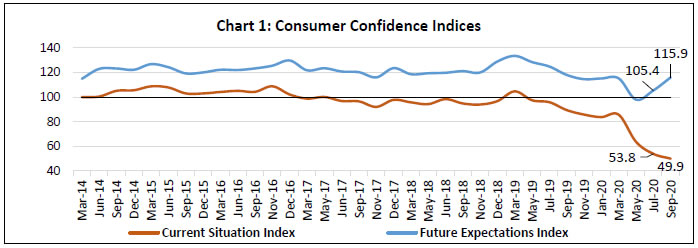

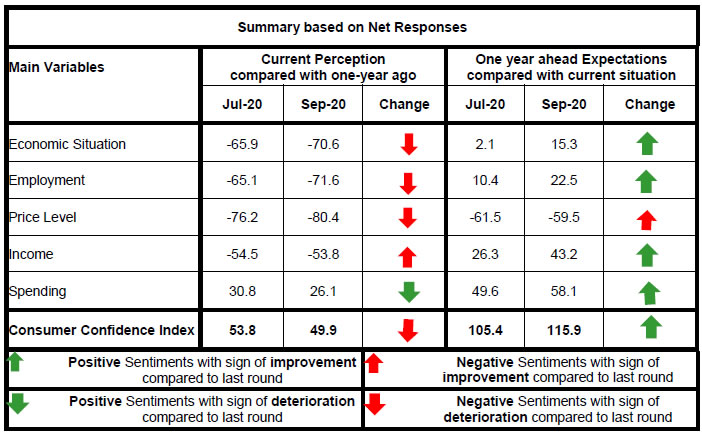

Today, the Reserve Bank released the results of the September 2020 round of its Consumer Confidence Survey (CCS)1. In view of the Covid-19 pandemic, the survey was conducted through telephonic interviews during August 29 – September 10, 2020 in thirteen major cities, viz., Ahmedabad; Bengaluru; Bhopal; Chennai; Delhi; Guwahati; Hyderabad; Jaipur; Kolkata; Lucknow; Mumbai; Patna; and Thiruvananthapuram. Perceptions and expectations on general economic situation, employment scenario, overall price situation and own income and spending have been obtained from 5,364 households across these cities2. Highlights: I. The current situation index (CSI)3 recorded its third successive all-time low, as the respondents perceived further worsening in general economic situation and employment scenario during the last one year (Chart 1, Tables 1 and 2). II. Households were, however, more confident for the year ahead: the future expectations index (FEI) improved for the second successive survey round. Note: Please see the excel file for time series data III. More respondents reported curtailment in both overall and essential spending during the past one year, when compared with the last survey round (Table 6, 7 and 8). IV. Consumers expect improvements in general economic situation, employment conditions and income scenario during the coming year; discretionary spending, however, is expected to remain low in the near future (Tables 1, 2, 5 and 8). | Table 1: Perceptions and Expectations on the General Economic Situation | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Improved | Remained Same | Worsened | Net Response | Will Improve | Will Remain Same | Will Worsen | Net Response | | Sep-19 | 33.5 | 18.6 | 47.9 | -14.4 | 53.2 | 15.0 | 31.8 | 21.4 | | Nov-19 | 30.0 | 18.4 | 51.6 | -21.6 | 48.9 | 16.5 | 34.7 | 14.2 | | Jan-20 | 27.1 | 18.0 | 54.9 | -27.8 | 48.8 | 14.3 | 36.9 | 11.9 | | Mar-20 | 28.4 | 19.3 | 52.3 | -23.9 | 49.8 | 15.6 | 34.7 | 15.1 | | May-20 | 14.4 | 11.2 | 74.4 | -60.0 | 39.6 | 9.0 | 51.4 | -11.7 | | Jul-20 | 11.9 | 10.3 | 77.8 | -65.9 | 44.3 | 13.5 | 42.2 | 2.1 | | Sep-20 | 9.0 | 11.4 | 79.6 | -70.6 | 50.1 | 15.1 | 34.8 | 15.3 |

| Table 2: Perceptions and Expectations on Employment | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Improved | Remained Same | Worsened | Net Response | Will Improve | Will Remain Same | Will Worsen | Net Response | | Sep-19 | 28.0 | 19.5 | 52.5 | -24.5 | 51.2 | 15.4 | 33.4 | 17.8 | | Nov-19 | 24.4 | 18.1 | 57.5 | -33.1 | 46.3 | 17.7 | 36.0 | 10.3 | | Jan-20 | 24.6 | 17.8 | 57.7 | -33.1 | 48.4 | 16.3 | 35.4 | 13.0 | | Mar-20 | 25.2 | 19.1 | 55.7 | -30.5 | 48.8 | 17.1 | 34.1 | 14.7 | | May-20 | 19.2 | 13.4 | 67.4 | -48.2 | 41.5 | 11.1 | 47.4 | -5.9 | | Jul-20 | 13.0 | 8.9 | 78.1 | -65.1 | 48.6 | 13.3 | 38.2 | 10.4 | | Sep-20 | 10.1 | 8.1 | 81.7 | -71.6 | 54.1 | 14.3 | 31.6 | 22.5 |

| Table 3: Perceptions and Expectations on Price Level | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Sep-19 | 86.1 | 10.6 | 3.3 | -82.8 | 75.9 | 13.8 | 10.3 | -65.6 | | Nov-19 | 86.8 | 10.2 | 2.9 | -83.9 | 78.0 | 14.1 | 7.9 | -70.1 | | Jan-20 | 90.6 | 7.6 | 1.9 | -88.7 | 76.9 | 12.9 | 10.2 | -66.7 | | Mar-20 | 87.2 | 10.3 | 2.6 | -84.6 | 78.1 | 14.2 | 7.7 | -70.4 | | May-20 | 79.1 | 17.5 | 3.4 | -75.8 | 75.8 | 14.8 | 9.4 | -66.4 | | Jul-20 | 79.7 | 16.7 | 3.6 | -76.2 | 71.6 | 18.3 | 10.1 | -61.5 | | Sep-20 | 82.9 | 14.6 | 2.5 | -80.4 | 69.5 | 20.5 | 10.0 | -59.5 |

| Table 4: Perceptions and Expectations on Rate of Change in Price Level (Inflation)* | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Sep-19 | 74.2 | 19.5 | 6.3 | -67.9 | 77.9 | 16.1 | 6.1 | -71.8 | | Nov-19 | 77.2 | 17.4 | 5.5 | -71.7 | 77.3 | 17.3 | 5.4 | -71.9 | | Jan-20 | 84.9 | 11.2 | 4.0 | -80.9 | 80.3 | 14.7 | 5.0 | -75.3 | | Mar-20 | 80.8 | 15.7 | 3.5 | -77.3 | 75.6 | 20.3 | 4.1 | -71.5 | | May-20 | 74.8 | 18.6 | 6.6 | -68.2 | 73.4 | 19.5 | 7.1 | -66.3 | | Jul-20 | 79.8 | 15.6 | 4.5 | -75.3 | 76.4 | 18.6 | 5.0 | -71.4 | | Sep-20 | 83.0 | 13.1 | 3.9 | -79.1 | 75.9 | 19.6 | 4.6 | -71.3 | | *Applicable only for those respondents who felt price has increased/price will increase. |

| Table 5: Perceptions and Expectations on Income | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Sep-19 | 25.0 | 48.3 | 26.7 | -1.7 | 53.0 | 37.4 | 9.6 | 43.4 | | Nov-19 | 24.1 | 49.2 | 26.7 | -2.6 | 52.8 | 38.9 | 8.3 | 44.5 | | Jan-20 | 21.9 | 51.2 | 26.9 | -5.0 | 51.9 | 38.9 | 9.2 | 42.7 | | Mar-20 | 22.7 | 52.4 | 24.9 | -2.2 | 52.0 | 40.2 | 7.8 | 44.2 | | May-20 | 12.6 | 34.0 | 53.4 | -40.8 | 39.5 | 39.1 | 21.4 | 18.1 | | Jul-20 | 8.3 | 28.9 | 62.8 | -54.5 | 43.5 | 39.3 | 17.2 | 26.3 | | Sep-20 | 8.9 | 28.4 | 62.7 | -53.8 | 53.2 | 36.7 | 10.0 | 43.2 |

| Table 6: Perceptions and Expectations on Spending | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Sep-19 | 74.1 | 22.0 | 3.8 | 70.3 | 77.0 | 19.0 | 4.0 | 73.0 | | Nov-19 | 73.2 | 23.4 | 3.4 | 69.8 | 77.4 | 19.0 | 3.6 | 73.8 | | Jan-20 | 76.3 | 20.5 | 3.2 | 73.1 | 78.7 | 17.3 | 4.0 | 74.7 | | Mar-20 | 72.6 | 24.0 | 3.4 | 69.2 | 75.8 | 20.7 | 3.5 | 72.3 | | May-20 | 56.1 | 31.0 | 12.9 | 43.2 | 64.3 | 27.0 | 8.7 | 55.6 | | Jul-20 | 48.1 | 34.7 | 17.2 | 30.8 | 60.2 | 29.2 | 10.6 | 49.6 | | Sep-20 | 47.2 | 31.8 | 21.1 | 26.1 | 65.3 | 27.5 | 7.2 | 58.1 |

| Table 7: Perceptions and Expectations on Spending- Essential Items | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Sep-19 | 83.8 | 13.6 | 2.6 | 81.2 | 83.0 | 13.7 | 3.3 | 79.7 | | Nov-19 | 83.6 | 13.6 | 2.7 | 80.9 | 83.0 | 13.9 | 3.1 | 79.9 | | Jan-20 | 85.3 | 12.2 | 2.6 | 82.7 | 83.7 | 12.9 | 3.4 | 80.3 | | Mar-20 | 83.0 | 14.6 | 2.4 | 80.6 | 82.1 | 15.0 | 2.9 | 79.2 | | May-20 | 69.3 | 20.9 | 9.8 | 59.5 | 73.0 | 20.6 | 6.4 | 66.7 | | Jul-20 | 64.0 | 23.9 | 12.1 | 51.9 | 69.4 | 22.9 | 7.7 | 61.7 | | Sep-20 | 61.4 | 23.9 | 14.7 | 46.7 | 71.9 | 22.8 | 5.3 | 66.6 |

| Table 8: Perceptions and Expectations on Spending- Non-Essential Items | | (Percentage responses) | | Survey Round | Current Perception | One year ahead Expectation | | Increased | Remained Same | Decreased | Net Response | Will Increase | Will Remain Same | Will Decrease | Net Response | | Sep-19 | 29.9 | 40.0 | 30.1 | -0.2 | 34.7 | 39.2 | 26.0 | 8.7 | | Nov-19 | 27.5 | 42.4 | 30.1 | -2.6 | 33.4 | 43.0 | 23.5 | 9.9 | | Jan-20 | 28.0 | 37.3 | 34.6 | -6.6 | 34.3 | 37.8 | 27.9 | 6.4 | | Mar-20 | 27.7 | 42.0 | 30.3 | -2.6 | 32.4 | 43.5 | 24.1 | 8.3 | | May-20 | 13.9 | 39.6 | 46.4 | -32.5 | 22.0 | 42.4 | 35.6 | -13.6 | | Jul-20 | 9.2 | 29.4 | 61.4 | -52.2 | 22.2 | 37.9 | 39.9 | -17.7 | | Sep-20 | 10.7 | 29.5 | 59.8 | -49.1 | 31.3 | 37.4 | 31.4 | -0.1 |

|  IST,

IST,