IST,

IST,

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Eligible entities and requirements to submit the FLA return

Ans: FLA return and Annual Performance Report (APR) for ODI are two different returns and monitored by two different departments of RBI. So, you are required to submit both the returns if these are applicable for your entity. For more information on APR, please refer to the Master Direction – Reporting under Foreign Exchange Management Act, 1999 on RBI’s website.

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Paytm Payments Bank Wallet

External Commercial Borrowings (ECB) and Trade Credits

E. AVERAGE MATURITY PERIOD

Government Securities Market in India – A Primer

Foreign Investment in India

Indian Currency

B) Banknotes

The paper currently being used for printing of banknotes in India is made by using 100% cotton.

Biennial survey on Foreign Collaboration in Indian Industry (FCS)

Some important definitions and concepts

Ans.: An Indian company is called as a Foreign Subsidiary if a non-resident investor owns more than 50 per cent of the voting power / equity capital or where a non-resident investor and its subsidiary(s) combined own more than 50 per of the voting power / equity capital of an Indian enterprise.

Core Investment Companies

B. Registration and related matters:

Ans: The NBFC would have to apply to RBI with full details of the plan and exemptions could be considered on a selective basis on the merits of the case.

Portfolio Investment Positions (PIP) by Counterpart Economy (formerly CPIS) – India

What to report under PIP?

Ans: Reporting entities should report the data in the unit mentioned in the survey schedule (for eg., INR Lakh).

Remittances [Money Transfer Service Scheme (MTSS) and Rupee Drawing Arrangement (RDA)]

Money Transfer Service Scheme (MTSS)

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

Reserve Bank of India has deregulated interest rates to be charged to borrowers by NBFCs. The rate of interest to be charged by the company is governed by the terms and conditions of the loan agreement entered into between the borrower and the NBFCs. However, the NBFCs have to be transparent and the rate of interest and manner of arriving at the rate of interest to different categories of borrowers should be disclosed to the borrower or customer in the application form and communicated explicitly in the sanction letter and on their websites, Key Facts Statement, etc., to enable the borrower to take an informed decision.

Housing Loans

When other banks reduce the interest rate, you may prefer to close your account with the bank with whom you are banking, to avail of the loan from the bank offering reduced rates of interest. You have to pay pre-payment charges for doing so. In order to ensure that their customers do not approach other banks for availing reduced interest rates, banks allow customers to switch over from a higher interest loan to a lower interest loan by paying a switch over fees which is lesser than the pre-payment charges. Generally switchover fee is taken as percentage of the outstanding loan amount.

Keep up-dating yourself on various changes in the home loan market. Visit the branch, discuss with the officials to get the best out of any changes in the home loan scenario.

Targeted Long Term Repo Operations (TLTROs)

FAQs pertaining to TLTRO 2.0

Ans: The funds availed under TLTRO 2.0 are to be deployed in investment grade bonds, commercial paper (CPs) and non-convertible debentures (NCDs) of Non-Banking Financial Companies (NBFCs) and MFIs in the manner outlined in the press release dated April 17, 2020.

FAQs on Non-Banking Financial Companies

Ceiling on deposits

A. As per the new Regulatory framework, there is no overall ceiling on the borrowings of NBFCs. However, limits have been prescribed for acceptance of Public Deposits as indicated here.

Level of credit rating | Ceiling on public deposits | |

EL/HP Cos. | LC/ICs | |

AAA | 4.0 | 2.0 |

AA | 2.5 | 1.0 |

A | 1.5 | 0.5 |

A - (CRISIL & ICRA) } | ||

BBB (CARE) } | 0.5 | Nil |

BBB- (DCR India) } | ||

It is to be noted that there is an in-built ceiling on the total borrowings of the NBFCs accepting deposits from public, because they are required to maintain a capital adequacy ratio of 10 per cent of their risk weighted assets effective from 31.3.1998 and 12 per cent from 31.3.1999. Their capacity to create assets and raise corresponding borrowings will be restricted because of capital adequacy norms.

Domestic Deposits

I. Domestic Deposits

-

In the case of term deposit standing in the name/s of a deceased individual depositor, or two or more joint depositors, where one of the depositor has died, the criterion for payment of interest on matured deposits in the event of death of the depositor in the above cases has been left to the discretion of individual banks subject to their Board laying down a transparent policy in this regard.

-

In the case of balances lying in current account standing in the name of a deceased individual depositor/ sole proprietorship concern, interest should be paid only from May 1, 1983 or from the date of death of the depositor, whichever is later, till the date of repayment to the claimant/s at the rate of interest applicable to savings deposit as on the date of payment. However, in the case of NRE deposit, if the claimants are residents, the deposit on maturity is treated as domestic rupee and interest is paid for the subsequent period at a rate applicable to the domestic deposit of similar maturity.

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Eligible entities and requirements to submit the FLA return

Ans: If all non-resident shareholders of an entity have transferred their shares to the residents during the reporting period and the entity does not have any outstanding investment in respect of inward and outward FDI as on end-March of the latest FY, then the entity need not submit the FLA return.

Retail Direct Scheme

Know Your Customer (KYC) related queries

-

Enter your PAN card number and date of birth to retrieve details available in CKYC.

-

Provide address details, scanned copy of your signature, bank account details and nominee details.

-

Authenticate the user agreement form using Aadhaar by submitting the OTP sent on your mobile number linked to Aadhaar.

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Paytm Payments Bank Wallet

Government Securities Market in India – A Primer

14.1 The return on a security is a combination of two elements (i) coupon income – that is, interest earned on the security and (ii) the gain / loss on the security due to price changes and reinvestment gains or losses.

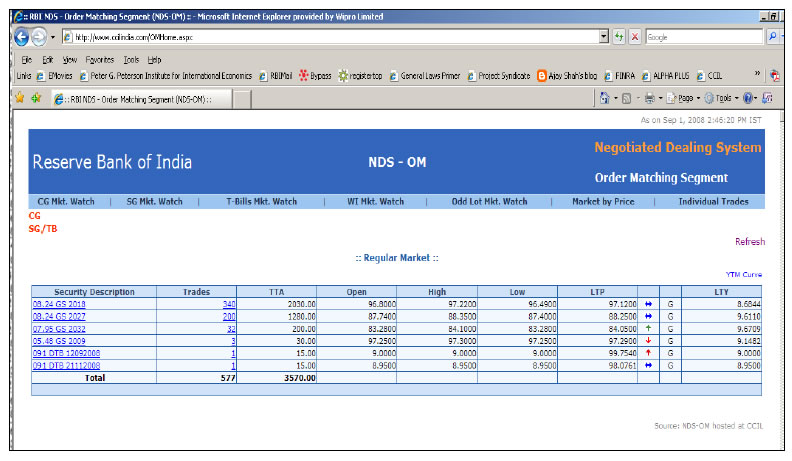

14.2 Price information is vital to any investor intending to either buy or sell G-Secs. Information on traded prices of securities is available on the RBI website http://www.rbi.org.in under the path Home → Financial Markets → Financial Markets Watch → Order Matching Segment of Negotiated Dealing System. This will show a screen containing the details of the latest trades undertaken in the market along with the prices. Additionally, trade information can also be seen on CCIL website http://www.ccilindia.com/OMHome.aspx. On this page, the list of securities and the summary of trades is displayed. The total traded amount (TTA) on that day is shown against each security. Typically, liquid securities are those with the largest amount of TTA. Pricing in these securities is efficient and hence UCBs can choose these securities for their transactions. Since the prices are available on the screen they can invest in these securities at the current prices through their custodians. Participants can thus get near real-time information on traded prices and take informed decisions while buying / selling G-Secs. The screenshots of the above webpage are given below:

NDS-OM Market

The website of the Financial Benchmarks India Private Limited (FBIL), (www.fbil.org.in) is also a right source of price information, especially on securities that are not traded frequently.

External Commercial Borrowings (ECB) and Trade Credits

E. AVERAGE MATURITY PERIOD

Foreign Investment in India

Indian Currency

B) Banknotes

Fifteen languages are appearing in the language panel of banknotes in addition to Hindi prominently displayed in the centre of the note and English on the reverse of the banknote.

Biennial survey on Foreign Collaboration in Indian Industry (FCS)

Some important definitions and concepts

Ans.: An Indian company is called as Foreign Associate if non-resident investor owns at least 10% and no more than 50% of the voting power/equity capital or where non-resident investor and its subsidiary(s) combined own at least 10% but no more than 50% of the voting power/equity capital of an Indian enterprise.

Core Investment Companies

B. Registration and related matters:

Ans: CICs need not meet the principal business criteria for NBFCs.

Portfolio Investment Positions (PIP) by Counterpart Economy (formerly CPIS) – India

What to report under PIP?

Ans.: If the responding entity does not have any portfolio investment asset during the reference period, then that entity is required to submit NIL survey schedule to the generic email ID of the Reserve Bank as per the instruction in the survey schedule.

Remittances [Money Transfer Service Scheme (MTSS) and Rupee Drawing Arrangement (RDA)]

Money Transfer Service Scheme (MTSS)

All you wanted to know about NBFCs

C. Definition of deposits, Eligible / Ineligible Institutions to accept deposits and Related Matters

The term ‘deposit’ is defined under Section 45 I(bb) of the RBI Act, 1934. ‘Deposit’ includes and shall be deemed always to have included any receipt of money by way of deposit or loan or in any other form but does not include:

-

amount raised by way of share capital, or contributed as capital by partners of a firm;

-

amount received from a scheduled bank, a co-operative bank, a banking company, Development bank, State Financial Corporation, IDBI or any other institution specified by RBI;

-

amount received in ordinary course of business by way of security deposit, dealership deposit, earnest money, advance against orders for goods, properties or services;

-

amount received by a registered money lender other than a body corporate;

-

amount received by way of subscriptions in respect of a ‘Chit’.

The term 'public deposit' is defined under paragraph 7(14) of the Reserve Bank of India (Non-Banking Financial Companies – Acceptance of Public Deposits) Directions, 2025 (as amended from time to time) as a ‘deposit’ as defined under Section 45I(BB) of the RBI Act, 1934 and further excludes the following:

-

amount received from the Central/ State Government or any other source where repayment is guaranteed by Central/ State Government or any amount received from local authority or foreign government or any foreign citizen/ authority/ person;

-

any amount received from financial institutions specified by RBI for this purpose;

-

any amount received by a company from any other company;

-

amount received and held pursuant to an offer made in accordance with the provisions of the Companies Act, 2013, towards subscription to any securities, including share application money or advance towards allotment of securities pending allotment, to such extent and for such period as permissible under the Companies (Acceptance of Deposit) Rules, 2014 and as amended from time to time;

-

amount received from directors of a company or from its shareholders by private company or by a private company which has become a public company, provided that the director or shareholder furnishes a declaration in writing that the amount is not given out of funds acquired by borrowing or accepting from others;

-

amount raised by issue of bonds or debentures secured by mortgage of any immovable property or other asset of the company subject to conditions;

-

any amount raised by issuance of non-convertible debentures with a maturity more than one year and having the minimum subscription per investor at ₹1 crore and above, provided it is in accordance with the guidelines issued by the Bank.

-

the amount brought in by the promoters by way of unsecured loan;

-

amount received from a mutual fund;

-

any amount received as hybrid debt or subordinated debt, the minimum maturity of which is not less than 60 months provided there is no option for recall by the issuer within the period;

-

amount received from a relative of the director of an NBFC;

-

any amount received by issuance of Commercial Paper in accordance with the guidelines issued by the Bank;

-

any amount received by a NBFC-Middle Layer and above, by issuance of ‘perpetual debt instruments’ in accordance with the guidelines issued by the Bank;

-

any amount raised by the issue of infrastructure bonds by an Infrastructure Finance Company as specified in the notification issued by Central Government under Section 80CCF of the Income Tax Act, 1961.

Thus, the directions exclude from the definition of public deposit, amounts raised from certain set of informed lenders who can make independent decision.

Targeted Long Term Repo Operations (TLTROs)

FAQs pertaining to On Tap TLTRO/ reversal of TLTRO/ TLTRO 2.0 transactions

Ans: Banks can submit their request for exercising the repayment option till October 28, 2020. On repayment of funds availed under TLTRO/ TLTRO 2.0, the associated securities shall be shifted out of the HTM category. The shifting of the TLTRO/ TLTRO 2.0 investments out of HTM shall be in addition to the shifting of investments permitted at the beginning of the accounting year and subject to adherence to the guidelines contained in the Master Circular – Prudential Norms for Classification, Valuation and Operation of Investment Portfolio by Banks dated July 1, 2015. These investments under TLTRO/ TLTRO 2.0 against which funds are being repaid will not be exempted from reckoning under the large exposure framework (LEF) and computation of adjusted non-food bank credit (ANBC) for the purpose of determining priority sector targets/sub-targets.

Housing Loans

FAQs on Non-Banking Financial Companies

Ceiling on deposits

Domestic Deposits

I. Domestic Deposits

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Eligible entities and requirements to submit the FLA return

Ans: Shares issued by reporting entities to non-resident on non-repatriable basis should not be considered as foreign investment; therefore, entities which have issued the shares to non-resident only on non-repatriable basis, is not required to submit the FLA return.

Retail Direct Scheme

Know Your Customer (KYC) related queries

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

FASTag issued by Paytm Payments Bank

Government Securities Market in India – A Primer

15.1 Transactions undertaken between market participants in the OTC / telephone market are expected to be reported on the NDS-OM platform within 15 minutes after the deal is put through over telephone. All OTC trades are required to be mandatorily reported on the NDS-OM reported segment for settlement. Reporting on NDS-OM is a two stage process wherein both the seller and buyer of the security have to report their leg of the trade. System validates all the parameters like reporting time, price, security etc. and when all the criterias of both the reporting parties match, the deals get matched and trade details are sent by NDS-OM system to CCIL for settlement.

15.2 Reporting on behalf of entities maintaining gilt accounts with the custodians is done by the respective custodians in the same manner as they do in case of their own trades i.e., proprietary trades. The securities leg of these trades settles in the CSGL account of the custodian. Funds leg settle in the current account of the PM with RBI.

15.3 In the case of NDS-OM, participants place orders (amount and price) in the desired security on the system. Participants can modify / cancel their orders. Order could be a ‘bid’ (for purchase) or ‘offer’ (for sale) or a two way quote (both buy and sell) of securities. The system, in turn, will match the orders based on price and time priority. That is, it matches bids and offers of the same prices with time priority. It may be noted that bid and offer of the same entity do not match i.e. only inter-entity orders are matched by NDS-OM and not intra-entity. The NDS-OM system has separate screen for trading of the Central Government papers, State Government securities (SDLs) and Treasury bills (including Cash Management Bills). In addition, there is a screen for odd lot trading also essentially for facilitating trading by small participants in smaller lots of less than ₹ 5 crore. The minimum amount that can be traded in odd lot is ₹ 10,000 in dated securities, T-Bills and CMBs. The NDS-OM platform is an anonymous platform wherein the participants will not know the counterparty to the trade. Once an order is matched, the deal ticket gets generated automatically and the trade details flow to the CCIL. Due to anonymity offered by the system, the pricing is not influenced by the participants’ size and standing.

External Commercial Borrowings (ECB) and Trade Credits

F. LEVERAGE CRITERIA AND BORROWING LIMIT

Foreign Investment in India

Answer: No, refer to Para 7.13 of Master Direction-Foreign Investment in India.

Indian Currency

B) Banknotes

Yes, it is possible to have two or more banknotes with the same serial number, but they would either have a different Inset Letter or year of printing or signature of a different Governor of RBI. An Inset Letter is an alphabet printed on the Number Panel of the banknote. There can be notes without any inset letter also.

Biennial survey on Foreign Collaboration in Indian Industry (FCS)

Some important definitions and concepts

Ans.: An Indian company is said have Pure Technical Collaboration if the company has only foreign technical collaboration and have not received any foreign direct investment.

Core Investment Companies

B. Registration and related matters:

Ans: A holding company not meeting the criteria for a CIC laid down in para 2 of Master Direction DoR(NBFC).PD.003/03.10.119/2016-17 dated August 25, 2016 would require to register as an NBFC. However, if such company wishes to register as CIC/ be exempted as CIC, it will have to apply to RBI with an action plan achievable within the specific period to reorganize its business as CIC. If it is not able to do so, it would need to comply with NBFC requirements and prudential norms.

Portfolio Investment Positions (PIP) by Counterpart Economy (formerly CPIS) – India

What to report under PIP?

Ans.: If the entity’s accounts are not audited before the due date of submission, then they should report in the survey based on unaudited (provisional) account.

All you wanted to know about NBFCs

C. Definition of deposits, Eligible / Ineligible Institutions to accept deposits and Related Matters

Banks, including co-operative banks, can accept deposits. NBFCs (including Housing Finance Companies), which have been issued Certificate of Registration by the Reserve Bank with a specific licence to accept deposits, are entitled to accept public deposit. In other words, not all NBFCs registered with the Reserve Bank are entitled to accept deposits but only those that hold a deposit accepting Certificate of Registration, can accept deposits. Further, these deposit accepting NBFCs can accept deposits, only to the extent permissible. Companies authorized by Ministry of Corporate Affairs under the Companies (Acceptance of Deposits) Rules framed by Central Government under the Companies Act can also accept deposits upto a certain limit. Cooperative Credit Societies (including Salary Earners Societies) can accept deposits from their members but not from the general public, and are under the purview of Registrar of Cooperative Societies. The Reserve Bank regulates the deposit acceptance only of banks, cooperative banks and NBFCs.

It is not legally permissible for other entities to accept public deposits. Unincorporated bodies like individuals, partnership firms, and other association of individuals are prohibited from carrying on the business of acceptance of deposits as their principal business. Such unincorporated bodies are prohibited from accepting deposits even if they are carrying on financial business. Further, The First Schedule of the ‘The Banning of Unregulated Deposit Schemes Act, 2019’ may be referred for the list of regulated deposit schemes.

Housing Loans

- At the time of sourcing the loan, banks are required to provide information about the interest rate applicable, the fees / charges and any other matter which affects your interest and the same are usually furnished in the product brochure of the banks. Complete transparency is mandatory.

- The banks will supply you authenticated copies of all the loan documents executed by you at their cost along with a copy each of all enclosures quoted in the loan document on request.

A bank cannot reject your loan application without furnishing valid reason(s) for the same.

Targeted Long Term Repo Operations (TLTROs)

FAQs pertaining to On Tap TLTRO/ reversal of TLTRO/ TLTRO 2.0 transactions

Ans: Banks can use either of the alternatives. However, the request of the bank will be subject to availability of funds as on date of application i.e., funds cannot be guaranteed in case the total amount of ₹1,00,000 crore is already availed.

FAQs on Non-Banking Financial Companies

Ceiling on deposits

Retail Direct Scheme

Know Your Customer (KYC) related queries

-

Upload a scanned copy of your PAN card.

-

Download the XML version of your Aadhaar from the UIDAI website and upload it. Use the 4-digit pin specified while downloading XML version.

-

Provide address details, scanned copy of your signature, bank account details and nominee details.

-

Complete the video KYC by choosing a time slot for later or immediately, depending on the availability at that point of time.

-

Authenticate the user agreement form by Aadhaar using the OTP sent on your mobile number linked to Aadhaar.

Domestic Deposits

II. Deposits of Non-Residents Indians (NRIs)

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Eligible entities and requirements to submit the FLA return

Ans: No, balance sheet or profit and loss (P&L) accounts are not required to be submitted along with the FLA return.

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

FASTag issued by Paytm Payments Bank

Government Securities Market in India – A Primer

Primary Market

16.1 Once the allotment process in the primary auction is finalized, the successful participants are advised of the consideration amounts that they need to pay to the Government on settlement day. The settlement cycle for auctions of all kind of G-Secs i.e. dated securities, T-Bills, CMBs or SDLs, is T+1, i.e. funds and securities are settled on next working day from the conclusion of the trade. On the settlement date, the fund accounts of the participants are debited by their respective consideration amounts and their securities accounts (SGL accounts) are credited with the amount of securities allotted to them.

Secondary Market

16.2 The transactions relating to G-Secs are settled through the member’s securities / current accounts maintained with the RBI. The securities and funds are settled on a net basis i.e. Delivery versus Payment System-III (DvP-III). CCIL guarantees settlement of trades on the settlement date by becoming a central counter-party (CCP) to every trade through the process of novation, i.e., it becomes seller to the buyer and buyer to the seller. 16.3 All outright secondary market transactions in G-Secs are settled on a T+1 basis. However, in case of repo transactions in G-Secs, the market participants have the choice of settling the first leg on either T+0 basis or T+1 basis as per their requirement. RBI vide FMRD.DIRD.05/14.03.007/2017-18 dated November 16, 2017 had permitted FPIs to settle OTC secondary market transactions in Government Securities either on T+1 or on T+2 basis and in such cases, It may be ensured that all trades are reported on the trade date itself.

પેજની છેલ્લી અપડેટની તારીખ: