IST,

IST,

Minutes of the Monetary Policy Committee Meeting, June 4 to 6, 2025

|

[Under Section 45ZL of the Reserve Bank of India Act, 1934] The fifty fifth meeting of the Monetary Policy Committee (MPC), constituted under Section 45ZB of the Reserve Bank of India Act, 1934, was held during June 4 to 6, 2025. 2. The meeting was chaired by Shri Sanjay Malhotra, Governor and was attended by all the members – Dr. Nagesh Kumar, Director and Chief Executive, Institute for Studies in Industrial Development, New Delhi; Shri Saugata Bhattacharya, Economist, Mumbai; Professor Ram Singh, Director, Delhi School of Economics, Delhi; Dr. Poonam Gupta, Deputy Governor in charge of monetary policy and Dr. Rajiv Ranjan, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934). 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:

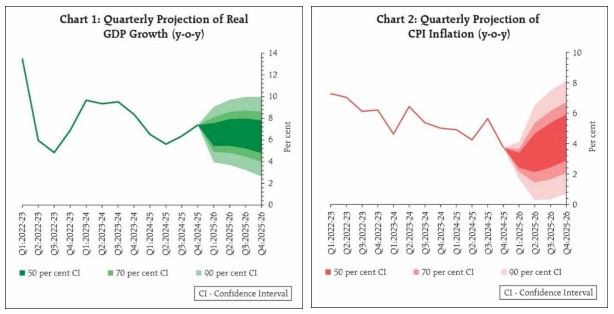

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail the staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. The Monetary Policy Committee (MPC) held its 55th meeting from June 4 to 6, 2025 under the chairmanship of Shri Sanjay Malhotra, Governor, Reserve Bank of India. The MPC members Dr. Nagesh Kumar, Shri Saugata Bhattacharya, Prof. Ram Singh, Dr. Poonam Gupta and Dr. Rajiv Ranjan attended the meeting. 6. After assessing the current and evolving macroeconomic situation, the MPC voted to reduce the policy repo rate by 50 basis points (bps) to 5.50 per cent with immediate effect. Consequently, the standing deposit facility (SDF) rate under the liquidity adjustment facility (LAF) shall stand adjusted to 5.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate to 5.75 per cent. This decision is in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. Growth and Inflation Outlook 7. The uncertainty around the global economic outlook has ebbed somewhat since the MPC met in April in the wake of temporary tariff reprieve and optimism around trade negotiations. However, it continues to remain elevated to weaken sentiments and lower global growth prospects. Accordingly, global growth and trade projections have been revised downwards by multilateral agencies. Market volatility has eased in the recent period with equity markets staging a recovery, dollar index and crude oil softening though gold prices remain high. 8. According to the provisional estimates released by the National Statistical Office (NSO) on May 30, 2025, real GDP growth in Q4:2024-25 stood at 7.4 per cent as against 6.4 per cent in Q3. On the supply side, real gross value added (GVA) rose by 6.8 per cent in Q4:2024-25. For 2024-25, real GDP growth was placed at 6.5 per cent, while real GVA recorded a growth of 6.4 per cent. 9. Going forward, economic activity continues to maintain the momentum in 2025-26, supported by private consumption and traction in fixed capital formation. The sustained rural economic activity bodes well for rural demand, while continued expansion in services sector is expected to support the revival in urban demand. Investment activity is expected to improve in light of higher capacity utilization, improving balance sheets of financial and non-financial corporates, and government’s capital expenditure push. Trade policy uncertainty continues to weigh on merchandise exports prospects, while the conclusion of free trade agreement (FTA) with the United Kingdom and progress with other countries is supportive of trade activity. On the supply side, agriculture prospects remain bright on the back of an above normal south-west monsoon forecast and resilient allied activities. Services sector is expected to maintain its momentum. However, spillovers emanating from protracted geopolitical tensions, and global trade and weather-related uncertainties pose downside risks to growth. Taking all these factors into account, real GDP growth for 2025-26 is projected at 6.5 per cent, with Q1 at 6.5 per cent, Q2 at 6.7 per cent, Q3 at 6.6 per cent, and Q4 at 6.3 per cent (Chart 1). The risks are evenly balanced. 10. CPI headline inflation continued its declining trajectory in March and April, with headline CPI inflation moderating to a nearly six-year low of 3.2 per cent (year-on-year) in April 2025. This was led mainly by food inflation which recorded the sixth consecutive monthly decline. Fuel group witnessed a reversal of deflationary conditions and recorded positive inflation prints during March and April, partly reflecting the hike in LPG prices. Core inflation remained largely steady and contained during March-April, despite increase in gold prices exerting upward pressure. 