IST,

IST,

मौद्रिक नीति समिति की 5 से 7 फरवरी 2025 के दौरान हुई बैठक का कार्यवृत्त

|

[भारतीय रिज़र्व बैंक अधिनियम, 1934 की धारा 45ज़ेडएल के अंतर्गत] भारतीय रिज़र्व बैंक अधिनियम, 1934 की धारा 45जेडबी के अंतर्गत गठित मौद्रिक नीति समिति (एमपीसी) की तिरपनवीं बैठक 5 से 7 फरवरी 2025 के दौरान आयोजित की गई थी। 2. बैठक की अध्यक्षता श्री संजय मल्होत्रा, गवर्नर ने की तथा सभी सदस्य – डॉ. नागेश कुमार, निदेशक एवं मुख्य कार्यपालक, इंस्टिट्यूट फॉर स्टडीज इन इंडस्ट्रियल डेवलपमेंट, नई दिल्ली; श्री सौगत भट्टाचार्य, अर्थशास्त्री, मुंबई; प्रोफेसर राम सिंह, निदेशक, दिल्ली स्कूल ऑफ इकोनॉमिक्स, दिल्ली; डॉ. राजीव रंजन, कार्यपालक निदेशक (भारतीय रिज़र्व बैंक अधिनियम, 1934 की धारा 45 ज़ेडबी (2) (सी) के अंतर्गत केंद्रीय बोर्ड द्वारा नामित रिज़र्व बैंक के अधिकारी); श्री एम राजेश्वर राव, मौद्रिक नीति के प्रभारी उप गवर्नर इसमें उपस्थित रहें। 3. भारतीय रिज़र्व बैंक अधिनियम, 1934 की धारा 45 ज़ेडएल के अनुसार, रिज़र्व बैंक मौद्रिक नीति समिति की प्रत्येक बैठक के चौदहवें दिन इस बैठक की कार्यवाहियों का कार्यवृत्त प्रकाशित करेगा जिसमें निम्नलिखित शामिल होगा: (क) मौद्रिक नीति समिति की बैठक में अपनाया गया संकल्प; (ख) मौद्रिक नीति समिति के प्रत्येक सदस्य का वोट, जो उक्त बैठक में अपनाए गए संकल्प पर उस सदस्य को दिया जाएगा; और (ग) उक्त बैठक में अपनाए गए संकल्प पर धारा 45ज़ेडआई की उप-धारा (11) के अंतर्गत मौद्रिक नीति समिति के प्रत्येक सदस्य का वक्तव्य। 4. एमपीसी ने भारतीय रिज़र्व बैंक द्वारा उपभोक्ता विश्वास, परिवारों की मुद्रास्फीति प्रत्याशा, कॉर्पोरेट क्षेत्र के कार्यनिष्पादन, ऋण की स्थिति, औद्योगिक, सेवाओं और आधारभूत संरचना क्षेत्रों की संभावनाएं और पेशेवर पूर्वानुमानकर्ताओं के अनुमानों का आकलन करने के लिए किए गए सर्वेक्षणों की समीक्षा की। एमपीसी ने इन संभावनाओं के विभिन्न जोखिमों के इर्द-गिर्द स्टाफ के समष्टि आर्थिक अनुमानों और वैकल्पिक परिदृश्यों की विस्तृत रूप से भी समीक्षा की। उपर्युक्त पर और मौद्रिक नीति के रुख पर व्यापक चर्चा करने के बाद एमपीसी ने संकल्प अपनाया जिसे नीचे प्रस्तुत किया गया है। संकल्प 5. मौद्रिक नीति समिति (एमपीसी) की 53वीं बैठक 5 से 7 फरवरी 2025 तक श्री संजय मल्होत्रा, गवर्नर, भारतीय रिज़र्व बैंक की अध्यक्षता में आयोजित की गई। एमपीसी के सदस्य डॉ. नागेश कुमार, श्री सौगत भट्टाचार्य, प्रो. राम सिंह, डॉ. राजीव रंजन और श्री एम. राजेश्वर राव बैठक में शामिल हुए। वर्तमान और उभरती समष्टि-आर्थिक स्थिति के आकलन के पश्चात, एमपीसी ने सर्वसम्मति से यह निर्णय लिया कि:

ये निर्णय संवृद्धि को समर्थन देते हुए उपभोक्ता मूल्य सूचकांक (सीपीआई) मुद्रास्फीति के लिए +/- 2 प्रतिशत के दायरे में 4 प्रतिशत के मध्यम अवधि लक्ष्य को प्राप्त करने के उद्देश्य के अनुरूप हैं। संवृद्धि और मुद्रास्फीति संभावना 6. वैश्विक अर्थव्यवस्था ऐतिहासिक औसत से कम बढ़ रही है, यद्यपि उच्च आवृत्ति संकेतक विश्व व्यापार में निरंतर विस्तार के बीच आघात-सहनीयता का संकेत दे रहे हैं। विश्व आर्थिक परिदृश्य, अवस्फीति की धीमी गति, भू-राजनीतिक तनाव और नीतिगत अनिश्चितताओं के साथ चुनौतीपूर्ण बना हुआ है। मजबूत डॉलर ने, अन्य बातों के साथ-साथ, उभरते बाजार मुद्राओं पर दबाव डालना जारी रखा है और वित्तीय बाजारों में अस्थिरता को बढ़ाया है। 7. घरेलू स्तर पर, प्रथम अग्रिम अनुमान (एफएई) के अनुसार, वास्तविक सकल घरेलू उत्पाद (जीडीपी) निजी खपत में बहाली के समर्थन से वर्ष 2024-25 में 6.4 प्रतिशत (वर्ष-दर-वर्ष) की दर से बढ़ने का अनुमान है। आपूर्ति पक्ष पर, संवृद्धि को सेवा क्षेत्र और कृषि क्षेत्र में बहाली का समर्थन प्राप्त है, जबकि धीमी औद्योगिक संवृद्धि एक बाधा है। 8. आगे देखते हुए, रबी की अच्छी संभावनाएँ और औद्योगिक गतिविधि में अपेक्षित बहाली से 2025-26 में आर्थिक संवृद्धि को समर्थन मिलना चाहिए। मांग पक्ष के प्रमुख चालकों में से, केंद्रीय बजट 2025-26 में कर राहत से घरेलू खपत के मजबूत बने रहने की आशा है। उच्च क्षमता उपयोग स्तरों, वित्तीय संस्थानों और कॉरपोरेट्स के मजबूत तुलन-पत्र और पूंजीगत व्यय पर सरकार के निरंतर जोर से समर्थित, नियत निवेश में बहाली की आशा है। रिज़र्व बैंक के उद्यम सर्वेक्षणों और पीएमआई में रेखांकित सकारात्मक कारोबारी मनोभावों से इसकी पुष्टि होती है। आघात-सह सेवा निर्यात से संवृद्धि को समर्थन मिलता रहेगा। तथापि, भू-राजनीतिक तनाव, संरक्षणवादी व्यापार नीतियों, अंतरराष्ट्रीय कमोडिटी कीमतों में उतार-चढ़ाव और वित्तीय बाजार की अनिश्चितताओं से उत्पन्न प्रतिकूल परिस्थितियां, संभावना के लिए अधोगामी जोखिम उत्पन्न कर रहीं हैं। इन सभी कारकों को ध्यान में रखते हुए, 2025-26 के लिए वास्तविक जीडीपी संवृद्धि 6.7 प्रतिशत रहने का अनुमान है, जो पहली तिमाही में 6.7 प्रतिशत, दूसरी तिमाही में 7.0 प्रतिशत तथा तीसरी और चौथी तिमाहियों में 6.5 प्रतिशत रहेगी (चार्ट 1)। जोखिम समान रूप से संतुलित हैं। 9. हेडलाइन मुद्रास्फीति अक्तूबर में अपने हाल के शीर्ष-स्तर 6.2 प्रतिशत से नवंबर-दिसंबर 2024 में क्रमिक रूप से कम हुई। सब्जियों की कीमत मुद्रास्फीति के अक्तूबर के उच्च स्तर से नीचे आने के कारण खाद्य मुद्रास्फीति में कमी ने हेडलाइन मुद्रास्फीति में गिरावट को बढ़ावा दिया। सभी वस्तुओं और सेवाओं के घटकों में मूल मुद्रास्फीति कम रही और ईंधन समूह में अवस्फीति जारी रही। 10. आगे बढ़ते हुए, खाद्य मुद्रास्फीति का दबाव, आपूर्ति पक्ष के किसी भी आघात के अभाव में, अच्छे खरीफ उत्पादन, सर्दियों में सब्जियों की कीमतों में कमी और अनुकूल रबी फसल की संभावनाओं के कारण महत्वपूर्ण रूप से कम होना चाहिए। मूल मुद्रास्फीति में वृद्धि की आशा है, लेकिन यह मामूली रहेगी। वैश्विक वित्तीय बाजारों में निरंतर अनिश्चितता के साथ-साथ ऊर्जा की कीमतों में उतार-चढ़ाव और प्रतिकूल मौसम की घटनाओं से मुद्रास्फीति के लिए ऊर्ध्वगामी जोखिम है। इन सभी कारकों को ध्यान में रखते हुए, 2024-25 के लिए सीपीआई मुद्रास्फीति 4.8 प्रतिशत और चौथी तिमाही में 4.4 प्रतिशत रहने का अनुमान है। अगले वर्ष सामान्य मानसून की परिकल्पना करते हुए, 2025-26 के लिए सीपीआई मुद्रास्फीति 4.2 प्रतिशत रहने का अनुमान है, जो पहली तिमाही में 4.5 प्रतिशत, दूसरी तिमाही में 4.0 प्रतिशत, तीसरी तिमाही में 3.8 प्रतिशत और चौथी तिमाही में 4.2 प्रतिशत रहने का अनुमान है (चार्ट 2)। जोखिम समान रूप से संतुलित हैं। मौद्रिक नीति निर्णयों का औचित्य

11. एमपीसी ने कहा कि मुद्रास्फीति में कमी आई है। खाद्य पदार्थों पर अनुकूल संभावना और पिछली मौद्रिक नीति कार्रवाइयों के निरंतर संचारण के समर्थन से, 2025-26 में इसके और कम होने की आशा है, जो धीरे-धीरे लक्ष्य से संरेखित होगी। एमपीसी ने यह भी कहा कि यद्यपि संवृद्धि के 2024-25 की दूसरी तिमाही के निचले स्तर से बहाली की आशा है, लेकिन यह पिछले वर्ष की तुलना में काफी कम है। ये संवृद्धि-मुद्रास्फीति गतिकी, एमपीसी के लिए मुद्रास्फीति को लक्ष्य के साथ संरेखित करने पर ध्यान केंद्रित करते हुए संवृद्धि को समर्थन प्रदान करने के लिए नीतिगत स्थान खोलती है। तदनुसार, एमपीसी ने सर्वसम्मति से नीतिगत रेपो दर को 25 आधार अंक घटाकर 6.25 प्रतिशत करने के लिए वोट किया। 12. साथ ही, वैश्विक वित्तीय बाजारों में अत्यधिक अस्थिरता और वैश्विक व्यापार नीतियों के बारे में निरंतर अनिश्चितताओं के साथ-साथ प्रतिकूल मौसम की घटनाओं ने संवृद्धि और मुद्रास्फीति की संभावना के लिए जोखिम उत्पन्न किया है। इसके लिए एमपीसी को सतर्क रहने की आवश्यकता है। तदनुसार, एमपीसी ने सर्वसम्मति से तटस्थ रुख जारी रखने के लिए वोट किया। इससे एमपीसी को उभरते समष्टि-आर्थिक माहौल पर प्रतिक्रिया करने के लिए लचीलापन प्राप्त होगा। 13. एमपीसी की इस बैठक का कार्यवृत्त 21 फरवरी 2025 को प्रकाशित किया जाएगा। 14. एमपीसी की अगली बैठक 7 से 9 अप्रैल 2025 के दौरान निर्धारित है।

नीतिगत रेपो दर को 6.25 प्रतिशत पर कम करने के संकल्प पर वोटिंग

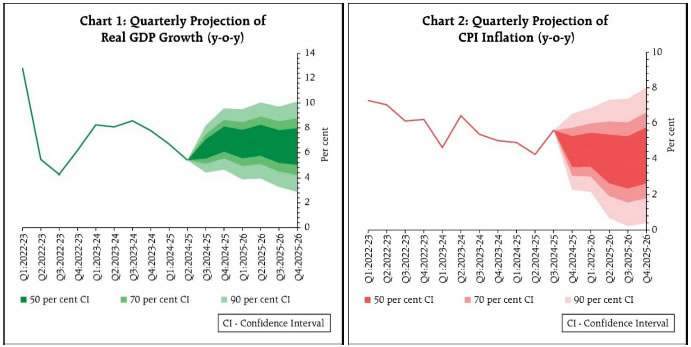

डॉ. नागेश कुमार का वक्तव्य 15. मैं अक्तूबर 2024 में एमपीसी की बैठक के बाद से ही अर्थव्यवस्था की मंदी को लेकर चिंतित हूं और संवृद्धि को समर्थन देने के लिए दरों में कटौती की मांग कर रहा हूं। पिछले कुछ महीनों में, हमने संवृद्धि में मंदी के गहराने पर चिंता व्यक्त की है, जिसके कारण आरबीआई ने 2024-25 के लिए संवृद्धि की संभावना को अक्तूबर 2024 की नीति में 7.2% से घटाकर दिसंबर 2024 में 6.6% और अब एनएसओ के पहले अग्रिम अनुमान के अनुसार 6.4% कर दिया है, अर्थात्, चार महीनों में 80 आधार अंकों की गिरावटI 16. यह मंदी विशेष रूप से, विनिर्माण क्षेत्र की कमज़ोरी को दर्शाती है, क्योंकि सेवा क्षेत्र में मज़बूती से वृद्धि जारी है, और चालू वर्ष में कृषि संवृद्धि प्रदर्शन में सुधार हुआ है। विनिर्माण क्षेत्र की मंदी चिंता का विषय है, क्योंकि हमारी युवा आबादी के लिए अच्छे रोज़गार के सृजन में इसकी भूमिका है। 17. कई संकेत विनिर्माण क्षेत्र की कमज़ोरी की पुष्टि करते हैं, जिसमें सूचीबद्ध कंपनियों का कार्यनिष्पादन भी शामिल है, जो दर्शाता है कि विनिर्माण कंपनियों की बिक्री वृद्धि बेहतर लाभ मार्जिन के बावजूद कमज़ोर बनी हुई है, क्योंकि लोहा और इस्पात, सीमेंट और पेट्रोलियम उत्पादों जैसे मुख्य क्षेत्रों में अधोगामी वृद्धि जारी है या वे संकुचित हो रहे हैं। 2024-25 की तीसरी तिमाही में विनिर्माण उद्यमों के लिए कारोबार मूल्यांकन सूचकांक पिछली तिमाही के अपने स्तरों के करीब रहा। 18. शहरी खपत में कमी के कारण विनिर्माण क्षेत्र में मंदी आ रही है, जिससे टिकाऊ वस्तुओं की मांग प्रभावित हो रही है, तथा निजी निवेश में धीमी वृद्धि हो रही है, जिसकी पुष्टि भारत सरकार द्वारा 31 जनवरी 2025 को प्रस्तुत आर्थिक सर्वेक्षण से भी होती है। वैश्विक अर्थव्यवस्था और अंतर्राष्ट्रीय व्यापार तथा निवेश के धीमे प्रदर्शन के कारण बाहरी वातावरण भी कम अनुकूल हो गया है। विश्व व्यापार की औसत वार्षिक वृद्धि दर 2003-2008/09 के दौरान लगभग 16-20% से घटकर मात्र 3-4% रह गई है, जिसने चीन को वैश्विक विनिर्माण केंद्र के रूप में उभरने में मदद की थी।[1] संयुक्त राष्ट्र, आईएमएफ और विश्व बैंक के अनुमानों के अनुसार इस वर्ष यह लगभग 3.4% रहने की उम्मीद है। फिर अमेरिका जैसे प्रमुख औद्योगिक देशों में संरक्षणवाद की प्रवृत्ति बढ़ रही है, जो औद्योगिक नीति को बहुत आक्रामक तरीके से आगे बढ़ा रहे हैं, जिसमें Inflation Reduction Act, the Chips Act and the Infrastructure and Jobs Act के तहत कर छूट, प्रोत्साहन और सब्सिडी के रूप में उद्योग को एक ट्रिलियन डॉलर से अधिक दिया जाना है। श्री ट्रम्प के राष्ट्रपति बनने के बाद, संरक्षणवाद की इस प्रवृत्ति के और भी बढ़ने की उम्मीद है। यह उम्मीद करना भी जल्दबाजी होगी कि भारत को बख्शा जाएगा जबकि मेक्सिको, कनाडा और चीन पर टैरिफ लगाए जाएंगे! ऐसी संरक्षणवादी व्यापार नीतियों के कारण विश्व अर्थव्यवस्था के गहन और लंबे समय तक मंदी में जाने की अत्यंत आशंकाएं हैं। 19. चीन में अतिरिक्त क्षमता को डंप करने के खतरे से संबंधित चिंता भी है, क्योंकि उनके पास बहुत ज़्यादा पैसा है और पश्चिमी बाज़ारों तक उनकी पहुँच खतरे में है। स्टील सहित हमारे कुछ विनिर्माण क्षेत्रों में दबाव (संभवतः अधोगामी संवृद्धि की वजह से) महसूस होने लगा है, जबकि श्रम-प्रधान उपभोक्ता क्षेत्र जैसे कि वस्त्र और चमड़े के सामान पर भी दबाव है। जैसा कि हालिया आर्थिक सर्वेक्षण से पता चलता है, एफडीआई अंतर्वाह कम हो गया है, विदेशी निवेशक एफडीआई और एफपीआई दोनों ही वापस लौट रहे हैं, जिससे निवल रूप से बहुत कम निवेश रह गया है। 20. इसलिए, संवृद्धि को समर्थन देने के मामले पर अधिक जोर नहीं दिया जा सकता। 1 फरवरी 2025 को प्रस्तुत किए गए केंद्रीय बजट 2025-26 में, राजकोषीय नीति ने सार्वजनिक निवेश (कैपेक्स) को बनाए रखने और मध्यम आय वर्ग को आयकर रियायतों के माध्यम से उपभोग बढ़ाने के लिए डिस्पोजेबल आय बढ़ाने के लिए अपना काम किया है। अब मौद्रिक नीति की बारी है कि वह दरों में कटौती के माध्यम से आर्थिक संवृद्धि का समर्थन करे। दरों में कटौती से आवास और टिकाऊ उपभोग वस्तुओं में निवेश की मांग को बढ़ावा देने में मदद मिल सकती है और पूंजी की लागत को कम करके निजी निवेश का समर्थन किया जा सकता है। 21. सौभाग्य से, पिछली एमपीसी के बाद से मुद्रास्फीति संभावना सौम्य हुई है, जो दरों में कटौती की गुंजाइश प्रदान करता है। जनवरी 2025 के लिए मुद्रास्फीति अक्टूबर 2024 में 6.2% की तुलना में 5% से कम रहने की उम्मीद है। सीपीआई हेडलाइन नवंबर में 5.5% से घटकर दिसंबर में 5.2% हो गई है। लेकिन खाद्य और ईंधन को छोड़कर सीपीआई 3.7% पर बनी हुई है। इसलिए, मुद्रास्फीति का बड़ा हिस्सा खाद्य कीमतों, विशेष रूप से सब्जियों की कीमतों के कारण है, जो मौसमी मांग-आपूर्ति बेमेल के परिणामस्वरूप होती है जो खुद को ठीक कर लेती है। जैसा कि मैंने पिछली बैठकों में तर्क दिया है, सब्जियों में मांग-आपूर्ति बेमेल को दूर करने में मौद्रिक नीति की सीमाएँ हैं। सौभाग्य से, खाद्य कीमतों में कमी आने लगी है। इसके अलावा, केंद्रीय बजट ने 2025-26 के लिए राजकोषीय घाटे को जीडीपी के केवल 4.4% तक सीमित करके राजकोषीय समेकन के मार्ग को तेज कर दिया है। 22. वैश्विक स्तर पर कमोडिटी की कीमतों में कई कारणों से नरमी आ रही है। चीन में मंदी के कारण कच्चे तेल की कीमतों में गिरावट आने की संभावना है, यूक्रेन संघर्ष की संभावनाओं के साथ मध्य पूर्व में हाल ही में घोषित युद्ध विराम में भी ट्रम्प के दूसरे कार्यकाल (2.0) के कारण तेजी आ रही है, जिससे अमेरिका में तेल उत्पादन बढ़ने और नवीकरणीय ऊर्जा पर निर्भरता बढ़ने की भी संभावना है। 23. संवृद्धि में मंदी की गंभीरता और मुद्रास्फीति की संभावना को कम करके प्रदान की गई गुंजाइश को देखते हुए, मेरा दृढ़ विश्वास है कि एमपीसी को दरों में कटौती के साथ मौद्रिक नीति के सामान्यीकरण की प्रक्रिया शुरू करनी चाहिए। हम अधिक महत्वाकांक्षी हो सकते हैं और 50 आधार अंकों की कटौती का लक्ष्य रख सकते हैं। यह देश के भीतर और बाहर के बाजारों और निजी निवेशकों को यह संकेत देगा कि भारत गंभीर है और आर्थिक संवृद्धि की गति को पुनर्जीवित करने के लिए जो कुछ भी करना होगा, वह करेगा। 24. हालांकि, वैश्विक अनिश्चितताओं को देखते हुए, वर्तमान नीति के लिए मैं तटस्थ रुख बनाए रखते हुए रेपो दर में 25 आधार अंकों की कटौती के लिए वोट करता हूं। श्री सौगत भट्टाचार्य का वक्तव्य 25. दिसंबर 2024 में मौद्रिक नीति समिति (एमपीसी) की बैठक के बाद से, दो महत्वपूर्ण समष्टि-आर्थिक संकेतक, अर्थात् संवृद्धि और मुद्रास्फीति, अनुकूल रूप से आगे बढ़े हैं। 26. सबसे पहले, घरेलू आर्थिक गतिविधि में वित्त वर्ष 25 की दूसरी तिमाही के जीडीपी संवृद्धि के निम्न स्तर के बाद सुधार हुआ है। वित्त वर्ष 25 के जीडीपी के एनएसओ अग्रिम अनुमानों से पता चलता है कि दूसरी छमाही में जीडीपी संवृद्धि दर 6.7% रहेगी। वित्त वर्ष 26 के लिए आरबीआई का जीडीपी पूर्वानुमान वर्ष-दर-वर्ष 6.7% है; आर्थिक सर्वेक्षण में 6.3 - 6.8% का अनुमान है। दूसरा, मुद्रास्फीति का दबाव धीरे-धीरे कम होता दिख रहा है। अक्टूबर 2024 में वर्ष-दर-वर्ष 6.2% सीपीआई मुद्रास्फीति का उच्च स्तर, जो दिसंबर 2024 की एमपीसी बैठक में मेरे वोट को प्रभावित करने वाला कारक था, दिसंबर 2024 में घटकर 5.2% रह गया है। 27. इन दोनों संकेतकों में सुधार के बावजूद दो प्रासंगिक प्रश्न हैं। 28. सबसे पहले, संवृद्धि का मुद्दा। सूचीबद्ध विनिर्माण कंपनियों के वित्त वर्ष 25 की तीसरी तिमाही के प्रारंभिक वित्तीय परिणामों से पता चलता है कि निवल बिक्री में वृद्धि मुश्किल से ही हो रही है, जबकि परिचालन और निवल लाभ वृद्धि दबाव में बनी हुई है। हालांकि कई उच्च आवृत्ति संकेतक आघात-सह बने हुए हैं, लेकिन वे पिछले वर्षों की तुलना में कमजोर हैं। जनवरी 2025 के पीएमआई में निरंतर आर्थिक लचीलापन देखने को मिल रहा है, लेकिन केंद्रीय बैंक और निजी सर्वेक्षणों में मिली-जुली तस्वीर देखने को मिल रही है, खास तौर पर विनिर्माण के लिए। दूसरे शब्दों में, खपत और निवेश आधारित वृद्धि दोनों को समर्थन देने की जरूरत के पर्याप्त संकेत मिल रहे हैं। 29. वैश्विक व्यापार और संरक्षणवादी नीतियों में घर्षण के संभावित प्रसार-प्रभाव को ध्यान में रखना महत्वपूर्ण है। व्यापार संबंधों में व्यवधान और वैश्विक केंद्रीय बैंकों की प्रतिक्रियाओं के बारे में अनिश्चितता के कारण वैश्विक संवृद्धि में मंदी घरेलू नीतिगत विकल्पों को और जटिल बना सकती है। इस मोड़ पर नीति में ढील को तेज करने का सबसे महत्वपूर्ण सन्निकट जोखिम, बाह्य वित्तीय स्थितियों में नए सिरे की अस्थिरता है। 30. दूसरा, मुद्रास्फीति के मामले में, कुछ हद तक आशावाद है। विशेष रूप से खाद्य तेलों की कीमतें अपने उच्चतम स्तर से नीचे आने के कारण एफएओ खाद्य मूल्य सूचकांक दिसंबर'24 में कम हो गया। प्रमुख धातुओं की कीमतों में भी गिरावट आई है या स्थिर बनी हुई हैं। आईईए का आकलन[2] है कि गैर-ओपेक+ तेल उत्पादन "संभावित आपूर्ति व्यवधानों और अपेक्षित मांग संवृद्धि दोनों को कवर करेगा"। अप्रत्याशित होने के बावजूद, संभावना का संतुलन यह है कि उच्च तेल की कीमतें मध्यम अवधि की मुद्रास्फीति के पूर्वानुमान के लिए एक महत्वपूर्ण जोखिम नहीं होंगी। विश्लेषकों का मानना है कि जनवरी '25 का प्रिंट व्यापक रूप से वर्ष-दर-वर्ष 5% से कम होगा। आरबीआई ने वित्तीय वर्ष 26 के लिए सीपीआई मुद्रास्फीति का अनुमान 4.2% लगाया है, जो वित्तीय वर्ष 26 की चौथी तिमाही में 4.2% (और वित्तीय वर्ष 26 की दूसरी छमाही में औसतन 4.0%) तक (थोड़ा अस्थिर) ग्लाइड पथ के साथ है। पेशेवर पूर्वानुमानकर्ताओं के सर्वेक्षण (एसपीएफ़) में अधिकांश भाग के लिए सीपीआई "मूल" (जिसमें 'खाद्य और पेय पदार्थ', 'ईंधन और प्रकाश' और 'पान, तंबाकू और मादक द्रव्य' शामिल नहीं हैं) मुद्रास्फीति के लिए औसत पूर्वानुमान, जो वित्तीय वर्ष 26 की तीसरी तिमाही में धीरे-धीरे 4.1% तक बढ़ रहा है, अधिकांश तिमाहियों के लिए हेडलाइन सीपीआई लक्ष्य से कम है। मध्यम अवधि के लक्ष्य के कारण हेडलाइन मुद्रास्फीति के टिकाऊ संरेखण के लिए यह महत्वपूर्ण सुदृढ़ीकरण होने की संभावना है। 31. हालांकि, 3- और 12-महीने आगे के आरबीआई का परिवार का मुद्रास्फीति प्रत्याशा सर्वेक्षण (जनवरी'25 सर्वेक्षण दौर में) थोड़ी बढ़ गई हैं। आईआईएम अहमदाबाद का दिसंबर '24 दौर के कारोबार मुद्रास्फीति सर्वेक्षण से पता चलता है कि अधिकांश उत्तरदाताओं को उम्मीद है कि एक वर्ष आगे इनपुट लागत में तेजी से वृद्धि होगी। विनिर्माण और सेवा जनवरी '25 पीएमआई सर्वेक्षण भी इनपुट और आउटपुट दोनों की कीमतों में वृद्धि का संकेत देते हैं, हालांकि अलग-अलग परिमाण में, फिर भी ज्यादातर अपने दीर्घकालिक औसत से ऊपर। 32. सभी बातों पर विचार करने के बाद, मैं अब मुद्रास्फीति के अधोगामी प्रक्षेपवक्र के बारे में आशावादी हूँ। मेरा मानना है कि, इस समय, मुद्रास्फीति पर आवश्यक नीतिगत प्रतिक्रिया – संवृद्धि ट्रेड-ऑफ- यहां तक कि उभरते जोखिमों से त्रुटि के महत्वपूर्ण मार्जिन को ध्यान में रखते हुए - बाद वाले के पक्ष में दिखती है। 33. पूर्वानुमानित मुद्रास्फीति प्रक्षेपवक्र को देखते हुए, नीति रेपो दर जल्द ही, यदि अभी तक नहीं भी, अत्यधिक प्रतिबंधात्मक हो सकती है, जिससे संचयी रूप से संवृद्धि के आवेगों को नुकसान पहुंचाने का जोखिम बढ़ सकता है। यह आकलन "वास्तविक प्राकृतिक ब्याज दर" के पिछले अध्ययन[3] पर आधारित है, जिसके बारे में मैं जानता हूँ। 34. आर्थिक गतिविधियों को बढ़ावा देने के लिए एक महत्वपूर्ण क्षेत्र एमएसएमई है। एमएसएमई के “सूक्ष्म और लघु उद्यम” खंड को बैंक ऋण दिसंबर 2024 तक वर्ष-दर-वर्ष आधार पर 12.1% तक धीमा हो गया था, जबकि एक वर्ष पहले इसी महीने में यह 20.3% था; विनिर्माण खंड में यह 14.8% से 9.8% तक गिर गया। मेरे लिए, यह – प्राथमिकता-प्राप्त क्षेत्र वाले खंड को प्रदत्त ऋण की गति में धीमापन है, जोकि चिंता का विषय है। जैसा कि मैंने दिसंबर 2024 की एमपीसी बैठक के अपने कार्यवृत्त में उल्लेख किया था, छोटी सूचीबद्ध कंपनियों के लिए ब्याज व्यय और ईबीआईडीटीए का अनुपात उच्च बना हुआ है; अधिकांश छोटे उद्यमों के लिए, यह काफी अधिक होने की संभावना है। इस क्षेत्र से ऋण की बढ़ती मांग को प्रेरित करने का एक साधन उधार लेने की लागत को कम करना है। ईबीएलआर मूल्य निर्धारण को देखते हुए एमएसएमई के लिए उधार लेने की लागत में नीतिगत रेपो दर में कटौती का प्रसारण अपेक्षाकृत जल्दी होने की संभावना है। इसके अलावा, आरबीआई के चलनिधि निवेश उपायों से एमसीएलआर-आधारित उधार लेने की लागत में धीरे-धीरे कमी आने की संभावना है, जिससे भारित औसत उधार दर (डब्ल्यूएएलआर) में कमी आएगी। 35. नीति में ढील का संभावित असर मुद्रा में अस्थिरता और यूएसडीआईएनआर जोड़ी का अवमूल्यन हो सकता है। यह चिंता का प्रमुख कारण नहीं हो सकता है। एक हालिया अध्ययन[4] का अनुमान है कि यदि आईएनआर में 5% की गिरावट आती है, तो सीपीआई "मुद्रास्फीति लगभग 35 बीपीएस तक अधिक हो सकती है" जबकि जीडीपी वृद्धि "निर्यात की अल्पकालिक बढ़ोत्तरी के माध्यम से 25 बीपीएस तक बढ़ सकती है"। इस अध्ययन के बाद से दुनिया में हुए महत्वपूर्ण बदलावों को देखते हुए इसे संभवतः सांकेतिक माना जाना चाहिए। 36. तदनुसार, मुद्रास्फीति के अधोगामी प्रक्षेवक्र के मेरे आकलन के आधार पर, मैं रेपो दर को 25 आधार अंकों से घटाकर 6.25 प्रतिशत करने के लिए वोट करता हूँ। मेरा मानना है कि आर्थिक चक्र के इस बिंदु पर यह उचित नीतिगत प्रतिक्रिया है। मैं तटस्थ मौद्रिक नीति रुख को जारी रखने के लिए भी वोट करता हूँ। यह रुख किसी भी उभरते आघात और आर्थिक वातावरण में परिणामी अनिश्चितता का उचित तरीके से प्रतिक्रिया देने के लिए लचीलापन प्रदान करेगा। प्रोफेसर राम सिंह का वक्तव्य 37. एमपीसी की दिसंबर की बैठक के बाद से, हमें अर्थव्यवस्था की मुद्रास्फीति के प्रक्षेपपथ और संवृद्धि की संभावनाओं से संबंधित अतिरिक्त डेटा प्राप्त हुआ है। इसके अलावा, विदेशी मुद्रा दरों के संबंध में भी महत्वपूर्ण गतिविधियां हुई हैं। ये समष्टि डेटा और संबंधित संकेतक मौजूदा मौद्रिक नीति (एमपी) की व्यापक समीक्षा के मामले को रेखांकित करते हैं। मुद्रास्फीति 38. अनुमानित अधोगामी प्रक्षेपपथ बाद, दिसंबर 2024 में हेडलाइन मुद्रास्फीति 5.2% थी, जिसमें खाद्य और ईंधन को छोड़कर सीपीआई मुद्रास्फीति 3.7% थी। सोने को छोड़कर अधिकांश कृषि उपज और गैर-खाद्य वस्तुओं की कीमतें कम हुई हैं। आगे देखते हुए, खाद्य मुद्रास्फीति 2024-25 की चौथी तिमाही में कम होने की संभावना है, और निकट भविष्य में ऊर्जा की कीमतें भी स्थिर रहने की आशा है। कुल मिलाकर, 2024-25 के लिए सीपीआई मुद्रास्फीति, 4.8 प्रतिशत पर अनुमानित है, जो सहन स्तर के भीतर है, तथापि 4.0 प्रतिशत लक्ष्य से ऊपर है। 39. दिसंबर 2024 में मूल वस्तुओं और सेवाओं की मुद्रास्फीति दर क्रमशः 3.6% और 3.5% पर सामान्य बनी हुई है। पेट्रोल, डीजल, सोना और चांदी को छोड़कर सीपीआई मूल 3.3% पर नीचे है। वित्त वर्ष 2025-26 के लिए, सीपीआई मुद्रास्फीति 4.2% रहने की आशा है। 40. यदि सीपीआई मुद्रास्फीति में खाद्य और पेय पदार्थों की हिस्सेदारी को हाल के वर्षों के घरेलू उपभोग और व्यय सर्वेक्षण (एचसीईएस) के आंकड़ों में देखे गए स्तरों तक कम कर दिया जाए तो सीपीआई हेडलाइन मुद्रास्फीति के आंकड़े और भी अधिक अनुकूल दिखाई देंगे। इस प्रकार, हेडलाइन भारतीय मुद्रास्फीति दर वास्तव में वैश्विक औसत से कम है। जीडीपी संवृद्धि 41. रिज़र्व बैंक ने वित्त वर्ष 25 के लिए जीडीपी संवृद्धि पूर्वानुमान को 7.2 से घटाकर 6.4 प्रतिशत कर दिया है। 2024-25 की तीसरी तिमाही में, विनिर्माण क्षेत्र की बिक्री संवृद्धि धीमी बनी हुई है, तथा निवल लाभ मार्जिन में और कमी आई है। आईटी क्षेत्र के लिए, कर्मचारियों की लागत में मामूली वृद्धि हुई है, जबकि शीर्ष आईटी कंपनियों के लिए कर्मचारियों की संख्या में कमी आई है। सीयू में सुधार नहीं हुआ है, और गैर-आईटी सेवा क्षेत्र की कंपनियों की ब्याज कवरेज दर कम बनी हुई है, तथापि एक से अधिक है। आगे देखते हुए, रिज़र्व बैंक के उद्यम सर्वेक्षण से कुल कारोबार और कर्मचारियों के संबंध में मांग मापदंडों में मामूली सुधार का संकेत मिलता है। 2024-25 की दूसरी तिमाही में सीयू 74.2 प्रतिशत पर दीर्घकालिक औसत से ऊपर है। 42. इसी संदर्भ में आर्थिक सर्वेक्षण 2024-25 ने वित्त वर्ष 25 में जीडीपी संवृद्धि 6.4% और वित्त वर्ष 26 में 6.3% से 6.8% के बीच रहने का अनुमान लगाया है। पहले अग्रिम अनुमानों के अनुसार, वित्त वर्ष 25 में वास्तविक और अंकित जीडीपी क्रमशः 6.4% और 9.7% की दर से बढ़ने की आशा है। वित्त वर्ष 26 में नाममात्र जीडीपी में 10.1% की वृद्धि होने का अनुमान है। ये आंकड़े मुद्रास्फीति के संबंध में पर अधोगामी प्रक्षेपपथ की ओर इशारा करते हैं। 43. वास्तविक मजदूरी की कम वृद्धि दर के कारण निजी खपत में कमी मंदी के पीछे एक कारक है। तथापि, अत्यधिक संकुचनकारी मौद्रिक नीति ने समस्या को और बढ़ा दिया है। उच्च ब्याज दरों और विनियामक सख्ती ने ऋण वृद्धि दर को कम कर दिया है। बैंक ऋण की वृद्धि दर दिसंबर 2023 में 15.6% (वर्ष-दर-वर्ष) से घटकर दिसंबर 2024 में 12.4% हो गई है। इससे अर्थव्यवस्था के कई क्षेत्रों में मांग वृद्धि पर अधोगामी दबाव पड़ता है। 44. इस क्षेत्र में निजी पूंजीगत व्यय में धीमी बहाली के पीछे अक्सर मामूली मांग को कारण बताया जाता है। जबकि निवेश निर्णयों के लिए मांग प्रत्याशाएँ महत्वपूर्ण हैं, उच्च ब्याज दरों ने पूंजी निवेश के जोखिम प्रीमियम को बढ़ा दिया है। वाणिज्यिक क्षेत्र में निधियों के प्रवाह में उल्लेखनीय मंदी के पीछे यह एक प्रमुख कारक प्रतीत होता है। बैंक/वित्तीय संस्थाओं द्वारा वित्तपोषित परियोजनाओं की कुल लागत में कोई उल्लेखनीय वृद्धि नहीं देखी गई है। दिसंबर 2024 में कुल बैंक ऋण वृद्धि दर 12.4% पर कम बनी हुई है। कुल मिलाकर बहुत सख्त वित्तीय परिस्थितियों में उद्योग के लिए दर और भी कम (7.4%) है। 45. केंद्रीय बजट 2025 ने मांग को बढ़ावा दिया है। तथापि, मांग में वृद्धि से निजी पूंजीगत व्यय में वृद्धि नहीं होगी, जब तक कि ब्याज दरों में तत्काल कमी नहीं की जाती। सोने और चांदी को छोड़कर मूल मुद्रास्फीति (<4%) और नीतिगत दर (6.5%) के बीच का अंतर पिछले वर्ष 2.5% से अधिक रहा है। इसका अर्थ है कि पूंजीगत व्यय-संबंधित वास्तविक ब्याज दर संवृद्धि-तटस्थ वास्तविक ब्याज दर, आर-स्टार से काफी अधिक है। पूंजीगत वस्तुओं के लिए बहुत अधिक प्रभावी वास्तविक ब्याज दरें निजी पूंजीगत व्यय पर दबाव डालती हैं और एक प्रमुख कारक है कि निवेश दरें उच्च संवृद्धि दर के लिए आवश्यक दरों से कम क्यों रहती हैं। 46. सीपीआई मुद्रास्फीति के संदर्भ में भी, नीतिगत दरें अगली पांच तिमाहियों के लिए सीपीआई मुद्रास्फीति पूर्वानुमान से दो प्रतिशत अधिक हैं - 2024-25 की चौथी तिमाही: 4.4 प्रतिशत, 2025-26 की पहली तिमाही: 4.5 प्रतिशत, 2025-26 की दूसरी तिमाही: 4.0 प्रतिशत, तीसरी तिमाही 3.8 प्रतिशत और चौथी तिमाही 4.2 प्रतिशत; और वित्त वर्ष 2025-26: 4.2% पर है। निस्संदेह, वर्तमान एमपी संकुचनकारी है। 47. पिछले दो वर्षों के दौरान लगातार कम मूल मुद्रास्फीति दर और वित्त वर्ष 25 में मंदी का संयोजन यह सुझाव देता है कि वास्तविक संवृद्धि संभावित संवृद्धि दर से काफी नीचे है। 48. बजट 2025 से मांग में वृद्धि को देखते हुए, चलनिधि में आनुपातिक वृद्धि द्वारा संचालित दर में कटौती निवेशकों द्वारा मांगे जाने वाले जोखिम प्रीमियम को कम करेगी, जिससे संवृद्धि को समर्थन देने के लिए निजी निवेश को बढ़ावा मिलेगा। पूंजी की लागत को कम करके, दर में कटौती गोदामों, कोल्ड स्टोरेज और बुनियादी ढांचे के लॉजिस्टिक्स के लिए सार्वजनिक-निजी भागीदारी योजनाओं की व्यावसायिक व्यवहार्यता को बढ़ा सकती है। फलों और सब्जियों (मुद्रास्फीति के महत्वपूर्ण कारण) की बर्बादी को कम करके, ऐसे निवेश तेजी से संवृद्धि और कम मुद्रास्फीति के एक अच्छे चक्र को प्रेरित करने में मदद कर सकते हैं। 49. कम मूल मुद्रास्फीति दर में कटौती के मामले को मजबूत करती है, विशेषतया तब जब खाद्य मूल्य मुद्रास्फीति में और कमी आने की आशा हो। खाद्य कीमतों से मुद्रास्फीति जोखिम उत्पन्न होने की सीमा तक, मूल मुद्रास्फीति पर इसका सीमित प्रभाव पड़ने की आशा है। पिछली पांच तिमाहियों के दौरान, पेट्रोल, डीजल, सोना और चांदी को छोड़कर, सीपीआई मूल, ज्यादातर 4% के मूल्य मुद्रास्फीति लक्ष्य से नीचे रही है। 50. इसके विपरीत, पिछले दस वर्षों के दौरान, जिसमें 2016 के लचीले मुद्रास्फीति लक्ष्यीकरण ढांचे के अंतर्गत आठ वर्ष शामिल हैं, रेपो दरों का खाद्य कीमतों या उनकी अस्थिरता पर कोई महत्वपूर्ण प्रभाव नहीं पड़ा है। यह इस दावे को बल देता है कि खाद्य मुद्रास्फीति मूल रूप से आपूर्ति-पक्ष की घटना है। 51. इसके अतिरिक्त, सीपीआई में लगातार द्वैधता - अर्थात हाल के वर्षों में खाद्य और मूल मुद्रास्फीति के स्तरों के बीच एक महत्वपूर्ण और निरंतर विचलन - एमपीसी को नीतिगत दरें निर्धारित करते समय खाद्य कीमतों में उतार-चढ़ाव पर ध्यान देने को आवश्यक बनाता है। इसके अलावा, खाद्य कीमतों को संवृद्धि के आय-बढ़ाने वाले प्रभाव और उपभोग समूह में खाद्य की कम हिस्सेदारी के व्यापक संदर्भ में देखा जाना चाहिए, जैसा कि 2023 और 2024 में एचसीईएस के दो लगातार दौरों से स्पष्ट है। 52. सर्वसम्मति से, दर में कटौती से जोखिम भी जुड़े हैं। इससे भारत और उन्नत अर्थव्यवस्थाओं (एई) के बीच ब्याज दर के अंतर में कमी आएगी। सैद्धान्तिक रूप में, इससे बहिर्वाह बढ़ सकता है, जिससे विनिमय दर पर दबाव पड़ सकता है। इसके परिणामस्वरूप आयातित मुद्रास्फीति हो सकती है। आंकड़ों के अनुसार, यह एक कम संभावना वाला परिदृश्य प्रतीत होता है। पिछले पाँच वर्षों के दौरान, भारत और उन्नत अर्थव्यवस्थाओं के बीच बेंचमार्क दर अंतर में कमी आई है। उदाहरण के लिए, अमेरिका के मुकाबले, नीतिगत दर अंतर 2020 में लगभग 4% से घटकर सितंबर 2024 में, जब तक कि अमेरिकी फेड ने दर में कटौती शुरू नहीं की, लगभग 1.5% हो गया - वास्तविक नीतिगत दर अंतर में भी काफी बदलाव आया है। बढ़े हुए अंतरों ने यूएसडी के अंतर्वाह को प्रतिकूल रूप से प्रभावित नहीं किया, संभवतः मजबूत संवृद्धि मूल तत्वों के कारण। 53. अल्पावधि में, वैश्विक अनिश्चितता सहित कई कारक पूंजी प्रवाह की दिशा और मात्रा को बदल सकते हैं। दिलचस्प बात यह है कि हाल के महीनों में बहिर्वाह देखा गया है, जबकि भारत और अधिकांश उन्नत अर्थव्यवस्थाओं के बीच ब्याज अंतर सितंबर 2024 से शुरू होने वाले यूएस फेड और अन्य केंद्रीय बैंकों द्वारा दरों में कटौती के बाद बढ़ गया है। किसी भी मामले में, चूंकि अधिकांश प्रमुख अर्थव्यवस्थाओं ने पहले ही अपनी ब्याज दरों को कम कर दिया है, यहां तक कि ब्याज दर अंतर के प्रभाव को ध्यान में रखते हुए भी, हमारे लिए विदेशी मुद्रा प्रवाह को प्रतिकूल रूप से प्रभावित किए बिना नीतिगत दरों को कम करने की गुंजाइश है। 54. आयातित मुद्रास्फीति का जोखिम भी बहुत अधिक नहीं लगता है। एक ओर, आईएनआर-यूएसडी विनिमय दर में कुछ समायोजन से मना नहीं किया जा सकता है। दूसरी ओर, विश्व बैंक के कमोडिटी बाजार संभावना के अनुसार, वर्ष 2025 और 2026 में तेल की कीमतों और अन्य वस्तुओं के जोखिम में कमी आने की आशा है। भारत पर टैरिफ बढ़ोतरी के प्रभाव का अनुमान लगाना मुश्किल है। कुल मिलाकर, आयातित मुद्रास्फीति का जोखिम कम प्रतीत होता है।

के लिए वोट करता हूँ। डॉ. राजीव रंजन का वक्तव्य 56. अगस्त 2024 के अपने वक्तव्य में, जब जून की मुद्रास्फीति संख्या 5.1 प्रतिशत उपलब्ध थी और हम जुलाई और अगस्त 2024 में लगभग 4 प्रतिशत मुद्रास्फीति संख्या की आशा कर रहे थे, मैंने कहा था कि मुद्रास्फीति और संवृद्धि के संबंध में सकारात्मक घटनाक्रम मौद्रिक नीति के लिए अपना रास्ता बदलने की संभावना खोल सकते हैं। लेकिन साथ ही, अधिक स्पष्टता और निश्चितता की आवश्यकता थी क्योंकि हमें सितंबर और अक्तूबर में कुछ मूल्य आघातों की आशंका थी, जो अनुमान से कहीं अधिक निकले, जिससे संभावना खुलने में देरी हुई। दिसंबर में, जब अक्तूबर की संख्या 6.2 प्रतिशत पर उपलब्ध थी, जो सहन स्तर से ऊपर थी, तो नीतिगत दरों को कम करना विश्वसनीय और सही नहीं था। इस प्रकार, हमने इस रास्ते पर बने रहना और इन अनिश्चितताओं के सामने आने के लिए सतर्क और सजग रहना पसंद किया। 57. इन परिस्थितियों में, हमने अपने नीतिगत उपायों को क्रमबद्ध किया - अक्तूबर 2024 में मौद्रिक नीति रुख को 'निभाव को वापस लेने' से 'तटस्थ' में बदल दिया, जिससे कार्रवाई करने के लिए लचीलापन बढ़ा और बाद में टिकाऊ चलनिधि जारी करने के लिए दिसंबर 2024 में सीआरआर को कम किया।[5] वास्तव में, हमने अक्तूबर 2024 में एमपीसी संकल्प में दिए गए अपने रुख के शब्दों में "... मुद्रास्फीति का लक्ष्य से टिकाऊ संरेखण" से "... मुद्रास्फीति का लक्ष्य के साथ एक टिकाऊ संरेखण" में एक बहुत ही सूक्ष्म परिवर्तन किया - जो हमारे दृष्टिकोण में अधिक लचीलापन दर्शाता है। शायद, इस पर ध्यान नहीं दिया गया। 58. वैश्विक स्तर पर भी, उच्च मुद्रास्फीति से जूझ रहे विश्व में अत्यधिक समकालिक सख्त चरण की तुलना में, अब एक संकोची, सतर्क, भिन्न और असंतत दर कटौती चक्र चल रहा है। उच्च व्यापार विखंडन चिंताओं, लगातार भू-राजनीतिक तनाव और धीमी गति से होने वाली मुद्रास्फीति के कारण अनिश्चितता अधिक रही है। निश्चित रूप से, हमारे निर्णय वैश्विक विकास के प्रति सजग रहते हुए घरेलू संवृद्धि-मुद्रास्फीति समझौताकारी समन्वयन द्वारा निर्देशित होते हैं। 59. हमने जिस अनुक्रम पथ का अनुसरण किया है, उसके अनुरूप, फरवरी 2025 में नीतिगत दर में कटौती सबसे तर्कसंगत और उचित अगला कदम है क्योंकि अब हमें अवस्फीति पथ पर अधिक विश्वास है। इस पूर्वानुमान के अनुरूप, हमने बेहतर संचरण के लिए पर्याप्त चलनिधि डालकर बाजार को भी तैयार किया। आधारभूत अनुमानों से पता चलता है कि 2025-26 के दौरान हेडलाइन मुद्रास्फीति औसतन 4.2 प्रतिशत रहेगी। तेल और अन्य वैश्विक कमोडिटी की कीमतें सीमित दायरे में रहने की आशा है। दूसरी ओर, संवृद्धि में मंदी की चिंताएँ आज अधिक स्पष्ट हैं। 60. इस बात पर जोर दिया जाना चाहिए कि भारत की ताकत इसके अपार संवृद्धि के अवसर और मजबूत समष्टि मूल आर्थिक तत्व हैं। मध्यम अवधि में उच्च संवृद्धि गति को बनाए रखने की आवश्यकता है, जिसके लिए मौद्रिक नीति को उभरते संवृद्धि परिदृश्य के प्रति संवेदनशील होना चाहिए और संवृद्धि को पुनर्जीवित करने के लिए चलनिधि बढ़ाने सहित विभिन्न नीतिगत लिखतों का उपयोग करना चाहिए। भारत में पूंजी प्रवाह ब्याज दर अंतरों के बजाय इसकी विशिष्ट संवृद्धि कहानी से अधिक प्रेरित है, जो कई ईएमई के लिए एक घटना देखी गई है।[6] संवृद्धि को पुनर्जीवित करना और आघात-सहनीयता बनाना एक अनिवार्यता है, विशेष रूप से देश विशेष के स्तर पर। विनिमय दर की ब्याज दर रक्षा प्रतिउत्पादक साबित हो सकती है, विशेष रूप से वैश्विक स्तर पर बहिर्वाह की प्रवृत्ति के समय, जो ऐसे कारकों के कारण होता है जो राष्ट्रों में भिन्न नहीं होते हैं, जैसे वैश्विक निवेशकों की जोखिम लेने की प्रवृत्ति या आरक्षित मुद्रा की मजबूती को प्रभावित करने वाली अनिश्चितता।[7] 61. केंद्रीय बजट 2025-26 ने संवृद्धि को प्रतिचक्रीय गति देने के लिए भी आधार तैयार किया है, जिसे बाद में मौद्रिक नीति द्वारा पूरक बनाया जा सकता है। अगले पांच वर्षों में राजकोषीय समेकन को आगे बढ़ाने की प्रतिबद्धता के साथ-साथ कृषि को मजबूत करने और दालों में आत्मनिर्भरता प्राप्त करने और शुल्क संरचनाओं को युक्तिसंगत बनाने के प्रस्ताव मूल्य स्थिरता के लिए सहायक होंगे और मध्यम अवधि में मुद्रास्फीति की प्रत्याशाओं को स्थिर करने में मदद करेंगे। इसके अलावा, व्यय की गुणवत्ता से समझौता किए बिना राजकोषीय समेकन और ऋण पथ का पालन करने से देश की रेटिंग में सुधार, प्रवाह को आकर्षित करने, वित्तीय स्थितियों को आसान बनाने तथा समग्र रुख और दृष्टिकोण में सुधार करने में मदद मिलेगी। अच्छी तरह से समन्वित राजकोषीय और मौद्रिक नीति के मिलकर काम करने से निस्संदेह बेहतर संवृद्धि-मुद्रास्फीति संतुलन के मामले में बेहतर परिणाम मिल सकते हैं। 62. संक्षेप में, पिछली दो नीतियों के दौरान हमारे रुख और चलनिधि उपायों को उचित रूप से क्रमबद्ध करने और मुद्रास्फीति की संभावना को देखते हुए, हमारी नीति विन्यास में संवृद्धि को अधिक महत्व देने का समय आ गया है। केंद्रीय बजट में उपभोग को बढ़ावा देने के लिए सरकारी उपायों के साथ, मौद्रिक नीति में सुलभता से उच्च समग्र मांग को समर्थन मिलेगा। तथापि, उच्च वैश्विक अनिश्चितता बनी हुई है, जिससे उभरती स्थिति के अनुसार उचित रूप से कार्य करने के लिए लचीलापन बनाए रखने के लिए तटस्थ रुख जारी रखने की आवश्यकता है। तदनुसार, मैं तटस्थ रुख बनाए रखते हुए नीतिगत रेपो दर में 25 बीपीएस की कमी के लिए वोट करता हूँ। एम. राजेश्वर राव का वक्तव्य 63. दिसंबर 2024 की नीति के बाद से घरेलू संवृद्धि मुद्रास्फीति संतुलन में बदलाव आया है - जबकि मुद्रास्फीति में क्रमिक नरमी दर्ज की गई, संवृद्धि के परिणाम कमजोर रहे। वैश्विक वित्तीय बाजारों और व्यापार नीतियों से उत्पन्न अनिश्चितताएं भी घरेलू संवृद्धि और मुद्रास्फीति की संभावना को धुंधला कर रही हैं। 64. 2024-25 में वास्तविक सकल घरेलू उत्पाद की संवृद्धि 6.4 प्रतिशत (वर्ष-दर-वर्ष) रहने का अनुमान, उम्मीद से कम रही, कमजोर पूंजी निर्माण के कारण इसमें बाधा उत्पन्न हुई, जबकि निजी उपभोग में सुधार दर्ज किया गया। दिसंबर 2024 के संकल्प में दिए गए 2025-26 की पहली छमाही के लिए संवृद्धि अनुमानों को पहली तिमाही और दूसरी तिमाही के लिए क्रमशः 20 बीपीएस और 30 बीपीएस तक घटा दिया गया है। कुल मिलाकर, 2025-26 में वास्तविक सकल घरेलू उत्पाद संवृद्धि 6.7 प्रतिशत तक बढ़ने का अनुमान है। घरेलू उपभोग संवृद्धि को मजबूत कृषि संभावना , स्थिर उपभोक्ता विश्वास और केंद्रीय बजट में कर राहत से समर्थन मिलेगा। बढ़ती क्षमता उपयोगिता, स्वस्थ कॉर्पोरेट और बैंक तुलन-पत्र तथा बेहतर होते कारोबारी रुझान ने निजी निवेश में तेजी लाने के लिए अनुकूल परिस्थितियां तैयार की हैं। साथ ही, बाह्य वातावरण में लम्बे समय से जारी अनिश्चितता - विशेष रूप से अस्थिर वित्तीय बाजार और बढ़ती संरक्षणवादी व्यापार नीतियां – संवृद्धि की गति को धीमा कर सकती हैं। 65. मुद्रास्फीति संभावना अधिक अनुकूल होती जा रही है। वर्तमान में खाद्य मुद्रास्फीति हेडलाइन मुद्रास्फीति का प्रमुख चालक है, जो दिसंबर में समग्र मुद्रास्फीति में लगभग 70 प्रतिशत का योगदान देती है (सीपीआई बास्केट में खाद्य समूह का भार 45.86 प्रतिशत है)। हेडलाइन मुद्रास्फीति में स्थायी नरमी के लिए खाद्य मुद्रास्फीति में सुधार आवश्यक है। आश्वस्त करने वाली बात यह है कि हाल के आंकड़े अनुकूल रबी सीजन का संकेत दे रहे हैं। इसके साथ ही खरीफ बाजार में आवक और सर्दियों के मौसम में सब्जियों की कीमतों में चल रहे सुधार से आने वाले महीनों में खाद्य मुद्रास्फीति के दबाव में उल्लेखनीय कमी आएगी। मूल मुद्रास्फीति (खाद्य और ईंधन को छोड़कर सीपीआई में मुद्रास्फीति) का दबाव भी कम रहने की उम्मीद है। 2025-26 के दौरान हेडलाइन मुद्रास्फीति औसतन 4.2 प्रतिशत रहने का अनुमान है, जो 2024-25 में 4.8 प्रतिशत होगी। साथ ही, आधारभूत मुद्रास्फीति अनुमानों में काफी वृद्धि की संभावना बनी हुई है, विशेष रूप से प्रतिकूल मौसम की घटनाओं के कारण रबी फसल की पैदावार पर असर पड़ने तथा वित्तीय बाजारों में अस्थिरता के कारण आयातित मुद्रास्फीति बढ़ने के जोखिम के कारण। 66. कोविड-19, यूक्रेन युद्ध और बार-बार घरेलू खाद्य मूल्य झटकों से उत्पन्न चुनौतियों के बीच मौद्रिक नीति, संवृद्धि के उद्देश्य को ध्यान में रखते हुए मूल्य स्थिरता के अपने प्राथमिक उद्देश्य के अनुरूप, संवृद्धि -मुद्रास्फीति संतुलन को प्रभावी ढंग से बनाए रखने में सक्षम रही है। वर्तमान समय में, हेडलाइन मुद्रास्फीति के 4 प्रतिशत के लक्ष्य की ओर अग्रसर होने के साथ, नीतिगत रेपो दर में कटौती के माध्यम से संवृद्धि से संबंधित चिंताओं को दूर करने की अधिक गुंजाइश है। बजट में घोषित राजकोषीय उपायों के साथ इस मौद्रिक नीति उपाय से समग्र मांग की स्थिति को बढ़ावा मिलेगा। इसके अलावा, सरकार ने राजकोषीय समेकन के प्रति अपनी प्रतिबद्धता की पुनः पुष्टि की है, जिससे मध्यम अवधि की मुद्रास्फीति अपेक्षाओं को नियंत्रित करने में मदद मिलेगी। चलनिधि उपायों - दिसंबर 2024 में सीआरआर में कमी के साथ-साथ बैंकिंग प्रणाली की टिकाऊ चलनिधि आवश्यकताओं को पूरा करने के लिए जनवरी 2025 में किए गए अन्य उपायों ने दर में कटौती के लाभ को पहुंचाने में मदद करने के लिए अनुकूल परिस्थितियां उत्पन्न की हैं। 67. वर्तमान परिवेश अनिश्चितताओं से भरा हुआ है, जिसके लिए सतर्कता के साथ-साथ प्रतिक्रिया में तत्परता और चपलता की आवश्यकता है। इस समय मौद्रिक नीति को संवृद्धि -मुद्रास्फीति संतुलन के लिए उभरते जोखिमों से सक्रिय रूप से निपटने के लिए अपेक्षित लचीलापन बनाए रखना होगा। इसके लिए फरवरी की नीति में तटस्थ रुख जारी रखना आवश्यक है। 68. तदनुसार, मैं नीतिगत रेपो दर में 25 आधार अंकों की कटौती करके इसे 6.25 प्रतिशत करने तथा तटस्थ रुख बनाए रखने के पक्ष में वोट करता हूं। श्री संजय मल्होत्रा का वक्तव्य 69. निरंतर भू-राजनीतिक तनावों तथा बढ़ती व्यापार एवं नीतिगत अनिश्चितताओं से प्रभावित विश्व व्यवस्था में, समष्टि आर्थिक एवं वित्तीय स्थिरता के संरक्षक के रूप में मौद्रिक नीति एक चुनौतीपूर्ण दौर से गुजर रही है। इसे अनेक दबाव बिंदुओं और निरंतर विकसित हो रही नीतिगत बाधाओं के बीच संतुलन बनाना होगा। मजबूत नीतिगत ढांचे और मजबूत समष्टि आधारभूत आघात-सह और समग्र समष्टि आर्थिक स्थिरता को बढ़ावा देने की कुंजी बने हुए हैं। घरेलू स्तर पर भी, मूल्य स्थिरता बनाए रखते हुए उच्च समविरधी गति को बनाए रखने की आवश्यकता है, जिसके लिए मुद्रास्फीति-संवृद्धि संतुलन बनाए रखने के लिए विभिन्न नीतिगत लिखतों का उपयोग करने हेतु मौद्रिक नीति की आवश्यकता है। 70. अक्टूबर में ऊपरी सहनीय सीमा से ऊपर जाने के बाद, हेडलाइन मुद्रास्फीति नवंबर और दिसंबर में कम हुई है। आगे चलकर, खरीफ फसल की अच्छी आवक, सर्दियों के मौसम में सब्जियों की कीमतों में सुधार और रबी फसल के अच्छे पूर्वानुमान के कारण खाद्य मुद्रास्फीति के दबाव में उल्लेखनीय कमी आने की संभावना है। खाद्य मुद्रास्फीति की संभावना निर्णायक रूप से सकारात्मक होता जा रहा है। इसके अलावा, कृषि पर बजट प्रस्ताव और राजकोषीय समेकन के प्रति प्रतिबद्धता, मूल्य स्थिरता के लिए सकारात्मक हैं और मध्यम अवधि में मुद्रास्फीति की संभावना को नियंत्रित करने में मदद करेंगे। इससे हेडलाइन सीपीआई में कमी लाने और वित्त वर्ष 2025-26 में लक्ष्य दर के साथ इसके संरेखण को और अधिक प्रोत्साहन मिलेगा। चौथी तिमाही के लिए सीपीआई मुद्रास्फीति 4.2 प्रतिशत और वित्तीय वर्ष 2025-26 के लिए 4.2 प्रतिशत रहने का अनुमान है। 71. चालू वर्ष के लिए वास्तविक सकल घरेलू उत्पाद संवृद्धि दर 6.4 प्रतिशत रहने का अनुमान है, जो पिछले वर्ष की 8.2 प्रतिशत की मजबूत वृद्धि के बाद सौम्य विस्तारित है। यद्यपि, 2024-25 की दूसरी छमाही और 2025-26 में सकल घरेलू उत्पाद की वृद्धि दर 2024-25 की पहली छमाही में दर्ज 6.0 प्रतिशत से ठीक होने की उम्मीद है, 2025-26 के लिए विभिन्न पूर्वानुमानों द्वारा अनुमानित संवृद्धि दर 6.3 से 6.8 प्रतिशत तक भिन्न हो सकती है। इसे रबी की अच्छी संभावनाओं और औद्योगिक गतिविधि में अपेक्षित सुधार से समर्थन मिलेगा। मांग पक्ष से उपभोग और निवेश में भी सुधार होने की उम्मीद है। 72. समष्टि आर्थिक संभावना को देखते हुए, जब मुद्रास्फीति के लक्ष्य के अनुरूप रहने की उम्मीद है, तथा यह मानते हुए कि मौद्रिक नीति दूरदर्शी है, मैं वर्तमान स्थिति में कम नीति दर को अधिक उपयुक्त मानता हूं। तदनुसार, मैं रेपो दर में 25 आधार अंकों की कटौती के पक्ष में वोट करता हूं। मौद्रिक नीति में ढील, कृषि क्षेत्र में अच्छी संवृद्धि और केंद्रीय बजट में विभिन्न संवृद्धि सहायक उपायों के कारण घरेलू उपभोग, आवास में निवेश, पूंजीगत व्यय आदि को बढ़ावा मिलेगा, जिससे समग्र मांग में तेजी आएगी। 73. साथ ही, वैश्विक वित्तीय बाजारों और व्यापार नीति के मोर्चे पर बढ़ती अनिश्चितताओं के साथ-साथ प्रतिकूल मौसम संबंधी घटनाओं का जोखिम भी मुद्रास्फीति और संवृद्धि की संभावना के लिए जोखिम उत्पन्न करता है। हमें इस बात पर सतर्क रहना होगा कि ये ताकतें किस प्रकार कार्य करती हैं। अतः , मैं मौद्रिक नीति के तटस्थ रुख को जारी रखने के पक्ष में वोट करता हूं। इससे उभरते हुए समष्टि-आर्थिक परिवेश के अनुरूप प्रतिक्रिया करने में लचीलापन मिलेगा। इस तार्किक मार्ग को अपनाकर, मौद्रिक नीति अपने अधिदेश को पूरा करने तथा भारतीय अर्थव्यवस्था के सतत विकास में अपनी भूमिका निभाने में सक्षम हो सकेगी। (पुनीत पंचोली) प्रेस प्रकाशनी: 2024-2025/2219 [1] आईएसआईडी (2025) भारत औद्योगिक विकास रिपोर्ट 2024-25, नई दिल्ली: औद्योगिक विकास अध्ययन संस्थान (आईएसआईडी) के लिए अकादमिक फाउंडेशन। [3] बेहरा, एच. के., “महामारी के बाद के साक्ष्य के साथ भारत के लिए ब्याज की प्राकृतिक दर के अनुमान को अद्यतन करना”, आरबीआई मासिक बुलेटिन, जुलाई 2024। [6] ऐज़ेनमैन जे, पार्क डी, कुरैशी आई, सादाउई जे और उद्दिन जी (2024), "फेड के सुलभ और सख्ती चक्रों के दौरान उभरते बाजारों का प्रदर्शन: अर्थव्यवस्थाओं में एक आघात-सहनीयता विश्लेषण, एशियाई विकास बैंक, अगस्त (https://www.adb.org/publications/emerging-markets-fed-easing-tightening-cycles) [7] गेलोस जी., पटेली पी., और शिम आई. (2024), "अमेरिकी डॉलर और ईएमई में पूंजी प्रवाह, बीआईएस त्रैमासिक समीक्षा, सितंबर (https://www.bis.org/publ/qtrpdf/r_qt2409d.htm). |

पृष्ठ अंतिम बार अपडेट किया गया: