IST,

IST,

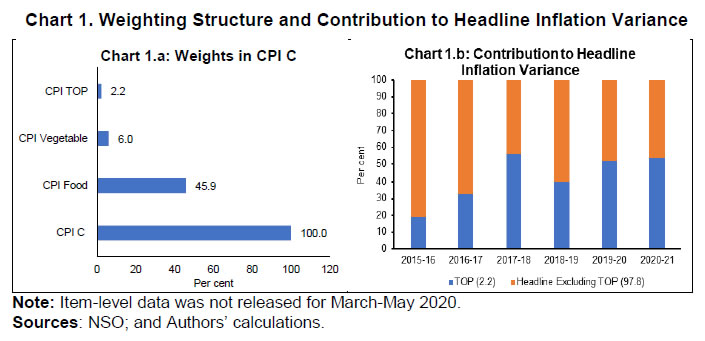

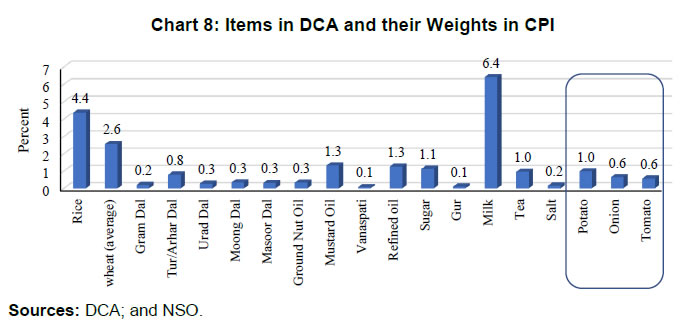

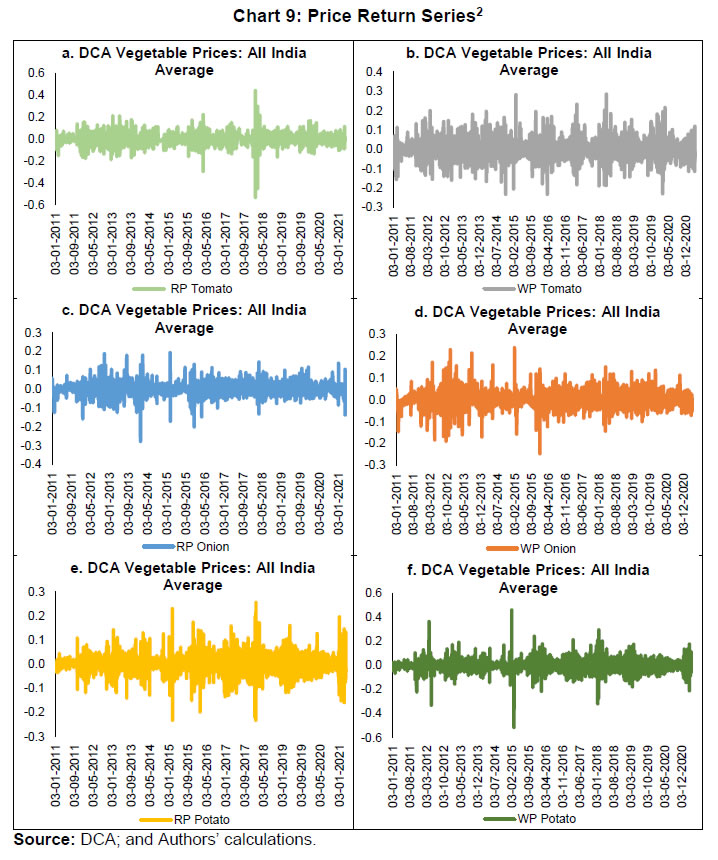

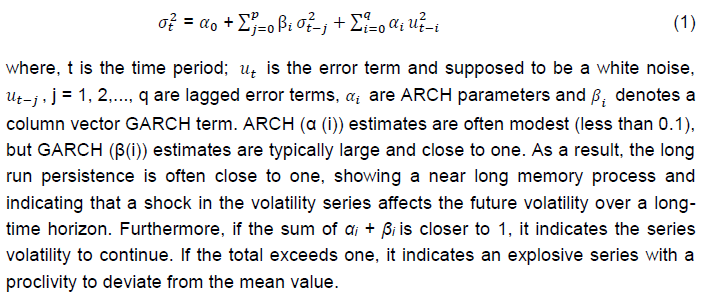

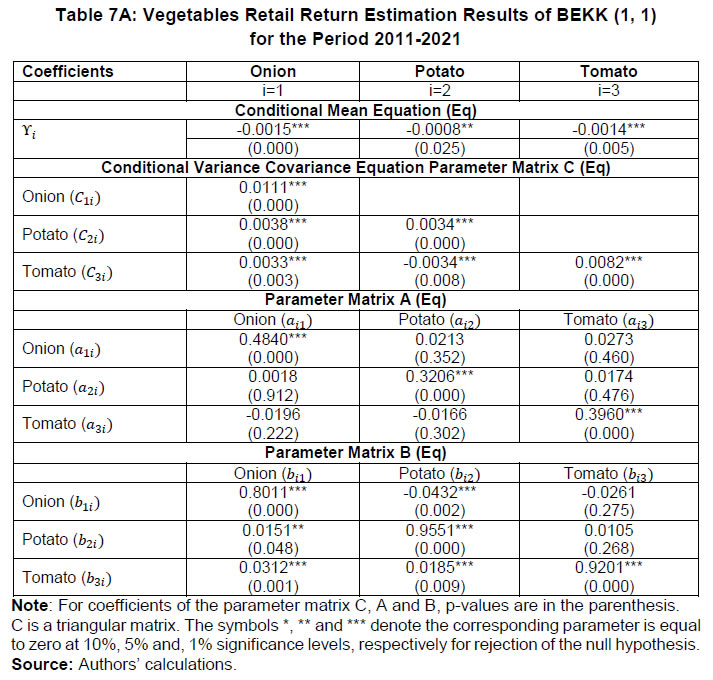

DRG Study No. 49: Anatomy of Price Volatility Transmission in Indian Vegetables Market