IST,

IST,

Protecting Customers - Safeguarding Stability

Dr. (Smt.) Deepali Pant Joshi, Executive Director, Reserve Bank of India

delivered-on ಸೆಪ್ಟೆಂ 17, 2014

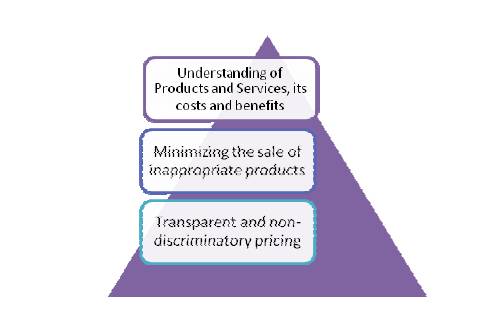

Introduction: At the outset, I thank the All India Bank Depositors’ Association for inviting me to this - their Annual event. I am deeply honoured to be here today for the 10th M R Pai Memorial Awards. It is with a sense of great humility that I deliver this address. The memorial is a fitting tribute to Shri M R Pai, a crusader of Customer Rights. A Karma Yogi in the spirit of the Bhagwad Geeta, one who worked selflessly and without hope of reward, guided by the Gita’s maxim “Karmaniva Dhikaraste ma phaleshu kadachanam.” The Indian edition of Reader's Digest featured him on the cover of their October 1995 issue under the title “M R Pai - Champion of the Consumer.” I had occasion to meet him when he visited the RBI colony at Prabhadevi in 1996. He founded the All India Bank Depositors’ Association (AIBDA) which he steered for decades. He published the book “Depositors’ Rights and Customer Service in Banks” Under the aegis of the AIBDA. This award, I understand, was instituted in the year 2004 posthumously to honour Shri M R Pai by Punjab and Maharashtra Co-operative Bank. It is apposite that the All India Bank Depositors’ Association has chosen to celebrate his life and commemorate his memory by conferring this award. I am delighted that this year’s award has been claimed in the same spirit by another relentless crusader of Customer rights, Ms Sucheta Dalal. I understand the process of selection is rigorous and I extend warm congratulations to Ms Dalal and Debasis Basu whose articles in Business Standard are often on consumer protection and Money life Foundation, on securing this prestigious award which is a recognition of their untiring efforts in the cause of the customer. RBI MISSION The RBI’s mission of safeguarding stability and protecting customers places Customer Protection at the core of our work. We are mandated in terms of Section 35A of the Banking Regulation Act, 1949, which explicates the Power of the Reserve Bank to give directions — (1) Where the Reserve Bank is satisfied that— (a) in the 178 [public interest]; or (aa) in the interest of banking policy; or (b) to prevent the affairs of any banking company being conducted in a manner detrimental to the interests of the depositors or in a manner prejudicial to the interests of the banking company; or (c) to secure the proper management of any banking company generally, it is necessary to issue directions to banking companies generally or to any banking company in particular, it may, from time to time, issue such directions as it deems fit, and the banking companies or the banking company, as the case may be, shall be bound to comply with such directions.. This mandate clearly places the protection of customers’ best interests at the heart of the Central Bank’s work. The issue of services rendered by banks to the common person dates back to the R.K. Talwar Committee (1975) and the Goiporia Committee (1990). The Report of the first Narasimham Committee (1991) ushered in the financial sector reforms, which were expected to spur competition in the banking sector through deregulation and entry of new private sector banks, which, in turn, was to ensure high quality customer service to meet the long pending aspirations of the bank customers. There is an increasing realisation, that competitive forces alone, the invisible hand of the market do not ensure fair treatment or adequate quality in service to the customers at a justifiable price, in a transparent manner. Regulatory intervention and oversight are necessary In his seminal and oft quoted report, Dr. Rajan stated “Consumer Protection is important. Not every household is fully cognizant of the transactions they enter into. While the line between excessive paternalism and appropriate individual responsibility is always hard to draw in a developing country like ours, it may well veer to a little more paternalism in interactions between financial firms and less sophisticated households. It is important to improve Consumer literacy, the transparency of products that are sold and in certain cases limit sales of certain products in certain jurisdictions especially if these have prudential consequences.” Reserve Bank of India as the Central Bank of the country, is proactively engaged in initiatives to further Customer Service. First, by building a strong banking system which enables access to financial services for all. Second, to enhance and expand the reach of the Banking system both in quantitative and qualitative terms. RBI, through micro level supervisory processes and macro level assessments, institutes measures to increase Customer Awareness to ensure Customer Protection. As Central Bankers we are not alone, Customer protection is now recognized as an important function – indeed the Dharma of the Central Bank. The post-crisis financial sector is driven by a new paradigm of customer awareness, empowerment and protection. The financial crisis brought into sharp focus the importance of customer protection which underpins the stability of the financial system. Rapid increase in the use of financial services underscores the need for strengthening measures to protect the customers of financial services. We have the largest and most widespread network of Banks in Asia. Banks dominate the financial landscape of our country. The Financial intermediation process offers efficiency, rewards and optimal returns but also poses risks to the customers and hence the active regulatory initiatives on customer protection have gained traction and salience. Let us remember the Mahatma who enunciated that “A customer is the most important visitor on our premises. He is not dependent on us. We are dependent on him. He is not an interruption of our work. He is the purpose of it. He is not an outsider of our business. He is part of it. We are not doing him a favour by serving him. He is doing us a favour by giving us the opportunity to do so.” Greater and repeated reminders of this adage are needed. Firstly, there is a granularity of customers due to differences in age, income, education and awareness. Secondly, we must recognize that there is an asymmetry of bargaining power between the financial service providers and the customer. By and large, customers are always the weaker parties in need of protection and the vulnerable and poor customers in even greater need of protection, i.e.,LIC of India vs. Consumer Education & Research Centre (AIR 1995 SC-1811). While considering the validity of LIC policy under table 58 restricted only to salaried persons in government/semi-government or reputed commercial firms, the Supreme Court observed: "It is well settled law that if a contract or a clause in a contract is found unreasonable or unfair or irrational, one must look to the relative bargaining power of the contracting parties." Thirdly customers need to be enabled to navigate the financial markets to make choices appropriate to their needs. There should be an ingrained Suitability clause in all the products sold by the financial service providers. Customers must be able to understand financial products appropriate to their needs and income streams and should be equipped with the knowledge and skills to assess measure and mitigate risks and make informed decisions about the suitability of financial products to their situation. As Dr. Chakrabarty put it, let me raise a fundamental issue here. The financial services sector is essentially driven by commercial intent and the actions of service providers and the issue of consumer protection should be taken care of by competitive market forces. Why are we then discussing the issue of financial consumer protection? It is because the barriers to entry for the service providers in the financial sector, especially banking, are quite stiff. In view of regulatory restrictions on number of market players, consumers are forced to receive services from a limited set of service providers. Furthermore, in view of rampant information, illiteracy, the self-regulating market behaviour does not work especially for the poor and vulnerable and hence, ensuring consumer protection becomes a regulatory obligation. There is no acme of customer service. The present experience of the customer must be better than the previous experience of the customer. The bank’s front line staff should be sympathetic and empathetic. They must be adequately sensitized, trained and given exposure to interact with customers and deal with the issues raised by them. RBI customer service initiatives include the setting up of the Banking Ombudsman recognizing the need for an Ombudsman in larger public interest as a public good. To encourage a formal channel of communication between the customers and the bank at the branch level, banks were advised to take necessary steps for strengthening the branch level customer service committees with greater involvement of customers. Senior citizens are important, they are to be included in the branch level customer service committees. These should be as a mechanism of effective corporate governance. In the mid-term review of the Monetary and Credit Policy 2003-2004 a decade back, to review the level of public service provided by the Reserve Bank and banks, to evolve appropriate incentives to facilitate change on an ongoing basis, the Committee on Procedures and Performance Audit of Public Services was set up under DG, Dr. Tarapore. The Committee stressed the need to (i) benchmark the current level of service, (ii) review the progress periodically, (iii) enhance the timeliness and quality, (iv) rationalize the processes taking into account technological developments, and (v) suggest appropriate incentives to facilitate change on an ongoing basis. This led to the setting up of the Banking Codes and Standards Board of India. Annual Consolidation of all RBI instructions on Customer Service through a Master Circular on Customer Service in Banks, amendment of the Banking Ombudsmen Scheme in the year 2006 to make the alternate redress mechanism more efficient and easily accessible, our recent customer protection measures include: • Simplification of KYC Measures - Measures taken for simplification: 1. Single document for proof of identity and proof of address There is now no requirement of submitting two separate documents for proof of identity and proof of address. If the officially valid document submitted for opening a bank account has both identity and address of the person, then there is no need for submitting any other documentary proof. Apart from passport, driving licence, voters’ ID card and PAN card, Aadhaar letter issued by UIDAI and Job Card issued by NREGA signed by a State Government official are also accepted as proof of identity/address. These are known as officially valid documents (OVDs) for KYC purpose. To further ease the KYC process, the information containing personal details like name, address, age, gender, etc., and photographs made available from UIDAI as a result of e-KYC process can also be treated as an ‘Officially Valid Document’. 2. No separate proof of address is required for current address If the current address is different from the address mentioned on the Proof of Address submitted by the customer, a simple declaration by her/him about her/his current address would be sufficient. 3. Relaxation regarding officially valid documents (OVDs) for low risk customers If a person does not have any of the ‘officially valid documents’ mentioned above, but if is categorised as ‘low risk’ by the banks, then she/he can open a bank account by submitting any one of the following documents: (a) identity card with applicant's Photograph issued by Central/State Government Departments, Statutory/Regulatory Authorities, Public Sector Undertakings, Scheduled Commercial Banks, and Public Financial Institutions; (b) letter issued by a gazetted officer, with a duly attested photograph of the person. 4. Periodic updation of KYC Time intervals for periodic updation of KYC for existing low/medium and high risk customers have been increased from 5/2 years to 10/8/2 years, respectively. The requirement of positive confirmation at the interval of 3/2 years in respect of low/medium risk customers has been withdrawn. 5. Other relaxations (i) In case a customer categorised as low risk is unable to submit the KYC documents due to genuine reasons, she/he may submit the same to the bank within a period of six months from the date of opening account. (ii) Third party verification of KYC is allowed, which allows banks/FIs to rely on KYC/CDD carried out by other banks/FIs. Once the proposed Central KYC Registry is in place, customers would be saved from the trouble of submitting the KYC documents to each and every bank/FI whenever she/he opens an account with a different bank/FI. (iii) KYC verification of all the members of SHG is not required while opening the savings bank account of the SHG and KYC verification of only the officials would suffice. No separate KYC verification is needed at the time of credit linking the SHG. • Home Loans-Levy of Foreclosure Charges/Pre-payment Penalty In accordance with the recommendations of The Committee on Customer Service in Banks (Chairman : M. Damodaran), the foreclosure charges / prepayment penalty on home loans has been removed. This is expected to lead to reduction in discrimination between existing and new borrowers. Though many banks had in the recent past voluntarily abolished pre-payment penalties on floating rate home loans, there is a need to ensure uniformity across the banking system, banks will not be permitted to charge foreclosure charges / pre-payment penalties on home loans on floating interest rate basis, with immediate effect. In case of Dual Rate/Special Rate home loans, the provisions of our above mentioned circular will be applicable from the date the rate of interest on the loan becomes floating. • Recommendations of Damodaran Committee on Customer Service in Banks – Uniformity in Intersol Charges As 'Intersol' charges are charges levied by the bank to cover the cost of extending services to customers by using the CBS / Internet / Intranet platform, the cost should be branch / customer agnostic in-principle. In order to ensure that bank customers are treated fairly and reasonably without any discrimination and in a transparent manner at all branches of banks / service delivery locations under CBS environment, banks are expected to follow a uniform, fair and transparent pricing policy and not discriminate between their customers at home branch and non-home branches. Accordingly, if a particular service is provided free at home branch the same should be available free at non home branches also. There should be no discrimination as regards intersol charges between similar transactions done by customers at home branch and those done at non-home branches. • Charges Levied by Banks for sending SMS Alerts Banks have put in place a system of SMS alerts so as to help customers in fraud mitigation and have been levying uniform service charges to various categories of customers. Considering the technology available with banks and the telecom service providers, it should be possible for banks to charge customers based on actual usage of SMS alerts. Accordingly, with effect from November 26, 2013, with a view to ensuring reasonableness and equity in the charges levied by banks for sending SMS alerts to customers, banks are advised to leverage the technology available with them and the telecom service providers to ensure that such charges are levied on all customers on actual usage basis. • Levy of penal charges on Non-Maintenance of Minimum Balance in Inoperative Accounts Consequent upon First Bi-monthly Policy Statement 2014-15 announced on April 1, 2014, banks have been advised that with effect from May 6, 2014, banks cannot levy penal charges for non-maintenance of minimum balances in any inoperative account. • Levy of Foreclosure Charges/Prepayment Penalty on Floating Rate Term Loans Consequent upon First Bi-monthly Policy Statement 2014-15 announced on April 1, 2014, with effect from May 7, 2014, banks are not permitted to charge foreclosure charges/ prepayment penalties on floating rate term loans sanctioned to individual borrowers. • Premature repayment of term/fixed deposits with ‘either or survivor’ or ‘former or survivor’ mandate In case of term deposits with ‘either or survivor’ or ‘former or survivor’ mandate, banks are permitted to allow premature withdrawal of the deposit by the surviving joint depositor on the death of the other, only if, there is a joint mandate from the joint depositors to this effect. The joint deposit holders may be permitted to give the mandate either at the time of placing fixed deposit or anytime subsequently during the term / tenure of the deposit. If such a mandate is obtained, banks can allow premature withdrawal of term / fixed deposits by the surviving depositor without seeking the concurrence of the legal heirs of the deceased joint deposit holder. Premature withdrawal would not attract any penal charge. • Acknowledgement of From 15-G/15-H With a view to protect interest of the depositors and for rendering better customer service, banks were advised in May 2013 to give an acknowledgment at the time of receipt of Form 15-G/15-H. This will help in building a system of accountability and customers will not be put to inconvenience due to any omission on part of the banks. • Settlement of Claims of Deceased Depositor – Simplification of Procedure - Placing of Claim Forms on Bank’s Website Banks have been advised once again that they should strictly comply with the instructions contained in our Circular dated June 9, 2005 for hassle-free settlement of claims on the death of a depositor. Further, with a view to facilitate timely settlement of claims on the death of a depositor, banks have been advised to provide claim forms for settlement of claims of the deceased accounts, to any person/s who is/are approaching the bank/branches for forms. Claim forms may also be put on the bank’s website prominently so that claimants of the deceased depositor can access and download the forms without having to visit the concerned bank/branch for obtaining such forms for filing claim with the bank. • Unclaimed Deposits/Inoperative Accounts in Banks – Treatment of certain Savings Bank Accounts opened for Credit of Scholarship Amounts and Credit of Direct Benefit Transfer under Government Schemes State and Central Governments had expressed difficulties in crediting cheques/Direct Benefit Transfer/Electronic Benefit Transfer/Scholarships for students, etc. into accounts/accounts with zero balance opened for the beneficiaries under various Central/State Government schemes but had been classified as dormant/inoperative due to non-operation of the account for over two years. Keeping this in view, banks have been advised to allot a different ‘product code’ in their CBS to all such accounts opened by banks so that the stipulation of inoperative/dormant account due to non-operation does not apply while crediting proceeds. In order to reduce the risk of fraud in such accounts, while allowing operations in these accounts, due diligence should be exercised by ensuring the genuineness of transactions, verification of signature and identity, etc. However, banks have to ensure that the customer is not inconvenienced in any manner. • Timely issue of TDS Certificate to Customers It had come to our notice that some banks were not providing TDS Certificate in Form 16A to their customers in time, causing inconvenience to customers in filing income-tax returns timely. With a view to protecting the interest of the depositors and for rendering better customer service, banks have been advised to provide TDS Certificate in Form 16A, to their customers in respect of whom they (banks) have deducted tax at source. Banks have been advised to put in place systems that will enable them to provide Form 16A to the customers within the time-frame prescribed under the Income Tax Rules. • Guidelines for the purpose of opening/operating bank accounts of Persons with Autism, Cerebral Palsy, Mental Retardation, Mental Illness and Mental Disabilities • Need for Bank Branches/ATMs to be made accessible to Persons with Disabilities Banks are advised to take necessary steps to provide all existing ATMs/future ATMs with ramps. Care may also be taken to make arrangements in such a way that the height of ATMs does not create an impediment in their use by wheelchair users. However, in cases where it is impracticable to provide such ramp facilities, whether permanently fixed to earth or otherwise, this requirement may be dispensed with, for reasons recorded and displayed in branches or ATMs concerned. Banks are also advised to take appropriate steps, including providing of ramps at the entrance of bank branches, wherever feasible, so that the persons with disabilities/wheel chair users can enter bank branches and conduct business without difficulty. Banks have been advised to report the progress made in this regard periodically to their respective Customer Service Committee of the Board and ensure compliance. • Talking ATMs with Braille keypads to facilitate use by persons with visual impairment Banks should make all new ATMs installed from July 1, 2014 as talking ATMs with Braille keypads. Banks should lay down a road map for converting all existing ATMs as talking ATMs with Braille keypads and the same may be reviewed from time to time by the Customer Service Committee of the Board. Magnifying glasses should also be provided in all bank branches for the use of persons with low vision, wherever they require for carrying out banking transactions with ease. The branches should display at a prominent place notice about the availability of magnifying glasses and other facilities available for persons with disabilities. Dr. Rajan recently stated “we have to reach everyone, however remote or small, with financial services. It means financial literacy and consumer protection. I should emphasize the need for banks like the ones represented in this room to move beyond simply opening bank accounts to ensuring that poor customers are confident and comfortable enough to use them.” Banks would do well to heed this sage counsel. Customers should be able to understand not only simple financial products but also complex financial products. They should be equipped with the knowledge and skills to assess risks and make informed decisions about the suitability of financial products to their own individual situation. A well-functioning customer protection regime provides effective safeguards for retail financial services customers while empowering customers to exercise their legal rights and fulfill their legal obligations. 2. Banking Ombudsman Scheme (BOS) The Banking Ombudsman Scheme (BOS) was introduced in the year 1995 by the RBI for expeditious and inexpensive redress of customers’ grievances against deficiencies in banking services. Due to increasing levels of awareness and expectations of the customers of banks Gunnar Myrdal in Asian Drama terms “the revolution of rising expectations” and the range of new products offered by these banks. The BOS has undergone extensive changes. The administration of the Scheme vests with RBI since 2006. In May 2007, the BOS 2006 was amended to enable appeal against Award, to the Appellate Authority, the Deputy Governor in charge of the department. The BOS 2006 was amended extending its ambit to deficiencies in internet banking and non-adherence to the BCSBI Codes and the Code of Bank’s commitment to Customers. Though the necessary institutional arrangement for establishing standards and codes for banking services and grievance redress are in place, these rules need objective, timely and fair implementation. The Suitability clause, if implemented in letter and spirit by Banks will enable them to understand the specific expectations of diverse customer groups and to devise products, pricing and delivery strategies that are in alignment with these. Consumer issues in the new economic order are even more pressing the urgency of Customer Protection post-crisis in the developed countries and the concerns on consumer protection of the developing countries have led the G-20 Finance Ministers and Central Bank Governors to formulate ‘Principles on Consumer Protection’. The presence of a credible and effective regulatory regime acts as a source of confidence and comfort in the financial system and is a safeguard of financial stability. This helps in attracting more participants to the marketplace, thereby making the financial system inclusive and efficient. The experience from the global financial crisis is that self-regulation, often, does not work. The presence of a strong, intrusive and hands-on regulator / supervisor gives the confidence that markets will operate as per sound principles and would be free from unfair and unethical practices. This trust forms the basis of functioning of the entire financial system and any dent in this trust can have a significant destabilizing influence. As Governor Reddy expressed and I quote, “Banking is a trust-based relationship and the banking licence from the regulator provides an assurance of trust to the public at large. To the banks, the banking licence provides the privilege of accepting uncollateralised deposits from the public. However, the acts of stealth banking, negative option marketing, misleading advertisements, information gathering from customers for cross selling of products and services, and tie-up arrangements are inconsistent with the concept of a trust-based relationship. The lack of transparency, coupled with the difficulty of consumers in identifying key information from the large volume of material and communication in fine print, leads to an information asymmetry, which renders the banker-customer relationship one of unequals." 3. Retention of Customers: All banks offer similar products (i) Accept Deposits (ii) Provide credit (iii) provide payments and remittance services (iv) foreign exchange facilities (v) provide financial instruments. In the process, banks extend services to their customers. Sadly, the friendly neighbourhood Banker is disappearing as is the feet on street, ear to the ground salesman, the distance between banks and customers is increasing. This is not a good thing. Branch Manager who was a friend, may not be aware of the number of customers of the branch, frontline staff may be ignorant of features of the varied products on offer. Technology emerged as the backbone of banking operations, revolutionizing service delivery through new platforms and channels. These developments created greater challenges for the customer in terms of service quality, non-human interface, unsolicited marketing of products, ever-increasing fine-prints etc. all of these disagreeable compounded due to lack of awareness of the average customer. Hence, knowing their customers and understanding their own product offerings must be the starting point of the Banks’ customer protection framework. As all banks broadly have the same products, it is only better customer service which sets one Bank apart from another. The cost of Customer acquisition is 8-10 times greater than of retention of current customer. Broadly, customer expectations while dealing with banks are a) professionalism, quick and efficient service b) transparent, fair and non-discriminatory dealings c) clear communication about charges/costs d) safety of their deposits in the account and e) To be listened to with courtesy and respect. Putting in place a formal customer retention framework would be a smart move. Twin Peak Approach to Customer Protection The twin-peak approach focuses on customer protection. It distinguishes two agencies, one which focusses on Prudential Regulation and the other on Market Conduct/Customer Protection. Though the structure varies, the underlying thesis is to strengthen customer protection and ensure Financial Stability. Right To Fair Treatment is the most important right of Customers. TCF principles Treating Customers Fairly – TCF  • Helping customers fully understand the features, benefits, costs and risks associated with the financial products and services they buy/avail • Minimizing the sale of inappropriate financial products/render undesirable financial services by encouraging best practices before, during and after sale of products/rendering services • Transparent and non-discriminatory pricing of products and services .The concept of Treating Customers Fairly needs to underpin the business model. Consumer Protection – The RBI’s charter of Customer Rights Let me quote Dr. Rajan on the FSLRC at the SBI oration. Dr. Rajan succinctly explained, in laying out the need for consumer protection, raising the issue of whether products sold are suitable for the target customer, and putting the onus on the financial institution to determine suitability, the report has forced regulators to review their consumer protection frameworks. We at the RBI are indeed engaged in such an exercise, informed by the valuable guidelines in the FSLRC report. Reserve Bank of India, as announced in its first Bi-Monthly Monetary Policy in April 2014 evolved a draft Charter of Customer Rights after extensive consultations with all stakeholders, studying global best practices and domestic experience. The Charter of Customer Rights is simple and comprises five critical rights viz., a) Right to Fair Treatment, b) Right to Transparency, Fair and Honest Dealing, c) Right to Suitability, d) Right to Privacy and e) Right to Grievance Redress and Compensation Right to Fair Treatment I will not say more on this as the draft is in public domain as part of the consultative process for comment. "From the principle of 'caveat emptor', Latin for 'buyer beware', we have to move to the principle 'caveat Venditor', Latin for 'seller beware.' The current system of regulations that govern sale of financial products and services is based on caveat emptor as a doctrine. The caveat emptor principle has led to fundamental flaws in the customer protection architecture and has created large welfare losses for customers. Let me explain further, caveat venditor principle is a counter to caveat emptor and suggests that seller (banks) can also be deceived in a market transaction. This forces the seller to take responsibility for the product and discourages the seller from selling the products of inferior quality, "Caveat Venditor” vests the burden of effort of proving that the shortcoming deficiency of service was absent on the seller of the product. We have to reach everyone with Financial services as per the Prime Minister’s vision of the Jan DhanYojana and extend the highest degree of Consumer protection to all users of financial services but very specially, for the vulnerable poor. Profit is certainly essential and not an ugly word at all. Banks can and do charge for their services but we must again stress the need for reasonableness of service charges while accepting the need for profit margins and profitability of Banks. Market based returns over inflation must be offered to Customers. There is a pressing need to move to a customer protection regime where the provider is held accountable for the service sold to the buyer, by ascertaining that the products sold or the advice given was suitable for the buyer considering her needs and current financial situation, that is, the customer must have a 'right to suitability'. Once the rights are enshrined in the Charter of Customer Rights, it will be mandatory for all banks to adhere to them. The framework governing customer protection should consist of fairness, transparency of rules and conditions, suitability of products that matches customer needs, ability to repay, existence of a grievance redress process, clear specifications of liability if things go wrong, simplicity of the product and duty to inform about changes in the product. Customer protection is very important both for all those of us who are literate and enlightened customers in this room and even more for those who are not in this room - the poor, the uneducated and the illiterate customers. With the increasing complexity of Banking and the growing chasm of the dangerous digital, this acquires even greater salience. The All India Bank Depositors’ Association, Money Life Consumer Activists, Complainants, Customer vigilantes all play a significant role in providing valuable inputs to RBI in furthering our initiatives in the area of Customer Protection. What we need are collaboration, commitment, credible action and concrete deliverables. Governor Rajan’s Five Pillar financial sector blueprint will chart the direction of development of our financial system in years to come. Pillar Four places a high priority on the Consumer Protection agenda. Among the areas of policy focus are the development of cost efficient delivery channels as Payment Banks and Small Banks that will enhance the outreach of financial services, expand the range of products and services to meet the distinct financial needs of the underserved and strengthen the institutional arrangements to enhance the capacity of providers of such financial services. Equally important will be the attention accorded to financial consumer education and protection in which the standards of consumer care are high and consumers have choices and are confident about making their financial decisions. The customer Charter of rights will go some way in enhancing financial literacy and financial capability of consumers to make well informed and responsible financial decisions and thus participate meaningfully and effectively in the financial system. 5C’s Framework to support our mission to safeguard stability and protect consumers: Customer– is at the heart of the Central Bank’s focus and must be the core of the Bank’s focus too; Confidence– working to help consumers have confidence in financial services, products and regulation; Compliance– monitoring and enforcing compliance with consumer protection rules; Challenge– being prepared to challenge firms and ourselves to get a better outcome for customers; in case of doubt, the customer is always right and Culture– promoting a consumer-focussed approach to the provision of financial services. This talk is titled Protecting Customers Safeguarding Stability as the two are inalienable. There has to be a synergy between financial inclusion, financial literacy and customer protection for sustainable financial stability. Appropriately, the All India Bank Depositors’ Association has selected Money Life Foundation for this year’s award for their zealous efforts and hard work in the area Customer Protection. Inclusion, Economic Growth and Stability - these are the watch words of the Central Bank. The macro economic framework and financial sector development necessitate financial deepening and a robust framework of Customer Protection for stability. We are at an inflection point. We have gone some way, yet much needs to be done in this area. The crusader’s work in the area of Customer Protection is never done, the bar of necessity must be raised higher. Thank you for a patient hearing! And again thanks to All India Depositors’ Association for having me here today. References

|

ಪೇಜ್ ಕೊನೆಯದಾಗಿ ಅಪ್ಡೇಟ್ ಆದ ದಿನಾಂಕ: