IST,

IST,

Chapter III: Digitilisation and The Payment Revolution in India

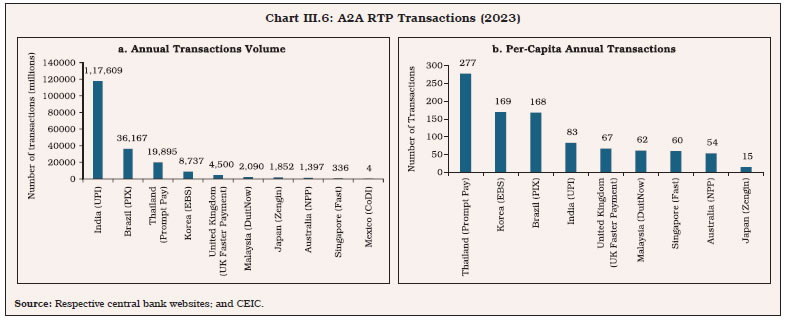

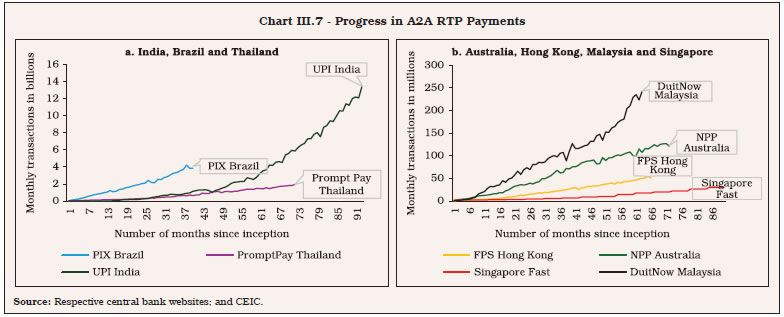

|

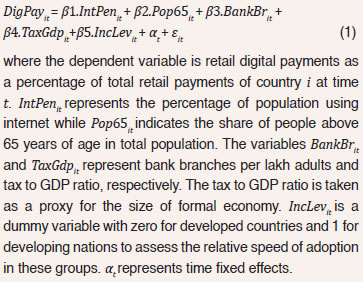

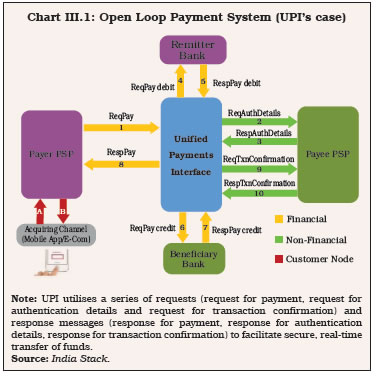

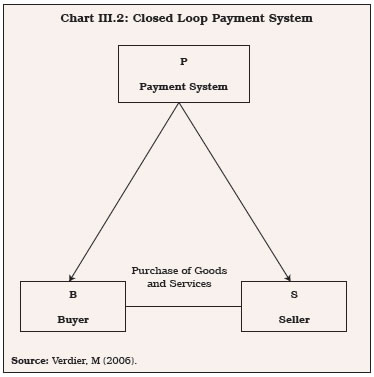

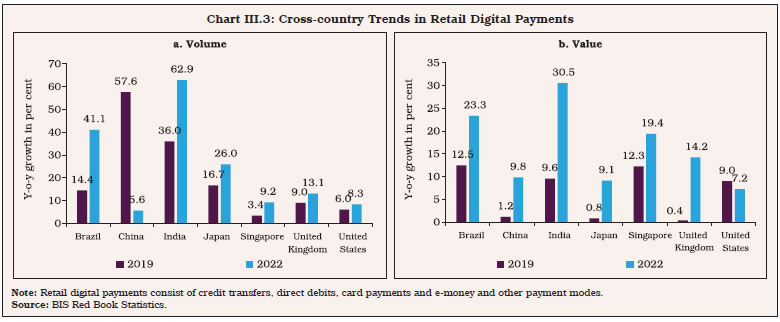

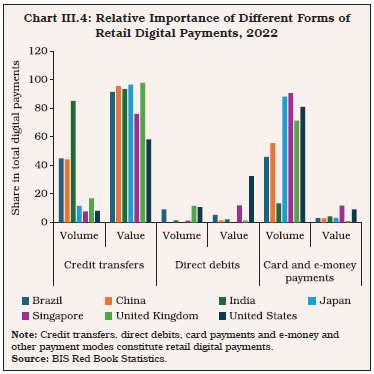

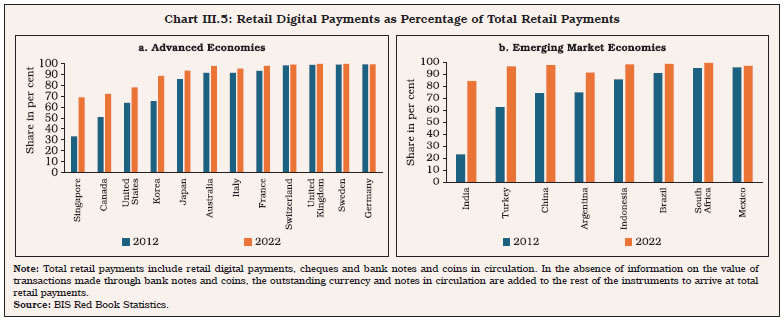

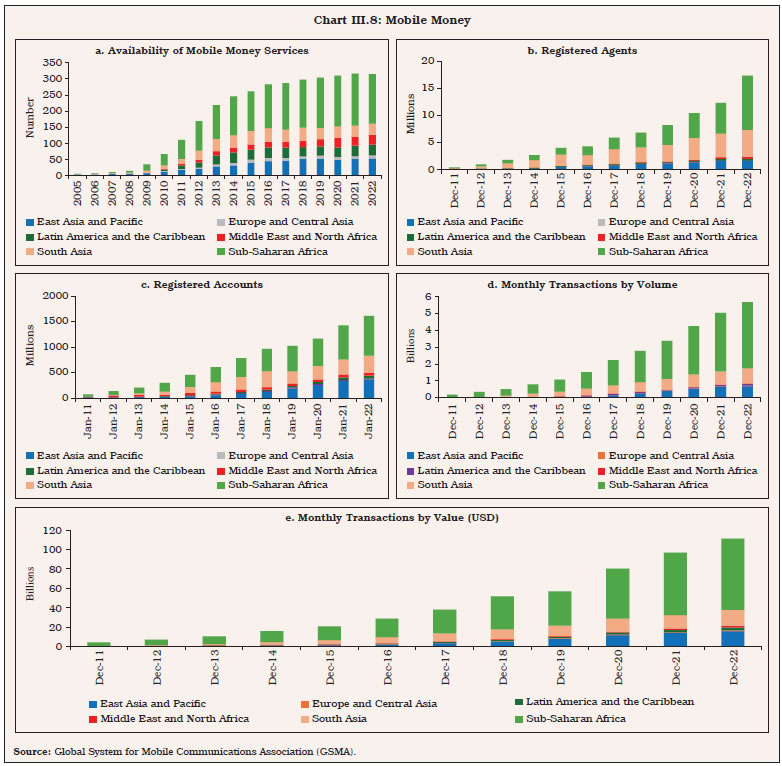

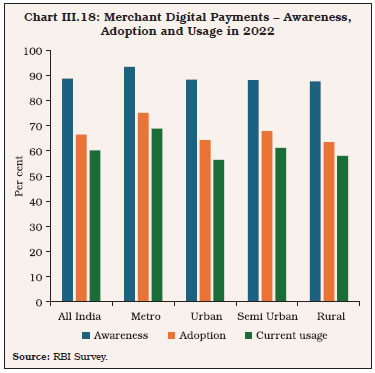

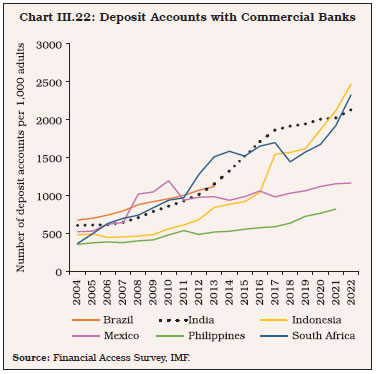

Payment infrastructure has made significant strides in recent years, aided by digital technologies enhancing the ease of payment delivery and reducing the cost of transactions. At the cross-country level, digital payments’ adoption is supported by banking penetration, technological advancements, degree of formalisation of economy and younger cohorts. India has been at the forefront of this payment revolution with UPI transforming the retail payment landscape. India’s payment architecture is influenced by a combination of factors like technological advancements, agents, institutions, and policy interventions. This transformation, while fostering financial inclusion and inclusive growth, can result in new challenges for policy makers. 1. Introduction III.1 Over the last two decades, digitalisation has revolutionised the payment landscape, transforming the organisational structure, business practices and fundamentally the reach of the payment services fostering inclusiveness. The ease and speed of digital payments have made them a preferred choice, bringing in new players to the payments market, which hitherto was monopolised by the financial sector. From a handful of alternate methods of payments such as cash, cheques, credit/debit cards and bank transfers, currently there are over 300 alternative methods of payments worldwide, most of which ride on the digitalisation wave (Mauro and Li, 2021). The push towards a cashless society has become synonymous with modernity and efficiency. III.2 India is a leader in development of state-of- the-art payment infrastructure and products leading to a wider adoption of digital payments (Das, 2021). India is a frontrunner in the global digital payments revolution and is an inspiration for other economies (The Economist, 2023). The unified payments interface (UPI), a flagship product of India’s digital payment ecosystem, introduced in 2016, has emerged as the most preferred choice for payments in India, owing to its transactional ease and accessibility. The reach of India’s payment advancements has transcended national boundaries with the internationalisation of the UPI. Emerging market economies (EMEs), in general, are leading the digital payments revolution as evident in the success of UPI of India, M-PESA of Kenya, PIX of Brazil, and PromptPay of Thailand. III.3 The efficiency gains from harnessing digital technologies in payments are leading to significant reduction in transaction costs and ease of doing business, benefitting consumers, businesses, and economies. Along with e-commerce, digital payments through the ease and convenience of transactions have fostered entrepreneurship. Further, digital trails have enabled easy credit appraisal resulting in the reduction of information asymmetry in the credit market. III.4 Central banks, being the fulcrum of payment architecture, have played a pivotal role in this digital payments’ revolution. At the same time, advancements in digital payments have significant implications on central bank’s objectives, operations and policy instruments, and can enhance economic growth through the productivity channel on the one hand and alter the price setting behaviour and inflation dynamics on the other. Digitalisation influences the nature, composition, and behaviour of money in the economy, with ramifications for monetary aggregates and monetary policy transmission. Digital payments can foster financial inclusion, financial deepening and instantaneous transfer of funds across financial intermediaries, with implications for financial stability and for the regulatory and supervisory role of central banks. Emerging cybersecurity risks associated with digitalisation of payments also pose challenges. III.5 Against this backdrop, this chapter provides a detailed account of the evolution of digital payments and factors that contributed to its rapid growth, the impact of digital payments in various spheres of the economy and implications for central banks and their policies. Section II examines the evolution of digital payments in a cross-country perspective. Section III traces the stages of India’s digital payments trajectory and examines the enabling forces; it also presents insights from a primary survey of merchants and consumers on the awareness, adoption and usage of digital payments. Section IV analyses the impact of digital payments on the various facets of the economy. Section V explores the challenges and way forward. Concluding observations are set out in Section VI. 2. Evolution of Digital Payment Systems: A Cross-country Analysis 2.1. Historical Context III.6 Payment systems are the lifeline of an economy (Das, 2021). By facilitating exchange of goods and services in an economy, they are imperative for the smooth conduct of economic activities. Payment infrastructure has evolved over time, with its progress mirroring the level of economic development as well as technology. The relationship between the medium of payments and technology has been deeply intertwined, with advancements in technology continuously shaping the nature and functionality of money throughout history. For example, the development of flint blades in the stone age represented a significant technological leap, which also served as a medium of exchange (Sahlins, 2013). As societies progressed into the bronze age, the discovery of metals and the development of metallurgical techniques led to metals assuming roles as currency in diverse forms (Curta, 2021). The emergence of coinage can be attributed more to social innovation than to technological advancement. Tiny pieces of metal were transformed into coins through stamping, with the stamp serving as a guarantee of authenticity. Over time, growing trust and confidence in governmental institutions paved the way for the adoption of paper and fiat currencies, which continue till date, while incorporating stronger security features to increase confidence and to prevent counterfeiting. III.7 Continuing this tradition, the rapid advancements in information and communication technologies (ICTs) have led to the digitalisation of payments and currency. At the core of this revolution lies a profound philosophical notion that ‘money is memory’, and a ‘superLedger’ could facilitate transactions akin to traditional currency. This concept posits that a ledger not only tracks who possesses what, but also who owes and is owed what (Carstens, 2018). Within this superLedger framework, the exchange of money can be seen as being analogous to transfer of data. III.8 While technological advancements have taken place across the globe, countries have embraced different models of digital payments, influenced by their technological readiness as well as the existing financial landscape. The global evolution of retail digital payments system can be broadly categorised into two main types: open and closed loop systems. In open loop systems, payment systems are operated by central banks or other payment system operators, allowing banks, non-bank payment service providers or third-party application providers (TPAPs) to use the system to process and settle payments. These systems link payers and payees without requiring a direct relationship between them. An example of an open loop system is UPI1, where the National Payments Corporation of India (NPCI) owns and operates the payment system infrastructure. The TPAPs develop and maintain user-friendly mobile applications for end-users, collaborating with payment service providers2 (PSPs) that connect to the UPI system. PSPs act as the link between TPAPs and the UPI system, facilitating transactions. Therefore, payers and payees can use different UPI apps and have accounts in different banks but can still transact seamlessly (Chart III.1). Open-loop systems are accepted across multiple merchants and locations, rather than being restricted to a single organisation or group of organisations. Despite multiple participants in a transaction, the UPI enables instant payment on its platform unlike some card networks that operate on open loop systems. III.9 In contrast, in a closed loop system, the payment platform is managed by a single entity which is responsible for the payment and settlement of funds. These systems operate without intermediaries, establishing a direct relationship between payer and payee within the payment network3 (Chart III.2). These payment systems have limited reach and are restricted to specific networks or group of merchants, and transactions are processed internally without the need for external financial networks. Examples of closed loop payment systems include Alipay, WeChat Pay4, transit cards, retail specific cards and gift cards. Initially, mobile money services also operated as closed loop systems, restricting money transfers only to registered consumers, and payments only to registered merchants within the system. Yet, over time, these services have evolved, and have now established connections through bilateral integrations to enable domestic interoperability and have subsequently integrated themselves into the broader financial system, expanding their outreach considerably (GSMA, 2023).    2.2. Digital Payments Revolution Across Geographies III.10 Retail digital payments, in terms of both volume and value, have recorded significant growth across economies, led by EMEs (Chart III.3). III.11 In both advanced economies (AEs) and EMEs, credit transfers5 accounted for most of the retail digital payments by value (Chart III.4). The value of e-money payments made up only a small share of the total, although it has witnessed strong growth in both groups of economies.   III.12 Overall, the adoption of digital payments is growing, especially in those countries where the initial share of digital payments has been low, and currently, this is the dominant mode of payment in major economies (Chart III.5). III.13 In AEs, card-based payment systems, established prior to the internet era, are still widely used (World Bank, 2023).6 While AEs dedicated the past decade to upgrade their bank-based magnetic striped cards with chips, EMEs embarked on a transformative shift in their retail payment landscape. Some EMEs adopted payment systems such as China’s closed-loop wallet system and mobile money models prevalent in Sub-Saharan Africa. Other EMEs, including India, Brazil, Nigeria, Thailand and Malaysia, leveraged their banking systems to create account-to-account (A2A) real-time payment (RTP) rails to boost the digitalisation of payments. In major AEs and EMEs, central banks, sovereigns, and bank unions have invested in developing A2A RTP rails, which have taken the lead role in digital payment evolution. Within the A2A RTP schemes, India’s UPI stands out as the leading platform in terms of the absolute number of transactions (Chart III.6). UPI crossed over a 100 billion transactions in 2023. Examples of other A2A RTP are PIX system that is being used by more than 80 per cent of the adult population in Brazil; similarly, more than 80 per cent of the Thai population uses PromptPay. The US Federal Reserve launched its own A2A RTP rail called FedNow service in July 2023 with 35 participating financial institutions, which increased to 864 as on June 28, 2024. The penetration levels of the A2A RTP systems in many EMEs are much higher than that of AEs (Chart III.7). III.14 In this context, India’s experience is notable. In 2008, India seemed an unlikely candidate for implementing an A2A RTP system, with only 1 in 25 people having formal identity, and around one in four adults holding a bank account (D’Silva et al., 2019). Additionally, mobile and internet penetration were significantly lower than global standards. The JAM trinity - Pradhan Mantri Jan Dhan Yojana (PMJDY), Aadhaar, and Mobile7 - launched by government laid the foundation for the rapid and transformative rollout of UPI. The success of UPI has inspired other A2A RTP systems and NPCI is actively collaborating with other countries to help them develop their own systems similar to the UPI.  III.15 The mobile money model, another variant of digital payment system, has gained prominence in many developing countries, especially in Sub- Saharan Africa (Chart III.8). Under this model, a phone with an active connection and a valid government ID would help customers to open a mobile money account. The agents present in remote locations act as ATMs where people can use their services to deposit and withdraw cash from their mobile money account. Initially, mobile money’s focus centred on enabling consumers to conduct person-to-person (P2P) payments digitally, eliminating the necessity for bank accounts or wire transfers. As mobile money expanded its scope, it enabled the consumers to pay bills (including utilities), store money, execute person-to-business (P2B) payments, receive payments from businesses (such as wages), and receive government-to-person (G2P) payments (Suri, 2017). Globally, the mobile money ecosystem has 315 mobile money services and 1.6 billion registered mobile money accounts spread across 102 countries. In 2022, there were 17.4 million registered agents with 65 billion annual transactions totalling US$ 1.26 trillion. On average, a mobile money provider was connected to around 18 banks and processed US$ 22 billion of international remittances in 2022 (GSMA, 2023).   III.16 The adoption of digital payments is supported by banking penetration, technological advancements, the degree of formalisation of the economy and younger cohorts (Box III.I).

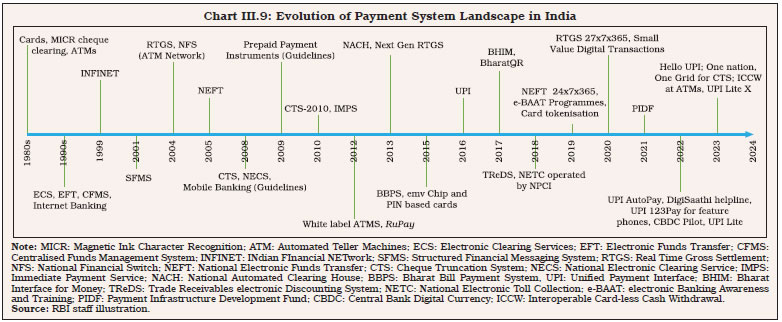

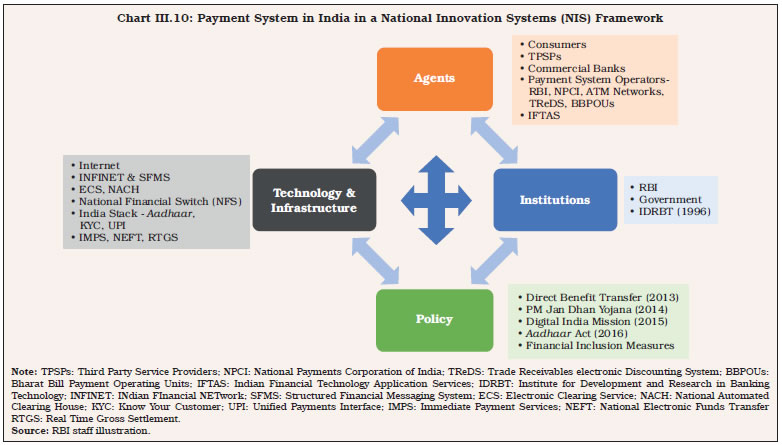

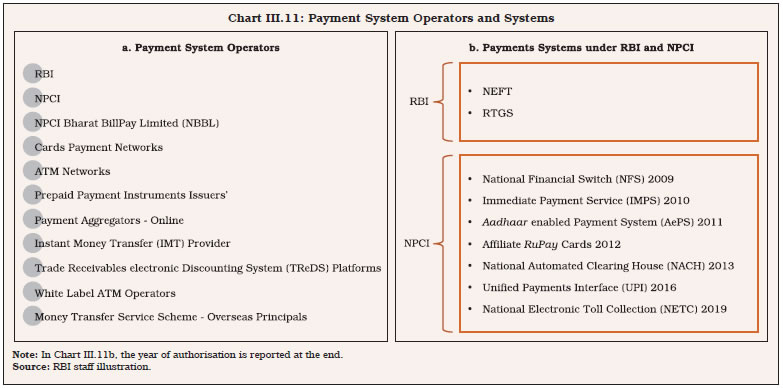

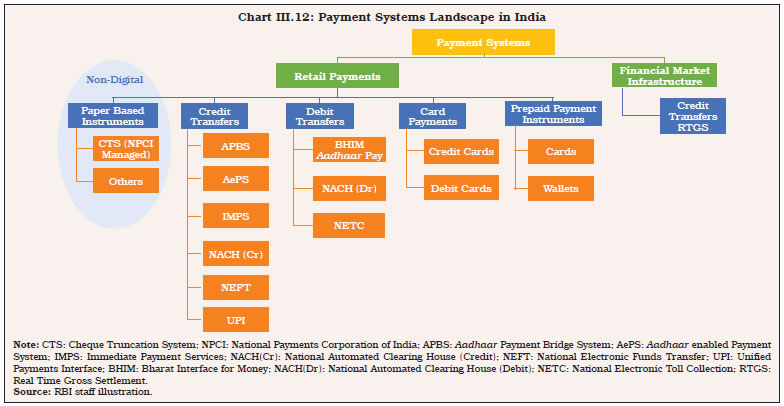

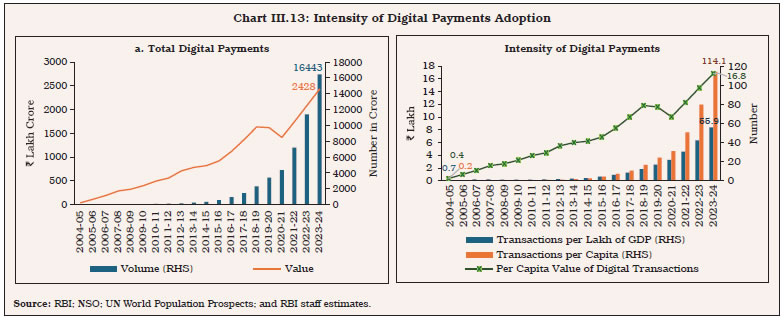

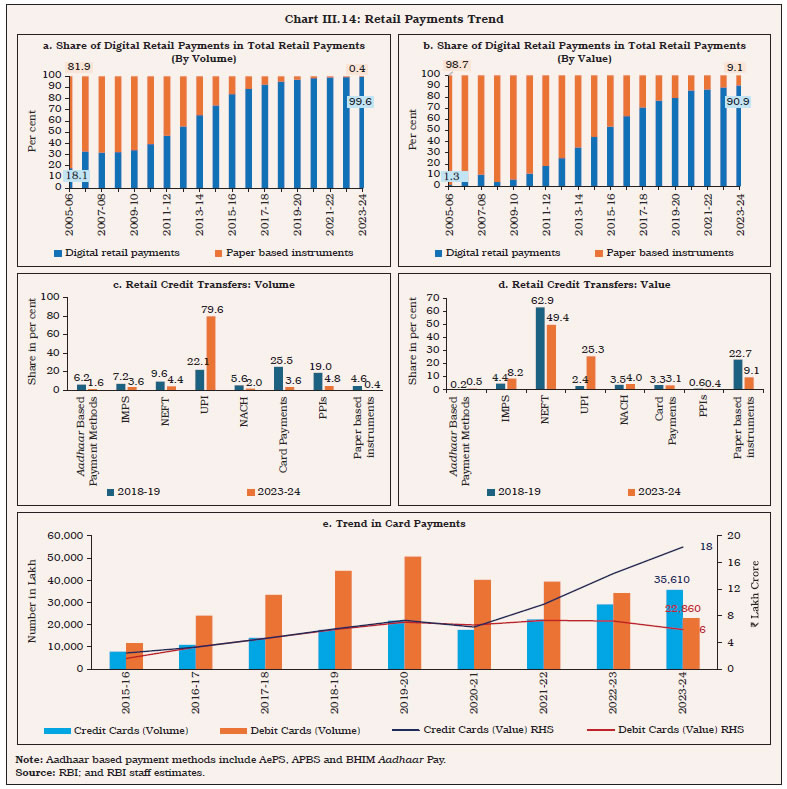

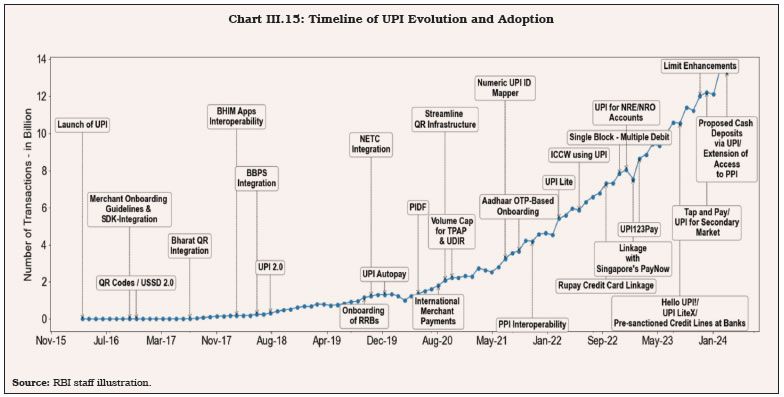

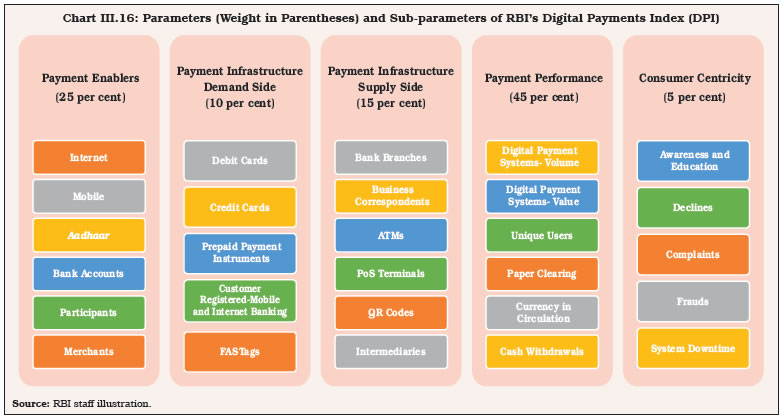

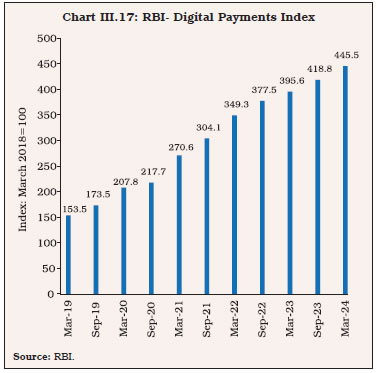

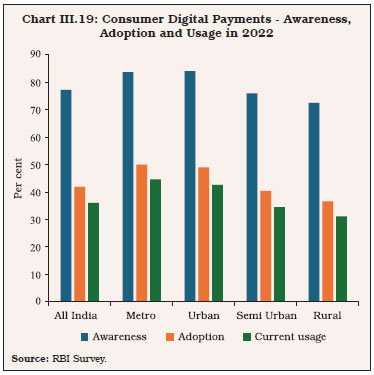

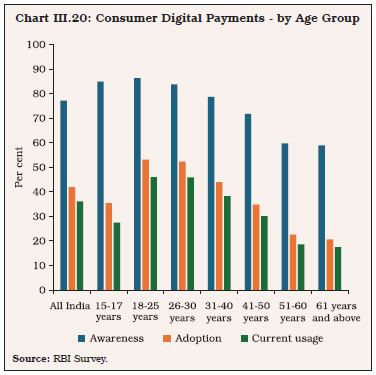

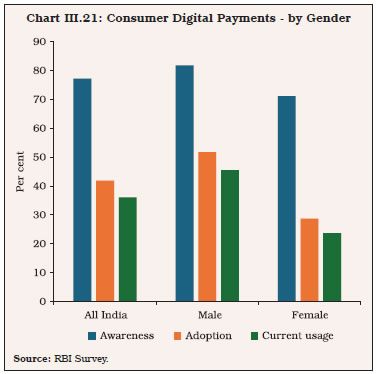

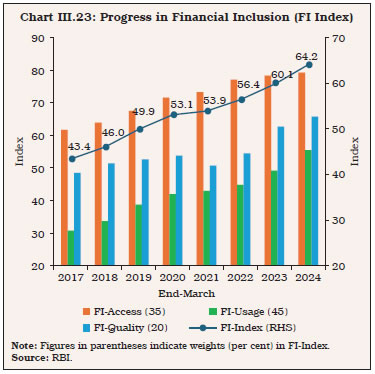

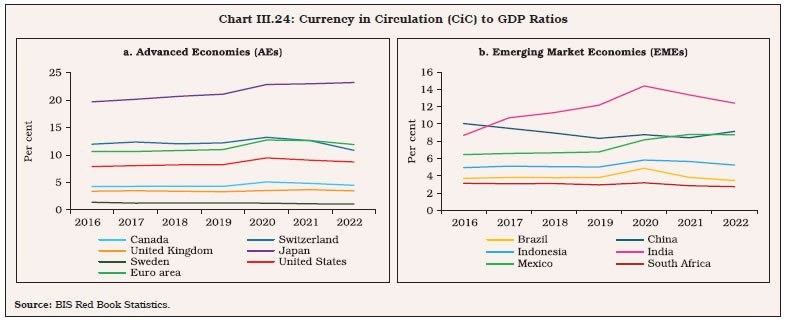

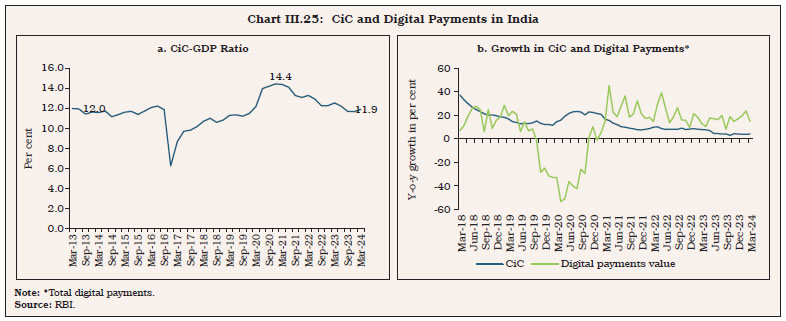

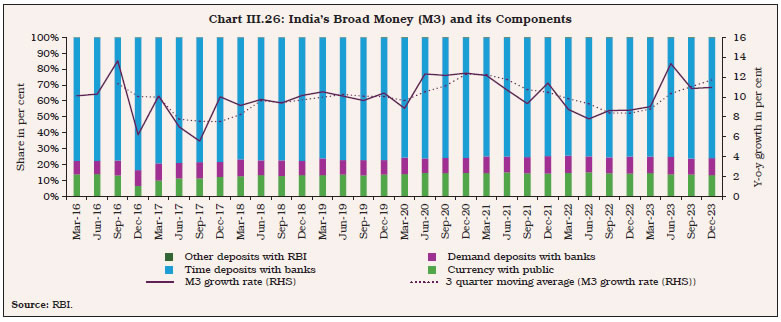

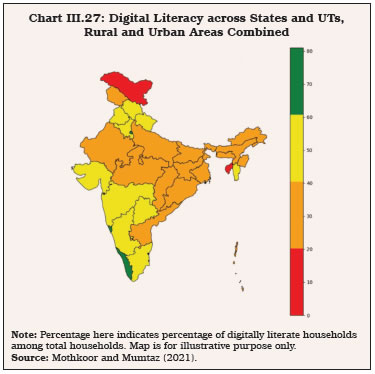

3. The Digital Payment Revolution in India III.17 India has witnessed a revolution in its digital payments journey, without so realising, to become a leader in the digital payments landscape (Gandhi, 2016; Ramasastri, 2018). Underscored by the Reserve Bank’s commitment to move towards a “less-cash” society, India’s journey to become a global leader in the payments’ space has witnessed many global firsts – a low cost, interoperable, mobile-based acceptance solution like Bharat QR Code; Two Factor Authentication; Aadhaar enabled payment systems (AePS); and the UPI (Gandhi, 2017). This journey began in relative obscurity in the 1980s, and the strong retail payments framework in the country today is comparable to that of any advanced country, and perhaps even surpassing some in terms of the variety and efficiency (Gandhi, 2016; RBI, 2022b). The payments revolution in India offers critical lessons for cooperation between a central bank and private firms in bringing about technological progress (Kearns and Mathew, 2022; D’Silva et al., 2019). Payment systems in India have not only navigated through the fast-evolving technological innovations but also developed into one of the most modern and diverse systems with a whole gamut of bill payments, merchant payments, vendor payments, transit payments, and recurring payments (Das, 2024). The flexibility of interoperability among payment systems has brought in unparalleled ease of transactions while robust customer protection measures have made India’s retail payment system one of the safest in the world (BRICS, 2021). 3.1. Evolution of Digital Payments in India III.18 The foundation of an efficient digital payment system was laid down in the 1990s when the modernisation of the payment and settlement systems was accorded high priority in the agenda of financial sector reforms to improve the efficiency of financial intermediation and financial system stability. The reform in payment and settlement systems were facilitated by advancements in computerisation and technology. The payment systems evolution in India can be roughly categorised in two distinct waves: a) digitalisation of existing systems to improve efficiency, and b) changes in payment space brought about by the digital revolution (Chart III.9).  3.1.1. Digitalisation of Existing Payment Systems to Improve Efficiency III.19 In the 1980s, ICT revolution brought significant changes in operating systems at the bank level, beginning from back-office automation of cheques to the front desk total branch automation. Under changes in the banking methods, in the first phase, a three-pronged approach of consolidation, development and integration was adopted (RBI, 2002). Connectivity of bank branches through networking of computers and inter-connectivity of banks were the earliest objectives for the modernisation of the payment and settlement systems.9 The operationalisation of the INdian FInancial NETwork (INFINET), a Closed User Group, in June 1999, was a major step forward in providing a robust communication network for the exclusive use of banks and financial institutions. Until the 1990s, the major alternative to cash was the cheque clearing system. The switchover from physical currency to paper-based payment instruments and to electronic media warranted technological upgradation in clearing arrangements. The evolution of cheque clearing systems progressed from manual to Magnetic Ink Character Recognition (MICR) clearing in the mid-1980s, introducing automation and standardisation. MICR instruments enabled electronic clearing while physically exchanging cheques. The Cheque Truncation System (CTS), introduced in 2008, allowed digital processing of cheques and eliminated the need for their physical movement. Standardised under CTS-2010, with enhanced security features, it replaced MICR completely, starting 2014. To promote efficient cheque processing, the Reserve Bank decided to migrate CTS from an architecture of three regional grids to one national grid. The merger was completed on October 13, 2023, and the merged grid has been named as National Grid Clearing House (NGCH). The merger has improved liquidity and efficiency of the system and enabled rationalisation of cheque clearing infrastructure. After the merger, all cheques presented through the CTS are being processed as local cheques. III.20 The introduction of Central Bank Digital Currency (CBDC) on a pilot basis in 2022 is the latest innovation which would entail a ‘more efficient and cheaper currency management system’ (GOI, 2022; RBI, 2022c). Digital currency is expected to complement cash and current payment systems. “Digital Rupee”, is the digital form of India’s currency, the Rupee, and is a legal tender issued by the Reserve Bank of India. It can be held as a store of value or used to carry out transactions. In May 2024, India was among the 36 countries where CBDC was in pilot stage.10 Based on usage, CBDCs can be classified into wholesale (CBDC-W) and retail (CBDC-R). While wholesale CBDC (CBDC-W) caters to institutional participants of the financial markets, retail CBDC (CBDC-R) is a risk-free digital medium of exchange for the retail consumers. The initial use cases for the pilot of CBDC-R included Person to Person (P2P) and Person to Merchant (P2M) transactions. The pilot has also introduced additional use cases using programmable and offline functionalities. As of June 2024, 50 lakh users and 4.2 lakh merchants were participating in the CBDC retail pilot. 3.1.2. Changes in Payment Space brought about by the Digital Revolution III.21 In the second wave, significant innovations in the payment and settlement landscape were driven by technology-based solutions. Early initiatives in this regard were the introduction of credit cards and ATM networks in the late 1980s. The current wave of innovations in payments system began with the rationalisation of decentralised electronic products like ECS and EFT into centralised pan-India payment solutions like the NACH and NEFT which enabled servicing customers spread throughout the country with settlement at a central location. This phase was facilitated by the adoption of Core Banking Solutions (CBS)/centralised liquidity management solutions in banks which enabled straight-through-processing of payments. In 2012, RuPay card was introduced as the first of its kind global card payment network of India with lower transaction fees and wider acceptance at ATMs, Point of Sale devices, and e-commerce platforms across the country. Mass adoption of e-banking and newer delivery channels for the customers – such as internet banking (the primary mode of e-banking in India) and mobile banking – evolved. As internet connectivity and mobile phone penetration surged, payment mechanism shifted from cards and ATM networks to mobile phones as a convenient alternative for small value transactions. III.22 In recent years, new dimensions have been added to the payment systems, such as the Immediate Payment Service (IMPS) and the UPI, which provide instant credit to the beneficiary, and are available round the clock for undertaking fund transfers. The Real Time Gross Settlement (RTGS) has been developed as a Financial Market Infrastructure, which processes large payment transactions. Initiatives like Bharat Bill Payment System (BBPS) and Pre-paid Payment Instruments (PPIs) (which facilitate payment of bills and purchase of goods and services), and the National Electronic Toll Collection (NETC) which allows for electronic toll payments have further enhanced convenience. Innovations like the Bharat Interface for Money (BHIM) App, interoperable QR code, and 24×7×365 of NEFT and RTGS enhanced the convenience of these payment systems and ensured their rapid acceptance. The facilitation of non-bank FinTech firms in the payment ecosystem as PPI issuers offering stored value services to customers, and in payment gateway and aggregation services like Bharat Bill Payment Operating Units (BBPOUs) and TPAPs in the UPI platform have furthered the adoption of digital payments in the country (RBI, 2021a). Leveraging increasing mobile density, PSPs, both banks and non-banks, have started services using mobile as an access device as well as an access channel.11 III.23 The introduction of UPI in 2016 brought twin benefits for mobile banking - convenience of operations for customers, and merchant ‘pull’ payments. Prior to this, mobile banking applications were largely operating in silos, particularly for merchant payments and were generally not interoperable across merchants and customers of different banks (Das, 2024). In 2022, the interlinking of RuPay credit cards with the UPI platform offered more convenience to users and expanded the reach of digital payments. III.24 To broaden access to digital payments in areas of low internet connectivity, a pilot scheme was launched in August 2020 to enable small value digital transactions in offline mode. In 2022, the framework was formalised with offline payments allowed using any channel or instrument like cards, wallets and mobile devices in proximity (face-to-face) mode without mandatory Additional Factor of Authentication (AFA). UPI Lite was introduced in this framework in September 2022 as a simplified version of the UPI payment system. Using the same account, payments of up to ₹500 can be made without pin authentication, making payments faster and more convenient. In September 2023, UPI Lite X was introduced for offline payments where transactions are carried out using the Near Field Communication (NFC) technology. UPI Tap & Pay, introduced at the same time, allows tapping NFC-enabled QR codes at merchant locations and aids in faster digital transactions. 3.2. Factors Contributing to Digitalisation of Payments in India III.25 The evolution of retail payment landscape in India can be analysed using the innovation systems approach, which was first introduced in the late 1980s as a framework to understand technological innovations at the national level. It has been defined as “the network of institutions in the public and private sectors whose activities and interactions initiate, import, modify and diffuse new technologies” (Freeman, 1987), and “the elements and relationships which interact in the production, diffusion and use of new, and economically useful, knowledge ... and are either located within or rooted inside the borders of a nation state” (Lundvall, 1992). The concept rests on the premise that understanding the interactions among the actors involved in innovation is crucial for enhancing technology performance (OECD, 1997). Nations excel in specific industries because their domestic environment is exceptionally forward-looking, dynamic, and challenging (Porter, 1998).  III.26 Through the lens of the National Innovation Systems (NIS) framework, the payment landscape in India can be seen as influenced by the interaction of various factors including technological advancements, agents, institutions and policy prescription (Chart III.10). The pace and sequencing of payment system reform has been impacted by several factors, viz., (i) the different degrees of computerisation in the financial system; (ii) geographical spread of the banking sector; (iii) the regulatory role of the Reserve Bank in relation to the payment systems; (iv) systemic risks in payment and settlement systems; (v) legal infrastructure; and (vi) impact of payment and settlement system reforms on the conduct of monetary policy (RBI, 2001). III.27 The public sector’s pioneering role in the evolution of payments systems included a four-pronged strategy: treating digital financial infrastructure as a public good, fostering private innovation with open access, ensuring a fair regulatory environment, and empowering individuals through a consensual data-sharing framework. The top-down strategising fostered an open loop digital payments system, which enabled banks to take centre stage in the evolution and integrate themselves in the payment infrastructure. These strategies led to innovative digital platforms that served specific needs like identity verification, payments, and data sharing and collectively form a powerful integrated system known as the Digital Public Infrastructure or the “India Stack” (D’Silva et al., 2019). The multidimensionality of the stack and the open loop system (where settlement happens in the fiat currency), facilitated interoperability and mass adoption, and enhanced financial inclusion. III.28 The Reserve Bank is vested with the power to regulate payment and settlement systems in the country under the Payment and Settlement Systems Act, 2007 (PSS Act). The Board for Regulation and Supervision of Payment and Settlement Systems (BPSS), a Committee of the Central Board of the Reserve Bank of India oversees the payment and settlement systems in India. It is instrumental in prescribing policies and setting standards for regulating and supervising all the payment and settlement systems in the country. III.29 The continuous establishment and development of several institutions by the Reserve Bank played an immense role in the evolution and regulation of payment systems. The Institute for Development and Research in Banking Technology (IDRBT) was established in 1996 with a focus on sculpting the technological infrastructure of the banking sector. It pioneered vital technological infrastructure systems like the INFINET and the Structured Financial Messaging System (SFMS). The IDRBT also developed the National Financial Switch (NFS) in 2004, which is currently under the NPCI. The NPCI was established in 2008 by the Reserve Bank of India and the Indian Banks’ Association exclusively for promoting payment systems. In 2015, the Indian Financial Technology Application Services (IFTAS) was created as a subsidiary of the Reserve Bank which took over key services like INFINET, SFMS, Indian Banking Community Cloud (IBCC), and Global Interchange for Financial Transactions (GIFT), offering uninterrupted 24x7 IT services to the banking sector, including as a communication backbone, messaging platform, and community cloud. In April 2020, NPCI International Payments Limited (NIPL) was established as a subsidiary dedicated to globalising NPCI’s payment systems, focusing initially on the internationalisation of RuPay and UPI. The IDRBT has expanded its focus to research centres, addressing areas like analytics, cyber security, mobile banking, affordable technologies, cloud computing, and payment systems. The setting up of the Reserve Bank Innovation Hub in March 2022 is another step taken to encourage and nurture financial innovation in a sustainable manner through an institutional set-up. III.30 With institutions in place, the Reserve Bank authorised various agents like Payment System Operators (PSOs) such as NPCI (retail payments organisation), card payment networks, cross-border inbound money transfers entities, ATM networks, PPI issuers, Instant Money Transfer operators, TReDS platform providers and NPCI Bharat BillPay Limited (NBBL) to operate payment systems in the country (Chart III.11a). Of all the operators, the Reserve Bank and the NPCI are the major ones entrusted with overseeing vital payment systems like RTGS, NEFT and UPI; IMPS and NACH respectively (Chart III.11b).  III.31 Concurrently, changes in the payment landscape were brought from the perspective of government payments. As noted earlier, the trifecta of JAM trinity revolutionised the retail payment landscape. Bulk and repetitive government benefit and subsidy payments to Aadhaar-seeded bank accounts of identified beneficiaries were facilitated by the Aadhaar Payments Bridge System (APBS). Aadhaar Enabled Payment System, operational since 2011, uses Aadhaar authentication for online transactions and offers cash withdrawal, balance enquiry, and fund transfers. Nearly 352 million RuPay cards have been issued under Jan Dhan Yojana accounts (PMJDY, 2024). Mobile based banking developed as fast payments systems like IMPS and UPI accorded multi-channel access including internet and mobile banking. Amidst this evolution, a universe of Third-Party Service Providers (TPSPs) developed simultaneously, which includes, payment gateways (PGs), payment aggregators (PAs), and TPAPs. These TPSPs play a significant role in furthering public-private partnership in the FinTech sphere. III.32 To further expand the digital payment ecosystem in India, the Reserve Bank in 2019 introduced the ‘Expanding and Deepening of Digital Payment Ecosystem’ (EDDPE) programme. Under this programme, State Level Bankers’ Committees (SLBCs)/Union Territory Level Bankers’ Committees (UTLBCs) of respective states and union territories (UTs) provide every eligible individual in the identified district with at least one mode of digital payments viz., debit/ RuPay cards, net banking, mobile banking, UPI, USSD, AePS, to facilitate him/her to make/receive payments digitally in a safe, secure, quick, affordable, and convenient manner. As on March 31, 2024, all districts across the country (except two districts from the UT of Andaman and Nicobar Islands) have been identified for the purpose, and 179 districts were 100 per cent digitally enabled. III.33 The Payments Infrastructure Development Fund (PIDF) operationalised by the Reserve Bank in January 2021 provided a further fillip to the digital payments revolution. The PIDF Scheme, initially implemented for a period of three years was extended further for a period of two years, i.e., up to December 31, 2025. It encourages deployment of payment acceptance infrastructure such as physical Point of Sale (PoS) terminals and Quick Response (QR) codes in tier-3 to tier-6 centres, north-eastern states and UTs of Jammu & Kashmir and Ladakh, and beneficiaries of Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi Scheme) and PM Vishwakarma scheme in tier-1 and tier-2 centres (Table III.1). The PIDF had a corpus of ₹1,239 crore in May 2024. III.34 Apart from these factors, digital payments were boosted by the demonetisation of banknotes of ₹500 and ₹1000 denominations in 2016. The year-on-year growth in retail electronic payments jumped from around 37 per cent during April to October 2016 to nearly 70 per cent in November and 123 per cent in December 2016. There appears to be a structural break in the volume and value of retail electronic payments, coinciding with the onset of demonetisation (RBI, 2017). The COVID-19 pandemic also hastened the adoption of digital payments in India with consumers and businesses increasingly choosing contactless transactions amidst social distancing norms and lockdowns. Realising the importance of financial literacy in digital payments’ adoption, the Reserve Bank, along with several non-governmental organisations and financial institutions, has initiated various programmes to educate the underserved segments about the benefits of digital payments. The Reserve Bank has been conducting electronic banking awareness and training (e-BAAT) programmes regularly to educate the masses to move their focus of payments from physical presence of money to electronic money payments. III.35 Overall, the evolution of the retail payment landscape in India within the context of the NIS reflects a dynamic ecosystem characterised by policy support, technological innovation, stakeholder collaboration, and consumer-driven demand. These efforts were a part of a broader strategy to promote financial inclusion, enhance the efficiency of the payment system, and boost the digital economy. Going forward, the Payments Vision Document 2025 (RBI, 2022a) further builds upon the five pillars of integrity, inclusion, innovation, institutionalisation and internationalisation and is indicative of the future evolution of payment systems in India. 3.3. Trends in Digital Payments III.36 Payment transactions in India currently comprise bulk payment transfers (RTGS), which include both customer and inter-bank transactions; and retail payment transfers12 (Chart III.12). Except paper-based instruments, all other payments constitute digital transactions. The digital payments system has been developed to offer a bouquet of products to cater to diverse needs. While the UPI has facilitated digital payments to merchants such as retail outlets/vendors across the country, the BBPS has ensured migration of bill payments from cash/cheques to digital mode. Likewise, the NETC system aided migration of toll payments to digital mode, and the NACH facilitated digital direct benefit transfers (DBT). III.37 The transition to digital modes of payment is borne out by the phenomenal growth witnessed across all facets of digital transactions over the past decade. The volume of digital transactions recorded a compound annual growth rate (CAGR) of 52 per cent during 2013-14 to 2023-24 while the value of these transactions exhibited a 12 per cent CAGR (Chart III.13a). The intensity of digital payment usage has shot up multi-fold: the number of transactions per lakh of GDP increased from 0.8 in 2005-06 to 56 in 2023-24, and the number of transactions per capita from 0.2 in 2005-06 to 114 in 2023-24. The average value of transaction per capita for total digital payments surged from ₹0.4 lakhs to ₹16.8 lakhs over the same period (Chart III.13b).   III.38 The share of the volume of paper clearing plummeted to 0.4 per cent in 2023-24 in total retail payments from 81.9 per cent in 2005-06. Further, the share of digital retail transactions in total value of retail payments increased to 90.9 per cent in 2023-24 from 1.3 per cent in 2005-06 (Chart III.14a and b). UPI has emerged as the preferred method of retail payments, with a share of 79.6 per cent in total volumes of retail payments made in 2023-24 (Chart III.14c). In value terms, NEFT transactions had the highest share (49.4 per cent) in total retail payments in 2023-24, followed by UPI (25.3 per cent share in 2023-24 as compared to only 2.4 per cent in 2018-19) [Chart III.14d]. Within card payments, the usage of credit cards has increased over the years. In 2023-24, credit cards accounted for 61 per cent of total volume and 76 per cent of total value of card payments (Chart III.14e). The integration of functionality of UPI with RuPay credit cards increased credit card usage further in 2023. Consequently, the market share of outstanding RuPay credit cards in circulation also increased from 3 per cent in 2022- 23 to 10 per cent in 2023-24.13 III.39 UPI is now the most popular and preferred payment mode in India revolutionising the P2P as well as P2M transactions (Das, 2023a). Apart from being a user-friendly interface and facilitating QR code-based payments, the UPI has evolved to include advanced functionalities such as offline payments through NFC technology (UPI Lite X), payments through feature phones (UPI 123Pay) and AI based conversational payments (hello! UPI) [Chart III.15]. The volume of UPI transactions has increased multi-fold from 539 crore in 2018-19 to 13,113 crore in 2023-24 and their value from ₹8.8 lakh crore to ₹200 lakh crore during the same period. Currently, UPI is processing close to 45 crore transactions in a day (June 2024).  III.40 The Digital Payments Index (DPI), constructed by the Reserve Bank of India with March 2018 as the base year, captures the extent of digitisation of payments across the country. It comprises of five broad parameters that capture demand and supply side factors to measure deepening and penetration of digital payments: (i) payment enablers, (ii) payment infrastructure – demand-side factors, (iii) payment infrastructure – supply-side factors, (iv) payment performance and (v) consumer centricity. Each of these parameters have sub-parameters that consist of various measurable indicators (Chart III.16).  III.41 Since March 2018, the DPI has increased more than four-fold to reach 445.5 in March 2024 (Chart III.17). The increase has been recorded across all parameters and driven particularly by payment performance and payment infrastructure across the country, over the period.   3.4. Awareness and Adoption of Digital Payments in India: Evidence from User Survey III.42 Even as there has been significant progress in digital payments adoption in India as captured by the broad aggregates discussed above, micro level evaluation from the users’ perspective is crucial to extract important policy lessons regarding the degree of penetration of digital payments as well as gaps, if any, which need focused attention. Accordingly, the Reserve Bank conducted a nationwide survey of merchants and consumers with approximately 90,000 participants from both the rural as well as urban areas in all States and Union Territories (UTs), ensuring a proportionate representation according to population size and geographies in 2022.14 The major survey results are set out below. 3.4.1. Merchants III.43 As per the survey, familiarity with digital payments is widespread across geographical locations with 88.8 per cent of the merchants being aware of digital payments (the highest in metro areas at 93.4 per cent). About two-third of the survey respondents had tried digital payments at least once.15 The adoption levels were, however, lower than the awareness levels suggesting scope for expanding the usage of digital payments. In metro areas, the percentage of merchants who had adopted digital payments was higher at 75.2 per cent, along with higher current usage (Chart III.18). At an all-India level, about one-fifth of the merchants had never used digital payments despite being aware of it, while another 11.2 per cent had never used digital payments because of the lack of awareness. Around 60 per cent of merchants observed an uptick in digital payments usage following the COVID-19 pandemic. This pattern was consistent across different groups, with a notably higher increase among merchants in metro areas.  3.4.2. Consumers III.44 The pattern of digital payment awareness among consumers was like that of merchants, although the awareness levels were somewhat lower. As in the case of merchants, the awareness among metro and urban consumers was higher and the awareness in semi-urban and rural areas did not see a significant drop from the all-India average. The adoption levels among consumers were lower compared to merchants, with only 41.9 per cent consumers having used any of the digital payment modes at least once in their lifetime. The adoption of digital payment modes was higher in metros and urban areas. The conversion from awareness to trial was 54.3 per cent, suggesting scope for further penetration. III.45 According to the survey, about 36.1 per cent consumers were current users of any of the digital payment modes in India. When compared to 41.9 per cent of users who have tried digital payments at least once, this translates to a conversion rate of 86.1 per cent, implying that most people having once used, continue to use digital payments regularly. This also indicates that efforts towards initiating consumers to digital payments on a trial basis could result in long term adoption. The current usage of digital payments was also found to be higher among metro and urban residents (Chart III.19). Approximately 4 in every 10 consumers reported that they started using digital payments post the pandemic. Among the remaining 59.9 per cent who had been using digital payments pre-Covid, 64.7 per cent reported an increase in their usage post-Covid.  III.46 By age groups, the awareness of digital payments was high among the younger age groups. Adoption and current usage followed similar trends, with the age group 18-30 years using digital payments the most (Chart III.20).   III.47 Awareness and usage levels among males were higher than females. While 51.8 per cent of the males had used digital payment mode at least once in their lifetime, the number was 28.7 per cent for females, according to the survey (Chart III.21). III.48 Across states, the overall awareness was in the range of 60-93 per cent, with twelve states/ UTs exhibiting awareness levels equal to or higher than the all-India average (Table III.2). 3.4.3. Key Drivers of Adoption of Digital Payments III.49 The survey also elucidated information on what facilitated the adoption of digital payments ecosystem from the consumers’ perspective. Ease and convenience were cited as key reasons, with 61.8 per cent consumers quoting the same. Amongst users of digital payments in the country, 86.6 per cent respondents did not face any difficulty while using digital payment methods. Among the small set of customers who did face difficulty while using digital payments, server being down/not working was reported as the key issue (59.1 per cent). Other challenges were consumers’ habituality with cash (30.7 per cent) and unacceptability of digital payments (19.7 per cent). III.50 Through their fast, convenient, cost-effective, and transparent nature, digital payments offer significant advantages to consumers as well as producers – they foster financial inclusion and inclusive growth and boost productivity and incomes. In a panel of 90 economies over 2014-19, a one percentage point increase in digital payments use was associated with 0.04 percentage point and 0.10 percentage point growth in total factor productivity and GDP per capita, respectively (Aguilar et al., 2024). The study also found that digital payments facilitated greater access to credit and resulted in 0.06 percentage point decline in the share of informal employment. Digital payments enhance the well-being of households by reducing the risk from economic shocks; they also facilitate informal-risk- sharing networks by facilitating timely transfer of small amounts of money, enabling mitigation of negative shocks, and more efficient investment decisions (Jack and Suri, 2014; Jack and Suri, 2011). 4.1 Financial Inclusion and Inclusive Growth III.51 The emergence of digital payments has quickened the pace of financial inclusion by breaking many of the obstacles faced by traditional financial inclusion channels, like cost, geographical barriers, and information asymmetry (Khera et al., 2022). Digital finance complements traditional finance in areas where formal finance is already engraved and supplements in places where traditional financial modes have limited reach. Inclusive digital financial services, including online accounts, mobile money services, electronic payments, combinations of insurance and credit as well as FinTech applications have the capacity to reach individuals and firms which were hitherto excluded. Digital financial services (DFS), by virtue of being faster, more efficient, and typically cheaper than traditional financial services, are becoming increasingly capable of reaching lower-income households as well as micro, small, and medium enterprises (MSMEs) [Khera, 2023]. The advent of digital innovations and payments has the potential to be an enabler for the next level of financial inclusion where the quality of inclusion takes precedence over just the availability of financial services (Rao, 2022). III.52 By widening the reach of financial payments to poor households and micro enterprises, digital payments enhance their opportunities for participating in formal economic activities, fostering growth and bringing down poverty and inequality. Higher access to payment services is associated with a reduction in income inequality, particularly for those at the lower end of the income distribution, and when female financial inclusion is high (Čihák and Sahay, 2020). Additionally, DFS reduce gender gap in financial inclusion by addressing constraints that affect women in particular, such as mobility and time constraints (Khera, 2023). DFS also holds promise for reducing costs, improving speed, security, and transparency, and facilitating more tailored financial services that cater to the disadvantaged and underserved populations (Thomas and Hedrick-Wong, 2019; Pazarbasioglu et al., 2020). III.53 Digital payments help in consumption-smoothing and increasing savings for households, while helping in stabilising income and increasing sales for firms in the informal sector. In Bangladesh, mobile banking increased urban-to- rural remittances; rural households receiving digital payments borrowed less, saved more, and consumed more in the lean season (Lee et al., 2021). Based on a study of 400 million mobile money users in India, Patnam and Yao (2020) found that mobile money use increased the resilience of households to shocks by dampening the impact of rainfall shocks on economic activity and household consumption. The study also indicated that firms adopting mobile payments improved their sales after six-months of use, had lower subjective uncertainty and greater sales optimism. III.54 India’s financial inclusion initiatives received a fillip when PMJDY was launched in 2014 (Chart III.22). The digital technological revolution widened the usability of bank accounts from a traditional deposit or credit account to a payment intermediary. As per the World Bank’s Findex database, 78 per cent of Indian adults (population with 15 years or more of age) had a bank account in 2021 as compared to 53 per cent in 2014.  III.55 The strides in furthering financial inclusion are captured by the Reserve Bank’s Financial Inclusion Index (FI-Index), a comprehensive index incorporating details of banking, investments, insurance, pension as well as the postal sector. The FI-Index, on a scale of 0 to 100, comprises of three broad parameters, viz., access (35 per cent), usage (45 per cent) and quality (20 per cent), with each of these consisting of various dimensions. The index improved to 64.2 in March 2024 from 43.4 in March 2017, with growth across all sub-indices (Chart III.23). 4.2 Improving Credit Assessment and Availability III.56 Digital payments generate real-time data on sellers’ businesses, timing of cash flows, and buyers’ purchasing habits, allowing payment providers to offer credit, savings, wealth management, collections, insurance, and other financial services. Ouyang (2021) found that cashless payment adoption in China increased credit access by 56.3 per cent, and a 1 per cent rise in payment flow increased credit line by 0.4 per cent. These effects were found to be more pronounced among individuals with lower levels of education, and the older population. Digital payments also simplify the transaction process, making it faster and more efficient and eliminate manual cash handling and record-keeping. In India, internet adoption by small businesses has increased over the years, though the usage remains low. As per the Annual Survey of Unincorporated Sector Enterprises (ASUSE) 2022-23 (October-September), 21.1 per cent of unincorporated establishments used internet for entrepreneurial purposes during the year compared to 4.0 per cent in 2015-1616. A major share of these establishments with internet used internet banking (61.5 per cent) for business purposes during 2022-23.  III.57 Digital payment history enables lenders to gauge cash flow, revenue patterns, and repayment habits of borrowers, enhancing their ability to obtain credit at more favourable lending terms and opportunities for expansion. This data-driven approach bridges the gap that often hampers credit access for smaller businesses. For India, Dubey and Purnanandam (2023) found that digital payments alleviated credit constraints and transaction cost frictions, especially in areas where the presence of conventional banking infrastructure was limited. Digital payment infrastructure helped reduce impediments faced by marginal self-employed households, such as hawkers and small traders; and small entrepreneurs’ borrowing from formal sources of financing increased with digital payments. Additionally, digital payments help small businesses to innovate and explore new business models such as subscription services, online marketplaces, and digital platforms, enabling them to transcend geographical boundaries and reach a wider customer base both domestically and internationally. 4.3 Better Targeting of Government Support Schemes III.58 Digital payment systems facilitate a cost-effective expansion of government-to-persons social assistance programmes, given their ability to reach far-flung and remote areas (Yawe et al., 2022). In India, one of the most significant impacts of digital payments on under-served populations has been through the implementation of DBTs. The Aadhaar Payment Bridge (Digital ID and Digital Payment) allowed the government to make direct transfers of subsidies, wages, and other benefits into beneficiaries’ bank accounts in an efficient, transparent, and speedy manner, while reducing leakage and corruption. The number of transfers as well as the total amount transferred under DBTs have witnessed a significant rise in recent years (See Chapter I, Chart I.19). DBTs and other governance reforms have led to an estimated savings of ₹3.49 lakh crore till March 2023 (Table III.3). During 2023-24, 1006 crore DBT transactions were made by the Central Government amounting to ₹6.9 lakh crore.17 4.4 Impact on Central Banking Operations III.59 The rapid pace of technological advancements in digital payments could have a significant bearing on monetary transmission mechanism and central banks’ operational frameworks and instruments. This would require them to adapt their policies and frameworks to navigate the realities of the new financial landscape efficiently and effectively to maintain their key objectives of price and financial stability (BIS, 2020). 4.4.1. Money Demand III.60 Even as digital payments are growing rapidly, demand for cash still remains generally high. Cash continues to be used as a store of value and a preferred choice during periods of heightened uncertainty, as seen during the COVID-19 pandemic (Ashworth and Goodhart, 2021; Awasthy et al., 2022). It is also the dominant mode of payment for certain segments of population, like older people (Khiaonarong and Humphrey, 2022). These developments and country-specific factors are reflected in divergent currency to GDP ratios and trends across the world. For instance, among the major AEs, Japan has the highest currency in circulation (CiC) to GDP ratio, which is even higher than major EMEs (Chart III.24). Sweden’s payments market, on the other hand, has digitalised at a rapid pace, with its CiC to GDP ratio at 1.1 per cent in 2022, among the lowest in the world. III.61 In India, currency/GDP ratio has been broadly range-bound in recent years, with variations due to events such as demonetisation in 2016 (and subsequent remonetisation), a temporary jump in precautionary demand due to uncertainties induced by the COVID-19 pandemic and the withdrawal of ₹2000 banknotes in May 2023 (Chart III.25a). CiC growth has recorded some moderation amidst strong expansion in digital payments (Chart III.25b). The negative and statistically significant substitution effect between cash and digital modes can, however, be outweighed by the combination of positive income and precautionary effects depending upon the prevailing circumstances (Awasthy et al., 2022). III.62 Digital payments influence monetary aggregates – both narrow money (M1) by influencing CiC and demand deposits (Columba, 2009) and broad money (M3) by affecting levels of saving and deposits (Demirgüç-Kunt et al., 2022). Further, as transactions become faster and more seamless in the digital mode, money can change hands faster, thereby affecting the velocity of money. Digital payments can also make it easier to respond to changes in interest rates, with implications for interest rate sensitivity of money and monetary policy transmission (Kahn et al., 2022). In several countries, like the US, Canada, China, Kenya, Singapore, and Sweden, the digitalisation of payments was accompanied by a structural shift and instability in money velocity. The effect was, however, dampened by other macroeconomic factors. In the US, important innovations in the payment space were accompanied by an increase in income velocity of M1, while a decline of the same was registered in the aftermath of the GFC and the COVID-19 pandemic. Canada experienced a similar uptick in money velocity for narrow money, coinciding with the introduction of credit cards. In the case of China, expansion in mobile money around 2002 led to an increase in volatility of money velocity (Lukonga, 2023).  III.63 In India, in the aftermath of the COVID-19 pandemic, M3 growth accelerated transiently, as its largest component, aggregate deposits, grew sharply owing to COVID-19 induced uncertainties and the lack of avenues to spend (Chart III.26). This also led to a sharp drop in the velocity of money (RBI, 2021b). The velocity of money returned to its long run trend in 2022-23 (RBI, 2023). III.64 In India, financial innovations (cards and mobile banking, among others) are important determinants of real money balances (Adil et al., 2020). In China, digital finance impacts stability of money demand differently across monetary aggregates: it leaves M0 unaltered, has no effect on the volatile M1, but disrupts the previously stable M2 (Zhan et al., 2023). In Italy, the diffusion of ATMs and PoS had a negative impact on CiC, but a positive impact on M1, as payment innovations lead to a shift away from cash towards demand deposits (Columba, 2009). In the Indian context, digitalisation appears to reduce money demand (Box III.2).   4.4.2. Impact of CBDC III.65 CBDCs are being introduced in different economies in pilot mode, including India. While CBDCs offer a range of benefits like reduced dependency on cash, lower currency management cost and reduced settlement risk, these also have implications for financial stability, monetary policy, financial market structure, and cost and availability of credit (RBI, 2022b). Conceptually, CBDCs can induce changes in public’s demand for currency; banking system deposits and credit; retail, wholesale and cross-border payments; and monetary policy implementation and transmission. CBDC can reduce transaction demand in deposits, as it brings down settlement risk, reducing the liquidity needs for settlement of transactions (Sankar, 2021). At the same time, it can also reduce bank deposits affecting the credit creating capacity of commercial banks. As deposits are a cheap and stable source of funding for banks, substitution of bank deposits with CBDCs could impact banks’ overall funding, and ability to lend (Chang et al., 2023). Bank disintermediation due to introduction of CBDCs would depend, inter alia, upon the design features of the CBDC (for example, whether remunerative or not). CBDCs could also impact the commercial bank reserves at the central bank and open market operations. Countries with banking systems dominated by small retail deposits and a high share of non-interest- bearing demand deposits could be more vulnerable to deposit disintermediation (Lukonga, 2023). The implications of CBDC for central banking operations and monetary policy essentially depend on the way it is designed and its degree of usage. If the CBDCs get a positive remuneration, higher usage and adoption of CBDCs could weaken monetary policy transmission. A reduction in availability, and/or an increase in the cost of credit from the banking sector could impact aggregate demand and supply in the economy and weaken the bank lending channel of monetary policy transmission; alternatively, positively remunerated CBDCs could lead to more effective monetary policy transmission as banks will need to compete for more deposits, and thereby maintain competitive deposit rates. Further, interest bearing CBDCs could transmit monetary policy actions directly to economic agents improving efficacy of transmission (RBI, 2022c).