RESERVE BANK OF INDIA

AND

SECURITIES AND EXCHANGE BOARD OF INDIA

JUNE 2009

Chapter 1

Background

1.1 Brief Overview of the Debt Market in India

Debt market comprises the primary as well as the secondary market for debt instruments - both sovereign and corporate. A well functioning debt market is critical for inter-temporal resource allocation and is therefore significant for all economic agents.

The development of financial markets started in the early 1990’s. Since then, a series of reforms - both structural as well as institutional – have been initiated with a view to having market determined interest rates. The other objectives of these reforms have been to improve transparency, efficiency and accessibility of the debt market.

The Government started the reforms by borrowing from the market at rates determined through auctions. Previously, this was being carried out at pre-announced rates. Other reforms include introduction of new instruments such as - zero coupon bonds, floating rate bonds, capital index bonds; establishment of specialized institutions such as Discount and Finance House of India (DFHI) and Securities Trading Corporation of India (STCI), setting up of the Negotiated Dealing System (NDS), implementation of the Patil Committee recommendations for corporate bonds, etc.

While these reforms have resulted in increased trading volumes in the debt market (total turnover in Government of India (GoI) dated securities increased from Rs. 1,770,980 crore in 2006-07 to Rs. 2,957,070 crore in 2007-08), yet the trading volume has remained low in comparison to the developed markets. There is a strong need to further deepen and widen the market by offering a wide range of products.

1.2 Need for Interest Rate Futures

Interest rate risk affects not only the financial sector, but also the corporate and household sectors. As observed in the Report on Interest Rate Futures, banks, insurance companies, primary dealers and provident funds bear a major portion of the interest rate risk on account of their exposure to government securities. As such these entities need a credible institutional hedging mechanism1. Today, with a large stock of household financial savings on the assets side and an increasing quantum of housing loans on the liabilities side, interest rate risk is becoming increasingly important for the household sector as well. Moreover, because of the Fisher effect2, interest rate products are the primary instruments available to hedge inflation risk which is typically the single most important macroeconomic risk faced by the household sector3. In this context, therefore, it is important that the financial system provides the household sector greater access to interest rate risk management tools through Exchange-Traded interest rate derivatives.

1.3 Benefits of Exchange-Traded Interest Rate Derivatives

Interest rate futures, a derivative instrument with linear pay-offs, provide benefits typical to any Exchange-Traded product, such as:

a.

Standardization – Through standardization, the Exchanges offer market participants a mechanism for gauging the utility and effectiveness of different positions and strategies.

b.

Transparency – Transparency, efficiency and accessibility is accentuated through online real time dissemination of prices available for all to see and daily mark-to-market discipline.

c.Counter-party Risk – The credit guarantee of the clearing house eliminates counter party risk thereby increasing the capital efficiency of the market participants.

1.4 Constitution of the Group

With the expected benefits of Exchange-Traded interest rate futures, it was decided in a joint meeting of RBI and SEBI on February 28, 2008, that an RBI-SEBI Standing Technical Committee on Exchange-Traded Currency and Interest Rate Derivatives would be constituted. The Committee submitted its Report on Exchange-Traded Currency Futures on May 29, 2008.

The Committee is constituted with the following officials from RBI and SEBI: |

i. |

Shri Manas S. Ray |

ED, SEBI |

ii. |

Shri Nagendra Parakh |

CGM, SEBI |

iii. |

Dr. Sanjeevan Kapshe |

OSD, SEBI |

iv. |

Dr. K.V.Rajan |

CGM, RBI |

v. |

Shri Prashant Saran* |

CGM, RBI |

vi. |

Shri Salim Gangadharan |

CGM, RBI |

vii. |

Shri Chandan Sinha |

CGM, RBI |

viii. |

Shri H.S. Mohanty |

DGM, RBI |

ix. |

Shri Sujit Prasad |

GM, SEBI (Member-Secretary) |

*Shri Prashant Sharan has since joined SEBI as a Whole Time Member on May 18,2009 |

1.5 Terms of Reference

The Committee was given the following terms of reference:

i.

To coordinate the regulatory roles of RBI and SEBI in regard to trading of Currency and Interest Rate Futures on the Exchanges.

ii.

To suggest the eligibility norms for existing and new Exchanges for Currency and Interest Rate Futures trading.

iii.

To suggest eligibility criteria for the members of such exchanges.

iv. To review product design, margin requirements and other risk mitigation measures on an ongoing basis

v.

To suggest surveillance mechanism and dissemination of market information

vi.

To consider microstructure issues, in the overall interest of financial stability.

With a view to operationalising the Interest Rate Futures products, the Committee deliberated upon the recommendations of the Technical Advisory Committee Report on Interest Rate Futures (August 2008). The Report had primarily focused on introduction of a physically settled Interest Rate Futures contract on 10 year GoI coupon bearing security. It had also recommended retention of the contract based on 91-day Treasury Bills (introduced in 2003) with some modification in the settlement price and consideration of a contract based on some suitable index of money market rates. The High Level Coordination Committee for Financial Markets (HLCCFM) has decided that (1) futures based on the 91-day Treasury Bills may be considered later as deemed appropriate and (2) futures based on the overnight rate may not be introduced. Accordingly, the operational norms for the 10-year Notional Coupon-bearing GoI Security Futures are being issued to the market through this Report for early implementation.

1.6 Acknowledgement

The Committee is grateful for the guidance provided by the senior management of both RBI and SEBI. In particular, the Committee is thankful to Shri V K Sharma, Executive Director, RBI (Chairman: Working Group on Interest Rate Futures) for suggesting an alternate methodology for margin computation.

The Committee places on record its appreciation of the contribution by Shri Bithin Mahanta, Shri Navpreet Singh, Ms. Rajeswari Rath, Shri Ashish Kumar Singh, Shri Shailesh Pingale, Shri Lakshaya Chawla and Shri Sahil Tuli of SEBI.

The Committee also places on record its appreciation of the contribution made by Dr. Abhiman Das and Shri Puneet Pancholy of RBI in data and statistical analysis.

Chapter 2

Product Design, Margins and Position Limits for 10-Year Notional Coupon-bearing Government of India (GoI) Security Futures

2.1 Underlying

10-Year Notional Coupon-bearing GoI security

2.2 Coupon

The notional coupon would be 7% with semi-annual compounding.

2.3 Trading Hours

The Trading Hours would be from 9 a.m. to 5.00 p.m on all working days from Monday to Friday.

2.4 Size of the Contract

The Contract Size would be Rs. 2 lakh.

2.5 Quotation

The Quotation would be similar to the quoted price of the GoI security. The day count convention for interest payments would be on the basis of a 360-day year, consisting of 12 months of 30 days each and half yearly coupon payment.

2.6 Tenor of the Contract

The maximum maturity of the contract would be 12 months.

2.7 Available Contracts

The Contract Cycle would consist of four fixed quarterly contracts for entire year, expiring in March, June, September and December.

2.8 Daily Settlement Price

The Daily Settlement Price would be the closing price of the 10-year Notional Coupon-bearing GoI security futures contract on the trading day. (Closing price = Weighted Average price of the futures for last half an hour). In the absence of last half an hour trading the theoretical price, to be determined by the exchanges, would be considered as Daily Settlement Price. The exchanges will be required to disclose the model/methodology used for arriving at the theoretical price.

2.9 Settlement Mechanism

The contract would be settled by physical delivery of deliverable grade securities using the electronic book entry system of the existing Depositories (NSDL and CDSL) and Public Debt Office (PDO) of the RBI. The delivery of the deliverable grade securities shall take place from the first business day of the delivery month till the last business day of the delivery month. The owner of a short position in an expiring futures contract shall hold the right to decide when to initiate delivery. However, the short position holder shall have to give intimation, to the Clearing Corporation, of his intention to deliver two business days prior to the actual delivery date.

2.10 Deliverable Grade Securities

GoI securities maturing at least 7.5 years but not more than 15 years from the first day of the delivery month with a minimum total outstanding stock of Rs 10,000 crore.

2.11 Conversion Factor

The Conversion Factor for deliverable grade security would be equal to the price of the deliverable security (per rupee of the principal), on the first day (calendar day) of the delivery month, to yield 7% with semiannual compounding.

For deliveries into 10-Year Notional Coupon-bearing GoI security futures, the deliverable security’s remaining term to maturity shall be calculated in complete three-month quarters, always rounded down to the nearest quarter. If, after rounding, the deliverable security lasts for an exact number of 6-month periods, the first coupon shall be assumed to be paid after 6 months. If, after rounding, the deliverable security does not last for an exact number of 6-month periods (i.e. there are an extra 3 months), the first coupon would be assumed to be paid after 3 months and accrued interest would be subtracted.

2.12 Invoice Price

Invoice Price of the respective deliverable grade security would be the futures settlement price times a conversion factor plus accrued interest.

2.13 Last Trading Day

Seventh business day preceding the last business day of the delivery month.

2.14 Last Delivery Day

Last business day of the delivery month.

2.15 Initial Margin

Initial Margin requirement shall be based on a worst case loss of a portfolio of an individual client across various scenarios of price changes. The various scenarios of price changes would be so computed so as to cover a more than 99% VaR over a one day horizon. In order to achieve this, the price scan range may initially be fixed at 3.5 standard deviation4. The initial margin so computed would be subject to a minimum of 2.33% of the value of the futures contract on the first day of trading in 10-year Notional Coupon-bearing GoI security futures and 1.6% of the value of the futures contract thereafter. The initial margin shall be deducted from the liquid net worth of the clearing member on an online, real time basis.

2.16 Extreme Loss Margin

Extreme loss margin of 0.3% of the value of the gross open positions of the futures contract shall be deducted from the liquid assets of the clearing member on an on line, real time basis.

2.17 Calendar Spread Margin

Interest rate futures position at one maturity hedged by an offsetting position at a different maturity would be treated as a calendar spread. The calendar spread margin shall be at a value of Rs.2000/- per month of spread. The benefit for a calendar spread would continue till expiry of the near month contract.

2.18 Model for Determining Standard Deviation

The Committee examined the results of empirical tests carried out using different risk management models in the Value at Risk (VaR) framework in the 10-year GoI security yields. Data for the period January 3, 2000 to September 16, 2008 was analyzed. GARCH (1,1)-normal and GARCH (1,1)-GED (Generalized Auto-Regressive Conditional Heteroskedasticity) at 3 and 3.5 sigma levels were not found to perform well at 1% risk level, as the actual number of violations were found to be statistically much higher than the expected number of violations. The EWMA (Exponentially weighted moving average) model used by J.P.Morgan’s Risk Metrics methodology was found to work well at 3 and 3.5 sigma levels at 5% risk level and not at 1% risk level.

Given the computational ease of the EWMA model and given the familiarity of the Exchanges with this particular model (it is currently being used in the equity derivatives market), the Committee, after considering the various aspects of the different models, decided that EWMA method would be used to obtain the volatility estimate every day fixing the price scan range at 3.5 standard deviation. During the first time-period on the first day of trading in 10-year Notional Coupon-bearing GoI security futures, the sigma would be equal to 0.8 %.

2.19 Formula for Determining Standard Deviation

The EWMA method would be used to obtain the volatility estimate every day. The estimate at the end of time period t (σyt) is arrived at using the volatility estimate at the end of the previous time period i.e. as at the end of t-1 time period (σyt-1), and the return (ryt) observed in the futures market during the time period t. The formula would be as under:

(σyt)2 = λ (σyt-1)2 + (1 - λ ) (ryt)2

Where

λ(lambda) is a parameter which determines how rapidly volatility estimates changes. The value of λ is fixed at 0.94.

i.

σyt (sigma) is the standard deviation of daily logarithmic returns of yield of 10-year Notional Coupon-bearing GoI security futures at time t.

ii. The "return" is defined as the logarithmic return: rt = ln(Yt/Yt-1) where Yt is the yield of 10-year Notional Coupon-bearing GoI security futures at time t.

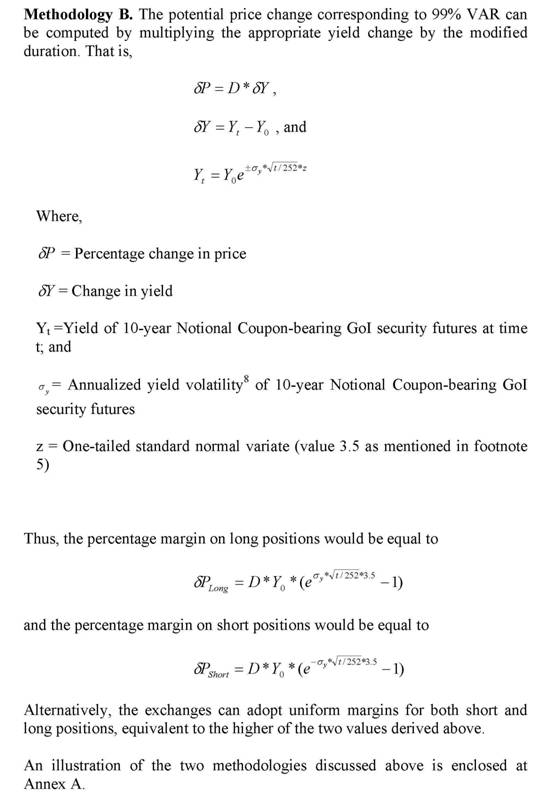

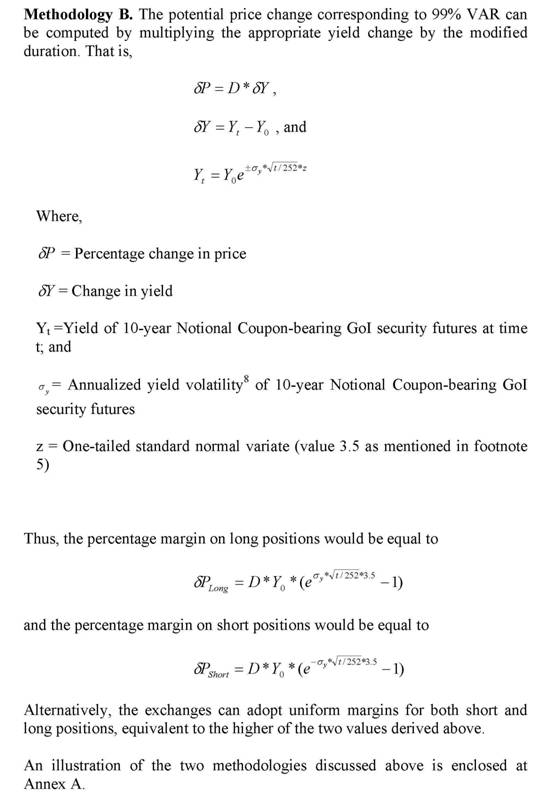

For computing the margin, two methodologies can be considered.

Methodology A. The plus/minus 3.5 sigma limits5 for a 99% VAR based on logarithmic returns on yield of 10-year Notional Coupon-bearing GoI security futures would have to be converted into price volatility through the following formula :

σpt=D*σyt* Yt

where

σpt is the standard deviation of percentage change in price at time t;

D is Modified Duration6;

Y7t is the yield of 10-year Notional Coupon-bearing GoI security futures at time t; and

σyt (sigma) is the standard deviation of daily logarithmic returns of yield of 10-year Notional Coupon-bearing GoI security futures at time t.

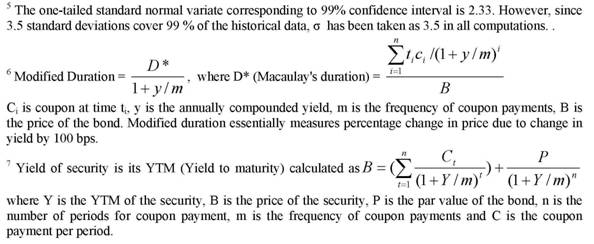

The percentage margin on long position would be equal to 100 (D*3.5σyt* Yt) and the percentage margin on short position would be equal to 100 (D*(-3.5σyt)* Yt). The Modified Duration for 10-Year Notional Coupon-bearing GoI security futures shall be 10.

iii. The volatility estimation and margin fixation methodology should be clearly made known to all market participants so that they can compute the margin for any given closing level of the interest rate futures price. Further, the trading software itself should provide this information on a real time basis on the trading workstation screen.

2.20 Position Limits

i. Client level: The gross open positions of the client across all contracts should not exceed 6% of the total open interest or Rs 300 crores whichever is higher. The Exchange will disseminate alerts whenever the gross open position of the client exceeds 3% of the total open interest at the end of the previous day’s trade.

ii. Trading Member level: The gross open positions of the trading member across all contracts should not exceed 15% of the total open interest or Rs. 1000 crores whichever is higher.

iii. Clearing Member level: No separate position limit is prescribed at the level of clearing member. However, the clearing member shall ensure that his own trading position and the positions of each trading member clearing through him is within the limits specified above.

iv. FIIs and NRIs: Total gross long position in the debt market and the Interest Rate Futures would not exceed the maximum permissible debt market limit prescribed from time to time. Short position in Interest Rate Futures would not exceed long position in the debt market and in Interest Rate Futures.

Chapter 3

Risk Management Measures

3.1 Introduction

In exchange traded derivative contracts, the Clearing Corporation acts as a central counterparty to all trades and performs full novation. The risk to the Clearing Corporation can only be taken care of through a stringent margining framework. Also, since derivatives are leveraged instruments, margins also act as a cost and discourage excessive speculation. A robust risk management system should therefore, not only impose margins on the members of the Clearing Corporation but also enforce collection of margins from the clients.

3.2 Portfolio Based Margining

The Standard Portfolio Analysis of Risk (SPAN) methodology shall be adopted to take an integrated view of the risk involved in the portfolio of each individual client comprising his positions in futures contracts across different maturities. The client-wise margins would be grossed across various clients at the Trading / Clearing Member level. The proprietary positions of the Trading / Clearing Member would be treated as that of a client.

3.3 Real-Time Computation

The computation of worst scenario loss would have two components. The first is the valuation of the portfolio under the various scenarios of price changes. At the second stage, these scenario contract values would be applied to the actual portfolio positions to compute the portfolio values and the initial margin. The exchanges shall update the scenario contract values at least 6 times in the day, which may be carried out by taking the closing price of the previous day at the start of trading and the prices at 11:00 a.m., 12:30 p.m., 2:00 p.m., 3.30 p.m. and at the end of the trading session. The latest available scenario contract values would be applied to member/client portfolios on a real time basis.

3.4 Liquid Networth

The initial margin and the extreme loss margin shall be deducted from the liquid assets of the clearing member. The clearing member’s liquid net worth after adjusting for the initial margin and extreme loss margin requirements must be at least Rs. 50 Lakhs at all points in time. The minimum liquid networth shall be treated as a capital cushion for days of unforeseen market volatility.

3.5 Liquid Assets

The liquid assets for trading in Interest Rate Futures would have to be provided separately and maintained with the Clearing Corporation. However, the permissible liquid assets, the applicable haircuts and minimum cash equivalent norms would be mutatis mutandis applicable from the equity/currency derivatives segment.

3.6 Mark-to-Market (MTM) Settlement

The MTM gains and losses shall be settled in cash before the start of trading on T+1 day. If MTM obligations are not collected before start of the next day’s trading, the Clearing Corporation shall collect correspondingly higher initial margin to cover the potential for losses over the time elapsed in the collection of margins.

The daily closing price of interest rate futures contract for mark to market settlement would be calculated on the basis of the last half an hour weighted average price of the futures contract. In the absence of trading in the last half an hour the theoretical price would be taken. The eligible exchanges shall define the methodology for calculating the ‘theoretical price’ at the time of making an application for approval of the interest rate futures contract to SEBI. The methodology for calculating the ‘theoretical price’ would also be disclosed to the market.

3.7 Margin Collection and Enforcement

The client margins (initial margin, extreme loss margin, calendar spread margin and mark to market settlements) have to be compulsorily collected and reported to the Exchange by the members. The Exchange shall impose stringent penalty on members who do not collect margins from their clients. The Exchange shall also conduct regular inspections to ensure margin collection from clients.

3.8 Safeguarding Clients Money

The Clearing Corporation should segregate the margins deposited by the Clearing Members for trades on their own account from the margins deposited with it on client account. The margins deposited on client account shall not be utilized for fulfilling the dues which a Clearing Member may owe the Clearing Corporation in respect of trades on the member’s own account. The client’s money is to be held in trust for client purpose only. The following process is to be adopted for segregating the client’s money vis-à-vis the clearing member’s money:

i.

At the time of opening a position, the member should indicate whether it is a client or proprietary position.

ii.

Margins across the various clients of a member should be collected on a gross basis and should not be netted off.

iii.

When a position is closed, the member should indicate whether it was a client or his own position which is being closed.

iv.

In the case of default, the margins paid on the proprietary position would only be used by the Clearing Corporation for realizing its dues from the member.

3.9 Periodic Risk Evaluation Report

The Clearing Corporation of the Exchange shall on an ongoing basis and atleast once in every six months, conduct back testing of the margins collected vis-à-vis the actual price changes. A copy of the study shall be submitted to SEBI along with suggestions on changes to the risk containment measures, if any.

Chapter 4

Regulatory and Legal aspects

4.1 The Interest Rate Derivative contracts shall be traded on the Currency Derivative Segment of a recognized Stock Exchange. The members registered by SEBI for trading in Currency/Equity Derivative Segment shall be eligible to trade in Interest Rate Derivatives also, subject to meeting the Balance Sheet networth requirement of Rs 1 crore for a trading member and Rs 10 crores for a clearing member. Before the start of trading, the Exchange shall submit the proposal for approval of the contract to SEBI giving:

i

The details of the proposed interest rate futures contract to be traded in the exchange;

ii

The economic purposes it is intended to serve;

iii

Its likely contribution to market development;

iv

The safeguards and the risk protection mechanisms adopted by the exchange to ensure market integrity, protection of investors and smooth and orderly trading;

v

The infrastructure of the exchange and surveillance system to effectively monitor trading in such contracts.

4.2 SEBI-RBI Coordination Mechanism

A SEBI-RBI constituted committee would meet periodically to sort out issues, if any, arising out of overlapping jurisdiction of the interest rate futures market.

Chapter 5

Miscellaneous Issues

5.1 Banks Participation in Interest Rate Futures

It is stated in the RBI Report on Interest Rate Futures that “…the current approval for banks’ participation in IRF for hedging risk in their underlying investment portfolio of government securities classified under the Available for Sale (AFS) and Held for Trading (HFT) categories should be extended to the interest rate risk inherent in their entire balance sheet – including both on, and off, balance sheet items – synchronously with the re-introduction of the IRF.”

5.2 Extending the Tenor of Short Sales

In the RBI Report on Interest Rate Futures, it has been recommended that the time limit on short selling be extended so that term / tenor / maturity of the short sale is co-terminus with that of the futures contract and a system of transparent and rule-based pecuniary penalty for SGL bouncing be put in place, in lieu of the regulatory penalty currently in force.

Annex A - Illustration of margin computation

- Product: 10-Year Notional Coupon-bearing Government of India (GoI) Security Futures

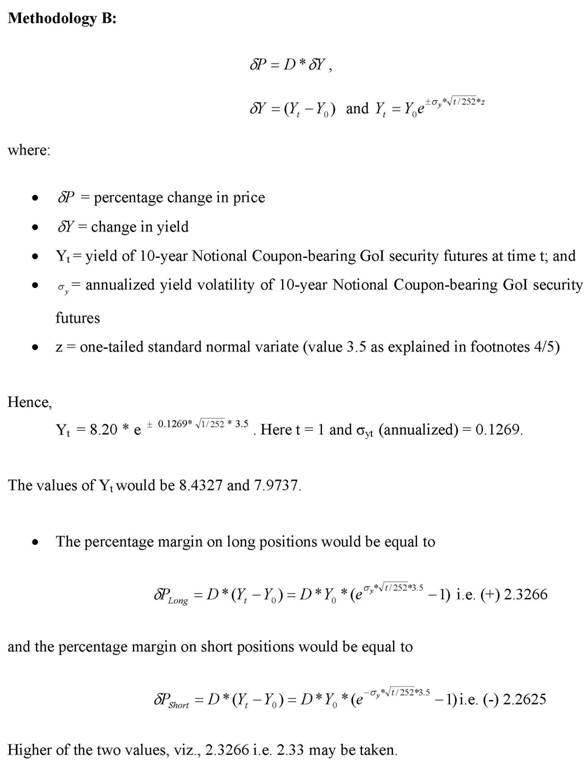

- Given a time series (January 3, 2000 to September 16, 2008) of yields of a 10-year Constant Maturity Security. Say, the last yield in the time series, Yt was 8.20%. The volatility can be calculated using EWMA method:

(σyt)2 = λ (σyt-1)2 + (1 - λ ) (ryt)2 ………………………………………..(1)

where:

- λ (lambda) is a parameter which determines how rapidly volatility estimates changes. The value of λ is fixed at 0.94

- σyt (sigma) is the standard deviation of daily logarithmic returns of yield of 10-year Notional Coupon-bearing GoI security, the "return" is defined as the logarithmic return: rt = ln(Yt/Yt-1)

- Using formula (1) on the time series, the σYt (daily) is 0.008, and σYt (annualized) comes to 0.1269.

Methodology A :

σpt = D*σyt* Yt

Where:

- σpt is the standard deviation of percentage change in price at time t

- D is the modified duration;

- Yt is yield of 10-year Notional Coupon-bearing GoI security futures at time t; and

- σyt (sigma) is the standard deviation of daily logarithmic returns of yield of 10-year Notional Coupon-bearing GoI security futures at time t.

The percentage margin on long would be (D* 3.5 * σyt * Yt) i.e. 2.29and the percentage margin on short position would be equal to 100 (D* (-3.5*σyt) * Yt) i.e. (-) 2.29.

Annex B - List of Committee Members

The above Report is submitted by;

i. Shri Manas S. Ray

Executive Director,

SEBI -

ii. Shri Nagendra Parakh

Chief General Manager,

SEBI -

iii. Dr. Sanjeevan Kapshe

Officer on Special Duty,

SEBI -

iv. Dr. K.V.Rajan

Chief General Manager,

RBI -

v. Shri Chandan Sinha

Chief General Manager,

RBI -

vi. Shri Salim Gangadharan

Chief General Manager,

RBI -

vii. Shri H.S. Mohanty

Deputy General Manager,

RBI -

viii Shri Sujit Prasad (Member Secretary)

General Manager,

SEBI -

1 RBI Report on Interest Rate Futures (August 2008)

2 “Fisher effect” implies that ceteris paribus, increase in expected inflation rate leads to an increase in the nominal interest rate.

3 Exchange-traded Interest Rate Derivatives in India, Consultative Document, SEBI, March 2003.

4One tailed standard normal variate corresponding to 99 % confidence interval is 2.33. However, simulation on the historical data showed that 99 % of data could be covered only with 3.5 times standard.deviation.

8Annualized yield volatility is obtained by multiplying the standard deviation of daily logarithmic return by square root of the number of trading days, usually taken as 252.

|

IST,

IST,