IST,

IST,

Report of the Internal Technical Group on Central Government Securities Market

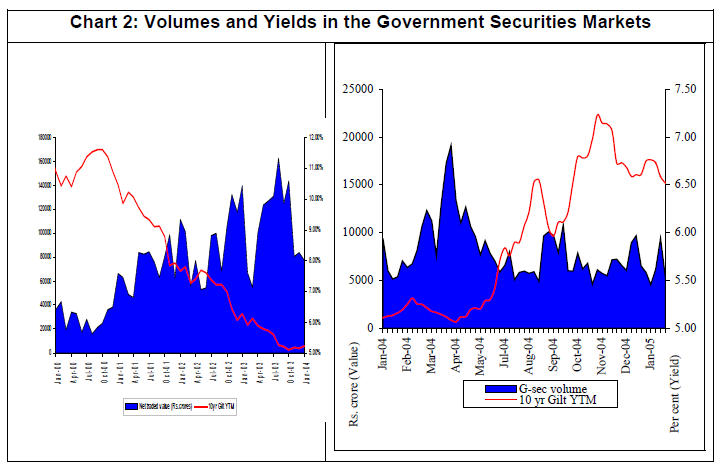

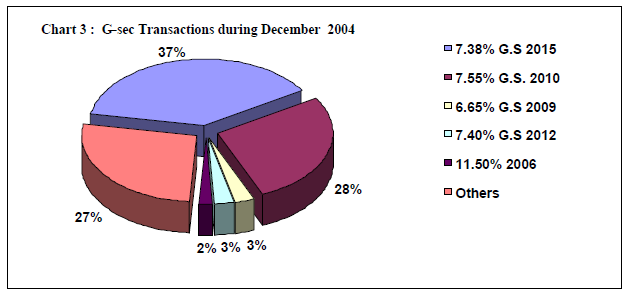

1. The Fiscal Responsibility and Budget Management (FRBM) Act, 2003 ushered in significant changes in the contextual setting and operating framework for the conduct of monetary policy, public debt management and regulatory oversight of the Government securities market by the Reserve Bank of India (RBI). Recognizing that the RBI’s participation in the primary issues of Government securities will stand withdrawn with effect from April 1, 2006 under the FRBM Act, the Mid-Term Review of the RBI’s Annual Policy Statement for the year 2004-05 envisaged that “open market operations (OMO) will become a more active instrument, warranting a review of processes and technological infrastructure consistent with market advancements” (Para 109). The Mid-Term Review also announced that a Study Group would be constituted “for strengthening the OMO framework to address these emerging needs and equip RBI as well as the market participants appropriately”. Accordingly, an internal Technical Group on Central Government Securities Market was constituted with the following terms of reference: i) To examine the implications of the RBI’s withdrawal under the FRBM Act from participation in primary issues (through devolvement or private placement) for the conduct of the RBI’s debt management function; ii) To make recommendations on the modifications required to the primary auction process, including redefining the role of Primary Dealers, to ensure that the RBI’s debt management objectives relating to the Central Government’s primary issuance of debt continue to be achieved efficiently; iii) To suggest measures to enhance the depth and liquidity of the secondary market for Central Government securities, which will be necessary for an efficient completion of Central Government’s Market Borrowing Programme without the RBI’s participation; iv) To study international experience with regard to Open Market Operations (OMOs) and consider a more active framework for OMOs to support the RBI’s regulatory role in Central Government securities market; v) To suggest steps that are needed for strengthening of processes and technological infrastructure within the RBI and strengthening of institutional arrangements, such as a review of the PD system, to support the modified primary issuance process and active debt market operations framework; vi) Any other related matter. 2. The Group benefited from the suggestions of the Fixed Income Money Market and Derivatives Association of India and the Primary Dealers’ Association of India with respect to laying a roadmap for the Government securities market. 3. The rest of this Report is organised as follows. Chapter II describes the evolution of debt management, OMO and the Government securities market in India. Chapter III examines the rationale for reorienting Open Market Operations in the emerging scenario and Chapter IV deals with the Institutional setting for debt management. Chapter V delves into the issues concerning developing the Government Securities Market. Chapter VI examines the changes required in the technological infrastructure, especially in trading and settlement systems. Chapter VII summarizes the recommendations of the Group. II. EVOLUTION OF DEBT MANAGEMENT, OPEN MARKET OPERATIONS AND 2.1 Open Market Operations (OMO) means the buying and selling of government securities in the open market in order to expand or contract the amount of money in the banking system. Purchases inject money into the banking system and stimulate growth while sales of securities do the opposite. 2.2 The RBI is authorised to deal in Government securities under Section 17(8) of the Reserve Bank of India Act, 1934. Open market operations (OMO) of RBI comprise outright sale and purchase of securities, Repo and Reverse Repo operations through LAF. While the outright OMO are directed at influencing enduring liquidity, the LAF OMO operations target the temporary liquidity in the system. In addition to the above mentioned monetary policy considerations, OMO were also undertaken through ‘switch’ operations wherein purchase of gilts of a particular maturity against the sale of another were used to provide liquidity to Government securities and enable smooth conduct of the borrowing programme. Although OMOs had initially served as a key instrument of monetary policy, the persistence of high Government deficits resulting from the shift from fiscal neutrality to fiscal activism from the late 1950s posed serious problems for prudent monetary management, in particular a conflict between the objectives of debt management and monetary policy. Interest rates were administered to contain the interest cost of public debt and statutory liquidity ratio requirements were periodically hiked for easy access to market borrowing. In this regard, the nationalization of banks and the transfer of ownership to the Government provided a captive market for Government securities. Simultaneously, recourse to the RBI was also high, leading to high levels of monetization of the fiscal deficit. 2.3 The need to free monetary policy from the fiscal constraint was recognized early. An internal working group proposed to segregate the RBI’s debt management function from the monetary management function as early as 1981. The Committee to Review the Working of the Monetary System, 1984 (Chairman: Professor Sukhomoy Chakravarty), in particular, made several recommendations to rekindle OMO as an instrument of monetary policy by limiting the monetization of the fiscal deficit, on the one hand, and developing the market for Government securities, on the other. The Committee on the Financial System, 1992 (Chairman: Shri M. Narasimham) recommended that the statutory liquidity ratio should be used in conformity with the original intention of a prudential requirement rather than a source of financing the public sector. Progress in the 1990s 2.4 The financial liberalization adopted in the 1990s with the overarching objective of reaping the benefits of competitive efficiency underscored the need to recast the monetary policy framework in tune with the increasing market orientation of the economy (Annex I). This required, ipso facto, a shift from relatively direct instruments of monetary control such as reserve requirements and credit controls to indirect instruments such as OMOs, which could work in consonance with the process of price discovery. 2.5 Liquidity expansion/contraction through OMOs was envisaged as an integral element of RBI’s monetary policy dispensation. The stage for OMOs was set by allowing the Discount and Finance House of India to deal in dated Government securities in April 1992 and issuing Government paper through the auction process in June 1992. The RBI created an Internal Debt Management Cell as an independent unit with effective from October 1, 1992. The RBI also decided to set up a new institution - the Securities Trading Corporation of India - dedicated to the development of a secondary market for Government securities. Open Market Operations and the Government Securities Market 2.6 The ability of the RBI to deploy OMO as a tool of monetary management in the 1990s was sharpened by the parallel development of the Government securities market and marketisation of debt management. With the switchover to borrowings by the Government at market-related interest rates through the auction system in 1992, the reduction in statutory liquidity requirements (SLR) to the statutory minimum of 25.0 per cent in October 1997 and the abolition of automatic monetisation by the replacement of ad hoc Treasury Bills by a system of Ways and Means Advances effective April 1997, it was possible to move towards greater market orientation in Government securities. 2.7 The RBI moved from a regime of de facto ‘privately fixed private placements’ (the pre-1992 period of ad hoc Treasury Bills) to ‘market-driven private placements’. Within the latter phase, the emphasis was on taking private placements with a view to offloading in the market when liquidity conditions stabilize. In more recent years, however, primary acquisitions through private placements have been ‘warehoused’ to smoothen volatility. This indicates that marketisation of Government’s borrowing programme is nearly complete. These measures have significantly empowered the conduct of monetary policy. 2.8 Further reforms in the Government securities markets have resulted in the rationalization of the Treasury Bills market, increase in instruments and participants, elongation of the maturity profile, creation of greater fungibility in the secondary market, institution of a system of Delivery versus Payment (1995), strengthening of the institutional framework through primary dealers (1996) and more recently, the creation of the Negotiated Dealing System (NDS) (2002) and the Clearing Corporation of India Limited (CCIL) (2002) and enhanced transparency in market operations. Clarity in the regulatory framework has also been established with the Notification under the Securities Contract Regulation Act (2000). 2.9 Further developments in the Government securities market hinge on the legislative changes consistent with modern technology and market practices, especially with the institution of the Real Time Gross Settlement System, integration of payment and settlement systems for Government securities and standardization of practices with regard to manner of quotes, conclusion of deals and code of best practices for repo transactions. Open Market Operations and the Conduct of Monetary Policy 2.10 The thrust of monetary policy in recent years has been to develop an array of instruments to transmit liquidity and interest rate signals in a more flexible and bidirectional manner. The RBI now manages liquidity through a market-oriented mix of repo operations under the Liquidity Adjustment Facility and outright transactions, reinforced by interest rate signals through changes in the Bank Rate and the reverse repo rate, in addition to the traditional tools of changes in reserve requirements and refinance facilities. The Market Stabilisation Scheme (MSS), introduced in April 2004, serves as an additional instrument of liquidity management. Under this scheme, the Government parks the proceeds of paper issued to mop up surplus market liquidity with the Reserve Bank. Liquidity management operations by the RBI are in alignment with the international country experience (Table 1 and Annex II). 2.11 The RBI has been able to use OMOs effectively to manage the impact of capital flows because of the stock of marketable Government securities at its disposal and development of financial markets as part of financial sector reforms (Table 2). During bouts of strong capital flows, such as during the first half of 1997-98 and 2002-04, the RBI was also able to convert the stock of non-marketable special securities, created out of funding of past ad hoc and tap Treasury Bills, into marketable paper. Besides, a strategy of combining private placements/devolvements with outright OMOs was able to neutralise the impact of temporary spells of tight liquidity on the interest cost of marketable public debt. Current Challenges for OMO 2.12 The large sterilization requirement of recent years has driven down the share of Government securities available with the RBI to 3 per cent of reserve money as at end-March 2004 from 91 per cent as at end-March 1991. This has circumscribed the ability of the RBI to conduct OMO in recent years. As a result, the RBI had to rely more on Liquidity Adjustment Facility and the MSS as OMO tools rather than outright absorption. III. REORIENTING OPEN MARKET OPERATIONS 3.1 The operating procedure of monetary policy has changed quite dramatically worldwide in the 1990s with the progress of financial liberalisation. The primary challenge of contemporary central banks is to harness liquidity conditions in financial markets to achieve their policy objectives. The international experience shows that OMO play an important role in steering interest rates, managing the liquidity situation in the market and signaling the stance of monetary policy. Broadly, OMO takes the form of reverse transactions (repo and reverse repo) when liquidity imbalances are expected to be short-lived; outright purchases or sales (and redemptions) of securities (including debt certificates) when liquidity shortages or excesses are expected to persist; foreign exchange swaps and deposit/lending facilities for finetuning operations. The evolution of operating procedures worldwide has been in tandem with the state of development of Government bond markets, integration of different segments of the financial markets and market infrastructure (Table 3). Open Market Operations in the Emerging Scenario 3.2 The Group is of the view that the need for reorienting OMO arises from the fact that the integration of financial market segments is far from complete (Annex III). Financial sector reforms undertaken since 1992-93 have brought in greater operational autonomy for banks and non-bank financial institutions, freeing of interest rates, introduction of financial innovations in various markets, development of new segments and opening up of the economy through a cumulative process of liberalisation of the exchange and payments regime and underlying policies for current and capital flows. Indian financial markets, however, continue to be characterised by segmentation in terms of maturity, liquidity and risk, asymmetric integration and lack of depth. 3.3 Even within the Government securities market, integration across tenor is as yet incomplete (Annex III). Pressures of surplus liquidity, in particular, have often ended up distorting the yield curve. The narrowing of yield spreads in the 2-year to 10-year residual maturity segment (from 183 basis points to 63 basis points) and in the 10-year to 20-year segment (from 95 basis points to 77 basis points) during September 2001 to May 2004 made the yield curve in India one of the flattest internationally then. During April-May 2004, abundant liquidity emanating from strong capital flows drove the yields on 91-day and 364-day Treasury Bills below the weekly reverse repo rate of 4.5 per cent (Chart 1). Furthermore, there were instances when the cut-off yield on 364-day Treasury Bills fell below that of 91-day Treasury Bills. 3.4 The debt management objective of developing a yield curve for the long end of the maturity spectrum, as well as the need to manage rollover risk has led to an elongation of the maturity profile in recent years (Table 4). However, liquidity continues to be limited to a few segments only. 3.5 Captive demand for Government securities in terms of Statutory Liquidity Ratio (SLR) requirements under the Banking Regulation Act, 1949 has been shrinking with the SLR having been brought down to the minimum statutory level. The proposed amendment to Banking Regulation Act would provide the Reserve Bank with the flexibility to set even lower levels of SLR requirements consistent with the objective of financial sector liberalisation. Also, the government securities market continues to experience episodes of severe illiquidity, particularly in a rising interest rate scenario. Furthermore, when banks, the major investor class in the Government securities markets, keep out of the market in view of the rise in interest rates, the participant base in the secondary market also thins substantially. In the context of possibility of varying SLR requirements, therefore, it is crucial to ensure that interest rate expectations or tight market conditions do not affect the ability of the Government to meet its fiscal borrowing requirements in a non-disruptive and stable manner. 3.6 Using OMOs to control longer term interest rates was actively mooted by US Fed as recently as 2002, in the context of containing deflationary pressures. The Fed had resorted to bond-price pegging before the Federal Reserve-Treasury Accord of 1951, when it maintained a ceiling of 2-1/2 percent on long-term Treasury bond yields for nearly a decade. In fact, it had even been advocated that the Fed could announce explicit ceilings for yields on longer-maturity Treasury debt and enforce these ceilings by committing to make unlimited purchases of securities at prices consistent with the targeted yields (Bernanke, 2002)1. 3.7 Taking into consideration all the above-mentioned factors and looking at the historical context of RBI’s developmental role and the evolution of the Government securities market in India, the Group felt that the RBI may continue its role of developing the markets with a view to facilitating market participants to take on themselves the role of supporting debt issuance in the context of RBI’s vacation from the primary market and engage in a process of efficient price discovery in the secondary market. The provisions of FRBM Act and proposed changes to BR Act are consistent with the RBI’s vision at the beginning of the reform process to work towards making the Government’s borrowing entirely market-based. 3.8 The FRBM Act also provides for ‘exceptional grounds’ that the Central Government may specify under which RBI may subscribe to primary issues. As the understanding stands today, action under exceptional grounds may be enabled by the Government. 3.9 The Group, therefore, recommended that while OMO would continue to be principally directed at residual/unanticipated liquidity movements driven by ‘autonomous’ forces such as the Government’s borrowing programme or capital flows, it may also be used to contain excessive volatility and promote orderly market conditions as well as to improve market liquidity in Government securities. RBI may, therefore, keep the option to participate in the secondary market as appropriate. IV. INSTITUTIONAL SETTING FOR DEBT MANAGEMENT 4.1 As the manager of public debt, the RBI is required to ensure that the borrowing programme of the Government is successfully carried out and the cost of borrowing, including roll-over costs, is kept low. Issues of timing, sequencing and judgment of market conditions are critical to ensure the successful execution of the borrowing programme. Current Status 4.2 An auction system for primary issuance of Government securities, introduced in 1992, currently covers almost the entire primary issuance of Government securities. Since 2002, the entire market borrowing programme of the Central Government is announced through half-yearly calendars. Generally, multiple price auctions are used for issuance of dated securities (barring special instruments like Floating Rate Bonds, bonds with optionality features and long tenor bonds) while Treasury Bills have been issued using both uniform and multiple price auctions at different points in time. Usually auction cut-offs are set at market-clearing levels. 4.3 The primary dealer (PD) system was created in 1996. There are currently 17 PDs. They are responsible for ensuring the success of primary auctions through a system of bidding commitments and success ratios and the scheme of underwriting of the auctions. Underwriting commitments are separately decided prior to the actual auction for primary issuance. PDs bid to underwrite various amounts at various commission rates. The actual allotment of the underwriting commitment is decided by the RBI after considering factors like the likelihood of devolvement and the commission sought. Rarely is the full notified amount allotted in underwriting auctions. Since underwriting is a purely voluntary responsibility, the success of primary auctions is sought to be achieved through bidding requirements, which are set at the beginning of the fiscal year for each PD depending mainly on its capital size. In order to ensure that bidding is not too defensive, the stipulation of a success ratio (40 per cent of bidding commitments) is mandated. There is no underwriting procedure for Treasury Bills and bidding commitments are fixed at a PD-wise flat percentage (determined at the beginning of the year) of the notified amount for each auction. The performance of bidding commitments and success ratios is monitored cumulatively over the year. 4.4 Even with the system of underwriting and bidding commitments for primary dealers (PDs) and buying interest from banks and large non-bank institutions compensating for any lack of interest by the PDs, some auctions of Government securities have remained undersubscribed. It is in these situations that the RBI took devolvement on itself of the uncovered portion in auctions and thereby ensured the success of each auction. In cases of sudden requirement of funds by the Government, or when market conditions were not favourable to holding an auction, the RBI has resorted to the route of private placements by purchasing the entire primary issue at market related rates. The RBI’s participation in the primary auction process, albeit at the margin, has ensured (i) that by acting as underwriter of the last resort, the central bank has enabled the Government to borrow as and when it required funds; and (ii) greater deterrence to irrational bidding behaviour. 4.5 In the final analysis therefore, the Group recognised the crucial role of the RBI in ensuring the full absorption of the Government borrowing programmes in the primary market. In the future, i.e., from April 2006, the RBI’s non-participation in primary auctions except under exceptional circumstances, as indicated in the FRBM Act, will require alternative institutional arrangements to ensure that • debt management objectives are met; and • the Government is able to borrow under all market conditions without exacerbating market volatility. Restructuring the Primary Auction Process 4.6 The Group was of the view that the RBI’s role in the primary market hitherto has to be replaced by a more active and dynamic participation by PDs. This will necessitate some restructuring of current institutional processes. 4.7 Since the current system of annual bidding commitments does not guarantee that the notified amount will be sold in each auction, the Group is of the view that a system of bidding commitments for each auction is preferable. All PDs put together must commit to bid 100 per cent of each auction. This would ensure that the notified amount is sold at each auction. 4.8 The Group recognised that 100 per cent bidding commitments by PDs does not ensure that the cost of issuance is minimised or is in line with price discovery. Accordingly, the Group felt that instead of bidding commitments, PDs could be required to underwrite the entire notified amount of an auction. As is the current practice, an underwriting auction will be held before the actual issuance. Each PD would have the responsibility of bidding a minimum percentage of the notified amount at the underwriting auction. The minimum amounts will be so fixed as to ensure that the entire notified amount is underwritten. This will also ensure that auction cut-offs are in line with market levels and the RBI will continue to have the option of cutting off the auction below the notified amount and devolving the remaining amount on PDs at the cut-off price so decided. Since PDs are free to bid underwriting commissions according to their perception of risk, the Group recommends the following institutional arrangements to ensure 100 per cent underwriting commitments by PDs: i) Minimum Underwriting Commitment (MUC): Secured and preferential access to primary auctions of government securities forms the rationale for developing PDs as a special class of investors in the primary market. Commensurate with this ‘special’ role, the responsibility of a PD in the primary auction process may be articulated in the form of a minimum underwriting commitment (MUC) in each auction. The MUC of each PD may be designed to ensure that at least 50 per cent of an auction is covered by the aggregate of all MUCs. Thus with 17 PDs in operation, each PD may be deemed to underwrite 3 per cent of the notified amount of each auction in its MUC. The MUC may be uniform for all PDs, irrespective of their capital or balance sheet size. PDs will not earn any commission on MUC, except as indicated in paragraph (4.8.3) below. ii) Additional Competitive Underwriting: The remaining portion of the notified amount may be open to competitive underwriting through underwriting auctions. Each PD would be required to bid a minimum of 3 per cent of notified amount. The auctions could be uniform price-based to ensure aggressive bidding and may be incentivised. The ACU will be remunerated through underwriting commission. iii) Commission on MUC - Only those PDs who succeed in the underwriting auction for a minimum of 5 per cent of the notified amount will be paid underwriting commission on their MUC. Others will get commission to the extent they are successful in ACU but will not get any commission for the 3 per cent MUC. 4.9 Recognising that the envisaged system casts a much larger responsibility on the PDs than under the current arrangements, the Group felt that PDs need to be compensated with appropriate incentives over and above those given currently such as access to the call market, cash and securities account with the RBI, refinance facility and access to LAF. RBI may examine the possibility of providing PDs with a facility to repo their auctioned stock with RBI for a limited period after the auction allotment to help them tide over temporary funding risk, in case liquidity conditions tighten in the markets. 4.10 In this context, the Group recommends exclusivity in primary auctions for PDs. Exclusivity may be brought about in phases, commencing with Treasury Bills and a few auctions of dated securities and expanded further as the system assimilates the process. Exclusivity in primary auctions is a fairly common phenomenon internationally (Table 5). Of the 39 countries surveyed, 29 had a primary dealer system. PDs had exclusive access to primary auctions in 15 countries and they had exclusive access to central bank OMO operations in 13 countries. Five countries offered exclusivity in second rounds of primary operations (after the main auction/tap issue) or offered non-competitive access to PDs. 4.11 In the light of the international experience and the critical role of PDs in the context of ensuring the smooth absorption of the Government’s borrowing programme in the emerging scenario, the Group felt that RBI could consider giving PDs preferential treatment in primary auctions. It may be iniquitous for PDs to discharge their obligations if they have to compete in primary auctions with entities that do not have such responsibilities. On the other hand there could be the risk that exclusivity may not be acceptable to some of the larger institutional investors at this stage. Besides, there could be concerns of cartelization and unhealthy practices in the market. The Group discussed the various issues that could arise in the context of exclusivity. i) Is there a possibility of cartelization – With 17 PDs who will be distributing the Government securities, there is some risk of cartelization among them because the entire market routes their demand through PDs. While it is not possible to entirely eliminate the possibility of cartelization in a skewed market, its possibility is sought to be minimized through competitive underwriting. The adverse consequence of cartelization is higher cost to the Government or to the investors. This may be unlikely in a situation where PDs underwrite the entire issue, since RBI retains the ability to control the issuance cost by devolving on the PDs. Similarly the possibility of manipulating secondary market prices through cartelization will be low because of more active RBI presence in the secondary market, and the fact that in a buyers market (supply exceeds demand) the ability of PDs to dictate terms to the buyers will be rather limited. If anything, there is a need to incentivise PDs to take up the responsibility of distribution of securities in what is essentially a buyers market. ii) Is there a risk of front running by PDs – Under exclusivity, investors, especially large institutional buyers would be routing their bids through PDs. There is a concern that if their position is exposed to PDs, the latter might front run the customers bids. Front running refers to a situation where a market maker trades ahead of any observed customer’s order in the same direction. The market maker buys securities ahead of his customer and therefore the price is higher at the time the customer’s order is executed. This is undesirable. However, it is unlikely to take place in the proposed primary issuance structure. Firstly, since large buyers will distribute their orders through many PDs, it is difficult for any one PD to know the order size. Secondly, since PDs are leveraged entities, their ability to hold securities is limited. As the customer can change/defer his decision to buy that security, the risk of PDs being left stranded with positions is a disincentive for front running. iii) Would the cost of primary acquisition go up for investors – Investors would only route their bids through PDs under exclusivity. Since investors will continue to have the full freedom to determine the price at which they would bid, there is no reason to believe that their cost of acquisition would go up. In fact, since PDs would compete to get customer bids to meet underwriting obligations, they might even pass on some of their underwriting commission to customer, reducing their cost of acquisition. iv) Bidding skills of investors – It is reasonable to presume that bidding skills of PDs would be superior to those of investors. There have been instances where institutional investors have placed rather inefficient bids in auctions. Routing them through PDs would mean that investors would price their bids on the basis of professional advice of PDs. This would be beneficial to the investors. 4.12 Exclusivity to PDs would not be an impediment to other categories of bidders since the only change for them is that they route their bids through PDs as is the informal system operating currently in case of most banks. The proposed system would improve the transparency of the bidding process. Moreover, PDs with underwriting obligations would compete for client bids and, therefore, the access to the auction for non-PDs would be efficient. Non-competitive bids can, however, be received directly from banks or PDs, as at present. Retail competitive bids will be placed through PDs or with banks that would, in turn, place them through PDs. 4.13 From the above, it is clear that despite some initial apprehensions of institutional investors, exclusivity may not inconvenience investors nor is it likely to compromise their treasury performance. However, RBI may consider taking a measured approach in selectively permitting exclusivity so as to introduce it in a smooth and non-disruptive manner, taking the comfort of end investors into account. More Flexible Issuance Process 4.14 The RBI has hitherto largely been resorting to multiple price auctions for dated securities. The Group is of the view that multiple price auctions are desirable in a bullish market where bidding tends to be aggressive because of the expected pay-off of long positions. Resorting to uniform price auctions in such markets would tend to make bidding overaggressive, as the experience of April 2004 shows. On the other hand, bidding tends to be very defensive in falling/flat markets. Resorting to uniform price auction would tend to make the bidding more aggressive, thereby improving the outcome for the issuer. The Group, therefore, recommends that the RBI conduct multiple as well as uniform price auctions flexibly depending on underlying market conditions. 4.15 In order to achieve better transparency and price discovery in the auction process (both primary auctions and OMO auctions), an open bidding process, where the participants would be aware of the bidding interest in a particular auction on a real time basis, can be introduced. The settlement of these auctions could also be STP enabled to settle along with secondary market transactions to improve netting efficiency. STP would also improve operational efficiency and enable same day settlement of auctions, thus facilitating quick tender auctions. 4.16 RBI may consider recourse to the book building method for some issues of Government securities when excessively uncertain market conditions increase the bidding risk at auctions. Select PDs may be appointed as arrangers for the issue (3 or 4 arrangers per issue, to avoid any single PD from being privy to investor interest for the entire auction). Each PD would arrange to place the stock within a range mutually agreed between RBI and the PD. As the PD undertakes to arrange the issue, the success of the issue is guaranteed, albeit at a cost. This method can also be used as an incentive for the PDs for better performance in primary and secondary markets. PDs may be selected for book building by ranking them according to stipulated criteria in terms of success in primary auctions and turnover in secondary markets. 4.17 The Group is also of the view that arrangements may be worked out to reduce the processing time for auctions to one or two days, particularly in extraordinary situations. 4.18 The Group notes that some of the above recommendations - exclusivity to PDs, open auction bidding process and book building route to issue securities – fundamentally alters the current issuance procedure, and therefore requires prior consultation with the Government of India. V. DEVELOPING THE GOVERNMENT SECURITIES MARKET Current Status 5.1 In the context of the more dynamic role sought for OMO and the associated debt management concerns, the Group is of the view that efforts need to be undertaken over the medium term to develop the Government securities market in terms of instruments/processes/participants. This should also encompass the removal of existing anomalies. The long-term objective should be to nurture a deep, liquid and vibrant market which can withstand pressures from large/unforeseen liquidity movements while simultaneously ensuring efficient price discovery. The development of a market for Government securities has been a sine qua non of the process of financial liberalisation. It is in this context that the RBI has taken a series of measures to develop the Government securities markets since the very inception of financial reforms. The Group noted that while market development has progressed satisfactorily, albeit in a graduated manner, there are still some imperfections in the markets which impede efficient price discovery as well as the conduct of debt management. 5.2 First, in the absence of instruments to take interest rate views, it is observed that the markets are active and liquid when rates are falling but turn lackluster and illiquid when rates rise (Chart 2). Low volumes render markets shallow and prone to price manipulations. Accordingly, the Group is of the view that it is necessary to enable market participants to take two-way positions, to ensure market liquidity, irrespective of the direction of interest rates. 5.3 Secondly, the number of actively traded securities is very low as compared with the total number of securities outstanding. As at end- February 2005, there were 121 Central Government securities with an outstanding amount of Rs. 8,953 billion. Of these, 44 securities with minimum outstanding issues of Rs. 100 billion or more accounted for 69 per cent of the total outstanding amount. The turnover to total outstanding ratio dipped sharply to 1.50 in 2004 from about 2 in 2003, while it ranged between 3-38 for developed countries. On a daily basis, hardly 10-12 securities are traded, of which the number of actively traded securities would be a mere 4-5. (Illustration given in Chart 3) . Without active trades in the markets, the yield curve is kinky making pricing of securities difficult. This also leads to a situation where securities of similar maturity profiles trade at very different yields, with the liquidity premium sometimes going as high as 50 basis points. 5.4 Thirdly, the investor base is thin leading to volatility in the markets and enabling a few active players to effectively determine prices (Table 4). A major portion of the Government securities are held by banks resulting in the concentration of risk in the financial system (Chart 3). Measures to Develop the Government Securities Markets 5.5 The Group felt that PDs may be invested with the following responsibility for market making. a. Market Making in the wholesale segment – The Group discussed various methods of evaluating secondary market performance of PDs such as mandating minimum bid-ask spreads (as it prevails in MTS2 in Europe), setting turnover targets etc. The recent episode on EuroMTS exposed the shortcomings of mandating spread limits. The Group felt that setting turnover targets may also be infructuous as PDs may resort to prearranged transactions just to meet turnover targets. The Group is also of the view that any targets mandated without the express consent of PDs is likely to prove ineffective. It, therefore, recommends that the RBI may, in consultation with the PDs, set some secondary market commitment linked to average stock and capital size. One possible criterion could be the transaction volume in Rs.5 crore (or higher) lots that PDs deal with non-PDs. A suitable penal provision could be built in to discourage prearranged deals just to build volumes. b. The Group also recommends that instead of ensuring strict adherence to any prefixed targets, it would be more effective if secondary market performance were also incentivised. Besides granting exclusivity to PDs as discussed earlier, the Group is of the view that the selection of eligible counterparties among PDs could be based on relative secondary market performance in both wholesale and retail segments. This selection may be done at reasonable frequency, say, quarterly, to ensure that PDs continue to strive to outperform each other. c. Market Making in the Mid Segment: PDs have remained, by and large, wholesale players only. Their contribution in making the market for the mid-segment investors like provident and pension funds, cooperative banks, trusts etc, has not been significant. The Group is of the view that PDs must be required to transact a minimum share (say 10 per cent) of their secondary market transactions (outright) with non-NDS members. Any excess over this minimum threshold would be reckoned for assessing secondary market performance of a PD for the purpose of exclusivity in secondary market transactions with the RBI. Active Consolidation of Government Securities 5.6 Reserve Bank has been, since the late 1990s, following a policy of passive consolidation, through the process of reissue of existing securities to achieve consolidation of stock. As a result, of the 118 outstanding securities issued by the Central Government as at the end of May 05, 13 have a size of Rs.15000 crore or more and together account for 29% of the total stock of Central Government securities. Twenty-two securities have an outstanding size of less than Rs.2000 crore. Thus, while re-issuance has achieved some degree of consolidation, there are still a large number of small sized securities and very few actively traded in the market. The lack of liquidity in all but a handful of securities underscores the need to ensure that adequate number of securities with sufficient outstanding size should be available in the market. 5.7 A faster way to consolidate stock would be through the process of active consolidation. This process of consolidation would involve, in one form or the other, buying back of large number of small sized illiquid Central Government securities from existing holders and issuing a smaller number of liquid securities in exchange. This will result in availability of more number of large sized securities. These large sized securities will be held across a wider base of market participants improving the availability of floating stock and thereby trading interest. The Group therefore recommends that active consolidation of securities may be considered. Instruments and Procedures: 5.8 Short selling3: In the current trading framework, market participants can only be ‘long’ in securities.4 This sometimes results in overpricing of certain securities as the participants who believe the security to be overpriced have no means of executing their view. In this context, the Group recommends that market participants be allowed to take short interest rate positions in the securities market. Specifically, the Group recommends the introduction of the following stages: Stage I -Intra-day Short Selling

Stage II - Short sale on zero net-duration basis - hedging

Stage III – Open Short Selling - position

5.9 The Group felt that in view of the skewed holding of Government securities in the Indian market, there could be instances of stock shortage for delivery. In view of the market-making role envisaged for PDs, the Group recommended that RBI may consider offering a securities borrowing window for PDs. US FED, for example, offers a similar facility to PDs. 5.10 Annex IV contains a detailed note on short sales, analyzing the risk factors and the safeguards. 5.11 STRIPS: The Group also recommends the expeditious introduction of STRIPS which enables better risk allocation in the appropriate investor class. It enables, for instance, the outstanding stock of long tenor securities held with banks to move to the insurance / PF segments while leaving the shorter dated STRIPS in the books of banks to match their liability profile. Besides, the derivatives market only extends up to five to seven years and this leaves the balance sheets of banks open to risk. STRIPS correct this mismatch by reallocation of risk. STRIPS also help in removing the anomaly of securities of similar maturity profile trading at yields much higher than those of benchmark bonds. Having an active STRIPS market would help the market correct such anomalies by stripping out the components of the illiquid, higher yielding bonds. The STRIPS could also help in creating more demand for Government securities since investors can generate a stream of future cash flows which has a better match with their liabilities. 5.12 There are certain preconditions that need to be met for the introduction of STRIPs. Firstly, the present Public Debt Act, 1944 does not have provisions for stripping and reconstitution of securities. The New Government Securities Act, when passed, would have the necessary enabling provisions. Secondly, there is a need to have a sizeable stock of securities having identical coupon payment dates so as to enable ‘bunching’ (subject to Government’s capacity to repay at a particular point of time). Thirdly, there should be fungibility among the coupon strips of the same date from different stocks. As regards technological and operational preparedness, the SRS (System Requirement Study) has already been done. The implementation of the module needs to be expedited so that the same takes off as soon as the legal enactments are in place. When Issued Market 5.13 “When, as and if issued” (also known as “when-issued” (WI)) markets are in place in many developed countries. WI trading in Government securities functions somewhat like trading in a futures market in that positions may be taken and covered many times before the actual settlement date. Such trading takes place between the time a new issue is announced and the time it is actually issued. WI trading has certain advantages like (i) facilitating the distribution process for Government securities by stretching the actual distribution period for each issue and allowing the market more time to absorb large issues without disruption and (ii) helping price discovery by reducing uncertainties surrounding auctions by enabling bidders to gauge market demand and price the securities being offered. 5.14 The international experience indicates that the estimated aggregate size of outstanding positions in the WI market typically exceeds the quantity of securities to be sold at that auction at some point between the date of announcement of the auction and the date on which the securities are delivered. Those positions can be taken more cheaply and potentially in greater size (due to the lack of a delivery requirement) during the WI period than in subsequent trading. Participants normally reduce the size of outstanding positions in the WI market as the issue date approaches. There is, however, the risk of participants overestimating their ability to cover short positions prior to settlement. Solutions to the potential for shortages may be found that do not impede when-issued trading. 5.15 The Group recommends that WI trading may be permitted in phases. In the first phase, WI trading be permitted in reissued securities. After about one year, it could be extended to new securities as well. The broad conditions subject to which WI trading could be permitted could be:

5.16 The introduction of WI trading involves short selling. Even in the absence of general short selling, the Group recommends that short selling can be considered for the limited purpose of WI trading. Also, since such trading involves settlement beyond the T + 1 cycle, the RBI has to specifically permit such settlement as the SCRA stipulates that all transactions other than spot transactions (T + 1) must be made on exchanges. Also, for the reasons stated in Para 5.10 in connection with short selling in Government securities, introduction of WI market would also have to be done after prior consultation with the Government. The treatment of gains or losses in trading would need to be clarified for market participants. Primary Dealers: Focus of Operations 5.17 The primary objectives of the PD system are to support the Government’s borrowing programme and provide liquidity in the secondary market. It is, therefore, desirable that the activities of the PDs remain focused on these objectives. The measures suggested in Chapter IV and in this Chapter will create an environment in which PDs would have the wherewithal to operate in all interest rate cycles. Accordingly, the Group is of the view that PDs’ exposures to non-Government securities as well as off-balance sheet business including merchant banking may be restricted in terms of appropriate limits on the risk-weighted assets in non- Government securities exposures. 5.18 The system of separate legal existence and not as part of a bank or financial institution for PDs has been favoured in India at the inception of PD system due to the then prevailing passive nature of investment by banks (due to high SLR requirements), lack of specialized skills in the areas of pricing, bidding, trading, risk management required for a primary dealer and need for a fresh approach to developing the Government Securities market. Looking at the performance of the PD system since its inception, there are no two opinions that the system has indeed played a great role in improving market liquidity. However, with the interest rate reversal and the current operating regulatory environment, the PDs have found it difficult to operate in a viable manner. In this context, suggestions have emerged that the participation in the PD system may be expanded to include banks to undertake PD activity departmentally. A review of PD system in various countries reveal that in almost all countries, the concept of Primary Dealers is limited to an activity and not an entity. That is institutions like commercial banks and investment banks, financial institutions and broker-dealers are designated as Primary Dealers, and no separate entity need be formed for this purpose. Annex V gives experience of some major countries in this regard. The Group therefore recommends that, in addition to current eligibility norms of becoming a non-bank financial company (NBFC) and the requirement of predominance of operations in Government securities, permitted structures for PD business may be expanded to include banks directly undertaking PD activity as a department with independent subsidiary books of account. The operations of the bank may be kept scrupulously distinct from the PD activities. In this background, appropriately restructuring the PD system may be encouraged with smaller PDs either raising the capital base or merging with parent banks where there are bank subsidiaries. Accounting Practices: 5.19 In the context of the sweeping changes envisaged for the secondary market for government securities, the Group felt it desirable to address the institution of appropriate accounting practices, including correction of existing anomalies. • Marking to Equity: Banks are reluctant to hold Government securities in a rising interest rate scenario, as the depreciation on securities in the Available for Sale (AFS) category are required to be charged to their Profit & Loss (P&L) account. If the depreciation as well as appreciation is permitted to be charged to the Reserve Account instead of P & L, the banks would have a greater incentive to hold/trade in Government securities than currently. IAS39 permits marking to market (MTM) on AFS to be charged to equity. Therefore, such a step would be in line with international standards. • Fair value Accounting: In line with international practices, adoption of fair value accounting may be considered so as to recognise both gains and losses in the case of the Held-for-Trading portfolio. This would give more operating elbow room for the participants. • Comprehensive Derivative Accounting Norms: To enhance transparency in the derivative market, which will also improve regulatory as well as internal management considerations, the Group felt that the ICAI may be requested to expedite introduction of comprehensive accounting standards covering all derivative instruments. VI. Technological Infrastructure for Trading and Settlement Systems: 6.1 The Group felt that it is desirable to move towards standardising T+1 settlement uniformly in lieu of T+0 and T+1 settlements that are being followed currently. This would standardise trading procedures and would help in better cash and risk management for both participants. In the event that participants might need to transact on a T+0 basis for any emergency purposes, it would be necessary for them to go through the RTGS instead of the NDS-CCIL settlement mechanism. The Group recommends, therefore, that the integration of Security Settlement System with RTGS may, therefore, be expedited. 6.2 Efforts may be made for early operationalisation of the proposed screen based order-matching trading system for Government securities. Since the proposed system provides transparency and real-time deal executions and reporting, the transactions involving short-sales and WI market may mandatorily be executed on the system. 6.3 With regard to the primary auction process, a fully automated underwriting auction module needs to be built into the NDS. Furthermore, a WI trading module will need to be introduced on the NDS with concomitant adjustments required to the systems with CCIL. Since it is preferable that WI trades are also settled along with primary market allotments, it may be useful to explore the possibility of primary and OMO auctions being routed through CCIL there may also be an exhaustive and effective monitoring of performance and surveillance module, either on NDS or as a standalone. 6.4 The NDS could be made robust by increasing the bandwidth to enable it to handle a larger number of participants accessing the system at the same time. The existing bottlenecks in terms of speed and availability may be addressed within the enhanced system requirement in an environment where participants will require to undertake quick tenders. The entire process from announcement of auction to announcement of results should not take more than one hour. In this regard, the Group felt that the Report of the Working Group on Screen Based Trading in Government Securities identifies the infrastructural bottlenecks in NDS and INFINET quite exhaustively and recommendations contained therein would largely address issues of systemic inadequacy. VII. SUMMARY OF RECOMMENDATIONS In pursuance of its terms of reference, the Group reviewed the evolution of OMO and noted the satisfactory albeit graduated progress since the 1990s. It also observed that the ability of the RBI to activate OMOs was sharpened by the parallel development of the Government securities markets. It also takes note of the constraints emerging on the use of OMO by the RBI on account of the depletion of Government securities in its portfolio due to large-scale sterilisation operations. The Group notes that some of the recommendations made by it fundamentally alter the debt issuance system/ prevailing regulation and therefore require prior consultations with the Government before they could be implemented. Against this background, the Group makes the following recommendations: 1. The Group recommended that RBI may keep the option to participate in the secondary market as considered appropriate with a view to contain excessive volatility, promote orderly market conditions and improve market liquidity in the Government securities market. (Para 3.9) 2. The Group favoured a system of 100 per cent underwriting commitment by PDs over a system of 100 per cent bidding commitments to be achieved through:

3. RBI may examine the possibility of providing PDs with a facility to repo their auctioned stock with RBI for a limited period after the auction allotment to help them tide over temporary funding risk, in case liquidity conditions tighten in the markets. (Para 4.9) 4. RBI may consider taking a measured approach in selectively permitting exclusivity to primary dealers in primary auctions, so as to introduce it in a smooth and non-disruptive manner, taking the comfort of end investors into account. (Para 4.13). 5. The RBI may resort to multiple and uniform price auctions flexibly depending on the underlying market conditions (Para 4.14). 6. In order to achieve better transparency and price discovery in the auction process (both primary auctions and OMO auctions), an open bidding process, where the participants would be aware of the bidding interest in a particular auction on a real time basis, can be introduced. (Para 4.15) 7. RBI may also be given flexibility to take recourse to the book building method for some issues of Government securities if considered necessary. (Para 4.16) 8. Arrangements may be worked out to reduce the processing time for auctions to one or two days, particularly in extraordinary situations. (Para 4.17) 9. The RBI may continue its role of developing the markets. In this regard, PDs may be invested with the responsibility for market making subject to incentives mentioned elsewhere like short selling, exclusivity, funding of G-secs already being allowed through repo. (Para 5.5) 10. The Group recommended the following market making obligations for PDs

11. In the mid-segment, PDs must make at least 10 per cent of their secondary market transactions (outright) with non-NDS members, with any excess reckoned for purpose of exclusivity in secondary market transactions with the RBI. (Para 5.5) 12. Active consolidation of securities may be considered to improve the availability of floating stock and thereby trading interest. (Para 5.7) 13. Market participants may be allowed to short sell Government securities. This may be introduced in a phase-wise manner and with appropriate safeguards. (Para 5.8) 14. RBI may consider offering a securities borrowing window for PDs. (Para 5.9) 15. The introduction of STRIPS will enable better risk allocation in the appropriate investor class. (Para 5.11) 16. WI market may be introduced in a phased manner. (Para 5.15-5.16) 17. PDs’ exposures to non-Government securities as well as off-balance sheet business including merchant banking may be restricted in terms of appropriate limits on the risk-weighted assets in non-Government securities exposures. (Para 5.17) 18. In addition to current eligibility norms of becoming a non-bank financial company (NBFC) and the requirement of predominance of operations in Government securities, permitted structures for PD business may be expanded to include banks fulfilling certain criteria directly undertaking PD activity as a department with independent subsidiary books of account. (Para 5.18) 19. The following changes in accounting practices will be desirable.

20. It is desirable to move towards standardising T+1 settlement uniformly in lieu of T+0 and T+1 settlements that are being followed currently (Para 6.1). 21. Integration of Security Settlement System with RTGS may be expedited. (Para 6.1). 22. Efforts may be made for early operationalisation of the proposed screen based order-matching trading system for Government securities. (Para 6.2) 23. With regard to the primary auction process, a fully automated underwriting auction module needs to be built into the NDS. Furthermore, a WI trading module will need to be introduced on the NDS with concomitant adjustments required to the systems with CCIL. Since it is preferable that WI trades are also settled along with primary market allotments, it may be useful to explore the possibility of primary and OMO auctions being routed through CCIL there should also be an exhaustive and effective monitoring of performance and surveillance module, either on NDS or as a standalone. (Para 6.3) 24. The NDS could be made robust by increasing the bandwidth to enable it to handle a larger number of participants accessing the system at the same time. The existing bottlenecks in terms of speed and availability may be addressed within the enhanced system requirement in an environment where participants will be required to undertake quick tenders. (Para 6.4) Annex I Review of Reforms in the Government Securities Market Reforms in the Government securities market have completed more than a decade since their initiation in 1992, a watershed year. Prior to 1992, the market was characterised by: • administered (and often artificially low) rates of interest to keep Government borrowing costs down; • captive investors (mostly banks) due to high SLR requirements; • an absence of a liquid and transparent secondary market resulting in the absence of a smooth and robust yield curve for pricing of the instruments. • higher lending rates led by non-market related yields on Government securities which affected the yield structure of financial assets in the system, and as a result of which Reserve Bank’s monetary management was dominated by direct instruments such as

2. It is against this backdrop of a burgeoning fiscal deficit and a compelling requirement of adopting fiscal prudence that the reforms in Government securities markets commenced in the beginning of the 1990s. Apart from the government’s increasing borrowing requirements and the requirement of keeping its borrowing cost reasonable it was the need to develop a benchmark for other fixed income instruments for the purposes of pricing and valuation, and to act as a conduit for convergence of interest rates in other markets together with a need to operate monetary policy through indirect instruments like outright OMOs and repos-which requires an active secondary market for G-Secs, that gave further rationale for undertaking reforms in Government securities market. Some of the most salient reforms initiated in the G-sec market since 1992 are presented in Box 1. The share of Government securities in financing the fiscal deficit of the Central government, has risen from 21 per cent in 1991-92 to 80 per cent in 2004-05, illustrates the significant role of the marketable dated securities and hence the continued vigor for carrying on with the reforms in government securities market. 3. It will be observed from Table 1 below that between 1992 and 2005, the outstanding stock of central government securities has increased twelve-fold to Rs.8,953.48 billion. As a proportion of GDP, it has more than doubled from 14.7 per cent to 33.51 per cent. The average maturity of securities issued during the current year (2004-2005) has elongated to 14.13 years from around 6 years in 1996. The weighted average cost of securities issued during the year first rose from 11.8 per cent in 1992 to 13.8 per cent in 1996 and then fell to 6.11 per cent in 2004-05. Turnover which had increased to over 200 per cent of GDP in 2003 in the falling interest rate scenario has reduced considerably (Table 1). Primary Market Developments Widening of Investor Base 4. Prior to the reforms, the investor base for government securities in India comprised banks, financial institutions, Provident Funds (PFs), insurance and pension funds primarily due to the nature of statutorily mandated investments. Diversification has taken place with the entry of cooperative banks, regional rural banks, mutual funds (especially the entry of 100 per cent Gilt Mutual Funds) and non-banking finance companies in the recent period. Even though the world over the Government securities markets has a dominant institutional holding pattern, to enable small and medium sized investors to participate in the primary auction of government securities, a “Scheme of Non Competitive Bidding” was introduced in January 2002, which is open to any person including firms, companies, corporate bodies, institutions, provident funds, trusts, and any other entity prescribed by RBI. The scheme provides for allocation of up to 5 per cent of the notified amount at the weighted average rate of accepted bids. Investors can bid through banks or PDs a minimum amount of Rs.10,000 to a maximum amount of Rs. 20 million. Screen based order-driven trading on the stock exchanges has also been introduced to encourage retail participation in the G-sec market. Consolidation of Issues to Improve Liquidity 5. In order to increase the secondary market turnover, especially in benchmark securities across the yield curve passive consolidation through reissuance/ reopenings was started in 1999 (Table 2).