11. The outlook for inflation points towards benign prices across major constituents. The record wheat production and higher production of key pulses in the Rabi crop season should ensure adequate supply of key food items. Going forward, the likely above normal monsoon along with its early onset augurs well for Kharif crop prospects. Reflecting this, inflation expectations are showing a moderating trend, more so for the rural households. Most projections point towards continued moderation in the prices of key commodities, including crude oil. Notwithstanding these favourable prognoses, we need to remain watchful of weather-related uncertainties and still evolving tariff related concerns with their attendant impact on global commodity prices. Taking all these factors into consideration, and assuming a normal monsoon, CPI inflation for the financial year 2025-26 is now projected at 3.7 per cent, with Q1 at 2.9 per cent; Q2 at 3.4 per cent; Q3 at 3.9 per cent; and Q4 at 4.4 per cent (Chart 2). The risks are evenly balanced.  Rationale for Monetary Policy Decisions 12. Inflation has softened significantly over the last six months from above the tolerance band in October 2024 to well below the target with signs of a broad-based moderation. The near-term and medium-term outlook now gives us the confidence of not only a durable alignment of headline inflation with the target of 4 per cent, as exuded in the last meeting but also the belief that during the year, it is likely to undershoot the target at the margin. While food inflation outlook remains soft, core inflation is expected to remain benign with easing of international commodity prices in line with the anticipated global growth slowdown. The inflation outlook for the year is being revised downwards from the earlier forecast of 4.0 per cent to 3.7 per cent. Growth, on the other hand, remains lower than our aspirations amidst challenging global environment and heightened uncertainty. 13. Thus, it is imperative to continue to stimulate domestic private consumption and investment through policy levers to step up the growth momentum. This changed growth-inflation dynamics calls for not only continuing with the policy easing but also frontloading the rate cuts to support growth. Accordingly, the MPC voted to reduce the policy repo rate by 50 bps to 5.50 per cent. Dr. Nagesh Kumar, Prof. Ram Singh, Dr. Rajiv Ranjan, Dr. Poonam Gupta and Shri Sanjay Malhotra, voted to decrease the policy repo rate by 50 bps. Shri Saugata Bhattacharya voted for a 25 bps cut in repo rate. 14. After having reduced the policy repo rate by 100 bps in quick succession since February 2025, under the current circumstances, monetary policy is left with very limited space to support growth. Hence, the MPC also decided to change the stance from accommodative to neutral. From here onwards, the MPC will be carefully assessing the incoming data and the evolving outlook to chart out the future course of monetary policy in order to strike the right growth-inflation balance. The fast-changing global economic situation too necessitates continuous monitoring and assessment of the evolving macroeconomic outlook. 15. The minutes of the MPC’s meeting will be published on June 20, 2025. 16. The next meeting of the MPC is scheduled from August 4 to 6, 2025. Voting on the Resolution to reduce the policy repo rate

Statement by Dr. Nagesh Kumar 17. The June MPC is taking place against the backdrop of continued global uncertainties on tariffs, protectionism, and trade wars that are affecting the global trade and growth outlook. The global economic outlook has been described as ‘fluid and fragile.’ The IMF has downgraded the global economic growth from 3.3% to 2.8% in 2025, with the OECD also projecting almost a similar figure. The global manufacturing PMI has dipped below 50, while the composite PMI has managed to barely stay just above 50. 18. The WTO has projected world trade to contract by 1.5% in 2025 in view of the trade policy uncertainties. The April 2025 world trade projection for 2025 is ‘nearly 3 percentage points lower than it would have been without such policy shifts’ and marks a significant reversal from the WTO’s assessment of world trade at the beginning of the year. The uncertainties surrounding the future of reciprocal tariffs beyond 9 July, when the 90-day pause ends, continue to occupy policymakers’ attention, with India, among several countries, engaged in negotiations with the Trump Administration for a bilateral trade deal. Besides the shrinking global trade, countries like India are also likely to face the onslaught of dumping of cheap Chinese goods in both domestic and overseas markets, which are shunned by the advanced economies, as I had argued in my April MPC statement. 19. Domestically, the recovery of economic growth to 7.4% in Q4:2025 from 6.4% in Q3:2025 was a pleasant surprise. It helped to close the year 2024-25 with 6.5% growth overall. However, the recovery has not been broad-based. It was supported by the rural consumption and government capex. Private investment, especially in manufacturing, and urban consumption, have continued to remain subdued. It is not clear that the growth momentum will continue in the Q1 of the current year, given the fact that consumption and investment growth is moderating. The survey of corporate performance shows that companies are deleveraging their balance sheets with rising profits. Despite the capacity utilisation crossing beyond 75%, the investment intentions in manufacturing have moderated in 2025-26. The difficult external environment is likely to further complicate the economic growth outlook for 2025-26, especially for the manufacturing sector outlook, with implications for job creation. It calls for supporting growth through both fiscal and monetary policy. 20. Fortunately, the policy space has been augmented in both domains. The fiscal consolidation, partly helped by the hefty transfers by the RBI, provides some potential for a fiscal stimulus to support growth if needed, including by front-loading the substantial magnitude of public investment provided in the Budget 2025-26. 21. Monetary policy space has been created by the benign inflationary outlook. Retail inflation in April 2025 slowed down to 3.2% is at its lowest level since 2019 (69 months). Furthermore, given the softening of commodity prices, especially the crude oil to around $ 65 p.b. compared to around $75 p.b. earlier, predictions of a good or above average monsoon, and a soft dollar, all indicate that the inflationary outlook would continue to remain sub-4% in 2025-26. Inflationary expectations also remain well anchored as per the RBI surveys. 22. Since the February 2025 MPC, the RBI has started to support growth by cutting policy rates. The repo rate has been cut by 50 basis points in two instalments, besides massive liquidity expansion. The monetary policy stance has also been changed to accommodative in April 2025. However, the transmission of the monetary easing has been slow or moderate as reflected by the sticky deposit and lending rates (especially for the public sector banks), and credit growth has been moderate, due to inefficiencies in the system. 23. In the April MPC, I had argued that a 50 basis points cut at one go may be more effective than two cuts of 25 basis points each. In view of difficult external circumstances requiring support to economic growth, and a favourable inflationary outlook providing headroom for further rate cuts, I believe that the case for a 50 basis points cut in the repo rate has become stronger. A heavier-than-expected cut in policy rate (along with the possible fiscal policy support) would send a clear message that India is serious about supporting economic growth momentum and would spare no effort in terms of policy interventions. A double dose of rate cut is likely to bring down lending rates significantly, helping to spur the investment and consumption of durable goods. 24. Hence, I vote for a 50-basis point cut in the repo rate to 5.50%. I also suggest a shift in stance from accommodative to neutral. Statement by Shri Saugata Bhattacharya 25. Phrases related to “uncertain” and “volatility” occur in the MPC statement 6 times. This continuing elevated uncertainty remains, to my mind, the primary reason to exercise caution in pacing monetary policy easing. Hence, there is little to add to the essence of my statement in the minutes of the last April ’25 meeting. 26. Given the growth performance of the Indian economy in Q4 FY25 and the full FY25 as well as incoming high frequency indicators, I believe that the current growth impulses continue to exhibit economic resilience despite the prevailing uncertainty stemming from external developments. Moreover, the experience of the periodic FY24 GDP data revisions also support a calibrated policy easing path. On the demand side, I await a sense of the effects of the well-thought income tax rate cuts, as well as other price and income support measures. 27. While the near- and longer-term forecast of inflation offers more space of easing, I also recognize that the transmission of the policy rate cuts into bank lending (and some deposits) rates did accelerate post March ’25 and is expected to proceed apace. RBI’s liquidity infusion and other measures have played a key role in this process, partly via lower money market and short-term interest rates reducing the overall banks’ cost of funds. RBI data suggests that Rs 9.5 lakh crores of durable liquidity was injected into the banking system since January ’25. In this context, I believe that the RBI’s assurance of continuing large durable liquidity support is likely to have a more dominant effect on further transmission compared to a deep cut in the repo rate. 28. Recognising the prevailing uncertainties, I believe that a measured and cautious progress in policy easing is more appropriate at this time. Accordingly, I vote to cut the policy repo rate by 25 basis points to 5.75%. I concur with the view to change the stance from accommodative to neutral. Statement by Prof. Ram Singh 29. My assessment of the current growth-inflation dynamics and the prospects is very similar to what is described in the MPC statement for the June 2025 meeting. Inflation 30. The current headline inflation print for April 2025 was below the target of 4%. The CPI inflation has fallen to a nearly 6-year low of 3.2% year-over-year (yoy) in April 2025, primarily due to a sharper than usual seasonal fall in vegetable prices by 3% month-over-month (mom). Vegetable inflation fell to a 26-month low of -11.0% yoy in April. The CPI Core inflation has inched upward to 4.2%, mainly due to the elevated gold prices. Excluding gold, the CPI Core inflation is 3.4%. For FY 2025-26, RBI’s average headline inflation forecast is 3.7%, comfortably below the target. The market expects even lower headline inflation prints for FY26. GDP Growth 31. The GDP growth rate remains below the aspirational levels of 7-8% - The RBI’s and GoI’s forecast for the GDP growth rate for FY 2025-26 is 6.5%. Given the prospect of benign inflation, there is a strong case for the rate cut to provide a helping hand to growth. 32. Therefore, I will directly address the two relevant issues: What is the scope of the rate cut in this cycle? How much rate cut is plausible given the current uncertainty on the global economic front? 33. Given the headline inflation forecast of 3.7% for FY 26, at the current policy rate (6%), the real repo rate turns out to be 2.3%, significantly higher than a rate that would qualify as growth supportive policy rate. At any point in time, there is uncertainty about the exact value of the neutral interest rate, r*, which is the real interest rate consistent with stable inflation and a growth path – to be growth supportive, real rate should be lower than neutral rate. The neutral interest rate fluctuates due to several factors, even in the short term. Except in the aftermath of Covid-19, neutral interest rates have been declining over the last two and a half decades, for both advanced and emerging economies, including India.1 Following the COVID-19 pandemic, the neutral rates experienced an uptick across countries, driven by short-term factors such as increases in public debt and changes in output gaps. 34. Due to the COVID-19 effect, the average r* estimated for India had increased from 1.2% for Q3:2021-22 to 1.65% for Q4: 2023-24. Now that the COVID specific factors – elevated public debt and pent-up demand - are behind us, the neutral rate has likely headed toward pre-COVID levels. Even if we go by the post-pandemic average neutral interest rate (1.65%), there is scope for about a 75 bps cut in the current cycle without heating the economy. 35. However, assumptions about global growth and inflation are changing daily. Given the high degree of uncertainty regarding growth and food inflation at home, caution is warranted in the rate cut. Moreover, the MPC needs to ascertain the likelihood and timeline of the pass-through of the rate cut, following two rate cuts in recent times. All considered, a 50-basis-point rate cut in this cycle seems very reasonable and highly desirable. Moreover, the current situation warrants a front-loaded rate cut. 36. While rural demand is holding up, riding on the back of rising rural real wages, several indicators point to a situation where there is a demand deficit. There is moderation in actual as well as expected salary outgo for the corporate sector along with slowing of the labour intensive sectors like, hotel, tourism, transport and communication. Demand for mid-size housing and urban consumption remains subdued. Private investment also remains tepid, despite the massive capital expenditure undertaken by the Centre.2 The Capex to net surplus from operations ratio remains below the pre-COVID level. Since H1: 2022-23, there has been a decline in the debt-to-equity ratio for listed private companies, as absolute debt levels have not increased during this period. During Q4:2024-25, sales growth has moderated for manufacturing and non-IT service companies. The business assessment index has also moderated in Q1: 2025-26. 37. Despite two rate cuts in February and April 2025, and call money rates dipping below the repo rate and at times even below the SDF rate, credit growth has not picked up. The demand for loanable funds is lower than usual. It has been moderating over the last 7 quarters to reach 9.8%, the weakest in recent times. Sanctioned loan books are not being utilised. The realisation of 7-8% GDP growth will require a credit growth rate, which is significantly higher than the current rate. 38. The expectation of further rate cuts has likely delayed the materialisation of demand and investment decisions. In such an environment, given the market expectation of a 50-bps rate cut in this cycle, a staggered rate cut can further delay the materialisation of demand and investment decisions. By contrast, a front-loaded 50-bps cut in the policy rate is likely to help achieve the twin objectives of supporting demand and growth by reducing the cost of funds for borrowers. It would result in a significant reduction in the EMI/NMI ratio or the debt service period for EBR-linked loans, including home and MSME loans, generating a substantial income effect for middle-income groups and the MSME sector. 39. While several factors determine demand and credit growth, with healthy bank balance sheets, a 50-basis-point rate cut is likely to provide the required push to borrowers and lenders alike. Given the under-leveraged corporate balance sheets, a pickup in private demand will, in turn, motivate private capital expenditure. 40. Furthermore, the 50-basis-point rate cut should not cause any overheating in the economy, as there are no indications of demand-pull inflation. The core CPI excluding petrol, diesel, gold and silver remains low at 3.5% yoy in April 2025. This inflation series has hovered in the 3.2-3.5% range for the last eight months. Even at the subgroup level, the core CPI inflation remains muted for most subgroups. According to the World Bank forecast and the S&P commodities index, global commodity prices are expected to remain stable, except for gold. 41. Food inflation continues to ease, driven by decline in inflation for cereals and animal proteins, while the deflation in pulses continues. In April 2025, pulses prices declined by 5.2% yoy, marking a 6-year low. From a near-term perspective, there is no visible sign of any adverse impact on vegetable prices from the unusually early onset of monsoon. The past episodes of early monsoon onset were not necessarily associated with a rise in vegetable prices. Going forward, edible oil prices are expected to decline supported by the recent reduction in the import duty (from 20% to 10%), strengthening the benign inflation outlook. 42. This suggests a healthy supply of the previous crop and buoyant expectations for the next harvest, which is currently being sown. Budget 2025 has focused on the food processing industry. This, along with the substantial improvements in supply chain logistics, means we can look forward to a period of moderated food inflation with reduced price volatility in the future. 43. Certainly, the banks would face pressure on their net interest margins (NIM). However, some of the adverse effect on NIM can be neutralised by other monetary policy instruments available with the RBI. Another concern is that a relatively big rate cut would mean that the interest rate differential with the U.S. Fed would reduce to lowest levels in recent time. This, ceteris paribus, can put pressure on the rupee, especially vis-à-vis the USD. However, given the robust fundamentals of Indian economy including comfortable current account situation, any pressure on INR is likely to be confined to short run. Further, a pick in growth can more than offset the adverse effect of reduced interest rate differentials, if any. 44. Considering the above-described strong case for a growth supportive MP, I vote to reduce the policy repo rate under the liquidity adjustment facility (LAF) by 50 basis points to 5.50 per cent. 45. However, in view of unquantifiable global uncertainties, I support the change in the monetary policy stance from ‘accommodative’ to ‘neutral’. Statement by Dr. Rajiv Ranjan 46. Since the April policy, the incoming data point to more than anticipated softening of inflation. The Reserve Bank’s anti-inflationary policy stance in the last two years, supply side measures by the Government and a good agricultural season seem to have helped gain control over inflation. This has given flexibility and opportunity for monetary policy to support growth. Accordingly, the MPC voted for a rate cut of 50-bps in this policy. My vote for this frontloaded rate cut was premised on following arguments. 47. First, on the inflation front, the baseline outlook for 2025-26 remain largely comfortable. Inflation is likely to undershoot the target as reflected in the downward revision of 30 bps in our projections in this policy. The headline CPI inflation in H1:2025-26 is projected to remain close to 3 per cent, with some pick up in second half. Food price pressures is expected to remain benign. Trends in core (CPI excluding food and fuel) inflation shows that the underlying inflation pressures remain quite contained. This is corroborated by various exclusion as well as trimmed mean measures. 48. Second, on growth, although we have not changed our projection, but it is felt that it could be higher given the trend in recent years. Domestic investment though on a recovery mode continues to suffer as enhanced global uncertainties are restraining investment impulses. Deflation in China is a pressure point and a possible threat to our manufacturing, which could further dampen investment sentiments. Thus, there is a strong case to support aggregate demand through a frontloaded rate cut. A larger cut in the expansionary cycle may be necessary to have the same effect on output as in the contractionary cycle (Barnichon and Matthes, 2014).3 49. Third, as monetary policy works with a lag, under the current circumstances, a 50-bps cut is preferable to two 25 bps cut for faster and greater transmission. Similar to the frontloaded rate hikes during the tightening cycle, frontloading rate cut could help in hastening transmission by providing decisive signals and confidence to the stakeholders. This rate cut, coupled withs several liquidity measures already undertaken, along with a CRR cut from September onwards should help boost credit growth while protecting bank margins in a rate easing cycle. 50. Fourth, on the global front, the outlook in 2025 continues to be disconcerting, even as trade policy uncertainty has somewhat ebbed since April. Amidst such global uncertainties, it would be appropriate to provide some certainty on the domestic rate and liquidity front so that agents do not delay and postpone their decisions. Literature suggest that uncertainty plays a role in forming the "zone of inaction" whereby economic agents may see-through incremental changes while larger policy impetus may trigger threshold effects (Belke et al, 2020; Bordo et al, 2016).4 51. On the whole, from the perspective of inflation, growth, transmission, global and most importantly signaling and imparting certainty perspective, a 50 bps cut is apt at this juncture. 52. At the same time, it was felt that pairing the 50 bps rate cut with the same accommodative stance is not suitable, even though we shifted to this stance just two months back. Having front-loaded the policy rate cut by 50 bps, we would be left with less room for further downward adjustments in policy rates. There is a risk that a combination of 50 bps cut with an accommodative stance could mislead financial markets about the scale and scope of further monetary policy easing, repricing of which eventually could create unnecessary volatility. At the same time, it is to be noted that the shift in stance to neutral should not be confused to be a sign that the direction of monetary policy has changed. The neutral stance provides flexibility and is meant to signal that there is no strong bias for any rate action absent any meaningful change in the macroeconomic outlook. It needs to be highlighted that our policy setting under prevailing uncertainties is not cast in stone. We will be responding appropriately through our policy action in the event of any material change in the outlook. In the near term, we need to focus more on facilitating transmission of easier monetary policy, while keeping a close watch on the incoming data. Statement by Dr. Poonam Gupta 53. The Indian economy has exhibited remarkable resilience during the past decade, amidst an extremely uncertain and shifting global economic outlook, marked by worsening trade dynamics, financial volatility and geopolitical flareups. Despite being one of the fastest growing large economies, its rate of economic growth, however, can be further accelerated based on the favourable demographics, conducive shift in regulatory policies, significant infrastructure enhancement, and leveraging on the macroeconomic stability achieved during the past decade. 54. As per the provisional estimate of the National Statistical Office, the Indian economy recorded a growth of 6.5 per cent in 2024-25, in line with the average growth rate of the last decade. Growth in 2024-25 was mainly driven by a revival in private consumption while private corporate capex remained tentative and confined to only certain pockets. Growth is projected to be in a similar ballpark for the current year. 55. On the inflation front, the headline CPI inflation averaged 4.6 per cent during 2024-25, but is seen to be on a downward trend, moderating to 4.0 per cent during Q4 and further to a 69-month low of 3.2 per cent in April 2025. While food inflation has decelerated sharply, core inflation has been contained at around 4 per cent and would be lower if the impact of high and rising gold prices is excluded. Inflation expectations too are on a moderating trend. With the inflation projection for 2025-26 revised downward from 4.0 per cent to 3.7 per cent, headline inflation is expected to align with the target further durably, and in fact undershoot at the margin, giving space for monetary policy to support growth. 56. Aforementioned developments indicate that there is both a need as well as the room for monetary policy to provide support to the economy in order for it to attain and even surpass the past rates of growth. 57. The issue then arises, how much support can be provided, and at what pace. Overall, while a case can be made for two consecutive rate cuts of 25 bps each in this as well as the next policy cycle, there is also merit in front-loading these cuts. Therefore, I vote for a policy rate cut by 50 bps in this meeting. This should help in fostering policy certainty and faster transmission than a staggered rate cut, and in more effectively countering the challenges emanating from the global economy. 58. Going forward, I support a change in stance from accommodative to neutral. This means that any further actions should be contingent upon incoming data and the evolving global uncertainties. Statement by Shri Sanjay Malhotra 59. The global economic situation remains fragile and fluid. Apart from the near-term uncertainties, the medium-term outlook is also overcast amidst recurrent geopolitical flareups and reshaping of a new global trade order. At present, global growth is on a weak footing, while inflation is generally receding, though at a slow pace. 60. Domestically, the GDP growth print for Q4:2024-25 released by the NSO at 7.4 per cent indicates sequential improvement in the economic activity. Going forward, the expected above-normal monsoon will provide further impetus to rural demand. Decline in inflation and continued momentum in the services sector will help revive urban consumption. On the investment front, the post-COVID recovery so far has been largely led by public investments, while private sector investments have been weak despite high capacity utilisation and improved corporate balance sheets. Moreover, heightened global uncertainties may put on hold investment decisions by businesses, underscoring the need for growth supportive policies. 61. Inflation has trended down since the last MPC meeting, with the headline CPI inflation recording a nearly six-year low of 3.2 per cent in April 2025. The recent moderation has been primarily driven by the sustained moderation in food inflation, which currently stands at 2.1 per cent in April, well below the headline. Core (CPI excluding food and fuel) Inflation has remained largely stable and contained (4.2 per cent in April 2025), even though rising gold prices have exerted significant upward pressure. With prospects of an above-normal southwest monsoon, food inflation is expected to remain moderate during the year. Core inflation is also likely to remain largely contained, especially in an environment of moderating commodity prices. 62. With a projection of 3.7 per cent for 2025-26, the inflation outlook for the year is looking more benign than we had anticipated in the April policy. On the other hand, while growth remains steady, it is lower than our aspirations. The growth forecast remains the same as the outturn of last year which was 6.5 per cent. On the whole, I believe that, given the current macroeconomic conditions and the outlook, monetary policy needs to support growth, while remaining consistent with the objective of price stability. Given the sharp reduction in inflation of about 3 percentage points over the past few months (6.2 in October 2024 to 3.2 in April, 2025), and the projected reduction in annual average inflation by almost one percentage point from 4.6 to 3.7 per cent, I vote for a 50 bps rate cut. It is expected that the front-loaded rate action along with certainty on the liquidity front would send a clear signal to the economic agents, thereby supporting consumption and investment through lower cost of borrowing. 63. As regards the stance for monetary policy, it is important to keep in mind that the stance not only reflects the current macroeconomic conditions, but more importantly the outlook that goes into policy calculus. While the CPI headline inflation for April 2025 is 3.2 per cent, the projection for Q4 is 4.4 per cent. Growth is projected to be 6.5 per cent in this year. This growth-inflation outlook is contingent on the spatial and temporal distribution of the southwest monsoon and at the same time considerable uncertainties persist in the global commodity, financial, and currency markets. Given these uncertainties, and after having reduced the policy rates by 100 bps in quick succession since February, in the prevailing growth-inflation scenario and the outlook, monetary policy will be left with very limited space to support growth. Thus, it would be appropriate to change the stance from accommodative to neutral. A neutral stance would provide monetary policy the necessary flexibility viz., to cut, pause or hike policy rate, in response to the evolving domestic and global economic conditions. This package of measures will provide some certainty in the times of uncertainty and is expected to support growth.

(Puneet Pancholy) Press Release: 2025-2026/570 1 Obstfeld, Maurice (2025), “Natural and Neutral Real Interest Rates: Past and Future”, NBER Working Paper No. 31949. 2 India's listed companies are holding onto cash or preferring to distribute it as dividend rather than invest. Dividend payouts are increasing despite relatively moderate growth in both revenue and net earnings. 3 https://events.bse.eu/live/files/383-tsa14-barnichonpdf 4 https://www.sciencedirect.com/science/article/abs/pii/S0167268120300962; https://www.nber.org/system/files/working_papers/w22021/w22021.pdf |

ಪೇಜ್ ಕೊನೆಯದಾಗಿ ಅಪ್ಡೇಟ್ ಆದ ದಿನಾಂಕ: