IST,

IST,

Early Issues

Paper Money, as we know it today, was introduced in India in the late Eighteenth Century. This was a period of intense political turmoil and uncertainty in the wake of the collapse of the Mughal Empire and the advent of the colonial powers. The changed power structure, the upheavals, wars, and colonial inroads led to the eclipse of indigenous bankers, as large finance in India moved from their hands to Agency Houses who enjoyed state patronage. Many agency houses established banks.

Among the early issuers, the General Bank of Bengal and Bahar (1773-75) was a state sponsored institution set up in participation with local expertise. Its notes enjoyed government patronage. Though successful and profitable, the bank was officially wound up and was short lived. The Bank of Hindostan (1770-1832) was set up by the agency house of Alexander and Company was particularly successful. It survived three panic runs on it. The Bank of Hindostan finally went under when its parent firm M/s Alexander and Co. failed in the commercial crisis of 1832. Official patronage and the acceptance of notes in the payment of revenue was a very important factor in determining the circulation of bank notes. Wide use of bank notes, however, came with the note issues of the semi-government Presidency Banks, notably the Bank of Bengal which was established in 1806 as the Bank of Calcutta with a capital of 50 lakh sicca rupees. These banks were established by Government Charters and had an intimate relationship with the Government. The charter granted to these banks accorded them the privilege of issuing notes for circulation within their circles.

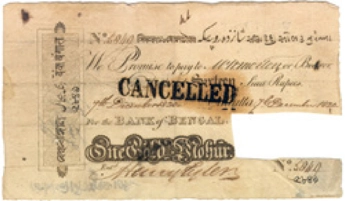

Notes issued by the Bank of Bengal can broadly be categorised in 3 broad series viz: the ‘Unifaced’ Series, the ‘Commerce’ Series and the ‘Britannia’ Series. The early notes of the Bank of Bengal were unifaced and were issued as one gold mohur (sixteen sicca rupees in Calcutta) and in denominations deemed convenient in the early 19th Century, viz., Rs. 100, Rs. 250, Rs. 500, etc.

Unifaced Notes of the Bank of Bengal

The Bank of Bengal notes later introduced a vignette represented an allegorical female figure personifying ‘Commerce’ sitting by the quay. The notes were printed on both sides. On the obverse the name of the bank and the denominations were printed in three scripts, viz., Urdu, Bengali and Nagri. On the reverse of such notes was printed a cartouche with ornamentation carrying the name of the Bank. Around the mid nineteenth century, the motif ‘Commerce’ was replaced by ‘Britannia’. The note had intricate patterns and multiple colours to deter forgeries.

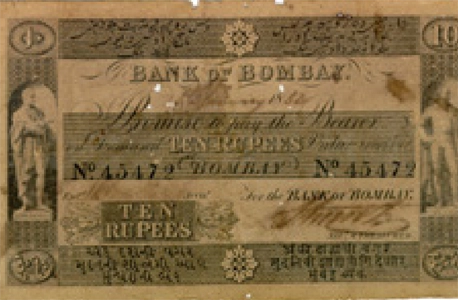

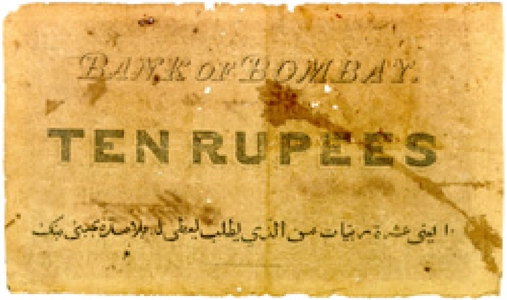

The second Presidency Bank was established in 1840 in Bombay, which had developed as major commercial centre. The Bank had a checkered history. The crisis resulting from the end of the speculative cotton boom led to the liquidation of Bank of Bombay in 1868. It was however reconstituted in the same year. Notes issued by the Bank of Bombay carried the vignettes of the Town Hall and others the statues of Mountstuart Elphinstone and John Malcolm.

Note issued by the Bank of Bombay

The Bank of Madras established in 1843 was the third Presidency Bank. It had the smallest issue of bank notes amongst Presidency Banks. The notes of the Bank of Madras bore the vignette of Sir Thomas Munroe, Governor of Madras (1817-1827).

The other private banks which issued bank notes were the Orient Bank Corporation established in Bombay as the Bank of Western India in 1842. Its notes featured the Bombay Town Hall as vignette. The Commercial Bank of India established in 1845 in Bombay (also an Exchange Bank) issued exotic notes with an interblend of Western and Eastern Motifs. The bank failed in the crash of 1866. The paper currency Act of 1861 divested these banks of the right to note issue; the Presidency Banks were, however, given the free use of Government balances and were initially given the right to manage the note issues of Government of India.