IST,

IST,

IV. Monetary and Liquidity Conditions

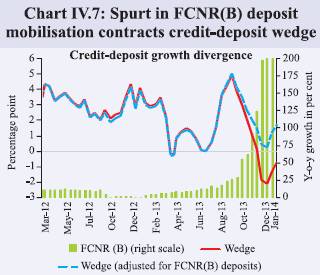

The course of gradual monetary easing that had started alongside some dampening of inflationary pressures was disrupted by the over-riding need to stabilise the exchange rate in the face of large capital outflows since May 2013. Liquidity conditions were tightened considerably till such time as the exchange rate stabilised. Since then the interest rate corridor’s width has been normalised through a 150 bps reduction in the MSF rate and an increase of 50 bps in the policy rate, the latter reflecting the need to tackle the resurgence in inflation. Additional liquidity was also provided in terms of variable rate term repos and forex swaps. The latter turned out to be a significant driver of reserve money growth in Q3 of 2013-14 as NFA were built up. The momentum in mobilising FCNR(B) deposits on the back of the swap facility also pushed up growth in aggregate deposits and, hence, money supply. Normalisation of exceptional monetary measures revert policy corridor back to (+/-) 100 bps IV.1 In the wake of the uncertainty emanating from the US tapering indication, the Reserve Bank resorted to exceptional monetary measures to address exchange market pressures. Inter alia, it raised the marginal standing facility (MSF) rate by 200 basis points (bps) in mid-July 2013 and capped the borrowing under LAF to 0.5 per cent of each bank’s net demand and time liabilities (NDTL). IV.2 Following the ebbing of volatility in the foreign exchange market, the Reserve Bank initiated normalisation of the exceptional measures in a calibrated manner since its mid-quarter review (MQR) of September 20, 2013. The interest rate corridor was realigned to normal monetary policy operations with the MSF rate being reduced in three steps to 8.75 per cent between September 20, 2013 and October 29, 2013 even as the repo rate was increased in two steps of 25 bps each to 7.75 per cent with a view to containing inflation and inflation expectations (Chart IV.1). Tight liquidity situation eased gradually in Q3 in line with unwinding of exceptional measures IV.3 The policy induced tight liquidity conditions during Q2 of 2013-14 eased considerably in October 2013 with the gradual normalisation of exceptional monetary measures. Although the festival-induced increase in currency in circulation kept the liquidity situation generally tight in November 2013, the buoyant capital inflows under the Reserve Bank’s swap facilities for bank’s overseas borrowings and non-resident deposit funds (which were operational till November 30, 2013), eased domestic liquidity significantly. The narrowing of wedge between the credit and deposit growth also contributed to improving the liquidity condition. IV.4 The easing of liquidity conditions got reflected in the under-utilisation of limits by the banks under the overnight LAF repo and export credit refinance, a steady decline in access to the MSF and the parking of excess liquidity with the Reserve Bank through reverse repos. Though the liquidity situation tightened temporarily from the third week of December 2013, reflecting advance tax outflows from the banking system and some restraint on government spending, it reverted to normal level in the first week of January 2014. However, the liquidity situation tightened again thereafter, primarily on account of build-up of government’s cash balances and a rise in currency in circulation. Reserve Bank steps up measures to ease frictional liquidity stress in the system IV.5 In order to manage the evolving liquidity situation, the Reserve Bank conducted two OMO purchase auctions during Q3 of 2013-14, injecting liquidity to the tune of `161 billion. Liquidity support was also provided through the variable rate 7-day and 14-day term repo facility up to a limit of 0.5 per cent of the banking system’s NDTL. Anticipating liquidity stress in mid-December, induced by the advance tax outflows, an additional liquidity support of `100 billion was provided through a 14-day term repo on December 13, 2013. As the strain on market liquidity is expected to continue in view of the fiscal targets set for the year, the Reserve Bank also conducted an OMO purchase auction injecting liquidity of `95 billion and two 28-day term repos to ease the liquidity pressure in January 2014. IV.6 To address the liquidity stress faced by the medium, micro and small enterprises sector, the Reserve Bank opened a refinance facility of `50 billion to the Small Industries Development Bank of India (SIDBI) (Chart IV.2). NFA pushes up reserve money growth in Q3 IV.7 The range of liquidity enabling measures undertaken by the Reserve Bank after the exchange market volatility subsided, have led to a significant build-up in two major sources of reserve money - net foreign assets (NFA) adjusted for valuation changes, and net credit to the centre. The latter expanded on account of LAF, MSF, term repo and OMO purchases. However, it moderated towards the end of Q3 on account of a build-up in the government’s surplus cash balances with the Reserve Bank on account of advance tax receipts. IV.8 Notwithstanding the offsetting effect of an increase in government deposits on the expansion in credit to the centre, reserve money increased by `542 billion in Q3 of 2013-14 following a build-up in net foreign assets (adjusted for valuation changes). While reserve money growth has mostly been led by domestic assets in recent years, 2013-14 so far has seen a more balanced NDA-NFA mix. NFA has been beefed up following the US$ 34 billion inflow under FCNR(B) funds and banks’ overseas borrowing related swap facilities (Chart IV.3). IV.9 The expansion in reserve money was matched by a seasonal pickup in the currency in circulation and an increase in bankers’ deposits on the components side. The y-o-y variation in reserve money averaged around 10.3 per cent in Q3. However, reflecting the pickup in the bankers’ deposit variation (y-o-y) on account of CRR cuts that became effective in September and November of the previous year, the reserve money growth (y-o-y) averaged around 11.3 per cent in the first half of November 2013 and has since been range bound (Table IV.1). Money supply picks up on the back of faster pace of deposit mobilisation IV.10 A stronger pickup in the seasonal festive demand in Q3 helped currency with the public increase to 11.2 per cent (y-o-y) at the end of Q3 from 9.6 per cent at the end of Q2 of 2013- 14. It has since moderated to 10.6 per cent in mid-January 2014. In addition, backed by a large flow of FCNR(B) deposits and advance tax mobilisation, aggregate deposit growth picked up to a financial year high of 17.1 per cent in mid-December which moderated to 15.6 per cent by mid-January 2014. The growth in aggregate deposits net of FCNR(B) deposits, however, has averaged around 14 per cent, in line with the Reserve Bank’s indicative trajectory, since October 2013. IV.11 In line with this, money supply growth increased to 14.5 per cent in mid-January 2014 from 12.9 per cent at the end of Q2 of 2013-14. On the sources side, the credit off-take, although moderating, supported money growth. The growth in money supply excluding the FCNR(B) effect, however, was lower at 12.4 per cent (mid-January 2014) (Chart IV.4). Sectoral deployment of credit shows slack agricultural and industrial off-take IV.12 There has been some moderation in credit disbursement (y-o-y) since November 2013. Private sector banks showed sharp deceleration in January 2014 (Chart IV.5a). IV.13 Based on gross non-food credit data of select SCBs, a slowdown in credit off-take across agriculture and allied activities and industry was observed during December 2013. On the other hand, the services sector continued to exhibit a strong build-up. The overall growth in credit to industry decelerated to 14.1 per cent (from 15.2 per cent last year) led by sectors, including petroleum, mining, gems and jewellery (Chart IV.5b). Despite moderation, pace of credit growth is in line with the indicative trajectory IV.14 Non-food credit growth (y-o-y) decelerated from a financial year peak of 18.1 per cent on September 6, 2013 to 15 per cent on January 10, 2014. In view of the higher cost of non-bank funds, corporates had earlier resorted to cheaper bank credit, thereby causing an uptick in the credit growth in Q2 of 2013-14. However, with the normalisation of the policy rate corridor, i.e., lowering of the MSF rate to the current 100 bps above the repo rate, credit growth moderated in line with the Reserve Bank’s indicative trajectory of 15 per cent. Asset quality indicators that have been deteriorating since 2011-12 are moderating credit off-take in the face of slowdown in economic activity. However, the fall in slippage ratio in Q2 of 2013-14 may offer some respite (Chart IV.6). IV.15 Following the build-up of FCNR(B) deposits, the y-o-y growth in deposit mobilisation outstripped that of credit off-take for SCBs since end-November 2013. However, adjusted for the FCNR(B) effect, the deposit growth lags credit growth, resulting in a small wedge (Chart IV.7). Lending rates decline tracking normalisation of the policy rate corridor IV.16 The weighted average lending rate (WALR) of banks declined during Q3 of 2013- 14 with the decline being more pronounced for fresh loans (Table IV.2). In the face of the gradual easing of the tight liquidity situation and the lowering of funding costs as normalcy returned to money markets, average domestic deposit rates across bank categories declined from the highs seen at the end of Q2. Notwithstanding the q-o-q decline, the average domestic deposit rates are about 45 bps higher than at the start of the financial year. In recent years, low deposit rates in the face of high inflation had been impacting the mobilisation of financial savings. Flow of resources to commercial sector weighed down by non-bank sources IV.17 During 2013-14 (up to January 10, 2014) the estimated flow of financial resources from banks to the commercial sector improved. Recourse to non-bank sources decelerated on account of CPs, non-deposit taking NBFCs, net investment by LIC and short-term credit from abroad (Table IV.3). Monetary policy evolving with changing macro-financial conditions IV.18 During the course of 2013-14, the Reserve Bank eased as well as tightened liquidity and monetary conditions in line with the rapidly changing macroeconomic and financial conditions. The width of the policy rate corridor has reverted to 100 bps on either side of the central policy rate, while the policy rate is 25 bps higher than at the start of the year. In the MQR (December 18, 2013), the Reserve Bank maintained the policy rate, awaiting further information on growth and inflation. |

ಪೇಜ್ ಕೊನೆಯದಾಗಿ ಅಪ್ಡೇಟ್ ಆದ ದಿನಾಂಕ: