IST,

IST,

Bankers’ Sentiments on Credit Demand - Post Pandemic Recovery

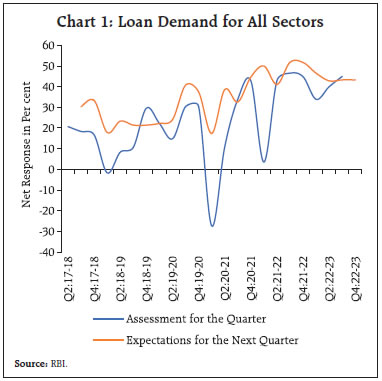

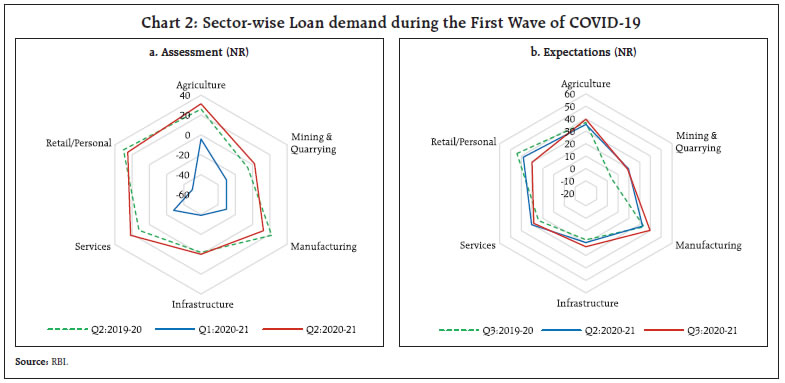

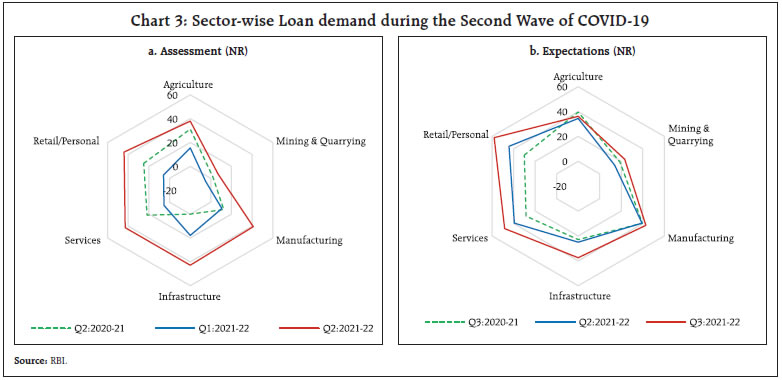

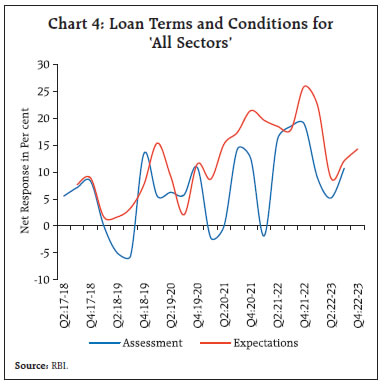

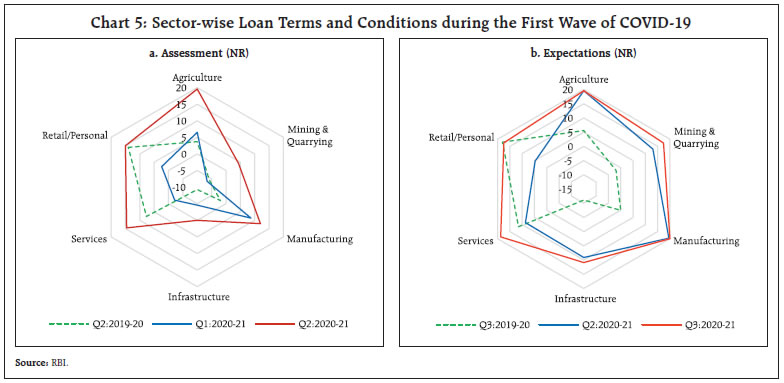

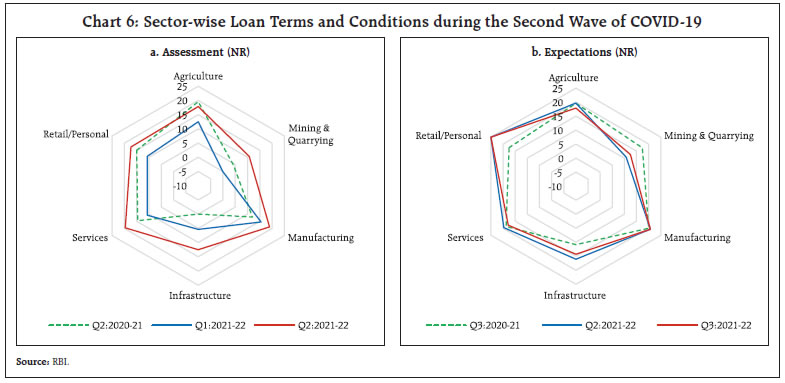

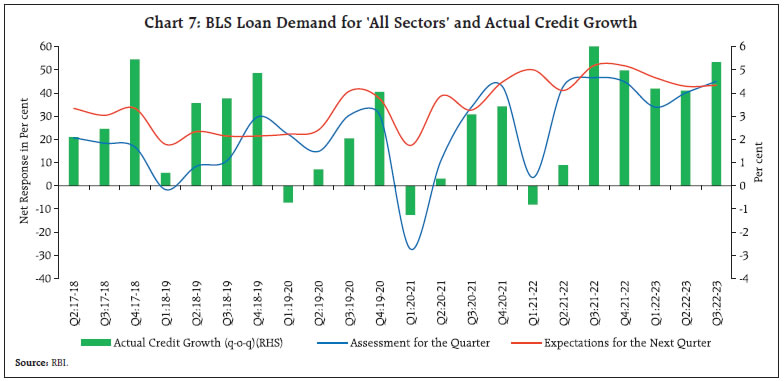

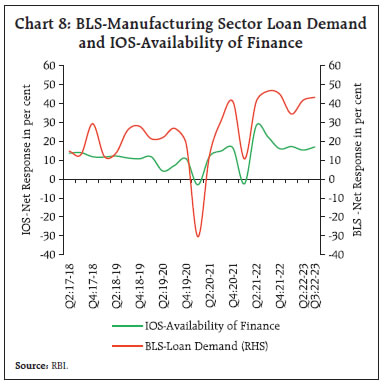

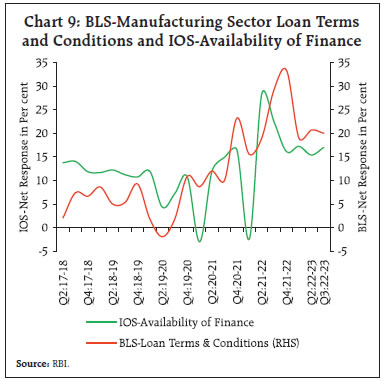

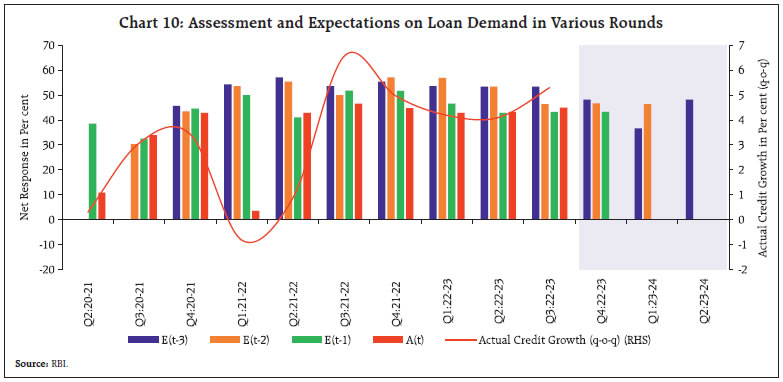

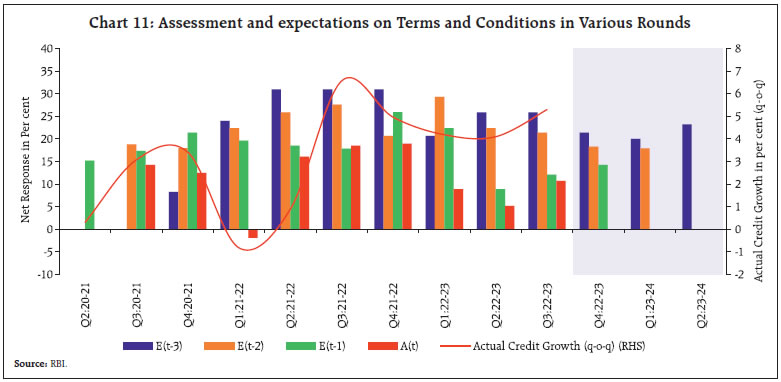

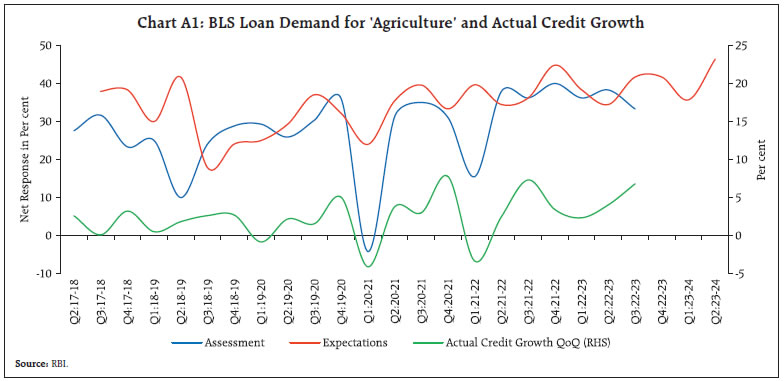

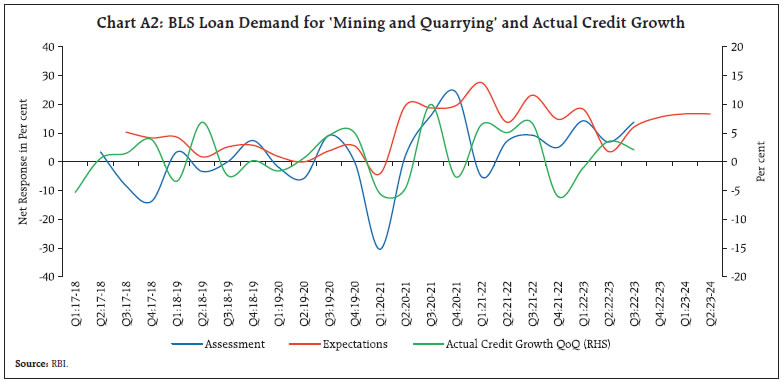

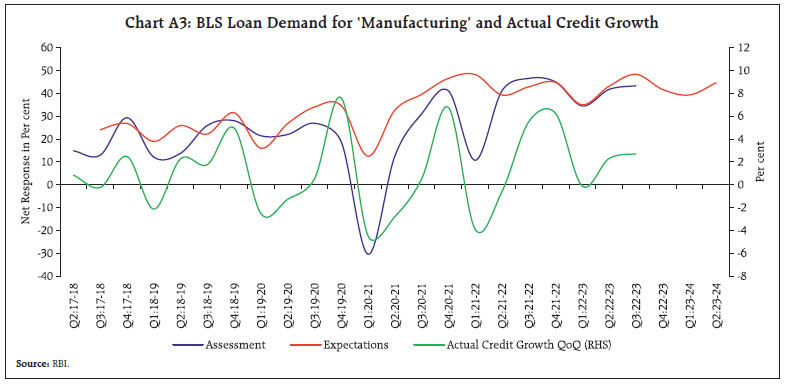

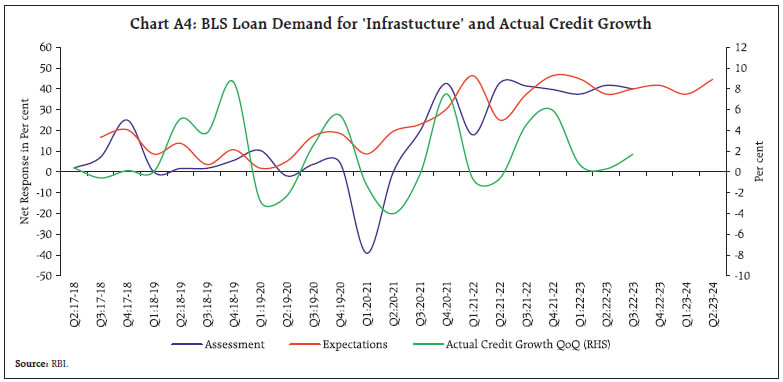

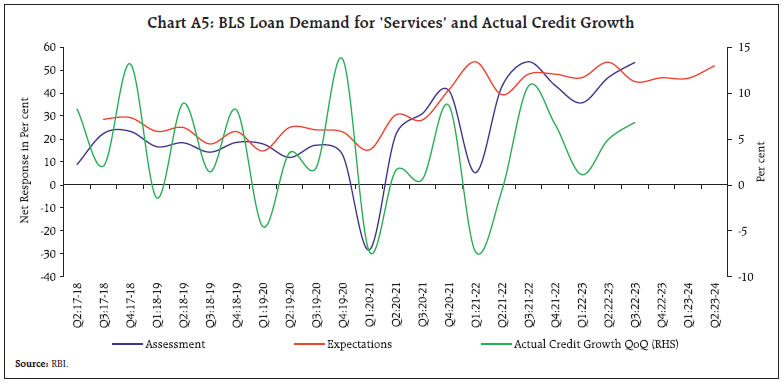

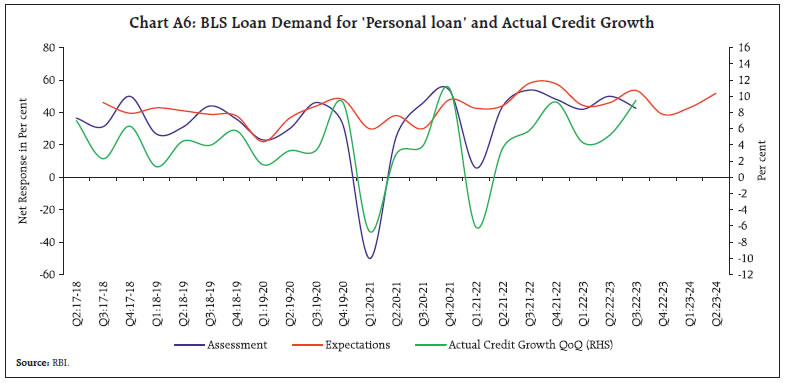

by Haridwar Yadav^ and Supriya Majumdar^ The Bank Lending Survey provides sentiments of banks on loan demand, loan terms, and their outlook in the near term across major sectors which acts as a lead indicator for actual credit growth. This article studies the evolution of bankers’ sentiments in India during the pandemic. Even though bankers’ sentiments on lending conditions were significantly impacted by the pandemic, especially during the first and second waves (April-June 2020 and April-June 2021), respectively, it exhibited a quick improvement thereafter. Lenders’ sentiments also co-move significantly with credit growth and borrowers’ perceptions in the manufacturing sector. Introduction Outlook on credit demand is an important input for policy making in a bank dominated economy like India. Bank credit depends on several factors like macroeconomic outlook, liquidity conditions, borrowers’ creditworthiness, uncertainty associated with the concerned sector, expected return including risk premium, portfolio mix and risk management abilities, among others. Many of these are directly observable and therefore bankers’ perceptions on credit demand, and terms and conditions, collected through the dedicated Bank Lending Survey (BLS)1, is usually supplement the information on bank credit. The BLS provides lender’s perspective on credit market conditions qualitatively, especially the impact of changing economic or financial conditions on loan demand and loan terms and conditions set by the banks for different sectors of the economy. In order to mitigate the impact of the COVID-19 crisis, central banks across the globe undertook a range of credit measures / schemes to support firms and households. The Reserve Bank of India (RBI) announced several measures, such as, reduction in policy rate and cash reserve ratio (CRR), increase in marginal standing facility (MSF) borrowing from 2 per cent of statutory liquidity ratio (SLR) to 3 per cent, special refinance facilities to NABARD, SIDBI and NHB, increase in borrowing limit of the states from 3 per cent to 5 per cent of the gross state domestic product (GSDP) among several other measures. These policy measures helped the economy to stage a quick turnaround in employment and consumption which also led to an increase in credit demand. Bank lending surveys, which play a crucial role in policy making, were used by a majority of the central banks to capture sentiments of banks and financial institutions on credit demand and terms and conditions during these challenging times when there were lacunae in credible data. The survey facilitated the measurement of the impact of the pandemic as well as evaluation of the timing and pace of the expected recovery process as perceived by the banks. In this article, we look at how the bankers’ sentiments evolved during the pandemic across successive waves. The rest of the article is structured in the following sections. Section II presents the sample frame, questionnaire, and methodology of the survey. Section III provides the key findings of the survey during 2019-22. Section IV discusses its relationship with official statistics and other surveys and Section V offers the perceptions of banks on post-COVID recovery process. Section VI concludes the article. II. Sample Frame, Questionnaire and Methodology The Reserve Bank conducts bank lending survey broadly in line with similar surveys done by other central banks across the world. The survey captures senior loan officers’ expectations on future credit demand along with adjustments in its terms and conditions and also seeks feedback on prevailing credit market conditions. It covers a panel of top 30 scheduled commercial banks (SCBs), which account for more than 90 per cent of the total outstanding credit of all SCBs. This panel is updated for each financial year by factoring in banking business/ mergers based on credit outstanding at the end of the previous financial year. The target respondents are heads of various credit departments or senior credit officers of various sectors in banks. The survey questionnaire is e-mailed to the banks during the quarter for which assessment is to be made and a two weeks’ time is generally given to respond to the survey. The banks participate in the survey voluntarily and the response rate is generally more than 90 per cent. The survey tracks outlook of banks for two quarters – assessment of credit demand and terms and conditions for the current quarter in which the survey is conducted vis-a-vis the previous quarter and expectations for the ensuing quarter vis-a-vis the current quarter. The questionnaire consists of qualitative questions with answers on a 5-point scale covering broad economic sectors, viz., agriculture, mining and quarrying, manufacturing, services, infrastructure and retail loans as well as for “all sectors”. In case of loan demand, responses are solicited on changes in the current quarter and expectations for the next quarter on a 5-point scale (viz., substantial increase, moderate increase, similar (no change), moderate decrease and substantial decline). Similarly, responses on loan terms and conditions are also marked on a 5-point scale (viz., considerable easing, somewhat easing, similar (no change), somewhat tightening, considerable tightening). The loan terms and conditions are specific to an approved loan, terms agreed between lender and borrower and laid down in the loan contract. It covers both price and non-price aspects and includes agreed spread over the relevant reference/interest rate, the size of the loan and other non-interest charges (e.g., fee, collateral or guarantee requirement, loan covenants, agreed loan maturity). Loan terms are conditional on borrower’s characteristics and may also change with bank’s loan approval criteria. The responses on a 5-point scale collected through the survey and compiled into a single number called the ‘Net Response’ (NR)2, also known as balance statistic (BS) score or net balance, is the weighted difference between the proportions of positive and negative responses. NR can take values ranging from –100 to +100: positive values of NR indicate optimism for the parameter/sector (e.g., banks expecting increase in loan demand or easing of loan terms and conditions), whereas a value below zero reflects pessimism (e.g., anticipating lower loan demand or tightening of loan terms and conditions). Thus, the net response helps in quantifying qualitative responses that indicate the direction of the change in sentiments; however, it does not strictly estimate the magnitude of change. Initiated in 2017, the survey completed its 22nd round with its recent data release in February 2023. Trends in bankers’ perceptions on loan demand and its terms and conditions during the two waves of COVID-19 are set out below. III.1 Loan Demand Conditions (i) First Wave of COVID-19 During Q4:2019-20 (January-March 2020), the round before the first wave of COVID-19, banks had indicated lower optimism on credit demand for all sectors (Chart 1). The usual survey for January-March 2020 was carried out much before imposition of lockdown on March 25, 2020 in India and thereby, banks did not anticipate the shrinkage in the economy in advance as they could not foresee the full impact of the severe and unexpected nature of the pandemic witnessed later. The first wave of COVID-19 during Q1:2020-21 (April-June 2020) resulted in a significant shrinkage in loan demand across all sectors, which had led to a drastic decline in the sentiments among Indian banks in terms of assessment. The NRs for all the sectors were negative in the assessed quarter (Chart 2, Annex Chart A1-A6). However, in terms of expectations it largely remained unaffected. In Q2:2020-21, bankers assessed a quick recovery of loan demand across the sectors. While mining and quarrying and infrastructure sectors recorded lower optimism as compared with other sectors, maximum recovery was observed in personal loans segment which had earlier witnessed the sharpest drop. Banks also expected a continued improvement in loan demand during Q3:2020-21. Thus, while assessments mirrored the overall economic conditions during the first wave of the pandemic, expectations of credit demand remained unaffected.    (ii) Second Wave of COVID-19 During the second wave of COVID-19 in Q1:2021-22 (April-June 2021), sentiments of banks on loan demand contracted significantly across all sectors (Chart 3, Annex Chart A1-A6). However, the extent of decline was much lower as compared with the first wave of the pandemic as the NRs for all the sectors, except mining and quarrying continued to remain positive. Similar to the first wave, bankers’ assessment on loan demand recovered quickly across all the sectors in the next quarter (Q2:2021-22). A sharp recovery was observed in personal loans segment and services sector in the quarter. Bankers’ expectations on credit demand were also upbeat for Q3:2021-22 and in fact were higher than that of the previous quarters for most of the sectors. III.2 Loan Terms and Conditions The COVID-19 pandemic resulted in a significant downward movement in the sentiments regarding loan terms and conditions among Indian banks during both the waves of the pandemic especially for assessment. Expectations, however, remained largely unaffected (Chart 4). (i) First Wave of COVID-19 In the first wave of COVID-19 in Q1:2020-21, NRs on terms and conditions for agriculture, retail loans and manufacturing sector were in the positive terrain, indicating easy loan terms and conditions in these sectors. For infrastructure and mining and quarrying sector, however, more banks reported some tightening of loan terms. The sentiments on loan terms and conditions for all the sectors indicated easing in Q2:2020-21. Bankers also expected further easing in loans’ terms and conditions during Q3:2020-21 (Chart 5).   (ii) Second Wave of COVID-19 Even though the bankers’ sentiments on loan terms deteriorated during the second wave as reflected in a fall in value of NRs for all loan segments, it remained in positive territory during the second wave of the pandemic, indicating easier terms and conditions in comparison with the first wave (Chart 6). Furthermore, easing in the sentiments on loan terms and conditions was recorded by banks in the next quarter Q2:2021-22 for all the major sectors.  IV. Relationship of BLS with Official Statistics and Other Surveys This section compares the survey results with trends in actual credit as well as other surveys to understand whether information available from these surveys can provide lead information to policy makers. IV.1 Bank Lending Survey and Actual Bank Credit Bankers’ assessment of changes in loan demand in terms of net responses closely tracks the growth in actual credit extended by SCBs. Bankers’ perceptions of loan demand broadly capture turning points in credit growth cycle. However, compared to the assessment, their expectations have generally been more upbeat (Chart 7). The correlation coefficient between the NRs for assessment and the actual credit growth is 0.49 whereas it is 0.23 between the NRs for expectations and the actual credit growth. IV.2 Manufacturing Sector - Assessment of Credit Conditions by Borrowers and Lenders The BLS captures lender’s perspectives (supply side view) of loan demand and its terms and conditions whereas RBI’s quarterly Industrial Outlook Survey (IOS)3 pursues manufacturers’ demand side perspectives on availability of finance from banks and other domestic sources.4 The IOS collects assessment and expectations on availability of finance on a 3-point scale (improve / worsen / no change) and results thereof are presented in the form of net responses. Loan demand from manufacturing sector assessed by bankers in the BLS and availability of finance from banks and other sources assessed by manufacturer in the IOS indicate similar directional changes across the study period (Chart 8).   Bankers’ assessment of loan terms and conditions for manufacturing sector is generally in line with manufacturers’ sentiments on availability of finance (Chart 9). Co-movement of the Net Reponses stemming from the two surveys indicates that the loan officers’ assessments are largely in line with industry expectations.  V. Perception of Banks on Post-COVID Recovery V.1 Cross Country Experiences5 As the bank lending surveys play an important role to support monetary policy decisions, major central banks used these surveys as instruments to capture the sentiments of the banks on the COVID-19 impact. The Federal Reserve of New York in their April 2020 Round of the Survey reported - “Many banks also provided written comments about the coronavirus (COVID-19) pandemic in addition to answering the standardised survey questions. In these comments, banks reported that the changes in standards and demand across loan categories reported for the first quarter occurred late in March as the economic outlook shifted when news emerged about the rapid global spread of COVID-19.” The euro area bank lending survey results showed that sentiments on credit demand and loan terms and conditions reached a trough in the first quarters of 2020-21 and 2021-22, similar to the first and second wave of COVID-19 in India. The Bank of Japan’s Senior Loan Officer Opinion Survey on bank lending practices at large Japanese banks also reflected that sentiments of the banks reached to lowest levels during various waves of the COVID-19 pandemic. The Bank of England in its Credit Condition Survey reflected that banks’ sentiment on secured as well as unsecured loan demand reached to a trough during the second quarter of 2020 before reviving in the next quarters. V.2 The Indian Context Since Q1:2020-21 survey round, a separate block was introduced for assessing the banks’ outlook on credit and its terms and conditions for two more subsequent quarters. Thus, data on expectations were collected for a total of three quarters which became extremely useful for policy decisions during the uncertain times. Moreover, expectations were also captured for the same quarter over successive survey rounds, enabling policy makers to observe the change in expectations in response to dynamically evolving pandemic and economic scenario. Using this additional block, we look at the expectations on credit demand and loan terms and how they shaped up during post-COVID recovery. (i) Credit Demand Conditions Stimulus packages and measures announced by the Government of India and the Reserve Bank boosted the recovery in banks’ sentiments on credit demand during the first two waves of the pandemic. Though the sentiments began firming up after the first wave, these were again clouded due to the second wave, though they reverted quickly (Chart 10)6. The banks’ sentiments were also observed to be in sync with the SCBs actual credit growth. It is observed that bankers tend to be more optimistic in terms of two- and three-quarter ahead expectations and the one quarter ahead expectations were able to capture the actual credit growth more closely. Turning to the recent period, we observe that bankers are highly optimistic of credit demand across all the main sectors in the coming quarters, viz., Q4:2022-23 to Q2:2023-24, as reflected in their higher NRs (Annex Chart A1-A6). (ii) Loan Terms and Conditions In terms of loan terms and conditions, after decline during the first wave, expectations indicated easing of credit terms and conditions. However, the sentiments were down again due to the second wave, though there was a quick revival. Data for more recent period indicated bankers are expecting easier terms and conditions for loans, going forward (Chart 11).   This article looks at the results of the Bank Lending Survey over successive rounds to understand how the sentiments responded to various shocks during the pandemic period. We find that assessment of lending conditions reacted to the pandemic in a pessimistic way, both during the first and second waves. However, the assessment of credit conditions improved significantly within a quarter indicating that policy measures were effective in instilling confidence during uncertain times. Among sectors, outlook on retail/personal loans were the most severely hit during both the waves of the pandemic, but they recorded a sharper recovery exhibiting fast catch-up. Information from the Bank Lending Survey tracks actual credit growth with reasonable accuracy and captures the turning points. Hence, it could be a useful tool for policymakers to gauge the underlying trends in credit market, as the survey results are available in advance by almost one quarter ahead. Also, the lenders’ perception in the BLS broadly corroborates with the borrowers’ perceptions in the Industrial Outlook Survey, which indicate that the suppliers’ assessment is in sync with the demand side of the credit conditions, again proving its usefulness. Going forward, bankers are positive on credit demand in the ensuing quarters. Expectations on terms and conditions for loans also point to easing in successive quarters. References Bank of England (2022), “Bank of England Credit Conditions Survey”, Quarterly Bulletin, Q1. https://www.bankofengland.co.uk/credit-conditions-survey/2022/2022-q1 Bank of Japan, “Senior Loan Officer Opinion Survey on Bank Lending Practices at Large Japanese Banks”. https://www.boj.or.jp/en/statistics/dl/loan/loos/index.htm/#p01. Berg, Jesper., Van Rixtel, Adrian A.R.J.M., Ferrando, Annalisa., de Bondt, Gabe and Scopel, Silvia., (2005), “The Bank Lending Survey for the Euro Area”. ECB Occasional Paper No. 23, February 2005. https://ssrn.com/abstract=752072. Board of Governors of the Federal reserve (2022), “Senior Loan Officer Opinion Survey on Bank Lending Practices”, July. https://www.federalreserve.gov/data/sloos.htm. Cunningham, Thomas J., (2006), “The Predictive Power of the Senior Loan Officer Survey: Do Lending Officers Know Anything Special?”, Federal Reserve Bank of Atlanta Working Paper, November. European Central Bank (2022), “The Euro Area Bank Lending Survey - First Quarter of 2022”, Q1. https://www.ecb.europa.eu/stats/ecb_surveys/bank_lending_survey/html/ecb.blssurvey2022q1~fd61911ffd.en.html. Faruqui, Umar, Paul Gilbert, and Wendy Kei., (2008), “Bank of Canada’s Senior Loan Officer Survey”, Bank of Canada Review, Autumn, https://www.bankofcanada.ca/wp-content/uploads/2010/06/faruqui.pdf. Filardo, Andrew J. and Siklos, Pierre L., (2020), “The cross-border credit channel and lending standards surveys”, Journal of International Financial Markets, Institutions and Money, Vol.67. Köhler-Ulbrich, Petra., Hempell, Hannah S., Scopel, Silvia., (2016), “The euro area bank lending survey: Role, development and use in monetary policy preparation”, European Central Bank Occasional Paper Series, No.179, September. Reserve Bank of India, Database on Indian Economy, https://dbie.rbi.org.in. Reserve Bank of India (2009), “Report of the Working Group on Surveys”, Reserve Bank of India Bulletin, September. Reserve Bank of India (2021), “Annual Report of the RBI for the Year 2020-21”, May. Reserve Bank of India (2022), “Annual Report of the RBI for the Year 2021-22”, May. Annex       ^ The authors are from the Department of Statistics and Information Management. * The views expressed in this article are those of the authors and do not represent the views of the Reserve Bank of India. The latest round of the survey data was released on February 8, 2023 on the Bank’s website (/en/web/rbi/-/publications/bank-lending-survey-for-q3-2022-23-21736). The previous article, the first on the Bank Lending Survey, giving its background, international experience time series data and methodological aspects was published in December 2020 issue of the RBI Bulletin (https://rbi.org.in/Scripts/BS_ViewBulletin.aspx?Id=19963). 1 This is also known as senior loan officers’ survey or credit condition survey internationally. 2 Net Response (NR) = {1*P2 + 0.5*P1 + 0*P0 + (-0.5)*P(-1) + (-1)*P(-2)}, where, P2 = per cent of banks reporting loan demand as ‘Substantial increase’ or loan terms and conditions as ‘Considerable easing’, P1 = per cent of banks reporting loan demand as ‘Moderate Increase’ or loan terms and conditions as ‘Somewhat easing’, P0 = per cent of banks reporting loan demand or loan terms and conditions to remain ‘Same/No Change’, P(-1) = per cent of banks reporting loan demand as ‘Moderate decrease’ or loan terms and conditions as ‘Somewhat tightening’ and P(-2) = per cent of banks reporting loan demand as ‘Substantial decrease’ or loan terms and conditions as ‘Considerable tightening’. 3 The IOS data are released on the RBI website (/en/web/rbi/-/publications/industrial-outlook-survey-of-the-manufacturing-sector-for-q3-2022-23-21734) on a quarterly basis, the latest was on February 8, 2023). 4 Parameters canvassed among manufacturers in the IOS are ‘Availability of finance (from banks and other domestic sources viz., financial institutions, capital markets etc.)’, ‘Availability of Finance (from internal accruals)’ and ‘Availability of Finance (from overseas)’. 5 Respective websites of the Central Banks (given in references) 6 A(t): Assessment for the current quarter (t), E(t-1)/ E(t-2)/ E(t-3): Expectations for the quarter (t) captures at one (-1)/ two (-2)/ three (-3) quarter before. |

ಪೇಜ್ ಕೊನೆಯದಾಗಿ ಅಪ್ಡೇಟ್ ಆದ ದಿನಾಂಕ: