|

भारतीय रिज़र्व बैंक ने आज औद्योगिक परिदृश्य सर्वेक्षण (आइओएस) के 102वें दौर के परिणाम जारी किये। इस सर्वेक्षण में 2023-24 की पहली तिमाही के लिए भारतीय विनिर्माण कंपनियों द्वारा किए जानेवाले कारोबार के परिवेश का गुणात्मक मूल्यांकन और 2023-241 की दूसरी तिमाही के लिए उक्त कंपनियों की अपेक्षाओं के साथ-साथ आगामी दो तिमाहियों के लिए चयनित मापदंडों पर उनके आउटलुक को समाहित किया गया है। 2023-24 की पहली तिमाही के दौरान सर्वेक्षण के इस दौर में कुल 1,247 कंपनियों ने प्रत्युत्तर दिए।

विशेष:

क. पहली तिमाही (Q1) 2023-24 का मूल्यांकन

-

जैसा कि उत्पादन, ऑर्डर बुक और क्षमता उपयोग पर उनके मूल्यांकन से पता चला है, विनिर्माण कंपनियों ने 2023-24 की पहली तिमाही के दौरान मांग की स्थिति में पूर्व की तुलना में धीमी सुधार की सूचना दी है (सारणी-ए)।

-

तिमाही के दौरान कच्चे माल की लागत का दबाव कम हुआ लेकिन निर्माताओं ने वेतन व्यय में बढ़ोतरी और बढ़ी हुई ऋण लागत का दबाव बरकरार रहने का आकलन किया है।

-

विनिर्माताओं ने लाभ मार्जिन के मूल्यांकन में अनुवर्ती परिवर्तन के साथ बिक्री मूल्य सेंटिमेंट्स में वृद्धि की सूचना दी।

-

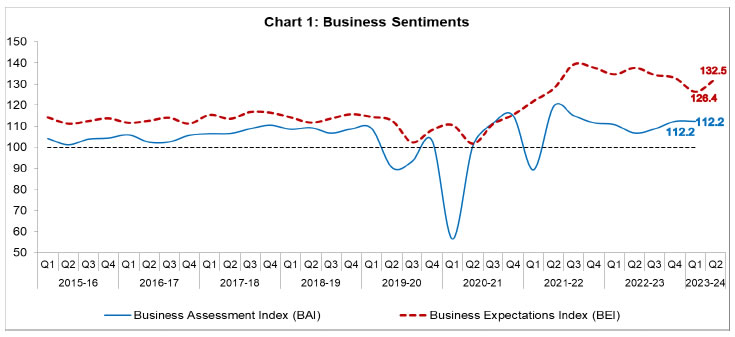

विनिर्माण क्षेत्र में समग्र कारोबारी धारणा सकारात्मक रही; व्यापार मूल्यांकन सूचकांक2 (बीएआई) 2023-24 की पहली तिमाही में 112.2 पर स्थिर रहा (चार्ट-1)।

ख. दूसरी तिमाही (Q2) 2023-24 के लिए अपेक्षाएं

-

2023-24 की दूसरी तिमाही के लिए निर्माता मांग की स्थिति पर अधिक आशावादी रहे जैसा कि उत्पादन, ऑर्डर बुक, क्षमता उपयोग और विदेशी व्यापार पर उनकी उन्नत अपेक्षाओं में परिलक्षित होता है (सारणी-ए)।

-

वित्तपोषण और मजदूरी की कीमतों से लागत मूल्य का दबाव 2023-24 की दूसरी तिमाही के दौरान जारी रहने की संभावना है, जबकि कच्चे माल की खरीद के मामले में इसमें थोड़ी नरमी अपेक्षित है।

-

निर्माताओं को 2023-24 की दूसरी तिमाही में अधिक बिक्री मूल्यों और लाभ मार्जिन अर्जित करने की उम्मीद है।

-

व्यावसायिक अपेक्षा सूचकांक (बीईआई) पिछली तिमाही के 126.4 से बढ़कर 2023-24 की दूसरी तिमाही में 132.5 हो गया (चार्ट-1)।

ग. 2023-24 की तीसरी और चौथी तिमाही के लिए अपेक्षाएं

-

विनिर्माता वित्त वर्ष की दूसरी छमाही में उत्पादन, ऑर्डर बुक, रोजगार, क्षमता उपयोग और समग्र कारोबारी स्थिति को लेकर आशावादी बने हुए हैं (सारणी बी)।

-

लागत मूल्य का दबाव कुछ नरमी के साथ जारी रहने की उम्मीद है और निर्माताओं को उम्मीद है कि बेहतर मूल्य निर्धारण की स्थिति उन्हें बिक्री मूल्य बढ़ाने में सक्षम बना सकती है।

| Table A: Summary of Net responses3 on Survey Parameters |

| (per cent) |

| Parameters |

Assessment period |

Expectation period |

| Q4:2022-23 |

Q1:2023-24 |

Q1:2023-24 |

Q2:2023-24 |

| Production |

33.0 |

25.3 |

54.8 |

58.0 |

| Order Books |

25.4 |

21.9 |

47.8 |

58.1 |

| Pending Orders |

8.9 |

4.9 |

3.4 |

-1.7 |

| Capacity Utilisation |

22.8 |

15.5 |

41.2 |

46.6 |

| Inventory of Raw Materials |

-8.3 |

-6.3 |

-18.0 |

-29.0 |

| Inventory of Finished Goods |

-8.2 |

-7.2 |

-17.2 |

-28.8 |

| Exports |

12.2 |

17.6 |

36.2 |

53.5 |

| Imports |

15.3 |

20.4 |

33.2 |

52.6 |

| Employment |

12.4 |

16.1 |

26.7 |

40.5 |

| Financial Situation (Overall) |

30.6 |

24.0 |

52.9 |

56.3 |

| Availability of Finance (from internal accruals) |

28.8 |

25.8 |

46.6 |

52.3 |

| Availability of Finance (from banks & other sources) |

23.3 |

20.4 |

40.1 |

49.0 |

| Availability of Finance (from overseas, if applicable) |

7.6 |

18.0 |

32.5 |

50.4 |

| Cost of Finance |

-32.4 |

-32.4 |

-45.8 |

-54.2 |

| Cost of Raw Material |

-59.1 |

-41.1 |

-60.9 |

-58.3 |

| Salary/ Other Remuneration |

-21.2 |

-38.1 |

-44.3 |

-49.3 |

| Selling Price |

9.7 |

12.8 |

28.4 |

41.4 |

| Profit Margin |

-5.4 |

-1.2 |

19.1 |

35.7 |

| Overall Business Situation |

34.4 |

24.9 |

58.3 |

60.7 |

| Table B: Business Expectations of Select Parameters for extended period – Net response |

| (per cent) |

| Parameters |

Round 101 |

Round 102 |

| Q1:2023-24 |

Q2:2023-24 |

Q3:2023-24 |

Q4:2023-24 |

| Overall Business Situation |

58.3 |

60.7 |

60.7 |

63.1 |

| Production |

54.8 |

58.0 |

58.0 |

60.2 |

| Order Books |

47.8 |

58.1 |

54.6 |

55.2 |

| Capacity Utilisation |

41.2 |

46.6 |

54.4 |

56.5 |

| Employment |

26.7 |

40.5 |

43.7 |

43.3 |

| Cost of Raw Materials |

-60.9 |

-58.3 |

-49.3 |

-49.6 |

| Selling Prices |

28.4 |

41.4 |

45.1 |

46.5 |

Note: Please see the excel file for time series data.

| Table 1: Assessment and Expectations for Production |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

36.6 |

14.4 |

48.9 |

22.2 |

70.4 |

4.9 |

24.7 |

65.6 |

| Q2:2022-23 |

1,234 |

34.3 |

16.3 |

49.4 |

18.1 |

72.4 |

5.0 |

22.6 |

67.4 |

| Q3:2022-23 |

1,356 |

40.5 |

15.4 |

44.1 |

25.1 |

60.8 |

4.6 |

34.5 |

56.2 |

| Q4:2022-23 |

1,066 |

46.3 |

13.3 |

40.4 |

33.0 |

61.2 |

3.8 |

34.9 |

57.4 |

| Q1:2023-24 |

1,247 |

39.6 |

14.3 |

46.0 |

25.3 |

60.6 |

5.8 |

33.6 |

54.8 |

| Q2:2023-24 |

|

|

|

|

|

63.0 |

5.0 |

31.9 |

58.0 |

‘Increase’ in production is optimistic.

Note: The sum of components may not add up to total due to rounding off (This is applicable for all tables). |

| Table 2: Assessment and Expectations for Order Books |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

34.1 |

12.5 |

53.4 |

21.7 |

70.4 |

4.2 |

25.4 |

66.1 |

| Q2:2022-23 |

1,234 |

30.7 |

12.1 |

57.2 |

18.6 |

72.7 |

4.6 |

22.6 |

68.1 |

| Q3:2022-23 |

1,356 |

33.1 |

12.1 |

54.8 |

21.0 |

67.1 |

4.7 |

28.3 |

62.4 |

| Q4:2022-23 |

1,066 |

37.2 |

11.8 |

51.0 |

25.4 |

63.3 |

3.9 |

32.8 |

59.4 |

| Q1:2023-24 |

1,247 |

33.0 |

11.1 |

55.9 |

21.9 |

54.6 |

6.8 |

38.6 |

47.8 |

| Q2:2023-24 |

|

|

|

|

|

63.0 |

4.8 |

32.2 |

58.1 |

| ‘Increase’ in order books is optimistic. |

| Table 3: Assessment and Expectations for Pending Orders |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Above Normal |

Below Normal |

Normal |

Net response |

Above Normal |

Below Normal |

Normal |

Net response |

| Q1:2022-23 |

1,239 |

6.7 |

14.2 |

79.1 |

7.5 |

8.8 |

10.6 |

80.6 |

1.8 |

| Q2:2022-23 |

1,234 |

10.3 |

17.6 |

72.0 |

7.3 |

7.7 |

10.3 |

82.1 |

2.6 |

| Q3:2022-23 |

1,356 |

8.4 |

14.6 |

76.9 |

6.2 |

10.8 |

10.1 |

79.2 |

-0.7 |

| Q4:2022-23 |

1,066 |

4.2 |

13.1 |

82.7 |

8.9 |

8.9 |

10.1 |

81.0 |

1.2 |

| Q1:2023-24 |

1,247 |

9.2 |

14.1 |

76.6 |

4.9 |

4.5 |

8.0 |

87.5 |

3.4 |

| Q2:2023-24 |

|

|

|

|

|

10.9 |

9.2 |

79.9 |

-1.7 |

| Pending orders ‘Below Normal’ is optimistic. |

| Table 4: Assessment and Expectations for Capacity Utilisation (Main Product) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

29.5 |

12.8 |

57.7 |

16.8 |

63.5 |

4.5 |

32.0 |

59.0 |

| Q2:2022-23 |

1,234 |

23.4 |

14.8 |

61.8 |

8.6 |

65.6 |

5.0 |

29.4 |

60.6 |

| Q3:2022-23 |

1,356 |

29.8 |

15.0 |

55.2 |

14.9 |

51.5 |

4.9 |

43.6 |

46.6 |

| Q4:2022-23 |

1,066 |

34.3 |

11.5 |

54.1 |

22.8 |

51.3 |

4.1 |

44.6 |

47.2 |

| Q1:2023-24 |

1,247 |

28.5 |

13.0 |

58.5 |

15.5 |

46.7 |

5.5 |

47.8 |

41.2 |

| Q2:2023-24 |

|

|

|

|

|

51.8 |

5.2 |

42.9 |

46.6 |

| ‘Increase’ in capacity utilisation is optimistic. |

| Table 5: Assessment and Expectations for Level of CU (compared to the average in last 4 quarters) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Above Normal |

Below Normal |

Normal |

Net response |

Above Normal |

Below Normal |

Normal |

Net response |

| Q1:2022-23 |

1,239 |

19.6 |

10.4 |

70.0 |

9.2 |

39.3 |

5.4 |

55.4 |

33.9 |

| Q2:2022-23 |

1,234 |

20.5 |

12.8 |

66.7 |

7.8 |

50.2 |

6.3 |

43.5 |

43.9 |

| Q3:2022-23 |

1,356 |

28.7 |

13.2 |

58.1 |

15.5 |

37.0 |

6.1 |

56.9 |

30.9 |

| Q4:2022-23 |

1,066 |

19.8 |

10.5 |

69.7 |

9.3 |

34.7 |

8.1 |

57.2 |

26.7 |

| Q1:2023-24 |

1,247 |

31.4 |

10.4 |

58.2 |

21.0 |

23.7 |

6.2 |

70.2 |

17.5 |

| Q2:2023-24 |

|

|

|

|

|

39.0 |

6.0 |

55.1 |

33.0 |

| ‘Above Normal’ in Level of capacity utilisation is optimistic. |

| Table 6: Assessment and Expectations for Assessment of Production Capacity (with regard to expected demand in next 6 months) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| More than adequate |

Less than adequate |

Adequate |

Net response |

More than adequate |

Less than adequate |

Adequate |

Net response |

| Q1:2022-23 |

1,239 |

25.2 |

7.2 |

67.6 |

18.0 |

42.7 |

3.9 |

53.5 |

38.8 |

| Q2:2022-23 |

1,234 |

21.1 |

6.8 |

72.1 |

14.3 |

51.5 |

5.4 |

43.0 |

46.1 |

| Q3:2022-23 |

1,356 |

28.9 |

4.4 |

66.7 |

24.6 |

42.9 |

4.5 |

52.7 |

38.4 |

| Q4:2022-23 |

1,066 |

17.3 |

5.7 |

77.0 |

11.6 |

42.7 |

3.3 |

53.9 |

39.4 |

| Q1:2023-24 |

1,247 |

25.8 |

5.7 |

68.4 |

20.1 |

25.3 |

3.8 |

70.9 |

21.5 |

| Q2:2023-24 |

|

|

|

|

|

43.4 |

3.9 |

52.7 |

39.5 |

| ‘More than adequate’ in Assessment of Production Capacity is optimistic. |

| Table 7: Assessment and Expectations for Exports |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

25.5 |

11.2 |

63.4 |

14.3 |

62.4 |

4.4 |

33.2 |

58.0 |

| Q2:2022-23 |

1,234 |

25.2 |

14.0 |

60.8 |

11.1 |

65.2 |

4.4 |

30.4 |

60.8 |

| Q3:2022-23 |

1,356 |

25.6 |

17.1 |

57.3 |

8.5 |

61.2 |

5.2 |

33.6 |

56.0 |

| Q4:2022-23 |

1,066 |

25.4 |

13.3 |

61.3 |

12.2 |

55.5 |

3.9 |

40.6 |

51.5 |

| Q1:2023-24 |

1,247 |

30.1 |

12.5 |

57.4 |

17.6 |

43.0 |

6.8 |

50.2 |

36.2 |

| Q2:2023-24 |

|

|

|

|

|

57.9 |

4.4 |

37.7 |

53.5 |

| ‘Increase’ in exports is optimistic. |

| Table 8: Assessment and Expectations for Imports |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

23.9 |

9.0 |

67.0 |

14.9 |

59.7 |

3.4 |

36.9 |

56.4 |

| Q2:2022-23 |

1,234 |

23.5 |

10.1 |

66.4 |

13.4 |

64.5 |

3.2 |

32.3 |

61.3 |

| Q3:2022-23 |

1,356 |

23.8 |

12.2 |

64.0 |

11.6 |

60.8 |

3.2 |

36.0 |

57.6 |

| Q4:2022-23 |

1,066 |

22.6 |

7.3 |

70.1 |

15.3 |

54.3 |

2.8 |

42.9 |

51.5 |

| Q1:2023-24 |

1,247 |

28.9 |

8.6 |

62.5 |

20.4 |

37.4 |

4.2 |

58.4 |

33.2 |

| Q2:2023-24 |

|

|

|

|

|

55.8 |

3.2 |

41.0 |

52.6 |

| ‘Increase’ in imports is optimistic. |

| Table 9: Assessment and Expectations for level of Raw Materials Inventory |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Above average |

Below average |

Average |

Net response |

Above average |

Below average |

Average |

Net response |

| Q1:2022-23 |

1,239 |

16.8 |

7.0 |

76.1 |

-9.8 |

42.4 |

3.6 |

54.0 |

-38.8 |

| Q2:2022-23 |

1,234 |

15.0 |

10.5 |

74.5 |

-4.6 |

46.1 |

4.6 |

49.3 |

-41.5 |

| Q3:2022-23 |

1,356 |

18.1 |

7.3 |

74.6 |

-10.8 |

32.8 |

7.1 |

60.1 |

-25.7 |

| Q4:2022-23 |

1,066 |

13.1 |

4.7 |

82.2 |

-8.3 |

32.4 |

5.6 |

62.0 |

-26.8 |

| Q1:2023-24 |

1,247 |

13.4 |

7.1 |

79.5 |

-6.3 |

20.5 |

2.5 |

76.9 |

-18.0 |

| Q2:2023-24 |

|

|

|

|

|

33.0 |

4.0 |

63.1 |

-29.0 |

| ‘Below average’ Inventory of raw materials is optimistic. |

| Table 10: Assessment and Expectations for level of Finished Goods Inventory |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Above average |

Below average |

Average |

Net response |

Above average |

Below average |

Average |

Net response |

| Q1:2022-23 |

1,239 |

16.4 |

7.4 |

76.2 |

-9.0 |

42.4 |

3.0 |

54.6 |

-39.5 |

| Q2:2022-23 |

1,234 |

14.2 |

10.2 |

75.6 |

-4.0 |

45.6 |

4.3 |

50.1 |

-41.3 |

| Q3:2022-23 |

1,356 |

17.1 |

7.7 |

75.2 |

-9.5 |

33.4 |

6.9 |

59.7 |

-26.5 |

| Q4:2022-23 |

1,066 |

13.3 |

5.1 |

81.5 |

-8.2 |

31.9 |

5.8 |

62.3 |

-26.1 |

| Q1:2023-24 |

1,247 |

14.0 |

6.8 |

79.2 |

-7.2 |

19.9 |

2.8 |

77.3 |

-17.2 |

| Q2:2023-24 |

|

|

|

|

|

33.2 |

4.4 |

62.4 |

-28.8 |

| ‘Below average’ Inventory of finished goods is optimistic. |

| Table 11: Assessment and Expectations for Employment |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

23.4 |

8.1 |

68.4 |

15.3 |

52.7 |

2.5 |

44.7 |

50.2 |

| Q2:2022-23 |

1,234 |

21.5 |

9.0 |

69.5 |

12.5 |

57.1 |

2.1 |

40.8 |

54.9 |

| Q3:2022-23 |

1,356 |

23.0 |

9.4 |

67.7 |

13.6 |

45.0 |

1.2 |

53.9 |

43.8 |

| Q4:2022-23 |

1,066 |

19.3 |

7.0 |

73.7 |

12.4 |

39.0 |

2.5 |

58.5 |

36.4 |

| Q1:2023-24 |

1,247 |

25.9 |

9.9 |

64.2 |

16.1 |

29.8 |

3.1 |

67.1 |

26.7 |

| Q2:2023-24 |

|

|

|

|

|

43.5 |

3.0 |

53.5 |

40.5 |

| ‘Increase’ in employment is optimistic. |

| Table 12: Assessment and Expectations for Overall Financial Situation |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Better |

Worsen |

No change |

Net response |

Better |

Worsen |

No change |

Net response |

| Q1:2022-23 |

1,239 |

33.0 |

12.3 |

54.7 |

20.6 |

69.3 |

3.9 |

26.7 |

65.4 |

| Q2:2022-23 |

1,234 |

28.7 |

14.8 |

56.4 |

13.9 |

70.4 |

3.4 |

26.2 |

67.1 |

| Q3:2022-23 |

1,356 |

35.6 |

15.5 |

49.0 |

20.1 |

61.4 |

3.8 |

34.8 |

57.7 |

| Q4:2022-23 |

1,066 |

40.2 |

9.6 |

50.2 |

30.6 |

63.9 |

3.3 |

32.8 |

60.6 |

| Q1:2023-24 |

1,247 |

36.6 |

12.6 |

50.7 |

24.0 |

56.3 |

3.4 |

40.3 |

52.9 |

| Q2:2023-24 |

|

|

|

|

|

60.2 |

3.9 |

35.9 |

56.3 |

| ‘Better’ overall financial situation is optimistic. |

| Table 13: Assessment and Expectations for Working Capital Finance Requirement |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

33.4 |

7.9 |

58.7 |

25.5 |

62.8 |

1.4 |

35.7 |

61.4 |

| Q2:2022-23 |

1,234 |

29.6 |

6.8 |

63.5 |

22.8 |

65.0 |

2.6 |

32.5 |

62.4 |

| Q3:2022-23 |

1,356 |

35.2 |

7.3 |

57.5 |

27.9 |

51.2 |

1.6 |

47.3 |

49.6 |

| Q4:2022-23 |

1,066 |

36.4 |

4.3 |

59.3 |

32.1 |

52.3 |

1.1 |

46.5 |

51.2 |

| Q1:2023-24 |

1,247 |

34.8 |

5.8 |

59.4 |

29.1 |

48.0 |

1.9 |

50.0 |

46.1 |

| Q2:2023-24 |

|

|

|

|

|

53.3 |

2.2 |

44.4 |

51.1 |

| ‘Increase’ in working capital finance is optimistic. |

| Table 14: Assessment and Expectations for Availability of Finance (from Internal Accruals) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Improve |

Worsen |

No change |

Net response |

Improve |

Worsen |

No change |

Net response |

| Q1:2022-23 |

1,239 |

27.8 |

9.7 |

62.4 |

18.1 |

62.4 |

2.5 |

35.2 |

59.9 |

| Q2:2022-23 |

1,234 |

24.0 |

8.0 |

68.0 |

15.9 |

64.2 |

2.4 |

33.4 |

61.9 |

| Q3:2022-23 |

1,356 |

31.1 |

9.1 |

59.8 |

21.9 |

51.3 |

2.0 |

46.7 |

49.3 |

| Q4:2022-23 |

1,066 |

33.3 |

4.5 |

62.2 |

28.8 |

55.2 |

1.7 |

43.1 |

53.5 |

| Q1:2023-24 |

1,247 |

33.2 |

7.4 |

59.4 |

25.8 |

48.7 |

2.0 |

49.3 |

46.6 |

| Q2:2023-24 |

|

|

|

|

|

54.4 |

2.1 |

43.5 |

52.3 |

| ‘Improvement’ in availability of finance is optimistic. |

| Table 15: Assessment and Expectations for Availability of Finance (from banks and other sources) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Improve |

Worsen |

No change |

Net response |

Improve |

Worsen |

No change |

Net response |

| Q1:2022-23 |

1,239 |

24.8 |

7.6 |

67.5 |

17.2 |

59.3 |

1.5 |

39.2 |

57.8 |

| Q2:2022-23 |

1,234 |

21.9 |

6.5 |

71.6 |

15.4 |

62.2 |

1.8 |

36.1 |

60.4 |

| Q3:2022-23 |

1,356 |

26.0 |

9.1 |

64.9 |

17.0 |

56.7 |

1.7 |

41.6 |

55.1 |

| Q4:2022-23 |

1,066 |

27.8 |

4.5 |

67.7 |

23.3 |

50.5 |

1.3 |

48.2 |

49.2 |

| Q1:2023-24 |

1,247 |

26.5 |

6.1 |

67.4 |

20.4 |

42.2 |

2.1 |

55.7 |

40.1 |

| Q2:2023-24 |

|

|

|

|

|

50.5 |

1.5 |

47.9 |

49.0 |

| ‘Improvement’ in availability of finance is optimistic. |

| Table 16: Assessment and Expectations for Availability of Finance (from overseas, if applicable) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Improve |

Worsen |

No change |

Net response |

Improve |

Worsen |

No change |

Net response |

| Q1:2022-23 |

1,239 |

21.9 |

7.5 |

70.6 |

14.4 |

60.2 |

0.9 |

38.9 |

59.2 |

| Q2:2022-23 |

1,234 |

17.4 |

6.8 |

75.8 |

10.6 |

65.8 |

1.2 |

33.0 |

64.6 |

| Q3:2022-23 |

1,356 |

20.4 |

9.7 |

69.9 |

10.7 |

59.6 |

0.8 |

39.6 |

58.9 |

| Q4:2022-23 |

1,066 |

11.1 |

3.6 |

85.3 |

7.6 |

51.3 |

1.3 |

47.4 |

50.1 |

| Q1:2023-24 |

1,247 |

23.8 |

5.8 |

70.4 |

18.0 |

34.3 |

1.8 |

64.0 |

32.5 |

| Q2:2023-24 |

|

|

|

|

|

52.4 |

2.0 |

45.7 |

50.4 |

| ‘Improvement’ in availability of finance is optimistic. |

| Table 17: Assessment and Expectations for Cost of Finance |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

30.5 |

6.9 |

62.6 |

-23.6 |

57.0 |

2.1 |

40.9 |

-54.9 |

| Q2:2022-23 |

1,234 |

36.1 |

6.1 |

57.8 |

-30.1 |

65.6 |

1.6 |

32.8 |

-64.0 |

| Q3:2022-23 |

1,356 |

37.0 |

5.9 |

57.1 |

-31.1 |

53.5 |

1.6 |

44.9 |

-51.9 |

| Q4:2022-23 |

1,066 |

36.2 |

3.8 |

60.0 |

-32.4 |

51.6 |

1.1 |

47.3 |

-50.5 |

| Q1:2023-24 |

1,247 |

36.9 |

4.5 |

58.6 |

-32.4 |

47.5 |

1.7 |

50.8 |

-45.8 |

| Q2:2023-24 |

|

|

|

|

|

56.4 |

2.2 |

41.5 |

-54.2 |

| ‘Decrease’ in cost of finance is optimistic. |

| Table 18: Assessment and Expectations for Cost of Raw Materials |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

85.5 |

1.1 |

13.3 |

-84.4 |

78.2 |

1.2 |

20.6 |

-77.0 |

| Q2:2022-23 |

1,234 |

77.0 |

4.6 |

18.4 |

-72.5 |

80.6 |

1.6 |

17.9 |

-79.0 |

| Q3:2022-23 |

1,356 |

73.0 |

8.1 |

18.9 |

-64.9 |

66.8 |

2.6 |

30.7 |

-64.2 |

| Q4:2022-23 |

1,066 |

64.5 |

5.4 |

30.2 |

-59.1 |

63.4 |

2.4 |

34.2 |

-60.9 |

| Q1:2023-24 |

1,247 |

49.1 |

8.0 |

42.8 |

-41.1 |

62.6 |

1.7 |

35.8 |

-60.9 |

| Q2:2023-24 |

|

|

|

|

|

60.6 |

2.4 |

37.0 |

-58.3 |

| ‘Decrease’ in cost of raw materials is optimistic. |

| Table 19: Assessment and Expectations for Salary/Other Remuneration |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

39.6 |

4.8 |

55.5 |

-34.8 |

66.3 |

0.7 |

33.0 |

-65.6 |

| Q2:2022-23 |

1,234 |

30.8 |

4.4 |

64.7 |

-26.4 |

61.3 |

0.4 |

38.3 |

-60.8 |

| Q3:2022-23 |

1,356 |

30.1 |

3.1 |

66.8 |

-27.0 |

46.3 |

0.3 |

53.4 |

-46.0 |

| Q4:2022-23 |

1,066 |

23.1 |

1.9 |

75.0 |

-21.2 |

39.3 |

0.6 |

60.0 |

-38.7 |

| Q1:2023-24 |

1,247 |

41.1 |

3.0 |

56.0 |

-38.1 |

45.2 |

0.9 |

53.9 |

-44.3 |

| Q2:2023-24 |

|

|

|

|

|

49.8 |

0.5 |

49.7 |

-49.3 |

| ‘Decrease’ in Salary / other remuneration is optimistic. |

| Table 20: Assessment and Expectations for Selling Price |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

33.3 |

8.3 |

58.4 |

25.0 |

59.5 |

3.8 |

36.7 |

55.7 |

| Q2:2022-23 |

1,234 |

25.1 |

10.7 |

64.2 |

14.4 |

63.4 |

3.2 |

33.4 |

60.3 |

| Q3:2022-23 |

1,356 |

23.3 |

12.9 |

63.8 |

10.4 |

48.8 |

3.7 |

47.5 |

45.1 |

| Q4:2022-23 |

1,066 |

21.6 |

11.8 |

66.6 |

9.7 |

43.2 |

3.6 |

53.1 |

39.6 |

| Q1:2023-24 |

1,247 |

26.1 |

13.3 |

60.6 |

12.8 |

34.0 |

5.6 |

60.4 |

28.4 |

| Q2:2023-24 |

|

|

|

|

|

46.9 |

5.4 |

47.7 |

41.4 |

| ‘Increase’ in selling price is optimistic. |

| Table 21: Assessment and Expectations for Profit Margin |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q1:2022-23 |

1,239 |

22.5 |

20.7 |

56.7 |

1.8 |

53.6 |

10.4 |

35.9 |

43.2 |

| Q2:2022-23 |

1,234 |

16.2 |

25.5 |

58.2 |

-9.3 |

57.6 |

10.1 |

32.3 |

47.4 |

| Q3:2022-23 |

1,356 |

17.6 |

26.1 |

56.3 |

-8.4 |

44.2 |

9.0 |

46.8 |

35.2 |

| Q4:2022-23 |

1,066 |

16.2 |

21.6 |

62.1 |

-5.4 |

41.0 |

8.1 |

50.9 |

32.9 |

| Q1:2023-24 |

1,247 |

20.6 |

21.8 |

57.5 |

-1.2 |

30.5 |

11.4 |

58.1 |

19.1 |

| Q2:2023-24 |

|

|

|

|

|

43.8 |

8.1 |

48.1 |

35.7 |

| ‘Increase’ in profit margin is optimistic. |

| Table 22: Assessment and Expectations for Overall Business Situation |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Better |

Worsen |

No change |

Net response |

Better |

Worsen |

No change |

Net response |

| Q1:2022-23 |

1,239 |

36.0 |

13.8 |

50.2 |

22.3 |

71.8 |

3.8 |

24.4 |

68.0 |

| Q2:2022-23 |

1,234 |

31.6 |

15.7 |

52.7 |

15.8 |

73.9 |

3.2 |

22.9 |

70.7 |

| Q3:2022-23 |

1,356 |

37.7 |

17.4 |

44.9 |

20.3 |

63.8 |

4.4 |

31.7 |

59.4 |

| Q4:2022-23 |

1,066 |

45.9 |

11.4 |

42.7 |

34.4 |

66.9 |

3.7 |

29.4 |

63.1 |

| Q1:2023-24 |

1,247 |

39.9 |

15.0 |

45.1 |

24.9 |

62.4 |

4.0 |

33.6 |

58.3 |

| Q2:2023-24 |

|

|

|

|

|

65.0 |

4.3 |

30.7 |

60.7 |

| ‘Better’ Overall Business Situation is optimistic. |

| Table 23: Business Sentiments |

| Quarter |

Business Assessment Index (BAI) |

Business Expectations Index (BEI) |

| Q1:2022-23 |

110.1 |

134.7 |

| Q2:2022-23 |

106.7 |

137.5 |

| Q3:2022-23 |

108.6 |

134.4 |

| Q4:2022-23 |

112.2 |

132.9 |

| Q1:2023-24 |

112.2 |

126.4 |

| Q2:2023-24 |

|

132.5 |

|

IST,

IST,