Growth is expected to firm up in 2018-19 and 2019-20 on the back of higher private consumption and investment. Consumer price inflation is expected to remain above 4.0 per cent from Q2:2018-19 to Q4:2018-19. The Reserve Bank has been conducting the Survey of Professional Forecasters (SPF) since September 2007. Twenty-five panellists participated in the 53rd round of the survey conducted during July 20182. The survey results are summarised in terms of their median forecasts and consolidated in Annexes 1-8, along with quarterly paths for key variables. Highlights: 1. Output • Real gross domestic product (GDP) is likely to grow at 7.4 per cent in 2018-19 ― up from 6.7 per cent in 2017-18 ― and is expected to accelerate further i.e., by 20 basis points (bps) in 2019-20 on the back of support from private consumption and investment (Table 1). • The investment rate, proxied by gross fixed capital formation, is expected to improve in 2018-19 and further in 2019-20, commensurate with an upturn in the saving rate. • Real gross value added (GVA) is expected to grow by 7.2 per cent in 2018-19 and by 7.4 per cent in 2019-20, supported by activity in the industrial and services sectors. | Table 1: Median Forecast of Growth in Real GDP, GVA and Components | | (in per cent) | | | 2018-19 | 2019-20 | | Real GDP Growth | 7.4

(0.0) | 7.6

(0.0) | Private Final Consumption Expenditure (nominal)

(growth rate in per cent) | 11.6

(+0.6) | 11.8

(+0.5) | Gross Fixed Capital Formation Rate

(per cent of GDP) | 29.0

(0.0) | 29.5

(+0.3) | | Real GVA Growth | 7.2

(+0.1) | 7.4

(0.0) | | a. Agriculture and Allied Activities | 3.4

(+0.4) | 3.0

(0.0) | | b. Industry | 6.9

(+0.1) | 7.0

(+0.2) | | c. Services | 8.2

(-0.1) | 8.6

(0.0) | Gross Saving Rate

[per cent of gross national deposable income (GNDI)] | 30.0

(0.0) | 30.5

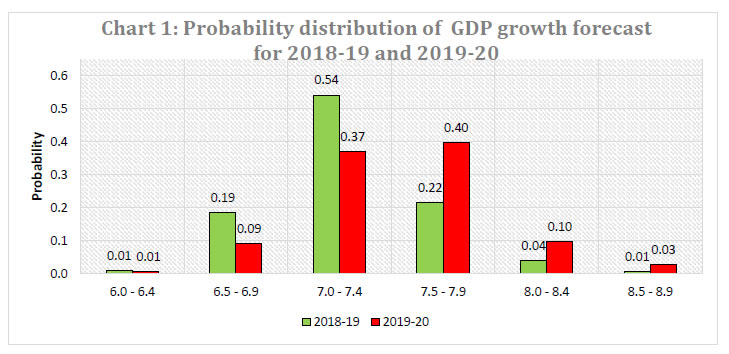

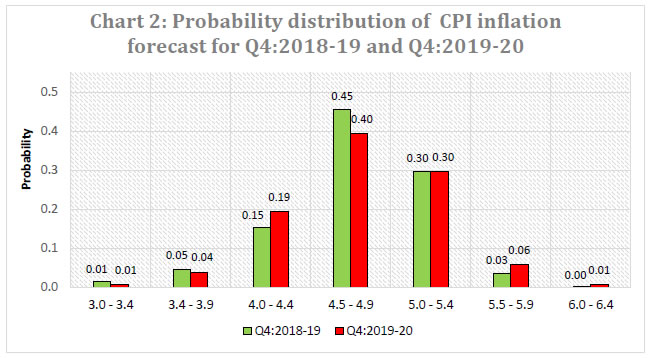

(0.0) | | Note: In all the tables, the figures in parentheses indicate the extent of revision in median forecasts (percentage points) relative to the previous SPF round. | • Forecasters have assigned the maximum probability to GDP growth being in the range of 7.0-7.4 per cent in 2018-19 and 7.5-7.9 per cent in 2019-20 (Chart 1). 2. Inflation • Headline consumer price index (CPI) inflation is likely to remain above 4.0 per cent till Q1:2019-20. • Core inflation (i.e., CPI excluding food and beverages, pan, tobacco and intoxicants, and fuel and light) is likely to remain above 5.0 per cent during 2018-19. | Table 2: Median Forecast of Quarterly Inflation | | (in per cent) | | | Q2:18-19 | Q3:18-19 | Q4:18-19 | Q1:19-20 | | CPI Headline | 4.7

(-0.2) | 4.3

(-0.1) | 4.8

(+0.2) | 5.1 | | CPI excluding food & beverages, pan, tobacco & intoxicants and fuel & light | 6.1

(+0.2) | 5.6

(+0.1) | 5.3

(+0.1) | 4.9 | | WPI All Commodities | 5.1

(+0.8) | 4.3

(+0.7) | 4.2

(+1.0) | 4.0 | | WPI Non-food Manufactured Products | 4.9

(+0.9) | 4.5

(+1.1) | 4.0

(+1.6) | 2.6 | • Forecasters have assigned the highest probability to CPI inflation being in the range 4.5-4.9 per cent in Q4:2018-19 as well as in Q4:2019-20 (Chart 2). 3. External Sector • The forecast of growth in merchandise exports and merchandise imports during 2018-19 have been revised up significantly to 9.8 per cent and 13.0 per cent, respectively, but some deceleration is expected in 2019-20 (Table 3). • The current account deficit (CAD) is expected to remain at around 2.5 per cent of GDP in 2018-19 and 2019-20. • The Indian rupee is likely to remain stable against the US dollar till Q4:2018-19 (Annex 3). | Table 3: Median Forecast of Select External Sector Variables | | | 2018-19 | 2019-20 | Merchandise Exports – in US $ terms

(annual growth in per cent) | 9.8

(+1.7) | 8.4

(0.0) | Merchandise Imports– in US $ terms

(annual growth in per cent) | 13.0

(+0.5) | 8.6

(+0.1) | Current Account Deficit

(Ratio to GDP at current market price, in per cent) | 2.5

(+0.1) | 2.5

(+0.1) |

The Reserve Bank thanks the following institutions for their participation in this round of the Survey of Professional Forecasters (SPF): Aditi Nayar, ICRA Limited; Anubhuti Sahay, Standard Chartered Bank; CRISIL Ltd; Debopam Chaudhuri, Piramal Enterprises Limited; Gaurav Kapur, IndusInd Bank Ltd.; ICICI Securities PD; Indranil Pan, IDFC Bank Ltd.; Nikhil Gupta, Motilal Oswal; Pinaki M. Mukherjee, Maruti Suzuki; Sameer Narang, Bank of Baroda; Shailesh Kejariwal, B&K Securities India Pvt Ltd; and Siddharth V Kothari, Sunidhi Securities & Finance Ltd. The Bank also acknowledges the contribution of 13 others SPF panellists, who prefer to remain anonymous. |

| Annex 1: Annual Forecasts for 2018-19 | | Key Macroeconomic Indicators | Annual Forecasts for 2018-19 | | Mean | Median | Max | Min | 1st quartile | 3rd quartile | | 1 | GDP at constant (2011-12) prices: Annual Growth (per cent) | 7.3 | 7.4 | 7.8 | 6.9 | 7.2 | 7.5 | | 2 | Private Final Consumption Expenditure (PFCE) at current prices: Annual Growth (per cent) | 11.4 | 11.6 | 12.3 | 10.3 | 10.7 | 12.0 | | 3 | Gross Fixed Capital Formation (GFCF) Rate (per cent of GDP at current market prices) | 28.9 | 29.0 | 30.0 | 26.5 | 28.9 | 29.4 | | 4 | GVA at basic prices at constant (2011-12) prices: Annual Growth rate (per cent) | 7.2 | 7.2 | 7.7 | 6.7 | 7.0 | 7.3 | | a | Agriculture & Allied Activities (growth rate in per cent) | 3.5 | 3.4 | 4.4 | 2.8 | 3.0 | 4.0 | | b | Industry (growth rate in per cent) | 7.0 | 6.9 | 8.1 | 4.9 | 6.4 | 7.6 | | c | Services (growth rate in per cent) | 8.2 | 8.2 | 9.1 | 7.3 | 7.8 | 8.4 | | 5 | Gross Saving Rate (per cent of Gross National Disposable Income) - at current prices | 29.7 | 30.0 | 32.1 | 27.7 | 28.7 | 30.1 | | 6 | Fiscal Deficit of Central Govt. (per cent of GDP at current market prices) | 3.4 | 3.3 | 3.7 | 3.2 | 3.3 | 3.5 | | 7 | Combined Gross Fiscal Deficit (per cent to GDP) | 6.1 | 6.1 | 6.6 | 5.7 | 6.0 | 6.3 | | 8 | Bank Credit - Scheduled commercial banks: Annual Growth (per cent) | 11.1 | 11.3 | 15.0 | 8.0 | 9.8 | 12.0 | | 9 | Yield on 10-Year G-Sec of Central Govt. (end-period) | 7.8 | 7.7 | 8.3 | 7.3 | 7.5 | 8.0 | | 10 | Yield on 91-day T-Bill of Central Govt. (end-period) | 6.6 | 6.6 | 6.9 | 6.2 | 6.5 | 6.8 | | 11 | Merchandise Exports - BoP basis (in US$ terms)- Annual Growth (per cent) | 9.8 | 9.8 | 17.3 | 2.0 | 9.0 | 11.7 | | 12 | Merchandise Imports - BoP basis (in US$ terms)- Annual Growth (per cent) | 13.6 | 13.0 | 20.7 | 9.6 | 12.0 | 15.3 | | 13 | Current Account Balance - Ratio to GDP at current market price (per cent) | -2.5 | -2.5 | -2.0 | -3.2 | -2.7 | -2.4 | | 14 | Overall BoP - In US $ bn. | -0.4 | -3.2 | 45.5 | -25.6 | -12.8 | 9.2 | | 15 | Inflation based on CPI-Combined - Headline | 4.7 | 4.7 | 5.2 | 4.0 | 4.5 | 4.9 | | 16 | Inflation based on CPI-Combined - excluding 'Food & Beverages', 'Pan, Tobacco & Intoxicants' and 'Fuel & Light' | 5.7 | 5.7 | 6.4 | 4.8 | 5.6 | 6.0 | | 17 | Inflation based on WPI - All Commodities | 4.4 | 4.5 | 5.1 | 2.9 | 4.2 | 4.6 | | 18 | Inflation based on WPI -Non-food Manufactured Products | 4.2 | 4.4 | 5.0 | 2.8 | 3.9 | 4.6 |

| Annex 2: Annual Forecasts for 2019-20 | | Key Macroeconomic Indicators | Annual Forecasts for 2019-20 | | Mean | Median | Max | Min | 1st quartile | 3rd quartile | | 1 | GDP at constant (2011-12) prices: Annual Growth (per cent) | 7.5 | 7.6 | 8.1 | 6.6 | 7.4 | 7.7 | | 2 | Private Final Consumption Expenditure (PFCE) at current prices: Annual Growth (per cent) | 12.0 | 11.8 | 13.3 | 11.0 | 11.5 | 12.5 | | 3 | Gross Fixed Capital Formation (GFCF) Rate (per cent of GDP at current market prices) | 29.3 | 29.5 | 30.4 | 27.0 | 29.2 | 29.8 | | 4 | GVA at basic prices at constant (2011-12) prices: Annual Growth rate (per cent) | 7.4 | 7.4 | 7.9 | 6.3 | 7.2 | 7.7 | | a | Agriculture & Allied Activities (growth rate in per cent) | 3.2 | 3.0 | 4.7 | 1.2 | 2.9 | 3.7 | | b | Industry (growth rate in per cent) | 7.1 | 7.0 | 8.2 | 5.8 | 6.6 | 7.6 | | c | Services (growth rate in per cent) | 8.4 | 8.6 | 9.5 | 7.6 | 8.1 | 8.7 | | 5 | Gross Saving Rate (per cent of Gross National Disposable Income) - at current prices | 30.1 | 30.5 | 32.4 | 27.4 | 29.1 | 30.7 | | 6 | Fiscal Deficit of Central Govt. (per cent of GDP at current market prices) | 3.2 | 3.1 | 3.5 | 3.0 | 3.0 | 3.3 | | 7 | Combined Gross Fiscal Deficit (per cent to GDP) | 5.9 | 5.8 | 6.3 | 5.5 | 5.7 | 6.1 | | 8 | Bank Credit - Scheduled commercial banks: Annual Growth (per cent) | 12.1 | 12.3 | 15.0 | 8.0 | 11.5 | 13.9 | | 9 | Yield on 10-Year G-Sec of Central Govt. (end-period) | 7.6 | 7.6 | 8.3 | 7.0 | 7.4 | 8.0 | | 10 | Yield on 91-day T-Bill of Central Govt. (end-period) | 6.8 | 6.7 | 7.8 | 6.1 | 6.4 | 7.2 | | 11 | Merchandise Exports - BoP basis (in US$ terms)- Annual Growth (per cent) | 8.2 | 8.4 | 14.0 | 2.7 | 5.7 | 9.4 | | 12 | Merchandise Imports - BoP basis (in US$ terms)- Annual Growth (per cent) | 8.4 | 8.6 | 15.0 | 3.1 | 5.8 | 12.0 | | 13 | Current Account Balance - Ratio to GDP at current market price (per cent) | -2.5 | -2.5 | -2.2 | -3.1 | -2.6 | -2.4 | | 14 | Overall BoP - In US $ bn. | 6.7 | 8.0 | 25.0 | -19.9 | 0.6 | 16.7 | | 15 | Inflation based on CPI-Combined - Headline | 4.7 | 4.7 | 5.2 | 4.5 | 4.5 | 5.0 | | 16 | Inflation based on CPI-Combined - excluding 'Food & Beverages', 'Pan, Tobacco & Intoxicants' and 'Fuel & Light' | 4.9 | 5.0 | 5.7 | 4.2 | 4.7 | 5.1 | | 17 | Inflation based on WPI - All Commodities | 4.0 | 4.2 | 5.0 | 2.4 | 3.7 | 4.5 | | 18 | Inflation based on WPI -Non-food Manufactured Products | 4.0 | 4.3 | 4.8 | 2.7 | 3.1 | 4.5 |

| Annex 3: Quarterly Forecasts from Q2:2018-19 to Q1:2019-20 | | Key Macroeconomic Indicators | Quarterly Forecasts | | Q2: 2018-19 | Q3: 2018-19 | | Mean | Median | Max | Min | Mean | Median | Max | Min | | 1 | GDP at constant (2011-12) prices: Annual Growth (per cent) | 7.5 | 7.5 | 8.1 | 7.0 | 7.1 | 7.2 | 7.8 | 6.3 | | 2 | PFCE at current prices: Y-on-Y Growth (per cent) | 10.4 | 11.1 | 12.7 | 7.0 | 10.4 | 11.2 | 12.2 | 6.5 | | 3 | GFCF Rate (per cent of GDP at current market prices) | 28.8 | 28.6 | 30.3 | 28.2 | 28.8 | 28.8 | 29.3 | 28.3 | | 4 | GVA at constant (2011-12) prices: Annual Growth (per cent) | 7.3 | 7.3 | 8.0 | 6.8 | 7.0 | 7.1 | 7.7 | 6.2 | | a | Agriculture & Allied Activities (growth rate in per cent) | 3.6 | 3.5 | 4.7 | 2.2 | 3.6 | 3.5 | 5.0 | 2.7 | | b | Industry (growth rate in per cent) | 6.7 | 6.8 | 7.9 | 4.9 | 6.8 | 6.7 | 8.7 | 5.0 | | c | Services (growth rate in per cent) | 8.2 | 8.1 | 9.0 | 7.4 | 8.1 | 8.2 | 9.3 | 6.9 | | 5 | IIP (2011-12=100): Quarterly Average Growth (per cent) | 5.0 | 5.2 | 6.1 | 4.0 | 4.2 | 4.5 | 6.0 | 2.4 | | 6 | Merchandise Exports - BoP basis (in US$ bn.) | 83.4 | 83.1 | 86.8 | 80.6 | 84.3 | 84.5 | 85.6 | 82.2 | | 7 | Merchandise Imports - BoP basis (in US$ bn.) | 127.6 | 127.6 | 135.3 | 120.6 | 135.2 | 136.0 | 141.2 | 130.1 | | 8 | Rupee – US Dollar Exchange rate (RBI reference rate) (end-period) | 68.3 | 68.5 | 70.0 | 64.5 | 68.5 | 68.8 | 72.0 | 65.5 | | 9 | Crude Oil (Indian basket) price (US $ per barrel) (end-period) | 74.1 | 73.4 | 77.8 | 72.0 | 74.3 | 73.5 | 81.3 | 70.2 | | 10 | Repo Rate (end-period) | 6.4 | 6.5 | 6.5 | 6.3 | 6.5 | 6.5 | 6.8 | 6.3 |

| Key Macroeconomic Indicators | Quarterly Forecasts | | Q4: 2018-19 | Q1: 2019-20 | | Mean | Median | Max | Min | Mean | Median | Max | Min | | 1 | GDP at constant (2011-12) prices: Annual Growth (per cent) | 7.1 | 7.2 | 7.6 | 6.4 | 7.3 | 7.5 | 7.9 | 6.4 | | 2 | PFCE at current prices: Y-on-Y Growth (per cent) | 10.7 | 11.8 | 12.5 | 6.5 | 11.2 | 11.7 | 12.8 | 7.8 | | 3 | GFCF Rate (per cent of GDP at current market prices) | 29.3 | 29.4 | 30.0 | 28.4 | 29.9 | 30.1 | 30.7 | 29.1 | | 4 | GVA at constant (2011-12) prices: Annual Growth (per cent) | 7.0 | 7.0 | 7.5 | 6.2 | 7.2 | 7.3 | 7.7 | 6.2 | | a | Agriculture & Allied Activities (growth rate in per cent) | 3.3 | 3.4 | 4.5 | 1.9 | 3.2 | 3.0 | 4.7 | 1.7 | | b | Industry (growth rate in per cent) | 6.6 | 6.5 | 8.0 | 5.0 | 7.0 | 6.8 | 8.7 | 5.5 | | c | Services (growth rate in per cent) | 8.2 | 8.2 | 9.4 | 7.4 | 8.2 | 8.1 | 9.3 | 7.3 | | 5 | IIP (2011-12=100): Quarterly Average Growth (per cent) | 4.2 | 4.4 | 6.5 | 1.9 | 5.4 | 5.5 | 7.3 | 3.3 | | 6 | Merchandise Exports - BoP basis (in US$ bn.) | 87.7 | 87.9 | 90.7 | 84.7 | 86.3 | 85.5 | 90.7 | 82.2 | | 7 | Merchandise Imports - BoP basis (in US$ bn.) | 136.8 | 135.0 | 145.3 | 130.0 | 137.8 | 137.8 | 149.2 | 130.4 | | 8 | Rupee – US Dollar Exchange rate (RBI reference rate) (end-period) | 68.1 | 68.5 | 72.0 | 65.0 | 67.7 | 67.5 | 72.0 | 65.0 | | 9 | Crude Oil (Indian basket) price (US $ per barrel) (end-period) | 75.0 | 73.4 | 85.5 | 70.0 | 72.7 | 72.0 | 80.0 | 69.0 | | 10 | Repo Rate (end-period) | 6.6 | 6.5 | 6.8 | 6.5 | 6.6 | 6.5 | 6.8 | 6.5 |

| Annex 4: Forecasts of CPI-Combined Inflation | | (per cent) | | | CPI Combined Headline | Core CPI Combined (excluding ‘Food & Beverages’, 'Pan, Tobacco & Intoxicants' and ‘Fuel & Light’) | | Mean | Median | Max | Min | Mean | Median | Max | Min | | Q2:2018-19 | 4.7 | 4.7 | 5.1 | 4.1 | 6.1 | 6.1 | 6.6 | 5.7 | | Q3:2018-19 | 4.4 | 4.3 | 5.1 | 3.8 | 5.7 | 5.6 | 6.5 | 5.2 | | Q4:2018-19 | 4.8 | 4.8 | 5.9 | 4.3 | 5.3 | 5.3 | 6.6 | 5.0 | | Q1:2019-20 | 5.1 | 5.1 | 6.0 | 4.3 | 5.0 | 4.9 | 6.1 | 4.3 |

| Annex 5: Forecasts of WPI Inflation | | (per cent) | | | WPI Headline | WPI Non-food Manufactured Products | | Mean | Median | Max | Min | Mean | Median | Max | Min | | Q2:2018-19 | 4.9 | 5.1 | 5.4 | 4.3 | 4.7 | 4.9 | 5.2 | 2.8 | | Q3:2018-19 | 4.4 | 4.3 | 5.2 | 3.8 | 4.5 | 4.5 | 5.5 | 2.7 | | Q4:2018-19 | 4.3 | 4.2 | 5.1 | 3.6 | 3.8 | 4.0 | 5.0 | 2.6 | | Q1:2019-20 | 3.9 | 4.0 | 4.8 | 3.2 | 2.8 | 2.6 | 4.1 | 2.2 |

| Annex 6: Mean probabilities attached to possible outcomes of Real GDP growth | | Growth Range | Forecasts for 2018-19 | Forecasts for 2019-20 | | 10.0 per cent or more | 0.00 | 0.00 | | 9.5 to 9.9 per cent | 0.00 | 0.00 | | 9.0 to 9.4 per cent | 0.00 | 0.00 | | 8.5 to 8.9 per cent | 0.01 | 0.03 | | 8.0 to 8.4 per cent | 0.04 | 0.10 | | 7.5 to 7.9 per cent | 0.22 | 0.40 | | 7.0 to 7.4 per cent | 0.54 | 0.37 | | 6.5 to 6.9 per cent | 0.19 | 0.09 | | 6.0 to 6.4 per cent | 0.01 | 0.01 | | 5.5 to 5.9 per cent | 0.00 | 0.00 | | 5.0 to 5.4 per cent | 0.00 | 0.00 | | 4.5 to 4.9 per cent | 0.00 | 0.00 | | 4.0 to 4.4 per cent | 0.00 | 0.00 | | 3.5 to 3.9 per cent | 0.00 | 0.00 | | 3.0 to 3.4 per cent | 0.00 | 0.00 | | 2.5 to 2.9 per cent | 0.00 | 0.00 | | 2.0 to 2.4 per cent | 0.00 | 0.00 | | Below 2.0 per cent | 0.00 | 0.00 |

| Annex 7: Mean probabilities attached to possible outcomes of Real GVA growth | | Growth Range | Forecasts for 2018-19 | Forecasts for 2019-20 | | 10.0 per cent or more | 0.00 | 0.00 | | 9.5 to 9.9 per cent | 0.00 | 0.00 | | 9.0 to 9.4 per cent | 0.00 | 0.00 | | 8.5 to 8.9 per cent | 0.01 | 0.01 | | 8.0 to 8.4 per cent | 0.01 | 0.09 | | 7.5 to 7.9 per cent | 0.13 | 0.35 | | 7.0 to 7.4 per cent | 0.52 | 0.36 | | 6.5 to 6.9 per cent | 0.29 | 0.18 | | 6.0 to 6.4 per cent | 0.03 | 0.01 | | 5.5 to 5.9 per cent | 0.00 | 0.00 | | 5.0 to 5.4 per cent | 0.00 | 0.00 | | 4.5 to 4.9 per cent | 0.00 | 0.00 | | 4.0 to 4.4 per cent | 0.00 | 0.00 | | 3.5 to 3.9 per cent | 0.00 | 0.00 | | 3.0 to 3.4 per cent | 0.00 | 0.00 | | 2.5 to 2.9 per cent | 0.00 | 0.00 | | 2.0 to 2.4 per cent | 0.00 | 0.00 | | Below 2.0 per cent | 0.00 | 0.00 |

| Annex 8: Mean probabilities attached to possible outcomes of CPI (Combined) inflation | | Inflation Range | Forecasts for Q4:2018-19 | Forecasts for Q4:2019-20 | | 8.0 per cent or above | 0.00 | 0.00 | | 7.5 to 7.9 per cent | 0.00 | 0.00 | | 7.0 to 7.4 per cent | 0.00 | 0.00 | | 6.5 to 6.9 per cent | 0.00 | 0.00 | | 6.0 to 6.4 per cent | 0.00 | 0.01 | | 5.5 to 5.9 per cent | 0.03 | 0.06 | | 5.0 to 5.4 per cent | 0.30 | 0.30 | | 4.5 to 4.9 per cent | 0.45 | 0.40 | | 4.0 to 4.4 per cent | 0.15 | 0.19 | | 3.5 to 3.9 per cent | 0.05 | 0.04 | | 3.0 to 3.4 per cent | 0.01 | 0.01 | | 2.5 to 2.9 per cent | 0.00 | 0.00 | | 2.0 to 2.4 per cent | 0.00 | 0.00 | | 1.5 to 1.9 per cent | 0.00 | 0.00 | | 1.0 to 1.4 per cent | 0.00 | 0.00 | | 0.5 to 0.9 per cent | 0.00 | 0.00 | | 0 to 0.4 per cent | 0.00 | 0.00 | | Below 0 per cent | 0.00 | 0.00 | | Note: CPI: Consumer Price Index; GDP: Gross Domestic Products; GNDI: Gross National Disposable Income; GVA: Gross Value Added; IIP: Index of Industrial Production; WPI: Wholesale Price Index. |

|

IST,

IST,