IST,

IST,

Monetary Policy Report – October 2024

|

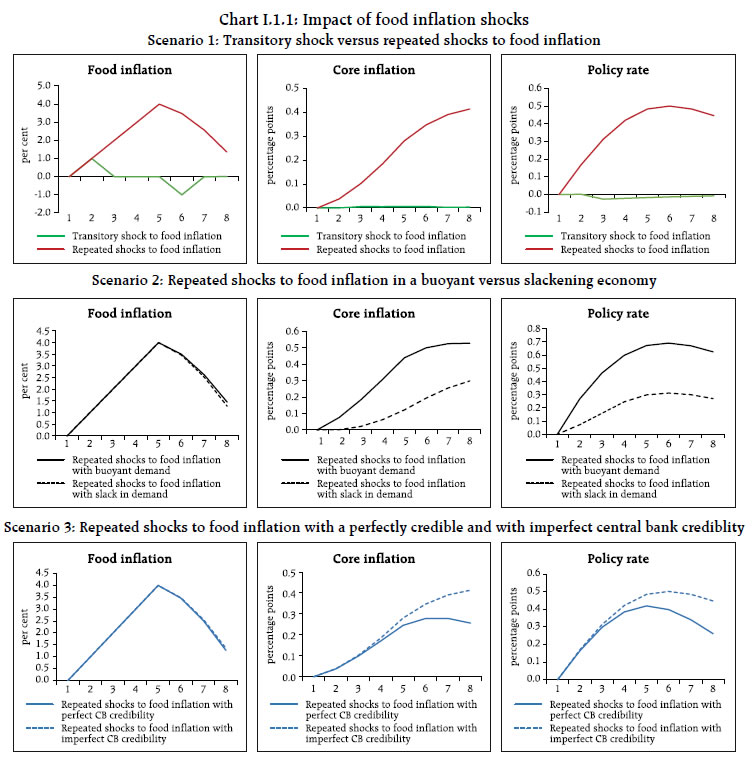

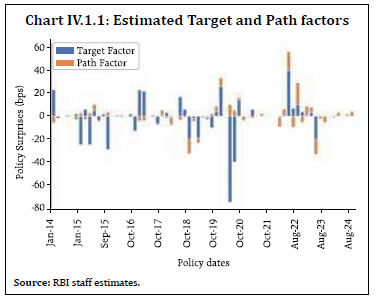

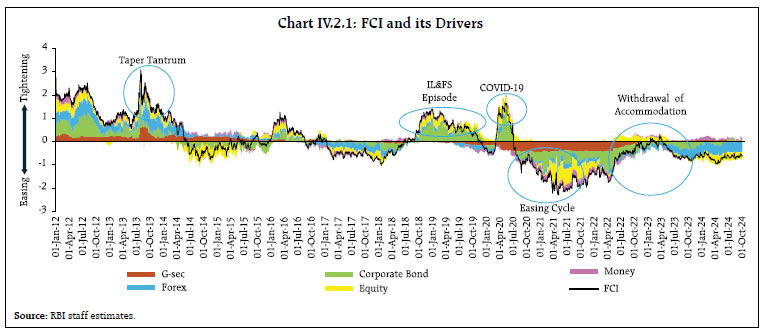

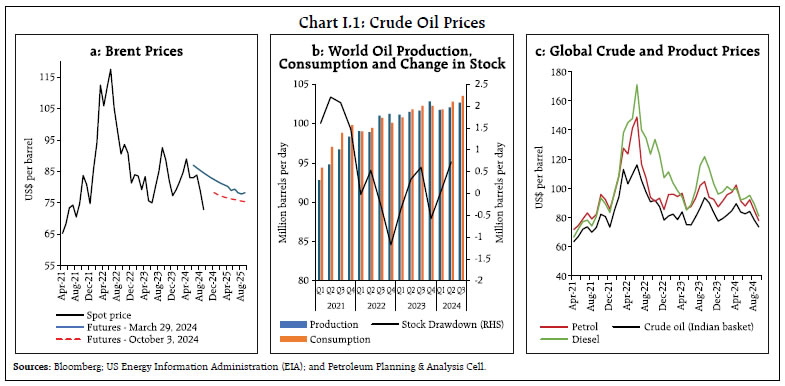

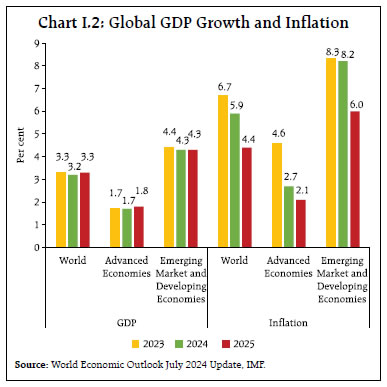

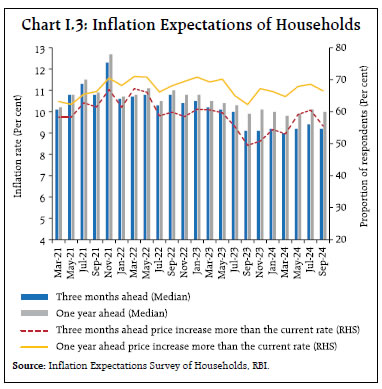

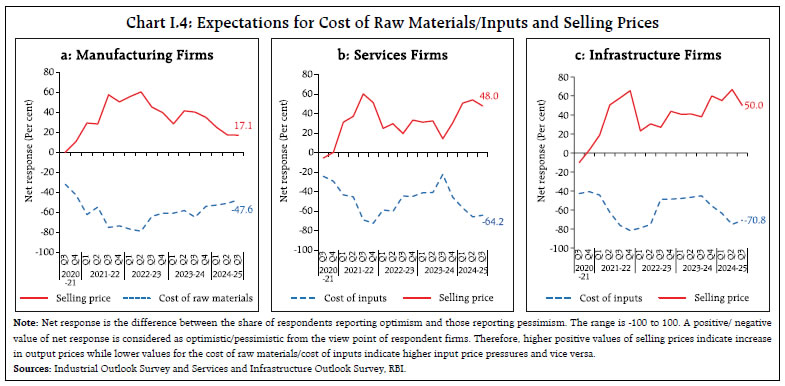

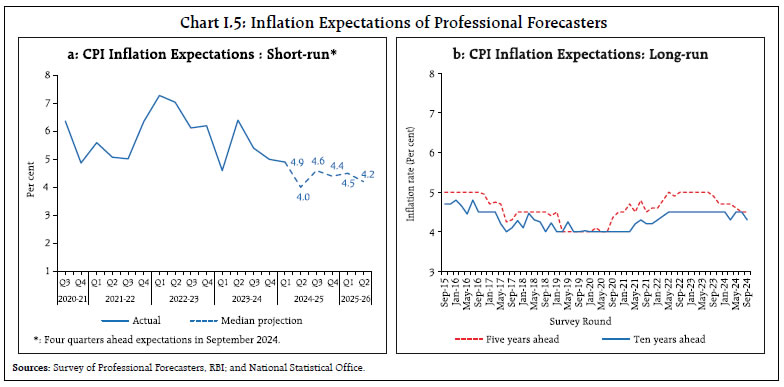

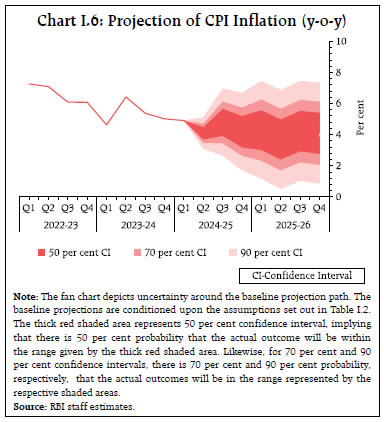

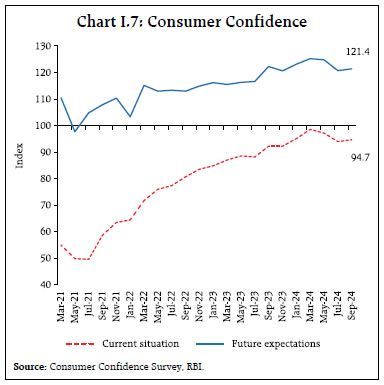

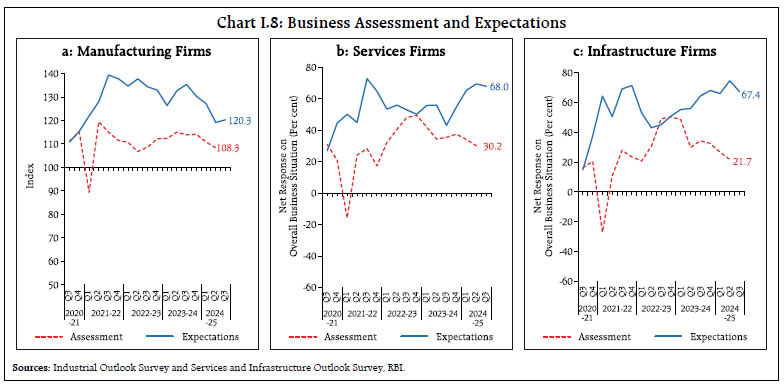

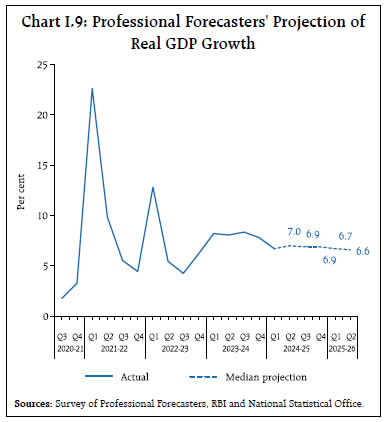

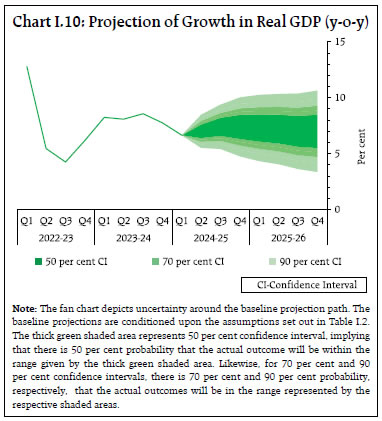

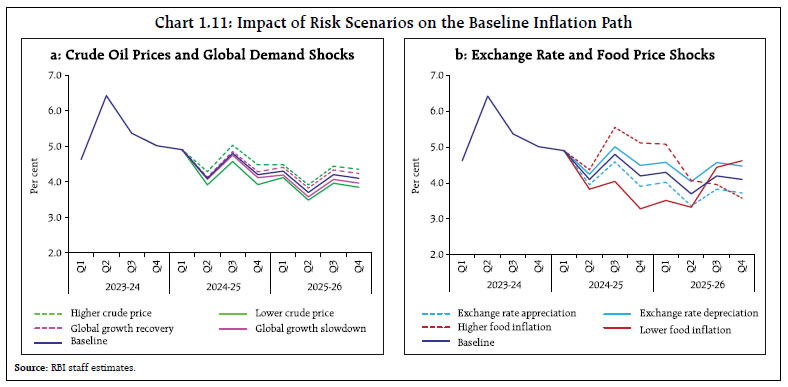

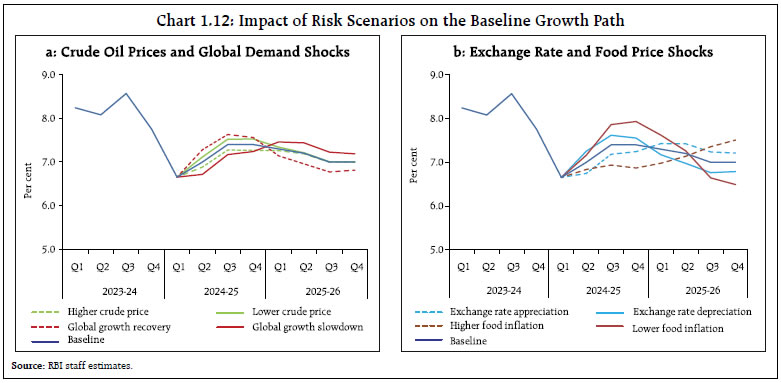

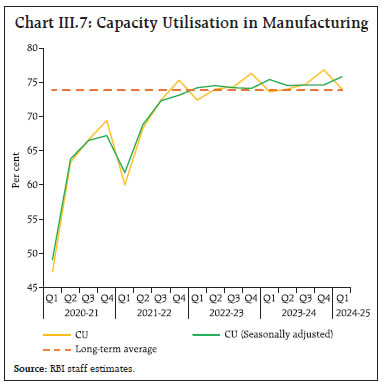

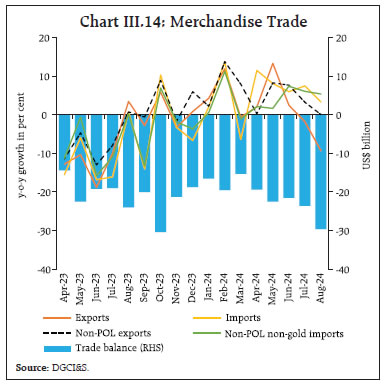

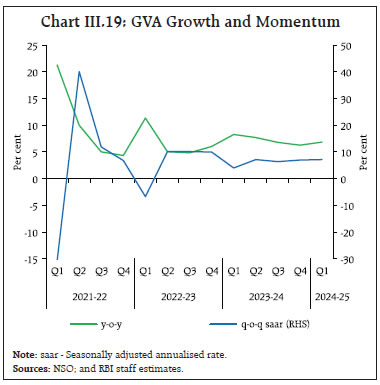

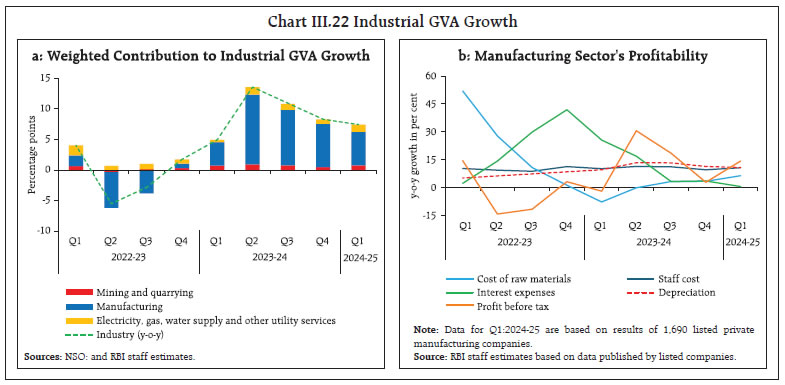

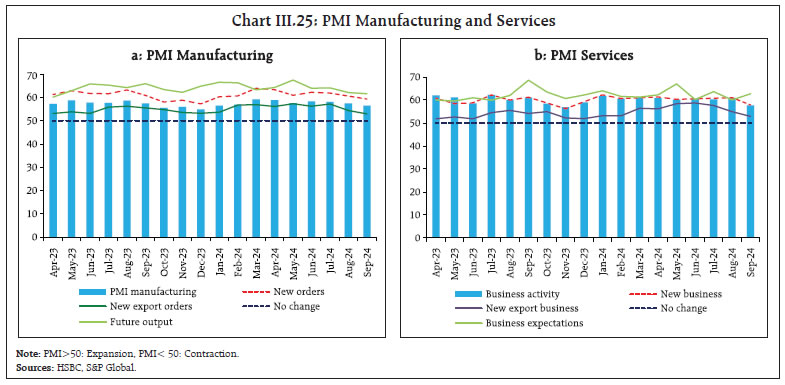

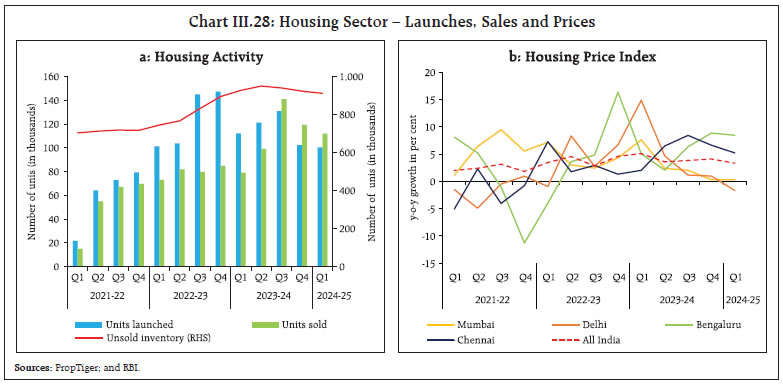

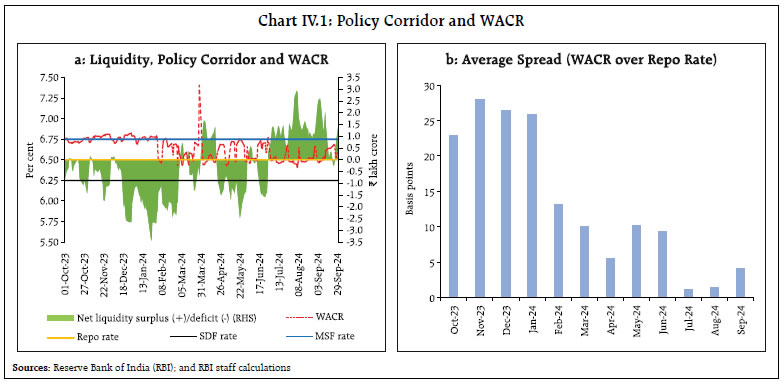

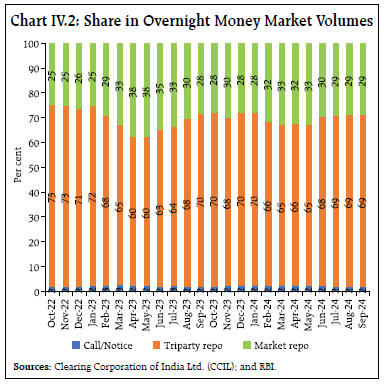

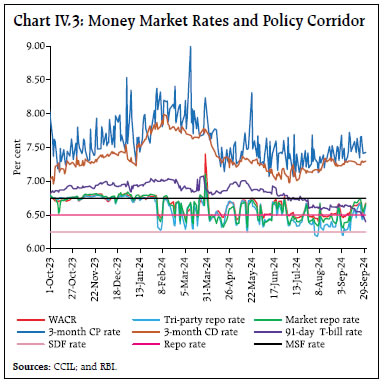

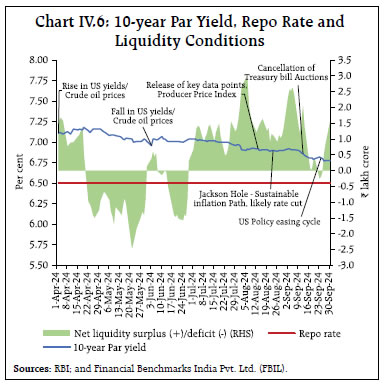

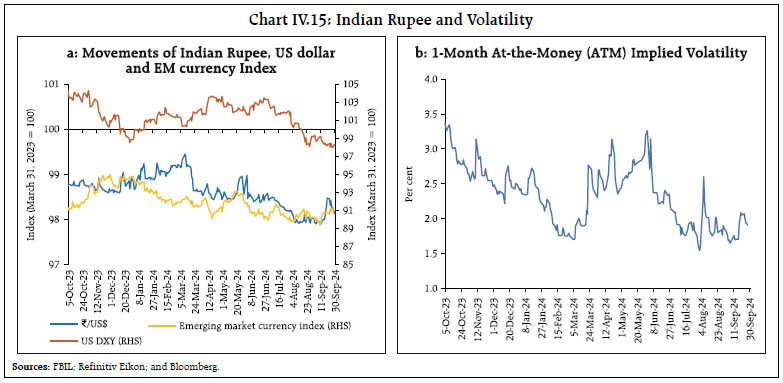

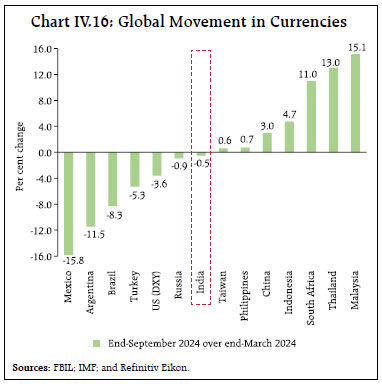

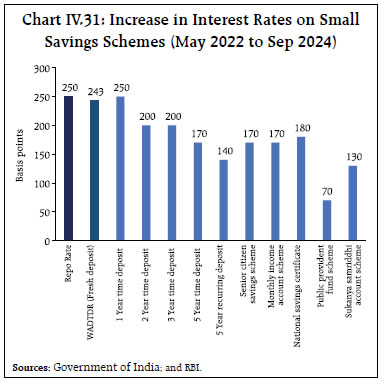

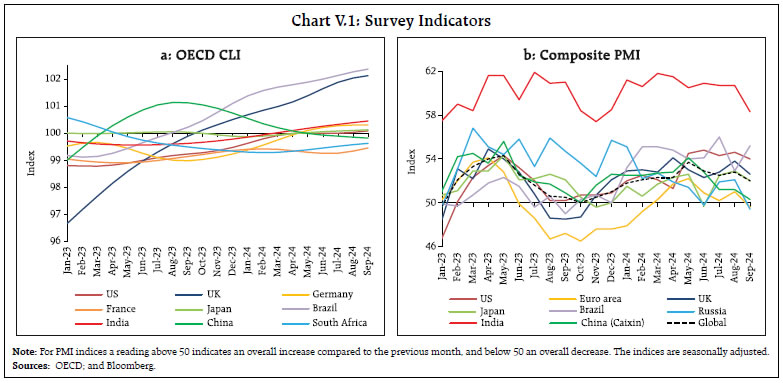

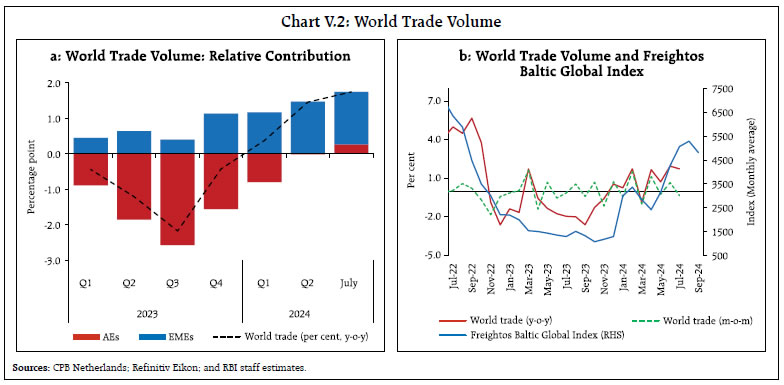

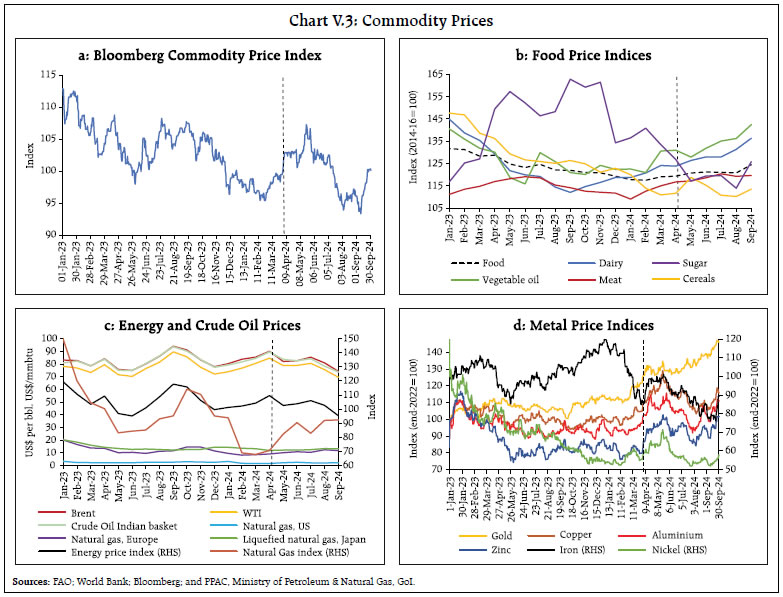

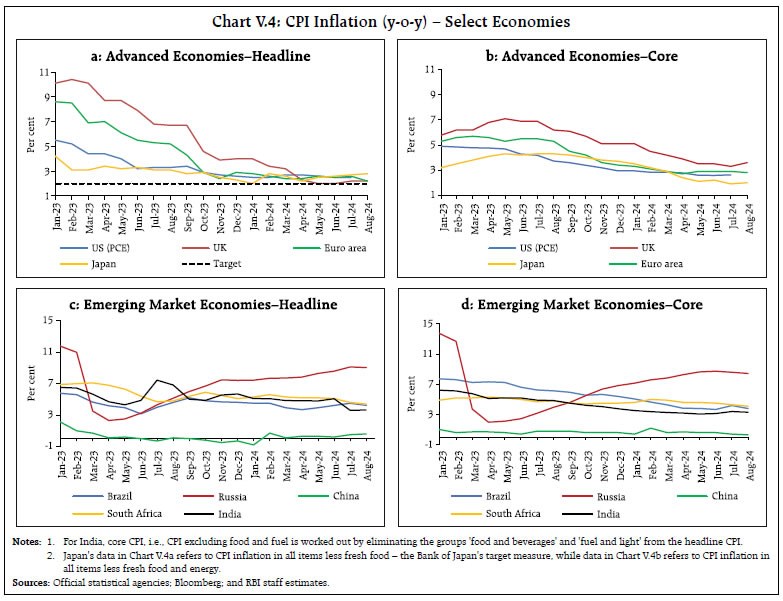

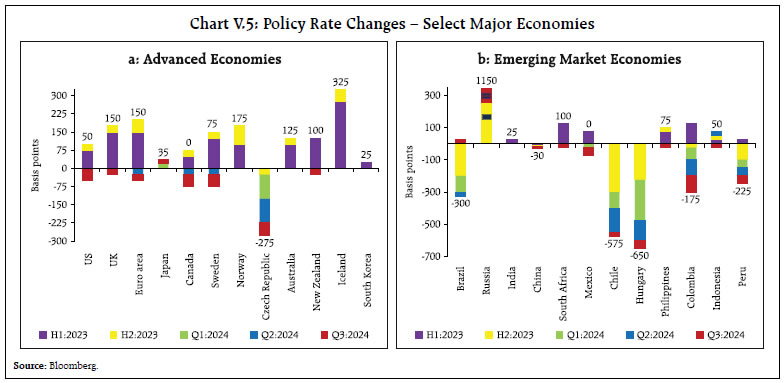

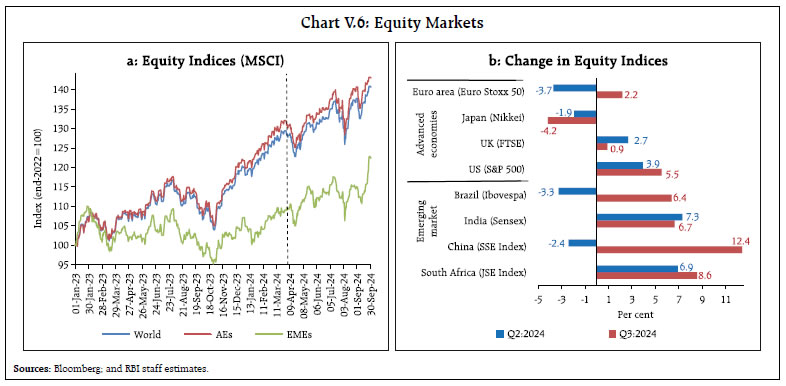

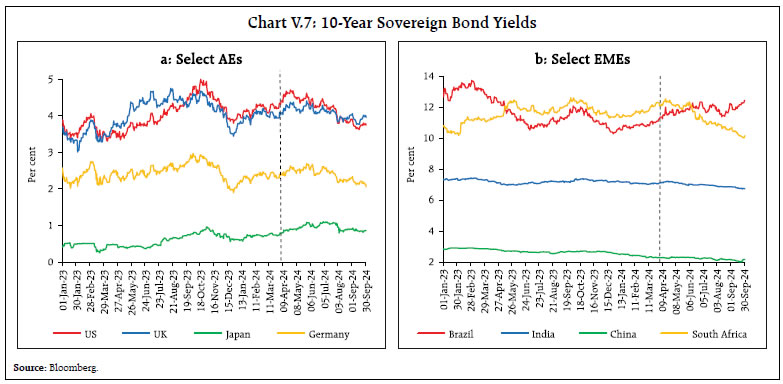

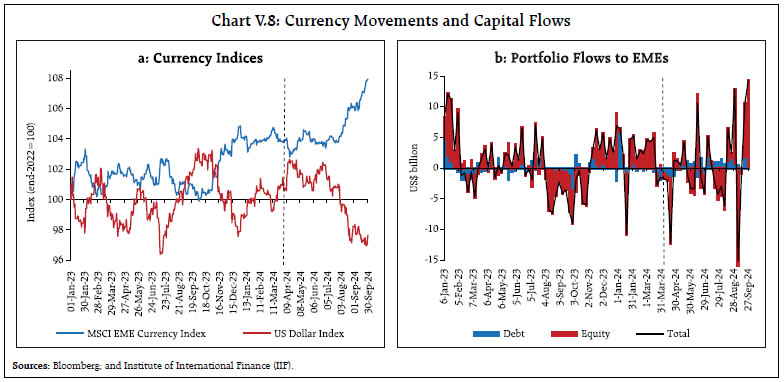

The outlook for domestic economic activity remains resilient buoyed by strong consumption and investment activities. Geopolitical conflicts, uncertain global outlook, volatile global financial markets amidst changing perceptions on monetary policy trajectories, and climate shocks are the key risks to the outlook. Monetary policy remains steadfast on aligning inflation with the target on a durable basis, setting strong foundations for a sustained period of high growth. I.1 Key Developments since the April 2024 MPR Since the release of the April 2024 Monetary Policy Report (MPR), global economic activity has shown resilience in the face of continuing geopolitical tensions and intermittent financial market volatility. Disinflation in headline inflation has been slow due to stubborn services inflation which is keeping core inflation (i.e., CPI inflation excluding food & fuel) elevated, relative to the headline. Several central banks have started easing monetary policy while others have maintained a restrictive stance, leading to divergence in policy pathways. Financial markets have been on edge, with incoming data shifting expectations about the direction of monetary policy. Sovereign bond yields have trended downwards on anticipation of policy pivots. Global equity markets have exhibited resilience, recovering quickly and regaining risk-taking appetite in spite of stretched valuations and still high leverage. Capital flows to emerging market economies (EMEs) have resumed albeit amidst heightened volatility. The US dollar index peaked in mid-June and receded thereafter on signs of cooling labour market conditions and easing inflation. Supply chain pressures have inched up since May driven by conflicts in the Middle East. Global commodity prices declined on the back of softening prices of base metals, agricultural products, and energy, however, price pressures have increased recently amidst heightened geopolitical tensions. Brent crude oil prices, that were hovering around US dollar (US$) 90 per barrel in April 2024, have since declined – even dipping below US$ 70 briefly – due to slowdown in demand and the Organization of the Petroleum Exporting Countries (OPEC) plus’ intent to gradually restore supplies. Of late, the US dollar index, sovereign bond yields and crude oil prices have inched up. International prices of most agricultural commodities have risen due to increase in prices of vegetable oil, dairy and meat. Turning to the domestic economy, real gross domestic product (GDP) grew by 6.7 per cent in Q1:2024-25 as per the National Statistical Office (NSO). Private consumption expenditure registered a growth of 7.4 per cent, contributing 63 per cent to overall GDP growth. Consumption spending has been robust in Q1:2024-25, supported by rural demand which is expected to improve further on the back of favourable monsoon, higher sowing activity and moderating inflation. Investment activity also maintained its momentum in Q1, supported by high capacity utilisation, continued buoyancy in steel consumption and capital goods imports. On the supply side, real gross value added (GVA) expanded by 6.8 per cent in Q1, with industry and services sectors being the key drivers. Headline consumer price index (CPI) inflation moderated to 4.4 per cent in April-August 2024 from 5.2 per cent in H2:2023-24. Base effects continue to have an outsized role in monthly inflation prints. Consequently, the moderation in headline inflation has been uneven. Core inflation was on a steadily declining path–in May 2024, it fell to its lowest level of 3.1 per cent in the current series (since January 2012) before increasing in July-August. Food price inflation, on the other hand, remained elevated, averaging 6.9 per cent over the last five months (April-August 2024), and contributing 72.5 per cent of headline inflation during the period. Recognising the risks from volatile and elevated food prices and its likely adverse impact on inflation expectations and spillovers to core inflation, the Monetary Policy Committee (MPC) kept the policy repo rate unchanged at 6.5 per cent through H1 and remained resolute in its commitment to aligning inflation with the target, while supporting growth. Monetary Policy Committee Meetings: April 2024 - September 2024 When the MPC met in April 2024, global economy was showing resilience and inflation was trending down. Financial markets were responding to the timing and pace of monetary policy trajectories, with heightened uncertainty pushing up gold prices on safe haven demand. The domestic economic momentum appeared strong, supported by healthy bank and corporate sector balance sheets and upbeat business and consumer sentiments. Hence, the real GDP growth projection for 2024-25 was retained at 7 per cent. CPI headline inflation had softened in January-February 2024 from its December high although food inflation edged up. The MPC noted the uncertainties around the inflation trajectory stemming from weather-driven food price shocks, cost push pressures, firming crude oil prices due to geopolitical tensions and volatility in financial markets, and retained the projection of CPI inflation for 2024-25 at 4.5 per cent. The MPC observed that food price pressures have been interrupting the ongoing disinflation process, posing challenges for the final descent of inflation to the target. Considering that the path of disinflation has to be sustained till inflation reaches the 4 per cent target on a durable basis, MPC also decided, by a 5-1 majority, to keep the policy repo rate unchanged at 6.5 per cent. The MPC decided by a majority of 5-1 to remain focused on withdrawal of accommodation so as to ensure that inflation progressively aligns with the target, while supporting growth. At the time of June 2024 meeting, global growth was sustaining momentum. Central banks remained steadfast and data-dependent in their fight against inflation, acknowledging that the final leg of disinflation might be tough. High frequency indicators for domestic economic activity showed resilience, with expectations of above normal monsoon brightening the prospects of agriculture sector and rural demand. Investment demand in the private sector was buoyed by high capacity utilisation and healthy balance sheet of banks and corporates while improving world trade was expected to support external demand. The projection of real GDP growth for 2024-25 was revised upwards by 20 basis points from the previous meeting to 7.2 per cent. In India, headline CPI inflation moderated for three successive months to 4.8 per cent in April 2024. Food inflation was persistently high while core inflation had fallen to historic lows. Nevertheless, the future inflation trajectory remained uncertain due to supply shocks, input cost pressures and crude oil price volatility. The projection of CPI inflation for 2024-25 was retained at 4.5 per cent. The MPC noted that while the growth-inflation balance had moved favourably since its previous meeting, risks to inflation remain from recurring food price shocks and monetary policy has to stay watchful of the spillovers of food price pressures to core inflation and inflation expectations. Accordingly, the MPC decided by a majority of 4-2 to keep the policy rate unchanged at 6.5 per cent. The MPC voted with a 4-2 majority to continue with the stance of withdrawal of accommodation. In the run up to August 2024 meeting, headline inflation, after remaining steady at 4.8 per cent during April and May 2024, increased to 5.1 per cent in June 2024, primarily driven by the food component even though fuel prices remained in deflation and core inflation touched new lows. Assuming a normal monsoon, CPI inflation projection for 2024-25 was retained at 4.5 per cent. Domestic economic activity was strengthening, with the pick-up in southwest monsoon rainfall and improved spatial spread translating into higher kharif sowing. Other high frequency indicators suggested expansion in services activity. A revival in private consumption has been underway with rural demand catching up with urban consumption. The pickup in investment activity gathered strength as reflected by expansion in steel consumption, high capacity utilisation and the government’s thrust on infra-spending. The projection of real GDP growth for 2024-25 was retained at 7.2 per cent. The MPC observed that risks from volatile and elevated food prices remain high, which may adversely impact inflation expectations and result in spillovers to core inflation. Accordingly, the MPC decided by a majority of 4-2 to keep the policy repo rate unchanged at 6.5 per cent while retaining the stance of withdrawal of accommodation. The MPC’s voting pattern reflects the diversity in individual members’ assessments, expectations and policy preferences - a characteristic also reflected in voting patterns of other central banks (Table I.1). With the emerging view that the disinflation process is in its final leg, a larger number of central banks have begun an easing cycle while others have retained policy rates at restrictive levels. EME central banks that began policy rate easing have undertaken larger cuts since April 2024 while two major advanced economies (AEs) the US and the United Kingdom - have begun their policy pivot in the second half of 2024. Macroeconomic Outlook Chapters II and III analyse macroeconomic developments relating to inflation and economic activity during H1:2024-25 (April-September 2024). Turning to the baseline assumptions, international crude prices exhibited sizeable two-way movements in H1, receding from their five-month peak of US$ dollar (US$) 91 per barrel in early April 2024 to US$ 77 per barrel by early June 2024 on slowing demand in Organization for Economic Cooperation and Development (OECD) countries and easing supply conditions. In September 2024, they were settling around US$ 71-78 per barrel. While global growth uncertainties on the demand side and geopolitical tensions on the supply side impart significant volatility to the outlook (Charts I.1a and I.1b), easing global demand-supply refinery divergences have reduced the wedge between global petroleum product prices and crude prices (Chart I.1c). Considering these factors, crude prices (Indian basket) are assumed at US$ 80 per barrel in the baseline as compared with US$ 85 in the April 2024 MPR (Table I.2).  Second, the nominal exchange rate of the Indian rupee (₹) saw two-way movements in the range of ₹83-84 per US$ in H1, with a depreciating bias since July 2024. Taking into consideration the uncertainty around US dollar movements, the ebbs and flows of global capital flows and international crude oil prices, the exchange rate is assumed at INR 83.5 per US dollar in the baseline as against INR 83 in the April 2024 MPR. Third, repeated geopolitical tensions, rekindled fears of a potential recession in key economies and financial market volatility in response to monetary policy divergence weigh heavily on global growth prospects. The global composite purchasing managers' index (PMI) has exhibited moderation since May 2024 with PMI manufacturing in contraction zone since July 2024. The IMF retained the global growth estimate for 2024 at 3.2 per cent and revised upwards its growth forecast for 2025 to 3.3 per cent in its July World Economic Outlook (WEO) compared with April 2024 update. With modest recovery on the global front, the projection for global growth in 2024 and 2025 is still below the historical annual average1 of 3.8 per cent. Inflation is projected to fall from 5.9 per cent in 2024 to 4.4 per cent in 2025. The pace of decline in inflation to targets, however, is likely to be faster in AEs vis-à-vis EMEs (Chart I.2). Global trade growth is estimated to rebound to 3.1 per cent in 2024 from 0.8 per cent in 2023, notwithstanding the surge in cross-border trade restrictions that pose risks to the global trade outlook.  In H1:2024-25 (up to August), headline inflation remained within the tolerance band while food inflation remained elevated and persistent (Chapter II). In the September 2024 round of the Reserve Bank’s survey2, the three months and one year ahead median inflation expectations of urban households reduced by 20 and 10 bps to 9.2 per cent and 10.0 per cent, respectively, vis-à-vis the previous round. The proportion of respondents expecting the general price level to increase by more than the current rate declined for both horizons vis-à-vis the previous round (Chart I.3). Manufacturing firms polled in the July - September 2024 round of the Reserve Bank’s industrial outlook survey expect pressures from cost of raw materials to continue, with some softening and selling price growth momentum to continue in Q3:2024-25 (Chart I.4a).3 Services sector companies and infrastructure firms expect input cost pressures to persist and selling prices growth to moderate in Q3:2024-25 (Charts I.4b and I.4c).4 In the PMI surveys for September 2024, input price indices of both manufacturing and services firms increased vis-à-vis the previous month while output prices decreased for both firms.    Professional forecasters surveyed by the Reserve Bank in September 2024 expect headline CPI inflation to increase from 4.0 per cent in Q2:2024-25 to 4.6 per cent in Q3, 4.4 per cent in Q4 and 4.2-4.5 per cent in H1:2025-26 (Chart I.5a and Table I.3).5 Core inflation (i.e., CPI excluding food and beverages, pan, tobacco and intoxicants, and fuel and light) is expected to successively increase from 3.5 per cent in Q2:2024-25 to 3.9 per cent in Q3 and is expected to remain between 4.2-4.3 per cent in the next three quarters.In the September 2024 round, their 5-year ahead expected inflation remained unchanged at 4.5 per cent, while their 10-year ahead expectations moderated to 4.3 per cent as compared to 4.5 per cent in the previous round (Chart I.5b). Looking ahead, evolving food inflation dynamics will impinge upon the outlook for inflation. The above normal south-west monsoon rainfall, significantly higher reservoir levels as compared to decadal average and higher kharif sowing vis-a-vis last year bode well for the inflation outlook. Nevertheless, rising global supply chain pressures, adverse weather events, volatile food prices and continuing geopolitical strife remain key risks. Taking into account the initial conditions, signals from forward-looking surveys and estimates from time-series and structural models6, CPI inflation is projected to average 4.5 per cent in 2024-25 – 4.1 per cent in Q2, 4.8 per cent in Q3 and 4.2 per cent in Q4, with risks evenly balanced (Chart I.6). The 50 per cent and the 70 per cent confidence intervals for headline inflation in Q4:2024-25 are 3.2-5.2 per cent and 2.6-5.8 per cent, respectively. For 2025-26, assuming a normal monsoon, and no further exogenous or policy shocks, structural model estimates indicate that inflation will average 4.1 per cent with 4.3 per cent in Q1, 3.7 per cent in Q2, 4.2 per cent in Q3 and 4.1 per cent in Q4. The 50 per cent and the 70 per cent confidence intervals for headline inflation in Q4:2025-26 are 2.8-5.4 per cent and 2.1-6.1 per cent, respectively.  The baseline forecasts are subject to several upside and downside risks. The upside risks emanate from uneven distribution of rainfall; prolonged geopolitical conflicts and resultant supply disruptions; recent uptick in food and metal prices; volatility of crude oil prices; and adverse weather events. The downside risks could materialise from an early resolution of geopolitical conflicts; weakening of global demand accompanied by further easing of global food and commodity prices; improvement in supply conditions; and proactive supply side measures by the government. Domestic economic activity remains resilient. Improved performance of industrial sector, upturn in investment activity, above normal monsoon, pick up in rural demand, high capacity utilisation, healthy balance sheets of banks and corporates, and the government’s continued thrust on infrastructure spending augur well for the growth outlook. Uncertain global economic outlook, lingering geopolitical conflicts, rising supply chain pressures, and volatile global financial conditions, however, weigh heavily on the outlook to the downside. Turning to the key messages from forward-looking surveys, consumer confidence (the current situation index) improved in the September 2024 survey round vis-à-vis the previous round on account of better perceptions about the general economic, employment, and income conditions. Consumers’ optimism for the year ahead, measured by the future expectations index, also improved in the latest round vis-à-vis the previous one (Chart I.7).7 Optimism in the manufacturing sector for Q3:2024-25 improved in the July- September 2024 round of the Reserve Bank’s industrial outlook survey (Chart I.8a). Services and infrastructure companies continue to maintain a highly optimistic outlook for Q3:2024-25 (Charts I.8b and I.8c).  Recent surveys by other agencies report sequential improvement in business expectations relative to the previous round (Table I.4). Manufacturing and services firms in the PMI surveys for September 2024 remained upbeat for the year ahead though a marginal deceleration in expectations is observed vis-à-vis the previous month for manufacturing firms. Professional forecasters polled in the September 2024 round of the Reserve Bank’s survey expected real GDP growth at 6.9-7.0 per cent during 2024-25 and 6.6-6.7 per cent during H1:2025-26 (Chart I.9 and Table I.3). Real GDP growth exceeded 8 per cent growth in the first three quarters of 2023-24 before dipping marginally to 7.8 per cent in Q4. Real GDP growth of 6.7 per cent in Q1:2024-25 is reflective of the underlying momentum in key drivers of the economy viz., private consumption and investment. Taking into account the baseline assumptions, survey indicators and model forecasts, real GDP growth is expected at 7.2 per cent in 2024-25 with 7.0 per cent in Q2; 7.4 per cent both in Q3 and Q4 - with risks evenly balanced around the baseline (Chart I.10 and Table I.3). For 2025-26, assuming a normal monsoon and no major exogenous or policy shocks, structural model estimates indicate real GDP growth at 7.1 per cent, with Q1 at 7.3 per cent, Q2 at 7.2 per cent, Q3 and Q4 both at 7.0 per cent.   There are upside and downside risks to this baseline growth path. The upside risks emanate from robust government capex and revival in private investment; improved prospects of agricultural sector due to favourable monsoon rainfall; strengthening manufacturing and services sector activity sustained by strong domestic demand; retreating global and domestic inflation; improvement in global trade; and earlier than anticipated easing of global financial conditions. On the contrary, further escalation in geopolitical tensions; volatility in international financial markets and geoeconomic fragmentation; deceleration in global demand; frequent weather-related disturbances due to climate change; and supply chain disruptions pose downside risks to the baseline growth path.  The baseline projections of growth and inflation are conditional on assumptions of the future path of key domestic and global macroeconomic variables set out in Table 1.2. These baseline assumptions are, however, subject to uncertainties emanating from prolonged geopolitical conflicts, volatility in global financial markets and recurrent adverse climate events. In this context, this section explores the plausible alternative scenarios to assess the balance of risks around the baseline projections. (i) Global Growth Uncertainties Global economic activity is subject to uncertainties going forward. Policy divergence among major central banks could trigger heightened volatility in global financial markets, with spillovers to emerging market economies. Services price and wage inflation remain areas of concern for the last mile of disinflation which might keep global interest rates higher for longer, with adverse impact on global growth prospects. The global economic outlook is also subject to headwinds from prolonged geopolitical and trade tensions, supply chain disruptions and swings in economic policies resulting from impending elections in major economies. In case these downside risks materialise, and, if global growth is 100 bps lower than the baseline, domestic growth and inflation could be lower than baseline projections by around 30 bps and 15 bps, respectively. If, however, there is faster convergence in global disinflation and alignment in monetary policy paths going forward, recovery in global trade and resolution of geopolitical tensions, there can be an upside to global growth. If global growth is higher by 50 bps, domestic growth and inflation could turn out to be higher by around 15 bps and 7 bps, respectively (Charts I.11a and I.12a). (ii) International Crude Oil Prices Global crude oil prices have exhibited some moderation, with Brent crude falling from a high of US$ 93 per barrel in mid-April 2024 to US$73 per barrel by end-September. Global growth recovery, continuation of geo-political tensions and non-reversal of production cut by OPEC plus may put upward pressure on crude oil prices. In this scenario, assuming crude oil price to be 10 per cent above the baseline and full pass-through to domestic product prices, domestic inflation could be higher by 30 bps and growth weaker by around 15 bps, respectively. Conversely, early resolution of geopolitical tensions, weak global demand, higher production from non-OPEC economies along with unwinding of production cuts by OPEC plus may soften crude oil prices. If crude oil prices fall by 10 per cent relative to the baseline, inflation could ease by around 30 bps with a boost of 15 bps to India’s real GDP growth (Charts I.11a and I.12a).   (iii) Exchange Rate The Indian Rupee (INR) has remained steady against the US dollar, being least volatile among major EME currencies in recent months. Going ahead, restrictive monetary policy by major AEs to achieve the last mile of disinflation could limit attractiveness of EME assets and trigger reversal of capital flows. Crude oil and other global commodity prices could also harden in comparison with the baseline. In this scenario, if INR depreciates by 5 per cent over the baseline, inflation could be higher by around 35 bps while GDP growth could edge up by around 25 bps through short term stimulation of exports. On the other hand, the Indian economy remains the fastest growing major economy globally and is poised to play an important role in revival of global growth. These developments, along with robust domestic macroeconomic fundamentals, inclusion of government bonds in global indices, and faster than anticipated monetary policy easing by AEs would attract foreign investors. In this scenario, if the INR appreciates by 5 per cent relative to the baseline, inflation and GDP growth could moderate by around 35 bps and 25 bps, respectively (Charts I.11b and I.12b). (iv) Food Inflation Food inflation remained persistently high in H1:2024-25, driven by high prices in cereals and pulses along with large shocks to vegetable prices triggered by recurrent adverse climate events of rising intensity. Further, food prices may be subject to extreme weather events such as excess rains and floods affecting kharif crops, unseasonal rains typically associated with extreme La Niña conditions, which may result in damage of winter crops and perishables. In such a scenario, there could be upward pressures on food prices and could raise headline inflation by around 50 bps over the baseline. Persistent shocks to food inflation warrant a cautious approach by monetary policy to contain spillover effects (Box I.1). On the other hand, kharif sowing remained robust, with higher acreage for major crops. Reservoir levels, too, are higher than both last year’s levels and the decadal average, which augurs well for the rabi season. These developments along with effective supply management measures may result in easing of food inflation pressures and could lower headline inflation by 50 bps compared with the baseline (Charts I.11b and I.12b).

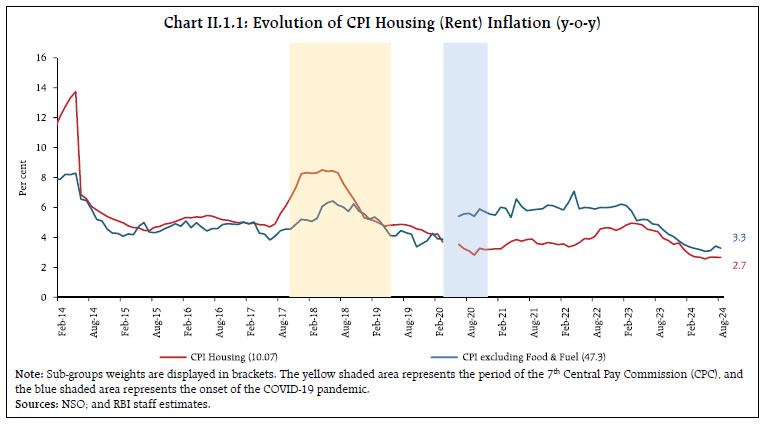

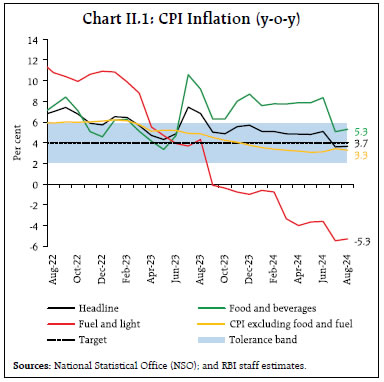

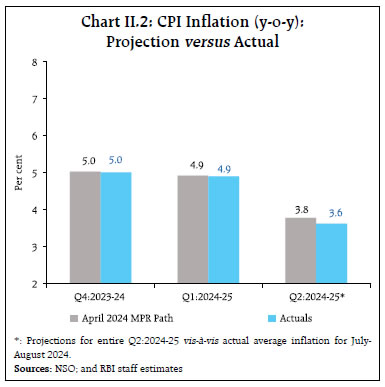

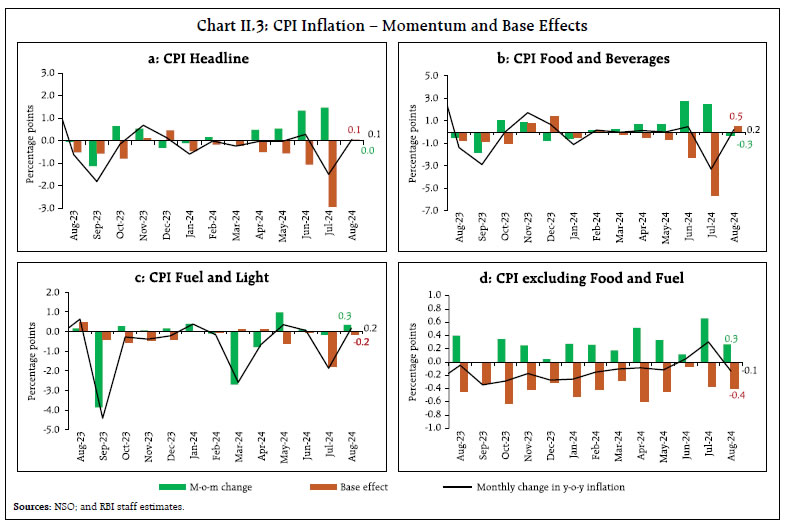

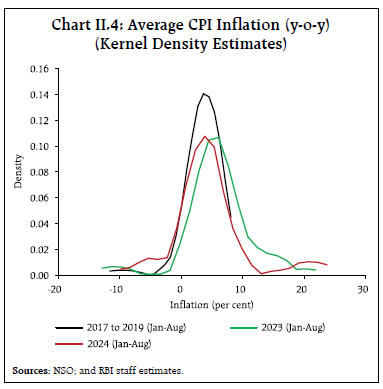

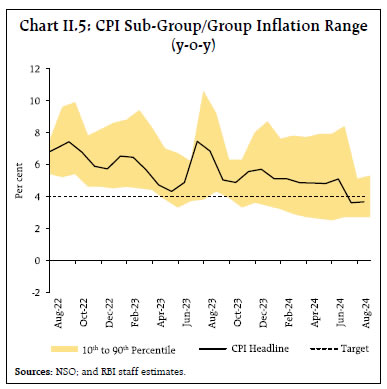

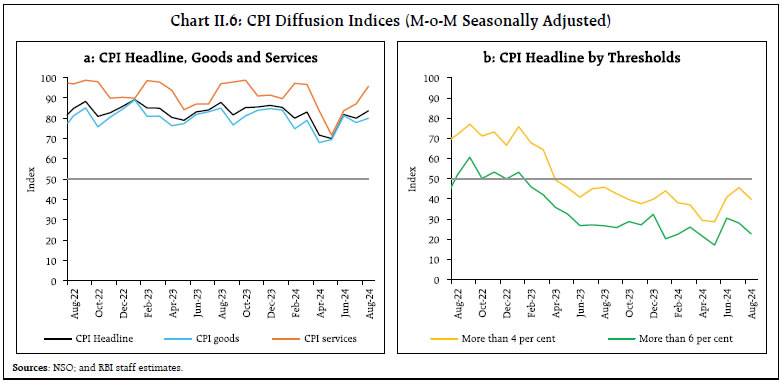

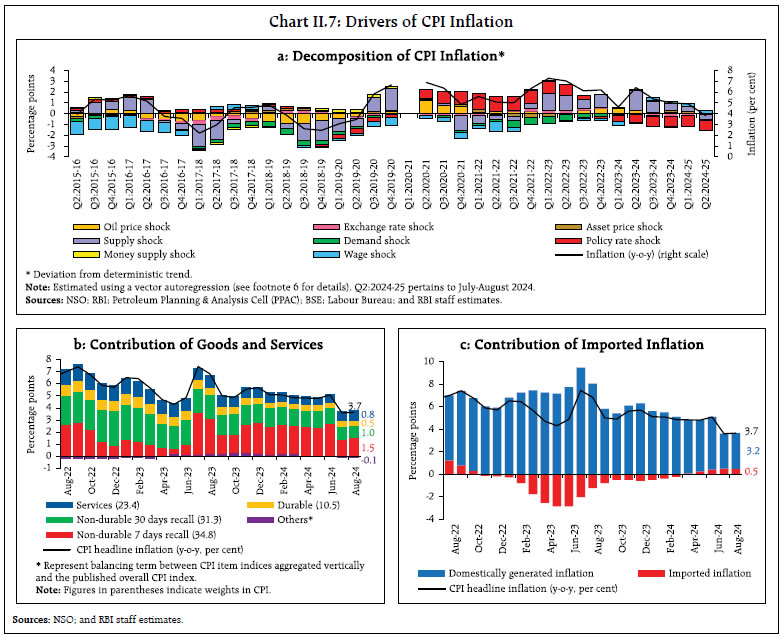

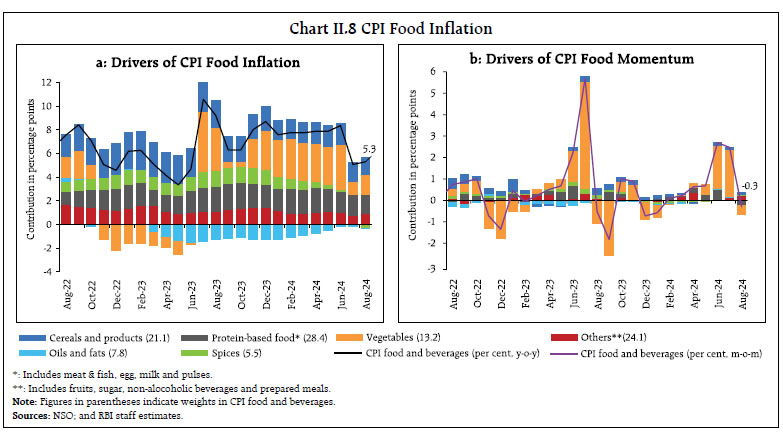

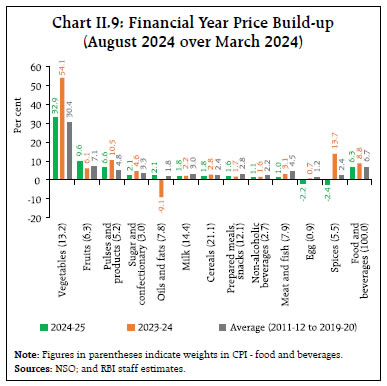

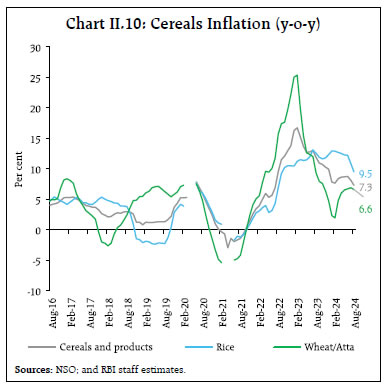

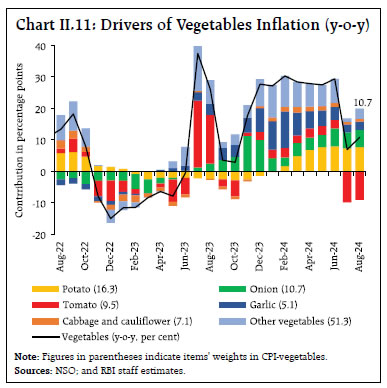

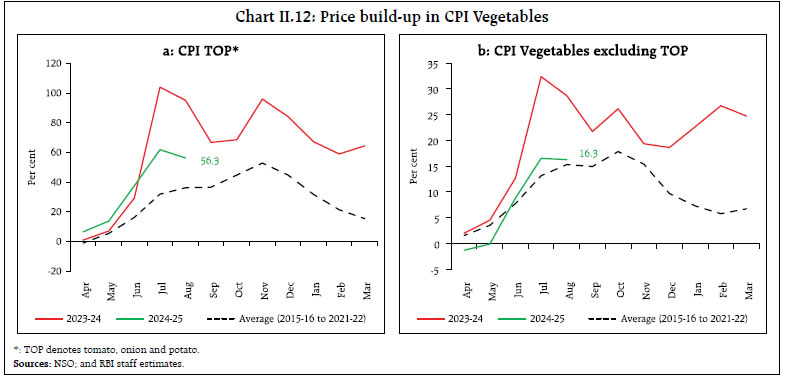

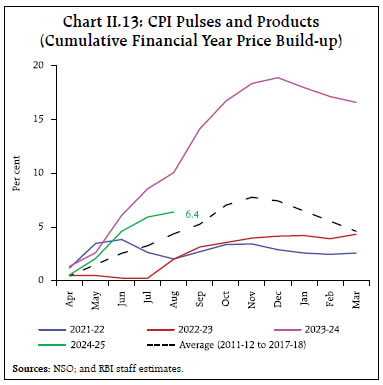

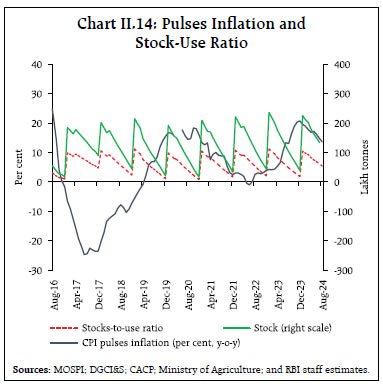

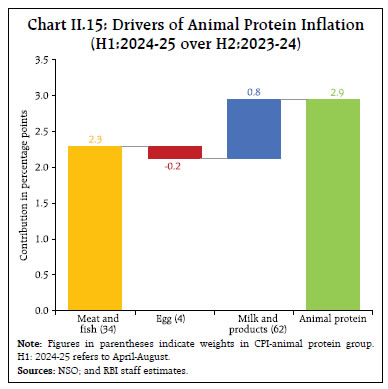

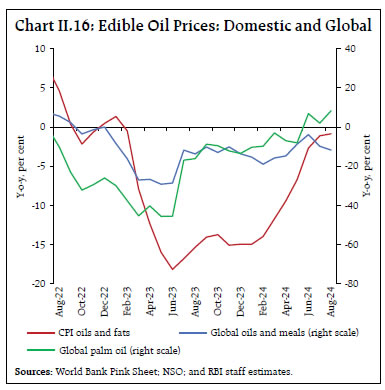

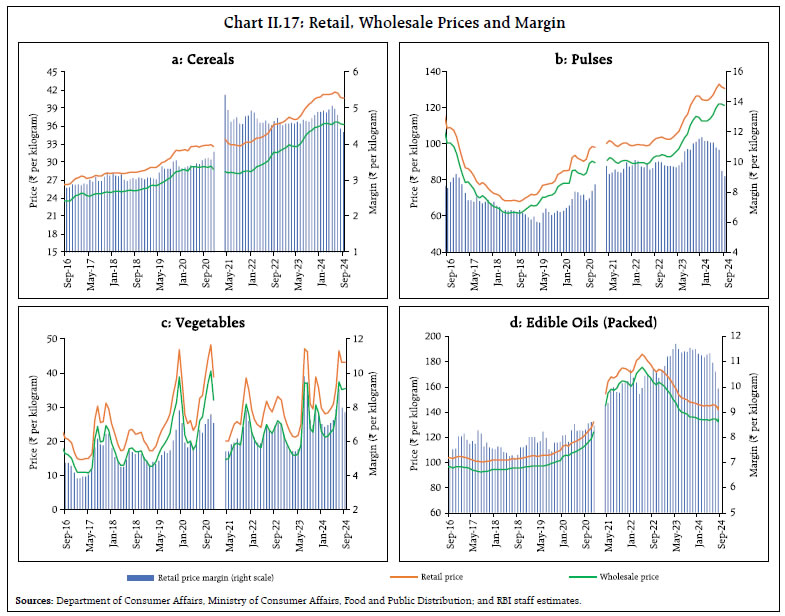

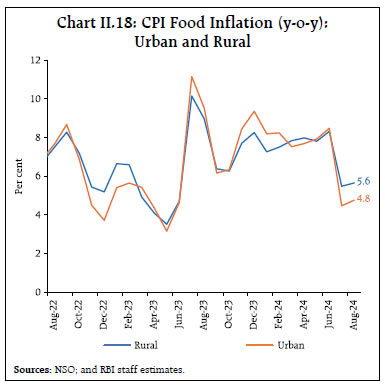

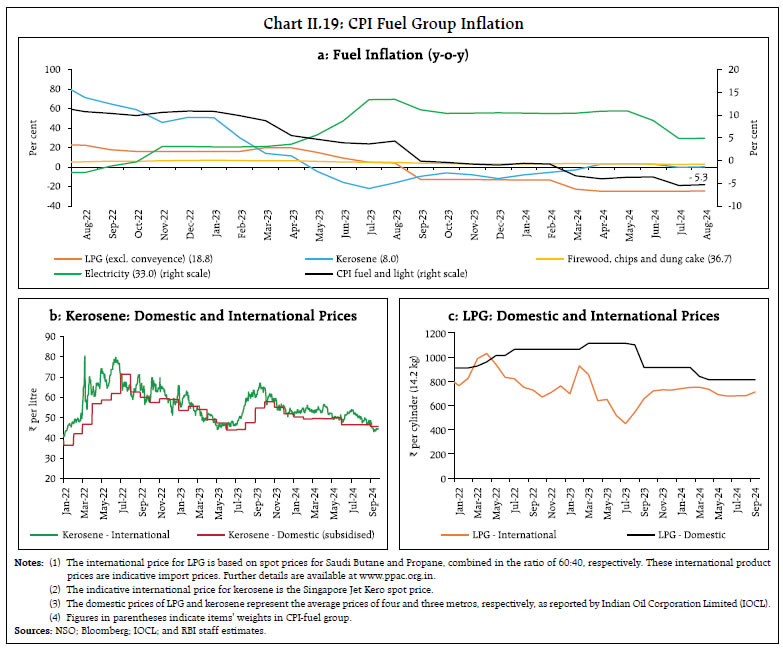

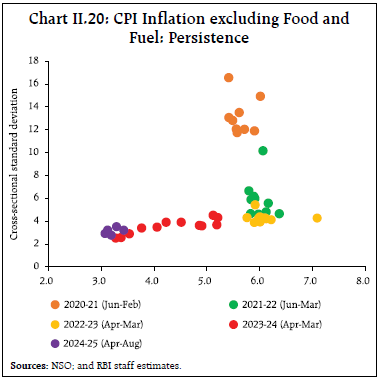

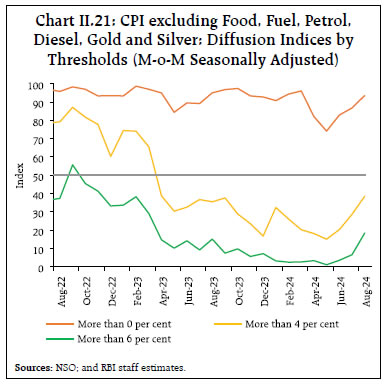

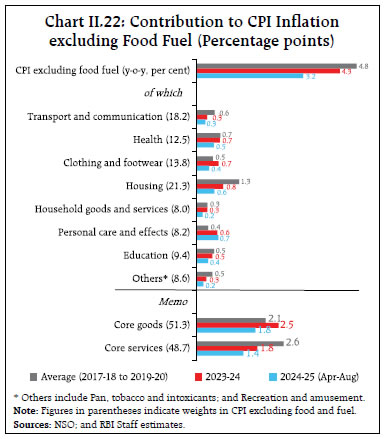

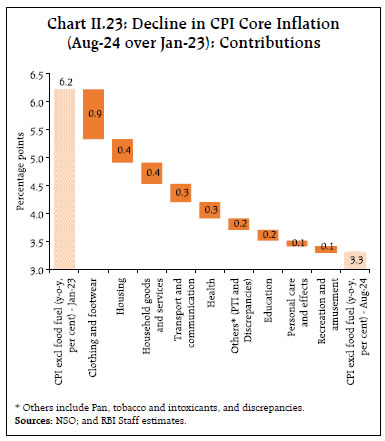

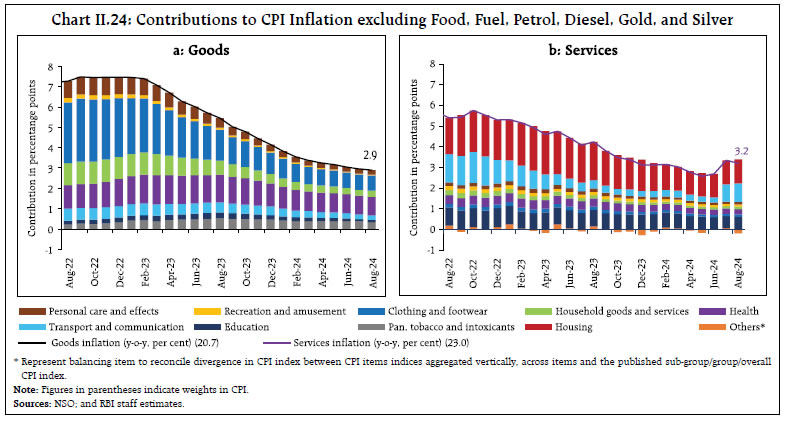

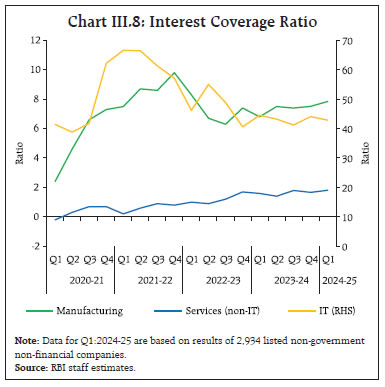

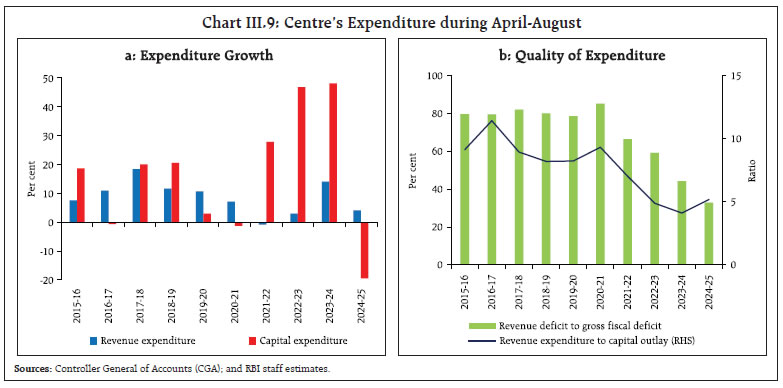

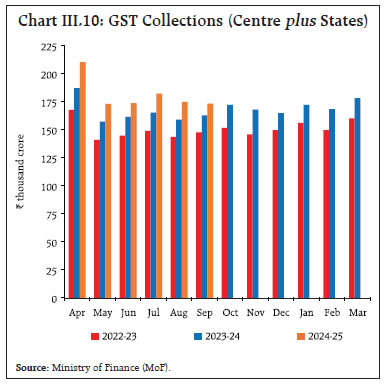

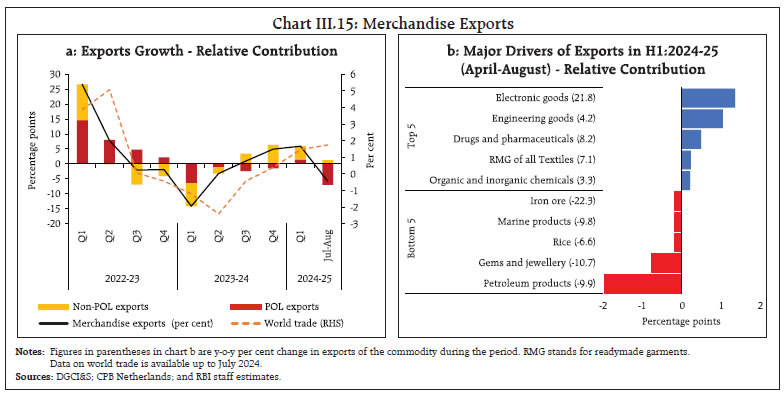

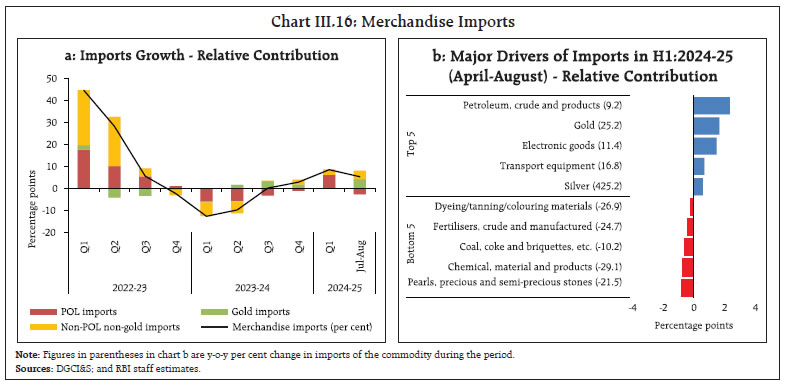

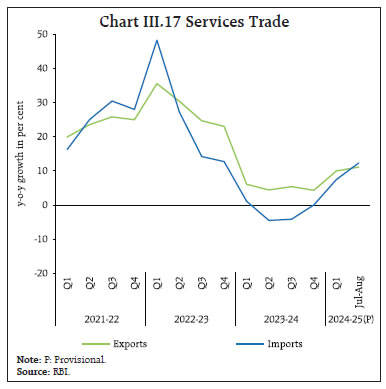

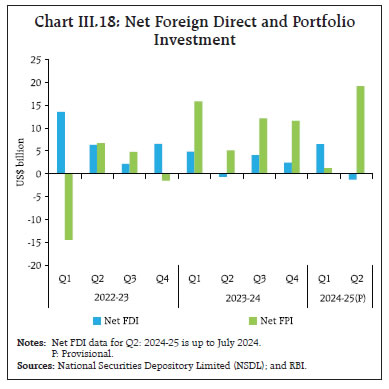

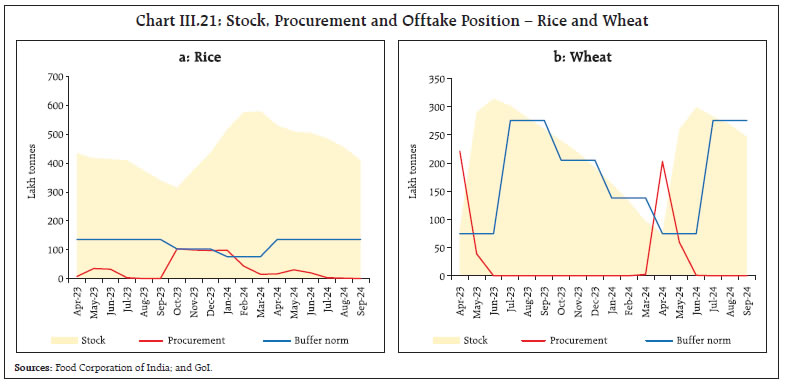

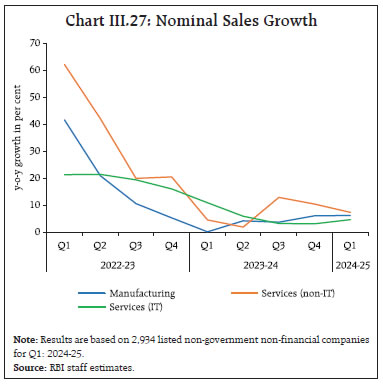

Domestic economic activity is expected to remain robust on the back of strong fundamentals. The revival of private consumption is buoyed by receding inflation and pick-up in rural demand is expected to be its mainstay. The Government’s capex push on infrastructure, upturn in investment activity, improved prospects of agricultural sector, strong corporate and bank balance sheets and improved outlook of global growth and trade are further aiding the growth momentum. Headline inflation is on a downward trajectory and is expected to moderate further in 2024-25, though the pace may be slow and uneven. Core inflation has bottomed out but remains subdued, supported by disinflationary monetary policy. The last mile of disinflation is contingent upon reining in food inflation and checking its spillover impact on inflation expectations and core inflation. Monetary policy remains steadfast on aligning inflation with the target. Geopolitical conflicts, uncertain global outlook, volatile global financial markets, and climate shocks remain key risks to the growth and inflation outlook. _________________________________________________________________________________ 1 Historical annual average during 2000 - 2019. 2 The Reserve Bank’s inflation expectations survey of households is being conducted in 19 cities since March 2021 (18 cities in the previous rounds) and the results of the September 2024 round are based on responses from 6,076 households. 3 The results of the July-September 2024 round of the industrial outlook survey are based on responses from 1,300 companies. 4 Based on 622 services companies and 139 infrastructure firms polled in the July-September 2024 round of the services and infrastructure outlook survey. 5 47 panellists participated in the September 2024 round of the Reserve Bank’s survey of professional forecasters. 6 Joice John, Deepak Kumar, Asish Thomas George, Pratik Mitra, Muneesh Kapur and Michael Debabrata Patra (2023), “A Recalibrated Quarterly Projection Model (QPM 2.0) for India”, Reserve Bank of India Bulletin, February, Volume LXXVII(2), pp.59-77. 7 The Reserve Bank’s consumer confidence survey is being conducted in 19 cities since March 2021 (13 cities in the previous rounds) and the results of the September 2024 round are based on responses from 6,087 respondents.  Headline CPI inflation after remaining sticky till June 2024, fell sharply thereafter buoyed by favourable base effects. The wedge between headline and core inflation widened further in June, before moderating in July-August. Input costs have remained subdued while rural wages and manufacturing staff cost growth decelerated. Headline consumer price index (CPI) inflation1 remained sticky at around 5 per cent during March to June 2024, with key groups displaying considerable divergence. Food inflation edged up from an elevated level of 7.8 per cent in February 2024 to 8.4 per cent by June under the impact of repeated supply-side shocks. Deflation in fuel prices deepened from (-)0.8 per cent in February to (-)3.6 per cent in June. Core (CPI excluding food and fuel) inflation2 softened from 3.4 per cent to 3.1 per cent over the same period, the lowest reading recorded in the current CPI (2012=100) series so far. The wedge between headline and core inflation widened, from 1.7 percentage points in February 2024 to 2.0 percentage points in June. In July-August 2024, headline CPI inflation fell sharply to 3.6-3.7 per cent, buoyed by large favourable base effects in July, which also pulled food inflation down to 5.1-5.3 per cent. Core inflation edged up to around 3.4 per cent in July-August, primarily on account of a pick-up in core services inflation, while deflation in fuel prices intensified (Chart II.1). The Reserve Bank of India (RBI) Act enjoins the RBI to set out deviations of actual inflation outcomes from projections, if any, and explain the underlying reasons thereof. The April 2024 MPR had projected inflation at 4.9 per cent in Q1:2024-25 and 3.8 per cent in Q2:2024-25 (Chart II.2). Actual inflation outcomes have largely mirrored these projections. The projections of a significant softening of inflation in Q2 (July to September), induced by large favourable base effects in July, was also confirmed by actual inflation outcomes. The projections for Q2 (July-September) had also factored in a likely pick-up in inflation in September due to adverse base effects.   Inflation dynamics in 2024-25 so far (April to August) have undergone two distinct phases. First, after moderating to 4.9 per cent in March from 5.1 per cent in February, on favourable base effects and a sharp fall in fuel price momentum3, headline inflation remained steady at 4.8 per cent in April-May and edged up thereafter to 5.1 per cent in June due to a sharp pick up in price momentum triggered by an increase in food prices, notwithstanding significant favourable base effects. In the second phase from July, CPI price momentum remained firm across food and core groups, while statistical gains from favourable base effects pulled down headline CPI inflation by 1.5 percentage points to 3.6 per cent. In August, the modest increase in headline inflation by 5 basis points (bps) to around 3.7 per cent reflected base effects only as the overall prices remained unchanged (Chart II.3). The distribution of CPI inflation in 2024 so far (January-August) reflects a lower median and mean along with lower standard deviation than a year ago when large and multiple food price shocks had played an outsized role (Chart II.4). Stickiness in headline inflation between January-June 2024 was accompanied by a considerable divergence in food, fuel and core inflation trajectories. In July-August, a fall in food inflation led to narrowing of these divergences (Chart II.5).   Diffusion indices (DIs)4 remained in high expansionary zone between March and August 2024, indicative of positive price increases across a broad spectrum of the CPI basket. After recording a transient uptick in March 2024, headline CPI DI dipped in April-May across both goods and services components. During June-August 2024, headline CPI DI edged up due to wider dispersion of price increases, first in goods and thereafter in services (Chart II.6a). Threshold DI5 – for price increases in excess of 4 per cent as well as 6 per cent on a seasonally adjusted annualised rate (saar) basis – continued to remain well below the 50 level mark, indicating little incidence of any broad-basing of such price momentum (Chart II.6b).   A historical decomposition of inflation using a vector autoregression (VAR)6 model indicates that the moderation in inflation in Q2:2024-25 stemmed from the negative contribution of supply side shocks to overall inflation - after being the major driver of inflation in the last four successive quarters - and from the disinflationary impact of past monetary policy actions (Chart II.7a). Goods inflation (with a weight of 76.6 per cent in the overall CPI) contributed around 88 per cent of headline inflation between March and June 2024 and around 82 per cent in July and August 2024 (Chart II.7b). The contribution of services (with a weight of 23.4 per cent) edged up over this period due to the pick-up in mobile tariffs. The increase in the contribution of perishable items (non-durable with a 7-day recall7), which include vegetables, spices, fruits and other food items such as milk, meat and fish and prepared meals, contributed to the stickiness in inflation in Q1. The contribution of semi-perishables (non-durable goods with a 30-day recall) to overall inflation remained broadly unchanged with cereals, pulses, and personal care items being the main inflation drivers. The contribution of durable items (goods with a 365-day recall) to overall inflation edged up during April-August 2024, primarily reflecting the uptick in gold prices.  The contribution of imported components8 to headline inflation turned positive from April 2024 and increased gradually to 0.5 percentage points by August 2024, driven by higher gold and silver prices (Chart II.7c). CPI Food Group Food and beverages (weight of 45.9 per cent in the CPI basket) inflation exhibited distinct phases during the year so far. It averaged 8.0 per cent during April-June 2024, as weather disturbances such as heatwave conditions and uneven rainfall distribution, as well as tight supply conditions led to inflationary pressures in vegetables, cereals, and pulses. There was, however, a sharp moderation in food inflation to 5.1 per cent in July 2024, as favourable base effects more than offset a significant pickup in momentum. In August, despite a decline in food price momentum, food inflation increased to 5.3 per cent due to unfavourable base effects (Chart II.8). The food price build-up during 2024-25 so far (up to August) has been substantial, although lower than last year and the long-term historical average. High vegetable prices contributed a disproportionately large share to this build-up for the second successive year in a row (Chart II.9).   Cereals (weight of 9.7 per cent in the CPI and 21.1 per cent in the food and beverages group) inflation remained elevated at an average of 8.3 per cent during April-August 2024 (Chart II.10). Within cereals, rice inflation remained in double digits, despite export restrictions, reflecting tight supply conditions due to lower rabi and summer production [(-)2.4 per cent year-on-year (y-o-y) in 2023-24]. For effective supply management and price stabilisation, government has announced several measures including the retail sale of ‘Bharat Rice’ and allowing rice-deficient states to directly purchase rice from the Food Corporation of India at a fixed price of ₹2800/quintal under the Open Market Sale Scheme (OMSS) from August 2024. The buffer stocks of rice (3.0 times the norm as of September 16, 2024) are comfortable and kharif sowing has been higher by 2.5 per cent in 2024-25 as on September 27, 2024 compared to the corresponding period of last year, which are likely to improve supply conditions and contain price pressures. With signs of easing of supply conditions, government has lifted the ban on exports of non-basmati white rice subject to a minimum export price (MEP) of $490/tonne, while removing the MEP on Basmati rice in September 2024 to support farmers’ price realisation. Wheat inflation, on the other hand, was moderating till February 2024, but it hardened thereafter to reach 6.6 per cent in August, reflecting lower buffer stocks (0.9 times the norm as of September 16, 2024) and lower mandi arrivals than in 2023-24. Wheat inflation was elevated despite higher production and price stabilisation measures, including the imposition of stock limits for traders/wholesalers and retailers till March 2025, the likely offloading of stocks under the OMSS and continued restrictions on wheat exports.  Vegetables (weight of 6.0 per cent in the CPI and 13.2 per cent in the food and beverages group) inflation remained elevated till June 2024, but witnessed a sharp correction in July primarily because of favourable base effect (Chart II.11). The price momentum, however, remained firm in July, reflecting lower production [(-)3.2 per cent in 2023-24 over 2022-23 as per 3rd advance estimates (AE) 2023-24] and supply disruptions due to heatwave conditions in parts of northern India, excess rains in parts of central and southern India and the resultant lower market arrivals. As supplies resumed, vegetable prices declined in August, particularly from a sharp correction in tomato prices.  Among key vegetables, potato prices, on a y-o-y basis, increased sequentially in 2024, reaching 65 per cent in July-August, driven by production shortfalls [(-)5.1 per cent in 2023-24 over 2022-23 as per 3rd AE 2023-24] due to unseasonal rains and prolonged spells of fog and cold conditions during winter in the major producing states of Uttar Pradesh, West Bengal, and Bihar. Onion prices moderated during January-February 2024, but started rising again, recording a y-o-y inflation of 60.6 per cent in July 2024 and 54.1 per cent in August due to deficient production [(-)19.7 per cent in 2023-24 over 2022-23 as per 3rd AE 2023-24]. For effective supply management, onion exports were allowed and 40 per cent export duty with a MEP of $550 per metric tonne was imposed in May 2024. Subsequently, in September 2024, the export duty was reduced to 20 per cent, and MEP was removed, allowing free shipments of onion. Tomato price increase, which averaged around 37 per cent during December 2023-June 2024 on a y-o-y basis, was on account of tight supply conditions induced by heatwaves and unseasonal rainfall. Prices declined by (-)43.0 per cent, on a y-o-y basis, in July 2024 as a strong favourable base effect outweighed the substantial increase in price momentum. Softening in prices in August further pulled down tomato inflation to (-)47.9 per cent. Vegetables excluding TOP (tomato; onion; and potato), particularly garlic, also witnessed considerable price build-up in Q1:2024-25, emerging as another major driver of vegetables inflation (Chart II.12).  Inflation in fruits (weight of 2.9 per cent in the CPI and 6.3 per cent within the food and beverages group) eased in July on a strong favourable base effect, after rising during April-June 2024 to 6.3 per cent on average. In August, it rose to 6.5 per cent despite higher production (2.3 per cent in 2023-24 over 2022-23 as per the 3rd AE), with price increases primarily driven by bananas, apples and mangoes. Inflation in groundnut prices, however, moderated from around 10.4 per cent in December 2023 to 1.7 per cent in July 2024 before falling into the deflationary zone at (-)1.5 per cent in August 2024, on account of higher kharif production (1.1 per cent in 2023-24). Pulses, the primary source of plant-based protein (weight of 2.4 per cent in the CPI and 5.2 per cent in the food and beverages group), continued to record double-digit inflation due to deficient kharif and rabi production [(-)7.0 per cent in 2023-24 over 2022-23] on top of a decline in production in 2022-23. Within pulses, lower production of gram [(-)10 per cent in 2023-24], urad [(-)11.9 per cent] and moong [(-)15.6 per cent] as well as subdued production in tur (3.2 per cent increase in 2023-24 over 2022-23 against 21.5 per cent decline in 2022-23) were the primary drivers of price pressures (Chart II.13). Inflation in pulses prices moderated to 13.6 per cent in August 2024 on interventions to ease supply conditions through imposition of stock limits on tur and gram (till September 30, 2024), extension of free import policy for yellow peas (till December 31, 2024), and tur and urad (till March 31, 2025), weekly stock disclosure requirements for five major pulses, and sale of chana dal under the brand ‘Bharat Dal’. As a result, the stock-to-use ratio improved to 6.8 per cent during April-August 2024 from 6.5 per cent during the corresponding period of 2023 (Chart II.14). Animal-based protein items exhibited high and volatile inflation movements during April-August 2024. Inflation in prices of meat and fish (weight of 3.6 per cent in the CPI and 7.9 per cent in the food and beverages group) averaged 6.2 per cent during April-August 2024. Inflation in the price of eggs (weight of 0.43 per cent in the CPI and 0.9 per cent in the food and beverages group) exhibited considerable volatility, falling from 10.3 per cent in March to 4.1 per cent in June before increasing to 7.1 per cent in August. Inflation in milk and products (weight of 6.6 per cent in the CPI and 14.4 per cent within the food and beverages group) has remained range bound at around 3 per cent during April-August. Although milk price hikes by several cooperatives, including Amul and Mother Dairy, in June 2024 led to higher price momentum in June, it was offset by favourable base effects (Chart II.15).     Prices of oils and fats (weight of 3.6 per cent in the CPI and 7.8 per cent within the food and beverages group) remained in deflation during April-August 2024 on higher imports and lower international prices of major edible oils (Chart II.16). The pace of deflation, however, moderated, with continued positive momentum reflecting pick-up in international edible oil prices as well as lower domestic production of oilseeds in the 2023-24 season [(-)4.1 per cent in 2023-24 over 2022-23]. The current kharif season sowing of oilseeds has been encouraging, particularly for groundnut. In January 2024, the regime of lower import duties on crude palm, sunflower and soyabean oil were extended till March 2025. To improve domestic price realisation, however, the import duty on crude and refined edible oils has been hiked by 20 percentage points in September 2024. Among other items in the oils and fats sub-group, inflation in ghee and butter prices continued to moderate. Inflation in prices of sugar and confectionery (weight of 1.4 per cent in the CPI and 3.0 per cent in the food and beverages group) has moderated in 2024-25 compared to H2:2023-24 despite lower sugarcane production [(-)7.6 per cent in 2023-24 over 2022-23]. Measures to augment domestic availability of sugar include extension of export restrictions, and imposition of 50 per cent export duty on molasses used for ethanol production as well as restriction on the use of sugarcane juice and syrup for ethanol production since December 2023. The restrictions on sugar diversion for ethanol production were, however, eased in August 2024. Among other food items, inflation in spices moderated on a sustained basis since April 2024 and slipped into deflation since July after recording double-digit inflation for a 22-month period till March 2024. The recent decline was led by jeera and dry chillies, on account of higher spices production (5.5 per cent as per 3rd AE in 2023-24 over 2022-23). Inflation in prices of prepared meals has moderated gradually, reflecting the pass-through of lower input costs. Retail Margins Retail price margins – the difference between retail and wholesale prices9 – in the case of cereals edged up during March-May 2024 and thereafter started to decline from June 2024 onwards to ₹4.3 per kg, the lowest since December 2020. After recording a sustained increase between September 2023 and January 2024, pulses price margins witnessed a sustained decrease during February-September 2024. Retail price margins in edible oils continued to soften since June 2024, primarily due to the moderation in the margin of refined oils. Retail price margins of TOP vegetables started firming up from March 2024 onwards (Chart II.17).  Sectoral and Spatial Distribution of Food Inflation Heightened CPI food inflation pressures were seen across both rural and urban areas, with average rural food inflation during April to August 2024 outpacing its urban counterpart (Chart II.18).  Spatially, food inflation pressures have heightened – the number of states/UTs with food inflation higher than 6.0 per cent in the period April-August 2024 has increased to 20 vis-à-vis 16 in the corresponding period a year ago (Table II.1). CPI Fuel Group The deflation in fuel prices deepened from (-)0.8 per cent in February 2024 to (-)5.3 per cent in August 2024, reflecting the cumulative impact of the LPG price reduction in August 2023 and March 2024. Fuel deflation was also aided by softening of price pressures, on a y-o-y basis, in kerosene, reflecing the pass-through of lower international prices, as well as in firewood and chips, and dung cake. Electricity prices also moderated sharply from a record high of 13.5 per cent in August 2023, on a y-o-y basis, to 4.8-4.9 per cent in July-August 2024 (Chart II.19).  Core CPI (CPI excluding Food and Fuel Groups) Core (CPI excluding food and fuel) disinflation continued during H1 of 2024-25 (April-August) as it softened to 3.1 per cent by May-June 2024. This sustained sequential softening observed for more than a year (since June 2023) was disrupted in July-August 2024 with core inflation averaging 3.4 per cent, primarily reflecting the impact of mobile tariff revisions. Exclusion-based measures of underlying inflation, which remove volatile items such as petrol, diesel, gold, and silver in addition to food and fuel, also witnessed similar movements during this period (Chart II.20 and Table II.2). While diffusion index for CPI excluding food, fuel, petrol, diesel, gold and silver indicated positive price increases across much of its consitutents, a vast majority of these price increases were less than 6 per cent (m-o-m saar) and 4 per cent (m-o-m saar), as indicated by the steep fall in threshold DIs to well below the 50 level mark. Threshold DIs for CPI core, however, exhibited a sustained pick-up during June-August 2024, indicating a likely bottoming out of muted price momentum (Chart II.21). Both core goods and services experienced significant easing of inflationary pressures in 2024-25 so far (April-August) with contribution from all sub-groups/groups (Chart II.22).  Out of the 2.9 percentage points moderation in core inflation from its peak in January 2023 till August 2024, around 90 bps was contributed by the clothing and footwear sub-group. In addition, housing accounted for 42 bps, while household goods and services, and transport and communication contributed 38 bps and 33 bps, respectively (Chart II.23).    Decomposing core inflation – CPI excluding food, fuel, petrol, diesel, gold, and silver inflation – into its goods (with a weight of 20.7 per cent in the headline CPI) and services (weight of 23.0 per cent) components shows a sequential softening of around 65 bps in core goods from 3.5 per cent in February 2024 to 2.9 per cent in August. The key drivers of this softening were clothing and footwear, transport and communication, household goods, and health items (Chart II.24a).  Core services inflation, on the other hand, fell from 3.2 per cent in February 2024 to 2.6 per cent in May, primarily driven by housing (house rent), transport (such as railway charges and porter fares), and education (tuition fee and other educational expenses) services. It rose to 3.3 per cent during July-August due to tariff hikes across major private mobile operators resulting in a rise in prices of communication services (Chart II.24b). An analysis of the determinants of house rent inflation indicate that demand and supply conditions and inflation expectations have a significant role in shaping house rent inflation (Box II.I).

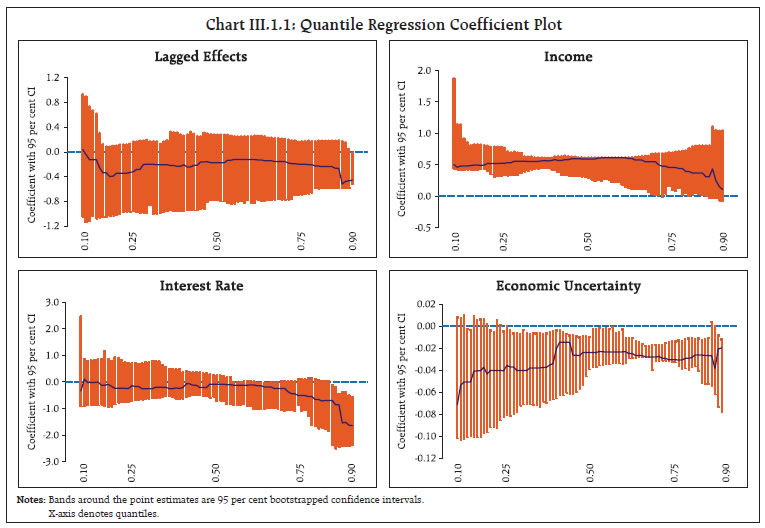

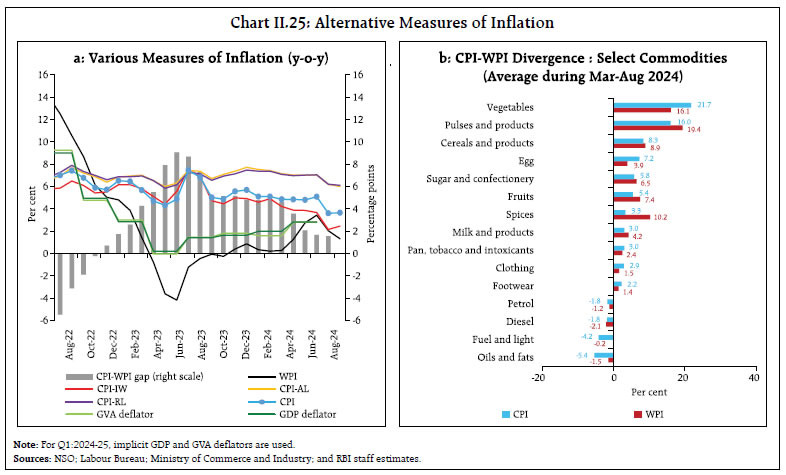

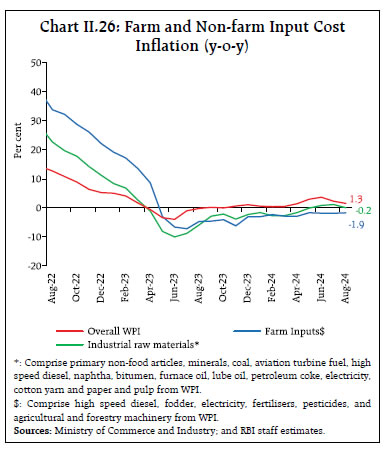

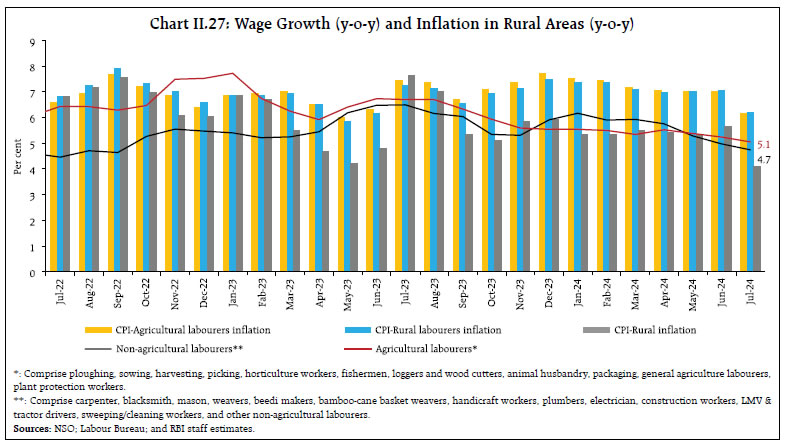

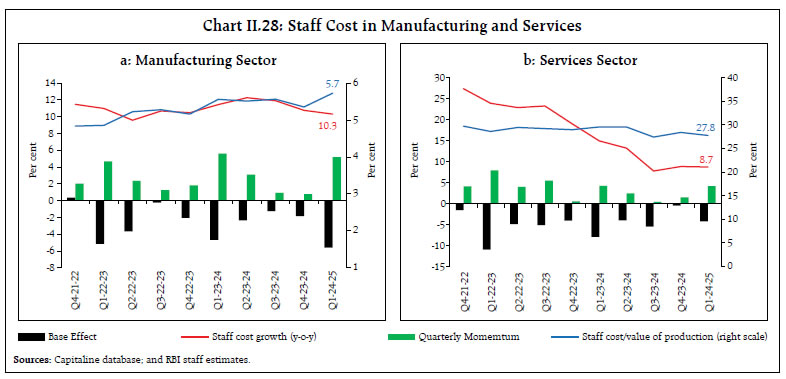

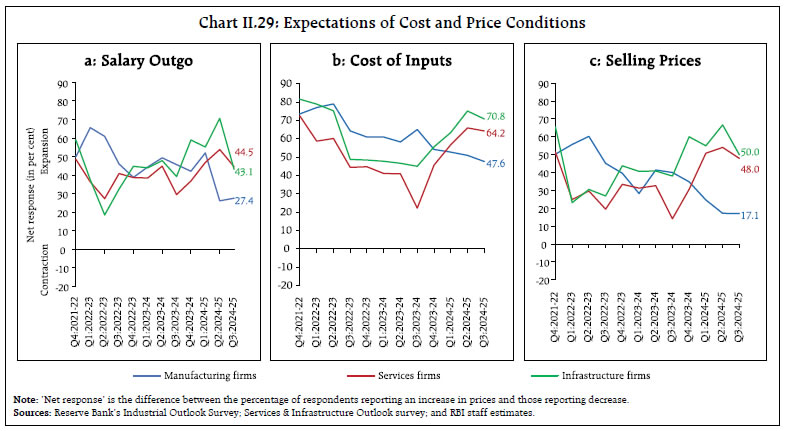

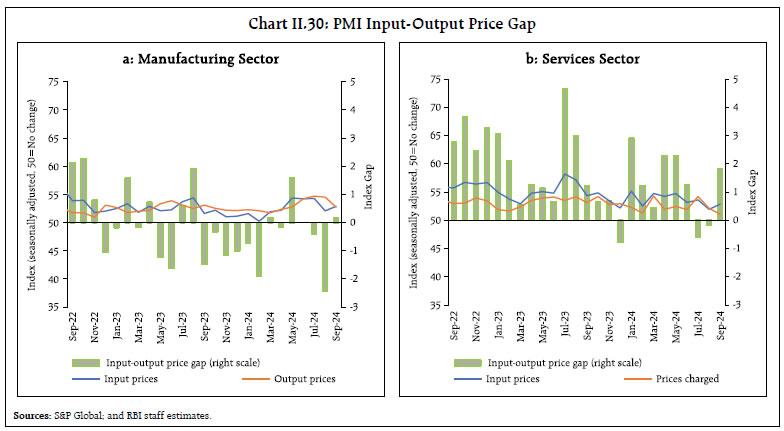

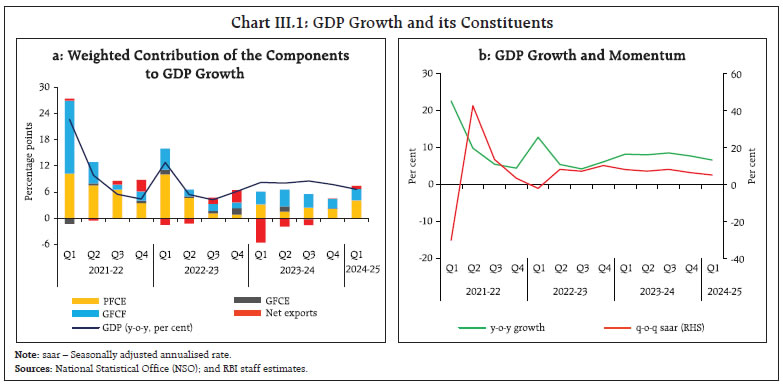

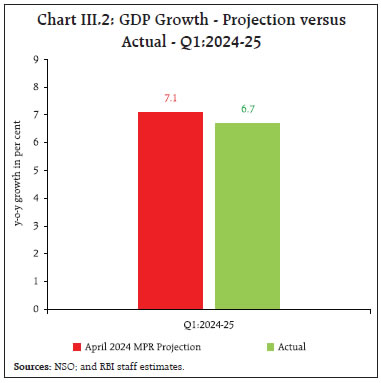

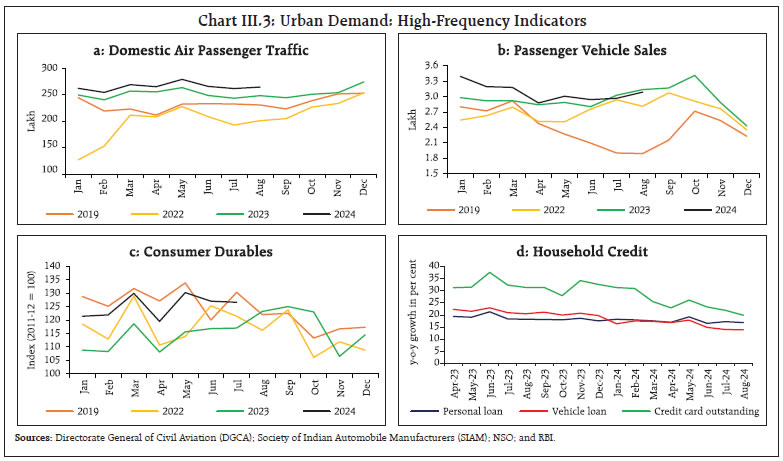

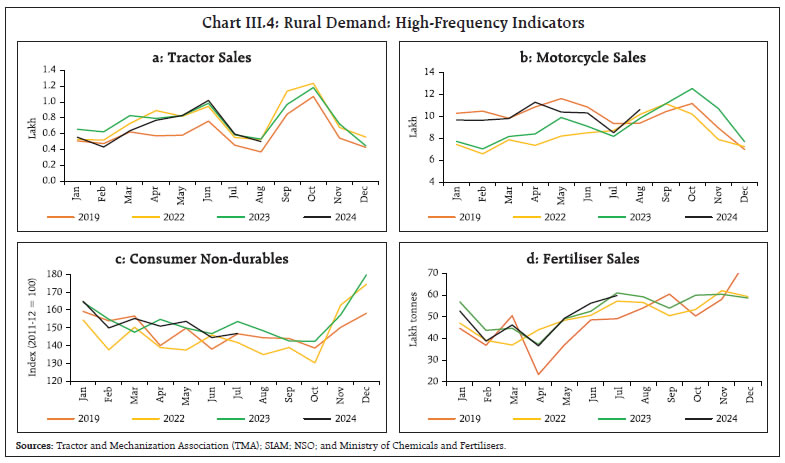

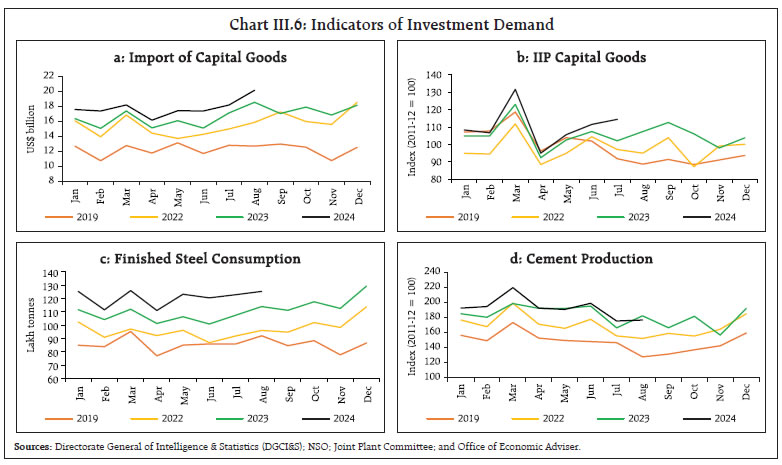

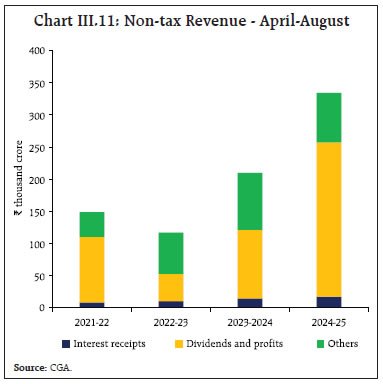

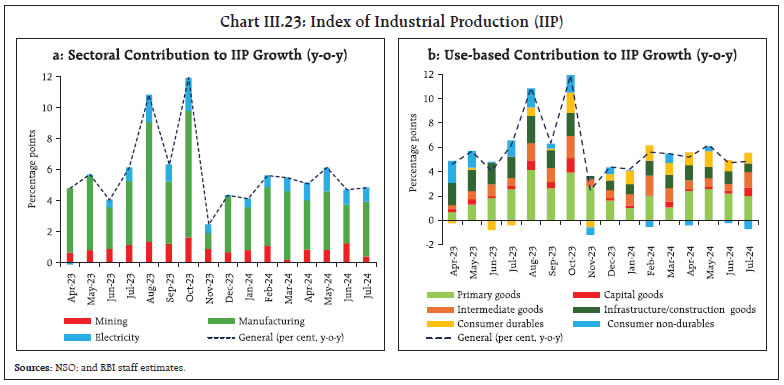

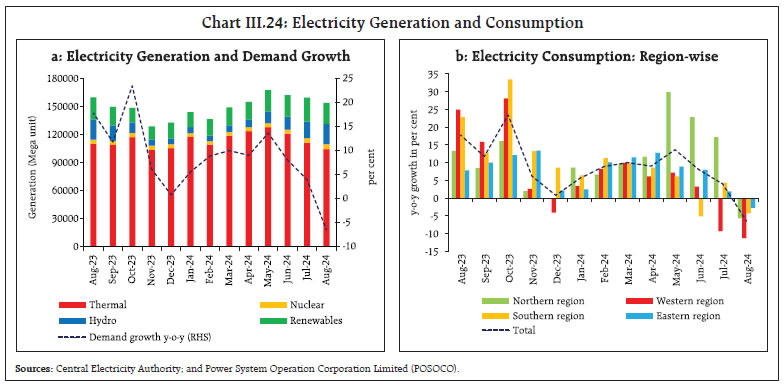

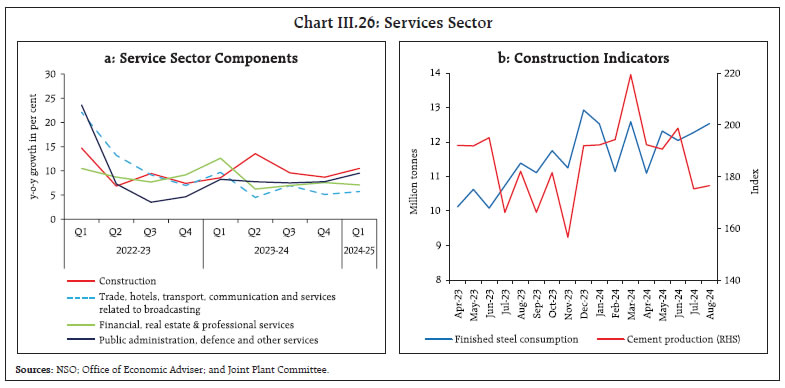

Trimmed mean measures15 also indicate an easing of underlying inflation pressures since March 2024, with weighted median inflation moderating from 3.3 per cent in March 2024 to 2.9 per cent in June (Table II.3). Other Measures of Inflation CPI inflation for agricultural labourers (CPI-AL) and rural labourers (CPI-RL) were substantially higher than the CPI headline inflation during March-August 2024 reflecting the impact of higher food inflation, which has a relatively higher weight in CPI-AL and CPI-RL. CPI inflation for industrial workers (CPI-IW), on the other hand, was below the headline CPI during the same period, primarily on account of double-digit fuel deflation, despite higher food inflation in CPI-IW vis-à-vis headline CPI. After remaining subdued till end of 2023-24, wholesale price index (WPI) inflation picked up during April-June 2024 with food inflation registering a sharp uptick along with fuel and non-food manufactured products moving out of deflation. Thereafter, WPI inflation softened in July, primarily due to favourable base effects. The softening continued in August on account of negative price momentum mainly coming from the food group. With overall WPI recording sequential increase since April 2024, inflation measured by deflators for gross value added (GVA) and gross domestic product (GDP) hardened in Q1:2024-25 (Chart II.25a). Similar sub-groups/items across CPI and WPI exhibited varying inflation movements. While WPI inflation in major food sub-groups (particularly cereals, pulses, milk, sugar, fruits and spices) ruled above corresponding CPI groups/subgroups, inflation in vegetables and egg prices, and clothing and footwear was higher in the CPI than in the WPI. Similarly, deflation in petrol was lower in the WPI vis-à-vis CPI, while the same was higher for diesel in the former (Chart II.25b).  Costs, as measured by WPI inflation in industrial raw materials and farm inputs, remained subdued during April-August 2024. While the prices of farm inputs remained in deflation, those of industrial inputs entered positive territory in June 2024, but turned negative again in August, mirroring movements in international commodity prices (Chart II.26). Prices of industrial inputs such as high-speed diesel (HSD), bitumen and petroleum coke were mostly in deflation during April-August 2024. The other contributory factors were non-food articles, particularly raw cotton and oilseeds, whose prices also recorded deflation during this period. Minerals price inflation, however, remained positive during April-August 2024, primarily driven by iron ore, due to increased global demand. Farm input prices remained in deflation, driven by those of high-speed diesel (HSD), electricity, and fodder and pesticides.  Moving from input costs to wage costs, nominal rural wage growth (y-o-y) decelerated to 4.9 per cent in July 2024 from 5.7 per cent in March 2024 driven by both non-agricultural and agricultural occupations (Chart II.27). On a month-on-month basis, however, both agricultural and non-agricultural wages sustained a steady growth of around 0.45 per cent and 0.4 per cent during the same period, respectively. The month-on-month increase in agricultural wage was mainly driven by ploughing/tilling workers, followed by loggers and woodcutters, plant protection workers, and general agricultural labourers, while the increase in non-agricultural wages was on account of masons, electricians, and light motor vehicle and tractor drivers in the rural sector. Despite the deceleration in nominal rural wages, real rural wages (deflated using CPI rural inflation) recorded a marginal growth of 0.8 per cent in July from 0.2 per cent in March 2024, primarily reflecting the sharp fall in CPI rural inflation in July.  In the organised sector, staff cost growth (y-o-y) decelerated for manufacturing firms among listed companies in Q1:2024-25, while it remained steady for services firms. The share of staff cost in the value of production increased for manufacturing but stayed stable for services in Q1 (Chart II.28). Firms polled in the Reserve Bank’s enterprise surveys16 indicate that in Q3:2024-25, the cost of inputs are expected to soften for manufacturing while remaining elevated for services and infrastructure sectors. On the other hand, selling prices are expected to soften across manufaturing, services and infrastructure sectors in Q3:2024-25. The pace of salary outgo is expected to moderate for services and infrastructure in Q3:2024-25 while it is anticipated to rise for manufacturing (Chart II.29). One year ahead business inflation expectations17 declined to 4.05 per cent in August 2024 from 4.21 per cent in the previous month on account of moderation in cost pressures with ‘somewhat less than normal’ or lower sales and subdued profit margin expectations. As per the purchasing managers’ index (PMI), manufacturing firms, which had been reporting increasing input price pressures since March 2024, pointed to a moderation in the rate of input cost expansion during August-September 2024. In tandem with input prices, pace of output price increases across manufacturing also rose before decelerating in September 2024. This turned the input-output price gap for manufacturers marginally positive in September 2024. In case of services sector, the rate of expansion in input costs remained elevated during March-May 2024, before it saw a softening during June-September. The prices charged across services firms, which had been lagging behind input price increases during March-June 2024, quickened in July 2024 on the back of pent up pass-through of rising labour and material costs. Subsequently, with cost pressures moderating, the rate of expansion in prices charged receded in August-September 2024 (Chart II.30).    The disinflation process in H1 of 2024-25 so far (April-August) has been characterised by interruptions on account of persistent food inflation pressures from adverse weather events, despite steady softening of core inflation. Food inflation could see an easing in H2 of 2024-25, benefiting from normal monsoons and improvements in agricultural output on the back of a likely good kharif production and healthy rabi sowing, although occurrences of adverse weather events and recent uptick in global food prices, if sustained, could impinge upon the food inflation outlook. Core inflation pressures have remained muted with the continuing impact of disinflationary monetary policy stance and softening bias in international commodity prices. Recent pickup in global metals and crude oil prices and uncertainties on account of geopolitical developments need to be monitored. In the context of the apparent rigidities to the last mile of disinflation in the recent period, a steadfast commitment to alignment of inflation with the target is imperative to preserve and build upon the credibility gains in monetary policy achieved during the pre- and post-COVID flexible inflating targeting (FIT) period. A durable low inflation environment will strengthen the foundations of a sustained high growth trajectory. _________________________________________________________________________________ 1 Headline inflation is measured by year-on-year (y-o-y) changes in the all-India consumer price index (CPI) produced by the National Statistical Office (NSO). 2 Core CPI, i.e., CPI excluding food and fuel is worked out by eliminating the groups ‘food and beverages’ and ‘fuel and light’ from the headline CPI. 3 A change in CPI year-on-year (y-o-y) inflation between any two months is the difference between the current month-on-month (m-o-m) change in the price index (momentum) and the m-o-m change in the price index 12 months earlier (base effect). For more details, see Box I.1 of the MPR, September 2014. 4 The CPI diffusion index, a measure of dispersion of price changes, categorises items in the CPI basket according to whether their m-o-m seasonally adjusted prices have risen, remained stagnant or fallen over the previous month. The higher the reading above 50, the broader is the expansion or generalisation of price increases; the further is the reading below 50, the broader is the price decline across items. 5 Threshold diffusion indices capture the dispersion of price increases in CPI basket beyond the specified saar thresholds of 4 per cent and 6 per cent. 6 Historical decomposition estimates the contribution of each shock to the movements in inflation over the sample period (Q4:2010-11 to Q4:2024-25) based on a vector autoregression (VAR) with the following variables (represented as the vector Yt) – crude oil prices (US$ per barrel); exchange rate (INR per US$), asset price (BSE Sensex), CPI; the output gap; rural wages; the policy repo rate; and money supply (M3). All variables other than policy repo rate are y-o-y growth rates. The VAR can be written in reduced form as: Yt = c + A Yt-1 + et; where et represents a vector of shocks. Using Wold decomposition, Yt can be represented as a function of its deterministic trend and sum of all the shocks et. This formulation facilitates decomposition of the deviation of inflation from its deterministic trend into the sum of contributions from various shocks. 7 The CPI weighting diagrams use the modified mixed reference period (MMRP) data based on the 2011-12 Consumer Expenditure Survey conducted by the National Sample Survey Office (NSSO). Under MMRP, data are collected on expenditure incurred during the last seven days for frequently purchased items like edible oil, eggs, fish, meat, vegetables, fruits, spices, beverages, processed foods, pan, tobacco and intoxicants; expenditure incurred during the last 365 days for items like clothing, bedding, footwear, education, medical (institutional), durable goods; and expenditure incurred in the last 30 days for all other food, fuel and light, miscellaneous goods and services including non-institutional medical services, rents and taxes. 8 Global commodities that drive domestic prices include petroleum products; coal; electronic goods; gold; silver; chemical products; metal products; textiles; cereals; milk products, and vegetables oils – these together have a weight of 36.4 per cent in the CPI basket. 9 Item level retail and wholesale prices are aggregated at respective subgroups using item level CPI weights. Data for January-March 2021 have been excluded due to changes in price collection mechanism and item varieties by DCA. 10 Housing is a major component in the CPI basket with a weight of 10.07 per cent, with house rent contributing 9.51 per cent and other housing services 0.56 per cent. Housing has a weight of 21.3 per cent in the CPI excluding food and fuel (core). The National Statistics Office (NSO) compiles the housing index for urban areas, considering both rented and self-owned dwellings. The NSO uses a rental equivalent approach for self-owned properties, applying market rent rates for similar rented homes. Actual rents are collected for private rentals, while government accommodation rents include the license fee and HRA foregone, adjusted by the occupant rank. 11 Sourced from Ministry of Statistics and Programme Implementation, Government of India. 12 Sourced from Indian Space Research Organisation (ISRO) Annual Night Light dataset. This has been interpolated to quarterly frequency using Denton-Cholette method with output gap as the proxy variable. 13 Night light gap (NLG) has been estimated as the gap between the night light index and its trend, using the Hodrick-Prescott filter. 14 HPI@Assesment Prices accessible through https://residex.nhbonline.org.in/. 15 While exclusion-based measures drop a fixed set of volatile items (for example, food and fuel) in each period, trimmed measures exclude items located in the tails of the inflation distribution - items displaying changes more than the specified threshold in prices each month are excluded, and the items dropped differ from month to month. 16 Industrial Outlook Survey; and Services and Infrastructure Outlook Survey. 17 Based on the monthly Business Inflation Expectations Survey (BIES) of the Indian Institute of Management, Ahmedabad. The survey polls a panel of business leaders primarily from the manufacturing sector about their inflation expectations in the short and medium term. Domestic economic activity in H1:2024-25 was supported by a strong performance from the two main drivers of aggregate demand – private consumption and investment activity. Improved agriculture prospects, sustained buoyancy in services, consumer and business optimism, government’s continued thrust on capex, and healthy balance sheets of banks and corporates brighten the outlook. Geopolitical tensions, geoeconomic fragmentation, unseasonal rains and weather disturbances, and volatility in financial markets pose downside risks. Domestic economic activity remained resilient in H1:2024-25. Private consumption rebounded, driven by the turnaround in rural demand and sustained urban demand. Investment activity held firm despite lower government capex. Government consumption contracted (year-on-year, y-o-y) during Q1:2024-25. On the supply side, industry and services remained buoyant with construction, education, health and other services supporting growth. Aggregate demand conditions witnessed some moderation as real gross domestic product (GDP) growth decelerated to 6.7 per cent (y-o-y) in Q1:2024-25 from 7.8 per cent in the previous quarter (Table III.1 and Chart III.1). The momentum of GDP – quarter-on-quarter (q-o-q) seasonally adjusted annualised growth rate (saar) – slowed down in relation to the previous quarter (Chart III.1b). GDP Projections versus Actual Outcomes The Monetary Policy Report (MPR) of April 2024 had projected real GDP growth at 7.1 per cent for Q1:2024-25. Actual growth turned out to be lower, mainly on account of lower government consumption expenditure as election-related restrictions were in place (Chart III.2).  III.1.1 Private Final Consumption Expenditure Private final consumption expenditure (PFCE) – the mainstay of aggregate demand – rebounded strongly, growing at 7.4 per cent in Q1:2024-25 and contributing 4.2 percentage points to overall GDP growth. Amongst the high frequency indicators (HFIs) of urban consumption, domestic air passenger traffic rose by 5.6 per cent in Q1:2024-25 and sustained its momentum in July-August 2024. Passenger vehicle sales posted positive y-o-y growth in Q1:2024-25 but contracted in July-August 2024. The index of industrial production (IIP) for consumer durables was robust at 10.6 per cent in Q1:2024-25 and 8.2 per cent in July 2024, indicating steady expansion in discretionary spending in urban areas (Chart III.3). As per the latest round of the Reserve Bank’s consumer confidence survey, consumer confidence (current situation index) improved in September 2024, along with an improvement in households' optimism on one year ahead economic conditions. Bank credit to households grew in double digits, despite the slowdown in unsecured personal loans and credit cards outstanding that set in after the November 16, 2023 measures (Chart III.3d).  Rural demand is showing a gradual pickup. While motorcycle sales continued to record upbeat growth in April-August 2024, tractor sales expanded in June-July 2024 (Chart III.4). The demand for work under the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) contracted by 16.6 per cent in Q2:2024-25, reflecting an improvement in farm sector employment. Spending on fast moving consumer goods (FMCG) in the rural areas bodes well for rural demand. The positive outlook for agriculture, supported by above normal south-west monsoon (SWM) rainfall, higher cumulative kharif sowing and improved reservoir levels augurs well for sustaining the revival in rural demand. An examination of macroeconomic drivers of item group-wise consumption reveals that income effect boosts consumption demand while economic uncertainty dampens it. As consumption of necessary items have lower elasticity of substitution than discretionary items, they are more insulated from economic uncertainty (Box III.1).