IST,

IST,

Consumer Confidence Survey

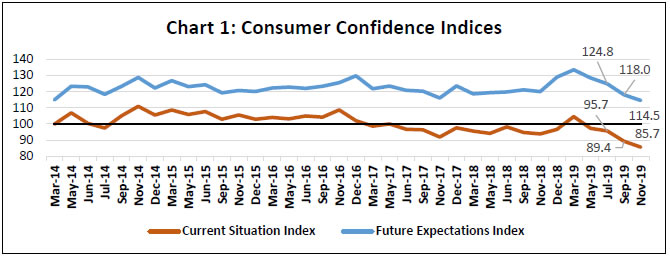

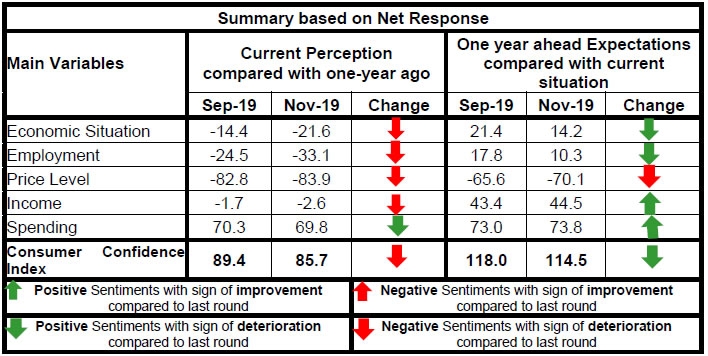

Today, the Reserve Bank released the results of the November 2019 round of its Consumer Confidence Survey (CCS)1. The survey was conducted in 13 major cities viz., Ahmedabad; Bengaluru; Bhopal; Chennai; Delhi; Guwahati; Hyderabad; Jaipur; Kolkata; Lucknow; Mumbai; Patna; and Thiruvananthapuram. Perceptions and expectations on the general economic situation, the employment scenario, the overall price situation and own income and spending are obtained from 5,334 households across these cities. Highlights: I. Consumer confidence weakened further in November, with both the current situation index (CSI) and the future expectations index (FEI)2 declining (Chart 1).  Note: Please see the excel file for time series data II. Consumers’ sentiments on the general economic situation and the employment scenario weakened, but their one year ahead expectations remained in the optimistic terrain for all parameters, except prices (Tables 1 and 2); expectations on income one year ahead improved marginally over the previous survey round (Table 5). III. Most respondents perceived prices as having increased during the last one year, and they expect further rise in prices in the year ahead (Tables 3 and 4); households’ sentiments on overall spending remained resilient (Tables 6, 7 and 8).  1 The survey results are based on the views of respondents. 2 CSI and FEI are compiled on the basis of net responses on the economic situation, income, spending, employment and the price level for the current period and a year ahead, respectively. CSI/FEI = 100 + Average of Net Responses of the above parameters. |

ಪೇಜ್ ಕೊನೆಯದಾಗಿ ಅಪ್ಡೇಟ್ ಆದ ದಿನಾಂಕ: