Table

VI.17: Public Deposits held by NBFCs-D by Classification of NBFCs |

(Amount

in Rs. crore) | Classification | As

at end-March | Percentage

Variations | Number

of NBFCs | Public

Deposits | 2007 | 2008

P | 2007 | 2008

P | 2007-08 |

1 | 2 | 3 | 4 | 5 | 6 |

Asset Finance | 72 | 178 | 186 | 1,156 | 522.4 |

|

| | (8.9) | (56.7) |

| Equipment Leasing | 28 | 14 | 43 | 8 | -81.8 |

|

| | (2.1) | (0.4) |

| Hire Purchase | 240 | 78 | 1,683 | 533 | -68.3 |

|

| | (81.0) | (26.2) |

| Investment | 3 | 1 | 45 | 19 | -58.1 |

|

| | (2.2) | (0.9) |

| Loan | 29 | 62 | 117 | 321 | 174.3 |

|

| | (5.6) | (15.8) |

| MNBC | 1 | – | 2 | – | – |

|

| | (0.1) | (0.0) |

| Total | 373 | 333 | 2,077 | 2,038 | -1.9 |

– : Nil/Negligible. P

: Provisional.

Note :

1) Figures in respect of 2007-08

include 'IFCI Ltd' and 'TFCI Ltd'.

2) Figures in parentheses are percentages

to respective totals.

Source : Annual Returns. |

Table

VI.18: Range of Deposits held by NBFCs-D |

(Amount

in Rs. crore) | Deposit

Range | As

at end-March | No.

of NBFCs | Amount

of Deposit | 2007 | 2008

P | 2007 | 2008

P | 1 | 2 | 3 | 4 | 5 |

1. | Less

than Rs.0.5 crore | 226 | 205 | 31 | 27 |

|

| |

| (1.5) | (1.3) |

2. | More

than Rs.0.5 crore and up to Rs.2 crore | 92 | 80 | 86 | 76 |

|

| |

| (4.1) | (3.7) |

3. | More

than Rs.2 crore and up to Rs.10 crore | 36 | 35 | 161 | 174 |

|

| |

| (7.7) | (8.5) |

4. | More

than Rs.10 crore and up to Rs.20 crore | 7 | 4 | 93 | 61 |

|

| |

| (4.5) | (3.0) |

5. | More

than Rs.20 crore and up to Rs.50 crore | 5 | 1 | 177 | 29 |

|

| |

| (8.5) | (1.4) |

6. | Rs.50

crore and above | 7 | 8 | 1,529 | 1,671 |

|

| |

| (73.6) | (82.0) |

Total |

| 373 | 333 | 2,077 | 2,038 |

P : Provisional.

Note

:

1) Figures in respect of 2007-08 include 'IFCI Ltd' and 'TFCI

Ltd'.

2) Figures in parentheses are percentages to respective totals.

Source: Annual Returns. | crore and up

to Rs.10 crore' and ‘Rs.50 crore and above’. Significantly, the share

of the deposit class ‘Rs.50 crore and above’ in total deposits was

82 per cent, while that of other deposit classes combined together was only about

18 per cent of total public deposits of the NBFC sector. Region-wise Composition

of Deposits held by NBFCs 6.56 Following the trend of the previous year,

deposits held by NBFCs across all the regions declined during 2007-08 (Table

VI.19). As in the previous year, the southern region accounted for the largest

share of

Table

VI.19: Public Deposits Held by NBFCs-D | Region-wise

| (Amount

in Rs.crore) | Region | As

at end-March | 2007 | 2008

P | Number | Amount | Number | Amount |

1 | 2 | 3 | 4 | 5 |

1. Central | 59 | 27 | 51 | 23 |

|

| (1.3) |

| (1.1) |

2. Eastern | 9 | 28 | 8 | 16 |

|

| (1.3) |

| (0.8) |

3. North-Eastern | 1 | 0 | 0 | 0 |

|

| (0.0) |

| (0.0) |

4. Northern | 196 | 289 | 181 | 285 |

|

| (13.9) |

| (14.0) |

5. Southern | 85 | 1,647 | 70 | 1,630 |

|

| (79.3) |

| (80.0) |

6. Western | 23 | 86 | 23 | 84 |

|

| (4.2) |

| (4.1) |

Total (1 to 6) | 373 | 2,077 | 333 | 2,038 |

Memo |

| |

| |

Metropolitan cities: |

| |

| |

1. Kolkata | 6 | 21 | 5 | 13 |

2. Chennai | 47 | 1,541 | 36 | 1,564 |

3. Mumbai | 10 | 78 | 10 | 76 |

4. New Delhi | 68 | 219 | 64 | 205 |

Total (1 to 4) | 131 | 1,859 | 115 | 1,857 |

P : Provisional.

Note :

1) Figures in respect of 2007-08 include 'IFCI Ltd'

and 'TFCI

Ltd'.

2) Figures in parentheses are percentages to respective

totals.

Source: Annual Returns. | deposits

(80 per cent), followed by the northern region (14 per cent) and the western region

(4.1 per cent). The presence of NBFCs in the north-eastern region continued to

be nil during the year. Among the metropolitan cities, Chennai continued to hold

the largest share of deposits, while New Delhi continued to account for the largest

number of NBFCs. Interest Rate on Public Deposits with NBFCs

6.57 The share of deposits contracted by NBFCs in the interest rates up to 10

per cent declined (from 88.5 per cent to 73.1 per cent), while those contracted

in the bracket ‘more than 10 per cent and up to 12 per cent’ witnessed

a sharp rise (from 9.7 per cent to 25.4 per cent), partly reflecting the hardening

of interest rates during the year (Table VI.20).

Table

VI.20: Distribution of Public Deposits of

NBFCs-D According

to Rate of Interest | (Amount

in Rs.crore) | Deposit

Interest Rate Range | As

at end-March | 2007 | 2008

P | 1 | 2 | 3 |

Up to 10 per cent | 1,839 | 1,489 |

| (88.5) | (73.1) |

More than 10 per cent and up

to 12 per cent | 202 | 517 |

| (9.7) | (25.4) |

12 per cent and above | 36 | 32 |

| (1.7) | (1.5) |

Total | 2,077 | 2,038 |

P : Provisional.

Note :

1)Figures in respect of 2007-08 include ' IFCI Ltd'

and ' TFCI

Ltd'.

2)Figures in parentheses are percentages to respective

totals.

Source :

Annual Returns. | Maturity

Pattern of Public Deposits 6.58 Deposits with the maturity period

of 'less than 1 year', 'more than 3 years and up to 5 years' and '5 years and

above' declined during the year. Deposits in the maturity bucket of ‘more

than 1 years and up to 2 years’ increased marginally, while deposits in

the maturity bucket of ‘ more than 2 years and up to 3 years’ increased

significantly at end-March 2008. As a result, their share in total deposits increased

(Table VI.21).

| Table

VI.21: Maturity Pattern of Public Deposits | Held

by NBFCs-D | (Amount

in Rs.crore) | Maturity

Period | As

at end-March |

| 2007 | 2008

P | 1 | 2 | 3 |

1. Less than 1 year | 724 | 609 |

| (34.9) | (29.9) |

2. More than 1 and up to 2

years | 477 | 480 |

| (23.0) | (23.6) |

3. More than 2 and up to 3

years | 561 | 653 |

| (27.0) | (32.0) |

4. More than 3 and up to 5

years | 234 | 229 |

| (11.3) | (11.3) |

5. 5 years and above | 80 | 66 |

| (3.8) | (3.3) |

Total | 2,077 | 2,038 |

P : Provisional

Note:1)Figures in respect of 2007-08 include ' IFCI Ltd' and

' TFCI Ltd'

2)Figures in parentheses are percentages to respective totals.

Source : Annual Returns. | Borrowings

by NBFCs 6.59 The outstanding borrowings by NBFCs increased by

55.3 per cent during 2007-08 (Table VI.22). Borrowings by equipment

Table

VI.22: Borrowings by NBFCs-D -Group-wise | (Amount

in Rs.crore) | NBFC

Classification | As

at end-March | Percentage

Variations | Number

of NBFCs | Total

Borrowings |

| 2007 | 2008

P | 2007 | 2008

P | 2007-08 |

1 | 2 | 3 | 4 | 5 | 6 |

Asset Finance | 72 | 178 | 19,091 | 32,461 | 70.0 |

|

| | (58.8) | (64.4) |

| Equipment Leasing | 28 | 14 | 128 | 69 | -46.3 |

|

| | (0.4) | (0.1) |

| Hire Purchase | 240 | 78 | 10,683 | 3,516 | -67.1 |

|

| | (32.9) | (7.0) |

| Investment Company | 3 | 1 | 133 | 358 | 168.9 |

|

| | (0.4) | (0.7) |

| Loan Company | 29 | 62 | 2,417 | 13,980 | 478.3 |

|

| | (7.4) | (27.7) |

| MNBC | 1 | 0 | - | - | - |

Total | 373 | 333 | 32,452 | 50,384 | 55.3 |

P : Provisional

Note :

1) Figures in respect of 2007-08 include 'IFCI Ltd'

and 'TFCI Ltd'

2) Figures in parentheses are percentages to respective totals.

Source: Annual Returns. | leasing and

hire purchase companies declined, while those by loan companies, investment

companies and asset finance companies increased during the year partly reflecting

the reclassification of NBFCs. AFCs continued to hold the largest share

(64.4 per cent) of borrowings of all NBFCs, followed by loan companies (27.7 per

cent). 6.60 Borrowings by NBFCs from banks and financial institutions and

by way of bonds and debentures and ‘other sources’ (which include

miscellaneous factors including inter alia, money borrowed from other

companies, unsecured loans from directors/ promoters, commercial paper, borrowings

from mutual funds and any other type of funds which are not treated as public

deposits), increased sharply during 2007-08. This broadly reflected the

pattern of borrowings of asset finance companies (Table VI.23).

Significantly, the borrowing from Government, which was nil during 2006-07, increased

sharply to Rs.2,319 crore during 2007-08 largely due to inclusion of IFCI Ltd.

and TFCI Ltd. in this category.

Table

VI.23: Sources of Borrowings by NBFCs-D - Group wise |

(Amount

in Rs. crore) | NBFC

Classification | As

at end-March | Government | External

Sources @ | Banks

and Financial

Institutions | Debentures | Others |

2007 | 2008

P | 2007 | 2008

P | 2007 | 2008

P | 2007 | 2008

P | 2007 | 2008

P | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

Asset Finance |

| |

| |

| |

| |

| |

| 0 | 0 | 975 | 828 | 9,148 | 16,329 | 5,808 | 10,216 | 3159 | 5,088 |

|

| |

| (-15.2) |

| (78.5) |

| (75.9) |

| (61.1) |

Equipment

Leasing |

| |

| |

| |

| |

| |

| 0 | 0 | 0 | 0 | 39 | 2 | 0 | 0 | 89 | 67 |

|

| |

| |

| (-95.5) |

| |

| (-24.7) |

Hire Purchase |

| |

| |

| |

| |

| |

| 0 | 0 | 225 | 0 | 4,295 | 501 | 1,950 | 3 | 4212 | 3,012 |

|

| |

| |

| (-88.3) |

| (-99.9) |

| (-28.5) |

Investment |

| |

| |

| |

| |

| |

| 0 | 72 | 0 | 0 | 0 | 82 | 7 | 0 | 126 | 204 |

|

| |

| |

| |

| |

| (62.3) |

Loan |

| |

| |

| |

| |

| |

| 0 | 2,247 | 1 | 627 | 1,442 | 1,848 | 901 | 1,690 | 74 | 7,568 |

|

| |

| |

| (28.2) |

| (87.6) |

| |

MNBC | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Total | 0 | 2,319 | 1,201 | 1,455 | 14,925 | 18,762 | 8,667 | 11,909 | 7,659 | 15,939 |

|

| |

| (21.1) |

| (25.7) |

| (37.4) |

| (108.1) |

P : Provisional.

@ :

Comprises (i) foreign Government, (ii) foreign authority, and (iii) foreign citizen

or person.

Note :

1. Figures in respect of 2007-08

include 'IFCI Ltd' and 'TFCI Ltd'.

2. Figures in parentheses are percentage

variations over the previous year.

Source :

Annual

Returns. | Assets of NBFCs 6.61

The sharp increase in assets of deposit-taking NBFCs was mainly on account of

increase in assets of asset finance companies and loan companies. Loans and advances

as well as investments of NBFCs also increased during the year (Table

VI.24). At end-March 2008, 64.1 percent of assets, 71.2 per cent of total

loans and advances and 34.5 per cent of investments by all NBFCs were held by

asset finance companies.

| Table VI.24: Major Components

of Assets of NBFCs-D -Group -wise | (Amount

in Rs.crore) | Classification | As

at end-March | Assets | Advances | Investment |

2007 | 2008

P | 2007 | 2008

P | 2007 | 2008

P | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

|

| |

| |

| | Asset

Finance | 24,718 | 45,071 | 20,882 | 38,341 | 2,413 | 3,964 |

| (50.9) | (64.1) | (54.0) | (71.2) | (32.6) | (34.5) |

Equipment Leasing | 325 | 156 | 252 | 85 | 56 | 47 |

| (0.7) | (0.2) | (0.7) | (0.2) | (0.8) | (0.4) |

Hire Purchase | 17,376 | 5,302 | 14,781 | 4,953 | 1,743 | 238 |

| (35.8) | (7.5) | (38.2) | (9.2) | (23.5) | (2.1) |

Investment | 1,633 | 402 | 498 | 146 | 1,110 | 256 |

| (3.4) | (0.6) | (1.3) | (0.3) | (15.0) | (2.2) |

Loan | 4,499 | 19,362 | 2,240 | 10,348 | 2,089 | 6,995 |

| (9.3) | (27.5) | (5.8) | (19.2) | (28.2) | (60.8) |

MNBC | 2 | 0 | 0 | 0 | 0 | 0 |

| (0.0) | (0.0) | (0.0) | (0.0) | (0.0) | (0.0) |

Total | 48,554 | 70,292 | 38,653 | 53,873 | 7,412 | 11,500 |

P: Provisional.

Note

:

1) Figures in respect of 2007-08 include 'IFCI Ltd' and 'TFCI

Ltd'

2) Figures in parentheses are percentages to respective totals.

Source : Annual Returns. | Distribution

of NBFCs-D According to Asset Size 6.62 The asset size of NBFCs varies

significantly from less than Rs.25 lakh to above Rs.500 crore. The asset holding

pattern remained skewed in 2007-08, with fifteen NBFCs with asset size of ‘above

Rs.500 crore’ holding 94.9 per cent of total assets of all NBFCs, while

the remaining 318 NBFCs held about 5.1 per cent of total assets at end-March 2008

(Table VI.25).

Table

VI.25: NBFCs-D According to Asset Size | (Amount

in Rs.crore) | Asset

Size | As

at end-March | No.

of Reporting Companies | Assets |

2007 | 2008

P | 2007 | 2008

P | 1 | 2 | 3 | 4 | 5 |

1. | Less

than 0.25 crore | 8 | 38 | 1 | 4 |

|

| |

| (0.0) | (0.0) |

2. | More

than 0.25 crore and up to 0.50 crore | 27 | 27 | 11 | 10 |

|

| |

| (0.0) | (0.0) |

3. | More

than 0.50 crore and up to 2 crore | 163 | 114 | 185 | 127 |

|

| |

| (0.4) | (0.2) |

4. | More

than 2 crore and up to 10 crore | 102 | 86 | 435 | 361 |

|

| |

| (0.9) | (0.5) |

5. | More

than 10 crore and up to 50 crore | 45 | 37 | 1,073 | 764 |

|

| |

| (2.2) | (1.1) |

6. | More

than 50 crore and up to 100 crore | 5 | 9 | 339 | 558 |

|

| |

| (0.7) | (0.8) |

7. | More

than 100 crore and up to 500 crore | 8 | 7 | 1,386 | 1,729 |

|

| |

| (2.9) | (2.5) |

8. | Above

500 crore | 15 | 15 | 45,125 | 66,739 |

|

| |

| (92.9) | (94.9) |

| Total

| 373 | 333 | 48,554 | 70,292 |

P : Provisional.

Note

:

1) Figures in respect of 2007-08 include 'IFCI Ltd' and 'TFCI

Ltd' .

2) Figures in parentheses are percentages to respective totals.

Source : Annual Returns. | Distribution

of Assets of NBFCs – Type of Activity 6.63 While

assets held in the form of equipment and leasing witnessed a sharp decline during

2007-08, assets in the form of loans and inter-corporate deposits as also other

assets witnessed a sharp growth. Assets in the form of loans and bills, which

had witnessed a decline during 2006-07, increased sharply by 39.8 per cent. Assets

held in the hire purchase activity as well as investment activity, however witnessed

a deceleration. The hire purchase activity continued to constitute the largest

share (46.7 per cent) in total assets, followed by loans and inter-corporate deposits

(28.3 per cent) and investments (16.4 per cent) (Table VI.26).

Table

VI.26: Distribution of Assets of NBFCs-D | Activity-wise

| (Amount

in Rs. crore) | Activity | As

at | Percentage |

end-March | Variations |

2007 | 2008

P | 2006-07 | 2007-08 |

1 | 2 | 3 | 4 | 5 |

Loans and Inter- |

| |

| |

corporate Deposits | 11,059 | 19,921 | 3.5 | 80.1 |

| (22.8) | (28.3) |

| |

Investments | 7,412 | 11,500 | 71.3 | 55.2 |

| (15.3) | (16.4) |

| |

Hire Purchase | 26,222 | 32,842 | 31.1 | 25.2 |

| (54.0) | (46.7) |

| |

Equipment and Leasing | 740 | 411 | 20.0 | -44.5 |

| (1.5) | (0.6) |

| |

Bills | 7 | 10 | -83.1 | 39.8 |

| (0.0) | (0.0) |

| |

Other assets | 3,113 | 5,607 | 45.0 | 80.2 |

| (6.4) | (8.0) |

| |

Total | 48,554 | 70,292 | 28.4 | 44.8 |

P: Provisional. |

| |

| | Note

:

1) Figures in respect of 2007-08 include 'IFCI Ltd' and

'TFCI Ltd'.

2) Figures in parentheses are percentages to respective totals.

Source :

Annual Returns. | Financial

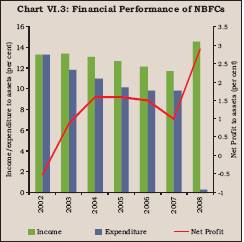

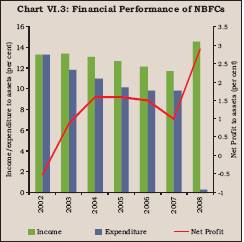

Performance of NBFCs 6.64 Financial

performance of NBFCs continued to improve during 2007-08. Both fund based income

(79.8 per cent) and fee based income (56.6 per cent) increased sharply.

As a result, even though expenditure witnessed an increase of 45.4 per cent, operating

profits increased by 263.2 per cent and net profits by 298.3 per cent. The cost

to income ratio declined sharply (to 68.5 per cent in 2007-08 from 84.4 per cent

in 2006-07) (Table VI.27).

| Table VI.27: Financial

Performance of NBFCs-D | (Amount

in Rs. crore) | Indicator | As

at end-March | Percentage

Variations | 2007 | 2008

P | 2006-07 | 2007-08

P | 1 | 2 | 3 | 4 | 5 |

A. | Income

(i+ii) | 5,721 | 10,255 | 24.4 | 79.3 |

| (i) | Fund

Based | 5,590 | 10,051 | 25.5 | 79.8 |

|

| | (97.7) | (98.0) |

| |

| (ii) | Fee-Based | 131 | 204 | -11.2 | 56.6 |

|

| | (2.3) | (2.0) |

| |

B. | Expenditure

(i+ii+iii) | 4,831 | 7,023 | 28.7 | 45.4 |

| (i) | Financial | 2,765 | 4,696 | 29.0 | 69.8 |

|

| | (57.2) | (66.9) |

| |

| of

which | |

| |

| | Interest

Payment | 508 | 385 | -6.1 | -24.1 |

| (ii)

Operating | 1,261 | 2,167 | 33.4 | 71.9 |

|

| | (26.1) | (30.9) |

| |

| (iii) | Others | 804 | 160 | 21.1 | -80.1 |

|

| | (16.6) | (2.3) |

| |

C. | Tax

Provisions | 385 | 1,223 | 32.5 | 217.3 |

D. | Operating

Profit (PBT) | 890 | 3,232 | 5.1 | 263.2 |

E. | Net

Profit (PAT) | 504 | 2,009 | -9.3 | 298.3 |

F. | Total

Assets | 48,554 | 70,292 | 28.4 | 44.8 |

G. | Financial

Ratios | |

| |

| | (as

percentage of total assets) |

| |

| | i) | Income | 11.8 | 14.6 |

| |

| ii) | Fund

Income | 11.5 | 14.3 |

| |

| iii) | Fee

Income | 0.3 | 0.3 |

| |

| iv) | Expenditure | 9.9 | 10.0 |

| |

| v) | Financial

Expenditure | 5.7 | 6.7 |

| |

| vi) | Operating

Expenditure | 2.6 | 3.1 |

| |

| vii) | Tax

Provision | 0.8 | 1.7 |

| |

| viii)

Net Profit | 1.0 | 2.9 |

| |

H. | Cost

to Income Ratio | 84.4 | 68.5 |

| |

P : Provisional.

Note

:

1) Figures in respect of 2007-08 include 'IFCI Ltd' and 'TFCI

Ltd'.

2) Figures in parentheses are percentages to respective totals.

Source : Annual Returns. | 6.65 Out of

the total cost incurred by NBFCs, the non-interest cost continued to constitute

the largest share (94. 5 per cent in 2007-08 as compared with 89.5 per cent in

2006-07). The interest cost constituted a smaller share of the total cost (Table

VI. 28).

| Table

VI.28: Interest Cost of NBFCs-D | (Amount

in Rs. crore) | End-March | Total

Income | Total

Cost | Interest

Cost | Non-

Interest Cost | 1 | 2 | 3 | 4 | 5 |

2006-07 | 5,721 | 4,831 | 508 | 4,323 |

2007-08 P | 10,255 | 7,023 | 385 | 6,638 |

P: Provisional.

Note:

1) Figures in respect of 2007-08 include 'IFCI Ltd' and 'TFCI Ltd'.

2) Figures

in parentheses are percentages to respective totals.

Source :

Annual Returns. | 6.66 While income as

percentage of assets increased, expenditure (including provisions) as percentage

of assets declined sharply, resulting in a rise in the net profits to asset ratio

(Chart VI.3).

Soundness

Indicators Asset Quality of NBFCs-D

6.67 Continuing the trend witnessed during the last few years, gross NPAs as well

as net NPAs (as percentage of gross advances and net advances, respectively) of

reporting NBFCs declined further during the year ended March 2008 (Table

VI.29).

Table

VI.29: NPA Ratios of NBFCs-D | (Per

cent) | End-March | Gross

NPAs

to Gross Advances | Net

NPAs to

Net Advances | 1 | 2 | 3 |

2001 | 11.5 | 5.6 |

2002 | 10.6 | 3.9 |

2003 | 8.8 | 2.7 |

2004 | 8.2 | 2.4 |

2005 | 5.7 | 2.5 |

2006 | 3.6 | 0.5 |

2007 | 2.2 | 0.2 |

2008 P | 1.5 | -8.7 |

P: Provisional.

Note

: Figures in respect of 2007-08 include 'IFCI Ltd' and 'TFCI Ltd'.

Source : Half-Yearly Returns. | 6.68

Gross NPAs (as percentage of gross advances) of equipment leasing and hire purchase

companies increased during 2007-08, due to reclassification of NBFCs, while those

of asset finance companies and loan companies declined. Net NPAs (as percentage

of net advances) increased marginally in case of asset finance companies, hire

purchase companies and investment companies, while those of equipment leasing

companies, and loan companies improved further (Table VI.30).

Table

VI.30: NPAs of NBFCs-D by Classification of NBFCs |

(Amount

in Rs. crore) | Classification/

End-March | Gross

Advances | Gross

NPAs | Net

Advances | Net

NPAs | Amount | Percent

to Gross

Advances | Percent

to

Assets | Amount | Percent

to Net

Advances | Percent

to

Advances | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

Asset Finance |

| |

| |

| |

| | 2007 | 11,824 | 262 | 2.2 | 2.2 | 11,548 | -14 | -0.1 | -0.1 |

2008 P | 37,254 | 656 | 1.8 | 1.7 | 36,626 | 28 | 0.1 | 0.1 |

Equipment Leasing

| 2001 | 4,118 | 304 | 7.4 | 6.1 | 3,826 | 12 | 0.3 | 0.2 |

2002 | 1,625 | 646 | 39.7 | 28.0 | 1,330 | 351 | 26.3 | 15.2 |

2003 | 5,969 | 932 | 15.6 | 11.1 | 5,506 | 469 | 8.5 | 5.6 |

2004 | 3,306 | 582 | 17.6 | 13.3 | 3,067 | 344 | 11.2 | 7.8 |

2005 | 4,187 | 514 | 12.3 | 11.0 | 4,018 | 345 | 8.6 | 7.4 |

2006 | 2,878 | 69 | 2.4 | 2.2 | 2,786 | -23 | -0.8 | -0.7 |

2007 | 1,057 | 45 | 4.2 | 4.0 | 992 | -20 | -1.9 | -1.8 |

2008 P | 26 | 6 | 24.3 | 7.2 | -10 | -29 | -114.9 | -34.2 |

Hire Purchase

| 2001 | 8,296 | 1,324 | 16.0 | 12.3 | 7,604 | 631 | 8.3 | 5.9 |

2002 | 6,825 | 1,167 | 17.1 | 14.8 | 6,068 | 410 | 6.8 | 5.2 |

2003 | 16,489 | 1,288 | 7.8 | 6.8 | 15,305 | 104 | 0.7 | 0.5 |

2004 | 10,437 | 942 | 9.0 | 7.3 | 9,748 | 253 | 2.6 | 2.0 |

2005 | 15,900 | 610 | 3.8 | 3.6 | 15,544 | 253 | 1.6 | 1.5 |

2006 | 17,607 | 444 | 2.5 | 2.4 | 17,238 | 74 | 0.4 | 0.4 |

2007 | 18,280 | 464 | 2.5 | 2.3 | 17,884 | 67 | 0.4 | 0.3 |

2008 P | 249 | 73 | 29.2 | 26.0 | 181 | 4 | 1.8 | 1.6 |

Investment

| 2001 | 232 | 53 | 22.9 | 5.1 | 223 | 45 | 20.0 | 4.3 |

2002 | 149 | 2 | 1.6 | 0.1 | 147 | 1 | 0.4 | – |

2003 | 93 | 11 | 11.9 | 2.1 | 90 | 8 | 8.9 | 1.5 |

2004 | 63 | 15 | 24.2 | 2.6 | 55 | 7 | 12.7 | 1.2 |

2005 | 58 | 10 | 18.0 | 1.8 | 58 | 10 | 18.0 | 1.8 |

2006 | 59 | – | 0.4 | 0.0 | 59 | – | 0.4 | – |

2007 | 31 | 1 | 2.8 | 0.1 | 31 | 1 | 2.8 | 0.1 |

2008 P | – | – |

| – | – | – |

| – |

Loan

| 2001 | 7,414 | 595 | 8.0 | 5.9 | 7,118 | 299 | 4.2 | 3.0 |

2002 | 3,986 | 549 | 13.8 | 10.1 | 3,615 | 177 | 4.9 | 3.3 |

2003 | 2,707 | 144 | 5.3 | 4.8 | 2,503 | -60 | -2.4 | -2.0 |

2004 | 2,038 | 142 | 7.0 | 4.1 | 1,833 | -63 | -3.4 | -1.8 |

2005 | 1,955 | 117 | 6.0 | 5.1 | 1,772 | -65 | -3.7 | -2.8 |

2006 | 690 | 252 | 36.5 | 19.3 | 483 | 45 | 9.3 | 3.4 |

2007 | 7,594 | 124 | 1.6 | 5.9 | 7,463 | -6 | -0.1 | -0.3 |

2008 P | 16,487 | 34 | 0.2 | 0.2 | 11,007 | -5,447 | -33.0 | -27.7 |

– : Nil/Negligible. P:

Provisional.

Note :

Figures in respect of 2007-08

include 'IFCI Ltd' and 'TFCI Ltd'.

Source :

Half-Yearly

Returns. | 6.69 Asset

quality of various types of NBFCs as reflected in various categories of NPAs (substandard,

doubtful and loss) remained broadly at the previous year’s level.

The sharp increase in the standard assets of asset finance companies and the corresponding

sharp decline in the case of equipment leasing companies and hire purchase companies

was mainly due to the reclassification of NBFCs (Table VI.31).

Table

VI.31: Classification of Assets of NBFCs-D - Group-wise |

(Amount

in Rs. crore) | Classification/ | Standard | Sub- | Doubtful | Loss

Assets | Gross

NPAs | Credit |

End-March | Assets | Standard

Assets | Assets |

|

| Exposure |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

Asset Finance |

| |

| |

| | 2007 | 11,562 | 242 | 17 | 3 | 262 | 11,824 |

| (97.8) | (2.1) | (0.1) | – | (2.2) |

| 2008 P | 36,599 | 586 | 41 | 29 | 656 | 37,254 |

| (98.2) | (1.6) | (0.1) | (0.1) | (1.8) |

| Equipment Leasing |

| |

| |

| |

2005 | 3,673 | 383 | 91 | 39 | 514 | 4,187 |

| (87.7) | (9.1) | (2.2) | (0.9) | (12.3) |

| 2006 | 2,809 | 12 | 21 | 36 | 69 | 2,878 |

| (97.6) | (0.4) | (0.7) | (1.2) | (2.4) |

| 2007 | 1,013 | 4 | 2 | 38 | 45 | 1,057 |

| (95.8) | (0.4) | (0.2) | (3.6) | (4.3) |

| 2008 P | 19 | 1 | 1 | 4 | 6 | 26 |

| (75.7) | (4.7) | (4.5) | (15.0) | (24.3) |

| Hire Purchase |

| |

| |

| |

2005 | 15,290 | 386 | 130 | 94 | 610 | 15,900 |

| (96.2) | (2.4) | (0.8) | (0.6) | (3.8) |

| 2006 | 17,163 | 184 | 47 | 212 | 444 | 17,607 |

| (97.5) | (1.0) | (0.3) | (1.2) | (2.5) |

| 2007 | 17,817 | 194 | 81 | 188 | 464 | 18,280 |

| (97.5) | (1.1) | (0.4) | (1.0) | (2.5) |

| 2008 P | 177 | 8 | 7 | 58 | 73 | 249 |

| (70.8) | (3.0) | (3.0) | (23.2) | (29.2) |

| Investment |

| |

| |

| |

2005 | 48 | 1 | 10 | – | 10 | 58 |

| (82.8) | (1.7) | (17.2) | – | (17.2) |

| 2006 | 59 | – | – | – | – | 59 |

| (99.6) | – | – | – | (0.4) |

| 2007 | 31 | 1 | – | – | 1 | 31 |

| (97.2) | (2.8) | – | – | (2.8) |

| 2008 P | – | – | – | – | – | – |

Loan |

| |

| |

| |

2005 | 1,837 | 14 | 42 | 61 | 117 | 1,955 |

| (94.0) | (0.7) | (2.1) | (3.1) | (6.0) |

| 2006 | 438 | 19 | 99 | 134 | 252 | 690 |

| (63.5) | (2.7) | (14.3) | (19.4) | (36.5) |

| 2007 | 7,470 | 9 | 91 | 24 | 124 | 7,594 |

| (98.4) | (0.1) | (1.2) | (0.3) | (1.6) |

| 2008 P | 16,454 | 21 | 11 | 2 | 34 | 16,487 |

| (99.8) | (0.1) | (0.1) | – | (0.2) |

| – : Nil/Negligible.

P: Provisional

Note :

1) Figures in respect of 2007-08

include 'IFCI Ltd' and 'TFCI Ltd'.

2) Figures in parentheses are percentages

to credit exposures.

Source : Half-Yearly Returns |

Capital Adequacy Ratio

6.70 Capital to risk-weighted assets ratio (CRAR) norms were made applicable to

NBFCs in 1998, in terms of which every deposit-taking NBFC is required to maintain

a minimum capital, consisting of Tier-I and Tier-II capital, of not less than

12 per cent (15 per cent in the case of unrated deposit-taking loan/investment

companies) of its aggregate risk-weighted assets and of risk-adjusted value of

off-balance sheet items. Total of Tier-II capital, at any point of time, cannot

exceed 100 per cent of Tier-I capital. The number of NBFCs with less than the

minimum regulatory CRAR of 12 per cent increased to 44 at end-March 2008 from

20 at end-March 2007 (Table VI.32). At end-March 2008, 276

out of 320 NBFCs had CRAR of 12 per cent or more as against 354 out of 374 NBFCs

at end-March 2007. The number of NBFCs with CRAR more than 30 also declined

to 238 at end-March 2008 from 305 at end-March 2007. Notwithstanding this, it

is noteworthy that the NBFC sector is witnessing a consolidation process in the

last few years, wherein the weaker NBFCs are gradually exiting, paving the way

for a stronger NBFC sector. 6.71 Net owned fund (NOF) of

NBFCs is the aggregate of paid-up capital and free reserves, netted by (i) the

amount of accumulated losses; and (ii) deferred revenue expenditure and other

intangible assets, if any, and

Table

VI.32: Capital Adequacy Ratio of NBFCs-D |

(per

cent) | CRAR

Range | As

at end-March | 2007 | 2008

P | AFC | EL | HP | LC/

IC | Total | AFC | EL | HP | LC/

IC | Total |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

1) | Less

than 12 per cent (a+b) | 0 | 4 | 13 | 3 | 20 | 20 | 4 | 12 | 8 | 44 |

| a)

Less than 9 per cent | 0 | 4 | 13 | 3 | 20 | 20 | 4 | 12 | 7 | 43 |

| b)

More than 9 and up to 12 per cent | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

2) | More

than 12 and up to 15 per cent | 2 | 0 | 2 | 0 | 4 | 3 | 0 | 0 | 1 | 4 |

3) | More

than 15 and up to 20 per cent | 3 | 1 | 7 | 1 | 12 | 5 | 0 | 0 | 1 | 6 |

4) | More

than 20 and up to 30 per cent | 2 | 2 | 23 | 6 | 33 | 24 | 0 | 1 | 3 | 28 |

5) | Above

30 per cent | 44 | 22 | 217 | 22 | 305 | 115 | 10 | 70 | 43 | 238 |

Total | 51 | 29 | 262 | 32 | 374 | 167 | 14 | 83 | 56 | 320 |

P: Provisional.

Note

:

AFC: Asset Finance

Companies; EL: Equipment

Leasing

Companies; HP: Hire Purchase Companies; LC/IC = Loan

Companies/Investment

Companies.

Source : Half-yearly Returns. |

adjusted by investments in shares, and loans and advances

to (a) subsidiaries, (b) companies in the same group, and (c) other NBFCs (in

excess of 10 per cent of owned fund). Information about NOF can complement the

information on CRAR. The ratio of public deposits to NOF in the case of

loan companies and MNBCs declined during the year ended March 2008, while that

of other category companies witnessed a marginal increase.

The ratio of equipment leasing companies continued to be negative because of negative

net owned funds, although there was some moderation. The ratio of public deposit

to NOF for all categories of NBFCs taken together was 0.2 per cent at end-March

2008 as compared with 0.3 per cent at end-March 2007 (Table VI.33).

Table

VI.33 Net Owned Fund vis-à-vis Public Deposits of NBFCs-D

| (Amount

in Rs.crore) | Classification | As

at end-March | Net

Owned Fund | Public

Deposits | 2007 | 2008

P | 2007 | 2008

P | 1 | 2 | 3 | 4 | 5 |

1. | Asset

Finance | 2,673 | 6,452 | 186 | 1,156 |

|

| |

| (0.1) | (0.2) |

2. | Equipment

Leasing | -15 | -42 | 43 | 8 |

|

| |

| (-2.9) | (-0.2) |

3. | Hire

Purchase | 3,004 | 675 | 1,683 | 533 |

|

| |

| (0.6) | (0.8) |

4. | Investment | 822 | 83 | 45 | 19 |

|

| |

| (0.1) | (0.2) |

5. | Loan | 437 | 3,379 | 117 | 321 |

|

| |

| (0.3) | (0.1) |

6. | MNBC | 0 | 0 | 2 | 0 |

|

| |

| (6.6) | (0.0) |

Total | 6,921 | 10,546 | 2,077 | 2,038 |

|

| | (0.3) | (0.2) |

P: Provisional

Note

:

1) Figures in respect of 2007-08 include 'IFCI Ltd' and 'TFCI

Ltd'.

2) Figures in parentheses are ratio of public deposits to net owned

fund.

Source :

Annual Returns. | 6.72

Net owned funds of NBFCs range from less than Rs.25 lakh to above Rs.500 crore.

Public deposits, as ratio of NOF, held by NBFCs in the category of NOF of ‘more

than Rs.2 crore and up to Rs.10 crore’, ‘more than Rs.50 crore and

upto Rs.100 crore' and 'above Rs.500 crore' remained constant, while those by

NBFCs in all other ranges of NOF generally declined except in the case of the

category ‘more than Rs.100 crore and upto Rs.500 crore’ (Table

VI.34).

| Table

VI.34: Range of Net Owned Funds vis-à-vis

Public

Deposits of NBFCs-D | (Amount

in Rs.crore) | Ranges

of Net Owned Fund | As

at end-March | 2006-07 | 2007-08

P | No.

of | Net

Owned | Public | No.

of | Net

Owned | Public |

Companies | Fund | Deposits | Companies | Fund | Deposits |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

1. | Up

to Rs.0.25 crore | 18 | -442 | 173 | 8 | -229 | 137 |

|

| |

| -(0.4) |

| | -(0.6) |

2. | More

than Rs.0.25 crore and up to Rs.2 crore | 255 | 181 | 101 | 227 | 163 | 88 |

|

| |

| (0.6) |

| | (0.5) |

3. | More

than Rs.2 crore and up to Rs.10 crore | 63 | 287 | 129 | 60 | 258 | 135 |

|

| |

| (0.5) |

| | (0.5) |

4. | More

than Rs.10 crore and up to Rs.50 crore | 22 | 498 | 275 | 21 | 440 | 145 |

|

| |

| (0.6) |

| | (0.3) |

5. | More

than Rs.50 crore and up to Rs.100 crore | 2 | 125 | 45 | 3 | 226 | 91 |

|

| |

| (0.4) |

| | (0.4) |

6. | More

than Rs.100 crore and up to Rs.500 crore | 7 | 1540 | 683 | 7 | 1496 | 677 |

|

| |

| (0.4) |

| | (0.5) |

7. | Above

Rs.500 crore | 6 | 4733 | 671 | 7 | 8192 | 765 |

|

| |

| (0.1) |

| | (0.1) |

Total | 373 | 6,921 | 2,077 | 333 | 10,546 | 2,038 |

|

| | (0.3) |

| | (0.2) |

P: Provisional.

Note

:

1) Figures in respect of 2007-08 include 'IFCI Ltd' and 'TFCI

Ltd'.

2) Figures in parentheses are ratio of public deposit to the respective

net owned fund.

Source : Annual Returns. |

Residuary Non-Banking Companies (RNBCs) 6.73

Assets of the RNBCs increased by 5.5 per cent during the year ended March 2008.

Their assets in the form of unencumbered approved securities declined, while those

in bonds/debentures and fixed deposits/ certificates of deposit of SCBs registered

an increase. Net owned funds of RNBCs increased by 25.5 per cent during 2007-08

on top of the rise of 15.5 per cent witnessed during 2006-07 (Table

VI.35).

| Table

VI.35: Profile of RNBCs | (Amount

in Rs.crore) | Item | As

at end-March | Percentage

Variation | 2007 | 2008

P | 2006-07 | 2007-08

P | 1 | 2 | 3 | 4 | 5 |

A. | Assets

(i to v) | 23,172 | 24,452 | 5.9 | 5.5 |

| (i) | Investment

in Unencumbered Approved Securities | 3,317 | 3,137 | 41.4 | -5.4 |

| (ii) | Investment

in Fixed deposits/

Certificates of Deposit of |

| |

| |

| | Scheduled

Commercial Banks/

Public Financial Institutions | 5,604 | 6,562 | -8.0 | 17.1 |

| (iii)

Debentures/Bonds/Commercial Papers of Govt. |

| |

| |

| | Companies/Public

Sector Banks/Public Financial | |

| |

| |

| Institution/Corporation | 11,700 | 12,320 | 22.2 | 5.3 |

| (iv) | Other

investments | 1,156 | 573 | -30.2 | -50.4 |

| (v) | Other

Assets | 1,394 | 1,860 | -37.2 | 33.5 |

B. | Net

Owned Funds | 1,366 | 1,714 | 15.5 | 25.5 |

C. | Total

Income (i+ii) | 1,893 | 2,325 | 16.9 | 22.8 |

| (i) | Fund

Income | 1,886 | 2,303 | 16.7 | 22.1 |

| (ii) | Fee

Income | 8 | 22 | 156.7 | 191.7 |

D. | Total

Expenses (i+ii+iii) | 1,648 | 1,725 | 14.5 | 4.7 |

| (i) | Financial

Cost | 1,230 | 1,321 | 5.5 | 7.5 |

| (ii) | Operating

Cost | 284 | 329 | 78.8 | 15.5 |

| (iii) | Other

cost | 134 | 75 | 17.4 | -44.1 |

E. Taxation | 44 | 224 | 101.1 | 406.8 |

F. Operating Profit

(PBT) | 246 | 601 | 36.5 | 144.5 |

G. Net profit (PAT) | 201 | 377 | 27.5 | 86.9 |

P : Provisional

Note

:

PBT - Profit Before Tax; PAT - Profit After Tax

Source:

Annual Returns. | 6.74

In continuation of the trend witnessed in 2006-07, the increase in income of RNBCs

during 2007-08 was more than the increase in expenditure, as a result of which

the operating profit of RNBCs increased sharply. Even though the provision for

taxation also registered a sharp rise, the net profit of RNBCs increased by 86.9

per cent during 2007-08 as compared with 27.5 per cent during 2006-07. Regional

Pattern of Deposits of RNBCs 6.75 Of the two RNBCs, one is based in

the Eastern region (Kolkata) and the other in the Central region. The public deposits

held by RNBCs in both the Eastern region and Central region registered a marginal

decline. Of the four metropolitan cities, RNBCs held public deposits only in one

metropolitan city, i.e., Kolkata (Table VI.36).

Table

VI.36: Public Deposits Held by | RNBCs

- Region-wise | (Amount

in Rs.crore) | Region | As

at end-March | 2006-07 | 2007-08

P | No

of RNBCs | Amount | No

of RNBCs | Amount |

1 | 2 | 3 | 4 | 5 |

1. | Central | 1 | 18,108 | 1 | 18,056 |

|

| | (80.0) |

| (80.8) |

2. | Eastern | 2 | 4,515 | 1 | 4,302 |

|

| | (20.0) |

| (19.2) |

3. | North-Eastern | - | - | - | - |

4. | Northern | - | - | - | - |

5. | Southern | - | - | - | - |

6. | Western | - | - | - | - |

Total (1 to 6) | 3 | 22,622 | 2 | 22,358 |

Metropolitan Cities: |

| |

| |

1. | Chennai | - | - | - | - |

2. | Kolkata | 2 | 4,515 | 1 | 4,302 |

3. | Mumbai | - | - | - | - |

4. | New

Delhi | - | - | - | - |

Total (1 to 4) | 2 | 4,515 | 1 | 4,302 |

-: Nil/Negligible; P: Provisional.

Note : Figures in parentheses are percentages to respective totals.

Source : Annual Return. | Investment

Pattern of RNBCs 6.76 The investment pattern of RNBCs as prescribed

in the Residuary Non-Banking (Reserve Bank) Directions, 1987 was reviewed and

modified on March 31, 2006. The aggregate liability to depositor (ALD) was bifurcated

under two heads, viz., aggregate liability to depositor (ALD) as on December

31, 2005 and incremental ALDs. Incremental ALDs are the liabilities to the depositors

exceeding the aggregate amount of the liabilities to the depositors as on December

31, 2005. RNBCs were advised to invest, with effect from April 1, 2006, not less

than 95 per cent of the ALD as on December 31, 2005 and the entire incremental

ALD in the prescribed manner. RNBCs were also advised that on and from April 1,

2007, the entire amount of ALD would be invested in directed investments only

and no discretionary investment would be allowed to be made by them. 6.77

Aggregate liability to depositor (ALD) declined marginally by 1.7 per cent during

2007-08. While fixed deposits with banks and bonds and debentures increased,

unencumbered approved securities and other investments registered a decline (Table

VI.37).

Table

VI.37: Investment Pattern of RNBCs |

(Amount in

Rs.crore) | Item | End-

March | 2006-07 | 2007-08

P | 1 | 2 | 3 |

Aggregated Liabilities to the

Depositors (ALD) | 22,622 | 22,358 |

(i) | Unencumbered

Approved Securities | 3,317 | 3,137 |

|

| (14.7) | (14.0) |

(ii) | Fixed

Deposits with Banks | 5,604 | 6,562 |

|

| (24.8) | (29.3) |

(iii) | Bonds

or debentures or commercial papers of a Govt. company/ |

| |

| public

sector bank/

public financial institution/ corporations | 11,700 | 12,320 |

|

| (51.7) | (55.1) |

(iv) | Other

investments | 1,156 | 573 |

|

| (5.1) | (2.6) |

P: Provisional.

Note

:

Figures in parentheses are percentages to ALDs.

Source

: Annual Returns. | Non-Deposit Taking

Systemically Important Non-Banking Finance Companies (NBFCs - ND - SI) 6.78

Information based on the returns received from non-deposit taking systemically

important NBFCs (with asset size of Rs.100 crore and above) for the year ended

March 2008 showed an increase of 28.6 per cent in their liabilities/assets over

the year ended March 2007. Unsecured loans continued to constitute the single

largest source of funds for NBFCs-ND-SI, followed by secured loans and reserves

and surplus (Table VI.38).

TableVI.38:

Liabilities of NBFCs-ND-SI | (Amount

in Rs.crore) | Items | As

at end | March

2007 | March

2008 | June

2008 | 1 | 2 | 3 | 4 |

Total Liabilities | 3,17,898 | 4,08,705 | 4,23,083 |

of which: |

| |

| a) Paid up Capital | 18,904 | 24,490 | 27,217 |

| (5.9) | (6.0) | (6.4) |

b) Preference Shares | 2,192 | 4,573 | 4,845 |

| (0.7) | (1.1) | (1.1) |

c) Reserve & Surplus | 52,090 | 81,055 | 78,467 |

| (16.4) | (19.8) | (18.5) |

d) Secured Loans | 93,765 | 1,21,082 | 1,23,764 |

| (29.5) | (29.6) | (29.3) |

e) Unsecured Loans | 1,18,221 | 1,50,206 | 1,55,727 |

| (37.2) | (36.8) | (36.8) |

Note : Figures

in parentheses are percentages to Total Liabilities.

Source : Monthly

return by NBFCs-ND-SI. | Borrowings

6.79 Total borrowings (secured and unsecured) by NBFCs-ND-SI increased by 28.0

per cent to Rs.2,71,288 crore during the year ended March 2008, constituting 66.4

per cent of their total liabilities. During the quarter ended June 2008, the total

borrowings increased further by 3.0 per cent to Rs.2,79,491 crore (Table

VI.39).

| Table

VI.39: Borrowings by NBFCs-ND-SI |

(Amount in

Rs crore) | Items | As

at end | March

2007 | March

2008 | June

2008 | 1 | 2 | 3 | 4 |

A | Secured

Borrowings (i to vi) | 93,765 | 1,21,082 | 1,23,764 |

|

| | (44.2) | (44.6) | (44.3) |

| i. | Secured

Debentures | 32,564 | 44,439 | 44,809 |

|

| | (15.4) | (16.4) | (16.0) |

| ii. | Deferred

Credit | 0 | 0 | 0 |

|

| | (0.0) | (0.0) | (0.0) |

| iii. | Term

Loan from Banks | 19,503 | 25,774 | 27,795 |

|

| | (9.2) | (9.5) | (9.9) |

| iv. | Term

Loan from FIs | 5,030 | 5,988 | 5,757 |

|

| | (2.4) | (2.2) | (2.1) |

| v. | Others | 35,745 | 42,864 | 42,608 |

|

| | (16.9) | (15.8) | (15.2) |

| vi. | Interest

accrued | 923 | 2,017 | 2,795 |

|

| | (0.4) | (0.7) | (1.0) |

B | Unsecured

borrowings( i to viii) | 1,18,221 | 1,50,206 | 1,55,727 |

|

| | (55.8) | (55.4) | (55.7) |

| i. | Loans

from

Relatives | 1,621 | 1,822 | 1,390 |

|

| | (0.8) | (0.7) | (0.5) |

| ii. | ICDs | 20,018 | 22,019 | 20,610 |

|

| | (9.4) | (8.1) | (7.4) |

| iii. | Loans

from Banks | 33,191 | 46,243 | 45,946 |

|

| | (15.7) | (17.0) | (16.4) |

| iv. | Loans

from FIs | 4,218 | 2,956 | 4,030 |

|

| | (2.0) | (1.1) | (1.4) |

| v. | Commercial

Papers | 14,031 | 20,068 | 21,282 |

|

| | (6.6) | (7.4) | (7.6) |

| vi. | Unsecured

Debentures | 30,549 | 44,432 | 47,008 |

|

| | (14.4) | (16.4) | (16.8) |

| vii. | Others | 13,786 | 10,847 | 13,193 |

|

| | (6.5) | (4.0) | (4.7) |

| viii. | Loans

Interest accrued | 807 | 1,819 | 2,268 |

|

| | (0.4) | (0.7) | (0.8) |

| Total

Borrowings | 2,11,986 | 2,71,288 | 2,79,491 |

| Memo:

| |

| |

| Total

Liabilities | 3,17,898 | 4,08,705 | 4,23,083 |

Note :

Figures

in parentheses are percentages to 'Total Borrowings'.

Source:

Monthly returns of NBFCs-ND-SI. | Application

of Funds 6.80 The pattern of application of funds

by NBFCs-ND-SI during the year ended March 2008 remained broadly in line with

the pattern witnessed during the previous year. The secured loans continued to

constitute the largest share (44.7 per cent), followed by unsecured loans with

a share of 24.8 per cent (Table VI.40).

Table

VI.40: Select Indicators on Application of Funds by NBFCs-ND-SI |

(Amount

in Rs.crore) | Items | As

at end | March

2007 | March

2008 | June

2008 | 1

| 2 | 3 | 4 |

Secured Loan | 1,14,898 | 1,60,017 | 1,67,767 |

| (41.5) | (44.7) | (44.0) |

Unsecured Loan | 69,609 | 88,783 | 90,746 |

| (25.2) | (24.8) | (23.8) |

Hire Purchase Assets | 28,160 | 29,832 | 34,693 |

| (10.2) | (8.3) | (9.1) |

Long-term Investment | 43,309 | 53,856 | 57,888 |

| (15.7) | (15.0) | (15.2) |

Current Investment | 20,671 | 25,758 | 29,763 |

| (7.5) | (7.2) | (7.8) |

Total | 2,76,647 | 3,58,246 | 3,80,855 |

Memo Items: |

| |

| Capital Market Exposure | 81,435 | 1,11,630 | 1,05,111 |

of which: |

| |

| Equity Market | 34,196 | 35,957 | 35,203 |

Note :

Figures in parentheses are percentages to respective totals.

Source

:

Monthly returns of NBFCs-ND-SI. | Financial

Performance 6.81 NBFCs-ND-SI earned a profit of Rs.8,705

crore during the year ended March 2008, which was higher by 16.7 per cent as compared

with the profit earned during the year ended March 2007 (Rs.7,460 crore) (Table

VI.41).

| Table

VI.41: Financial Performance by NBFCs-ND-SI | (Amount

in Rs.crore) | Items

| Year

Ended | Quarter

Ended | March

2007 | March

2008 | June

2008 | 1 | 2 | 3 | 4 |

Total Assets | 3,17,898 | 4,08,705 | 4,23,083 |

Total Income @ | 31,281 | 39,537 | 11,564 |

| (9.8) | (9.7) | (2.7) |

Total Expenses @ | 20,552 | 27,291 | 8,877 |

| (6.5) | (6.7) | (2.1) |

Net Profit @ | 7,460 | 8,705 | 2,150 |

| (2.3) | (2.1) | (0.5) |

@: Cumulative

Note: Figures in parentheses are percentages to Total Assets.

Source: Monthly returns of NBFCs-ND-SI. | 6.82

The gross NPAs to total assets ratio of NBFCs-ND-SI remained unchanged at 2.3

per cent for the year ended March 2008 and also for the quarter ended June 2008.

The net NPAs to total assets ratio increased from 1.5 per cent as at end March

2007 to 1.6 per cent as at end March 2008, but declined to 1.4 per cent during

the quarter ended June 2008 (Table VI.42).

| Table

VI.42: Gross and Net NPAs of NBFCs-ND-SI | (Per

cent) | Items | As

at end | March | March | June |

2007 | 2008 | 2008 |

1 | 2 | 3 | 4 |

1 | Gross

NPAs to Total Assets | 2.3 | 2.3 | 2.3 |

2 | Net

NPAs to Total Assets | 1.5 | 1.6 | 1.4 |

3 | Gross

NPAs to Total Credit Exposure | 4.9 | 3.1 | 4.5 |

4 | Net

NPAs to Net Credit Exposure | 1.9 | 2.0 | 2.2 |

Source :

Monthly returns of NBFCs-ND-SI. | 4. Primary

Dealers 6.83 In order to strengthen the market

infrastructure of Government securities market and make it vibrant, liquid and

broad-based, the primary dealers (PDs) system was introduced by Reserve Bank in

1995. The PD system is designed to facilitate Government's market borrowing programme

and improve the secondary market trading system by contributing to price discovery,

enhancing liquidity and turnover and encouraging voluntary holding of Government

securities amongst a wider investor base. The PD system developed significantly

over the years and currently it serves as an effective conduit for conducting

open market operations. 6.84 The PD system continued to

play a significant role in the Government securities market during the year 2007-08.

The number of PDs increased to 19 at end-March 2008 as compared with 17

at the end-March 2007. Of these 19 entities, 10 were banks undertaking PD business

departmentally (Bank-PDs) and the remaining nine were stand-alone, non-bank entities.

HDFC Bank Limited was authorised to take up PD business with effect from April

2, 2007 and one new stand-alone PD, viz., Lehman Brothers Fixed Income

Securities Pvt. Limited (LBFISL), was also authorised to undertake PD business

with effect from November 1, 2007. However, following the filing of a petition

under Chapter 11 of the US Bankruptcy code by Lehman Brothers Holding Inc. in

the US, the Reserve Bank announced certain measures in public interest and in

the interest of financial stability. As such, LBFISL was advised not to declare

any interim dividend or remit any amount to its holding company or any other group

company without prior approval of the Reserve Bank. Further, they were advised

not to undertake transactions in Government securities as a PD in the primary

market.

6.85 The regulatory guidelines issued in July 2006 prohibited PDs

from setting up step-down subsidiaries. Accordingly, PDs that already had step-down

subsidiaries (in India and abroad) were required to restructure the ownership

pattern of those subsidiaries. The stand-alone PDs complied with these guidelines

during the year. 6.86 The Reserve Bank initiated steps to

phase out current account facility allowed to the non-bank and non-PD entities.

The establishment of Multi Modal Settlements (MMS) system was a major step in

this regard (Box VI.3)

6.87 In recent years, the non-competitive bidding facility has been receiving

good response. The Working Group on Auction Process of Government of India Securities

(Chairman: H.R. Khan), which submitted its report in March 2008, made several

important recommendations regarding the non-competitive bidding facility (Box

VI.4).

6.88 The bidding commitment of PDs in the underwriting auction of dated Government

of India securities was revised from the earlier stipulation of a minimum of 3

per cent of the notified amount to an amount equal to the minimum underwriting

commitment (MUC) with effect from November 22, 2007. Operations

and Performance of PDs 6.89 A significant portion

of the market demand for Government securities in the primary market emanates

from the PDs. The aggregate bids submitted by the PDs in the auctions of Treasury

Bills and dated securities, as reflected in the bid-cover ratio, tended to increase

in recent years in tandem with the increase in issuances. The PDs also maintained

a dominant share of over 45 per cent in primary auction allotments.

6.90 During 2007-08, cumulative bidding commitments in Treasury Bills auctions

were fixed to ensure that PDs bid for the notified amount. The aggregate bids

at Rs.3,18,201 crore were, however, much higher at 3.04 times of the aggregate

commitment of Rs.1,04,385 crore (under the regular borrowing programme). Bids

amounting to Rs.1,04,819 crores were accepted in Treasury Bill auctions. PDs are

required to achieve a success ratio of 40 per cent of bidding commitment in respect

of Treasury Bill auctions on a half-yearly basis. While the PDs achieved a success

ratio of 94.43 per cent during the year 2006-07, the achievement during 2007-08

was higher at 100.42 per cent. The PDs’ share in the primary auctions of

Treasury Bills increased to 48 per cent during 2007-08 from 38 per cent during

2006-07. 6.91 In terms of the Fiscal Responsibility and

Budget Management Act, 2003, the Reserve Bank was prohibited from participating

in the primary auctions of Central Government securities. The PDs were, therefore,

enjoined to underwrite the entire notified amount in the auctions of dated Government

of India securities. During 2007-08, the PDs offered to underwrite the auctions

of Central Government dated securities to the extent of Rs.2,76,518 crore as against

the notified amount of Rs.1,56,000 crore. This represented a bid-cover ratio of

1.77 in underwriting auctions. Of the total thirty five primary auctions of dated

securities held during the year, there was a devolvement of Rs.957 crore on PDs

in one auction. 6.92 The actual bids tendered by the PDs

(Rs.2,54,253 crore) in the auction of dated securities were 1.6 times of the notified

amount. Of the total bids made by PDs in dated securities, bids worth Rs.72,122

crore were accepted. The success ratio at 46.2 per cent was a marginal increase

over 44.3 per cent during the period 2006-07 (Table VI.43).

| Table VI.43: Performance

of the PDs in the Primary Market (At end-March)

| (Amount

in Rs. crore) | Items | 2007 | 2008 |

1 | 2 | 3 |

Treasury Bills |

| | 1.

Bidding Commitment | 1,02,675 | 1,04,385 |

2. Actual Bids Submitted | 2,84,686 | 3,18,201 |

3. Bid to Cover Ratio (in per cent) | 2.77 | 3.04 |

4. Bid Accepted | 96,952 | 1,04,819 |

5. Success Ratio

(in per cent) | 94.43 | 100.42 |

Central Govt. Securities |

| |

1. Notified Amount | 1,46,000 | 1,56,000 |

2. Actual Bids submitted | 2,02,462 | 2,54,253 |

3. Bid to Cover Ratio (in per cent) | 1.39 | 1.63 |

4. Bid Accepted | 64,727 | 72,122 |

5. Success Ratio in (in per cent) | 44.33 | 46.23 |

6.93 The secondary market turnover of Treasury Bills

and Government dated securities (both outright and repo) traded by stand-alone

PDs amounted to Rs.1,57,747 crore and Rs.16,80,073 crore, respectively, constituting

16 per cent and 17 per cent, respectively, of the market turnover. The share of

PDs in total market turnover worked out to 16 per cent.

Sources and Application of Funds 6.94 The consolidated

balance sheet size of nine stand-alone PDs at end-March 2008 declined by 19.7

per cent as compared with the position at end-March 2007 due to restructuring

of their businesses. Three PDs hived off their PD operations to newly set up group

entities with reduced capital. Capital funds of the stand-alone PDs declined by

27.8 per cent as on March 31, 2008 in contrast with the sharp increase of 46.3

per cent as on March 31, 2007. On the sources side, secured loans increased by

17.1 per cent during 2007-08, while unsecured loans registered a sharp decline

of 36.1 per cent. The decline in the growth rate of unsecured loans during 2007-08

was in contrast with the sharp rise (of 20.3 per cent) witnessed during 2006-07.

On the deployment side, investments in corporate bonds increased by 4.3 per cent

(from Rs.595 crore to Rs.621 crore) in contrast to the decline of 12.7 per cent

witnessed during 2006-07. (Table VI.44). The share of Government

securities and Treasury Bills in total assets of PDs increased to 70 per cent

at end-March 2008 from 55 per cent at end-March 2007.

| Table

VI.44: Sources and Applications of Funds of Primary Dealers

| (Amount

in Rs. crore) | Items | End-March | Percentage

Variations | 2007 | 2008 | 2007 | 2008 |

1 | 2 | 3 | 4 | 5 |

Sources of Funds | 13,557 | 10,882 | 26.1 | -19.7 |

1. | Capital | 2,088 | 1,508 | 46.3 | -27.8 |

2. | Reserves

and Surplus | 3,102 | 1,944 | 8.6 | -37.3 |

3. | Loans

(a+b) | 8,367 | 7,430 | 29.4 | -11.2 |

| a)

Secured | 3,910 | 4,580 | 41.7 | 17.1 |

| b)

Unsecured | 4,457 | 2,850 | 20.3 | -36.1 |

Application of Funds | 13,557 | 10,882 | 26.1 | -19.7 |

1. | Fixed

Assets | 72 | 14 | 12.2 | -80.5 |

2. | Investments

(a to c) | 9,248 | 8,291 | 16.3 | -10.3 |

| a)

Government Securities | 7,412 | 7,584 | 11.5 | 2.3 |

| b)

Commercial Papers | 1,241 | 86 | 98.2 | -93.1 |

| c)

Corporate Bonds | 595 | 621 | -12.7 | 4.3 |

3. | Loans

and Advances | 1,135 | 429 | -39.7 | -62.2 |

4. | Non-current

Assets | - | - | - | - |

Equity, Mutual Funds, etc. | 928 | 150 | - | -83.9 |

Others* | 2,174 | 2,148 | 156.4 | -1.2 |

No. of PDs ** | 8 | 9 | 8 | 9 |

*: Others include cash+ bank

balances + accrued interest + DTA - current liabilities and provisions.

** : Stand-alone PDs only.

Source : Annual Reports of respective

PDs. | Financial Performance of PDs

6.95 The income earned by the PDs declined by 33 per cent during

the year 2007-08 as compared with that in 2006-07, due to restructuring of business

by PDs and consequent decline in income from other activities that were not allowed

to be undertaken by PDs. However, a corresponding sharp decline on the expenditure

front and a rise in trading profits restricted the decline in net profit during

the year (Table VI.45).

Table

VI.45: Financial Performance of | Primary

Dealers | (Amount

in Rs. crore) | Items |

| 2006-07 | 2007-08 | Percentage

Variations |

|

|

|

| 2006-07 | 2007-08 |

1 |

| 2 | 3 | 4 | 5 |

A. Income (i to iii) | 1,950 | 1,307 | 17 | -33 |

i) | Interest

and discount | 986 | 914 | 21 | -7 |

ii) | Trading

Profit | -17 | 255 | - | - |

iii) | Other

income | 979 | 138 | 22 | -86 |

B. Expenses (i+ii) | 1,314 | 775 | 49 | -43 |

i) | Interest | 668 | 595 | 38 | -11 |

ii) | Administrative

Costs | 645 | 180 | 62 | -76 |

Profit Before Tax | 636 | 531 | -18 | -16 |

Profit After Tax | 444 | 373 | -20 | -16 |

No. of PDs ** | 8 | 9 | 8 | 9 |

** : Stand-alone PDs only.

Source: Primary Dealers' Return (PDR) | however,

increased from 9.5 per cent during 2006-07 to 10.8 per cent in 2007-08, reflecting

the better use of capital. (Appendix

Table VI.5). The cost-income ratio declined from 50 per cent in 2006-07 to

25 per cent in 2007-08 as some PDs significantly improved their efficiency ratio.

6.97 Stand-alone PDs continued to be adequately capitalised.

The capital to risk weighted-assets ratio (CRAR) of individual stand-alone PDs

remained above the prescribed minimum CRAR of 15 per cent. The CRAR of the stand-alone

PDs as a group was at 38 per cent as on March 31, 2008. (Appendix

Table VI.6 and Table VI.47).

Table

VI.47: Select Indicators of Primary Dealers

(At end-March)

| (Amount

in Rs. crore) | Items | 2007 | 2008 |

1 | 2 | 3 |

Total Assets* | 13,557 | 10,882 |

Of which: Government Securities | 7,412 | 7,584 |

Government Securities as Per cent of Total

Assets | 55 | 70 |

Total Capital Funds | 4,026 | 3,611 |

CRAR (in per cent) | 33 | 38 |

Liquidity Support Limit | 3,000 | 3,000 |

No. of PDs ** | 8 | 9 |

* : Net of Current Assets and

Liabilities.

** : Stand-alone PDs only.

Source : Primary

Dealers' Returns (PDR). | |

IST,

IST,