IST,

IST,

Annual Report on Banking Ombudsman Scheme, 2007-08

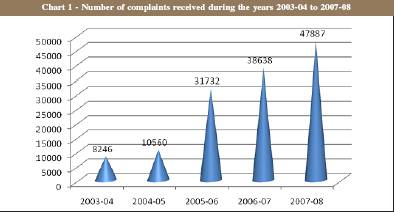

In the area of treating customers fairly, the cherished principles are transparency and reasonableness in pricing, customer appropriateness, confidentiality, and effective grievance redressal machinery. The Reserve Bank as the banking regulator has been actively engaged in the review, examination and evaluation of customer service rendered by banks. It has been continually nudging the Indian banking industry to become more customer-friendly and customer-centric in its conduct and business practices. The broad approach of RBI has been to empower the common person while strengthening the customer-service delivery systems in banks by engaging in a consultative process with them. The Reserve Bank introduced the Banking Ombudsman Scheme in 1995 to provide an expeditious and inexpensive forum to bank customers for resolution of their complaints relating to banking services. The Scheme covered banking services rendered by scheduled commercial banks and scheduled primary cooperative banks. The objective of the Banking Ombudsman Scheme is to be a visible and reliable system of dispute resolution mechanism for bank customers. The Ombudsmen generally resort to conciliation or mediation for settlement of complaints. The Banking Ombudsman Scheme was revised in 2002 to cover Regional Rural Banks and to permit a review of the Banking Ombudsman’s Awards against the banks by the Reserve Bank. The Scheme was further revised in 2006 giving it a much wider scope by including several new areas of customer complaints. The Banking Ombudsmen currently have their offices in 15 Centers spread across the country and are fully funded by the Reserve Bank. The Banking Ombudsmen are serving Officers of Reserve Bank in the rank of Chief General Managers and General Managers. Two major challenges in effective implementation of Banking Ombudsman Scheme are creating widespread awareness about the Scheme and providing easy access to grievance redressal under the Scheme. Banking Ombudsmen have been touring across the country to popularize the Scheme. There is a steady increase in the number of complaints under the scheme indicating the growing awareness among the people. It is observed that more and more complaints are being received reflecting the increased awareness and empowerment of customers. The use of internet by complainants is steadily picking up with the Banking Ombudsmen receiving as much as 30% of all complaints in electronic mode (e-mail/ online). The Annual Report 2007-08 covers the activities of the 15 Banking Ombudsman Offices, with specific reference to the number and nature of complaints received, the banks complained against and the manner of disposal of complaints. The Report also highlights certain exemplary decisions given by Banking Ombudsman. During the year 2007-08, the Banking Ombudsmen received 47887 complaints as against 38638 received in the previous year (an increase of 24%) and disposed of 89% of the total complaints (84% in the previous year), with only 11% carried forward to the next year. Of the 11% of complaints carried forward to the next year, only 6 % were more than 2 months old. The Banking Ombudsmen have been generally effective in redressal of complaints. One of the challenges that bank customers continue to face is ensuring fair treatment from banks. The cases handled by the Banking Ombudsmen reveal that bankers need to deal with customers in a more transparent manner, particularly in making them aware of the terms and conditions of sanction and the specific connotation associated with them right at the beginning. Reasonableness in pricing of products by banks and their dealing with default situations are other areas which require added focus, as complaints on these fronts continue to come to the Banking Ombudsman. The Office of the Banking Ombudsman has evolved over the years in ensuring better customer service in the banking industry. The Office would continue to play lead role in customer empowerment and in creating a customer-centric environment in banks.

November 20, 2008 Vision and Goals of the Banking Ombudsman Offices Vision Statement:

Goals:

1. The Banking Ombudsman Scheme, 1995 was notified by RBI on June 14, 1995 in terms of the powers conferred on the Reserve Bank by Section 35A of the Banking Regulation Act, 1949 (10 of 1949) to provide for a system of redressal of grievances against banks. The Scheme sought to establish a system of expeditious and inexpensive resolution of customer complaints. The Scheme has been in operation since 1995 and revised during the years 2002 and 2006. As enumerated in clause 8, the Banking Ombudsman Scheme, 2006 covers a wide range of complaints concerning deficiency in banking services. Since May 2007, the Scheme allows appeals from complainants and banks in respect of decisions given by the Banking Ombudsman in matters falling within the grounds of complaint specified under the Scheme. The Scheme covers all commercial banks, scheduled primary cooperative banks and the regional rural banks. Reserve Bank frames the guidelines for operationalizing the Scheme and administers the running of the Scheme. In order to make the Scheme independent and effective, since January 2006, the 15 Banking Ombudsmen Offices are fully funded by the Reserve Bank with serving officers of Reserve Bank in the rank of Chief General Managers and General Managers posted as Banking Ombudsmen. The names, addresses and area of operation of the Banking Ombudsman have been given as an annex (Annex I) to the Report. 2. Any person, whose grievance against a bank is not resolved to his/her satisfaction by that bank within a period of one month, can approach the Banking Ombudsman if his complaint pertains to any of the matters specified in the Scheme. The matters include (a) non-payment or inordinate delay in the payment or collection of cheques, drafts, bills etc.;(b) non-acceptance, without sufficient cause, of small denomination notes tendered for any purpose, and for charging of commission in respect thereof; (c) non-acceptance, without sufficient cause, of coins tendered and for charging of commission in respect thereof; (d) non-payment or delay in payment of inward remittances ; (e) failure to issue or delay in issue of drafts, pay orders or bankers’ cheques; (f) non-adherence to prescribed working hours ; (g) failure to provide or delay in providing a banking facility (other than loans and advances) promised in writing by a bank or its direct selling agents; (h) delays, non-credit of proceeds to parties’ accounts, non-payment of deposit or non-observance of the Reserve Bank directives, if any, applicable to rate of interest on deposits in any savings, current or other account maintained with a bank ; (i) complaints from Non-Resident Indians having accounts in India in relation to their remittances from abroad, deposits and other bank-related matters; (j) refusal to open deposit accounts without any valid reason for refusal; (k) levying of charges without adequate prior notice to the customer; (l) non-adherence by the bank or its subsidiaries to the instructions of Reserve Bank on ATM/Debit card operations or credit card operations; (m) non-disbursement or delay in disbursement of pension (to the extent the grievance can be attributed to the action on the part of the bank concerned, but not with regard to its employees); (n) refusal to accept or delay in accepting payment towards taxes, as required by Reserve Bank/Government; (o) refusal to issue or delay in issuing, or failure to service or delay in servicing or redemption of Government securities; (p) forced closure of deposit accounts without due notice or without sufficient reason; (q) refusal to close or delay in closing the accounts; (r) non-adherence to the fair practices code as adopted by the bank and (s) any other matter relating to the violation of the directives issued by the Reserve Bank in relation to banking or other services. In respect of loans and advances complaints relating to (a) non-observance of Reserve Bank Directives on interest rates; (b) delays in sanction, disbursement or non-observance of prescribed time schedule for disposal of loan applications; (c) non-acceptance of application for loans without furnishing valid reasons to the applicant; and (d) non-observance of any other direction or instruction of the Reserve Bank as may be specified by the Reserve Bank for this purpose from time to time. 2.2 Generally on receipt of any complaint, the Banking Ombudsman endeavors to resolve the complaint by agreement between the complainant and the bank named in the complaint through a process of conciliation or mediation. For the purpose of such resolution of the complaint, the Banking Ombudsman follows such procedures as he may consider appropriate and he is not bound by any legal rule of evidence. If a complaint is not settled by agreement within a period of one month from the date of receipt of the complaint or such further period as the Banking Ombudsman may consider necessary, he may pass an Award after affording the parties reasonable opportunity to present their case. He shall be guided by the evidence placed before him by the parties, the principles of banking law and practice, directions, instructions and guidelines issued by the Reserve Bank from time to time and such other factors, which in his opinion are necessary in the interest of justice. Therefore the steps involved in complaint handling are:

3.1 The Banking Ombudsman Offices receive complaints pertaining to deficiency in service provided by banks. The number of complaints received has increased phenomenally since the revised Banking Ombudsman Scheme 2006 came into force (Chart 1). The number of complaints increased as new grounds of complaints such as credit card issues, failure in providing the promised facilities, non-adherence to fair practices code and levying of excessive charges without prior notice were included. Increased awareness and accessibility also contributed to the increase in receipt of complaints. (Table-1)

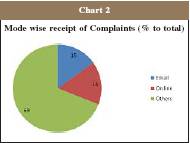

Mode-wise Receipt 3.2 Complainants can log on to the Reserve Bank web site at www. rbi.org.in and complain about deficiency in bank’s services by using the online complaint form. The email ids of the Banking Ombudsmen are also available in the public domain and complainants can send emails to them. For those who have no access to internet, complaints can be sent by post and in any language. Complaints received are acknowledged and tracked till they are closed in the book of the Office of the Banking Ombudsman. During the year 2007-08, the complaints received by these different modes are as under (Table 2, Chart 2):

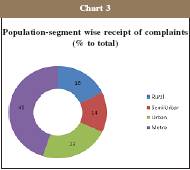

Though 69% of complaints received are in hard copy, the receipt in the electronic mode has been slowly picking up. It is learnt that those who require quick response use this mode. The Complaint Tracking Software in place in the Banking Ombudsman Office gives acknowledgement automatically and complaint number is given as soon as it is taken into the book of the Banking Ombudsman. Population-segment wise Receipt 3.3 The offices of the Banking Ombudsman received complaints from almost all the regions of the country. The region wise position of complaints is given in Table 3 Chart 3:

The reasons for larger number of complaints from the urban and metropolitan regions are increased penetration of banking, increased awareness and increased expectations of customers in such areas. There is however evidence that there is increase in the receipt of complaints from rural and semi-urban areas, as the Banking Ombudsman have created more awareness in such areas through personal visits, media coverage and advertisements. Complainant group-wise Receipt 3.4 The majority of complaints are from individuals as seen from the break up given in Table 4:

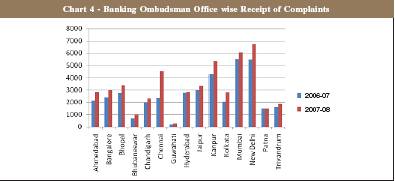

Banking Ombudsman-wise receipt 3.5 The 15 Offices of the Banking Ombudsman receive and consider complaints from customers relating to the deficiencies in banking services in respect to their territorial jurisdiction. The territorial jurisdiction is given in Annex 1. It is observed that in 2007-08, the largest number of complaints was received by the BO offices in New Delhi, Mumbai, Kanpur and Chennai followed by Bhopal and Jaipur (Table 5 Chart 4).

Bank Group-Wise Receipt at Banks 3.6.1 All complaints

received by the banks are not expected to reach the Banking Ombudsman Offices.

The data on complaints received by banks is given in

The above data does not include complaints redressed within a day. It may be seen that in the year 2007-08, bulk of the complaints at 92.95% has been received by the new private sector banks and foreign banks. However, there has been a fall in the number of complaints received by banks in 2007-08 compared to 2006-07 mainly due to reduction in complaints against new private sector banks. 3.6.2 Bankers are required to place a complaint form in their home page. With a view to enhance the effectiveness of the grievance redressal mechanism, banks were advised to place a statement of complaints before their Boards/Customer Service Committees along with an analysis of the complaints received with effect from February 2007. The analysis should (i) identify customer service areas in which the complaints are frequently received, (ii) identify frequent sources of complaint, (iii) identify systemic deficiencies and (iv) make recommendations for initiating appropriate action to make the grievance redressal mechanism more effective. Details of complaints received and disposed off, awards passed and unimplemented awards of the Banking Ombudsman are required to be disclosed along with financial results. Banks were also advised in May 2008 to (i) Ensure that the complaint registers are kept at prominent place in their branches which would make it possible for the customers to enter their complaints, (ii) Have a system of acknowledging the complaints, where the complaints are received through letters / forms, (iii) Fix a time frame for resolving the complaints received at different levels, (iv) Ensure that redressal of complaints emanating from rural areas and those relating to financial assistance to Priority Sector and Government’s Poverty Alleviation Programmes also form part of the above process, (v) Prominently display at the branches, the names of the officials who can be contacted for redressal of complaints, together with their direct telephone number, fax number, complete address (not Post Box No.) and e-mail address etc. for proper and timely contact by the customers and for enhancing the effectiveness of the redressal machinery. 3.6.3 Bank Group wise receipt of complaints at Banking Ombudsman Offices The complaints received by Banking Ombudsman against different bank groups are indicated in Table 7:

3.6.4 Instead of considering complaints in isolation, the number of complaints is seen with reference to the bank’s business size and the number of accounts is given in Table 8.

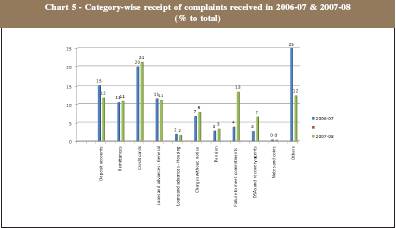

It may be observed from the above the private sector banks, foreign banks and to a certain extent SBI Group have larger share in the number of complaints than in the total number of deposit and loan accounts. 3.6.5 The break-up of bank wise (scheduled commercial banks) complaints received in the year 2007-08 is given in Annex 4. Initiatives taken by Banking Ombudsman 3.7.1 As awareness regarding the Banking Ombudsman Scheme and ease of access to its grievance resolution mechanism are major planks for the empowerment of the bank customers and the success of the Scheme, a number of focused initiatives were taken during the year to reach out, facilitate and spread the message of the Scheme across the length and breadth of the country. These initiatives were in the shape of organizing awareness camps, participation in exhibitions and Kisan melas, passing on information to students visiting Reserve Bank’s premises, news paper advertisements, etc. One Banking Ombudsman office had set a target of taking the awareness campaign about the Banking Ombudsman Scheme 2006 to all the districts in the State and this was achieved. The Banking Ombudsman Scheme - 2006 in regional languages, “Frequently Asked Questions” and ‘Dos and Don’ts’ were brought out by the Banking Ombudsman Offices and distributed through Lead District Officers and Government officials to generate awareness amongst people in rural and semi urban areas. One Banking Ombudsman office adopted an innovative approach by utilizing the services of the postal department network on payment basis for the purpose of spreading awareness regarding the scheme. A small message indicating “If you have any complaint against your bank, please contact Secretary, Office of the Banking Ombudsman,” was embossed on a metallic stamp and was affixed by the postal department employees in all incoming and outgoing letters from certain major post offices of the city for a particular period of time. Broadcast of advertisements on All-India Radio was another means of awareness campaign. One Banking Ombudsman Office’s public outreach initiative was a periodical feature published in a vernacular daily newspaper with substantial circulation in the State where the Banking Ombudsman responds to public queries on banking services related issues. Sensitization of banks to customer rights, the imperatives of dealing with customers in a fair and transparent manner and the adoption of best practices in customer relationship management comprised the parallel prong of the awareness strategy of Banking Ombudsmen. Periodic meetings with nodal officers led to such dissemination of this important message of being customer-centric banks. Participation in seminars organized by banks, taking classes to bankers in in-house bankers’ training institutions were also means of reaching the bankers. 4.1 The grounds of complaint have been enumerated in Clause 8 of the Banking Ombudsman Scheme 2006. The Table 9 & Chart 5 gives the category wise complaints received during the year under review. 4.2 Complaints relating to credit cards form an important part of the complaints. The type of complaints pertain to issuance of unsolicited Credit Cards and unsolicited insurance policy and recovery of premium charges, charging of annual fee in spite of being offered as ‘free’ cards and issuance of loans over phone, disputes over wrong billing, settlement

offers conveyed telephonically, non-settlement of insurance claims after the demise of the card holder, abusive calls etc. A general feature of these complaints across the board is the problem in accessing the Credit Card issuers and the poor response from the call centers. Further, it has been observed that often the card issuers attribute their mistakes in billing, accounting and reporting to technical snags. On pursuing the complaints with the Card Issuers, the charges debited are reversed in most cases without demur. The ATM-related complaints primarily involved disputes in respect of alleged short payment or non-receipt of cash by customers though their saving accounts were debited. These complaints were primarily against public sector banks which do not have CCTVs installed at their ATMs. Other areas of complaint in this regard relate to the time taken to solve these problems and lack of sensitivity in rectification of errors in billing attributed to technical snags. 4.3 Misrepresentation and misleading information provided by Direct Selling Agents (DSAs)/Direct Marketing Agents (DMAs) as also non-fulfillment of such oral promises made by these agents or bank officials at the time of marketing of products leads to a number of complaints. Complaints relating to failure on commitments made ranked second among the complaints received at the offices of the Banking Ombudsman. 4.4 A number of complaints relate to deposits and remittances. Typically they relate to (i) non-payment or delay in collection of cheques, bills and drafts, (ii) delay in crediting the inward remittances and (iii) delay in issue of pay orders, drafts and bankers cheques. Complaints concerning delays in NEFT transfers were seen to be on the increase with customers complaining that despite their accounts having been debited, the corresponding credit had not reached the beneficiary account and the remitting bank’s call centre simply provided the transaction number reference for follow-up with the beneficiary bank, which in turn, did not give much credence to the complainant, as it simply stated that the remittance had not been received. 4.5 Notwithstanding several initiatives taken by the Reserve Bank to bring about transparency in imposition and application of various charges by banks including display of these charges in bank branches/offices and on the websites of banks, complaints relating to charges for non-maintenance of average quarterly balance, revision in locker charges, processing/renewal/pre-closure charges being levied without due notice to the customers were received. 4.6 The issue of harassment by bank’s recovery agents had assumed such serious regulatory dimensions, that the Reserve Bank issued regulatory instructions to all scheduled commercial banks as it felt that the adverse publicity suffered by banks on account of disputes and litigations involving recovery agents would cause serious reputational risk for the banking sector as a whole. Complaints on this front continue to reach the Offices of the Banking Ombudsman. 4.7 The rude and indifferent attitude of bank officials and staff often caused dissatisfaction among the complainants. Delays in providing services and lack of knowledge among the bank staff irked complainants to a degree where they were compelled to file their grievances with the Office of the Banking Ombudsman. Demand of gratifications by branch officials/ agents was also a cause for complaint. 4.8 Complaints relating to alleged inclusion of name in defaulters list and delay / time-lag in removal of their names from the list even after settling the accounts with banks are being received in large numbers. Complaints are received regarding non-sanction of education loans by banks and insistence on collateral security. A number of complaints are received from customers regarding floating rates of interest on loans and they relate to lack of comprehension regarding the implication of bench marks and margins. 5.1 On receipt of a complaint, the details are sent to the concerned branch/ department under advice to the Nodal Officers. Endeavors are made to resolve the complaints through conciliation or mediation efforts, if necessary, to the ultimate satisfaction of the complainant on all the points/issues referred to the office. These mediation efforts include interaction with both parties over phone, in person or in writing. The conciliation meetings are held for arriving at amicable settlement. If this does not yield results then the Banking Ombudsman passes an Award, which becomes binding on the bank once the complainant agrees to it. Few cases where Awards were issued and a few cases where the Banking Ombudsman has accepted the action of the bank as in order are given in Annex 3. 5.2 Banking Ombudsman Offices disposed of more than 80% of the complaints dealt on an annual basis. During the year 2007-08, 89% of the complaints dealt were disposed off. Around 53% of the complaints dealt have been disposed by mutual settlement or by award while around 36% of the complaints dealt have been rejected. (Table 10)

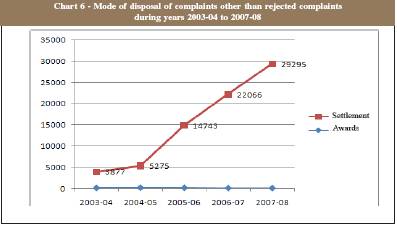

5.3 The Banking Ombudsmen disposed of complaints, other than the rejected complaints, either by settlement or by issuing an Award. During the period reviewed, the ratio of complaints disposed by settlement to the complaints disposed by award was around 0.28 clearly indicating the effectiveness of the Banking Ombudsmen in arriving at mutually agreed consensus between bankers and complainants. During the above period, only 70 awards were issued. From the year 2005-06, the number of awards issued and the percentage of disposal through award issuance have come down despite huge increase in the complaints received. The fact that the Banking Ombudsmen could dispose of 99.72 % of the complaints by settlement between the complainant and the concerned banks, indicates that the conciliation approach was effective, and there was no need for the Banking Ombudsman to pass any award. (Table 11 & Chart 6)

5.4 Conciliation meetings played an important role in the process of resolution of complaints. A conciliation meeting enables the two parties to meet “face to face”. Often this turned out to be the first time that the parties discuss the cause of complaint with a view to resolving the issue. The aim of the conciliation meeting is to allow the parties to discuss issues relating to the complaint or the dispute and to find a mutually acceptable way of resolving the complaint. Banking Ombudsman does not force the parties to settle but a conciliation meeting gives a chance to the parties to come to their own solution rather than have a solution imposed upon them. Most of the complainants have conveyed that no officer in the bank was designated to listen to their woes. 5.5 Of the 54,992 complaints (47,887 complaints received during the year and 7105 brought forward from the previous year), 29,365 (53%) were settled, 19, 735 complaints (36%) were rejected and 5,892 (11%) were carried forward to the next year. 5.6 As observed from Table 12 and chart 7 below, as much as 40 % of the complaints were not considered by the Banking Ombudsmen as they were first resort cases i.e. where the complainants had approached BOs without seeking reddressal from the banks concerned. Such complaints reflected lack of

awareness of the bank’s grievance redressal mechanism among the customers or inept handling of customers by front line staff or inaccessibility of staff. Also, the complaints made without sufficient cause (16%) indicated the need for customer education and this is being addressed by the banks and the Banking Ombudsmen. 5.7 As regards pendency, the number of complaints pending is around 16% to 19% of the total complaints dealt. During the year 2006-07, 41% of the pending complaints were pending for more than 2 months and 28% of them were pending for more than 3 months. However, the position has improved in the year under review as seen from the Table 13:

Disposal of Complaints—Staff wise 6. Till the year 2006, the Banking Ombudsman Offices had some staff from the Convenor Bank of the State Level Bankers Committee (SLBC). During the year under review, the SLBC staff was repatriated back to their banks in a phased manner. Only few Banking Ombudsman Offices have been permitted to retain few staff from the Convenor bank. To handle the increased number of complaints and as replacement for the SLBC staff, the offices of Banking Ombudsman were given additional staff. The staff wise position of complaints handled is given in the Table 14:

7.1 The total expenditure in operationalizing the Banking Ombudsman Scheme was shared by the banks, in the proportion of their working funds, up to December 2005. From January 1, 2006, the expenditure is fully borne by Reserve Bank in terms of the Banking Ombudsman Scheme, 2006. The costs of the Scheme include the revenue expenditure and capital expenditure incurred in running the Banking Ombudsman offices. The revenue expenditure includes the establishment items like salary and allowances of the staff attached to Banking Ombudsman offices and non-establishment items such as law charges, postage and telegram charges, printing and stationery expenses, publicity expenses, depreciation and other miscellaneous items. The capital expenditure items include the furniture, electrical installations, computers/ related equipments, telecommunication equipments and motor vehicle. 7.2 While the aggregate cost of running the fifteen Banking Ombudsman offices has increased with the increase in the number of complaints dealt with, the cost per complaint dealt has been steadily decreasing. The details are given in Table 15 .

Appeal against the decisions of the Banking Ombudsmen 8. The Banking Ombudsman Scheme 2006 permits banks and complainants to appeal against the decisions of the Banking Ombudsman. The appeal option is exercised by banks on grounds that the Award appears to be patently in conflict with the Reserve Bank’s instructions and/ or the law and practice relating to banking. Complainants can appeal against the decision of the Banking Ombudsman in respect of complaints falling on such grounds specified in the Scheme. The Appellate Authority is the Deputy Governor in charge of the Banking Ombudsman Scheme. The number of Appeals preferred by banks and complainants during the year 2007-08 is as in Table 16: The Appellate Authority either dismisses the appeal or allows the appeal and sets aside the Award or remands the matter to the Banking Ombudsman for fresh disposal in accordance with such directions as the Appellate Authority may consider necessary or proper or modify the Award and pass directions as may be necessary to give effect to the Award so modified or pass any other order as it may deem fit.

Meetings with the Banks 9.1.1 The Banking Ombudsman Scheme 2006 mandates that every bank nominate a Nodal Officer in every region/zone for facilitating the functioning of the Banking Ombudsman Offices. Besides taking up individual complaints, the Banking Ombudsman offices also periodically review the outstanding complaints with the nodal officers. This mechanism has yielded good results in resolving the complaints expeditiously. 9.1.2The Customer Service Department also holds half yearly meetings with the in-charges of customer service departments (grievance redressal officers) of commercial banks for an interaction and for briefing them about the expectations of Reserve Bank. Issues relating to grievance redressal, response to Banking Ombudsmen, adherence to Bank’s circulars were discussed in the meetings. Advisories are issued to banks on customer service issues on matters where it is felt that it is necessary to sensitise banks. Customer Service Meeting 9.2 In 2007, Reserve Bank institutionalized the process of examining important feedback emanating out of the complaints received at the Banking Ombudsman Offices. A quarterly meeting is conducted by the Customer Service Department in which senior level representatives of regulatory departments of Reserve Bank, Banking Code and Standards Board of India (BCSBI), Indian Bank Association (IBA) and a few Banking Ombudsmen are invited. The meeting focuses on resolving systemic issues raised by any participant and other customer service related issues. 9.3 During 2007, half yearly Regional Conferences of Banking Ombudsmen were held. Officers from Central Office attended these Conferences. The deliberations in conferences and the sharing of experiences by the Banking Ombudsmen were mutually beneficial and helped in sorting out problems of mutual interest including those of processing of complaints. The occasion was also used to meet the Nodal Officers of banks to sensitize them on issues relating to customer service. Studies / Working Group 9.4.1Comprehensive Display Board In order to promote transparency in the operations of banks, various instructions were given to banks with regard to display of various key aspects such as service charges, interest rates, services offered, product information, time norms for various banking transactions and grievance redressal mechanism etc. However, during the course of inspection/ visits to bank branches by Reserve Bank it was observed that many banks were not displaying the required information due to space constraints, lack of standardization of the instructions etc. Keeping in view the need to ensure that essential information was provided to customers, while avoiding overcrowding of the items requiring display, an Internal Working Group was constituted by Reserve Bank, to revisit all the existing instructions relating to display boards by commercial banks so as to rationalize them. Based on the recommendations of the group, a comprehensive circular was issued to all banks in August 2008. 9.4.2 Banking Facility for visually challenged Based on complaints received from educated visually challenged persons and on the feed back received from banks and IBA, certain suggestions were made on the bases of which a circular on extension of banking facilities to the visually challenged persons was issued in June 2008. 9.4.3 A study on credit card operations of banks Reserve Bank issued comprehensive guidelines on November 21, 2005 (and Master Circulars in July every year) for the credit card operations by banks in India. However, complaints against credit card operations reaching the offices of the Reserve Bank, Banking Ombudsman and the Ministry of Finance steadily increased. The Standing Committee on Finance advised Reserve Bank to undertake a detailed study on the credit card operations of banks in India. Accordingly, the Customer Service Department undertook a study on credit card operations of banks. Based on the findings and suggestions made a detailed circular was issued by the regulatory department of Reserve Bank in July 2008. Complaint Tracking Software 9.5 To monitor the performance of the Banking Ombudsman Offices as well as to facilitate their functioning, the Complaint Tracking Software was introduced in September 2005. The software facilitates viewing of the data by the Reserve Bank as well as Ministry of Finance. After introduction of the Banking Ombudsman Scheme 2006 in January 2006, the existing package was revamped to incorporate the required changes including online complaint submission facility. The important notifications issued by Reserve Bank relating to Customer Service and Banking Ombudsman Scheme in 2007-08 (July 2007 to June 2008) are given in Annex 2.

A. Important cases dealt with by the Banking Ombudsman, where customers were right 1. Debit for invalid ATM transaction The complainant had a savings bank

account in the ABC Bank. On December 3, 2005, he operated his account through

his ATM card at XYZ Bank for withdrawal of Rs. 10,000/- in cash and the same was

not dispensed with by the machine. However, his account at ABC Bank was debited

for Rs. 10,020. As complainant had not received any payment, he requested ABC

Bank to reverse this entry. The complainant submitted application to XYZ Bank

through ABC Bank in this regard on April 20, 2006. ABC Bank did not reverse the

entry. The case was brought before the Banking Ombudsman. The Banking Ombudsman, therefore, directed the ABC Bank to reverse the disputed debit entry dated December 3, 2005 aggregating Rs. 10,020 and also pay interest at fixed deposit rate from December 3, 2005 to the date on which the reversal of the amount is effected. The Award was implemented. 2. Loan installment debited to account without the availment of loan The complainant was sanctioned a used car loan amount of Rs. 2.45 lakh by the bank on December 26, 2005. The installment amount for repayment was fixed at Rs. 6943/- and the repayment was to begin on/from January 7, 2006. The complainant alleged that the loan was not disbursed to him. The bank had deducted seven installments of Rs. 6,943/-each from the complainant’s account. The complainant requested the Banking Ombudsman to ask the bank to stop recovery of installments of loan from his account and to refund the amount already deducted with interest as he had not availed the loan. He also wanted NOC in this regard from the bank. According to the bank, the loan was disbursed to the Direct Selling Associate (DSA) of the bank on December 3, 2005 with instruction to release the payment in favour of the complainant once all the papers for transfer of ownership and/or hypothecation in favour of the bank were received and found to be in order by the RTO. As advised by the DSA, the payment was released by them to their sub-agent, for onward transmission to the complainant. However, the cheques issued by the subagent were returned unpaid. A fresh set of cheques were issued by the sub-agent, which were reportedly intercepted in transit and encashed by another individual with an identical name. FIR was then registered following which non-bailable warrants were issued in the name of the culprit, who was reported to be absconding. The bank maintained that it was in no way involved in the matter and could not be held accountable for non-receipt of funds by the complainant. As per the bank, the loans against used cars were disbursed through DSAs to exercise proper control over the process of transfer of ownership and recording of hypothecation in favour of the bank. Though the bank conceded that the complainant had not received the loan amount due to fault of its DSA, it continued to ignore the fact that the complainant was unnecessarily and unreasonably being harassed for no fault of his. To that extent, the bank’s internal grievance redressal system was considered weak, unreasonable and unfair to the complainant. Moreover, the bank’s controls in respect of used car loans appeared to be one-sided as it did not bother to ensure that the loans disbursed actually reached the customers. The Banking Ombudsman directed the bank to refund the amount of Seven EMIs of Rs. 6943/- each with interest @16% (compounding) to the complainant i.e. the rate at which the loan was initially sanctioned by the bank, pay to the complainant Rs. 1000/- for incurring expenses relating to follow-up of the complaint with the bank and the Banking Ombudsman review its compensation policy to include such cases involving omission or commission of its DSAs and accepting bank’s responsibility with a view to redress complaints through its internal grievance redressal machinery. The Award was implemented. 3. Housing Loan - Interest Rate The complainant who represented his son alleged that his son had applied for a housing loan at Fixed Rate of 7.5% but the bank sanctioned the loan at floating rate of 8% p.a. Subsequently the bank without any intimation to the party increased the rate of interest from 8% to 11% at various stages. Since the party had applied for the loan from the bank on a fixed rate basis, he took up the matter with the bank. The bank was not responsive and did not furnish the required clarification to him. Not satisfied by the bank’s attitude, the party approached the Banking Ombudsman for redressal. The Banking Ombudsman observed from the copy of the housing loan agreement that the loan was sanctioned at a fixed rate of interest of 8% which would continue for minimum period of 5 years. Contrary to the terms of the agreement, the bank had charged the interest at floating rate varying from 8% to 11.5%. This action of the bank violated the terms of the agreement and had led to collection of excess interest from the complainant. The bank was directed to refund the excess interest collected and charge interest only as per the agreed terms. This was complied with by the bank by refunding Rs. 54,886/-. 4. Refund of excess interest charged by a bank A project under Khadi and Village Industry Board (KVIB) was financed by a bank. The bank loan of Rs. 4,34,021/-, included a KVIB sanctioned margin money of Rs. 2,22,175/-. The complainant stated that the margin money should have been interest free and the bank should have charged interest only on an amount of Rs. 2,11,846/-. However, the bank charged interest on total term loan amount and also imposed penal interest without any default in the loan account of the complainant. Even after several reminders and written communication with the bank, it kept on charging interest on the full amount of the term loan. The complainant wrote to the Banking Ombudsman for refund of overcharged interest on term loan. The matter was taken up with the bank and it informed the Banking Ombudsman that it had refunded Rs. 75,296/- being the excess interest amount. 5. Misrepresentation by the Bank Officials for opening an FDR A complainant approached the bank with an amount of Rs. 60,000/- for issue of fixed deposit of 46 days. He was advised by the bank official to open a savings fund account in the bank. He deposited the money and received the receipt of Rs. 55,000/- and Rs. 5,000/-. After 46 days, the complainant visited the bank branch for withdrawal of the maturity amount of the FDR. He was told by the bank official that the amount was invested in an investment fund which would earn higher rate of return than that on the FDR but it could only be withdrawn only after six months. The complainant lodged a complaint with the bank but failed to receive any response. The complainant was in urgent need of money for school fees. The complainant lodged a complaint with the Banking Ombudsman because the bank was not responding to his complaint. The bank was advised to submit its comments in the matter. It was confirmed that the money has been deposited in some insurance scheme. However, the bank approached the complainant and resolved his grievance by refunding the amount to him. The complainant also forwarded his satisfaction letter to the Banking Ombudsman 6. Withdrawal of Rs. 25,000/-through ATM Card The complainant submitted that he was availing services of the bank by using a debit card issued by them. In the first week of September 2006, the complainant applied for a new Gold Card with zero liability and signed various forms at the instance of bank’s executive, who visited his office. He did not receive the card and Rs. 25,000/- was debited from his account on October 9, 2006. On enquiry from the bank, it was gathered that the card was delivered to a security staff in his office building, without checking the identification particulars. The PIN was also delivered to some other staff in his office. The complainant, therefore, requested the bank to refund the amount. The bank submitted that the Proof of Delivery (POD) depicted acceptance of Gold Card and PIN at the mailing address and it bore the rubber stamp of the company. One Ms.Sumita received the PIN and one Shri Narender received the debit card which proved correct delivery of the Gold Card and PIN. The bank also reiterated that the use of debit card in the ATM indicated that the withdrawal had been made by an authorised person, using the Gold Card and the relevant PIN and as such the said transactions were valid. As such, the bank was not liable or responsible for any consequences in this regard. A conciliation meeting was held on December 5, 2007 where the Banking Ombudsman observed that the bank could not escape its responsibility by stating that the card and PIN were delivered at the mailing address of the complainant to ‘unauthorized’ persons increasing the risk of misuse by them. The card and PIN should have been delivered to the complainant in person or to his authorized representative only under his proper acknowledgement. Thus, the bank was directed to reimburse the complainant Rs. 25,000/-being the amount of withdrawal made through the use of card by an unauthorized person. The bank was also asked to pay to the complainant interest at savings bank rate and an additional amount of Rs. 1000/- to meet the expenses relating to follow-up of the complaint to the complainant. The bank could approach appropriate authority for fixing the responsibility for recovery of the above unauthorized withdrawal. The Award was implemented. B. Important cases dealt with by the Banking Ombudsman, where banks were right 7. Right of set off The complainant was sanctioned a Cash Credit limit by the R bank in 1990. As the loan became NPA, the complainant approached the bank for OTS which was sanctioned in 2007. He also obtained ‘no- dues certificate’ from the bank. The documents kept as equitable mortgage was also returned to him by the bank. Besides landed property, the complainant had pledged a few fixed deposits as security for the said loan which he wanted to be returned to him after OTS. R bank clarified that when the loan became NPA due to non-servicing of interest as well as non-payment of principal, all the liquid securities kept as lien were adjusted as per banking practice under bank’s “right of set-off” against the over dues before 2007, the year of OTS settlement. More over the complainant had not made this a condition in the OTS settlement. On enquiry from the Banking Ombudsman office the complainant could not submit any evidence regarding exemption of the fixed deposits from the OTS amount. No deficiency of service by the bank was observed and the complaint was rejected under Clause 13(d) of the Banking Ombudsman Scheme, 2006 “without any sufficient cause”. 8. Interest on matured Fixed Deposit The complainant alleged that his Fixed Deposit (FD) with the X bank has been renewed at a lower rate of interest for the overdue period. The complainant demanded for automatic renewal of the FDR and requested that interest should be calculated and paid accordingly. A compensation for Rs. 10,000/- was also claimed by the complainant for mental agony suffered in the matter. The bank submitted that the FD matured on February 19, 1993 and it was presented with a request for renewal in the month of December 2007 - January 2008 approximately after 14 years. As per guidelines in force, the deposit ceases to earn interest from the due date of the deposit and there was no system of Automatic Renewal of Term Deposits at the time when the deposit was made. However, in good gesture, the bank had paid interest to the complainant at the prevailing rate. Regarding the claim of the complainant for compensation, the bank denied any such harassment on the part of the officials and there was only a minor delay in renewing the deposit and interest was paid for the above period also. The bank, requesting dismissal of the case, also submitted copy of the FDR (both side), Interest Calculation Sheet and copy of Bank’s guidelines in support of their submissions. After the perusal of the comments of the bank and the documentary evidence submitted, it was observed that it has been clearly mentioned on the top of the Deposit Receipt that ‘Interest will not accrue on the deposit amount from the due date’. Accordingly, the Banking Ombudsman accepted the submissions of the bank and rejected the complaint under clause 13(d) (without sufficient cause). 9. Dishonor of cheque Complainant stated that he had issued a cheque of Rs. 1,094/- for payment of his electricity charges. The complainant alleged that the bank dishonored the above mentioned cheque for the reason that the balance in his overdraft account was short by Rs. 719.67 only. He wanted the reimbursement of penalty of Rs. 310/-charged by the electricity company and refund of cheque bouncing charges of Rs. 100/- imposed by the bank. The bank explained that the cheque was dishonored because the amount of cheque was exceeding the overdraft limit (OD) granted to the complainant. It is the bank’s discretion to honor or dishonor a cheque of an amount exceeding the OD limit sanctioned. Therefore the complaint was treated as having made without sufficient cause and rejected under Clause 13(d) of the Banking Ombudsman Scheme, 2006. DISCLAIMER The Reserve Bank of India does not vouch the correctness, propriety or legality of orders and awards passed by Banking Ombudsmen. The object of placing this compendium is merely for the purpose of dissemination of information on the working of the Banking Ombudsman Scheme and the same shall not be treated as an authoritative report on the orders and awards passed by Banking Ombudsmen and the Reserve Bank of India shall not be responsible or liable to any person for any error in its preparation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

पृष्ठ अंतिम बार अपडेट किया गया: