IST,

IST,

IX. Payment and Settlement Systems and Information Technology

IX. PAYMENT AND SETTLEMENT SYSTEMS AND INFORMATION TECHNOLOGY The payment and settlement systems in India functioned normally in the midst of the global financial crisis, ensuring the continued confidence of the public in these systems. The Payment and Settlement Systems Act, Board for Regulation and Supervision of Payments and Settlement Systems Regulations, 2008 and the Payment and Settlement Systems Regulations, 2008 have come into effect in August 2008 and accordingly, the Board for Regulation and Supervision of Payment and Settlement Systems was reconstituted. While the growth and penetration of conventional non-cash modes of payments continued to remain strong in 2008-09, new modes of payments like mobile payment transactions and pre-paid credit instruments have also started. Harnessing information technology (IT) for internal functioning of the Reserve Bank as well as for delivery of services have continued to ensure greater efficiency. The rapid advances in the application of IT and emerging forms of payments and their settlement systems necessitate the Reserve Bank to improve the regulatory frameworks while integrating these developments to the overall goals of the financial system. IX.1 The ability of economic agents to transfer money and exchange financial claims embedded in financial instruments smoothly and securely through payment and settlement systems is critical not only for sustaining the public confidence in the financial system but also for creating an efficient and deep financial system. The Reserve Bank, as the supervisor and regulator of the payments and settlement systems, strives to ensure development of efficient and smooth systems matching the needs and growing sophistication of the financial sector. The rapid advancements in the field of information technology (IT) have contributed to emergence of new products as well as methods of payment and settlement. Emergence of new modes of payments and increasing complexity of transactions, however, also pose challenges in terms of formulating appropriate regulatory and supervisory frameworks. Apart from facilitating advancements in the payment and settlement systems, the information and communication technology has been harnessed into the functioning of the Reserve Bank in all important areas. IX.2 This chapter outlines the major developments in the payment and settlement systems in India during 2008-09 as well as the progress made in terms of use of information technology both in service delivery as well as in operations relating to core functional areas of the Reserve Bank. Various developments in terms of designing and implementing regulatory frameworks to effectively monitor the emerging modes of payments and settlements as well as the increasing diversification of payments and settlement systems in terms of greater penetration of information technology are discussed in detail. Apart from this, the developments in information technology front, both in terms of use of IT within the Reserve Bank and initiatives for enhancing IT intensity of the financial sector are also highlighted. PAYMENT AND SETTLEMENT SYSTEMS IX.3 The Reserve Bank, as the Central Bank of the country has played a catalytic role, over the years, in creating an institutional framework for development of a safe, secure, sound and efficient payment system in the country. A major milestone was achieved when the Payment and Settlement Systems Act, 2007 was enacted empowering the Reserve Bank to regulate and supervise the payment and settlement systems, lay down policies to this effect and provide a legal basis for multilateral netting and settlement finality. Accordingly, the Reserve Bank framed and notified the ‘Board for Regulation and Supervision of Payment and Settlement Systems Regulations, 2008’ and ‘Payment and Settlement Systems Regulations, 2008’ for operationalisation of the Payment and Settlement Systems Act. Regulation and Supervision of Payment Systems IX.4 The Payment and Settlement Systems Act,2007 (the PSS Act, 51 of 2007) and the two regulations (i) Board for Regulation and Supervision of Payment and Settlement Systems Regulations 2008 and (ii) Payment and Settlement Systems Regulations, 2008 have come into effect from August 12, 2008. The PSS Act stipulates that no person other than the Reserve Bank shall commence or operate a payment system, except under and in accordance with an authorisation issued by the Reserve Bank as per the provisions of the PSS Act. All persons operating a ‘payment system’ or desirous of setting up a payment system as defined in the PSS Act, need to apply for authorisation to the Reserve Bank, unless specifically exempted in terms of the PSS Act, in the form and manner as stipulated in the Payment and Settlement Systems Regulations, 2008. The Stock Exchanges and the Clearing Corporations of the Stock Exchanges have been exempted from the provisions of the PSS Act. IX.5 Since the PSS Act became effective, the Reserve Bank has received applications for authorisation from operators/proposed operators of prepaid and other cards, payment gateways, money transfers, mobile payments, Automated Teller Machine (ATM) network, etc. Authorisation has so far been accorded to 21 entities for operating specified payment systems. The banks providing mobile payment services in accordance with the “Mobile Banking Transactions in India - Operative Guidelines for Banks” issued on October 8, 2008 under Section 18 of the PSS Act, are required to obtain approval from the Reserve Bank. Approval has so far been accorded to 29 banks to provide mobile payment services. Board for Regulation and Supervision of Payment and Settlement Systems (BPSS) IX.6 In order to strengthen the institutional framework for the payment and settlement systems in the country, the Board for Regulation and Supervision of Payment and Settlement Systems (BPSS) as a Committee of its Central Board was constituted by the Reserve Bank in March 2005 following the notification of the Reserve Bank of India, Regulations, 2005. The BPSS was reconstituted in August 2008 following the notification of the PSS Act and the Board for Regulation and Supervision of Payment and Settlement Systems Regulations, 2008. The Board met on five occasions during the period from July 2008 to June 2009. The operationalisation of the PSS Act, issuance of guidelines for smooth operations of payment systems and transparency in charges levied to customers for the services offered by banks were some of the key focus areas of the BPSS at its meetings. The important directions of the Board, inter-alia, include: (i) grant of authorisation to various payment system providers in terms of the provisions of the PSS Act, (ii) guidelines on mobile payments, (iii) guidelines on issuance and operation of prepaid payment instruments in India, (iv) rationalisation of the charges for electronic payment products and outstation cheque collection, (v) migration of large-value payments to more secure electronic modes and (vi) incentivising the usage of satellite communication for penetration of banking services to remote places. IX.7 In accordance with the directions of the BPSS, operative guidelines on mobile banking for banks were issued on October 8, 2008 and Guidelines for prepaid payment instruments in India were issued on April 27, 2009. The use of other bank ATMs for cash withdrawal has become free of charge with effect from April 1, 2009. The Reserve Bank has also rationalised the service charges for ‘Electronic Payment Products’ and outstation cheque collection. Steps have been initiated to increase the threshold limit of cheques in ‘High Value Clearing’ from Rs.1 lakh to Rs.10 lakhs and to progressively discontinue this service in view of alternate channels being already available to clear high value transactions. DEVELOPMENTS IN PAYMENT AND SETTLEMENT SYSTEMS IX.8 The total turnover under various payment and settlement systems rose by 13.9 per cent in terms of value during 2008-09 as compared with 41.8 per cent during 2007-08. As a ratio to GDP, the annual turnover in terms of value increased marginally from 12.7 per cent in 2007-08 to 12.9 per cent in 2008-09 (Table 9.1). The Systemically Important Payment System’s (SIPS) share in the total turnover accounted for 53.8 per cent followed by Financial Markets’ Clearing at 33.9 per cent.

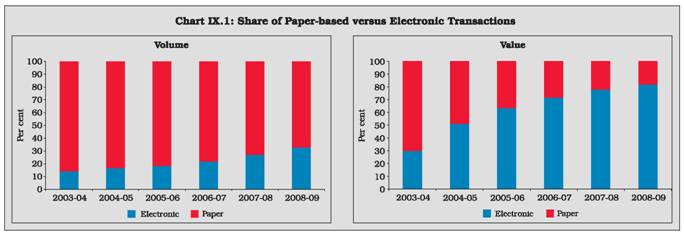

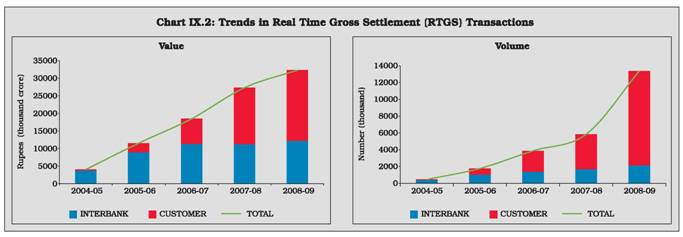

IX.9 The SIPS continued to exhibit the rising trend and there was an increase of 12.2 per cent in terms of value in 2008-09 on top of the increase of 39.6 per cent in the previous year. The rise was mainly contributed by increase in Real Time Gross Settlement (RTGS) transactions in 2008-09, while high value clearing component of SIPS, declined by 17.3 per cent during the year. This decline in high value SIPS clearing could be due to shift from paper based transactions to electronic modes of payments like RTGS, besides the impact of the general slowdown in the economy on the value and volume of such transactions. Retail Payment Systems IX.10 The retail payment system includes cheque clearing (automated clearing done using magnetic ink character recognition (MICR) and non-MICR), retail electronic fund transfer and card payments. The year 2008-09 registered a decline of 5.9 per cent in the overall turnover of various retail payment products as compared to an increase of 23.4 per cent during 2007-08, mainly on account of negative growth in retail electronic clearing and MICR clearing. The issue and refund of IPOs during 2007-08, among others, was one of the reasons for the significant increase in 2007-08. The depressed primary and secondary market in 2008-09 partly contributed to the drop in turnover from the high base in 2007-08. Paper-based Clearing and Settlement IX.11 Cheque is still being predominantly used as an important instrument of cashless paper based mode of payment and, therefore, sustaining and promoting efficiency in this system for clearing and settlement of cheques assumes importance. During 2008-09, six new MICR cheque processing centres (Belgaum, Bhavnagar, Jamnagar, Kota, Tirunelveli and Anand) were opened. At present there are 71 MICR-CPCs functioning in the country. At centres where setting up of MICR-CPC was not found to be viable, the settlement operations have been computerised (1064 clearing houses) so that the settlement is done electronically even though the instruments still continue to be sorted manually. So far, operations of more than 99.3 per cent of the total number of 1138 Clearing Houses in the country have been computerised. The year 2008-09 registered a decline of 5.0 per cent in the volume and 3.0 per cent in the value of MICR transactions. This decline could be attributed to shift to electronic modes of payment and general slowdown in the economy. X.12 High Value Clearing: High Value Clearing is available at 24 major locations in the country. In view of the various risks associated with the use of paper-based instruments for clearing and settlement of large-value transactions, it has been decided to increase the threshold limit for cheques eligible to be presented in High Value Clearing from the present Rs.1 lakh to Rs.10 lakh. This is also a step towards encouraging migration of large value payments from paper based instruments like cheque to electronic mode like RTGS/NEFT. IX.13 Speed Clearing: A new clearing arrangement named ‘Speed Clearing’was introduced in June 2008 for collection of outstation cheques through local clearing, if such cheques are drawn on core banking enabled branches of the paying banks. Under Speed Clearing, cheques drawn on outstation CBS branches of a drawee bank can be processed in the local clearing. Speed Clearing reduces the time taken for realisation of outstation cheques and can now be paid on T+1 or T+2 basis. Speed Clearing has been introduced at 53 centres. The introduction of Speed Clearing has reduced the volume of cheques processed in Inter-City Clearing (conducted at Reserve Bank locations) to a great extent; as a result Inter-City (Outward) Clearing has also been discontinued at 11 Reserve Bank locations and is now available at only 4 centres. IX.14 Cheque Truncation: To enhance the efficiency of the paper based clearing system, the Cheque Truncation System (CTS) was implemented in February 2008 as a pilot project with the 10 banks in the National Capital Region (NCR). Since July 2008, all the member banks of the New Delhi Bankers’ Clearing House are participating in the CTS. To encourage complete migration of cheques in the National Capital Region of Delhi to CTS, the processing charges in respect of cheques presented in CTS were waived till June 2009. With the complete migration of cheque to CTS, the separate paper based clearing held has been discontinued from July 2009. A fee of Rs.0.50 per instrument each for both the presenting and the paying bank in CTS has been introduced from July 1, 2009. IX.15 The trends in the volume and value of paper clearing versus electronic clearing over the recent years show that while in value terms the share of electronic transactions has increased significantly, in volume terms paper based transactions still dominate (Chart IX.1). Electronic Fund Transfer Systems IX.16 Electronic fund transfer systems comprising electronic clearing service (ECS), electronic funds transfer (EFT) and national electronic funds transfer (NEFT) showed a decline of 57.1 per cent in value during 2008-09 as compared to a rise of over 422.0 per cent during 2007-08. The sharp growth in 2007-08 was due to the transactions relating to refund of oversubscription amount relating to IPOs floated by companies through ECS Credit and NEFT. The ECS Debit and EFT/NEFT showed a growth of 36.9 per cent and 79.6 per cent, respectively, in terms of value. The coverage of ECS has been increased to 75 centres and T+1 Settlement cycle (from earlier T+3) is implemented across all the centres. A new system called National Electronic Clearing Service (NECS) having centralised processing capabilities was operationalised with effect from September 29, 2008 to bring in uniformity and efficiency in the system. While NECS-Credit facilitates multiple credits to beneficiary accounts at destination branches across the country against a single debit in the account of a user with the sponsor bank from a single central location at Mumbai, the NECS-Debit when implemented shall facilitate multiple debits to destination account holders across the country against a single credit to the user account at Mumbai. The NECS is a nationwide system leveraging on core banking solutions (CBS) of member banks. All CBS bank branches are participants in the system, irrespective of their location. As of March 31, 2009 as many as 114 banks with 26,275 branches participate in NECS. Local ECS (Credit) at Mumbai was merged with NECS-Credit effective from March 24, 2009. IX.17 It has been decided to extend the waiver of charges for processing electronic payment products (ECS / NECS / NEFT / RTGS) for a further period of one year, i.e., up to 31st March 2010. IX.18 Banks have been advised to encourage their customers to use NEFT which is a nation-wide electronic fund transfer system. As at the end of March 2009, 55,225 branches of 89 banks were participating in NEFT. To encourage the retail electronic payment systems various measures were initiated by the Reserve Bank, viz., (i) facilitating initiation of NEFT transactions by accepting cash from walk-in customers (from the earlier account to account transfer), (ii) option to make credit card payments, (iii) extending the settlement time window for NEFT by one and half hours. Reflecting these, there has been substantial increase in both the volume and amount of transactions in retail electronic fund transfer systems during 2008-09 (Table 9.2).

Cards IX.19 The use of card based payments rose by 22.3 per cent in volume and by 19.0 per cent in value during 2008-09. One notable trend in the context of economic slowdown was that while the growth in value of credit card transactions decelerated in 2008-09, the growth in the value of debit card transactions continued to remain strong as in the previous year (Table 9.3). Automated Teller Machines (ATMs) IX.20 ATMs have become an important channel for delivering banking transactions and services in India, particularly for cash withdrawal and account balance enquiry. The spread of ATMs has increased from 34,789 in March 2008 to 43,651 in March 2009. To extend the facility of use of ATMs of one bank to the customers of other banks, banks have entered into bilateral or multilateral arrangements with other banks to have bilateral or inter-bank ATM networks. The charges levied on the customers for use of ATMs varied from bank to bank and also varied according to the ATM network that was used for the transaction. In order to bring greater transparency and reasonableness in ATM charges being levied by banks on their customers, the Reserve Bank issued directives making use of own bank’s ATM or any other bank’s ATM free of charge for cash withdrawal, from April 1, 2009. The volume of ATM transactions has increased from 17,797 lakh aggregating to Rs.4,38,151 crore during 2007-08 to 23,530 lakh aggregating to Rs.6,16,456 crore during 2008-09.

IX.21 ATMs have the potential to provide facilities other than balance enquiry and cash dispensing. Some banks have tapped these capabilities and are providing value added services to their customers such as funds transfer, bill payment services, mobile phone recharge, etc. An assessment carried out in the Reserve Bank revealed that density of ATM availability (as the ratio of availability of ATM to population) in India was very low compared to developed countries and some emerging market economies. The population per ATM in India was more than 29,500 (March 2008) as against the range of 1000 – 9500 in some of the EMEs. To encourage the spread of ATMs for building the national payment infrastructure, relaxation has been announced in the Annual Policy Statement 2009-10 to allow scheduled commercial banks (SCBs) to set up offsite ATMs without prior approval of the Reserve Bank. Real Time Gross Settlement (RTGS) System IX.22 The RTGS system in operation since March 2004 is primarily for large value transactions with the minimum threshold limit at Rs.1 lakh. The service window for customer transactions is available from 09.00 hours to 16.30 hours on weekdays (up to 12.30 hours on Saturdays). For inter-bank transactions, the RTGS system stays open up to 18.00 hours on week days (14.30 hours on Saturdays). IX.23 The number of RTGS enabled bank branches stood at 55,006 as on March 31, 2009 with the addition of 11,494 branches to the RTGS network during the year 2008-09. The increased network coverage is reflected in the increase in the volume and value settled in RTGS (Chart IX.2). RTGS peak volume and value in a day were 1,28,295 transactions and Rs.2,73,450 crore, respectively, on March 30, 2009. IX.24 RTGS being a systemically important payment system, which is reflected in value settled in RTGS and also with other Multilateral Net Settlements relating to important retail and large value payments being settled in RTGS, it was imperative to assess the operations of the system against the international standards. The assessment was done against the Core Principles for Systemically Important Payment Systems, published by the Committee on Payment and Settlement Systems of the Bank for International Settlements (BIS). The Reserve Bank’s own assessment published as part of the Report of the Committee on Financial Sector Assessment (CFSA) assessed that the RTGS system in India fully complied with 6 core principles and broadly complied with the Core Principle numbers 3, 7 and 8 relating to management of credit and liquidity risk, operational reliability and efficiency. Core Principle 5 is not applicable to RTGS. IX.25 Reserve Bank also commissioned an external assessment of the RTGS system by a team of experts from the Swiss National Bank. These experts viewed that the RTGS system in India is compliant with all the Core Principles, except the one on efficiency. The recommendations made by the team for compliance with this Core Principle is to have a strategy and project business development over the next 5 to 10 years, to monitor the relationship with third-party vendors and ensure effective safeguards in order to retain full control over all aspects of the RTGS system, to have a cost-benefit-analysis, appropriate pricing of payment services, etc. Indo-Nepal Remittance Facility Scheme IX.26 The Indo-Nepal Remittance Facility Scheme was launched in May 2008, which enables one-way funds transfer from India to Nepal. A remitter can transfer funds up to Indian rupees 50,000 from any of the NEFT-enabled bank branches in the country to Nepal. The beneficiary would receive funds in Nepalese Rupees. The charges for effecting funds transfer under the Scheme were rationalised and revised effective from February 9, 2009, with the maximum charge being Rs.75. Although the use of this scheme has been minimal, efforts are being made to popularise this scheme through meetings held with associations of Nepalese migrant workers in various cities in India. New Payment Channels / Products IX.27 The developments in computer and communication technology have also resulted in the spread of new retail payment products and new modes of delivering/settling such payments. These products and channels of effecting payments are innovative, using the latest available technology interfaces and such transactions do not rely on traditional payment systems to transfer value between person to person. Mobile Banking Transactions IX.28 Rapid expansion in the use of mobile phones as a mode of communication has created new opportunities for banks to use this mode for banking transactions. Many countries have adopted this delivery channel as a means of financial inclusion as this facilitates small value payments at a very low cost (Box IX.1). Predominantly, two distinct models are in vogue in countries where mobile banking has taken off – the bank-led model and the telecom company-led model. The telecom company led model is preferred in countries which have relatively less coverage of formal banking facilities (e.g. Kenya). After taking into account various issues involved, India has adopted the bank-led model. IX.29 Operative guidelines for Mobile Banking Transactions in India were notified on October 8, 2008. The major features of the guidelines are: (i) Only banks who have received one time approval from Reserve Bank are permitted to provide this facility to customers; (ii) Banks can extend this facility only to their customers and their holders of debit/credit cards issued as per the extant Reserve Bank guidelines; (iii) banks can extend only Indian Rupee based domestic services as per the guidelines; (iv) banks can extend this facility through their business correspondents also in order to promote financial inclusion; (v) Minimum “Technology and Security Standards” have been prescribed in the guidelines; (vi) limit of Rs.5000 per transactions for funds transfer and m-commerce transaction limit of Rs.10,000 has been prescribed to ensure the safety of transactions through this channel; and (vii) the guidelines mandate interoperability among ser vice providers to ensure prevention of monopoly by one or a few mobile operators. Pre-paid Payment Instruments IX.30 Prepaid payment instruments are payment instruments where value for use is stored in advance, such as, smart cards, magnetic strip cards, internet accounts, internet wallets, mobile accounts, mobile wallets, paper vouchers, etc. Prepaid payment instruments enhance convenience as a mode of payment in lieu of cash. Also, this facilitates e-payment for goods/services purchased/availed through internet/ mobile. The maximum loss on account of fraudulent use of the card is limited to balance available on the card. Mobile Banking : Select Country ExperiencesThe efforts for promoting financial inclusion are often constrained by the spread/dispersion of banks’ networks, cost of banking services, and lower priority attached to small value transactions associated with customers who are underprivileged. The wide penetration and acceptance of mobile phones in the country, irrespective of the social and economic status of the people, provides an opportunity to extend banking facilities to the hitherto excluded sections of the population. The developing countries have adopted different approaches for promoting mobile phone based banking facility in their countries, depending on the banking and financial infrastructure available. Two models have mainly been chosen – ‘Bank Led Model’ and ‘Mobile Service Provider Led Model’. The bank-led model provides for promotion of mobile phone banking through business correspondents of banks, whereas in mobile service providers led model, the agent network of cellular operators are identified as the correspondents. The experiences of Philippines, Kenya and South Africa in implementing mobile banking facilities are outlined below: Philippines: The country has been the pioneer in implementation of mobile phone led banking facilities. Both bank-led and mobile service provider led models have been implemented in the country. SMART Cash is a bank led model where the customer service outlets are provided by the mobile service providers and the customer accounts are maintained by the partnering banks. Customers are also given a debit card linked to their account for cash withdrawal. Cash based transactions at the agents of mobile service provider require identification of the customer. ‘G-Cash’ is a mobile service provider led model. In this model the funds collected are maintained at a bank by the mobile service provider as per the requirement prescribed by the central bank. The agents of the mobile service provider facilitate customer acquisition and extension of services to the customers. Both the models facilitate a number of transactional banking services. Receipt of cross border remittance is also permitted. The Philippines central bank has placed restriction on the amount that can be maintained in SMART Cash and G-Cash accounts. Kenya: In Kenya, mobile service providers (Safaricom and Vodafone) have implemented the mobile banking facility called M-Pesa. The accounts of the customers are maintained with the mobile service provider. M-Pesa provides a number of transactional services to its customers. The agents of mobile service provider act as the agent for customer acquisition and servicing. M-Pesa facilitates receipt of cross border remittances also. South Africa: South Africa has mainly chosen bank led mobile banking facilities. One of the products, ‘MTN Banking’ is the result of the tie-up between a bank and a mobile service provider. The agents of mobile service provider act as the agent for collection, customers acquisition and servicing. ‘Wizzit’ is another mobile banking facility promoted by a commercial bank. Wizzit has been set-up as a branchless bank. The customer acquisition and servicing are done through dedicated group of people known as Wizzkids. Wizzit provides number of transactional banking services to its customers. The customers are also provided debit cards facilitating cash withdrawal. IX.31 The development of any new payment product and mode of payment requires the confidence of the public in the efficiency and safety of the technology and the systems offered. Further, to bring about efficiency and competitive pricing, a level playing field has to be ensured. Taking into consideration these issues, the Reserve Bank issued Policy Guidelines for ‘Issuance and Operation of Pre-paid Payment Instruments in India on April 27, 2009’ (Box IX.2). Information Exchange IX.32 An international seminar on Payment and Settlement Systems was held in March 2009 at Chennai, which was organised jointly by the Reserve Bank and the Committee on Payment and Settlement Systems set up under the aegis of Bank for International Settlements. Deliberating on the theme ‘Retail Payment – Issues and Risks’, the seminar highlighted that with the role of non-banks gaining importance in payment systems, the central banks worldwide have to remain more vigilant about the challenges to regulate and monitor the operations of diverse entities in payments arena; rationalise charges for retail payments; mitigate risks in retail payment systems; and implement initiatives needed to address customer-protection related issues. Pre-paid Payment Instruments in IndiaConsequent to the passing of the Payment and Settlement Systems Act, 2007, all persons currently operating payment systems involved in the issuance of Pre-paid Payment Instruments and those proposing to operate such systems would have to approach the Reserve Bank for authorisation. To ensure orderly development and operation of pre-paid payment instruments in the country, a set of guidelines were issued by the Reserve Bank in April 2009. The salient aspects covered in the guidelines are: Categorising the instruments: The pre-paid payment instruments that can be issued in the country are classified under three categories, viz. (i) closed system payment instruments, (ii) semi-closed system payment instruments and (iii) open system payment instruments. (i) Closed System Payment Instruments: These are payment instruments issued by a person for facilitating the purchase of goods and services from him/it. These instruments do not permit cash withdrawal or redemption. As these instruments do not facilitate payments and settlement for third party services, issue and operation of such instruments are not classified as payment systems. (ii) Semi-Closed System Payment Instruments: These are payment instruments which are redeemable at a group of clearly identified merchant locations/ establishments which contract specifically with the issuer to accept the payment instruments. These instruments do not permit cash withdrawal or redemption by the holder. (iii) Open System Payment Instruments: These are payment instruments which can be used for purchase of goods and services at any card accepting merchant locations (point of sale terminals) and also permit cash withdrawal at ATMs.

The money collected against issue of pre-paid payment instruments at a point of time could be substantial. Further, the turnover of funds may also be rapid. The confidence of public and merchant establishments on pre-paid instruments schemes depends on the timely settlement of claims arising from use of such instruments. To ensure timely settlement, conditions have been stipulated on deployment of money collected by the issuer. The money collected by banks against issue of pre-paid payment instruments shall be part of the ‘net demand and time liabilities’ for the purpose of maintenance of reserve requirements. Other non-banks issuing payment instruments are required to maintain their outstanding balance in an ‘escrow account ’ with any scheduled commercial bank. The amount in the escrow account would be only for making payment to the participating merchant establishments and no interest is payable by the bank on such balances, and no loan is permissible against such deposits. The entities can enter into an agreement with the bank where escrow account is maintained to transfer “core portion” (i.e., the average of the lowest daily outstanding balance (LB) on a fortnightly (FN) basis, for one year (26 fortnights) from the preceding month) of the amount, in the escrow account to a separate account on which interest is payable, subject to the bank satisfying itself that the amount deposited represents the “core portion”. The amount shall be linked to the escrow account, i.e., the amounts held in the interest bearing account shall be available to the bank, to meet payment requirements. This facility is, however, only available to entities who have been in business for more than a year.

IX.33 The Fifth Annual Conference of the Heads of National Clearing Cells was organised in February 2009 at Jaipur with active participation from heads of Banking Departments and National Clearing Cells from Reserve Bank, senior executives from IBA, settlement banks and vendors. The focus of the Conference was to synergise and organise the oversight and monitoring mechanism to deliver optimal benefits efficiently by the Clearing Houses in their payment system activities. The deliberations at the seminar on the recent initiatives and the participants’ expectations as well as suggestions for shaping the future of payment systems provided inputs for reforms in the payment systems. National Payments Corporation of India (NPCI) IX.34 The process for setting-up an umbrella organisation for retail payment systems was initiated by Indian Banks’ Association (IBA). Accordingly, National Payments Corporation of India (NPCI) has since been incorporated as a company under section 25 of the Companies Act. NPCI has an authorised capital of Rs.300 crore. Oversight of the Payment and Settlement Systems IX.35 In order to ensure that the efforts taken for improving the clearing and settlement operations and the various instructions issued for the same are adhered to by all, the Reserve Bank has framed the minimum standards of operational efficiency (MSOE) for MICR CPCs, MSOE for MMBCS (automated) Clearing Houses, Benchmark Indicators for ECS and NEFT benchmark indicators of efficiency. The minimum standards prescribed require submission of quarterly/half yearly self assessment reports to the Regional Office of the Reserve Bank under whose jurisdiction they operate. DEVELOPMENTS IN USE OF INFORMATION TECHNOLOGY Information Technology in the Reserve Bank IX.36 In its efforts to ensure that IT paves the way for efficiency and excellence, the Reserve Bank has been taking steps to ensure that users of IT get the IT services at their desktop and ensure business continuity at all times without the end users having to worry about the activities ‘behind the scene’. Towards this end, the major focus of the IT related endeavours was on migration of various application systems to the data centres, aimed at providing all IT based services from the data centres, for both the users within the Reserve Bank as well as external users. IX.37 Operations resulting in the uninterrupted availability of critical payment and settlement systems such as the RTGS system, the Public Debt Office – Negotiated Dealing System/Securities Settlement System(PDO-NDS/SSS), the Centralised Funds Management System (CFMS) and the Structured Financial Messaging System (SFMS)) were also primary focus areas of the data centres – aimed at the financial sector in particular and the general public at large. In respect of the RTGS system, the system has been fine-tuned to be able to process increasing transactions, which have increased substantially to about 80,000 transactions a day during 2008-09 from about 40,000 transactions on an average day during 2007-08. IX.38 The Reserve Bank followed a three-pronged approach with regard to the technology initiatives within the organisation. The first pertained to the centralisation of all application systems while providing for decentralised access to IT users within the Reserve Bank. The second related to the migration of all IT based application systems to the ‘state-of-the-art’ data centres of the Reserve Bank. The third - at the heart of all IT initiatives - was the implementation of appropriate security safeguards in all the IT based systems. IX.39 As part of the approach towards centralisation of IT based application systems, all the application systems pertaining to the Banking Department have been restructured to function in a centralised environment, with users spread across the various locations having access to these systems in a decentralised manner. The first initiative in this area was the ‘Centralised Public Debt Office’ (CPDO) system which has been in vogue for some time now. The ‘Integrated Accounting System’ for the Deposit Accounts Department has established itself well in the Mumbai Regional Office where it was used as the primary accounting system for the first time during the year 2008-09. The implementation of the ‘Centralised Public Accounts Department System’ (CPADS) across all offices of the Reserve Bank during the year resulted in the culmination of efforts aimed at centralising the Banking Department's functions. Continuing the trend of centralisation, the ‘Integrated Computerised Currency Operations and Management System’ (ICCOMS) was extended to cover all the currency chests in the country and all the Issue Departments of the Reserve Bank, thereby making the IT based currency management system also function in a centralised manner. IX.40 The housekeeping and other internal functions of the Reserve Bank were also brought under the ambit of computerisation during 2008-09. The complete operationalisation of the ‘Integrated Establishment System’ (IES) across all the offices took care of the establishment related functions for the staff of the Reserve Bank. The advanced level of completion of the ‘Human Resources Management System’ (HRMS), the implementation of the computerisation modules of the ‘Central Debt Division’ of the Department of Government and Bank Accounts and the issue of Multi-Application-Smart Card based identity cards for the staff members of the Reserve Bank on an enterprise wide basis, have been some of the other IT based projects providing support to the internal requirements of the Reserve Bank. IX.41 During 2008-09, substantial progress could be made in the migration of existing application systems to the newly set up IT infrastructure at the data centres. The use of IT based applications for workflow and knowledge management has emerged as a key development in the use of IT within the Reserve Bank (Box IX.3). IX.42 A self evaluation of the IT based operational thresholds of the Reserve Bank reveals a high level of conformity to the objectives in this regard (Table 9.4). IX.43 An important constituent of IT based operations pertains to business continuity, with the objective being that IT based systems should be available even in the event of any breakdown, and more so, if a disaster strikes. All the critical systems at the data centres have been planned and designed in such a manner that there is adequate provision for redundancy and back-up. Furthermore, Disaster Recovery (DR) exercises covering all systems as also the participants are conducted on a regular basis. Technology upgradation IX.44 On account of the quick rate of technological obsolescence, continuous technological upgradation is an aspect that is given adequate importance in respect of the IT systems implemented in the Reserve Bank. The major initiatives on technological upgradation taken by the Reserve Bank during 2008-09 include migration of the inter-office communication network to Multi Protocol Label Switching (MPLS) technology. MPLS adopts the usage of Virtual Private Networks, with enhanced security levels, (Box IX.4), thereby improving network based telecommunication. Work Flow and Knowledge ManagementKnowledge management and workflow refers to a system which ensures that all users have instant access to all the information needed for their roles within an organisation. Some of the other aspects covered under workflow and knowledge management include training management features and user-specific responsibilities notification and reporting. As a central feature of the knowledge management workflow, there is a ‘dashboard’ which is customisable to ensure that all users are aware of the tasks, actions and documents that they are responsible for or need to be aware of. The dashboard also provides user-specific traffic light performance and compliance scorecards and keeps users up-to-date with news, events and alerts. Resource features allow users to share information and enable executives and senior managers to set, communicate and monitor compliance with policies, procedures and guidelines. This ‘resources library’ also provides easy access to best practices, corporate guidance and the features necessary to document the expanding knowledge base of experience and expertise of the organisation. Communication and people search tools make it quick and easy to locate and connect with other users within the organisation, so that organisational knowledge is optimally used. IT for the Financial Sector IX.45 IT intensity of banks and the speed of adaptation of new technology in the financial sector are closely related, to a large extent, on the IT initiatives of the Reserve Bank. With the objective of achieving harmony, the Reserve Bank publishes the Financial Sector Technology (FST) Vision, which enable the banks to plan their IT implementation in a manner which would ensure congruity with the approaches followed by the Reserve Bank. The latest version of the FST Vision document was published in 2007-08, which outlined various goal posts for adoption by both the Reserve Bank and the commercial banks. Virtual Private Networks : Safety and Efficiency Parameters A virtual private network (VPN) is a computer network in which some of the links between nodes use virtual circuits in larger networks, such as the Internet, as opposed to running across a single private network. One common approach is to secure communications through the public Internet, as the VPN has security features such as authentication and encryption. For example, VPNs can also be used to separate the traffic of different user communities over an underlying network with strong security features, or to provide access to a network via customised or private routing mechanisms. From the security standpoint, VPNs either trust the underlying delivery network, or must enforce security with mechanisms in the VPN itself. Unless the trusted delivery network runs only among physically secure sites, both trusted and secure models need an authentication mechanism for users to gain access to the VPN. Some Internet Service Providers offer managed VPN service for business customers who want the security and convenience of a VPN but prefer not to undertake administering VPN services themselves. In addition to providing remote workers with secure access to their employer’s internal network, other security and management services are sometimes included as part of the package. Examples include keeping anti-virus and anti-spyware programs updated on each client’s computer. Secure VPNs use cryptographic tunneling protocols to provide the intended confidentiality and sender authentication to achieve privacy. When properly chosen, implemented, and operated, such techniques can provide secure communications over unsecured networks. IX.46 A review of the achievements vis-à-vis the goals reveal the following: (i) network based operations and centralised processing of data has been achieved by the migration to core banking systems by banks, (ii) sharing of resources for reaping economies of scale and mutual benefit has commenced for the ATMs by making them part of the National Financial Switch (NFS) established by the Institute for Development and Research in Banking Technology (IDRBT), (iii) initial trial runs have commenced for introduction of Extensible Markup Language (XML) for easy inter-operability, (iv) completion of the implementation of core banking systems (CBS) in banks has been almost achieved with many banks reporting 100 per cent CBS coverage, (v) integrating the CBS with common interbank applications such as the RTGS, NEFT, PDO-NDS/Security Settlement Systems (SSS), etc. has been completed by most of the banks, (vi) migration to electronic modes of payments on a time bound basis has been achieved in a phased manner by means of a minimum limit for RTGS transactions, compulsory processing of large values only through electronic means and the discontinuance of the high value clearing, (vii) effective and failsafe business continuity plans (BCP) have been put in place and periodical BCP exercises initiated by the Reserve Bank, (viii) Information Systems Audit is now an integral part of the controls and checks measures implemented by banks and (ix) management of outsourcing, especially with reference to vendor management, has improved. IX.47 Efforts have been directed at benchmarking the various payment products and systems to assure availability and continuity of business, even in the unlikely event of disruptions to normal operations, besides assessment against Systemically Important Payment Systems. The new frontiers of technology are being adopted to make further advances in areas like mobile banking, electronic fund transfer, development of pre-paid payment instruments, speed clearing, cheque truncation, besides gradual shifting of paper based payments to electronic payment modes. The Reserve Bank’s approach is also to ensure that regulations do not stifle innovations and competition, and the new products and systems must embrace high levels of safety and security so as to instill confidence among the users. The infrastructure of core-banking solutions that is available across the banking industry has to be leveraged to launch payment applications and products that benefit the cross-section of customers across banks in a cost-effective manner. IX.48 To sum up, non-disruptive functioning of the payment and settlement system during the period of global financial crisis is a notable aspect of the Indian financial system. Since markets and institutions in India functioned normally even during the peak of the crisis, it did not give rise to concerns regarding payment and settlement of transactions. More importantly, the advancements made in payment and settlements on account of sustained forward looking measures taken by the Reserve Bank have contributed to strengthening a major pillar of the financial system, which provides resilience against shocks to the financial system. The regulatory interventions of the Reserve Bank in new emerging modes of payments and their settlement have ensured appropriate institutional mechanisms for their functioning in consonance with the overall objectives of an efficient and stable financial system. The IT initiatives, both for the internal functioning of the Reserve Bank and for adoption in the financial system have facilitated improved service delivery as well as greater efficiency of the financial system, besides substantially contributing to the Reserve Bank’s efforts for promoting financial inclusion. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

પેજની છેલ્લી અપડેટની તારીખ: