International Financial Markets

Global financial markets witnessed turbulent conditions during 2007-08 as the crisis in the US sub-prime mortgage market deepened and spilled over to markets for other assets. Concerns about slowdown in the real economy propelled a broad-based re-pricing of growth risk by the end of the year. In the wake of the persistent uncertainties about the US sub-prime mortgage market and other credit markets exposures, liquidity demand surged. To ease liquidity conditions, major central banks continued to inject liquidity in a more collaborative manner. Elevated inflationary pressures in many economies reflected historical peaks in crude oil prices. Share prices in advanced economies fell, while those in emerging market economies (EMEs), which had shown some resilience, declined sharply from January 2008. Long-term government bond yields in advanced economies softened, reflecting flight to safety by investors and easing of monetary policy in the US. In the currency markets, the US dollar depreciated against major currencies.

Recent financial market developments unfolded against the backdrop of an extended period of strong broad-based global growth and overall financial stability. The congruence of favourable macroeconomic conditions, abundant liquidity and low nominal rates generated perception of low financial risks. Investor appetite for high returns in a low interest rate environment encouraged market participants to undertake progressively higher risks, stimulated further technological development for unbundling and distributing risks through financial markets and boosted demand for a range of high yielding and complex financial products. Greater appetite for structured instruments was evident in the rapid rise in the issuance of asset-backed securities (ABSs), collateralised debt obligations (CDOs) and credit default swaps.

According to the IMF’s assessment in April 20081, the recent financial market turbulence that erupted in August 2007 has developed into the largest financial shock since the Great Depression, inflicting heavy damage on markets and institutions at the core of the financial system. The turmoil, which was initiated by rapidly rising defaults on sub-prime mortgages in the context of a major US housing correction, subsequently spread to securities backed by mortgages, including CDOs structured to attract high credit ratings.

Delinquency rates on sub-prime mortgages (residential loans extended to individuals with poor credit history) had started rising markedly after mid-2005. However, the trigger for deterioration in the credit market was provided by the news that two hedge funds, which were active in the structured markets for credit instruments that had sub-prime exposure, had suffered heavy losses and almost lost their capital. The market value of credit products based on sub-prime mortgages also declined2. These losses were aggravated by a sharp fall in financial market liquidity as investors became reluctant to invest in such products. These events resulted in a tightening in underwriting standards, with fewer households qualifying for sub-prime loans. Losses on mortgage exposures worsened following adverse developments in the US housing market. There was further downgrading of ABSs with underlying assets as US sub-prime residential mortgages. Many issuers of asset-backed commercial paper (ABCP) programs found it extremely difficult to roll over maturing asset backed paper into new longer-term paper. The uncertainty over financial system exposures spread to banks and hedge funds outside the US as they indicated their exposures to this market. The rating agencies also announced that they would be downgrading asset backed securities with underlying pools of sub-prime mortgages.

In the wake of these events, activity in ABCP dwindled, while concerns about banks being forced to take ABCP exposures on to their balance sheets generated apprehensions about an impending credit crunch. Inability of commercial paper issuing vehicles to finance at longer maturities induced them to seek liquidity needs from their sponsor banks, which in turn, prompted banks to hoard liquidity. The uncertainty about the quality of counter-party assets also aggravated the situation. The disturbances, thus, spilled over into short-term money markets, causing steep increases in overnight interest rates in major economies in August 2007. The steep increases in the inter-bank rates occurred as banks sought to conserve their own liquidity in the face of pressures to absorb assets from off-balance-sheet vehicles for which they were no longer able to obtain funding and uncertainty about the size and distribution of banks' losses on holding of sub-prime securities and other structure credits. The UK witnessed some of the sharpest increases in the inter-bank rates as liquidity problems at the mortgage lender Northern Rock became more pronounced eventually triggering a bank run. The government bond yields in industrialised countries declined sharply with the yield on the 10-year paper in the US dropping by around 65 basis points, and those in the Euro area and Japan by around 40 basis points each by late August 2007 over first half of June 2007 as markets sold off and investors retreated from risky assets.

In August 2007, central banks in the US and other affected economies, therefore, injected liquidity to stabilise inter-bank markets. Open market operations of increased size and maturity were undertaken by the Bank of England, European Central Bank (ECB) and the US Federal Reserve System. The types of securities against which banks could borrow were broadened by the US Fed and the ECB to include mortgage backed securities. The US Fed also decided to accept ABCPs as collateral. On August 16, 2007, the US Federal Open Market Committee (FOMC) lowered its discount rate by 50 basis points, bringing in some calmness in markets. The Bank of England provided emergency liquidity assistance to Northern Rock. The US FOMC, at its meeting held on September 18, 2007, decided to cut the fed funds rate target by 50 basis points (bps) from 5.25 per cent to 4.75 per cent and correspondingly the federal discount rate from 5.75 per cent to 5.25 per cent. While the primary concern of the FOMC till August 2007 was the existence of inflationary pressures, the risks to economic growth were indicated as an added concern in its September 18, 2007 statement.

As a consequence of successive central bank liquidity injections into the inter-bank money markets and lower policy rates in the US, the credit markets recovered briefly in early October 2007. Renewed concerns about the uncertainty in the US housing market and direct and indirect exposures to associated economic and financial risks from mid-October 2007 led to widening of credit spreads. Mirroring the developments in the US, the credit spreads widened in the Euro area. Market conditions weakened for structured instruments, reflecting the deteriorating asset quality and uncertainties about valuation of structured credit products. This also reflected worsening of sentiment in the money market beginning mid-October 2007 as liquidity conditions became adverse leading to rise in inter-bank rates. The swap spreads between three-month inter-bank interest rates and overnight index swaps rose sharply reflecting greater preference for liquidity and rising counterparty risk premia. Spreads also increased sharply across other related market segments, including securities backed by credit cards, auto loans, student loans, and commercial mortgages, as a result of concerns about rising default rates, excessive leverage, and questionable securitisation techniques. Market participants evinced keen interest in government paper. Bond yields also fell in anticipation of weakening of economic activity and expectations of further monetary policy easing in the US.

In order to improve liquidity, the US Federal Reserve Board reduced its fed funds rate target by 25 basis points each on October 31, 2007 and December 11, 2007. The Bank of England and the Bank of Canada also reduced their policy rates in December 2007. In the situation of heightened tensions and serious impairment of functioning of the money markets, five central banks, viz., the Bank of Canada, the Bank of England, the European Central Bank, the Federal Reserve and the Swiss National Bank announced measures on December 12, 2007 in a collaborative manner to address elevated pressures. Actions taken by the Federal Reserve included the establishment of a Term Auction Facility (TAF) and the establishment of foreign exchange swap lines with the European Central Bank and the Swiss National Bank. The TAF allowed a potentially much larger pool of banks to bid for funds direct from the Fed. The goal of the TAF was to reduce the incentive for banks to hold cash and increase their willingness to provide credits to households and firms. The ECB announced that the Eurosystem would conduct two US dollar liquidity-providing operations, in connection with the US dollar TAF, against ECB-eligible collateral for a maturity of 28 and 35 days. The Bank of England expanded the amount of reserves offered at three months maturity in its long-term repo open market operations scheduled on December 18, 2007 and January 15, 2008. It also widened the range of collateral accepted for funds advanced at this maturity. The Bank of Canada announced that it would enter into term purchase and resale agreements extending over the calendar year-end.

In the UK, the Government had to extend guarantees to depositors of Northern Rock to avoid contagion in the banking system. The Northern Rock was also provided a large loan by the Bank of England. Under a fresh rescue plan under current consideration of the authority, the money lent to Northern Rock could be converted into government bonds, a move that would allow a private buyer to reduce the burden of heavy loan repayment immediately.

As evidence accumulated on an imminent slowdown in the real economy since January 2008, a broad-based re-pricing of growth risk ensued. In the wake of further worsening of the baseline outlook for real activity in 2008 and increasing downside risks to growth, the US Fed reduced the fed funds rate target sharply by 75 basis points to 3.50 per cent on January 22, 2008 and further by 50 basis points to 3.00 per cent on January 30, 2008, taking the total reduction to 225 basis points beginning September 18, 2007.

Sentiment in the credit market deteriorated along with weak growth in the US manufacturing sector, adverse labour market conditions, and uncertainty about the ability of the financial system to provide and allocate credit. Expectations of downgrading of monoline financial guarantees further affected market sentiment. Thus, global credit markets witnessed further volatility and spreads rose sharply across the board as further writedowns by major financial institutions and adverse news from the US housing sector aggravated the concerns of further weakening of the US economy. Between end-November 2007 and February 22, 2008, the US five-year CDX high-yield index spread rose by 204 basis points to 696, while corresponding investment grade spreads moved by 76 basis points to 152. European and Japanese indices broadly mirrored the performance of their US counterparts. The five-year iTraxx Crossover CDS index climbed 227 basis points to 575, while investment grade spreads rose by 71 basis points to 124. Spreads on the iTraxx Japan index also widened considerably. All the indices had moved to the widest levels since their inception back in 2004 on or around January 22, 2008, before reaching even higher peaks by late February 2008.

Nervousness about the feedback effect between market developments and economic outlook fuelled further volatility among all other segments of the financial market. Equity markets and the government bonds markets also remained volatile in February 2008, reflecting spillover of risks from the credit market to these segments and indications of further slowdown of the US economy. Government bond yields has declined sharply, and investment in commodity markets has escalated as investors sought alternative asset classes. The news of additional monoline downgrades, related recapitalisations and restructuring plans and increased loss estimates for exposures similar to those of the monolines, and renewed concerns about unwinds and structured instruments added further volatility to the financial markets. The equity markets declined in the US, Europe, Japan and other advanced economies. The equity markets in the EMEs, which had shown some resilient, saw more pronounced weaknesses from January 2008. Government bond yields declined further consequent to the decline in the equity markets and increasing safe haven flows towards the government securities market. This was supported by anticipations of further monetary policy easing in the US. The US Federal Reserve on March 14, 2008 announced to provide emergency funding to Bear Stearns, an investment bank. As per the arrangement, the New York Fed will fund the investment bank through its discount window by passing funds to JPMorgan Chase, which has set up a secured loan facility with Bear Stearns. In order to foster market liquidity and to promote moderate growth over time and to mitigate the risks to economic activity, the US Fed reduced the fed funds rate target sharply by 75 basis points to 2.25 per cent on March 18, 2008, taking the total reduction to 300 basis points beginning September 18, 2007.

In strong contrast to earlier periods of global financial disruption, the direct spillovers to emerging and developing economies have been largely contained so far. Issuance activity by these economies has moderated since August 2007, compared with the very high levels of issuance experienced during the previous year. However, the overall foreign exchange flows have been largely sustained, and international reserves have continued to rise. Foreign direct investment and portfolio equity flows have generally remained strong, although there have been sharp portfolio outflows during periods of market nervousness. Most emerging markets have significantly outperformed those in advanced economies since June 2007, even though spreads on emerging economies' sovereign and corporate debt have widened and equity prices retreated in early 2008.

Recent financial market developments raise several issues and concerns. First, according to the IMF’s assessment, experience from the past episodes may not provide much guidance for the current unprecedented situation in the financial markets. In particular, the global economy is now facing widespread deleveraging as mechanisms for credit creation have been damaged in both the banking system and in the securities markets: the financial system’s twin engines are both faltering at the same time. According to the IMF’s staff estimates, potential losses to banks from exposure to the US sub-prime mortgage market and from related structured securities, as well as losses on other US credit classes such as consumer and corporate loans, could be of the order of US$ 440 - US$ 510 billion out of total potential losses of US$ 945 billion, which would put significant pressure on the capital adequacy of the US and European banks. Capital adequacy and leverage ratios were also being adversely affected by the re-intermediation onto bank balance sheets of off-balance-sheet structures such as conduits and leveraged buyout financing underwritten by major banks. According to the IMF, the adverse impact of bank lending reflected tightening of lending standards of the banks rather than deterioration in capital adequacy. In the securities markets, financial tightening measures have affected business conditions due to rise in spreads on corporate securities. For higher-risk borrowers, the rise was somewhat less pronounced than during the 2001 recession. Spreads facing prime corporate borrowers were close to 2002 highs, although overall yields still remain lower given the decline in government benchmarks. According to the IMF’s expectations, issuances of complex structured credits are likely to be very limited until underlying weaknesses in the securitisation process are adequately addressed.

Second, while the practices of increased use of innovative credit instruments and complex layering of risk diffusion have reduced information costs, they have also enabled the investor or risk taker to become progressively remote from the ultimate borrowers where the actual risks reside. With a host of intermediaries in the form of mortgage brokers, mortgage companies and societies, packaging their mortgage assets including non-conforming loans and selling down to different categories of investors, including Special Investment Vehicles (SIVs), and hedge funds, the identification and location of risks in the whole chain is becoming increasingly challenging.

Third, the role of rating agencies has also come under scrutiny. The issues such as small number of rating agencies and the possible conflict of interest clearly suggest that the reliance only on rating agencies for risk assessment needs to be avoided.

Fourth, the confidence is also falling in the strength of the insurers that guarantee payments on bonds (monoline industry). Two major bond insurers reportedly have huge exposures in securities backed by assets, including subprime mortgages. Some of the bond insurers in fact, have already been downgraded by the rating agencies because of the losses on the sub-prime mortgage bonds they had insured. The cost of buying protection against defaults by US companies has also risen.

Fifth, as far as role of central banks is concerned, on one hand, there is a view that increased credibility of monetary policy has enhanced expectations for stability in both inflation and interest rates, which has led to the mispricing of risk and hence enhanced risk taking. On the other hand, another view is that the repeated assurances of stability and guidance to markets about the future path of interest rates by the central banks, coupled with the availability of ample liquidity, have led markets to underprice risks.

Sixth, the increased complexity of financial products and markets poses greater challenges to the regulators and supervisors to keep pace with the evolving risks to markets and institutions. As reported in the Report of the Financial Stability Forum3, supervisors and regulators need to make sure that the risk management and control framework within financial institutions keeps pace with the changes in instruments, markets and business models, and that firms do not engage in activities without having adequate controls.

Seventh, an important lesson emerging from the recent financial market developments is that the focus should not be on how the turmoil should be managed, but on what policies could be put in place to strengthen the financial system on a longer-term basis regardless of specific sources of disturbances4. Two important areas that need attention in this regard are architecture of prudential framework and monetary policy. A strong macro-prudential principle to financial regulation and supervision would need to be put in place. This would address the limitations in risk perceptions and in incentives as well as the self-reinforcing processes that lie behind the generalised build-up of risk and financial imbalances. The basic principle would be to encourage a build up of cushions in booms, so that they can be run down, up to a point, in bad times, as the imbalances unwind. In the US, a view has emerged that an objective-based regulatory structure focussing on three goals such as the market stability regulation, prudential financial regulation and business conduct regulation could be the optimal regulatory structure5 for the future.

The main challenge for monetary policy is that financial imbalances can also build up in the absence of overt inflationary pressures4. This suggests that it is important for monetary policy frameworks to allow for the possibility of a tightening even if near-term inflation remains under control – what might be called the "response option". This would limit the risk of a painful macroeconomic adjustment subsequently, as the unwinding of the imbalances can result in macroeconomic weakness, broader financial strains, unwelcome disinflation and possibly even disruptive deflation. On the other hand, when the imbalances unwind, challenges are somewhat different. As in the build-up phase, one relates to adjustments in

policy rates, i.e., in the monetary policy stance. Additionally, the other one may relate to the central bank’s liquidity operations, which are aimed at implementing the policy stance and/or at responding to dysfunctional inter-bank market conditions. Furthermore, there appears to be simultaneous challenges from several angles to the conduct of monetary policy emanating from recent financial turbulence. These relate to abrupt and large shifts in monetary policy measures of the major economies, major realignments in exchange rates within a short period and unprecedented inflationary pressures due to food and energy prices. These warrant significant and innovative ways of cooperation among the central bankers.

Short-term Interest Rates

Short-term interest rates in 2007-08 witnessed a mixed trend. They declined in the US, and in the UK from December 2007, reflecting monetary easing. During 2007-08, the US Fed reduced its fed funds rate target by 300 basis points to 2.25 per cent. The Bank of England, which had increased its policy rate in May 2007 and July 2007, reduced it in December 2007 and February 2008 in the wake of concerns of slow growth. On the other hand, short-term interest rates increased in other advanced economies such as the Euro area and Sweden as central banks in these countries raised their policy rates. In the EMEs, short-term interest rates also witnessed a mixed trend during 2007-08, firming up in Argentina, China, South Korea and the Philippines, while softening in Hong Kong, Brazil and Thailand (Table 43).

Table 43 : Short-term Interest Rates |

(Per cent) |

Region/Country |

End of |

|

March

2006 |

March

2007 |

June

2007 |

September

2007 |

December

2007 |

March

2008 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Advanced Economies |

Euro Area |

2.80 |

3.91 |

4.16 |

4.73 |

4.88 |

4.72 |

Japan |

0.04 |

0.57 |

0.63 |

0.73 |

0.73 |

0.75 |

Sweden |

1.99 |

3.21 |

3.42 |

3.54 |

4.02 |

4.11 |

UK |

4.58 |

5.55 |

5.92 |

6.28 |

6.41 |

6.01 |

US |

4.77 |

5.23 |

5.27 |

4.72 |

4.16 |

2.26 |

Emerging Market Economies |

Argentina |

9.63 |

9.63 |

9.25 |

12.31 |

14.50 |

10.44 |

Brazil |

16.54 |

12.68 |

11.93 |

11.18 |

11.18 |

11.18 |

China |

2.40 |

2.86 |

3.08 |

3.86 |

4.35 |

4.50 |

Hong Kong |

4.47 |

4.17 |

4.43 |

4.97 |

3.73 |

1.83 |

India |

6.11 |

7.98 |

7.39 |

7.19 |

7.35 |

7.23 |

Malaysia |

3.51 |

3.64 |

3.62 |

3.62 |

3.62 |

3.62 |

Philippines |

7.38 |

5.31 |

6.19 |

6.94 |

6.56 |

6.44 |

Singapore |

3.44 |

3.00 |

2.55 |

2.56 |

2.56 |

1.38 |

South Korea |

4.26 |

4.94 |

5.03 |

5.34 |

5.71 |

5.32 |

Thailand |

5.10 |

4.45 |

3.75 |

3.55 |

3.90 |

3.25 |

Note : Data for India refer to 91-day Treasury Bills rate and for other countries 3-month money market rates.

Source : The Economist. |

Government Bond Yields

During the first quarter of 2007-08, government bond yields increased in major advanced economies, reflecting higher short-term rates and upward revision in growth expectations. Long-term government bond yields, however, softened in the subsequent part of the year, reflecting lower investor appetite for riskier assets in the wake of deteriorating housing market, turbulence in the credit market and monetary policy easing in the US (Chart 30). The 10-year government bond yield in the US increased from 4.65 per cent on March 30, 2007 to a high of 5.26 per cent on June 12, 2007 but declined to 3.45 per cent on March 31, 2008. On the whole, during 2007-08, the 10-year yield declined by 120 basis points in the US. Yield on 10-year government paper in other advanced economies also declined (49 basis points in the UK, 41 basis points in Japan and 16 basis points in the Euro area).

Equity Markets

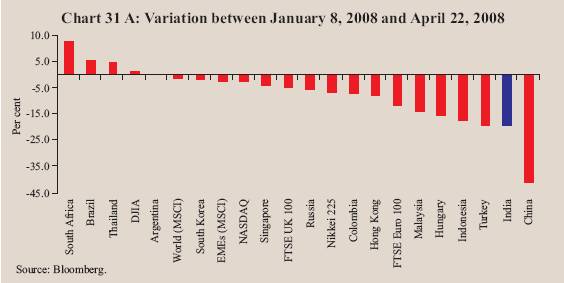

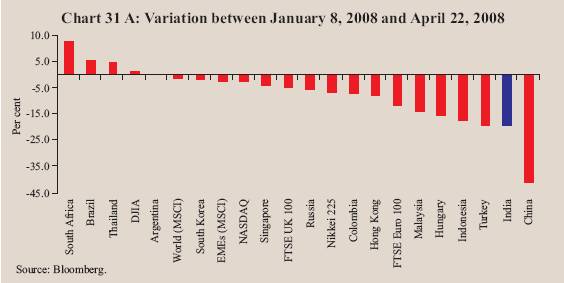

Equity markets in the advanced economies declined reflecting concerns over recession in the US economy on account of contraction in the US service industry, weak earnings growth reported by some of the leading US companies, home foreclosures climbing to record high levels and lacklustre retail sales in the US. Equity markets bottomed out around January 22, 2008 following the unanticipated reduction in US short-term interest rates and news of possible capital injections into the monoline insurers. Equity markets rebounded somewhat in late January 2008, but much of these gains subsequently petered out in February-March 2008, reflecting further weakening of growth prospects. Between end-October 2007 and January 23, 2008, the MSCI developed markets index declined by 17.0 per cent and was still down about 14.0 per cent between end-October 2007 and end-March

2008. On the other hand, equity markets in the EMEs recorded further gains during most part of 2007-08 amidst sharp intermittent corrections, reflecting healthy corporate earnings, strong portfolio flows and buoyant merger and acquisition activity. After remaining resilient, however, equity markets in EMEs witnessed pronounced weaknesses from January 2008 as risk tolerance and earning expectations were under pressure (Chart 31A). Between end-October 2007 and January 23, 2008, the MSCI emerging markets index declined by 21.1 per cent and was still down by about 17.2 per cent between end-October 2007 and end-March 2008.

Between end-March 2007 and end-March 2008, the MSCI emerging market index increased by 18.9 per cent, while the MSCI developed markets index declined by 5.1 per cent. These gains in the emerging markets were led by stock markets in Indonesia (33.7 per cent), Brazil (33.1 per cent), Thailand (21.3 per cent), India (19.7 per cent), South Korea (17.3 per cent), Hong Kong (15.4 per cent), South Africa (11.5 per cent), China (9.1 per cent) and Russia (6.1 per cent) (Chart 31B).

Foreign Exchange Market

In the foreign exchange market, the US dollar depreciated against the major currencies in the international market during 2007-08, reflecting US sub-prime crisis, fed funds rate cuts and lower than expected economic activity. The US dollar touched a historic low against the euro, Pound sterling and the Japanese yen in the last two quarters. During 2007-08, the US dollar depreciated by 15.8 per cent against the euro, 1.5 per cent against the Pound sterling and 14.9 per cent against the yen. Amongst Asian currencies, the US dollar depreciated by 9.3 per cent against the Chinese yuan, 10.2 per cent against the Thai baht; but it appreciated by 5.5 per cent against the South Korean won (Table 44).

Domestic Financial Markets

Indian financial markets remained largely orderly during 2007-08, barring the equity market which witnessed bouts of volatility, especially beginning second week of January 2008 in tandem with trends in major international equity markets. Over the year, however, the equity market registered further gains. Brief spells of volatility were observed in the money market on account of changes in capital flows and cash balances of the Central Government with the Reserve Bank. Interest rates in the money markets remained generally within the informal corridor set by reverse repo and repo rates during the year. Interest rates in the collateralised

Table 44: Appreciation (+)/Depreciation (-) of the US dollar vis-à-vis other Currencies |

(Per cent) |

Currency |

End-March

2006 @ |

End-March

2007 @ |

End-March

2008 @ |

April 21,

2008 * |

1 |

2 |

3 |

4 |

5 |

Euro |

7.1 |

-9.1 |

-15.8 |

-0.5 |

Pound Sterling |

8.5 |

-11.4 |

-1.5 |

0.3 |

Japanese Yen |

9.4 |

0.2 |

-14.9 |

3.8 |

Chinese Yuan |

-3.1 |

-3.4 |

-9.3 |

-0.2 |

Russian Rubble |

-0.6 |

-6.1 |

-9.7 |

-0.1 |

Turkish Lira |

-2.0 |

3.2 |

-5.8 |

0.1 |

Indian Rupee |

2.2 |

-2.5 |

-9.0 |

-0.2 |

Indonesian Rupiah |

-4.3 |

0.5 |

1.1 |

-0.3 |

Malaysian Ringgit |

-3.0 |

-6.2 |

-7.8 |

-1.4 |

South Korea Won |

-4.7 |

-3.7 |

5.5 |

0.9 |

Thai Baht |

-0.7 |

-9.9 |

-10.2 |

-0.1 |

Argentina |

5.4 |

0.7 |

2.1 |

0.3 |

Brazilian Real |

-18.1 |

-6.4 |

-17.0 |

-2.8 |

Mexican Peso |

-2.6 |

1.3 |

-3.5 |

-1.2 |

South African Rand |

-0.5 |

17.2 |

11.3 |

-4.0 |

@ : Year-on-year variation.

* : Variation over end-March 2008. |

segment of the money market remained below the call rate during the year. In the foreign exchange market, the Indian rupee generally exhibited two-way movements. Yields in the Government securities market softened during most part of the year (Table 45).

Money Market

In the call/notice money market, liquidity pressures eased gradually from April 4, 2007 till mid-April 2007 partly on account of reduction in the cash balances of the Central Government. Reflecting this, the weighted average call/notice rate, which had moved above the repo rate in the second half of March 2007, gradually eased to 3.27 per cent on April 12, 2007. Notwithstanding the continued reduction in the cash balances of the Central Government, liquidity conditions tightened

Table 45: Domestic Financial Markets at a Glance |

Year/ Month |

Call Money |

Government Securities |

Foreign Exchange |

Liquidity Management |

Equity |

|

Ave

rage

Daily Turnover

(Rs.

crore) |

Ave

rage

Call

Rates*

(Per

cent) |

Ave

rage

Turn

over in

Govt.

Sec

urities

(Rs.

crore)+ |

Ave

rage

10-year Yield

@

(Per

cent) |

Ave

rage

Daily

Inter-

bank Turnover

(US $ million) |

Ave

rage

Ex

change Rate

(Rs.

per

US

$) |

RBI’s

net Foreign Currency

Sales

(-)/Pur

chases

(+)

(US $

million) |

Ave

rage3-month Forward Premia

(Per cent) |

Ave

rage

MSS

Out-

standing

#

(Rs.

crore) |

Ave

rage

Daily

LAF

Out-

standing

(Rs.

crore) |

Ave

rage

Daily BSE Turn

over

(Rs.

crore) |

Ave

rage

Daily NSE Turn

over

(Rs.

crore) |

Ave

rage

BSE

Sen

sex** |

Ave

rage

S & P

CNX

Nifty** |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

14 |

15 |

2004-05 |

14,170 |

4.65 |

4,826 |

6.22 |

8,860 |

44.93 |

20,847 ## |

1.66 |

46,445 |

35,592 |

2,050 |

4,506 |

5741 |

1805 |

2005-06 |

17,979 |

5.60 |

3,643 |

7.12 |

12,655 |

44.27 |

8,143 ## |

1.60 |

58,792 |

10,986 |

3,248 |

6,253 |

8280 |

2513 |

2006-07 |

21,725 |

7.22 |

4,863 |

7.78 |

18,717 |

45.28 |

26,824 ## |

2.14 |

37,698 |

21,973 |

3,832 |

7,812 |

12277 |

3572 |

2007-08 |

21,393 |

6.07 |

8,104 |

7.91 |

33,792 P |

40.24 |

- |

2.16 |

1,28,684 |

4,677 |

6,335 |

14,148 |

16569 |

4897 |

Mar 2006 |

18,290 |

6.58 |

2,203 |

7.40 |

17,600 |

44.48 |

8,149 |

3.11 |

29,652 |

-6,319 |

5,398 |

9,518 |

10857 |

3236 |

Apr 2006 |

16,909 |

5.62 |

3,685 |

7.45 |

17,712 |

44.95 |

4,305 |

1.31 |

25,709 |

46,088 |

4,860 |

9,854 |

11742 |

3494 |

May 2006 |

18,074 |

5.54 |

3,550 |

7.58 |

18,420 |

45.41 |

504 |

0.87 |

26,457 |

59,505 |

4,355 |

9,155 |

11599 |

3437 |

Jun 2006 |

17,425 |

5.73 |

2,258 |

7.86 |

15,310 |

46.06 |

0 |

0.73 |

31,845 |

48,610 |

3,131 |

6,567 |

9935 |

2915 |

Jul 2006 |

18,254 |

5.86 |

2,243 |

8.26 |

14,325 |

46.46 |

0 |

0.83 |

36,936 |

48,027 |

2,605 |

5,652 |

10557 |

3092 |

Aug 2006 |

21,294 |

6.06 |

5,786 |

8.09 |

15,934 |

46.54 |

0 |

1.22 |

40,305 |

36,326 |

2,867 |

5,945 |

11305 |

3306 |

Sep 2006 |

23,665 |

6.33 |

8,306 |

7.76 |

18,107 |

46.12 |

0 |

1.31 |

40,018 |

25,862 |

3,411 |

6,873 |

12036 |

3492 |

Oct 2006 |

26,429 |

6.75 |

4,313 |

7.65 |

16,924 |

45.47 |

0 |

1.67 |

41,537 |

12,983 |

3,481 |

6,919 |

12637 |

3649 |

Nov 2006 |

25,649 |

6.69 |

10,654 |

7.52 |

20,475 |

44.85 |

3,198 |

2.07 |

38,099 |

9,937 |

4,629 |

8,630 |

13434 |

3869 |

Dec 2006 |

24,168 |

8.63 |

5,362 |

7.55 |

19,932 |

44.64 |

1,818 |

3.20 |

38,148 |

-1,713 |

4,276 |

8,505 |

13628 |

3910 |

Jan 2007 |

22,360 |

8.18 |

4,822 |

7.71 |

21,171 |

44.33 |

2,830 |

4.22 |

39,553 |

-10,738 |

4,380 |

8,757 |

13984 |

4037 |

Feb 2007 |

23,254 |

7.16 |

4,386 |

7.90 |

20,298 |

44.16 |

11,862 |

3.71 |

40,827 |

648 |

4,676 |

9,483 |

14143 |

4084 |

Mar 2007 |

23,217 |

14.07 |

2,991 |

8.00 |

25,992 |

44.03 |

2,307 |

4.51 |

52,944 |

-11,858 |

3,716 |

7,998 |

12858 |

3731 |

Apr 2007 |

29,689 |

8.33 |

4,636 |

8.10 |

29,311 |

42.15 |

2,055 |

6.91 |

71,468 |

-8,937 |

3,935 |

8,428 |

13478 |

3947 |

May 2007 |

20,476 |

6.96 |

4,442 |

8.15 |

25,569 |

40.78 |

4,426 |

4.58 |

83,779 |

-6,397 |

4,706 |

9,885 |

14156 |

4184 |

Jun 2007 |

16,826 |

2.42 |

6,250 |

8.20 |

30,538 |

40.77 |

3,192 |

2.59 |

83,049 |

1,689 |

4,537 |

9,221 |

14334 |

4222 |

Jul 2007 |

16,581 |

0.73 |

13,273 |

7.94 |

32,586 |

40.41 |

11,428 |

1.12 |

82,996 |

2,230 |

5,684 |

12,147 |

15253 |

4474 |

Aug 2007 |

23,603 |

6.31 |

6,882 |

7.95 |

31,994 |

40.82 |

1,815 |

1.59 |

1,00,454 |

21,729 |

4,820 |

10,511 |

14779 |

4301 |

Sep 2007 |

21,991 |

6.41 |

5,859 |

7.92 |

36,768 |

40.34 |

11,867 |

1.45 |

1,17,674 |

16,558 |

6,157 |

13,302 |

16046 |

4660 |

Oct 2007 |

18,549 |

6.03 |

5,890 |

7.92 |

39,452 P |

39.51 |

12,544 |

1.12 |

1,58,907 |

36,665 |

9,049 |

20,709 |

18500 |

5457 |

Nov 2007 |

20,146 |

6.98 |

4,560 |

7.94 |

30,677 P |

39.44 |

7,827 |

1.40 |

1,75,952 |

-2,742 |

7,756 |

18,837 |

19260 |

5749 |

Dec 2007 |

16,249 |

7.50 |

7,704 |

7.91 |

31,547 P |

39.44 |

2,731 |

1.64 |

1,64,606 |

-10,804 |

8,606 |

19,283 |

19827 |

5964 |

Jan 2008 |

27,531 |

6.69 |

19,182 |

7.61 |

38,008 P |

39.37 |

13,625 |

2.07 |

1,59,866 |

15,692 |

8,071 |

19,441 |

19326 |

5756 |

Feb 2008 |

22,716 |

7.06 |

12,693 |

7.57 |

40,441 P |

39.73 |

3,884 |

0.24 |

1,75,166 |

-1,294 |

5,808 |

13,342 |

17728 |

5202 |

Mar 2008 |

22,364 |

7.37 |

5,881 |

7.69 |

38,617 P |

40.36 |

- |

1.25 |

1,70,285 |

-8,271 |

6,166 |

14,056 |

15838 |

4770 |

* : Average of daily weighted call money borrowing rates.

+ : Average of daily outright turnover in Central Government dated securities.

@ : Average of daily closing rates.

# : Average of weekly outstanding MSS.

** : Average of daily closing indices.

## : Cumulative for the financial year.

LAF : Liquidity Adjustment Facility.

MSS : Market Stabilisation Scheme.

BSE : Bombay Stock Exchange Limited. NSE : National Stock Exchange of India Limited.

P : Provisional - : Not available.

Note :

In column 11, (-) indicates injection of liquidity, while (+) indicates absorption of liquidity. |

thereafter partly on account of a two-stage hike in the cash reserve ratio (CRR) by 25 basis points each, announced on March 30, 2007; the CRR was placed at 6.25 per cent effective from the fortnights beginning from April 14, 2007 and at 6.50 per cent from April 28, 2007. Consequently, the call/notice money market rates edged higher and exceeded the repo rate during the second half of April 2007 and some part of May 2007. From May 28, 2007 onwards, the liquidity conditions eased significantly, reflecting the reduction in cash balances of the Central Government and Reserve Bank’s foreign exchange market operations. In the background of excess liquidity and the cap of Rs. 3,000 crore under the reverse repo window of LAF imposed with effect from March 5, 2007, the call rate remained below the reverse repo rate in June and July 2007. In fact, the call rate was placed below 1 per cent on a number of occasions in June and July 2007; it reached as low as 0.13 per cent on August 2, 2007(Chart 32).

With the withdrawal of the ceiling of Rs.3,000 crore on the daily reverse repo window of LAF with effect from August 6, 2007, the call rate increased but remained mostly within the informal corridor of the reverse repo and repo rates of 6.00-7.75 per cent during August, September and October 2007. In the wake of relative tightness in the liquidity conditions from the second week of November 2007, however, call/notice money market rates edged up and moved around the upper bound of the informal corridor. This was mainly because of festive season demand for currency, increase in Central Government cash balances with the Reserve Bank and further hike in the CRR by 50 basis points to 7.5 per cent with effect from the fortnight beginning November 10, 2007. In December 2007, the call/notice rate continued to move around the repo rate as the liquidity conditions remained tight on account of advance tax outflows.

Call rates eased from the first week of January 2008 on the back of improvement in liquidity conditions partly on account of reduction in the surplus balances of the Central Government, but remained within the informal corridor for most of the days. Although call/notice money market rates edged up in the second half of March 2008, pre-emptive steps taken by the Reserve Bank, including special arrangements under the LAF, to smoothen the liquidity management, helped in maintaining orderly conditions in the money market. Call/notice money rates softened during the first three weeks of April 2008 and hovered around the reverse repo rate as liquidity conditions eased. The weighted average call/notice rate was 6.09 per cent on April 23, 2008. In the light of the prevailing macroeconomic, monetary and anticipated liquidity conditions, and with a view to contain inflation expectations, the Reserve Bank increased the CRR by 50 basis points to 8.0 per cent in two stages by 25 basis points each, to be effective from the fortnights beginning from April 26, 2008 and May 10, 2008.

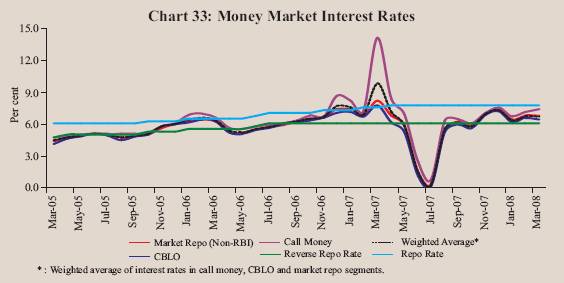

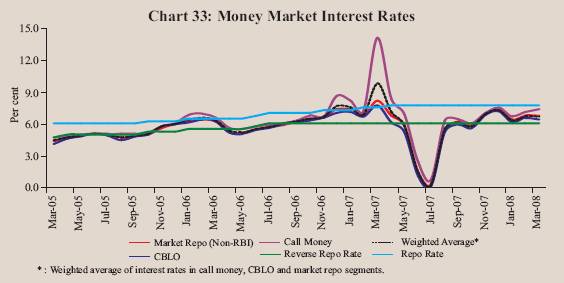

Interest rates in the collateralised segment of the money market – market repo (outside the LAF) and collateralised borrowing and lending obligation (CBLO) – moved in line with call rates, but remained below call money rates during the major part of the year (Chart 33). During 2007-08, interest rates averaged 5.50 per cent and 5.20 per cent and 6.07 per cent, respectively, in market repo, CBLO segment and call/notice money market (6.34 per cent, 6.24 per cent and 7.22 per cent, respectively, a year ago). The weighted average rate in all the three money market segments combined together was 5.48 per cent during 2007-08 as compared with 6.57 per cent a year ago.

The collateralised segment now constitutes the predominant segment of the money market, accounting for around 80 per cent of the total volume (Table 46).

Table 46: Activity in Money Market Segments |

(Rupees crore) |

|

|

Average Daily Volume (One Leg) |

|

Commercial Paper |

Certificates of Deposit |

Year/ Month |

Call |

Repo |

Collateralised |

Total |

Term |

Outstanding |

WADR |

Outstanding |

WADR |

|

Money Market |

Market

(Outside

the LAF) |

Borrowing

and

Lending

Obligation

(CBLO) |

(2+3+4) |

Money Market |

|

(per cent) |

|

(per cent) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

2004-05 |

7,085 |

4,284 |

3,349 |

14,718 |

263 |

11,723 |

5.34 |

6,052 |

- |

2005-06 |

8,990 |

5,296 |

10,020 |

24,306 |

417 |

17,285 |

6.46 |

27,298 |

- |

2006-07 |

10,863 |

8,419 |

16,195 |

35,477 |

506 |

21,329 |

8.08 |

64,821 |

8.24 |

2007-08 |

10,697 |

13,684 |

27,813 |

52,194 |

352 |

33,813 |

9.20 |

1,15,617 |

8.89 |

Mar 2006 |

9,145 |

7,991 |

17,888 |

35,024 |

669 |

12,718 |

8.59 |

43,568 |

8.62 |

Apr 2006 |

8,455 |

5,479 |

16,329 |

30,263 |

447 |

16,550 |

7.30 |

44,059 |

7.03 |

May 2006 |

9,037 |

9,027 |

17,147 |

35,211 |

473 |

17,067 |

6.89 |

50,228 |

7.17 |

Jun 2006 |

8,713 |

10,563 |

13,809 |

33,085 |

628 |

19,650 |

7.10 |

56,390 |

7.19 |

Jul 2006 |

9,127 |

9,671 |

15,670 |

34,468 |

432 |

21,110 |

7.34 |

59,167 |

7.65 |

Aug 2006 |

10,647 |

7,764 |

15,589 |

34,000 |

510 |

23,299 |

7.31 |

65,621 |

7.77 |

Sep 2006 |

11,833 |

9,185 |

14,771 |

35,789 |

568 |

24,444 |

7.70 |

65,274 |

7.80 |

Oct 2006 |

13,214 |

9,721 |

16,964 |

39,899 |

466 |

23,171 |

7.77 |

65,764 |

7.73 |

Nov 2006 |

12,825 |

9,374 |

16,069 |

38,268 |

348 |

24,238 |

7.88 |

68,911 |

7.99 |

Dec 2006 |

12,084 |

7,170 |

15,512 |

34,766 |

481 |

23,536 |

8.52 |

68,619 |

8.28 |

Jan 2007 |

11,180 |

6,591 |

15,758 |

33,529 |

515 |

24,398 |

9.09 |

70,149 |

9.22 |

Feb 2007 |

11,627 |

7,794 |

19,063 |

38,484 |

467 |

21,167 |

10.49 |

72,795 |

9.87 |

Mar 2007 |

11,608 |

8,687 |

17,662 |

37,957 |

739 |

17,863 |

11.33 |

93,272 |

10.75 |

Apr 2007 |

14,845 |

7,173 |

18,086 |

40,104 |

440 |

18,759 |

10.52 |

95,980 |

10.75 |

May 2007 |

10,238 |

8,965 |

20,810 |

40,013 |

277 |

22,024 |

9.87 |

99,715 |

9.87 |

Jun 2007 |

8,413 |

10,295 |

20,742 |

39,450 |

308 |

26,256 |

8.93 |

98,337 |

9.37 |

Jul 2007 |

8,290 |

12,322 |

20,768 |

41,380 |

288 |

30,631 |

7.05 |

1,05,317 |

7.86 |

Aug 2007 |

11,802 |

16,688 |

26,890 |

55,380 |

319 |

31,527 |

8.30 |

1,09,224 |

8.67 |

Sep 2007 |

10,995 |

17,876 |

29,044 |

57,915 |

265 |

33,614 |

8.95 |

1,18,481 |

8.57 |

Oct 2007 |

9,275 |

15,300 |

29,579 |

54,154 |

221 |

42,183 |

7.65 |

1,24,232 |

7.91 |

Nov 2007 |

10,073 |

12,729 |

28,614 |

51,416 |

184 |

41,307 |

9.45 |

1,27,142 |

8.48 |

Dec 2007 |

8,124 |

13,354 |

30,087 |

51,565 |

509 |

40,243 |

9.27 |

1,23,466 |

8.81 |

Jan 2008 |

13,765 |

17,029 |

35,711 |

66,505 |

312 |

50,062 |

11.83 |

1,29,123 |

8.73 |

Feb 2008 |

11,358 |

17,682 |

36,007 |

65,047 |

525 |

40,642 |

9.73 |

1,39,160 |

9.94 |

Mar 2008 |

11,182 |

14,800 |

37,413 |

63,395 |

571 |

32,592 |

10.38 |

1,43,714 |

#

9.98 # |

- : Not available. WADR : Weighted Average Discount Rate.

#: As on March 14, 2008. |

In both the CBLO and market repo sub-segments, mutual funds are the major providers of funds, while the commercial banks and primary dealers are the major borrowers of funds.

Certificates of Deposit

The outstanding amount of certificates of deposit (CDs) increased to Rs. 1,43,714 crore (6.0 per cent of deposits of issuing banks) by March 14, 2008 from Rs.93,272 crore at end-March 2007 (4.8 per cent of aggregate deposits) (Table 46). The weighted average discount rate (WADR) of CDs declined from 10.75 per cent as at end-March 2007 to 7.91 per cent in October 2007 and then increased to 9.98 per cent by March 14, 2008.

Commercial Paper

Commercial paper (CP) outstanding rose to Rs. 32,592 crore by March 31, 2008 from Rs. 17,863 crore at end-March 2007 (Table 46). The weighted average discount rate (WADR) on CP declined from 11.33 per cent at end-March 2007 to 7.65 per cent at end-October 2007. Thereafter, WADR hardened to 10.38 per cent as on March 31, 2008 in tandem with the liquidity conditions in the short-term money market. "Leasing and finance companies" continued to be the major issuers of CP, followed by "manufacturing and other companies" and financial institutions (Table 47). The CP issuance has been dominated by the prime-rated companies.

Treasury Bills

Primary market yields on Treasury Bills (TBs) hardened in the range of 41-46 basis points during 2007-08. TBs yields dipped on July 18, 2007, reflecting easy liquidity conditions and very low short-term interest rates (Chart 34). The surplus liquidity in the wake of ceiling of Rs. 3,000 crore in LAF reverse repo resulted in extremely low short-term rates and aggressive bidding in auctions of TBs. Hence, the cut-off yield in auction of TBs declined. Treasury Bills yields hardened during August-September 2007 in tandem with higher money market interest rates and removal of the ceiling on absorption through reverse repo. Yields softened in October 2007, reflecting easy liquidity conditions and cut in the fed funds rate target. Yields hardened again in November 2007 with a hike in the CRR by 50 basis points with effect from November 10, 2007. Following the aggressive rate cuts by the US Fed, yields softened during January-March 2008. The yield spread between 364-day and 91-day TBs was 9 basis points March 2008 (17 basis points in March 2007) (Table 48).

Table 47: Commercial Paper - Major Issuers |

(Rupees crore) |

Category of Issuer |

End of |

|

March

2006 |

March

2007 |

June

2007 |

September

2007 |

December

2007 |

March

2008 |

|

1 |

2 |

3 |

4 |

5 |

6 |

Leasing and Finance |

9,400 |

12,594 |

18,260 |

24,396 |

27,529 |

24,925 |

|

(73.9) |

(70.5) |

(69.5) |

(72.6) |

(68.4) |

(76.5) |

Manufacturing |

1,982 |

2,754 |

3,956 |

5,538 |

9,419 |

5,687 |

|

(15.6) |

(15.4) |

(15.1) |

(16.4) |

(23.4) |

(17.4) |

Financial Institutions |

1,336 |

2,515 |

4,040 |

3,680 |

3,295 |

1,980 |

|

(10.5) |

(14.1) |

(15.4) |

(11.0) |

(8.2) |

(6.1) |

Total |

12,718 |

17,863 |

26,256 |

33,614 |

40,243 |

32,592 |

|

(100.0) |

(100.0) |

(100.00) |

(100.0) |

(100.0) |

(100.0) |

Note : Figures in parentheses are percentage shares in the total outstanding. |

Table 48: Treasury Bills in the Primary Market |

Month |

Notified Amount |

Average Implicit Yield at Minimum Cut-off Price

(Per cent) |

Average Bid-Cover Ratio |

|

(Rupees crore) |

91-day |

182-day |

364-day |

91-day |

182-day |

364-day |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

2004-05 |

1,38,500 @ |

4.91 |

- |

5.16 |

2.43 |

- |

2.52 |

2005-06 |

1,55,500 @ |

5.68 |

5.82 |

5.96 |

2.64 |

2.65 |

2.45 |

2006-07 |

1,86,500 @ |

6.64 |

6.91 |

7.01 |

1.97 |

2.00 |

2.66 |

2007-08 |

2,24,500 @ |

7.10 |

7.40 |

7.42 |

2.84 |

2.79 |

3.21 |

Mar 2006 |

6,500 |

6.51 |

6.66 |

6.66 |

4.17 |

3.43 |

3.36 |

Apr 2006 |

5,000 |

5.52 |

5.87 |

5.98 |

5.57 |

4.96 |

2.02 |

May 2006 |

18,500 |

5.70 |

6.07 |

6.34 |

1.88 |

1.84 |

1.69 |

Jun 2006 |

15,000 |

6.15 |

6.64 |

6.77 |

1.63 |

1.35 |

2.11 |

Jul 2006 |

16,500 |

6.42 |

6.75 |

7.03 |

1.82 |

1.55 |

3.12 |

Aug 2006 |

19,000 |

6.41 |

6.70 |

6.96 |

2.03 |

2.71 |

3.48 |

Sep 2006 |

15,000 |

6.51 |

6.76 |

6.91 |

1.35 |

1.80 |

2.92 |

Oct 2006 |

15,000 |

6.63 |

6.84 |

6.95 |

1.31 |

1.20 |

2.02 |

Nov 2006 |

18,500 |

6.65 |

6.92 |

6.99 |

1.33 |

1.22 |

2.49 |

Dec 2006 |

15,000 |

7.01 |

7.27 |

7.09 |

1.19 |

1.29 |

3.34 |

Jan 2007 |

19,000 |

7.28 |

7.45 |

7.39 |

1.02 |

1.35 |

1.74 |

Feb 2007 |

15,000 |

7.72 |

7.67 |

7.79 |

2.48 |

2.56 |

3.16 |

Mar 2007 |

15,000 |

7.73 |

7.98 |

7.90 |

2.08 |

2.15 |

3.87 |

Apr 2007 |

15,000 |

7.53 |

7.87 |

7.72 |

2.87 |

3.36 |

3.16 |

May 2007 |

18,500 |

7.59 |

7.70 |

7.79 |

2.33 |

2.57 |

2.33 |

Jun 2007 |

35,000 |

7.41 |

7.76 |

6.67 |

3.23 |

4.11 |

3.97 |

Jul 2007 |

12,500 |

5.07 |

5.94 |

6.87 |

4.48 |

2.70 |

4.56 |

Aug 2007 |

20,500 |

6.74 |

7.37 |

7.42 |

2.11 |

1.41 |

2.46 |

Sep 2007 |

25,000 |

7.08 |

7.33 |

7.48 |

2.07 |

2.91 |

2.83 |

Oct 2007 |

28,500 |

7.11 |

7.45 |

7.37 |

2.16 |

1.73 |

3.23 |

Nov 2007 |

22,500 |

7.47 |

7.65 |

7.75 |

1.63 |

1.38 |

1.88 |

Dec 2007 |

7,500 |

7.41 |

7.60 |

7.69 |

4.41 |

4.67 |

3.67 |

Jan 2008 |

19,000 |

7.08 |

7.24 |

7.39 |

2.63 |

1.61 |

4.36 |

Feb 2008 |

15,500 |

7.33 |

7.40 |

7.51 |

2.15 |

2.91 |

2.78 |

Mar 2008 |

5,000 |

7.33 |

7.45 |

7.40 |

3.97 |

4.17 |

3.34 |

@ : Total for the financial year.

Note:

1. 182-day TBs were reintroduced with effect from April 2005.

2. Notified amounts are inclusive of issuances under the Market Stabilisation Scheme (MSS). |

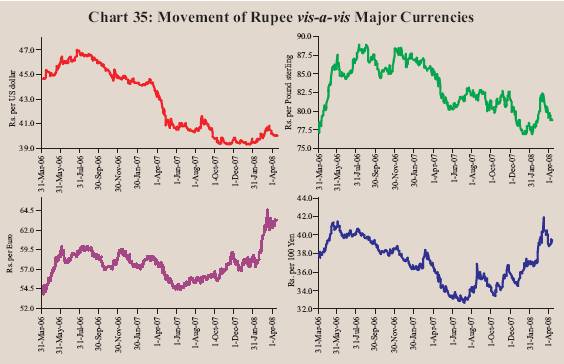

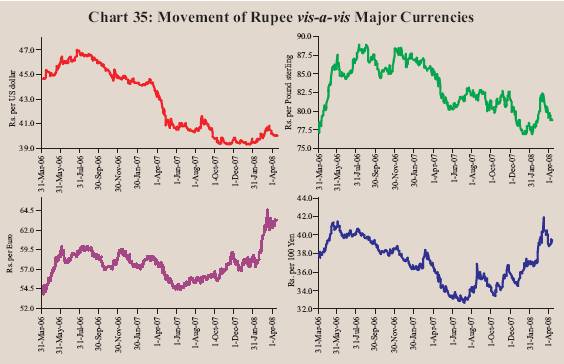

Foreign Exchange Market

During 2007-08, the Indian rupee generally exhibited two-way movements (Chart 35). The rupee moved in the range of Rs.39.26-43.15 per US dollar during 2007-08. The rupee depreciated during the first half of August 2007 due to bearish conditions in the Asian stock markets including India, strong FII outflows and concerns over sub-prime lending crisis in the US, while it appreciated thereafter reflecting large capital inflows, weakening of the US dollar vis-à-vis other currencies and strong performance in the domestic stock markets. However, the rupee started depreciating against the US dollar from the beginning of February 2008 on account of bearish conditions in the stock market, capital outflows, rising crude oil prices and increased demand for US dollars by corporates. The exchange rate of the rupee was Rs.39.99 per US dollar on March 31, 2008. At this level, the Indian rupee appreciated by 9.0 per cent over its level on March 31, 2007. Over the same period, the rupee appreciated by 7.6 per cent against the Pound sterling, while it depreciated by 7.8 per cent against the Euro, 7.6 per cent against the Japanese yen and 1.1 per cent against the Chinese yuan. The exchange rate of the rupee was Rs.39.95 per US dollar on April 24, 2008. At this level, the rupee appreciated by 0.1 per cent against the US dollar over its level on March 31, 2008. Over the same period, the rupee appreciated by 0.1 per cent against the Pound sterling, 3.3 per cent against the Japanese yen, but depreciated by 1.1 per cent against the Euro.

On an average basis, the 36-currency trade-weighted nominal effective exchange rate (NEER) and real effective exchange rate (REER) of the Indian rupee appreciated by 5.0 per cent and 4.5 per cent, respectively, between March 2007 and February 2008 (Table 49). During 2007-08, the 6-currency trade-weighted NEER and REER appreciated by 0.4 per cent and 2.7 per cent, respectively. However, 6-currency REER appreciated by 1.4 per cent between end-March 2008 and April 22, 2008; NEER appreciated by 0.1 per cent during the same period.

Table 49: Nominal and Real Effective Exchange Rate of the Indian Rupee |

(Trade Based Weights) |

Year/Month |

Base : 1993-94 (April-March) = 100 |

|

6-Currency Weights |

36-Currency Weights |

|

NEER |

REER |

NEER |

REER |

1 |

2 |

3 |

4 |

5 |

1993-94 |

100.00 |

100.00 |

100.00 |

100.00 |

2000-01 |

77.43 |

102.82 |

92.12 |

100.09 |

2001-02 |

76.04 |

102.71 |

91.58 |

100.86 |

2002-03 |

71.27 |

97.68 |

89.12 |

98.18 |

2003-04 |

69.97 |

99.17 |

87.14 |

99.56 |

2004-05 |

69.58 |

101.78 |

87.31 |

100.09 |

2005-06 |

72.28 |

107.30 |

89.85 |

102.35 |

2006-07 (P) |

68.93 |

105.47 |

85.89 |

98.51 |

2007-08 (P) |

74.13 |

114.73 |

92.97 |

106.17 |

Mar 2006 |

72.45 |

107.41 |

89.52 |

101.25 |

Apr 2006 |

71.04 |

105.75 |

87.73 |

98.19 |

May 2006 |

68.79 |

103.48 |

85.43 |

96.42 |

Jun 2006 |

68.21 |

103.06 |

85.11 |

96.57 |

Jul 2006 |

67.59 |

102.25 |

84.22 |

95.72 |

Aug 2006 |

67.08 |

102.14 |

83.61 |

95.61 |

Sep 2006 |

67.84 |

104.75 |

84.65 |

97.98 |

Oct 2006 |

69.11 |

107.25 |

86.18 |

99.94 |

Nov 2006 |

69.34 |

107.82 |

86.50 |

100.32 |

Dec 2006 |

68.82 |

106.39 |

85.89 |

99.16 |

Jan 2007 (P) |

69.77 |

107.70 |

87.05 |

100.73 |

Feb 2007(P) |

69.88 |

107.71 |

87.20 |

100.71 |

Mar 2007(P) |

69.70 |

107.41 |

87.11 |

100.75 |

Apr 2007 (P) |

72.18 |

111.59 |

91.50 |

103.45 |

May 2007 (P) |

74.64 |

115.67 |

94.38 |

106.84 |

Jun 2007 (P) |

74.83 |

115.28 |

93.24 |

106.82 |

Jul 2007 (P) |

74.62 |

115.27 |

93.09 |

106.89 |

Aug 2007 (P) |

73.91 |

114.24 |

92.65 |

106.28 |

Sep 2007 (P) |

74.11 |

115.14 |

92.91 |

106.87 |

Oct 2007 (P) |

74.92 |

115.91 |

93.48 |

107.12 |

Nov 2007 (P) |

73.82 |

114.03 |

92.92 |

105.71 |

Dec 2007 (P) |

74.17 |

114.67 |

92.97 |

106.25 |

Jan 2008 (P) |

73.87 |

113.97 |

92.59 |

106.36 |

Feb 2008 (P) |

73.01 |

113.20 |

91.43 |

105.28 |

Mar 2008 (P) |

70.00 |

110.27 |

- |

- |

April 22, 2008 (P) |

70.19 |

112.71 |

- |

- |

NEER: Nominal Effective Exchange Rate. REER: Real Effective Exchange Rate.

P : Provisional. - : Not available.

Note: Rise in indices indicates appreciation of the rupee and vice versa. |

Spot market conditions kept forward premia on US dollar low during 2007-08 (Chart 36). In February 2008, while the rupee traded one-month forward at discount, three-month and six-month forward premia remained at their lowest levels during the financial year as exporters continued to offload forward positions. The one-month, three-month and six-month forward premia declined from 7.30 per cent, 5.14 per cent and 4.40 per cent, respectively, at end-March 2007 to 3.45 per cent, 2.75 per cent and 2.50 per cent, respectively, as on March 31, 2008.

The average daily turnover in the foreign exchange market increased to US $ 48.1 billion during 2007-08 from US $ 25.8 billion during 2006-07, reflecting large cross border trade and capital flows. While average inter-bank turnover increased to US $ 33.8 billion from US $ 18.7 billion, merchant turnover increased to US $ 14.3 billion from US $ 7.0 billion (Chart 37). The ratio of inter-bank to merchant turnover was 2.4 during 2007-08 as compared with 2.7 a year ago.

Credit Market

The deposit rates of scheduled commercial banks (SCBs) softened, particularly at the longer end of the maturities during 2007-08. Interest rates offered by public sector banks (PSBs) on deposits of maturity of one year to three years were placed in the range of 8.25-9.25 per cent in March 2008 as compared with 7.25-9.50 per cent in March 2007, while those on deposits of maturity of above three years were placed in the range of 8.00-9.00 per cent in March 2008 as compared with 7.50-9.50 per cent in March 2007 (Table 50). Similarly, interest rates offered by private sector banks on deposits of maturity of one year to three years were placed in the range of 7.25-9.25 per cent in March 2008 as compared with 6.75-9.75 per cent in March 2007, while those on deposits of maturity above three years were placed in the range of 7.25-9.75 per cent in March 2008 as compared with 7.75-9.60 per cent in March 2007. Interest rates offered by foreign banks on deposits of maturity of one year to three years were placed in the range of 3.50-9.75 per cent in March 2008 as compared with 3.50-9.50 per cent in March 2007.

Table 50: Deposit and Lending Rates |

(Per cent) |

Item |

March |

March |

June |

September |

December |

March |

|

2006 |

2007 |

2007 |

2007 |

2007 |

2008 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

1. |

Domestic Deposit Rate |

|

|

|

|

|

|

|

Public Sector Banks |

|

|

|

|

|

|

|

Up to 1 year |

2.25-6.50 |

2.75-8.75 |

2.75-8.75 |

2.75-8.50 |

2.75-8.50 |

2.75-8.50 |

|

More than 1 year and up to 3 years |

5.75-6.75 |

7.25-9.50 |

7.25-9.75 |

8.00-9.00 |

8.00-9.25 |

8.25-9.25 |

|

More than 3 years |

6.00-7.25 |

7.50-9.50 |

7.75-9.75 |

8.00-9.50 |

8.00-9.00 |

8.00-9.00 |

|

Private Sector Banks |

|

|

|

|

|

|

|

Up to 1 year |

3.50-7.25 |

3.00-9.00 |

3.00-9.50 |

2.50-9.25 |

2.50-8.50 |

2.50-9.25 |

|

More than 1 year and up to 3 years |

5.50-7.75 |

6.75-9.75 |

6.75-10.25 |

6.25-10.00 |

7.25-9.60 |

7.25-9.25 |

|

More than 3 years |

6.00-7.75 |

7.75-9.60 |

7.50-10.00 |

7.25-10.00 |

7.25-10.00 |

7.25-9.75 |

|

Foreign Banks |

|

|

|

|

|

|

|

Up to 1 year |

3.00-6.15 |

3.00-9.50 |

0.25-9.00 |

2.00-9.00 |

2.00-9.25 |

2.25-9.25 |

|

More than 1 year and up to 3 years |

4.00-6.50 |

3.50-9.50 |

3.50-9.50 |

2.00-9.50 |

2.00-9.75 |

3.50-9.75 |

|

More than 3 years |

5.50-6.50 |

4.05-9.50 |

4.05-9.50 |

2.00-9.50 |

2.00-9.50 |

3.60-9.50 |

2. |

Benchmark Prime Lending Rate |

|

|

|

|

|

|

|

Public Sector Banks |

10.25-11.25 |

12.25-12.75 |

12.50-13.50 |

12.50-13.50 |

12.50-13.50 |

12.25-13.50 |

|

Private Sector Banks |

11.00-14.00 |

12.00-16.50 |

13.00-17.25 |

13.00-16.50 |

13.00-16.50 |

13.00-16.50 |

|

Foreign Banks |

10.00-14.50 |

10.00-15.50 |

10.00-15.50 |

10.00-15.50 |

10.00-15.50 |

10.00-15.50 |

3. |

Actual Lending Rate* |

|

|

|

|

|

|

|

Public Sector Banks |

4.00-16.50 |

4.00-17.00 |

4.00-17.75 |

4.00-17.75 |

4.00-17.75 |

- |

|

Private Sector Banks |

3.15-20.50 |

3.15-25.50 |

4.00-26.00 |

4.00-24.00 |

4.00-22.00 |

- |

|

Foreign Banks |

4.75-26.00 |

5.00-26.50 |

2.98-28.00 |

2.00-28.00 |

5.00-28.00 |

- |

4. |

Weighted Average Actual Lending Rate |

11.97 |

11.92 |

- |

- |

- |

- |

- : Not available.

* : Interest rate on non-export demand and term loans above Rs.2 lakh excluding lending rates at the extreme five per cent on both sides. |

As regards lending rates, the benchmark prime lending rates (BPLRs) of PSBs and private sector banks were placed in the range of 12.25-13.50 per cent and 13.00-16.50 per cent, respectively, in March 2008 as compared with 12.25-12.75 per cent and 12.00-16.50 per cent, respectively, in March 2007 (Chart 38). The BPLR of foreign banks remained unchanged during this period. The weighted average BPLR of PSBs increased from 12.4 per cent in March 2007 to 12.8 per cent in March 2008. Over the same period, the weighted average BPLR of private sector banks increased from 14.3 per cent to 15.1 per cent. The weighted average BPLR of foreign banks also increased from 12.6 per cent in March 2007 to 13.9 per cent in March 2008. The weighted average actual lending rate of SCBs declined from 12.57 per cent at end-March 2005 to 11.97 per cent at end-March 2006 and further to 11.92 per cent at end-March 2007.

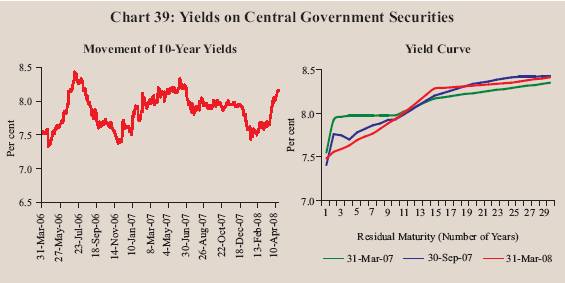

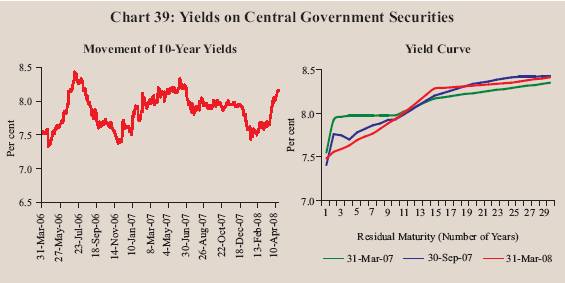

Government Securities Market

Yields in the government securities market hardened somewhat during the first quarter of 2007-08, partly reflecting global trends and announcement of an unscheduled auction. Yields, however, remained generally range-bound during July-December 2007, partly reflecting global trends in yields, lower inflation and easy liquidity conditions (Chart 39). Yields softened during January and February 2008, reflecting easy liquidity conditions and lower inflation. From the second half of March 2008 yields hardened reflecting higher inflation. The 10-year yield moved in a range of 7.42-8.32 per cent during 2007-08. As on March 31, 2008, the yield was 7.93 per cent, 4 basis points lower than that at end-March 2007. The 10-year yield was 8.23 per cent on April 23, 2008. The spread between 1-year and 10-year yields was 45 basis points at end-March 2008 as compared with 42 basis points at end-

March 2007. The spread between 10-year and 30-year yields was 47 basis points at end-March 2008 as compared with 37 basis points at end-March 2007.

The turnover in the government securities market increased in 2007-08 (Chart 40). The turnover almost doubled in July 2007 from its level in June 2007 on account of low funding cost at the shorter-end, but reverted in August-September 2007 as overnight rates rose to the corridor set by the reverse repo and repo rates. The turnover declined in November 2007 after increasing in October 2007 on account of hike in the CRR. The turnover increased in December 2007 and reached a peak in January 2008, reflecting lower yields. The turnover declined sharply in March 2008 as yields hardened.

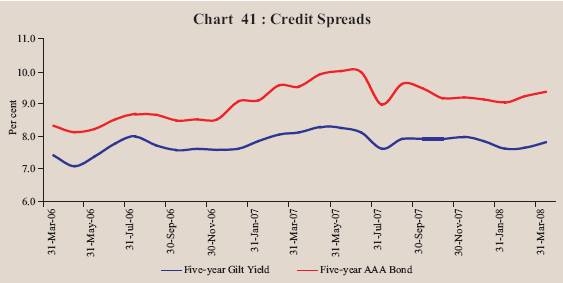

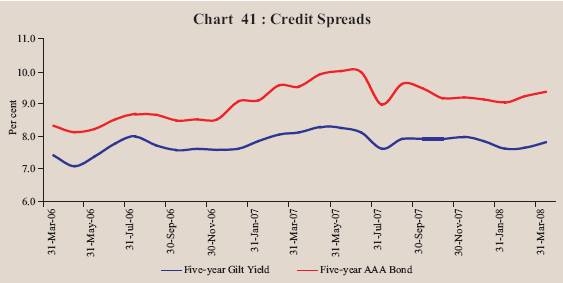

The yield on 5-year AAA-rated corporate bonds softened during May-January 2007-08 in tandem with government securities yield. The credit spread between the yields on 5-year AAA-rated bonds and 5-year government securities was 156 basis points at end-March 2008 as compared with 142 basis points at end-March 2007 (Chart 41).

Equity Market

Primary Market

Resources raised through public issues by the corporate sector increased sharply by 158.5 per cent to Rs. 83,707 crore during 2007-08 over those in last year. The number of issues remained unchanged at 119 in 2007-08 (Table 51). The average size of public issues, however, increased from Rs.272 crore in 2006-07 to Rs.703 crore in 2007-08. All public issues during 2007-08 were in the form of equity, barring three which were in the form of debt. Out of 119 issues, 82 issues were initial public offerings (IPOs), accounting for 47.7 per cent of total resource mobilisation.

Mobilisation of resources through private placement increased by 34.9 per cent to Rs.1,49,651 crore during April-December 2007 over the corresponding period of the previous year (Table 51). Resources mobilised by private sector entities increased by 49.4 per cent, while those by public sector entities increased by only 15.5 per cent during April-December 2007. Financial intermediaries (both from public sector and private sector) accounted for the bulk (68.3 per cent) of the total resource mobilisation from the private placement market during April-December 2007 (69.0 per cent during April-December 2006).

Table 51: Mobilisation of Resources from the Primary Market |

(Amount in Rupees crore) |

Item |

2006-07 |

2007-08 P |

|

No. of Issues |

Amount |

No. of Issues |

Amount |

1 |

2 |

3 |

4 |

5 |

A. Prospectus and Rights Issues* |

|

|

|

|

|

1. |

Private Sector (a+b) |

117 |

30,603 |

115 |

63,638 |

|

|

a) |

Financial |

8 |

1,425 |

11 |

14,676 |

|

|

b) |

Non-financial |

109 |

29,178 |

104 |

48,962 |

|

2. |

Public Sector (a+b+c) |

2 |

1,779 |

4 |

20,069 |

|

|

a) |

Public Sector Undertakings |

1 |

997 |

- |

- |

|

|

b) |

Government Companies |

- |

- |

2 |

2,516 |

|

|

c) |

Banks/Financial Institutions |

1 |

782 |

2 |

17,553 |

|

3. |

Total (1+2) |

119 |

32,382 |

119 |

83,707 |

|

|

of which: |

|

|

|

|

|

|

(i) |

Equity |

116 |

31,532 |

116 |

82,398 |

|

|

(ii) |

Debt |

3 |

850 |

3 |

1,309 |

|

|

|

|

2006-07

(April-December) |

2007-08

(April-December) P |

B. |

Private Placement |

|

|

|

|

|

1. |

Private Sector |

1,145 |

63,418 |

1,248 |

94,746 |

|

a) |

Financial |

462 |

38,159 |

696 |

64,438 |

|

b) |

Non-financial |

683 |

25,259 |

552 |

30,308 |

|

2. |

Public Sector |

96 |

47,549 |

111 |

54,905 |

|

|

a) |

Financial |

78 |

38,360 |

74 |

37,709 |

|

|

b) |

Non-financial |

18 |

9,189 |

37 |

17,196 |

|

3. |

Total (1+2) |

1,241 |

1,10,967 |

1,359 |

1,49,651 |

|

|

of which: |

|

|

|

|

|

|

(i) |

Equity |

1 |

57 |

- |

- |

|

|

(ii) |

Debt |

1,240 |

1,10,910 |

1,359 |

1,49,651 |

Memo: |

|

|

|

|

|

|

C. Euro Issues |

40 |

17,005 |

26 |

26,556 |

P : Provisional. * : Excluding offers for sale. - : Nil/Negligible. |

Resources raised through Euro issues _ American Depository Receipts (ADRs) and Global Depository Receipts (GDRs) _ by Indian corporates during 2007-08 at Rs.26,556 crore were higher by 56.2 per cent than those during the previous year (Table 51).

During 2007-08, net mobilisation of resources by mutual funds increased by 63.6 per cent to Rs.1,53,802 crore over those in 2006-07 (Table 52). Net resource mobilisation by mutual funds increased sharply to Rs. 1,12,824 crore during April-August 2007 due to buoyant capital market conditions. However, resource mobilisation declined to Rs. 40,978 crore between September 2007 and March 2008 due to volatile conditions in the stock market. About 67.5 per cent of net mobilisation of funds by mutual funds during 2007-08 was under income/debt market-oriented schemes, out of which bulk of the resources were mobilised through debt other than assured return schemes. Growth-oriented schemes accounted for only 30.5 per cent of net resource mobilisation during 2007-08.

Table 52 : Resource Mobilisation by Mutual Funds |

(Rupees crore) |

|

April-March |

April-March |

Category |

2006-07 |

2007-08 |

|

Net

Mobilisation @ |

Net

Assets# |

Net

Mobilisation @ |

Net

Assets # |

1 |

2 |

3 |

4 |

5 |

Private Sector |

79,038 |

2,62,079 |

1,33,304 |

4,15,621 |

Public Sector * |

14,947 |

64,213 |

20, 498 |

89,531 |

Total |

93,985 |

3,26,292 |

1,53,802 |

5,05,152 |

@: Net of redemptions. #: End-period. *: Including UTI Mutual fund.

Note : Data exclude funds mobilised under Fund of Funds Schemes.

Source : Securities and Exchange Board of India. |

Secondary Market

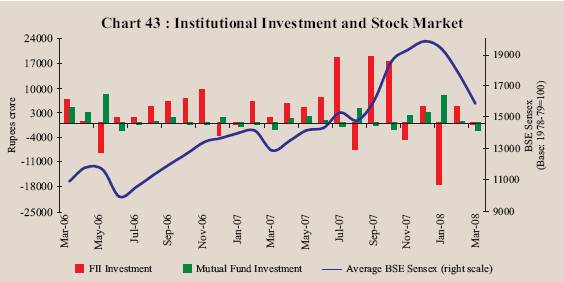

The domestic stock markets, which remained generally firm up to early January 2008, witnessed a sharp correction beginning January 11, 2008 (Chart 42). Liquidity support from foreign institutional investors (FIIs), strong macroeconomic fundamentals, healthy corporate earrings, upward trend in EMEs equity markets and other sector and stock specific news helped to boost the market sentiment during April-December 2007. Although the domestic stock markets during this period witnessed corrections in mid-August, mid-October and mid-December 2007, they again recovered to reach new high. Reflecting this, the BSE Sensex reached an all-time high of 20873.33 on January 8, 2008.

Beginning January 11, 2008, the domestic stock markets witnessed severe bouts of volatility due to heightened concerns over the severity of sub-prime lending crises in the US and its spill-over to other market segments and in other countries.

Fears of recession in the US economy on account of contraction in the US service industry, weak earnings growth reported by some of the leading US companies, home foreclosures climbing to record high levels and lacklustre retail sales in the US also impacted the sentiment. Liquidity squeeze from the secondary market in the wake of the IPO issuances, heavy sales by FIIs in the Indian equity market, hike in short-term capital gains tax from 10 per cent to 15 per cent announced in the Union Budget 2008-09, increase in domestic inflation rate, rise in global crude oil prices to record highs and decline in ADR prices in the US markets were some of the other factors that adversely affected the market sentiment. Between end-March 2007 and March 31, 2008, the BSE Sensex moved in a wide range of 12455.37-20873.33. The BSE Sensex and the S&P CNX Nifty, closed at 15644.44 and 4734.50, respectively, on March 31, 2008 registering gains of 19.7 per cent and 23.9 per cent, respectively, over end-March 2007. The BSE sensex was 16698.04 on April 23, 2008.

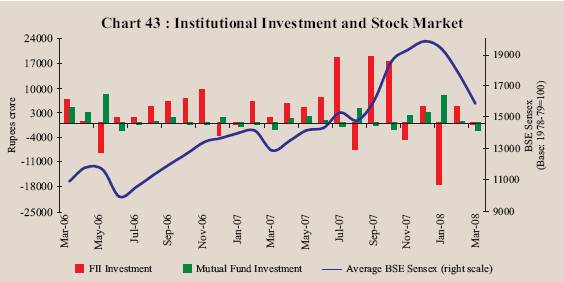

According to the data released by the Securities and Exchange Board of India (SEBI), FIIs have invested Rs.52,574 crore (US $ 12.7 billion) in the Indian stock markets during 2007-08 as compared with net purchases of Rs.26,031 crore (US $ 5.7 billion) during 2006-07 (Chart 43). Between April 1, 2007 and January 8, 2008, FIIs invested Rs.66,898 crore (US $ 16.3 billion) in the Indian stock markets. However, FIIs made net sales of Rs.14,324 crore (US $ 3.6 billion) between January 9, 2008 and March 31, 2008. Mutual funds made net investments of Rs. 15,775 crore during 2007-08 as compared with net investments of Rs.9,062 crore during 2006-07.

The major gainers in the domestic stock markets during 2007-08 were metal, oil and gas, capital goods, fast moving consumer goods, public sector undertakings, banking and consumer durables sector stocks (Table 53).

Table 53 : BSE Sectoral Stock Indices |

(Base: 1978-79=100) |

Sector |

Variation (per cent) |

|

End-March 2006@ |

End-March 2007@ |

End-March 2008 @ |

April 17,

2008 # |

1 |

2 |

3 |

4 |

5 |

Fast Moving Consumer Goods |

109.9 |

-21.4 |

33.3 |

2.1 |

Public Sector Undertakings |

44.0 |

-3.2 |

30.2 |

0.4 |

Information Technology |

49.2 |

21.6 |

-23.3 |

10.5 |

Auto |

101.2 |

-8.5 |

-5.9 |

-1.5 |

Oil and Gas |

61.1 |

30.5 |

63.7 |

9.0 |

Metal |

40.3 |

-4.3 |

72.6 |

0.0 |

Health Care |

51.2 |