IST,

IST,

RBI WPS (DEPR): 01/2018 : Operating Performance of Initial Public Offering Firms after Issue in India - A Revisit

| RBI Working Paper Series No. 01 @Avdhesh Kumar Shukla Abstract *The paper examines how the operating performance of the Indian firms changed after their initial public offerings. It is found that the operating performance does not deteriorate post IPOs, if a performance indicator like “profit” is normalised by sales volumes (i.e., return on sales) rather than assets (i.e., return on assets). Unlike a distinct decline in return on assets reported in similar other studies, a stable return on sales is found in this study. This paper highlights the importance of choice of right variables for matching and normalisation purposes. JEL Classification: O16, G32, G39 Key words: Initial public offers, return on assets, turnover ratio, promoters’ shareholding and agency relationship. Introduction In the life of a firm, transition from a privately-owned to public-owned firm through an initial public offering (IPO) is probably the most important event (Pagano, Panetta, and Zingales, 1998). The existing economic and financial literature has studied a number of issues relating to firms’ performance post issuance such as under-pricing of IPOs (Ibbotson, 1975; Ritter, 1980), firms’ underperformance post issuance (Ritter 1991, Loughran and Ritter 1995), and firms’ operating performance after going public (Bruton et al., 2010; Cai and Wei, 1997; Jain and Kini, 1994; Kim, Kitsabunnarat and Nofsinger, 2004; Mikkelson, Partch and Shah, 1997). These studies have concluded that IPO firms’ profitability, measured as a ratio of operating profit to total assets, was lower in the post-issue period than in the pre-issue period. In the Indian context also, Janakiramanan (2008), Kohli (2009), Mayur and Mittal (2014) and Bhatia and Singh (2013) have concluded that return on assets (ROA) of IPO firms decline post issuance. Most of the studies in the Indian context have covered a period after the 1990s. Since the initiation of economic reforms in the early 1990s, the Indian capital market has witnessed a spate of reforms. The initial phase of reforms comprised mainly liberalisation and consolidation, while reforms in the 2000s aimed at putting a robust regulatory structure in place and increasing the integrity of both markets and institutions. Important reforms carried out during this period related to introduction of fit and proper criterion for public issuers, Clause 49 relating to rules of listing, book building norms, and submission of annual and quarterly financial statements, among others. Marisetty and Subrahmanyam (2010) have termed the period after 2000 as the reformed regulated era of the Indian capital market. Consequent upon these reforms and policy changes, the Indian IPO market has increased in complexity and size. It has emerged as one of the most important markets for global investors among emerging market economies. In light of the above, it is worthwhile to revisit post-issue performance of Indian firms to shed light on changes in firms’ behaviour in the reformed regulated era. Various reforms were intended to increase the entry and survival of good firms relative to firms with poorer credentials. A study of post-issue operating performance of firms will indicate whether regulation has resulted in any distinctive shift in their performance. A majority of the studies have been undertaken in the context of advanced economies and it has been generally observed that IPO firms underperform post-issue vis-à-vis their pre-issue performance. In this study, we have analysed the operating performance of IPO firms in the long run after controlling for firms’ ownership structure and size using univariate and difference-in-differences regression (DID) method. Control firms for DID are selected by matching asset size and debt-equity ratio using Mahalanobis distance technique in the same industry. Alternatively, following Barber and Lyon (1996) and Kothari, Leone and Wasley (2005) we have matched IPO firms with control firms using ROA in the same industry. Empirical results of our study indicate that IPO firms’ ROA and turnover ratios (TOR) record decline after issue while the ratio of net operating cash flows to total assets (RCFA) declines in the first-year post issuance but recovers in subsequent years. At the same time, ROS does not show any statistically significant decline. We find that faster expansion of asset base of IPO firms immediately after issue largely explains the decline in asset-scaled performance variables such as ROA. The decline is not observed when profit is scaled by sales. Furthermore, when IPO firms are matched on the basis of pre-issue performance, as suggested by Barber and Lyon (1996), decline in ROA is small. This study contributes to literature in two important ways: first, the study finds that ROS of Indian IPO firms does not decline after issue, and, second, the decline in asset-scaled variables is moderate when firms are matched in terms of ROA. As the majority of the literature following Jain and Kini (1994) has focused on ROA, the finding of stable ROS is important. To our knowledge, this is the first study analysing the performance of IPO firms floated during the post reforms regulated era. Furthermore, apart from asset-scaled variables, the study analyses sales-scaled variables, hence controlling for natural bias. The rest of this paper is structured as follows: Section II covers theoretical underpinnings and literature survey; Section III explains research methodology and data along with data sources; Section IV discusses descriptive statistics, followed by regression results in Section V and conclusions in Section VI. II. Theoretical Underpinnings and Literature Survey The main focus of this paper is to examine the impact of firms’ decision to go public on their operating performance. There is a fairly large body of literature analysing post-issue performance vis-à-vis firms’ pre-issue performance (Cai and Wei, 1997; Jain and Kini, 1994; Kao, Wu and Yang, 2009; Kim, Kitsabunnarat and Nofsinger, 2004; Mikkelson, Partch and Shah, 1997; Pagano, Panetta and Zingales, 1998). Generally, the existing literature has found that IPO firms’ post-issue performance relative to their pre-issue performance declines mainly due to agency cost (Bruton et al., 2010; Jain and Kini, 1994), entrenchment hypothesis (Kim, Kitsabunnarat and Nofsinger, 2004) and window of opportunity hypothesis (Cai and Wei, 1997; Loughran and Ritter, 1995). Lyandres, Sun and Zhang (2006) support an investment-based explanation of decline in performance, whereby firms go for aggressive physical investment. In the investment-based explanation, firms are not able to exploit their new investment efficiently and hence make relatively lower profits. Agency cost arises due to “separation of ownership and control”, or “principal-agent problem” in a public firm (Jensen and Meckling, 1976). According to the agency theory, agency cost may manifest in the form of increased consumption of non-pecuniary benefits by firm managers or lower efforts to maximise its value. An IPO leads to reduction in ownership of existing owner-managers which results in agency problem between owner-managers and new shareholders leading to increase in agency cost. This predicts a linear relationship between managerial ownership and operating performance of a firm (ibid.). Entrenchment hypothesis, on the other hand, indicates that convergence of interest between a firm and its owner-manager occurs at lower and higher levels of ownership by the firm’s managers (Morck, Shleifer and Vishny, 1988). Entrenchment hypothesis suggests that a firm’s performance initially deteriorates as managerial ownership increases, while it improves as their ownership increases further. Besides, we may observe a decline in the post issue operating performance if the firms time their issue. Firms going for an IPO have an incentive to time it when their performance is at peak so as to get the highest possible return. Firm managers also time the market to bring their issue at the peak of the market. This hypothesis is known as “window of opportunity” hypothesis (Ritter, 1991; Loughran and Ritter 1995). One of the early studies on the topic by Jain and Kini (1994) found that IPO firms exhibit a decline in post-issue operating performance vis-à-vis pre-issue mainly due to increase in agency cost arising on account of reduced ownership of the owner-manager in the firm. They found a positive and linear relationship between promoters’1 share in equity holding of a firm and its performance. Mikkelson, Partch and Shah (1997) also concluded that the operating performance of IPO firms declines post issuance. However, unlike Jain and Kini (1994), they did not find any relationship between firms’ operating performance and retained ownership of the owner-manager. They attributed the decline in post-issue performance of IPO firms to younger age and small size of these firms which were not able to sustain their competitive advantage as they lacked adequate managerial skills and economies of scale. In a relatively underdeveloped market structure of the Thai economy, Kim, Kitsabunnarat and Nofsinger (2004) tested the entrenchment hypothesis by using a cubic function and concluded that there was a curvy-linear relationship between ownership share of owner-manager and firm performance. Use of cubic function by Kim, Kitsabunnarat and Nofsinger allows for “three levels of managerial ownership”. They found that managerial ownership between 0–31 per cent and 71–100 per cent leads to increase in performance, it decreases for firms with managerial ownership between 31 and 71 per cent. Their findings about Thai IPO firms support the entrenchment theory of Shleifer and Vishny (1989) and Morck, Shleifer and Vishny (1988). Recent literature has focused on the impact of large-block shareholding on post-issue operating performance of IPO firms (Bruton et al., 2010; Jain and Kini, 1995; Krishnan et al., 2009; Rindermann, 2003). Agency relation literature has considered block holding as an important governance mechanism as it contains agency cost in multiple ways. A large block shareholding signifies alignment of managers’ interests with that of the firm’s leading to reduced adverse selection (Leland and Pyle, 1977). It also reduces coordination cost among dispersed owners. However, in the case of divergence in economic goals, block shareholders may pose conflicting agency problems. Analysing IPO firms of the United Kingdom (UK) and France, Bruton et al. (2010) concluded that venture capital (VC) funds, whose goal is to earn a high return within a short period of time, adversely affect IPO firms’ performance, while long-term angel funds affect their performance favourably (Annex). Corporate governance literature emphasises that unlike advanced economies that are characterised by principal-agent problems, emerging economies manifest principal-principal conflict which is attributed to concentrated ownership and control, poor institutional protection to minority shareholders and weak governance structure (Young et al., 2008). Cai and Wei (1997) argued that financial institutions, such as banks and insurance companies, in Japan are permitted to own sizeable share in a firm’s equity and are allowed to have representation in the board, which reduces the agency problem and managerial entrenchment behaviour in Japanese firms. Pagano, Panetta and Zingales (1998) argued that post-issue decline in investment and profitability of the IPO firm points towards a window of opportunity. In a tad different financial set up in China, where state-controlled firms go for public issue, Wang (2005) found coexistence of agency conflicts, management entrenchment and large shareholders’ expropriation. In another study on newly-privatised firms in China, Fan, Wong and Zhang (2007) found that the post-issue decline in operating performance is more pronounced in firms where the chief executive officer (CEO) is politically connected and which have a weak corporate governance structure. Barber and Lyon (1996) have criticized event studies relating to IPOs and have argued that in the case of IPO firms, performance variables such as ROA give biased results as asset size of firms changes significantly post issuance. According to them, generally literature has ignored this fact while selecting control firms. They suggested that instead of size, firms should be matched by the relevant variables. They favoured use of profit scaled by sales. Supporting the hypothesis of Barber and Lyon, Brav and Gompers (1997) and Kothari Leone and Wasley (2005) found that post-issue decline of performance was concentrated in small firms. Lyandres, Sun and Zhang (2006) matched IPO firms using investment to asset ratio and concluded that IPO firms invest heavily in real assets and exhaust higher net present value opportunity leading to lower return afterwards. Though India has a thriving IPO market, there are not many studies on post-issue performance of IPOs. During the late 1990s and early 2000s, India witnessed a number of capital market reforms (Goswami 2000; Marisetty and Subramanium 2010) putting in place a world class regulatory and governance regime in the country. Most studies focus on the period immediately after or prior to the reforms, but do not adequately cover the reformed regulated era, i.e. the period after the 2000s. Results of studies on IPO operating performance in India are mixed. Ghosh (2005) found that post-issue performance of Indian banks does not decline. Kohli (2009) found that post-issue operating performance of IPO firms decline, both with and without industry adjustment. The main goal of this study is to compare the allocative efficiency of resources in a market-based system (stock market) vis-à-vis a bank-based system. Kohli attributed the decline of the ROA of IPO firms to the relative inefficiency of the market-based structure in India. He did not attempt to find out the causes of decline in firm performance. Mayur and Mittal (2014), following the methodology of Kim, Kitsabunnarat and Nofsinger (2004), found the presence of entrenchment behaviour of controlling managers in India. In line with the existing literature, studies in India have mainly focused on asset-scaled variables. Tough literature survey indicates a near unanimity on decline of operating return in IPO firms after issue; there is no agreement on causes of the decline. Data This study is based on data on non-financial firms, which floated IPOs during April 1, 2000 to March 31, 2011. The study focuses on their long-term operating performance, for which it uses minimum three years post-issue data. Thus the data up to end of March 2011 allow assessment of performance up to 2015. The data are extracted from Prowess database maintained by the Centre for Monitoring Indian Economy (CMIE). Our sample consists of 413 IPO firms. There is considerable amount of variability in terms of numbers of issuances during the studied period. Largest numbers of issues were floated in 2000-01 followed by the financial year 2007-08 (Table 1).

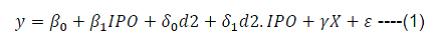

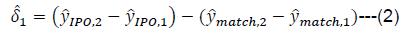

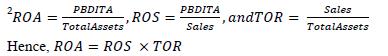

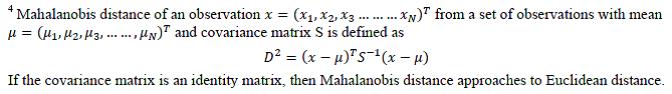

The study employs ROA, RCFA, ROS, asset turnover ratio (TOR) and sales growth as indicators of operating performance. In the study, a multiple variables approach was preferred, as a single variable gives only partial information about performance. ROA was calculated as ratio of profit before interest, taxes, depreciation and amortisation (PBDITA) to total assets. Problem with operating income is that it is based on accrual accounting, hence, prone to manipulation (Barber and Lyon, 1996). This can be addressed by use of operating cash flows. Difference between net operating cash flow and PBDITA is that the latter does not take into account changes in working capital and capital expenditure. Net operating cash flow is the amount which the owner can take out from the company in the form of dividend or other distributions. It is used for calculation of net present value (NPV) of a project, which is an important criterion for future capital expenditure by firms. Furthermore, around 80 per cent of chief financial officers (CFOs) globally and around 65 per cent in India use NPV as criteria for investment (Anand, 2002; Brealey et al., 2014; Graham and Harvey, 2001). ROA and RCFA are based on historic valuations of assets and some part of total assets could be non-operating. This problem can be overcome by ROS or operating profit margin of the firm (Barber and Lyon, 1996). Profit margin is unaffected from post-issue increase in assets which is used as denominator in some performance indicators. Ratio of sales with total assets, known as TOR, can be used to estimate efficiency of assets of a firm. ROA, ROS and TOR are related to each other. Through Du Pont2 analysis we can ascertain the variable contributing to a firm’s performance when measured by ROA (Brealey et al., 2014). Besides these ratios, the study also examines growth rates of sales and capital expenditure as they indicate growth opportunities for the firm. Methodology We use both univariate and multivariate approaches to test the change in performance of IPO firms. Change in operating performance is calculated as the median change in performance in post-issue years over the year immediately before issue, i.e. operating performance in year [t] minus operating performance in year [-1], where [t] represents financial year after the issue year. The use of median is preferred over mean because of its relative immunity to extreme values. Industry adjusted operating performance is adjusted with median firm’s and matched firm’s performance at 5-digit national industrial classification (NIC)3. A matched firm is selected using Mahalanobis4 distance criterion. For the purpose of hypothesis testing, we use the Wilcoxon signed-rank test in line with literature. For ascertaining causes of change in performance, a majority of studies have employed ordinary least squares (OLS) regression as the principal technique with retained ownership of owner-manager as explanatory variable. Such models, however, only show average change in performance, without giving information on break-up of change due to IPO and industry trend. This technique also suffers from self-selection and endogeneity. These problems can be addressed, to some extent, by using difference-in-differences (DID) estimator method (Card and Krueger, 1994; Wooldridge, 2007). We, therefore, use DID method for ascertaining the causal effect of IPOs on firms’ post-issue performance. IPO firms have been used as treatment firm, whereas matched firms have been used as control/comparison firms. To estimate the causal effect using DID method, we estimate the following equation:  Here, IPO is the dummy variable for IPO firms; it captures possible difference in operating performance of IPO firms and control firms. d2 is the time dummy; which captures aggregate changes in operating performance in absence of issue. Interaction term d2.IPO is equal to one for issue firms after IPO. Coefficient of d2.IPO is the DID representing effect of IPO on the post issue-operating performance of IPO firms after controlling for the industry effect.  Following Mikkelson, Partch and Shah (1997), Lukose and Rao (2003), Kim, Kitsabunnarat and Nofsinger (2004), Wang (2005), and Rajan and Zingales (1995) size and debt-equity ratio of firms are used for identifying matching firms. Alternatively, as suggested by Barber and Lyon (1996), firms have also been matched using ROA, size, debt-equity ratio and ROA and size, and debt-equity ratio, ROA and PB of firms. The standard errors of coefficient estimates are corrected using cluster robust following Bertrand, Duflo and Sendhil (2004). Summary statistics relating to IPO firms are set out in Table 2. Mean (median) issue size of sample firms was ₹ 2163.0 million (₹ 584 million). Mean (median) return on the listing day was 20.4 per cent (13.7 per cent), indicating very high underpricing by many of the firms. Median shareholding of promoters and promoter groups in firms declines to 49.7 per cent post issuance, from 70.4 per cent prior to issuance which is lower than what has been reported by Jain and Kini (1994) and Mikkelson, Partch and Shah (1997) in case of the United States (US). Median age of IPO firms was 11 years at the time of issue. V. Univariate Analysis of Operating Performance IPO firms are not able to maintain high ROA post issuance, however, it remains above the industry median (Table 3). RCFA declines sharply in year [0] but recovers thereafter and converges to industry median indicating a tendency of convergence in IPO firms’ performance with the industry average. IPO firms witness a sharp expansion in assets size and capital expenditure in the post-issue period5. In comparison with matched firms, IPO firms report higher ROA throughout the sample period but somewhat lower RCFA. Median turnover ratio of IPO firms is almost similar to matched firms in the year [-1]; however, it declines post issuance and difference widens in post- issue years. As against asset- scaled variables, ROS – profit scaled by sales – does not show any significant post-issue decline; it remains steady and significantly higher than the industry median and matched firm. Steady ROS is in contrast with the ostensible view that IPO firms’ performance declines post issuance. After the snapshot of performance indicators, we next analyse post-issue change in these indicators. Change in performance is adjusted for industry median and matched firm’s performance. Median change in operating returns of IPO firms post issuance relative to year [-1] was (-) 3.0 per cent, (-) 4.4 per cent, (-) 5.6 per cent and (-) 6.2 per cent in years [0], [1], [2] and [3], respectively. Industry-adjusted operating returns also showed a similar trend. Median industry-adjusted operating returns in year [0], [1], [2] and [3] vis-à-vis year [-1] were (-) 2.5 per cent, (-) 2.7 per cent, (-) 3.9 per cent and (-) 3.5 per cent, respectively (Table 4). Operating performance measured by RCFA also declined during the post-issue period. The decline, however, became muted in the first and the second year post issuance and turned positive in the third year. Industry median adjusted and Mahalanobis distance matched firm adjusted RCFA also showed the same trend in a statistically significant manner indicating that IPO firms do not face post-issue cash flow problems. These results are in contrast with Jain and Kini (1994). Interestingly, though change in ROS was negative for IPO firms, adjusted ROS - for industry median as well as matched firms - did not show any decline, in fact it increased marginally in year [3] post issuance. IPO firms continue to maintain higher sales growth post-issue vis-à-vis industry median and also higher growth in capital expenditure (Table 4). Nevertheless, IPO firms witness decline in the asset turnover ratio. As univariate results are not controlled for confounding variables, we conduct multivariate analysis, controlling for firms’ sales promotion expenditures, R&D expenses, short-term liquidity, business group affiliations, promoters ownership, and executive directors’ ownership. For multivariate analysis, we use difference-in-differences (DID) approach to estimate the impact of IPO on performance post issuance using operating returns relative to pre-issue period as the dependent variable. In addition to dummy for IPO, year dummies and interaction terms [IPO dummy × Year dummy], we used control variables such as size of firm, advertisement intensity, R&D intensity, slack ratio and retained shareholding of promoters of the firm post-issue. Logarithm of sales is used as a proxy for size of the firm. Advertisement, R&D intensity and slack variables are taken as ratios to total sales of the firm. Slack is calculated as a difference between current assets and current liabilities of firm. Advertisement intensity and R&D intensity indicate firm’s efforts to augment its operations, while slack indicates availability of liquidity. Results indicate a consistent decline in ROA in the three years post issuance compared to the matched firms. TOR also shows a similar decline. RCFA, however, shows decline only in the first year post issuance. The decline in ROS which is not scaled by assets is statistically insignificant6. It may, thus, be concluded that the primary reason for the decline in the operating performance is rapid rise in assets of an IPO firm (Table 5). We test theoretical prepositions, such as agency theory and entrenchment theory, using multivariate regressions. To test agency theory, we regress ROA, RCFA, TOR and ROS on promoters’ retained shareholding in firm. We also regress change in performance of firm i in year[t] relative to year[-1] on promoters’ residual ownership. Regressions are controlled by advertisement intensity, R&D ratio, slack ratio, ownership group dummy and family firm dummy (Tables 6, 7, 8 and 9). Promoters’ retained shareholding has positive and statistically significant coefficient for ROA and RCFA. However, its impact on TOR and ROS is statistically insignificant. Thus, the results are not conclusive to either rejecting or supporting agency relationship hypothesis. In line with Jain and Kini (1994) and Kim, Kitsabunnarat and Nofsinger (2004), when change in operating ratios were regressed over retained shareholdings of the promoters, none of the coefficients were found statistically significant7. In addition to agency relationship, managerial entrenchment has also been tested. Following Mikkelson, Partch and Shah (1997), it has been measured by residual personal holdings of members of board of directors retained post issuance. Regression results indicates statistically insignificant coefficient of the management ownership which are in line with Mikkelson, Partch, & Shah (1997). Alternatively, following Kim, Kitsabunnarat and Nofsinger (2004), we replace personal shareholding of directors/managers of the firm with overall shareholding of the promoters but do not find statistically significant results. Hence, our findings do not support entrenchment hypothesis as well. As regression results on agency relationship and entrenchment hypotheses are inconclusive, we matched control firms on the basis of ROA within the same industry at 2-digit NIC8. Decline in ROA is substantially muted when IPO firms are matched with the same operating variable (Table 11). This indicates that decline in performance of high-performance firms is rather a common phenomenon and not limited to IPO firms only. VII. Conclusion An IPO is a major event in the life of a firm. Academic literature has investigated deeply the various aspects of the organisational and operational changes facing a firm after an IPO. Change in operating performance is one such issue, which has been studied extensively, both theoretically and empirically. This study revisits the post-issue performance of IPO firms in India. One distinct feature of this study vis-à-vis earlier studies is that instead of confining itself to an analysis of movement of asset-scaled variables of a firm, it also analyses variable scaled by sales. In addition to return on asset and ratio of operating cash flow with total assets, it analyses turnover ratio, return on sales and growth of sales to access the operating variables. An advantage of return on sales is that it does not have Barber and Lyon’s (1996) bias. Our analysis indicates that the post-issue operating performance of IPO firms measured as return on asset and turnover ratio records a sharp decline. However, contrary to the findings of extant literature, we find that the decline in ratio of operating cash flow with total assets is confined to the issue year and year after the issue only. Initial decline in the ratio of operating cash flow with total assets could be on account of enlarged capital expenditures, which firms resort to after the IPO. We also find that as far as return on sales and sales growth are concerned there is no statistically significant change after issue. This study also finds that IPO firms continue to outperform matched firms from the same industry when compared in terms of change in relevant operating variables. A battery of tests conducted after controlling for firms’ various attributes such as family-control, business group ownership, size, expenditure on R&D and advertisement and liquidity, etc., indicate that decline in performance cannot be completely explained by agency relationship and entrenchment hypothesis. We also found that the major cause for decline in asset-scaled operating ratios after an IPO is sharper than industry average expansion of the balance sheet size and consequential increase in assets of IPO firms. Therefore, normalisation of the operating performance variables by sales rather than assets is considered by us as more appropriate. @ Avdhesh Kumar Shukla is Assistant Adviser in the Department of Economic and Policy Research, Reserve Bank of India. Professor Tara Shankar Shaw is a member of faculty at the Department of Humanities and Social Sciences, Indian Institute of Technology Bombay, Mumbai. * The authors would like express their sincere thanks to K. Naryanan, Rajiv Ranjan, Sitikantha Pattanaik, , Anupam Prakash, Saurabh Ghosh, Kunal Priyadarshi and Dipak Chaudhari for valuable comments on the paper and encouragement. We are also thankful to anonymous referee(s) for their suggestions. The authors also express their gratitude for the comments received from the participants of the Department of Economic and Policy Research (DEPR) Study Circle presentation series. The views expressed in this paper and all errors, whether of omission or commission, are to be attributed to the authors only. All the usual disclaimers apply. 1 By “promoter” we mean an initial investor who has set up the business and one who stays invested for a longer period of time either himself or through his/her family members.  3 Alternatively, the same exercise was performed at 2-digit NIC. Results do not change.  5 It is not surprising, given the fact that capital expenditure is the stated goal of a majority of issues. Around 250 firms out of 285 firms, which brought issues from April 2005 to March 2011, have indicated capital expenditure as an objective of the issue. 6 As DID results in respect of ROA, ROS, TOR and RCFA are not in same direction, DID was conducted on absolute values of performance and it indicates that IPO firms continue to outperform matched firms even after the IPO. 8 Alternatively, firms were matched on the basis of asset size, debt-equity ratio and ROA as well as asset size, debt-equity ratio, ROA and price to book ratio of firms. Results do not change significantly. References Anand, M. (2002), “Corporate Finance Practices in India: A Survey”, Vikalpa, 27(4), pp. 29–56. Balatbat, M.C., S.L. Taylor and T.S. Walter (2004), “Corporate Governance, Insider Ownership and Operating Performance of Australian Initial Public Offerings”, Accounting and Finance, 44, pp. 299–328. Barber, B.M. and J.D. Lyon (1996), “Detecting Abnormal Operating Performance: The Empirical Power and Specification of Test Statistics”, Journal of Financial Economics, 41(3), pp. 359–99. Bertrand, Marianne, Esther Duflo and Mullainathan Sendhil (2004), “How Much Should We Trust Differences-In-Differences Estimates?” The Quarterly Journal of Economics, 119(1), pp. 249–75. Bhatia, S. and B. Singh (2013), “Ownership Structure and Operating Performance of IPOs in India”, The IUP Journal of Applied Economics, 12(3), pp. 7–37. Brav A. and Gompers, P. A. (1997), Myth or Reality? The Long-Run Underperformance of Initial Public Offerings: Evidence from Venture and Nonventure Capital-Backed Companies. The Journal of Finance, 52: 1791–1821. doi: 10.1111/j.1540-6261.1997.tb02742.x Brealey, R.A., S.C. Myers, F. Allen, and P. Mohanty (2014), “Financial Analysis”, in Principles of Corporate Finance, pp. 737–65. Bruton, G.D., I. Filatotchev, S. Chahine and M. Wright (2010), “Governance, Ownership Structure, and Performance of IPO Firms: The Impact of Different Types of Private Equity Investors and Institutional Environments”, Strategic Management Journal, 31, pp. 491–509. Cai, J. and K.J. Wei (1997). “The Investment and Operating Performance of Japanese Initial Public Offerings”, Pacific-Basin Finance Journal, 5, pp. 389–417. Card, David and Krueger, Alan B (1994). “Minimum Wages and Employment: A Case Study of the Fast Food Industry in New Jersey and Pennsylvania”, American Economic Review, Vol. 84, No. 4, pp. 772-793. Chahine, S. (2007), “Block-holder Ownership, Family Control and Post-listing Performance of French IPOs”, Managerial Finance, 33(6), pp. 388–400. Chen, A. and L. Kao (2005), “The Conflict between Agency Theory and Corporate Control on Managerial Ownership: The Evidence from Taiwan IPO Performance”, International Journal of Business, 10(1). Fan, J.P., T. Wong and T. Zhang (2007), “Politically Connected CEOs, Corporate Governance, and Post-IPO Performance of China’s Newly Partially Privatized Firms”, Journal of Financial Economics, 84, pp. 330–57. Ghosh, S. (2005), “The Post-offering Performance of IPOs in the Indian Banking Industry”, Applied Economics Letters, 12(2), pp. 89–94. Goswami, O. (2000), “The Tide Rises, Gradually: Corporate Governance in India”. Available at: http://www.oecd.org/daf/ca/corporategovernanceprinciples/1931364.pdf. Graham, J.R. and C.R. Harvey (2001), “The Theory and Practice of Corporate Finance: Evidence from the Field”, Journal of Financial Economics, 61, pp. 1–28. Helwege, J. and N. Liang (2004), “Initial Public Offerings in Hot and Cold Markets”, The Journal of Financial and Quantitative Analysis, 39(3), pp. 541–69. Ibbotson, R. (1975). “Price Performance of Common Stock Issues”, Journal of Financial Economics, 2, pp. 235–72. Jain, B. A., & Kini, O. (1994). The Post-Issue Operating performance of IPO Firms. The Journal of Finance, Vol. 49, No. 5 (Dec., 1994), pp. 1699-1726 Jain, B. A. and Kini, O. (1995), Venture Capitalist Participation and the Post-Issue Operating Performance of IPO Firms. Manage. Decis. Econ., 16: 593–606. doi:10.1002/mde.4090160603 Janakiramanan, S. (2008). “Under-pricing and Long-run Performance of Initial Public Offerings in Indian Stock Market”, National Stock Exchange of India Research Papers. Retrieved 5 May 2015, from http://www.nseindia.com/content/research/comppaper184.pdf. Jensen, M.C. and W.H. Meckling (1976). “Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure”, Journal of Financial Economics, 3(4), pp. 306–60. Kao, J.L., D. Wu and Z. Yang (2009). “Regulations, Earnings Management, and Post-IPO Performance: The Chinese Evidence”, Journal of Banking and Finance, 33(1), pp. 63–76. Kim, K.A., P. Kitsabunnarat and J.R. Nofsinger (2004), “Ownership and Operating Performance in an Emerging Market: Evidence from Thai IPO Firms”, Journal of Corporate Finance, 10, pp. 355–81. Kohli, V. (2009). “Do Stock Markets Allocate Resources Efficiently? An Examination of Initial Public Offerings”, Economic & Political Weekly, XLIV(33), pp. 63–72. Kothari, S.P., A.J. Leone and C.E. Wasley (2005). “Performance Matched Discretionary Accrual Measures”, Journal of Accounting and Economics, 39(1), pp. 163–97. Kotsuna, K., H. Okamura and M. Cowling (2002), “Ownership Structure Pre- and Post-IPOs and the Operating Performance of JASDAQ Companies”, Pacific-Basin Finance Journal, 10(2), pp. 163–81. Krishnan, C.N.V., V.I. Ivanov, R.W. Masulis and A.K. Singh (2009), “Venture Capital Reputation, Post-IPO Performance and Corporate Governance”, ECGI Working Paper Series in Finance. Retrieved from http://ssrn.com/abstract_id=910982. Kurtaran, A. and B. Er (2008), “The Post-issue Operating Performance of IPOs in an Emerging Market: Evidence from Istanbul Stock Exchange”, Management and Financial Innovations, 5(4), pp. 50–62. Leland, H.E. and D.H. Pyle (1977), “Informational Asymmetries, Financial Structure, and Financial Intermediation”, Journal of Finance, 32, pp. 371–87. Loughran, T. and J. Ritter (1995), “The New Issue Puzzle”, Journal of Finance, 50, pp. 23–51. Lukose, P.J. and S.N. Rao (2003), “Operating Performance of the Firms Issuing Equity through Rights Offer”, Vikalpa, 28(4), pp. 25–40. Lyandres, E. L. Sun and L. Zhang (2006), “The New Issues Puzzle: Testing the Investment-Based Explanation”, The Review of Financial Studies, 21(6), pp. 2825–55. Marisetty, V.B. and M.G. Subrahmanyam (2010), “Group Affiliation and the Performance of IPOs in the Indian Stock Market”, Journal of Financial Markets, 13, pp. 196–223. Mayur, Manas (2013), “Ägency Problems and Operating Performance in an Emerging Market: Evidence from Indian IPOs”. Available at https//ssrn.com/abstract=2283585. Mayur, M. and S. Mittal (2014), “Relationship between Under-pricing and Post-IPO Performance: Evidence from Indian IPOs”, Asia-Pacific Journal of Management Research and Innovation, 10, pp. 129–36. Michel, A., J. Oded and I. Shaked (2014), “Ownership Structure and Performance: Evidence from the Public Float”, Journal of Banking and Finance, 40 (March), pp. 54–61. Mikkelson, W.H., M.M. Partch and K. Shah (1997). “Ownership and Operating Performance of Companies that Go Public”, Journal of Financial Economics, 44(3), pp. 281–307. Morck, R., A. Shleifer and R.W. Vishny (1988). Management Ownership and Market Valuation: An Empirical Analysis”, Journal of Financial Economics, 20 (January-March), pp. 293–315. Pagano, M., F. Panetta and L. Zingales (1998), “Why do Companies Go Public? An Empirical Analysis”, The Journal of Finance, LIII(1), pp. 27–64. Pastor, L., L.A. Taylor and P. Veronesi (2009), “Entrepreneurial Learning, the IPO Decision, and the Post-IPO Drop in Firm Profitability”, The Review of Financial Studies, 22(8), pp. 3005–46. Pereira, T.P. and M. Sousa (2017), “Ïs there still a Berlin Wall in the Post-issue Operating Performance of Europeans IPOs?”, International Journal of Finance and Economics, 22(2), pp. 139-58. Rindermann, G. (2003), “Venture Capitalist Participation and the Performance of IPO Firms: Empirical Evidence from France, Germany, and the UK”. EFMA 2003 Helsinki Meetings. Available at SSRN: https://ssrn.com/abstract=425080 or http://dx.doi.org/10.2139/ssrn.425080. Ritter, J. (1980), “The 'hot issue' Market of 1980”, Journal of Business, 32, pp. 215–40. —. (1987). “The Costs of going Public”, Journal of Financial Economics, 19(2), pp. 269–81. —. (1991), “The Long-run Performance of Initial Public Offerings”, Journal of Finance, 46, pp. 3–27. Shleifer, A., and R.W. Vishny (1989). “Management Entrenchment: The Case of Manager-Specific Investments”, Journal of Financial Economics, 25(1), pp. 123–39. Wang, C. (2005), “Ownership and Operating Performance of Chinese IPOs”, Journal of Banking and Finance, 29(7), pp. 1835–56. Wooldridge, J.M. (2007), “Pooling Cross Sections across Time: Simple Panel Data Methods”, in Introductory Econometrics: A Modern Approach, Third Edition, pp. 448–84 Mason, Ohio: South-Western Cengage Learning. Young, M.N., M.W. Peng, D. Ahlstrom, G.D. Bruton, and Y. Jiang (2008), “Corporate Governance in Emerging Economies: A Review of the Principal–Principal Perspective”, Journal of Management Studies, 45(1), pp. 196–220. | ||||||||||||||||||||||||||||

પેજની છેલ્લી અપડેટની તારીખ: