IST,

IST,

RBI WPS (DEPR): 05/2017: Comparison of Consumer and Wholesale Prices Indices in India: An Analysis of Properties and Sources of Divergence

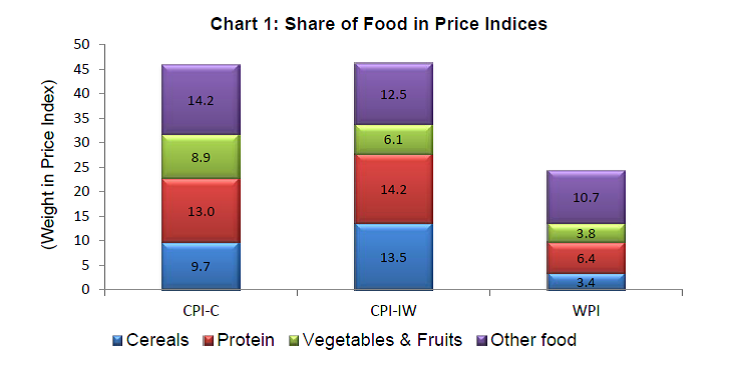

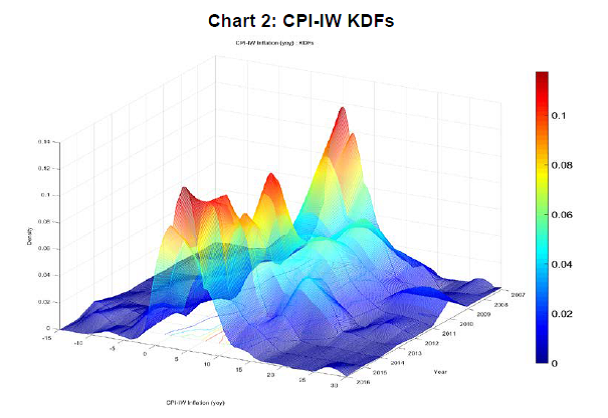

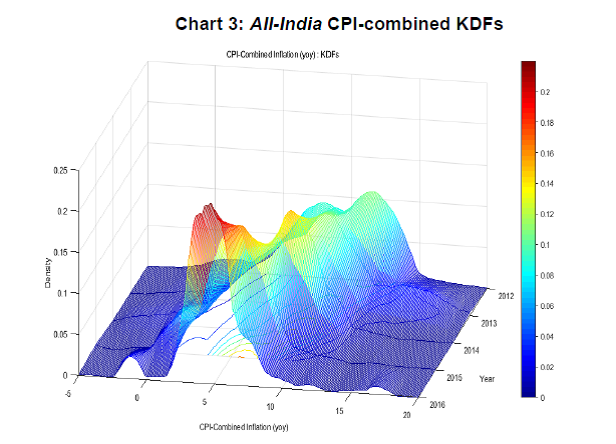

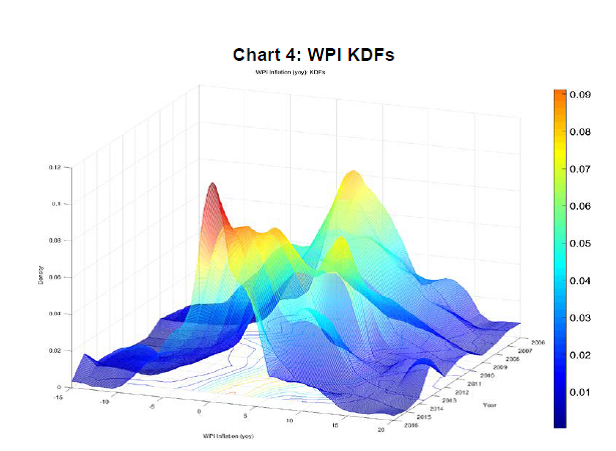

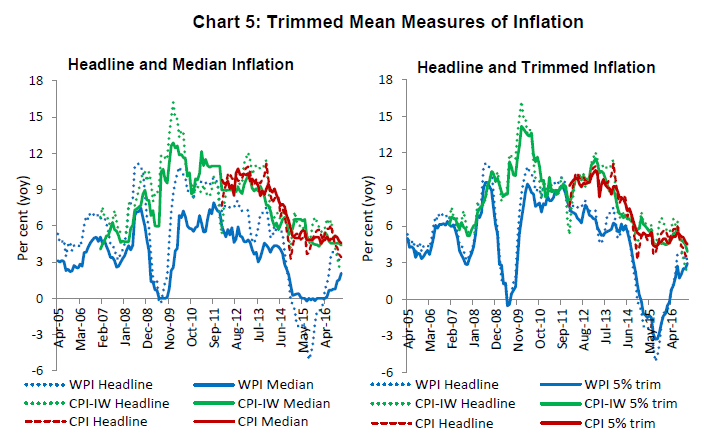

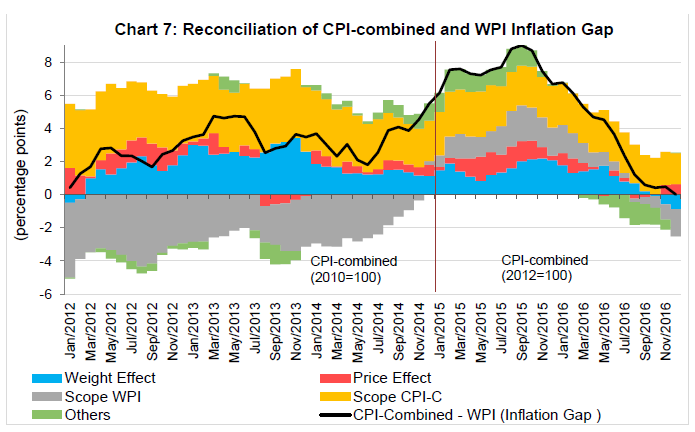

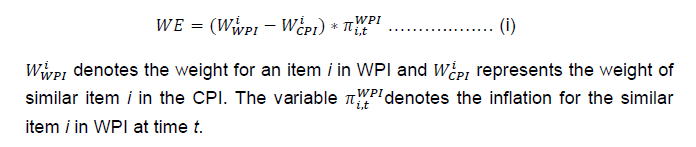

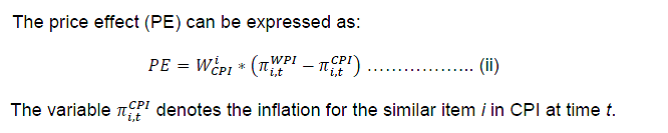

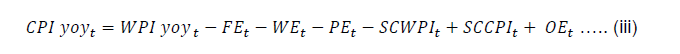

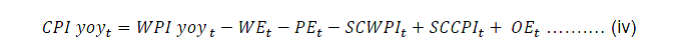

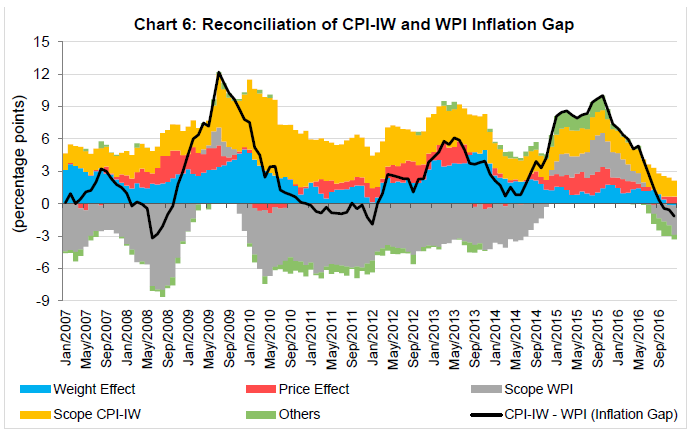

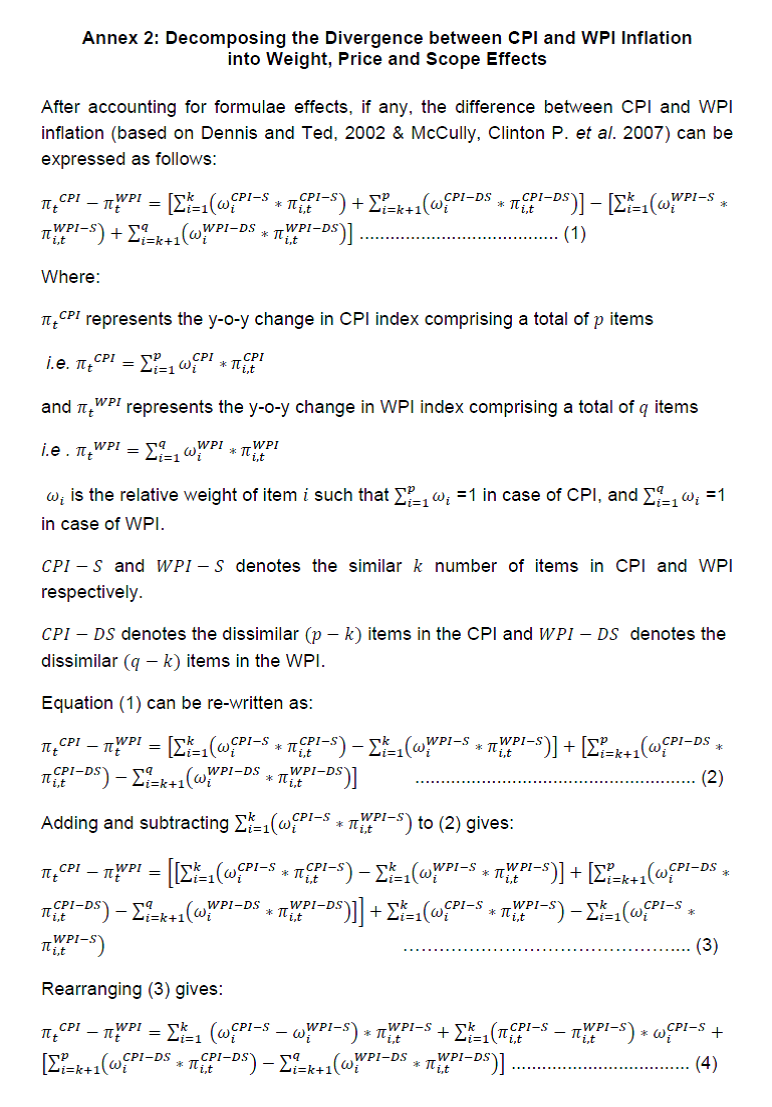

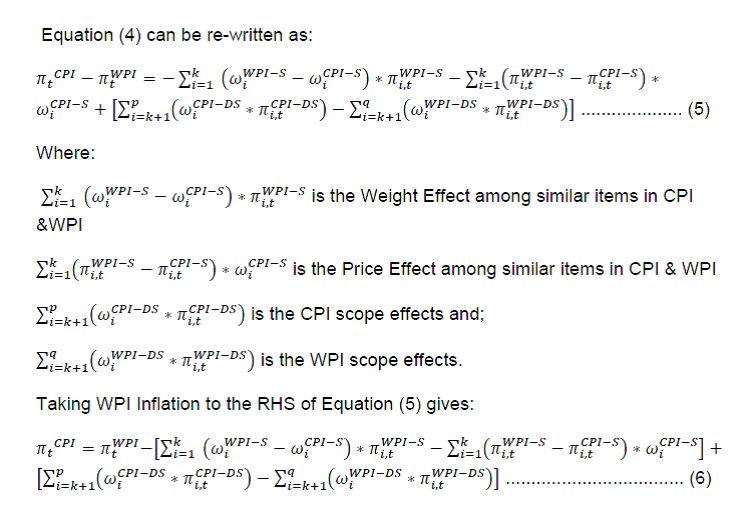

| Press Release RBI Working Paper Series No. 05 @Praggya Das and Abstract ♣ A key feature of the inflationary process during 2015-16 was the large divergence in the Consumer Price Index (CPI) and Wholesale Price Index (WPI) inflation. The CPI-WPI divergence resulted in considerable debate amongst policy makers and academia on its causes and its implications for monetary policy. In this context, this paper provides a comparative assessment of CPI and WPI in terms of its key characteristics, particularly on the method of compilation, distributional properties and measures of underlying inflation. The paper further attempts a full reconciliation of inflation divergence between CPIs and WPI with particular emphasis on 2015-16. The analysis shows that differences in weight for similar items as well as differences in composition played a crucial role in determining the level and duration of observed divergence between the retail and wholesale prices inflation. JEL Classification Numbers: E30, E31, E50 Keywords: Consumer Price Index, Wholesale Price Index, Inflation, Flexible Inflation Targeting, Monetary Policy Introduction Inflation in India, as measured by annual changes in wholesale and retail prices, averaged 7.2 per cent and 8.0 per cent, respectively, in the last four and a half decades, which in comparison with other emerging market economies is noteworthy, and by developed country standards relatively high (Basu, 2011). Generally, the retail and wholesale price measures in India moved in coherence, though there were instances of periodic divergences (Table 1). In the period following the global financial crisis, retail and, with a lag, wholesale inflation, became unhinged from their pre-crisis averages and hovered around double digits for four successive years. The high and rising inflation persistence set the stage for an intense debate on nature of post-crisis inflation in India and its implications for macro-stability and policy1. This culminated with the setting up of the Expert Committee to Revise and Strengthen the Monetary Policy Framework (Chairman: Dr. Urjit R. Patel) on September 12, 2013 with a mandate, inter alia, to recommend an appropriate nominal anchor for the conduct of monetary policy. The Committee, recommended headline CPI-combined2 as the nominal anchor for monetary policy and set out a glide path3 to bring down inflation. Following the recommendations of the Expert Committee, in January 2014, the Reserve Bank started to pursue a glide path for disinflation expressed in terms of headline CPI-combined for medium term monetary policy. Subsequently, on February 20, 2015, the Agreement on a flexible inflation targeting framework for monetary policy between the Government of India (GoI) and the Reserve Bank, formalised CPI-combined inflation as the nominal anchor for monetary policy (GoI, 2015) and on May 14, 2016, the same was explicitly mandated by an amendment to the Reserve Bank of India Act, 1934 (GoI, 2016). In this context of the shift in monetary policy framework towards flexible inflation targeting with a nominal anchor based on CPI, the period from late 2014 onwards also saw a sustained divergence in inflation as measured by the WPI and the CPI. While CPI inflation moderated in line with the disinflation glide path and reached 5.2 per cent by January 2015; since November 2014, WPI turned into deflation territory, resulting in the average gap between wholesale and retail inflation, which was historically less than one percentage point, to rise to as high as 8 percentage points during 2015. The stark divergence in WPI and CPI inflation, especially at a time when the country was transiting to a flexible inflation targeting framework, invited considerable debate on its implication for macro-economic policy, particularly monetary policy. The Chief Economic Adviser, GoI was of the view that “in terms of the prices measured by the national income accounts, we are closer to deflation territory and far, far away from inflation territory4” and that “this diverging wedge (between CPI and WPI) is not completely understood5”. The implications for policy on account of the diverging movements in WPI and CPI was aptly summarised by Mr. Prannoy Roy in a panel discussion6 with Governor and the Chief Economist Adviser where he posed the question to the then Governor, Dr. Raghuram Rajan that “...if you take CPI as the authentic measure of inflation, you are worried about inflation, so you will not lower interest rates and if you take WPI as authentic you will lower interest rates as you are not worried about inflation – a huge impact on policy?” In reply, Governor noted “…if you are really interested in protecting the consumer, and thereby worrying about either his investment decisions or his consumption decisions, I think the CPI is probably what you should be looking at, rather than intermediate prices”. While there has been considerable print on the broad factors that contributed to the inflation divergence, there has not been much literature identifying and quantifying the factors that cause wide divergence during some periods and complete convergence during the other. One of the recent studies that explained the divergence between retail and wholesale prices was carried out by Kumar and Sinha (2015). The study focussed on the movements of similar items in WPI and CPI-combined, and its divergence was largely attributed to the difference in weights of the two indices and difference in prices of common items; and items that moved differently in the two series were identified. This paper contributes to the literature by providing a comprehensive assessment of wholesale and retail prices in India and the sources of divergence. The rest of the paper is organised as follows. Section II presents a brief history of the production and use of price indices in India and their distributional properties. Section III gives the methodology for analysis and presents the results. Section IV summarises the key finding of the study and its macroeconomic policy implications. II. Inflation Measures in India Until recently, India had several sectoral consumer price indices (CPI) and a national level wholesale price index (WPI). A national level consumer price index (CPI-combined) was released in 2011 and the inflation target for monetary policy is prescribed in term of all-India CPI-combined index. However to understand the presence of multiple price indices, and demystify their recent divergent behaviour, we discuss below the history of construction of these price indices. II.1 A Brief History on Production and Use of Price Indices in India India has a rich history of compilation of price indices. The records of compilation of WPI, the oldest among the price indices in India, are available for as far back as the early 20th century (1915). Publication of these indices started from the period of the Second World War with introduction of a ‘quick’ series using the week ended August 19, 1939 as the base and computation of the Index from January 10, 1942. With regular publication of WPI since 1947, the index continued as a weekly series till January 2012 and is thereafter being released as a monthly series. WPI underwent several base revisions, usually decadal, and the present base (2004-05) series is available since April 2004. The universe of wholesale prices consists of all transactions at the first point of bulk sale in the domestic market and the weighting structure is derived from the national accounts statistics using gross value of output at an appropriate level of disaggregation (Office of the Economic Adviser, 2010). This index provides a comprehensive measure of wholesale prices in the economy and is widely used by the Government, industry, financial sector in their policies and served, until recently, as the key indicator for monetary policy communication by the Reserve Bank. The history of CPI in India is also very old. The consumer price index for industrial workers (CPI-IW) is being compiled since October 1946. Though the coverage of CPI-IW was limited to industrial workers in three sectors under the 1960 series, the coverage was extended to seven sectors7 with effect from 1982. The weighting diagrams for the present series (base 2001) have been derived from the results of Working Class Family Income and Expenditure Surveys conducted during 1999-2000. CPI-IW provides price indices for 78 different centres and is utilised for fixation and revision of wages and for determining inflation compensation to workers in organized sectors of the economy (Labour Bureau, 2015b). Monetary policy reviews in the past, while discussing retail price inflation, occasionally discussed CPI-IW movements. The Government also compiled another series of consumer price indices for agricultural labourers (CPI-AL) since September 1964. The series was split into separate indices for agricultural labourers and rural labourers (CPI-RL) from November 1995. The present base (1986-87 = 100) uses consumer expenditure data collected in the 38th Round of National Sample Survey8 (NSS), 1983, for deriving weighting diagrams – separately for agricultural labourers and rural labourers. The indices utilise same retail prices of rural markets but use different weighting pattern. Compiled separately for 20 states, these indices have been used primarily for fixing and revising minimum agricultural and rural labour wages (Labour Bureau, 2015a). While the Government was publishing retail price indices for several decades, each of these catered to a specific sector of the economy. To get an economy wide gauge of consumer price behaviour, the report of the National Statistical Commission in 2001 (Chairman: Dr. C. Rangarajan) recommended compilation of national CPI for both rural and urban areas. Based on these recommendations, the Technical Advisory Committee on Statistics of Prices and Cost of Living (TAC on SPCL) headed by the Central Statistics Office (CSO) started the process of constructing an all-India CPI in December 2005 by making use of the NSS 61st consumption expenditure survey (CES) data for construction of weighting diagrams. The all-India CPI series was released for January 2011 for rural (CPI-Rural) and urban (CPI-Urban) areas along with a combined (rural + urban) all-India CPI index (CPI-combined). These indices were constructed for all-India level and separately for States/ Union Territories. Based on the observation that there exists considerable gap between the base year of 2010 and the weighting reference year of 2004-05, the TAC on SPCL in January 2013 decided to revise the all-India CPIs to base year of 2012 while using NSS 68th Round CES of 2011-12 for construction of the weighting diagrams (CSO, 2014). The revised all-India CPI-Rural, CPI-Urban and CPI-combined were released with effect from January 2015. II.2 An Overview of the Price Indices Basic description of wholesale and retail price indices are presented in Table 2. The indices are brought out by different ministries of the Government with the CPI-combined being released by the Central Statistics Office, Ministry of Statistics and Programme Implementation. As can be seen from the Table 2, there are differences in the scope and coverage of retail and wholesale indices. On one hand, WPI collects price quotations from 5½ thousand first points of bulk sale, while on the other, CPI-combined covers 2300 rural and urban centres and collects 5½ lakh price quotations from various retail outlets. A quarter of CPI-combined consists of non-tradable like services that are not included in WPI. On the other hand, about 60 per cent of WPI consist of either non-food manufactured products (including intermediate goods, capital goods, etc.), or commodities such as minerals and crude petroleum. With a share of 48-72 per cent, food items dominate the CPI basket; its share in WPI is way lower. Within food group, the weights for similar food groups differ considerably in the wholesale and retail indices (Chart 1). There also exist difference in the price collection methodology between the two indices. In case of CPI-combined, prices are collected for those specification of items, which are popular and reflect the buying behaviour of most of the consumers from (i) local outlets i.e. licensed/ unlicensed markets, street vendors as well as shops by price collector by visiting, or by telephonic enquiry; and (ii) regulatory authorities in case of items where prices are regulated without the need for field work. On the other hand, for WPI, prices are mostly collected at first point of bulk sale in the domestic market – both by online reporting as well as field visit. Thus the point of data collection could cause variation in prices – as retail prices faced by consumers includes all costs incurred to reach the produce to the final consumer, including transportation, traders’ commission and margins; whereas wholesale prices are the prices quoted by the wholesale dealers. All the price indices use Laspeyres Index formula to arrive at headline indices from elementary/ item-level indices. However the method of construction of elementary indices varies. Thus, apart from difference in coverage and price collection; WPI, CPI-combined and CPI-IW differ in the methodology of basic level of aggregation to arrive at item indices. The three widely used methods for compiling item/ elementary indices are: (i) ratio of simple arithmetic average of all price quotations for an item in the current period to the average of prices in the base year, i.e. the Dutot index; (ii) a simple arithmetic average of price relative ratio, i.e. the Carli index; and (iii) the ratio of simple geometric averages of prices, i.e. the Jevons index (see reference [29]). The WPI (as also CPI-combined for base 2010=100) uses Carli index (see reference [9] and [23]), wherein simple arithmetic mean of price relatives are used to compute elementary indices. CPI-combined for the base 2012=100 uses geometric mean or the Jevons index, which has best properties for arriving at elementary indices as discussed in Verma (2016). CPI-IW, on the other hand, uses the ratio of arithmetic mean of prices called the Dutot method for compilation of item indices from price quotations. There exist differences between CPI-combined and WPI in terms of aggregation of the two indices from item level to consolidated level also. As discussed earlier, WPI is constructed using a national level weighting diagram while CPI-combined weights are based on consumer expenditure surveys. The consumer expenditure surveys are conducted state-wise and there is no national consumption basket that NSSO9 arrives at. Thus, when WPI inflation is aggregated, it is aggregated from items to item-groups to headline. Contrastingly, the construct of CPI-combined is such that it aggregates items to item-groups at state level and then to headline state level indices. Having arrived at the item indices at all-India level, CSO does not consolidate item-groups or aggregate headline from here. Indices even at item-group level and headline are consolidated by aggregating these indices across states. When national level item indices are aggregated to get item-groups, there is difference compared to the published index, sometimes this difference is significant (Table 3). This leads to the inflation from derived series to be different from published series. In the two years ending December 2016, the inflation difference across groups/ sub-groups ranged from -90 to +50 basis points (bps). Even though at headline level, the difference is small, this method of aggregation has important implications. Short-term forecasts are generally done on disaggregate components approach, whereby major components of the all-India index are separately projected and the projected components are aggregated, using their weights, to arrive at the projected headline index. This horizontal method of aggregation (across states) in CPI, at times leads to significant short-term forecast errors since the All-India CPI-combined indices by construct is not sum of its subcomponents. II.3 Distributional Properties of Price Indices With a backdrop of difference in composition and construction of retail and wholesale price indices, we now discuss the distributional properties of these indices. II.3.1 Moments Approach As a first step in analysing the behaviour of annual inflation rates10 across CPIs and WPI, we undertake a comparative assessment of the moments of the CPI and WPI distribution. The analysis of moments in this Section draws on studies by Ball and Mankiw (1995), Kearns (1998), Roger (2000), Dopke and Pierdzioch (2001), Assarsson (2003) among others which look into the distributional properties of price indices to analyse the impact of volatility and relative price changes on overall inflation movements and to construct measures of underlying inflation. Studies in the context of India based on WPI inflation, which include Darbha and Patel (2012), Patra et al. (2014), have documented some key stylised facts of its distribution. These include mainly the existence of sharp positive skew, caused by large supply shocks from food and fuel prices coupled with chronic kurtosis11. This implies that the distribution of price changes has been leptokurtic or fat tailed wherein a large portion of the price index (WPI) experiences price changes significantly different from the mean or headline inflation rate (Patra et al.2014). The Kernel Density Function12 (KDF) of retail and wholesale inflation were considered for a comparative assessment of the moments of the distribution over time. For this, the annual inflation rates for CPI-IW and WPI items, weighted by their importance in the respective indices were taken for the period 2007 to 2016, for which item level data is available for both WPI and CPI-IW. The choice of annual inflation rates were driven by the consideration of capturing a robust measure of moments, less influenced by noise in monthly data arising out of missing data, seasonal omission of items, among others. In case of the all-India CPI-combined inflation, the KDFs starts only from 2012 given its recent introduction (with 2010 as base year). However, since 2014, CPI-combined is being compiled using a revised 2012 base year. In order to have a longer time series for all-India CPI, an attempt was made to construct KDFs of annual inflation rates for CPI-combined items from 2012 onwards by splicing together the common items across 2010 and 2012 base years. The weighted KDF of inflation over time based on annual inflation rates, for CPI-IW, CPI-combined and WPI are presented in Charts 2, 3 and 4. The values of the moments are given in Annex Table A1. An examination of the KDFs of CPI-IW and WPI inflation during the pre-crisis period of 2007 and 2008 indicated an inflationary process that was fast inching up much above the decadal average inflation of 5.2 per cent and 5.6 per cent for WPI and CPI-IW respectively. Both CPI-IW and WPI inflation rates exceeded 8 per cent by 2008. The first episode of divergence between CPI-IW and WPI, in the sample period considered, occurred in 2009 when WPI inflation dropped to 2.4 per cent and CPI-IW inflation accelerated to 10.9 per cent. The fall observed in overall WPI inflation was occurring even as the distribution exhibited a positive skew. The distribution of CPI-IW inflation, also exhibited a combination of high positive skew and high standard deviation, which probably fuelled further the inflationary process in the vein of Ball and Mankiw (1995). The specific index properties that led to the vastly different inflation readings between CPI-IW and WPI is examined in Section III. The ensuing years, 2010 and 2011 saw CPI-IW inflation remaining at highly elevated levels of 12.1 per cent and 8.9 per cent respectively. WPI inflation also caught up quickly with readings in excess of 9 per cent in 2010 and 2011. In case of both CPI-IW and WPI, this period also saw the co-existence of high mean inflation rates with high standard deviation and high positive skew. Since 2012, WPI inflation has been moving southwards even as inflation in CPI-IW continued to remain elevated. In 2013, CPI-IW inflation again breached single digits to stand at around 11 per cent. The higher order moments i.e. standard deviation, skewness and kurtosis also showed a sharp rise in 2013 suggesting that the high CPI-IW inflation in the period can also be attributed to high inflation reading in a subset of items in the distribution. The all-India CPI-combined inflation data available since 2012 also broadly followed the CPI-IW trajectory. By 2014, WPI inflation slumped to 3.8 per cent even as CPI-IW and CPI-combined inflation remained at 6.2 per cent and 6.4 per cent13 respectively setting the stage for the second episode of divergence between WPI and CPIs. Unlike the previous instance, the divergence between WPI and CPIs was more acute, with WPI slipping into deflation in the latter part of 2014 while CPI-combined inflation remained steady at around 5 per cent. This episode of divergence was also more prolonged, with divergence persisting throughout 2015. The deflation in WPI in 2015 depicted a KDF that registered sharp fall in kurtosis and also a largely symmetric distribution, though with a mild negative skew. In 2015, CPI-combined inflation was centred at around 5 per cent and was also largely symmetric with skewness coefficient near zero. Further, the sharp fall in kurtosis also indicated a relatively lower concentration of symmetric fat tails or outlying observations in the distribution. While 2016 saw WPI coming out of deflation to register an average inflation rate of 2 per cent, CPI-IW inflation saw further disinflation to around 5 per cent and CPI-combined inflation remaining steady at around 5 per cent. Even so, CPI-combined witnessed negative skewness largely due to food price shocks, CPI-IW inflation distribution was largely symmetrical and WPI inflation exhibited a positive skew. II.3.2 Measures of Underlying Inflation – Trimmed Means The assessment of distribution of prices changes in the items in CPIs and WPI since 2007 showed frequent episodes on high dispersion, asymmetry and non-normality of inflation distribution. This has important implication for using weighted mean, solely, as a measure of inflationary process. In such a scenario, one also needs to assess how the underlying inflation moved across the price indices, after adjusting for much of the volatility and outlying inflation reading. A way to deal with the high (positive as well as negative) skew and chronic leptokurtosis in the inflation distribution is by way of trimming. Trimming removes specific upper and lower tails of the distribution corresponding to a chosen percentage of trim. For instance a 10 per cent trimmed mean is carved out from truncating a distribution in a manner that removes items corresponding to 5 per cent of index weight from both upper and lower tails of the distribution. The decision on the percentage of trim is usually judgemental and to counter any arbitrariness, in practice users look at more than one trim. Silver14 (2006) argued that though trimmed mean estimators can be calculated at different levels of trim, there is a trade-off between the ability of the measure to exclude extreme values and the loss of information. Some researchers believe that trimming, by addressing the tails, reduces the distribution to a normal distribution (Aucremanne, 2000 and Heath et al., 2004). Weighted median is a specific and most effective case of trimmed mean. It is the value of middle price of an item such that half of the index’s weight is above and half is below its value. Weighted median, as the distribution’s middle price change, is arrived at by making use of all information in the price set, is easy to comprehend, and is robust against outliers or extreme values. Chart 5 shows the behaviour of trimmed means for CPI-combined, CPI-IW and WPI. The preponderance of positive skew and excess kurtosis in CPI-IW and WPI has kept mean inflation above median and trimmed mean for most of the time stamps. With commodity prices dragging down the mean WPI inflation to contractionary zone for a year, and distribution turning negatively skewed, median inflation and trimmed mean were larger than the mean during this period. The CPI-combined, in its short history, has been through periodic swings in skewness as well as kurtosis. Resultantly, the average headline inflation has not shown a systematic bias. While the mean inflation has exceeded median and trimmed mean during certain months, it has been below them during other months (Chart 5). Thus there is clear divergence in the distribution of prices in WPI, CPI-IW and CPI-combined. III. Reconciling the Divergence between CPIs and WPI This Section attempts a formal reconciliation of the observed divergence in CPI and WPI inflation by decomposing the observed divergence into a set of index characteristics. III.1 Methodology for Reconciliation between CPIs and WPI Inflation The methodology adopted for the reconciliation exercise follows the methodology of Dennis and Ted (2002), McCully, Clinton P. et al. (2007) used for decomposing the CPI and Personal Consumption Expenditure (PCE) price index divergence in the US; and of Miller (2011) for explaining divergence between CPI and Retail Price Index (RPI) in the UK. For the purpose of the reconciliation exercise WPI inflation is taken as the starting point and quantifying the sources of divergence, it is finally reconciled with CPI inflation. It needs to be noted outright that there is no unique procedure for reconciliation of divergence. The focus here is to quantify the divergence to a set of effects, which are highlighted in various studies that cause overall inflation rates measured by different indices to vary at a point in time. These effects are broadly identified as due to difference in formula used in construction of indices, difference in weights and prices for similar items, difference in items included in the price indices and other seasonality related differences. These effects are explained below: a. Formula Effect: Formula effects arise from difference in the choice of index used for aggregation of the most disaggregated elementary price indices to higher level indices. For example formulae effects becomes prominent if one price index used fixed weight Laspeyres type index formula for compilation and the other uses say Fisher-Ideal chain-type price index, as in the case of PCE price index in the US. By construct, other things remaining the same, Fisher-Ideal chain-type price relative or Paasche price relative would be lower than a Laspeyres price relative (McCully, Clinton P. et al., 2007). The formulae effect could also come into play if the elementary price quotes are aggregated or price relatives are constructed based on Arithmetic Mean (AM) or Geometric Mean (GM) (Miller, 2011). GM is better-suited to situations where there is a ‘need to reflect substitution in the index or where there is a large dispersion in price levels or changes’ (TAC on SPCL, 2014). The formula effect cannot be estimated from published item level elementary indices. To estimate the formula effect, detailed price quotes are required. Given the price quotes, WPI can be ‘reaggregated’ to arrive at elementary indices using the techniques used in CPI (i.e. using Dutot index in case of comparison with CPI-IW and using Jevons index in case of comparison with CPI-combined of 2012 base). Thereafter, elementary aggregates can be reaggregated to sub-groups, groups and finally headline WPI using Laspeyres index (which is same across all indices). The formula effect will then be estimated as the percentage point difference in inflation rates between published WPI and ‘reaggregated’ WPI. In absence of availability of price quotes data, the formula effect cannot be estimated. b. Weight Effect: Two price indices can also show divergence if the relative weights assigned to comparable items differ on account of different data sources. For example, as noted in Section II, in case of CPI-combined the weights are based on the NSSO Consumption Expenditure Survey, CPI-IW weights are based on Working Class Family Income and Expenditure Survey and that for WPI is based on National Accounts Statistics. The weight effect (WE) in case of CPI and WPI can be represented, based on Mc Cully, Clinton P. et al. (2007), as:  c. Price Effect: As noted in Fixler, Dennis and Jaditz, Ted (2002), the price effect captures the divergence on account of price movement for the same item after adjusting for differences in weights. In the Indian context, unlike the advanced countries, price effect variations can be significant considering that WPI and CPI have large difference in number of price quotations collected (as noted in Section II, prices are measured in wholesale markets by merely 5½ thousand quotations as against 5½ lakh quotations in case of CPI-combined); and the large, heterogeneous and informal nature of markets. If we consider that wholesale price index presents proper measurement of prices in the wholesale markets then the price effect also captures the impact of changes in wholesale to retail margins.  d. Scope Effect: The scope effect measure, calculated separately for CPI and WPI, measures the contribution of inflation coming from items that are included only in CPI but not WPI and vice versa to the observed divergence in overall inflation. To calculate the scope effect, first, the contribution of items exclusive to WPI and not included in CPI to overall WPI inflation is computed. In the second stage the contribution of items in CPI that are not included in WPI to overall CPI inflation is computed. The difference between the WPI and CPI scope effect is then calculated to arrive at the net scope effect. Scope effect for reconciling the divergence between WPI and CPI assumes significance given the difference in composition between CPI and WPI. While WPI consists of primary and intermediate commodities as well as finished goods, CPI consists of finished goods and services consumed by a typical household. e. Other Effects: In Mc Cully et al. (2007) other effects largely capture the divergence coming out of the differences in the revision cycles for computing the seasonal factors as well in the methodology used for capturing seasonality of items, especially in case of seasonal food items. In this study, other effects are taken as a residual component and as such it would also capture the aggregation errors arising out of approximation of aggregate inflation as weighted sum of component inflation rates. To sum up, for the purpose of the reconciliation exercise WPI inflation is taken as the starting point and it is adjusted for the various ‘effects’ to arrive at the CPI inflation i.e. inflation in CPI-IW and CPI-combined. It can be represented as:  As per (iii) WPI year-on-year (yoy) inflation (WPI yoy) is first adjusted for inflation arising from difference in formulae used for WPI and CPI index construction, or formulae effect (FE), if any. In the second stage, the WPI inflation is further reduced for effects arising out of differences in weights or weight effect (WE) and prices or price effect (PE), among similar items. In the third stage the adjusted WPI inflation is further reduced for inflation from items which are exclusive to WPI i.e. Scope WPI effects (SCWPI). To this CPI inflation arising from items exclusive to CPI or Scope CPI effects (SCCPI) is added to arrive at the CPI inflation (CPI yoy). The other effects (OE) acts as the residual balancing item. Further details on the reconciliation methodology are given in Annex 2. However as mentioned earlier, and as discussed in the following section, due to non-availability of price quote data the reconciliation exercise attempted does not include the formula effects. The reconciliation in equation (iii) can then be rewritten as:  III.2 Data Source The reconciliation exercise was first carried out using the item wise data for WPI (2004-05=100) and CPI-IW (2001=100) index baskets. In case of WPI, the inflation rate for 676 item level data and in case of CPI-IW, the inflation reading based on Retail Price Index (RPI) for 393 items for the common period of January 2007 to December 2016 were used for the analysis. The housing index for CPI-IW was also added to the RPI. The item level inflation data of all-India CPI-combined for base 2010=100 for 318 items was used for reconciliation of CPI-combined with WPI for the period January 2012 to December 2014. The item level inflation for CPI-combined with base 2012=100 for 299 items was used for reconciliation of WPI and CPI-combined for the period January 2015 to December 2016. Based on these item wise indices the index items were regrouped to work out the various effects that account for the inflation divergences. In this context, as noted earlier, the lack of publicly available price quote data for CPIs and WPI make it difficult to capture the formulae effect directly. However, given that WPI, CPI-IW and CPI-combined (2010=100 base) use arithmetic mean of the elementary price quotes for constructing an item index and fixed weight Laspeyres type index formula for compilation of higher level index, the formulae effects is in effect minimal and any formulae effect will be limited to the difference in computation of mean at the first stage in index construction. As noted in Section II, WPI and CPI-combined (2010=100) both use Carli index, i.e., average of ratio of price relatives, for arriving at elementary indices; whereas CPI-IW uses Dutot index, i.e. ratio of average prices. Unlike the WPI and other CPIs, which use arithmetic mean at the first stage of compilation, in case of CPI-combined (2012=100) the item level indices are constructed using geometric mean for averaging of price quotations (Jevons index). In this case, formulae effects could be significant. However, in absence of publicly available price quote data, the formulae effect cannot be directly captured when comparing WPI and CPI-combined (2012=100). The reconciliation exercise between CPIs and WPI can be refined, especially in case of CPI-combined (2012=100), with availability of price quotes data. III.3 Results Based on the methodology explained above, we work out the quantification of various effects that explain the divergence in inflation measured by the wholesale and retail prices indices. The rest of this section presents the finding from the analysis. III.3.1 WPI and CPI-IW To explain the divergence, first we start with the WPI inflation and then arrive at the CPI-IW inflation after adjusting WPI inflation for various effects. Chart 6 present the results of the reconciliation exercise between WPI and CPI-IW.  Table 4 presents the numerical quantification of various effects. These are further broken up into major groups of items that explain these effects. During the period January 2007 to December 2016 CPI-IW on an average was higher than WPI by 3.2 percentage points. Chart 6 indicates episodic movements in divergence; while in 2007 CPI-IW was higher than WPI, in 2008 it reversed. Thereafter, CPI-IW inflation was in excess of WPI inflation by around 10 percentage points by second half of 2009. In 2011 with sharp increase in wholesale prices, the WPI and CPI-IW inflation converged. During 2013, the divergence again started edging up, barring for a brief period in Q2 of 2014, it further increased to reach close to 10 percentage points by end of 2015. The divergence collapsed to zero by October 2016 and turned negative during November-December 2016 driven by sharp fall in domestic food prices and rising global non-food commodity prices. Given these volatile movements in divergence, the reconciliation analysis in terms of “effects” points to the following: Weight Effect: The weight effects, which were negative in value throughout the period of analysis, implied that for similar items15 in WPI and CPI-IW, which comprise largely of food items, weights in WPI were lower than those in CPI-IW. This fact was also noted in Section II. It implied that relatively higher weight for similar items in CPI-IW, after accounting for price effects, would result in a higher inflation in CPI-IW than in WPI for similar items. Though food items largely explain weight effect based divergence, the sharp increase in contribution of non-food manufactured products in 2011 was brought about by textiles among others. Weight effect can be seen to be a major factor in explaining inflation divergence. Price Effect: The price effect, the mirror image of weight effect, showed that the differences in inflation across similar items in WPI and CPI-IW (adjusted with WPI weights) were, on an average, largely negative. This can also be rephrased as – on an average, inflation among similar items, which are largely food items, was lower in WPI than in CPI-IW. In case of food items, these effects reflect that the markup in retail prices (as captured by CPI-IW) over the wholesale mandi16 prices (as captured by WPI) for food items changed differently with change in wholesale prices. The ‘clothing and footwear’ sub-group was also a significant source of price effects, reflecting significant and variable margin difference between wholesale and retail markets. The analysis shows that while on an average these effects have been small, during the periods of large divergence in inflation, price effects tend to become significant indicating that rate of change in margins is not constant and varies with the inflation cycles. For instance, in 2015 the margins between wholesale and retail prices rose considerably, primarily on account of food items, making the price effects large. Kumar and Sinha (2014) noted that retail market generally experiences higher price rise as trade and transport margins change at higher rate with price rise in wholesale market. Scope Effect: First, we try to explain the scope WPI and CPI-IW separately and then comment on their net impact. Scope WPI effect, which captures the contribution to WPI inflation from items that are included in WPI but not in CPI-IW, was a major, albeit volatile, component explaining divergence between WPI and CPI-IW inflation. These items in WPI consist mainly of non-food items, particularly basic or intermediate goods. Throughout most of the time period considered, WPI scope effects seem to correlate strongly with international non-food primary commodity price cycles. A recent example of that is 2015, where scope WPI items on an average witnessed deflation mirroring the collapse in international commodity prices. Scope WPI also includes some of the final finished goods that are part of WPI but are not included in CPI-IW, which is based on an older base year. The exclusion of ‘diesel’ in CPI-IW also explains for the high WPI scope effects for ‘Fuel and Light’ sub-group. Scope CPI-IW effects, coming from items exclusive to CPI-IW, on an average, was the other predominant effect explaining inflation divergence. Scope CPI-IW largely reflects the impact of CPI-IW housing inflation and showed a perceptible increase in 2009 and 2010 as the housing inflation increased due to increase in house rent allowance (HRA) paid for Government provided accommodation following the implementation of 6th pay commission award for Government employees. An increase in HRA leads to an increase in imputed rent for Government provided accommodation. Other services items, which are covered under the group ‘Miscellaneous’, which as a category are not covered under WPI, also form part of CPI-IW scope. Though individually, scope WPI and scope CPI-IW effects were observed to be large, on a net basis they largely cancelled out each other, with CPI-IW scope net of WPI scope, on an average, contributing only about 6 per cent of the observed higher inflation in CPI-IW over WPI. Furthermore, CPI-IW scope inflation, due to the presence of considerable non-tradable and services, is stickier of the two. In such a situation where usually the CPI-IW and WPI scope effects offset each other, weight effects alone contribute around 70 per cent of the observed divergence between CPI-IW and WPI. In instances of very high WPI scope inflation, induced by commodity price surges, WPI inflation can turn out to be higher than CPI-IW inflation, as was the case in 2008 and 2011. However, in 2015 – with WPI scope effects turning negative, WPI scope and CPI-IW scope effects reinforced each other and contributed to about 53 per cent of the observed divergence. III.3.2 WPI and CPI-combined This section attempts a reconciliation exercise between the all-India CPI-combined and WPI inflation. As in the earlier section, the reconciliation began with the WPI inflation and CPI-combined inflation was arrived after adjusting WPI inflation for the various effects. The reconciliation exercise for the period January 2012 to December 2016 was carried out using both the base years available for CPI-combined, i.e. CPI-combined (2010=100) for the period January 2012 to December 2014 and CPI-combined (2012=100) from January 2015 to December 2016. The results of the analysis are presented in Chart 7 and Table 5. Weight Effect: Comparison of items in CPI-combined and WPI showed that, on an average as in case of CPI-IW, for similar items17 CPI-combined has higher weight than WPI. This is coming largely from higher weight of food items in CPI-combined compared to WPI. In case of fuel group, weights in WPI were overall seen to be higher and to an extent dampened the impact of food items. This is on account of the substantially higher weight for diesel in WPI when compared to CPI-combined. Even so, overall, on account of food items, weight effect, on an average, added to the observed divergence in CPI-combined inflation from WPI. The relatively higher contribution of non-food manufactured products to the weight effect based inflation divergence in 2016, compared to other years, was on account of high price increases in gold, which has a higher weight in CPI-combined over WPI. Price Effect: The price effect, though small in magnitude, also added to the divergence of CPI-combined from WPI inflation. On an average, after adjusting with WPI weights, for similar items, inflation in CPI-combined was higher than that in WPI. As noted in case of CPI-IW and WPI, the analysis reveals that during the periods of large movements in inflation, price effects become significant indicating that rate of change in margins varies with the inflation cycles. In case of CPI-combined, price effects were observed to be prevalent across the major sub-groups. For food items, it is explained by higher change in retail margins over wholesale during high food inflation cycles. Price effects in clothing bedding and footwear sub-group also captures the higher retail prices and variable margins over wholesale prices. In case of fuel group also it is explained by large variations in prices for LPG, kerosene and electricity in CPI-combined and WPI. While wholesale prices of these items are ex-storage point prices (in case of LPG, these prices are before bottling) that do not include any taxes except excise, the retail prices are pump/ distributor prices that include all taxes and transport and dealers’ margins. The price effects in miscellaneous category is largely driven by household goods like soap, tooth-paste, hair-oil and shampoo as well by items such as gold ornaments among others. Weight and price effects together, on an average, contributed to around 54 per cent of the observed higher inflation in CPI-combined over WPI. Scope Effect: While scope CPI-combined more than offset scope WPI for the period 2012 to 2014, in 2015 and 2016 negative WPI scope reinforced CPI-combined scope effects (rather than offsetting it). For example in 2015, sharp negative scope WPI effects reinforced CPI-combined scope effects resulting in the contribution of net scope effects in explaining inflation divergence to jump to about 54 per cent from about 29 per cent in 2014. Overall, high CPI-combined scope effect was not just through housing inflation, but also due to the inclusion of a significant number of other services in CPI-combined that are non-tradable and whose inflation are highly sticky. Food items also contributed to CPI scope effect, particularly on account of ‘cooked meals & snacks’. The recent episode of sustained divergence in inflation between WPI and CPI have elicited strong debate on the state of the macro-economy and its implications for monetary policy, especially so since the latter part of 2014 when WPI experienced deflation and CPI inflation, notwithstanding disinflation, remained elevated. This led to contrasting call on monetary policy stance, with calls for monetary easing or tightening depending on which inflation one chose to follow. This paper presents details on the statistical properties of the price indices and analytically documents the episodes of divergence through an analysis of moments, underlying inflation trends and a statistical reconciliation of difference in inflation between CPIs and WPI. The analysis conducted for the period 2007 to 2016 showed distinct episodes of divergence between CPI and WPI inflation. Decomposing the episodic bursts of divergence into various ‘effects’, the analysis shows that some index characteristic or effects create a seemingly permanent wedge between CPI and WPI inflation. Composition of food items and to some extent fuel items are seen to be largely similar across CPIs and WPI. However, higher weight in CPIs for food items and their higher prices and variable trade and transport margins in the retail market compared to wholesale market, creates a permanent source of wedge in inflation between CPI and WPI. However, episodes of spectacular divergence in CPI and WPI inflation are often caused by divergent movements in inflation of dissimilar items or scope effects. Scope CPI vis-à-vis scope WPI is seen to be sticky on account of non-tradable services related items; services as a component is absent in WPI. Instead, basic and intermediate commodities and industrial products, which are not included in CPI, from a sizeable share of scope WPI. These are largely internationally traded goods, with domestic prices closely linked to global commodity price cycles and by nature are volatile. High inflation in global non-food commodity prices, especially in the run up to the 2008 crisis, and the continuous rise again after a short-lived post-crisis collapse, led to sharp persistent increase in inflation in scope WPI items. This was, on a net basis, often masked by the high and sticky inflation in CPI scope items – driven largely by non-tradable services including housing. Hence, in a period of rising commodity prices, these scope effects for WPI and CPI tend to more or less cancel out. However, whenever global commodity prices collapsed, as seen from the latter part of 2014 to the first half of 2016, scope WPI items registered persistent deflation, and ended up reinforcing scope CPI inflation. This, in addition to the ‘structural’ factors that would cause higher CPI inflation over WPI inflation – brought about by higher weight of food in consumption basket, dynamic margins in prices of retail over wholesale, and most importantly higher sticky inflation in non-tradables vis-à-vis tradables, resulted in CPI and WPI inflation to follow sharply divergent trajectories. Going forward, scope WPI inflation could again show sharp increases depending on the degree of increase in global non-food commodity prices. At the same time, the scope CPI (i.e. items exclusive to CPI) inflation could also see further increases or at best remain at current levels on account of the sticky nature of services inflation and also considering the impact of the implementation of the 7th pay commission award on housing inflation. Even if the divergence between CPI and WPI at an aggregate level, at a point in time, turns out to be zero, the analysis points out that this is more of an unstable “knife-edge” equilibrium rather than an enduring process brought about by congruence of underlying factors. These observations have large implications on the choice of appropriate index for monetary policy formulation. First, it reinforces the appropriateness of the adoption of CPI (the all-India CPI-combined) inflation as the nominal anchor for monetary policy formulation in India recently. The analysis brings out the inherent price stickiness in CPI scope items and its importance in explaining inflation divergence. Hence, along the lines of Aoki (2001), for monetary policy purposes, scope CPI-combined carries more information on the most persistent price components or underlying inflationary pressures and inflation expectations. Furthermore, given the growing evidence of persistence in food and fuel prices and its importance for understanding underlying inflation (Cashin et al., 2016), CPI offers a better way for capturing its transmission to non-food non-fuel categories, given the finding that food items and to a lesser extent fuel items exhibit considerable similarity between CPIs and WPI. @ The authors are Director and Assistant Adviser in the Monetary Policy Department of the Reserve Bank of India. The authors would like to acknowledge the officials at the Central Statistics Office, Ministry of Statistics and Programme Implementation for their valuable inputs on the work. ♣ An earlier version of this paper was presented at the UNESACAP Asia Pacific Statistics Week Seminar, May 2016. The authors also acknowledge the participants for their comments and feedback. The authors would like to express their sincere thanks to R Nagaraj, Gunjeet Kaur, Joice John and anonymous referees for valuable comments on the paper. The authors also express their gratitude for the comments received from the participants of the Department of Economic and Policy Research (DEPR) study circle presentation series. The views expressed in this paper and all errors, whether of omission or commission, are to be attributed to the authors only. All the usual disclaimers apply. 1 See Patra et. al. (2014) for a discussion on the debates surrounding the post-crisis inflation dynamics in India. 2 Consumer price index (CPI) refers to all-India CPI Combined (Rural + Urban). 3 The disinflation glide path set a target of 8 per cent inflation by January 2015, 6 per cent by January 2016 with the ultimate aim of stabilising inflation around 4 per cent with an error band of ± 2 percentage points. The monetary policy statement of April 2016 announced an intermediate target of 5 per cent by March 2017. 4 Quote by Dr. Arvind Subramanian, Chief Economic Adviser to Government of India in “Government flags deflation as new challenge for economy, hopes growth will be close to 8%”, Economic Times, September 3, 2015. Retrieved from http://articles.economictimes.indiatimes.com/2015-09-02/news/66144108_1_gdp-deflator-rbi-governor-raghuram-rajan-abheek-barua 5 “India seeks to solve inflation-deflation puzzle”, Financial Times, September 15, 2015. Retrieved from http://www.ft.com/intl/cms/s/0/6f1b3578-5b8f-11e5-a28b-50226830d644.html 6 “Economy Unplugged”, Dr. Prannoy Roy in conversation with Governor Raghuram G. Rajan and CEA Arvind Subramanian November 05, 2015 – Unedited Transcript – NDTV. Retrieved from /en/web/rbi/-/speeches-interview/economy-unplugged-981 7 CPI-IW covers seven sectors viz. (i) Factories, (ii) Mines, (iii) Plantations, (iv) Railways, (v) Public Motor Transport Undertakings, (vi) Electricity Generating and Distributing Establishments, and (vii) Ports and Docks. The last four sectors were added with effect from 1982. 8 NSS is conducted by the National Sample Survey Office (NSSO). 9 National Sample Survey Office (NSSO) conducts the Consumption Expenditure Survey. 10 The annual inflation rates denote the annual percentage change of the CPIs and WPI. 11 The fourth order moment around the mean – the kurtosis – provides a measure of peakedness or tailedness of a distribution. The normal distribution has a kurtosis of 3. A distribution with kurtosis more than 3 is called leptokurtic and has heavier tails and higher peak than the normal. Similarly kurtosis less than 3 gives a platykurtic distribution that is marked by light tails relative to normal, a flat centre and heavy shoulders. 12 KDF is an estimate of the probability density function of a variable based on a non-parametric approach. 13 The annual average inflation rate for 2014 based on CPI (2012 =100) back series provided by CSO. Based on CPI-combined (2010=100) the annual average inflation rate for 2014 was 7.2 per cent. 14 Silver Mick (2006), Core inflation measures and statistical issues in choosing them, IMF Working Paper WP/06/97, April 15 Items that are similar between WPI and CPI-IW constitute about 35 per cent of WPI basket and about 63 per cent of CPI-IW basket. 16 Wholesale mandis refer to wholesale markets 17 In the reconciliation exercise between CPI-combined (2010=100) and WPI, similar items accounted for about 44 per cent of WPI basket and about 61 per cent of CPI-combined (2010=100) basket. In case of CPI-combined (2012=100) and WPI, similar items constitute about 44 per cent of WPI basket and about 57 per cent of CPI-combined (2012=100) basket. References Aoki, K., (2001), “Optimal Monetary Policy Responses to Relative-price Changes,” Journal of Monetary Economics, Elsevier, vol. 48(1), pages 55-80, August. Assarsson, B., (2003), “Inflation and Higher Moments of Relative Price Changes”, BIS Papers, 19. Aucremanne, L. (2000), “The Use of Robust Estimators as Measures of Core Inflation”, National Bank of Belgium Working Paper - Research Series, No.2, March Ball, L. and N. G. Mankiw, (1995), “Relative-Price Changes as Aggregate Supply Shocks”, Quarterly Journal of Economics, Vol. 110:1, 161–93, February. Basu, K., (2011), “Understanding Inflation and Controlling it”, Economic and Political Weekly, Vol.46, No.41, Oct 8-14, 2011. 50-64. Cashin, P. and R. Anand. Ed. (2016), “Taming Indian Inflation”, International Monetary Fund, February. Central Statistical Office (2001), “Report of the National Statistical Commission”, September. Central Statistics Office (2011), “Consumer Price Index Numbers - Separately for Rural and Urban Areas and also Combined (Rural plus Urban)”, Ministry of Statistics and Programme Implementation, Government of India. Central Statistical Office (2014), “Report of the Technical Advisory Committee on Statistics of Prices and Cost of Living”, Prices & Cost of Living Unit, National Accounts Division. Darbha, G. and U. R., Patel, (2012), “Dynamics of Inflation ‘Herding’: Decoding India's Inflationary Process”, Global Economy and Development (Brookings), Working Paper 48. Dopke, J. and C. Pierdzioch, (2001), “Inflation and the Skewness of the Distribution of Relative Price Changes: Empirical Evidence for Germany”, Kiel Working Paper No. 1059, July. Fixler, D., and T. Jaditz, (2002), “An Examination of the Difference Between the CPI and the PCE Deflator”, Bureau of Labor Statistics Working Paper, No. 361, June. Government of India (2015) Agreement on Monetary Policy Framework between the Government of India and the Reserve Bank of India, February. Available at http://finmin.nic.in/reports/MPFAgreement28022015.pdf Government of India, 2016, Amendments to The Reserve Bank Of India Act, 1934, Chapter XII, Miscellaneous, Part I, The Finance Act 2016, pp. 82-87, May. Available at www.cbec.gov.in/htdocs-cbec/fin-act2016.pdf Heath A, ID Roberts and TJ Bulman (2004), ‘Inflation in Australia: Measurement and Modelling’, in C Kent and S Guttmann (eds), The future of inflation targeting, Proceedings of a Conference, Reserve Bank of Australia, Sydney, pp 167–207. Kumar A. and D.K. Sinha (2014), ‘Measuring Change in Trade and Transport Margins using WPI and CPI”, The Journal of Income & Wealth, Volume 36, Issue 2, pp. 153-158 Kumar A. and D.K. Sinha (2015), “Divergence between CPI and WPI”. Paper presented at the Conference of Indian Association of National Income and Wealth, November. Kearns, J., (1998), “The Distribution and Measurement of Inflation”, Research Discussion Paper 9810, Economic Analysis Department, Reserve Bank of Australia, September. Labour Bureau (2015a), “Consumer Price Index Numbers for Agricultural and Rural Labourers, Annual Report 2013-14” Ministry of Labour and Employment, Government of India. Labour Bureau (2015b), “Consumer Price Index Numbers for Industrial Workers, Annual Report 2014” Ministry of Labour and Employment, Government of India. McCully, C. P., Brian C. Moyer, and K. J. Stewart, (2007), “A Reconciliation Between the Consumer Price Index and the Personal Consumption Expenditures Price Index”, Survey of Current Business, Volume 87(11), Bureau of Economic Analysis, November. Miller, R., (2011), “The Long-Run Difference Between RPI and CPI Inflation”, Office for Budget Responsibility, Working Paper No. 2, November. Office of the Economic Adviser (2010), “Revision of Index Numbers of Wholesale Prices in India with base: 2004-05=100- Methodology, Basket and Weights”, Ministry of Commerce and Industry, Department of Industrial Policy and Promotion, Government of India. Patra, M. D., Khundrakpam, J. and A. T. George, (2014), “Post-Global Crisis Inflation Dynamics in India: What has Changed?”, in Shekhar Shah, Barry Bosworth and Arvind Panagariya eds. India Policy Forum 2013-14, Volume 10, Sage Publications, July. Reserve Bank of India (2014), Report of the Expert Committee to Revise and Strengthen the Monetary Policy Framework, January. Roger, S., (2000), “Relative Prices, Inflation and Core Inflation”, IMF Working Paper, WPI/00/58, March. Silver, M. (2006), “Core Inflation Measures and Statistical Issues in Choosing Them”, IMF Working Paper WP/06/97, April. United Nations (2009), “Practical Guide to Producing Consumer Price Index”, New York and Geneva. Verma A., (2016), “Formula Does Matter - Finding the Right Prices”, Economic & Political Weekly, Vol. LI No. 16, April 16. Annex 1

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

ಪೇಜ್ ಕೊನೆಯದಾಗಿ ಅಪ್ಡೇಟ್ ಆದ ದಿನಾಂಕ: