Monetary and Credit Information Review - ಆರ್ಬಿಐ - Reserve Bank of India

Monetary and Credit Information Review

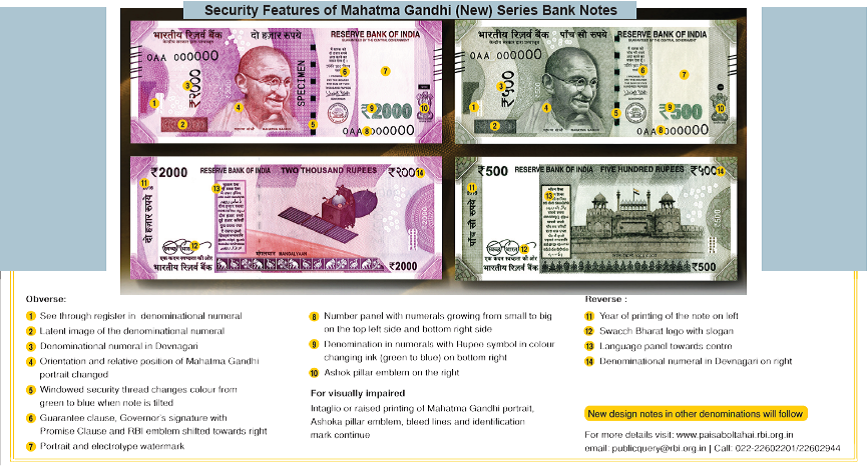

Volume XIII MONETARY AND CREDIT INFORMATION REVIEW Banking Regulation Asset Classification Norms under S4A - Revisions Based on the feedback received from stakeholders as also analysing the rationale behind asset classification norms, the Reserve Bank revised paragraphs 9(B) (iii) and (iv) of the the Scheme for Sustainable Structuring of Stressed Assets(S4A), pertaining to the asset classification norms for loans under the Scheme, in cases where there is no change of promoters as under: (iii) In respect of an account that is classified as a non-performing asset as on the reference date, the Part B instruments shall continue to be classified as non-performing investment and provided for as a non-performing asset as per extant prudential norms, as long as such instruments remain in Part B. The sustainable portion (Part A) may optionally be treated as ‘Standard’ upon implementation of the resolution plan by all banks, subject to provisions made upfront by the lenders being at least the higher of 50 percent of the amount held in part B or 25 percent of the aggregate outstanding (sum of Part A and part B). For this purpose, the provisions already held in the account can be reckoned. (iv) In all cases, lenders may upgrade Part B to standard category and reverse the associated enhanced provisions after one year of satisfactory performance of Part A loans. In case of any pre-existing moratorium in the account, this upgrade will be permitted one year after completion of the longest such moratorium, subject to satisfactory performance of Part A debt during this period. However, in all cases, the required MTM provisions on Part B instruments must be maintained at all times. The transition benefit available in terms of paragraph 9(B)(vi) can however be availed. Banks shall make disclosures in their annual financial statements on application of the Scheme for Sustainable Structuring of Financial Assets, as per the prescribed format. (/en/web/rbi/-/notifications/scheme-for-sustainable-structuring-of-stressed-assets-revisions-10694) Issuance of Rupee Denominated Bonds Overseas With a view to developing the market of Rupee Denominated Bonds overseas, as also providing an additional avenue for Indian banks to raise capital / long term funds, the Reserve Bank on November 8, 2016 permitted banks to raise funds through issuance of rupee denominated bonds overseas for the following purposes: • Perpetual Debt Instruments (PDI) qualifying for inclusion as Additional Tier 1 capital under the extant Basel III Capital Regulations as amended from time to time; • Debt capital instruments qualifying for inclusion as Tier 2 capital under the extant Basel III Capital Regulations as amended from time to time; • Financing of infrastructure and affordable housing on Issue of Long Term Bonds by Banks - Financing of Infrastructure and Affordable Housing, as amended from time to time. The issuances as above shall be subject to all applicable prudential norms and FEMA guidelines.(/en/web/rbi/-/notifications/issue-of-rupee-denominated-bonds-overseas-10676) Permissible Activities of IFSC Banking Units The Reserve Bank on November 10, 2016 examined the issues regarding setting up of IFSC Banking units and accordingly on November 10, 2016 modified directions as under: • The sources for raising funds, including borrowing in foreign currency, will be persons not resident in India and overseas branches of Indian banks. • The deployment of funds can be with both persons resident in India as well as persons not resident in India. However, deployment of funds with persons resident in India shall be subject to the provisions of FEMA, 1999.” The existing paragraph shall be amended to read as follows. “IFSC banking Units (IBUs) can undertake transactions with resident (for deployment of funds) and non-resident (for both raising of resources and deployment of funds) entities other than individuals including High Net Worth Individuals (HNIs)/retail customers. The existing paragraph shall be amended to read as follows: “With the prior approval of their board of directors, the IBUs may undertake derivative transactions including structured products that the banks operating in India have been allowed to undertake as per the extant RBI directions. However, IBUs shall obtain RBI’s prior approval for offering other derivatives or structured products. Before seeking RBI’s approval, banks shall ensure that the IBUs have necessary expertise to price, value and compute the capital charge and manage the risks associated with the products / transactions intended to be offered and should also obtain their Board’s approval for undertaking such transactions”. A new paragraph shall be added which reads as under: “IBUs are allowed to open foreign currency escrow account of Indian resident entities to temporally hold subscriptions to the global depository receipt (GDR) / American depository receipts (ADR) issues until issuance of the Receipts. After GDRs/ADRs are issued, the funds should immediately be transferred to the client’s account outside the IBU and cannot be retained by the bank in any form including in long term deposits”. “IBUs are allowed to act as underwriter / arranger of Indian Rupee (INR) denominated overseas bonds issued by Indian entities in overseas market in terms of extant RBI instructions. However, in cases where part of the issuance underwritten by an IBU devolves on it, efforts must be made to sell the underwritten holdings and after 6 months of the issue date these holdings must not exceed 5% of the issue size.” (/en/web/rbi/-/notifications/setting-up-of-ifsc-banking-units-ibus-permissible-activities-10691) Currency Management Withdrawal of Legal Tender Character of existing ₹500/- and ₹1000/- Bank Notes In terms of Gazette Notification No 2652 dated November 8, 2016 issued by the Government of India,₹ 500 and ₹ 1000 denominations of Bank Notes of the existing series issued by the Reserve Bank of India (Specified Bank Notes) ceased to be legal tender with effect from November 9, 2016. A new series of Bank Notes called Mahatma Gandhi (New) Series (Please see page three) having different size and design, highlighting the cultural heritage and scientific achievements of the country, were issued on November 10, 2016. Bank branches are the primary agencies through which the members of public and other entities need to exchange the Specified Bank Notes for Bank Notes in other valid denominations. The last date for exchanging these notes was November 24, 2016 and for depositing them in their bank account the last date specified is December 30, 2016. The Government of India and the Reserve Bank issued a spate of comunications to banks and members of public to operationalise the scheme. All comunications released by the Reserve Bank on the subject are available at (/en/web/rbi/-/all-you-wanted-to-know-from-rbi-about-withdrawal-of-legal-tender-status-of-%E2%82%B9-500-and-%E2%82%B9-1000-notes-3270) for “All You wanted to know from RBI about: Withdrawal of Legal Tender Status of ₹ 500 and ₹ 1000 Notes”. (/en/web/rbi/-/notifications/rbi-instructions-to-banks-10684). The Reserve Bank has also published FAQs (/en/web/rbi/faq-page-2?ddm__keyword__26256231__FaqDetailPage2Title_en_US=Withdrawal of Legal Tender Character of the Old Bank Notes in the denominations of ₹ 500 and ₹ 1000 and The Specified Bank Notes (Cessation of Liabilities) Act 2017 and Specified Bank Notes (Deposit of Confiscated Notes) Rules 2017) based on the instructions. Both the links are updated on a daily basis. Given below are the RBI instructions on the subject in nutshell:

Activity at Banks during November 10-27, 2016

Fraudulent Practices – Specified Bank Notes The Reserve Bank has come to know that at certain places, few bank branch officials, in connivance with some miscreants, are indulging in fraudulent practices while exchanging SBNs in cash / accepting SBN deposits into account. The Reserve Bank on November 22, 2016 advised banks to ensure that such fraudulent practices are stopped forthwith through enhanced vigilance and take stern action against officials involved in such activities. Banks are further advised to ensure strict compliance with the instructions issued with regard to exchange of SBNs as also deposit of such notes into the accounts of their customers. The bank branches are also required to maintain proper record of the following: • Denomination-wise details of Specified Bank Notes and aggregate value of non-SBN note deposited in the account of each deposit or loan customer from November 10, 2016 onwards. • Customer-wise and denomination-wise record in respect of SBNs exchanged by walk-in and regular customers.(/en/web/rbi/-/notifications/fraudulent-practices-10731) Financial Markets Regulation The Reserve Bank on October 28, 2016 introduced Interest Rate Futures based on any rupee denominated money market interest rate or money market instrument on Securities and Exchange Board of India (SEBI) authorised stock exchanges . Highlights: I R F (Reserve Bank) (Amendment) Directions, 2016 Short Title and commencement These directions shall be referred to as the Interest Rate Futures(IRF) (Reserve Bank) Directions, 2016 These directions shall, come into force with effect from October 28, 2016. Eligible Instruments Any Money market interest rate or instrument other than 91-day Treasury bill Explanation – ‘Money Market Interest Rate’ means interest rate on any money market instrument. Necessary Conditions of the Interest Rate Futures Contract Any futures contract issued shall satisfy the following requirements • The futures contract shall be based on any Rupee denominated money market interest rate or money market instrument. • The method of computation of the rate/benchmark should be objective and transparent. • The futures contract shall be cash settled in Indian Rupees or as approved by the Reserve Bank. • Registered exchanges shall, before any futures contract is introduced on the exchanges, submit complete details of the futures contract duly ratified by SEBI to the Reserve Bank for approval. Registered exchanges are free to select the underlying instrument or interest rate and structure other details of the contracts. However, before any new or modified futures contract is introduced for trading on the exchanges, the registered exchanges shall submit complete details of the futures contract, duly ratified by Securities and Exchange Board of India (SEBI), to the Reserve Bank for approval. Background The Reserve Bank had already permitted introduction of futures based on the 91-day Treasury Bill, which is a money market instrument. The purpose of the current directions is to permit futures based on any money market instrument or money market interest rate, other than the 91-day Treasury Bill Futures, which has been already permitted. (/en/web/rbi/-/notifications/money-market-futures-10668) Foreign Exchange Management External Commercial Borrowings by Startups The Reserve Bank in consultation with the Government of India on October 27, 2016 has permitted Authorised Dealer (AD) Category-I banks to allow Startups to raise External Commercial Borrowings (ECBs) under the prescribed framework. It may be noted that Startups raising ECB in foreign currency, whether having natural hedge or not, are exposed to currency risk due to exchange rate movements and hence are advised to ensure that they have an appropriate risk management policy to manage potential risk arising out of ECBs. (/en/web/rbi/-/notifications/external-commercial-borrowings-ecb-by-startups-10667) ECB – Clarifications on Hedging With a view to providing clarity and bring uniformity in hedging practices in the market so as to effectively address currency risk at a systemic level, the Reserve Bank on November 7, 2016 has issued the following clarifications: • Coverage: Wherever hedging has been mandated by the Reserve Bank, the External Commercial Borrowings (ECB) borrower will be required to cover principal as well as coupon through financial hedges. The financial hedge for all exposures on account of ECB should start from the time of each such exposure (i.e. the day liability is created in the books of the borrower). • Tenor and rollover: A minimum tenor of one year of financial hedge would be required with periodic rollover duly ensuring that the exposure on account of ECB is not unhedged at any point during the currency of ECB. • Natural Hedge: Natural hedge, in lieu of financial hedge, will be considered only to the extent of offsetting projected cash flows / revenues in matching currency, net of all other projected outflows. For this purpose, an ECB may be considered naturally hedged if the offsetting exposure has the maturity/cash flow within the same accounting year. Any other arrangements/ structures, where revenues are indexed to foreign currency will not be considered as natural hedge. The designated Authorised Dealer (AD) Category-I banks will have the responsibility of verifying that 100 per cent hedging requirement is complied with. All other aspects of the ECB policy shall remain unchanged. (/en/web/rbi/-/notifications/external-commercial-borrowings-ecb-clarifications-on-hedging-10682) Investment by FPIs in Corporate Debt Securities As announced in the Union Budget 2016-17, the Reserve Bank on November 17, 2016 has decided to expand the investment basket of eligible instruments for investment by FPIs under the corporate bond route to include the following: • Unlisted corporate debt securities in the form of non-convertible debentures/bonds issued by public or private companies subject to minimum residual maturity of three years and end use-restriction on investment in real estate business, capital market and purchase of land. The expression ‘Real Estate Business’ shall have the same meaning as assigned to it in Foreign Exchange Management (Transfer or issue of Security by a Person Resident outside India). The custodian banks of FPIs shall ensure compliance with this condition. • Securitised debt instruments as under: a. any certificate or instrument issued by a special purpose vehicle (SPV) set up for securitisation of asset/s where banks, FIs or NBFCs are originators; and/or b. any certificate or instrument issued and listed in terms of the SEBI Regulations on Public Offer and Listing of Securitised Debt Instruments, 2008. Investment by FPIs in the unlisted corporate debt securities and securitised debt instruments shall not exceed ₹ 35,000 crore within the extant investment limits prescribed for corporate bond from time to time which currently is ₹ 2,44,323 crore. Further, investment by FPIs in securitised debt instruments shall not be subject to the minimum 3-year residual maturity requirement. (/en/web/rbi/-/notifications/investment-by-foreign-portfolio-investors-fpi-in-corporate-debt-securities-10718) Edited and published by Alpana Killawala for the Reserve Bank of India, Department of Communication, Central Office, Shahid Bhagat Singh Marg, Mumbai - 400 001. MCIR can be accessed at www.mcir.rbi.org.in |

Issue 5

Issue 5