IST,

IST,

Finances of Foreign Direct Investment Companies, 2014-15

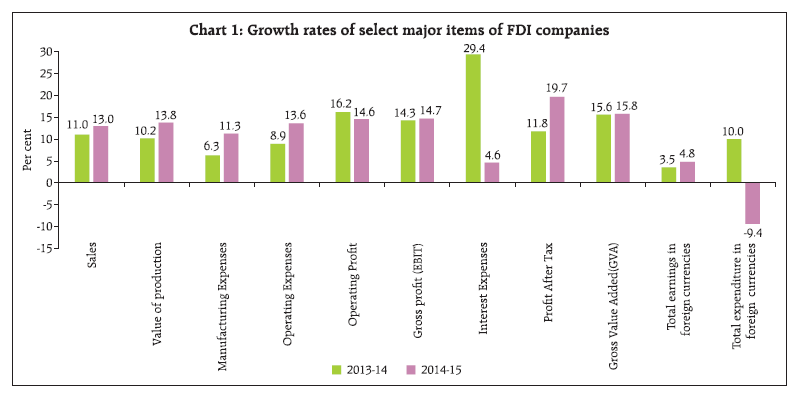

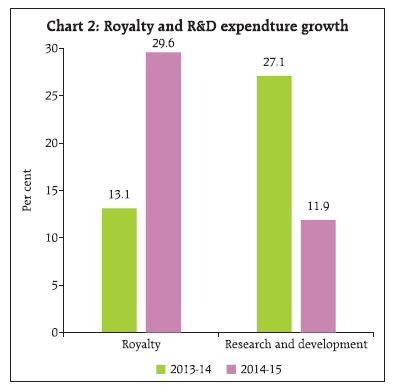

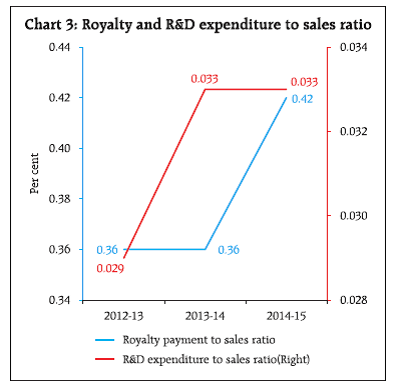

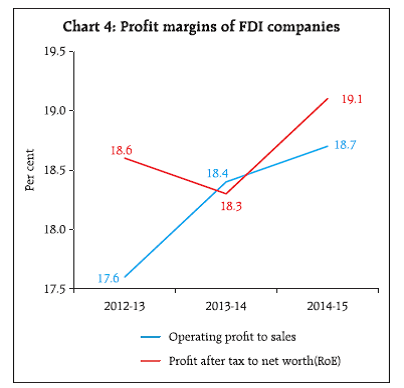

An analysis of financial performance of select 3,320 non-government non-financial foreign direct investment (FDI) companies for the year 2014-15, based on their audited annual accounts closed on March 31, 2015 showed that FDI companies performed better than non-FDI companies in terms of Gross Value Added (GVA) during the study period. The growth in GVA for FDI companies accelerated in 2014-15, whereas for non-FDI companies, it had decelerated. The sales growth for FDI accelerated during 2014-15 vis-à-vis the previous year. The growth in operating profits moderated, due to increased operating expenses. Net profit (i.e., Profit after Tax) growth accelerated during 2014-15. The performance of both manufacturing and services sectors improved in terms of sales growth in 2014-15 vis-à-vis the previous year. Merchandise exports remained in contraction mode as in the previous year. Gross fixed assets as well as net fixed assets grew at lower rates in 2014-15 as compared to the previous year. Operating profit margin and Return on equity (RoE) increased marginally in 2014-15. FDI companies relied mainly on external sources of funds for expanding their business and these funds were predominantly used for gross fixed asset formation as well as in non-current investment. Further, the share of cash and cash equivalents in total uses of funds increased significantly in 2014-15 as compared to the previous year. This article presents an analysis of the financial performance of non-government non-financial (NGNF) foreign direct investment (FDI)1 companies for the financial year 2014-15 based on the audited annual accounts of select 3,320 FDI companies which closed their accounts on March 31, 20152. The data are based on Ministry of Corporate Affairs (MCA) systems (Extensible Business Reporting Language (XBRL) and Form AOC-4 (Non-XBRL) platform). Of these companies, 327 were public limited companies and 2,993 pertain to private limited companies. These companies were classified into 10 major countries and 9 major industry groups. A company is classified into a country depending upon the country of origin with the largest FDI shareholder in the company. The information on activities code available in the Corporate Identity Number (CIN) of a company was used to classify the companies into various industry groups based on National Industrial Classification (NIC) 2004 classification3. The article assesses the performance of the select FDI companies during the period 2012-13 to 2014-15 based on the same set of companies’ data compiled for relevant financial years. Further, the performance of these companies were also compared with those of 2,50,983 select non-FDI companies. Reference may be made to the detailed data of FDI companies for the year 2014-15 released in May 2016 under ‘Press Release’ in the Reserve Bank of India website along with explanatory notes. Industrial composition of these FDI companies, showed that ‘Computer and related activities’ (601)4,‘Trade Wholesale & Retail’ (234), ‘Machinery and machine tools’ (232),‘Chemicals and chemical products’ (131), and ‘Transport, storage and communication’ (110) were the predominant industries for foreign direct investment. Among the countries of origin of foreign direct investment, USA has the highest number of companies of FDI origin (675), followed by Mauritius (563), Singapore (383), UK (201) and Japan (200). 1. Growth: Gross Value Added (GVA) improved marginally 1.1 FDI companies performed better than non-FDI companies in terms of GVA during the study period, i.e., 2012-13 to 2014-15. Growth in GVA of FDI companies accelerated marginally to 15.8 per cent in 2014-15 from 15.6 per cent in 2013-14, mainly due to manufacturing and services sectors. However, growth in GVA of non-FDI companies moderated to 11.7 per cent in 2014-15 from 12.2 per cent in 2013-14, mainly due to deceleration in services sector (Table 1). 1.2 Sales and value of production of select FDI companies grew at higher rates of 13.0 per cent and 13.8 per cent in 2014-15, respectively, as compared with 11.0 per cent and 10.2 per cent recorded in 2013-14. Growth in operating expenses also increased significantly to 13.6 per cent in 2014-15 from 8.9 per cent in 2013-14 (Chart 1). 1.3 The growth in operating profit moderated to 14.6 per cent in 2014-15 from 16.2 per cent in 2013-14, due to increased in operating expenses. However, the net profits (PAT) grew at a higher rate of 19.7 per cent in 2014-15 as compared to11.8 per cent in 2013-14, mainly due to deceleration in growth of interest expenses during the year (Chart 1). 1.4 The sales growth of both manufacturing as well as services sector of FDI companies accelerated in 2014-15 as compared to the previous year. In the manufacturing sector, the sales growth of all the industry groups increased in 2014-15 except for ‘Chemicals and chemical products’ and ‘Rubber and plastic products’. In the services sector, the sales for all the industry groups accelerated in 2014-15 except for ‘Computer and related activities’ (Statement 1). 1.5 The operating profit for manufacturing and services sectors of FDI companies accelerated during 2014-15. In the manufacturing sector, except for ‘Chemicals and chemical products’, all industry groups registered an increase in the growth of operating profits. In the services sector, significant growth in operating profit was witnessed for ‘Transport, storage and communication’ industry during 2014-15 as compared to the previous year (Statement 1). 1.6 In contrast with FDI companies, the sales growth for non-FDI companies declined from 10.0 per cent in 2013-14 to 6.4 per cent in 2014-15. The non-FDI companies witnessed deceleration in operating expenses in 2014-15 vis-à-vis the previous year. The growth in operating profits of manufacturing and services sectors for non-FDI companies moderated in 2014-15 as compared to the previous year (Statement 1). 2. Growth in earnings in foreign currencies improved whereas expenditure declined 2.1 Growth in total earnings in foreign currencies of FDI companies increased to 4.8 per cent in 2014-15 as against 3.5 per cent in 2013-14. However, the total expenditure in foreign currencies contracted by 9.4 per cent in 2014-15 which grew at 10.0 per cent in 2013-14 (Chart 1). 2.2 Merchandise exports remained in contraction mode in 2014-15 as was in the previous year. Also the exports intensity of sales (measured as exports to sales ratio) of FDI companies declined continuously in the study period and was at 8.4 per cent in 2014-15. Among the FDI share classes, sharp increase in exports growth was observed for the companies categorised in FDI share class of ‘25 per cent to 50 per cent’, largely due to base effect, whereas the other FDI share classes remained in contraction mode. Further, manufacturing sector exports remained in contraction mode in 2014- 15. However, services sector registered increase in exports growth during 2014-15, mainly driven by ‘Computer and related activities’ (Statement 1 and Statement 2). 2.3 For FDI companies, imports contracted by 9.2 per cent in 2014-15 from 8.2 per cent growth in 2013-14. For manufacturing sector, imports contracted by 11.1 per cent in 2014-15 from 4.0 per cent growth recorded in 2013-14. The contraction in imports growth was observed in ‘Food products and beverages’, ‘Motor vehicles and other transport equipment’s’ and ‘Electrical machinery and apparatus’ industries. Services sector also witnessed sharp decline in imports growth during 2014-15, largely driven by industries in ‘Wholesale and retail trade’ and ‘Computer and related activities’, which contracted by 27.6 per cent and 3.7 per cent, respectively, in 2014-15 (Statement 1). 2.4 For non-FDI companies, both exports and imports contracted in 2014-15. The exports contracted by 4.1 per cent in 2014-15 as against 11.8 per cent growth in 2013-14. Also, imports remained in contraction mode in both 2013-14 and 2014-15. The contraction in imports and exports for non-FDI companies was mainly on account of manufacturing sector. The exports intensity of non-FDI companies declined to 13.5 per cent in 2014-15 from 15.0 per cent in 2013-14 (Statement 1 and Statement 2). 2.5 The share of earnings in foreign currencies in the total income for both FDI and non-FDI companies declined in 2014-15. As regards the merchandise exports of goods, the share in total income for FDI and non-FDI companies declined in the 2014-15 as compared to the previous year (Table 2). 2.6 The share of expenditure in foreign currencies in the total expenditure of both FDI and non-FDI declined in the study period, i.e. 2012-13 to 2014-15, mainly on account of decline in the share of imports (Table 2). 3. Growth in Research and Development expenditure moderated 3.1 The growth in Research and Development (R&D) expenditure declined to 11.9 per cent in 2014-15 from 27.1 per cent in 2013-14. However, royalty payment grew at higher rate of 29.6 per cent in 2014-15 as compared with 13.1 per cent in 2013-14 (Chart 2). 3.2 R&D expenditure to sales ratio remained unchanged at 0.033 per cent in 2014-15, whereas royalty payments to sales ratio increased in 2014-15 as compared to the previous year (Chart 3). 3.3 Among the FDI share classes, the R&D expenditure decelerated significantly to 12.3 per cent in 2014-15 from 35.9 per cent in the 2013-14 for companies in FDI share class of ‘50 per cent and above’. Deceleration in the R&D expenditure during 2014-15 was also witnessed for both manufacturing and services sector industries (Statement 1). 3.4 Significant growth in royalty payment was witnessed for manufacturing and services sectors in 2014-15. The growth in royalty payment for manufacturing sector increased to 30.7 per cent in 2014-15 from 19.4 per cent in the previous year. Also, royalty payment for services sector accelerated to 30.9 per cent in 2014-15 after witnessing a contraction of 9.1 cent in 2013-14 (Statement 1). 3.5 For non-FDI companies, growth in R&D expenditure moderated to 6.0 per cent in 2014-15 from 8.9 per cent in 2013-14, whereas growth in royalty payment accelerated to 28.3 per cent in 2014-15 from 11.0 per cent in 2013-14 (Statement 1). 4. Growth in total net assets moderated 4.1 The growth in total net assets of FDI companies moderated to 12.6 per cent in 2014-15 from 14.0 per cent in the previous year. However, companies categorised in the FDI share class of ‘25 per cent to 50 per cent’ witnessed an increase in growth in total net assets (Statement 1). 4.2 Manufacturing sector witnessed a moderation in total net asset growth, whereas for services sector, it increased. Except ‘Food products and beverages’ and ’Chemicals and chemical products’ in the manufacturing sector, all other industry groups registered a moderation in total net assets’ growth during 2014-15. In the services sector, growth in total net assets marginally improved to 16.2 per cent in 2014-15 from 15.1 per cent in 2013-14, which was mainly contributed by ‘Wholesale and retail trade’ and ‘Transport, storage and communication’ industries (Statement 1). 4.3 Similar to FDI companies, the non-FDI companies also witnessed a moderation in total net asset growth in 2014-15. The moderation in growth of total net assets was observed for the manufacturing sector, whereas for services sector, the total net assets accelerated in 2014-15, mainly due to ‘Computer and related activities’ industry (Statement 1). 5. Profitability ratios increased marginally 5.1 Profitability ratios of FDI companies as measured by operating profit margin as well as RoE (Return on Equity – measured as ratio of Profit after tax to Networth) increased marginally in 2014-15 as compared to the previous year (Chart 4). 5.2 The increase in operating profit margin as well as RoE during 2014-15 was observed for ‘50 per cent and above’ FDI-share class and manufacturing sector. On the other hand, operating profit margin as well as RoE declined steadily for services sector over the three years period (Statement 2). 5.3 For non-FDI companies, both operating profit margin and RoE improved marginally in 2014-15 over 2013-14. Both manufacturing and services sectors witnessed improvement in operating profit margin and RoE during the study period (Statement 2). 6. Leverage ratio declined and Interest coverage ratio improved 6.1 The leverage ratio (measured as a ratio of total borrowings to equity) of FDI companies declined to 70.3 per cent in 2014-15 as compared to 77.6 per cent in the previous year. Further, the interest coverage ratio (measured as a ratio of earnings before interest and tax to interest expenses) improved to 4.5 per cent in 2014- 15 from 4.1 per cent in 2013-14 (Chart 5). 6.2 Decrease in leverage ratio was observed among all FDI share classes except for the companies categorised in ‘25 per cent to 50 per cent’ class. The leverage ratio declined for manufacturing and services sectors during 2014-15. In manufacturing sector, decrease in leverage ratio was observed among all industry groups except for ‘Rubber and plastic products’ industry (Statement 2). 6.3 In contrast to the FDI companies, the leverage ratio for non-FDI companies increased to 72.1 per cent in 2014-15 from 71.3 per cent in the 2013-14, aided by services sector. However, the leverage ratio for manufacturing sector declined to 52.7 percent in 2014-15 from 54.8 percent in the previous year (Statement 2). 7. Liabilities Structure: Share of Shareholders’ fund in total liabilities increased marginally 7.1 The share of shareholders’ fund in total liabilities of FDI companies improved marginally to 41.0 per cent in 2014-15 from 40.4 per cent in 2013-14, mainly on account of ‘share capital’ and ‘reserves and surplus’. The share of short-term and long-term borrowings in total liabilities declined to 7.8 per cent and 21.2 per cent, respectively, in 2014-15 from 10.2 per cent and 21.3 per cent observed in 2013-14, aided by lower share of borrowings from banks (Statement 3). 7.2 For non-FDI companies, share of shareholders’ fund as well as share of long-term borrowings in total liabilities increased marginally in 2014-15, whereas the share of short-term borrowings in total liabilities decreased in 2014-15 (Statement 3). 8. Asset Structure: Share of gross fixed assets in total assets decreased 8.1 The share of gross fixed assets in total assets, which was a major component of the total assets of FDI companies, decreased to 51.7 per cent in 2014-15 from 52.8 per cent in 2013-14, mainly due to tangible assets. However, the share of non-current investments in total assets increased to 7.6 per cent in 2014-15 as compared to 6.4 per cent in the 2013-14. The shares of current investments and ‘cash and cash equivalents’ in total assets increased in 2014-15 as compared to the previous year (Statement 3). 8.2 In contrast to FDI companies, share of gross fixed assets in total assets for non-FDI companies increased to 38.9 per cent in 2014-15 from 37.6 per cent in 2013-14. However, the share of non-current investments in total assets declined marginally in 2014-15 (Statement 3). 9. Sources of Funds : External sources continued to dominate in business expansion and its share in total sources of funds increased 9.1 The select FDI companies relied mainly on external sources of funds for expanding their business and their share had increased to 62.4 per cent in 2014- 15 from 60.4 per cent in the 2013-14, mainly on account of ‘share capital and premium’ and ‘trade payable’. The share of trade payable in total sources of funds increased significantly to 15.9 per cent in 2014-15 from 8.1 per cent in 2013-14 (Statement 4). 9.2 The share of internal sources of funds in total sources of funds declined to 37.6 per cent in 2014-15 from 39.6 per cent in 2013-14, mainly due to decline in the share of provisions (Statement 4). 9.3 In contrast to FDI companies, the share of external sources of funds in total sources of funds for non-FDI companies declined to 67.8 per cent in 2014-15 from 70.9 per cent in 2013-14, largely due to significant decline in the funds raised through short-term borrowings. The share of internal sources of funds in total sources of funds increased from 29.1 per cent in 2013-14 to 32.2 per cent in 2014-15 (Statement 4). 10. Uses of Funds: Share of gross fixed assets formation declined significantly 10.1 The share of gross fixed assets formation in total uses of funds for FDI companies declined significantly to 37.8 per cent in 2014-15 from 54.0 per cent observed in 2013-14. Further, the share of long-term loans and advances in total uses of funds had gone down in 2014-15. However, the share of non-current investments in total uses of funds increased significantly to 14.8 per cent in 2014-15 from 2.2 per cent in 2013-14 (Statement 4). 10.2 The share of current assets in the total uses of funds increased significantly to 47.7 per cent in 2014-15 as compared to 22.2 per cent in the 2013-14, mainly due to significant increase in ‘cash and cash equivalents’, whose share increased to 13.0 per cent in 2014-15 as compared to the contraction of 1.2 percent observed in the previous year (Statement 4). 10.3 In contrast to FDI companies, the share of gross fixed assets formation in total uses of funds for non-FDI companies increased in 2014-15 as compared to the previous year. However, the share of non-current investments in total uses of funds decreased to 13.7 per cent in 2014-15 from 20.0 per cent in 2013-14 (Statement 4). 11. Conclusion 11.1 Select FDI companies performed better than non- FDI companies during the study period. The growth in GVA for FDI companies accelerated in 2014-15, whereas for non-FDI companies, it had decelerated. The sales growth of FDI companies accelerated in 2014-15 as compared to the previous year. The performance of both manufacturing and services sectors for FDI companies improved in terms of sales growth in 2014- 15 vis-à-vis the previous year. However, the growth in operating profits decelerated, mainly due to acceleration in growth of operating expenses. However, operating profit margin as well as RoE (Return on Equity – measured as ratio of Profit after tax to Net-worth) FDI companies increased marginally in 2014-15. Merchandise exports as well as imports growth remained in contraction mode as in the previous year. 11.2 The growth in total net assets of FDI companies moderated during the year. The leverage ratio declined and debt serviceability of FDI companies improved in 2014-15 as compared to the previous year. The FDI companies relied mainly on external sources of funds for expanding their business and these funds were predominantly for gross fixed asset formation as well as in non-current investment. Further, the share of cash and cash equivalents in total uses of funds increased significantly in 2014-15 as compared to the previous year.

* Prepared in the Company Finances Division of the Department of Statistics and Information Management, Reserve Bank of India, Mumbai. Previous article was published in December 2015 issue of the RBI Bulletin. 1 As per the Balance of Payments Manual, Sixth Edition(BPM6) and International Investment Position Manual, of the International Monetary Fund (IMF), Foreign Direct Investment is a ‘category of cross-border investment associated with a resident in one economy having control or a significant degree of influence on the management of an enterprise that is resident in another economy.’ The BPM6 suggests that ‘immediate direct investment relationships arise when a direct investor directly owns equity that entitles it to 10 per cent or more of the voting power in the direct investment enterprise.’ 2 The paid-up capital (PUC) of select 3,320 NGNF FDI companies in the year 2014-15 accounted for 21.4 per cent of total PUC of Non-Financial FDI companies reported in the Reserve Bank’s Census on Foreign Liabilities and Assets of Indian Direct Investment Companies, 2014-15. 3 The classification of industry groups may not be same as in the previous article. In the previous article, the industry group of the company is determined on the basis of the industry from which the company has reported more than 50 per cent of its total income. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

પેજની છેલ્લી અપડેટની તારીખ: