IST,

IST,

Does Fiscal Policy Matter for Growth? Evidence from EMEs

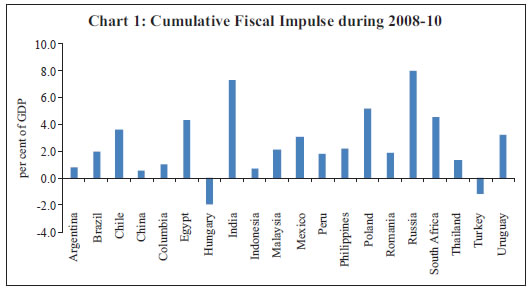

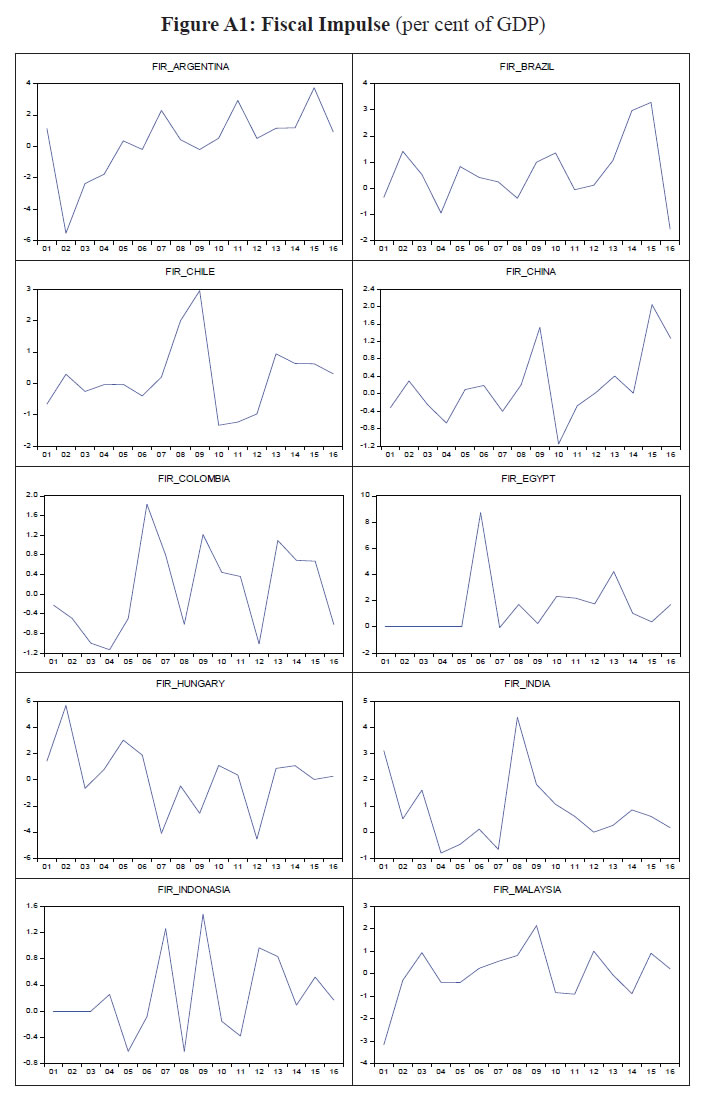

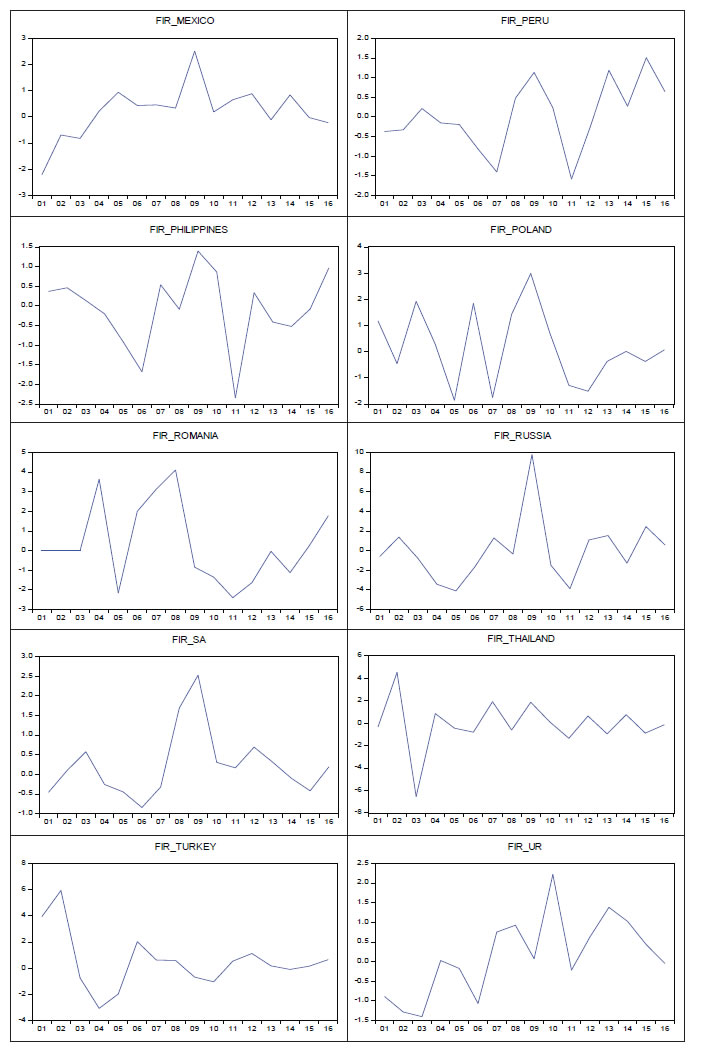

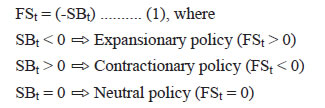

Indranil Bhattacharyya and Atri Mukherjee* In the wake of greater fiscal activism advocated globally to revive economies after the 2008 financial crisis, we examine the efficacy of fiscal policy in stimulating economic growth of 20 major Emerging Market Economies (EMEs) using dynamic panel estimation for the period 2000–16. Our findings, based on the fiscal stance derived from the Structural Balance (SB) approach of the International Monetary Fund (IMF), provide some revealing insights. For the full sample period, the results indicate the ineffectiveness of fiscal expansion in stimulating growth. Controlling for financial factors that caused the growth slump and truncating the sample in terms of pre- and post-crisis years, the impact of fiscal stimulus turns out to be positive and statistically significant in the latter period. These findings, which are robust to alternative measures of stimulus, indicate that the observed slump in growth in the post-crisis period would have been much sharper in the absence of stimulus, implying that fiscal activism pursued by these EMEs was successful in arresting the downslide of growth. JEL Classification : E60, E62, E32, F41 Keywords : Fiscal stimulus, structural balance, dynamic panel estimation, emerging markets Introduction Fiscal policy, as a prime lever of economic stabilisation policy, seeks to influence the level of aggregate demand in the economy in pursuit of the larger societal goals of higher economic growth, full employment and price stability. In the first half of the twentieth century, fiscal policy came to the centre stage of economic policy with its ascendancy attributed to the Keynesian policy prescription that deficiency of aggregate demand could be overcome by expansionary fiscal policy – through higher government spending. It became the principal tool in fighting wide-scale unemployment caused by the Great Depression of the 1930s and rebuilding the war-ravaged economies of Europe and Japan after the Second World War. Subsequently, fiscal activism (through tax cuts) undertaken by the Kennedy and Johnson administration helped in stimulating the American economy during the 1960s. The primacy of fiscal policy was challenged in the early 1970s by (i) the breakdown of the Bretton Woods Agreement; (ii) the OPEC oil shock of 1973; and (iii) mounting inflationary pressures in the United States (US). In this milieu, economists of the new classical persuasion argued that discretionary fiscal (and monetary) policy leads to market distortions and recommended the adoption of rule-based policies that help in avoiding expectation mismatches and uncertainty of outcomes. It was argued that fiscal policy was not sufficiently flexible for stabilisation purposes as it is often driven by exogenous political factors (Blanchard and Fischer, 1989); thus, the role of macroeconomic stabilisation is best left to the central bank. In this framework, fiscal policy was reduced to being a mere demand shock to be addressed through monetary policy (Kuttner, 2002). Against the background of rising deficit and debt problems circumscribing the fiscal space for policy activism, monetary policy gradually became the dominant theme in the general discourse on stabilisation policy during the 1990s. In a world of free capital flows, brought about by rapid deregulation and the development of financial markets worldwide, greater flexibility in exchange rates ensured that monetary policy supplanted fiscal policy as the prime instrument for achieving stabilisation objectives.1 In this regard, the adoption of the inflation targeting (IT) framework by many central banks and the subsequent easing of inflation pressures – coined as the ‘Great Moderation’ – provided credible evidence and intellectual succour for the dominance of monetary policy till the onset of the global financial crisis (GFC) in 2008. In the immediate aftermath of the GFC, the global economy experienced major deflationary shocks as aggregate demand plummeted owing to the loss of confidence in the financial system. Notwithstanding concerted and coordinated efforts undertaken to deal with both liquidity and solvency problems in major economies, the global economy stared at the prospect of severe depression worldwide. Despite the best efforts of major central banks in reducing interest rates to unprecedented levels (the ‘zero lower bound’) followed by the adoption of quantitative easing (QE) measures, credit conditions remained tight resulting in large-scale unemployment in many countries. With monetary policy rendered ineffective at the zero lower bound, attention once again turned to fiscal policy in stemming the rot. In typical Keynesian spirit, it was forcefully argued that government spending could provide the necessary stimulus to the economy to prevent the slide towards depression.2 While fiscal intervention turned out to be larger and of longer duration than initially envisaged, its success in reinvigorating economic activity has not been decisively established. While extensive literature is available which assesses the effectiveness of fiscal stimulus in advanced economies (AEs) (Baker and Rosnick, 2014; Coenen et al., 2012) and the subsequent ‘growth versus austerity’ debate sparked off by unfettered stimulus (Haltom and Lubik, 2013; Ortiz, 2012), similar work on EMEs are few and far between (e.g., Kandil and Morsy, 2010; Hory, 2016). EMEs, as a case study, are particularly interesting as they are distinctly different from AEs for several reasons. First, the fiscal space in several EMEs is usually much less as they are already saddled with high debt burden. Second, fiscal policy is generally procyclical in EMEs (Ilzetzki and Vegh, 2008) as against being countercyclical in AEs (IMF, 2009). Finally, the effectiveness of fiscal stimulus in EMEs gets negated to a large extent since policy credibility in these countries is usually weaker than in AEs. In this paper, we assess the effectiveness of fiscal stimulus on growth in 20 major EMEs vis-à-vis monetary and exchange rate policy. Although our paper is similar in spirit to Kandil and Morsy (2010), it is distinctly different in terms of the research question, data and methodology. While the former examines the cyclicality of the fiscal impulse and its impact on growth of real output in 34 (major and small) EMEs from the perspective of underlying conditions that enable fiscal stimulus to be successful, we study the efficacy of fiscal policy vis-à-vis monetary and external sector policies in stimulating growth using more recent data (2000-16). Moreover, we use SB as the measure of fiscal stance – a superior measure on methodological grounds as discussed later – in contrast to the cyclically-adjusted measure of government revenue and spending used by Kandil and Morsy to capture discretionary policies. Furthermore, we use the dynamic panel estimation method to examine the effectiveness of fiscal stimulus while Kandil and Morsy study the short- and long-run impact of such stimulus and its underlying conditions through a Vector Error Correction Model (VECM). Our results indicate that expansionary fiscal policy was ineffective in stimulating economic growth for the full sample period. The results, however, undergo a sharp change in the post-crisis period (2008–16), if controlled for financial factors that caused the growth slump suggesting that the slide in growth would have been more severe in the absence of fiscal stimulus. The rest of the paper is structured as follows: Section II provides a brief review of the theoretical underpinnings and the related empirical literature on the relationship between fiscal stimulus and growth, while Section III sets out the data and methodology of the empirical exercise. Section IV presents the results while some observations on the findings are discussed in Section V. Concluding remarks are set out in Section VI. Section II Theoretical Underpinnings The relevance and efficacy of fiscal policy as an instrument of macroeconomic stabilisation has generated a wide-ranging debate, both on theoretical grounds and empirical evidence. For instance, economists of the Keynesian tradition argue that the government spending multiplier is greater than one in contrast to neoclassical economists who are of the view that it is less than unity. Various extensions of the Keynesian model demonstrate that the magnitude of the spending multiplier is, however, not necessarily greater than one but depends on (i) the extent of monetary policy accommodation, (ii) the prevailing exchange rate regime, (iii) the degree of trade openness in the economy, and (iv) the extent of financial development (Tang et al., 2013). Illustratively, in a flexible exchange rate regime, higher interest rates caused by an increase in government spending may lead to greater capital inflows leading to an appreciation of the domestic currency. This may deteriorate the current account balance which is likely to depress the multiplier below unity. Similarly, the leakage from aggregated demand (spurred by higher government spending) through imports will be higher in a relatively more open economy, causing the multiplier to be small. On the other extreme, forward-looking households may save more during tax cuts to bear the burden of higher taxes in future; in fact, the tax multiplier would be zero resulting in no changes in output under strict Ricardian equivalence (Barro, 1974). There is another strand of literature that questions the basic direction of the multiplier and argues that it is, in fact, negative. This explanation is based on several ideas such as (i) fiscal credibility, (ii) uncertainty, (iii) debt sustainability, and (iv) risk premium which is largely drawn from empirical work (Giavazzi and Pagano, 1990; Alesina and Perotti, 1997; Alesina and Ardagna, 1998; 2009). Against a background of high levels of debt, early fiscal consolidation could augment households’ lifetime wealth by reducing the uncertainty of more costly and painful adjustments later (Blanchard, 1990). In a world of greater uncertainty and in which the government’s credibility is questionable, any fiscal expansion is likely to strengthen precautionary behaviour of households and firms which will make the multiplier negative (Hemming et al., 2002). Empirical Evidence Structural macroeconomic or vector autoregression (VAR) models often generate fiscal multipliers in a wide range (from negative to greater than four) depending on (i) underlying assumptions, (ii) fiscal instruments used, (iii) country specific factors, and (iv) sample periods (Spilimbergo et al., 2008). In studies based on structural macroeconomic models, the short-run multiplier is often positive, the spending multiplier is greater than the tax multiplier, and both are higher when monetary policy is accommodative. In the long term, however, crowding out effects can cause the multiplier to be negative. Based on the IMF Multimod model, the OECD Interlink model and the McKibbin- Sachs (MSG) model, research on US, Germany and Japan suggests that the short-term spending and tax multipliers are in the range of 0.6-1.4 and 0.3-0.8, respectively (Hemming et al., 2002). Findings from the IMF Global Integrated Monetary and Fiscal Model (GIMF) suggest that during periods of globally coordinated policy on fiscal stimulus, the world spending and tax multiplier is about 1.7 and 0.3, respectively (Freedman et al., 2009). Nevertheless, an increase in the world debt-gross domestic product (GDP) ratio consequent to fiscal expansion could lead to a permanent contraction in world GDP in the long run. Research based on the VAR approach suggests that while the multipliers are generally positive, both the spending and tax multipliers’ value is less than one with the latter being even lower than the former. While a structural vector autoregression (SVAR) model for the US yields a spending and tax multiplier of 0.9 and 0.7, respectively (Blanchard and Perotti, 2002), a sign restriction VAR produces even lower values at 0.6 and 0.3, respectively, for the two multipliers (Mountford and Uhlig, 2009). Empirical investigation of five OECD countries (including the US) over two sample periods found that the spending multiplier in the pre-1980 period for only the US was greater than unity although, over time, the value of the multiplier declined for all countries in the sample (Perotti, 2004). A comprehensive exercise on 20 advanced and 25 developing countries found that the impact spending multipliers were consistent with theory. For instance: (i) AEs recorded a higher multiplier than developing countries (0.24 as against 0.04); (ii) economies operating under fixed exchange rates showed a positive multiplier (0.2) in contrast to those having flexible exchange rates (-0.04); and (iii) closed economies had a positive multiplier (0.26) as against a negative one in open economies (-0.05). Furthermore, the spending multiplier for more indebted developing countries (debt–GDP ratio above 50 per cent) turned negative after four quarters (Ilzetzki et al., 2013). In contrast, based on quarterly data of 17 AEs for the period 1960-2015 and using a panel VAR approach, empirical evidence suggests that both the cumulative government consumption and investment multipliers are significantly higher than one at the effective lower bound (Bonam et al., 2017).3 These findings remain robust if (i) the eurozone is excluded from the sample or (ii) the business cycle is taken into account. In a similar vein, a recent study found that fiscal stimulus can reduce interest rates and credit default swap (CDS) spreads on government debt while improving fiscal sustainability in developed countries, especially during periods of economic slack (Auerbach and Gorodnichenko, 2017). Based on a cyclically-adjusted measure of government revenue and spending of 34 EMEs and using a VECM framework, a study suggested that fiscal policy tends to be procyclical in practice (implying stronger fiscal impulse, on average, during expansions vis-a-vis downturns), although the scope of countercyclical policy increases with increase in the level of foreign exchange reserves (Kandil and Morsy, 2010). Adequate reserve availability also enhances the credibility and effectiveness of fiscal policy. High inflation erodes policy credibility and offsets the effectiveness of fiscal stimulus in the short run, while fiscal expansion, if undertaken against the backdrop of a high debt burden, has an enduring negative impact on growth. In the context of 10 Asian developing countries, a study using the Mountford and Uhlig sign restrictions VAR framework found evidence of expansionary fiscal contraction (in terms of a positive tax shock) on output in China, Singapore, Taiwan, and Thailand (Jha et al., 2010). Empirical evidence suggests that the size of the fiscal multiplier is much smaller in EMEs compared to AEs. In this regard, the potential sources of difference between AEs and EMEs can be attributed to five key determinants, viz. (i) degree of trade openness; (ii) health of public finances; (iii) savings rate; (iv) capacity utilisation rate; and (v) the level of financial development in the economy. While higher levels of imports, public debt and savings reduce spending multipliers, unemployment and financial development increase their impact, both in EMEs and AEs. The size of the impact of each determinant is relatively more important in EMEs than in AEs, but the small magnitude of fiscal multipliers in EMEs suggest that governments in these countries must improve efficiency of fiscal policy. Moreover, such efficiency is nearly insignificant at low levels of public debt in EMEs thereby suggesting that a reduction in debt is not sufficient to improve policy effectiveness. Furthermore, spending multipliers become negative in relatively more open EMEs which is symbolic of crowding out of private demand (Hory, 2016). In this context, EMEs need to augment their policy credibility by improving the quality of their institutions in order to establish a stable macroeconomic environment and enhance the efficacy of fiscal policy (Lane, 2003). Section III We empirically test the relative impact of fiscal policy, monetary policy and external sector developments on economic growth of EMEs through fiscal stimulus, broad money and real effective exchange rate (REER), respectively. While growth in broad money (a commonly used proxy for the extent of monetary accommodation) is representative of monetary policy in a cross-country perspective, changes in REER are indicative of external sector developments. Fiscal impulse, our measure of fiscal activism, is more balanced than both the spending and the tax multipliers (which are commonly used in the literature to represent fiscal proactiveness) as it takes a composite view of both the revenue and expenditure position of the government. Fiscal impulse, which is a derived measure from overall government balance, is discussed below. Measuring Fiscal Stimulus Conventional wisdom suggests that fiscal policy could act as a stabilisation instrument through (i) the automatic stabilisers that makes fiscal policy expansionary during recessions and contractionary during booms, and (ii) the discretionary channel by which changes in government spending and taxation respond to changes in economic activity (Weil, 2008). As a result, conclusions drawn from the overall fiscal balance about the fiscal policy stance can often be misleading. In view of this, cyclically adjusted balances (CAB) i.e., the fiscal balance adjusted for the business cycle has gained traction both in empirical work and policy debates. Moreover, any adjustment that corrects for transitory factors apart from the business cycle, such as terms-of-trade shocks or one-off factors (large windfall revenue gains, sales of concession rights, write-offs related to recapitalisation of banks, changes in asset prices, etc.) generates the SB. Thus, while the CAB corrects for cyclical effects of revenue and expenditure, the SB further adjusts for temporary revenue and expenditure items and factors that are not closely related to the business cycle (Bornhorst et al., 2011)4. In the case of countries whose fiscal revenues are significantly dependent on commodity exports, one common adjustment that is usually made is the effect of terms-of-trade shocks (Ghosh and Misra, 2016). Illustratively, adjusting for this factor is particularly appropriate for export-oriented economies such as Chile (a copper exporter) whose government spending may be highly correlated with movement in copper prices. In recent years, several AEs and some EMEs have incorporated SBs in their fiscal rules as it improves fiscal transparency and enhances the stabilising properties of the rule (Misra and Trivedi, 2016). In this study, the fiscal impulse (FI), i.e., the addition or withdrawal of fiscal stimulus by the government is derived from the incremental change in fiscal stance (FS) over time. The FS measures the discretionary component of fiscal policy. In other words, the FS provides a quantification of aggregate demand management through fiscal policy which can be (i) expansionary (if fiscal balance is negative); (ii) contractionary (if fiscal balance is positive); and (iii) neutral (if fiscal balance is zero). The most commonly used indicators of FS include (a) CAB, (b) SB, (c) Primary Balance (PB), and (d) neutral balance.5 In our analysis, FS of each of the 20 EMEs has been estimated based on SB by using the following formula:  Our preference for choosing SB over CAB for estimating FS is based on superiority of SB over CAB as mentioned before: SB is a further refinement over CAB as it corrects for a broader range of factors.6 The change in FS amounts to FI, which measures the addition or withdrawal of fiscal stimulus. Accordingly, FI is estimated in the second stage based on the formula:  A positive FI implies that the FS is getting more expansionary, i.e., accommodative over time and vice versa.7 FI, thus estimated, is expressed as a proportion of GDP to ensure scale neutrality across countries. The derived estimates reveal that there is significant variation in FI across the select group of EMEs, though most of them embarked on an expansionary fiscal policy during the GFC or in its immediate aftermath (Figure A1, Annex). Data In contrast to Kandil and Morsy, we leave out the relatively smaller EMEs from the sample and concentrate on the major ones (20) which account for around 80 per cent of GDP of all EMEs. The select group of countries include Argentina, Brazil, Chile, China, Colombia, Egypt, Hungary, India, Indonesia, Malaysia, Mexico, Peru, Philippines, Poland, Romania, Russia, South Africa, Thailand, Turkey and Uruguay for whom data are available for all the relevant variables. Our estimation is based on annual data for the period 2000-16 which is more recent than Kandil and Morsy’s unbalanced panel (1963-2008). While real GDP have been sourced from the IMF’s World Economic Outlook (WEO) database, fiscal impulse is estimated from the SB which is also obtained from the WEO database. Broad money and REER are sourced from the IMF’s International Financial Statistics (IFS) and the Bruegel datasets, respectively. While real GDP growth is the dependent variable, the explanatory variables in the model are the fiscal impulse (as proportion of GDP), growth in broad money and changes in the real effective exchange rate. Real GDP growth for most of the EMEs lies in the range of 2-6 per cent for the sample period, except for China and India whose growth rates have been significantly higher. There are substantial variations across countries in terms of monetary stimulus, with average broad money growth exceeding 20 per cent in the case of Argentina, Russia and Turkey, and being less than 10 per cent for Hungary, Malaysia, Poland and Thailand (Table A1, Annex). Most of the EMEs recorded small appreciation in REER during the period with few exceptions. Diagnostics The time series characteristics (stationary properties) of the variables viz., real GDP growth, fiscal impulse, monetary growth and changes in real effective exchange rate are verified through panel unit root tests (Im et al., 2003; Levin et al., 2002; Maddala and Wu, 1999). In comparison to the unit root test applied on a single series, panel unit root tests are considered to be more powerful as the information content of the individual time series gets significantly enhanced by that contained in the cross-section data within a panel set up (Ramirez, 2006). The results of panel unit root tests reject the null hypothesis of a unit root for each of the four series indicating all the four variables are stationary (Table 1). Section IV Estimation Technique Economic policy interventions (both fiscal and monetary) usually entail a dynamic adjustment process. In empirical analysis of policy interventions, policy variables are usually not strictly exogenous but simultaneously determined with the outcome variable (Besley and Case, 2000). Even when the covariates are not simultaneously determined, they may still be influenced by past values of the outcome variable. Linear dynamic panel models, which include past (lagged) values of the dependent variable as explanatory variables, contain some unobserved panellevel effects, which can be fixed or random. By construction, the unobserved panel-level effects are correlated with the lagged dependent variables in a dynamic panel set-up, which make the standard errors inconsistent. To address this problem, a consistent generalised method of moments (GMM) estimator for this model was developed by Arellano and Bond (1991), which, however, performs poorly if (a) the autoregressive parameters are too large; or (b) the ratio of the variance of panel-level effect to the variance of idiosyncratic error is too high. Overcoming this shortcoming, Arellano and Bover (1995) subsequently developed a system estimator that uses additional moment conditions.8 In this methodology, it is assumed that there is no autocorrelation in the idiosyncratic errors and requires the initial condition that panel-level effects are uncorrelated with the first difference of the first observation of the dependent variable.9 Results In view of the above, the following model is estimated in a dynamic panel framework with annual data from 2000-16 for the select group of EMEs mentioned above.  In this equation, real GDP growth (Δy) is the dependent variable while its one period lagged value has been taken as an explanatory factor in the model. X is the matrix of explanatory variables: i (i = 1....N), t (t = 1…..T), where i indicates country and t represents year. The other explanatory variables include fiscal impulse, growth in broad money and changes in real effective exchange rate. Model estimation is done through GMM as the data used for this analysis constitutes a wide panel involving larger number of cross sections and relatively shorter time period. The endogeneity problem is addressed by using both Arellano-Bond (1991) and Arellano-Bover (1995) estimation methodology. The country fixed effects are removed by transforming the variables through first difference in case of the former and through orthogonal deviations for the latter. The efficiency of the GMM estimator depends on the validity of its instruments; in this case, lagged values of the dependent variable are used as instruments for the GMM which captures the persistence of both GDP and fiscal impulse. White period GMM weighing matrix has been used which assumes that innovations have time series correlation structure that varies by cross section. Robustness of the models are examined through Sargan-Hansen J test and Arellano-Bond serial correlation test. The empirical results are presented in Table 2. For Model 1, the Arellano– Bond serial correlation test accepts the null hypothesis that the errors in the first-differenced equation do not exhibit second order serial correlation (p-value of AR(2) is 0.88) and thus ensures consistent parameter estimates for the model. The results of the Sargan–Hansen J test for both the models (acceptance of the null) indicate that the instruments are valid. The results of the two models are similar, both in sign and magnitude. In both the models, the coefficients of all the explanatory variables (except the lagged dependent variable) are found to have strong statistical significance. The estimation results reveal that real growth is positively impacted by past GDP growth, growth in broad money and changes in REER (implications are discussed in Section V). Contrary to a priori expectations, however, fiscal impulse seems to have a strong negative impact on real growth implying expansionary fiscal contraction in our sample. These results are consistent with other findings about fiscal expansion having a negative impact on real growth of EMEs in the short run (Jha et al., 2010; Kandil and Morsy, 2010). As an alternative methodology, a panel autoregressive distributed lag (ARDL) model was estimated to capture the dynamic influence of the explanatory variables on real GDP growth with identical time period (2000-16) covering the same set of countries.10 In a panel ARDL approach, the unit root test is applied to exclude the possibility of I(2) variables (Pesaran et al., 2001). In this case, all the variables are I(0) and thus suitable for application of panel ARDL technique (Table 1). The optimal number of lags was selected using the Akaike Information Criterion (AIC). The long-run estimation results are presented in Table A2 in the Annex. The results are broadly similar to that of the dynamic GMM. The coefficients of broad money growth and REER are positive and significant, whereas the fiscal impulse has a negative impact on growth. Anatomy of a Negative Fiscal Impact The counter-intuitive result of a negative fiscal effect on growth is somewhat paradoxical given the large stimulus programmes undertaken during the crisis. While the direction of the estimated equation (Equation 3) runs from fiscal stimulus to growth, it was the slump in growth in the post-crisis period which warranted the fiscal stimulus in the first place. The fall in growth was caused by several financial factors. Consequent to the global financial meltdown after the crisis, credit markets were in seizure as banks exhibited extreme risk aversion in lending. Beside the direct impact through the credit channel, growth in EMEs also suffered from the collapse of global trade, commodity prices, investment and remittances sent by migrant workers. Thus, the slump in growth was the disease for which the fiscal stimulus was touted as the cure. These financial factors, however, are not captured by the model (equation 3). Omission of such variables (mis-specification errors) could lead to inaccurate estimates which may be misleading from a policy perspective. To address this problem and get more robust estimates, we augment our model with time-specific fixed effects. While correcting for the omitted variable bias, the time-fixed effects also capture the influence of aggregate time series trends. Controlling for time effects (by using a dummy variable for each period) removes the influence of aggregate trends which have nothing to do with the causal relationship between the dependent and explanatory variables. An estimation of equation 3 after controlling for the time effects generates results which are in sharp contrast with the earlier ones.11 Although the coefficient of lagged dependent variable continues to remain significant with a positive sign, the impact of fiscal impulse, monetary growth and REER are rendered insignificant after the introduction of period dummies (Table 3). The sign of the fiscal impulse, however, now turns positive. Did Fiscal Stimulus Matter in the Post-GFC Period? While the findings of the previous exercise refute the idea of fiscal stimulus accelerating growth over the full sample period, an interesting proposition to investigate is whether the stimulus undertaken during the GFC and its immediate aftermath were effective in reviving growth thereafter, particularly in view of its widespread acceptability among economists and policymakers not only in AEs but also in EMEs. The full impact of the GFC was first realised at the beginning of 2009 after the global financial market meltdown of October 2008 with the collapse of Lehman Brothers. To counter its adverse impact on the economy, many countries favoured an aggressive fiscal stance in the wake of monetary policy being ineffective at the zero lower bound. It was hoped that fiscal stimulus through government spending and tax cuts could resurrect aggregate demand and lift the economy from sliding into a deep and prolonged depression. Similar to AEs, EMEs also embarked on a path of stimulus which was mostly concentrated during 2008-10. During this period, the average cumulative stimulus in our sample was around 2.5 per cent of GDP, with 18 countries undertaking positive stimulus in the range of 0.7-8.0 per cent of GDP (Chart 1). Equation 3 is re-estimated separately for the pre-crisis (2000-07) and post-crisis (2008-16) periods, using the Arellano-Bover methodology with time-fixed effects. The estimated results for the pre- and post-GFC periods are presented in Table 4. The results of the Sargan-Hansen J test for both periods suggest that the instruments are valid. The coefficients of the explanatory variables in the two sub-periods are now strikingly different from each other. For the pre-GFC period, the coefficients of lagged GDP, monetary growth and real effective exchange rate growth turned out to be positive and significant. Past GDP has a positive impact on real growth confirming persistence. Monetary growth stimulates real GDP positively as does exchange rate appreciation (see explanations in Section V). The coefficient of fiscal impulse, on the other hand, was insignificant, implying relative ineffectiveness of fiscal policy in stimulating aggregate demand. The picture, however, changes dramatically in the post-GFC period. The coefficient of fiscal impulse turns positive and significant during this period, whereas all other explanatory variables are rendered insignificant. Thus, the results are indicative of the resurgence of fiscal policy in stimulating growth in the post-GFC period. Before the crisis, the role of fiscal stimulus was on the wane as fiscal discipline- enforced through the introduction of fiscal rules- was taking centre stage in several countries. After the outbreak of the crisis, adherence to such rules became questionable given that growth concerns remained paramount in public policy debates. The extraordinary fiscal expansion undertaken by the EMEs to combat the crisis, however, gave rise to the apprehension that monetary policy will have no choice but to accommodate higher government borrowings in the medium term (RBI, 2013). The positive and statistically significant impact of fiscal stimulus in the post-crisis period basically indicates that after controlling for the unobserved factors, the relationship between fiscal stimulus and economic growth turns out to be positive. In other words, the observed slump in growth in the post-crisis period would have been much sharper in the absence of fiscal stimulus. From that perspective, the post-crisis stimuli undertaken by these EMEs have been able to arrest the downward spiral of growth. Robustness To verify the strength of the results, equation 3 is re-estimated using the Arellano-Bover methodology with time-fixed effects for the select group of EMEs with fiscal impulse derived from CAB rather than SB. There is, however, one limitation for this dataset as CAB data for four countries, viz. Chile, Egypt, Indonesia and Romania are not available before 2004 resulting in an unbalanced panel. Nevertheless, the estimation results in Table 5 suggest a similar direction of impact (with marginal change in magnitude) to that obtained from the analysis using SB thus validating our earlier findings in Table 4. A closer look at the headroom available for fiscal and monetary policy operations in the selected set of EMEs reveals that the policy rates were much higher than the ‘zero lower bound’ for all the EMEs in the pre-GFC period (2006-07) (Table 6). Post-GFC (2010-11), policy rates generally declined in all countries, reflecting monetary easing by the central banks to arrest fears of a liquidity crunch. In contrast, there was limited fiscal headroom in many of the EMEs in the pre-GFC period; in Brazil, Egypt, Hungary, India, Poland, Romania and Turkey, the general government structural deficit exceeded 3 per cent of GDP. As expected, the average government balance in most of these countries deteriorated in the post-GFC period. It is pertinent to note that despite less headroom for manoeuvrability in these EMEs, fiscal stimulus was undertaken which essentially reflects the desperation of the authorities to get the economy back on track. For the full sample period, our empirical findings can be interpreted in the following manner. While the positive coefficient of the lagged dependent variable confirms the persistence of real GDP growth, monetary expansion stimulates growth; perhaps, through greater availability of resources leading to lower cost of funds which facilitate higher investment and capacity creation in the economy. The positive impact of REER, however, runs contrary to common perception. It is important to note that EMEs witnessed large capital inflows before the crisis, basically in search of higher yields. Such flows resulted in easy monetary conditions and an appreciating REER in these countries. Since EMEs were experiencing higher growth in the pre-crisis period, its coexistence with an appreciating REER is not surprising.12 As mentioned earlier, the negative (but statistically significant) fiscal impact can be attributed to factors such as: (i) low policy credibility; (ii) reserve inadequacy; (iii) more open economy; and (iv) more indebtedness. Controlling for omitted variables in the model, the impact of fiscal impulse on growth turns positive (although statistically insignificant) which is similar to that of monetary policy and REER. After truncating the sample, the results from the pre- and post-crisis periods reveal starkly contrasting outcomes. For the pre-crisis period, the impact of monetary policy and REER on growth turns out to be positive (and significant) while fiscal impulse is negative (but insignificant). In the immediate aftermath of the GFC, many EMEs embarked on a path of sustained stimulus hoping that government spending could resurrect the economy from sliding into depression. Our results for the post-crisis period suggest that fiscal stimulus arrested the slide in growth (positive and significant impact) implying that the growth slump could have been much more severe in the absence of stimulus. The results also reflect the potency of fiscal policy in arresting the growth slowdown vis-à-vis other instruments. The smaller impact of fiscal stimulus on growth (less than one) warrants some explanation. As mentioned before, there are some key determinants of the fiscal multiplier which vary significantly between AEs and EMEs, resulting in more modest multipliers for the latter vis-à-vis the former. First, greater trade openness is expected to have a negative impact on the fiscal multiplier as higher imports are a leakage from aggregate demand. Second, against the backdrop of persistent concerns on debt sustainability, any fiscal expansion can crowd out private demand in EMEs due to the absence of alternative modes of financing and endemic credit constraints. Along with the possibility of forward-looking agents increasing current savings to bear higher tax burden in future, these two effects, cumulatively, could depress the multiplier (Sutherland, 1997). Third, the extent of capacity utilisation in the economy is an important determinant of the size of the multiplier which is at its maximum when (a) the inventory level is insignificant; and (b) there is existing excess capacity in the economy which can respond to the rise in demand without stoking inflation pressures (Baum and Koester, 2011; Baum et al., 2012). Finally, the level of financial development – often proxied by the credit-to-GDP ratio – also matters in determining the multiplier’s magnitude. For instance, a weak credit-GDP ratio can signify credit-constrained economic agents who, being less forward-looking, cannot undertake consumption smoothing. As such, the sensitivity of EMEs to these various factors crucially depends upon the relative phase of their financial development (Hory, 2016). Our findings may also be reflective of the diversity in our sample, ranging from large semi-open economies (e.g., China, India) to the much smaller but largely open economies (e.g., Hungary, Malaysia). Exploring the determinants, size and sign of the fiscal multiplier in each country would require a more nuanced approach which would recognise the heterogeneity in the level of financial development and the prevailing country-specific institutional features and practices. This paper investigates whether fiscal policy is an effective macroeconomic stabilisation tool in EMEs – a topic which has received relatively limited attention in the empirical literature. Judging from the active use of discretionary fiscal policy in several EMEs, especially after the GFC, policymakers had unequivocal confidence in its efficacy. Our empirical findings suggest that the disruption of growth could have been much more severe had stimulus measures not been undertaken by these EMEs. Despite limited headroom, particularly in EMEs, fiscal policy measures can sometimes be effective under specific circumstances. Yet, differences in the stage of economic development and inherent fiscal strengths/weaknesses of each country can provide contrasting results. As mentioned before, greater diversity in country-specific characteristics and heterogeneity in the level of financial development among EMEs calls for a more nuanced approach in assessing the impact of fiscal policy rather than straightjacketing them in some benchmarks which are more appropriate for AEs. Admittedly, this is an area for more focussed research in future. References Alesina, A., and Ardagna, S. (1998). ‘Tales of fiscal adjustments’, Economic Policy, 13(27), 489–545. — (2009). ‘Large changes in fiscal policy: Taxes versus spending’, NBER Working Paper Series, 15348. Alesina, A., and Perotti, R. (1997). ‘The welfare state and competitiveness’, American Economic Review, 87(5), 921–39. Arellano, M. and Bond, S. (1991). ‘Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations’, The Review of Economic Studies, 58 (2), 277-297. Arellano, M. and Bover, O. (1995). ‘Another look at the instrumental variable estimation of error-components models’, Journal of Econometrics, 68(1), 29–51. Auerbach, A. J., and Gorodnichenko, Y. (2017). ‘Fiscal stimulus and fiscal sustainability’, Paper presented at 2017 Economic Policy Symposium hosted by the Federal Reserve Bank of Kansas City, Jackson Hole, August 24–26. Baker, D. and Rosnick, D. (2014). ‘Stimulus and fiscal consolidation: The evidence and implications’, Macroeconomic Policy Institute, IMK Working Paper 135, July. Barro, R. (1974). ‘Are government bonds net wealth?’ Journal of Political Economy, 82(6), 1095–1117. Baum, A. and Koester, G. B. (2011). ‘The impact of fiscal policy on economic activity over the business cycle-evidence from a threshold VAR analysis’, Discussion Paper Series 1: Economic Studies, (03–2011). Baum, A., Poplawski-Ribeiro, M., and Weber, A. (2012). ‘Fiscal multipliers and the state of the economy’, IMF Working Paper, WP/12/286. Besley, T. and Case, A. (2000). ‘Unnatural experiments? Estimating the incidence of endogenous policies’, The Economic Journal, 110, F672–F694. Blanchard, O. (1990). ‘Suggestions for a new set of fiscal indicators’, OECD Economics Department Working Paper No. 79. Blanchard, O. and Fischer, S. (1989). Lectures on macroeconomics, Cambridge, MA: The MIT Press. Blanchard, O., and Perotti, R. (2002). ‘An empirical characterization of the dynamic effects of changes in government spending and taxes on output’, Quarterly Journal of Economics, 117(4), 1329–68. Blundell, R.W. and Bond, S.R. (1998). ‘Initial conditions and moment restrictions in dynamic panel data models, Journal of Econometrics, 87, 115–43. Bonam, D., de Haan, J., and B. Soederhuizen (2017). ‘The effects of fiscal policy at the effective lower bound’, DeNederlandscheBank, DNB Working Paper No. 565 / July. Bornhorst, F., Gabriela, D., Fedelino, A., Gottschalk, J., and Nakata, T. (2011). ‘When and how to adjust beyond the business cycle? A guide to structural fiscal balances’, Technical Notes and Manuals 11/02, Washington, DC: International Monetary Fund. Coenen, G., Straub, R., and Trabandt, M. (2012). ‘Gauging the effects of fiscal stimulus packages in the Euro area’, Board of Governors of the Federal Reserve System, International Finance Discussion Papers, No. 1061, November. Council of Economic Advisers (CEA), (2009). ‘The effects of fiscal stimulus: A cross-country perspective’, Executive Office of The President, September. Freedman, C., Kumhoff, M., Laxton, D., and Lee, J. (2009). ‘The case for global fiscal stimulus’, IMF Staff Position Note, No. 09/03. Giavazzi, F., and Pagano, M. (1990). ‘Can severe fiscal contractions be expansionary? Tales of two small European countries’, NBER Working Paper No. 3372, NBER. Ghosh, S. and Misra, S. (2016). ‘Quantifying the cyclically adjusted fiscal stance for India’, Macroeconomics and Finance in Emerging Market Economies, 9(1), 1–17. Haltom, R. and Lubik, T.A. (2013). ‘Is fiscal austerity good for the economy?’, Economic Brief, EB13-09 - Federal Reserve Bank of Richmond, September. Hemming, R., Kell, M., and Mahfouz, S. (2002). ‘The effectiveness of fiscal policy in stimulating economic activity - A review of the literature’, IMF Working Paper No. WP/02/208. Hory, M.P. (2016). ‘Fiscal multipliers in Emerging Market Economies: Can we learn something from Advanced Economies?’ International Economics, 146, 59–84. Ilzetzki, E., and Vegh, C. (2008). ‘Procyclical fiscal policy in developing countries: Truth or fiction?’ NBER Working Paper No. 14191, July. Ilzetzki, E., Mendoza, E., and Vegh, C. (2013). ‘How big (small ?) are fiscal multipliers?’ Journal of Monetary Economics, 60(2), 239–54. Im, K.S, Pesaran, M. H., and Shin, Y. (2003). ‘Testing for unit roots in heterogeneous panels’, Journal of Econometrics, 115(1), 53–74. International Monetary Fund (IMF) (2009). ‘The case for global fiscal stimulus’, IMF Staff Position Note, March 6, SPN/09/03. Jha, S., Mallick, S., Park, D., and Quising, P. (2010). ‘Effectiveness of countercyclical fiscal policy: Time-series evidence from developing Asia’, ADB Economics Working Paper Series, No. 211. Kandil, M. and Morsy, H. (2010). ‘Fiscal stimulus and credibility in emerging countries’, IMF Working Paper WP/10/123. Kuttner, K.N. (2002). ‘The monetary-fiscal policy mix: Perspectives from the U.S.’, Paper presented at the conference on The Monetary Policy Mix in the Environment of Structural Changes sponsored by the National Bank of Poland, October 24–25, 2002. Lane, P.R. (2003). ‘Business cycles and macroeconomic policy in emerging market economies’, Trinity Economic Papers 20032, Trinity College Dublin. Levin, A., Lin, C.-F., and Chu, C.-S.J. (2002). ‘Unit root tests in panel data: Asymptotic and finite-sample properties’, Journal of Econometrics, 108(1),1–24. Maddala, G. S., and Wu, S. (1999). ‘A comparative study of unit root tests with panel data and a new simple test’, Oxford Bulletin of Economics and Statistics, 61, 631–52. Misra, S., and Trivedi, P. (2016). ‘Structural fiscal balance: An empirical investigation for India’, Reserve Bank of India Occasional Papers, 35 & 36(1 & 2), 111–59. Mountford, A., and Uhlig, H. (2009). ‘What are the effects of fiscal policy shocks’, Journal of Applied Econometrics, 24(6), 960–92. Ortiz, G. (2012). ‘The false dilemma between austerity and growth’, Think Tank 20: New Challenges for the Global Economy, New Uncertainties for the G-20, Brookings Institute. Perotti, R. (2004). ‘Estimating the effects of fiscal policy in OECD countries’, Innocenzo Gasparini Institute for Economic Research (IGIER) Working Papers, Bocconi University, 276. Pesaran, M.H., Shin, Y., and Smith, R.J. (2001). ‘Bounds testing approaches to the analysis of level relationships’, Journal of Applied Econometrics, 16, 289-321 Ramirez, M.D. (2006). ‘A panel unit root and panel cointegration test of the complementarity hypothesis in the Mexican case, 1960–2001’, Economic Growth Center, Yale University Discussion Paper No. 942. Reserve Bank of India (RBI) (2013). ‘Fiscal monetary co-ordination’, The Report on Currency and Finance (2009–12). Spilimbergo, A., Symansky, S., Blanchard, O., and Cottarelli, C. (2008). ‘Fiscal policy for the crisis’, IMF Staff Position Note 08/01. Sutherland, A. (1997). ‘Fiscal crises and aggregate demand: Can high public debt reverse the effects of fiscal policy?’ Journal of Public Economics, 65(2), 147–62. Tang, H.C., Liu, P., and Cheung, E.C. (2013). ‘Changing impact of fiscal policy on selected ASEAN countries’, Journal of Asian Economics, 24, 103–16. Weil, D.N. (2008). ‘Fiscal policy’. In David R. Henderson (ed.), Concise Encyclopaedia of Economics, 2nd ed., Indianapolis, Indiana : Liberty Fund Inc. * The authors are Directors in the Monetary Policy Department and the Department of Economic and Policy Research, Reserve Bank of India. They wish to thank the Editor, an anonymous referee and Joice John, Assistant Adviser, Monetary Policy Department for valuable suggestions and feedback. An earlier version of the paper was presented in the RBI–ECB Seminar on Monetary and Fiscal Coordination held in Mumbai during September 14–15, 2017. The views expressed in the article represent those of the authors and not of the Reserve Bank of India. 1 In the early 1960s, the Mundell – Fleming model demonstrated that monetary policy was an effective stabilisation instrument under flexible exchange rates. 2 In 2009, the strength of the stimulus varied from Italy’s near zero (0.1 per cent of GDP) to a high in Korea (3.0 per cent of GDP) with the average stimulus for 20 countries at 1.6 per cent of GDP (CEA, 2009). 3 The effective lower bound is defined as interest rates being below one per cent for at least four consecutive quarters. 4 The first step in computation of SB involves identification and removal of one-off fiscal operations as large non-recurrent items are likely to distort the underlying fiscal position of a government. Next, an assessment is made of the impact of the business cycle on government revenue and expenditure, either through (i) an aggregate method (when elasticities are used to measure the sensitivity of total revenue and expenditure to the output gap), or (ii) a disaggregated method (when elasticities specific to various revenue and expenditure components are used to measure the responsiveness of government revenue and expenditure to the output gap). The cyclical components of revenue and expenditure, thus estimated, are then netted from total revenue and expenditure, respectively, to obtain cyclically adjusted revenue and expenditure. The SB estimates are then obtained by subtracting the cyclically adjusted expenditure from cyclically adjusted revenue. In the final step, the standard cyclical adjustment may be further fine-tuned by provisioning for large movements in asset or commodity prices (IMF, 2011). 5 Indicators of FS implicitly assume that the impact of different policy measures (viz., revenues, public expenditures and transfers) are identical. 6 Many of the countries in our sample are commodity exporters. 7 The net impact of the FI on economic activity is dependent on (i) expectations of the private sector; (ii) the mode of financing the deficit; and (iii) the composition of the change in fiscal policy. 8 Based on the work of Arellano and Bover (1995), Blundell and Bond (1998) proposed further refinements by developing a system estimator that uses moment conditions in which lagged differences are used as instruments for the level equation, in addition to moment conditions of lagged levels as instruments for the differenced equation. 9 stata.com : xtdpdsys – Arellano-Bover/Blundell–Bond linear dynamic panel-data estimation. 10 We are grateful to the anonymous referee for this suggestion. As the results are similar, it strengthens the robustness of our findings. The ARDL method, however, has not been pursued subsequently as we feel that dynamic GMM method is preferable as the data used for this analysis constitute a wide panel involving large number of cross sections and relatively shorter time period. In contrast, panel VAR and panel ARDL methods are more appropriate for longer time periods and relatively smaller cross-section observations. 11 Results for Arellano–Bond (1991) estimates with time-fixed effects for the full sample are not reported as the diagnostics were not found to be robust. The coefficients of the period dummies are not reported in the paper. They are, however, available from the authors on request. 12 Moreover, REER appreciation may sometimes be supportive of growth in EMEs by reducing the cost of imported inputs such as capital goods and oil. Since the import component of exports in EMEs is usually high, the benefit of cheaper imports may reflect in lower cost of production and, therefore, potential terms of trade gains which may outweigh the negative impact arising from lower export competitiveness. |

ಪೇಜ್ ಕೊನೆಯದಾಗಿ ಅಪ್ಡೇಟ್ ಆದ ದಿನಾಂಕ: