IST,

IST,

Global Economic Turmoil: Impact on Indian Economy and the Way Forward

Shri Harun R Khan, Deputy Governor, Reserve Bank of India

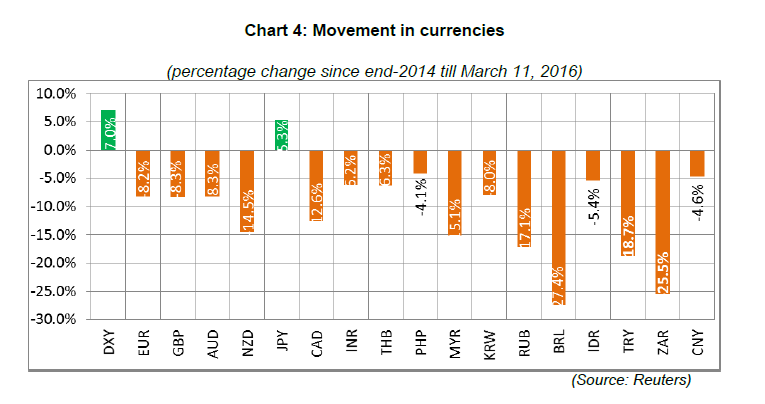

delivered-on માર્ચ 16, 2016

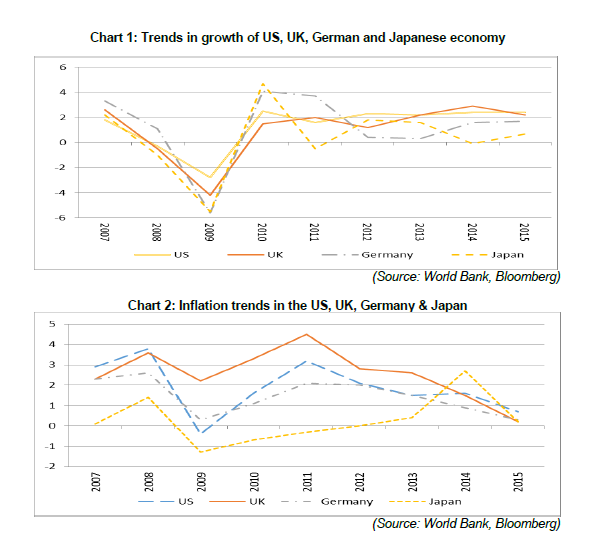

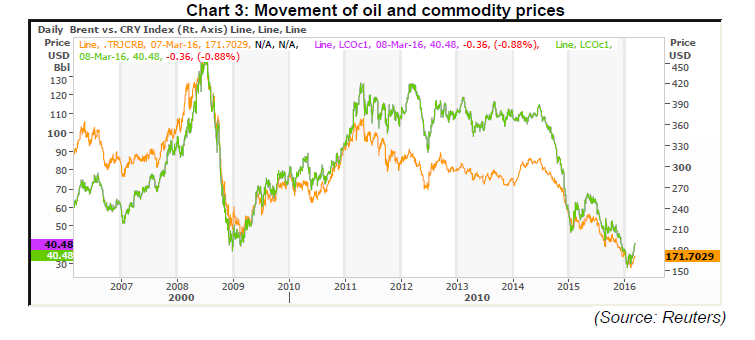

It is a pleasure to be here amongst the captains of Indian Industries who drive India’s growth amidst global uncertainty and economic slowdown. I thank the organisers for allowing me to share my thoughts on a topic which is quite relevant in the current context. 2. While preparing myself for today’s discussion, I was not very sure whether the current global economic situation warrants the characterisation as “turmoil”. Turmoil is defined as “a state of great disturbance, confusion, or uncertainty.” While there is a high degree of disturbance, confusion and uncertainty and some would like to characterise the current situation as a newer version of VUCA (volatility, uncertainty, complexity and ambiguity), I would still be hesitant to use the word “turmoil” to describe the prevailing market conditions. I intend to highlight some features of the evolving global economic scenario. I would then touch upon its impact on the Indian economy and what could be the way forward. Global scenario 3. More than eight years have passed since the onset of the Global Financial Crisis (GFC) in 2007. Yet the world economy is not out of the woods yet. Central banks of Europe, UK and Japan continue to remain in an accommodative mode, a clear indication that growth and inflation have not recovered to a sustainable level (Charts 1 & 2). The US economy has been doing well enough in growth terms for the Federal Reserve to begin, in December 2015, the process of normalising policy rates that had been hugging the zero lower bound since late 2008. The fragility of their economic outlook was, however, clearly revealed in the reversal of the impact of lift-off in less than a month as China started showing signs of weakening. Inflation outlook in all these countries continue to be soft which has been dampening hopes of a sustained recovery. In the US in particular, the softness in wages despite the unemployment rate edging below five per cent does not auger well for the inflation outlook. This together with fragility of the global economic conditions and the strengthening of the US dollar are the reasons the market seems to be sceptical of pace of rate hikes by the Federal Reserve in the near future. 4. Fears of further weakening of the Chinese economy, its falling equity market and the depreciation of its currency loom large over global economic prospects. In January, capital outflows from China triggered sell-offs across both Advanced Economies (AEs) and Emerging Market & Developing Economies (EMDEs), exacerbating currency declines and heightening volatilities. Crude oil prices fell to multi-year lows to below US$ 30 per barrel. The risk-off sentiment was reflected in the sharp surge in the prices of gold and the US treasuries and in the unwinding of carry trades undertaken with Euro and Japanese Yen as funding currencies, leading to their unexpected strengthening. Markets have somewhat settled down since then but the threat of renewed volatility is ever present. 5. Apart from uncertain recovery prospects in the AEs, the major reason behind such turbulence is the real prospect of a China slowdown. Global economic performance post GFC has been largely supported by Chinese growth and demand, particularly for commodities (oil, industrial metals, etc.), needed to support the huge infrastructure build-up. During the period 2005-2014, China’s share in world GDP has increased from two per cent to around 12 per cent. The massive liquidity pumped into the global system as the consequence of the easy monetary policies pursued by the AEs (viz. US, Europe, Japan, UK), managed to find assets in which it could be invested, be it emerging market assets or commodities. In fact, commodity prices managed to stay well supported after their post-2008 crash, until they started to unwind from mid-2014. (Chart 3) 6. There are now indications that China’s efforts at rebalancing its economy are facing serious challenges, at least in the near term. Prolonged slowdown in developed economies is increasingly making it improbable that even a big economy like China will be able to create the level of demand lost by the advanced economies for much longer. China generated demand as it went on a colossal spree to build infrastructure. In the process, the economy might have created large overcapacity not just in infrastructure but also in the manufacturing sector. In fact, China is said to be now taking steps to cut down excess capacities in sectors like steel and coal mining over the next few years. The scope for further activity in this sector, therefore, looks diminished at this juncture. Simultaneously, the financial health of banks and local bodies, which had funded this huge expenditure, is being called into question. 7. These factors have led to an outflow of capital from China, particularly in the last one year. China’s forex reserves have come down from US$ 3.9 trillion to US$ 3.2 trillion. The Chinese currency has been under increasing pressure. The stock markets have sold off and lost nearly 50 per cent of their value since mid-2015. The prospect of effectively containing the pressures of a more open capital account also looks uncertain. The slowdown in China has also led to a sharp correction in commodity prices, which, in turn, had major consequences as under:

8. To sum up, global economic growth has slowed down but has not really reversed the direction. The International Monetary Fund (IMF), in its January 2016 World Economic outlook, has projected global growth at 3.4 per cent in 2016, marginally going up to 3.6 per cent in 2017, helped largely by EMDEs, projected to grow at 4.3 per cent and 4.7 per cent respectively. Fears of a 2008 like crisis may still be a long way off unless things get a lot worse in China. Being an optimist, I would, be hesitant in using the word ‘turmoil’ to describe the current global economic situation. There are certain concerns though. The risk of a deflationary spiral looks more immediate and has the potential to cause damage. With some sovereign and corporate balance sheets sitting highly leveraged, a deflationary period and the increase in the real value of debt could weaken the debt repayment capacity of many economies and corporations. Persistent low interest rates, which cast a shadow on the capabilities of central banks to stimulate growth and stability, make the outlook on global financial markets highly uncertain. Critical issues relating to global geo-political developments and idiosyncratic socio-political challenges being faced by many advanced economies would have a spill-over impact on the economic outlook and have to be kept in view. Of course, this would require separate discussions. Impact on India 9. Let me now briefly discuss about India’s positioning vis-à-vis its peers in the EMDE space at the current juncture. While I share with you some facts and figures which are quite impressive, I would also flag certain issues which, if not addressed properly, could be a drag on the economy. India has been variously hailed as “beacon of stability”, “haven of stability” and “bright spot” amidst a slowing global economy”. This flows from the fact that India is the best performing large economy (GDP close to US$ two trillion) with a 7.6 per cent estimated growth rate for FY16. Both IMF and the World Bank in their January 2016 outlook project India to grow at the highest rate among major economies in 2016 and 2017. Notwithstanding the volatility seen in some of the vital data points (e.g., falling exports, low IIP numbers, etc.) the growth trajectory remains on track. Importantly, such growth has been accompanied by macro-economic stability. Inflation has been under control and the balance of payment position looks healthy. Current Account Deficit (CAD) has narrowed to 1.4 per cent of GDP (Q2, FY16) from the high of 4.8 per cent in FY13. Capital flows have remained strong during the last few years as can be seen from the data given in table 1: India’s foreign exchange reserves stand at a robust level of about US$ 350 billion. The ratio of short-term debt to foreign exchange reserves remains around 25.0 per cent. As illustrated in the Economic Survey 20162, India has made significant progress in reducing its macro-vulnerability, as gauged by an overall index of macro-economic vulnerability based on fiscal deficit, current account deficit and inflation. According to the Survey, India, which was most vulnerable among the major EMDEs in 2012, has sharply reduced its vulnerabilities. Since 2013, India’s index has gone up to 5.3 per cent compared to say, that of 0.7 per cent of China and 0.4 per cent for many other EMDEs which are in the ‘BBB’ category of rating. In Global Competitiveness Index, India has also moved up 16 places from 71 to 55 in 2015. This index is based on 12 pillars, such as, macroeconomic environment, institutions, infrastructure, innovations, market size, health, education, etc. The Survey also suggests that India compares favourably to its peers in its credit rating universe when it comes to India’s attractiveness to investors based on macro-economic stability and growth rate. This is captured in the Rational Investor Rating Index (RIRI). 10. On the flip side, like most other EM currencies, Rupee did come under pressure, and so was the stock market. Over a longer time horizon, say the last five quarters, Rupee has, however, shown more resilience as compared to its peers reflecting the improving macro-economic fundamentals of the country. 11. Another area that has been affected by global weakness is the exports sector. India’s exports have been in contraction mode for fourteen successive months although there are indications of a sequential bottoming out. While the CAD has improved, the external sector has been contracting. Though India’s foreign exchange reserves are at almost record high levels, the external sector vulnerabilities have not completely disappeared. India’s external debt has increased from US$ 446.0 billion as at end-March 2014 to US$ 483.2 billion as at September-end 2015. Foreign exchange reserves provide 72.5 per cent cover to external debt though vis-à-vis some of its EM peers, India is better placed as can be seen in Table 2 below: Way Forward 12. The inter-linkage of Indian economy with the rest of the world has been growing at a rapid pace, and therefore, global developments influence the domestic economy in a much bigger way than before. Though the spill over effect can take place through multiple channels, it mostly gets transmitted through the commerce or trade channel, through the capital flows channel and through the confidence channel. 13. As stated earlier, the falling exports for a prolonged period is an issue that needs serious attention. What is worrying is the fact that our market shares have fallen from 1.7 in 2011 per cent to 1.6 per cent in 2015. The falling crude prices may have helped the country to bring down the current account deficit but once oil prices start recovering, the challenge before the country would be to increase exports if the CAD has to be contained on a sustainable basis. A recent IMF working paper3 on Price and Income Elasticity of Indian Exports has concluded that Indian goods exports are sensitive to external demand and to international relative price-competitiveness. Manufacturing sector exports are estimated to be more price elastic and sensitive to global demand developments in the short-term. Services exports are also not exhibiting buoyant trends with the market share falling from 3.2 per cent in 2011-12 to 3.1 per cent in 2013-14. The prospects of a sluggish global economic recovery may pose challenges for India to achieve significant export growth acceleration in the coming years whereas supply-side constraints could dampen the price responsiveness in the short-term. In the backdrop of uncertain global demand, the challenge for the country would be to search for new markets and new products for existing markets besides addressing the issues relating to competitiveness of Indian exports. 14. As we have seen in the past, capital flows are usually susceptible to periodic phases of sudden stops and/or reversals which can put downward pressure on Rupee. Despite India’s relatively stronger fundamentals, the confidence or contagion effect of a global safe haven move could have its impact on the Rupee. Here the importance of attracting stable flows like FDI needs to be highlighted. As shown in Table 1, the policy adjustments and improved macro-economic environment have helped us to attract more FDI flows this year than the last year. As hitherto, Government and Reserve Bank would, of course, continue to be on constant vigil and be ready to take proactive measures in respect of the evolving situation in the external sector. 15. Macroeconomic stability is important to contain contagion effects arising out of the confidence channel. Government has shown its firm commitment for fiscal consolidation. The Economic Survey 2016 has brought out that India taxes and spends less than OECD countries and even its emerging market peers. After adjusting for the level of economic development and democracy, India’s tax/GDP ratio is 5.4 per cent less than that of comparable countries, while its expenditure/GDP ratio lags by 6.4 per cent. Nearly 85 per cent of the economy is outside the tax net. While these developments may be explained by historical differences, the need to catch up with EM peers and the OECD countries in the next few decades would be important in determining the extent and pace of India’s infrastructure development and, by extension, future economic development. Therefore, even as fiscal consolidation is on track in terms of GFD/GDP target ratios, there may well be a need to broaden the reach of fiscal reform by setting a targeted path to increase both tax revenue and fiscal expenditure. 16. Retail inflation in India as measured by CPI rose for the sixth straight month in January 2016. The CPI for January at 5.69 per cent was the highest figure recorded since August of 2014. Similarly, food inflation at 6.85 per cent in January was also the highest in 17 months. Despite these numbers, we are on track as far as meeting the inflation targets is concerned in near term4. There are, however, risks to meeting our projections. Besides structural factors like persistent high level of food prices due to rising income level not being matched by increase in productivity, production and distribution of food items, in particular protein/pulses food, the implementation of the seventh Central Pay Commission award, monsoon and the path of commodity prices including crude prices have to be factored in the near term inflation outlook. 17. There have been discussions in recent times about the stress in banking and corporate balance sheets. In respect of health of Indian banks, the Reserve Bank has taken various steps to address the issue of stressed assets of the banks. After a comprehensive asset quality review, banks have initiated the process of cleaning up balance sheets by March 2017. While this may lead to a short-term impact on profitability of some of the PSU banks, it would enable a healthy flow of credit to the system in the long run. Further, efforts at improving the capital buffers of banks will be helpful as they prepare to lend more now, after cleaning up their balance sheets. Also, the steps being taken to improve governance in banks, such as the setting up of a Banks’ Board Bureau (BBB), would complement these efforts to develop and strengthen the banking sector. In respect of corporate sector stress, as evident from profitability and lower interest coverage ratio, the efforts at deleveraging, including by way of exit from non-core business, enhanced productivity and additional equity infusion and better governance practices supported by policies aimed at containing the global headwinds have to be fast-tracked. 18. A deep, vibrant and well-developed financial market is needed to facilitate efficient resource allocation, risk dispersion and credit intermediation. Government, Reserve Bank, and other regulators have been constantly engaged in taking measures that would help in developing markets. During the last few years, Reserve Bank has taken various measures including introduction of currency futures and options, interest rate futures which would add to the menu of already existing over the counter instruments for managing the currency and interest rate risks. Further, in order to give a fillip to the development of term repo market, Reserve Bank allowed re-repoing of securities acquired under market repo. These products, if used judiciously would facilitate corporates to manage their risk exposure efficiently. 19. Underscoring the importance of a vibrant corporate bond market that could help the country in meeting the large scale infrastructure financing, Reserve Bank has allowed repo in corporate bonds as well as selling and buying of single name Credit Default Swaps. There is also a proposal to introduce electronic trading platform for corporate bonds in India. I would, however, like to add here that we have not seen a wide range of players participating in recently launched products-be it in the area of currency derivatives or interest rate derivatives. Government is initiating the process of legislation for lender protection that would incentivise flow of debt funds to corporates. The Government has announced a slew of proposals in the Union Budget for 2016-17 that would give a fillip to the corporate bond market in India. These include expanding the investment basket for foreign portfolio investors to include unlisted debt securities and pass through securities issued by securitisation and introduction of electronic auction platform for primary debt. Early passage of the Bankruptcy Code will greatly facilitate the development of corporate debt market. Reserve Bank in collaboration with the Government and other regulators will continue with its efforts in bringing about reforms in the financial sector. 20. While domestic policies that reinforce the macro-economic fundamentals help us to cope with external vulnerabilities, given our increasing level of international linkages we cannot be immune to spill-back effects of action or inaction of other countries, particularly arising from surges in inflows or sudden & substantial outflows. This calls for regional and global safety nets in terms of multilateral institutional mechanisms for funding support. It is also imperative that institutional mechanisms (e.g., the International Monetary Fund) should exist at the global level to assess the policies of large economies from the point of their contagion impact on other countries, particularly EMDEs and advise them to factor such consequences in their policy framework. India will have to work vigorously to build-up global consensus in this area. In Conclusion 21. As I said in the beginning, I do not take a very pessimistic view of the current global situation and would prefer not to call it ‘turmoil’. I would rather consider the current situation as a great opportunity for India to position itself as a leader who would shape the world economic order in years to come. There would be challenges, nevertheless. The real challenge would be to sustain the improved fundamentals over a longer period and contain the spill over effect from other parts of the world. While other countries may take measures best suited to them, our focus should continue to remain on improving domestic macroeconomic fundamentals, including addressing the infrastructure bottlenecks, ensuring price stability, narrowing current account deficit, continuing fiscal reforms, increasing the competitiveness of our products and services for the global market and improved governance. I have no doubt that the steps taken by the Government, including those aimed at ease of doing business in India and regulatory measures initiated by the Reserve Bank and other regulators, would give enormous confidence to local & foreign investors, our trade partners, rating agencies and the large community of non-resident Indians. Simultaneously, we have to work to build international consensus on policy coordination among advanced and emerging economies for minimising the spill-over and spill-back impacts of the policies of the former on the latter. 22. Thank you all for your attention. 1 Address of Shri Harun R Khan, Deputy Governor Reserve Bank of India at the Programme on Global Economic Turmoil, Impact on Indian Economy organized by PHD Chamber of Commerce on March 12, 2016 in New Delhi. The speaker acknowledges the contribution of Shri T. Rabi Sankar, Shri Rakesh Tripathy and Shri D. K. Loharia of the Reserve Bank of India. 2 Economic Survey 2016 -p 9-10, chapter 1: http://indiabudget.nic.in/es2015-16/echapvol1-01.pdf 3 https://www.imf.org/external/pubs/ft/wp/2015/wp15161.pdf 4 Consumer prices in India decreased to 5.18 percent year-on-year in February 2016, lower than 5.69 percent in January. Consumer inflation eased for the first time in seven months, reaching the lowest since October. Inflation averaged 7.85 percent from 2012 until 2016, reaching an all time high of 11.16 percent in November of 2013 and a record low of 3.69 percent in July of 2015. |

પેજની છેલ્લી અપડેટની તારીખ: