strong

pace for the third successive year, albeit with some moderation. Deposits

exhibited sharp growth and enabled financing of sustained high demand for credit.

Banks’ investments in SLR securities increased during the year, but the

pace of expansion did not keep pace with the expansion in their net demand and

time liabilities (NDTL). As a result, banks’ SLR investments, as a proportion

of their NDTL, declined further during 2006-07. The Reserve Bank continued to

modulate market liquidity with the help of repo and reverse repos under the liquidity

adjustment facility (LAF), issuance of securities, including dated securities,

under the Market Stabilisation Scheme (MSS) and the cash reserve ratio (CRR).

The task of liquidity management was complicated during 2006-07 due to large variations

in market liquidity on account of variations in cash balances of the Governments

and capital flows.

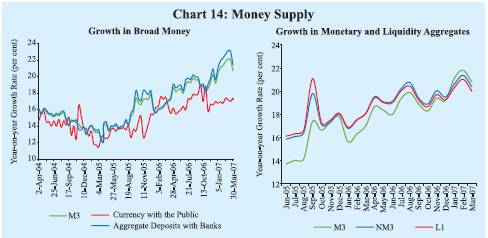

Monetary Survey

Broad money

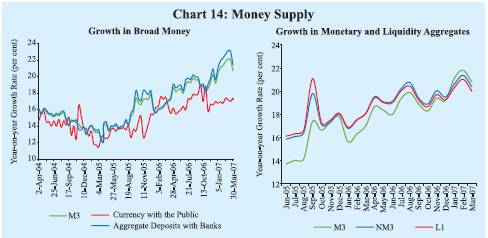

(M3) growth, year-on-year (y-o-y), accelerated to 20.8 percent as at end-March

2007 from 17.0 per cent a year ago. Expansion in the residency-based new monetary

aggregate (NM3) – which does not directly reckon non-resident foreign currency

deposits such as FCNR(B) – also accelerated from 18.1 per cent as at end-March

2006 to 20.4 per cent as at end-March 2007. Growth in liquidity aggregate, L1,

at 20.0 per cent was also higher than that of 18.1 per cent a year ago. Growth

in NM3 as at end-March 2007 was marginally lower than that in on M3. Growth in

L1 was marginally lower than that in NM3 account of lower growth in postal deposits

vis-à-vis bank deposits (Chart 14 and Table

22).

Taking into account, inter alia, high growth in monetary

aggregates, sustained growth in credit offtake, trends in liquidity absorbed under

LAF/MSS, challenges emanating from the effects of capital flows on liquidity,

acceleration in inflation, growth in real GDP, expectations of the private corporate

sector of higher increase in prices of both inputs and outputs, reports of growing

strains on domestic capacity utilisation, global developments in monetary management

and the paramount need to contain inflationary expectations, the Reserve Bank

has announced an increase of 150 basis points in the cash reserve ratio (CRR)

in phases from December 2006 (see also Chapter IV). The first round of increase

in the CRR, announced on December 8, 2006, of 50 basis points – 25 basis

points each – was effective in the fortnights

beginning

December 23, 2006 and January 6, 2007. The second round of the increase, announced

on February 13, 2007, also of 50 basis points – 25 basis points

Table

22: Monetary Indicators | (Amount

in Rupees crore) | Item

| Outstanding as

on March 31,

2007 | Variation

| 2005-06

| 2006-07 |

Amount | Per

cent | Amount | Percent |

1 | 2 | 3 | 4 | 5

| 6 | I. | Reserve

Money | 7,08,950 | 83,922 | 17.2 | 1,35,892

| 23.7 |

II. | | | | 9,59,875 | 1,43,825 | 21.1 | 1,33,497

| 16.2 |

| Narrow

Money (M1) | | | | | |

III. | | | | 32,96,919 | 3,96,881 | 17.0 | 5,67,372

| 20.8 |

| Broad

Money (M3) | | | | | |

| a) | Currency

with the Public | 4,84,171 | 58,248 | 16.4 | 71,052

| 17.2 |

| b) | Aggregate

Deposits | 28,05,261 | 3,38,081 | 17.1 | 4,95,704

| 21.5 |

| | i) | Demand

Deposits | 4,68,216 | 85,025 | 26.5 | 61,829

| 15.2 |

| | ii) | Time

Deposits | 23,37,045 | 2,53,056 | 15.3 | 4,33,875

| 22.8 |

| | | of

which: Non-Resident Foreign Currency Deposits | 66,242 | -16,876 | -22.2 | 6,967

| 11.8 |

IV. | | | | 33,06,958 | 4,21,126 | 18.1 | 5,59,370

| 20.4 |

| NM | 3 | | | | | | |

| of

which: Call Term Funding from FIs | 86,151 | 11,224 | 15.6 | 3,007

| 3.6 | V. | a) | | | 34,21,762 | 4,36,397 | 18.1 | 5,70,256

| 20.0 |

| | L1 | | | | | | |

| | of

which: Postal Deposits | 1,14,804 | 15,271 | 17.2 | 10,886

| 10.5 |

| b) | | | 34,24,694 | 4,37,206 | 18.1 | 5,70,256

| 20.0 |

| | L2 | | | | | | |

| c) | | | 34,50,758 | 4,41,207 | 18.1 | 5,72,479

| 19.9 |

| | L3 | | | | | | |

VI. | Major

Sources of Broad Money | | | | | |

| a

) | Net Bank Credit to the Government

(i+ii) | 8,32,867 | 17,888 | 2.4 | 66,272

| 8.6 | | | i) | Net

Reserve Bank Credit to Government | 4,362 | 35,799 | | -3,775

| | | | ii) | Other

Banks’ Credit to Government | 8,28,505 | -17,910 | -2.3 | 70,046

| 9.2 | | b) | Bank

Credit to Commercial Sector | 21,23,290 | 3,61,746 | 27.2 | 4,30,287

| 25.4 |

| c) | Net

Foreign Exchange Assets of Banking Sector | 9,30,319 | 78,291 | 12.1 | 2,04,125

| 28.1 |

| Memo: | | | | | | |

| SCBs

Aggregate Deposits | 25,94,259 | 3,23,913 | 18.1 | 4,85,210

| 23.0 |

| SCBs

Non-food Credit | 18,76,672 | 3,54,193 | 31.8 | 4,10,285

| 28.0 |

SCBs : Scheduled Commercial Banks.

FIs : Financial Institutions.

NBFCs : Non-Banking Financial Companies.

NM3 is the residency-based broad money aggregate and L1, L2 and L3

are liquidity aggregates compiled on the recommendations of the Working Group

on Money Supply

(Chairman: Dr. Y.V. Reddy, 1998).

Liquidity aggregates are defined

as follows:

L1= NM3 + Select deposits with the post office saving banks.

L2 = L1 +Term deposits with FIs + Term borrowing by FIs + Certificates of deposits

issued by FIs.

L3 = L2 + Public deposits of non-banking financial companies.

Note:

1. Data are provisional.

2. Data reflect redemption

of India Millennium Deposits (IMDs) on December 29, 2005.

3. Government balances

as on March 31, 2007 are before closure of accounts.

4. Variation during 2006-07

is worked out from March 31, 2006, whereas variation during 2005-06 is worked

out from April 1, 2005. | each – was effective in

the fortnights beginning February 17, 2007 and March 3, 2007. On March 30, 2007,

the Reserve Bank announced a further increase of 50 basis points in the CRR –

25 basis points each – effective in the fortnights beginning April 14, 2007

and April 28, 2007. As a result of the above increases in the CRR, an amount of

about Rs.43,000 crore of resources of banks is likely to be absorbed.

Amongst

the major components of M3, growth in currency with the public was 17.2 per cent,

year-on-year (y-o-y), as at end-March 2007 as compared with 16.4 per cent a year

ago (Table 22). Currency with the public followed the usual

seasonal pattern, contracting during the second quarter and expanding during the

remaining quarters (Table 23). On a y-o-y basis, growth in

demand deposits (15.2 per cent) as at end-March 2007 was of a lower order than

a year ago (26.5 per cent). As a result, growth in narrow money, M1, decelerated

to 16.2 per cent as at end-March 2007 from 21.1 per cent a year ago.

Table

23: Monetary Aggregates – Variations | (Rupees

crore) | Item | 2005-06 | 2006-07 | 2006-07

| Q1 | Q2 | Q3 | Q4 |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

| (=1+2+3=4+5+6+7-8) | 3,96,881 | 5,67,372 | 55,414 | 1,65,809 | 62,607 | 2,83,542 |

M3 | | | | | | | | |

Components | | | | | | |

1. | Currency with

the Public | 58,248 | 71,052 | 23,797 | -3,091 | 27,849 | 22,497 |

| | | (16.4) | (17.2) | | | | |

2. | Aggregates

Deposits with Banks | 3,38,081 | 4,95,704 | 33,227 | 1,68,447 | 35,253 | 2,58,777 |

| | | (17.1) | (21.5) | | | | |

| 2.1 | Demand

Deposits with Banks | 85,025 | 61,829 | -42,399 | 41,595 | -7,462 | 70,094 |

| | | (26.5) | (15.2) | | | | |

| 2.2 | Time

Deposits with Banks | 2,53,056 | 4,33,875 | 75,626 | 1,26,851 | 42,715 | 1,88,682 |

| | | (15.3) | (22.8) | | | | |

3. | ‘Other’

Deposits with Banks | 552 | 617 | -1,610 | 453 | -495 | 2,269 |

Sources | | | | | | |

4. | Net Bank Credit

to Government | 17,888 | 66,272 | 23,431 | 15,705 | -13,091 | 40,227 |

| | | (2.4) | (8.6) | | | | |

| 4.1 | RBI’s

net credit to Government | 35,799 | -3,775 | 53 | 2,826 | -12,754 | 6,100 |

| | 4.1.1

RBI’s net credit to Centre | 33,374 | -1,042 | 3,071 | 2,584 | -12,568 | 5,871 |

| 4.2 | Other

Banks’ Credit to Government | -17,910 | 70,046 | 23,378 | 12,879 | -337 | 34,127 |

5. | Bank Credit

to Commercial Sector | 3,61,746 | 4,30,287 | 14,930 | 1,39,859 | 76,271 | 1,99,227 |

| | | (27.2) | (25.4) | | | | |

6. | Net Foreign

Exchange Assets of Banking Sector | 78,291 | 2,04,125 | 58,087 | 20,197 | 43,160 | 82,682 |

| 6.1 | Net

Foreign Exchange Assets of RBI | 61,545 | 1,93,170 | 71,845 | 11,392 | 27,250 | 82,682 |

7. | Government’s

Currency Liabilities to the Public | 1,306 | -525 | -920 | 155 | 166 | 75 |

8. | Net Non-Monetary

Liabilities of Banking Sector | 62,351 | 1,32,786 | 40,114 | 10,107 | 43,898 | 38,668 |

| | | | | | | | |

Memo: | | | | | | | |

Non-resident Foreign Currency Deposits with

SCBs | -16,876 | 6,967 | 3,917 | 1,671 | 1,233 | 145 |

SCBs’ Call-term Borrowing from FIs | 11,224 | 3,007 | 3,118 | -1,576 | -4,468 | 5,933 |

Overseas Borrowing by SCBs | 1,295 | 2,543 | 3,301 | -3,685 | -2,774 | 5,702 |

| | | | | | | | |

SCBs : Scheduled Commercial Banks.

Note

:

1. Variation during 2006-07 is worked out from March 31, 2006,

whereas the variation

during 2005-06 is worked out from April 1, 2005.

2.

Figures in parentheses are percentage variations.

3. Data reflect redemption

of India Millennium Deposits (IMDs) on December 29, 2005.

4. Government balances

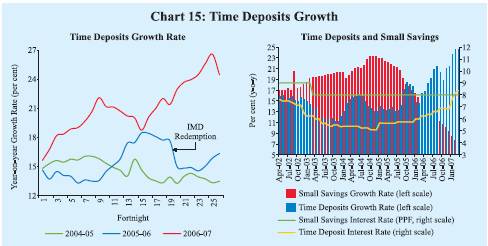

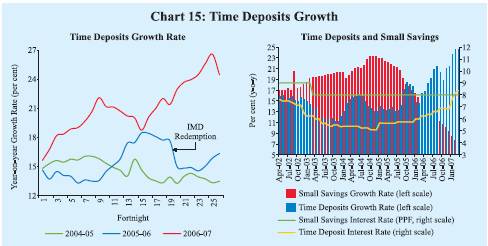

as on March 31, 2007 are before closure of accounts. | Growth

in time deposits of banks accelerated to 22.8 per cent, y-o-y, as at end-March

2007 from 15.3 per cent a year ago (Chart 15) which could

be attributed, inter alia, to higher economic activity, increase in interest

rates on deposits and extension of tax benefits under Section 80C for deposits

with maturity of five years and above. Interest rates on time deposits of 1-3

years maturity offered by public sector banks increased from a range of 5.75-6.75

per cent in March 2006 to 7.25-9.50 per cent in March 2007. Rates offered by private

sector banks on deposits of similar maturity increased from a range of 5.50-7.75

per cent to 6.75-9.75 per cent over the same period. Concomitantly, postal deposits,

with unchanged interest rates, witnessed a deceleration in growth to 10.5 per

cent in February 2007 from 17.2 per cent a year ago.

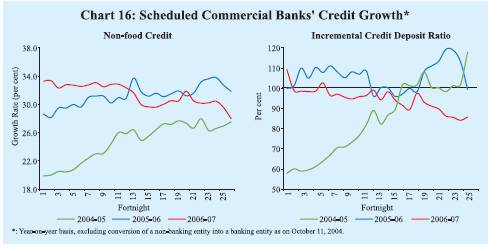

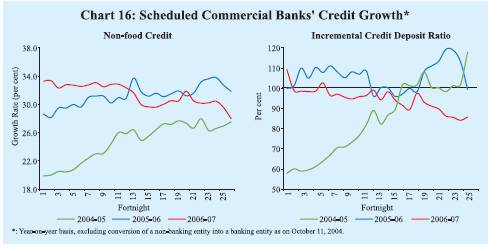

Demand for bank

credit continued to remain strong during 2006-07, albeit with a marginal

deceleration. On a year-on-year basis, scheduled commercial banks’ (SCBs’)

non-food credit registered a growth of 28.0 per cent as at end-March 2007 on top

of 31.8 per cent a year ago. The incremental credit-deposit ratio of SCBs, after

remaining above/around 100 per cent for the most part between October 2004 and

September 2006, has exhibited some moderation in subsequent months reflecting

the combined impact of acceleration in deposit growth and modest deceleration

in credit growth. As at end-March 2007, the incremental credit-deposit ratio was

around 86 per cent (y-o-y) as compared with 110 per cent a year ago (Chart

16). Scheduled commercial banks’ food credit rose by 14.3 per cent during

2006-07 as compared with an increase of 1.7 per cent in the previous year.

Disaggregated data available up to December 2006 show that credit growth

has been largely broad-based. About 35 per cent of incremental non-food credit

was absorbed by industry and another 12 per cent by agriculture. Personal loans

absorbed 29 per cent of the incremental non-food credit, mainly as loans to the

housing sector

and

‘other retail loans’. Loans to commercial real estate, which increased

by 66.7 per cent, y-o-y, absorbed 4.1 per cent of incremental non-food credit

(Table 24). Against the backdrop of continuing high credit

growth to the real estate sector, outstanding credit card receivables, loans and

advances qualifying as capital market exposure and personal loans, the Reserve

Bank in its Third Quarter Review (January 2007) raised provisioning requirements

in respect of the standard assets in the aforesaid four categories of loans and

advances (excluding residential housing loans) to two per cent from one per cent.

The provisioning requirement for banks’ exposures in the standard assets

category to the non-deposit taking systemically important non-banking financial

companies (NBFCs) was raised to two per cent from 0.4 per cent; the risk weight

for banks’ exposure to such NBFCs was also raised to 125 per cent from 100

per cent. In addition to bank credit for financing their requirements, the

corporate sector continued to rely on a variety of non-bank sources of funds such

as capital markets, external commercial borrowings and internal funds. Resources

raised through domestic equity issuances during 2006-07 (Rs.28,595 crore) were

more than double of those raised in 2005-06. Mobilisation through issuances of

commercial papers during 2006-07 registered a turnaround, notwithstanding some

sluggishness in the second half of the year. Resources raised through markets

abroad – equity issuances (ADRs/GDRs) and external commercial borrowings

–also increased substantially during 2006-07. While amounts raised through

ADRs/ GDRs increased to Rs.16,184 crore during 2006-07 from Rs.7,263 crore a year

ago, net disbursements under external commercial borrowings (ECBs) increased to

Rs.48,328 crore during April-December 2006 from Rs.27,228 crore during April-December

2005. Finally, internal sources of funds continued to provide large financing

support to the domestic corporate sector during the first three quarters of 2006-07.

Profits after tax of select non-financial non-government companies during April-

December 2006 were almost 43 per cent higher than the corresponding period

of 2005 (Table 25).

Table

24: Deployment of Non-food Bank Credit | (Amount

in Rupees crore) | Sector/Industry | Outstanding

as on

December22, 2006 | Year-on-year

Variation | December

23, 2005 | December

22, 2006 | Absolute | Per

cent | Absolute | Per

cent | 1

| 2 | 3 | 4 | 5 | 6 |

Non-food Gross Bank Credit

(1 to 4) | 16,23,653 | 2,83,487 | 33.3 | 3,84,785 | 31.1 |

1. | Agriculture

and Allied Activities | 1,97,763 | 41,771 | 39.6 | 46,991 | 31.2 |

2. | Industry

(Small, Medium and Large) | 6,25,309 | 86,215 | 25.0 | 1,35,929 | 27.8 |

| Small

Scale Industries | 1,00,599 | 12,717 | 18.7 | 18,822 | 23.0 |

3. | Personal

Loans | 4,27,909 | n.a. | n.a. | 1,10,613 | 34.9 |

| Housing | 2,17,829 | n.a. | n.a. | 50,622 | 30.3 |

| Advances

against Fixed Deposits | 35,764 | 6.016 | 23.1 | 3,634 | 11.3 |

| Credit

Cards | 11,913 | n.a. | n.a. | 3,595 | 43.2 |

| Education | 13,399 | n.a. | n.a. | 4,418 | 49.2 |

| Consumer

Durables | 8,558 | -1,084 | -13.5 | 1,615 | 23.3 |

4. | Others | 3,72,672 | n.a. | n.a. | 91,252 | 32.4 |

| Transport

Operators | 22,610 | n.a. | n.a. | 10,598 | 88.2 |

| Professional

and Others | 19,379 | n.a. | n.a. | 6,

051 | 45.4 |

| Trade | 99,194 | n.a. | n.a. | 23,139 | 33.9 |

| Real

Estate Loans | 39,642 | 14,201 | 155.4 | 15,859 | 66.7 |

| Non-Banking

Financial Companies | 38,150 | 10,111 | 59.4 | 7,456 | 24.3 |

| | | | | | |

Memo: | | | | | |

| | | | | | |

Priority Sector | 5,64,396 | 1,28,773 | 41.7 | 1,12,782 | 25.0 |

Industry (Small, Medium

and Large) | 6,25,309 | 86,215 | 25.0 | 1,35,929 | 27.8 |

Food Processing | 34,492 | 4,094 | 20.1 | 7,033 | 25.6 |

Textiles | 69,305 | 10,891 | 30.7 | 18,

274 | 35.8 |

Paper and Paper Products | 10,140 | 1,723 | 30.9 | 1,775 | 21.2 |

Petroleum, Coal Products and

Nuclear Fuels | 31,021 | 2,962 | 20.6 | 12,441 | 67.0 |

Chemical and Chemical Products | 51,153 | 5,836 | 19.5 | 7,607 | 17.5 |

Rubber, Plastic and their Products | 7,

979 | 2,660 | 92.4 | 1,950 | 32.3 |

Iron and Steel | 58,896 | 10,391 | 38.2 | 14,877 | 33.8 |

Other Metal and Metal Products | 19,727 | 2,821 | 29.6 | 5,737 | 41.0 |

Engineering | 38,439 | 3,976 | 15.6 | 6,306 | 19.6 |

Vehicles, Vehicle Parts and Transport

Equipments | 20,272 | 5,319 | 91.5 | 3,771 | 22.9 |

Gems and Jewellery | 21,795 | 4,572 | 42.3 | 3,613 | 19.9 |

Construction | 16,524 | 2,992 | 38.7 | 4,784 | 40.7 |

Infrastructure | 1,24,271 | 27,802 | 42.2 | 22,197 | 21.7 |

n.a. : Not available.

Note:

1. Data are provisional and relate to select scheduled commercial banks.

2. Owing to change in classification of sectors/industries and coverage of banks,

data

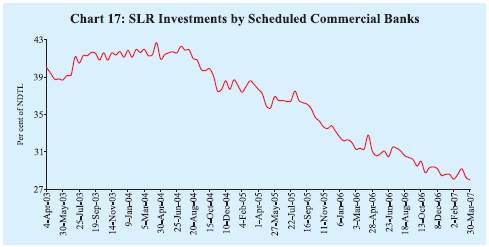

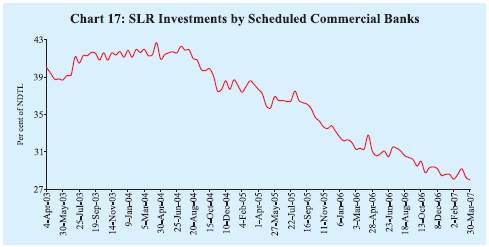

for 2006 are not comparable with earlier data. | Commercial

banks’ investments in gilts increased by 10.0 per cent, y-o-y, as at end-March

2007 as against a decline of 2.7 per cent a year ago (Table 26).

Growth in commercial banks’ investments in gilts was, however, substantially

below the growth of 23.5 per cent in their net demand and time liabilities (NDTL).

As a result, commercial banks’ holdings of Government securities declined

to 28.0 per cent of their NDTL as at end-March 2007 from 31.3 per cent as at end-March

2006

(Chart 17). Excess SLR investments of SCBs fell

to Rs.85,728 crore as at end-March 2007 from Rs.1,45,297 crore as at end-March

2006. Thus, apart from higher deposit growth, excess SLR investments continued

to provide banks the flexibility to sustain strong demand for bank credit. Banks’

balances with the Reserve Bank expanded, reflecting the impact of the increase

in their NDTL as well as the increase in the CRR.

Table

25: Select Sources of Funds to Industry | (Rupees

crore) | Item | 2005-06 | 2006-07 | 2006-07 |

Q1 | Q2 | Q3 | Q4 |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

A. | Bank

Credit to Industry # | 1,27,192 | 74,981* | -2,724 | 49,290 | 28,415 | – |

| | | | (66,244)* | | | | | |

B. | Flow

from Non-banks to Corporates | | | | | | |

| 1.

Capital Issues (i+ii) | 13,781 | 29,180 | 10,627 | 1,882 | 10,840 | 5,831 |

| | i) | Non-Government

Public Ltd. | | | | | | |

| | | Companies

(a+b) | 13,408 | 29,180 | 10,627 | 1,882 | 10,840 | 5,831 |

| | | a)

Bonds/Debentures | 245 | 585 | 0 | 0 | 491 | 94 |

| | | b)

Shares | 13,163 | 28,595 | 10,627 | 1,882 | 10,349 | 5,737 |

| | ii) | PSUs

and Government Companies | 373 | 0 | 0 | 0 | 0 | 0 |

| 2.

ADR/GDR Issues | 7,263 | 16,184 | 4,965 | 2,130 | 924 | 8,165 |

| 3.

External Commercial

Borrowings (ECBs) | 45,078 | 48,328* | 20,503 | 13,651 | 14,174 | – |

| | | | (27,228)* | | | | | |

| 4.

Issue of CPs | -1,517 | 6,384@ | 6,931 | 4,795 | -908 | -4,434@ |

C. | Depreciation

Provision + | 28,883 | 24,557* | 8,449 | 8.892 | 9,172 | – |

| | | | (22,044)* | | | | | |

D. | Profit

after Tax + | 67,506 | 75,460* | 24,845 | 27,710 | 28,698 | – |

| | | | (52,891)* | | | | | |

#: Data pertain to select scheduled

commercial banks. Figures for 2005-06 are not comparable

with those of 2006-07

due to increase in number of banks selected in the sample.

+: Data are based

on audited/ unaudited abridged results of select sample of non-financial non-Government

companies.

Quarterly variations may not add up to annual variation due to

difference in coverage of companies.

*: Data pertain to April-December.

@ : Up to March 15, 2007.

Note: 1. Data are provisional.

2. Data on capital issues pertain to gross issuances excluding issues by banks

and financial institutions. Figures are not adjusted for banks’ investments

in capital issues, which are not expected to be significant.

3. Data on ADR/GDR

issues exclude issuances by banks and financial institutions.

4. Data on ECBs

include short-term credit. Data for 2005-06 are exclusive of the IMD redemption. |

Table

26: Scheduled Commercial Bank Survey | (Amount

in Rupees crore) | Item | Outstanding

as on

March 30, 2007 | Variation

(year-on-year) | As

on March 31, 2006 | As

on March 30, 2007 | Amount | Per

cent | Amount | Per

cent | 1 | 2 | 3 | 4 | 5 | 6 |

Sources of Funds | | | | | |

1. | Aggregate

Deposits | 25,94,259 | 3,23,913 | 18.1 | 4,85,210 | 23.0 |

2. | Call/Term

Funding from FIs | 86,151 | 11,224 | 15.6 | 3,007 | 3.6 |

3. | Overseas

Foreign Currency Borrowings | 32,377 | 1,295 | 4.5 | 2,543 | 8.5 |

4. | Capital | 33,868 | 5,705 | 21.2 | 1,254 | 3.8 |

5. | Reserves | 1,66,290 | 34,616 | 31.3 | 21,177 | 14.6 |

Uses of Funds | | | | | |

1. | Bank

Credit | 19,23,192 | 3,54,868 | 30.8 | 4,16,115 | 27.6 |

| of

which: Non-food Credit | 18,76,672 | 3,54,193 | 31.8 | 4,10,285 | 28.0 |

2. | Investments

in Government Papers | 7,71,060 | -19,514 | -2.7 | 70,318 | 10.0 |

3. | Investments

in Other Approved Securities | 21,100 | -3,295 | -16.5 | 4,388 | 26.3 |

4. | Investments

in Non-SLR Securities | 1,43,750 | -11,838 | -8.0 | 8,410 | 6.2 |

5. | Foreign

Currency Assets | 39,287 | 14,059 | 47.8 | -4,207 | -9.7 |

6. | Balances

with the RBI | 1,80,222 | 34,077 | 36.6 | 53,161 | 41.8 |

Note: Data are

provisional. |

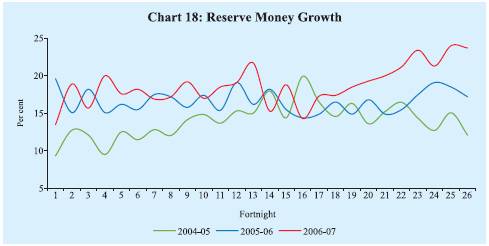

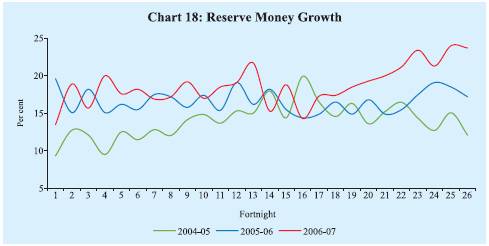

Reserve

Money Survey

Reserve money expanded by 23.7 per cent, y-o-y, as on

March 31, 2007 as compared with 17.2 per cent a year ago (Chart

18). Adjusted for the first round effects of the hikes in the CRR, reserve

money growth (y-o-y) was 18.9 per cent as on March 31, 2007.

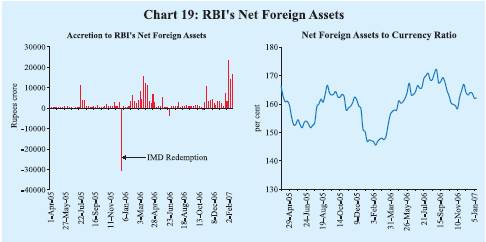

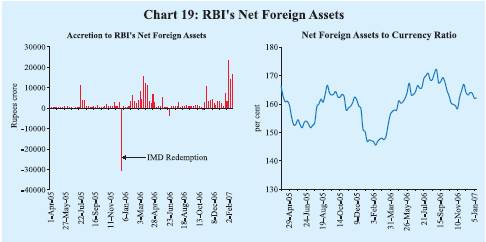

Growth

in reserve money during 2006-07 was driven largely by the expansion in the Reserve

Bank’s net foreign assets (NFA). The Reserve Bank’s foreign currency

assets (net of revaluation) increased by Rs.1,64,601 crore during 2006-07 as compared

with an increase of Rs.68,834 crore during the previous year (Table

27 and Chart 19). More than one-half of the increase

in the Reserve Bank’s foreign currency assets (net of revaluation) during

2006-07 took place in the fourth quarter.

Table

27: Reserve Money | (Rupees

crore) | | Outstanding

as on

March 31, 2007 | Variation

during | 2005-06 | 2006-07 | 2006-07

| Q1 | Q2 | Q3 | Q4 |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

Reserve Money | | 7,08,950 | 83,922 | 1,35,892 | 13,470 | 18,666 | 14,210 | 89,546 |

(= 1+2+3 = 4+5+6+7-8) | | (17.2) | (23.7) | | | | |

Components | | | | | | | | |

1. | Currency

in Circulation | 5,04,167 | 62,015 | 73,491 | 22,283 | -2,011 | 26,871 | 26,348 |

| | | | (16.8) | (17.1) | | | | |

2. | Bankers’

Deposits with RBI | 1,97,295 | 21,515 | 61,784 | -7,204 | 20,224 | -12,165 | 60,929 |

| | | | (18.9) | (45.6) | | | | |

3. | ‘Other’

Deposits with the RBI | 7,487 | 393 | 617 | -1,610 | 453 | -495 | 2,269 |

| | | | (6.1) | (9.0) | | | | |

Sources | | | | | | | | |

4. | RBI’s

net credit to Government | 4,362 | 26,111 | -3,775 | 53 | 2,826 | -12,754 | 6,100 |

| of

which: to Centre (i+ii+iii+iv-v) | 4,118 | 28,417 | -1,042 | 3,071 | 2,584 | -12,568 | 5,871 |

| i.

Loans and Advances | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| ii.

Treasury Bills held by the RBI | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| iii.

RBI’s Holdings of Dated | | | | | | | |

| Securities | | 97,172 | 13,869 | 26,763 | -27,610 | 24,944 | 22,733 | 6,696 |

| iv.

RBI’s Holdings of Rupee coins | 12 | 7 | -143 | 9 | -107 | 97 | -142 |

| v.

Central Government Deposits | 93,066 | -14,541 | 27,662 | -30,672 | 22,253 | 35,398 | 683 |

5. | RBI’s

credit to banks and | | | | | | | |

| commercial

sector | | 9,173 | 535 | 1990 | -3,135 | 3,107 | 2,065 | -47 |

6. | NFEA

of RBI | | 8,66,153 | 60,193 | 1,93,170 | 71,845 | 11,392 | 27,250 | 82,682 |

| | | | (9.8) | (28.7) | | | | |

| of

which : | | | | | | | | |

| FCA,

adjusted for revaluation | – | 68,834 | 1,64,601 | 28,107 | 10,948 | 31,634 | 93,913 |

7. | Governments’

Currency | | | | | | | |

| Liabilities

to the Public | 8,229 | 1,306 | -525 | -920 | 155 | 166 | 75 |

8. | Net

Non-Monetary liabilities of RBI | 1,78,967 | 4,222 | 54,968 | 54,373 | -1,186 | 2,517 | -736 |

| | | | | | | | | |

Memo: | | | | | | | | |

Net Domestic Assets | | -1,57,203 | 23729 | -57277 | -58,376 | 7,274 | -13,040 | 6,864 |

Reserve Bank’s Primary

Subscription | | | | | | | |

to Dated Securities | | 0 | 10,000 | 0 | 0 | 0 | 0 | 0 |

LAF, Repos (+) / Reverse Repos

(-) | 29,185 | 12,080 | 36,435 | -23,060 | 28,395 | 22,195 | 8,905 |

Net Open Market Sales # * | – | 3,913 | 5,125 | 1,536 | 1,176 | 389 | 2,024 |

Mobilisation under MSS | * | 62,974 | -35,149 | 33,912 | 4,062 | 8,940 | -3,315 | 24,225 |

Net Purchases(+)/Sales(-) from | | | | | | | |

Authorised Dealers | | – | 32,884 | 1,07,347@ | 21,545 | 0 | 19,776 | 66,026@ |

NFEA/Reserve Money £ | | 122.2 | 117.4 | 122.2 | 127.0 | 125.0 | 126.5 | 122.2 |

NFEA/Currency £ | | 171.8 | 156.3 | 171.8 | 164.4 | 167.7 | 164.0 | 171.8 |

NFEA: Net Foreign Exchange Assets.

FCA : Foreign Currency Assets.

@: up to end-February 2007.

*: At face

value.

# : Excludes Treasury Bills

£ : per cent, end of period.

Note: 1.Data are based on March 31 for Q4 and last reporting

Friday for all other quarters.

2.Figures in parentheses are percentage variations

during the fiscal year.

3.Government balances as on March 31, 2007 are before

closure of accounts. |

Mirroring

the liquidity management operations, the Reserve Bank’s net credit to the

Centre declined by Rs.1,042 crore in 2006-07 as against an increase of Rs.28,417

crore in the previous year. The decline in net RBI credit to the Centre during

2006-07 could be attributed mainly to an increase in balances under MSS (Rs.33,912

crore) and open market sales (Rs.5,125 crore), partly offset by increase in repo

balances under LAF (Rs.36,435 crore).

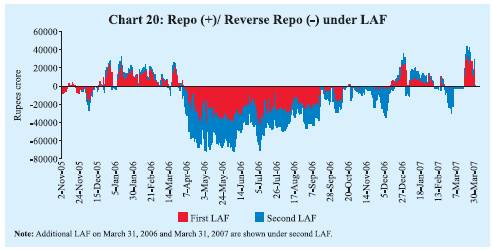

Liquidity Management

During 2006-07, the Reserve Bank continued with its policy of active management

of liquidity through open market operations (OMO) including MSS, LAF and CRR,

and using all the policy instruments at its disposal flexibly. The liquidity management

operations during the year were aimed at ensuring maintenance of appropriate liquidity

in the system so that all legitimate requirements of credit, particularly for

productive purposes, are met, consistent with the objective of price and financial

stability. However, the task of liquidity management was complicated during 2006-07,

with greater variation in market liquidity, largely reflecting variations in cash

balances of the Governments and capital flows.

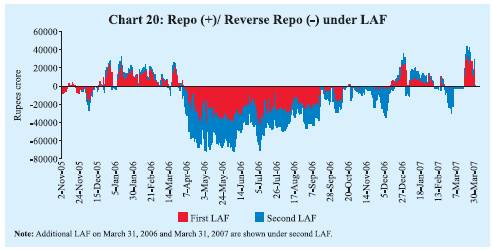

During the first quarter

of 2006-07, unwinding of the Centre’s surplus balances with the Reserve

Bank and the Reserve Bank’s purchase of foreign exchange from authorised

dealers resulted in ample liquidity into the banking system. This was mirrored

in an increase in the LAF reverse repo balances. Liquidity conditions continued

to remain easy during the most part of the second quarter of 2006-07. Balances

under the MSS also rose between May 2006 and September 2006, following the re-introduction

of auctions under the MSS in May

2006. However, in view of some build-up

of Government cash balances with the Reserve Bank during August-September 2006,

there was a decline in balances under LAF reverse repos during the second quarter

(Table 28).

Around mid-September 2006, liquidity

conditions turned tight on account of advance tax outflows and festival season

currency demand. The Reserve Bank, accordingly, injected liquidity through repos

on eight occasions between mid-September 2006 and end-October 2006. However, there

was net injection of liquidity only on two occasions (October 20 and October 23,

2006). Liquidity pressures eased by end-October 2006 following some decline in

Government cash balances (Table 29). Liquidity conditions

eased further during November 2006, partly reflecting purchases of foreign exchange

by the Reserve Bank. Balances under LAF reverse repos started rising from the

third week of November 2006, reaching Rs 34,255 crore as on December 6, 2006 (Chart

20).

Liquidity conditions, however, again turned tight from the second

week of December 2006 largely due to advance tax outflows and announcement of

increase in the CRR by 50 basis points. The Centre’s surplus with the Reserve

Bank increased from Rs.31,305 crore at end-November 2006 to Rs.73,534 crore as

on December 22, 2006. In view of the prevailing liquidity conditions, the Reserve

Bank injected liquidity into the system through repo operations from December

13, 2006. Average daily net injection of liquidity by the Reserve Bank amounted

to Rs.15,013 crore during December 13, 2006 in contrast to the average daily absorption

of Rs.12,262 crore and Rs.9,937 crore during October and November 2006, respectively.

Concomitantly, balances under the MSS declined during September-December 2006

in view of under-subscription in some of the auctions.

Although the Centre’s

surplus declined during January 2007, liquidity conditions remained tight, partly

reflecting the impact of the CRR hike. The Reserve Bank continued to inject liquidity

through LAF operations during January 2007 (except for January 3-5, when there

were net absorption of liquidity). Daily net injection of liquidity averaged Rs.10,738

crore during January 2007.

Table

28: Reserve Bank's Liquidity Management Operations |

(Rupees crore) |

Item | 2005-06 | 2006-07 | 2006-07 |

| | Q1 | Q2 | Q3 | Q4 | Jan. | Feb. | Mar. |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

A. | Drivers

of Liquidity (1+2+3+4) | -31,696 | 60,981 | 36,247 | -16,683 | -25,903 | 67,320 | 22,708 | 26,744 | 17,868 |

1. | RBI’s Foreign Currency

Assets | | | | | | | | | |

| (adjusted for revaluation) | 68,834 | 1,64,601 | 28,517 | 10,538 | 34,821 | 90,725 | 13,304 | 56,780 | 20,641 |

2. | Currency with the Public | -57,256 | -71,052 | -19,648 | -1,058 | -27,296 | -23,050 | -10,306 | -10,283 | -2,461 |

3. | Surplus Cash balances

of the Centre | | | | | | | | | |

| with the Reserve Bank | -22,726 | -1,164 | 40,207 | -26,199 | -30,761 | 15,590 | 23,088 | -10,621 | 3,123 |

4. | Others (residual) | -20,547 | -31,405 | -12,828 | 36 | -2,667 | -15,945 | -3,379 | -9,131 | -3,435 |

| | | | | | | | | | |

B. | Management

of Liquidity (5+6+7+8) | 57,969 | -24,257 | -39,003 | 32,026 | 31,625 | -48,905 | -29,051 | -28,817 | 8,963 |

5. | Liquidity impact of LAF

Repos | 12,080 | 36,435 | -35,315 | 40,650 | 33,600 | -2,500 | -20,240 | -18,385 | 36,125 |

6. | Liquidity impact of OMO

(Net) * | 10,740 | 720 | 545 | 145 | 25 | 5 | 0 | 0 | 5 |

7. | Liquidity impact of MSS | 35,149 | -33,912 | -4,232 | -8,769 | 4,750 | -25,660 | -2,061 | -3,432 | -20,167 |

8. | First round liquidity

impact | | | | | | | | | |

| due to CRR change | 0 | -27,500 | 0 | 0 | -6,750 | -20,750 | -6,750 | -7,000 | -7,000 |

| | | | | | | | | | |

C. | Bank

Reserves (A+B) # | 26,273 | 36,724 | -2,756 | 15,343 | 5,722 | 18,415 | -6,343 | -2,073 | 26,831 |

(+) : Indicates injection of liquidity into

the banking system.

(-) : Indicates absorption of liquidity from the banking

system.

# : Includes vault cash with banks and adjusted for first round liquidity

impact due to CRR change.

* : Adjusted for Consolidated Sinking Funds (CSF)

and Other Investments and including private placement.

Note : Data

pertain to March 31 and last Friday for all other months. |

Table

29: Liquidity Management | (Rupees

crore) | Outstanding as on

last

Friday of | LAF | MSS | Centre's

Surplus

with the RBI @ | Total

(2 to 4) | 1 | 2 | 3 | 4 | 5 |

2005 | | | | |

March* | 19,330 | 64,211 | 26,102 | 1,09,643 |

April | 27,650 | 67,087 | 6,449 | 1,01,186 |

May | 33,120 | 69,016 | 7,974 | 1,10,110 |

June | 9,670 | 71,681 | 21,745 | 1,03,096 |

July | 18,895 | 68,765 | 16,093 | 1,03,753 |

August | 25,435 | 76,936 | 23,562 | 1,25,933 |

September | 24,505 | 67,328 | 34,073 | 1,25,906 |

October | 20,840 | 69,752 | 21,498 | 1,12,090 |

November | 3,685 | 64,332 | 33,302 | 1,01,319 |

December | -27,755 | 46,112 | 45,855 | 64,212 |

2006 | | | | |

January | -20,555 | 37,280 | 39,080 | 55,805 |

February | -12,715 | 31,958 | 37,013 | 56,256 |

March* | 7,250 | 29,062 | 48,828 | 85,140 |

April | 47,805 | 24,276 | 5,611 | 77,692 |

May | 57,245 | 27,817 | 0 | 85,062 |

June | 42,565 | 33,295 | 8,621 | 84,481 |

July | 44,155 | 38,995 | 8,770 | 91,920 |

August | 23,985 | 42,364 | 26,791 | 93,140 |

September | 1,915 | 42,064 | 34,821 | 78,800 |

October | 12,270 | 40,091 | 25,868 | 78,229 |

November | 15,995 | 37,917 | 31,305 | 85,217 |

December | -31,685 | 37,314 | 65,582 | 71,211 |

2007 | | | | |

January | -11,445 | 39,375 | 42,494 | 70,424 |

February | 6,940 | 42,807 | 53,115 | 1,02,862 |

March* | -29,185 | 62,974 | 49,992 | 83,781 |

@ : Excludes minimum cash balances

with the Reserve Bank.

* : Data pertain to March 31.

Note :

Negative sign in column 2 indicates injection of liquidity through LAF repo. |

Liquidity

conditions eased from the second week of February 2007, partly reflecting the

purchases of foreign exchange from authorised dealers. LAF window witnessed net

absorption of liquidity during February 8 - March 4, 2007 (except during February

15-20, 2007). Taking into account, inter alia, the liquidity conditions,

the Reserve Bank, on February 13, 2007, announced another increase of 50 basis

points in the CRR – 25 basis points each – effective in the fortnights

beginning February 17, 2007 and March 3, 2007. Furthermore, on a review

of the liquidity conditions, the Reserve Bank on March 2, 2007 announced modifications

in liquidity management operations. An enhanced MSS programme was put in place

to restore LAF as a facility for equilibrating very short-term mismatches and

modulating the liquidity it absorbs through the daily reverse repo auctions. It

was decided to use a mix of Treasury Bills and dated securities for MSS issuances

in a more flexible manner keeping in view the capital flows in the recent period,

the assessment of volatility and durability of capital flows, and the paramount

importance attached to liquidity management in containing inflation. Concomitantly,

beginning March 5, 2007, daily reverse repo absorptions were restricted to a maximum

of Rs.3,000 crore comprising Rs.2,000 crore in the First LAF and Rs.1,000 crore

in the Second LAF. Reflecting the modified arrangements, the balances under the

LAF remained at around Rs.3,000 crore during March 5-15, 2007 while those under

the MSS increased from Rs.42,807 crore at end-February 2007 to Rs.62,974 crore

by March 31, 2007.

Liquidity conditions tightened from March 16, 2007

in view of advance tax outflows, the concomitant increase in the Centre’s

surplus from Rs.36,476 crore as on March 9, 2007 to Rs.77,006 crore as on March

23, 2007 and the effect of the CRR hike. Accordingly, the Reserve Bank injected

liquidity through repo operations, averaging Rs.31,254 crore during March 16-30,

2007. On March 21, 2007, the Reserve Bank clarified that the recourse to LAF by

market participants should not be persistent in order to fund balance sheets for

credit needs of customers, but banks could utilise the funds borrowed under this

facility for inter-bank lending. Such inter-bank lending is part of normal money

market functioning and enables daily liquidity management by market participants

with temporary mismatches. At the request of the market participants, the Reserve

Bank conducted an additional LAF auction between 3.30 PM and 4.00 PM on March

31, 2007.

Liquidity conditions eased in early April 2007, partly on account

of the reduction in the Centre's surplus. Balances under LAF repos, net of reverse

repos, fell from Rs.29,185 crore as on March 31, 2007 to Rs.1,455

crore as on April 8, 2007. During April 9-15, 2007, there was net absorption of

liquidity. Absorptions under the reverse repo remained limited to a maximum of

Rs.3,000 crore in accordance with the modified arrangements. There was again net

injection of liquidity during April 16-18, 2007, averaging Rs.16,988 crore daily. |

IST,

IST,