IST,

IST,

Operations and Performance of Scheduled Commercial Banks

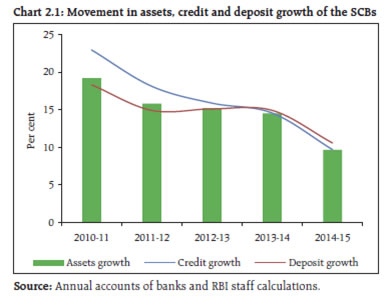

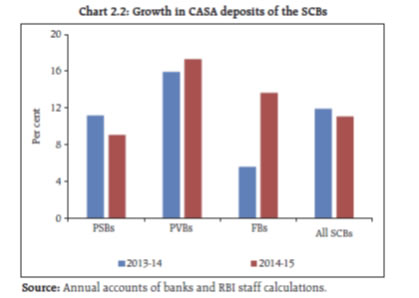

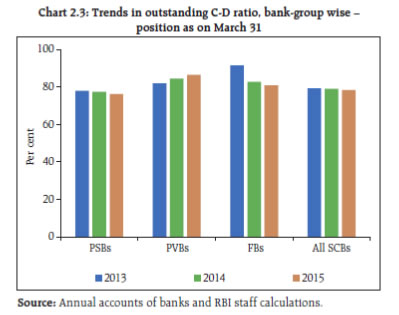

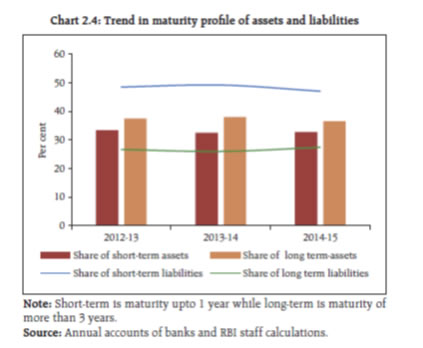

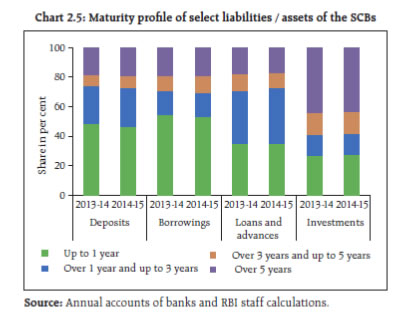

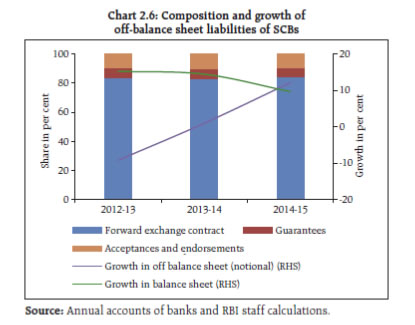

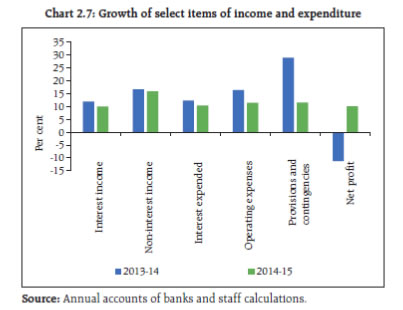

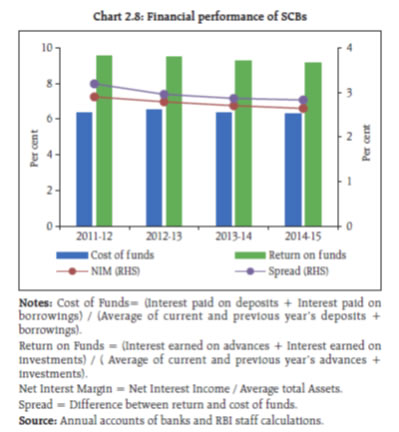

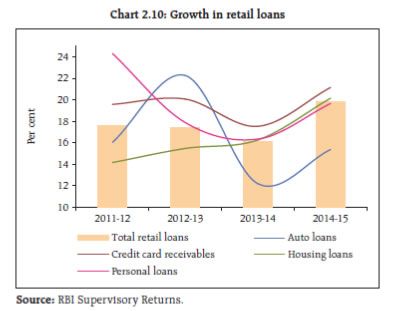

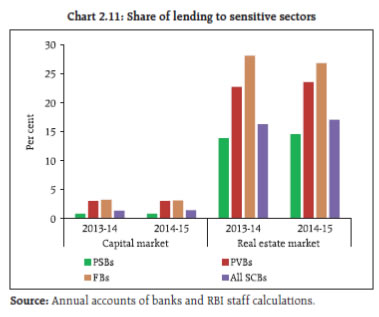

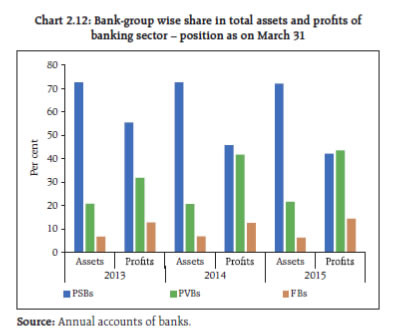

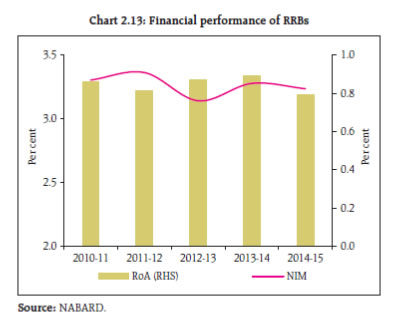

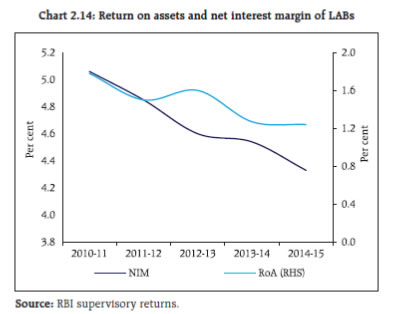

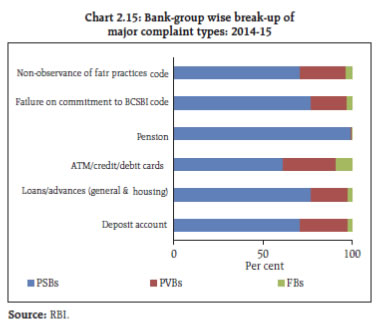

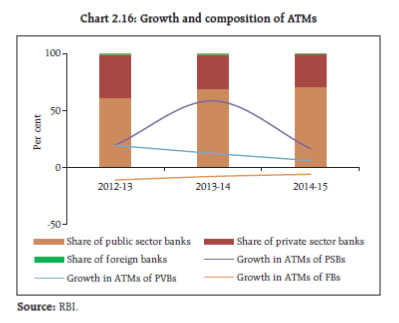

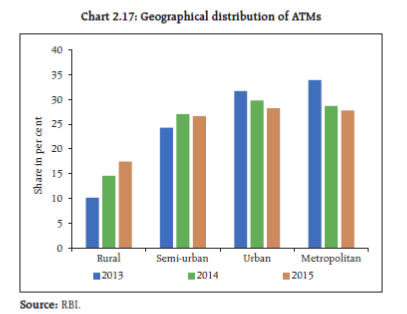

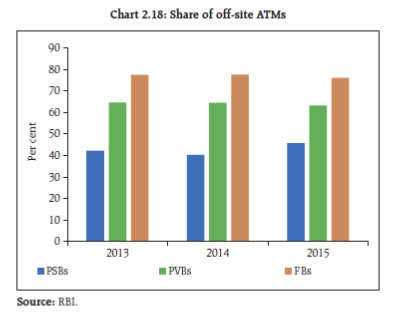

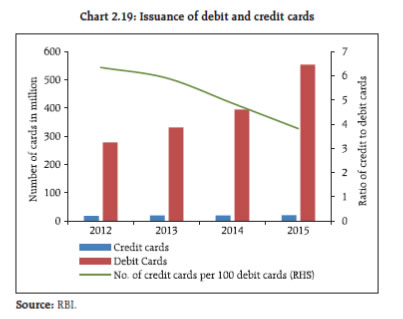

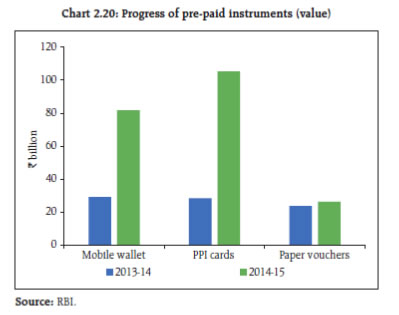

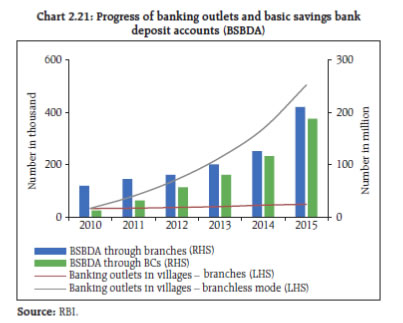

Consolidated operations1 2.1 The slowdown in growth in the balance sheets of banks witnessed since 2011-12 continued during 2014-15. The moderation in assets growth of scheduled commercial banks (SCBs) was mainly attributed to tepid growth in loans and advances to below 10 per cent (Chart 2.1). Growth in investments also slowed down marginally. The decline in credit growth reflected the slowdown in industrial growth, poor earnings growth reported by the corporates, risk aversion on the part of banks in the background of rising bad loans and governance related issues. Further, with the availability of alternative sources, corporates also switched part of their financing needs to other sources such as external commercial borrowings (ECBs), corporate bonds and commercial papers. On the liabilities side, growth in deposits and borrowings also declined significantly. Bank-group wise, public sector banks (PSBs) witnessed deceleration in credit growth in 2014-15; private sector banks (PVBs) and foreign banks (FBs), however, indicated higher credit growth. CASA deposits 2.2 Growth in current account and saving account (CASA) deposits moderated due to decline in saving deposits which in turn got reflected in deceleration in overall deposit growth (Chart 2.2). Bank-group wise, PSBs recorded decline in CASA deposits while PVBs and FBs recorded higher growth during 2014-15. Credit-deposit ratio 2.3 Credit-Deposit (C-D) ratio of the SCBs stood at around 78 per cent, same as that of previous year. Among the bank-groups, the C-D ratio of the private sector banks improved marginally with the other constituents recording a decline (Chart 2.3). Maturity profile of liabilities and assets 2.4 The maturity profile of liabilities of the SCBs witnessed an improvement during 2014-15 as the proportion of short-term liabilities declined and that of long-term liabilities increased. On the assets side, share of long-term assets declined and the share of short-term assets increased marginally (Chart 2.4). This can be seen in the light of risk aversion on the part of banks in the backdrop of rising share of nonperforming loans. The proportion of long-term loans and advances declined to 27.3 per cent in 2014-15 from 28.9 per cent in the previous year (Chart 2.5). 2.5 The PSBs, however, had 52 per cent of their investments in more than 5 year maturity bracket during 2014-15 while investments of the PVBs and FBs in that tenor, aggregated 30.4 per cent and 5.6 per cent, respectively. Off-balance sheet operations 2.6 Off-balance sheet liabilities (notional) of banks showed some resilience on the back of a lukewarm growth in the previous year and the deceleration in the growth of balance sheet operations of the banks. This was mainly driven by contingent liabilities on account of outstanding forward exchange contracts, which has the largest share in off-balance sheet operations of banks (Chart 2.6). Bank group-wise analysis revealed that, off-balance sheet exposure (notional) as percentage of on-balance sheet liabilities remained significantly higher for foreign banks as compared with other bank groups, due to their higher exposure to forward contracts, guarantees and acceptance/endorsements. Financial performance of the SCBs 2.7 Both interest earnings and interest expended recorded a lower growth during 2014-15 as compared to the previous year. Interest earnings reflected the impact of slower credit growth. However, decline in interest income was marginally higher than interest expended. As a result, net interest income grew less than the previous year despite an improvement in the operating expenses (through reduction in the growth of wage bill). Also, the pace of increase in provisions and contingencies due to delinquent loans declined sharply. This led to an increase in net profits at the aggregate level by 10.1 per cent during 2014-15 as against a decline in net profits during the previous year (Chart 2.7). 2.8 Following the trend in the recent past, both net interest margin (NIM) and spread (difference between return and cost of funds) witnessed marginal decline (Chart 2.8). 2.9 During 2014-15, return on assets (RoA) remained at the same level as previous year, however, return on equity (RoE) dipped marginally (Table 2.1). At the bank-group level, the RoA of PSBs declined though that of PVBs and FBs showed an improvement. Priority sector credit 2.10 Following the overall trend, credit growth to priority sector also declined during 2014-15 (Chart 2.9) and this decline was spread over all the subsectors with growth in credit to agriculture declining to 12.6 per cent from 30.2 per cent in the previous year. Credit to priority sectors by PSBs, PVBs and FBs was 38.2 per cent, 43.2 per cent and 32.2 per cent (of adjusted net bank credit (ANBC)/credit equivalent of off-balance sheet exposure, whichever is higher) respectively, during the year. Thus, PSBs indicated a shortfall from the overall target of 40 per cent.2 Within priority sector credit, both PSBs (16.5 per cent) and PVBs (14.8 per cent) had a shortfall in advances to agricultural sector against the target of 18 per cent. Retail credit 2.11 Retail loan portfolio of the banks continued to grow at around 20 per cent during 2014-15 even though there was deceleration in the total credit growth of banks. Housing loans (constituted around half of the total outstanding retail loans) and credit card receivables grew by more than 20 per cent. Auto-loans also recorded a recovery (Chart 2.10). Credit to sensitive sectors 2.12 Capital market, real estate market and commodities market have been classified as sensitive sectors as fluctuations in prices of underlying assets in these sectors could adversly affect the asset quality of banks. In 2014-15, sensitive sectors accounted for 18.5 per cent of the total loans and advances of banks. Within these sensitive sectors, more than 90 per cent comprised lending to real estate market. However, in line with overall trend, credit growth to sensitive sectors also witnessed a decline on account of lower growth in lending to real estate market.3 Neverthless, lending to capital market recorded higher growth during 2014-15. At the bank group level, in both the sectors, FBs’ exposure was highest followed by PVBs (Chart 2.11). Ownership pattern of SCBs 2.13 The banking sector in the country remained predominantly in the public sector with the PSBs accounting for 72.1 per cent of total banking sector assets, notwithstanding a gradual decline in their share in recent years. However, despite substantive share in total assets, the PSBs accounted for only 42.1 per cent in total profits during 2014-15, with the PVBs surpassing the PSBs in the share of total banking sector profits (Chart 2.12). 2.14 The Government of India continued to have more than the stipulated 51 per cent shareholding in all the public sector banks, despite decline in the stake in some of them in recent years. The maximum foreign shareholding in the case of PSBs was around 17 per cent as at end-march 2015 (20 per cent is regulatory maximum prescribed by the Reserve Bank). In case of the PVBs, the maximum non-resident shareholding was 73.4 per cent (74 per cent is regulatory maximum prescribed by the Reserve Bank).4 Regional rural banks (RRBs) 2.15 The number of RRBs declined to 56 from 57 during the year 2014-15 due to amalgamation. Following the trend in line with SCBs, the loans and advances of RRBs also recorded a deceleration in growth to 11.7 per cent during 2014-15 as against 15.2 per cent in the previous year. Investments also recorded a slower growth. On the liabilities side, deposit growth remained flat at around 14 per cent. 2.16 During 2014-15, both interest income and interest expended of RRBs recorded a lower growth as compared to previous year with the former registering a larger decline in growth. This led to marginal decline in net interest margin (NIM). Further, RRBs witnessed sharp deceleration in profits growth to 1.9 per cent in 2014-15 as against 18.5 per cent in the previous year. This resulted in decline in RoA of RRBs during the year (Chart 2.13). Local area banks 2.17 Local Area Banks (LABs) were established in 1996 as local banks in the private sector with jurisdiction over two or three contiguous districts to enable the mobilisation of rural savings by local institutions and make them available for investments in the local areas. Presently, four LABs are in operation. Out of these, Capital Local Area Bank Ltd. accounted for 72.9 per cent of the total assets of LABs as at end-March 2015. 2.18 Assets of the LABs grew by 22.2 per cent during 2014-15 while net interest income grew by 16.4 per cent. However, RoA witnessed a marginal decline as compared to previous year (Chart 2.14). 2.19 With the Capital Local Area Bank Ltd. getting the Reserve Bank’s ‘in-principle’ approval for the license for Small Finance Bank (SFB), share of the LABs in the total banking assets will get further reduced. Customer service 2.20 PSBs accounted for more than 70 per cent of the complaints received during 2014-15 and in all major categories, the share of PSBs was more than 60 per cent. However, the PVBs accounted for more than 25 per cent of complaints relating to ATMs, credit/ debit cards and non-observance of fair practices code (Chart 2.15). Technological Developments in Scheduled Commercial Banks Growth in automated teller machines (ATMs) 2.21 The banks increased their penetration further with the total number of ATMs reaching 0.18 million in 2015. However, there was a decline in growth of ATMs of both PSBs as well as PVBs. PSBs recorded a growth of 16.7 per cent during 2014-15 maintaining a share of around 70 per cent in total number of ATMs. FBs continued to record a negative growth in number of ATMs (Chart 2.16). Population group-wise distribution of ATMs 2.22 In recent years, the shares of ATMs in rural and semi-urban area have been rising, though urban and metropolitan centres still dominate. In 2015, about 44 per cent of the ATMs were located in rural and semi-urban centres (Chart 2.17). Off-site ATMs 2.23 The share of off-site ATMs in total ATMs increased to 50.9 per cent as at end-March 2015 from 47.9 per cent in the previous year. The increase in share of off-site ATMs of public sector banks played a major role, which increased to 45.7 per cent in 2015 from 40.3 per cent in 2014. The share of private sector and foreign banks was already more than 60 per cent (Chart 2.18). White label ATMs 2.24 Looking at the efficiency and cost-effectiveness of off-site ATMs, non-bank entities were allowed to own and operate ATMs called ‘White Label ATMs (WLA)’ by the Reserve Bank in 2012. As on October 31, 2015, 10,983 WLAs were installed. Debit cards and credit cards 2.25 Issuance of debit cards is much higher as compared to credit cards and they remain a preferred mode of transactions. In 2012, there were 6.3 credit cards for every 100 debit cards, which declined to 3.8 in 2015 (Chart 2.19). PSBs maintained a lead over PVBs and FBs in issuing debit cards. As on March 31, 2015 approximately 83 per cent of the debit cards were issued by PSBs, while around 80 per cent of the credit cards were issued by the PVBs (57.2 per cent) and FBs (22.4 per cent). Prepaid payment instruments 2.26 Pre-paid payment instruments (PPIs) are payment instruments that facilitate purchase of goods and services, including funds transfer, against the value stored on such instruments. The value stored on such instruments represents the value paid for by the holders by cash, by debit to a bank account, or by credit card. In the past few years, PPIs have emerged as an easy alternative to cash for performing day to day small value payment transactions. Value of PPIs has increased from ₹79.2 billion in 2012-13 to ₹213.4 billion in 2014-15. Among the PPI instruments, PPI card has been the most popular one (Chart 2.20), with non-bank PPIs having fuelled most of this growth. Financial inclusion initiatives 2.27 The Reserve Bank continued its efforts towards universal financial inclusion. Given the boost provided by the Pradhan Mantri Jan Dhan Yojana (PMJDY) during the period, considerable banking penetration has occurred, particularly in rural areas. However, significant numbers of banking outlets operate in branchless mode through business correspondents (BCs)/facilitators (Chart 2.21). Dominance of BCs in the rural areas can be gauged from the fact that almost 91 per cent of the banking outlets were operating in branchless mode as on March 31, 2015. 2.28 As on December 9, 2015, 195.2 million accounts have been opened and 166.7 million RuPay debit cards have been issued under PMJDY. The scheme was launched on 28th August, 2014 with the objectives of providing universal access to banking facilities, providing basic banking accounts with overdraft facility and RuPay Debit card to all households, conducting financial literacy programmes, creation of credit guarantee fund, micro-insurance and unorganised sector pension schemes. The objectives are expected to be achieved in two phases over a period of four years up to August 2018. Banks are also permitted to avail of Reserve Bank’s scheme for subsidy on rural ATMs. The objectives of the financial inclusion plan (FIP), spearheaded by the Reserve Bank and PMJDY are congruent to each other. 2.29 To further strengthen the financial inclusion efforts and increase the penetration of insurance and pension coverage in the country, the Government of India has launched some social security and insurance schemes, i.e., Pradhan Mantri Jeevan Jyoti Bima Yojana, Pradhan Mantri Suraksha Bima Yojana and Atal Pension Yojana in May 2015. As on December 16, 2015, 92.6 million beneficiaries have been enrolled under the Pradhan Mantri Suraksha Bima Yojana and 29.2 million have been enrolled under Pradhan Mantri Jeevan Jyoti Bima Yojana. Further, 1.3 million account holders have been enrolled under Atal Pension Yojana. 1 Including overseas operations. 2 For foreign banks, priority sector target is 32 percent of ANBC or credit equivalent amount of off-balance sheet exposure, whichever is higher. 3 Please refer to Table 9 of Statistical Tables Relating to Banks in India, 2014-15. 4 See Table 15 of Statistical Tables Relating to Banks in India, 2014-15. |

ಪೇಜ್ ಕೊನೆಯದಾಗಿ ಅಪ್ಡೇಟ್ ಆದ ದಿನಾಂಕ: