IST,

IST,

India Productivity Report

by

Profiles of Authors K L Krishna, a Founder Member of CDE (Centre for Development Economics), at the Delhi School of Economics, has been the Principal Investigator of the RBI-funded India KLEMS Productivity Project since 2009. With post-graduate qualifications in Statistics from the University of Kerala, and the Indian Statistical Institute, Kolkata, and Ph.D. degree in Economics from the University of Chicago, he taught Econometrics and Industrial Economics for four decades and supervised around 45 Ph.D. and M.Phil. theses in a variety of fields. He served as Head of the Department of economics. and Director, Delhi School of Economics in the 1980s and 1990s. He was the Founder Managing Editor of the Journal of Quantitative Economics for one decade, and President of the Indian Econometric Society (TIES) for one term. He is a member of the TIES Trust. He was the Chairman or member of several official Committees of the Government of India. He held the position of Chairman of CESS, Hyderabad, during 2007-13, and MIDS, Chennai during 2013-20. Bishwanath Goldar is a Retired Professor of Economics of the Institute of Economic Growth, Delhi. He has an M.A. in Economics and Ph.D. from Delhi School of Economics, University of Delhi. He has been at the Institute of Economic Growth from 1979 to 2014, except for three brief stints at a professorial or equivalent position at the National Institute of Public Finance and Policy (1988-90), the Indian Council for Research on International Economic Relations (2003-04), and the Jawaharlal Nehru University (2012-13). During 2015-2016 he was a National Fellow of the Indian Council of Social Science Research, affiliated with the Institute of Economic Growth. He is a former member of the National Statistical Commission and is currently a member of the Standing Committee on Economic Statistics, constituted by the Ministry of Statistics and Programme Implementation, Government of India. His area of specialization is industrial economics and international trade. The bulk of his research has been on productivity and employment in Indian Industries, wage share in value added, and price-cost margin in Indian manufacturing, export performance of Industrial firms, effective protection of Indian industries, impact of trade reforms on the performance of industrial firms, and foreign direct investment in India. He has also undertaken studies on rural water supply in India and Bangladesh, water supply in Delhi, pollution of river water and river water quality in India, and the environmental aspects of Indian industries including studies on energy efficiency in Indian industrial firms and the impact of environmental performance of industrial firms on their stock prices. Deb Kusum Das, Professor at the Department of Economics, Ramjas College. He has a PhD from the Delhi School of Economics and received the EXIM Bank IEDRA Award 2004 for his doctoral dissertation, “Some Aspects of Productivity and Trade in Indian Industry”. He is also associated with ICRIER as an external researcher and researched on important issues related to Indian economy: jobs, labour intensive manufacturing, India’s global competitiveness. His research interests are empirical international trade, labour markets and productivity growth of the Indian economy. He is the co-founder of a network for South Asian undergraduate students of Economics (SAESM). Suresh Chand Aggarwal is currently the Senior Fellow, ICSSR at Department of Business Economics. Earlier retired as Head and Professor from the Department of Business Economics (now known as Department of Finance and Business Economics), University of Delhi. He has guided a number of students for their Ph.D. and M.Phil. thesis. He does research in Labour Economics, Econometrics and Development Economics and has published a number of papers in the related areas in national and international Journals. He has been associated as a Lead researcher on Labour in the India KLEMS project from its beginning and participated in numerous national and international conferences and has contributed to a number of papers under the KLEMS project. He has earlier done projects and consultancies for many organizations, e.g., ILO, World bank, UGC, ICRIER, etc. His current projects are RBI funded 'INDIA KLEMS' Project, and ICSSR funded ‘Inclusive Growth Project’. Abdul Erumban teaches and researches at the University of Groningen (RuG), Groningen, The Netherlands. He is also a senior research fellow at the Conference Board (TCB) and an academic member of the Productivity Institute at the Alliance Manchester Business School. During 2013-2019, he worked as a senior economist at TCB, leading their research on global productivity, global economic outlook, and emerging markets. He has an M.A. in Development Economics from John Matthai Centre, University of Calicut, an M.Phil in Applied Economics from the Centre for Development Studies, and a Ph.D. in Economics from the University of Groningen. His research centers on productivity, technological change, structural change, digital transformation and its impact, globalization, global value chain, and international comparisons of economic development. He maintains a particular interest in economic issues in emerging markets, particularly India, China, and the Middle East economies. Being an active participant in the KLEMS research initiatives aimed to understand productivity dynamics in the world's major economies, he sustains a good relationship with international networks on productivity research. He is an advisor to the Asia KLEMS, which aims to understand productivity dynamics in Asian economies, and a lead researcher on capital in the Reserve Bank of India's India KLEMS project, seeking to understand productivity and competitiveness in Indian industries. He has also actively participated in European Commission's World Input-Output Database project at the University of Groningen. His principal publications are in the Journal of Economic Perspectives, Review of Income and Wealth, Journal of Comparative Economics, Industrial and Corporate Change, and Structural Change and Economic Dynamics. Pilu Chandra Das is an Assistant Professor in the department of economics at Kidderpore College, University of Calcutta. He has an M.A. in economics and M.Phil. from Delhi School of Economics, University of Delhi. His M.Phil. thesis was on “Total Factor Productivity in Indian Organised Manufacturing: the story of the Noughties”, dealing with productivity in Indian registered manufacturing sector. He has been associated with the India KLEMS project since 2012. His research interest is mostly in productivity and has been a co-author of several papers prepared under the India KLEMS project. He has several published papers. Earlier, he was associated with ICRIER as a research assistant in a project named ‘Estimating Domestic Value Added and Foreign Content in India’s Exports’ sponsored by the Department of Economic Affairs, Ministry of Finance, Government of India. He was also associated with National University of Singapore in constructing the variables for the Singapore KLEMS data set. The innovative work of the India KLEMS team has resulted in the groundbreaking India Productivity Report, which is a comprehensive report primarily using the India KLEMS database to examine various aspects of productivity dynamics in Indian industries. The India KLEMS project, which follows the standards of World KLEMS and EU KLEMS, provides a database on capital, labour, and intermediate inputs along with total factor productivity, thus facilitating a comparison of India's productivity dynamics with other global players. It is an important step in analyzing the role of factor accumulation, productivity, and structural change in the Indian economy. The India KLEMS project came to fruition in 2009 with Prof. KL Krishna as chairperson. I have known Krishna since he received his PhD from the University of Chicago in 1967, after completing his dissertation on productivity and then returning to DSE at the University of Delhi. Krishna has been the ideal lead on this project. From the inception of the project, Prof. Bishwanath Goldar served as advisor and the late Deb Kusum Das served as the coordinator. Prof. Suresh Chand Aggarwal and Dr. Abdul Azeez Erumban were among the original project team. Most-recently, Pilu Chandra Das joined the team in 2015. They, along with numerous collaborators, have made an outstanding contribution with the publication of the India Productivity Report. The Report was more than a decade-long endeavor, during which time numerous articles have been published in international journals by the team. The India KLEMS team has attended and presented at all World KLEMS conferences, starting in 2010, and all Asia KLEMS meetings starting in 2011. The India team will host the next Asia KLEMS meeting in 2022. As in many other Asian economies, overcoming the legacies of past policies has been a major challenge for India. India had adopted the path of an inward-oriented closed economy policy atmosphere since it embarked on its path of planned industrialization in the mid-1950s. Since the mid-1980s, there has been some rethinking in the policy circles. Liberalization of the Indian economy to private and foreign investors began in 1988, which led to a foreign exchange crisis and IMF program in 1991. Manmohan Singh was appointed Finance Minister in July 1991, during which time India undertook bold steps to reform the economy. This changed the economic development path in the country, eventually giving India a more prominent and visible presence in the global economy. The pro-market policy changes have altered the business climate for the private and external sectors, making the importance of productivity growth more significant in the Indian context. While many researchers have explored the productivity dynamics in India, their work was confined mostly to the formal manufacturing sector, which had relatively better data. The constraints on data for inputs and output at the detailed industry level made it difficult to produce a fair analysis of factor inputs and productivity in other sectors of the economy. A country’s economic policies and investment climate are key components of factor accumulation and productivity, which drive economic growth. Therefore, understanding sources of economic growth is paramount to researchers and policymakers. In today’s market-oriented economy, productivity growth is as important to fostering economic growth in India as it is in raising the living standards of millions of people in the world's second most populated country. Moreover, analysis of changes in factor inputs and productivity at the industry level is essential in identifying India's growth path to facilitate a pro-growth structural transformation. Evidence suggests consistent decline in poverty over the years in India. However, as home to the world's young population, India has vast human capital potential, if tapped properly. Additionally, market opportunities for investors, along with its resources, provide the potential to improve India's living standards. Productivity plays a key role in this process by improving production efficiency and helping generate surplus for additional consumption and investment. Overcoming productivity growth challenges requires a better understanding of the underlying features of productivity of specific industries. Since the 1990s, intensified global integration as well as global fragmented production chains have resulted in drastic changes in the global economy. This has created opportunities for many developing economies, including India, to participate in segments of the global value chain, where they have a comparative advantage, and further climb up the quality ladder. Increased productivity would help better position India in the global value chain and fend off the intense competition from imports which displaces domestic producers. It is this perspective that gives the India KLEMS project and the India Productivity Report added significance. The Report also documents the changes in the employment structure of the economy, which features a fall in agriculture – as one would expect – but stagnant manufacturing. The Report has noted the recent fall in manufacturing jobs in India and the failure of the sector to absorb workers who leave the primary sector. While overall employment growth has been relatively weak, there has been a shift in the structure towards service sector jobs. Along with the need to create manufacturing jobs, the Report analyzes energy intensity to reveal the need for policy implementation that encourages energy conservation in the manufacturing sector. Policy adjustments are also recommended to enhance India's human capital. While improvements are being made, the pace must accelerate given the size of the population and labour force. Meanwhile, the agricultural sector remains the largest job-providing broad sector in India although its relative importance in job creation is declining. By developing future extensions of the KLEMS data, researchers may gain an understanding of dynamics within the sector by considering sub-sectors within the agricultural sector. Undoubtedly, the India KLEMS database and the productivity report demonstrate substantial improvements in the data and analysis of the Indian economy. The continued work on the data will lend itself to fewer assumptions. Currently, in addition to several comparability issues across various employment surveys, the researchers needed to make assumptions to fill in the gaps between survey years, as there are no comprehensive official time-series estimates available. With the liberalization of the economy in the 1990s the country became attractive to domestic and foreign investors, but hurdles still exist, namely stimulating investments in the formal sectors such as the much-important manufacturing sector. According to the Report the investment to GDP ratio in India has recently fallen. The need for reforming the labour market, improving infrastructure – both physical and human – and investment climate, are essential to stimulate investment and productivity. Although India is an excellent exporter of IT professionals and services, previous research by the India KLEMS team indicated a tremendous untapped potential in many sectors of the economy from the use of ICT, through investing in IT equipment, software, and communication. Taking into consideration various policy reforms, the trends in productivity demonstrate that productivity benefits from outward-oriented policies rather than inward-oriented ones. The India Productivity Report, as well as the India KLEMS data, have a profound impact not just on India, but on the global economy. The Report does a phenomenal job of unveiling productivity dynamics in India, which creates a clearer understanding of the growth process in the country. The India KLEMS data is a crucial tool for researchers to more intensely study and understand various aspects of India's economic growth in the coming years. Moreover, the database can serve as an invaluable resource for policymakers. Globally, the KLEMS research has advanced further to incorporate the roles of ICT and intangibles in the growth process. As the KLEMS research continues, focusing on the participation of several industries in the global value chain and the potential for specializing in specific tasks and sectors will impact India research. I look forward to the policies and research that will result from this report, as well as further development of the data. This research was made possible by the generous support of the Reserve Bank of India. For almost 13 years, RBI has funded the work on India KLEMS at the Indian Council for Research on International Economic Relations, and the Centre for Development Economics at the Delhi School of Economics. This level of support has been instrumental in building India KLEMS and the data that through continued policy and research will impact the global economy. In closing, I would like to offer my profound appreciation for the work of the late Deb Kusum Das. His role leading the India KLEMS initiative was key in bringing this publication to fruition. His focus on quantifying trade barriers in India and the impact of the economic liberalization helped drive the research of the entire group. Applause to the India KLEMS team and sincere gratitude to D.K.D. At the time of his passing, he was serving as the President of Asia KLEMS, where his passion for his work was impactful. I, along with his many friends and colleagues, will be forever grateful for his contribution to the economic community. Dale W. Jorgenson University Research Professor, Harvard University This report, titled “India Productivity Report” is based on research work carried out under the India KLEMS project at the Centre for Development Economics (CDE), Delhi School of Economics (DSE) in collaboration with the Reserve Bank of India (RBI). We, the team members of the research project, prepare this preface and acknowledgements to the report with a deep sense of grief because of the sudden and untimely passing away of Prof. Deb Kusum Das on the Christmas eve of 2021. Prof. Das has been a prominent member of the research team. He is the person who brought us into the research team. This report marking the culmination of the research project has been his dream undertaking. He played a pivotal role in the endeavour to prepare this report, from conceptualizing the content of different chapters at the early stage, to ensuring that the chapters get written in time, to getting the chapters copy edited as the work progressed, and even to attending to nitty-gritties such as the colours of lines and bars in the graphs placed in different chapters as the work had come almost to an end. The team members gratefully acknowledge the amount of work Prof Deb Kusum Das had done for the preparation of the report till the cruel hands of destiny took him away, and they have now collectively taken over the responsibility to ensure that the report be of high quality, as envisioned by Prof. Deb Kusum Das. As said earlier, the India KLEMS research project is housed at the Centre for Development Economics (CDE), Delhi School of Economics (DSE). The research project has been there from 2014. Prof. K.L. Krishna led the research project. Prof. Bishwanath Goldar acted as research advisor. Other senior members of the team that carried out research work under the India KLEMS project are Prof. Deb Kusum Das who acted as the project coordinator, Prof. Suresh Chand Aggarwal, Dr Abdul Azeez Erumban, and Shri Pilu Chandra Das. Dr Erumban is at the Groningen Growth and Development Centre, University of Groningen, the Netherlands. The research team is thankful to the Groningen Growth and Development Centre, University of Groningen for the research time Dr Erumban has devoted to the project. The project team has received ample guidance from a Research Advisory Committee whose members include the leading international experts on measurement of productivity, the most prominent of them being Prof. Dale Jorgenson of Harvard University, Cambridge MA, USA. Other experts in the advisory committee who provided direction to the research done in the project include Prof. Marcel Timmer, Prof. Bart van Ark, and Prof. Mary O’Mahony. The team will fail in its duty if it does not place on record the encouragement that they have received from the international KLEMS research community. Special thanks are due to Prof. Hak Kil Pyo, Prof. Kyoji Fukao and Prof. Harry Wu for the interaction that the team members had with them in connection with Asia KLEMS, particularly in attending meetings and conferences of Asia KLEMS. Prof Wu has been very kind to the India KLEMS research team. He has provided data and has actively participated in the studies undertaken on India-China productivity comparison. The India KLEMS research team is grateful to Prof Wu for immense helpfulness and intellectual engagement. The India KLEMS project first started at Indian Council for Research on International Economic Relations (ICRIER) in 2009, where the foundations of the subsequent research work was laid. Prior to that, a feasibility report for construction of data series on output and inputs of different sectors of Indian economy and carrying out research based on those data, similar in spirit and design to EU-KLEMS, was prepared by Prof. K.L. Krishna, Prof. Arup Mitra and Prof. Bishwanath Goldar. The feasibility report provided the basis for the development of a research proposal which was submitted to the RBI. This met with a positive response and the RBI very kindly funded the project from its inception. The first phase of the research project continued in ICRIER till 2013. Later in 2014, the new phase of the project began at CDE, DSE. The National Statistical Office (NSO) had provided a great deal of support in the form of data and technical advice when the project was at ICRIER, and they have provided such valuable support and advice also later when the new phase of the project began and continued at CDE, DSE. A series of consultation workshops were held at ICRIER in the initial phase of the research project. This was done for developing the methodologies for the measurement of inputs, output and productivity, and further refinements were made in the meetings and annual workshops held at CDE, DSE. A large number of scholars and experts, and persons with substantial knowledge of the data particularly India’s national accounts have contributed majorly in the ten odd years’ journey of the project. It is difficult to name all of them. To take a few names out of the long list, the research team members gratefully acknowledge that they have immensely benefited in the course of last 14 years of work on the project from the intellectual inputs received from Prof. T.N. Srinivasan, Prof. Isher Judge Ahluwalia, Prof. K. Sundaram, Dr Pronab Sen, Prof. T.C.A. Anant, Prof. T.S. Papola, Prof. Ashok Gulati, Prof. Simrit Kaur, Prof. Surender Kumar, Prof. Ravindra Dholakia, Prof. Pushpa Trivedi, Mr Ramesh Kolli, Mr. G. Raveendran, Mr. Bimal Giri, Mr Nilachal Ray, Dr G.C. Manna and Shri Ashish Kumar. The National Accounts Division of the National Statistical Office (NSO) has provided a great deal of support to the research project both when it was at ICRIER and when it got relocated at CDE, DSE. The support has been in the form of data and technical advice. Indeed, some unpublished data on the asset composition of investment in different industries for different years has been a major, invaluable help in the preparation of capital input series. For this support regarding capital series and in general about output and input series, the research team thanks Mr S.V. Ramanamurthy, Mr P.C. Mohanan, Mr. P.C. Nirala, Ms. T. Rajeshawari, and Ms. Anindita Sinharoy. Mr Ramanamurthy has been attending the coordination committee meetings and advisory committee meetings and has contributed to the project through his advice. Interaction with officers of RBI has been of immense benefit to the research project. In the presentations made at the Mumbai Office of RBI in 2011 and 2012, considerable insights were obtained from the comments and suggestions received from Late Dr Subir Gokarn (Deputy Governor, RBI) and Shri Deepak Mohanty (Executive Director, RBI). Subsequently, in July 2018, the research team got an opportunity to make a presentation of their research findings at a workshop at the Mumbai Office of the RBI. Dr Viral Acharya (Deputy Governor, RBI) gave the introductory observations and chaired one of the sessions of the workshop, and Dr Amartya Lahiri contributed to the workshop with his comments and suggestions. The comments and suggestion received at the workshop were a great help to the research. The team wishes to thank particularly Prof. T.C.A. Anant, Prof. Pami Dua, Prof. Chetan Ghate, Prof. K. Narayanan, and Prof. Pushpa Trivedi. In the course of that workshop, several RBI officers made presentations based on their research, which provided useful intellectual inputs for the research undertaken by the India KLEMS team. Over the last seven years, since the second phase of the project started at CDE, DSE from 2014, the India KLEMS research team had the benefit of interacting with RBI officials in the co-ordination committee meetings, advisory committee meetings, and at the annual workshops where the research undertaken during the year was presented. There is a long list of RBI officers to whom the India KLEMS team is indebted for intellectual inputs and ideas that they have provided in such meetings. The presentations made by RBI officers at the annual workshops held under the research project have been a matter of great encouragement to the India KLEMS research team. The research team wishes particularly to thank Dr. Rajeev Ranjan, Ms. Balbir Kaur, Ms. Rekha Mishra, Dr. Jai Chander, and Mr. S.V. Arunachalam for the support, encouragement and constructive suggestions in the coordination meetings and advisory committee meetings. Other RBI officers that the India KLEMS research teams wish to thank sincerely include Shri B. M. Misra, Dr Satyananda Sahoo, Ms. Rigzen Yangdol and Mr Avdhesh Kumar Shukla. The Indian KLEMS research team thanks the RBI officers who made presentations of their research at the annual workshops of the KLEMS project held at DSE. To name some of them, these include Shri Sarthak Gulati, Shri Utsav Saksena, Shri Avdhesh Shukla, Ms. V. Dhanya, Mr. Sonna Thangzason, Ms. Sonam Choudhury, Shri Rajib Das, Shri Siddhartha Nath, Dr. Harendra Behra and Shri Saurabh Sharma. In addition, for chairing the sessions of the annual workshops, the India KLEMS team would like to thank Dr M.D. Patra and Dr Rajeev Ranjan. In the course of last two years, the India KLEMS research team has been interacting with several senior officers of RBI, Dr M. D. Patra, Dr Sitikantha Pattanaik, Dr D. P. Rath, and Dr Rajiv Ranjan for the coordination of the project. The team is sincerely thankful to them. The team would like to thank Mr. Avdhesh Kumar Shukla for the interactions it had with him in the course of meetings and annual workshops. During 2021, training programs for RBI officers were held for the purpose of skill transfer, so that after 2021, the project could be housed at the RBI, implemented by the RBI officers. The India KLEMS research team greatly appreciates the efforts made towards learning and interest shown in the training programs by Dr Sadhan Chattopadhyay, Shri Siddhartha Nath, and Dr Sreerupa Sengupta. The annual workshops under the KLEMS project gave an opportunity to interact with other researchers working in the area of productivity in India. For making presentations at the workshops and for participation in the discussions, thanks are due to Prof. Dibyendu Maiti, Dr Jagganath Mallick, Ms. Niti Khandelwal, and Ms Rupika Khanna. The India KLEMS research team is grateful to Dr Rakesh Mohan who was the Director of ICRIER when the research proposal and the request for grant was given to the RBI. For providing ample encouragement and for helping in administrative matters, thanks are due to the successive Directors of ICRIER during 2009-2013 when the research project was housed at ICRIER, Dr Rajeev Kumar, Dr Parthasarathi Shome, and Dr Rajat Kathuria, and to the successive Executive Directors of CDE, Prof. Sunil Kanwar Prof J.V. Meenakshi, , Prof. Rohini Somanathan, Prof. Shreekant Gupta, Prof. Aditya Bhattacharjea, and Prof. Dibyendu Maiti in the course of last eight years when the project was housed at CDE. The ICRIER staff and CDE staff have been always helpful in the implementation of the research project, for which the research team wish to record their appreciation and thanks. Among the ICRIER staff, the KLEMS research team are especially thankful to Shri Manmeet Ahuja and Mr Krishan Kumar, who along with their team members provided considerable help in organizing workshops, co-ordination committee meetings, and other meetings connected with research work. The research team particularly wants to thank Mr Surjit Singh, Manager of CDE during the first five years of the project at CDE, 2014 to 2018, and Ms Deepika Garg, who has been the Manager of CDE since 2019. The research team wishes to thank Shri Rajesh Papnai who maintains accounts, the ICT personnel over the years, Mr. Sanjeev Sharma, Ms. Mandeep Kaur, Mr. Raju Chauhan, Mr. Sonveer Vats and Mr. Rohit Kohli, for the ICT related support they have provided, and other subordinate staff, Mr. Mritunjay Bisht and Mr. Ashok Kumar for making arrangements in connection with meetings and workshops. The research work under the India KLEMS project involved a massive amount of work for data collection and processing. This would not have been possible without the support received from other members of the research team, which is gratefully acknowledged. In the course of the initial four years of the project at ICRIER valuable research work has been done and support provided by Ms Kuehlika De, Ms Shreerupa Sengupta, Mr. Gunajit Kalita, Ms Deepika Wadhwa, Mr Jaggannath Mallick, Mr Pilu Chandra Das, Mr Subhojit Bhattacharjya, and Mr Parth Goyal. In the course of last seven years so, from 2014 to 2021, support for research in the India KLEMS project has been provided by Ms. Sanghita Mondal, Mr Vinay Sharma, Mr. Maajid Mehaboob Chakkarathodi, Mr. Anuj Goyal, Ms. Mehak Gupta, Ms. Prachi Madan, Mr Sk Md Azharuddin, Ms. Suchetna Pahwa and Mr. Samiran Dutta. The research team members do not words enough to thank these persons for the role they have played through their hard work and dedication for the successful completion of the India KLEMS research project. We wish to place on record our great appreciation of the review of the Report done by Prof. Hak K. Pyo, Professor Emeritus, Faculty of Economics, Seoul National University, Prof. H. Chun and Dr. K.H. Rhee, members of the Korea KLEMS team, and Prof. Minh Khuong Vu of Lee Kuan Yew School of Public Policy, National University of Singapore. We have immensely benefited from their comments and suggestions. A presentation on the Report was made at a Webinar organized by the RBI in July 2022. Valuable comments and suggestion were received from the RBI officers who were discussants at the Webinar. Detailed, excellent comments were received subsequently from the National Accounts Analysis Division of the Department of Economic and Policy Research, RBI. We express our gratitude to the RBI officers for the comments and suggestions that they have given which has helped us improve the Report. Finally, the research team wishes to place on record their appreciation of the work done by Ms Poonam Madan for copy editing the manuscript prepared by members of the research team. K.L. Krishna Chapter 1: Introduction to India KLEMS Approach Economic growth and productivity at the global and country level is of major interest to researchers and policymakers, even more during global shocks and slowdowns, where the focus of economic policy becomes to rejuvenate “growth.” This gives productivity a prime place in academic research directed at understanding why some countries are able to do much better than other similarly placed countries in terms of the rate of economic growth and raising the standards of living. Going from the general to the specific, for India, a major emerging economy, productivity is the key force or driving engine for rapidly fostering the development and growth process.1 India has substantial economic potentials thanks to its enormous human and natural resources. Yet, the country is unable to lift in a short period the living standards of her vast population to sufficiently high levels owing to constraints of various kinds. A swift, substantial augmentation of productivity would enable India’s goods and services production units to penetrate in a much bigger way into the global export markets. Productivity improvements will help the country get better integrated into the global value chains and fend off the strong competition from imports that tends to displace domestic producers. It is also important for making small and medium firms more competitive, especially in the manufacturing sector, and for enhancing value addition in various economic activities securing higher profits, which would encourage further investments and higher remuneration for the worker. All of these will help make the size of the economy increasingly bigger and the Indian people progressively more prosperous. An understanding of India’s achievements regarding productivity advances, how productivity advances have contributed to economic growth, and the forces underlying the trends in productivity is obviously important both from an academic and policy point of view. While productivity can be measured using multiple approaches (Box 1), the discussion here is focused on introducing the KLEMS-based approach to productivity measurement in the Indian economy. The KLEMS approach takes into account the roles played by capital, labour, energy, materials and services as inputs in output growth. The evolution of the India KLEMS research effort is aimed at building quality as well as detailed disaggregated data for analyzing growth and productivity at the industry level in the context of the World KLEMS initiative, which aims at construction of comparable datasets for cross-country as well as country-specific detailed productivity analysis. A review of global literature on productivity research throws up some very significant studies indicating the importance of analysing the contribution of productivity to economic growth. Indeed, the research focussed on productivity as a source of growth makes an important contribution to the literature on economic growth. Box 1: Different Measures of Productivity

This report, titled India Productivity Report (IPR) provides the detailed analysis required to understand India’s performance since the 1980s, both at the economy-wide and disaggregated industry levels. The report is based on the India KLEMS database, version 2019, which includes important inputs as variables, such as capital (K), labour (L), energy (E) material (M) and services (S), at the industry level to construct estimates of labour and total factor productivity (TFP) across a set of 27 industries from seven broad sectors (Annexure 1A mentions the full list) using the growth accounting technique for productivity measurement and analysis (Box 2 outlines some measurement issues). This report devotes separate chapters to various aspects of the analysis undertaken, covering themes that have remained in focus and new themes added over the years, since the India KLEMS productivity study was launched in 2009. The report covers the analytical framework and detailed methodology as well as substantive empirical results for 27 industries, broad sectors and the overall economy. Alternative measures of output, including gross value of output and gross value added have been distinguished in the presentation of the results. The data sources and construction of variables are discussed in detail in the next chapter (Major point given in Annexure 1B). The period of study is from is from 1980-81(written alternatively as 1980) to 2017-18 (written as 2017) and includes periods of high growth (2003-07) as well as global slowdown (2008-17)2. Box 2: Evolving treatment of productivity in the global context

1.2 Evolution of India KLEMS Research The India KLEMS (Capital, Labour, Energy, Materials and Services, as inputs) research on growth and productivity in the Indian economy began in 2009 at ICRIER (Indian Council for Research on International Economic Relations), a leading think-tank in Delhi, at the instance of Prof. Dale Jorgenson of Harvard University. Prof. Jorgenson, a pioneer in KLEMS research worldwide, was on a visit to India in 2007 when he suggested to late Dr. Isher Judge Ahluwalia, chairperson of ICRIER, to undertake productivity research on the lines of EU-KLEMS which had been set up in 2003 for growth and productivity research at disaggregated levels in the advanced economies, comparing the European Union, the United States and Japan. ICRIER set up a working group in 2007 consisting of Prof. K. L. Krishna, Prof. Arup Mitra and Prof. B. Goldar to prepare a feasibility report which provided a basis or foundation to develop a detailed research proposal on the lines of EU KLEMS.3 Stage 1 ICRIER accepted the working group’s report, and a request was made to RBI (Reserve Bank India) for a research grant. After due consideration, RBI consented to support the project financially, subject to appropriate terms and conditions. An advisory committee was formed with Prof K. L. Krishna as chairperson and nominees from RBI and CSO (Central Statistics Office), ICRIER external experts, Prof. Jorgenson, Prof. Bart van Ark, Prof. Marcel Timmer, and Prof. Mary O’Mahony of EU KLEMS to monitor and give advice for the research. The project was launched in 2009, with Prof Bishwanath Goldar as advisor and Dr. Deb Kusum Das as the coordinator. Prof. Suresh Chand Aggarwal and Dr. Abdul Azeez Erumban were the key members of the research team right from the beginning. The other members of the research team in the initial years were Ms Deepika Wadhwa, Mr. Gunajit Kalita, Mr. Jaggananath Mallick. Mr. Suvojit Bhattacharjya and Mr. Parth Goyal, and subsequent new members of the team were Ms Kuhelika De, Ms Sreerupa Sengupta, and Mr. Pilu Chandra Das. It is because of the excellent research support and high dedication to work of these members of the team that the India KLEMS project could make laudable progress. The first major task in the India KLEMS project was to construct time series data on gross output, GVA (Gross Value added) and five inputs, K (capital), L (labour), E (energy), M (materials), and S (Services) and factor income shares from 1980-81 (1980) onwards for 26 disaggregate industries comprising the Indian economy (number of industries later enhanced to 27). The data sets had to be consistent with the National Accounts Statistics (NAS) and other official economic statistics of the Indian government. The 26-industry classification was adopted from EU (European Union) KLEMS project for the sake of facilitating international comparisons (see Annexure Table A.1.1). The data sets of the Indian KLEMS project covering a period of 29 years, from 1980-81 (1980) to 2008-09 (2008) were used to prepare a comprehensive report, ‘Estimates of Productivity growth for Indian Economy’ and submitted to RBI in 2013. RBI published these on its website in July 2014. Stage 2 Since January 2015, the India KLEMS Project has been housed at the Centre for Development Economics (CDE), Delhi School of Economics, with continued financial support from RBI and the same team of researchers with Prof. K.L Krishna as the Principal Investigator and Chairman of the advisory committee. Prof. Bishwanath Goldar has continued as advisor and Dr. Deb Kusum Das as co-ordinator. Prof. Suresh Chand Aggarwal has continued to specialise in labour input data, and Dr. Abdul Azeez Erumban in Capital input data. Mr. Pilu Chandra Das has assisted the team on construction of annual time series on Output, Gross Output (GO), and Gross Value Added (GVA), and the five inputs, K, L, E, M and S, and factor income shares. Every year since then, the updated data set and the data manual have been submitted to RBI, as part of the deliverables. In addition, analytical papers using the latest data set have been prepared in accordance with the terms of the grant for the year. Members of the research team have made extensive use of the India KLEMS data sets to prepare research papers and present them at various national and international conferences (See Annexure 1C). Of special significance to the world KLEMS initiative are two papers4 comparing productivity performance in India and China that were undertaken in collaboration with researchers from China. With effect from 2022, RBI takes over the India KLEMS project. The India Productivity Report (IPR) covering the period 1980-2017 has been under preparation by the research team for the past two years to be submitted to RBI. 1.3 Global Productivity Research The advent of research on productivity dates to the works of Solow (1957) and Jorgenson and Griliches (1967). Since the World KLEMS research platform was initiated in 2010, there has been a continuous flow of research on sources of growth and productivity, with a primary focus on disaggregated sectors, incorporating the notion of a production function at the industry level. Following the success of the EU KLEMS project, Prof. Dale Jorgenson, Prof. Marcel Timmer and Prof. Bart Van Ark established the World KLEMS Initiative in 2010 at the first World KLEMS conference held at Harvard University. This is a platform of more than 40 countries, encompassing Europe, United States, Asia and Latin America. Two major regional platforms were also developed. The Chile-based Economic Commission for Latin American and the Caribbean (ECLAC), which is an agency of the United Nations, established the Latin American regional organization, LA KLEMS in 2009. The Asia KLEMS network was set up in 2010, comprising Japan, South Korea and Taiwan alongside China and India. These networks have organized several world and regional conference and meetings5 and the next Asia KLEMS conference is due to be held in India in 2022. The core of these regional networks has been to construct country specific KLEMS datasets. These conferences showcase research outputs in measurement and analysis of multifactor productivity with due attention to both country studies and cross-country comparisons. Productivity as a source of our understanding of economy-wide growth has been extensively researched both within and outside the KLEMS platform. We highlight here some of the important recent literature in this context. Van Ark et al. (2021) provide a key recent investigation into the question of how to avoid another phase of sluggish growth, after what occurred following the global financial crisis leading to a period of global slowdown for advanced economies. The authors state that in the past 15 years, productivity growth in advanced economies has significantly slowed, giving rise to the productivity paradox of the new digital economy – that is, increased business spending on information and communication technology assets and digital services without a noticeable increase in productivity. The study provides evidence that structural changes apparently underline the slowing productivity growth rates at the macro level. In the United States, most of the positive contribution to productivity growth is coming from the digital-manufacturing sector. The Euro Area and the United Kingdom show larger productivity contributions from the digital-using sectors. The paper outlines a series of policy measures to ensure medium as well as long-term recovery. Dabla-Norris et al (2015) observe that trend growth in advanced economies has been slowing, driven by a slowdown in human and capital accumulation and declining total factor productivity (TFP). The decline in TFP before the crisis reflected not only the reallocation of resources to sectors where productivity growth was slower, but also declining productivity growth within those sectors, which increasingly account for the bulk of employment and economic activity. Dieppe (2020) is a comprehensive contribution to global productivity research, covering an exhaustive sample of countries with a variety of data sources, including macroeconomic, sectoral and firm-level data. The book provides an in-depth view on Emerging Market and Developing Economies (EMDEs) relative to Advanced Economies (AEs), by using a comprehensive dataset for 35 AEs and 129 EMDEs. The largely policy-oriented assessments provide several perspectives on – trends and prospects of productivity growth; global, regional, domestic and sectoral drivers of productivity; factor reallocation and technological change; inter-country productivity convergence; and in the context of the COVID-19 pandemic, the effect of natural disasters and economic disruptions on productivity growth. Several important findings emerge from these assessments, namely weak investment, weak TFP growth and fading gains from factor reallocation. A key finding is that labour productivity growth in EMDEs has been undergoing multiple surges and declines since the 1980s, each of increasing magnitude over time. However, the COVID-19 pandemic threatens to cause the largest and most broad-based decline in EMDE productivity growth, compounding a trend slowdown in labour productivity growth in these countries, which began after the 2007-09 Global Financial Crisis (GFC). Fraumeni (2019) is a major attempt towards creating a foundational resource for the understanding of the various new and existing methodologies and their corresponding results. Most of the chapters use the KLEMS-type models to analyze sources and origins of growth and productivity for a host of nations – G7, E7, EU, Latin America, Norway, China, Taiwan, Japan, Korea, India and other South Asian countries. By going beyond traditional measurement techniques, the book explores new methodologies meant to better address the contemporary challenges of the global economy. Several other interesting studies may be mentioned here.6 Using the Conference Board’s Total Economy Database (TED), Erumban and Van Ark (2018), report that global labour productivity growth has undergone a drastic slowdown since the beginning of the 2010s – with the slowdown being driven largely by declines in TFP growth. Nomura (2018) aggregates output, labour and capital input growth rates for the period 1970-2014 across a group of 21 Asian countries by taking into account factor-price differentials. The study reports a post-crisis reduction in the TFP growth rate of the group. He identifies that regional productivity slowdown in Asia has been caused mainly by the post-crisis decline in TFP growth of the Chinese economy, on which the Asian economy has become increasingly reliant, and also due to the decline in India’s TFP performance over the same period. Hofman and Aravena (2018) use the growth accounting approach to explain the Latin American and Caribbean region’s economic growth during 1990-2013. They report that Latin American countries have substantially lower labour productivity than developed countries, with a gap that appears to be increasing mainly due to the relatively sluggish contribution of capital deepening and TFP growth in this region. 1.4 Productivity research in India While there are several Indian studies on productivity, covering the aggregate economy as well as broad sectors, the latter are largely about organized manufacturing and only a few on agriculture and service sectors. Bosworth et al. (2007) presented estimates of the sources of economic growth for the sub-periods of 1960-80 and 1980-2004, for the aggregate economy as well as at the sector level for agriculture, industry and services. The productivity estimates of Bosworth and Maertens (2010) echoed the pattern observed by Bosworth et al. (2007). Other earlier studies on sources of growth include Dholakia (2002), Sivasubramonian (2004) and Virmani (2004)7. In context of the manufacturing sector, such studies indicated a slow rate of TFP growth in Indian manufacturing for the period 1951 to 1979 (Reddy and Rao, 1962; Banerji, 1975; Goldar, 1986; and Ahluwalia, 1985). The literature in the 1990s started exploring the biases in productivity estimates of the manufacturing sector due to the use of the value-added function and the method of single deflation8 of value-added. In particular, Balakrishnan and Pushpangadan (1994) used the double-deflation method for value-added to contest the assertion of the study by Ahluwalia (1991) (which used single-deflated value-added) regarding the acceleration in manufacturing TFP growth in the 1980s.9 Subsequent studies mostly concluded that the post-reform improvement in TFP growth of Indian manufacturing was non-existent and rather, was slower compared with the TFP performance of the 1980s.10 The handful of earlier studies pertaining to the unorganized manufacturing sector (Prakash, 2004; Unni et al. ,2001; Kathuria et al., 2010) mostly reported a downward trend in TFP growth. The earlier productivity research on the Indian service sector had focused on specific sub-sectors, such as – Railways (Sailaja, 1988; Alivelu, 2006), Airlines (Hashim, 2003), Insurance (Sinha, 2007), ICT industries (Mathur, 2007) and a relatively larger number of studies were about the Banking sub-sector (De, 2004; Sinha and Chatterjee, 2008). For the services sector as a whole, Goldar and Mitra (2010) and Virmani (2004) indicated an acceleration in TFP growth after 1980. Even before the inception of the India KLEMS project, Banga and Goldar (2007) had used an econometric approach with the KLEMS production function framework to conclude that the contribution of the services (S) input to output and productivity growth of the organized manufacturing sector had increased substantially in the 1990s, with trade reforms identified as a major cause. The productivity research revolving around the agriculture sector has looked at both –the aggregate agriculture sector and sub-sectors such as crops, livestock, including crop-specific analysis of major crops such as rice and wheat. A number of studies found improvement in the TFP index of the Indian agriculture sector, following the introduction of high yielding varieties (Rosegrant and Evenson, 1992; Evenson et al., 1993; Fan et al., 1999). In particular, Fan et al. (1999) found a relatively faster TFP growth rate of 2.5 per cent per annum for the 1980s and a marginal slowdown to 2.3 per cent per annum in the 1990s. The introduction of high yielding varieties, adoption of new technologies and improvement in rural infrastructure were argued to have induced faster productivity growth. Although most of the studies estimated technological change for aggregate agriculture, micro-level farm data11 were deployed by several crop-specific studies (Pinstrup et al., 1991; Sindhu and Byerlee, 1992; Kumar and Rosegrant, 1994; Joshi et al., 2003). Krishna (2006) is a useful review of the early literature on TFP growth in Indian agriculture and its determinants, and Bhalla (2006) is a relevant study of the impact of agricultural growth on rural poverty, and it draws attention to measures for raising labour productivity in agriculture and diversification to high-value crops. Productivity analysis continues to be important in the Indian research agenda and agricultural productivity, in particular, continues to engage researchers (Nicholas Rada and David Schimmelpfennig 2015, Emerick 2018, Balaji and Suresh Babu 2020). Initiatives by the Indian government through several policy programmes such as “Make in India” attempt to boost competitiveness in the manufacturing sector, which has been characterised by low TFP growth. Several studies have sought to investigate the impacts of such initiatives by looking at the determinants of low productivity, keeping in consideration aspects of foreign involvement (Chawla, 2020), mark ups (Mukherjee and Chanda, 2020), firm size (Mitra and Sharma, 2018) and exports (Narayanan and Sahu, 2020). The use of diverse datasets pertaining to informal and formal manufacturing at firm as well as industry level enables analysis of the manufacturing dynamics prevalent in the Indian economy.12

The rapid expansion of the service sector and emergence of the service-driven growth has provided much scope for research, on issues related to the nature and implications of growth of this sector, including exports and employment (Bhide et al., 2021). Further, within the services-manufacturing linkage, the servification of manufacturing and the impact of reforms in the services sector13 on manufacturing performance remain dominant research themes in the Indian context. The importance of service-sector productivity with emphasis on both market and non-market services and its determinants is a potential research agenda that still needs to be explored. 1.4.3 Productivity research based on KLEMS database Since the construction of KLEMS dataset with estimates of labour as well as total factor productivity growth by industries, several comprehensive research papers have been written by the KLEMS research team. These papers, using growth accounting technique as their core methodology, attempt to analyse the performance of the aggregate economy and its sub sectors during 1980-2018. Prominent amongst these are Das et al. (2016), Erumban et al. (2019), Goldar et al. (2017), Krishna et al (2020) and Das et al. (2019). Their focus has been evaluation of productivity performance within different economic policy regimes, issues of structural change and growth and assessment of sources of growth for the Indian economy. In addition, Wu, Krishna et al., (2016) undertook a comparison of India’s growth and productivity performance with China. A related work that compares TFP levels in India and China (Erumban et al., 2019) is in progress. Other studies include analysis of structural changes in employment (Krishna et al., 2016), trends in labour quality, (Krishna et al., 2018), and growth and jobs - Indian experience in the international perspective (Aggarwal and Goldar, 2019). Further, issues such as ICT investment and growth (Erumban and Das, 2019), productivity growth and levels in formal and informal manufacturing (Krishna et al., 2018), productivity dynamics in services (Krishna et al., 2016), structural change (Erumban et al., 2019) and a paper exploring India’s trade-productivity linkage using KLEMS and other datasets (Das, 2019) have also been addressed.14

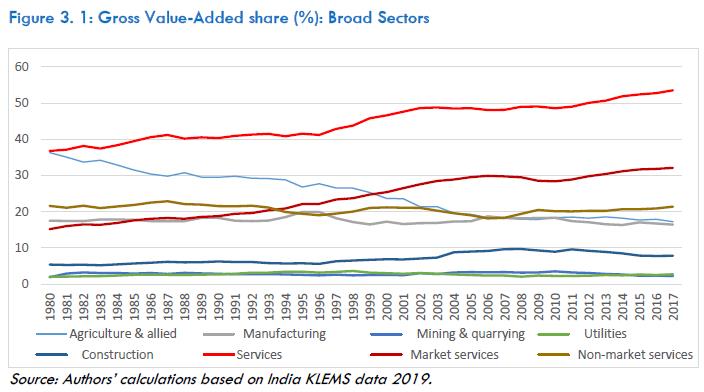

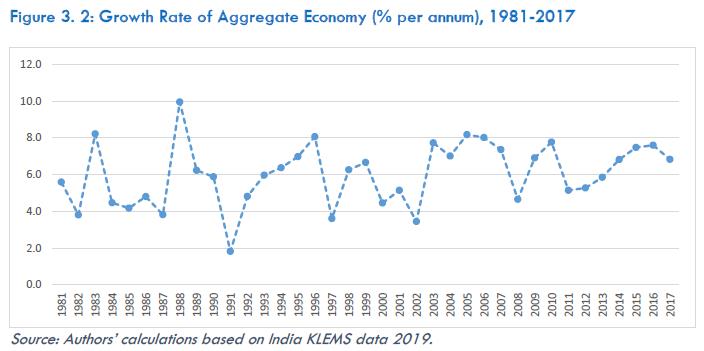

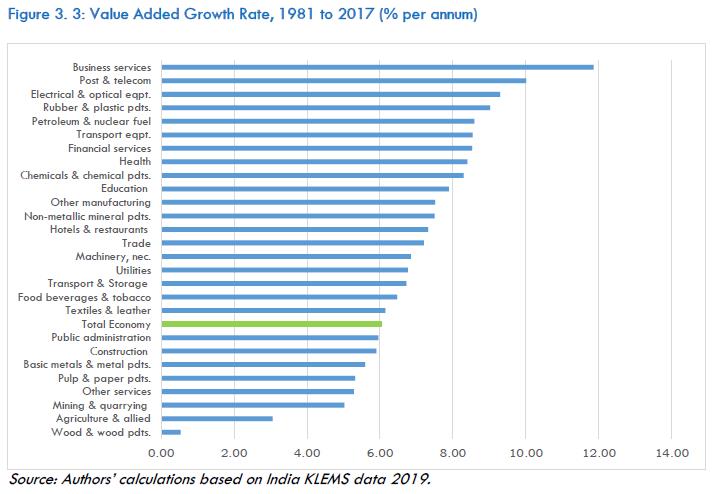

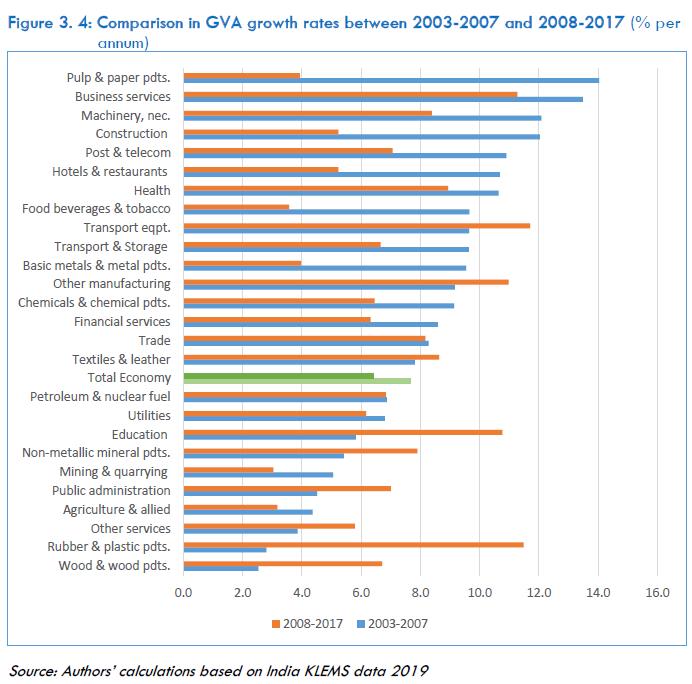

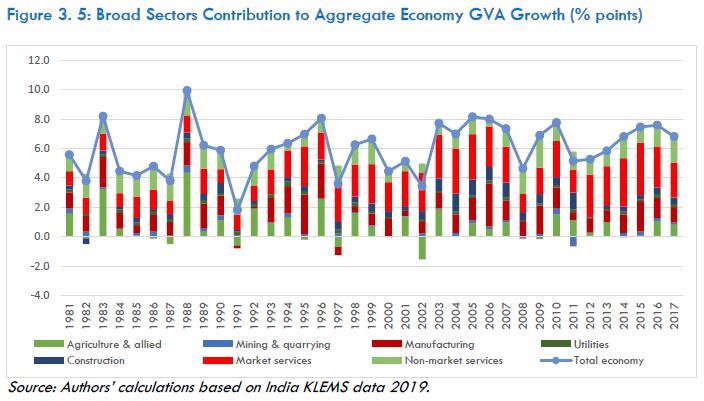

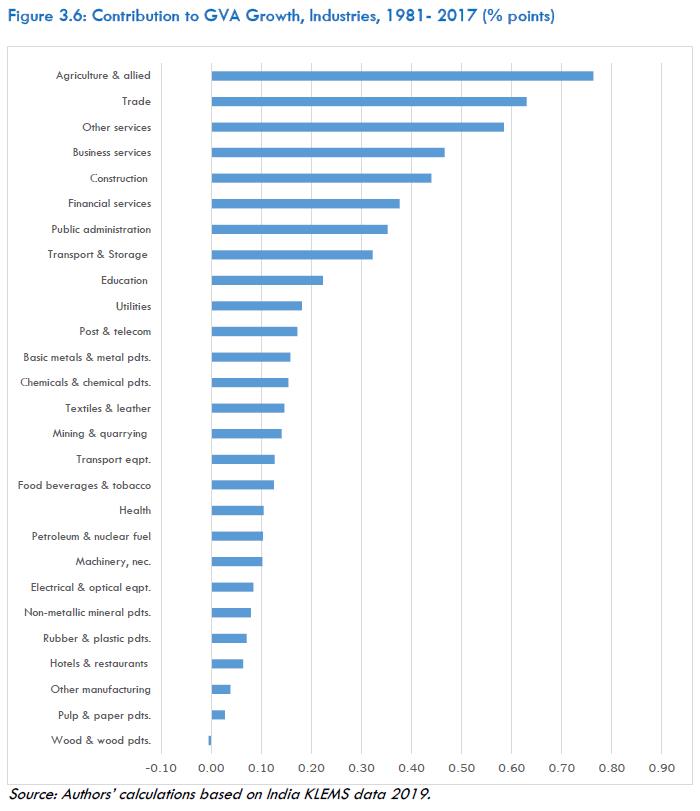

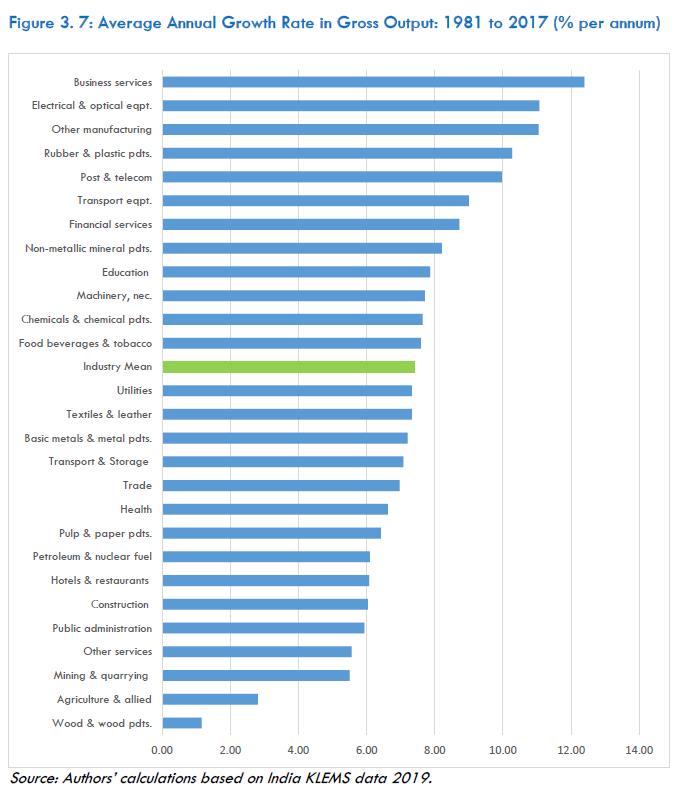

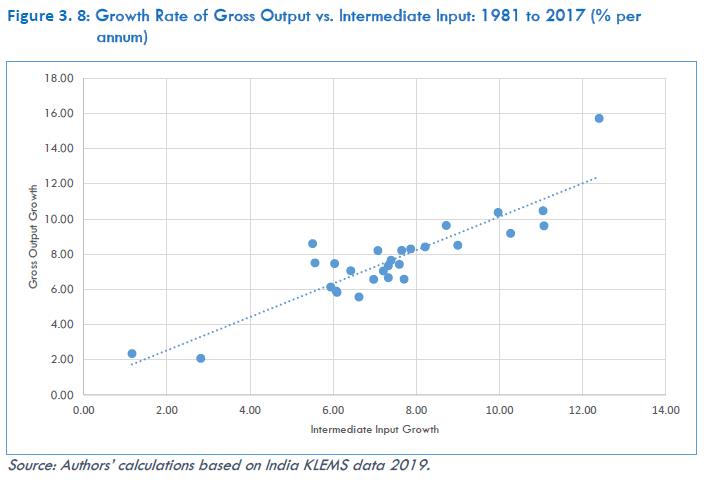

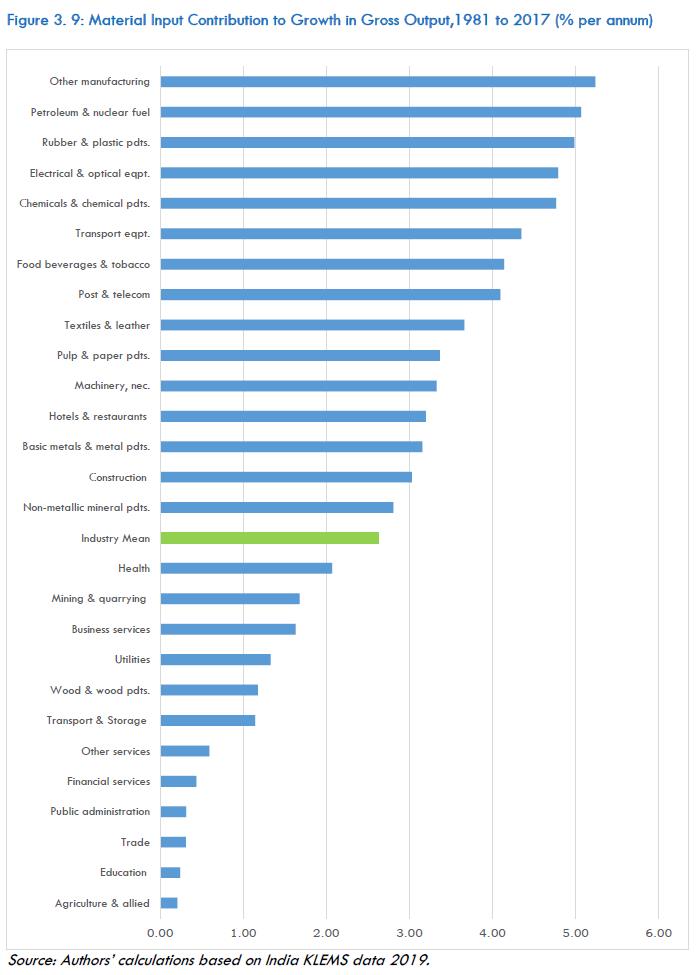

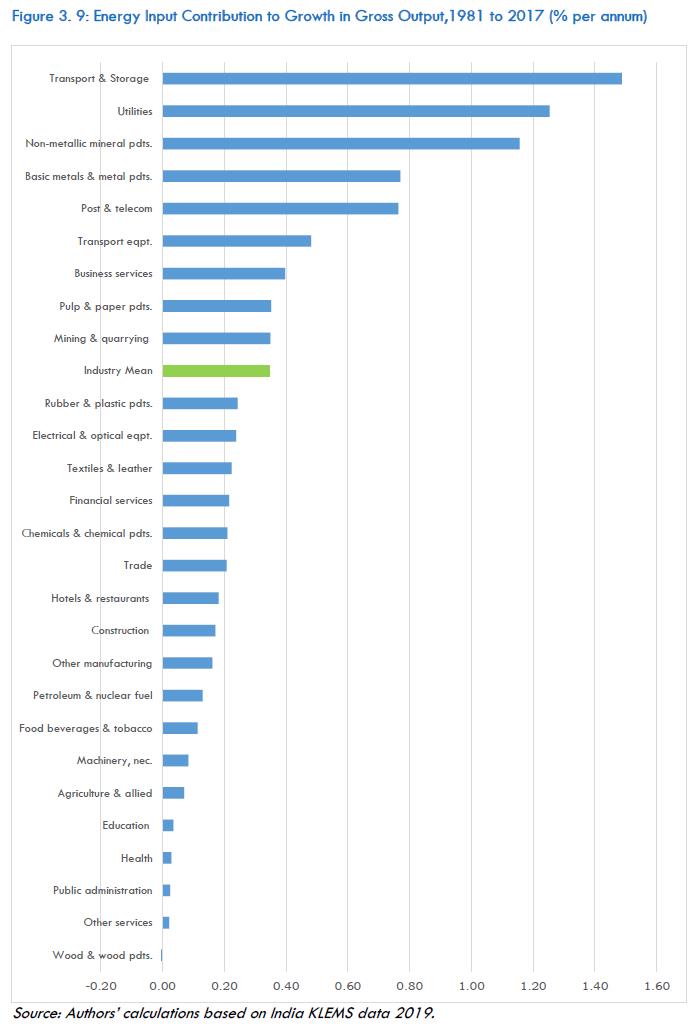

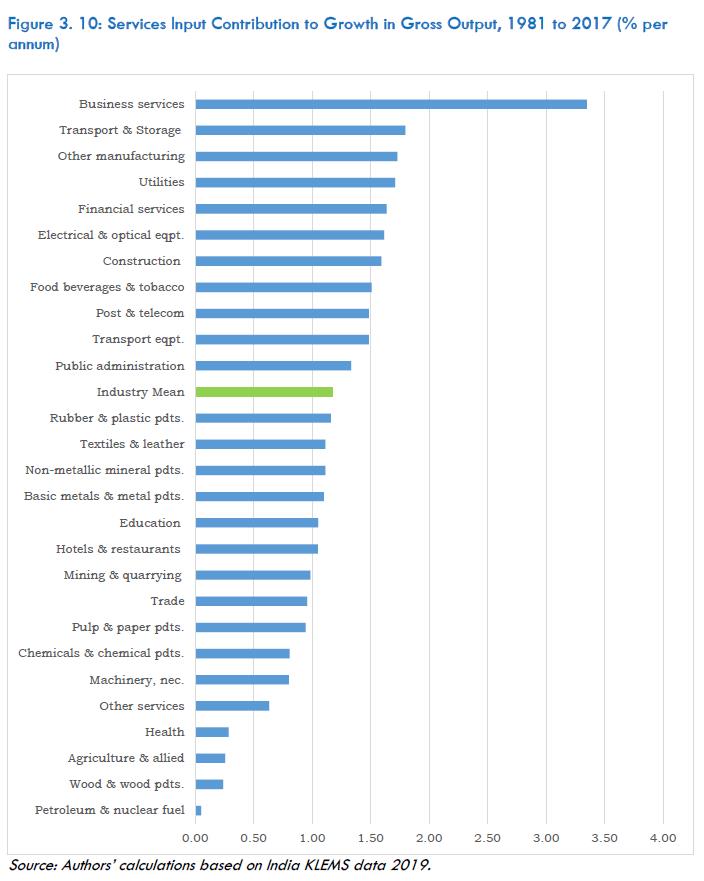

The research outputs of the KLEMS group bring several novel features to the analysis of productivity growth in the Indian economy. Its period of analysis witnessed piecemeal deregulation from 1980 until 1991 and subsequently, long-term reforms in trade and industry that followed the crisis of 1991-92. Further, the high-growth phase (2003-08) of the Indian economy followed by periods of global shocks and world slowdown in productivity allows examination of several research hypotheses, including the sources of growth and the contribution of productivity enhancement to the observed growth. The construction of dataset for 27 sectors of the economy allowed disaggregated industry-level analyses, which enabled the identification of the leading sectors within groups such as market economy, market services and manufacturing. The industry perspective provides important insights when compared with the aggregate. Analysis of how growth of inputs and total factor productivity of each industry contribute to aggregate value added, thereby also determining each industry’s contribution to aggregate growth forms a part of the research agenda. The growth accounting technique allows for studying sources of overall growth as well sources of both labour productivity and total factor productivity growth. In addition, while assessing the explicit role of inputs when accounting for output growth, the contribution of the inputs to observed productivity gets captured significantly better when the construction of variables, especially labour and capital, allows for heterogeneity within inputs than cases where measurements of these primary inputs did not consider heterogeneity. Finally, the main dataset used in our analysis is the India KLEMS database on inputs, outputs and productivity trends for 27 sectors of the Indian economy from 1980 onwards within a growth accounting framework. The dataset, publicly available at the RBI website15, illustrates to the research and policy communities, the benefits of using detailed data. 1.5 Report summary and contribution of chapters The next chapter (2) discusses the main database used in our analysis -- the India KLEMS dataset that provides harmonized statistics on outputs, inputs and productivity trends for 27 industries comprising the Indian economy; a wide range of manufacturing and services sector industries find place in the list of 27 industries. The dataset is constructed in a manner so as to maintain a close association with National Accounts Statistics (NAS), National Statistical Office, Ministry of Statistics and Programme Implementation, Government of India, with all variables benchmarked with the NAS database. It is freely downloadable and available at the RBI website.16 The chapter describes in brief how the series on various variables in the India KLEMS dataset are constructed and at the same time devotes considerable attention to the details of the data sources employed and methodology, which also receives attention in the subsequent chapters of the report where the data are analyzed. It may be pointed out here that for the construction of the database, several supplementary data sources are used in addition to National Accounts Statistics (NAS), such as the National Sample Survey Office (NSSO) data on employment and unorganized manufacturing, Periodic Labour Force Survey (PLFS), Annual Survey of Industries (ASI), Wholesale Price Index (WPI), Input-Output Transactions Tables (IOTT) and Supply-Use Tables (SUT). Several datasets not in the public domain were provided by National Statistical office (NSO) and information on several important variables had to be extracted using ASI unit level data. We claim justifiably that an industry-level focus allows for deeper insights when compared with aggregate analysis. It is important to point out that several industries are responsible for the observed productivity and growth performance. Given the large variation across industries with respect to technological characteristics and the regulatory environment, the observing of industries within certain broad groups – manufacturing as well as services, which drive the growth or productivity performance has profound implications for policy making. In addition, the use of detailed input measures allows us to study heterogeneity of inputs. Hence, this report, based on the India KLEMS research project (2009-21), provides new methodological perspectives on the use of data in economic growth and productivity analysis at a disaggregate level. Chapter 3 discusses the observed changes in structure of the economy, followed by growth decomposition at the industry as well as sectoral level in context of growth in value added. It goes on to examine the contribution of intermediate inputs to the observed growth, using a gross output specification of the industry level production function. It finds that value added share of agriculture & allied activities declined steadily over the past four decades and that of services sector increased from 37 per cent in 1980 to 53 per cent in 2017. A large part of this increase is on account of doubling of the share of market services from 15 to 32 per cent. Of the 6.03 per cent per annum observed average growth for the aggregate economy during 1981 to 2017, 2.03 percentage points came from market services, 1.21 from manufacturing, 1.26 from non-market services and less than 0.8 from agriculture and allied activities. Comparing growth in output with that in input, we observe a strong positive correlation between gross output and intermediate input growth. Further, it is observed that intermediate inputs share in gross output is relatively high in all manufacturing industries and within intermediate inputs, materials input’s share is high across a majority of the sectors or industries.

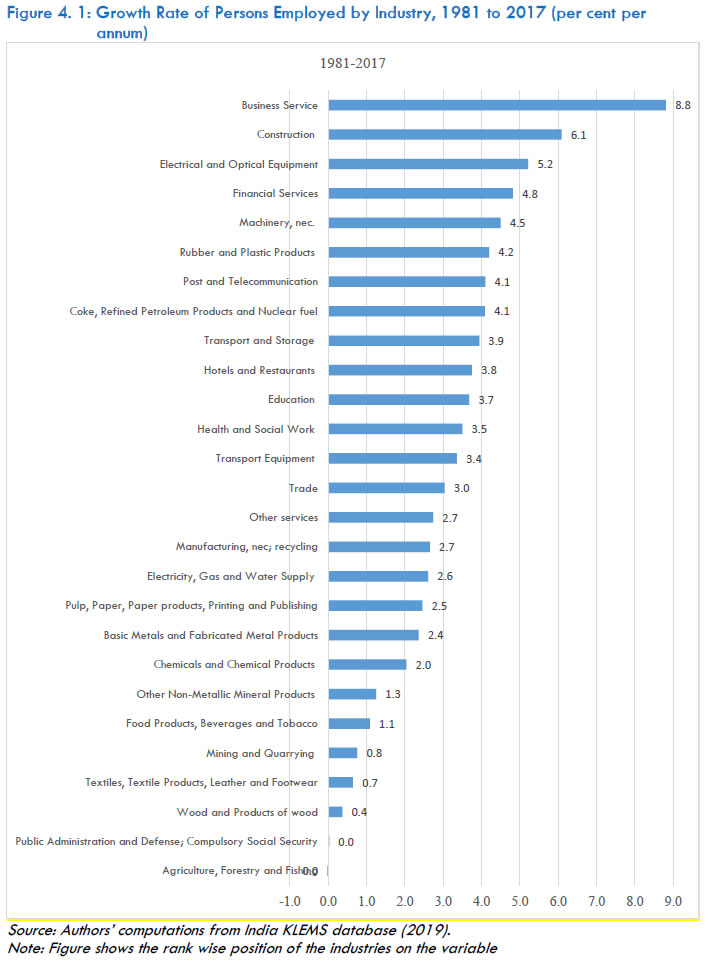

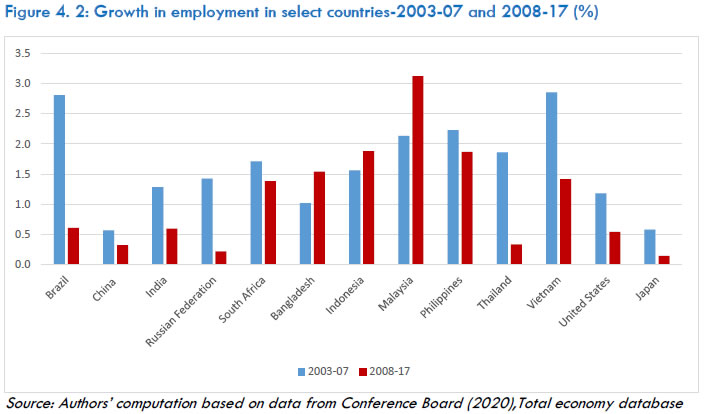

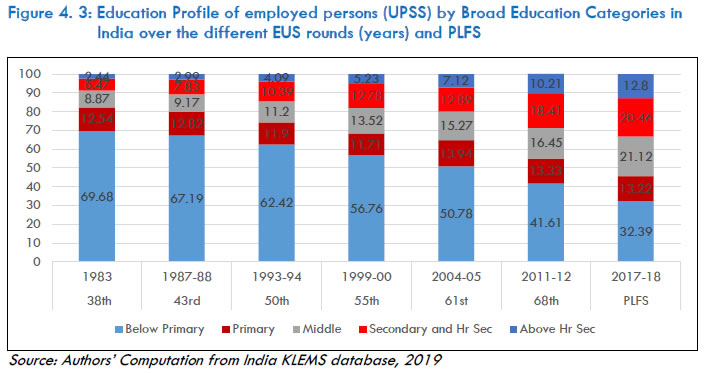

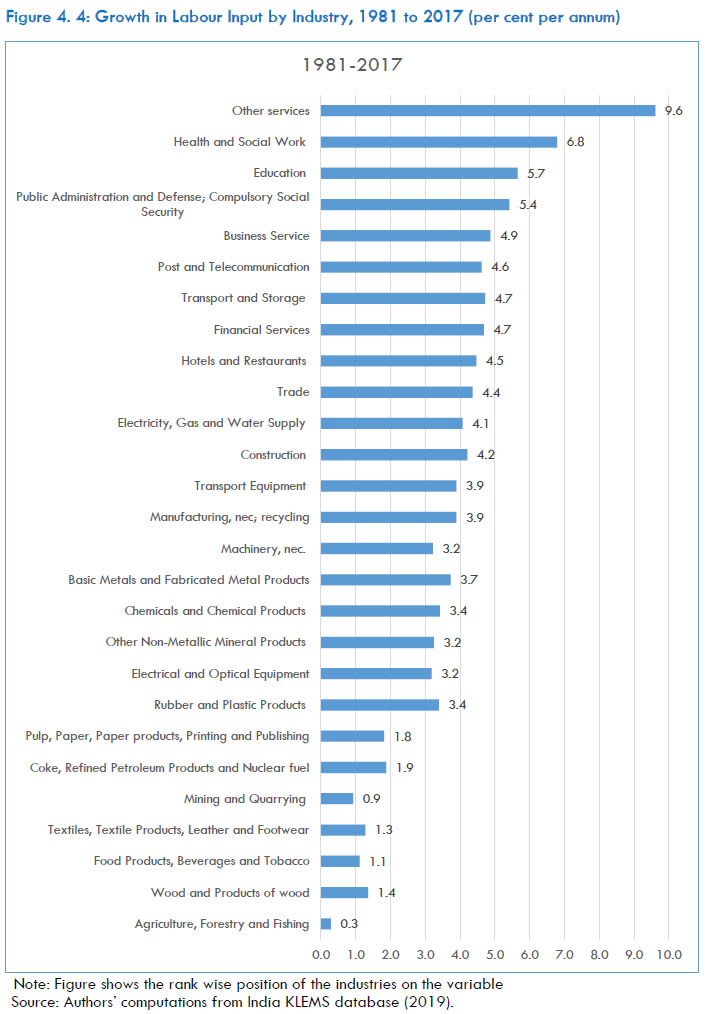

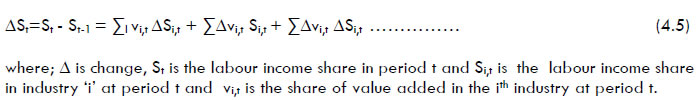

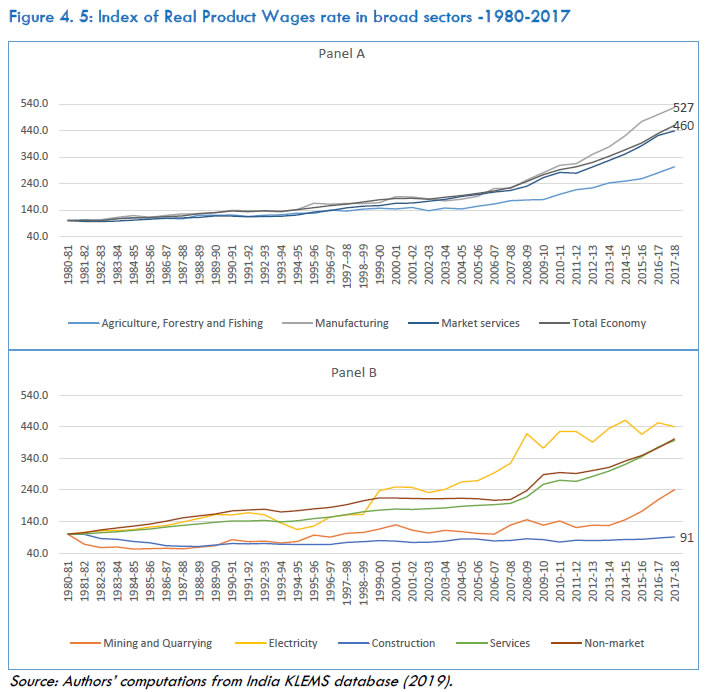

The next two chapters, 4 and 5, provide an in-depth review of labour and capital—two primary inputs used in assessing both labour and total factor productivity. Chapter 4 first discusses the profile of workers in the Indian economy and then an overview of the structure of employment during the period 1980-2017. It also looks at aspects of labour such as, labour quality and labour income share, from an industry perspective. The main variables used are (1) employment (2) growth rate of employment, (3) growth rate of labour inputs, (4) labour quality indices, (5) growth rate of labour quality and (6) labour income share in value added. The India KLEMS dataset provides time series and cross section evidence of labour input for 27 industry groups. It is also the only consistent time series data available on employment by industry for different categories of labour input. Using this database, a detailed insight is provided on the role of labour input in accounting for output and productivity growth at both aggregate and industry level. Chapter 4 offers several important insights pertaining to labour used in Indian industries. Employment, as measured by workforce participation rates have been declining in India, especially among rural females. Growth in employment in India also slowed considerably in the recent period and there was an absolute decline of eight million employed persons between 2011 and 2017. The level of employment declined in agriculture, mining, and manufacturing, and the growth in employment was driven mainly by construction and market services, underlying evidence of significant changes in the structure of employment. Further, during 2011-2017, the share of more educated workers significantly increased in the workforce. Another significant observation is that alongside overall growth in employment, there had been a significant growth in the labour quality index, leading to faster growth in labour input during 1980-2017. The observed change in labour income share seems to have occurred mainly due to the ‘within industry’ effects in the sectors and structural change effects were small as compared to the ‘within industry’ effect. The real product wages had experienced a consistent increase in the average annual growth rate during the overall period of 1980-2017. Finally, growth in employment and in labour quality index had neither been uniform across industries, nor across sub-periods, and considerable variations are observed in both these growth rates.

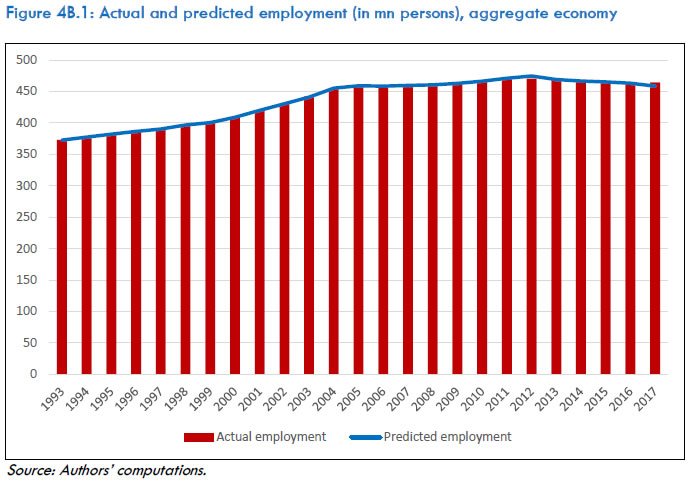

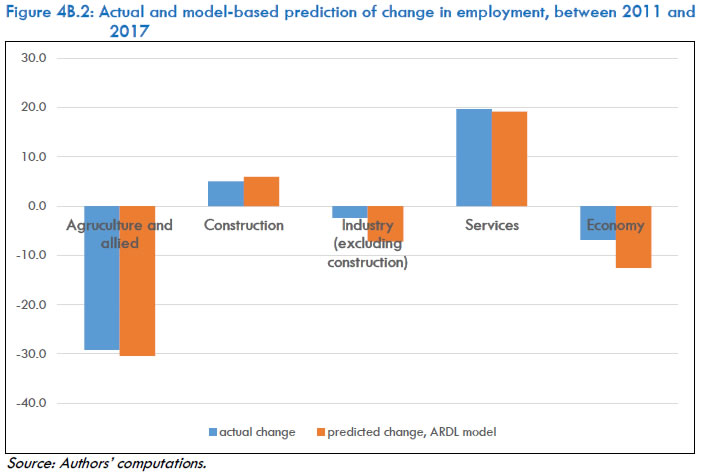

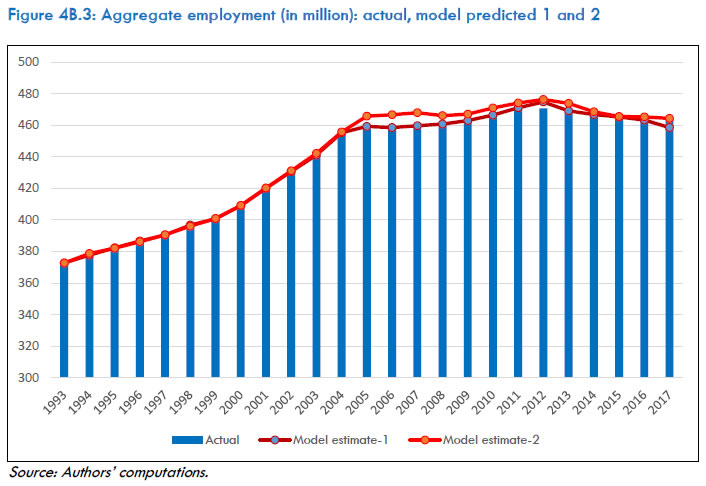

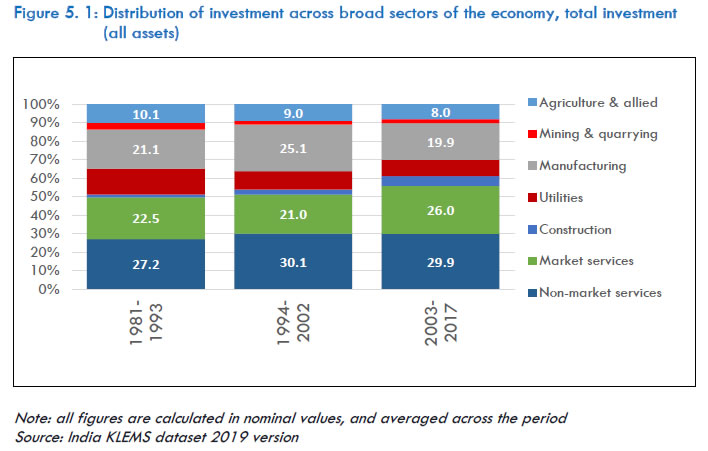

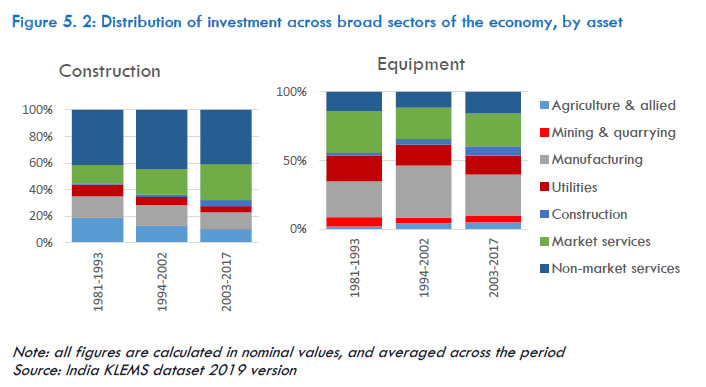

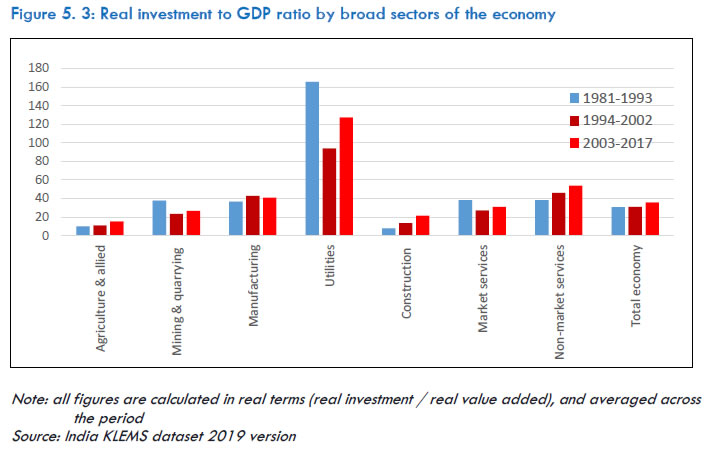

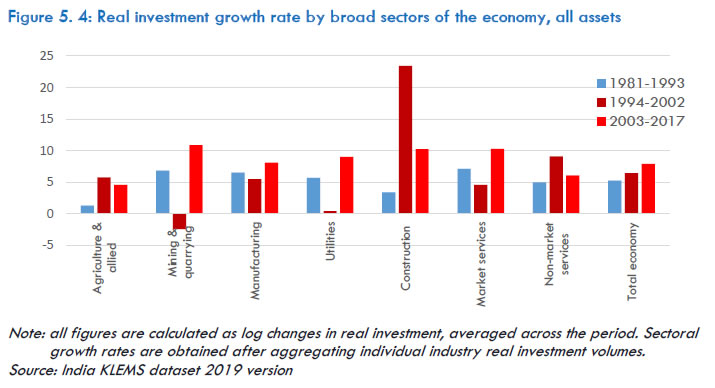

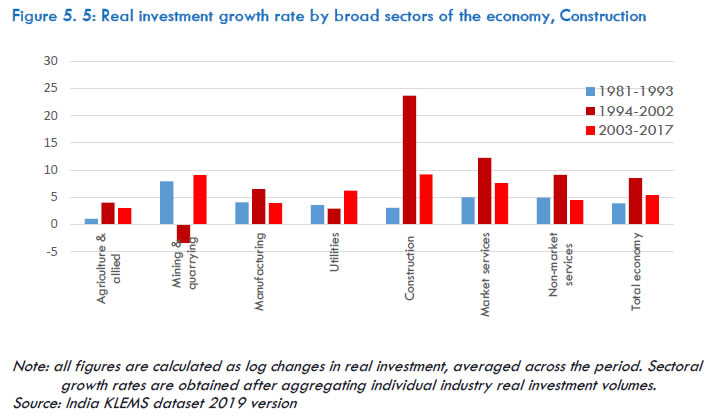

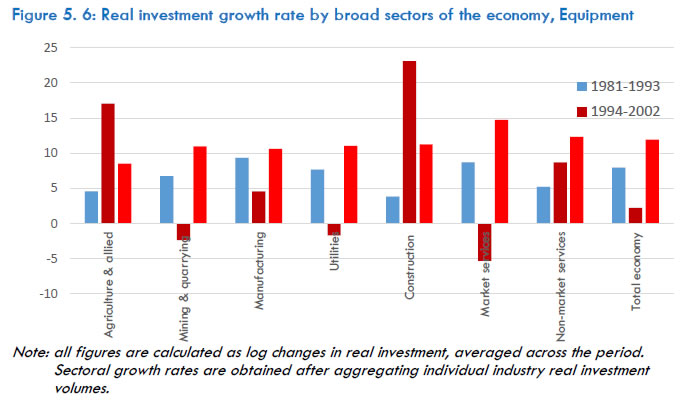

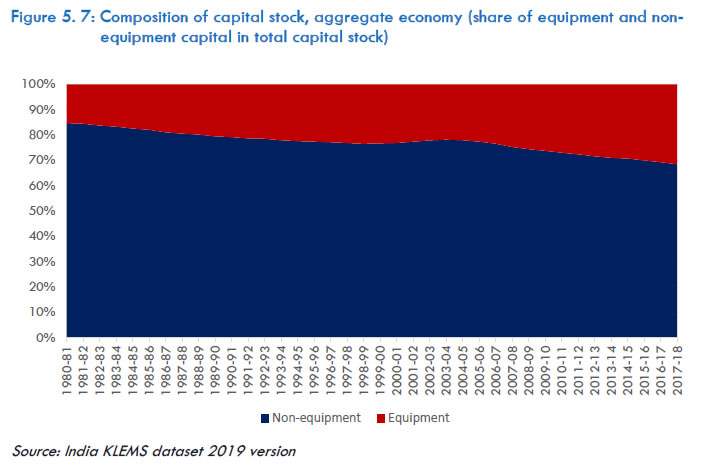

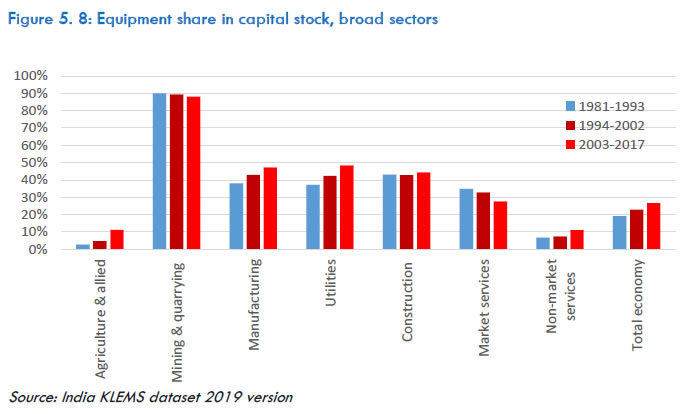

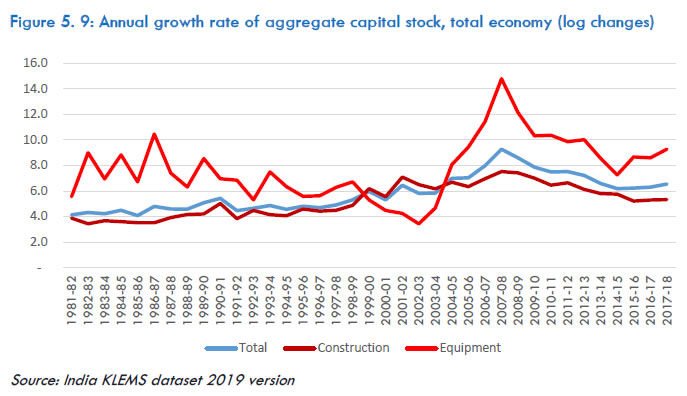

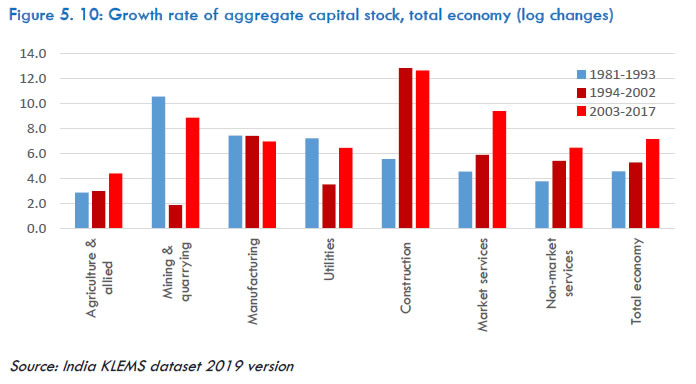

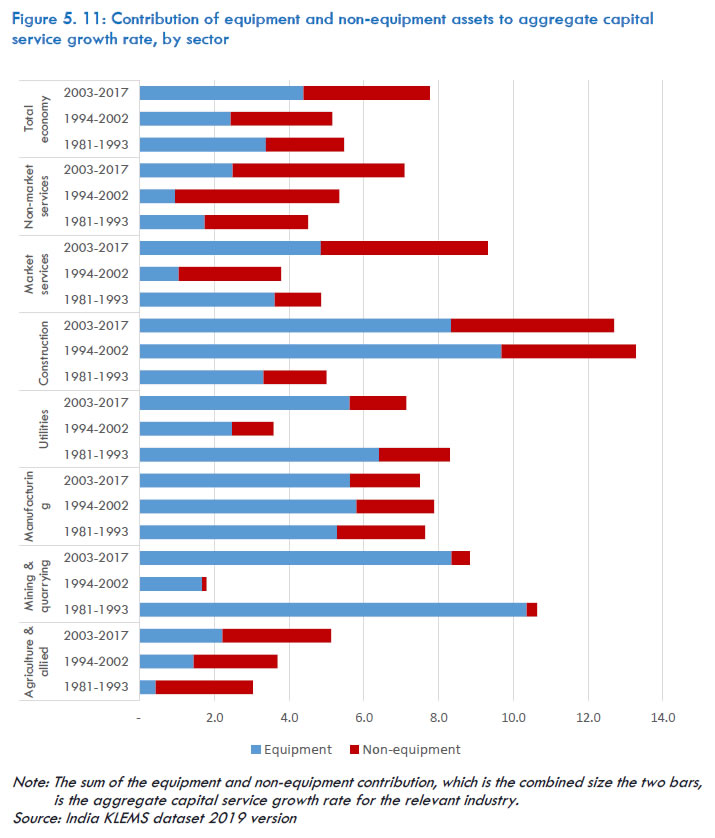

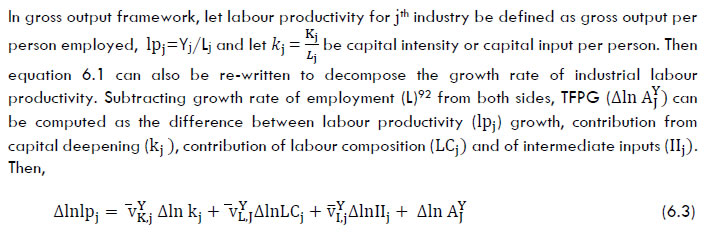

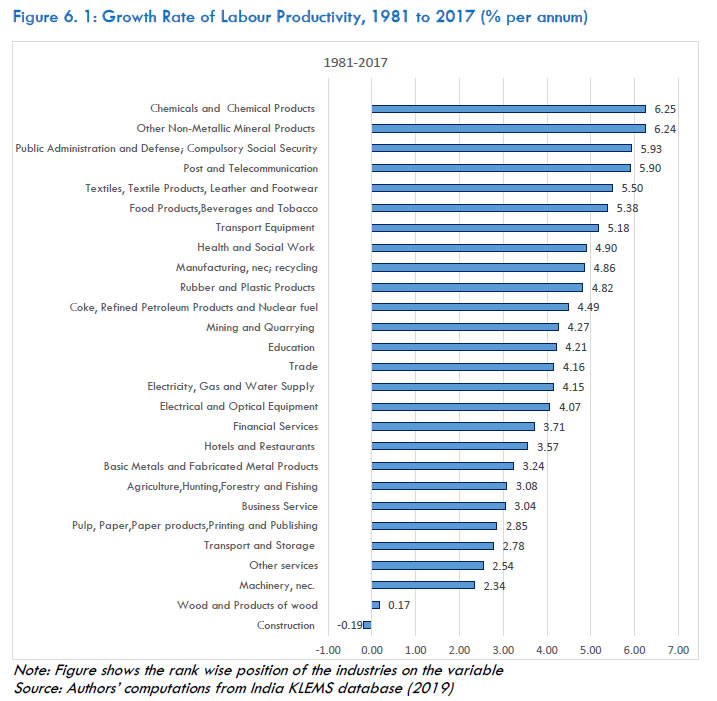

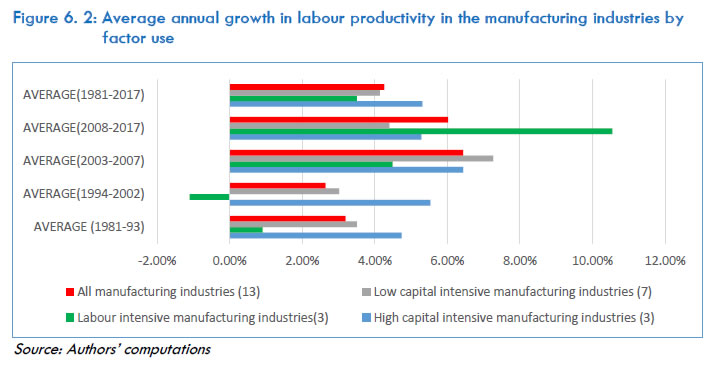

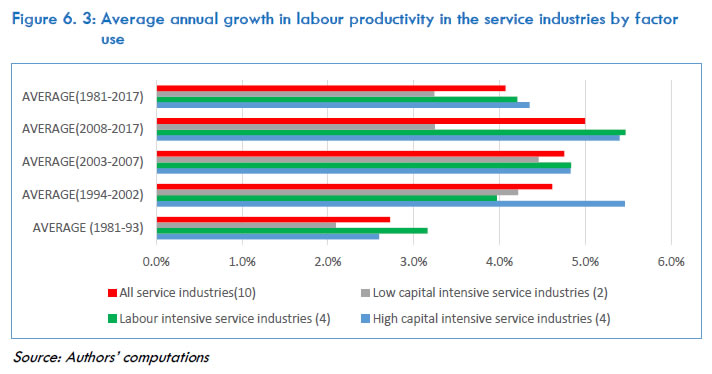

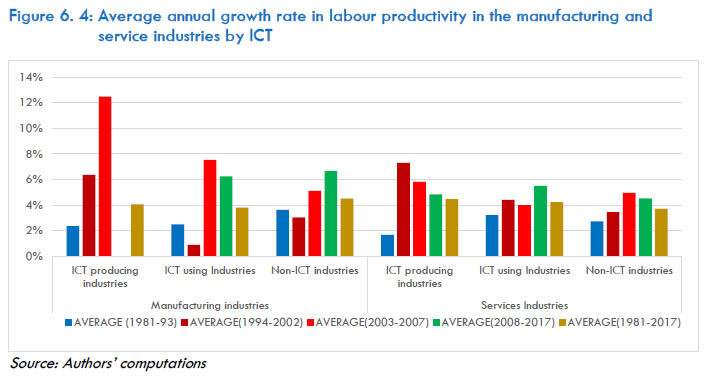

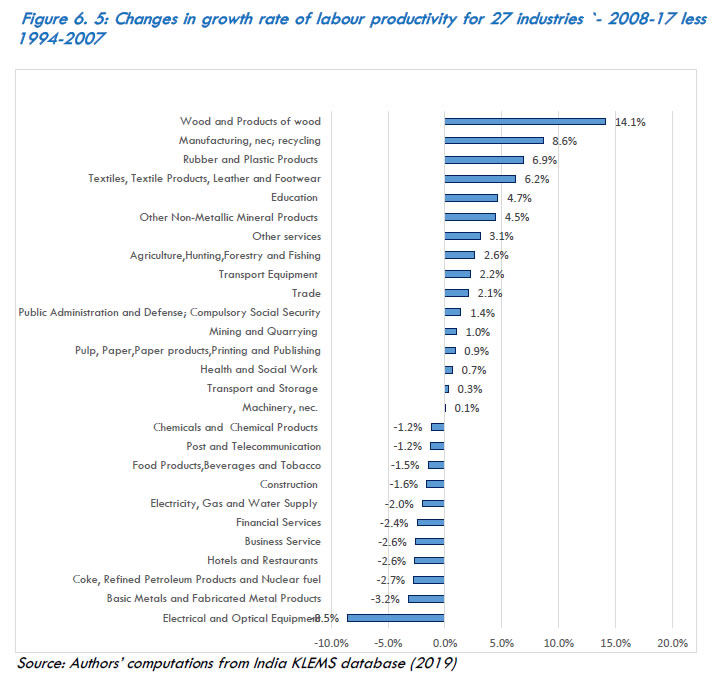

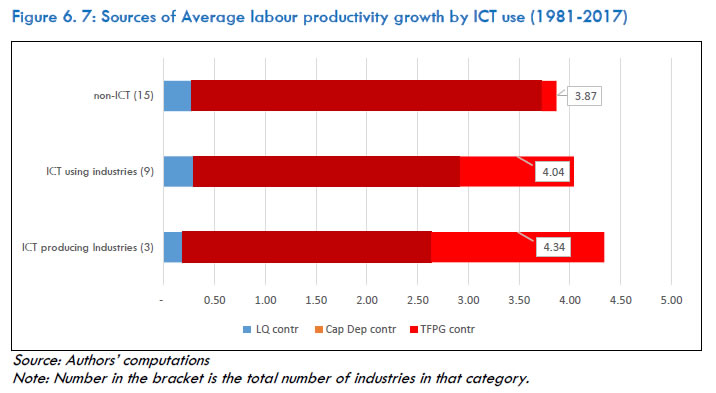

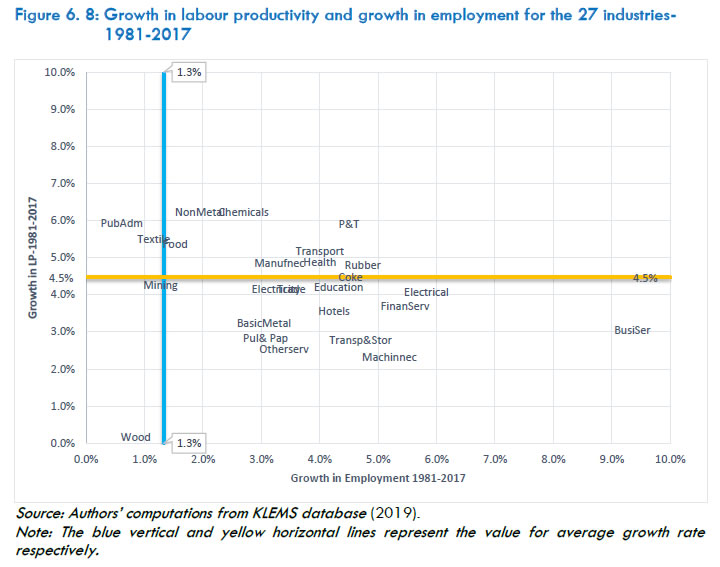

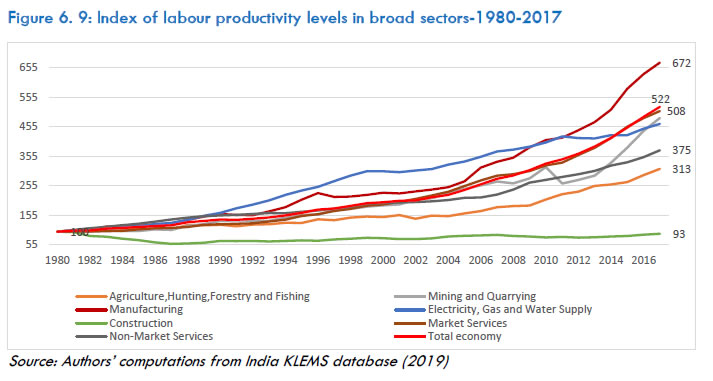

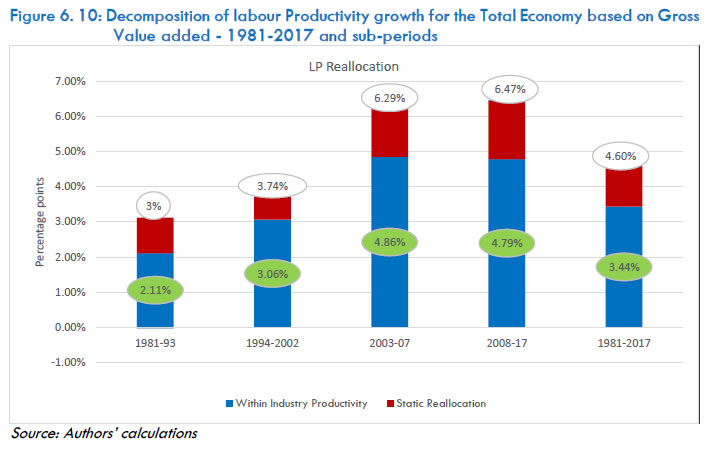

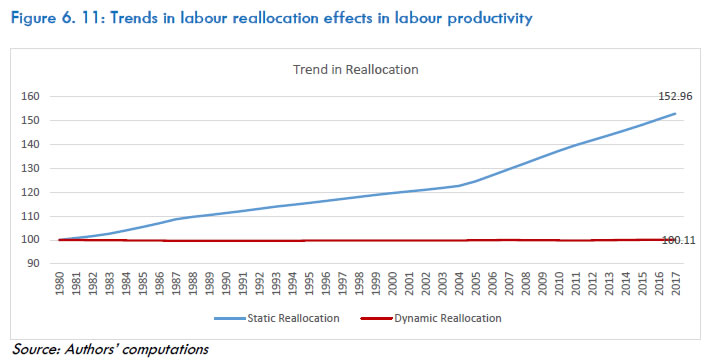

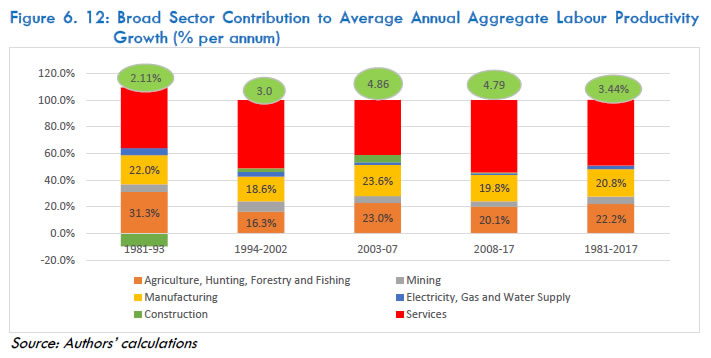

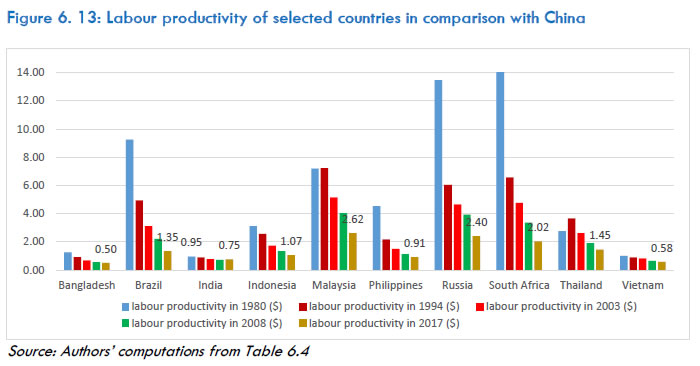

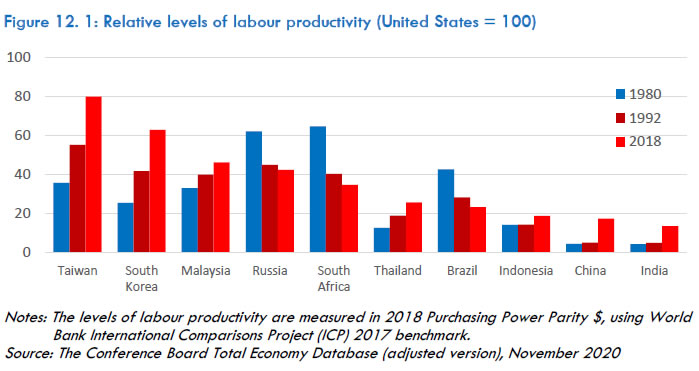

In an annexure to this chapter, an attempt has been made investigate some important factors impacting employment in different major segments of the economy. A positive effect of real value added and a negative effect of real wage rate is found. The models estimated could predict the fall that has actually occurred in employment in agriculture and manufacturing and in aggregate employment between 2011 and 2017. This finding has important implications for the issue of comparability of data sources used in the study to build employment series for recent years. Chapter 5 analyses the trends in deployment of physical capital in Indian industries during the period 1980-2017. It examines the trends in investment-to-GDP ratio, real investment, capital stock, and growth rates of capital services across various industries. Capital stock is measured using the standard perpetual inventory method for individual assets and capital services as a weighted aggregate individual asset-specific stock of capital. The difference between the two measures--capital stock and capital service growth rates--is the effect of changing composition of capital stock. The chapter documents the changes in capital composition in the broad sectors of the economy, along with trends in the capital-output ratio and capital intensity measured as capital stock per worker. It observes an increasing role of equipment capital in the Indian economy, which helps improve capital composition effects. Capital services growth rates were mostly higher than capital stock growth rates across the board. In Chapter 6, we examine trends in labour productivity and possible drivers of the observed productivity performances. Measure of labour productivity is deployed to carry out an analysis for broad sectors and the 27 disaggregated industries. Analysis of factor reallocation and sectoral decomposition is also attempted. Finally, for an international perspective, it compares growth and labour productivity in India with that in a select set of countries. The chapter offers several findings--There is large variation in observed labour productivity both, over time and across industries. The observed labour productivity growth is faster in capital-intensive and ICT-based industries. Further, labour productivity growth rates fluctuate considerably during the sub periods-1994-2007 and 2008-2017. The construction industry is the only sector that shows negative growth in labour productivity for the period 1980-2017. Industry decomposition shows that aggregate labour productivity growth is explained mainly by ‘within industry’ productivity growth, and ‘between’ or ‘structural change’ explains only a small part of it. The static reallocation effect has been positive and substantial during this entire period, suggesting a positive structural change effect. The main driver of the observed labour productivity growth in a majority of the industries is growth in capital intensity, with TFP growth contributing significantly to very few industries. The contribution of TFP is evident in ICT industries, with a range of 28 to 40 per cent. Finally, despite achieving one of the highest growth rates in labour productivity at an average of 5 per cent per annum during 1980-2017, the level of labour productivity in India is still very low as compared with countries such as BRICS, and other selected developing and developed countries.

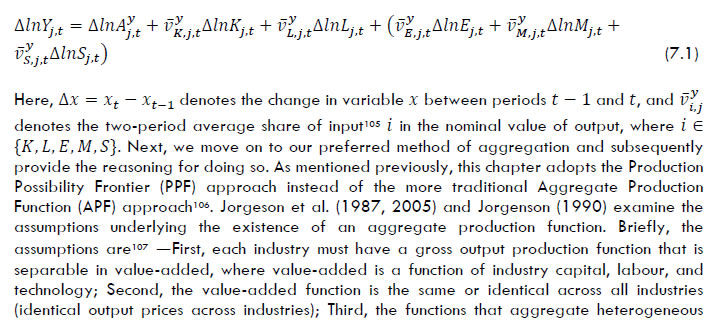

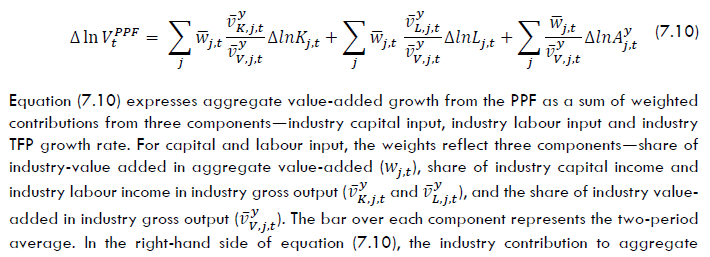

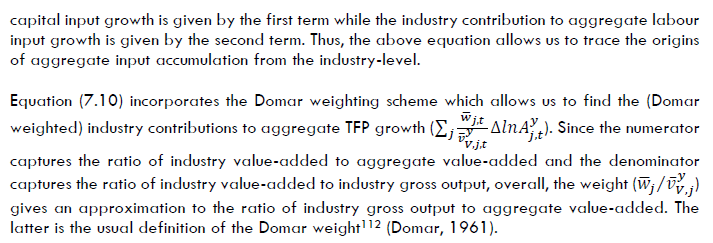

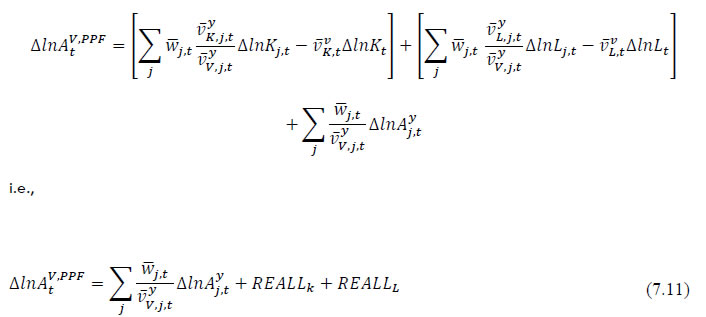

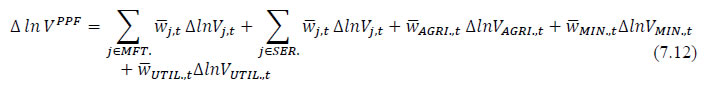

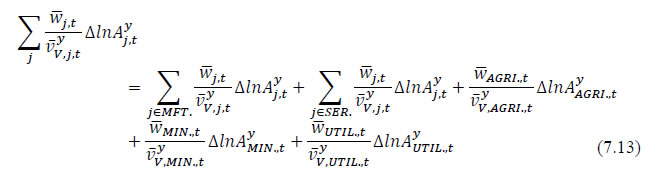

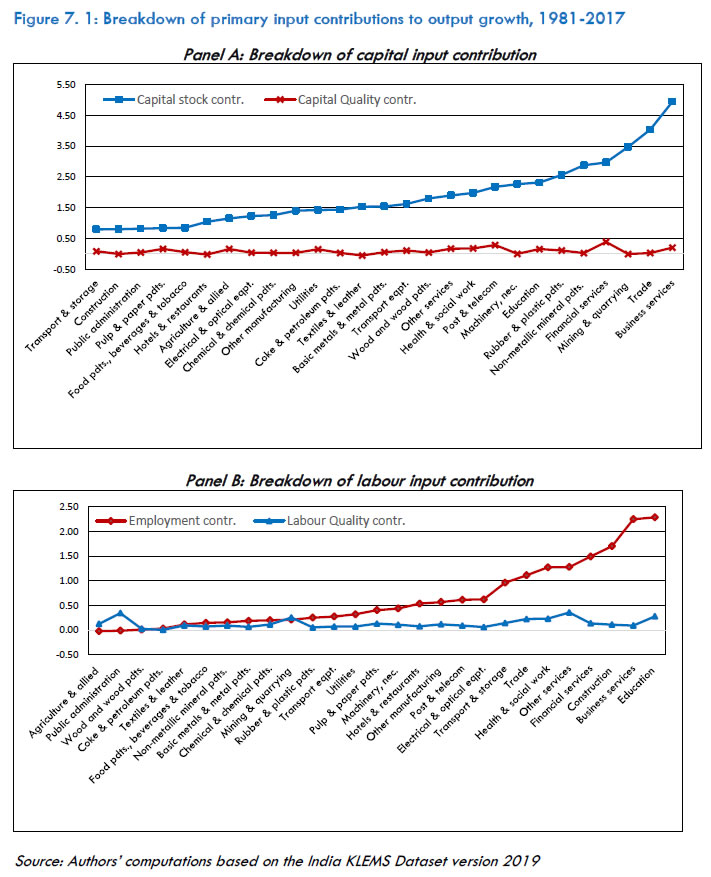

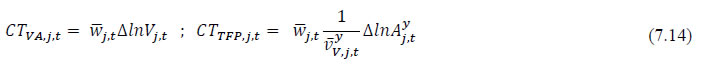

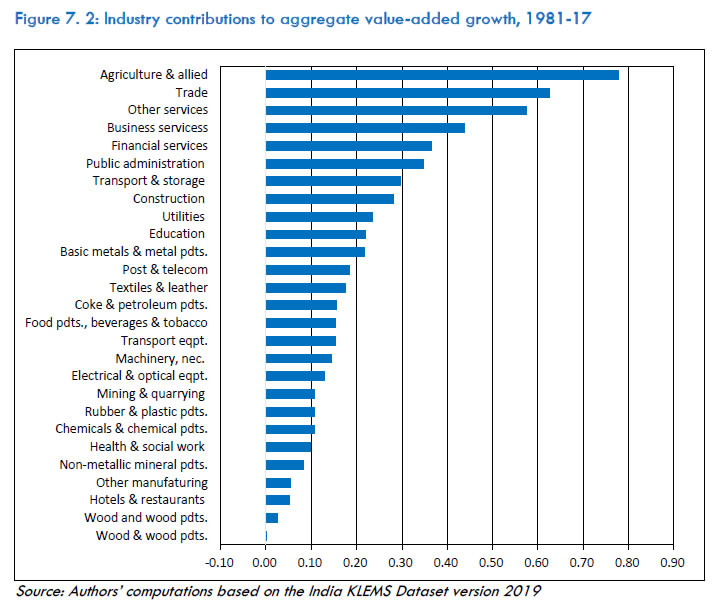

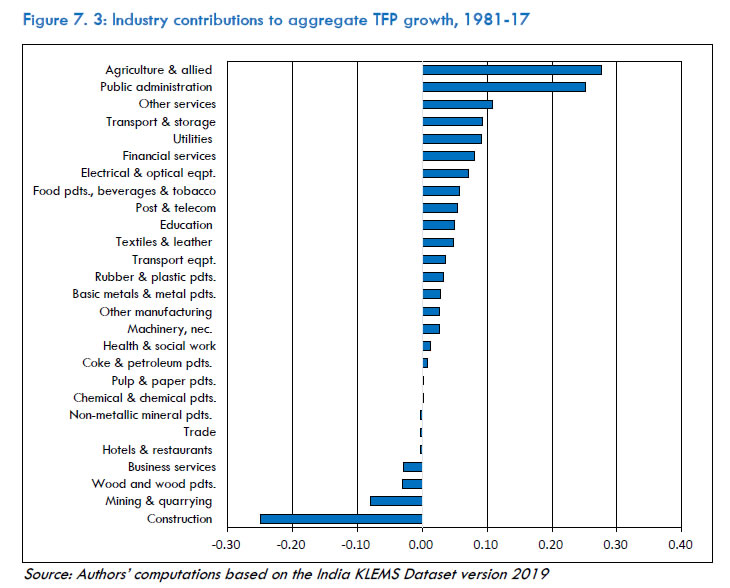

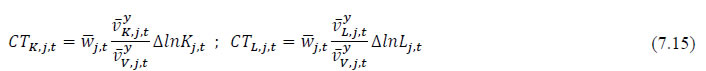

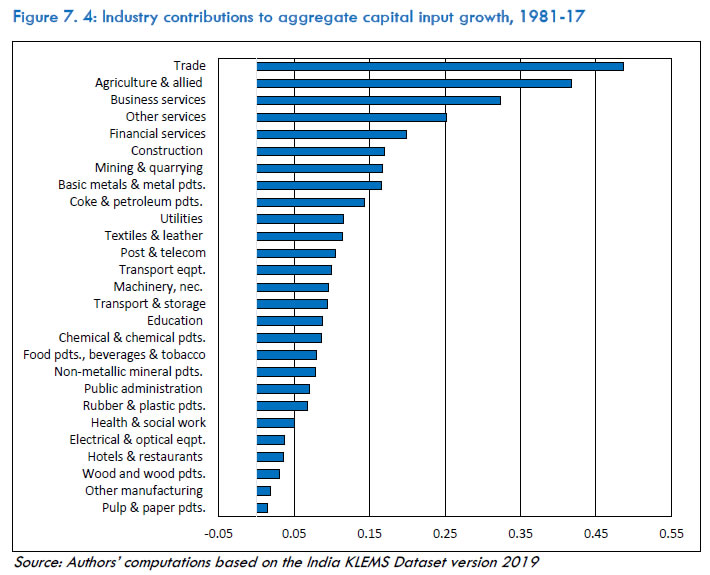

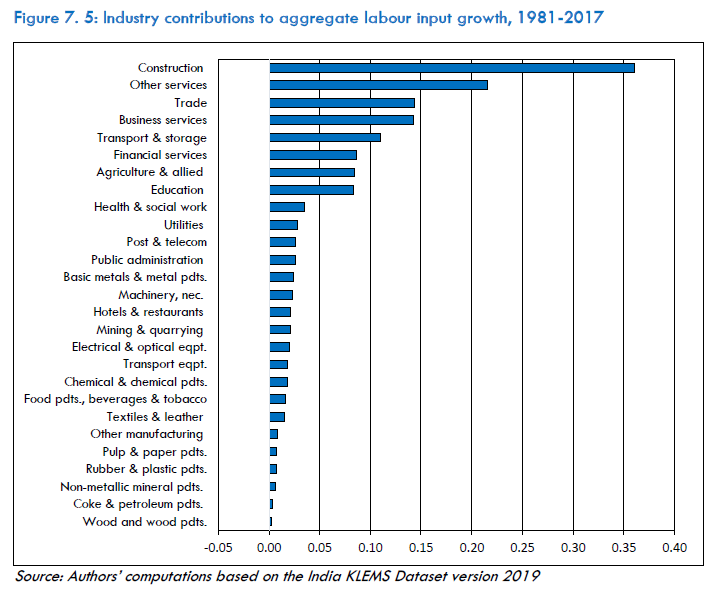

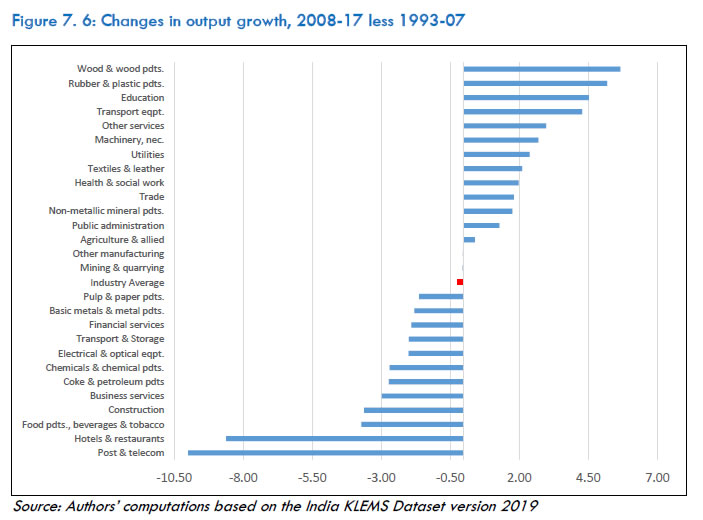

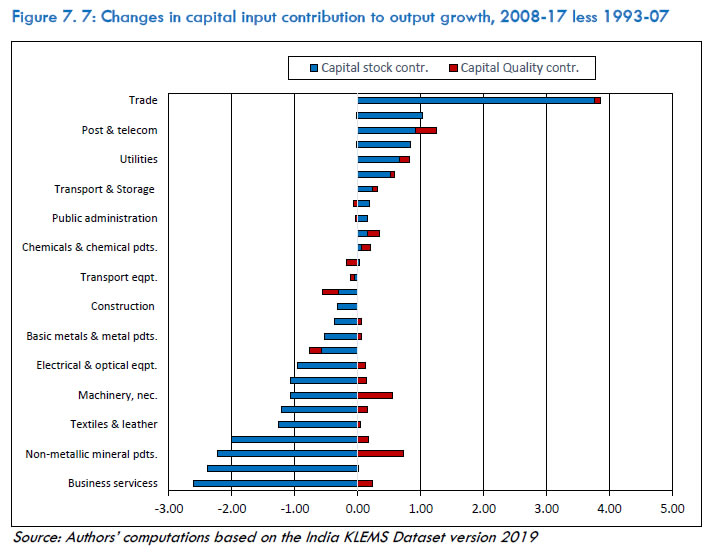

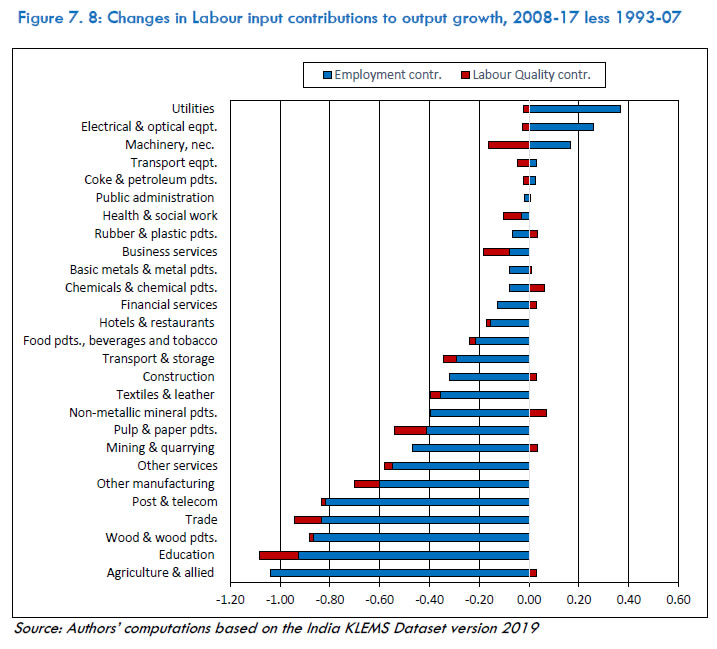

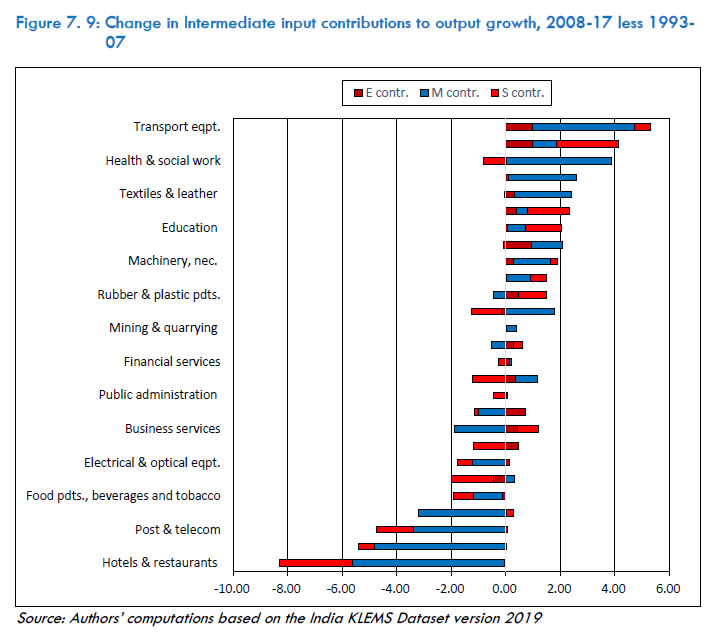

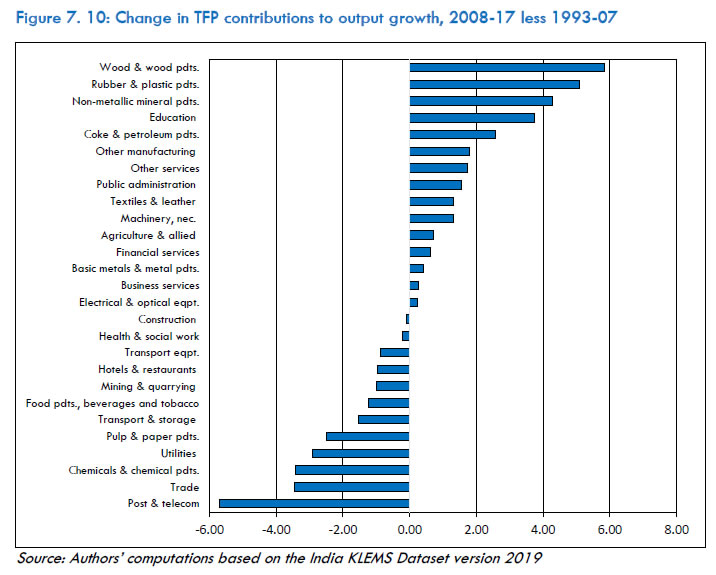

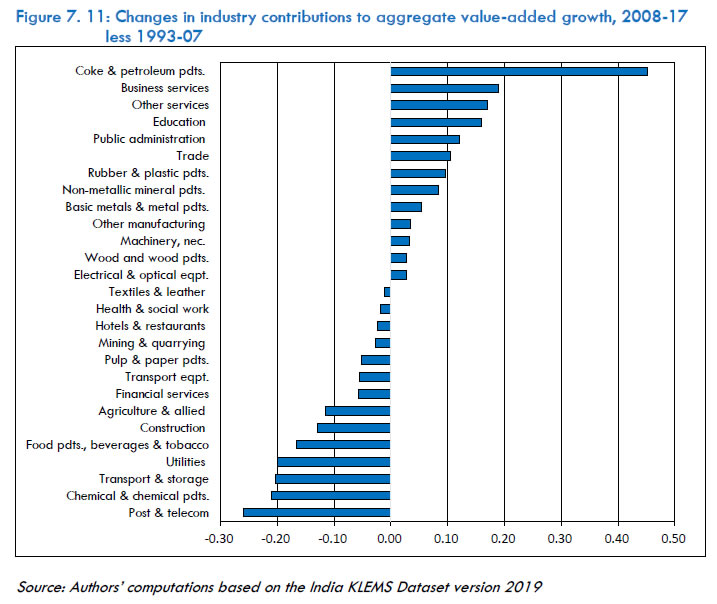

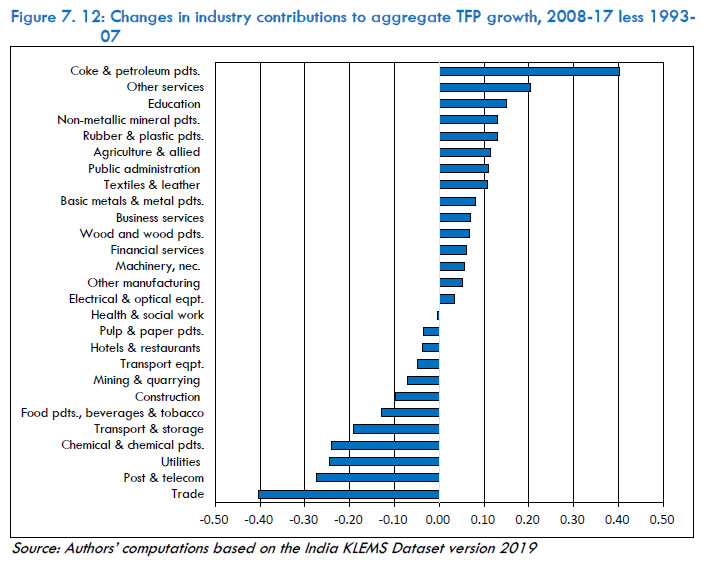

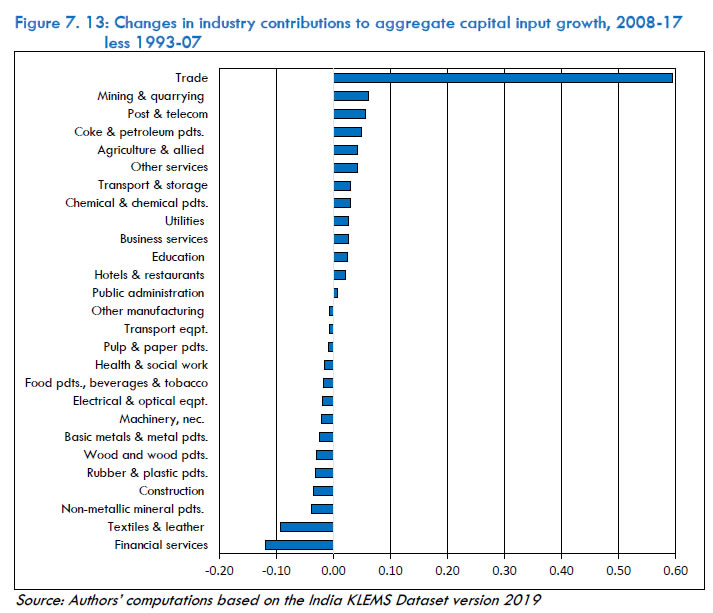

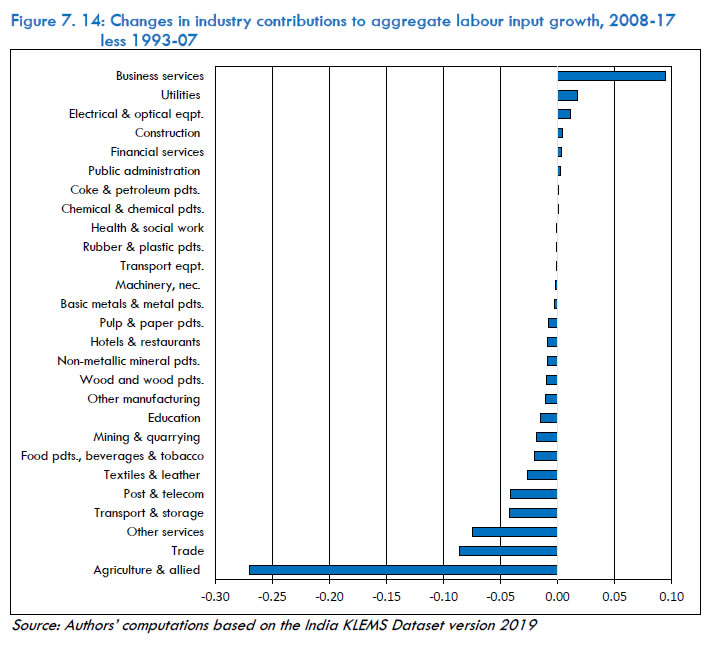

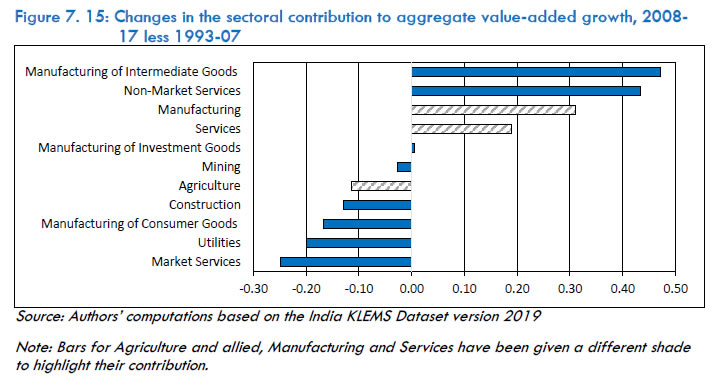

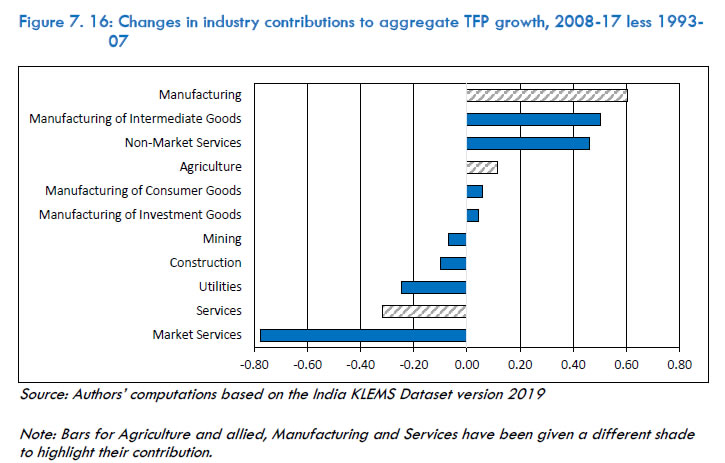

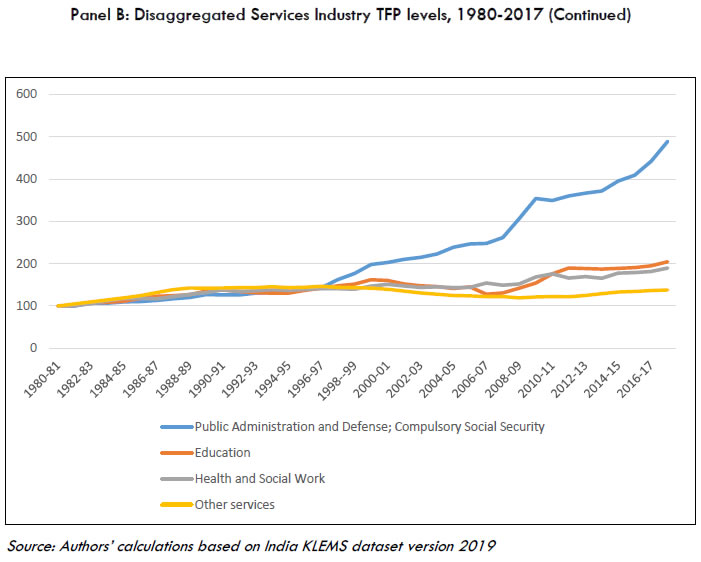

A detailed examination of industry origins of India’s growth and productivity forms the core of Chapter 7. The disaggregated industry-level production accounts are analyzed for the 27 India KLEMS industries and six broad sectors for the overall period of 1981-2017 and for two sub-periods—the pre-GFC phase of 1992-2007, pertaining to post-systematic reforms and 2009-17, the post-GFC phase of global productivity slowdown. The chapter uses growth accounting techniques based on the gross output framework to examine the industry-level sources of output growth. It deploys the methodologically superior and practically sound Production Possibility Frontier (PPF) approach to analyse the origins of aggregate value-added and TFP growth, instead of the more traditional Aggregate Production Function (APF) approach. The findings of the chapter are three-fold: Decomposition of the sources of growth using the gross output-based production approach yeilds several observations—First, intermediate inputs were the largest contributor to the observed output growth across the 27 industry groups, driven mostly by the contribution of Material (M) input. However, the contribution from the Services (S) input was substantial for the services industries--signaling the importance of intermediate transactions within this sector; Second, capital input was the second-most important contributor after intermediate inputs, especially for the services industries. Third, the contribution from labour input and TFP growth were negligible except for a few instances. A review of the industry origins of GVA growth reveals that apart from the agriculture & allied industries sector, industries belonging to the services sector exhibited impressive contributions to aggregate value-added growth. The substantial contribution of services was a combination of high value-added shares and impressive value-added growth rates. None of the manufacturing industries made it to the list of top contributors to aggregate value-added growth -- raising questions about the numerous policies that have been aimed at enhancing the sector’s competitiveness. The largest contribution to overall productivity growth came from agriculture & allied industries and public administration, a non-market service industry. Analysis at the broad sector level offers the following observations—first, the services sector was the largest contributor to aggregate value-added growth and TFP. The contribution of this sector to aggregate value-added growth was driven mostly by the strong performance of market services, while the corresponding contributions to aggregate TFP growth was driven by the non-market sub-sector. Second, aggregate TFP growth, estimate derived from the PPF, is mostly accounted for by Domar-weighted industry-level TFP growth, however substantial reallocation effects of labour and capital do exist.

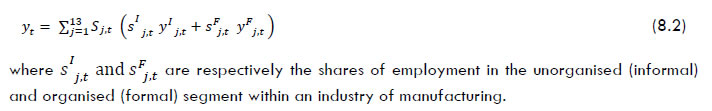

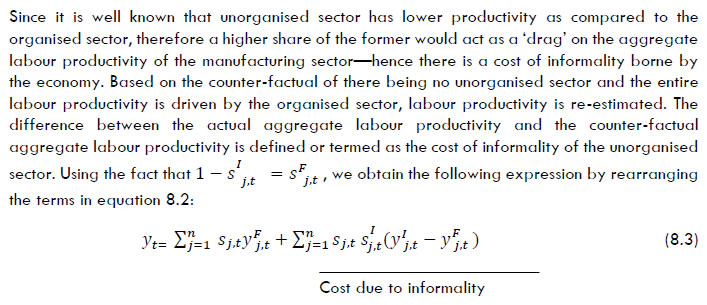

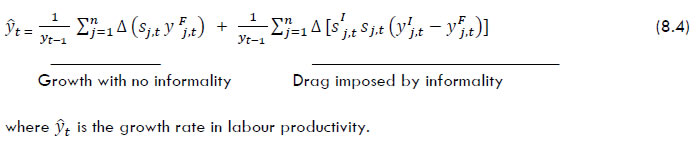

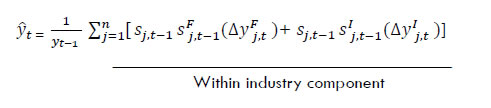

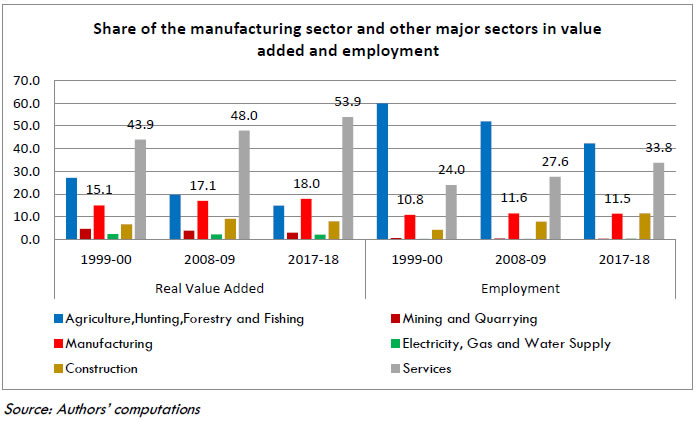

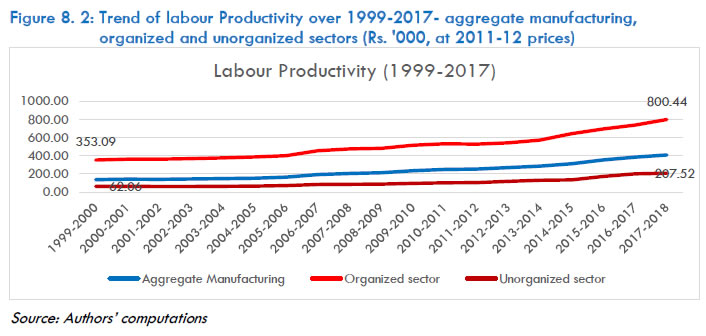

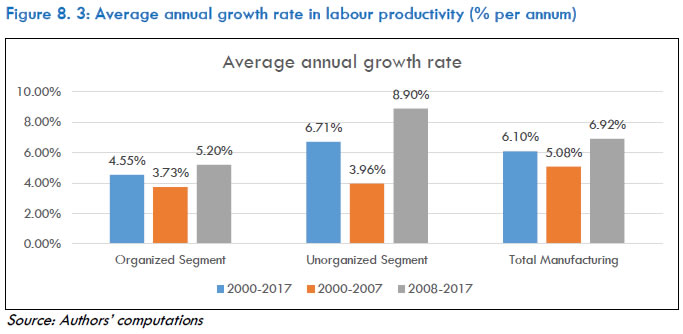

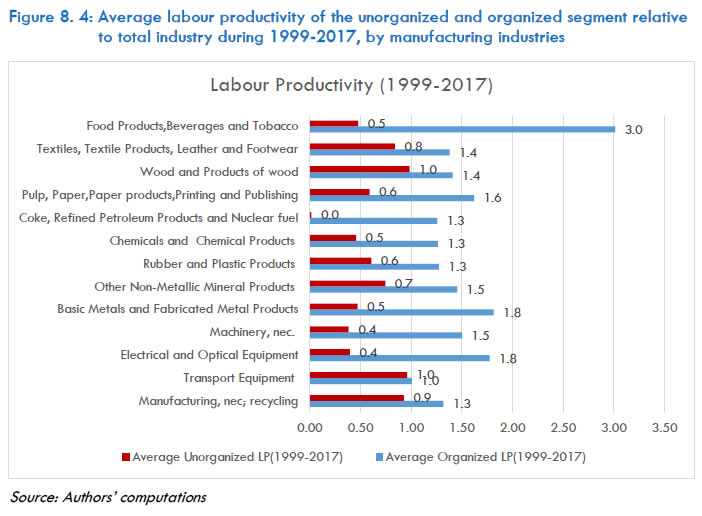

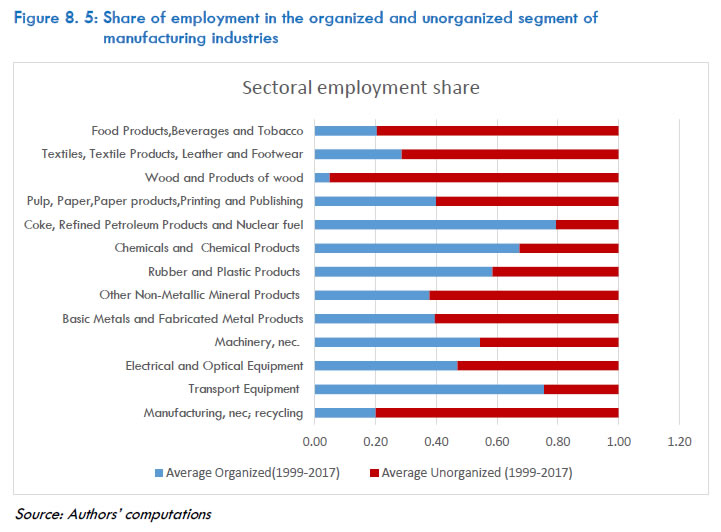

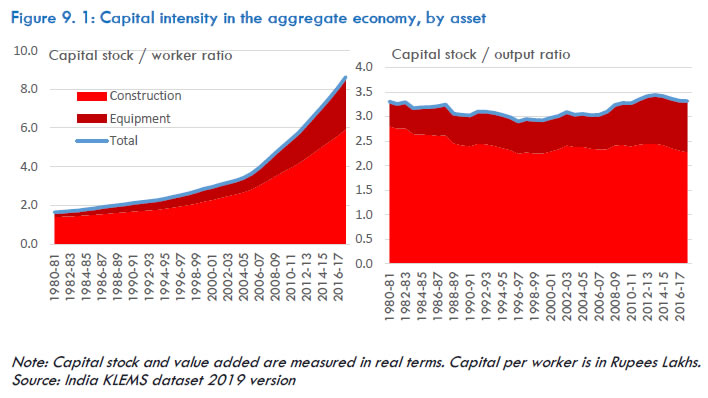

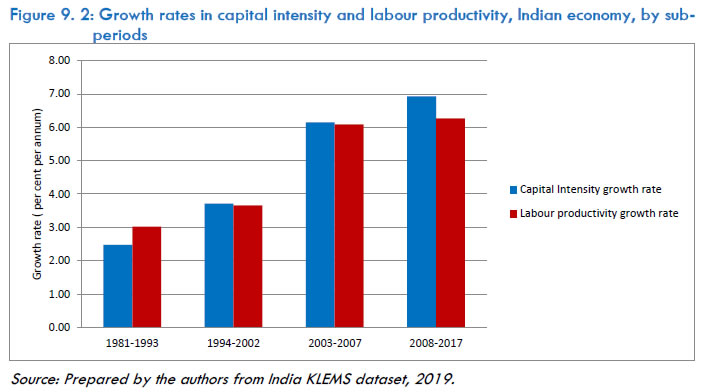

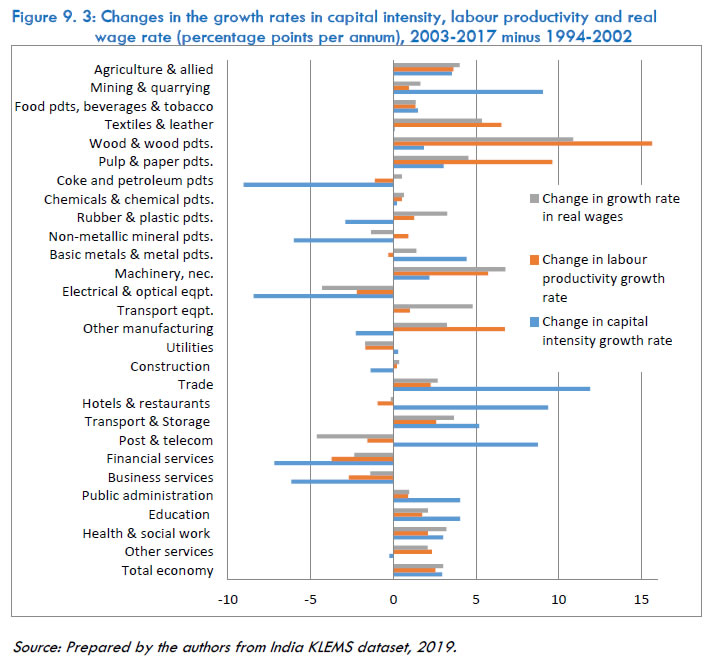

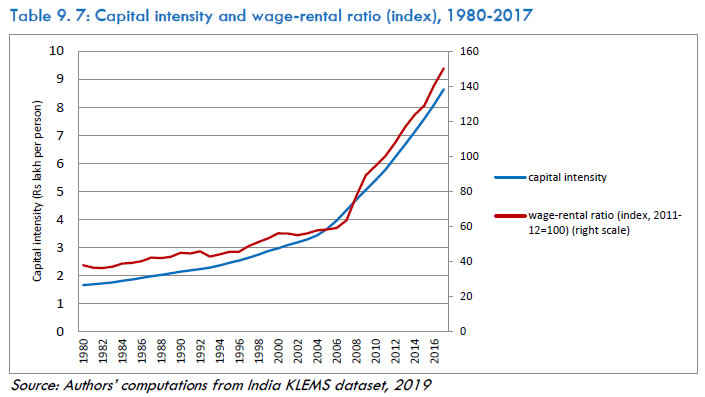

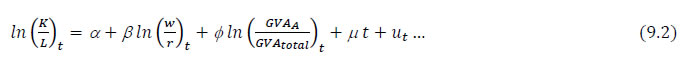

Chapter 8 is contextualised to the dualistic structure of manufacturing in India and considers the substantive differences between the formal and informal manufacturing segments in terms of growth in real GVA, employment and productivity. The dominance of the informal segment was evident in its two-third share in employment in 2017-18, and one-third share in GVA. Comparing the two segments in terms of growth in GVA and employment, we observe that faster growth in the formal segment accounted for seven million more jobs out of total 10 million in the overall manufacturing sector during the period of 1999-2017 and its share in employment had thus risen in recent years from 25 per cent in 1999 to 34 per cent in 2017. Labour productivity in the informal manufacturing segment had always been lower than that of the organised segment, though the relative difference had narrowed down and had always exerted a downward pressure, a ‘drag’ on the labour productivity of the overall manufacturing sector. Decomposition of the labour productivity growth shows a positive ‘within’ industry change and structural (or between industries) change, thus pointing to the phenomenon of movement of workers from less productive to industries that were more productive. The chapter offers some policy suggestions, such as, a greater focus could be on those industries, which could aid in accelerating the process of formalisation of Indian manufacturing, both from capital and labour point of view. In addition, unorganised sector enterprises may be incentivised to grow and become competitive by removing obstacles through the provisioning of cheap finance, regular supply of electricity and other necessary inputs, and access to new appropriate technology and markets. Research on India’s productivity performance has highlighted that factor accumulation rather than productivity improvements are behind the observed growth of the economy. Chapters 9 and 10 contributes to this literature by reviewing factor intensity, especially energy and capital intensities. The analysis of capital intensity in Chapter 9 reveals that the Indian economy was increasingly becoming capital intensive, amid a falling relative price of capital compared with labour. Much of the recent expansion in capital services and capital deepening was in the market services sector. The construction sector was another sector where capital intensity had been rapidly rising. While these were primarily in alliance with the fall in relative price of capital, the trends in the manufacturing sector remain a challenging question--as the relative prices of capital in this sector were among the highest across the broad sectors of the economy, yet it continues to see high growth in capital per worker. The results of the econometric analysis of capital intensity indicate that the finding of a marked increase in the growth rate in real wages during 2003-2017 as compared with 1981-2002 fits well with (and may be treated as a major explanation for) the finding of an accelerated growth in capital intensity in the Indian economy during 2003-2017. A significant positive effect of real wages on capital intensity is found from both an analysis based on time series data and an analysis based on panel data.

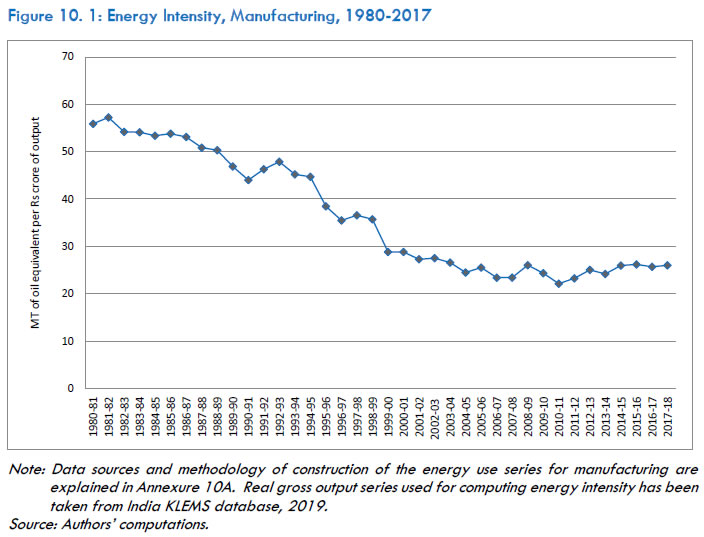

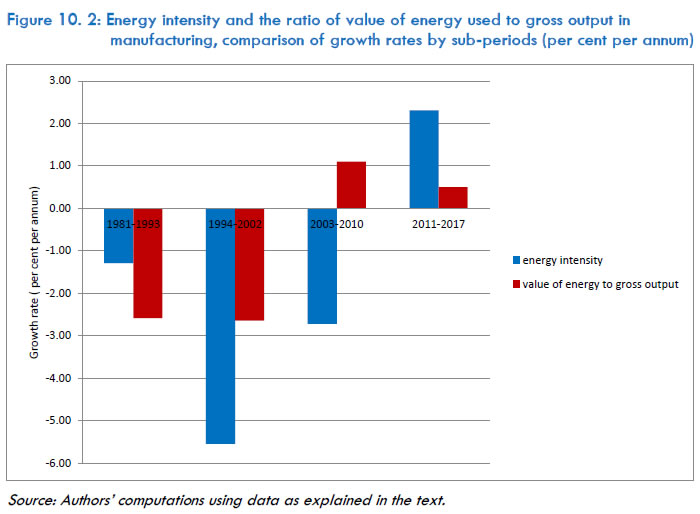

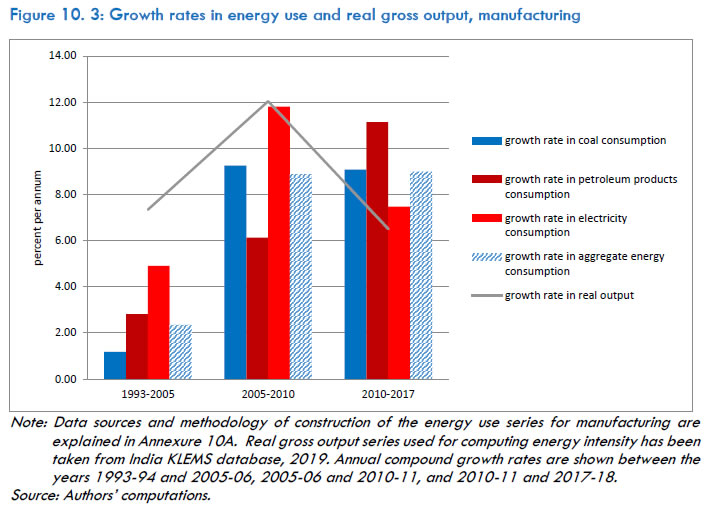

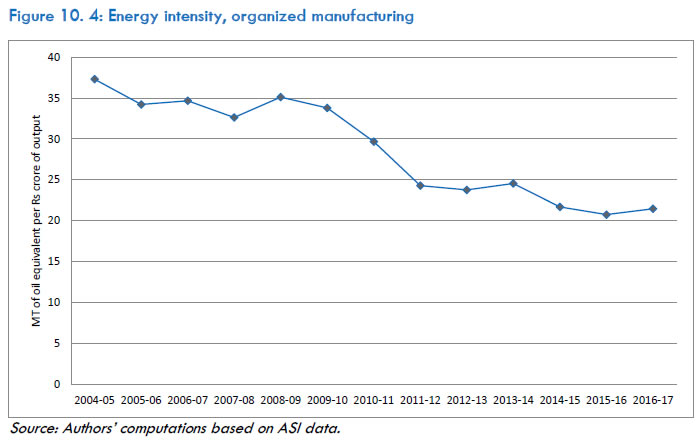

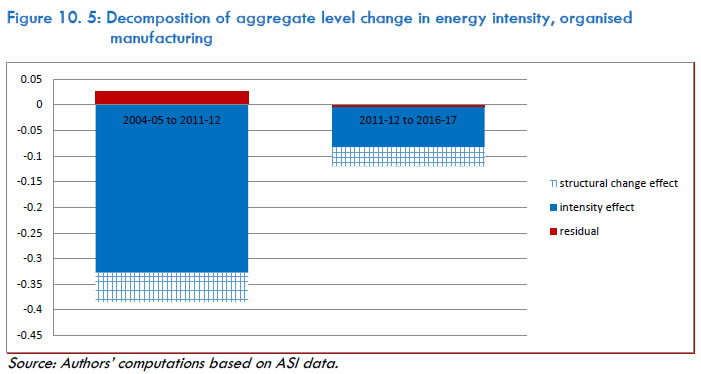

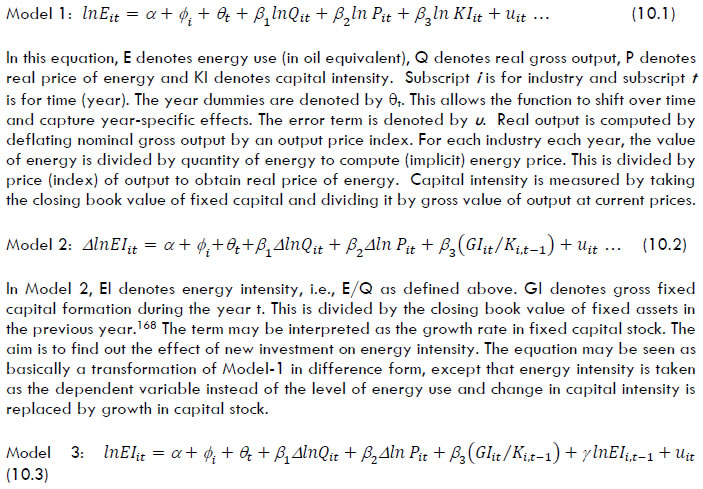

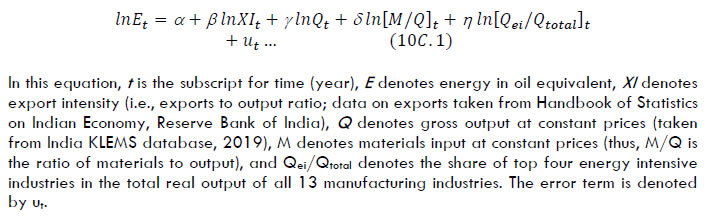

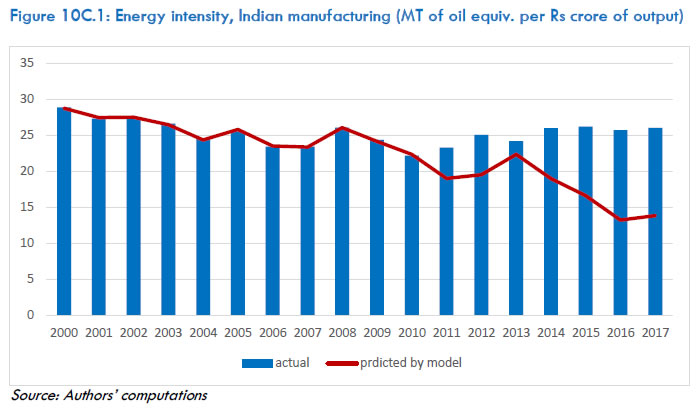

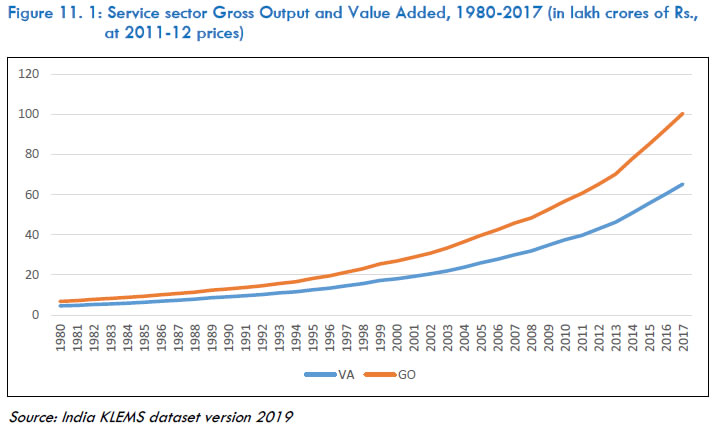

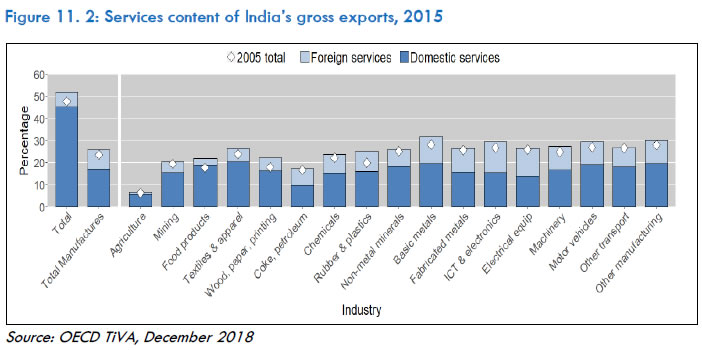

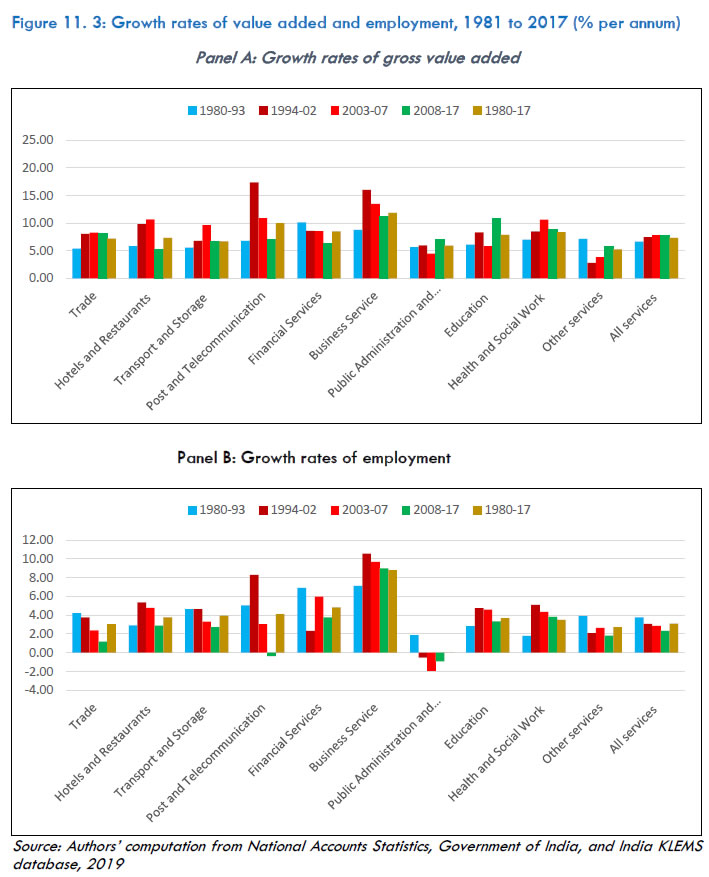

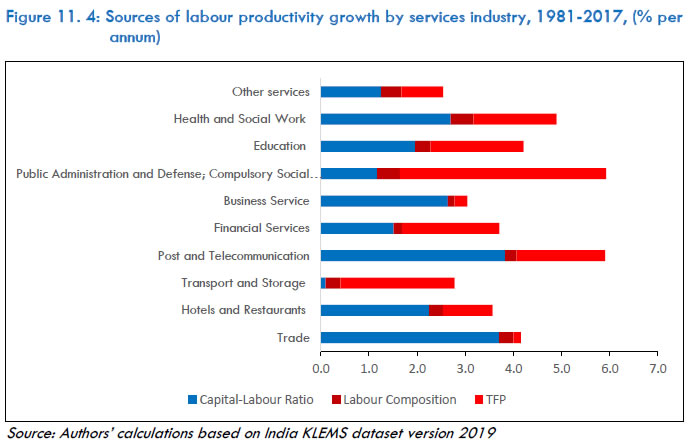

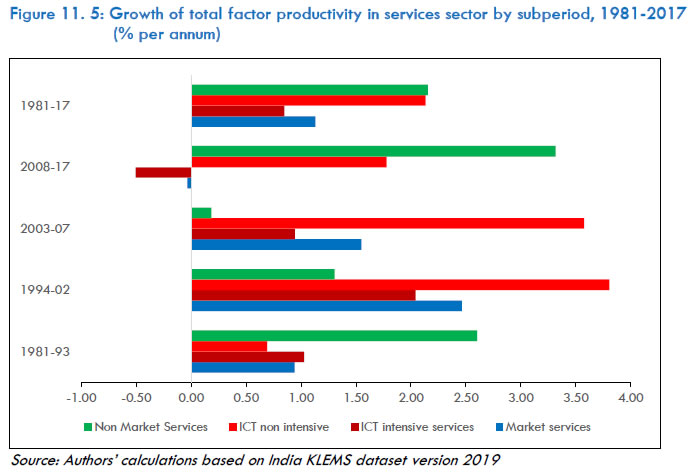

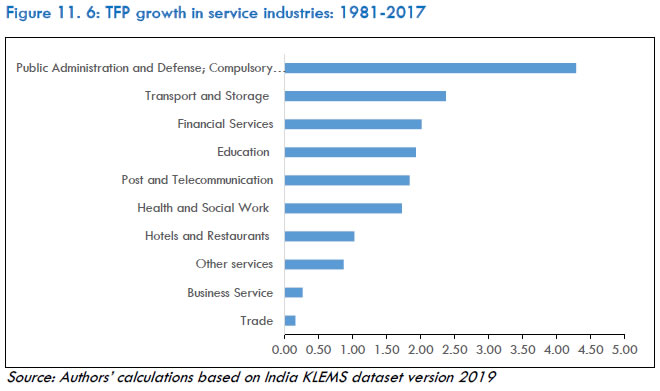

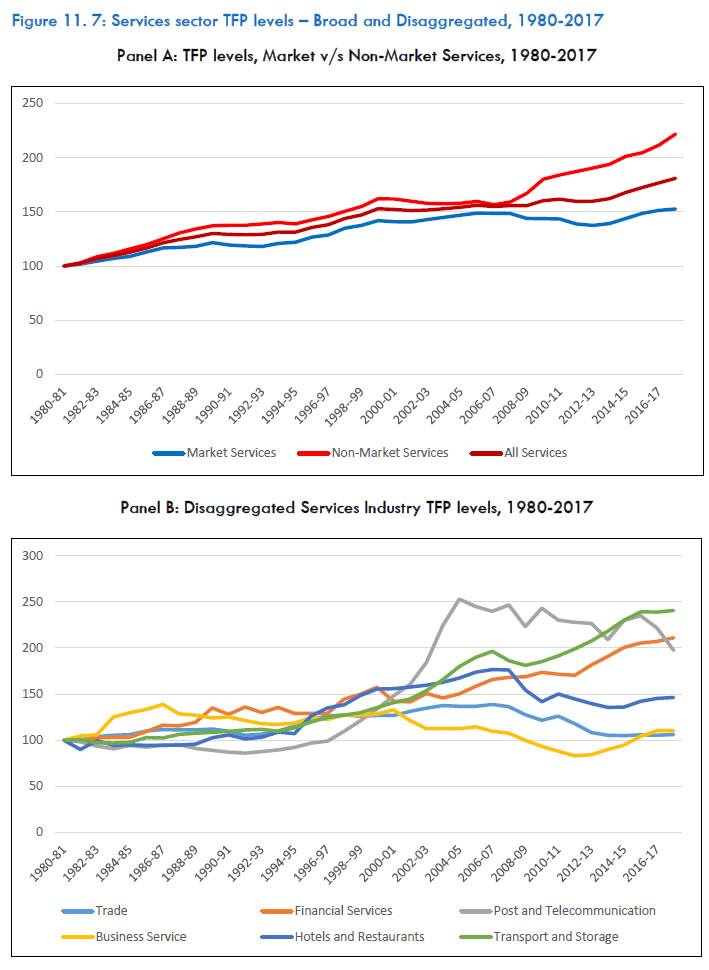

Analysis of trends in energy intensity in Chapter 10 is confined to manufacturing, which accounts for a substantial part of the economy’s energy consumption, with a focus on the formal segment of manufacturing at the aggregate and industry level for the period 2004-05 to 2016-17. A distinguishing feature here is that energy intensity is computed by taking a physical measure of energy. The analysis of trends in capital intensity has a wider industrial coverage, extending to the entire economy. The study covers the period 1980-81 to 2017-18. The analysis shows several significant findings. First, in the period from 1980 to the end of 2000s, there was a downward trend in energy intensity in manufacturing, which got subsequently halted. The energy intensity series for aggregate manufacturing shows a mild upward trend after 2010, whereas the energy intensity series for organized manufacturing based on a different data source, namely ASI, shows that after 2011 there was a marked slowdown in the downward trend as compared with the trend prevailing previously. Second, the average annual growth rate in capital intensity at the aggregate economy level during the period 2003-2017 was significantly higher than that during 1981-2002. Decomposition analysis revealed that a sizeable part of the hike in the growth rate in capital intensity in the period 2003-2017 as compared with the period 1994-2002 is explained by the effect of the inter-industry reallocation of labour. The econometric analysis of determinants of energy use and energy intensity presented in the chapter reveals a significant negative relationship between energy price and energy demand in manufacturing. An examination of movements in prices of energy and output shows that there was a fall in the real price of energy input in manufacturing in the period 2011-12 to 2017-18 and this could be one of the important factors that halted or slowed down the previously prevailing downward trend in energy intensity in manufacturing. Further analysis of trends in energy intensity using a time-series model finds the important role played by real price of energy. The analysis brings out that movements in manufacturing sector output and real price of energy fails to explain fully the movements in energy intensity in the more recent period, and the reversal from the previously prevailing downward trends seem traceable to some factors that tend to raise energy intensity of manufacturing. Chapter 11 examines the growth and productivity trends in the Indian services sector for the overall period of 1980-2017 and various sub-periods. The analysis has been done at the disaggregated level for the ten services industries and at the sectoral level for market and non-market services. Within the market services sub-sector, ICT-intensive and non-ICT-intensive service segments are analysed separately. Since there is substantial heterogeneity within the service sector, our detailed sectoral focus helps understand the relative position of market services versus non-market services, and ICT-using and producing services versus non-ICT services in the overall service sector performance in India. We use labour productivity as a measure of productivity performance and observe sources of labour productivity growth for the disaggregated services. Our main observation is that labour productivity in India’s service sector had been growing substantially in the period 1980-2017 and much of this productivity gain was accruing through acceleration in non-market services productivity. In the pre-reforms phase (1980-93), non-market services showed higher labour productivity growth relative to the market services, while the converse was true in the reform phase (1994-2002) and the golden growth phase (2003-07). However, market services fell behind non-market services in terms of labour productivity growth in the global slowdown phase (2008-17). A closer examination further suggests that ICT-intensive sectors, in particular trade and postal & telecommunication had driven much of the market services productivity growth, while non-market services growth had been driven by public administration. We further observe that TFP growth accounted for much of the improvements in labour productivity in financial services, public administration, and overwhelmingly for transportation and storage. For the rest of the services industries, except for education (where the contribution of TFP growth and capital deepening was very close), the contribution of TFP growth was mostly small. For non-market services, we find very low or negligible contributions from overall productivity growth in accounting for labour productivity growth. The decomposition of gross output growth reveals that capital and intermediate inputs (services input in particular) were the significant contributors to the observed output growth rates in different service industries.

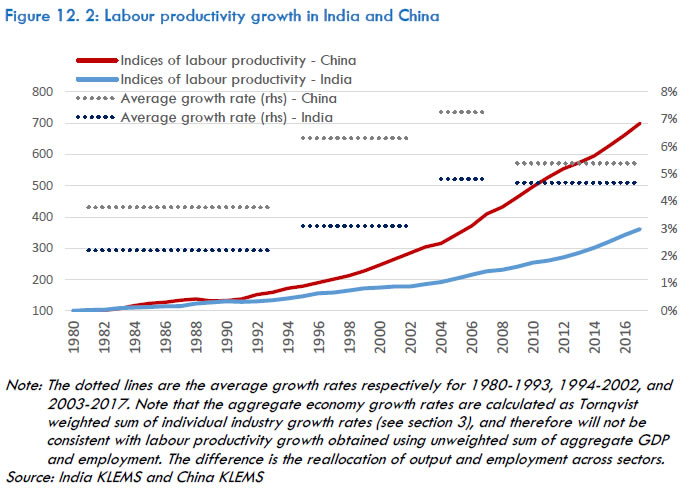

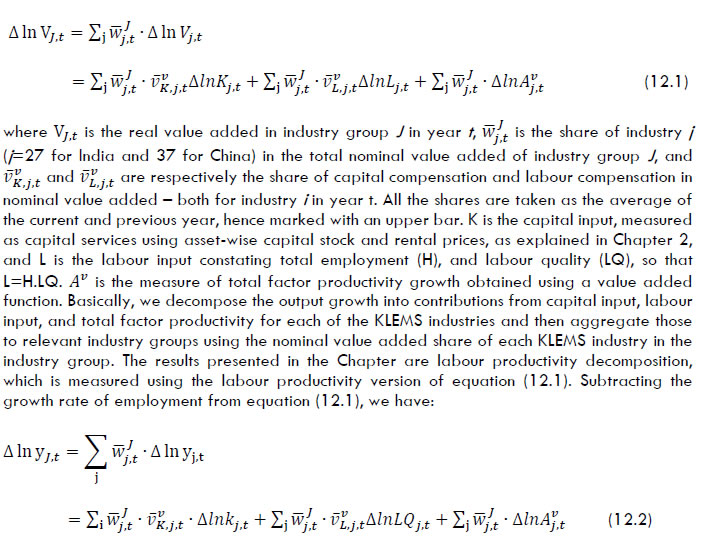

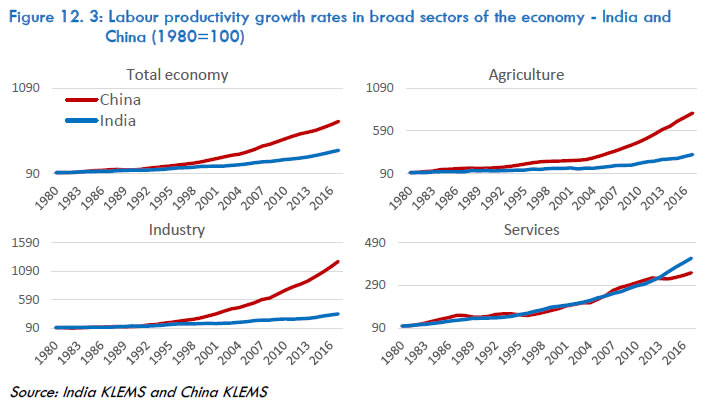

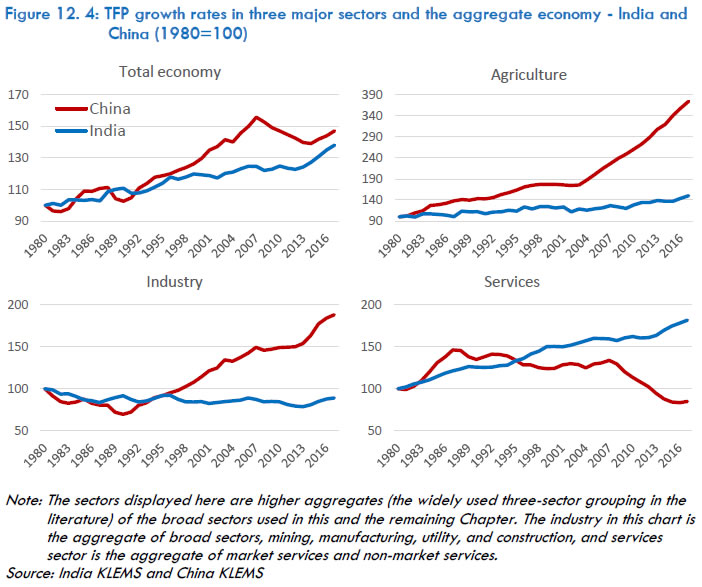

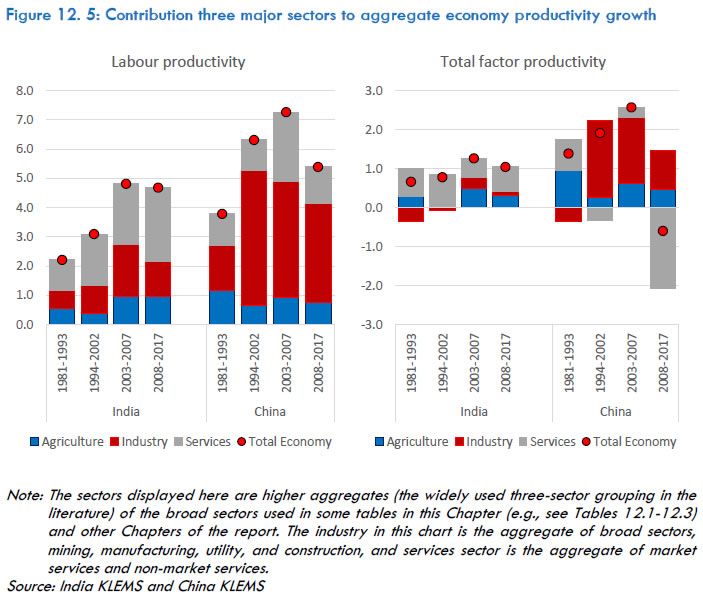

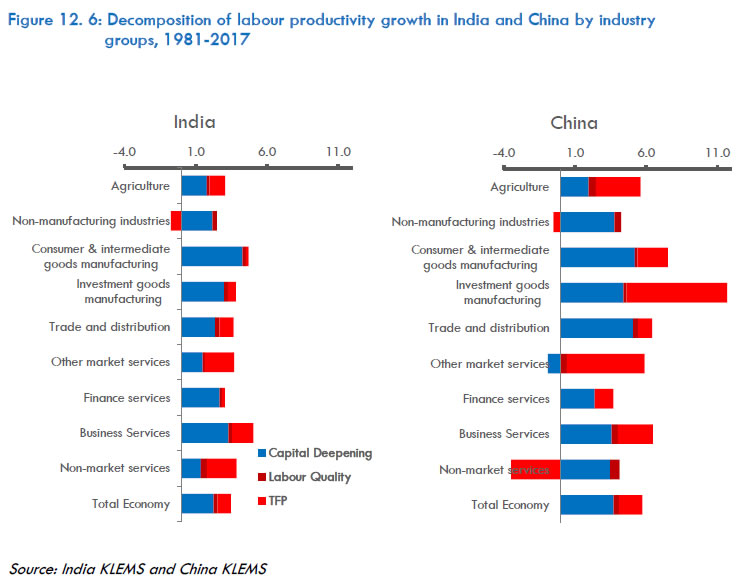

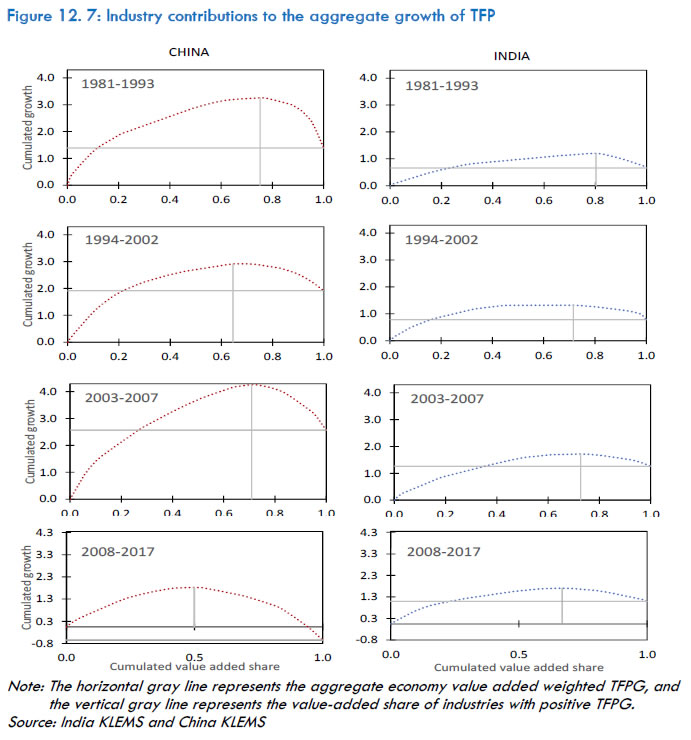

The role of TFP growth in accounting for the observed growth was negligible. In the pre-reform phase, non-market services outperformed that of market services in this regard; however, we observe that TFP growth of market services was higher in the reform phase of 1994-2002. Overall, in terms of broad sectors, the highest contribution for the period 1980-2017 was from services. In terms of industry-wise contribution to aggregate TFP growth for the period of 1980 to 2017, the top three contributors include agriculture et al, public administration and defence, and transport and storage. Financial services and ‘other services’ also contributed significantly. This substantiates our assertion about the growing importance of services in the overall economy and offers evidence that high productivity growth in many service sectors underlies the current dynamism in service sector growth to a considerable extent. Economic growth in India and China has been often compared in the literature, as these giant economies have lately been the major driving force of recent global growth. These two economies share the experience of a shift from a socialist past to a market economy, which happened around the early 1990s. However, their paths to economic growth have been different. While China's growth was largely driven by the manufacturing sector, India relied substantially on its services sector. One of the important features of the country KLEMS datasets, such as the India KLEMS, is that they allow cross-country comparison of growth and levels of both labour and total factor productivities. Chapter 12 addresses that aspect of KLEMS database by undertaking a comparison of China and India’s growth and productivity performance. This chapter compares the proximate sources of economic growth in the two countries, i.e., the role of capital accumulation and total factor productivity in driving labour productivity, using a comparable methodology and detailed industry-level data for the period 1980-2017. The analysis reveals that China's labour productivity had grown much faster than that of India over the last 40 years, thereby widening the gap between the two countries’ productivity levels. A massive tide in its non-service economy has driven China's labour productivity growth compared with India, where the services economy did relatively better over the years. China performed relatively better in all the nine industry groups reviewed in this chapter, except for the financial and business services sectors in the 1990s and non-market services through the entire 1981-2017 period. China's dominance in the industrial sector was also visible in its TFP performance. China performed better in the aggregate economy, agriculture, and industry, while India’s service sector performance was much better.