|

भारतीय रिज़र्व बैंक ने आज त्रैमासिक औद्योगिक परिदृश्य सर्वेक्षण (आइओएस) के 104वें दौर के परिणाम जारी किये। इस सर्वेक्षण में वर्ष 2023-24 की तीसरी तिमाही के लिए भारतीय विनिर्माण कंपनियों द्वारा कारोबार के परिवेश का गुणात्मक मूल्यांकन और वर्ष 2023-241 की चौथी तिमाही के लिए उक्त कंपनियों की प्रत्याशाओं के साथ-साथ आगामी दो तिमाहियों के लिए चयनित मापदंडों पर उनके आउटलुक को समाहित किया गया है। वर्ष 2023-24 की तीसरी तिमाही के दौरान सर्वेक्षण के इस दौर में कुल 1,040 कंपनियों ने प्रत्युत्तर दिए ।

विशेष:

क. तीसरी तिमाही (Q3) 2023-24 का मूल्यांकन

- विनिर्माण कंपनियों ने 2023-24 की तीसरी तिमाही के दौरान सकारात्मक मांग की स्थिति की सूचना दी, जैसा कि उनके उत्पादन, क्षमता उपयोग, लंबित ऑर्डर, रोजगार और समग्र व्यावसायिक स्थिति के आकलन में परिलक्षित होता है; हालाँकि, पिछले सर्वेक्षण दौर की तुलना में वे कम आशावादी थे (सारणी - ए) ।

- अनुमान है कि कच्चे माल की लागत, वित्तपोषण लागत और वेतन खर्च का दबाव थोड़ा कम हुआ है।

- अनुमान है कि तिमाही के दौरान बिक्री मूल्य और लाभ मार्जिन में बढ़ोतरी हुई है, हालांकि पिछली तिमाही के आकलन की तुलना में मनोभाव कुछ हद तक कम थे।

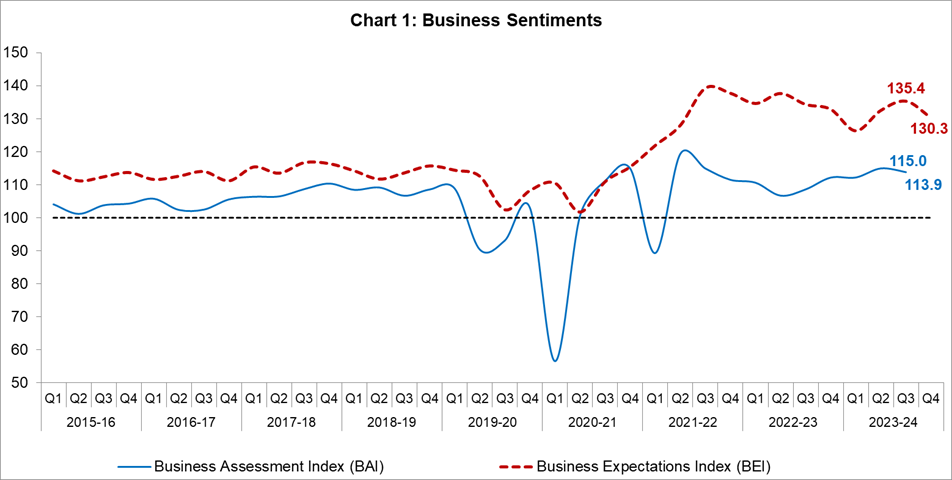

- विनिर्माण क्षेत्र में व्यापार मूल्यांकन सूचकांक (बीएआई) 2023-24 की तीसरी तिमाही में घटकर 113.9 हो गया, जो की पिछली तिमाही में 115.0 था (चार्ट 1)।

ख. चौथी तिमाही (Q4) 2023-24 के लिए प्रत्याशाएं

- विनिर्माता 2023-24 की चौथी तिमाही के दौरान मांग की स्थिति को लेकर आशावादी रहे, हालांकि पिछले सर्वेक्षण दौर की तुलना में संभावनाओं का स्तर अपेक्षाकृत कम था (सारणी - ए)।

- इनपुट लागत बढ़ने की संभावना है, हालांकि दबाव का स्तर कम होने की संभावना है।

- सकारात्मक मांग संभावनाओं के अनुरूप, बिक्री मूल्य और लाभ मार्जिन बढ़ने की उम्मीद है।

- व्यापार अपेक्षा सूचकांक (बीईआई) 2023-24 की चौथी तिमाही में 130.3 के उच्च स्तर पर रहा, हालांकि यह पिछली तिमाही के 135.4 के स्तर से कम हुआ (चार्ट 1)।

ग. 2024-25 की पहली और 2024-25 की दूसरी तिमाही के लिए प्रत्याशाएं

- विनिर्माण कंपनियां उत्पादन, क्षमता उपयोग, ऑर्डर बुक, रोजगार की स्थिति और समग्र व्यावसायिक स्थिति पर अत्यधिक आशावादी बनी हुई हैं (सारणी बी) ।

- 2024-25 की पहली अर्धवार्षिक अवधि के दौरान इनपुट लागत का दबाव बने रहने की संभावना है और बिक्री कीमतें भी उसी के अनुरूप रहने की उम्मीद है।

Table A: Summary of Net responses[2] on Survey Parameters

(per cent)

|

Parameters

|

Assessment period

|

Expectation period

|

|

Q2:2023-24

|

Q3:2023-24

|

Q3:2023-24

|

Q4:2023-24

|

|

Production

|

34.0

|

29.0

|

65.1

|

58.1

|

|

Order Books

|

30.7

|

26.3

|

62.3

|

55.8

|

|

Pending Orders

|

3.1

|

3.3

|

-1.1

|

1.1

|

|

Capacity Utilisation

|

29.5

|

19.6

|

57.5

|

46.7

|

|

Inventory of Raw Materials

|

-6.1

|

-8.9

|

-27.3

|

-25.7

|

|

Inventory of Finished Goods

|

-7.2

|

-9.5

|

-28.2

|

-25.3

|

|

Exports

|

17.7

|

11.6

|

53.1

|

43.6

|

|

Imports

|

17.2

|

14.5

|

51.0

|

41.0

|

|

Employment

|

18.0

|

18.2

|

38.8

|

39.5

|

|

Financial Situation (Overall)

|

30.9

|

25.6

|

63.5

|

54.2

|

|

Availability of Finance (from internal accruals)

|

30.8

|

23.7

|

59.1

|

47.4

|

|

Availability of Finance (from banks & other sources)

|

29.1

|

23.2

|

55.8

|

44.5

|

|

Availability of Finance (from overseas, if applicable)

|

18.6

|

14.2

|

53.5

|

43.9

|

|

Cost of Finance

|

-26.4

|

-22.5

|

-54.9

|

-45.9

|

|

Cost of Raw Material

|

-43.8

|

-33.4

|

-65.0

|

-54.2

|

|

Salary/ Other Remuneration

|

-28.8

|

-26.2

|

-45.6

|

-42.0

|

|

Selling Price

|

11.7

|

10.2

|

40.1

|

34.8

|

|

Profit Margin

|

4.5

|

1.4

|

35.8

|

30.8

|

|

Overall Business Situation

|

34.3

|

28.6

|

67.9

|

58.3

|

Table B: Business Expectations on Select Parameters for extended period – Net response

(per cent)

|

Parameters

|

Round 103

|

Round 104

|

|

Q3:2023-24

|

Q4:2023-24

|

Q1:2024:25

|

Q2:2024:25

|

|

Overall Business Situation

|

67.9

|

58.3

|

58.6

|

62.9

|

|

Production

|

65.1

|

58.1

|

57.0

|

59.7

|

|

Order Books

|

62.3

|

55.8

|

58.7

|

61.5

|

|

Capacity Utilisation

|

57.5

|

46.7

|

53.6

|

56.3

|

|

Employment

|

38.8

|

39.5

|

44.8

|

43.0

|

|

Cost of Raw Materials

|

-65.0

|

-54.2

|

-53.2

|

-54.0

|

|

Selling Prices

|

40.1

|

34.8

|

41.5

|

42.1

|

Note: Please see the excel file for time series data

|

Table 1: Assessment and Expectations for Production

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q3:2022-23

|

1,356

|

40.5

|

15.4

|

44.1

|

25.1

|

60.8

|

4.6

|

34.5

|

56.2

|

|

Q4:2022-23

|

1,066

|

46.3

|

13.3

|

40.4

|

33.0

|

61.2

|

3.8

|

34.9

|

57.4

|

|

Q1:2023-24

|

1,247

|

39.6

|

14.3

|

46.0

|

25.3

|

60.6

|

5.8

|

33.6

|

54.8

|

|

Q2:2023-24

|

1,223

|

45.2

|

11.2

|

43.6

|

34.0

|

63.0

|

5.0

|

31.9

|

58.0

|

|

Q3:2023-24

|

1,040

|

41.2

|

12.2

|

46.7

|

29.0

|

70.9

|

5.7

|

23.4

|

65.1

|

|

Q4:2023-24

|

|

|

|

|

|

62.3

|

4.2

|

33.6

|

58.1

|

|

‘Increase’ in production is optimistic.

Note: The sum of components may not add up to total due to rounding off (This is applicable for all tables).

|

|

Table 2: Assessment and Expectations for Order Books

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q3:2022-23

|

1,356

|

33.1

|

12.1

|

54.8

|

21.0

|

67.1

|

4.7

|

28.3

|

62.4

|

|

Q4:2022-23

|

1,066

|

37.2

|

11.8

|

51.0

|

25.4

|

63.3

|

3.9

|

32.8

|

59.4

|

|

Q1:2023-24

|

1,247

|

33.0

|

11.1

|

55.9

|

21.9

|

54.6

|

6.8

|

38.6

|

47.8

|

|

Q2:2023-24

|

1,223

|

41.1

|

10.4

|

48.5

|

30.7

|

63.0

|

4.8

|

32.2

|

58.1

|

|

Q3:2023-24

|

1,040

|

38.3

|

12.0

|

49.7

|

26.3

|

68.5

|

6.1

|

25.4

|

62.3

|

|

Q4:2023-24

|

|

|

|

|

|

61.8

|

6.0

|

32.1

|

55.8

|

|

‘Increase’ in order books is optimistic.

|

|

Table 3: Assessment and Expectations for Pending Orders

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Above Normal

|

Below Normal

|

Normal

|

Net response

|

Above Normal

|

Below Normal

|

Normal

|

Net

response

|

|

Q3:2022-23

|

1,356

|

8.4

|

14.6

|

76.9

|

6.2

|

10.8

|

10.1

|

79.2

|

-0.7

|

|

Q4:2022-23

|

1,066

|

4.2

|

13.1

|

82.7

|

8.9

|

8.9

|

10.1

|

81.0

|

1.2

|

|

Q1:2023-24

|

1,247

|

9.2

|

14.1

|

76.6

|

4.9

|

4.5

|

8.0

|

87.5

|

3.4

|

|

Q2:2023-24

|

1,223

|

8.6

|

11.6

|

79.8

|

3.1

|

10.9

|

9.2

|

79.9

|

-1.7

|

|

Q3:2023-24

|

1,040

|

8.6

|

11.9

|

79.4

|

3.3

|

9.7

|

8.5

|

81.8

|

-1.1

|

|

Q4:2023-24

|

|

|

|

|

|

8.2

|

9.3

|

82.5

|

1.1

|

|

Pending orders ‘Below Normal’ is optimistic.

|

|

Table 4: Assessment and Expectations for Capacity Utilisation (Main Product)

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net

response

|

|

Q3:2022-23

|

1,356

|

29.8

|

15.0

|

55.2

|

14.9

|

51.5

|

4.9

|

43.6

|

46.6

|

|

Q4:2022-23

|

1,066

|

34.3

|

11.5

|

54.1

|

22.8

|

51.3

|

4.1

|

44.6

|

47.2

|

|

Q1:2023-24

|

1,247

|

28.5

|

13.0

|

58.5

|

15.5

|

46.7

|

5.5

|

47.8

|

41.2

|

|

Q2:2023-24

|

1,223

|

38.2

|

8.7

|

53.0

|

29.5

|

51.8

|

5.2

|

42.9

|

46.6

|

|

Q3:2023-24

|

1,040

|

30.1

|

10.6

|

59.3

|

19.6

|

62.1

|

4.6

|

33.3

|

57.5

|

|

Q4:2023-24

|

|

|

|

|

|

51.2

|

4.6

|

44.2

|

46.7

|

|

‘Increase’ in capacity utilisation is optimistic.

|

|

Table 5: Assessment and Expectations for Level of CU

(compared to the average in last 4 quarters)

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Above Normal

|

Below Normal

|

Normal

|

Net response

|

Above Normal

|

Below Normal

|

Normal

|

Net response

|

|

Q3:2022-23

|

1,356

|

28.7

|

13.2

|

58.1

|

15.5

|

37.0

|

6.1

|

56.9

|

30.9

|

|

Q4:2022-23

|

1,066

|

19.8

|

10.5

|

69.7

|

9.3

|

34.7

|

8.1

|

57.2

|

26.7

|

|

Q1:2023-24

|

1,247

|

31.4

|

10.4

|

58.2

|

21.0

|

23.7

|

6.2

|

70.2

|

17.5

|

|

Q2:2023-24

|

1,223

|

30.5

|

9.0

|

60.6

|

21.5

|

39.0

|

6.0

|

55.1

|

33.0

|

|

Q3:2023-24

|

1,040

|

26.2

|

9.4

|

64.4

|

16.7

|

36.1

|

6.1

|

57.8

|

30.1

|

|

Q4:2023-24

|

|

|

|

|

|

33.3

|

5.7

|

61.1

|

27.6

|

|

‘Above Normal’ in Level of capacity utilisation is optimistic.

|

|

Table 6: Assessment and Expectations for Production Capacity

(with regard to expected demand in next 6 months)

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

More than adequate

|

Less than adequate

|

Adequate

|

Net response

|

More than adequate

|

Less than adequate

|

Adequate

|

Net response

|

|

Q3:2022-23

|

1,356

|

28.9

|

4.4

|

66.7

|

24.6

|

42.9

|

4.5

|

52.7

|

38.4

|

|

Q4:2022-23

|

1,066

|

17.3

|

5.7

|

77.0

|

11.6

|

42.7

|

3.3

|

53.9

|

39.4

|

|

Q1:2023-24

|

1,247

|

25.8

|

5.7

|

68.4

|

20.1

|

25.3

|

3.8

|

70.9

|

21.5

|

|

Q2:2023-24

|

1,223

|

23.3

|

4.0

|

72.7

|

19.3

|

43.4

|

3.9

|

52.7

|

39.5

|

|

Q3:2023-24

|

1,040

|

25.1

|

4.7

|

70.2

|

20.4

|

42.7

|

3.2

|

54.1

|

39.5

|

|

Q4:2023-24

|

|

|

|

|

|

38.5

|

3.6

|

57.9

|

34.9

|

|

‘More than adequate’ in Assessment of Production Capacity is optimistic.

|

|

Table 7: Assessment and Expectations for Exports

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q3:2022-23

|

1,356

|

25.6

|

17.1

|

57.3

|

8.5

|

61.2

|

5.2

|

33.6

|

56.0

|

|

Q4:2022-23

|

1,066

|

25.4

|

13.3

|

61.3

|

12.2

|

55.5

|

3.9

|

40.6

|

51.5

|

|

Q1:2023-24

|

1,247

|

30.1

|

12.5

|

57.4

|

17.6

|

43.0

|

6.8

|

50.2

|

36.2

|

|

Q2:2023-24

|

1,223

|

27.7

|

10.0

|

62.3

|

17.7

|

57.9

|

4.4

|

37.7

|

53.5

|

|

Q3:2023-24

|

1,040

|

25.1

|

13.5

|

61.3

|

11.6

|

58.1

|

5.0

|

36.9

|

53.1

|

|

Q4:2023-24

|

|

|

|

|

|

50.3

|

6.7

|

43.0

|

43.6

|

|

‘Increase’ in exports is optimistic.

|

|

Table 8: Assessment and Expectations for Imports

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q3:2022-23

|

1,356

|

23.8

|

12.2

|

64.0

|

11.6

|

60.8

|

3.2

|

36.0

|

57.6

|

|

Q4:2022-23

|

1,066

|

22.6

|

7.3

|

70.1

|

15.3

|

54.3

|

2.8

|

42.9

|

51.5

|

|

Q1:2023-24

|

1,247

|

28.9

|

8.6

|

62.5

|

20.4

|

37.4

|

4.2

|

58.4

|

33.2

|

|

Q2:2023-24

|

1,223

|

25.5

|

8.2

|

66.3

|

17.2

|

55.8

|

3.2

|

41.0

|

52.6

|

|

Q3:2023-24

|

1,040

|

23.2

|

8.7

|

68.0

|

14.5

|

54.8

|

3.9

|

41.3

|

51.0

|

|

Q4:2023-24

|

|

|

|

|

|

45.2

|

4.2

|

50.6

|

41.0

|

|

‘Increase’ in imports is optimistic.

|

|

Table 9: Assessment and Expectations for level of Raw Materials Inventory

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Above average

|

Below average

|

Average

|

Net response

|

Above average

|

Below average

|

Average

|

Net response

|

|

Q3:2022-23

|

1,356

|

18.1

|

7.3

|

74.6

|

-10.8

|

32.8

|

7.1

|

60.1

|

-25.7

|

|

Q4:2022-23

|

1,066

|

13.1

|

4.7

|

82.2

|

-8.3

|

32.4

|

5.6

|

62.0

|

-26.8

|

|

Q1:2023-24

|

1,247

|

13.4

|

7.1

|

79.5

|

-6.3

|

20.5

|

2.5

|

76.9

|

-18.0

|

|

Q2:2023-24

|

1,223

|

11.5

|

5.3

|

83.2

|

-6.1

|

33.0

|

4.0

|

63.1

|

-29.0

|

|

Q3:2023-24

|

1,040

|

12.9

|

4.1

|

83.0

|

-8.9

|

30.9

|

3.6

|

65.6

|

-27.3

|

|

Q4:2023-24

|

|

|

|

|

|

27.4

|

1.7

|

70.9

|

-25.7

|

|

‘Below average’ Inventory of raw materials is optimistic.

|

|

Table 10: Assessment and Expectations for level of Finished Goods Inventory

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Above average

|

Below average

|

Average

|

Net response

|

Above average

|

Below average

|

Average

|

Net response

|

|

Q3:2022-23

|

1,356

|

17.1

|

7.7

|

75.2

|

-9.5

|

33.4

|

6.9

|

59.7

|

-26.5

|

|

Q4:2022-23

|

1,066

|

13.3

|

5.1

|

81.5

|

-8.2

|

31.9

|

5.8

|

62.3

|

-26.1

|

|

Q1:2023-24

|

1,247

|

14.0

|

6.8

|

79.2

|

-7.2

|

19.9

|

2.8

|

77.3

|

-17.2

|

|

Q2:2023-24

|

1,223

|

11.7

|

4.5

|

83.7

|

-7.2

|

33.2

|

4.4

|

62.4

|

-28.8

|

|

Q3:2023-24

|

1,040

|

14.0

|

4.5

|

81.5

|

-9.5

|

31.4

|

3.3

|

65.3

|

-28.2

|

|

Q4:2023-24

|

|

|

|

|

|

27.3

|

2.0

|

70.7

|

-25.3

|

|

‘Below average’ Inventory of finished goods is optimistic.

|

|

Table 11: Assessment and Expectations for Employment

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q3:2022-23

|

1,356

|

23.0

|

9.4

|

67.7

|

13.6

|

45.0

|

1.2

|

53.9

|

43.8

|

|

Q4:2022-23

|

1,066

|

19.3

|

7.0

|

73.7

|

12.4

|

39.0

|

2.5

|

58.5

|

36.4

|

|

Q1:2023-24

|

1,247

|

25.9

|

9.9

|

64.2

|

16.1

|

29.8

|

3.1

|

67.1

|

26.7

|

|

Q2:2023-24

|

1,223

|

25.1

|

7.1

|

67.7

|

18.0

|

43.5

|

3.0

|

53.5

|

40.5

|

|

Q3:2023-24

|

1,040

|

25.1

|

6.9

|

67.9

|

18.2

|

42.5

|

3.7

|

53.8

|

38.8

|

|

Q4:2023-24

|

|

|

|

|

|

41.7

|

2.2

|

56.1

|

39.5

|

|

‘Increase’ in employment is optimistic.

|

|

Table 12: Assessment and Expectations for Overall Financial Situation

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Better

|

Worsen

|

No change

|

Net response

|

Better

|

Worsen

|

No change

|

Net response

|

|

Q3:2022-23

|

1,356

|

35.6

|

15.5

|

49.0

|

20.1

|

61.4

|

3.8

|

34.8

|

57.7

|

|

Q4:2022-23

|

1,066

|

40.2

|

9.6

|

50.2

|

30.6

|

63.9

|

3.3

|

32.8

|

60.6

|

|

Q1:2023-24

|

1,247

|

36.6

|

12.6

|

50.7

|

24.0

|

56.3

|

3.4

|

40.3

|

52.9

|

|

Q2:2023-24

|

1,223

|

41.6

|

10.7

|

47.7

|

30.9

|

60.2

|

3.9

|

35.9

|

56.3

|

|

Q3:2023-24

|

1,040

|

36.8

|

11.2

|

52.0

|

25.6

|

68.7

|

5.1

|

26.2

|

63.5

|

|

Q4:2023-24

|

|

|

|

|

|

58.2

|

4.0

|

37.8

|

54.2

|

|

‘Better’ overall financial situation is optimistic.

|

|

Table 13: Assessment and Expectations for Working Capital Finance Requirement

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q3:2022-23

|

1,356

|

35.2

|

7.3

|

57.5

|

27.9

|

51.2

|

1.6

|

47.3

|

49.6

|

|

Q4:2022-23

|

1,066

|

36.4

|

4.3

|

59.3

|

32.1

|

52.3

|

1.1

|

46.5

|

51.2

|

|

Q1:2023-24

|

1,247

|

34.8

|

5.8

|

59.4

|

29.1

|

48.0

|

1.9

|

50.0

|

46.1

|

|

Q2:2023-24

|

1,223

|

38.4

|

5.1

|

56.6

|

33.3

|

53.3

|

2.2

|

44.4

|

51.1

|

|

Q3:2023-24

|

1,040

|

32.8

|

6.9

|

60.3

|

26.0

|

60.2

|

2.6

|

37.3

|

57.6

|

|

Q4:2023-24

|

|

|

|

|

|

49.6

|

2.9

|

47.6

|

46.7

|

|

‘Increase’ in working capital finance is optimistic.

|

|

Table 14: Assessment and Expectations for Availability of Finance (from Internal Accruals)

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Improve

|

Worsen

|

No change

|

Net response

|

Improve

|

Worsen

|

No change

|

Net response

|

|

Q3:2022-23

|

1,356

|

31.1

|

9.1

|

59.8

|

21.9

|

51.3

|

2.0

|

46.7

|

49.3

|

|

Q4:2022-23

|

1,066

|

33.3

|

4.5

|

62.2

|

28.8

|

55.2

|

1.7

|

43.1

|

53.5

|

|

Q1:2023-24

|

1,247

|

33.2

|

7.4

|

59.4

|

25.8

|

48.7

|

2.0

|

49.3

|

46.6

|

|

Q2:2023-24

|

1,223

|

37.1

|

6.3

|

56.6

|

30.8

|

54.4

|

2.1

|

43.5

|

52.3

|

|

Q3:2023-24

|

1,040

|

30.6

|

6.9

|

62.5

|

23.7

|

61.6

|

2.5

|

35.9

|

59.1

|

|

Q4:2023-24

|

|

|

|

|

|

49.3

|

2.0

|

48.7

|

47.4

|

|

‘Improvement’ in availability of finance is optimistic.

|

|

Table 15: Assessment and Expectations for Availability of Finance (from banks and other sources)

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Improve

|

Worsen

|

No change

|

Net response

|

Improve

|

Worsen

|

No change

|

Net response

|

|

Q3:2022-23

|

1,356

|

26.0

|

9.1

|

64.9

|

17.0

|

56.7

|

1.7

|

41.6

|

55.1

|

|

Q4:2022-23

|

1,066

|

27.8

|

4.5

|

67.7

|

23.3

|

50.5

|

1.3

|

48.2

|

49.2

|

|

Q1:2023-24

|

1,247

|

26.5

|

6.1

|

67.4

|

20.4

|

42.2

|

2.1

|

55.7

|

40.1

|

|

Q2:2023-24

|

1,223

|

34.9

|

5.7

|

59.4

|

29.1

|

50.5

|

1.5

|

47.9

|

49.0

|

|

Q3:2023-24

|

1,040

|

28.8

|

5.6

|

65.5

|

23.2

|

58.2

|

2.5

|

39.3

|

55.8

|

|

Q4:2023-24

|

|

|

|

|

|

46.5

|

2.1

|

51.4

|

44.5

|

|

‘Improvement’ in availability of finance is optimistic.

|

|

Table 16: Assessment and Expectations for Availability of Finance (from overseas, if applicable)

(per cent)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Improve

|

Worsen

|

No change

|

Net response

|

Improve

|

Worsen

|

No change

|

Net response

|

|

Q3:2022-23

|

1,356

|

20.4

|

9.7

|

69.9

|

10.7

|

59.6

|

0.8

|

39.6

|

58.9

|

|

Q4:2022-23

|

1,066

|

11.1

|

3.6

|

85.3

|

7.6

|

51.3

|

1.3

|

47.4

|

50.1

|

|

Q1:2023-24

|

1,247

|

23.8

|

5.8

|

70.4

|

18.0

|

34.3

|

1.8

|

64.0

|

32.5

|

|

Q2:2023-24

|

1,223

|

24.3

|

5.7

|

69.9

|

18.6

|

52.4

|

2.0

|

45.7

|

50.4

|

|

Q3:2023-24

|

1,040

|

20.2

|

6.0

|

73.9

|

14.2

|

56.4

|

2.9

|

40.7

|

53.5

|

|

Q4:2023-24

|

|

|

|

|

|

45.3

|

1.4

|

53.4

|

43.9

|

|

‘Improvement’ in availability of finance is optimistic.

|

|

Table 17: Assessment and Expectations for Cost of Finance

(per cent)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net

response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q3:2022-23

|

1,356

|

37.0

|

5.9

|

57.1

|

-31.1

|

53.5

|

1.6

|

44.9

|

-51.9

|

|

Q4:2022-23

|

1,066

|

36.2

|

3.8

|

60.0

|

-32.4

|

51.6

|

1.1

|

47.3

|

-50.5

|

|

Q1:2023-24

|

1,247

|

36.9

|

4.5

|

58.6

|

-32.4

|

47.5

|

1.7

|

50.8

|

-45.8

|

|

Q2:2023-24

|

1,223

|

33.0

|

6.6

|

60.4

|

-26.4

|

56.4

|

2.2

|

41.5

|

-54.2

|

|

Q3:2023-24

|

1,040

|

29.2

|

6.8

|

64.0

|

-22.5

|

58.5

|

3.6

|

37.9

|

-54.9

|

|

Q4:2023-24

|

|

|

|

|

|

48.8

|

2.9

|

48.3

|

-45.9

|

|

‘Decrease’ in cost of finance is optimistic.

|

|

Table 18: Assessment and Expectations for Cost of Raw Materials

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net

response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q3:2022-23

|

1,356

|

73.0

|

8.1

|

18.9

|

-64.9

|

66.8

|

2.6

|

30.7

|

-64.2

|

|

Q4:2022-23

|

1,066

|

64.5

|

5.4

|

30.2

|

-59.1

|

63.4

|

2.4

|

34.2

|

-60.9

|

|

Q1:2023-24

|

1,247

|

49.1

|

8.0

|

42.8

|

-41.1

|

62.6

|

1.7

|

35.8

|

-60.9

|

|

Q2:2023-24

|

1,223

|

49.3

|

5.5

|

45.3

|

-43.8

|

60.6

|

2.4

|

37.0

|

-58.3

|

|

Q3:2023-24

|

1,040

|

41.8

|

8.4

|

49.7

|

-33.4

|

67.8

|

2.8

|

29.3

|

-65.0

|

|

Q4:2023-24

|

|

|

|

|

|

57.0

|

2.9

|

40.1

|

-54.2

|

|

‘Decrease’ in cost of raw materials is optimistic.

|

|

Table 19: Assessment and Expectations for Salary/Other Remuneration

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q3:2022-23

|

1,356

|

30.1

|

3.1

|

66.8

|

-27.0

|

46.3

|

0.3

|

53.4

|

-46.0

|

|

Q4:2022-23

|

1,066

|

23.1

|

1.9

|

75.0

|

-21.2

|

39.3

|

0.6

|

60.0

|

-38.7

|

|

Q1:2023-24

|

1,247

|

41.1

|

3.0

|

56.0

|

-38.1

|

45.2

|

0.9

|

53.9

|

-44.3

|

|

Q2:2023-24

|

1,223

|

32.3

|

3.5

|

64.2

|

-28.8

|

49.8

|

0.5

|

49.7

|

-49.3

|

|

Q3:2023-24

|

1,040

|

30.3

|

4.1

|

65.7

|

-26.2

|

47.3

|

1.7

|

51.0

|

-45.6

|

|

Q4:2023-24

|

|

|

|

|

|

42.9

|

0.9

|

56.2

|

-42.0

|

|

‘Decrease’ in Salary / other remuneration is optimistic.

|

|

Table 20: Assessment and Expectations for Selling Price

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q3:2022-23

|

1,356

|

23.3

|

12.9

|

63.8

|

10.4

|

48.8

|

3.7

|

47.5

|

45.1

|

|

Q4:2022-23

|

1,066

|

21.6

|

11.8

|

66.6

|

9.7

|

43.2

|

3.6

|

53.1

|

39.6

|

|

Q1:2023-24

|

1,247

|

26.1

|

13.3

|

60.6

|

12.8

|

34.0

|

5.6

|

60.4

|

28.4

|

|

Q2:2023-24

|

1,223

|

22.3

|

10.6

|

67.1

|

11.7

|

46.9

|

5.4

|

47.7

|

41.4

|

|

Q3:2023-24

|

1,040

|

22.0

|

11.9

|

66.1

|

10.2

|

45.2

|

5.2

|

49.6

|

40.1

|

|

Q4:2023-24

|

|

|

|

|

|

40.4

|

5.6

|

54.0

|

34.8

|

|

‘Increase’ in selling price is optimistic.

|

|

Table 21: Assessment and Expectations for Profit Margin

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q3:2022-23

|

1,356

|

17.6

|

26.1

|

56.3

|

-8.4

|

44.2

|

9.0

|

46.8

|

35.2

|

|

Q4:2022-23

|

1,066

|

16.2

|

21.6

|

62.1

|

-5.4

|

41.0

|

8.1

|

50.9

|

32.9

|

|

Q1:2023-24

|

1,247

|

20.6

|

21.8

|

57.5

|

-1.2

|

30.5

|

11.4

|

58.1

|

19.1

|

|

Q2:2023-24

|

1,223

|

21.9

|

17.4

|

60.7

|

4.5

|

43.8

|

8.1

|

48.1

|

35.7

|

|

Q3:2023-24

|

1,040

|

20.5

|

19.1

|

60.4

|

1.4

|

45.5

|

9.7

|

44.8

|

35.8

|

|

Q4:2023-24

|

|

|

|

|

|

40.3

|

9.5

|

50.2

|

30.8

|

|

‘Increase’ in profit margin is optimistic.

|

|

Table 22: Assessment and Expectations for Overall Business Situation

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Better

|

Worsen

|

No change

|

Net response

|

Better

|

Worsen

|

No change

|

Net response

|

|

Q3:2022-23

|

1,356

|

37.7

|

17.4

|

44.9

|

20.3

|

63.8

|

4.4

|

31.7

|

59.4

|

|

Q4:2022-23

|

1,066

|

45.9

|

11.4

|

42.7

|

34.4

|

66.9

|

3.7

|

29.4

|

63.1

|

|

Q1:2023-24

|

1,247

|

39.9

|

15.0

|

45.1

|

24.9

|

62.4

|

4.0

|

33.6

|

58.3

|

|

Q2:2023-24

|

1,223

|

46.0

|

11.8

|

42.2

|

34.3

|

65.0

|

4.3

|

30.7

|

60.7

|

|

Q3:2023-24

|

1,040

|

40.6

|

12.0

|

47.4

|

28.6

|

73.1

|

5.2

|

21.7

|

67.9

|

|

Q4:2023-24

|

|

|

|

|

|

62.5

|

4.2

|

33.3

|

58.3

|

|

‘Better’ Overall Business Situation is optimistic.

|

|

Table 23: Business Sentiments

|

|

Quarter

|

Business Assessment Index (BAI)

|

Business Expectations Index (BEI)

|

|

Q3:2022-23

|

108.6

|

134.4

|

|

Q4:2022-23

|

112.2

|

132.9

|

|

Q1:2023-24

|

112.2

|

126.4

|

|

Q2:2023-24

|

115.0

|

132.5

|

|

Q3:2023-24

|

113.9

|

135.4

|

|

Q4:2023-24

|

|

130.3

|

[1].सर्वेक्षण के परिणाम उत्तरदाताओं के विचारों को दर्शाते हैं, जिन्हें आवश्यक रूप से रिज़र्व बैंक द्वारा साझा नहीं किया जाता है। पिछले सर्वेक्षण दौर के परिणाम 6 अक्टूबर, 202 3 को बैंक की वेबसाइट पर जारी किए गए।

[2] Net Response (NR) is the difference between the percentage of respondents reporting optimism and those reporting pessimism. It ranges between -100 to 100. Any value greater than zero indicates expansion/optimism and any value less than zero indicates contraction/pessimism. In other words, NR = (I – D), where, I is the percentage response of ‘Increase/optimism’, and D is the percentage response of ‘Decrease/pessimism’ and E is the percentage response as ‘no change/equal’ (i.e., I+D+E=100). For example, increase in production is optimism whereas decrease in cost of raw material is optimism.

|

IST,

IST,