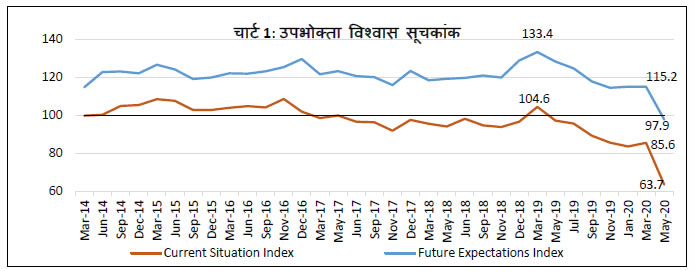

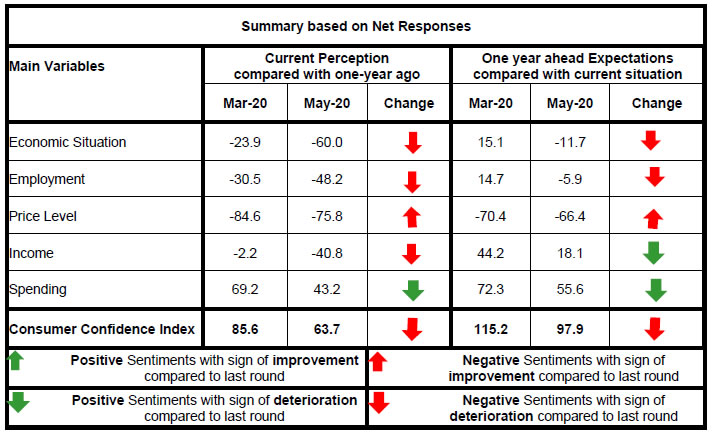

आज, भारतीय रिजर्व बैंक ने मई 2020 चक्र के उपभोक्ता विश्वास सर्वेक्षण (CCS)1 के परिणाम जारी किए। कोविद-19 महामारी के चलते, ये सर्वेक्षण 13 बड़े शहरों – अहमदाबाद, बेंगलुरु, भोपाल, चेन्नई, दिल्ली, गुवाहाटी, हैदराबाद, जयपुर, कोलकाता, लखनऊ, मुंबई, पटना और तिरुवनंतपुरम में मई 5-17, 2020 के बीच टेलीफोनिक साक्षात्कार के द्वारा आयोजित किया गया था। इसमें सामान्य आर्थिक स्थिति, रोजगार परिदृश्य, समग्र मूल्य स्थिति और पारिवारिक इकाइयों की आय और व्यय के संबंध में 5,300 पारिवारिक इकाइयों की धारणाओं और अपेक्षाओं के लिए प्रतिक्रियाएं प्राप्त की गईं। विशेष : I. वर्तमान स्थिति सूचकांक (CSI) के अपने ऐतिहासिक निम्न को छूने तथा एक वर्ष आगे की भावी अपेक्षाओं के सूचकांक (FEI)2 में तीव्र गिरावट के चलते मई 2020 में उपभोक्ता विश्वास निराशावादिता के क्षेत्र में प्रवेश कर गया (चार्ट 1)। नोट: कृपया समय श्रृंखला डेटा के लिए एक्सेल फ़ाइल देखें। II. सामान्य आर्थिक स्थिति, रोजगार परिदृश्य और घरेलू आय पर उपभोक्ता धारणाएं संकुचन क्षेत्र में अधिकाधिक जाती रही (तालिका 1, 2 और 5); जबकि आने वाले वर्ष में सामान्य आर्थिक स्थिति और रोजगार के परिदृश्य के बारे में प्रत्याशाएँ भी निराशावादी थी। III. सामान्यतया अतिआवश्यक खर्चों में अपेक्षाकृत रूप से कतर-ब्योत करने की कम गुंजाइश के चलते समग्र उपभोक्ता व्यय ठीक-ठाक रहा (तालिका 6 और 7); हालांकि, उपभोक्ताओं ने अपने ऐच्छिक खर्च में भारी कटौती रिपोर्ट की है और आने वाले वर्ष में इसमें अधिक सुधार की उम्मीद नहीं है (तालिका 8)।

| Table 1: Perceptions and Expectations on the General Economic Situation | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Improved | Remained Same | Worsened | Net Response | Will Improve | Will Remain Same | Will Worsen | Net Response | | May-19 | 38.8 | 23.6 | 37.7 | 1.1 | 61.4 | 17.7 | 20.9 | 40.5 | | Jul-19 | 37.4 | 24.2 | 38.4 | -1.0 | 59.4 | 16.0 | 24.6 | 34.8 | | Sep-19 | 33.5 | 18.6 | 47.9 | -14.4 | 53.2 | 15.0 | 31.8 | 21.4 | | Nov-19 | 30.0 | 18.4 | 51.6 | -21.6 | 48.9 | 16.5 | 34.7 | 14.2 | | Jan-20 | 27.1 | 18.0 | 54.9 | -27.8 | 48.8 | 14.3 | 36.9 | 11.9 | | Mar-20 | 28.4 | 19.3 | 52.3 | -23.9 | 49.8 | 15.6 | 34.7 | 15.1 | | May-20 | 14.4 | 11.2 | 74.4 | -60.0 | 39.6 | 9.0 | 51.4 | -11.7 |

| Table 2: Perceptions and Expectations on Employment | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Improved | Remained Same | Worsened | Net Response | Will Improve | Will Remain Same | Will Worsen | Net Response | | May-19 | 33.7 | 22.1 | 44.2 | -10.5 | 59.3 | 17.6 | 23.1 | 36.2 | | Jul-19 | 32.5 | 21.9 | 45.6 | -13.1 | 56.7 | 17.5 | 25.8 | 30.9 | | Sep-19 | 28.0 | 19.5 | 52.5 | -24.5 | 51.2 | 15.4 | 33.4 | 17.8 | | Nov-19 | 24.4 | 18.1 | 57.5 | -33.1 | 46.3 | 17.7 | 36.0 | 10.3 | | Jan-20 | 24.6 | 17.8 | 57.7 | -33.1 | 48.4 | 16.3 | 35.4 | 13.0 | | Mar-20 | 25.2 | 19.1 | 55.7 | -30.5 | 48.8 | 17.1 | 34.1 | 14.7 | | May-20 | 19.2 | 13.4 | 67.4 | -48.2 | 41.5 | 11.1 | 47.4 | -5.9 |

| Table 3: Perceptions and Expectations on Price Level | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | May-19 | 81.6 | 14.1 | 4.3 | -77.3 | 70.3 | 18.7 | 11.0 | -59.3 | | Jul-19 | 81.7 | 15.0 | 3.3 | -78.4 | 73.9 | 16.1 | 10.0 | -63.9 | | Sep-19 | 86.1 | 10.6 | 3.3 | -82.8 | 75.9 | 13.8 | 10.3 | -65.6 | | Nov-19 | 86.8 | 10.2 | 2.9 | -83.9 | 78.0 | 14.1 | 7.9 | -70.1 | | Jan-20 | 90.6 | 7.6 | 1.9 | -88.7 | 76.9 | 12.9 | 10.2 | -66.7 | | Mar-20 | 87.2 | 10.3 | 2.6 | -84.6 | 78.1 | 14.2 | 7.7 | -70.4 | | May-20 | 79.1 | 17.5 | 3.4 | -75.8 | 75.8 | 14.8 | 9.4 | -66.4 |

| Table 4: Perceptions and Expectations on Rate of Change in Price Level (Inflation)* | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | May-19 | 74.4 | 20.8 | 4.8 | -69.6 | 76.7 | 18.5 | 4.8 | -71.9 | | Jul-19 | 72.5 | 22.3 | 5.2 | -67.3 | 77.8 | 18.0 | 4.1 | -73.7 | | Sep-19 | 74.2 | 19.5 | 6.3 | -67.9 | 77.9 | 16.1 | 6.1 | -71.8 | | Nov-19 | 77.2 | 17.4 | 5.5 | -71.7 | 77.3 | 17.3 | 5.4 | -71.9 | | Jan-20 | 84.9 | 11.2 | 4.0 | -80.9 | 80.3 | 14.7 | 5.0 | -75.3 | | Mar-20 | 80.8 | 15.7 | 3.5 | -77.3 | 75.6 | 20.3 | 4.1 | -71.5 | | May-20 | 74.8 | 18.6 | 6.6 | -68.2 | 73.4 | 19.5 | 7.1 | -66.3 | | *Applicable only for those respondents who felt price has increased/price will increase. |

| Table 5: Perceptions and Expectations on Income | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | May-19 | 29.0 | 50.2 | 20.8 | 8.2 | 58.9 | 35.1 | 6.0 | 52.9 | | Jul-19 | 25.8 | 51.3 | 22.9 | 2.9 | 55.4 | 37.7 | 6.9 | 48.5 | | Sep-19 | 25.0 | 48.3 | 26.7 | -1.7 | 53.0 | 37.4 | 9.6 | 43.4 | | Nov-19 | 24.1 | 49.2 | 26.7 | -2.6 | 52.8 | 38.9 | 8.3 | 44.5 | | Jan-20 | 21.9 | 51.2 | 26.9 | -5.0 | 51.9 | 38.9 | 9.2 | 42.7 | | Mar-20 | 22.7 | 52.4 | 24.9 | -2.2 | 52.0 | 40.2 | 7.8 | 44.2 | | May-20 | 12.6 | 34.0 | 53.4 | -40.8 | 39.5 | 39.1 | 21.4 | 18.1 |

| Table 6: Perceptions and Expectations on Spending | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | May-19 | 68.6 | 28.0 | 3.4 | 65.2 | 74.7 | 22.5 | 2.9 | 71.8 | | Jul-19 | 71.7 | 25.0 | 3.4 | 68.3 | 76.8 | 20.1 | 3.2 | 73.6 | | Sep-19 | 74.1 | 22.0 | 3.8 | 70.3 | 77.0 | 19.0 | 4.0 | 73.0 | | Nov-19 | 73.2 | 23.4 | 3.4 | 69.8 | 77.4 | 19.0 | 3.6 | 73.8 | | Jan-20 | 76.3 | 20.5 | 3.2 | 73.1 | 78.7 | 17.3 | 4.0 | 74.7 | | Mar-20 | 72.6 | 24.0 | 3.4 | 69.2 | 75.8 | 20.7 | 3.5 | 72.3 | | May-20 | 56.1 | 31.0 | 12.9 | 43.2 | 64.3 | 27.0 | 8.7 | 55.6 |

| Table 7: Perceptions and Expectations on Spending- Essential Items | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | May-19 | 80.0 | 17.1 | 2.9 | 77.1 | 80.7 | 16.5 | 2.8 | 77.9 | | Jul-19 | 81.7 | 15.7 | 2.6 | 79.1 | 82.9 | 14.3 | 2.8 | 80.1 | | Sep-19 | 83.8 | 13.6 | 2.6 | 81.2 | 83.0 | 13.7 | 3.3 | 79.7 | | Nov-19 | 83.6 | 13.6 | 2.7 | 80.9 | 83.0 | 13.9 | 3.1 | 79.9 | | Jan-20 | 85.3 | 12.2 | 2.6 | 82.7 | 83.7 | 12.9 | 3.4 | 80.3 | | Mar-20 | 83.0 | 14.6 | 2.4 | 80.6 | 82.1 | 15.0 | 2.9 | 79.2 | | May-20 | 69.3 | 20.9 | 9.8 | 59.5 | 73.0 | 20.6 | 6.4 | 66.7 |

| Table 8: Perceptions and Expectations on Spending- Non-Essential Items | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | May-19 | 32.7 | 40.3 | 27.0 | 5.7 | 39.4 | 37.3 | 23.3 | 16.1 | | Jul-19 | 31.0 | 44.9 | 24.1 | 6.9 | 36.2 | 42.2 | 21.6 | 14.6 | | Sep-19 | 29.9 | 40.0 | 30.1 | -0.2 | 34.7 | 39.2 | 26.0 | 8.7 | | Nov-19 | 27.5 | 42.4 | 30.1 | -2.6 | 33.4 | 43.0 | 23.5 | 9.9 | | Jan-20 | 28.0 | 37.3 | 34.6 | -6.6 | 34.3 | 37.8 | 27.9 | 6.4 | | Mar-20 | 27.7 | 42.0 | 30.3 | -2.6 | 32.4 | 43.5 | 24.1 | 8.3 | | May-20 | 13.9 | 39.6 | 46.4 | -32.5 | 22.0 | 42.4 | 35.6 | -13.6 |

|

IST,

IST,