IST,

IST,

Monetary Policy Report - October 2017

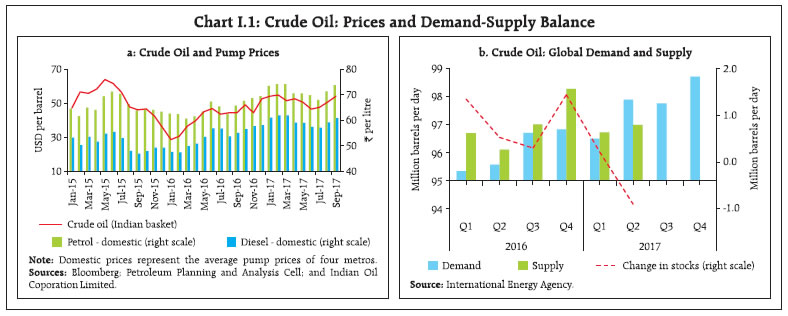

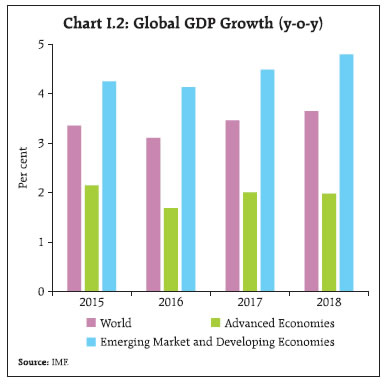

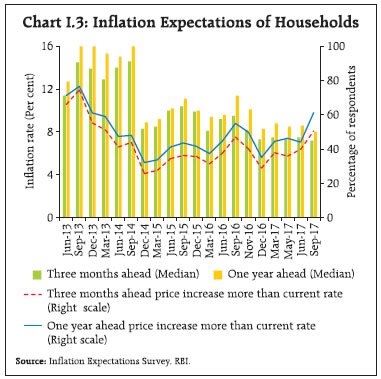

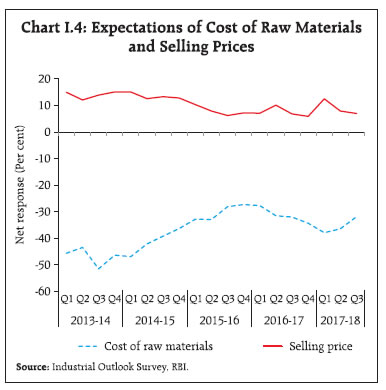

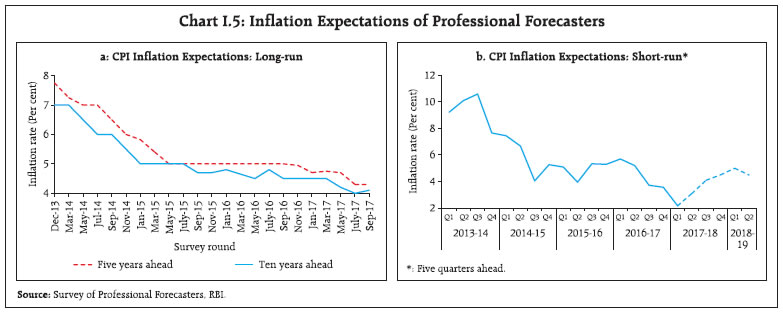

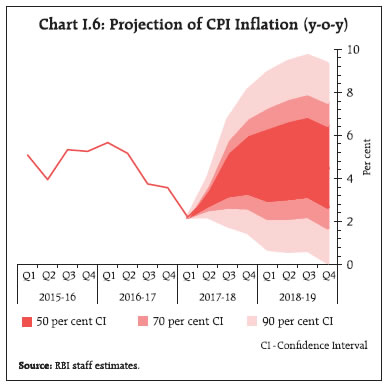

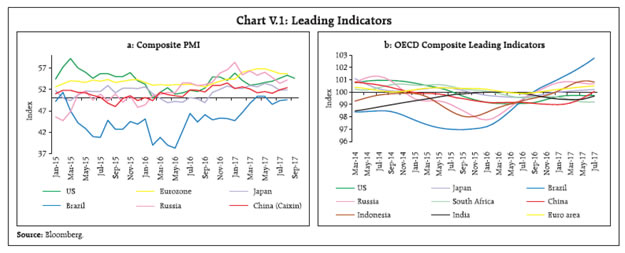

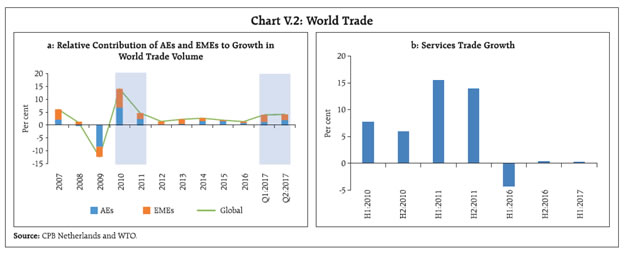

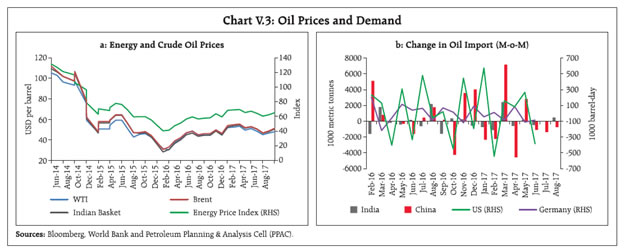

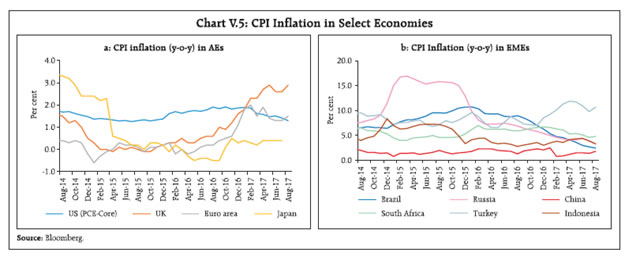

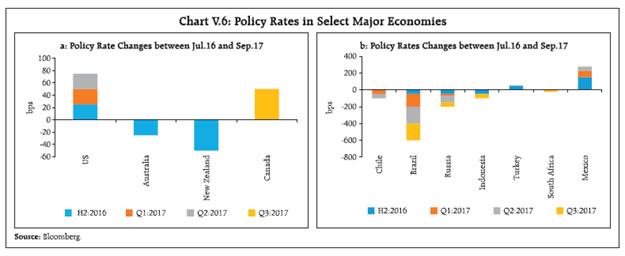

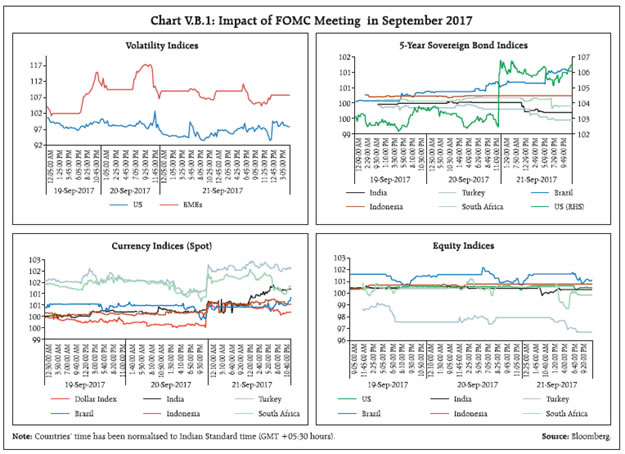

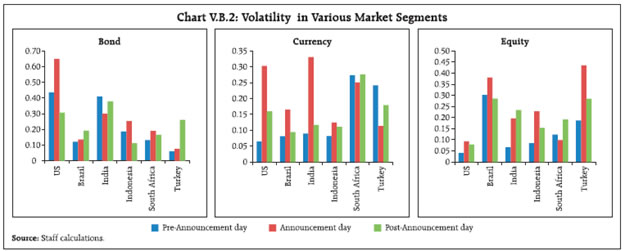

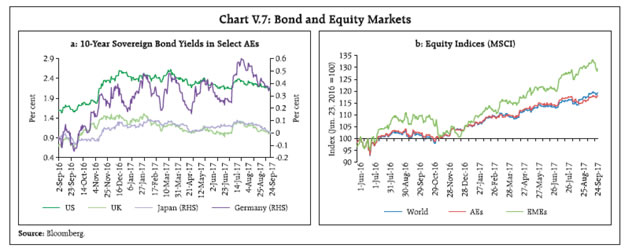

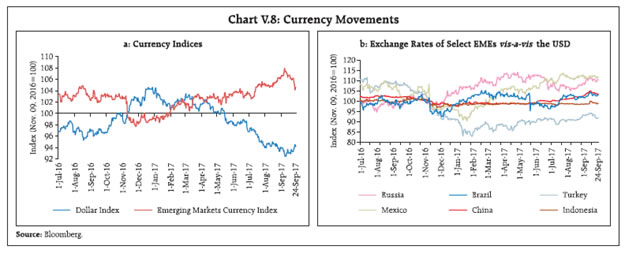

Inflation is expected to pick up from its recent lows as favourable base effects reverse and enhanced house rent allowances are disbursed to central government employees. Economic activity is expected to recover, with an improvement in the services sector, even as investment activity remains anaemic. Since the Monetary Policy Report (MPR) of April 2017, the macroeconomic setting for the conduct of monetary policy has undergone significant shifts. The gradual firming up of global growth, especially in advanced economies (AEs), has whetted a renewed search for returns that has buoyed global financial markets. Capital flows to emerging market economies (EMEs) have resumed strongly, albeit with some differentiation in favour of jurisdictions that have relatively resilient fundamentals. These flows are likely to abate to an extent due to the upcoming unwinding of quantitative easing (QE) by the US Federal Reserve. In India, the slowdown of economic activity that set in from Q1 of 2016-17 and became pronounced in the second half of the year appears to have extended into the first half of 2017-18. Looking ahead, some improvement in services may counterbalance the persisting weakness in industrial production. Inflation underwent a dramatic decline, reaching a historic low in June, but as the prints for July and August portend, a gradually rising trajectory may take hold over the rest of 2017-18. Alongside these developments, there has been an improvement in external viability; the foreign exchange reserves were around 11.5 months of imports in September 2017 and over 4 times short-term external debt. Monetary Policy Committee: April-August 2017 Against this backdrop, the monetary policy committee (MPC) met in June and August under its pre-announced bi-monthly schedule. Following up on its decision to keep the policy rate unchanged in April 2017, the MPC maintained status quo in its June 2017 meeting. While taking note of the significant easing of inflation, the MPC observed that there is considerable uncertainty around the evolving inflation trajectory. Accordingly, it persevered with a neutral stance, while remaining watchful of incoming data, and noted that premature action risked disruptive policy reversals later and loss of credibility. In its August 2017 meeting, the MPC decided to reduce the policy repo rate by 25 basis points (bps), noting that (i) the baseline path of headline inflation excluding the impact of house rent allowances (HRA) awarded under the recommendation of the seventh central pay commission (CPC) was likely to fall below the projection made in June to a little above 4 per cent by Q4; (ii) inflation excluding food and fuel had fallen significantly since May after remaining sticky through 2016-17; (iii) the roll-out of the GST during July 2017 had been relatively smooth; and (iv) the monsoon was expected to be normal. It judged, therefore, that several upside risks to the baseline inflation path had either reduced or not materialised. These factors opened up some space for monetary accommodation, especially after accounting for risks to the growth outlook. An interesting development has been the changing profile of voting in the MPC. After a unanimous vote in its April meeting, the MPC’s decision in June was by a majority. While five members voted for keeping the policy repo rate unchanged, one member voted in favour of a 50 bps cut in the policy repo rate. In the August meeting of the MPC, four members voted for a policy repo rate cut of 25 bps, one member voted for a cut in the policy repo rate by 50 bps and one member voted for status quo. These patterns reflect diversity, individual experiences and intellectual independence. This development is in consonance with the cross-country evidence on MPCs with external membership (Table I.1). Macroeconomic Outlook Chapters II and III present analyses of macroeconomic developments during 2017-18 so far that explain why inflation and growth of gross value added (GVA) undershot staff’s projections set out in the April 2017 MPR. Moving on to the outlook, staff’s assessment of the likely evolution of domestic and global macroeconomic and financial conditions over the forecast horizon remains broadly consistent with the baseline assumptions made in the April 2017 MPR (Table I.2). First, the spatial and temporal distribution of the south-west monsoon has been uneven and deficient in some parts of the country, which is expected to lead to a decline in kharif output. Second, global crude oil prices have moved in a relatively wide range of US$ 44- 57 per barrel over the past six months. Futures prices juxtaposed with the outlook for global production, demand and inventories suggest that crude prices could be around US$ 55 per barrel during the second half of 2017-18 (Chart I.1). Third, the exchange rate of the rupee has exhibited two-way movements vis-à-vis the US dollar since March 2017 with an appreciating bias until July 2017, given the strength of capital inflows and the weakening of the US dollar vis-à-vis other major currencies. The rupee has, however, reversed some recent gains with the announcement of the unwinding of QE by the Fed. Fourth, the outlook for global growth and trade remains broadly unchanged from the April 2017 assessment, with some acceleration relative to 2016 for both AEs and emerging market and developing economies (EMDEs) (Chart I.2). During 2018, AEs are expected to lose some momentum, with fiscal policy in the US projected to be less expansionary than expected in April. In contrast, EMDEs are expected to sustain the recent pick-up in growth. Increases in international air freight and container port throughput along with the plateauing of export orders suggest that the world trade volume growth, after some strengthening in the third quarter of 2017, could moderate towards the end of the year.1 This could have implications for staff’s baseline outlook for external demand. The softness in headline inflation observed during April-June 2017 is projected to reverse in the coming months. First, the prices of food items, especially of vegetables – which declined sharply in Q1 (April-June) as against the typical seasonal firming up in these months – have started edging higher. Second, the Central Government has implemented the increase in HRA for its employees effective July 2017. Third, there was a broad-based rebound in the various underlying measures of inflation in July-August 2017, reversing in large part the softness seen during April-June. Inflation expectations of economic agents play a key role in shaping the actual outcome through wages and price-setting behaviour. Quantitative inflation expectations of urban households eased by 30-60 bps in the September 2017 round of the Reserve Bank’s survey from the June 2017 round.2 Respondent households expected inflation to be 7.2 per cent three months ahead and 8.0 per cent a year ahead. In terms of qualitative responses, however, the proportion of respondents expecting the general price level to increase by more than the current rate rose over both the three-month and the one year horizons (Chart I.3). Manufacturing firms polled in the September 2017 round of the Reserve Bank’s industrial outlook survey expected some softening in inputs costs a quarter ahead, both for raw materials and staff costs.3 The respondents also expected some moderation in selling prices, indicating weak pricing power (Chart I.4). In the Nikkei’s purchasing managers’ survey for September 2017, firms in the manufacturing sector faced input and output price pressures from higher tax rates and prices of steel and petroleum products; firms in the services sector in August 2017 faced price pressures from higher tax rates. Professional forecasters surveyed by the Reserve Bank in September 2017 expected CPI inflation to pick up to 4.5 per cent by Q4:2017-18, with the ebbing away of favourable base effects (Chart I.5)4. Their medium-term inflation expectations (5 years ahead) remained unchanged at 4.3 per cent, while the longer-term inflation expectations (10 years ahead) rose by 10 bps to 4.1 per cent. Taking into account the revised assumptions on initial conditions, signals from forward looking surveys and estimates from structural and other models, CPI inflation is projected to pick up from 3.4 per cent during August 2017 to 4.2 per cent in Q3:2017-18 and 4.6 per cent in Q4, reflecting the combined effects of unfavourable base effects, the upturn in food prices and the impact of the increase in the HRA (a statistical effect on the CPI index) announced by the Central Government (Chart I.6). The 50 per cent and the 70 per cent confidence intervals for inflation in Q4:2017-18 are 3.3-6.0 per cent and 2.6-6.8 per cent, respectively. For 2018-19, assuming a normal monsoon and no major exogenous shocks, structural model estimates indicate that inflation is expected to increase from 4.6 per cent in Q1 to 4.9 per cent in Q3 and then soften to 4.5 per cent by Q4:2018-19 as the statistical impact of the Central Government’s HRA enhancement fades. The 50 per cent and the 70 per cent confidence intervals for Q4:2018-19 are 2.7-6.5 per cent and 1.7- 7.5 per cent, respectively. There are upside as well as downside risks to these baseline forecasts. The major upside risks emanate from the expected increases in salaries and allowances by State Governments; the possible fiscal slippages due to farm loan waivers by some States and potential stimulus measures by the Central Government (Box I.1); short-term uncertainty around the GST impact; and the expected decline in the production of kharif foodgrains. In terms of downside risks, adequate food stocks and effective supply management measures by the government could keep food inflation lower than expected and pull down headline inflation below the baseline.

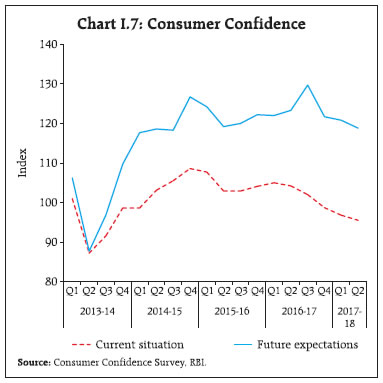

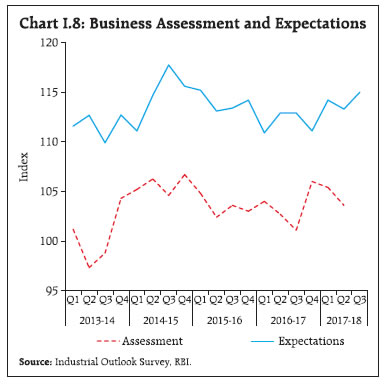

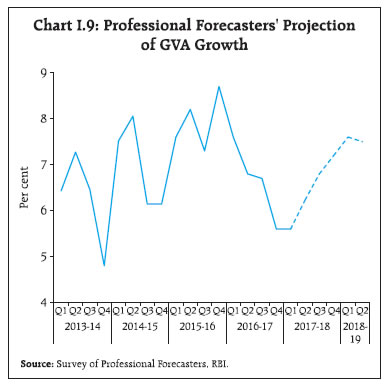

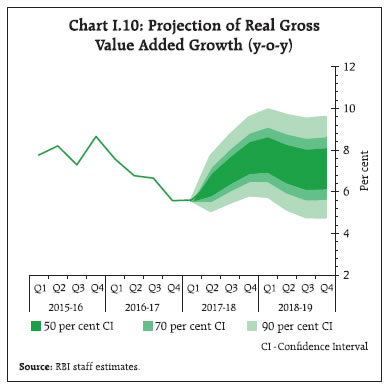

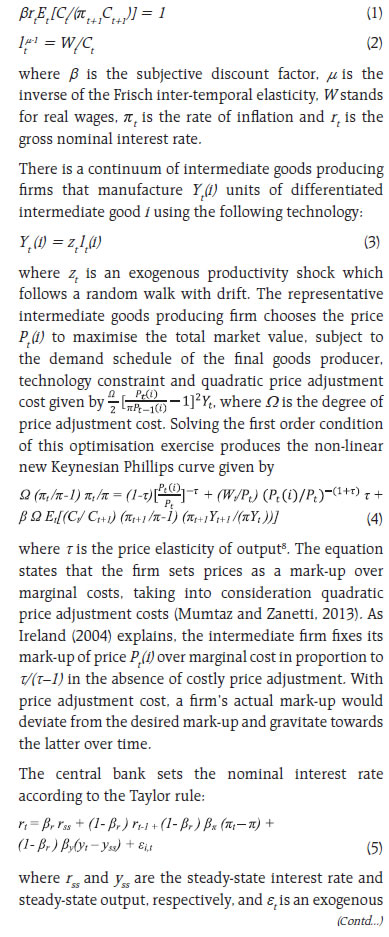

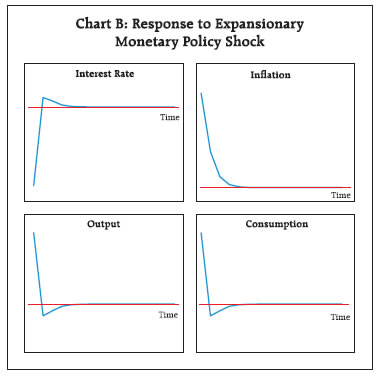

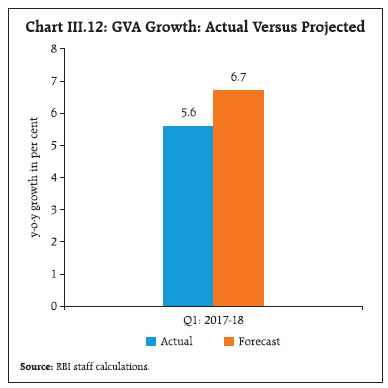

The April 2017 MPR had projected an acceleration in real GVA for 2017-18 on the back of (a) a recovery in discretionary spending spurred by the pace of remonetisation; (b) the reduction in banks’ lending rates on fresh loans brought about by demonetisation-induced liquidity; (c) the growth stimulating proposals in the Union Budget 2017-18; (d) a normal south-west monsoon; and (e) an improvement in external demand. Stressed balance sheets of banks and the possibility of higher global commodity prices were seen as downside risks to growth prospects. Some of these expectations have materialised, whereas the recovery in discretionary and investment spending has been weaker than expected and kharif foodgrains production is expected to be lower than last year in view of the shortfall and irregular rainfall during the south-west monsoon this year. The uncertainty about the implementation of GST also appears to have had some impact on economic activity, although it is expected to be offset by productivity-enhancing effects in the medium- and long-run. Consumer confidence dipped in the September 2017 round of the RBI’s survey on declining optimism about prospects of income and employment a year ahead (Chart I.7).6 Overall optimism in the manufacturing sector for the quarter ahead improved in the September round of the RBI’s industrial outlook survey on account of better prospects for production, order books, capacity utilisation, exports and profit margins, even as the current assessment dropped further (Chart I.8). Surveys conducted by other agencies indicate a dip in business confidence over the previous round (Table I.3). In the Nikkei’s purchasing managers’ survey, firms in the manufacturing sector (September 2017) and the services sector (August 2017) were optimistic about future output prospects. In the September round of the RBI’s survey, professional forecasters expected real GVA growth to pick up from 5.6 per cent in Q1:2017-18 to 7.2 per cent in Q4:2017-18 and to 7.5 per cent in Q2:2018-19, led by improvement in industry and services sector activity (Chart I.9 and Table I.4). Taking into account the outturn in the first half, the baseline assumptions, survey indicators and model forecasts, real GVA growth is projected at 6.7 per cent for 2017-18 – 6.4 per cent in Q2, 7.1 per cent in Q3 and 7.7 per cent in Q4 – with risks evenly balanced around this baseline path. For 2018-19, structural model estimates indicate that real GVA may grow by 7.4 per cent, assuming a normal monsoon, fiscal consolidation in line with the announced trajectory, and no major exogenous/policy shocks (Chart I.10). Dynamic Stochastic General Equilibrium (DSGE) models are workhorse tools for policy analysis by a number of central banks. In the RBI, efforts are underway to develop such a model to enrich analytical inputs for the conduct of future monetary policy (Box I.2).

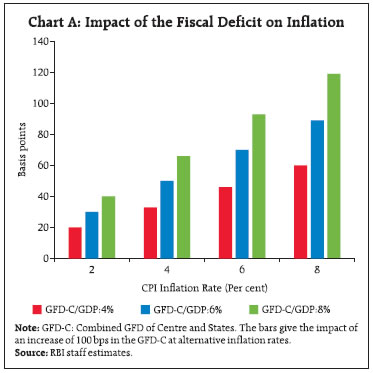

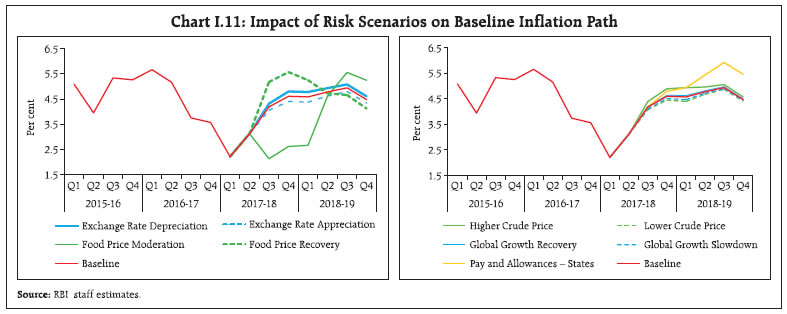

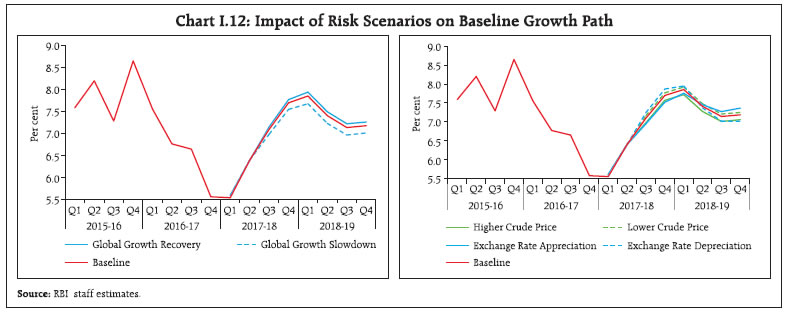

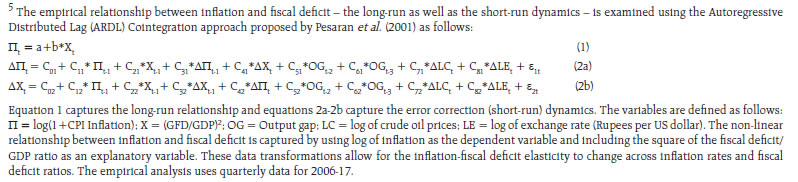

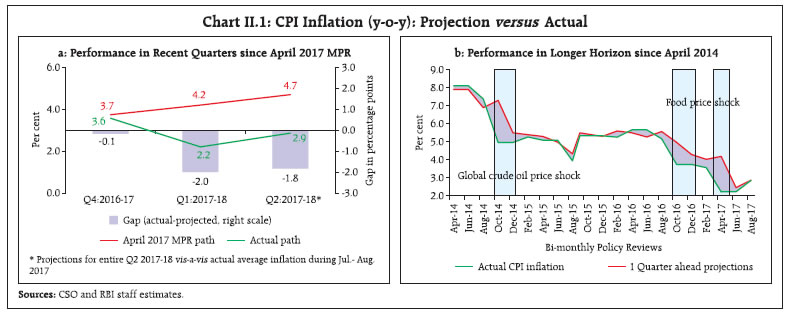

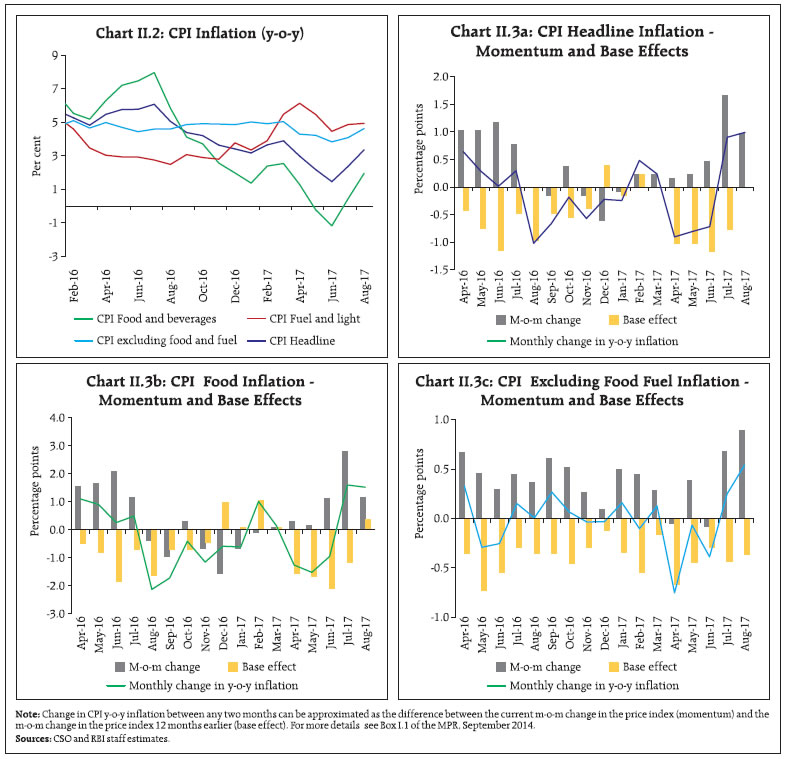

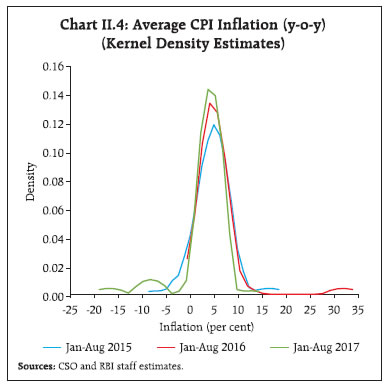

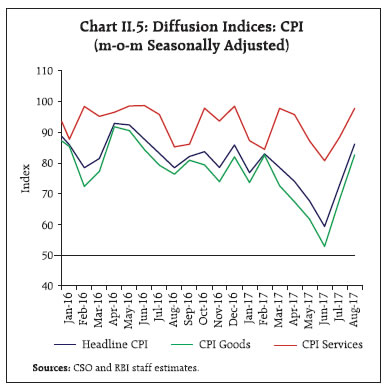

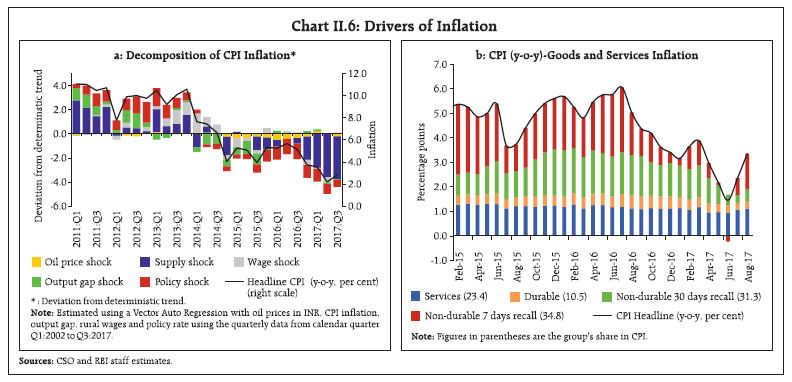

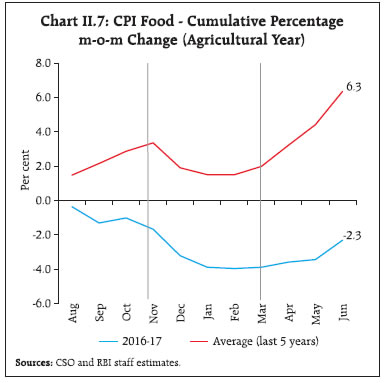

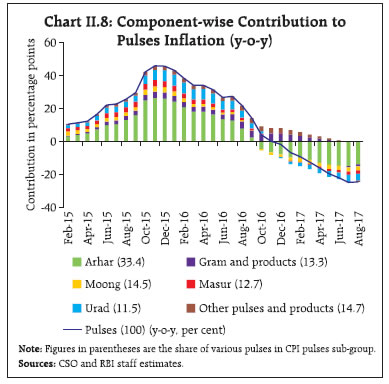

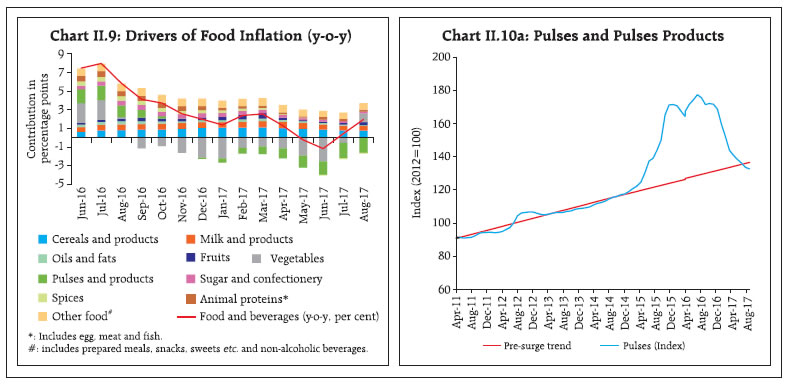

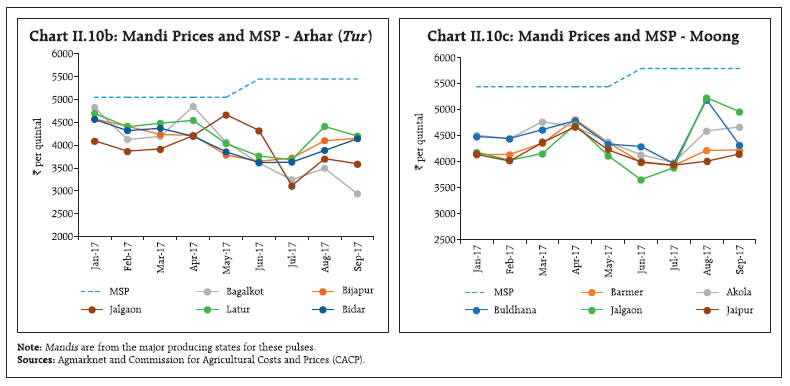

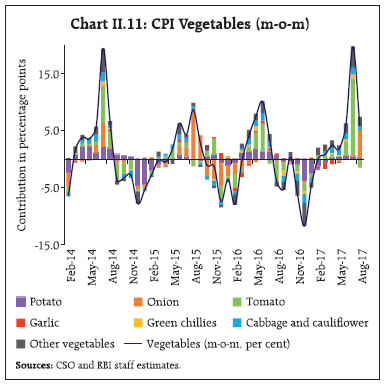

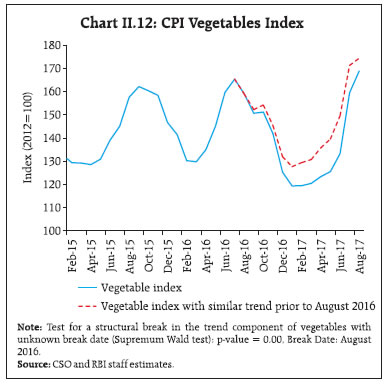

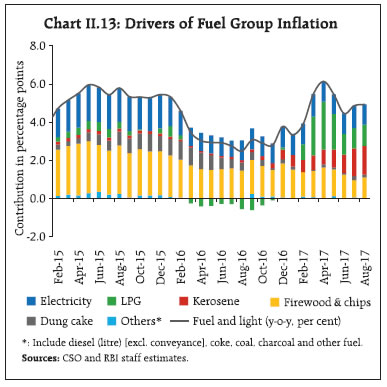

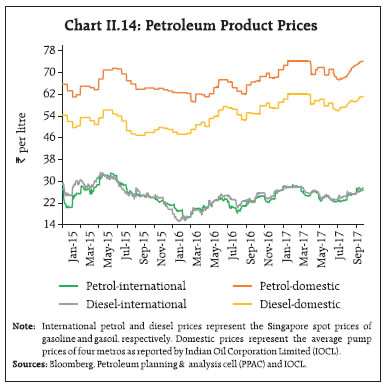

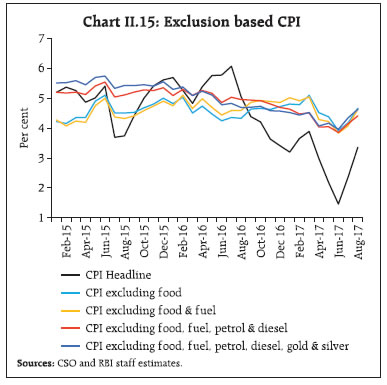

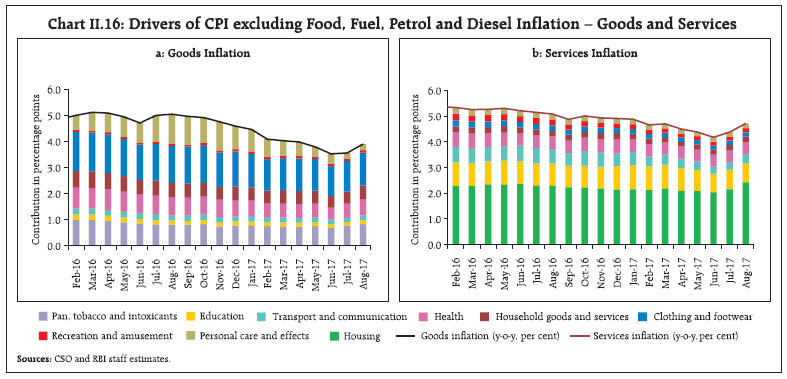

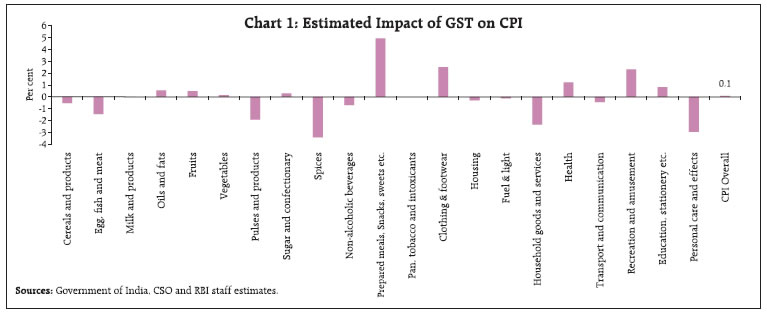

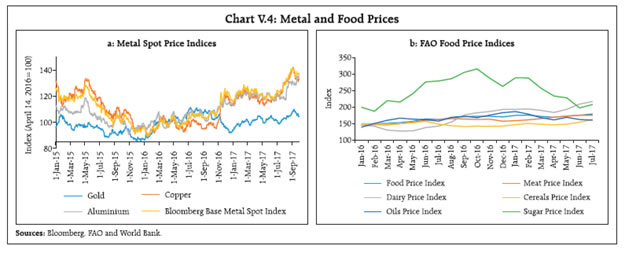

The baseline projections of growth and inflation are inter alia conditional on the assumptions set out in Table I.1. A caveat is that the baseline growth and inflation trajectories do not incorporate the impact of the likely increases in pay and allowances by State Governments for their employees. This section makes an assessment of the balance of risks around the baseline projections from a set of plausible alternative scenarios. (i) International Crude Oil Prices In the baseline forecasts, the crude oil (Indian basket) price is assumed to average around US$ 55 per barrel in the second half of 2017-18 on the expectation that the global oil supply would be sufficient to meet increasing global demand. However, supply disruptions due to geo-political developments with oil demand remaining robust could push crude oil prices higher. The upward pressures on oil prices could, however, get mitigated by the increased production of shale gas in response to higher prices. Assuming that crude oil prices reach US$ 65 in the second half of 2017-18 in this scenario, inflation could be higher by about 30 bps in 2017-18. Real GVA growth could weaken by around 15 bps in 2017-18 due to the direct impact of higher input costs as well as spillovers from lower world demand. If, in contrast, crude oil prices soften below the baseline due to oversupply by the Organisation of the Petroleum Exporting Countries (OPEC) and/or weaker than anticipated global demand and in particular, fall to around US$ 50, inflation may moderate by about 15 bps, with a boost to real GVA growth of around 5-10 bps above the baseline in 2017-18 (Charts I.11 and I.12). (ii) Global Demand Global demand is expected to be higher in 2017 and 2018 in the baseline scenario with both upside and downside risks to the outlook. On the downside, the expected demand boost from expansionary US fiscal policy may not materialise, given recent developments in the US. In China, growth has remained resilient, but concerns over its sustainability remain in view of the large overhang of debt. Persisting disconnect between market participants’ assessment and that of the US Federal Open Market Committee (FOMC) over the pace of US monetary policy normalisation could trigger volatility in financial markets, especially in view of stretched market valuations. The ensuing tightening of global financial conditions in a milieu of inward-looking protectionist tendencies could amplify downside risks, especially for EMEs. Assuming global growth turns out to be 50 bps below the baseline, domestic growth and inflation could fall below the baseline forecasts by around 20 bps and 10 bps, respectively. However, reduced political risks in the euro area could lead to a more sustained and stronger cyclical rebound, providing a boost to global growth. Assuming that global growth is higher by 25 bps, real GVA growth and inflation could turn out to be around 10 bps and 5 bps, respectively, above the baseline. (iii) Exchange Rate The exchange rate of the Indian rupee has exhibited two-way movements vis-à-vis the US dollar during the first half of 2017-18. Going forward, the normalisation of monetary policy in the US (and possibly other central banks in AEs) and protectionist policies of major AEs and EMEs could lead to some volatility in the foreign exchange market and downward pressures on the exchange rate. A depreciation of the Indian rupee by around 5 per cent relative to the baseline could raise inflation by around 20 bps in 2017-18, while producing some positive impact on net exports and growth. On the other hand, in view of the robust growth prospects of the Indian economy in a cross-country perspective and the various initiatives to attract foreign direct investment, India is likely to remain an attractive destination for foreign investors and this could lead to an appreciation of the domestic currency. An appreciation of the Indian rupee by 5 per cent could soften inflation by around 20 bps but also deliver a negative impact of 10-15 bps on real GVA growth. (iv) Food Inflation The substantial softening of headline inflation in the first quarter of 2017-18 reflected the absence of the usual seasonal pick up in food prices in the post-winter period, especially pulses and vegetables. These food price dynamics may have both structural and cyclical elements, although it is difficult to disentangle them at this juncture. If the softening in food inflation observed since the second half of 2016 is largely structural, then the momentum in food prices in the rest of 2017-18 could be negligible and headline inflation could be below the baseline by up to 2 percentage points. If however, low food inflation turns out to be largely cyclical, food prices are likely to revert to trend. Assuming that the momentum in the food prices in the coming months is in line with the average of the past five years, headline inflation may turn out to be 100 bps above the baseline. (v) Pay and Allowances – Implementation by States The impact of increased salaries and pensions of Central Government employees in 2016 and the implementation of HRA effective July 2017 has been embedded in the baseline forecasts. Assuming that State Governments implement a similar order of increase in their pay and allowances, CPI inflation could go up to 100 bps above the baseline on account of the direct statistical effect of higher house rents with possible indirect effects emanating from higher demand and increase in inflation expectations. (vi) Fiscal Slippage As noted earlier, there are upside risks to the Central Government’s fiscal deficit from possible measures to provide a boost to domestic demand and from lower tax revenues. Assuming that the Central Government’s fiscal deficit/GDP ratio widens by 50 bps in 2017-18, inflation could be around 25 bps above the baseline. To conclude, the growth outlook is expected to improve in the second half of 2017-18, although it could be weighed down by still sluggish investment and export activity. Higher food prices and the increase in house rent allowances by the Central Government for its employees are expected to result in an increase in headline inflation in the second half of 2017-18. There are upside risks to the inflation outlook from (i) the lower kharif foodgrains output; (ii) farm loan waivers by some State Governments and possibility of Central Government stimulus; and (iii) the implementation of higher pay and allowances by the State Governments for their employees, which will impact the baseline projections of growth and inflation as they materialise. 1 World Trade Outlook Indicator, August 7, 2017, World Trade Organisation (WTO). 2 The Reserve Bank’s inflation expectations survey of households is conducted in 18 cities and the results of the September 2017 survey are based on responses from 4,996 households. 3 The September round results are based on responses from 1,141 companies. 4 30 forecasters participated in the September round of the Reserve Bank’s survey of professional forecasters. 6 The survey is conducted by the Reserve Bank in six metropolitan cities and the September round elicited responses from 5,100 respondents. 9 A multi-sectoral model can enrich the dynamics by accommodating financial frictions reflecting the role of credit from banks as well as non-bank financial institutions, the external sector, the agriculture sector and the Government sector. Illustratively, such models can replicate the economic implications of fiscal stimulus or pass-through of international shocks. II. Prices and Costs Consumer price inflation fell sharply in the first quarter of 2017-18, driven down by a collapse in food inflation and a marked moderation in inflation in other components. The trajectory reversed in July and August as vegetable prices spiked and prices of other goods and services firmed up. Input costs tracked movements in international commodity prices, while wage growth in the organised and rural sectors firmed up modestly. The MPR of April 2017 had projected consumer price index (CPI) inflation1 to increase to 4.2 per cent in Q1:2017-18 and further to 4.7 per cent in Q2 on the expectation that the compression imposed by demonetisation on perishable food prices would wane, and the usual seasonal uptick that characterises pre-monsoon months would take over. In the event, inflation developments in the first half of 2017- 18 were foreshadowed by the prolonged impact of food supply shocks. Consequently, actual inflation outcomes were pushed much below their projected path. First, food prices sank into deflation in May and June 2017. Second, crude prices fell in April, remaining soft and range-bound in ensuing months; combined with an appreciating exchange rate, this resulted in a sharp disinflation in petrol and diesel prices in the early part of 2017-18. In the fuel group, liquefied petroleum gas (LPG) prices declined in the first quarter of 2017-18, tracking international prices. Third, inflation excluding food and fuel also eased significantly in Q1:2017-18, pending price revisions ahead of goods and services tax (GST) implementation. The cumulative impact was that headline inflation plunged to 2.2 per cent in Q1:2017-18 and 2.9 per cent in the first two months of Q2 – significantly lower than the assessment made at the time of the April MPR. Although these forces continue to drive a wedge between actual and projected inflation in terms of levels, a directional alignment is gradually occurring since July (Chart II.1a). Large and unanticipated supply shocks have produced at least two systematic deviations of actual and projected inflation in terms of the new index (Chart II.1b). Both capture significant underlying shifts in demand-supply balances in key inflation-sensitive goods and services, which should have warranted policy responses of a scale and range beyond the narrow remit of monetary policy. After the January 2017 trough, consumer price inflation increased for two months in succession to reach 3.9 per cent in March. Thereafter, inflation started declining sharply to reach a historic low of 1.5 per cent in June (Chart II.2), driven by the sequential decline in the momentum of food prices and the overwhelming downward pull of favourable base effects that took the prices of food items down into a deflation of (-)1.2 per cent by June. This dramatic decline was accentuated by the dampening of the usual seasonal spikes in prices of vegetables that typically manifest ahead of the onset of the monsoon. Inflation excluding food and fuel also declined sharply from 5 per cent in March to 3.8 per cent by June, after a long hiatus of stickiness. The sharp disinflation during April to June 2017 in prices of goods and services constituting this category came from favourable base effects offsetting positive but weak momentum (Chart II.3a, b and c). The sharp disinflation in CPI from 3.7 per cent in the second half of 2016-17 to 2.5 per cent in the first half of this year impacted the inflation distribution. The moderation in the central tendency of the distribution was also accompanied by an increase in kurtosis and a considerable negative skew, as against a positive skew during the corresponding period a year ago (Chart II.4). On a seasonally adjusted basis, prices of most items registered increases and the diffusion indices2 for goods, services and the overall CPI were well above 50 (Chart II.5). In July and August 2017, the incidence of delayed spikes in prices of vegetables within an overall firming up of prices of goods and services in the run up to the GST implementation reversed the trajectory of headline inflation and diffusion indices rose sharply, indicating renewed broad-basing of price pressures. A historical decomposition3 of inflation shows that large supply shocks dominated the disinflation of the first half of 2017-18, contributing 3.6 percentage points to it. This confirms the vulnerability of the Indian economy to exogenous shocks, viz., oil prices, and disruptions impacting the agriculture sector in spite of the diversification and weather proofing of the agricultural sector sought to be achieved by policy interventions over time. These developments may warrant a re-appraisal of the scope and quality of food management strategies that seem prone to failure in the face of shocks in either direction. In the past too, supply shocks, of which large one-sided deviations of inflation from projections are merely a symptom, drove disinflation episodes. The softening of oil prices in conjunction with exchange rate appreciation and the negative output gap, possibly due to weak credit growth, also contributed to the disinflation (Chart II.6a). Drilling down into granular constituents, non-durable goods, which account for 66 per cent of the CPI basket and include items such as petrol and diesel in addition to food items, were the main drivers of the disinflation. The contribution of services, on the other hand, remained broadly unchanged. The reversal in July and August was driven by inflation in non-durables which rebounded, led by food prices (Chart II.6b). Turning to a disaggregated analysis of food inflation, this recent experience with a disinflation episode yields several lessons that should inform the setting of macroeconomic policies going forward in order to pre-empt widespread distress in the farm economy or at least, to mitigate it. The precipitous decline in food prices appears to have overwhelmed supply management efforts, despite the fact that the downshift in momentum commenced as early as the second half of 2016-17 and continued well into the first quarter of 2017-18, affording lead time for course corrections. This decline in food prices during August 2016 to June 2017 [(-)2.3 per cent] was in stark contrast to the pattern of the last five years (2011-12 to 2015- 16) when food prices increased at an average annual rate of 6.3 per cent (Chart II.7). Two factors stand out in this experience as noteworthy. First, the unusually low and delayed seasonal upticks in vegetables prices coincided with larger than usual arrivals in mandis which did not get contemporaneously picked up by agri-information alerts. Also highly unusual were the spillovers to prices of vegetables other than the usual suspects – potatoes; onions; tomatoes – indicating the extent of dislocation caused by oversupply, since other vegetables do not typically exhibit significant seasonal swings. Second, there was a massive deflation in respect of prices of pulses – (-)24.6 per cent by July-August 2017 contributed by all items in the pulses group (Chart II.8). It was preceded, however, by a steady and sizable disinflation from the second half of 2015-16 which should have flashed in lead monitors of the pulses economy. In the absence of corrective action, the combination of augmented availability and inadequate procurement/marketing operations yielded a supply glut with which food supply management logistics failed to cope. As regards specific components in the food category, pulses constitute 2.4 per cent of the CPI and 5.2 per cent of the food category. The decline in prices of pulses contributed (-)1.4 percentage points to the food deflation during May and June and (-)0.7 percentage points to headline disinflation (Chart II.9). Historically, domestic production and imports of pulses have consistently lagged behind the level of domestic demand, resulting in inflationary pressures on the headline. Drawing upon this experience, the Government put in place several measures to augment supply during 2016-17, which inter alia included increasing the minimum support prices (MSPs) to incentivise farmers to increase acreage (MSP for kharif and rabi pulses increased in the range of 7.7-9.2 per cent and 14.3-16.2 per cent, respectively, in 2016-17); continuing zero import duty on pulses to augment domestic availability of pulses at reasonable prices (import duty of 10 per cent was imposed on tur in March 2017 to prevent prices from falling below MSPs); restricting exports (tur, moong and urad dal have been made free for exports, effective September 15, 2017); creating buffer stocks of pulses for the first time through involvement of agencies such as the Food Corporation of India (FCI), the National Agricultural Cooperative Marketing Federation of India Ltd. (NAFED), and the Small Farmers’ Agri Business Consortium (SFAC); discouraging hoarding by putting stock limits on pulses for traders (which were lifted in May 2017); and taking measures for revitalising the agriculture sector in general.4 With the domestic availability of pulses (domestic production and imports) increasing to 29.6 million tonnes in 2016-17 from 22.2 million tonnes in 2015- 16, the prices of pulses declined below their long-term trend as well as the MSPs in several mandis (Charts II.10a, b and c). This reflected the large gap in procurement relative to supply and the unanticipated shock to farmers’ expectations on price support. In the case of vegetables, prices fell significantly since August 2016, with statistical tests suggesting a trend break5 that altered their evolution incipiently under the cover of the transitory effects of demonetisation. A sequence of positive shocks brought about this sub-trend deviation. What started off as the reversal of the summer spike in August was followed by the sharp and more than seasonal winter price correction. Firesales post demonetisation set the stage for a plunge in the prices of other vegetables (cabbage; cauliflower; palak/other leafy vegetables; brinjal; gourd, peas and beans) during November-December 2016, which usually exhibit little seasonality, as stated earlier. Finally, there has been an unusually soft pickup in vegetable prices during the early months of 2017 (Charts II.11 and II.12). This was due to large arrivals of key vegetables during these months. These developments underscore the need for high frequency data and monitoring of prices, mandi arrivals, supply-demand balances and stock positions, especially with respect to horticulture. In Q2 so far, food inflation has edged up on the back of a sharp rise in vegetables prices, driven by a spike in tomato and onion prices (Chart II.11). In the case of tomatoes, sudden price movements propelled inflation in the item from (-)40.8 per cent in June 2017 to 49.9 per cent in July and further to 94.0 per cent in August. This was mainly on account of supply disruptions due to farmers’ agitations in Maharashtra in June and adverse weather conditions in important production centres. In early August, upside pressures also built up in onion prices, pushing onion inflation to 49.3 per cent in August from (-)10 per cent in July, reportedly due to damage caused by July rains and large procurement by a few State Governments. The sharp increase in these prices in retail markets reflects a statistically significant increase in margins6 in Q2:2017-18. Further analysis based on CPI regional prices data suggests that there is no significant difference in the changes in vegetable prices in urban and rural areas – the spike in vegetable prices has uniformly impacted rural and urban India.7 Among other food items, prices of spices moved into deflation territory since June 2017 on account of a fall in prices of chillies, dhania and black pepper. As per the 3rd advance estimates of the Ministry of Agriculture, production of spices recorded a growth of 17.4 per cent in 2016-17, up from 14.4 per cent a year ago. Sugar inflation, which was in double digits during 2016-17 (averaging 20 per cent), also eased in 2017-18 so far (up to August), largely due to measures facilitating imports and on expectations of higher domestic production. inflation in prices of animal proteins and milk has declined as momentum was weak and base effects favourable. Cereal inflation remained low and moved with a softening bias due to higher availability – production was higher and stocks were up by 5.09 million tonnes.8 Import duty on wheat that was reduced to zero in December 2016 was re-imposed in March 2017. In the fuel and light group, inflation picked up at the start of the financial year but softened transiently in May-June before resuming an upturn in July and August. The decision to allow oil marketing companies (OMCs) to raise subsidised kerosene and LPG prices in a calibrated manner has enhanced the responsiveness of prices of domestic household fuel items to international price benchmarks. The contribution of electricity to overall fuel inflation remained more or less unchanged in H1:2017-18 in relation to the corresponding period of last year, while that of firewood moderated (Chart II.13). Growth in electricity generation9 decelerated during Q1:2017- 18 to 5.3 per cent (from a robust base of 10 per cent last year) on account of subdued performance of the manufacturing sector; though it has accelerated significantly in the months of July and August with a growth rate of 7.5 per cent (from 2.1 per cent last year) with reports of surge in rural demand for irrigation. The long-term thermal-based power tariff through power purchasing agreements (PPA) by distribution companies (DISCOMs), the dominant source of electricity, has remained broadly unchanged. However, spot price of electricity reported on energy exchanges, which was broadly the same as last year till April 2017, have started rising from May 2017 onwards. Turning to the underlying inflation dynamics, CPI inflation excluding food and fuel edged down by 120 basis points during the year up to June. The softness in prices of petrol and diesel within the transport and communication group contributed substantially to the observed moderation in Q1 (Chart II.14). Excluding petrol and diesel prices from this category too, inflation moderated (Chart II.15). The sudden and sharp decline in inflation excluding food, fuel, petrol and diesel in Q1:2017-18 was driven by goods as well as services. Among goods, much of the moderation was in prices of personal care and effects due to a fall in the rate of change of domestic gold prices in tandem with international prices. inflation in respect of goods within the health sub-group and clothing also eased, pending price revisions held back ahead of GST, while clearance sales depressed inflation in the case of clothing (Chart II.16a). Services inflation eased during Q1:2017-18 in a broad-based manner. inflation in respect of education services moderated significantly, possibly on account of the revised school fee payment cycle for central school boards for the academic year. Lower inflation was recorded in transportation fares as fuel prices remained range-bound, coupled with food inflation – a major determinant of the cost of living – being lower than in the recent past. Prices of mobile communication expenses eased significantly, triggered by pricing war in the telecommunication sector. Housing inflation also moderated in Q1, reflecting lower rates of increase in rentals (Chart II.16b). Thereafter, in July and August, there was a broad based pickup in CPI inflation excluding food and fuel. inflation in transport and communication registered sharp increase driven by petrol and diesel (Chart II.14). Household goods and services; pan, tobacco and intoxicants; health; recreation; and clothing and footwear sub-groups also rose. This partly reflected the hike in the service tax rate under GST and the impact of GST on certain goods, especially packaged/ processed food; clothing and footwear; and recreation and amusement services. Housing inflation reversed with the implementation of house rent allowance (HRA) increases by the Centre from July. As a result, all other exclusion based measures also registered a pickup in Q2 so far (Chart II.15). The GST was rolled out in July 2017. The assessment at the current juncture is that price changes are not likely to have any material impact on headline inflation. However, in case the price increases show downward rigidity due to uncertainty in GST implementation, inflationary impact may emerge (Box II.1).

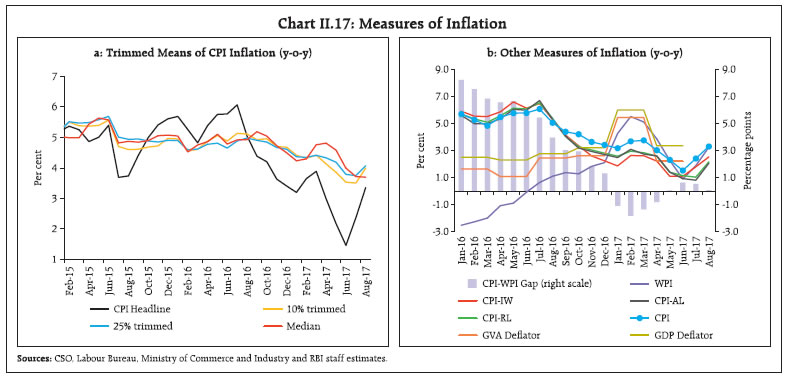

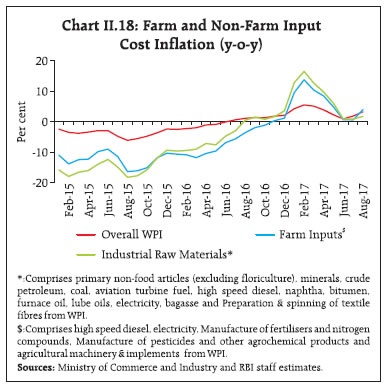

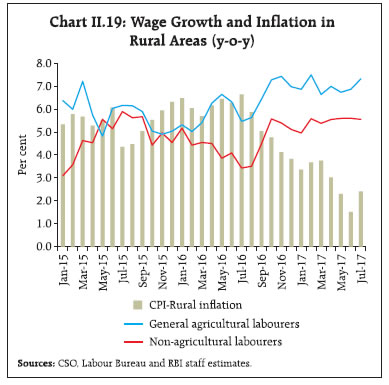

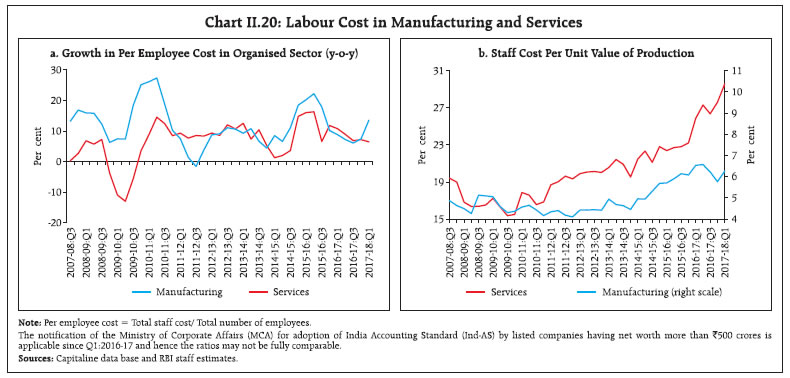

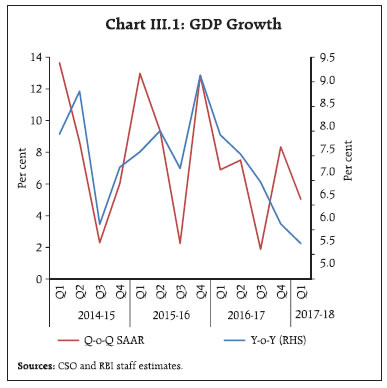

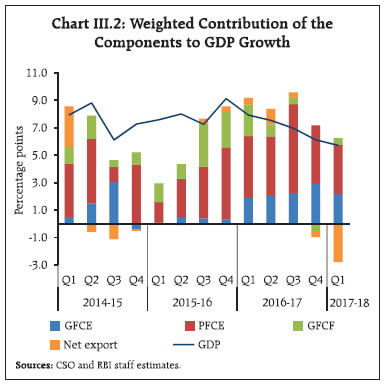

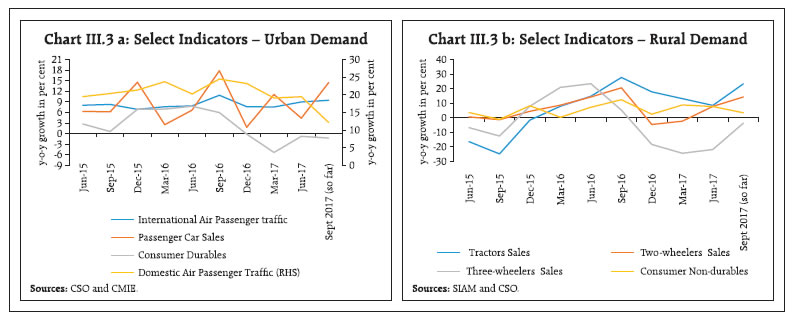

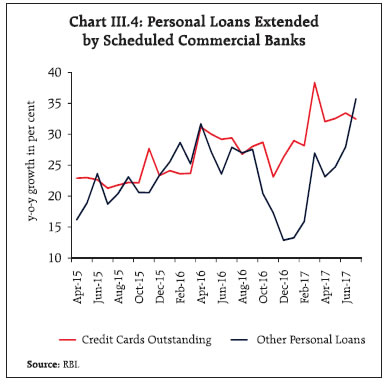

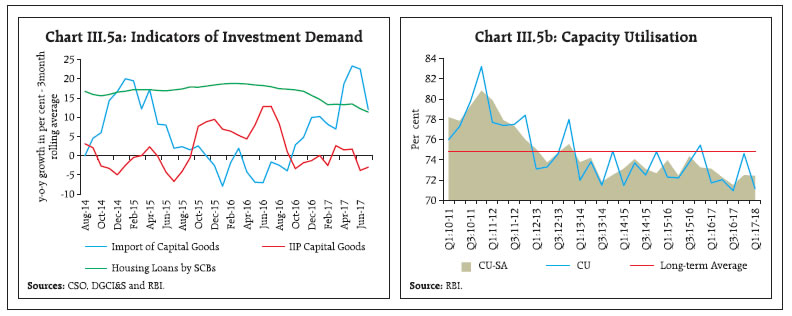

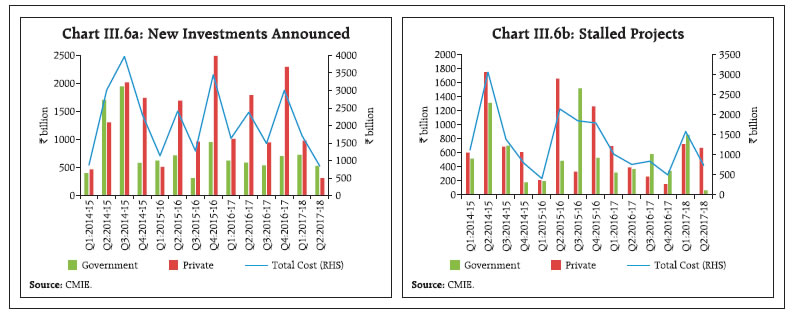

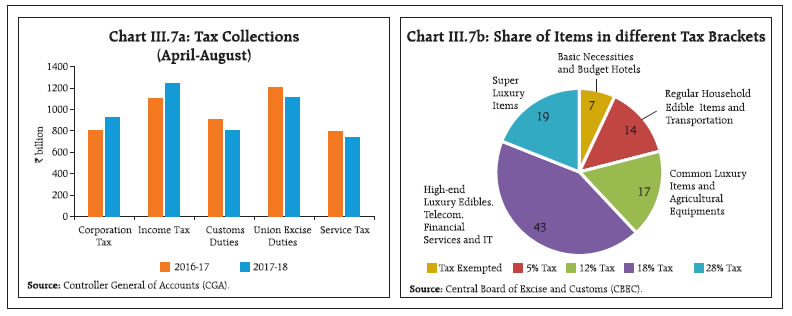

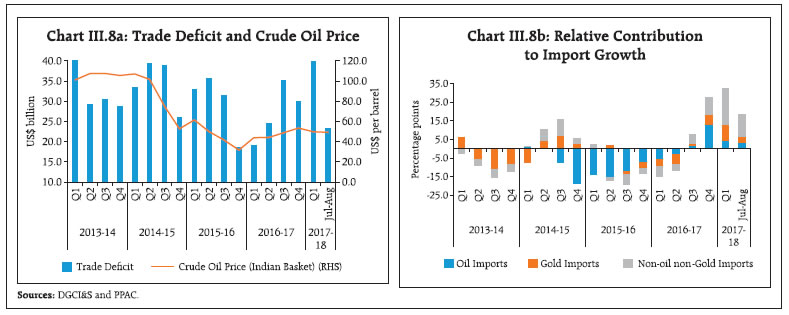

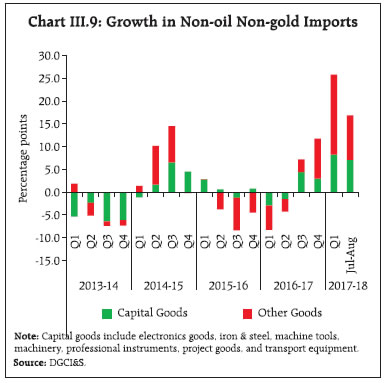

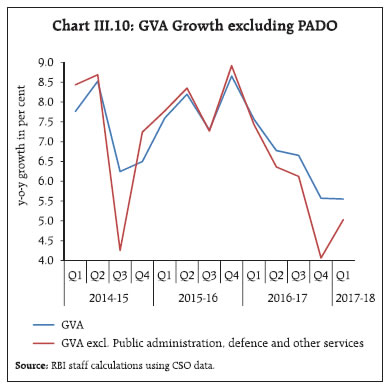

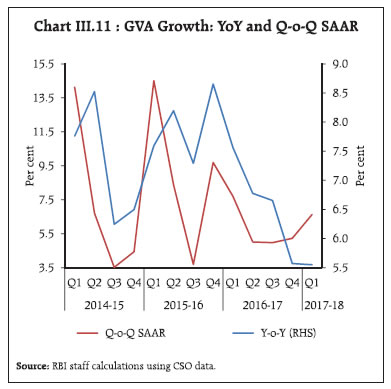

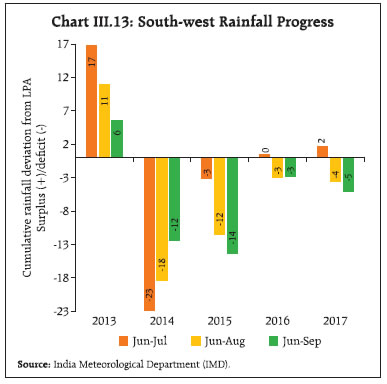

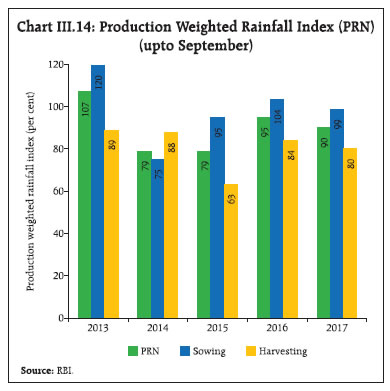

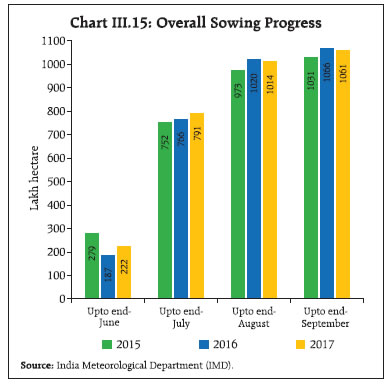

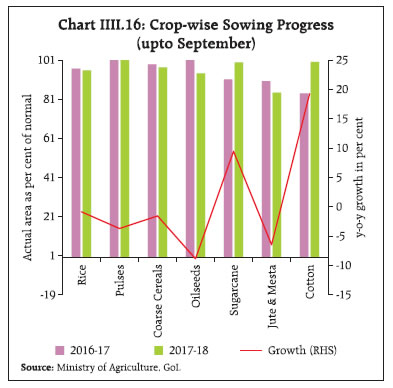

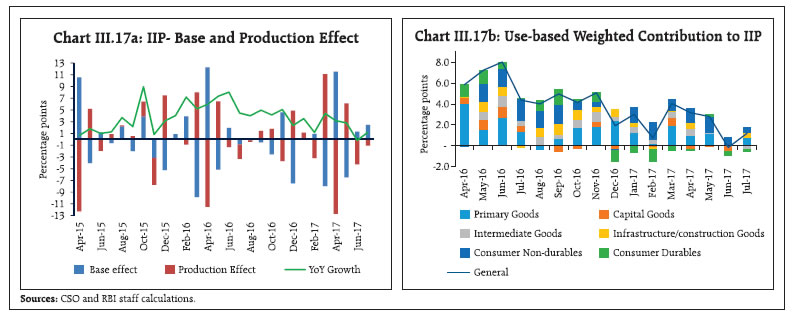

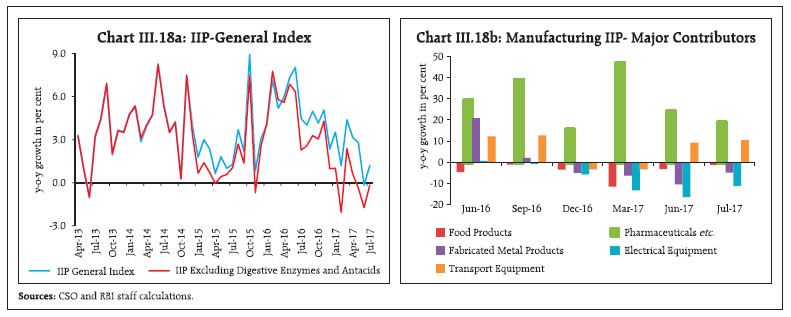

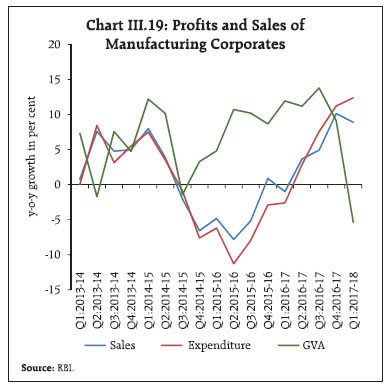

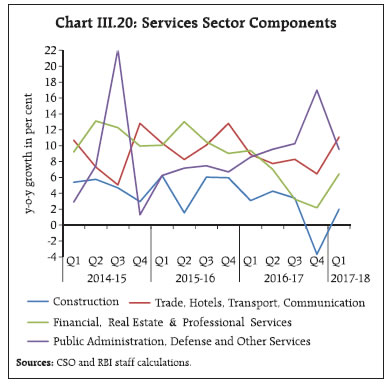

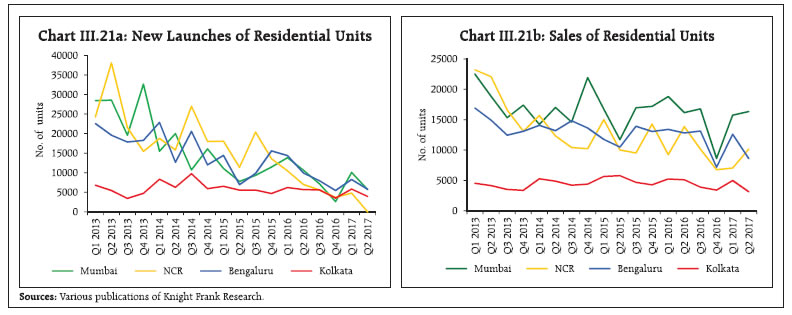

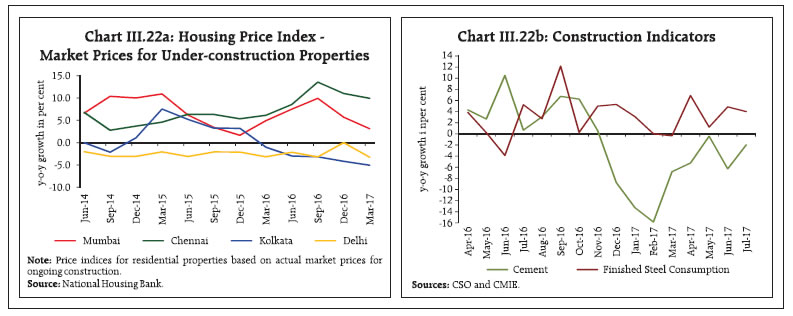

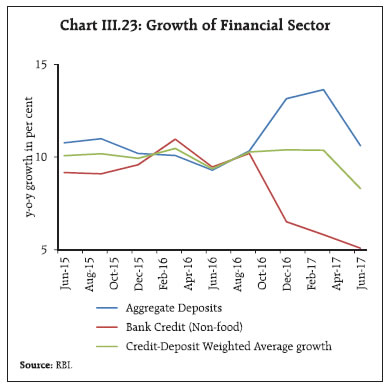

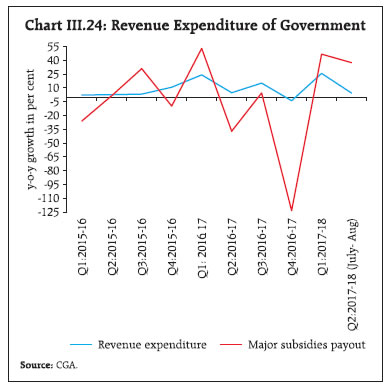

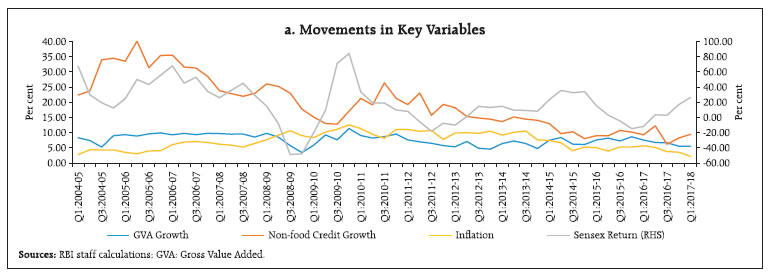

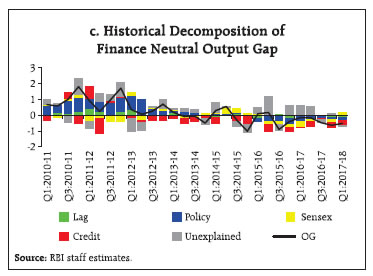

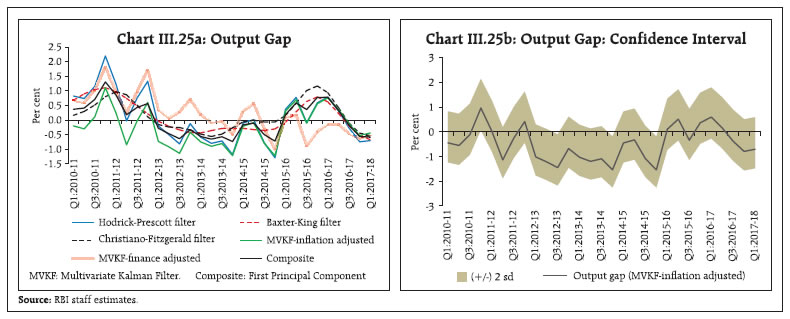

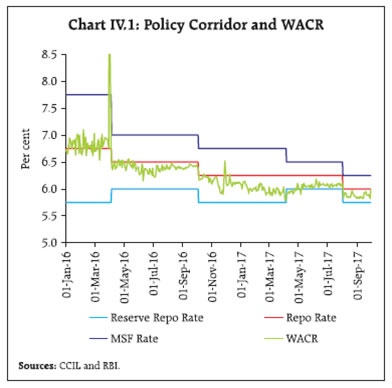

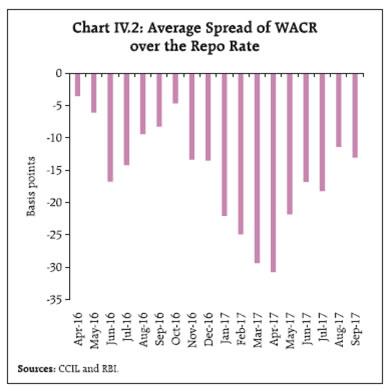

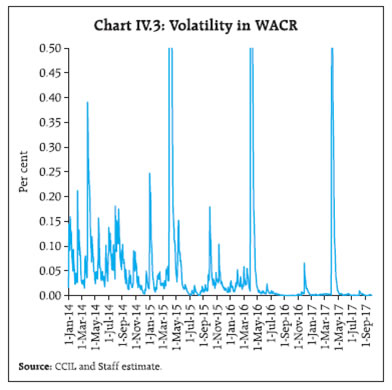

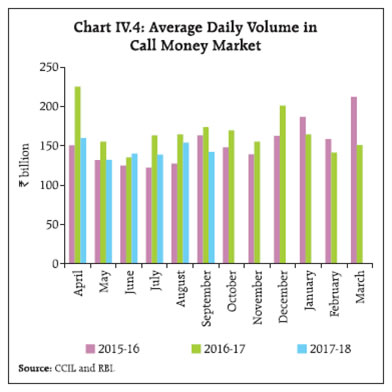

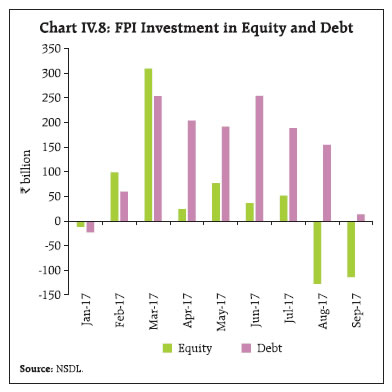

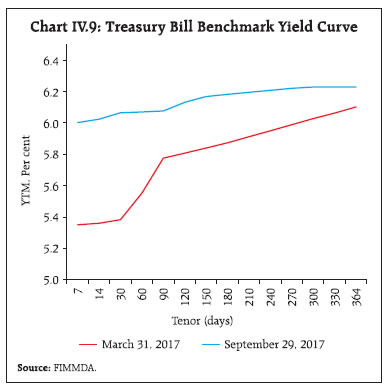

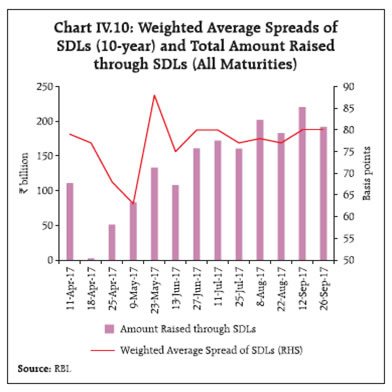

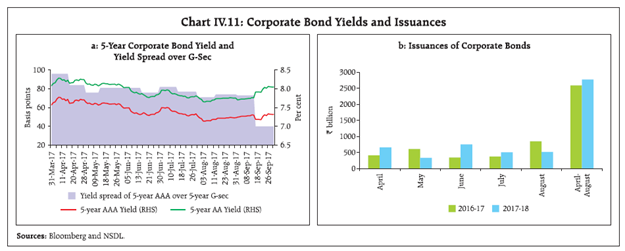

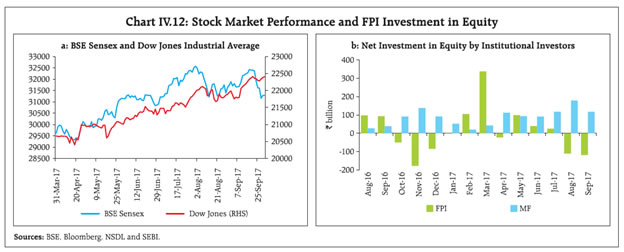

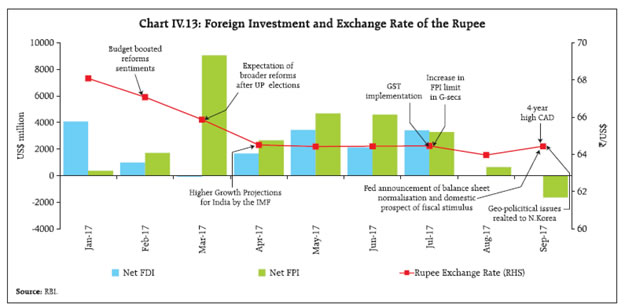

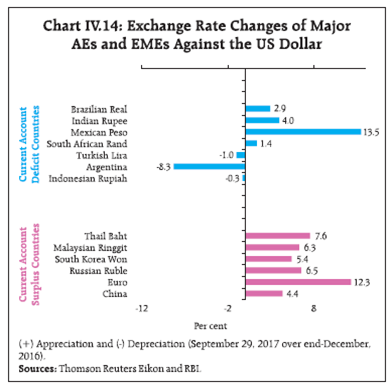

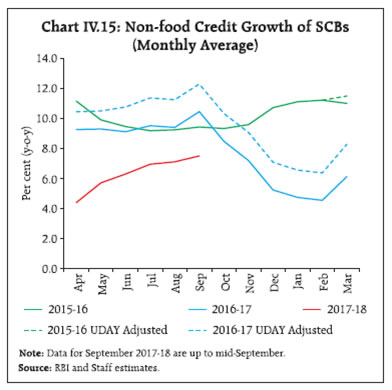

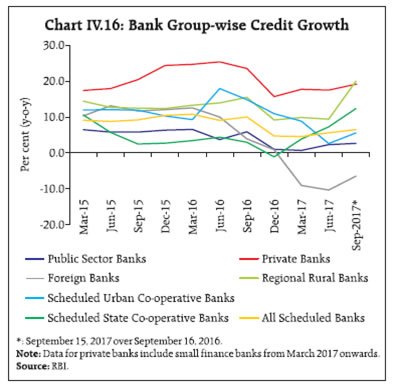

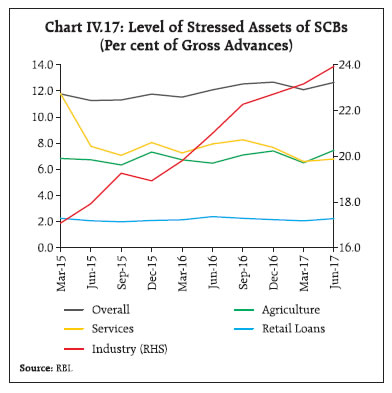

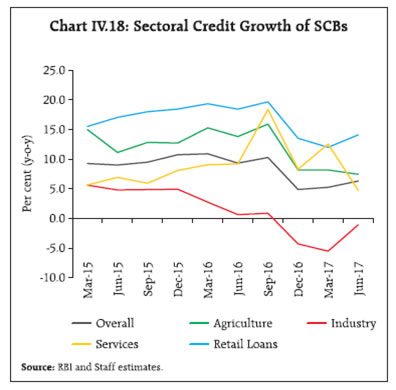

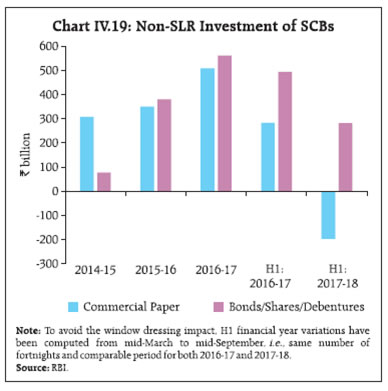

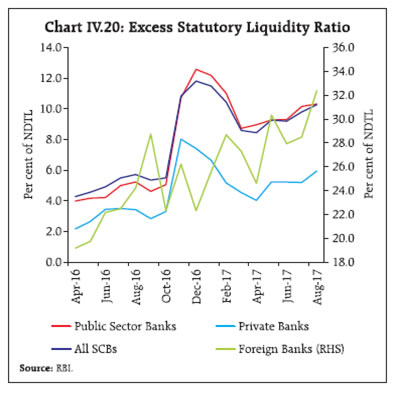

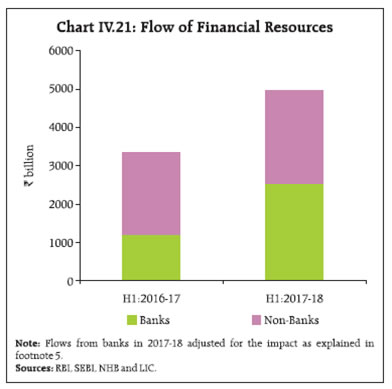

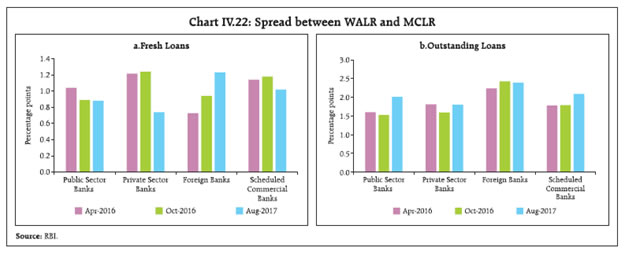

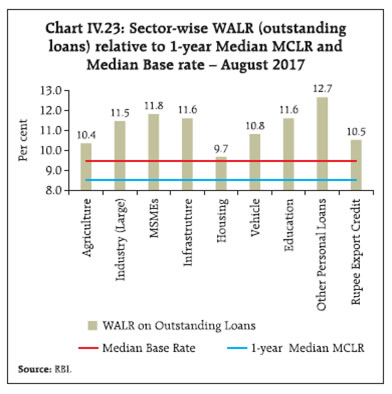

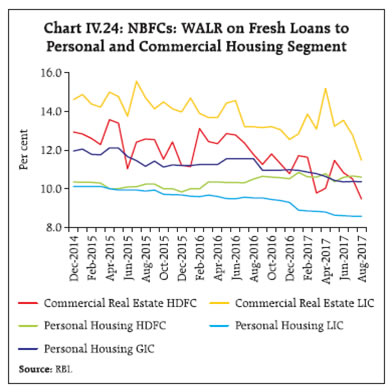

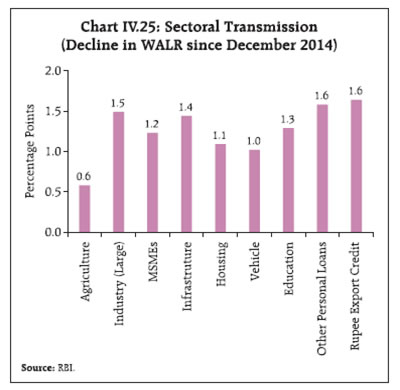

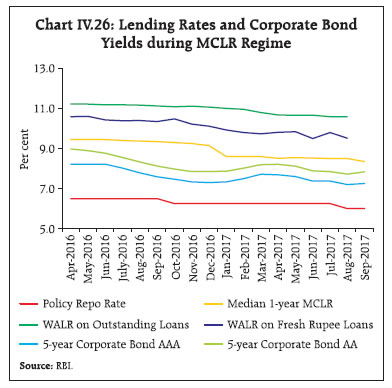

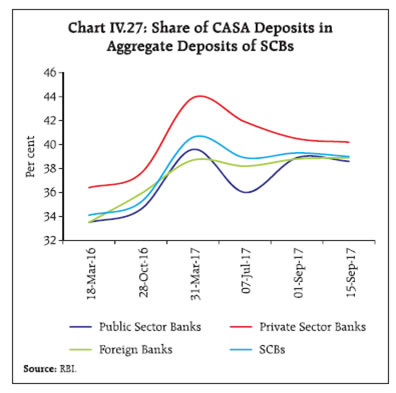

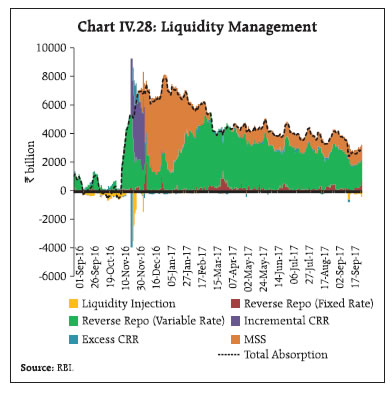

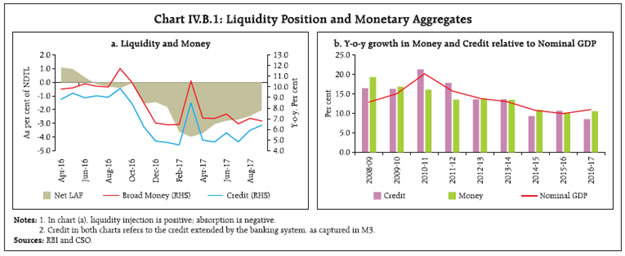

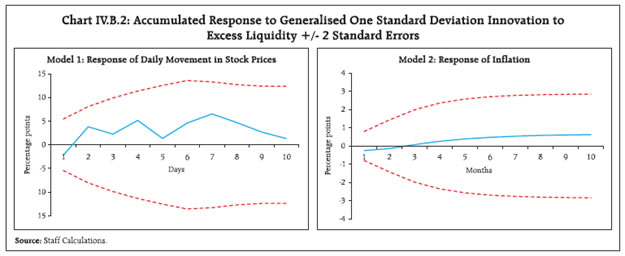

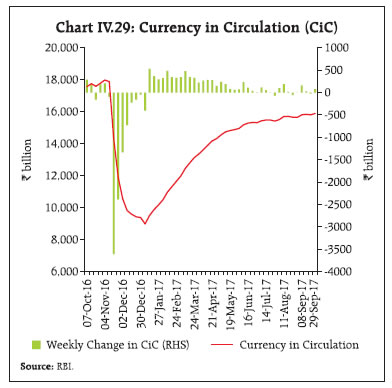

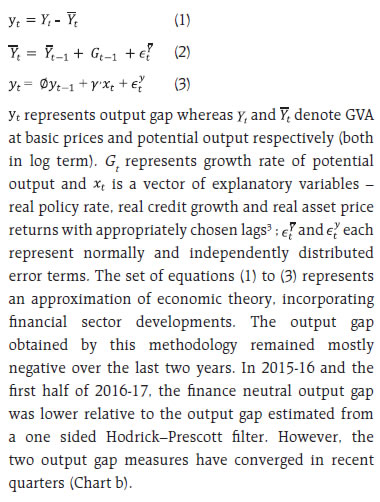

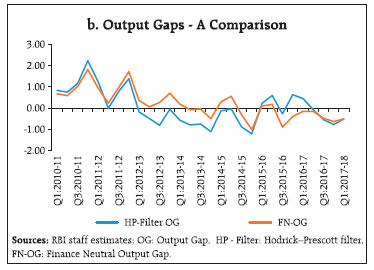

Other Measures of inflation In May 2017, the base year of wholesale price index (WPI) was revised from 2004-05 to 2011-12 to align it with the base year of other macroeconomic indicators such as gross domestic product (GDP) and the index of industrial production (IIP). The revision in the base year is also intended to capture structural changes in the economy and to improve the quality, coverage and representativeness of the index. In addition to an updated item basket, the revised WPI has included two new features in line with international best practices: (i) the use of the geometric mean for compilation of item-level indices; and (ii) the exclusion of indirect taxes from wholesale prices, thus bringing it conceptually closer to a producer price index. Reflecting these changes, headline WPI inflation in the new series declined by an average of one percentage point as compared with inflation calculated from the index with 2004-05 as base year during April 2013 to March 2017. After peaking in February, WPI inflation fell sharply up to June, but ticked up again in July and August following a sharp pickup in food prices. Between April and July, CPI trimmed means11 have softened; however, in August these registered an increase. Median inflation, a particular case of the trimmed mean, also declined, averaging 4.2 per cent since March 2017 (Chart II.17a). inflation measured by sectoral consumer price indices continued to undershoot headline CPI inflation, reflecting inter alia the higher weight of food in the former. Changes in GDP and gross value added (GVA) deflators have moved along with WPI inflation since the beginning of the year (Chart II.17b). In July and August, the movement in WPI inflation was consistent with that of headline CPI and all sectoral CPIs. Underlying cost conditions have largely co-moved with measures of inflation, with the pickup in the last quarter of 2016-17 turning out to be transient. Industrial and farm costs captured under the WPI eased significantly in Q1:2017-18 (Chart II.18). The fall in global crude oil prices and the easing of metal prices due to the slowdown of demand from China12, the world’s biggest metals consumer, also contributed to the significant decline in domestic farm and nonfarm input costs as they got passed on to inputs such as high speed diesel, aviation turbine fuel, naptha, bitumen, furnace oil and lube oils. In Q2, metal prices rose from the June trough, underpinned by expectations of strong global demand, particularly from China. However, prices moderated somewhat by end-September. Among other industrial raw materials, domestic coal prices remained range-bound while prices of other inputs such as fibres, oil seeds and pulp either declined or moved with a softening bias; and among farm sector inputs, diesel prices declined sharply, tracking international prices. Prices of other agricultural inputs such as electricity, fertilisers, pesticides and tractors softened. Due to excess inventory, supply of fertiliser remained comfortable despite deceleration in production in Q1:2017-18 which softened prices. Tractor shipments decelerated to 8.0 per cent in Q1:2017-18 (12.1 per cent last year) largely due to destocking in the pre-GST period, with discounts imparting low momentum to prices. However, the decline in inflation in both farm inputs and industrial raw materials was arrested in the August prints as the prices of urea, high speed diesel and other minerals oil rose tracking international prices. Following the monsoon and the pickup in agricultural activity, demand for agricultural labourers remained strong in 2017-18. This was reflected in a modest increase in the rate of wage growth for rural agricultural labourers, a key determinant of farm costs (Chart II.19). In the organised sector, the decline in growth of unit employee costs in listed private sector companies in manufacturing during 2016-17 reversed to register an uptick in Q1:2017-18. However, unit employee costs for companies in the services sector continued to decline in a pattern that has set in since Q2:2016-17.13 Unit labour costs14 in the manufacturing sector continued to rise as staff cost growth outpaced the growth in value of production.15 The growth in the ratio of staff costs to value of production in the manufacturing sector accelerated modestly in the first quarter of 2017-1816 after declining for the last two quarters of 2016-17 (Chart II.20). The value of production for manufacturing companies declined (probably due to de-stocking undertaken by the companies with respect to pre-GST sales) and staff costs rose marginally. The cost of raw materials, based on responses of manufacturing firms covered in the Reserve Bank’s industrial outlook survey, remained high in Q1:2017- 18, albeit with some moderation in relation to the previous quarter, possibly reflecting softer commodity prices. Firms assessed that the cost of raw materials remained elevated in Q2 as well; however, their inability to increase selling prices suggests that pricing power is still weak. The manufacturing purchasing managers’ index (PMI) also suggest that the cost of raw materials remained high in Q1 and Q2:2017-18, but failed to impact selling prices in view of weak pricing power. In contrast, the services PMI reported a sharp pickup in prices charged in Q2 – the upward revision in prices likely reflecting higher tax rates under GST. Globally, low inflation across AEs and EMEs is coexisting with a modest strengthening of demand. In India, uncertainty surrounds the path of inflation over the rest of the year. Overall inflation outcomes going forward will depend on the durability of the recent disinflation in food, given that base effects have turned unfavourable from August. Furthermore, there are likely headwinds from temporary price adjustments post-GST, the direct and second round impact of HRA increases (see MPR, April 2017, Chapter 1) and a recovery in demand in the second half of 2017-18 which would narrow the output gap. Consequently, the inflation trajectory is poised to firm up over the rest of the year. Finally, considerable upside risk to inflation stems also from the rather large scale of state level farm loan waivers and the reports of a likely fiscal stimulus (Chapter I, Box I.1). 1 Headline inflation is measured by year-on-year changes in all-India CPI Combined (Rural + Urban). 2 The CPI diffusion index, a measure of dispersion of price changes, categorises items in the CPI basket according to whether their prices have risen, remained stagnant or fallen over the previous month. A reading above 50 for the diffusion index signals a broad expansion or the extent of generalisation of price increases and a reading below 50 signals a broadbased deflation. 3 Historical decompositions are used to estimate the individual contribution of each shock to movements in inflation over the sample period based on a Vector Auto Regression (VAR) with the following variables (represented as the vector Yt): annual growth rate in crude oil prices in Indian rupees, inflation, output gap measured by using the Hodrick–Prescott filter, annual growth rate of rural wages and the policy repo rate. The VAR can be written in companion form as: Yt =c + A Yt-1 + et; where et represents a vector of shocks [oil price shock; supply shock (inflation shock); output gap shock; wage shock; and policy shock]. Using Wold decomposition, Yt can be represented as a function of deterministic trend and sum of all the shocks et. This formulation allows to decompose the deviation of inflation from the deterministic trend as the sum of contributions from various shocks. 4 Measures, inter alia, include issuing soil health cards to all farmers to provide information to farmers on nutrient status of their soil along with recommendation on appropriate dosage of nutrients to be applied for improving soil health and its fertility; Pradhan Mantri Krishi Sinchayee Yojana to help expand cultivated area with assured irrigation, reducing wastage of water and improving water use efficiency; onboarding 455 markets (out of 585 regulated market) in 13 states on the e-marketing platform under the National Agriculture Market scheme (eNAM) – as on September 8, 2017, 47.95 lakh farmers and 91,500 traders have registered on the e-NAM portal. 5 Monthly series of the CPI vegetable price index from January 2012 to June 2017 is decomposed into trend, cyclical, seasonal and irregular components using a univariate unobserved components model (UCM). The Supremum Wald test indicates a statistically significant break in August 2016, with the post-break trend sloping negatively. Comparing the observed vegetable price index with an index constructed by imputing the pre-break trend on to the post-break decomposition reveals a 6-10 percentage points deviation in inflation in 2017. Several caveats are in order: (i) the break is at the end of the sample; (ii) the post-break trend is negative sloping which means that reduction in prices on an enduring basis, controlling for other shocks and seasonality, is unlikely; and (iii) the July and August 2017 data already indicate a sharp reversal in vegetable prices. These need to be considered while interpreting the break as a structural change.represented as a function of deterministic trend and sum of all the shocks et. This formulation allows the decomposition of the deviation of inflation from its deterministic trend as the sum of contributions from various shocks. 6 Margin is measured as the difference between the retail and the wholesale price. The increase in margins is statistically significant at 5 per cent level. The kernel density function also suggests significant increases in onion and tomato prices and margins across a majority of the centres during July and August as compared to May and June 2017. 7 Based on analysis of variance (ANOVA) framework. 8 Total stock of rice, wheat and coarse cereals as at end-August 2017 compared to end-August 2016. 9 Electricity generation is based on the index of industrial production (IIP). 10 The Economic Survey 2016-17 expects that the impact of GST will be deflationary in nature. While some analysts see CPI inflation recording a marginal uptick on the back of pickup in prices of food and tobacco, and services, few analysts expect that the impact of GST on inflation will depend on a variety of factors such as the efficiency with which the input tax credit mechanism works and producers pass on tax cuts into final prices. 11 Trimmed means lessen noise by removing select proportions of upper and lower ends of the distribution corresponding to a chosen percentage of trim. They are used as indicators of underlying inflation behaviour. 12 This is due to China’s efforts to rein in its shadow banking sector from which credit in the form of off-balance sheet lending has gone to the metal sector through wealth management products. With the tightening of credit, China’s economy and its metal demand have been slowing (IMF Commodity Market Monthly, June 9, 2017). 13 Results for Q1:2017-18 are provisional. 14 Unit labour costs is defined here as the ratio of staff cost to value of production. 15 Results for Q1:2017-18 are based on 363 common set of services companies and are provisional. 16 Results for Q1:2017-18 are based on 992 common set of manufacturing companies and are provisional. III. Demand and Output Aggregate demand has been impacted by slowing consumption demand, still subdued investment and a slump in export performance in the early months of 2017-18. Manufacturing activity, which was dragged down by one-off effects of the implementation of GST, weighed heavily on aggregate supply conditions. Notwithstanding initial deceleration, agricultural prospects remain stable and acceleration in services sector activity could impart resilience to the overall supply situation in the rest of 2017-18. Aggregate demand slackened in Q1:2017-18 in a sequence that began a year ago; yet, it surprised expectations on the downside. Restrained by languishing investment and a distinct slowdown in exports, real GDP growth fell below 6 per cent in Q1:2017-18 for the first time in thirteen quarters. The deceleration in economic activity would have been more pronounced, but for the front loading of public spending which boosted government consumption and provided a cushion. Private consumption demand, still the fulcrum of overall demand in the economy, started losing momentum in Q4:2016-17 and slumped further in Q1:2017-18. Although gross fixed capital formation (GFCF) broke out of the steady decline since the beginning of 2016-17, the uptick in Q1:2017-18 was weak and will warrant more incoming data to confirm if a reversal has commenced. Aggregate supply conditions were flattened by the loss of momentum in agriculture and allied activities in spite of a sharp rise in rabi production. Industrial GVA slumped to a 20-quarter low in Q1:2017-18, impacted by one-off effects of the implementation of the goods and services tax (GST), rising input costs and the deepening weakness in aggregate demand. In the services sector, however, an upturn spread to several constituent parts. Looking ahead, supply conditions are poised to receive some boost from the agricultural sector and rising expectations of a durable upswing in services. The decline in momentum in manufacturing activity remains an area of significant concern. Measured by year-on-year (y-o-y) changes in real gross domestic product (GDP) at market prices, aggregate demand decelerated to 6.1 per cent in Q4:2016-17 and further to a thirteen-quarter low of 5.7 per cent in Q1:2017-18, extending the protracted slowdown that has already spanned five consecutive quarters. The loss of momentum was also evident on a seasonally adjusted basis (Chart III.1). Excluding the support from the robust growth of government final consumption expenditure (GFCE), real GDP growth would have slumped to a mere 4 per cent in Q4:2016- 17 and 4.3 per cent in Q1:2017-18, respectively. Demand conditions were debilitated by a collapse in GFCF that set in from Q2:2016-17; even though GFCF recovered from contraction, its growth was feeble in Q1:2017-18. Private final consumption expenditure (PFCE) slumped in Q1:2017-18 to record the slowest growth over the last six quarters. The high growth of exports in Q4:2016-17 could not be sustained and a levelling off in Q1:2017-18 appears to have prolonged into Q2 as well. Consequently, net exports depleted aggregate demand in the economy (Table III.1). III.1.1 Private Final Consumption Expenditure Even as PFCE remained the key driver of aggregate demand in the economy, contributing 54 per cent to real GDP, a marked deceleration has characterised its evolution in Q4:2016-17 and Q1:2017-18 in comparison with the preceding three quarters (Chart III.2). High frequency indicators for urban consumption paint a mixed picture, with sales of passenger cars and international air passenger traffic remaining robust, but consumer durables production having contracted (Chart III.3a). Going forward, urban consumption is expected to revive, following the upward revision in house rent allowances (HRA) for central government employees as also the likely implementation of the 7th Central Pay Commission (CPC) award at the sub-national level. High frequency indicators of rural demand, viz., growth in sales of two-wheelers and tractors, have witnessed sequential improvement in the recent months. The production of consumer non-durables, representing cash-intensive fast moving consumer goods (FMCG) demand, has, however, decelerated, though still exhibiting high growth among the components of industrial production (Chart III.3b). Retail consumption activity, reflected in drawals of personal loans from scheduled commercial banks (SCBs), suggests that underlying conditions are supportive of consumption demand, going forward (Chart III.4). III.1.2 Investment Demand Investment demand remained depressed, with its share in GDP declining from 34.3 per cent in 2011-12 to 29.5 per cent in 2016-17. Although GFCF exhibited a slender recovery in Q1:2017-18, the overall investment climate remains bleak. Subdued levels of investment activity were also reflected in the contraction of capital goods production, notwithstanding robust growth in imports of certain capital goods (III.5a). The corporate investment cycle is weighed down by excess capacity in the manufacturing sector. Capacity utilisation (CU) improved in Q4:2016-17, but it again dipped in Q1:2017-18, reflecting weak demand (Chart III.5b). High levels of stress in the balance sheets of banks and corporations continued to act as a drag on investment activity. Besides, households’ investment in dwellings, other buildings and structures also remained subdued due to high levels of inventories of residential houses and expectations of correction in prices. According to the Centre for Monitoring Indian Economy (CMIE), new investment proposals significantly declined in Q2: 2017-18 in terms of both numbers and value (Chart III.6a). Only 403 new projects were announced, the lowest since Q1:2004-05. The implementation of stalled projects still lacks adequate traction – there was a significant increase in stalled projects in Q1:2017-18; however, an improvement was reported in Q2:2017-18 (Chart III.6b). At the same time, anecdotal evidence suggests that awarding and construction of highway projects in the road sector have reached an all-time high and the daily additions of road construction have touched a peak. Some momentum in investment activity is also visible in sectors such as electricity transmission, roads and renewable power. Going forward, an increase in allocation of capital expenditure by 6.7 per cent in 2017-18 is expected to generate some multiplier and crowding-in effects, although a durable turnaround in the investment cycle largely hinges on a revival in private investment appetite. III.1.3 Government Expenditure As stated earlier, the slowdown in aggregate demand in Q1:2017-18 was cushioned by GFCE. Following advancement of the announcement of the Union Budget, the Centre undertook massive frontloading of expenditure. The disbursement of subsidies during April-August 2017, in particular, increased sharply. Consequently, revenue expenditure accounted for about 46 per cent of the budgeted expenditure (Table III.2). During Q2 so far (July-August 2017), revenue expenditure propped up GFCE with y-o-y growth of 4.4 per cent (-7.6 per cent in July-August 2016). Tax revenues (net) were higher during April-August 2017 than their levels a year ago on account of higher collections under corporate and income taxes. Receipts under customs duties, union excise duties and service tax moderated, however, mainly due to the ongoing migration of select indirect taxes to the GST (Chart III.7a). Uncertainty on the revenue front can have adverse implications for the viability of government finances, going ahead. The GST Council recommended a four-tier rate structure – 5, 12, 18 and 28 per cent – for the fitment of all 1,211 items of goods and services, including exemptions on basic necessities (Chart III.7b). After the introduction of the GST, the total tax incidence on motor vehicles (GST plus Compensation Cess) has come down vis-a-vis the total tax incidence in the pre-GST regime. Accordingly, the GST Council has recommended that the central government moves legislative amendments for increasing the maximum ceiling of cess to be levied on motor vehicles to 25 per cent from 15 per cent. Meanwhile, the government has also indicated that it would further rationalise rates, depending on the progress of implementation. The number of new taxpayers who registered with the GSTN up to August 29, 2017 reached around 1.9 million. As per the latest information (up to September 25, 2017), revenue collections under GST for the month of August amounted to ₹906.7 billion as against ₹940.6 billion for the month of July, 2017.1 Going forward, the gains from expansion of the tax base due to introduction of the GST and improved tax compliance post-demonetisation are expected to improve tax buoyancy over the medium-term. Nevertheless, businesses have been facing some IT challenges during the initial stage of implementation which are being looked into by the GST Council. After GST implementation, exporters can avail input tax credit only after sale within the domestic tariff area or after sending their shipments outside the country. They can subsequently claim the unutilised credit as refund, a process in which their working capital gets immobilised, thereby raising their operating cost. As exporters raised concerns over blockage of refunds and working capital on account of rollout of GST, the government has decided to refund substantial amount of taxes paid by them to provide immediate relief. In view of the difficulties being faced by taxpayers in filing returns, the dates for filing various GSTR have been extended. Furthermore, comprehending GST provisions and their impact on business along with the requirements for GST-compliance is still premature. Moreover, provisions for anti-profiteering as well as the now-deferred e-way bill which tracks consignments across states are unclear. After the fitment committee observed anomalies in GST levied on 40 items, the GST Council has lowered taxes on these products. In view of the above, it may be challenging to realise the projected tax revenues in the Union Budget 2017-18. The Centre’s borrowing programme was conducted as per the planned issuance schedule within the overall contour of its debt management strategy. Following the strategy of front loading of issuances, the central government completed 64.1 per cent (58.6 per cent in corresponding period of 2016-17) of its budgeted gross borrowings (₹5,800 billion) by September 2017 (Table III.3). The spate of increased borrowing by the state governments may, however, exert pressure on the finite pool of investible resources and crowd out private investment. Consolidated state finances are budgeted to improve in 2017-18 on account of a lower gross fiscal deficit- GDP ratio. While the capital expenditure-GDP ratio is budgeted to be lower in 2017-18 than in the previous year, capital outlay is projected to remain unchanged, which augurs well for the quality of expenditure. State finances, however, are likely to come under stress during 2017-18 from farm loan waivers announced during the year so far, which are estimated at around 0.5 per cent of GDP, and partial implementation of the seventh pay commission recommendations. This, in turn, has to be financed by additional market borrowings which push up interest rates, not just for the States but for the entire economy. A collateral damage could be that private borrowers are crowded out as the cost of borrowing rises. Even if the loan waiver is accommodated within budgetary provisions, it may force cutbacks in other heads of expenditure. Experience has shown that the most vulnerable category is capital expenditure. Illustratively, Uttar Pradesh, which presented its budget after the announcement of the loan waiver, has built in a decline in capital outlay and capital expenditure by 26.2 per cent and 30.4 per cent, respectively, during 2017-18. On the other hand, Maharashtra, which presented its budget before the announcement, projected a decline of around 4.2 per cent in capital expenditure. This, in turn, might entail deterioration in the quality of expenditure with attendant implications for productivity. III.1.4 External Demand With import growth far outpacing that of exports, the contribution of net external demand to GDP turned negative in Q1:2017-18, as in the preceding quarter. The slowdown in exports in Q1: 2017-18 was broad-based and encompassed oil and non-oil segments accounting for 74 per cent of the export basket. During July 2017, export growth slowed further despite a sharp increase in oil exports, but revived in August 2017 largely due to an increase in engineering goods, electronic goods and drugs and pharmaceuticals exports. Merchandise import growth accelerated in Q1:2017-18, taking the trade deficit to its highest level since Q2:2013-14, despite crude oil prices being half the level that prevailed in 2013-14 (Chart III.8a). In July-August too, the merchandise trade deficit expanded unrelentingly on the back of sustained import demand. Notwithstanding declining oil import volumes, gold imports grew strongly in Q1:2017-18 in anticipation of GST implementation. However, they moderated sequentially during June-August 2017 as stockpiling eased, while remaining high on a y-o-y basis (Chart III.8b). Among non-oil non-gold imports, which have been growing in double digits since Q4:2016-17, pearls and precious stones, electronics goods, coal and other goods contributed sizably, underlining the role of international commodity prices and increased domestic demand for electric, construction and dairy machinery even as a decline in imports of transport equipment coincided with an increase in domestic production (Chart III.9). While there has been a contraction in domestic production of capital goods, imports of capital goods, except transport equipment, gradually increased during April-August 2017. Similarly, higher imports of sugar reflected domestic consumption exceeding production in 2016-17. Net services receipts increased by 15.7 per cent on a y-o-y basis during Q1: 2017-18 largely driven by a rise in net earnings from travel, construction and other business services. While outflows of primary income remain a drag on the current account deficit (CAD), a modest rise in secondary income, primarily in the form of workers’ remittances, provided a partial offset. Both net FDI and net FPI flows to India rose during Q1:2017-18 over their levels a year ago, attesting to the attractiveness of the Indian economy as an investment destination. External commercial borrowings (ECBs) inflows also picked up modestly on the back of a sharp increase in issuance of rupee denominated bonds. In contrast, net accretion to NRI deposits declined marginally, reflecting lower inflows into Non-Resident External (NRE) rupee accounts. reflecting external sector resilience, foreign exchange reserves reached a level of US$ 399.7 billion on September 29, 2017 equivalent to 11.5 months of imports.2 The cyclical slowdown that set in at the beginning of 2016-17 pulled the growth of output measured by gross value added (GVA) at basic prices down to 5.6 per cent in Q1:2017-18, flat at the level of the preceding quarter (Table III.4). Underlying this subdued performance was the depressed state of industrial activity, particularly manufacturing. Although agricultural and allied activities also decelerated sequentially from Q3:2016- 17, they were in alignment with the typical outturn in the first quarter of the year. Services sector activity, however, posted a strong performance, dispelling the slack that had manifested itself through 2016- 17. In fact, the deceleration of GVA was cushioned by continuing strong growth in public administration, defence and other services (PADO) growth, a constituent of the services sector which has been buoyed by frontloading of Government expenditure in Q1:2017-18. Excluding this component, the GVA growth would have slipped to 5 per cent in Q1:2017-18 (Chart III.10). However, seasonally adjusted q-o-q annualised GVA growth suggests a modest strengthening of momentum in Q1:2017-18 vis-à-vis Q4:2016-17 (Chart III.11). The April MPR had projected GVA growth of 6.7 per cent for Q1:2017-18. The actual outcome undershot this projection by more than a full percentage point, indicative of the larger than expected loss of momentum (Chart III.12). The unexpected moderation in allied activities weighed heavily on the rate of growth of agricultural sector. In addition, the deceleration in the manufacturing sector reflected uncertainties surrounding GST implementation and higher than expected rise in input costs. III.2.1 Agriculture Agriculture and allied activities recorded a significant deceleration in Q1:2017-18 from Q4:2016-17, notwithstanding the jump of 8.5 per cent in rabi foodgrain production, the highest growth recorded in the last 13 years. Moreover, the area under horticulture grew by 2.6 per cent in 2016-17 from a year ago, while production increased by 4.8 per cent, reaching a record of 300 million tonnes. The moderation in agricultural GVA growth in relation to the preceding quarters mainly reflects the slowdown in ‘livestock products, forestry and fisheries’. South-west monsoon rainfall was higher than the long period average (LPA) till the fourth week of July, but turned significantly weak thereafter (Chart III.13). As of September 30, 2017, out of the 36 sub-divisions in the country, 30 divisions received excess/normal rainfall, while the remaining divisions (east and west UP, Haryana, Chandigarh & Delhi, Punjab, east MP and Vidarbha), covering 17 per cent of the sub-divisional area of the country, received deficient rainfall. In terms of the production weighted rainfall index (PRN), rainfall was lower than the previous year by 5 per cent, resulting in contraction in the area sown under key crops (Chart III.14). Although kharif sowing started on a high note, the momentum slowed down in August due to a lull in the south-west monsoon and lower than expected increase in MSPs (Table III.5) and decline in wholesale prices of major food items across mandis on account of the bumper harvest. The latest data suggest that sowing picked up again in September; however, kharif sowing for the year as a whole has remained lower than last year’s acreage (Chart III.15). In terms of crops, sown area was lower in the case of rice, coarse cereals, oilseeds pulses and jute and mesta, but it was higher in the case of sugarcane and cotton (Chart III.16). According to the first advance estimate (AE), the production of kharif foodgrains for 2017-18 at 134.7 million tonnes was 2.8 per cent lower than last year (4th AE). Water storage levels in 91 reservoirs across the country were lower at 66 per cent of the full reservoir level (74 per cent last year) as on September 28, 2017. Apart from the northern region, reservoirs in all other regions received less water than in the corresponding period last year. This could pose a challenge to the attainment of the crop production target set at 274.6 million tonnes for 2017-18. III.2.2 Industrial Sector Industrial GVA growth dipped to 1.5 per cent in Q1 of 2017-18 – the lowest in the last 20 quarters, mainly due to GST-related uncertainties. The index of industrial production (IIP) exhibited a broad-based deceleration in Q1. Large negative production effects partly offset positive base effects, especially in April and July (Chart III.17a). On a use-based analysis, the output of both capital goods and consumer durables contracted, highlighting weak investment appetite and slowing consumption demand. In terms of weighted contributions, the slowdown was led by capital goods, followed by intermediate goods (Chart III.17b). Acceleration in consumer non-durables was driven mainly by the contribution of a single item, viz., digestive enzymes and antacids (DEA); excluding this component, the overall index would have contracted by 0.2 per cent in July 2017 as compared with the growth of 2.2 per cent in July 2016 (Chart III.18a). Of the 23 industry groups that form the manufacturing sector, production in 15 industries contracted during July 2017. The strong performance in a few industries such as pharmaceuticals and transport equipment was pulled down by a broad-based slowdown in other industries, most notably electrical equipment (Chart III.18b). The sharp deceleration in manufacturing in Q1:2017- 18 was due to a combination of factors playing out simultaneously. While the uncertainties relating to GST implementation affected overall business sentiment, value added declined as sales decelerated and expenditure accelerated (Chart III.19). The mining and quarrying segment, which showed some signs of revival in the second half of 2016-17, sank back again to contraction mode in Q1:2017- 18. Although natural gas production has sustained the revival that set in from the second half of the previous year, contraction in crude oil production and subdued coal production pulled down mining output. Contraction in coal production was on account of lower demand for electricity generation, which has undergone significant transformation in the recent period. While renewable energy has made rapid strides due to falling costs and Government’s incentives, reports suggest that some of these projects are facing challenges in terms of collapse in prices resulting in low tariffs/renegotiations of tariffs, weak demand and exhausted tax benefits. These factors have raised concerns about the viability of such projects. Going forward, this segment may remain subdued until there is a significant pick-up in demand. The slowdown in IIP mirrored the lukewarm performance of eight core industries, except natural gas, coal and electricity. Contraction in cement, fertilisers and crude oil accentuated the overall slowdown. Early indicators for 2017-18 point to subdued industrial activity. The 79th round of the Reserve Bank’s Industrial Outlook Survey (IOS) signaled subdued demand conditions in Q2:2017-18. III.2.3 Services The services sector, which decelerated sequentially through 2016-17, recorded a significant improvement in Q1:2017-18 (7.8 per cent, up from 5.7 per cent in Q4:2016-17), driven mainly by trade, hotels, transport and communication as well as public administration, defence and other services. Financial, real and professional services also showed improvement in Q1:2017-18. Although the construction sector switched from contraction mode in Q4:2016-17 into expansion, it may be too early to conclude that the upturn is durable (Chart III.20). In the housing sector, new units launched have slowed down although units sold have shown an uptick in some cities in recent quarters (Chart III.21a and b). This is expected to continue as the industry gears up for further consolidation, and as greater clarity on the implementation of Real Estate Regulatory Act (RERA) across States emerges. With large unsold inventories, property prices showed a correction in Q4:2016-17 in major cities (Chart III.22a). Cement production – an indicator of construction activity – is still in contraction mode, while steel consumption improved in recent months (Chart III.22b). Activity in trade, hotels, transport and communication, which was affected post-demonetisation, bounced back to register a five-quarter high growth of 11.1 per cent in Q1:2017-18. Indirect taxes, a major indicator of activity of this segment, grew by 14 per cent in Q1:2017-18. Most of the lead indicators of activity in this segment, viz., foreign tourist arrivals, international passenger and air freight traffic, railway traffic, and telephone subscribers showed an uptick in recent months. Financial, real estate and professional services also accelerated in Q1:2017-18, partly reflecting robust value addition by information technology companies in the professional services segment. The financial sector’s growth decelerated in the recent period, mirrored in weak growth in aggregate deposits and bank credit. Notwithstanding low credit growth, high deposit growth in the second half of 2016-17 had helped in propping up activity in this sub-sector, maintaining the weighted average of the two. In Q1:2017-18, however, both credit growth and deposit growth declined, pulling down the sub-sectoral activity (Chart III.23). As in the previous quarter, public administration, defence and other services benefitted from higher revenue expenditure of the Centre in Q1 and continued to provide support to GVA growth (Chart III.24). The output gap measured by the deviation of actual output from its potential level and expressed as a percentage of potential output, is a gauge of demand conditions. Despite its usefulness as a summary measure of the cyclical component of aggregate demand, infirmities arise from the fact that the output gap is unobservable and needs to be estimated from the data. As different filtering techniques are highly sensitive to the choice of period, methodology and the availability of data, a pragmatic approach is followed by staff that involves various methodologies including univariate filters like Baxter-King (BK), Hodrick–Prescott (HP) and Christiano- Fitzgerald (CF), Multivariate Kalman filters (MVKF) and production functions. A finance adjusted measure of the output gap, which controls for the imbalances emanating from the financial sector, has also been introduced in this MPR (Box III.1). All these output gap measures are aggregated by using principal component analysis in order to construct a composite measure (Chart III.25 a and b). This measure indicates that the output gap has been negative since Q3:2016-17. Box III.1: Finance Neutral Output Gap The estimation of potential output - the level of output that an economy can produce sustainably over the medium-term consistent with low and stable inflation – enables an assessment of the output gap as the deviation of actual output from this potential level. Conventional estimates of the output gap largely ignore the role of financial sector (Borio et al., 2016). The preglobal financial crisis (GFC) period was characterised by high output growth, benign inflation and financial sector imbalances emanating from rapid growth in credit and asset prices, which eventually culminated in the GFC in 2008. It is plausible for inflation to remain low and stable in times when output growth is on an unsustainable path due to buildup of imbalances in financial sector. Taking these into consideration Borio et al. (2016) present an alternate measure of the output gap – “finance neutral output gap” – which incorporates the role of financial sector variables in the evolution of economic cycles. India also recorded high credit and asset prices growth along with rising output growth and moderately low inflation in the pre-GFC period. For instance, during 2002-03 to 2007-08 the average annual growth in nonfood credit and annual return on assets (measured by the Sensex) were 27 per cent and 32 per cent, respectively, while the CPI inflation was, on an average, about 5 per cent. Output growth was close to double digits during 2005-06 to 2007-08 (Chart a). Guided by empirical evidence of a significant relationship between financial factors and business cycles, real credit growth and real asset price growth were included along with the real policy rate to estimate the output gap in a semi-structural multivariate Kalman filter framework. The finance neutral output gap was estimated using quarterly data from Q1:2006-07 to Q1:2017-18 by the quasi maximum likelihood method on the following state space model:   The historical decomposition of the output gap, portraying the contribution of various factors on its evolution, suggests that financial factors have been contributing negatively to the output gap since 2012-13 (Rath et.al, 2017) (Chart c). High inflation and low real interest rates during the period 2010-13 contributed positively to the output gap. More recently, subdued credit growth has contributed negatively to demand conditions. References: Borio, C., Disyatat, P., & Juselius, M. (2016), “Rethinking Potential Output: Embedding Information about the Financial Cycle’’, Oxford Economic Papers, 69(3), 655- 677. Rath, D.P., Mitra, P. and John, J. (2017), “A Measure of Finance-Neutral Output Gap for India”, RBI Working Paper Series, WPS (DEPR): 03 / 2017. Conclusion Early indicators for Q2:2017-18 point to subdued industrial activity, in particular in the manufacturing sector. While many high frequency services sector indicators show signs of improvement, some others such as port traffic and domestic air freight traffic still show tepid growth. The Government’s initiatives in essential infrastructure, affordable housing, improved customer protection and transparency through the real estate regulatory act should be positive for construction activity, if they are implemented with speed and efficiency. The GST is likely to result in greater formalisation of the economy in due course as firms register to receive input tax credits even though teething problems remain a challenge at the current juncture. Improved prospects for rural incomes during 2017-18, higher MSPs, and large budgetary allocations for MGNREGA could lead to improvement in rural demand. Household consumption demand in urban areas may get a boost from the upward revision in HRA for government employees and implementation of the 7th CPC announced by States. The key to achieving a higher growth trajectory lies, however, in reviving investment activity. Major structural reforms already initiated, including the GST, enactment of the Insolvency and Bankruptcy Code (IBC), the likely recapitalisation of public sector banks and speedy resolution of stressed assets augur well for the outlook. 1 Press Information Bureau, MoF, GoI, September 26, 2017. 2 Calculated using imports of four quarters up to June 2017. 3 Lags are chosen based on the univariate analysis, cross correlations and OLS regression, while ensuring convergence of the optimisation algorithm. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||